Exhibit 99.1

SHC Prague InterContinental B.V.

and Subsidiaries

Unaudited Condensed Consolidated Financial Statements Prepared

in Conformity with Accounting Principles Generally Accepted

in the United States of America

As of June 30, 2006 and for the Six Months Ended June 30, 2006 and 2005

SHC Prague InterContinental B.V. and Subsidiaries

Unaudited Condensed Consolidated Balance Sheet

(In $ thousands)

| | | |

| | | June 30,

2006 |

Assets | | | |

| |

Property and equipment, net (Note 3) | | $ | 97,394 |

Goodwill | | | 33,442 |

Cash and cash equivalents | | | 11,864 |

Restricted cash (Note 4) | | | 7,248 |

Receivables (net of allowance for doubtful accounts of $ 258 and $ 284, respectively) | | | 3,351 |

Deferred financing costs | | | 52 |

Other assets | | | 2,202 |

| | | |

Total assets | | $ | 155,553 |

| | | |

Liabilities | | | |

| |

Bank debt (Note 5) | | $ | 87,397 |

Interest accrued on bank debt | | | 797 |

Notes payable to affiliates (Note 5) | | | 1,542 |

Interest accrued on notes payable to affiliates | | | 262 |

Accounts payable | | | 1,516 |

Accrued liabilities | | | 3,098 |

Advance deposits | | | 1,739 |

Current income taxes payable | | | — |

Deferred tax liabilities (Note 7) | | | 15,163 |

| | | |

Total liabilities | | | 111,514 |

| |

Minority interest (Note 8) | | | 1,798 |

| |

Shareholders’ equity | | | |

| |

Common stock – 90,000 shares authorized, 18,500 issued and outstanding with a par value of EURO 1 | | | 20 |

Additional paid-in capital | | | 24,350 |

Retained earnings | | | 751 |

Accumulated other comprehensive income | | | 17,120 |

| | | |

Total shareholders’ equity | | | 42,241 |

| | | |

Total liabilities and shareholders’ equity | | $ | 155,553 |

| | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

SHC Prague InterContinental B.V. and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(In $ thousands)

| | | | | | | | |

| | | Six months

ended

June 30, 2006 | | | Six months

ended

June 30, 2005 | |

Revenues | | | | | | | | |

Rooms | | $ | 10,815 | | | $ | 10,807 | |

Food and beverage | | | 4,283 | | | | 3,896 | |

Other operated departments | | | 1,154 | | | | 1,117 | |

Rental revenue | | | 1,295 | | | | 871 | |

| | | | | | | | |

Total revenues | | | 17,547 | | | | 16,691 | |

| | | | | | | | |

Costs and expenses | | | | | | | | |

Rooms | | | 1,825 | | | | 1,808 | |

Food and beverage | | | 2,702 | | | | 2,510 | |

Other operated departments | | | 525 | | | | 477 | |

Depreciation and amortization | | | 2,889 | | | | 3,137 | |

Management fees and other services | | | 723 | | | | 882 | |

Administrative and general | | | 1,989 | | | | 1,856 | |

Property operation and maintenance | | | 973 | | | | 1,019 | |

Marketing | | | 839 | | | | 875 | |

Utility costs | | | 587 | | | | 459 | |

| | | | | | | | |

Total costs and expenses | | | 13,052 | | | | 13,023 | |

| | | | | | | | |

Operating income | | | 4,495 | | | | 3,668 | |

| | |

Interest income | | | (121 | ) | | | (20 | ) |

Interest expense – affiliates | | | 32 | | | | 65 | |

Interest expense – bank loan | | | 2,050 | | | | 2,029 | |

Other financial expenses (income), net (Note 10) | | | 1,950 | | | | (3,169 | ) |

| | | | | | | | |

| | | 3,911 | | | | (1,095 | ) |

| | |

Income before income taxes and minority interest | | | 584 | | | | 4,763 | |

| | |

Income tax expense (benefit) | | | | | | | | |

Current tax expense | | | 1,277 | | | | 1,249 | |

Deferred tax benefit, net | | | (521 | ) | | | (723 | ) |

| | | | | | | | |

Total income tax expense | | | 756 | | | | 526 | |

| | |

Net income (loss) | | | (172 | ) | | | 4,237 | |

| | |

Other comprehensive income (loss) | | | | | | | | |

Foreign currency translation adjustment | | | 6,270 | | | | (6,227 | ) |

| | | | | | | | |

Comprehensive income (loss) | | $ | 6,098 | | | $ | (1,990 | ) |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

SHC Prague InterContinental B.V.

