EXHIBIT 2

orange capital Orange Capital ’s Independent Perspectives on Strategic Hotels & Resorts November 20, 2013 www.BEE - strategic.com

orange capital Table of Contents [ 1 ] I. Executive Summary II. Strategic Hotels Has Significantly Underperformed III. History of Poor Corporate Governance IV. Orange Capital’s Recommendations V. Orange Capital’s Nominees for Strategic Hotels VI. Appendix NAV Analysis of Strategic Hotels’ Individual Portfolio Holdings Strategic Hotels’ Peers

orange capital Additional Information Orange Capital, LLC, Orange Capital Master I, Ltd . and Daniel Lewis (collectively, “Orange Capital”) intend to file with the Securities and Exchange Commission (the “SEC") a definitive proxy statement and accompanying proxy card to be used to solicit proxies from the stockholders of Strategic Hotels & Resorts, Inc . (the “Company") in connection with the Company's 2014 annual meeting of stockholders . All stockholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by Orange Capital, Daniel Lewis, David W . Johnson, John Lyons, R . Mark Woodworth, and Russell Hoffman (collectively, the “Participants") when they become available because they will contain important information, including additional information related to the participants . When completed, the definitive proxy statement and form of proxy will be furnished to some or all of the stockholders of the Company and will, along with other relevant documents, be available at no charge on the SEC's web site at http : //www . sec . gov . In addition, Orange Capital will provide copies of the definitive proxy statement and accompanying proxy card (when available) without charge upon request . Information about the participants and a description of their direct or indirect interests by security holdings will be contained in Exhibit 4 to the Schedule 14 A to be filed by Orange Capital with the SEC on November 20 , 2013 . This document can be obtained free of charge from the sources indicated above . [ 2 ]

orange capital Forward - Looking Statements Orange Capital and its affiliates do not assume responsibility for investment decisions . This presentation does not recommend the purchase or sale of any security . Under no circumstances is this presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security . The participants include funds and accounts that are in the business of trading – buying and selling – public securities . It is possible that there will be developments in the future that cause one or more of the participants from time to time to sell all or a portion of their shares in open market transactions or otherwise (including via short sales), buy additional shares (in open market or privately negotiated transactions or otherwise) or trade in options, puts, calls or other derivative instruments relating to such shares . Orange Capital reserves the right to change any of its opinions expressed herein at any time as it deems appropriate . Orange Capital disclaims any obligation to update the information contained herein . Orange Capital has not sought or obtained consent from any third party to use any statements or information indicated in this presentation as having been obtained or derived from statements made or published by third parties . Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein . Orange Capital may have relied upon certain quantitative and qualitative assumptions when preparing the analysis which may not be articulated as part of the analysis . The realization of the assumptions on which the analysis was based are subject to significant uncertainties, variabilities and contingencies and may change materially in response to small changes in the elements that comprise the assumptions, including the interaction of such elements . Furthermore, the assumptions on which the analysis was based may be necessarily arbitrary, may be made as of the date of the analysis, do not necessarily reflect historical experience with respect to securities similar to those that may be contained in the analysis, and do not constitute a precise prediction as to future events . Because of the uncertainties and subjective judgments inherent in selecting the assumptions on which the analysis was based and because future events and circumstances cannot be predicted, the actual results realized may differ materially from those projected in the analysis . Nothing included in this analysis constitutes any representation or warranty by Orange Capital as to future performance . The information that is contained in the analysis should not be construed as financial, legal, investment, tax, or other advice . You ultimately must rely upon your own examination and that of your professional advisors, including legal counsel and accountants as to the legal, economic, tax, regulatory, or accounting treatment, suitability, and other aspects of the analysis . [ 3 ]

I. Executive Summary

orange capital Executive Summary: Overview of Orange Capital ▪ Orange Capital, LLC ("Orange Capital") is a New York - based investment firm ▪ Orange Capital was co - founded in 2005 by Daniel Lewis and Russell Hoffman ▪ Orange Capital has a successful history of activism in REITs to maximize shareholder returns and improve corporate governance ▪ Prior to founding the firm, Orange Capital's portfolio manager, Mr. Lewis, was a senior member of Citigroup's Global Special Situations Group ▪ Mr. Lewis has 17 years of investment experience [ 5 ] “The campaign we are leading at Strategic Hotels is about restoring credibility to the Board and maximizing value for shareholders.” - Daniel Lewis, Orange Capital

orange capital Executive Summary: Overview of Strategic Hotels ▪ Strategic Hotels & Resorts, Inc. (“Strategic,” “Strategic Hotels,” or “the Company”) is a Chicago - based Real Estate Investment Trust (REIT) that is traded on the New York Stock Exchange ▪ Strategic Hotels owns interests in 18 luxury hotels and resorts comprised of 8,271 rooms (6,743 rooms based on equity ownership in the assets), primarily located in high barrier - to - entry urban and resort markets in the United States, Mexico, and Europe – 15 properties owned in fee simple, comprised of 7,367 rooms (6,117 rooms based on equity ownership) – 2 properties owned subject to ground leases, comprised of 626 rooms – 1 leasehold property interest (as lessor ), comprised of 278 rooms – The asset base is US - focused, with 15 properties contributing roughly 90% of total Adj. EBITDA ▪ Strategic is considered by investors to be the only pure - play, upscale, luxury - focused public lodging REIT ▪ Strategic’s portfolio properties include: [ 6 ] Note: The Marriott Hamburg is a leasehold Source: Strategic Hotels’ SEC filings

orange capital Executive Summary: Orange Capital’s Perspective on Strategic Hotels ▪ Strategic Hotels has underperformed its peers (1) and has persistently traded at a large discount to estimated Net Asset Value (NAV) ▪ We believe the Company’s underperformance is directly linked to its poor governance and the lack of an effective strategy to maximize shareholder value ▪ In our opinion, the Board of Directors (the “Board”) lacks credibility with investors ▪ We believe the intrinsic value of Strategic’s assets are worth up to $14 per share and that a reconstituted Board can unlock significant value by following our recommendations ▪ Orange Capital is nominating a minority slate of directors , independent of the Company, who have pledged to focus on enhancing value for all shareholders [ 7 ] We believe Strategic could realize up to a 40% increase in share price for shareholders (1) See Appendix for list of selected peers

orange capital Executive Summary: We Believe Strategic Hotels Has Structural Challenges ▪ We believe Strategic has significant overhead expense relative to its current needs ▪ We are skeptical about Strategic’s ability to compete effectively as an acquisition/growth vehicle ▪ We believe the Company has a high cost of capital relative to others we view as acquirers of luxury real estate assets, including sovereign wealth funds, pension funds, and high net - worth individuals – implying the Company’s assets are likely worth more to others than in the public markets ▪ We believe the current management team lacks the relevant experience to identify and acquire accretive luxury real estate assets ▪ The current portfolio lacks consistency from a combined mix of iconic, stabilized, luxury assets with upscale, short - term value - driven properties – We believe this inconsistency makes the overall vehicle less attractive to investors [ 8 ] Strategic will benefit from a fresh perspective

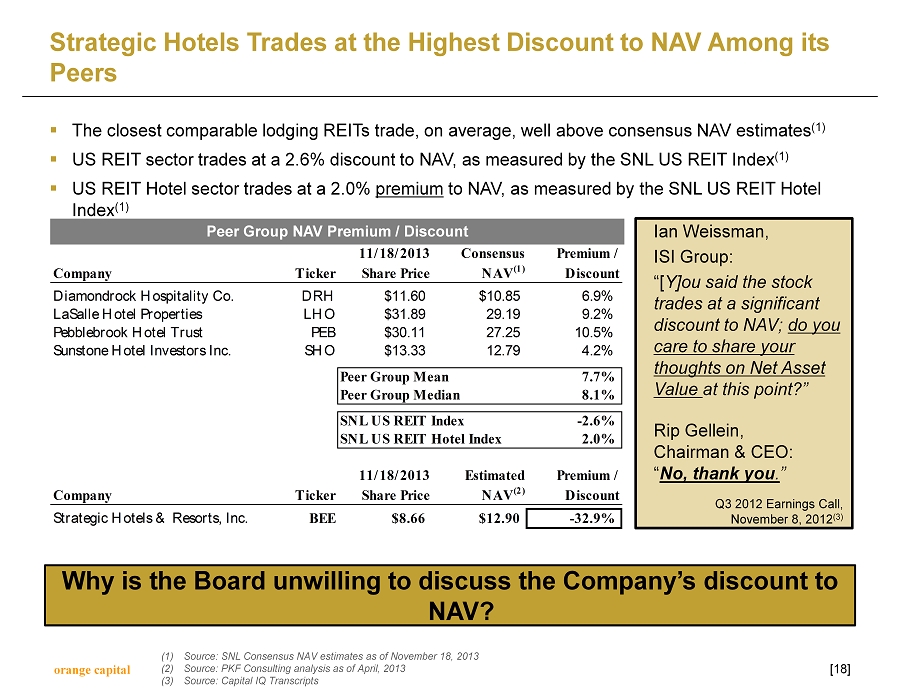

orange capital Executive Summary: Strategic Hotels Has Significantly Underperformed [ 9 ] ▪ Strategic Hotels trades at a 28% - 37% discount to NAV, as estimated by PKF Consulting 1 ▪ The Company has failed to publicly articulate a strategy to close the share price discount to NAV ▪ Despite our multiple requests, the Company has not responded to market rumors of a sale process, which we believe are influencing the share price ▪ Our financial advisor, Houlihan Lokey, has raised questions as to whether the rumored sale “process” was carried out in a manner to enhance shareholder value (1) Source: SNL Consensus NAV estimates as of November 18, 2013 (2) Source: PKF Consulting analysis as of April 2013 - 100% - 80% - 60% - 40% - 20% 0% 20% Historical Total Shareholder Return (11/2/2007 through 11/2/2012) – Monthly Chart Peer Group NAV Premium / Discount 11/18/2013 Consensus Premium / Company Ticker Share Price NAV (1) Discount Diamondrock Hospitality Co. DRH $11.60 $10.85 6.9% LaSalle Hotel Properties LHO $31.89 29.19 9.2% Pebblebrook Hotel Trust PEB $30.11 27.25 10.5% Sunstone Hotel Investors Inc. SHO $13.33 12.79 4.2% Peer Group Mean 7.7% Peer Group Median 8.1% SNL US REIT Index -2.6% SNL US REIT Hotel Index 2.0% 11/18/2013 Estimated Premium / Company Ticker Share Price NAV (2) Discount Strategic Hotels & Resorts, Inc. BEE $8.66 $12.90 -32.9%

orange capital Executive Summary: History of Poor Corporate Governance ▪ Strategic has a history of problematic compensation practices, highlighted by a failed say - on - pay vote in 2013 ▪ Institutional Shareholder Services (“ISS”) and Glass Lewis have repeatedly expressed concerns about Strategic’s corporate governance ▪ The Board did not interview a single outside candidate for the CEO position when it became vacant (1) ▪ The Board has had consistently low director support at their annual shareholder meetings, including a mere 66.1% average support at the 2013 annual meeting (2) ▪ The Company maintains numerous structural defenses which we believe serve to entrench Management and the Board [ 10 ] (1) Source: Special Call of the Company, November 2, 2012; Capital IQ Transcripts (2) See slide 35 for detailed analysis

orange capital Executive Summary: Orange Capital’s Recommendations ▪ Explore strategic alternatives ▪ Set strategy for closing the share price discount to NAV ▪ Adopt best practices of corporate governance [ 11 ] “Strategic Hotels has some irreplaceable assets. With the execution of just a few fundamental steps, we believe the Company can create tremendous value for shareholders.” - Daniel Lewis, Orange Capital

orange capital Mark Woodworth – President of PKF Hospitality Research Portfolio Construction Executive Summary: Orange Capital’s Nominees for Strategic Hotels [ 12 ] John D. Lyons – Founder & Principal of Granite Realty Advisors Exploring Strategic Alternatives Daniel Lewis – Managing Partner of Orange Capital, LLC Establishing Shareholder Accountability Dave Johnson – CEO of Aimbridge Hospitality Setting a Focused Strategy

