Investor Presentation May 2012

I.BEE’s Unique Value Proposition

II.Company Overview

III.Industry Update

IV.Operating Trends

V.Financial Overview

1

BEE’s Unique Value Proposition

BEE’s Unique Value Proposition

oThe only pure play high-end lodging REIT

oHigh-end outperforms the industry in a recovery

oIndustry leading asset management expertise

oAssets are in pristine condition

oEmbedded organic growth through revenue growth and ROI opportunities

oReplacement cost, excluding land, approximately $700,000 per key

oHistorically low supply growth environment, particularly in BEE markets

oBalance sheet positioned for growth

The best investment proposition in the lodging space

2

3

BEE’s Unique Value Proposition

Proven Investment Track Record

Industry Leading Asset Management

High-end, Unique & Irreplaceable Hotel & Resort Portfolio

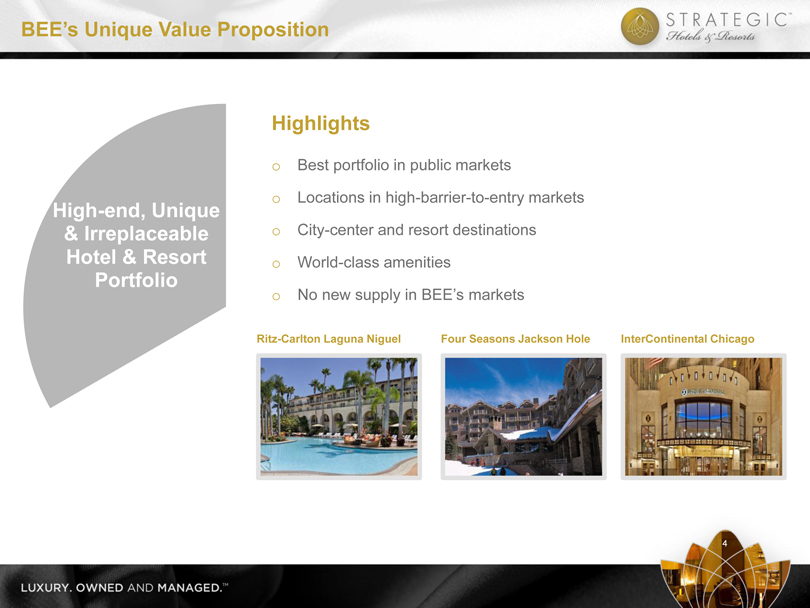

Highlights

oBest portfolio in public markets

oLocations in high-barrier-to-entry markets

oCity-center and resort destinations

oWorld-class amenities

oNo new supply in BEE’s markets

Four Seasons Jackson Hole Ritz-Carlton Laguna Niguel

InterContinental Chicago

4

BEE’s Unique Value Proposition Proven Investment Track Record Industry Leading Asset Management High-end, Unique & Irreplaceable Hotel & Resort Portfolio

BEE’s Unique Value Proposition

Proven Investment Track Record Industry

Highlights

oExecution of complex and accretive restructurings

oAssessment and development of ROI projects

oRecent success in acquiring hotels through off-market transactions

oMaximized proceeds through well-timed asset sales

Hotel del Coronado Michael Jordan’s Steak House Fairmont Scottsdale Princess

5

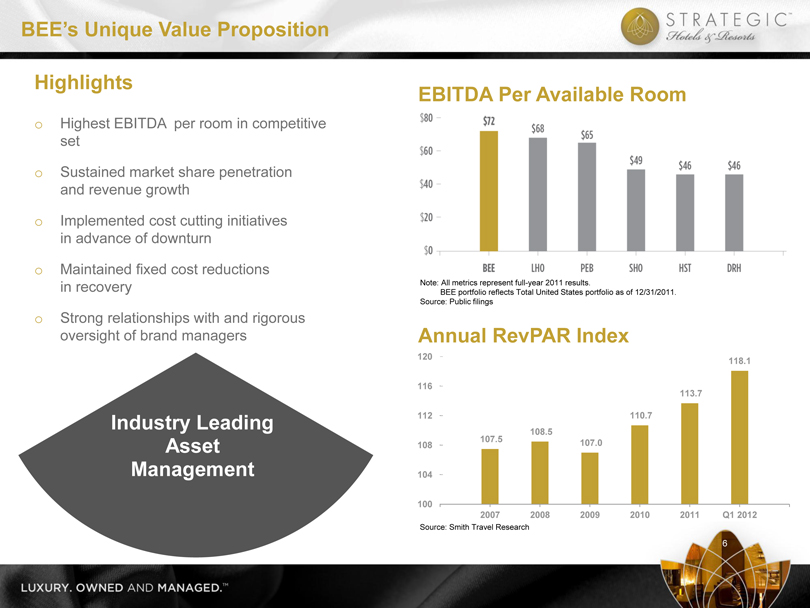

Proven Investment Track Record Industry Leading Asset Management High-end, Unique & Irreplaceable Hotel & Resort Portfolio Highlights

oHighest EBITDA per room in competitive set

oSustained market share penetration and revenue growth

oImplemented cost cutting initiatives in advance of downturn

oMaintained fixed cost reductions in recovery

oStrong relationships with and rigorous oversight of brand managers

EBITDA Per Available Room

Annual RevPAR Index

6

BEE’s Unique Value Proposition

Note: All metrics represent full-year 2011 results.

BEE portfolio reflects Total United States portfolio as of 12/31/2011.

Source: Public filings

Source: Smith Travel Research 107.5 108.5 107.0 110.7 113.7 118.110010410811211612020072008200920102011Q1 2012

I.BEE’s Unique Value Proposition

II.Company Overview

III.Industry Update

IV.Operating Trends

V.Financial Overview

Company Overview

8

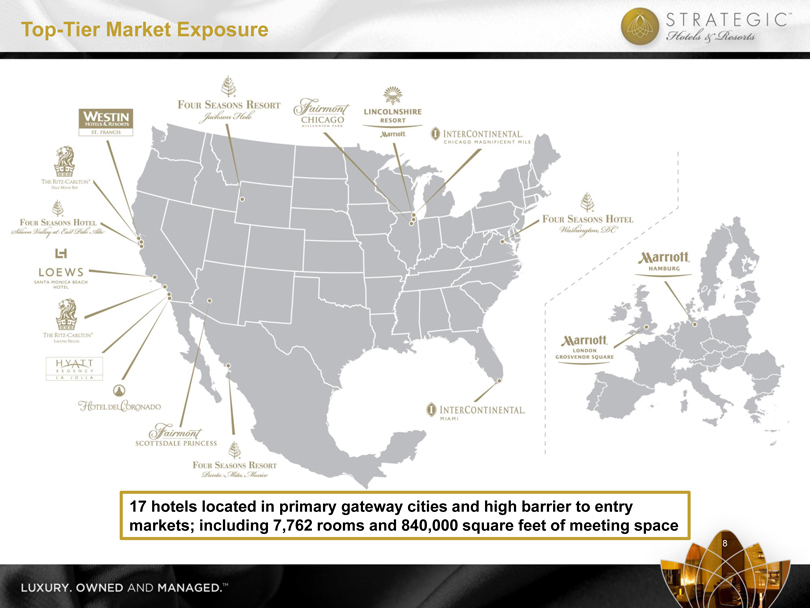

Top-Tier Market Exposure

17 hotels located in primary gateway cities and high barrier to entry markets; including 7,762 rooms and 840,000 square feet of meeting space

oInterContinental Miami – Guestroom renovation

oInterContinental Chicago – Michael Jordan’s Steak House

oFour Seasons Washington, D.C. – Retail outlet renovation

oMarriott Lincolnshire Resort – Lobby renovation

oWestin St. Francis – Michael Mina Steakhouse conversion

oFour Seasons Washington, D.C. – Lobby renovation, 11-room expansion, new restaurant, 63-room and suite renovation

oWestin St. Francis – Clock Bar

oFairmont Chicago – ENO wine tasting room, lobby renovation, guestroom renovation, new spa and fitness center

oFour Seasons Punta Mita Resort – New lobby bar

oRitz-Carlton Half Moon Bay – ENO wine tasting room, restaurant and lounge renovation, suite renovation

