- HCKT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

The Hackett Group, Inc. (HCKT) CORRESPCorrespondence with SEC

Filed: 20 Oct 22, 12:00am

THE HACKETT GROUP, INC.

1001 Brickell Bay Drive, Suite 3000

Miami, Florida 33131

October 20, 2022

Via Email and EDGAR

Mr. Rufus Decker

Ms. Linda Cvrkel

Division of Corporation Finance

Office of Trade & Services

Securities and Exchange Commission

Mail Stop 3233

100 F Street, N.E.

Washington, D.C. 20549

| Re: | The Hackett Group, Inc. |

Form 10-K for the fiscal year ended December 31, 2021, filed March 4, 2022 |

Item 2.02 Form 8-K filed February 22, 2022 |

File No. 333-48123 |

Dear Mr. Decker and Ms. Cvrkel,

On behalf of The Hackett Group, Inc. (the “Company”), set forth below is the Company’s response to your comment letter dated September 22, 2022, relating to the Company’s Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission (the “SEC”) on March 4, 2022 (the “Form 10-K”) and the Company’s Item 2.02 Form 8-K filed with the SEC on February 22, 2022.

The responses are keyed to correspond to the numbered paragraphs in your comment letter, which have been retyped herein in bold for ease of reference.

Financial Statements

Note 1. Basis of Presentation and General Information

Segment Reporting, page 42

| 1. | We read your response to comment 1. We have objected to your conclusion that you have one operating segment and one reportable segment. This represents an error in previously issued financial statements, as defined in ASC 250-10-20. Please provide us with a detailed analysis explaining how you evaluated the materiality of this error on your financial statements and related disclosures for all periods presented. Also, separately address in detail how this error impacted your conclusions regarding the effectiveness of your disclosure controls and procedures and your internal control over financial reporting. Finally, provide us with the disclosures you plan to provide in your periodic reports with respect to this error. |

Response

In the third quarter of 2022, the Company reconsidered the guidance under ASC 280, Segment Reporting in response to the SEC comment letters dated July 29, 2022, and September 22, 2022. We acknowledge that the CODM received discrete financial information at the individual practice level for each period presented in the financial statements contained in the 2021 Form 10-K, and acknowledge that our conclusion that we had one operating segment and one reportable segment was an error. As a result of the incorrect evaluation of ASC 280, we omitted certain segment related disclosures in our historical financial statements.

As previously provided to the Staff in our response dated September 6, 2022, the Company reassessed the potential impact that our practices operated as one operating segment to its reporting units and determined that its reporting units would have been the same as the sixteen operating segments in each period presented in the 2021 Form 10-K as there is no lower-level component under the operating segments. The Company performed an analysis to re-allocate goodwill to the sixteen reporting units and conducted a retrospective goodwill impairment analysis for each period presented in the 2021 Form 10-K in which it was concluded that there was no impairment to goodwill. Based on the analysis performed, there was no impairment to goodwill noted because of changes to its reportable segment and resulting changes to its reporting units.

SAB 99 analysis

Management exercised its professional judgment and considered all relevant qualitative and quantitative factors to assess the impact to prior periods of the above-mentioned changes and the resulting omission of certain required segment disclosures. Per SAB 99, “A matter is ‘material’ if there is a substantial likelihood that a reasonable person would consider it important.” As detailed in the Financial Accounting Standards Board’s (“FASB”) Statement of Financial Accounting Concepts No. 2,

Qualitative Characteristics of Accounting Information, “the omission or misstatement of an item in a financial report is material if, in the light of surrounding circumstances, the magnitude of the item is such that it is probable that the judgment of a reasonable person relying on the report would have been changed or influenced by the inclusion of a correction of the item.” Under SAB 99, both quantitative and qualitative factors must be considered.

The Company historically grouped all practices under one operating and reportable segment: business and technology consulting services. After the reassessment in accordance with ASC 280, we acknowledge that each of the practices would qualify as an operating segment. The operating segments would then result in more than one reportable segment under the guidance of ASC 280.

