UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

x Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ Definitive Proxy Statement | |

| |

¨ Definitive Additional Materials | | |

| |

¨ Soliciting Material Under Rule 14a-12 | | |

Paradigm Genetics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | 1) | | Amount previously paid: |

| | 2) | | Form, Schedule or Registration Statement No: |

April 07, 2004

Dear Stockholder,

You are cordially invited to attend the 2004 Annual Meeting of Stockholders of Paradigm Genetics, Inc. to be held at 10:00 a.m. (local time) on Wednesday, May 12, 2004 at the offices of Paradigm Genetics, Inc., 108 T.W. Alexander Drive, Research Triangle Park, NC 27709.

At the Annual Meeting, three people will be elected to the Board of Directors. We will seek Stockholder approval to increase the number of shares of common stock authorized for issuance and to increase the number of shares available under the Company’s 2003 Employee, Director and Consultant Stock Plan. In addition, we will ask the Stockholders to ratify the selection of PricewaterhouseCoopers LLP as our independent public accountants. The Board of Directors recommends the approval of each of these proposals. Such other business will be transacted as may properly come before the Annual Meeting.

We hope you will be able to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that your shares are represented. Therefore, you are urged to complete, sign, date and return the enclosed proxy card promptly in accordance with the instructions set forth on the card. This will ensure your proper representation at the Annual Meeting.

| | |

| | | Sincerely, |

G. Steven Burrill | | Heinrich Gugger, Ph.D. |

Chairman | | President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY PROMPTLY.

PARADIGM GENETICS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be Held Wednesday, May 12, 2004

To the Stockholders of Paradigm Genetics, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Paradigm Genetics, Inc., a Delaware corporation (the “Company”), will be held on Wednesday, May 12, 2004 at the offices of the Company, 108 T.W. Alexander Drive, Research Triangle Park, NC 27709 at 10:00 a.m. (local time) for the purpose of considering and taking action on the following proposals:

| | 1. | | To elect three members to the Board of Directors to serve for a three-year term ending in 2007 and until their successors are duly elected and qualified. |

| | 2. | | To amend the Company’s Certificate of Incorporation, as amended to date, to increase the authorized number of shares of the Company’s Common Stock from 50,000,000 to 100,000,000 shares. |

| | 3. | | To increase by 2,000,000 to 2,500,000 shares the aggregate number of shares of the Company’s Common Stock, $0.01 par value per share (the “Common Stock”) for which stock and stock options may be granted under the Company’s 2003 Employee, Director and Consultant Stock Plan (the “2003 Stock Plan”). |

| | 4. | | To ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent public accountants for the fiscal year ending December 31, 2004. |

| | 5. | | To transact such other business as may be properly brought before the Annual Meeting and any adjournments thereof. |

The Board of Directors has fixed the close of business on March 26, 2004 as the record date for the determination of Stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournments thereof.

All Stockholders are cordially invited to attend the Annual Meeting. Whether you plan to attend the Annual Meeting or not, you are requested to complete, sign, date and return the enclosed proxy card as soon as possible in accordance with the instructions on the proxy card. A pre-addressed, postage prepaid return envelope is enclosed for your convenience.

BY ORDER OF THE BOARD OF DIRECTORS

J. Barry Buzogany, Esquire

Secretary

March 31, 2004

PRELIMINARY COPY

SUBJECT TO COMPLETION

DATED: MARCH 08, 2004

PARADIGM GENETICS, INC.

108 T.W. ALEXANDER DRIVE

RESEARCH TRIANGLE PARK, NC 27709

(919) 425-3000

PROXY STATEMENT

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Paradigm Genetics, Inc. (“Paradigm Genetics” or the “Company”), a Delaware corporation, of proxies, in the accompanying form, to be used at the Annual Meeting of Stockholders to be held at the offices of Paradigm Genetics, 108 T.W. Alexander Drive, Research Triangle Park, NC 27709 on Wednesday, May 12, 2004 at 10:00 a.m. (local time), and any adjournments thereof (the “Meeting”). This Proxy Statement and the accompanying proxy are being mailed on or about April 7, 2004 to all Stockholders entitled to notice of and to vote at the Meeting.

At the Meeting, Stockholders entitled to vote will consider and act upon the matters outlined in the notice of meeting accompanying this Proxy Statement. Where the Stockholder specifies a choice on the proxy as to how his or her shares are to be voted on a particular matter, the shares will be voted accordingly. If no choice is specified, the shares will be voted:

| | · | | FOR the election of the three nominees for director named herein. |

| | · | | FOR the proposal to amend the Company’s Certificate of Incorporation to increase the authorized number of shares of the Company’s Common Stock from 50,000,000 to 100,000,000 shares. |

| | · | | FOR the proposal to increase by 2,000,000 to 2,500,000 shares the aggregate number of shares of the Company’s Common Stock, $0.01 par value per share (the “Common Stock”) for which stock and stock options may be granted under the Company’s 2003 Employee, Director and Consultant Stock Plan (the “2003 Stock Plan”). |

| | · | | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent public accountants for the fiscal year ending December 31, 2004. |

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date. Any Stockholder who has executed a proxy but is present at the Meeting, and who wishes to vote in person, may do so by revoking his or her proxy as described in the preceding sentence. Shares represented by valid proxies in the form enclosed, received in time for use at the Meeting and not revoked at or prior to the Meeting, will be voted at the Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s Common Stock is necessary to constitute a quorum at the Meeting. Votes of Stockholders of Record who are present at the meeting in person or by proxy, abstentions, and broker non-votes (as defined below) are counted as present or represented at the meeting for purposes of determining whether a quorum exists.

The nominees for election as directors at the meeting will be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting. Abstaining or withholding authority to vote for a nominee for director will have no effect on the election of directors. For the proposal to increase the aggregate number of shares of the Company’s Common Stock for which stock and stock options may be granted under the

1

Company’s 2003 Stock Plan and the proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent public accountants for the fiscal year ending December 31, 2004, the affirmative vote of a majority of shares of Common Stock present or represented by proxy and entitled to vote at the Meeting is necessary for approval. Because abstentions are treated as shares present or represented and entitled to vote at the Meeting, abstentions with respect to either of these proposals will have the same effect as a vote against the proposal. For the proposal to amend the Company’s Certificate of Incorporation, the affirmative vote of a majority of the Company’s outstanding Common Stock is necessary for approval. Abstentions with respect to this proposal will have the same effect as a vote against the proposal.

If you hold your shares of Common Stock through a broker, bank or other representative, generally the broker or your representative may only vote the Common Stock that it holds for you in accordance with your instructions. However, if it has not timely received your instructions, the broker or your representative may vote on certain matters for which it has discretionary voting authority. If a broker or your representative cannot vote on a particular matter because it does not have discretionary voting authority, this is a “broker non-vote” on that matter. Broker non-votes are not considered for the particular matter and have the practical effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of votes from which the majority is calculated. The proposal to increase the aggregate number of shares of the Company’s Common Stock for which stock and stock options may be granted under the Company’s 2003 Stock Plan is not considered a routine matter and therefore your broker or representative cannot vote on it unless they receive your instructions.

The close of business on March 26, 2004 has been fixed as the record date for determining the Stockholders entitled to notice of and to vote at the Meeting. As of the close of business on March 26, 2004, the Company had shares of Common Stock outstanding and entitled to vote. Holders of Common Stock are entitled to one vote per share on all matters to be voted on by Stockholders.

The cost of soliciting proxies, including expenses in connection with preparing and mailing this Proxy Statement, will be borne by the Company. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of Common Stock of the Company for their expenses in forwarding proxy materials to such beneficial owners. Solicitation of proxies by mail may be supplemented by telephone, telegram, telex and personal solicitation by the directors, officers or employees of the Company. No additional compensation will be paid for such solicitation.