Notable 2008 capital projects

Notable 2009 capital projects

Notable 2010 capital projects

Notable 2011 capital projects Fairmont Chicago Lobby Four Seasons Washington, D.C. Lobby Westin St. Francis Michael Mina Bourbon Steak

InterContinental Miami Guestroom

9

Portfolio Well-Positioned to Enhance Cash Flow Growth

Four Seasons Washington, D.C.

oENO Wine Room

oRetail space optimization

Four Seasons Silicon Valley

oQauttro patio renovation

oMeeting room renovation

Four Seasons Jackson Hole

oRestaurant re-concept

InterContinental Chicago

oNorth tower guestroom renovation

oMeeting space expansion

oMichigan Ave. façade optimization

Ritz-Carlton Laguna Niguel

o35-room fire pit addition

oPool deck upgrades

InterContinental Miami

oPublic space revitalization

oMeeting space expansion

oPool deck refurbishment

Fairmont Chicago

oMeeting space renovation

oRestaurant re-concept

Westin St. Francis

oENO Wine Room

Loews Santa Monica Beach Hotel

oExterior / interior upgrade

Significant ROI capital investment opportunities within existing portfolio; rigorous analysis and approval process for each project 10 Potential Capital Projects in the Pipeline

I.BEE’s Unique Value Proposition

II.Company Overview

III.Industry Update

IV.Operating Trends

V.Financial Overview

Industry Update

-7%-5%-3%-1%1%3%5%7%9%198919911993199519971999200120032005200720092011Supply % Change Demand % Change12

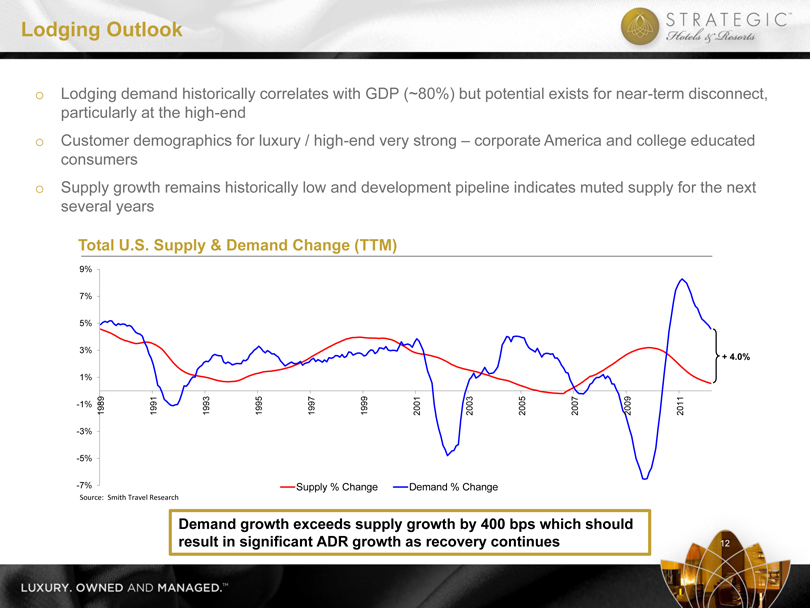

oLodging demand historically correlates with GDP (~80%) but potential exists for near-term disconnect, particularly at the high-end

oCustomer demographics for luxury / high-end very strong – corporate America and college educated consumers

oSupply growth remains historically low and development pipeline indicates muted supply for the next several years

Total U.S. Supply & Demand Change (TTM) Source: Smith Travel Research Demand growth exceeds supply growth by 400 bps which should result in significant ADR growth as recovery continues Lodging Outlook

12 + 4.0%

13 Source: Smith Travel Research Note: Data represents trends within the United States

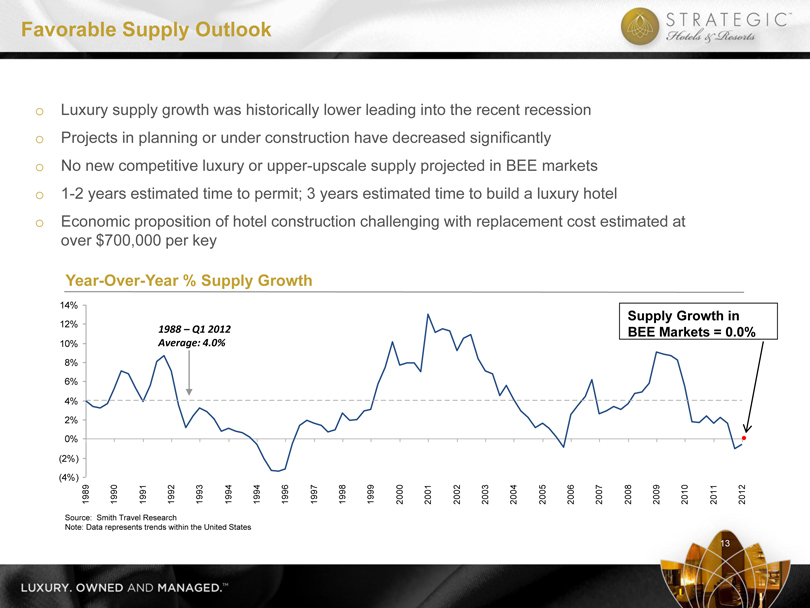

oLuxury supply growth was historically lower leading into the recent recession

oProjects in planning or under construction have decreased significantly

oNo new competitive luxury or upper-upscale supply projected in BEE markets

o1-2 years estimated time to permit; 3 years estimated time to build a luxury hotel

oEconomic proposition of hotel construction challenging with replacement cost estimated at over $700,000 per key

13

Favorable Supply Outlook Year-Over-Year % Supply Growth

1988 – Q1 2012 Average: 4.0% Supply Growth in BEE Markets = 0.0% (4%)(2%)0%2%4%6%8%10%12%14%198919901991199219931994199419961997199819992000200120022003200420052006200720082009201020112012

10,00015,00020,00025,00030,00035,00014 Source: Smith Travel Research and PWC -20%-15%-10%-5%0%5%10%15%20%198819911994199720002003200620092012ETotal U.S.LuxurySource: Smith Travel Research Luxury Outperformance: 2.2% CAGR