The historical reporting of one consolidated segment resulted in omitted disclosures in the financial statements due to the incorrect evaluation of guidance in ASC 280. Reporting one segment did not properly reflect the required financial disclosures of certain service offerings of the Company, which may have impacted the financial statement users’ understanding of the Company’s operations and their assessment of the Company’s performance. In the previously issued financial statements, although the Company presented one reportable segment, it included disaggregated revenue data by three major groups: Strategy & Business Transformation (“S&BT”), ERP, EPM and Analytics (“EEA”), and International (“International”) in Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations and in earnings releases and investor calls. S&BT consisted of practices that offer S&BT Consulting and our IP based services in the US; EEA primarily consisted of practices that offer Oracle and SAP products and related services; International consisted of practices that offer S&BT Consulting services and IP based services outside the US. Management believes disclosure by those three groups provided sufficient information to the users to assess the Company’s performance by different product and service offerings and its performance in the international market. However, after our re-evaluation of segments under ASC 280, we acknowledge that the disclosure of one reportable segment and the additional disclosures of S&BT, EEA and International did not align with the definition of operating and reportable segments under ASC 280. However, we do not believe that there is a substantial likelihood that a reasonable person would have considered the omitted information (i.e., the presentation of the disaggregated reportable segments under ASC 280) important in making investment decisions about the Company.

While the quantitative disclosures which would have been required were omitted, the omission related only to disclosures and did not result in misstatement of the financial statements or of any reported financial results. We believe that the Company’s investors are focused on consolidated results, including trends that impact consolidated results. Since the omission of disaggregated reportable segment information did not mask any trends in the Company’s performance, we do not believe that the omission of disaggregated segment information would have changed how investors view the Company’s results of operations. This was further substantiated by our reassessed goodwill impairment testing performed at each practice level being considered reporting unit as no impairment was identified.

As mentioned above, we performed a retrospective goodwill impairment evaluation on the basis of acknowledging the sixteen practices were each operating segments and therefore each a separate reporting unit. We have concluded that goodwill was not impaired for any of the sixteen reporting units during fiscal years 2019, 2020 and 2021 as each reporting unit’s fair value exceeded its carrying amount.

Additionally, we have considered the following qualitative factors noted in SAB 99:

| • | whether the misstatement arises from an item capable of precise measurement or whether it arises from an estimate and, if so, the degree of imprecision inherent in the estimate |

Not applicable. The change in reportable segments resulted in omission of disclosures within the financial statements but it did not result in changes to any reported financial results. Segment analysis involves a significant amount of judgment and does not involve precise or estimated measurements.

| • | whether the misstatement masks a change in earnings or other trends |

The change in reportable segments does not impact the Company’s earnings or other trends.

| • | whether the misstatement hides a failure to meet analysts’ consensus expectations for the enterprise |

The change in reportable segments does not hide a failure to meet analysts’ consensus expectations for the enterprise.

| • | whether the misstatement changes a loss into income or vice versa |

The change in reportable segments does not impact the consolidated financial results of the Company.

| • | whether the misstatement concerns a segment or other portion of the registrant’s business that has been identified as playing a significant role in the registrant’s operations or profitability |

The misstatement impacts the disclosure of disaggregated segment information. Although change in segment disclosure does not affect the Company’s overall operations or profitability, it did impact readers’ understanding of how individual reportable segments would have impacted the Company’s operations or profitability. Disaggregated segment disclosure would have been more informative and would have provided users with some additional insights to the Company’s performance at a more detailed level. However, this was mitigated by the presentation of revenue data for S&BT, EEA and International.

| • | whether the misstatement affects the registrant’s compliance with regulatory requirements |

The misstatement does not impact the Company’s compliance with any regulatory requirements.

| • | whether the misstatement affects the registrant’s compliance with loan covenants or other contractual requirements |

Not applicable. The Company’s loan covenants or other contractual requirements do not pose requirements on specific segments and are only based on the consolidated results of the Company.

| • | whether the misstatement has the effect of increasing management’s compensation – for example, by satisfying requirements for the award of bonuses or other forms of incentive compensation |

Management’s compensation and bonus are not based on practice level performance, but instead are based the Company’s consolidated non-GAAP diluted EPS measured against pre-established targets. As such, the historical omission of operating segment disclosure based on practice would not have impacted management’s compensation.

| • | whether the misstatement involves concealment of an unlawful transaction. |

Not applicable. The change in reportable segments and reporting units does not impact cash flows and does not otherwise conceal an unlawful transaction.

As acknowledged above, we conclude that the omitted segment disclosures represent an error in applying the guidance under ASC 280. Although the Company historically presented one reportable segment, we believe users of the financial statements received similar revenue metrics and additional data for different product and service offerings within our Form 10-K and our earnings calls. Therefore, based on our assessment of both quantitative and qualitative factors assessed, the historical financial statements are not materially misstated and we do not believe restatement of previously issued financial statement is required. We will adjust our reportable segments prospectively beginning in the third quarter 2022 Form 10-Q and present in all future quarterly filings the comparative prior period information on this same basis.