Unaudited Condensed Consolidated Statements of Cash Flows

(In $ thousands)

| | | | | | | | |

| | | Six months

ended June 30, 2006 | | | Six months

ended

June 30, 2005 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| | |

Net Income (Loss) | | $ | (172 | ) | | $ | 4,237 | |

Adjustments to Reconcile Net Income (Loss) to Cash Provided by Operating Activities: | | | | | | | | |

Non cash items | | | | | | | | |

Depreciation and amortization | | | 2,889 | | | | 3,137 | |

Amortization of deferred financing costs included in interest | | | 185 | | | | 314 | |

Deferred taxes | | | (521 | ) | | | (723 | ) |

Foreign exchange loss (gain) | | | 483 | | | | (3,169 | ) |

| | |

Change in operating assets and liabilities | | | | | | | | |

Accounts Receivable | | | (122 | ) | | | 1,870 | |

Prepaid Expenses and Other | | | (677 | ) | | | 296 | |

Payables | | | (481 | ) | | | (372 | ) |

Accrued liabilities and other | | | 780 | | | | 1,334 | |

Accrued Interest | | | 166 | | | | (32 | ) |

Taxes | | | (441 | ) | | | 439 | |

| | | | | | | | |

Net Cash Provided by Operating Activities | | | 2,089 | | | | 7,331 | |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| | |

Release of restricted cash | | | 56 | | | | 756 | |

Purchases of property and equipment | | | (557 | ) | | | (603 | ) |

| | | | | | | | |

Net Cash (Used in) Provided by Investing Activities | | | (501 | ) | | | 153 | |

| | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| | |

Debt Repayments | | | (1,526 | ) | | | (1,548 | ) |

| | | | | | | | |

Net Cash Used in Financing Activities | | | (1,526 | ) | | | (1,548 | ) |

| | | | | | | | |

Effect of foreign exchange differences on Cash | | | 1,099 | | | | (1,896 | ) |

| | | | | | | | |

CHANGE IN CASH AND CASH EQUIVALENTS | | | 1,161 | | | | 4,040 | |

CASH AND CASH EQUIVALENTS AT BEGINNING OF THE PERIOD | | | 10,703 | | | | 9,908 | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS AT END OF THE PERIOD | | $ | 11,864 | | | $ | 13,948 | |