Luxury

Outperformance:

4.1% CAGR Annual % Change in RevPAR

Quarterly Luxury Room Night Demand (000s)

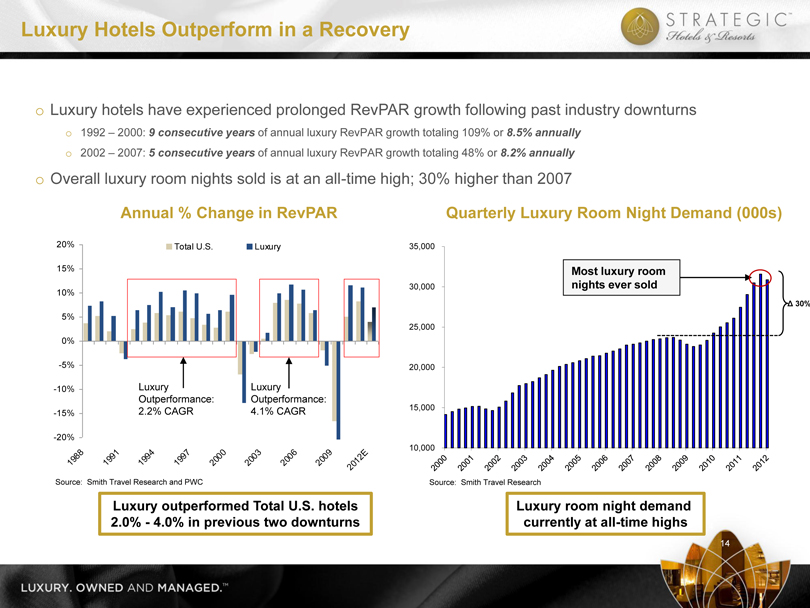

oLuxury hotels have experienced prolonged RevPAR growth following past industry downturns

o1992 – 2000: 9 consecutive years of annual luxury RevPAR growth totaling 109% or 8.5% annually

o2002 – 2007: 5 consecutive years of annual luxury RevPAR growth totaling 48% or 8.2% annually

oOverall luxury room nights sold is at an all-time high; 30% higher than 2007

Luxury outperformed Total U.S. hotels 2.0%—4.0% in previous two downturns

Luxury room night demand currently at all-time highs

14 Luxury Hotels Outperform in a Recovery

Most luxury room nights ever sold ? 30%

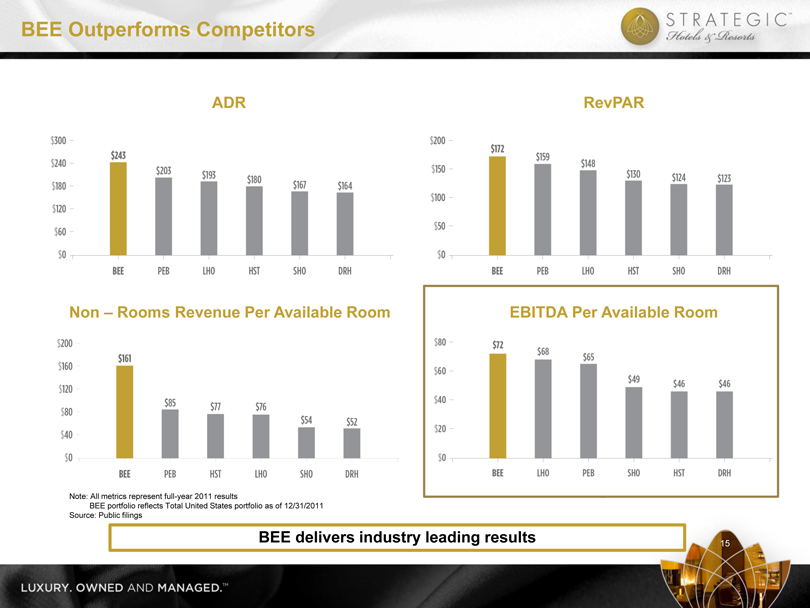

15 ADR RevPAR

EBITDA Per Available Room

Non – Rooms Revenue Per Available Room

Note: All metrics represent full-year 2011 results

BEE portfolio reflects Total United States portfolio as of 12/31/2011

Source: Public filings

BEE delivers industry leading results

15

BEE Outperforms Competitors

16

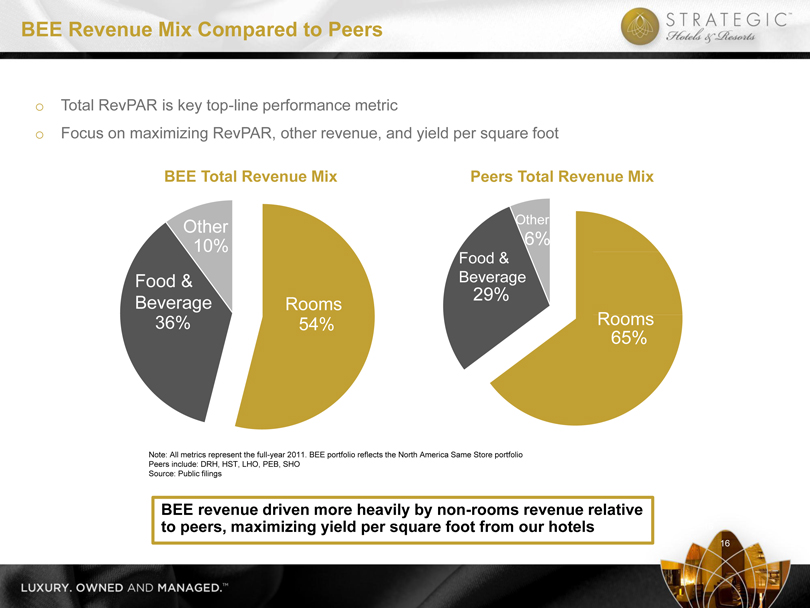

oTotal RevPAR is key top-line performance metric

oFocus on maximizing RevPAR, other revenue, and yield per square foot

BEE Total Revenue Mix

Peers Total Revenue Mix

Note: All metrics represent the full-year 2011. BEE portfolio reflects the North America Same Store portfolio

Peers include: DRH, HST, LHO, PEB, SHO

Source: Public filings

BEE revenue driven more heavily by non-rooms revenue relative to peers, maximizing yield per square foot from our hotels