II. Strategic Hotels Has Significantly Underperformed

orange capital Strategic Hotels Has Significantly Underperformed Its Peers [ 14 ] Source: Bloomberg as of November 18, 2013 Note: See Appendix for list of selected peers -100% -80% -60% -40% -20% 0% 20% Historical Total Shareholder Return (11/2/2007 through 11/2/2012) – Monthly Chart - Strategic Hotels - Selected Peer Group - MSCI US REIT Index - Russell 3000 Index - 70.2% - 30.2% +5.8% +16.4%

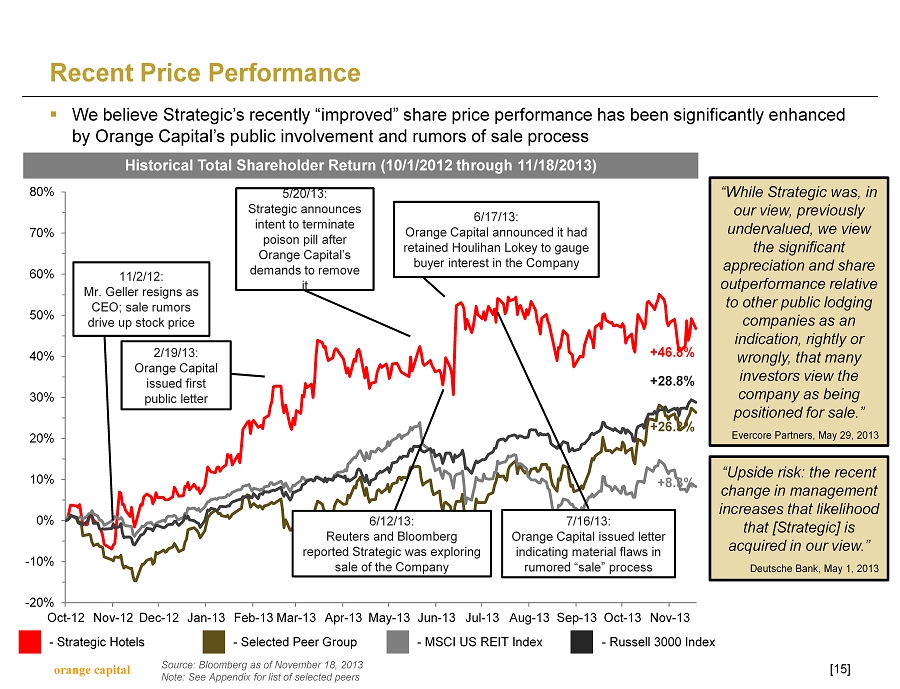

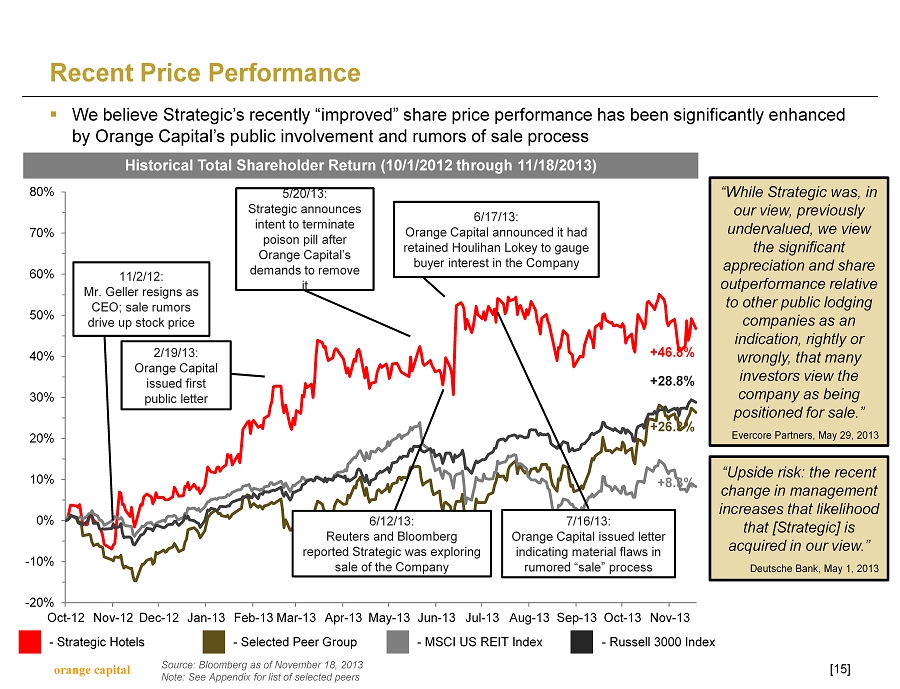

orange capital -20% -10% 0% 10% 20% 30% 40% 50% 60% 70% 80% Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Recent Price Performance [ 15 ] Historical Total Shareholder Return (10/1/2012 through 11/18/2013) 6/17/13: Orange Capital announced it had retained Houlihan Lokey to gauge buyer interest in the Company 2/19/13: Orange Capital issued first public letter 11/2/12: Mr. Geller resigns as CEO; sale rumors drive up stock price 7/16/13: Orange Capital issued letter indicating material flaws in rumored “sale” process 6/12/13: Reuters and Bloomberg reported Strategic was exploring sale of the Company 5/20/13: Strategic announces intent to terminate poison pill after Orange Capital’s demands to remove it +46.8% +26.3% +28.8% +8.3% Source: Bloomberg as of November 18, 2013 Note: See Appendix for list of selected peers - Strategic Hotels - Selected Peer Group - MSCI US REIT Index - Russell 3000 Index “While Strategic was, in our view, previously undervalued, we view the significant appreciation and share outperformance relative to other public lodging companies as an indication, rightly or wrongly, that many investors view the company as being positioned for sale.” Evercore Partners, May 29, 2013 “Upside risk: the recent change in management increases that likelihood that [Strategic] is acquired in our view.” Deutsche Bank, May 1, 2013 ▪ We believe Strategic’s recently “improved” share price performance has been significantly enhanced by Orange Capital’s public involvement and rumors of sale process

orange capital 0% 1% 2% 3% 4% Unlike All of Its Peers, Strategic Has Not Resumed Paying Dividends [ 16 ] Dividend Yield (11/18/2009 – 11/18/2013) - Strategic (Common) - Selected Peer Group (Common) 0.0% 2.6% Source: Capital IQ as of November 18, 2013 Note: See Appendix for list of selected peers Strategi c

orange capital Strategic Hotels Is Trading at a Significant Discount to PKF Consulting’s Net Asset Value ▪ The chart below demonstrates what we believe is the disparity between the current trading price and the Company’s underlying asset value ▪ Shareholders have been subjected to an approximately 28% to 37% discount to PKF Consulting’s NAV , which we believe is due to Strategic’s bloated cost structure, lack of an effective plan, and high cost of capital relative to the private market [ 17 ] PKF Consulting’s Summary Net Asset Value as of April, 2013 (1) Source: Capital IQ Transcripts Note: See appendix for values of individual assets Jeffrey Donnelly, Wells Fargo: “ [I]s your sense that there is unusually wide discount in this portfolio versus your peers or do you think it's more in line? ” Rip Gellein , Chairman & CEO: “ I don't think I want to comment on our peers at the moment.” Special Call, November 2, 2012 (1) ($ in thousands, except per share values) Low Medium High Total Value: Urban Hotels $2,509,000 $2,606,000 $2,726,000 Add: Total Value: Resorts 1,642,000 1,707,000 1,776,000 Less: Property-Level Debt (1,267,000) (1,267,000) (1,267,000) Owned-Hotel Equity Value $2,884,000 $3,046,000 $3,235,000 Add: Land Value 78,000 78,000 78,000 Add: Cash and Cash Equivalents 74,700 74,700 74,700 Add: Pro Rata Cash from JVs 6,380 6,380 6,380 Add: Restricted Cash 70,177 70,177 70,177 Less: Credit Facility (157,000) (157,000) (157,000) Less: Preferred Equity (289,781) (289,781) (289,781) Add: Other Assets and Liabilities (141,305) (141,305) (141,305) Net Asset Value (NAV) $2,525,171 $2,687,171 $2,876,171 Diluted Shares Outstanding 207,980 207,980 207,980 NAV per Share $12.10 $12.90 $13.80 Current Share Price $8.66 $8.66 $8.66 Premium / (Discount) to NAV (28.4%) (32.9%) (37.2%)

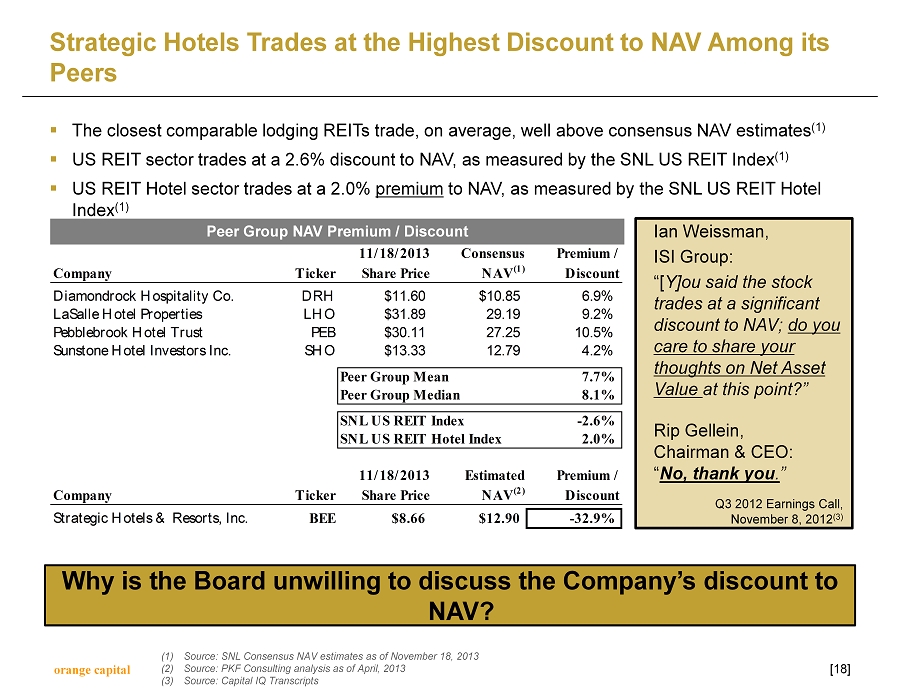

orange capital ▪ The closest comparable lodging REITs trade, on average, well above consensus NAV estimates (1) ▪ US REIT sector trades at a 2.6% discount to NAV, as measured by the SNL US REIT Index (1) ▪ US REIT Hotel sector trades at a 2.0% premium to NAV, as measured by the SNL US REIT Hotel Index (1) Strategic Hotels Trades at the Highest Discount to NAV Among its Peers [ 18 ] Ian Weissman , ISI Group: “[ Y] ou said the stock trades at a significant discount to NAV; do you care to share your thoughts on Net Asset Value at this point?” Rip Gellein , Chairman & CEO: “ No, thank you . ” Q3 2012 Earnings Call, November 8, 2012 (3) (1) Source: SNL Consensus NAV estimates as of November 18, 2013 (2) Source: PKF Consulting analysis as of April, 2013 (3) Source: Capital IQ Transcripts Why is the Board unwilling to discuss the Company’s discount to NAV? Peer Group NAV Premium / Discount 11/18/2013 Consensus Premium / Company Ticker Share Price NAV (1) Discount Diamondrock Hospitality Co. DRH $11.60 $10.85 6.9% LaSalle Hotel Properties LHO $31.89 29.19 9.2% Pebblebrook Hotel Trust PEB $30.11 27.25 10.5% Sunstone Hotel Investors Inc. SHO $13.33 12.79 4.2% Peer Group Mean 7.7% Peer Group Median 8.1% SNL US REIT Index -2.6% SNL US REIT Hotel Index 2.0% 11/18/2013 Estimated Premium / Company Ticker Share Price NAV (2) Discount Strategic Hotels & Resorts, Inc. BEE $8.66 $12.90 -32.9%