Control considerations

While we have concluded that the omitted disclosures are not material to the historical financial statements and do not require restatement of previously issued financial statements, we have assessed the impact of the omitted disclosures on the Company’s internal control over financial reporting. Based on this assessment, we identified a material weakness over internal control over financial reporting. The material weakness is a result of our processes and related controls not operating effectively to understand the use of the information by the CODM to allocate resources and the documentation of the evaluation of ASC 280. We concluded that this material weakness existed as of December 31, 2021. Based on the existence of this material weakness which has not been remediated, we determined that our disclosure controls and procedures were not effective as of December 31, 2021, April 1, 2022, July 1 2022, and September 30, 2022.

Planned disclosures the Company plans to provide in its periodic reports with respect to this error

Consolidated Financial Statements

As discussed above, we believe the omitted disclosures related to segment reporting do not have a material impact to the Company’s historical consolidated financial results for each of the respective fiscal years presented in the Annual Report on Form 10-K filed on March 4, 2022. As explained in more detail in the Company’s response to Comment #2, during the third quarter of 2022, the Company reorganized its reporting structure to closely align to its core solutions. This resulted in certain organizational changes to affect this reorganization. Beginning with the third quarter 2022 Form 10-Q, the Company will report three reportable segments as well as all comparative periods presented.

Disclosure of the Error and Material Weakness

The Company plans to promptly file a Form 10-K/A to amend its Annual Report on Form 10-K as filed on March 4, 2022 to amend and restate Part II, Item 9A (Controls and Procedures) to: (a) update our conclusions regarding the effectiveness of our disclosure controls and procedures and our internal control over financial reporting as a result of the material weakness, and (b) include the restated attestation report of RSM US LLP, our independent registered public accounting firm, regarding our internal control over financial reporting as a result of the material weakness. In addition, as required by Rule 12b-15, the certifications required by Rule 13a-14(a) will also be filed as exhibits to the Form 10-K/A. The Form 10-K/A will not include restated financial statements due to the Company’s conclusion that the error was immaterial. We are supplementally providing a draft of the relevant sections of the Form 10-K/A.

| 2. | Your response to comment 1 indicates that you plan to change to three reportable segments (SB&T-US, EEA and International) beginning in the third quarter of 2022. Please provide us with a detailed analysis of how you determined your new operating and reportable segments pursuant to ASC 280. As part of this, describe any changes to the structure of the organization and how the CODM will manage the business, including the segment measure of profitability that the entity will utilize. Explain how your CODM will allocate resources and assess performance. |

| Tell us how your budgeting process will be conducted, the organization levels that budget to actual results will be presented for budget monitoring purposes throughout the year and the frequency of your CODM’s budget monitoring process. Explain what financial information will be provided to your Board, including the organization levels at which it will be presented and the frequency it will be provided. Furthermore, provide us with sample disclosures showing what you plan to disclose in the segment footnote of your upcoming Form 10-Q. |

Response

In our response letter dated September 6, 2022, we indicated a plan to change to three reportable segments (S&BT-US, EEA and International). After further consideration on how our CODM effectively manages the business, we have decided to operationally change the Company’s organizational structure into three operating and reportable segments based on the main solutions that we offer: (1) Global Strategy & Business Transformation (“Global S&BT”), (2) Oracle Solutions, and (3) SAP Solutions. Our solutions noted here are comprised of skill sets housed in individual practices that are sold and deployed leveraging our intellectual property to clients who are considering enterprise performance improvement initiatives which require business process and technology transformation.

Global S&BT segment

Within the Global (US and International) S&BT segment, we offer the following primary competencies/offerings:

| • | S&BT Consulting |

| • | Benchmarking |

| • | Business Advisory Services (“BAS”) |

| • | IP as a Service (“IPaaS”) |

These offerings rely on the same IP that is contained in the Quantum Leap (“QL”) and Digital Transformation Platforms (“DTP”) which support the delivery of all of the offerings within Global S&BT.