16

BEE Revenue Mix Compared to Peers 54%36%10%Rooms Other

Food & Beverage 65%29%6%

Rooms

Other

Food & Beverage

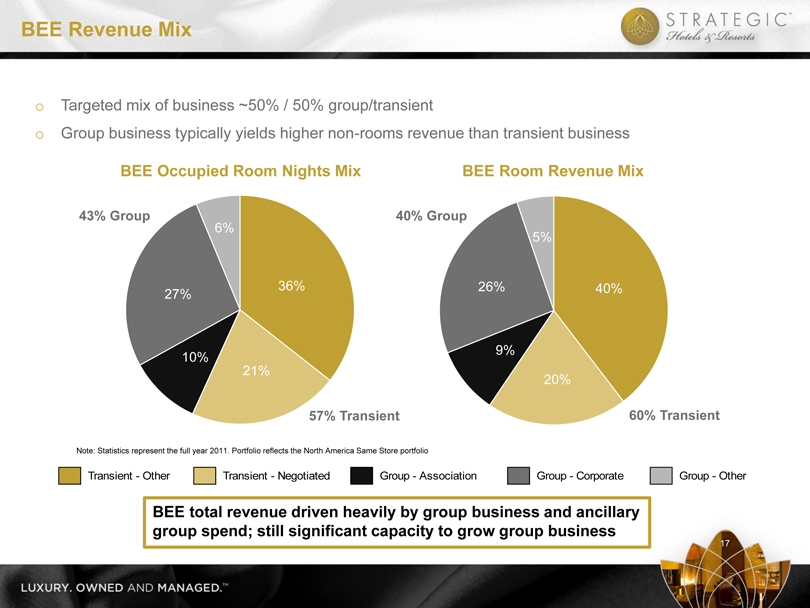

36%21%10%27%6%40%20%9%26%5%17

Note: Statistics represent the full year 2011. Portfolio reflects the North America Same Store portfolio BEE Occupied Room Nights Mix BEE Room Revenue Mix

oTargeted mix of business ~50% / 50% group/transient

oGroup business typically yields higher non-rooms revenue than transient business

43% Group

40% Group

57% Transient

60% Transient

BEE total revenue driven heavily by group business and ancillary group spend; still significant capacity to grow group business

17 BEE Revenue Mix Transient – Other Transient – Negotiated Group – Association Group – Corporate Group—Other

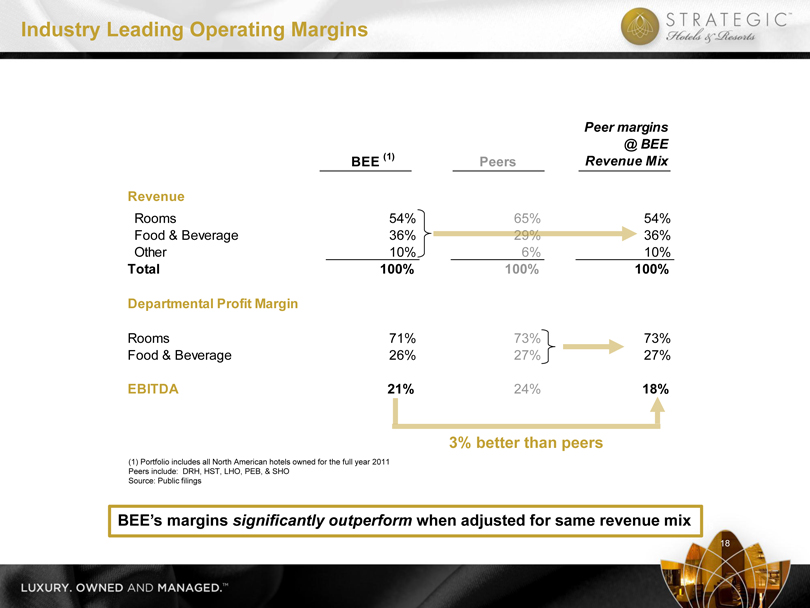

BEE (1)PeersPeer margins @ BEE Revenue MixRevenue Rooms54%65%54% Food & Beverage36%29%36% Other10%6%10%Total100%100%100%Departmental Profit MarginRooms71%73%73%Food & Beverage26%27%27%EBITDA21%24%18%18 3% better than peers

(1) Portfolio includes all North American hotels owned for the full year 2011

Peers include: DRH, HST, LHO, PEB, & SHO

Source: Public filings

BEE’s margins significantly outperform when adjusted for same revenue mix

18

Industry Leading Operating Margins

I.BEE’s Unique Value Proposition

II.Company Overview

III.Industry Update

IV.Operating Trends

V.Financial Overview

Operating Trends

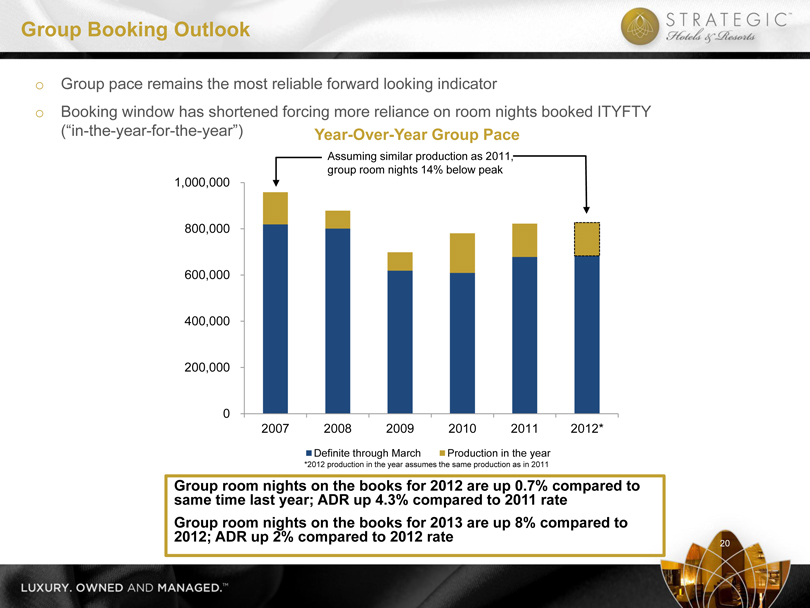

0200,000400,000600,000800,0001,000,000200720082009201020112012*Definite through MarchProduction in the year20

oGroup pace remains the most reliable forward looking indicator

oBooking window has shortened forcing more reliance on room nights booked ITYFTY (“in-the-year-for-the-year”)

Year-Over-Year Group Pace

Assuming similar production as 2011, group room nights 14% below peak *2012 production in the year assumes the same production as in 2011

Group room nights on the books for 2012 are up 0.7% compared to same time last year; ADR up 4.3% compared to 2011 rate

Group room nights on the books for 2013 are up 8% compared to 2012; ADR up 2% compared to 2012 rate

20

Group Booking Outlook

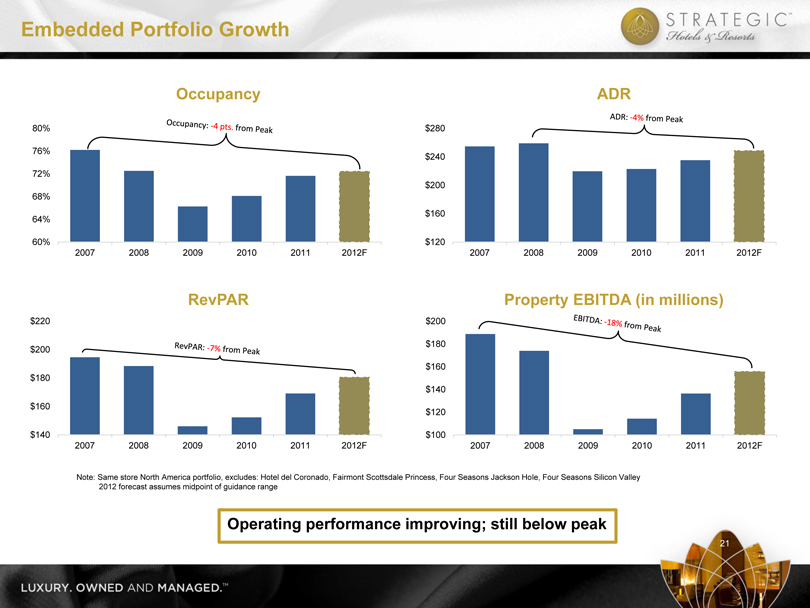

21 $100$120$140$160$180$200200720082009201020112012F$140$160$180$200$220200720082009201020112012F

$120$160$200$240$280200720082009201020112012F60%64%68%72%76%80%200720082009201020112012

FOcc u panc y AD R

Re vPAR Property EBITDA (in millions)