| | | | | | | | |

Cash Paid for Interest | | $ | 1,731 | | | $ | 2,126 | |

| | | | | | | | |

Cash Paid for Income Taxes | | $ | 1,475 | | | $ | 1,112 | |

| | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

1. The Consolidated Group

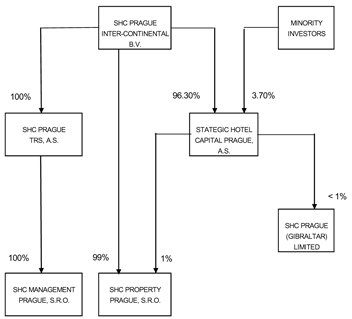

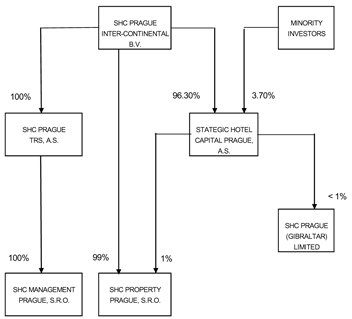

SHC Prague InterContinental B.V. (“the Company”) is a Dutch joint stock company that was incorporated on August 13, 1999. The Company either wholly or majority owns or has a controlling financial interest in the following entities: Strategic Hotel Capital Prague, a.s. (formerly Hotel InterContinental Prague, a.s.), SHC Management Prague, s.r.o., SHC Property Prague, s.r.o., SHC Prague TRS, a.s., SHC Prague (Gibraltar) Limited and, until May 5, 2004, Strategic Hotel Capital Prague Holding a.s. (together these entities are collectively referred to as “the Group”). The Group owns and operates the 364-room InterContinental Hotel in Prague, Czech Republic. The Company’s outstanding shares are held by Eu-Hotel Pte Ltd. (owning 65% of the Company and registered in Singapore) and SHC Prague Intercontinental, L.L.C. (owning 35% and registered in Delaware, United States).

On August 17, 1999, the Company acquired a 92.88% share in Hotel InterContinental Prague a.s., a joint stock company incorporated in the Czech Republic, which was later renamed Strategic Hotel Capital Prague, a.s. (“Prague AS”). Prague AS owned and operated a hotel located at Nám. Curieových 43/5, Prague 1, Czech Republic. The acquisition was accounted for under the purchase method. Since that date, the Company has increased its ownership to 96.30% and the total cost of the investment at June 30, 2006 amounted to $ 97,450,000. During the six month period ended June 30, 2006, the Company acquired no further shares.

After the initial acquisition in 1999, Prague AS formed two wholly-owned Czech Republic limited liability subsidiaries, a hotel operations company, SHC Management Prague s.r.o., and a property ownership company, SHC Property Prague s.r.o., (together “the Hotel”), by contribution of selected assets and liabilities to each (consisting of the hotel property and all hotel operating assets and liabilities). The property ownership company leases the hotel property to the hotel operations company under a 15-year operating lease.

On February 9, 2000, Prague AS contributed 100% of the hotel operation company and 99% of the property ownership company to SHC Prague (Gibraltar) Limited. The contribution was valued at $ 98,581,000. In exchange for the contribution, Prague AS acquired 39,999 ordinary shares of $ 1 par value stock in SHC Prague (Gibraltar) Limited, which represents a 100% interest in this class of shares; however, those shares bear voting rights lower than 0.01%. Ten thousand deferred shares and almost 100% of the voting rights in SHC Prague (Gibraltar) Limited are owned by a company outside of the Group.

On August 9, 2000, the 100% share in the hotel operations company and the 99% share in the property ownership company were sold by SHC Prague (Gibraltar) Limited to the Company for a total consideration of $ 110,000,000.

During 2004, the Company purchased 100% of a dormant Czech company, renamed SHC Prague TRS, a.s., for $ 77,000 (2,000,000 Czech crowns). SHC Prague TRS, a.s. had net assets at the date of acquisition totaling $ 75,000 (1,970,000 Czech crowns). On June 24, 2004, SHC Prague TRS, a.s. purchased 100% of the hotel operation company from the Company in exchange for a note payable. This note was later converted to equity of SHC Prague TRS, a.s. by the Company.

The investments in SHC Prague (Gibraltar) Limited and SHC Prague TRS, a.s. have been eliminated in consolidation and the resulting increases in the values of the assets arising from the aforementioned inter-group transactions which were recorded in the local statutory financial statements of those companies, have also been eliminated.

4

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

The structure of the Group as at June 30, 2006 was as follows (voting interests shown):

2. Summary of Significant Accounting Policies

a) Basis of Presentation

The financial statements presented are the consolidated accounts of SHC Prague InterContinental B.V. and its subsidiaries.

All significant intercompany transactions have been eliminated as part of the consolidation process.

The condensed consolidated financial statements are prepared under Accounting Principles Generally Accepted in the United States of America (“US GAAP”).

The financial statements are presented in U.S. Dollars and are prepared on a historical cost basis.