The Annual Report to Stockholders for the fiscal year ended December 31, 2003 is being mailed to the Stockholders with this Proxy Statement, but does not constitute a part hereof.

In December 2000, the Securities and Exchange Commission adopted a rule concerning the delivery of annual disclosure documents. The rule allows the Company or brokers holding shares on behalf of Company stockholders to send a single set of the Company’s annual report and proxy statement to any household at which two or more of the Company’s Stockholders reside, if either the Company or the brokers believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both Stockholders and the Company. It reduces the volume of duplicate information received by Stockholders and helps to reduce the Company’s expenses. The rule applies to the Company’s annual reports, proxy statements and information statements. Once Stockholders receive notice from their brokers or from the Company that communications to their addresses will be “householded,” the practice will continue until Stockholders are otherwise notified or until they revoke their consent to the practice. Each Stockholder will continue to receive a separate proxy card or voting instruction card.

Stockholders whose households received a single set of disclosure documents this year, but who would prefer to receive additional copies, may contact the Company’s transfer agent, American Stock Transfer & Trust Company, by calling their toll free number, 1-800-937-5449.

2

Stockholders who do not wish to participate in “householding” and would like to receive their own sets of the Company’s annual disclosure documents in future years, should follow the instructions described below. Stockholders who share an address with another stockholder of the Company and who would like to receive only a single set of the Company’s annual disclosure documents, should follow these instructions:

| | · | | Stockholders whose shares are registered in their own name should contact the Company’s transfer agent, American Stock Transfer & Trust Company, and inform them of their request by calling them at 1-800-937-5449 or writing them at 59 Maiden Lane, New York, New York 10038. |

| | · | | Stockholders whose shares are held by a broker or other nominee should contact the broker or other nominee directly and inform them of their request. Stockholders should be sure to include their name, the name of their brokerage firm and their account number. |

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of February 27, 2004 concerning the beneficial ownership of the Common Stock by each stockholder known by the Company to be the beneficial owner of 5% or more of the outstanding shares of Common Stock, each current member of the Board of Directors, each executive officer or former executive officer named in the Summary Compensation Table on page 14, and all directors and current executive officers as a group.

| | | | | |

| | | Shares Beneficially Owned(1)

| |

Name and Address**

| | Number

| | Percent

| |

Mazama Capital Management, Inc.(2) | | 7,477,032 | | 22.9 | % |

800 Fifth Ave.—Ste. 24-B New York, NY 10021 | | | | | |

| | |

Innotech Investments Limited(3) | | 3,966,542 | | 12.2 | % |

3 Charterhouse Mews Charterhouse Square London EC1M 6BB | | | | | |

| | |

Entities Affiliated with The Burrill AgBio Capital Fund L.P.(4) | | 2,157,828 | | 6.6 | % |

One Embarcadero Center Suite 2700 San Francisco, CA 94111 | | | | | |

| | |

G. Steven Burrill (5) | | 2,157,828 | | 6.6 | % |

Heinrich Gugger, Ph.D. (6) | | 635,967 | | 1.9 | % |

John E. Hamer, Ph.D. (7) | | 476,786 | | 1.5 | % |

Thomas J. Colatsky, Ph.D. (8) | | 190,500 | | * | |

Philip R. Alfano (9) | | 160,417 | | * | |

J. Barry Buzogany, Esq. (10) | | 155,417 | | * | |

Robert M. Goodman, Ph.D. (11) | | 70,666 | | * | |

Michael Summers (12) | | 65,666 | | * | |

Mark B. Skaletsky (13) | | 57,000 | | * | |

Susan K. Harlander, Ph.D. (14) | | 29,444 | | * | |

Henri Zinsli, Ph.D. (15) | | 26,000 | | * | |

Leroy E. Hood, M.D., Ph.D. (16) | | 17,500 | | * | |

All directors and current executive officers as a group (14 persons) | | 4,660,784 | | 13.5 | % |

| * | | Represents beneficial ownership of less than 1% of the Company’s outstanding shares of Common Stock. |

| ** | | Addresses are given for beneficial owners of 5% or more of the outstanding Common Stock only. |

| (1) | | The number of shares of Common Stock issued and outstanding on February 27, 2004, was 32,605,360. The calculation of percentage ownership for each listed beneficial owner is based upon the number of shares of Common Stock issued and outstanding at February 27, 2004, plus shares of Common Stock subject to options and warrants held by such person at February 27, 2004 and exercisable within 60 days thereafter. The persons and entities named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them, except as noted below. |

| (2) | | This information is based solely on the Schedule 13G/A filed by Mazama Capital Management Inc. with the Securities and Exchange Commission on February 11, 2004, which reported ownership as of December 31, 2003. |

| (3) | | Includes warrants to purchase 187,500 shares of our common stock. All of the issued capital stock of Innotech Investments Limited is owned by a blind trust, the sole Trustee of which is J. S. Portrait, who as a result of her control of the shares of Innotech, may be deemed to be the beneficial owner of the Paradigm shares held by Innotech. |

4

| (4) | | As the General Partner of Burrill AgBio Capital Fund L.P., Burrill & Company, LLC, is deemed to beneficially own the shares held of record by Burrill AgBio Capital Fund L.P. Mr. Burrill is the Chief Executive Officer of Burrill & Company, LLC. |

| (5) | | Includes 1,947,828 shares of record held by The Burrill AgBio Capital Fund L.P., which Mr. Burrill may be deemed to beneficially own by virtue of his position as the Chief Executive Officer of Burrill & Company, LLC, the General Partner of Burrill AgBio Capital Fund L.P. Mr. Burrill disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in Burrill AgBio Capital Fund L.P. Includes 74,666 shares that are subject to immediately exercisable stock options. Also includes an additional 1,334 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. Also includes 134,000 shares purchased on the open market. |

| (6) | | Consists of 363,750 shares that are subject to immediately exercisable stock options. Also includes of 193,050 shares of common stock purchased on the open market. Also includes 56,667 shares of common stock issued as part of 2002 bonuses and 10,000 shares purchased through an employee stock purchase plan. Also includes additional 12,500 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

| (7) | | Includes 8,350 shares held by Dr. Hamer’s wife, of which 7,300 shares were issued upon the exercise of stock options and 1,050 shares were purchased through an employee stock purchase plan. Also includes 2,000 shares held by Dr. Hamer’s daughter. Also includes 24,333 shares of common stock that were issued upon the exercise of stock options and 371,281 shares that are subject to immediately exercisable stock options held by Dr. Hamer. Also includes 68,333 shares of common stock issued as part of 2002 bonuses. Also includes an additional 2,489 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004 by Dr. Hamer. |

| (8) | | Consists of 132,500 shares that are subject to immediately exercisable stock options. Also includes 53,333 shares of common stock issued as part of 2002 bonuses. Also includes an additional 500 shares purchased on the open market. Also includes additional 4,167 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

| (9) | | Consists of 126,250 shares that are subject to immediately exercisable stock options. Also includes of 30,000 shares of common stock purchased on the open market. Also includes additional 4,167 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

| (10) | | Consists of 126,250 shares that are subject to immediately exercisable stock options. Also includes of 25,000 shares of common stock purchased on the open market. Also includes additional 4,167 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

| (11) | | Includes 52,666 shares, which were issued upon the exercise of stock options and 12,332 shares issuable upon the exercise of immediately exercisable stock options. Includes an additional 668 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. Also includes 5,000 shares purchase on the open market. |

| (12) | | Includes 64,998 shares that are subject to immediately exercisable stock options. Includes an additional 668 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

| (13) | | Includes 25,776 shares that are subject to immediately exercisable stock options and an additional 1,224 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. Also includes 30,000 shares purchased on the open market. |

| (14) | | Consists of 24,665 shares that are subject to immediately exercisable stock options and an additional 1,779 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. Also includes 3,000 shares purchased on the open market. |

| (15) | | Includes 11,000 shares, which were issued upon the exercise of stock options, and 12,332 shares that are subject to immediately exercisable stock options. Includes an additional 668 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. Also includes 2,000 shares purchase on the open market. |

| (16) | | Consists of 16,054 shares that are subject to immediately exercisable stock options and an additional 1,446 shares that may be acquired upon the exercise of options within 60 days of February 27, 2004. |

5

CORPORATE GOVERNANCE

In February 2003, the Company’s Board of Directors adopted a Code of Ethics and Conduct, which is posted, together with the charters for the Audit Committee and Nominating Committee of the Board, on the corporate governance page of our website. The corporate governance page can be accessed in the Investor Relations section of our website atwww.paradigmgenetics.com. Our Code of Ethics and Conduct applies to all directors, officers and employees of Paradigm Genetics, including the Chief Executive Officer, Chief Financial Officer and Corporate Controller. The three key principles of the Code are to act with integrity, to act legally and to act responsibly with respect to work for Paradigm Genetics.