Note: Same store North America portfolio, excludes: Hotel del Coronado, Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four Seasons Silicon Valley 2012 forecast assumes midpoint of guidance range

Operating performance improving; still below peak

21

Embedded Portfolio Growth

I.BEE’s Unique Value Proposition

II.Company Overview

III.Industry Update

IV.Operating Trends

V.Financial Overview

Financial Overview

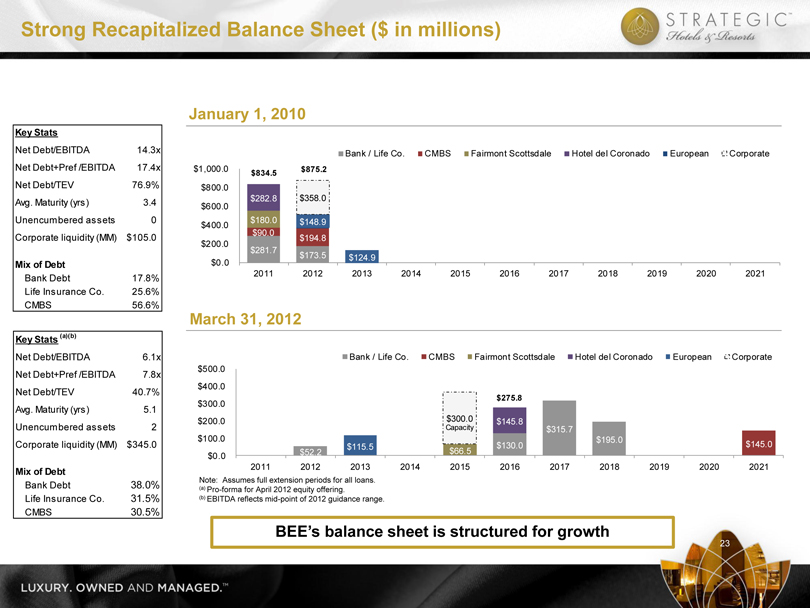

January 1, 2010

March 31, 2012

BEE’s balance sheet is structured for growth

23 Strong Recapitalized Balance Sheet ($ in millions) Key Stats (a)(b)Net Debt/EBITDA6.1xNet Debt+Pref /EBITDA7.8xNet Debt/TEV40.7%Avg. Maturity (yrs)5.1Unencumbered assets2Corporate liquidity (MM)$345.0Mix of DebtBank Debt38.0%Life Insurance Co.31.5%CMBS30.5%$52.2 $130.0 $315.7 $195.0 $145.0 $66.5 $145.8 $115.5 $0.0$100.0$200.0$300.0$400.0$500.020112012201320142015201620172018201920202021Bank / Life Co.CMBSFairmont ScottsdaleHotel del CoronadoEuropeanCorporate$300.0Capacity$275.8$281.7 $173.5 $90.0 $194.8 $180.0 $282.8 $148.9 $124.9 $358.0 $0.0$200.0$400.0$600.0$800.0$1,000.020112012201320142015201620172018201920202021Bank / Life Co.CMBSFairmont ScottsdaleHotel del CoronadoEuropeanCorporate$834.5$875.2

Note: Assumes full extension periods for all loans.

(a) Pro-forma for April 2012 equity offering.

(b) EBITDA reflects mid-point of 2012 guidance range.

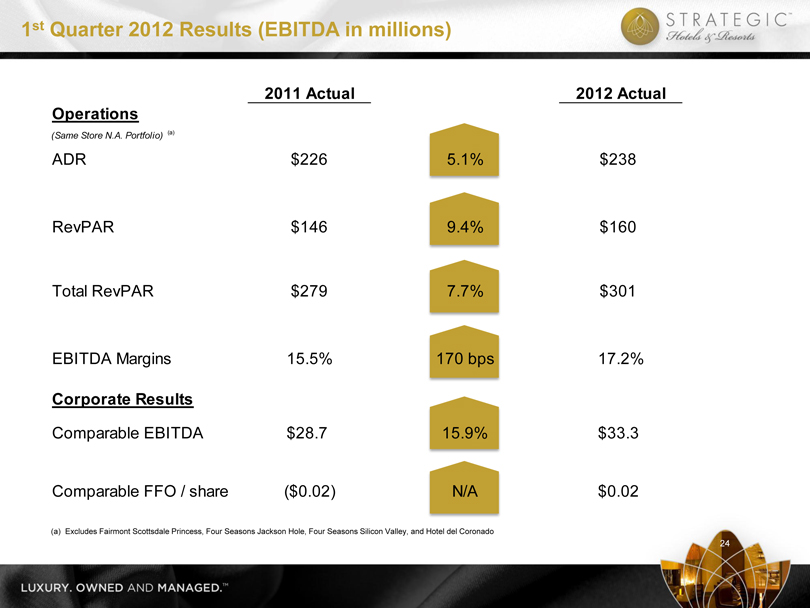

(a) Excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Hotel del Coronado 24

1st Quarter 2012 Results (EBITDA in millions) 2011 Actual2012 ActualOperations(Same Store N.A. Portfolio) (a)ADR$2265.1%$238RevPAR$1469.4%$160Total RevPAR$2797.7%$301EBITDA Margins15.5%170 bps17.2%Corporate Results Comparable EBITDA$28.715.9%$33.3Comparable FFO / share($0.02)N/A$0.02

(a) Portfolio excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four Seasons Silicon Valley, and Hotel del Coronado

(b) 2011 Comparable FFO / share excludes one-time gain associated with preferred equity tender

