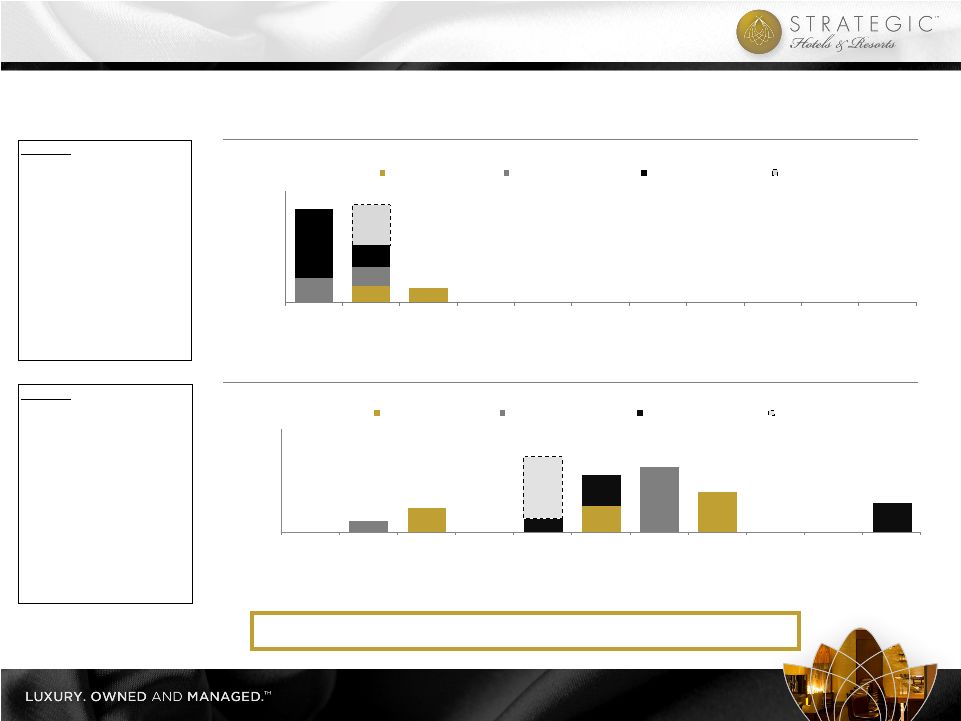

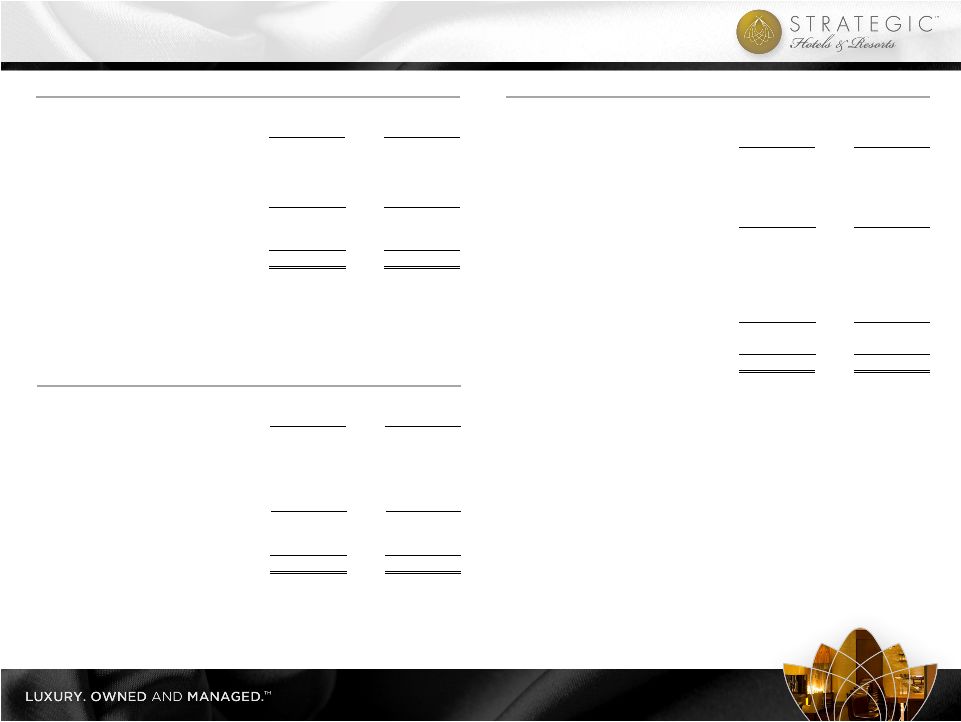

Non-GAAP to GAAP Reconciliations 29 Reconciliation of Net Debt / EBITDA ($ in 000s) YE 2009 (a) 1Q 2012 (b)(c) Consolidated debt $1,658,745 $1,046,128 Pro rata share of unconsolidated debt 282,825 212,275 Pro rata share of consolidated debt (107,065) (45,548) Cash and cash equivalents (116,310) (58,205) Net Debt $1,718,195 $1,154,650 Comparable EBITDA $119,953 $172,500 Net Debt / EBITDA 14.3x 6.7x (a) All figures taken from year-end 2009 financial statements. (b) Comparable EBITDA reflects mid-point of guidance range. (c) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering and June 2012 preferred dividend payment. Reconciliation of Net Debt + Preferred Equity / EBITDA ($ in 000s) YE 2009 (a) 1Q 2012 (b)(c) Preferred equity capitalization $370,236 $289,102 Consolidated debt 1,658,745 1,046,128 Pro rata share of unconsolidated debt 282,825 212,275 Pro rata share of consolidated debt (107,065) (45,548) Cash and cash equivalents (116,310) (58,205) Net Debt + Preferreds $2,088,431 $1,443,752 Comparable EBITDA $119,953 $172,500 Net Debt + Preferreds / EBITDA 17.4x 8.4x (a) All figures taken from year-end 2009 financial statements. (b) Comparable EBITDA reflects mid-point of guidance range. (c) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering and June 2012 preferred dividend payment. Reconciliation of Net Debt / TEV ($ in 000s) YE 2009 (a) 1Q 2012 (b) Consolidated Debt $1,658,745 $1,046,128 Pro rata share of unconsolidated debt 282,825 212,275 Pro rata share of consolidated debt (107,065) (45,548) Cash and cash equivalents (116,310) (58,205) Net Debt $1,718,195 $1,154,650 Market Capitalization $144,966 $1,364,370 Total Debt 1,834,505 1,212,855 Preferred Equity 370,236 289,102 Cash and cash equivalents (116,310) (58,205) Total Enterprise Value $2,233,397 $2,808,122 Net Debt / Enterprise Value 76.9% 41.1% (a) All figures taken from year-end 2009 financial statements. (b) All figures taken from 1st quarter 2012 financial statements and adjusted for April 2012 equity offering and June 2012 preferred dividend payment. |