MANAGEMENT

Board of Directors

Under the Company’s Charter and Bylaws, the number of members of the Company’s Board of Directors is fixed from time to time by the Board of Directors. The Board of Directors currently consists of nine members. The Board of Directors is classified into three classes as follows: Michael Summers, Leroy E. Hood, Ph.D., and Henri Zinsli, Ph.D. constitute a class with a term ending in 2005 (the “Class II directors”); G. Steven Burrill, Heinrich Gugger, Ph.D., and Robert Goodman, Ph.D. constitute a class with a term ending in 2006 (the “Class III directors”); Mark B. Skaletsky, Susan K. Harlander, Ph.D. and Douglas R. Morton, Jr., Ph.D. constitute a class with a term which expires at the upcoming meeting (the “Class I directors”);. At each annual meeting of Stockholders, directors are elected for a full term of three years to succeed those directors whose terms are expiring.

The Board of Directors has voted to set the size of the Board of Directors at nine members and to nominate Mark B. Skaletsky, Susan K. Harlander, Ph.D. and Douglas R. Morton, Jr., Ph.D. for election at the Meeting for a term of three years, to serve until the 2007 annual meeting of Stockholders, and until their respective successors have been elected and qualified. The Class II directors and the Class III directors will serve until the annual meetings of Stockholders to be held in 2005 and 2006, respectively, and until their respective successors have been elected and qualified.

Michael Summers, Leroy E. Hood, Ph.D., Henri Zinsli, Ph.D., G. Steven Burrill, Robert Goodman, Ph.D., Mark B. Skaletsky, Susan K. Harlander, Ph.D., and Douglas R. Morton, Jr. Ph.D. are independent directors, as defined in the listing criteria of the Nasdaq National Market System.

Set forth below are the names of the persons nominated as directors and the directors whose terms do not expire this year, their ages, their offices in the Company, if any, their principal occupations or employment for the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold directorships.

| | | | |

Name

| | Age

| | Position with the Company

|

G. Steven Burrill | | 59 | | Director and Chairman of the Board |

Robert M. Goodman, Ph.D. | | 58 | | Director |

Michael Summers | | 62 | | Director |

Henri Zinsli, Ph.D. | | 63 | | Director |

Mark B. Skaletsky | | 55 | | Director |

Susan K. Harlander, Ph.D. | | 55 | | Director |

Leroy E. Hood, Ph.D | | 65 | | Director |

Heinrich Gugger, Ph.D. | | 53 | | Director |

Douglas R. Morton, Jr., Ph.D. | | 58 | | Director |

6

G. Steven Burrill has been a member of our Board of Directors since March 1999, and has served as the chairman of our Board of Directors since December 1999. Mr. Burrill is the Chief Executive Officer of Burrill & Company, a life science merchant bank, which he founded in 1994. Prior to starting Burrill & Company, Mr. Burrill spent 27 years with Ernst & Young, including the last 17 years as a partner of the firm. Mr. Burrill received his BBA degree from the University of Wisconsin-Madison. Mr. Burrill currently serves on the Boards of Directors of DepoMed, Inc., Third Wave Technologies, Inc., Catalyst Biosciences, Inc., Galapagos Genomics, Inc., Pyxis Genomics, Inc., and Targacept, Inc.

Michael Summers has been a member of our Board of Directors since March 1998. Since October 1990, Mr. Summers has been a managing partner of Summers Associates, a specialized international business development organization. Mr. Summers is also managing director of Floranova Limited. He received his B.S. in Botany from the University of Exeter in 1964.

Robert M. Goodman, Ph.D. has been a member of our Board of Directors since June 1998. Since September 1991, Dr. Goodman has been a Professor of Plant Pathology at the University of Wisconsin-Madison. Dr. Goodman is also a member of the Microbiology graduate program, the interdepartmental program in plant genetics and plant breeding, the Gaylord Nelson Institute of Environmental Studies, the graduate program in cellular and molecular biology and the biotechnology training program. He previously was Executive Vice President, Research and Development, at Calgene, Inc., and presently serves as a director of Cornell Research Foundation, Inc., the International Maize and Wheat Improvement Center and of PlantGenix, Inc. He is co-founder of eMetagen LLC, a start up company offering a drug discovery platform based on natural products derived from microbial diversity. Dr. Goodman received a Ph.D. in plant virology from Cornell University in 1973.

Henri Zinsli, Ph.D. has been a member of our Board of Directors since June 1998. Since January 2002, Dr. Zinsli has served as the Executive Chairman of Discovery Partners International AG in Allschwil, Switzerland. From 1999 to 2002 Dr. Zinsli also served as the Chief Executive Officer of Discovery Technologies Ltd. Since 2002 Dr. Zinsli has served as the Chairman of the Board of Directors of Covalys AG in Witterswil, Switzerland, and on the Board of Directors of InPheno AG in Basel, Switzerland. From 1998 to 2002 Dr. Zinsli served as the Chairman of Zeptosens Inc. in Witterswil, Switzerland. He is also a non-executive director of Plasmon, plc, in Royston, England, a position that he has held since 1996. Until 1996, he was the head of Corporate Business Development at Ciba-Geigy Ltd. (now Novartis) in Basel, Switzerland. Dr. Zinsli had over 30 years of experience at Ciba-Geigy Ltd. He received his Ph.D. in economics at the University of St. Gallen, Switzerland in 1968.

Mark B. Skaletsky joined the Company as a director in February 2001. Mr. Skaletsky has been the Chairman and Chief Executive officer of Trine Pharmaceuticals, Inc. (formerly Essential Therapeutics, Inc.) since April 2001. From May 1993 to January 2001, Mr. Skaletsky was the President and Chief Executive Officer of GelTex Pharmaceuticals, Inc. From 1988 to 1993, Mr. Skaletsky served as Chairman and Chief Executive Officer of Enzytech, Inc., a biotechnology company. From 1981 to 1988, Mr. Skaletsky served as President and Chief Operating Officer of Biogen, Inc. Mr. Skaletsky is past Chairman of the Biotechnology Industry Organization. He also serves as a member of the Board of Directors of Isis Pharmaceuticals, Inc., ImmunoGen and Advanced Magnetics, Inc. In addition, Mr. Skaletsky is a member of the Board of Trustees of Bentley College located in Waltham, MA. Mr. Skaletsky attended Bentley College and graduated in 1970 with a Bachelor Degree in Finance.