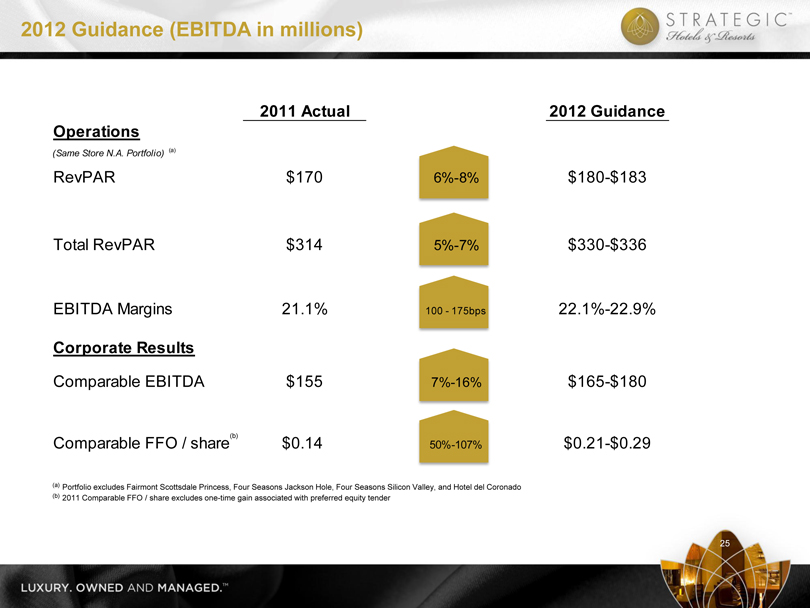

25

2012 Guidance (EBITDA in millions) 2011 Actual2012 GuidanceOperations(Same Store N.A. Portfolio) (a)RevPAR$1706%-8%$180-$183Total RevPAR$3145%-7%$330-$336EBITDA Margins21.1%100—175bps22.1%-22.9%Corporate ResultsComparable EBITDA$1557%-16%$165-$180Comparable FFO / share$0.1450%-107%$0.21-$0.29(b)

oThe only pure play high-end lodging REIT

oHigh-end outperforms the industry in a recovery

oIndustry leading asset management expertise

oAssets are in pristine condition

oEmbedded organic growth through revenue growth and ROI opportunities

oReplacement cost, excluding land, approximately $700,000 per key

oHistorically low supply growth environment, particularly in BEE markets

oBalance sheet positioned for growth

The best investment proposition in the lodging space

26

BEE’s Unique Value Proposition

Except for historical information, the matters discussed in this presentation are forward-looking statements subject to certain risks and uncertainties. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. These forward-looking statements are identified by their use of such terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “continue” and other similar terms and phrases, including references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance. Actual results could differ materially from the Company’s projections.

Factors that may contribute to these differences include, but are not limited to the following: the effects of the recent global economic recession upon business and leisure travel and the hotel markets in which the Company invests; the Company’s liquidity and refinancing demands; the Company’s ability to obtain or refinance maturing debt; the Company’s ability to maintain compliance with covenants contained in the Company’s debt facilities; the Company’s ability to meet the requirements of the Maryland General Corporation Law with respect to the payment of preferred dividends on the June 29, 2012 payment date; stagnation or further deterioration in economic and market conditions, particularly impacting business and leisure travel spending in the markets where the Company’s hotels operate and in which the Company invests, including luxury and upper upscale product; general volatility of the capital markets and the market price of the Company’s shares of common stock; availability of capital; the Company’s ability to dispose of properties in a manner consistent with the Company’s investment strategy and liquidity needs; hostilities and security concerns, including future terrorist attacks, or the apprehension of hostilities, in each case that affect travel within or to the United States, Mexico, Germany, England or other countries where the Company invests; difficulties in identifying properties to acquire and completing acquisitions; the Company’s failure to maintain effective internal control over financial reporting and disclosure controls and procedures; risks related to natural disasters; increases in interest rates and operating costs, including insurance premiums and real property taxes; contagious disease outbreaks, such as the H1N1 virus outbreak; delays and cost-overruns in construction and development; marketing challenges associated with entering new lines of business or pursuing new business strategies; the Company’s failure to maintain the Company’s status as a REIT; changes in the competitive environment in the Company’s industry and the markets where the Company invests; changes in real estate and zoning laws or regulations; legislative or regulatory changes, including changes to laws governing the taxation of REITS; changes in generally accepted accounting principles, policies and guidelines; and litigation, judgments or settlements.

Additional risks are discussed in the Company’s filings with the Securities and Exchange Commission, including those appearing under the heading “Item 1A. Risk Factors” in the Company’s most recent Form 10-K and subsequent Form 10-Qs. Although the Company believes the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. The forward-looking statements are made as of the date of this press release, and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

27 Disclaimer

28

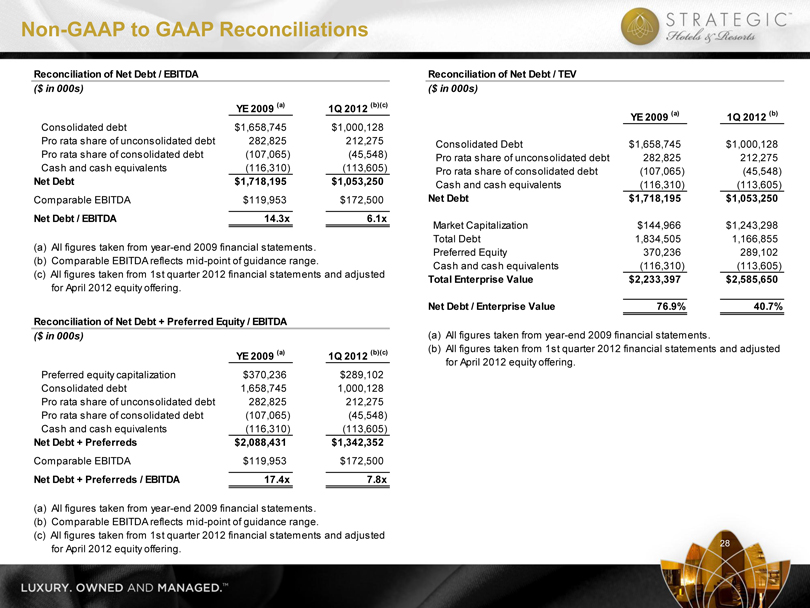

Non-GAAP to GAAP Reconciliations Reconciliation of Net Debt / EBITDA($ in 000s)YE 2009 (a)1Q 2012 (b)(c) Consolidated debt$1,658,745$1,000,128Pro rata share of unconsolidated debt282,825212,275Pro rata share of consolidated debt(107,065)(45,548)Cash and cash equivalents(116,310)(113,605)Net Debt$1,718,195$1,053,250Comparable EBITDA$119,953$172,500Net Debt / EBITDA14.3x6.1x(a) All figures taken from year-end 2009 financial statements.(b) Comparable EBITDA reflects mid-point of guidance range.(c) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering.Reconciliation of Net Debt / TEV($ in 000s)YE 2009 (a)1Q 2012 (b)Consolidated Debt$1,658,745$1,000,128Pro rata share of unconsolidated debt282,825212,275Pro rata share of consolidated debt(107,065)(45,548)Cash and cash equivalents(116,310)(113,605)Net Debt$1,718,195$1,053,250 Market Capitalization$144,966$1,243,298 Total Debt1,834,5051,166,855 Preferred Equity370,236289,102 Cash and cash equivalents(116,310)(113,605)Total Enterprise Value$2,233,397$2,585,650Net Debt / Enterprise Value 76.9%40.7%(a) All figures taken from year-end 2009 financial statements.(b) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering. Reconciliation of Net Debt + Preferred Equity / EBITDA($ in 000s)YE 2009 (a)1Q 2012 (b)(c) Preferred equity capitalization$370,236$289,102Consolidated debt1,658,7451,000,128Pro rata share of unconsolidated debt282,825212,275Pro rata share of consolidated debt(107,065)(45,548)Cash and cash equivalents(116,310)(113,605)Net Debt + Preferreds$2,088,431$1,342,352Comparable EBITDA$119,953$172,500Net Debt + Preferreds / EBITDA17.4x7.8x(a) All figures taken from year-end 2009 financial statements.(b) Comparable EBITDA reflects mid-point of guidance range.(c) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering.