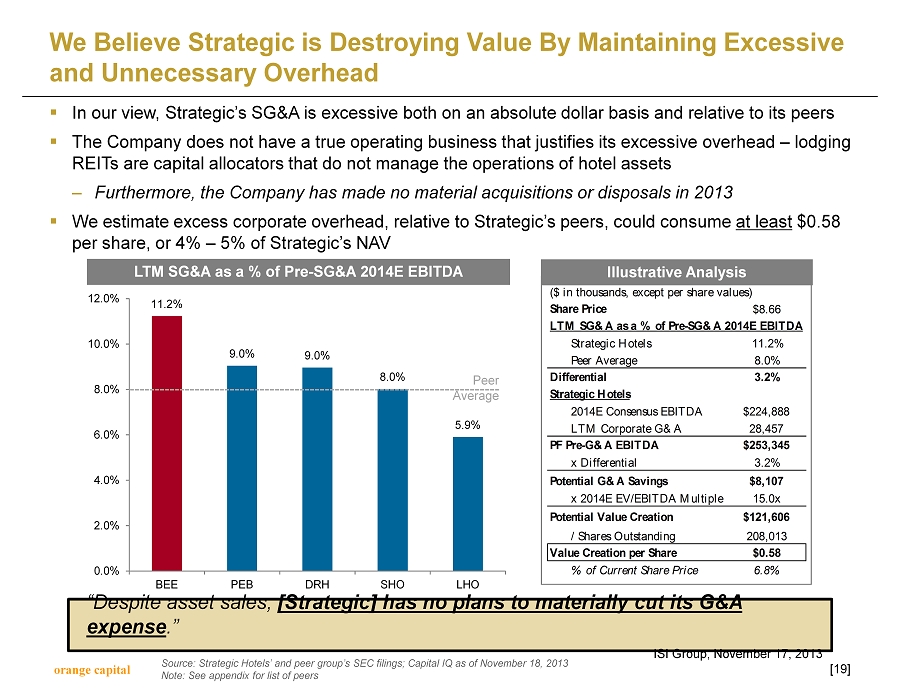

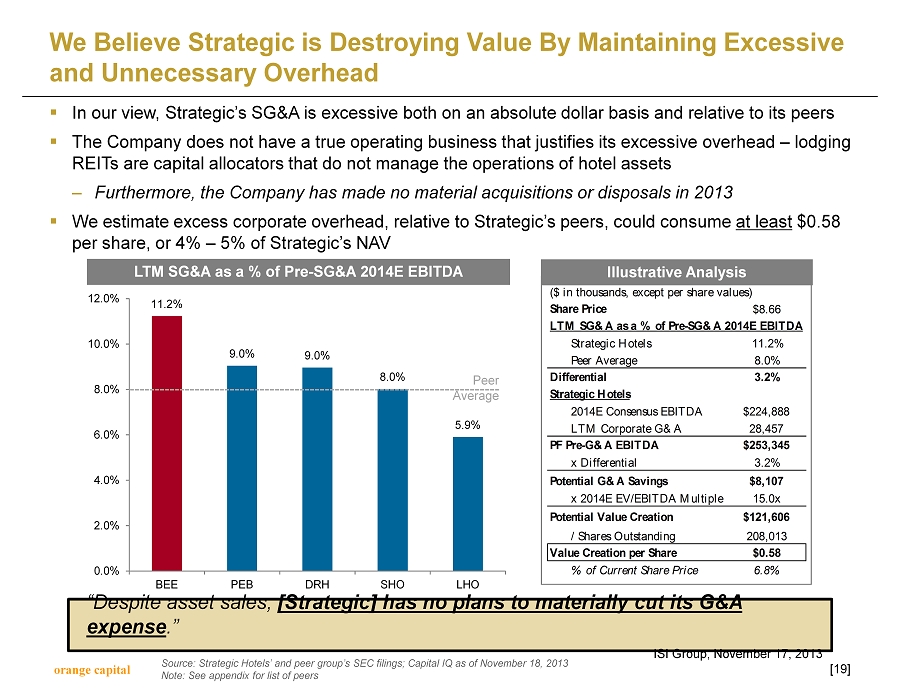

orange capital We Believe Strategic is Destroying Value By Maintaining Excessive and Unnecessary Overhead [ 19 ] Source: Strategic Hotels’ and peer group’s SEC filings; Capital IQ as of November 18, 2013 Note: See appendix for list of peers ▪ In our view, Strategic’s SG&A is excessive both on an absolute dollar basis and relative to its peers ▪ The Company does not have a true operating business that justifies its excessive overhead – lodging REITs are capital allocators that do not manage the operations of hotel assets – Furthermore, the Company has made no material acquisitions or disposals in 2013 ▪ We estimate excess corporate overhead, relative to Strategic’s peers, could consume at least $0.58 per share, or 4% – 5% of Strategic’s NAV “Despite asset sales, [Strategic] has no plans to materially cut its G&A expense .” ISI Group, November 17, 2013 11.2% 9.0% 9.0% 8.0% 5.9% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% BEE PEB DRH SHO LHO LTM SG&A as a % of Pre - SG&A 2014E EBITDA Peer Average ($ in thousands, except per share values) Share Price $8.66 LTM SG&A as a % of Pre-SG&A 2014E EBITDA Strategic Hotels 11.2% Peer Average 8.0% Differential 3.2% Strategic Hotels 2014E Consensus EBITDA $224,888 LTM Corporate G&A 28,457 PF Pre-G&A EBITDA $253,345 x Differential 3.2% Potential G&A Savings $8,107 x 2014E EV/EBITDA Multiple 15.0x Potential Value Creation $121,606 / Shares Outstanding 208,013 Value Creation per Share $0.58 % of Current Share Price 6.8% Illustrative Analysis

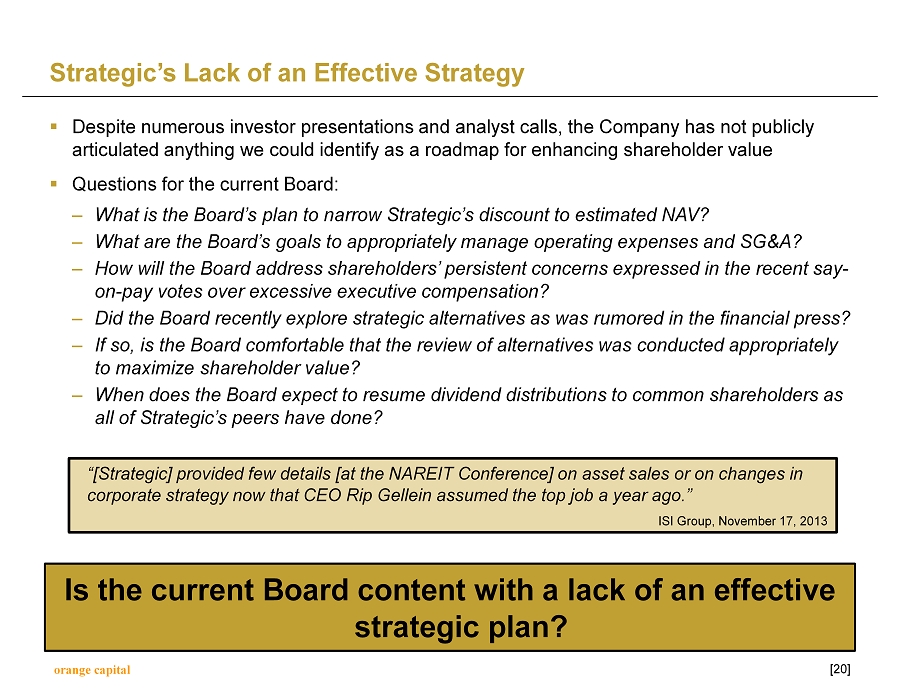

orange capital Strategic’s Lack of an Effective Strategy ▪ Despite numerous investor presentations and analyst calls, the Company has not publicly articulated anything we could identify as a roadmap for enhancing shareholder value ▪ Questions for the current Board: – What is the Board’s plan to narrow Strategic’s discount to estimated NAV? – What are the Board’s goals to appropriately manage operating expenses and SG&A? – How will the Board address shareholders’ persistent concerns expressed in the recent say - on - pay votes over excessive executive compensation? – Did the Board recently explore strategic alternatives as was rumored in the financial press? – If so, is the Board comfortable that the review of alternatives was conducted appropriately to maximize shareholder value? – When does the Board expect to resume dividend distributions to common shareholders as all of Strategic’s peers have done? [ 20 ] Is the current Board content with a lack of an effective strategic plan ? “[Strategic] provided few details [at the NAREIT Conference] on asset sales or on changes in corporate strategy now that CEO Rip Gellein assumed the top job a year ago.” ISI Group, November 17, 2013

orange capital ▪ On the Q1 2013 earnings call on April 30, 2013, Ryan Meliker of MLV & Co. and Chairman & CEO Rip Gellein had this exchange: ▪ On the Q3 2012 earnings call on November 8, 2012, Ian Weissman of ISI Group and Chairman & CEO Rip Gellein had this exchange: ▪ In a report issued August 7, 2013, Wells Fargo wrote: Market Participants Highlight Strategic’s Lack of an Effective Strategy [ 21 ] Mr. Weissman : “ The stock has underperformed for a myriad of reasons … is it possible though that we see a different strategy for Strategic going forward ? Whether it’s new markets, whether is it asset dispositions and what would be the goal to get the stock moving?” Mr. Gellein : “ I don't think you are going to see new strategy ….” (1) “We believe investors will find the lack of a Q2 sale announcement and / or the lack of an acknowledgement about a potential sale of the company to be disappointing.” Mr. Meliker : “ [C]an you just help us understand why it’s taking so long to identify an asset for sale… but Rip, you took over as CEO in October and you’ve been with this company for years now. What is it that is delaying, elongating the process to determine which asset is for sale?” Mr. Gellein : “ So it’s just we feel like we should take the time… we don’t feel any great urgency ….” (1) (1) Source: Capital IQ Transcripts