Susan K. Harlander, Ph.D. has been a member of our Board of Directors since May 1, 2001. Dr. Harlander has been the President of BIOrational Consultants, Inc. since May 2000. From May 1995 to May 2000, Dr. Harlander served in various positions at The Pillsbury Company, including Vice President, Biotechnology Development and Agricultural Research and Vice President, Green Giant and Progresso R&D and Agricultural Research. From 1991 to 1995, Dr. Harlander served as Director, Dairy Foods Research Development at Land O’ Lakes, Inc. From 1984 to 1992, Dr. Harlander served as an Assistant and Associate Professor in the Department of Food Science and Nutrition, University of Minnesota. Dr. Harlander received her Ph.D. in Food Science in 1984 from the University of Minnesota.

7

Leroy E. Hood, M.D., Ph.D.has been a member of our Board of Directors since January 2002. Dr. Hood founded and has been the President and Director of the Institute for Systems Biology in Seattle, Washington since January 2000. From 1992 until January 2000, Dr. Hood was the Gates Professor and Chairman, Department of Molecular Biotechnology, at the University of Washington in Seattle. Dr. Hood earned his M.D. from Johns Hopkins University in 1964 and a Ph.D. in biochemistry from the California Institute of Technology in 1968. He is recognized as one of the world’s leading scientists in molecular biotechnology and genomics. At the California Institute of Technology, he and colleagues pioneered four instruments that constitute the technological foundation for contemporary molecular biology. One of the instruments allows the rapid automated sequencing of DNA. Dr. Hood participated in the Human Genome Project—the quest to decipher the sequence of human DNA. He serves on the Board of Directors for Celtrans, Inc., Lynx Therapeutics Inc., Omeros Inc., and Targeted Growth, Inc.

Heinrich Gugger, Ph.D.has served as our Chief Executive Officer since July 2002. From July 1998 to January 2002, Dr. Gugger served as President of Syngenta Crop Protection Inc., a merger of Zeneca Agchemicals and Novartis Crop Protection. He led the $2 billion business through the North American merger planning and integration and was instrumental in the company’s introduction of 10 new products at formulation level in its first nine months. From December 1994 to June 1998, Dr. Gugger served as Head of Global Business Unit Fungicides for Novartis AG. From April 1992 to November 1994 he served as Ciba-Geigy’s (now Novartis) Head of Global Business Unit Electronic Materials, a global leader in providing polymeric materials to the printed wiring board and chip manufacturing industry. He began his professional career as a research scientist with Ciba-Geigy in Switzerland before joining Spectra-Physics, Inc., a laser and analytical instrumentation company, in April 1988. Dr. Gugger serves on the Board of Directors of the North Carolina Biotechnology Institute. He received his Ph.D. in Inorganic and Physical Chemistry from the University of Bern, Switzerland in October 1980. Dr. Gugger was an IBM World Trade Post Doctoral Fellow in Applied Physics at the IBM Research Division in San Jose, California and was supported by a grant from the Swiss National Science Foundation.

Douglas R. Morton, Jr., Ph.D. will become a member of our Board of Directors upon the closing of our acquisition of TissueInformatics, Inc. Dr. Morton has been the Chief Executive Officer of Southwest Michigan Innovation Center since November 2003. From April 2003 to October 2003, Dr. Morton served as a Vice President in the Discovery division of Pfizer, Inc. From April 2000 to March 2003, Dr. Morton served as Group Vice President—Technology Acquisitions & Operations of Pharmacia Corporation. From June 1998 to March 2000, Dr. Morton served as Group Vice President—Technology Acquisitions & Skillbase Development of Pharmacia & Upjohn, Inc. Dr. Morton graduatedmagna cum laude from Kenyon College with an A.B. in Chemistry; he was awarded a Ph.D. in Organic Chemistry by Columbia University and completed postdoctoral studies in that field at Stanford University. Dr. Morton has authored or co-authored 45 peer-reviewed scientific publications and holds 43 U.S. Patents.

Attendance at Stockholder Meetings

The Board has a policy that directors make all reasonable efforts to attend the Company’s annual stockholder meetings. All the current directors attended last year’s annual stockholders’ meeting, with the exception of Leroy E. Hood, Ph.D. Douglas R. Morton also did not attend the Company’s annual stockholder meetings as he was not a director at that time.

Communications with the Board

Stockholders may communicate with the Board of Directors by sending an email to BoardofDirectors@paradigmgenetics.com or by sending a letter to Paradigm Genetics Board of Directors, c/o the Office of the Corporate Secretary, 108 T.W. Alexander Drive, Research Triangle Park, North Carolina 27709. The Office of the Corporate Secretary will receive the correspondence and forward it to the Chairman of the Audit Committee or to any individual director or directors to whom the communication is directed, unless the

8

communication is unduly hostile, threatening, illegal, does not reasonably relate to Paradigm Genetics or its business, or is similarly inappropriate. The Office of the Corporate Secretary has the authority to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended December 31, 2003, there were four meetings of the Board of Directors, and the various committees of the Board of Directors met a total of 15 times. No director attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during fiscal 2003, with the exception of Dr. Hood, who attended approximately 50% of the Board meetings.

Audit Committee. The Audit Committee, which met eight times in fiscal 2003, has three members and presently consists of Mr. Skaletsky (as Chairman), Mr. Burrill and Mr. Summers. The Audit Committee is comprised solely of directors who meet all the independence standards for audit committee members, as set forth in the Sarbanes-Oxley Act of 2002 and the listing standards of the Nasdaq National Market System. The Board has designated Messrs. Skaletsky and Burrill as “audit committee financial experts” as that term is defined in the SEC rules adopted pursuant to the Sarbanes-Oxley Act. The Audit Committee is responsible for retaining and overseeing the Company’s independent auditors, approving the services performed by them and for reviewing the Company’s financial reporting process, accounting principles and its system of internal accounting controls. The Audit Committee operates under the amended written charter adopted by the Board of Directors on February 13, 2004, which is included in Appendix A to this proxy statement. Please see the “Report of Audit Committee” below.

Compensation Committee. The Compensation Committee, which met six times during fiscal 2003, has four members and presently consists of Mr. Burrill (as Chairman), Dr. Zinsli, Dr. Harlander, and Dr. Goodman. The Compensation Committee is comprised solely of directors who meet all the independence standards for compensation committee members, as set forth in the listing standards of the Nasdaq National Market System. The Compensation Committee reviews, approves and makes recommendations on the Company’s compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board of Directors are carried out and that such policies, practices and procedures contribute to the success of the Company. The Compensation Committee is responsible for establishing and administering the Company’s executive compensation, the Company’s 2003 Stock Plan and other employee equity plans. Please see the “Report of Compensation Committee” below.

Option Committee. Mr. Burrill is the sole member of the Option Committee, which did not formally act during fiscal 2003. The Option Committee has the authority to grant options within a prescribed limit (which limit may be changed by the Compensation Committee from time to time) to employees below the vice president level without seeking Compensation Committee approval.

Nominating Committee. The Nominating Committee, which met once during fiscal 2003, has three members, Mr. Burrill, Mr. Skaletsky and Dr. Harlander. The Nominating Committee is comprised solely of directors who meet all the independence standards for nominating committee members, as set forth in the listing standards of the Nasdaq National Market System. The Nominating Committee operates pursuant to a written charter adopted by the Board of Directors on February 13, 2004. The Nominating Committee’s role, following consultation with all other members of the Board of Directors, is to make recommendations to the full Board as to the size and composition of the Board and to make recommendations as to particular nominees. In evaluating and determining whether to recommend a person as a candidate for election as a director, the Committee considers, among other things, relevant management and/or industry experience; values such as integrity, accountability, judgment and adherence to high performance standards; independence pursuant to the guidelines set forth in the listing standard of the Nasdaq National Market System; ability and willingness to undertake the requisite time commitment to Board functions; and an absence of conflicts of interest with the Company.