The accompanying unaudited condensed consolidated financial statements have been prepared pursuant to rules and regulations of the Securities and Exchange Commission (the Commission) and, therefore, do not include all information and footnote disclosures normally included in audited financial statements. In the opinion of management, the accompanying financial statements contain all adjustments, consisting of normal recurring accruals, necessary to present fairly the financial position of SHC Prague InterContinental B.V. and its subsidiaries and its results of operations and cash flows for the interim periods presented. Management believes the disclosures made are adequate to prevent the information presented from being misleading. However, the financial statements should be read in conjunction with SHC Prague InterContinental B.V. and its subsidiaries’ consolidated financial statements as of December 31, 2005 and 2004 and for the years ended December 31, 2005, 2004 and 2003 and notes thereto which are incorporated by reference into this Form 8-K/A.

5

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

b) Revenue Recognition

Revenues are generally recognized as services are performed.

c) Property and Equipment and Depreciation

Property and equipment consists of the hotel, acquired land and site improvements and associated furniture, fixtures and equipment, which are carried at cost, net of accumulated depreciation and amortization.

Property and equipment purchased in the normal course of business is recorded at its acquisition cost which includes freight, customs duty and other related costs.

The costs of improvements that extend the useful life of property and equipment are capitalized. Repairs and maintenance costs are expensed as incurred.

Small tangible items are expensed upon purchase.

Depreciation is calculated on the straight-line basis over the future estimated useful life of the asset as follows:

| | |

| | | Years |

Buildings | | 37 |

Machinery and equipment | | 4-15 |

Furniture and fixtures | | 5 |

d) Income Taxes

The provision for income tax due is calculated in accordance with the local tax regulations of each Group company and is based on the profit or loss reported under local accounting regulations, adjusted for appropriate permanent and temporary differences from local taxable income.

The Group utilizes the asset and liability method of accounting for deferred income taxes. Under the asset and liability method, deferred income taxes are recognized for the future tax consequences attributable to differences between the financial statement carrying amount of existing assets and liabilities and their respective tax bases. Realization of the future tax benefits related to deferred tax assets is dependent on many factors, including the individual company’s ability to generate taxable income in future periods.

e) Use of Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

f) Cash and Cash Equivalents

All highly liquid investments with a maturity at the time of purchase of three months or less are considered to be cash equivalents. Temporary cash investments are comprised of term and money market deposits denominated in US Dollars (US$), Czech Crowns (CZK) and Euros (EUR).

g) Net Receivables

Receivables are carried at their nominal value and adjusted for uncollectible amounts through an allowance account reflected in the accompanying condensed consolidated balance sheet. Additions to the allowance account are charged to expense.

6

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

h) Inventories

Inventories are stated at the lower of cost (determined on an average cost basis) or market and consist primarily of food and beverages and supplies including assets such as china, glassware, silver, linen and uniforms. The cost of purchased inventories includes cost of acquisition and related costs. Inventories are recorded in other assets in the condensed consolidated balance sheet.

i) Accounting for long-lived assets

The Group evaluates the recoverability of the carrying amount of its long-lived assets in accordance with SFAS No. 144, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be disposed of”. Whenever events or changes in circumstances indicate that the carrying amounts of those assets may not be recoverable, the Group will compare undiscounted net cash flows estimated to be generated by those assets to the carrying amount of those assets. To the extent that these cash flows are less than the carrying amounts of the assets, an impairment loss will be recognized to adjust the carrying value to fair value. As of June 30, 2006, management believed that no such impairment existed.

j) Goodwill

Goodwill represents the excess of the purchase price over the fair market value of the assets acquired. Goodwill is reviewed annually for impairment or when events and circumstances warrant such a review.

Goodwill impairment testing, which is based on fair value, is performed on a reporting unit level on an annual basis as of December 31. Management of the Company considers the Group as a single reporting unit. As of June 30, 2006, management believed that no impairment of goodwill existed.

k) Deferred financing costs

Costs incurred as part of securing long-term financing are deferred and amortized into the consolidated statements of operations as interest expense over the term of the debt.

l) Minority Interest

Minority interest represents the portion of the historical financial statement carrying amounts of the net assets plus or minus the net profit or loss of any subsidiary attributable to equity interests that are not owned, directly or indirectly through subsidiaries, by the Company.

