- WST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

West Pharmaceutical Services (WST) 8-KRegulation FD Disclosure

Filed: 11 Feb 08, 12:00am

Donald E. Morel, Jr., Ph.D.

Chairman and Chief Executive Officer

William J. Federici

Vice President and Chief Financial Officer

Investor Relations Contact:

Michael A. Anderson

Vice President and Treasurer

mike.anderson@westpharma.com

UBS Global Healthcare Conference

New York, NY

February 11, 2008

NYSE: WST

westpharma.com

Certain statements in the following slides and certain statements that may be made by management of the Company orally during this presentation

contain some forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended, that are based on management’s plans and assumptions. Such statements give our current expectations or

forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever possible, to identify such statements by using

words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate” and other words and terms of similar meaning in connection with any

discussion of future operating or financial performance or condition. We cannot guarantee that any forward-looking statement will be realized. If known

or unknown risks or uncertainties materialize, or if underlying assumptions are inaccurate, actual results could differ materially from past results and

those expressed or implied in any forward-looking statement. You should bear this in mind as you consider forward-looking statements. We undertake

no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise.

Important factors that may affect future results include the following: sales demand and our ability to meet that demand; competition from other

providers in the Company’s business, including customers’ in-house operations, and from lower-cost producers in emerging markets which can impact

unit volume, price and profitability; customers’ changing inventory requirements and manufacturing plans that alter existing orders or ordering patterns

for the products we supply them; the timing, regulatory approval and commercial success of customer products incorporating our products and

services, including relevant third-party reimbursement for prescription products, medical devices and components and medical procedures in which

those products are employed or consumed; the ability of Nektar Therapeutics to market the Exubera® Inhalation-Powder insulin device and product and

the resolution of the parties’ obligations under the supply contract between the Company and Nektar consistent with the Company’s current

expectations; average profitability, or mix, of products sold in any reporting period; maintaining or improving production efficiencies and overhead

absorption; the timeliness and effectiveness of capacity expansions, particularly capacity expansions, including the effects of delays associated with

construction, availability and price of capital goods, and necessary internal, governmental and customer approvals of planned and completed projects,

and the demand for goods to be produced in new facilities; dependence on third-party suppliers and partners, including our Japanese partner Daikyo

Seiko Ltd.; the availability and cost of skilled employees required to meet increased production, managerial, research and other needs of the Company,

including professional employees and persons employed under collective bargaining agreements; interruptions or weaknesses in our supply chain,

which could cause delivery delays or restrict the availability of raw materials and key bought-in components and finished products; raw-material price

escalation, particularly petroleum-based raw materials, and our ability to pass raw-material cost increases on to customers through price increases; the

development, regulatory approval and marketing of new products as a result of the Company’s research and development efforts; the defense of self-

developed or in-licensed intellectual property, including patents, trade and service marks and trade secrets; dependence of normal business operations

on information and communication systems and technologies provided, installed or operated by third parties; the relative strength of the U.S. dollar in

relation to other currencies, particularly the Euro, British Pound, and Japanese Yen; changes in tax law or loss of beneficial tax incentives; the

conclusion of unresolved tax positions consistent with currently expected outcomes; and the timely execution and realization of savings anticipated by

the Company’s restructuring plan announced December 12, 2007.

Exubera® is a registered trademark of Pfizer, Inc.