9

The Nominating Committee may employ a variety of methods for identifying and evaluating nominees for director. The Committee regularly assesses the size of the Board, the need for particular expertise on the Board, the upcoming election cycle of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Committee considers various potential candidates for director that may come to the Committee’s attention through current Board members, professional search firms, stockholders or other persons. These candidates are evaluated at regular or special meetings of the Committee, and may be considered at any point during the year.

The Nominating Committee will consider candidates recommended by stockholders, when the nominations are properly submitted, under the criteria summarized above. The deadlines and procedures for stockholder submissions of director nominees are described below under “Stockholder Proposals and Director Nominations.” Following verification of the stockholder status of persons proposing candidates, the Committee makes an initial analysis of the qualifications of any candidate recommended by stockholders or others pursuant to the criteria summarized above to determine whether the candidate is qualified for service on the Company’s Board before deciding to undertake a complete evaluation of the candidate. If any materials are provided by a stockholder or professional search firm in connection with the nomination of a director candidate, such materials are forwarded to the Committee as part of its review. Other than the verification of compliance with procedures and stockholder status, and the initial analysis performed by the Committee, a potential candidate nominated by a stockholder is treated like any other potential candidate during the review process by the Committee.

Compensation Committee Interlocks and Insider Participation. The Compensation Committee has four members, Mr. Burrill (as Chairman), Dr. Zinsli, Dr. Harlander, and Dr. Goodman and the Option Committee has one member, Mr. Burrill. None of the members of our Compensation Committee has at any time been one of our officers or employees. No member of our Compensation Committee serves as a member of the Board of Directors or Compensation Committee of any entity that has an executive officer serving as a member of our Board of Directors or Compensation Committee.

Compensation of Directors

Our directors who are also our employees receive no compensation for serving on the Board of Directors.

Through December 2003, we paid each of our non-employee directors a fee of $16,000 per year. We reimburse our non-employee directors for reasonable expenses incurred in attending Board and Committee meetings. Annually, each non-employee director receives an option to purchase 6,000 shares each year upon grants by the Compensation Committee, except for the Chairman of the Board, who receives an option to purchase 12,000 shares. These options vest in equal monthly increments over 36 months beginning on January 1 of the year in which they are granted.

Commencing in 2004, we will pay each of our non-employee directors a fee of $25,000 per year, with the following exceptions, the Chairman of the Board will receive at 50% premium and the Audit Committee and Compensation Committee Chairmen will receive a 20% premium. This excluded duplicate premiums to the Compensation Committee Chairman and the Chairman of the Board. We reimburse our non-employee directors for reasonable expenses incurred in attending Board and Committee meetings. Quarterly, each non-employee director receives an option to purchase 1,500 shares each quarter upon grants by the Compensation Committee, except for the Chairman of the Board, who receives an option to purchase 3,000 shares. These options vest in equal monthly increments over 36 months. Upon a change in control these options become fully vested.

10

Executive Officers

The names of, and certain information regarding, executive officers of the Company are set forth below. Except for executive officers who have employment agreements with the Company, the executive officers serve at the pleasure of the Board of Directors.

| | | | |

Name

| | Age

| | Position

|

Heinrich Gugger, Ph.D. . | | 53 | | President and Chief Executive Officer |

Philip R. Alfano | | 54 | | Vice President, Finance, Chief Financial Officer and Treasurer |

Thomas J. Colatsky, Ph.D. | | 54 | | Vice President, Healthcare Research |

James D. Bucci | | 59 | | Vice President, Human Resources |

Keith R. Davis, Ph.D | | 46 | | Vice President, Agricultural Research |

J. Barry Buzogany, Esquire | | 59 | | Vice President, General Counsel and Corporate Secretary |

Peter Johnson M.D | | 49 | | Executive Vice President and Chief Medical Officer |

Mark Braughler, Ph.D | | 53 | | Vice President, Business Development – Healthcare |

Heinrich Gugger, Ph.D.has served as our Chief Executive Officer since July 2002. From July 1998 to January 2002, Dr. Gugger served as President of Syngenta Crop Protection Inc., a merger of Zeneca Agchemicals and Novartis Crop Protection. He led the $2 billion business through the North American merger planning and integration and was instrumental in the company’s introduction of 10 new products at formulation level in its first nine months. From December 1994 to June 1998, Dr. Gugger served as Head of Global Business Unit Fungicides for Novartis AG. From April 1992 to November 1994 he served as Ciba-Geigy’s (now Novartis) Head of Global Business Unit Electronic Materials, a global leader in providing polymeric materials to the printed wiring board and chip manufacturing industry. He began his professional career as a research scientist with Ciba-Geigy in Switzerland before joining Spectra-Physics, Inc., a laser and analytical instrumentation company, in April 1988. Dr. Gugger serves on the Board of Directors of the North Carolina Biotechnology Institute. He received his Ph.D. in Inorganic and Physical Chemistry from the University of Bern, Switzerland in October 1980. Dr. Gugger was an IBM World Trade Post Doctoral Fellow in Applied Physics at the IBM Research Division in San Jose, California and was supported by a grant from the Swiss National Science Foundation.

Philip R. Alfanohas served as our Vice President, Finance and Chief Financial Officer since November 2002. From February 2001 to November 2002, Mr. Alfano was Senior Vice President and Chief Financial Officer of Greenwood Group, Inc. (d.b.a. Manpower), the largest Manpower franchise in the United States. From April 1998 to January 2001, he was Senior Vice President and Chief Financial Officer of Research Triangle Commerce, Inc., a commerce infrastructure company for whom he directed initial and secondary equity raises and coordinated a merger with a Nasdaq-listed company. From August 1994 to December 1997, he served as Senior Vice President and Chief Financial Officer for Winston Hotels, Inc., a publicly held real estate investment trust. Mr. Alfano received his B.B.A. in Accounting at St. Bonaventure University and completed graduate finance courses at Pace University.

Thomas J. Colatsky, Ph.D. has served as our Vice President, Healthcare Research since August 2002. From September 2001 to August 2002, Dr. Colatsky was President and Chief Executive Officer of Argolyn Bioscience, a company focused on enabling the design and development of novel peptide drugs and diagnostics. From February 1999 to August 2001, he was Executive Vice President and Chief Scientific Officer at Physiome Sciences. From May 1982 to February 1999, he served in various research roles at Wyeth-Ayerst including Vice President, Cardiovascular and Metabolic Disorders, Discovery Research. Dr Colatsky received his Ph.D. in physiology from the State University of New York at Buffalo. His undergraduate degree is from Georgetown University in May 1972.

11

James Bucci has served as our Vice President of Human Resources since February 2000. From November 1997 to February 2000, Mr. Bucci was Senior Vice President of Human Resources for Suburban Hospital Healthcare Systems in Bethesda, Maryland, a not-for-profit integrated healthcare provider. From April 1993 to October 1997, he served as Group Vice President of Human Resources at First Citizens Bank in Raleigh, North Carolina, a closely held regional bank. Mr. Bucci has prior senior level human resources experience at Hallmark Cards, Inc. and Fidelity Investments. Mr. Bucci received his Masters degree in Human Development in 1984 from the University of Rhode Island. His undergraduate degree is from Brown University.

Keith R. Davis, Ph.D. has served as our Vice President, Agricultural Research since April 2002. From February 2000 to March 2002, he previously served as our Director of Plant Research. From July 1999 to January 2000 he served as our Manager of Molecular Biology and Genetics for plant research. From August 1989 to June 1999, Dr. Davis was an Associate Professor of Plant Biology and Acting Director of the campus-wide Plant Molecular Biology and Biotechnology group at The Ohio State University. Dr. Davis was also co-founder and Associate Director of the NSF-funded Arabidopsis Biological Resource Center at Ohio State University. Dr. Davis’ research on plant-virus interactions and plant responses to biotic and abiotic stress has been funded by the EPA, USDA, and NIH. Dr. Davis received his Ph.D. in Molecular, Cellular, and Developmental Biology from the University of Colorado, Boulder, in 1985.