|

|

29

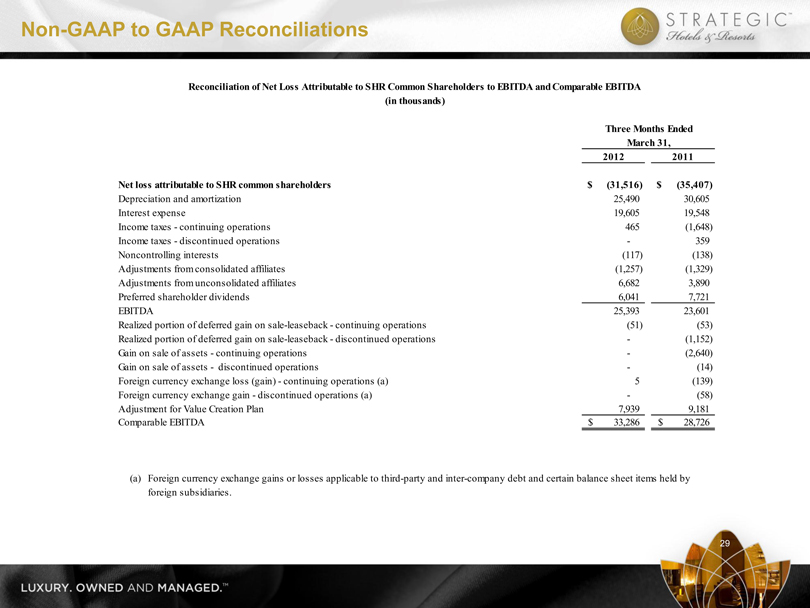

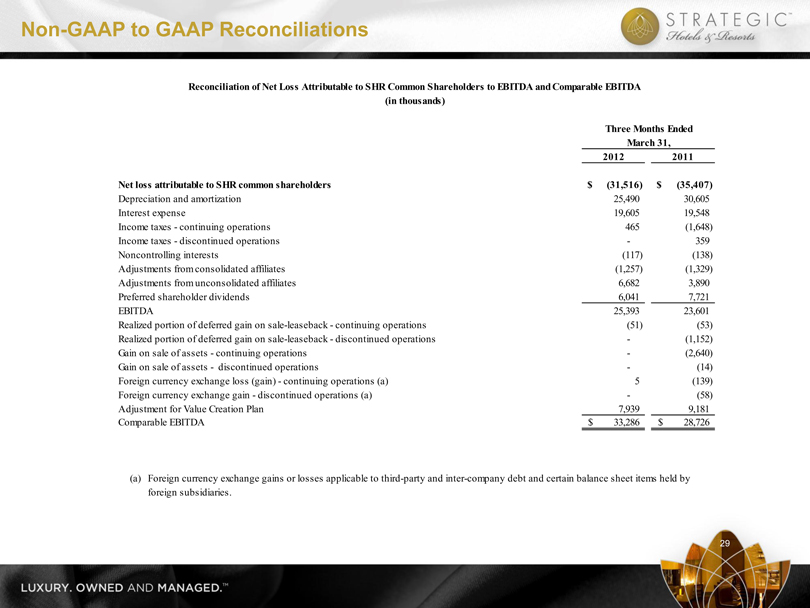

Non-GAAP to GAAP Reconciliations 20122011Net loss attributable to SHR common shareholders(31,516)$ (35,407)$ Depreciation and amortization 25,490 30,605 Interest expense 19,605 19,548 Income taxes—continuing operations465 (1,648) Income taxes—discontinued operations- 359 Noncontrolling interests(117) (138) Adjustments from consolidated affiliates (1,257) (1,329) Adjustments from unconsolidated affiliates6,682 3,890 Preferred shareholder dividends6,041 7,721 EBITDA25,393 23,601 Realized portion of deferred gain on sale-leaseback—continuing operations(51) (53) Realized portion of deferred gain on sale-leaseback—discontinued operations- (1,152) Gain on sale of assets—continuing operations- (2,640) Gain on sale of assets—discontinued operations- (14) Foreign currency exchange loss (gain)—continuing operations (a)5 (139) Foreign currency exchange gain—discontinued operations (a)- (58) Adjustment for Value Creation Plan7,939 9,181 Comparable EBITDA 33,286$ 28,726$ (a)Foreign currency exchange gains or losses applicable to third-party and inter-company debt and certain balance sheet items held by foreign subsidiaries.March 31,Reconciliation of Net Loss Attributable to SHR Common Shareholders to EBITDA and Comparable EBITDA(in thousands)Three Months Ended