7

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

m) Comprehensive Income

Comprehensive income is a measure of all changes in equity of an enterprise, which results from transactions or other economic events during the period. The Group’s accumulated other comprehensive income results from foreign currency translation adjustments.

n) Foreign currency

The functional currency for the Company’s operating subsidiaries is the Czech crown. The functional currency and reporting currency for the Company itself is U.S. dollars. Assets and liabilities denominated in non-US dollar functional currencies are translated into the reporting currency at rates of exchange in effect at the balance sheet date. Revenues and expenses are translated at average rates of exchange in effect during the period. Differences arising from the translation from the functional to the reporting currency are recorded to accumulated other comprehensive income.

Transactions in foreign currencies are translated into the functional currency at the exchange rate in effect at the date of each transaction. Differences in exchange rates during the period between the date a transaction denominated in a foreign currency is consummated and the date on which it is either settled or translated for inclusion in the condensed consolidated balance sheet are recognized in the consolidated statement of operations.

o) Restrictions

Dividends out of the Company are restricted by equity requirements at various entities within the Group. In addition, certain restricted cash balances are required by the Aareal bank debt and such balances are not available for distribution.

3. Property and equipment

Property and equipment comprises the following:

| | | | |

| | | June 30, 2006 ($ thousand) | |

Land | | $ | 27,411 | |

Buildings | | | 72,235 | |

Furnishings and equipment | | | 87,431 | |

Construction in progress | | | 741 | |

| | | | |

Total property and equipment | | | 187,818 | |

| |

Less: accumulated depreciation | | | (90,424 | ) |

| | | | |

Property and equipment, net | | $ | 97,394 | |

| | | | |

8

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

4. Restricted cash

As of June 30, 2006, the Group presented restricted cash of $ 4,528,600 which will be used for property and equipment replacement in accordance with the hotel’s management agreement (Note 9).

Other restricted cash amounts totaling $ 2,719,400 as of June 30, 2006 are held in the escrow accounts as a guarantee of the bank credit facilities. These accounts are subject to a restriction on drawings.

5. Debt

At June 30, 2006 the Group had the following bank loans payable and demand promissory notes/subordinated promissory notes.

| | | | | | | |

Party | | Interest | | Maturity (on earlier of) | | June 30, 2006 ($ thousand) |

Bank debt (denominated in EUR) | | | | | |

Aareal Bank AG | | EURIBOR (*) + 1.5% | | See below | | $ | 87,397 |

| | | | | | | |

| | | |

Notes payable to affiliates (denominated in USD) | | | | | | | |

SHC Europe LLC | | 8.25% per annum, quarterly | | Demand or August 16, 2009 | | $ | 540 |

Paris Properties PTE Ltd. | | 8.375% per annum, quarterly | | Demand or August 16, 2009 | | | 1,002 |

| | | | | | | |

Total notes payable to affiliates | | | | | | $ | 1,542 |

| | | | | | | |

| (*) | At June 30, 2006 EURIBOR was 2.05%. |

SHC Europe LLC and Paris Properties PTE Ltd. are affiliates of the Company’s shareholders. The notes payable to these entities are unsecured.

On June 26, 2003, the Group entered into an agreement to refinance its bank debt. As a result of this refinancing, the loan and all accrued interest payable to WestLB AG was fully repaid using EUR 70 million of proceeds funded on July 14, 2003 obtained from the EUR 75 million loan negotiated with Aareal Bank AG. An additional EUR 5 million was drawn in January 2004 under the same loan agreement between Aareal Bank AG and the Group. The loan bears floating interest at EURIBOR+1.5% from January 2004 (previously EURIBOR+2.25%) and matures in July 2007.