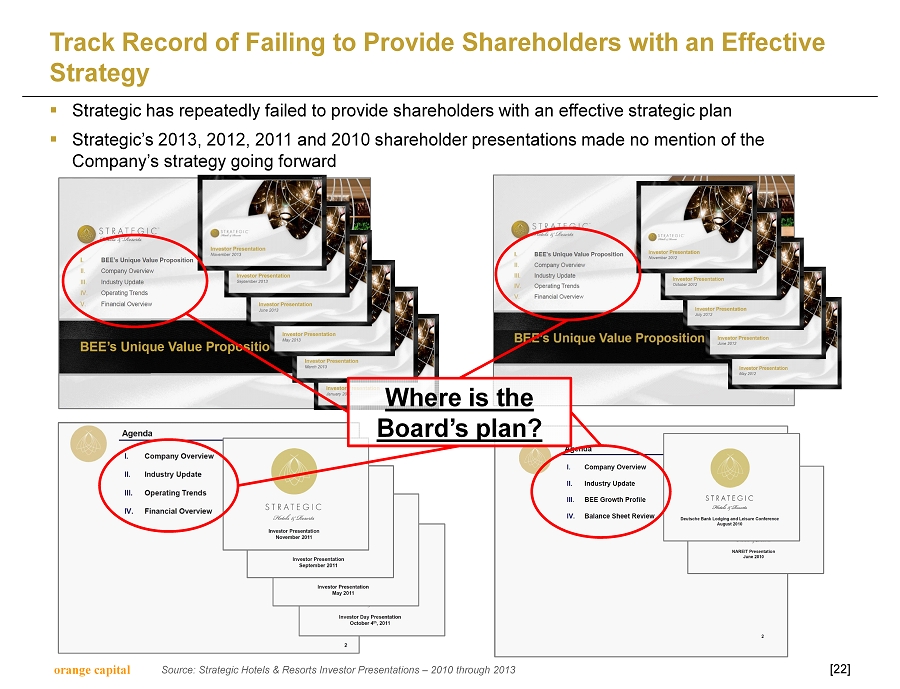

orange capital Track Record of Failing to Provide Shareholders with an Effective Strategy ▪ Strategic has repeatedly failed to provide shareholders with an effective strategic plan ▪ Strategic’s 2013, 2012, 2011 and 2010 shareholder presentations made no mention of the Company’s strategy going forward [ 22 ] Source: Strategic Hotels & Resorts Investor Presentations – 2010 through 2013 Where is the Board’s plan?

orange capital Strategic’s Track Record of Failing to Provide Shareholders with a Strategy ▪ In fact, the last time the Company articulated any discernable strategy was at the May 2009 annual shareholders meeting [ 23 ] Source: Strategic Hotels & Resorts Investor Presentation, May 2009

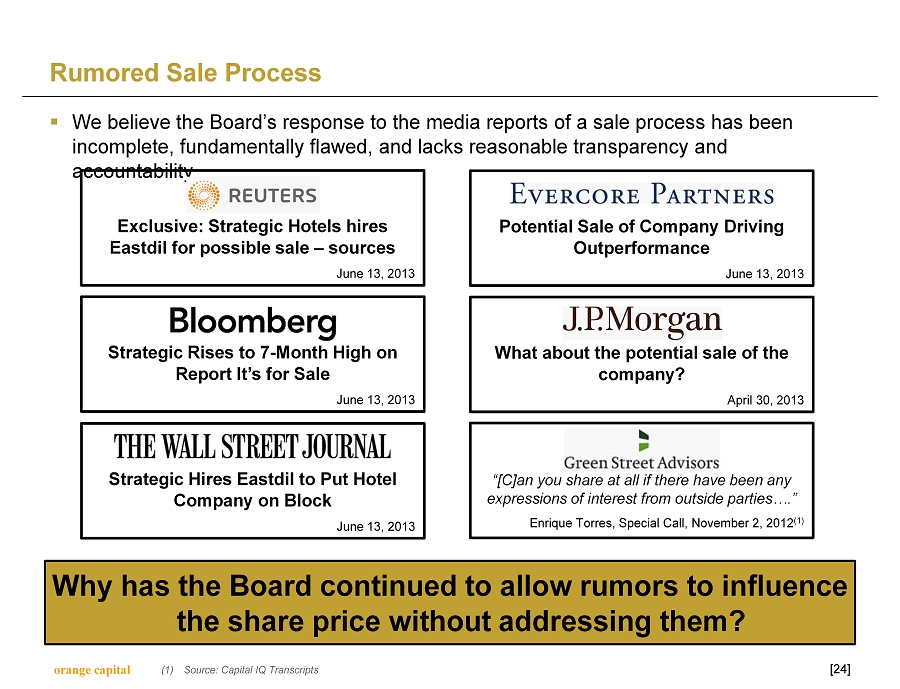

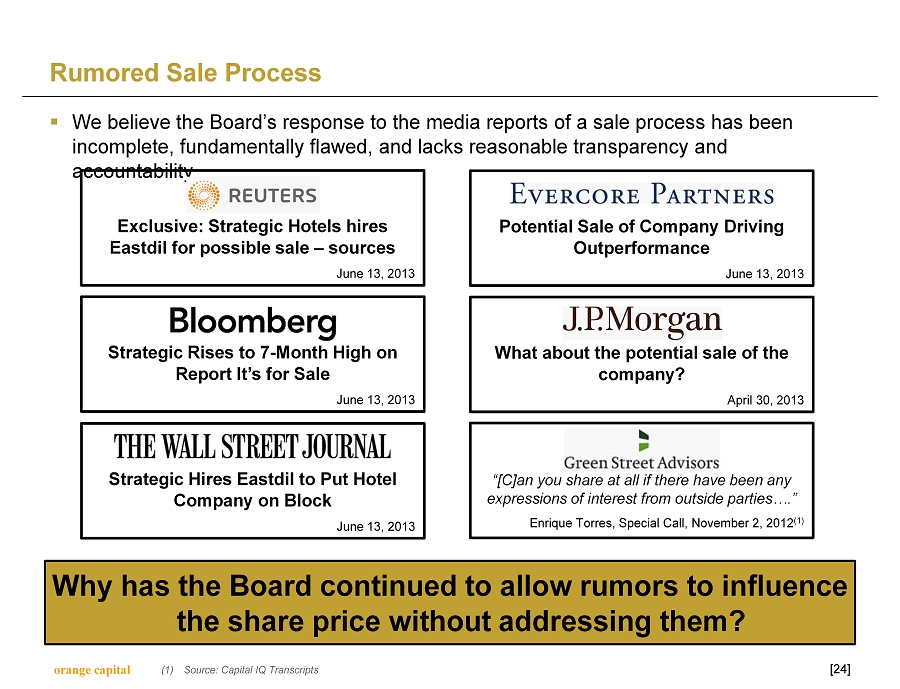

orange capital Potential Sale of Company Driving Outperformance June 13, 2013 What about the potential sale of the company? April 30, 2013 Rumored Sale Process ▪ We believe the Board’s response to the media reports of a sale process has been incomplete, fundamentally flawed, and lacks reasonable transparency and accountability [ 24 ] Why has the Board continued to allow rumors to influence the share price without addressing them? “[C]an you share at all if there have been any expressions of interest from outside parties….” Enrique Torres, Special Call, November 2, 2012 (1) Strategic Hires Eastdil to Put Hotel Company on Block June 13, 2013 Exclusive: Strategic Hotels hires Eastdil for possible sale – sources June 13, 2013 Strategic Rises to 7 - Month High on Report It’s for Sale June 13, 2013 (1) Source: Capital IQ Transcripts

orange capital Our Financial Advisor Questions the Rumored Sale “Process” ▪ Our financial advisor has raised important questions regarding the rumored sales process, including: – Whether all of the logical potential buyers were contacted – Whether some of the parties who were contacted were induced to enter into negotiations or deterred from participating in the process – Whether the brokerage firm retained by the Company is appropriate to conduct a full strategic review [ 25 ] Was the “process” designed to fail to simply provide “optical cover” to an entrenched Board and Management team, or was the process just severely mismanaged?

III. History of Poor Corporate Governance

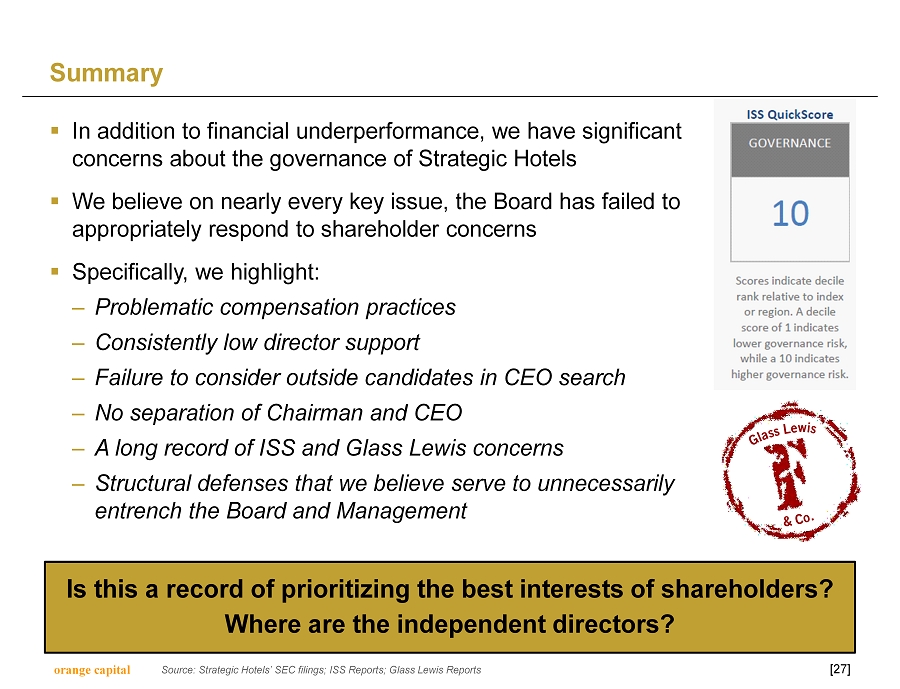

orange capital Summary [ 27 ] Is this a record of prioritizing the best interests of shareholders? Where are the independent directors? Source: Strategic Hotels’ SEC filings; ISS Reports; Glass Lewis Reports ▪ In addition to financial underperformance, we have significant concerns about the governance of Strategic Hotels ▪ We believe on nearly every key issue, the Board has failed to appropriately respond to shareholder concerns ▪ Specifically, we highlight: – Problematic compensation practices – Consistently low director support – Failure to consider outside candidates in CEO search – No separation of Chairman and CEO – A long record of ISS and Glass Lewis concerns – Structural defenses that we believe serve to unnecessarily entrench the Board and Management