The inclusion of our Benchmarking and BAS services with S&BT Consulting is driven by the close integration of the respective offerings as well as the interdependency of the components included in the sale and delivery of the most significant revenue generating solutions. Those solutions offer clients the ability to discover 1) opportunities to improve using QL and DTP to measure performance, 2) the implementation process of the required process changes utilizing our S&BT consulting group, and 3) the continuous support through our BAS offerings. The S&BT Consulting professionals utilize benchmarking and the IP from our QL and DTP to deliver its services. These platforms support the most Hackett solutions, which are to empirically and efficiently determine the performance improvement opportunities for clients as well as the best practices and process flows required to deliver these solutions. This IP allows us to offer clients an outcome based on proven practices (i.e., significant assurance that the value realization targeted can be achieved). Conversely, our Benchmarking and BAS offerings rely on the applied knowledge and expertise of our S&BT Consulting professionals to develop the key insights delivered through these offerings. Our Hackett Institute (“THI”) offering is comprised of global business services educational courses that leverage our best practice IP. In addition, we have begun to license our IP to third parties, which we refer to as IPaaS. Additionally, the sales personnel for these services are highly dependent on the demand generation and sales (direct and cross-sale) of all the practices within this operating segment. These interdependencies also pertain to the OneStream component which has historically reported up through the S&BT segment leaders and usually include S&BT consultants as part of their implementations. Our most significant resource allocation investment initiatives over the last 10 years have been the development and digitization of our performance improvement IP included within our QL and DTP which is utilized and benefits all of the components within Global S&BT.

Technology based Oracle and SAP segments

The Company’s remaining competencies will be organized in practices that support two fundamentally distinct ERP systems: Oracle and SAP. Additionally, the implementation skills and the understanding of the features and functionality of Oracle and SAP are unique and distinct to each ERP system and require employee skillsets that are not interchangeable between the two systems. As a result of these factors, the Company has reorganized the two ERP solutions into two separate operating segments, Oracle Solutions, and SAP Solutions.

Management view of the business

Our internal reporting reorganization around these three segments represents how our CODM effectively manages the business and:

| • | Assesses and develops business strategies, |

| • | Determines which comprehensive offerings to market within each of the segments, |

| • | Prioritizes investments and allocation of Company resources, and |

| • | Measures performance. |

More specifically, our CODM’s primary focus is to determine where to invest and allocate resources to the offerings that will best leverage our unique IP and talent to generate revenue growth and profitability that optimizes shareholder value.

As a result, when our CODM evaluates the results and performance, it is segment centric, focused on top line revenue growth and profitability of each of these segments and whether the Company was able to bring to bear the full capabilities within each of these segments completely. Further, our investors and other users of the financial statements will find this information more relevant, consistent, and useful as it is aligned directly to how management operates the business and clearly distinguishable solutions compared to the previously indicated S&BT-US, EEA, and International groupings.

Internal reorganization

To align the organization to the way our CODM effectively manages the business, we have made the following organizational changes:

| • | We have reorganized our practices into three operating segments that will be overseen by segment managers who will report to our COO. Their responsibilities will include working with the practice line leaders and the COO to develop budgets, determine resource needs, practice line level allocation of assigned resources to their segment, evaluate performance against budget and put in action any remediation plans in conjunction with service line leaders. |

| • | Our segment managers will work with practice leaders to develop annual budgets for each practice line. Our COO and segment managers will be responsible for approving or revising practice budgets to aggregate them into segment budgets which then will be provided to our CODM for review and approval. The CODM’s review will not include a review or approval of individual practice budgets. |

| • | Our Board of Directors, as well as the CODM, will be provided the same segment results on a quarterly and year to date basis compared to the annual plan/budget. |

| • | Our CODM will evaluate the performance of these segments against plan and budget using the following metrics which will be provided only at the segment level and will not comprise any other level (e.g., practice line information): |

| • | Revenue growth and profitability of each of the three segments as well as consolidated results compared to plan/budget. |

| • | Evaluating segment solutions and sales effectiveness to ensure that full and collective capabilities of the segment are being optimized and that any investment changes required are implemented. |

| • | Evaluating acquisitions and strategic partner opportunities that will accelerate growth and profitability. |

| • | Evaluating capital allocation strategies. |

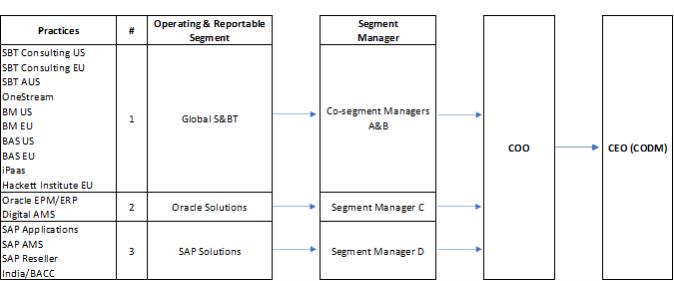

The table below illustrates the newly reorganized three operating and reportable segments, the underlying practices, and the reporting structure that reflect the transition to the above mentioned three segments. This organizational structure and reportable segments represent our primary marketed solutions and best reflect the solution-centric approach of how we operate the Company. The internal re-organization was substantially complete as of the end of the third quarter of 2022.