9

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

The loan from Aareal Bank AG is secured by:

| | • | | pledge agreements concerning several bank accounts of SHC Management Prague, s.r.o and SHC Property Prague, s.r.o., SHC Prague TRS, a.s. and the Company; |

| | • | | pledge agreements concerning insurance proceeds arising from certain insurance policies of SHC Management Prague, s.r.o and SHC Property Prague, s.r.o.; |

| | • | | pledge agreements concerning claims arising from the lease agreement between SHC Management Prague, s.r.o and SHC Property Prague, s.r.o. and (sub)lease agreements between SHC Management Prague, s.r.o. and third parties; |

| | • | | mortgage agreement concerning certain buildings and plots of land of SHC Property Prague, s.r.o.; |

| | • | | pledge agreements concerning the majority of shares in Prague AS, 99% ownership interest in SHC Property Prague, s.r.o. and 100% shares in SHC Prague TRS, a.s. held by the Company; |

| | • | | pledge agreements concerning 100% ownership interest in SHC Management Prague, s.r.o. held by SHC Prague TRS, a.s.; |

| | • | | guarantee in amount EUR 75 million by SHC Property Prague, s.r.o.; |

| | • | | pledge agreement concerning certain movable assets (FF&E) owned by SHC Management Prague, s.r.o.; |

| | • | | pledge agreements concerning rights arising from the Hotel Management Agreement, the License Agreement and the Hotel Services Agreement and |

| | • | | agreement on assignment for security of proceeds arising from the Hedging Agreement. |

Under the terms of the Aareal Bank AG loan agreement, the Group has two one-year extension possibilities. In April 2006, the Group has utilized one of the one-year extensions. The maturity schedule for repayments of the long-term bank debt at June 30, 2006 is as follows:

| | | | | | | | | | | | |

Year ending December 31, | | Actual repayment schedule | | Repayment assuming extension |

| | (Euro thousand) | | ($ thousand) | | (Euro thousand) | | ($ thousand) |

2006 (remainder) | | € | 1,352 | | $ | 1,669 | | € | 1,352 | | $ | 1,669 |

2007 | | € | 66,966 | | $ | 85,728 | | | 2,833 | | | 3,497 |

2008 | | | — | | | — | | | 64,133 | | | 82,231 |

| | | | | | | | | | | | |

Total | | € | 68,318 | | $ | 87,397 | | € | 68,318 | | $ | 87,397 |

| | | | | | | | | | | | |

Financing costs related to the Aareal Bank AG loan amounting to EUR 1,211,000 were initially capitalized in 2003 and are being amortized over the term of the debt (before extension options). The Group amortized as part of interest expense $ 185,000 and $ 314,000 through the condensed consolidated statements of operations for the six months ended June 30, 2006 and 2005, respectively.

As of June 30, 2006, the Group was in compliance with all terms and covenants associated with its other loan agreements.

10

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

7. Taxation

Income Tax Legislation

Corporate income tax is calculated in accordance with local tax regulations (statutory corporate tax rate for the Czech Republic is 24% in 2006 (2005: 26%).

The Dutch holding company’s investments into its subsidiaries qualify for treatment as qualifying investments for Dutch tax purposes. Income and expenses that are directly linked to qualifying investments are shielded from direct taxation by the Dutch tax authority and therefore income tax for this entity is calculated based on earnings and expenses that are directly attributable to the limited operations for the Holding Company.

SHC Prague (Gibraltar) Limited is not subject to income tax under Gibraltar Law.

Deferred tax assets and liabilities are measured at the balance sheet date based on the enacted tax rate applicable to the period in which they are expected to be recovered or settled. Consequently deferred tax assets and liabilities arising from temporary differences for the Czech operating entities are measured at 24% at June 30, 2006, which is the enacted tax rate for periods subsequent to June 30, 2006. Management records a valuation allowance related to deferred tax assets when it is more likely than not that such amounts will not be realized.

The income tax effect of differences between the financial statement’s carrying amounts of existing assets and liabilities and their respective tax base, comprising the deferred tax assets and deferred tax liabilities on the accompanying condensed consolidated balance sheet, consist of the following as of:

| | | | |

| | | June 30, 2006 ($ thousand) | |

Deferred tax liabilities: | | | | |

Property and equipment | | $ | (15,150 | ) |

Other (deferred financing cost, deferred foreign exchange gains) | | | (13 | ) |

| | | | |

Total deferred tax liabilities | | $ | (15,163 | ) |

| | | | |

The reconciliation of expected income tax expense to the effective income tax expense consists of the following for the six months ended June 30, 2006 and 2005:

| | | | | | | | |

| | | Six Months Ended

June 30, 2006 ($ thousand) | | | Six Months Ended

June 30, 2005 ($ thousand) | |

Income before income taxes | | $ | 584 | | | $ | 4,763 | |

Statutory income tax rate | | | 24 | % | | | 26 | % |

| | |

Tax expense at Czech statutory income tax rate | | | 140 | | | | 1,238 | |

| | |

Non-deductible expenses | | | 893 | | | | 471 | |

Non-taxable income | | | (320 | ) | | | (1,062 | ) |

Other | | | 43 | | | | (121 | ) |

| | | | | | | | |

Total Income tax expense | | $ | 756 | | | $ | 526 | |

| | | | | | | | |

8. Minority interest

Minority interest includes $ 1,798,000 at June 30, 2006 attributable to equity holders with a 3.7% interest in Strategic Hotel Capital Prague a.s.

11

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

9. Hotel management and other agreements

Hotel Management Agreement

There is an executed Hotel Management Agreement in place between InterContinental Hotels Corporation (“Manager”) and one of the Company’s subsidiaries. It defines general terms and a framework for Hotel management, Manager’s compensation scheme, accounting matters and taxes, repairs, maintenance, replacement, insurance, and financing, etc.

The fees due to the Manager include a base management fee, a license fee based upon gross receipts and an incentive management fee based upon net operating income. Such fees total $363,190 and $371,789 for the six months ended June 30, 2006 and 2005, respectively, and have been included in “Management fees and other services” in the accompanying condensed consolidated statements of operations.

In addition to the above fees, there are centralized services fees due to the Manager. These include fees for communication services, marketing and sales services, brand advertising and public relations, training and education. Centralized services fees total $ 216,304 and $ 195,719 for the six months ended June 30, 2006 and 2005, respectively.

The Manager is also entitled to a separate reservation fee calculated as 5% of room revenues generated through the Manager’s reservations systems. Reservation fees total $ 93,331 and $ 103,531 for the six months ended June 30, 2006 and 2005, respectively.

Asset Management Agreements

SHC DTRS Inc. (the “Asset Manager”) entered into separate asset management agreements with certain Group companies and is an affiliate of one of the Group’s owners. Under the terms of these agreements, the Asset Manager provides asset management services in return for aggregate management fees equal to 5% of earnings before interest, tax, depreciation and amortization of the Hotel. An amount of $ 359,828 and $ 510,393 for the six months ended June 30, 2006 and 2005, respectively have been included in “Management fees and other services” in the accompanying condensed consolidated statements of operations for these services.

Hotel Services Agreement

Effective May 24, 2004, the hotel operations company entered into a Hotel Services Agreement with an unrelated third party service provider. Under the terms of the agreement, all employees of the Hotel were transferred to the service provider, and the service provider in turn supplies all necessary staffing for all of the Hotel’s operations. In exchange for these services, the service provider is reimbursed for all costs associated with the supply of staff (including all wages and salaries, bonuses, taxes, fringe benefits, etc.), as well as related administrative and general expenses and operating costs, plus an additional fee of 2.75% of all service costs (as defined in the agreement).

Maintenance contract

In 1996, the Hotel entered into a maintenance contract for certain technological equipment. The contract is for ten years and the fee under this contract can be amended from year to year based on agreement by both parties. The amount paid under the terms of this contract during the six months ended June 30, 2006 and 2005 was $ 464,240 and $ 463,538, respectively. There are no special conditions for early termination of this contract.

10. Other financial income and expenses

Included within other financial income and expenses are the following amounts for the six months ended June 30:

| | | | | | | |

| | | 2006 ($ thousand) | | 2005 ($ thousand) | |

Foreign exchange (gain) loss related to bank debt, net | | $ | 913 | | $ | (3,781 | ) |

Other foreign exchange (gains) losses, net | | | 1,037 | | | 611 | |

Other expenses (income), net | | | — | | | 1 | |

| | | | | | | |

Other financial (income) expenses, net | | $ | 1,950 | | $ | (3,169 | ) |

| | | | | | | |

12

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

Other financial income and expense in the Group’s consolidated financial statements are subject to significant volatility due to the Group’s currency exposures. This volatility occurs at two levels in the Group: first, at the level of the Czech operating companies, which have the Czech crown as their functional currency; and, second at the level of the Company itself, which has the US Dollar as its functional currency. While foreign exchange volatility arises on all assets and liabilities that are not denominated in the functional currency of the Group company holding the asset or liability, the Group’s main exposure to foreign exchange risk arises from the Aareal bank loan.