|

|

30

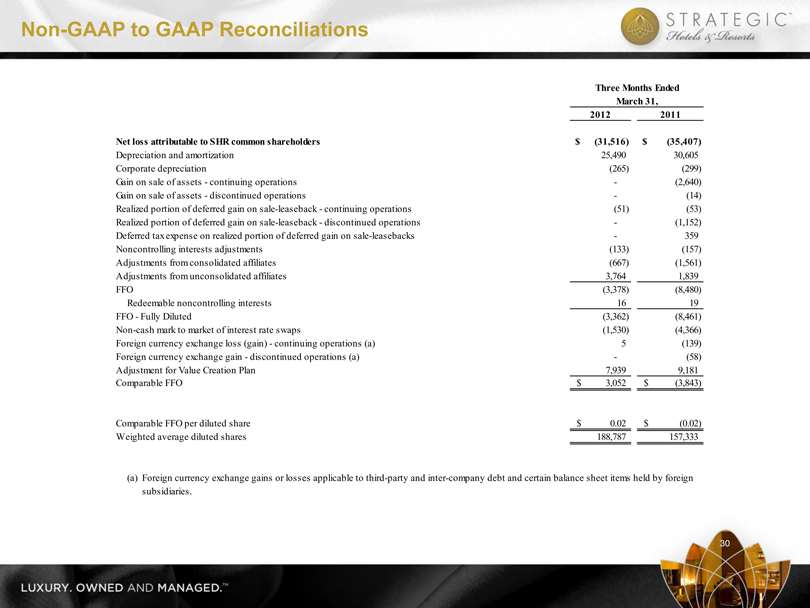

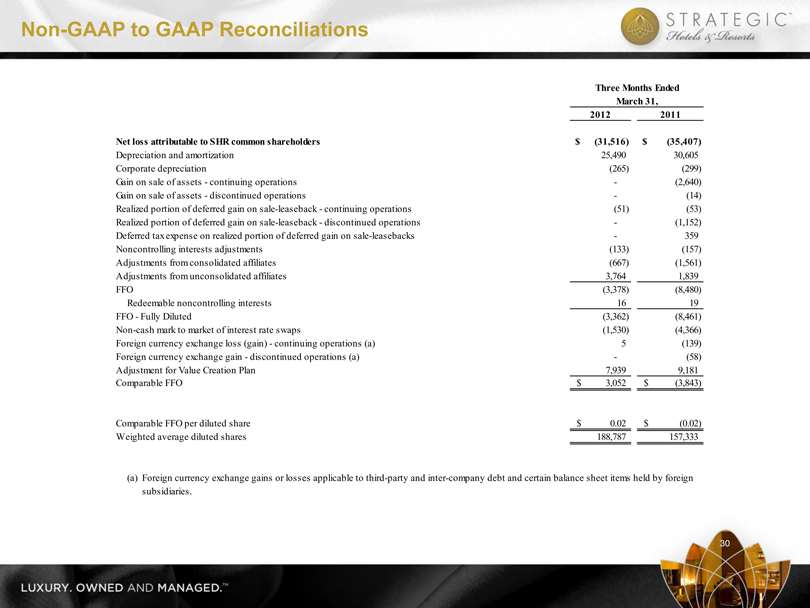

Non-GAAP to GAAP Reconciliations 20122011Net loss attributable to SHR common shareholders(31,516)$ (35,407)$ Depreciation and amortization 25,490 30,605 Corporate depreciation(265) (299) Gain on sale of assets—continuing operations- (2,640) Gain on sale of assets—discontinued operations- (14) Realized portion of deferred gain on sale-leaseback—continuing operations(51) (53) Realized portion of deferred gain on sale-leaseback—discontinued operations- (1,152) Deferred tax expense on realized portion of deferred gain on sale-leasebacks- 359 Noncontrolling interests adjustments(133) (157) Adjustments from consolidated affiliates (667) (1,561) Adjustments from unconsolidated affiliates3,764 1,839 FFO(3,378) (8,480) Redeemable noncontrolling interests16 19 FFO—Fully Diluted(3,362) (8,461) Non-cash mark to market of interest rate swaps (1,530) (4,366) Foreign currency exchange loss (gain)—continuing operations (a)5 (139) Foreign currency exchange gain—discontinued operations (a)- (58) Adjustment for Value Creation Plan7,939 9,181 Comparable FFO 3,052$ (3,843)$ Comparable FFO per diluted share0.02$ (0.02)$ Weighted average diluted shares188,787 157,333 (a)Foreign currency exchange gains or losses applicable to third-party and inter-company debt and certain balance sheet items held by foreign subsidiaries.March 31,Three Months Ended

|

|

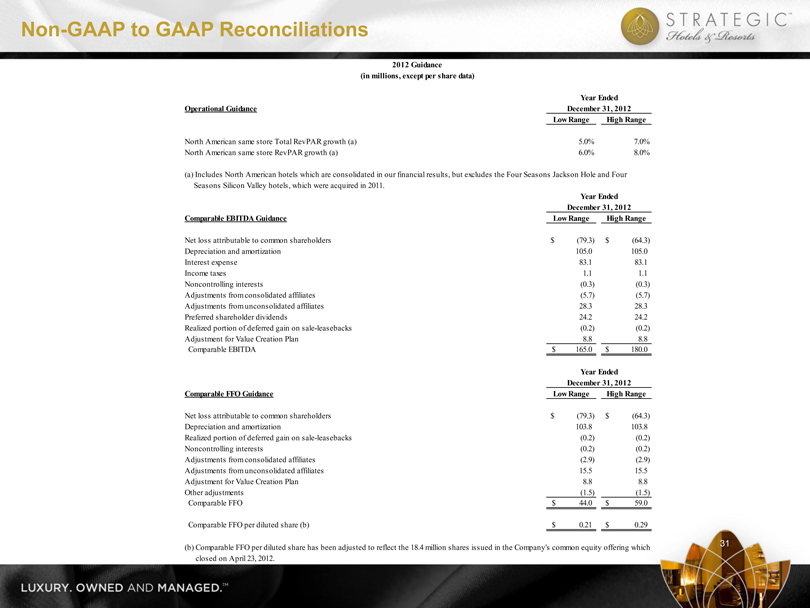

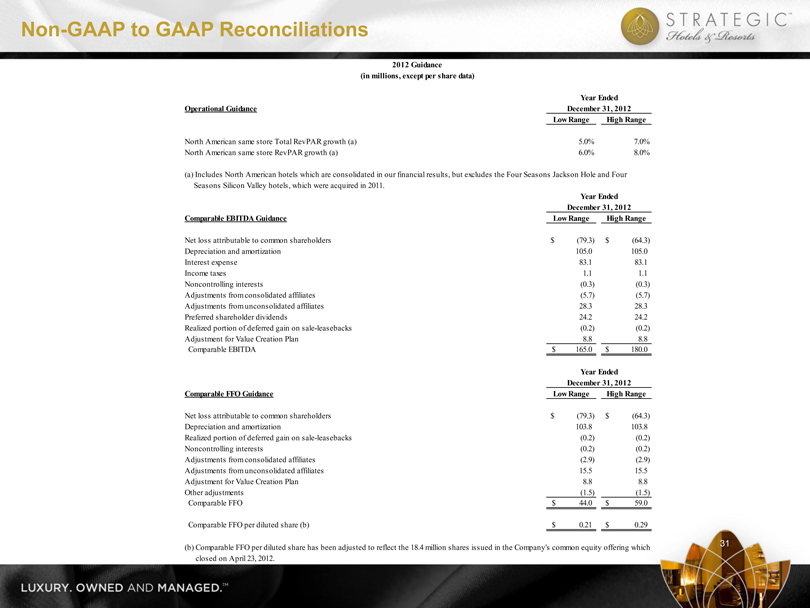

31 Non-GAAP to GAAP Reconciliations Operational GuidanceLow RangeHigh RangeNorth American same store Total RevPAR growth (a)5.0%7.0%North American same store RevPAR growth (a)6.0%8.0%(a) Includes North American hotels which are consolidated in our financial results, but excludes the Four Seasons Jackson Hole and FourSeasons Silicon Valley hotels, which were acquired in 2011.Comparable EBITDA GuidanceLow RangeHigh RangeNet loss attributable to common shareholders(79.3)$ (64.3)$ Depreciation and amortization 105.0 105.0 Interest expense83.1 83.1 Income taxes1.1 1.1 Noncontrolling interests(0.3) (0.3) Adjustments from consolidated affiliates(5.7) (5.7) Adjustments from unconsolidated affiliates28.3 28.3 Preferred shareholder dividends24.2 24.2 Realized portion of deferred gain on sale-leasebacks(0.2) (0.2) Adjustment for Value Creation Plan8.8 8.8 Comparable EBITDA165.0$ 180.0$ Comparable FFO GuidanceLow RangeHigh RangeNet loss attributable to common shareholders(79.3)$ (64.3)$ Depreciation and amortization 103.8 103.8 Realized portion of deferred gain on sale-leasebacks(0.2) (0.2) Noncontrolling interests(0.2) (0.2) Adjustments from consolidated affiliates(2.9) (2.9) Adjustments from unconsolidated affiliates15.5 15.5 Adjustment for Value Creation Plan8.8 8.8 Other adjustments(1.5) (1.5) Comparable FFO44.0$ 59.0$ Comparable FFO per diluted share (b)0.21$ 0.29$ (b) Comparable FFO per diluted share has been adjusted to reflect the 18.4 million shares

issued in the Company’s common equity offering which closed on April 23, 2012.2012 Guidance(in millions, except per share data)Year EndedDecember 31, 2012December 31, 2012Year EndedDecember 31, 2012Year Ended

32

Thank You