Changes to reporting package

In addition to the structural and organizational changes that have been made to the Company to reflect how our CODM effectively manages the business, we are also reorganizing the financial reporting packages being presented to our CODM and Board of Directors. The reporting package will only include segment level financial information and performance measures which better represents the data used by the CODM to understand go to market solution success and to make strategic decisions in order to manage the Company. The measure of profitability for the segment will include non-GAAP operating profit which excludes certain non-cash items and one-time expenses. The CODM reporting package will no longer contain practice level information and will only provide condensed financial information related to the three reportable segments. The CODM has not received and will not receive any practice level information related to actual results for the third quarter at the practice level.

Additionally, this same financial reporting package that will be presented to the CODM and the Board of Directors includes five metrics at the three operating and reportable segment levels: (1) revenue excluding reimbursable expenses, (2) non-GAAP metrics of cost of sales, (3) gross margin, (4) non-GAAP metrics of SG&A expenses, and (5) segment contribution. These five metrics are provided on a quarterly basis at the operating segment level and will include: a) actuals for the quarter, and b) year-to-date basis compared against the annual plan/budget. Additionally, the CODM will receive this information at the segment level compared against our quarterly forecast. No practice level information will be provided to either the Board of Directors or the CODM.

We have further evaluated this reorganization and its impact in technical determination of operating and reportable segments under ASC 280 as follows:

ASC 280 Segment Reporting Analysis

Our analysis of operating and reportable segments in accordance with ASC 280 is as follows:

Operating Segment Analysis

Per ASC 280-10-50-1, an operating segment is a component

1(a) – That engages in business activities from which it may earn revenues and incur expenses – each of these three segments engage in business activities through provision of services to our customers, earn revenues and incur expenses.

1(b)—Whose operating results are regularly reviewed by the enterprise’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance – starting from the third quarter of fiscal year 2022, our CODM will review financial information as part of the quarterly reporting package at the three segment solution levels to make specific resource or capital allocations that directly impact the performance of each operating segment. Discrete financial information at the practice level will no longer be included in the quarterly reporting package.

1(c) – For which discrete financial information is available – discrete financial information is available for the three operating segments and will continue to be reported to our CODM on a quarterly basis. Discrete financial information at the practice level will no longer be included in quarterly reporting package.

Reportable Segment Analysis

We have considered the aggregation criteria for operating segments below.

Per ASC 280-10-50-11: Two or more operating segments may be aggregated into a single operating segment if aggregation is consistent with the objective and basic principles of ASC 280, if the segments have similar economic characteristics, and if the segments are similar in all of the following areas:

a. The nature of the products and services – each of the operating segments represent the Company’s distinct service and product offerings.

b. The nature of the production processes – not applicable to the Company.

c. The type or class of customer for their products and services – the type of customer for each operating segment is different. Global S&BT targets customers who would benefit from for our Consulting, Benchmarking, BAS, IPaaS and THI offerings. Oracle Solutions and SAP Solutions target different customers with distinct needs for either Oracle or SAP products which are normally pursued through the respective software companies’ sales channels.

d. The methods used to distribute their products or provide their services – product distribution and service delivery methods are different for each operating segment due to their different software or functional skills required.

e. If applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities – not applicable to the Company.

In addition, ASC 280-10-50-18A states “An entity need not aggregate similar segments, and it may present segments that fall below the quantitative thresholds.” Each of the three operating segments represent over 10 percent of the Company’s consolidated revenues in fiscal year 2021 and the first three quarters in fiscal year 2022, which management estimates will continue in the future. Their total revenues represent 100 percent of the Company’s consolidated revenues, as such the 75 percent revenue threshold is met.