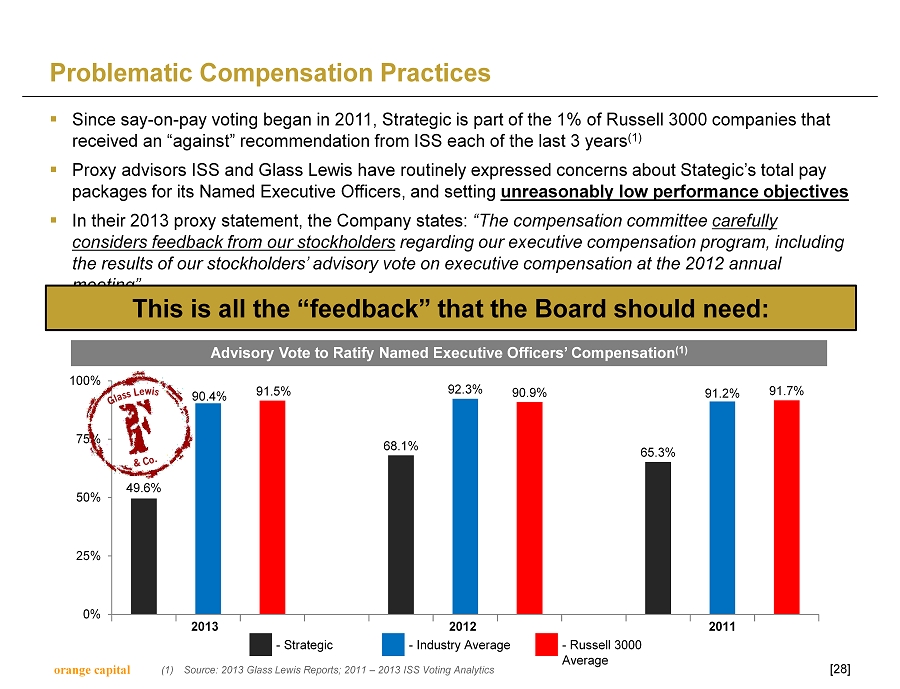

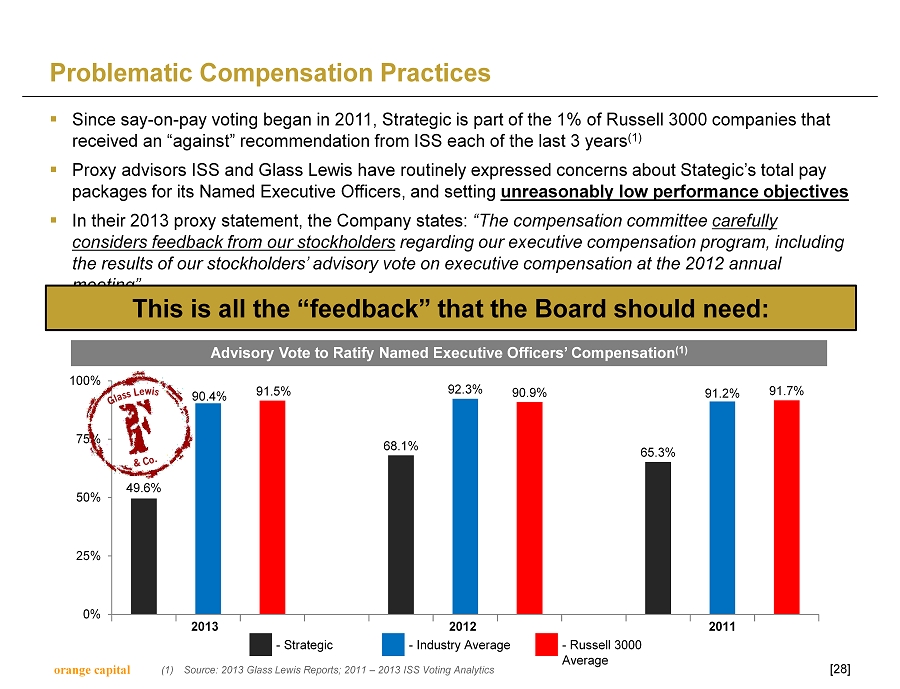

orange capital Problematic Compensation Practices ▪ Since say - on - pay voting began in 2011, Strategic is part of the 1% of Russell 3000 companies that received an “against” recommendation from ISS each of the last 3 years (1) ▪ Proxy advisors ISS and Glass Lewis have routinely expressed concerns about Stategic’s total pay packages for its Named Executive Officers, and setting unreasonably low performance objectives ▪ In their 2013 proxy statement, the Company states: “The compensation committee carefully considers feedback from our stockholders regarding our executive compensation program, including the results of our stockholders’ advisory vote on executive compensation at the 2012 annual meeting” [ 28 ] 49.6% 90.4% 91.5% 68.1% 92.3% 90.9% 65.3% 91.2% 91.7% 0% 25% 50% 75% 100% 2013 2012 2011 - Strategic - Industry Average - Russell 3000 Average This is all the “feedback” that the Board should need: Advisory Vote to Ratify Named Executive Officers’ Compensation (1) (1) Source: 2013 Glass Lewis Reports; 2011 – 2013 ISS Voting Analytics

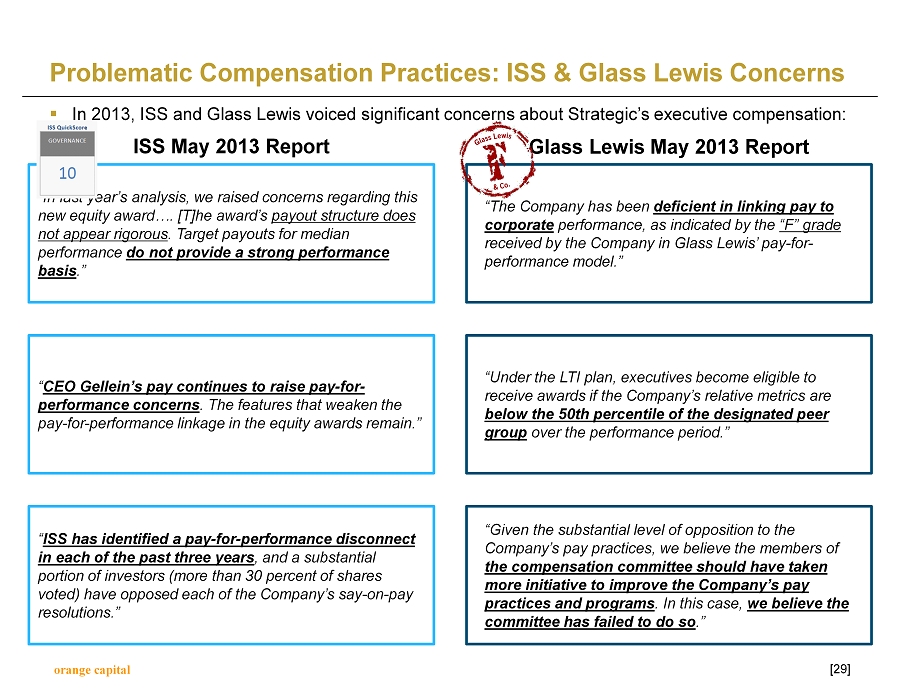

orange capital Problematic Compensation Practices: ISS & Glass Lewis Concerns [ 29 ] ISS May 2013 Report Glass Lewis May 2013 Report “The Company has been deficient in linking pay to corporate performance, as indicated by the “F” grade received by the Company in Glass Lewis’ pay - for - performance model.” “Under the LTI plan, executives become eligible to receive awards if the Company’s relative metrics are below the 50th percentile of the designated peer group over the performance period.” “Given the substantial level of opposition to the Company’s pay practices, we believe the members of the compensation committee should have taken more initiative to improve the Company’s pay practices and programs . In this case, we believe the committee has failed to do so .” “In last year’s analysis, we raised concerns regarding this new equity award…. [T]he award’s payout structure does not appear rigorous . Target payouts for median performance do not provide a strong performance basis .” “ CEO Gellein’s pay continues to raise pay - for - performance concerns . The features that weaken the pay - for - performance linkage in the equity awards remain.” “ ISS has identified a pay - for - performance disconnect in each of the past three years , and a substantial portion of investors (more than 30 percent of shares voted) have opposed each of the Company’s say - on - pay resolutions.” ▪ In 2013, ISS and Glass Lewis voiced significant concerns about Strategic’s executive compensation:

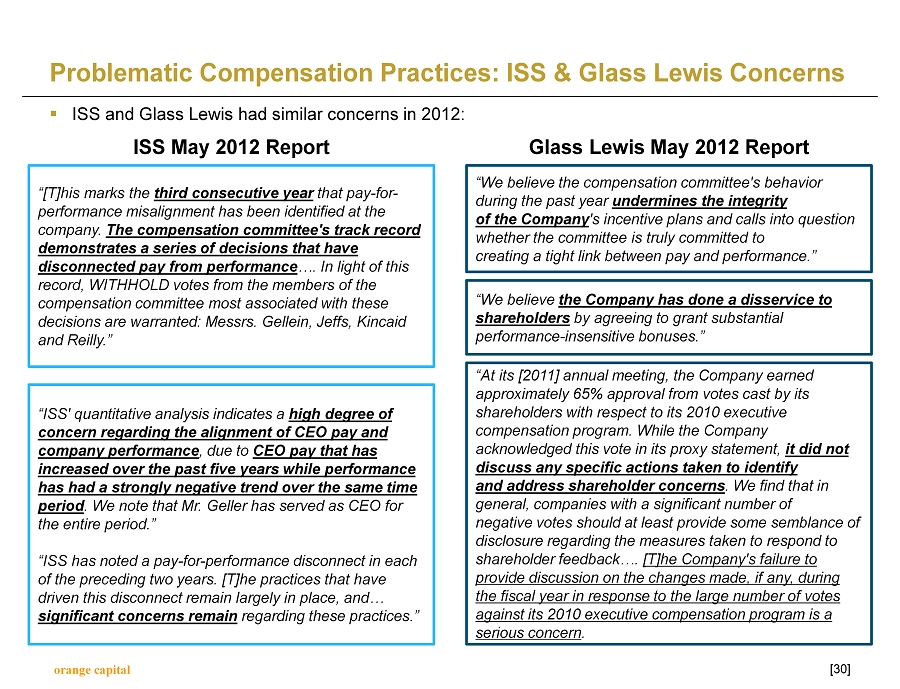

orange capital ▪ ISS and Glass Lewis had similar concerns in 2012: Problematic Compensation Practices: ISS & Glass Lewis Concerns [ 30 ] “[T]his marks the third consecutive year that pay - for - performance misalignment has been identified at the company. The compensation committee's track record demonstrates a series of decisions that have disconnected pay from performance …. In light of this record, WITHHOLD votes from the members of the compensation committee most associated with these decisions are warranted: Messrs. Gellein , Jeffs , Kincaid and Reilly.” “ISS' quantitative analysis indicates a high degree of concern regarding the alignment of CEO pay and company performance , due to CEO pay that has increased over the past five years while performance has had a strongly negative trend over the same time period . We note that Mr. Geller has served as CEO for the entire period.” “ISS has noted a pay - for - performance disconnect in each of the preceding two years. [T]he practices that have driven this disconnect remain largely in place, and… significant concerns remain regarding these practices.” ISS May 2012 Report Glass Lewis May 2012 Report “We believe the compensation committee's behavior during the past year undermines the integrity of the Company 's incentive plans and calls into question whether the committee is truly committed to creating a tight link between pay and performance.” “We believe the Company has done a disservice to shareholders by agreeing to grant substantial performance - insensitive bonuses.” “At its [2011] annual meeting, the Company earned approximately 65% approval from votes cast by its shareholders with respect to its 2010 executive compensation program. While the Company acknowledged this vote in its proxy statement, it did not discuss any specific actions taken to identify and address shareholder concerns . We find that in general, companies with a significant number of negative votes should at least provide some semblance of disclosure regarding the measures taken to respond to shareholder feedback…. [T]he Company's failure to provide discussion on the changes made, if any, during the fiscal year in response to the large number of votes against its 2010 executive compensation program is a serious concern .

orange capital “The Company has entered into executive employment agreements that have an automatic renewal feature. We believe this is concerning as what is best for the company and employee at one point in time may no longer be true. Furthermore, more and more companies are eliminating executive employment agreements altogether. Problematic Compensation Practices: ISS & Glass Lewis Concerns ▪ … and in 2011, ISS and Glass Lewis wrote: [ 31 ] ISS May 2011 Report Glass Lewis May 2011 Report “Our model and analysis reveals that the equity compensation expense as reported by the Company is quite high compared with the average expense of similar programs . We believe that shareholders should therefore reject [the 2004 Incentive Plan amendment] as being far too costly, given the financial results of the business .” “[T]he compensation committee possesses the discretion to award bonuses outside the STI plan…. In Glass Lewis’ view , such discretionary bonuses indicate a lack of resolve on the part of the compensation committee to put incentive awards truly ‘at risk’…. We believe the compensation committee’s behavior during the past year undermines the integrity of the Company’s incentive plans and calls into question whether the committee is truly committed to creating a tight link between pay and performance .” “Upon further review of the company's proxy statement, ISS notes that the Value Creation Plan… program may provide a sizable payment to the executives without creating sustainable long - term value to shareholders.” “Since the adoption of the VCP, the company's weighted common shares outstanding doubled… in fiscal 2010 through a public offering in May 2010…. [T]he increased number of shares outstanding will significantly increase the potential payout under this plan without increasing shareholder value.” “ In light of the company’s severely lagging three - and five - year returns and poor financials, such payouts appear to be excessive and are not rigorously performance - based . The company has increased its market capitalization through stock issuance and has diluted existing shareholders' interests . At the same time, the executives may receive sizable payouts in 2012 when the VCP program ends. Given the high potential payouts without a clear link to sustained shareholder value, a vote AGAINST [the Advisory Vote to Ratify Named Executive Officers' Compensation] is warranted.”

orange capital “The compensation committee is tasked with the responsibility to ensure that executive compensation is performance based and reasonable. In this case, ISS found the significant increase in the CEO's compensation to be concerning because such increase is done during a time when the company's performance trailed a majority of its peers, and its TSR has steadily declined for the past three years . As such, WITHHOLD votes are warranted for the members of the Compensation Committee on the ballot for re - election.” Problematic Compensation Practices: ISS & Glass Lewis Concerns ▪ … and, again, in 2010 ISS and Glass Lewis wrote: [ 32 ] ISS May 2010 Report Glass Lewis May 2010 Report “[W]e believe that the directors who served on the board at [the time of the adoption of the poison pill] bear the responsibility for implementing the shareholder rights plan without first allowing shareholders to vote on its adoption.” “ Accordingly we recommend that shareholders WITHHOLD votes from all [board] nominees.” “[C] oncerns remain with the following pay practices: (1) Multi - year guaranteed time - based [Restricted Stock Units (RSUs)] based on the lesser of $900,000 or 125,000 RSUs: The company's stock price has to increase to $7.20 before $900,000 will be paid out. Guaranteed equity awards run counter to the pay for performance philosophy . (2) Acceleration of outstanding time - based RSUs to compensate for diminished level of compensation….”