J. Barry Buzogany, Esquire has served as our Vice President, General Counsel and Secretary since November 2002. From March 2000 to April 2002, Mr. Buzogany was Senior Vice President, General Counsel and Secretary of Gene Logic, Inc., a publicly traded genomics and bioinformatics company, where he established the company’s first in-house legal function, resolved litigation issues and directed the intellectual property function. From May 1998 to November 1999, he was Executive Director and Corporate Counsel for Centocor, Inc., a biopharmaceutical company. From April 1992 to May 1998, he served as Vice President and General Counsel for Boehringer Mannheim, a pharmaceutical company. Additionally, he was General Counsel to public companies engaged in the manufacture and sale of bioindustrial products and specialty chemicals, respectively. Mr. Buzogany received his J.D. from University of Akron College of Law and his M.A. in International Relations from University of Southern California.

Peter C. Johnson, MD will become our Executive Vice President and Chief Medical Officer upon the closing of our acquisition of TissueInformatics, Inc, where he was a Co-Founder and served as Chairman and Chief Executive Officer since 1999. In 1994, he founded and became the first Executive Director and in 1996 the first President of the Pittsburgh Tissue Engineering Initiative, a regional collaboration of five research Universities/Hospitals that helped to spawn the emerging biotechnology industry in Pittsburgh, making it a world leader in tissue engineering. From 1989 to 1999, he served as Assistant Professor and then Associate Professor of Surgery at the University of Pittsburgh School of Medicine, where he practiced reconstructive surgery. He was also the Research Director in Plastic Surgery during that interval and founded and led the Facial Nerve Center, a multidisciplinary center for the care of facial paralysis patients. He presently serves as Adjunct Professor of Surgery at the University of Pittsburgh. Dr. Johnson is the Past President of the Pennsylvania Biotechnology Association (where he continues as a Board member), the Plastic Surgery Research Council and the Tissue Engineering Society, International. He is the Co-Editor of the journal, Tissue Engineering. He serves on the Board of Directors of the Carnegie Institute of Pittsburgh and the Carnegie Science Center, the Tissue Engineering Society, International and is a member of the Business Advisory Council of the Federal Reserve Bank, Cleveland Branch. Dr. Johnson received his BS degree from the University of Notre Dame and his MD degree from the State University of New York Upstate Medical Center. He took his General Surgery training at Case-Western Reserve University and his Plastic Surgery training at the University of Pittsburgh School of Medicine. He was a postdoctoral research fellow at Harvard University in the study of thrombosis. He is an author on multiple patents related to digital tissue analysis and clinical morphometry.

J. Mark Braughler, Ph.D., will become our Vice President, Business Development, Healthcare upon the closing of our acquisition of Tissue Informatics, Inc. From September 2000, Dr. Braughler has served as Senior Vice President of Business Development at TissueInformatics. From August 1998 to March 2000, Dr. Braughler

12

was President & CEO of Argonex Inc., a biotechnology company based in Charlottesville, VA which owned Upstate Biotechnology, one of the world’s leading privately held cell signaling reagent companies. From 1995 to 1998, Dr. Braughler was Vice President, Business Development of Pharmacia & Upjohn, a leading global pharmaceutical company formed through the merger of Pharmacia Corporation and The Upjohn Company in 1995. From 1989 to 1995, he served as Director of Acquisition Review, Research Contracts, Competitive Intelligence and Intellectual Property for The Upjohn Company. Prior to beginning his career in business, Dr. Braughler was a Senior Research Scientist for The Upjohn Company from January 1982 to August 1989 where he jointly led global drug discovery and development efforts in central nervous system trauma. Prior to beginning his career in industry in 1983, he was Associate Professor of Pharmacology with tenure at the Northeastern Ohio Universities College of Medicine from June 1979 to December 1982. Dr. Braughler received his Ph.D. in pharmacology in 1976 from the University of Pittsburgh School of Medicine. Dr. Braughler was an NIH post-doctoral fellow in Clinical Pharmacology at the University of Virginia School of Medicine from 1977 to 1979.

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth summary information as to compensation received by the Company’s Chief Executive Officer and each of the four other most highly compensated executive officers who were employed by the Company at the end of fiscal 2003 (collectively, the “named executive officers”) for services rendered to the Company in all capacities during the three fiscal years ended December 31, 2003.

| | | | | | | | | | | | | | | |

| | | Annual Compensation

| | | Securities Underlying

Options

| | All Other

Compensation

| |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | |

Heinrich Gugger, Ph.D. (1) President and Chief Executive Officer, and Director | | 2003

2002 | | $

$ | 340,000

123,448 | | $

$ | 153,450

104,000 |

(6) | | 170,000

300,000 | | $

$ | 2,295

17,439 | (9)

(10) |

| | | | | |

John E. Hamer, Ph.D. (2) Chief Scientific Officer. | | 2003

2002

2001 | | $

$

$ | 230,001

280,130

195,000 | | $

$

$ | 49,548

91,000

38,295 |

(7)

| | 70,000

200,000

19,500 | | $

$

$ | 5,350

3,450

1,650 | (11)

(9)

(9) |

| | | | | |

Thomas J. Colatsky, Ph.D. (3) Vice President, Healthcare Research | | 2003

2002 | | $

$ | 215,001

88,327 | | $

$ | 52,678

32,000 |

(8) | | 70,000

100,000 | | $

$ | 3,000

5,853 | (9)

(12) |

| | | | | |

Philip R. Alfano (4) Vice President, Finance, Chief Financial Officer and Treasurer | | 2003

2002 | | $

$ | 200,000

19,824 | | $

$ | 48,275

7,500 |

| | 70,000

100,000 | | $

$ | 2,850

— | (9)

|

| | | | | |

J. Barry Buzogany, Esq (5) Vice President, General Counsel and Corporate Secretary | | 2003

2002 | | $

$ | 200,000

24,579 | | $

$ | 47,525

17,500 |

| | 70,000

100,000 | | $

$ | 9,891

2,406 | (13)

(14) |

| (1) | | Dr. Gugger joined the Company in July 2002. |

| (2) | | Dr. Hamer resigned as of December 31, 2003. |

| (3) | | Dr. Colatsky joined the Company in August 2002. |

| (4) | | Mr. Alfano joined the Company in November 2002. |

| (5) | | Mr. Buzogany joined the Company in November 2002. |

| (6) | | Includes 56,667 shares of common stock valued at $17,000 (based upon a share price of $0.30 per share at date of grant), which shares were paid on June 30, 2003. |

| (7) | | Includes 68,333 shares of common stock valued at $20,500 (based upon a share price of $0.30 per share at date of grant), which shares were paid on June 30, 2003. |

| (8) | | Includes 53,333 shares of common stock valued at $16,000 (based upon a share price of $0.30 per share at date of grant), which shares were paid on June 30, 2003. |

| (9) | | Represents matching contributions made under the Company’s 401(K) plan. |

| (10) | | Represents reimbursements for moving expenses paid to Dr. Gugger. |

| (11) | | Represents payments paid on the behalf of Mr. Hamer for legal and tax consulting in the amount of $2,350 and matching contributions made under the Company’s 401(K) plan in the amount of $3,000. |

| (12) | | Represents reimbursement for moving expenses paid to Dr. Colatsky in the amount of $5,047 and matching contributions made under the Company’s 401(K) plan in the amount of $806. |

| (13) | | Represents reimbursement for moving expenses paid to Mr. Buzogany in the amount of $7,041 and matching contributions made under the Company’s 401(K) plan in the amount of $2,850. |

| (14) | | Represents reimbursement for moving expenses paid to Mr. Buzogany. |

14

Option Grants in Last Fiscal Year

The following table presents each grant of stock options during the fiscal year ended December 31, 2003, to each of the named executive officers. All options were granted under our 2000 Stock Option Plan.