The Company itself has drawn the Euro-denominated bank loan; however, most of the loan has been lent on to the hotel operating company as a separate Euro-denominated inter-group loan. At June 30, 2006 the Company’s loan balance from the hotel operating company was $ 64,040,000. As a result, the Company had in its stand-alone financial statements a net Euro exposure related to the Aareal Bank loan of $ 23,357,000 at June 30, 2006. Changes in the US Dollar to Euro exchange rate directly impact the condensed consolidated statements of operations with respect to this net exposure.

Foreign exchange volatility in the Czech operating companies arises mainly due to the outstanding Euro-denominated loan from the Company. Because the functional currency of the hotel operating company is the Czech crown, revaluation differences arising from the conversion of this loan from Euros to Czech crowns is recorded through the condensed consolidated statements of operations.

The Group has not hedged the exposures in the Company or in the hotel operating company arising from the Aareal Bank loan partly because of the cost involved and also because Management believes that the loan is an economic hedge of the net assets of the Czech operating companies. Currently the Czech crown is a separate legal currency, however, it is expected that in the coming years the Czech Republic will adopt the Euro and as a result all assets and liabilities of the operating companies will eventually become Euro-denominated.

When assessing the overall impact of changing exchange rates on the financial results and position of the Group, it is also important to consider the effect of the change in the Czech crown to US Dollar exchange rate on the net assets of the Czech operating companies, whose functional currency is the Czech crown. This impact is recorded through the currency translation adjustment.

11. Financial instruments

Fair values of current assets and current liabilities are equal to their reported carrying amounts because of the short maturity of those instruments. The carrying value of the bank debt approximates its fair value, as this instrument bears interest at floating rate. If the outstanding demand notes payable, which bear interest at fixed rates, are repaid at their latest maturity dates then the fair value of these notes would be estimated as to be $ 1,549,000 at June 30, 2006.

Financial instruments, which potentially subject the Group to concentrations of credit risk, consist principally of trade accounts receivable. Concentrations of credit risk with respect to trade accounts receivable are limited due to a large number of customers and their dispersion across many geographical areas.

12. Related parties

Included within accounts payable at June 30, 2006 are $ 940,000 due to Paris Properties PTE Ltd. and $ 506,000 due to SHC Europe, L.L.C., which are affiliates of the Company’s shareholders.

See Note 5 for demand promissory notes/subordinated promissory notes from related parties. See also Note 9 for Asset Management Agreement.

13

SHC Prague InterContinental B.V. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements (continued)

13. Commitments and contingencies

Environmental Matters

The property acquired by the Group has been subjected to environmental reviews. While some of these assessments have led to further investigation and sampling, none of the environmental assessments have revealed, nor is the Group aware of, any environmental liability that the Group believes would have a material adverse effect on the Group’s business or financial statements.

Litigation

The Group is party to various claims and routine litigation arising in the ordinary course of business. Based on discussions with legal counsel, Management does not believe that the results of these claims and litigation, individually or in the aggregate, will have a material adverse effect on the Group’s business or financial statements.

14. Subsequent events

On August 3, 2006, SHC Prague InterContinental, L.L.C., a wholly owned subsidiary of Strategic Hotel Funding, L.L.C., the operating company of Strategic Hotels & Resorts, Inc., closed on its acquisition of a 65% interest in the Group from EU-Hotel PTE Limited and Paris Properties PTE Limited, affiliates of GIC Real Estate, Inc., for $68.8 million and an assumption of approximately $56.5 million in debt (the “Acquisition”). The Acquisition brought SHC Prague InterContinental, L.L.C.’s interest in the entity that owns the InterContinental Prague Hotel to 100%.

14