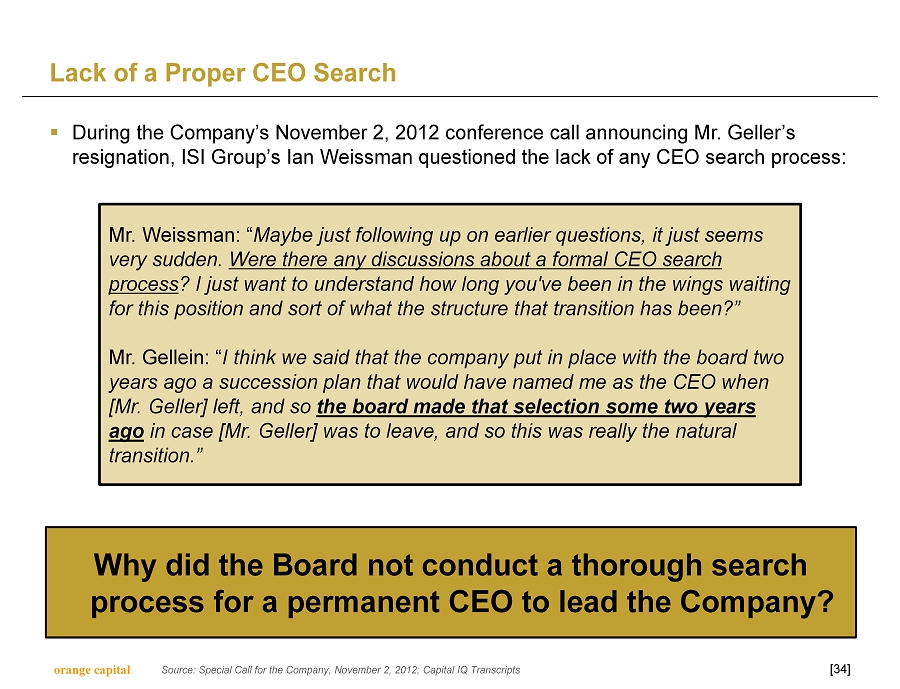

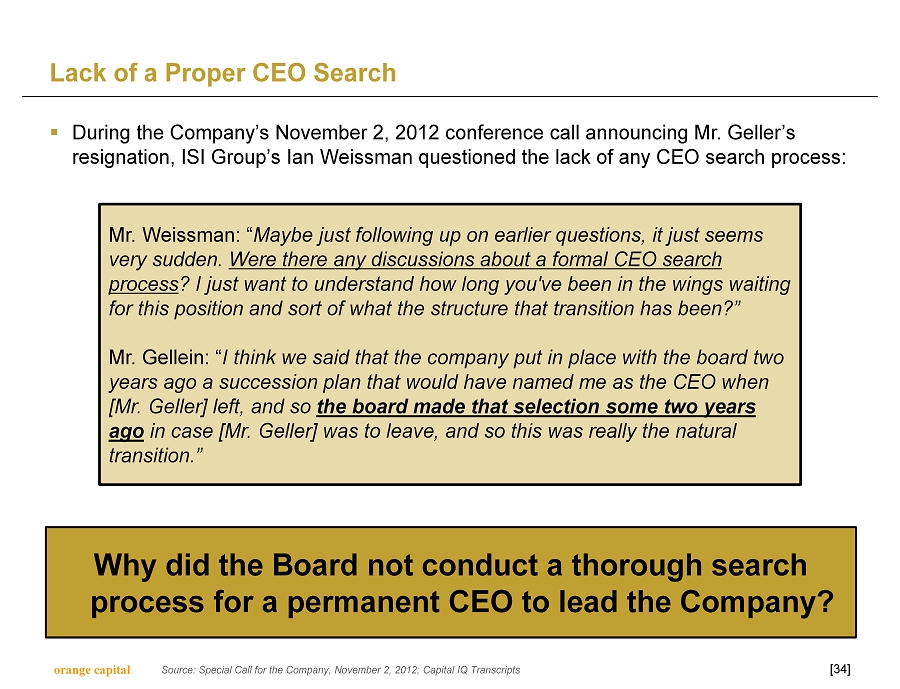

orange capital Lack of a Proper CEO Search ▪ On November 2, 2012, Strategic announced the resignation of longtime CEO Laurence Geller, and that Rip Gellein would replace Mr. Geller as CEO while also remaining Chairman ▪ The Board appointed Mr. Gellein to fill the CEO role without conducting a customary search to identify the best CEO candidate available at the time ▪ The Board followed an outdated CEO succession plan and, in our view, failed to fulfill its responsibility to shareholders in selecting a CEO ▪ We believe Mr. Gellein should have been one of the candidates considered to fill the CEO role, not the only candidate ▪ Interviewing a number of qualified candidates could have presented the Company with exposure to new ideas for enhancing shareholder value [ 33 ] The process used by a board to select a CEO is critical Source: Strategic Hotels’ SEC Filings; Special Call for the Company, November 2, 2012

orange capital Lack of a Proper CEO Search ▪ During the Company’s November 2, 2012 conference call announcing Mr. Geller’s resignation, ISI Group’s Ian Weissman questioned the lack of any CEO search process: [ 34 ] Mr. Weissman : “ Maybe just following up on earlier questions, it just seems very sudden. Were there any discussions about a formal CEO search process ? I just want to understand how long you've been in the wings waiting for this position and sort of what the structure that transition has been?” Mr. Gellein : “ I think we said that the company put in place with the board two years ago a succession plan that would have named me as the CEO when [Mr. Geller] left, and so the board made that selection some two years ago in case [Mr. Geller] was to leave, and so this was really the natural transition.” Why did the Board not conduct a thorough search process for a permanent CEO to lead the Company? Source: Special Call for the Company, November 2, 2012; Capital IQ Transcripts

orange capital 66.1% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 2013 2012 2011 2010 2009 Consistently Low Director Support [ 35 ] Average Voting Support Per Director (1) ISS Industry Average: ~95% We believe shareholders have sent a clear message of dissatisfaction to the Board by consistently withholding a significant percentage of votes from directors (1) Source: ISS Voting Analytics (2) Source: Capital IQ Transcripts Andrew Didora , Bank of America Merrill Lynch: “ Do you have any future plans in terms of separating the Chairman and CEO roles in the future? ” Rip Gellein , Chairman & CEO: “ That's a good question. The answer at this point in time is no.” Special Call, November 2, 2012 (2)

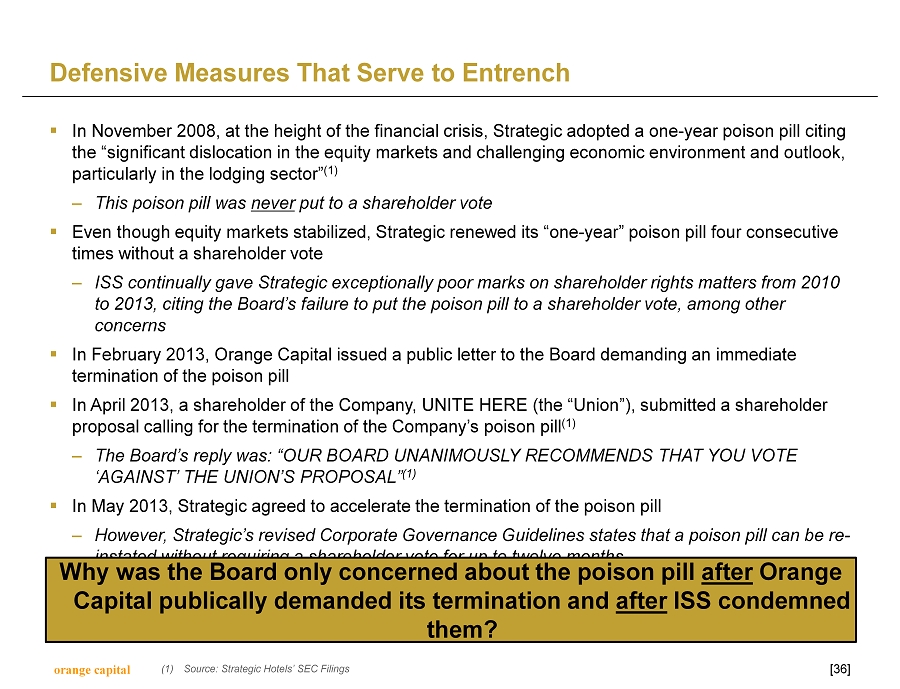

orange capital Defensive Measures That Serve to Entrench ▪ In November 2008, at the height of the financial crisis, Strategic adopted a one - year poison pill citing the “significant dislocation in the equity markets and challenging economic environment and outlook, particularly in the lodging sector” (1) – This poison pill was never put to a shareholder vote ▪ Even though equity markets stabilized, Strategic renewed its “one - year” poison pill four consecutive times without a shareholder vote – ISS continually gave Strategic exceptionally poor marks on shareholder rights matters from 2010 to 2013, citing the Board’s failure to put the poison pill to a shareholder vote, among other concerns ▪ In February 2013, Orange Capital issued a public letter to the Board demanding an immediate termination of the poison pill ▪ In April 2013, a shareholder of the Company, UNITE HERE (the “Union”), submitted a shareholder proposal calling for the termination of the Company’s poison pill (1) – The Board’s reply was: “OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE ‘AGAINST’ THE UNION’S PROPOSAL” (1) ▪ In May 2013, Strategic agreed to accelerate the termination of the poison pill – However, Strategic’s revised Corporate Governance Guidelines states that a poison pill can be re - instated without requiring a shareholder vote for up to twelve months [ 36 ] Why was the Board only concerned about the poison pill after Orange Capital publically demanded its termination and after ISS condemned them? (1) Source: Strategic Hotels’ SEC Filings

orange capital Defensive Measures That Serve to Entrench [ 37 ] Strategic continues to maintain strong structural defenses that serve to diminish shareholder influence Strategic’s Structural Defenses Directors can only be removed for cause with a vote of 66 2/3% of shares entitled to vote – effectively preventing shareholders from being able to remove directors All vacancies on Board filled solely by remaining directors Written consent by shareholders only permitted if unanimous – practically impossible for shareholders to act by written consent Board has exclusive power to amend and repeal bylaws Plurality vote standard to elect directors Corporate Governance Best Practices Shareholders should be permitted to remove with or without cause by majority vote Shareholders should be permitted to fill vacancies Shareholders should be permitted to act by written consent if signed by shareholders having not less than the minimum number of votes necessary to approve the action at a shareholder meeting Shareholders should have ability to amend / repeal bylaws by majority vote Majority vote standard to elect directors with a customary resignation policy for uncontested elections

orange capital What are Two of the Most Important Responsibilities of a Board of Directors? [ 38 ] The Board has failed to fulfill these key responsibilities to shareholders 1. Hire CEO The Board interviewed ZERO external candidates 2. Set Corporate Strategy The Board has been silent on strategy since 2009