The potential realizable value is calculated based on the seven year term of the option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to the rules promulgated by the SEC and does not represent our estimate of future stock price performance. The potential realizable value of 5% and 10% appreciation are calculated by:

| | · | | Multiplying the number of shares of common stock under the option by the market price at grant date; |

| | · | | Assuming that the aggregate stock value derived from that calculation compounds at the annual 5% or 10% rate shown in the table until the expiration of the options; and |

| | · | | Subtracting from that result the aggregate option exercise price. |

Percentages shown under “Percentage of Total Options Granted to Employees in Fiscal Year” are based on an aggregate of 1,264,645 options granted to our employees and directors under the Company’s 2000 Stock Option Plan and 2002 Non-Qualified Stock Option Plan.

Individual Grants

| | | | | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted (1)

| | % of Total

Options

Granted to

Employees

in Fiscal

Year

| | | Exercise

or Base

Price

($/Share)

| | Market

Price on

Date of

Grant

| | Expiration Date

| | Potential Realizable

Value at Assumed Annual

Rates of Stock Price

Appreciation for Option

Term (2)

|

| | | | | | | 5%

| | 10%

|

Heinrich Gugger, Ph.D. | | 170,000 | | 13.4 | % | | $ | 0.24 | | $ | 0.24 | | 2/12/10 | | $ | 16,610 | | $ | 38,708 |

John E. Hamer, Ph.D | | 70,000 | | 5.5 | % | | $ | 0.24 | | $ | 0.24 | | 2/12/10 | | $ | 6,839 | | $ | 15,938 |

Philip R. Alfano | | 70,000 | | 5.5 | % | | $ | 0.24 | | $ | 0.24 | | 2/12/10 | | $ | 6,839 | | $ | 15,938 |

Thomas J. Colatsky, Ph.D | | 70,000 | | 5.5 | % | | $ | 0.24 | | $ | 0.24 | | 2/12/10 | | $ | 6,839 | | $ | 15,938 |

J. Barry Buzogany, Esq. | | 70,000 | | 5.5 | % | | $ | 0.24 | | $ | 0.24 | | 2/12/10 | | $ | 6,839 | | $ | 15,938 |

| (1) | | Options were granted pursuant to the Company’s 2000 Stock Option Plan. The options cliff vest as to 100% after seven years of service with the opportunity at the Board of Directors discretion for up to 100% acceleration of vesting at December 31, 2003. The vesting period commenced February 12, 2003. On February 13, 2004 the Board of Directors accelerated the vesting period for 100% of these options. |

| (2) | | The amounts shown in this table represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise. Actual gains, if any, on stock option exercises will depend on the future performance of the Common Stock, the optionee’s continued employment through the option period and the date on which the options are exercised. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table provides information regarding the exercises of options by each of the named executive officers during fiscal year 2003. In addition, this table includes the number of shares covered by both exercisable and unexercisable stock options as of December 31, 2003 and the values of “in-the-money” options, which values represent the positive spread (if any) between the exercise price of any such option and the fiscal year-end value of the Common Stock.

15

The following table includes options granted under the Company’s 1998 Stock Option Plan, 2000 Stock Option Plan and 2002 Non-Qualified Stock Option Plan.

| | | | | | | | | | | | | | |

Name

| | Shares Acquired

On Exercise

| | Value Realized

(1)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of the Unexercised In-The-Money Options at Fiscal Year-End (2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Heinrich Gugger, Ph.D | | — | | — | | 351,250 | | 118,750 | | $ | 248,975 | | $ | 26,125 |

John E. Hamer, Ph.D.(3) | | — | | — | | 366,302 | | 57,365 | | $ | 269,805 | | $ | 4,688 |

Thomas J. Colatsky, Ph.D. | | — | | — | | 128,333 | | 41,667 | | $ | 124,600 | | $ | 27,500 |

Philip R. Alfano | | — | | — | | 122,083 | | 47,917 | | $ | 128,808 | | $ | 39,292 |

J. Barry Buzogany, Esq. | | — | | — | | 122,083 | | 47,917 | | $ | 131,413 | | $ | 41,688 |

| (1) | | Amounts shown in this column do not necessarily represent actual value realized from the sale of the shares acquired upon exercise of the option because in many cases the shares are not sold on exercise but continue to be held by the executive officer exercising the option. The amounts shown represent the difference between the option exercise price and the market price on the date of exercise, which is the amount that would have been realized if the shares had been sold immediately upon exercise. |

| (2) | | The value of unexercised in-the-money options at fiscal year end assumes a fair market value for the Company’s Common Stock of $1.47, which was the closing sale price per share of the Company’s Common Stock as reported in the NASDAQ National Market System on December 31, 2003. |

| (3) | | Dr. Hamer resigned effective as of December 31, 2003. |

Equity Compensation Plan Information

The following table provides certain aggregate information with respect to all of the Company’s equity compensation plans in effect as of December 31, 2003.

| | | | | | | |

| | | (a) | | (b) | | (c) |

Plan category

| | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding securities

reflected in column (a))

|

Equity compensation plans approved by security holders (1) | | 3,519,251 | | $ | 1.63 | | 380,373 |

Equity compensation plans not approved by security holders (2) | | 310,600 | | | 1.03 | | 89,400 |

| | |

| |

|

| |

|

Total | | 3,829,851 | | $ | 1.58 | | 469,773 |

| (1) | | These plans consist of the Company’s 1998 Stock Option Plan, 2000 Stock Option Plan and the 2003 Stock Plan. |

| (2) | | Consists of the Company’s 2002 Non-Qualified Stock Option Plan. |

Employment Contracts, Termination of Employment and Change of Control Arrangements

In July 2002, we entered into an employment agreement with Heinrich Gugger which provides for a minimum annual base salary of $270,000 and an award of options to purchase 300,000 shares of Common Stock at an exercise price of $1.25 per share. So long as Dr. Gugger remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Dr. Gugger is also eligible for an annual cash bonus and a special one-time $70,000 cash incentive upon the achievement of mutually agreed upon objectives. The agreement also required us to pay Dr. Gugger an allowance for his relocation to Raleigh/Durham, North Carolina. The agreement provides that Dr. Gugger’s

16

employment may be terminated with or without cause at any time by Dr. Gugger or us. However, the agreement provides that if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Dr. Gugger secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

In August 2002, we entered into an employment agreement with Thomas Colatsky which provides for a minimum annual base salary of $215,000 and an award of options to purchase 100,000 shares of Common Stock at an exercise price of $0.81 per share. So long as Dr. Colatsky remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Dr. Colatsky is also eligible for an annual cash bonus upon the achievement of mutually agreed upon objectives. The agreement also required us to pay Dr. Colatsky an allowance for his relocation to Raleigh/Durham, North Carolina. The agreement provides that Dr. Colatsky’s employment may be terminated with or without cause at any time by Dr. Colatsky or us. However, if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Dr. Colatsky secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

In November 2002, we entered into an employment agreement with Philip Alfano which provides for a minimum annual base salary of $200,000 and an award of options to purchase 100,000 shares of Common Stock at an exercise price of $0.65 per share. So long as Mr. Alfano remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Mr. Alfano is also eligible for an annual cash bonus upon the achievement of mutually agreed upon objectives. The agreement provides that Mr. Alfano’s employment may be terminated with or without cause at any time by Mr. Alfano or us. However, if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Mr. Alfano secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