To conclude, each of the three operating segments represents a distinct service/product offering. They do not meet all the aggregation criteria and more importantly, management believes reporting each of these three solutions as a separate segment are the most meaningful way for readers of the financial statements to understand the Company’s major solutions/service offerings and assess its performance. Therefore, we determine each of the three operating segments will be a reportable segment.

Additionally, in response to the comment on providing sample disclosures showing what the Company plans to disclose in the segment footnote of our upcoming Form 10-Q, we have prepared the following sample disclosures:

Sample Disclosures in Form 10-Q

Note 1- Basis of Presentation and General Information

Segment Reporting

The Company has re-assessed its operating segments under the management approach in accordance with ASC 280 and has determined that effective in the third quarter of 2022, it has three reportable segments: (1) Global Strategy & Business Transformation (“Global S&BT”), (2) Oracle Solutions, and (3) SAP Solutions. See Note 12 “Segment Information and Geographic Data” for detailed segment information.

Note 12 - Segment Information and Geographic Data

Effective in the third quarter of fiscal year 2022, the Company has reorganized its operating model to align with its core market driven solutions. Due to the reorganization, the Company re-assessed its operating segments under the management approach in accordance with ASC 280 and has determined that the Company has three operating segments and three reportable segments: (1) Global S&BT, (2) Oracle Solutions, and (3) SAP Solutions. Global S&BT includes the results of the Company’s strategic business consulting practices; Oracle Solutions includes the results of the Company’s Oracle EPM/ERP and Digital AMS practices; SAP Solutions includes the Company’s SAP applications and related SAP service offerings.

Due to the change in reportable segments, the Company has presented the segment information for the three and nine months ended September 30, 2022, and October 1, 2021, respectively. The SAP Solutions reportable segment is the only segment that contains software license sales.

The accounting policies of the reportable segments are the same as those described in the summary of significant accounting policies (see Note 1). The Company evaluates the performance of these reportable segments based on their revenue, operating income, and operating margins, excluding any unusual or infrequent items, if any. The measurement criteria for segment profit or loss and segment assets are substantially the same for each reportable segment. Segment operating income consists of the revenues generated by a segment, less operating expenses that are incurred directly by the segment. Unallocated costs include corporate costs related to administrative functions that are performed in a centralized manner that are not attributable to a particular segment. Segment information related to assets has been omitted as the CODM does not receive discrete financial information regarding assets at the segment level.

Information regarding the three reportable segments and geographical information was as follows (in thousands):

| Quarter Ended | Nine Months Ended | |||||||||||||||

| September 30, | October 1, | September 30, | October 1, | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

Global S&BT: | ||||||||||||||||

Total revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income as a percentage of segment total revenue | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||

Oracle Solutions: | ||||||||||||||||

Total revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income as a percentage of segment total revenue | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||

SAP Solutions: | ||||||||||||||||

Total revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income | $ | — | $ | — | $ | — | $ | — | ||||||||

Operating income as a percentage of segment total revenue | 0 | % | 0 | % | 0 | % | 0 | % | ||||||||

Total Company: | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

| |||||||||

Segment operating income | $ | — | $ | — | $ | — | $ | — | ||||||||

Items not allocated at segment level: | ||||||||||||||||

Other operating expenses | ||||||||||||||||

Non cash compensation | ||||||||||||||||

Depreciation and amortization | ||||||||||||||||

Interest expense | ||||||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income from continuing operations before taxes | $ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

| |||||||||

| Quarter Ended | Nine Months Ended | |||||||||||||||

| September 30, | October 1, | September 30, | October 1, | |||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

United States | $ | — | $ | — | $ | — | $ | — | ||||||||

Europe | — | — | — | — | ||||||||||||

Other (Australia, Canada, India and Uruguay) | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

| |||||||||

| September 30, | December 31, | |||||||

| 2022 | 2021 | |||||||

Long-lived assets: | ||||||||

United States | — | — | ||||||

Europe | — | — | ||||||

Other (Australia, Canada, India and Uruguay) | — | — | ||||||

|

|

|

| |||||

Total long-lived assets | $ | — | $ | — | ||||

|

|

|

| |||||

* * *

We hope that the foregoing has been responsive to the Staff’s comments. Should you have any questions relating to any of the foregoing, please direct such questions to the undersigned at (786) 497-7820 or rramirez@thehackettgroup.com.

| Sincerely, |

/s/ Robert A. Ramirez |

| Robert A. Ramirez |

| Executive Vice President, Finance and Chief Financial Officer |