IV. Orange Capital’s Recommendations

orange capital Summary ▪ Evaluate s trategic alternatives to maximize long - term shareholder value ▪ Set strategy for closing the share price discount to NAV ▪ Reform the Company’s governance [ 40 ] More than any one idea, Strategic Hotels and its Board need a cultural change that only comes with the election of new independent directors

orange capital Evaluate Strategic Alternatives ▪ Orange believes that there are a number of strategic alternatives available to the Company that should be fully and carefully evaluated ▪ The integrity of any strategic review is critical: – The Board should form a Special Committee comprised solely of independent directors mandated to evaluate all strategic alternatives – The Board should hire a traditional investment bank to do a strategic review and report solely to the Special Committee – Two Orange Capital nominees should sit on the Special Committee responsible for exploring strategic alternatives – As part of that review, the Company should contact select third parties to discuss a wide range of possible transactions to gain a complete picture of all available alternatives [ 41 ] By exploring all alternatives, the Board will acquire the market intelligence needed to set an effective strategy

orange capital Set Strategy for Realizing NAV ▪ Reduce Current SG&A – By bringing SG&A down to the average of its peers, Strategic could achieve an additional $0.58 per share, or a 11% - 17% reduction in discount to NAV ▪ Streamline Current Portfolio – Strategic’s portfolio inconsistencies make it challenging for investors to assign appropriate value for the overall company – As part of a strategic review, the Company should evaluate each property and how it contributes to the overall value of the portfolio. ▪ Communicate Strategy to Market – Once a strategy has been constructed by the Board and Management, it is crucial to articulate that strategy to the market – Ensure that all future investor presentations discuss current strategy in detail and address plans to close any share price discount to NAV [ 42 ] Absent a growth strategy, Strategic is simply a holding company for passive real estate investments

orange capital Reform the Company’s Governance ▪ Improve communications with shareholders – The Company should proactively address the share price discount to NAV without needing to be asked by the investment community ▪ Formulate appropriate succession planning practices – Mandate that comprehensive searches take place for vacancies in executive positions ▪ Recommend the separation of the Chairman and CEO roles ▪ Overhaul executive compensation practices to align management compensation with shareholder interests – Incentive compensation should include share price performance relative to NAV – Meet with shareholders and ISS about compensation concerns ▪ Ensure that shareholders can hold the Board accountable – Install ability to act by written consent (not only by unanimous written consent) – Allow shareholders the ability to amend bylaws – Establish majority voting standard for director elections [ 43 ] Beyond Orange Capital’s suggestions, the independent nominees are committed to making Strategic Hotels a model of good corporate governance

V. Orange Capital’s Nominees for Strategic Hotels

orange capital Experience and Expertise is Needed to Enhance Shareholder Value ▪ Dave Johnson – President & CEO of Aimbridge Hospitality – Setting a Focused Strategy ▪ Daniel Lewis – Managing Partner of Orange Capital, LLC – Establishing Shareholder Accountability ▪ John Lyons – Founder and Principal of Granite Realty Advisors – Exploring Strategic Alternatives ▪ Mark Woodworth – President of PKF Hospitality Research, LLC – Portfolio Construction [ 45 ] “The nominees we have put forward possess the appropriate expertise to help Strategic Hotels enhance shareholder value. Each of our nominees have pledged to work constructively with Management and the Board.” - Daniel Lewis, Orange Capital

orange capital Dave Johnson: Setting a Focused Strategy [ 46 ] Relevant Experience ▪ President & CEO of Aimbridge Hospitality ▪ Former Director of Ryman Hospitality Properties ▪ Former President of Wyndham Hotels, overseeing approximately 15,000 employees “Corporate strategy drives the day - to - day behaviors of employees. Are they part of a company that is ‘going places’ or are they part of a company that ‘just is?’” Comments on Setting a Focused Strategy: “Strategic Hotels has some iconic and valuable assets yet the Company trades at a large discount to NAV. I attribute this discount largely to Management’s lack of a communicated strategy. Shareholders are not attracted to companies that stand still. Shareholders want a company that has articulated a clear strategy and demonstrates a relentless commitment to executing that strategy.” Thoughts on Strategic Hotels:

orange capital Daniel Lewis: Establishing Shareholder Accountability [ 47 ] Relevant Experience ▪ Managing Partner of Orange Capital, LLC (2005 – Present) ▪ Former Director at Citigroup Global Special Situations “When independent shareholders join a board, the entire culture inside the boardroom changes. Rather than speculating about what shareholders think – or what questions they may have – the board is able to receive instant feedback. Having an independent shareholder on the board also gives a board additional credibility with institutional investors.” Comments on Establishing Shareholder Accountability: “When I look at Strategic Hotels as an outside shareholder I have numerous questions. What is the plan for closing the discount to NAV? How could this board be comfortable with its corporate governance? What kind of strategic review has been undertaken? How thorough was it? As a member of the board of Strategic Hotels, I would demand that the Company do a better job of performing for and communicating with shareholders.” Thoughts on Strategic Hotels:

orange capital John D. Lyons: Exploring Strategic Alternatives [ 48 ] ▪ Founder and Managing Principal of Granite Realty Advisors (2013 – Present) ▪ Former President and CEO of Savills LLC (2007 – 2012) ▪ Former Founder and CEO of Granite Partners LLC (1996 – 2007) – Acquired by Savills, plc in 2007 ▪ Former Principal and Managing Director at Eastdil Realty (1985 – 1996) ▪ Over 25 years of experience in real estate investment banking Relevant Experience “Exploring strategic alternatives is one of the best exercises a company can undertake. The process – if nothing else – provides a candid assessment of the current value of the business with insights on how best to create additional value.” Comments on Exploring Strategic Alternatives: “It appears that Strategic Hotels did not undertake a meaningful process to assess the value of the Company and the interest of potential suitors. Seemingly few parties were approached in the process and limited insight was gained. I see no reason why the Company should not run a full and inviting process. As a member of the Board, I would want to be closely involved in this process to make sure that it is both robust and objective.” Thoughts on Strategic Hotels:

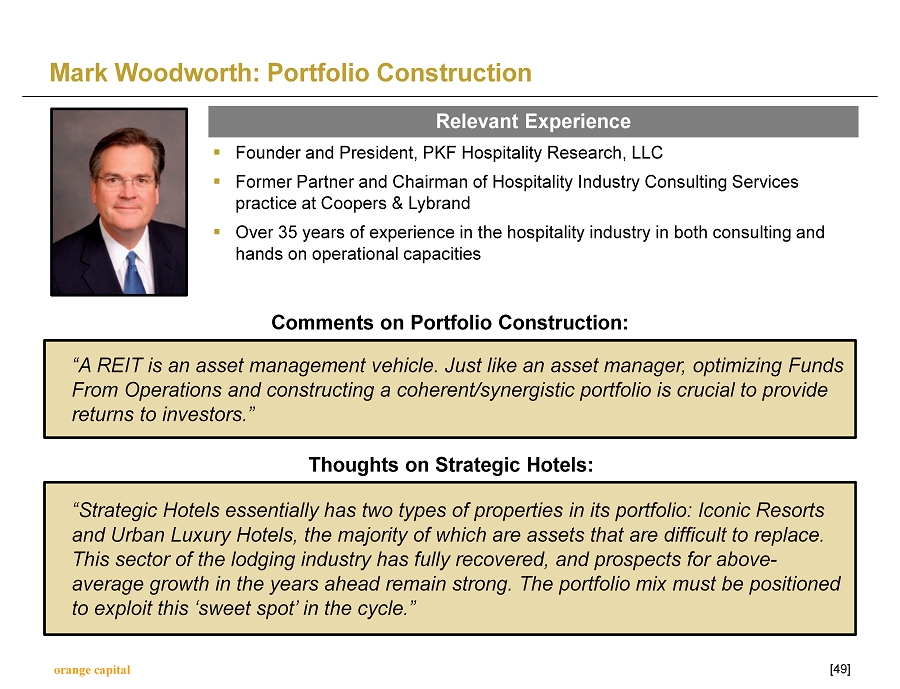

orange capital Mark Woodworth: Portfolio Construction [ 49 ] Relevant Experience ▪ Founder and President, PKF Hospitality Research, LLC ▪ Former Partner and Chairman of Hospitality Industry Consulting Services practice at Coopers & Lybrand ▪ Over 35 years of experience in the hospitality industry in both consulting and hands on operational capacities “A REIT is an asset management vehicle. Just like an asset manager, optimizing Funds From Operations and constructing a coherent/synergistic portfolio is crucial to provide returns to investors.” Comments on Portfolio Construction: “Strategic Hotels essentially has two types of properties in its portfolio: Iconic Resorts and Urban Luxury Hotels, the majority of which are assets that are difficult to replace. This sector of the lodging industry has fully recovered, and prospects for above - average growth in the years ahead remain strong. The portfolio mix must be positioned to exploit this ‘sweet spot’ in the cycle.” Thoughts on Strategic Hotels:

VI. Appendix

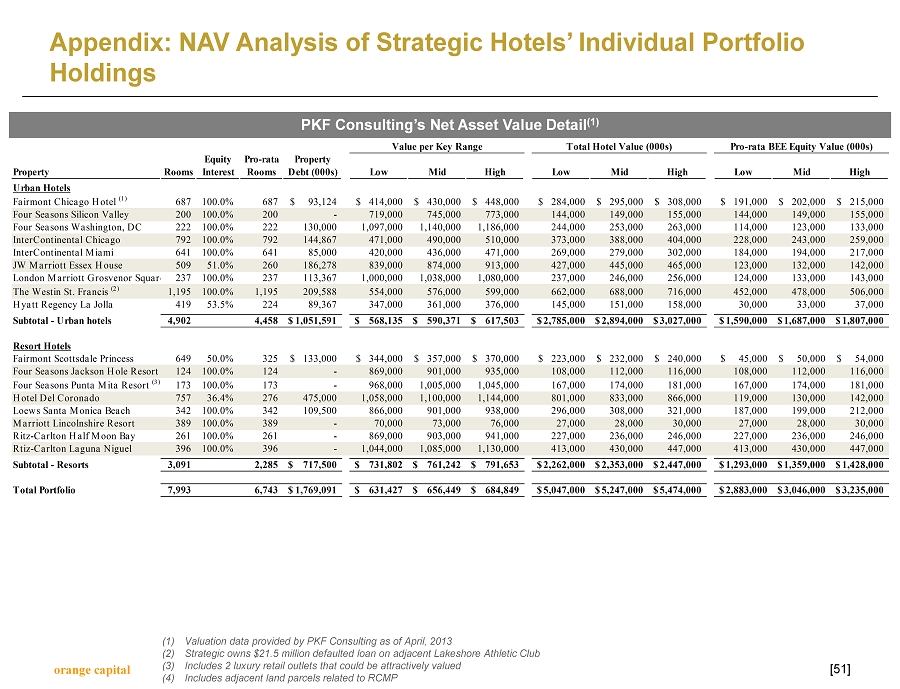

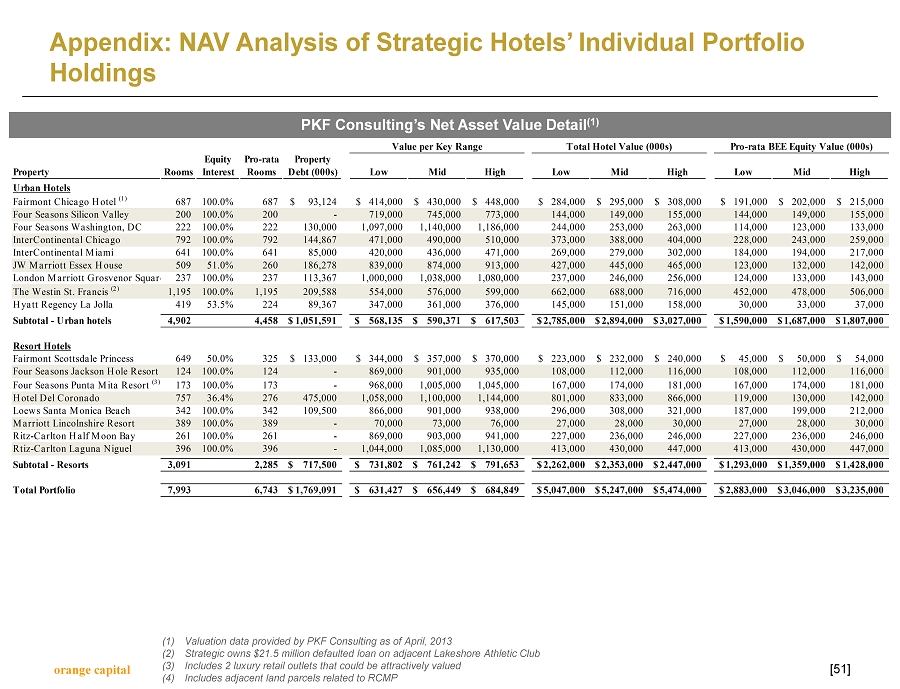

orange capital Appendix: NAV Analysis of Strategic Hotels’ Individual Portfolio Holdings [ 51 ] PKF Consulting’s Net Asset Value Detail (1) (1) Valuation data provided by PKF Consulting as of April, 2013 (2) Strategic owns $21.5 million defaulted loan on adjacent Lakeshore Athletic Club (3) Includes 2 luxury retail outlets that could be attractively valued (4) Includes adjacent land parcels related to RCMP Value per Key Range Total Hotel Value (000s) Pro-rata BEE Equity Value (000s) Equity Pro-rata Property Property Rooms Interest Rooms Debt (000s) Low Mid High Low Mid High Low Mid High Urban Hotels Fairmont Chicago Hotel (1) 687 100.0% 687 93,124$ 414,000$ 430,000$ 448,000$ 284,000$ 295,000$ 308,000$ 191,000$ 202,000$ 215,000$ Four Seasons Silicon Valley 200 100.0% 200 - 719,000 745,000 773,000 144,000 149,000 155,000 144,000 149,000 155,000 Four Seasons Washington, DC 222 100.0% 222 130,000 1,097,000 1,140,000 1,186,000 244,000 253,000 263,000 114,000 123,000 133,000 InterContinental Chicago 792 100.0% 792 144,867 471,000 490,000 510,000 373,000 388,000 404,000 228,000 243,000 259,000 InterContinental Miami 641 100.0% 641 85,000 420,000 436,000 471,000 269,000 279,000 302,000 184,000 194,000 217,000 JW Marriott Essex House 509 51.0% 260 186,278 839,000 874,000 913,000 427,000 445,000 465,000 123,000 132,000 142,000 London Marriott Grosvenor Square 237 100.0% 237 113,367 1,000,000 1,038,000 1,080,000 237,000 246,000 256,000 124,000 133,000 143,000 The Westin St. Francis (2) 1,195 100.0% 1,195 209,588 554,000 576,000 599,000 662,000 688,000 716,000 452,000 478,000 506,000 Hyatt Regency La Jolla 419 53.5% 224 89,367 347,000 361,000 376,000 145,000 151,000 158,000 30,000 33,000 37,000 Subtotal - Urban hotels 4,902 4,458 1,051,591$ 568,135$ 590,371$ 617,503$ 2,785,000$ 2,894,000$ 3,027,000$ 1,590,000$ 1,687,000$ 1,807,000$ Resort Hotels Fairmont Scottsdale Princess 649 50.0% 325 133,000$ 344,000$ 357,000$ 370,000$ 223,000$ 232,000$ 240,000$ 45,000$ 50,000$ 54,000$ Four Seasons Jackson Hole Resort 124 100.0% 124 - 869,000 901,000 935,000 108,000 112,000 116,000 108,000 112,000 116,000 Four Seasons Punta Mita Resort (3) 173 100.0% 173 - 968,000 1,005,000 1,045,000 167,000 174,000 181,000 167,000 174,000 181,000 Hotel Del Coronado 757 36.4% 276 475,000 1,058,000 1,100,000 1,144,000 801,000 833,000 866,000 119,000 130,000 142,000 Loews Santa Monica Beach 342 100.0% 342 109,500 866,000 901,000 938,000 296,000 308,000 321,000 187,000 199,000 212,000 Marriott Lincolnshire Resort 389 100.0% 389 - 70,000 73,000 76,000 27,000 28,000 30,000 27,000 28,000 30,000 Ritz-Carlton Half Moon Bay 261 100.0% 261 - 869,000 903,000 941,000 227,000 236,000 246,000 227,000 236,000 246,000 Rtiz-Carlton Laguna Niguel 396 100.0% 396 - 1,044,000 1,085,000 1,130,000 413,000 430,000 447,000 413,000 430,000 447,000 Subtotal - Resorts 3,091 2,285 717,500$ 731,802$ 761,242$ 791,653$ 2,262,000$ 2,353,000$ 2,447,000$ 1,293,000$ 1,359,000$ 1,428,000$ Total Portfolio 7,993 6,743 1,769,091$ 631,427$ 656,449$ 684,849$ 5,047,000$ 5,247,000$ 5,474,000$ 2,883,000$ 3,046,000$ 3,235,000$

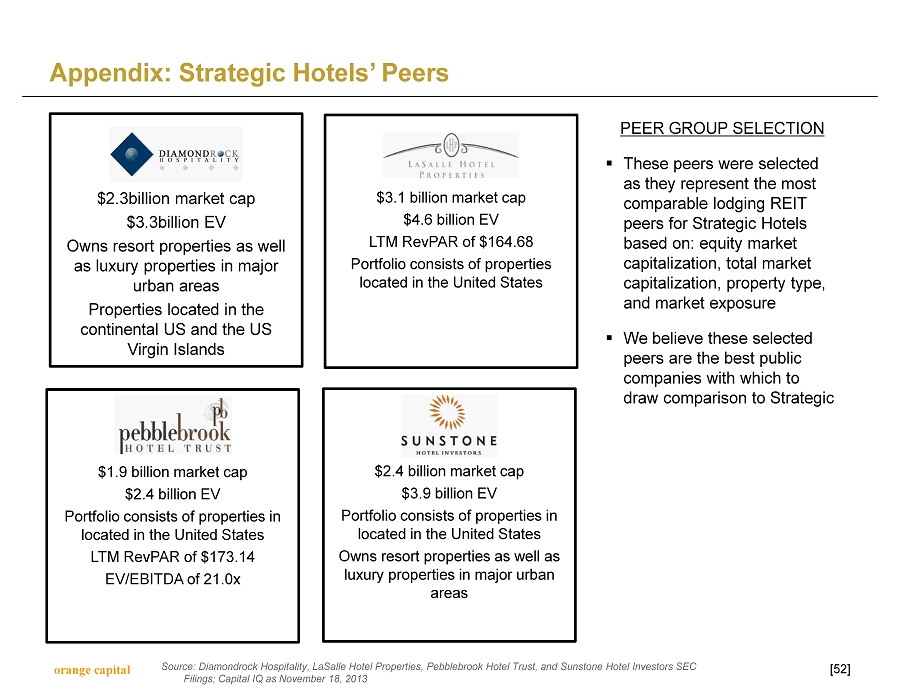

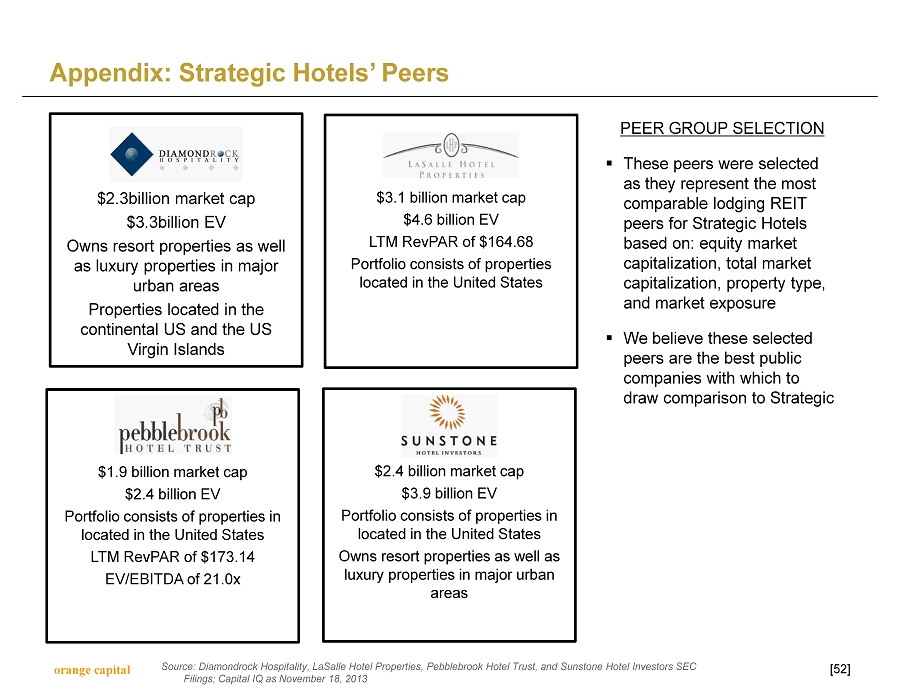

orange capital Appendix: Strategic Hotels’ Peers [ 52 ] $3.1 billion market cap $4.6 billion EV LTM RevPAR of $164.68 Portfolio consists of properties located in the United States $1.9 billion market cap $2.4 billion EV Portfolio consists of properties in located in the United States LTM RevPAR of $173.14 EV/EBITDA of 21.0x $2.4 billion market cap $3.9 billion EV Portfolio consists of properties in located in the United States Owns resort properties as well as luxury properties in major urban areas $2.3billion market cap $3.3billion EV Owns resort properties as well as luxury properties in major urban areas Properties located in the continental US and the US Virgin Islands Source: Diamondrock Hospitality, LaSalle Hotel Properties, Pebblebrook Hotel Trust, and Sunstone Hotel Investors SEC Filings; Capital IQ as November 18, 2013 PEER GROUP SELECTION ▪ These peers were selected as they represent the most comparable lodging REIT peers for Strategic Hotels based on: equity market capitalization, total market capitalization, property type, and market exposure ▪ We believe these selected peers are the best public companies with which to draw comparison to Strategic

orange capital Contact Information [ 53 ] Media: ICR, LLC Theodore Lowen / Phil Denning (646) 277 - 1238 / (203) 682 - 8246 Ted.Lowen@icrinc.com / Phil.Denning@icrinc.com Shareholders: Okapi Partners LLC Bruce H. Goldfarb / Patrick J. McHugh / Lydia Mulyk (855)305 - 0856 / (212) 297 - 0720 info@okapipartners.com