In November 2002, we entered into an employment agreement with Barry Buzogany which provides for a minimum annual base salary of $200,000 and an award of options to purchase 100,000 shares of Common Stock at an exercise price of $0.60 per share. So long as Mr. Buzogany remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Mr. Buzogany is also eligible for an annual cash bonus upon the achievement of mutually agreed upon objectives. The agreement also required us to pay Mr. Buzogany an allowance for his relocation to Raleigh/Durham, North Carolina. The agreement provides that Mr. Buzogany’s employment may be terminated with or without cause at any time by Mr. Buzogany or us. However, if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Mr. Buzogany secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

In January 2004, we entered into an employment agreement with Peter Johnson, M.D., which provides for a minimum annual base salary of $240,000 and an award of options to purchase 100,000 shares of Common Stock at a strike price determined on his first day of employment. So long as Dr. Johnson remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an

17

additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Dr. Johnson is also eligible for an annual cash bonus upon the achievement of mutually agreed upon objectives. The agreement provides that Dr. Johnson’s employment may be terminated, with or without cause, at any time by Dr. Johnson or us. However, if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Dr. Johnson secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

In January 2004, we entered into an employment agreement with Mark Braughler, which provides for a minimum annual base salary of $175,000 and an award of options to purchase 35,000 shares of Common Stock at a strike price to be determined on his first day of employment. So long as Dr. Braughler remains employed by the Company, these options vest over a period of 36 months with 25% of the shares vesting immediately, an additional 25% vesting after twelve months of service and the remaining 50% vesting over the following 24 months in equal monthly increments. Dr. Braughler is also eligible for an annual cash bonus upon the achievement of mutually agreed upon objectives. The agreement provides that Dr. Braughler’s employment may be terminated, with or without cause, at any time by Dr. Braughler or us. However, if we terminate his employment without cause, we must pay him the amount of his then current base salary until the earlier to occur of twelve months following the date of termination or the date on which Dr. Braughler secures comparable regular, full-time employment or a consulting engagement lasting for more than six months. If we experience a change of control after such a termination, all severance payments become immediately due and payable.

At the time of commencement of employment, all of our employees, including all of our officers, sign offer letters and employment agreements. These employment agreements provide for employment at will and contain standard provisions relating to confidential information and invention assignment by which the employee agrees not to disclose any confidential information received during his or her employment by us and that, with some exceptions, he or she will assign to us any and all inventions conceived or developed during employment.

The outstanding option agreements issued under our 1998 Stock Option Plan and 2000 Employee, Director and Consultant Stock Option Plan provide for accelerated vesting of options under certain circumstances in connection with a change of control (as defined in such option agreements). If an option holder’s employment is terminated by us for a reason other than for “cause” (as defined in the applicable stock option agreement) within 12 months of a subsequent change of control, that employee’s unvested options shall vest immediately upon such termination. If an option holder’s employment is terminated as a result of voluntary resignation, disability or death or is terminated by us for cause, then that employee’s unvested options shall cease to vest.

18

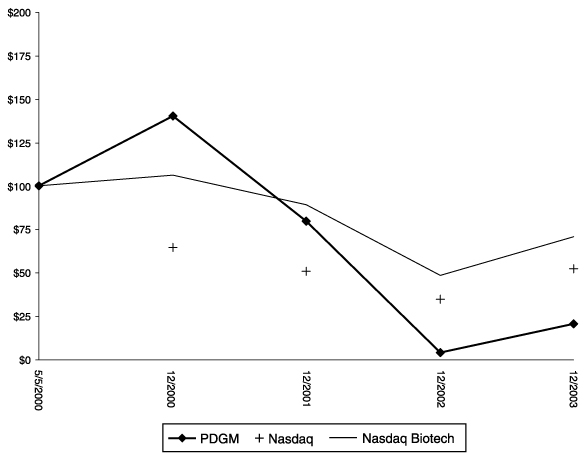

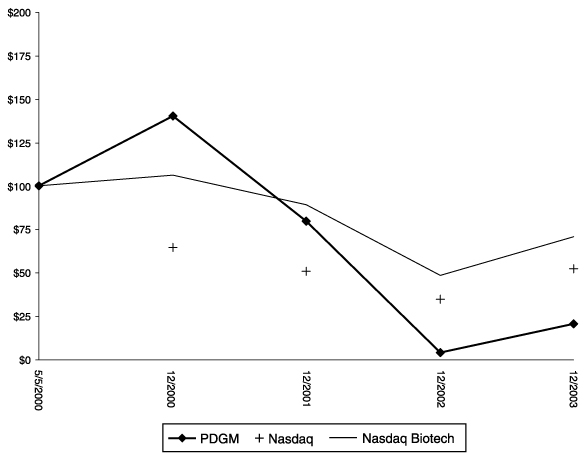

Performance Graph: Comparison of Cumulative Total Return

The graph set forth below compares the annual percentage change in the Company’s cumulative total stockholder return on its Common Stock between May 5, 2000 (the date the Common Stock commenced public trading) and December 31, 2003 with the cumulative total return of the NASDAQ Composite Index and the NASDAQ Biotechnology Index during the same period. This graph assumes the investment of $100 on May 5, 2000 in the Company’s Common Stock and each of the comparison groups and assumes reinvestment of dividends, if any. The Company has not paid any dividends on the Common Stock, and no dividends are included in the report of the Company’s performance. This graph is not “soliciting material,” is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934 whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. Information used on the graph was obtained from NASDAQ, a source believed to be reliable, but the Company is not responsible for any errors or omissions in such information.

| | | | | | | | | | | | | | | |

| | | May

2000

| | December

2000

| | December

2001

| | December

2002

| | December

2003

|

PDGM | | $ | 100 | | $ | 140.35 | | $ | 80.00 | | $ | 4.08 | | $ | 20.63 |

Nasdaq | | $ | 100 | | $ | 64.73 | | $ | 51.10 | | $ | 34.99 | | $ | 52.49 |

Nasdaq Biotech | | $ | 100 | | $ | 106.51 | | $ | 86.25 | | $ | 48.79 | | $ | 71.12 |

19

REPORT OF COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

Overview

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is composed entirely of Directors who are not current or former employees of the Company. The Compensation Committee is responsible for establishing and administering the Company’s executive compensation policies and the Company’s stock option and other employee equity plans. This report addresses the compensation policies for fiscal year 2003 as they affected Dr. Gugger, in his capacity as the President and Chief Executive Officer, and Director, and the other executive officers of the Company.

General Compensation Philosophy

The objectives of the Company’s executive compensation program are to:

| | · | | Attract, motivate and retain qualified executives and reward performance; |

| | · | | Reward executives for their contributions towards achieving the Company’s strategic goals; and |

| | · | | Align the interests of executives with the long-term interests of stockholders. |

Executive Officer Compensation Program

The Company’s executive officer compensation program is comprised of: (i) base salary, which is set on an annual basis; (ii) annual incentive bonuses, which are based on predetermined Company objectives and individual performance goals; and (iii) long-term incentive compensation in the form of periodic stock option grants, with the objective of aligning the executive officers’ long-term interests with those of the stockholders and encouraging the achievement of superior results over an extended period.

The Compensation Committee performs annual reviews of executive compensation to confirm the competitiveness of the overall executive compensation packages as compared with companies who compete with the Company for prospective employees.

In considering compensation of the Company’s executives, the Compensation Committee considers the anticipated tax treatment to the Company of various components of compensation. The Company does not believe Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), which generally disallows a tax deduction for certain compensation in excess of $1 million to any of the executive officers appearing in the Summary Compensation Table above, will have an effect on the Company. The Compensation Committee has considered the requirements of Section 162(m) of the Code and its related regulations. The Compensation Committee’s present policy is to take reasonable measures to preserve the full deductibility of substantially all executive compensation, to the extent consistent with its other compensation objectives.

Base Salary and Benefits