Safe Harbor Statement

Founded in 1923

Headquarters in Lionville, PA

Company Overview

Who we are

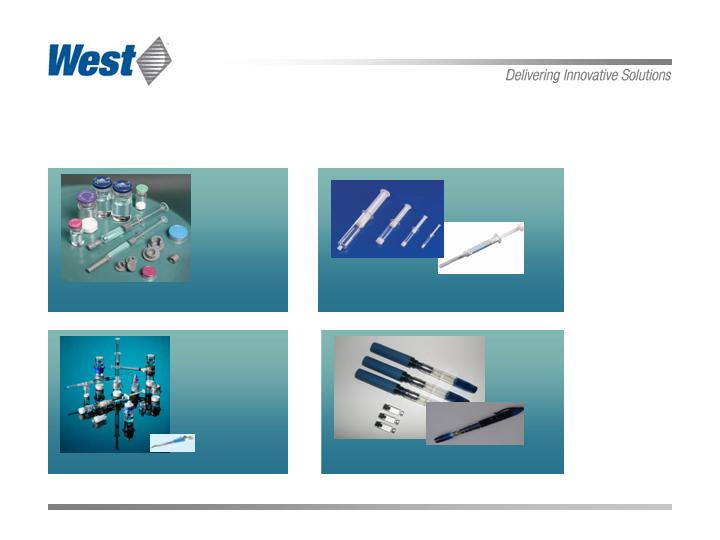

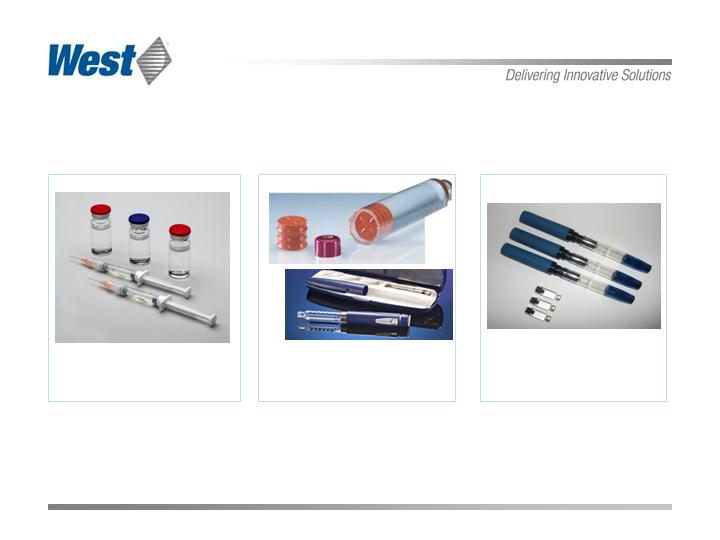

World’s premier manufacturer

of components and systems

for injectable drug delivery

Closure systems and prefillable

syringe components

Components for disposable systems

Devices and device sub-assemblies

Safety and administration systems

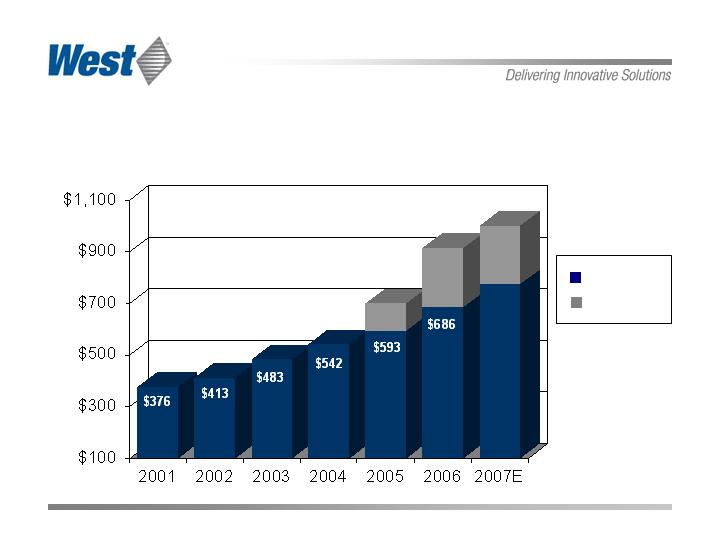

Estimated 2007 sales > $1.0 billion

Market cap $1.2 $1.3billion

Diverse, Stable Customer Base

Company Estimated Market Share: 70% in Pharma; 70% in Device; 95% in Biotech

Key Developments - 2007

Daikyo sales and technology agreements extended

to 2017

Raised $161.5 million, 4% convertible junior sub

debenture

Announced stock buy-back of up to 1 million shares

Pfizer exited Exubera®

CMS reimbursement changed for ESA drugs

Tech Group restructuring announced

China land use application approved

* Exubera is a registered trademark of Pfizer, Inc.

($ millions)

Strong Sales Growth

Core Business

Acquisitions

$107

$227

Global

Revenue

Breakdown

Based on 2007 estimates

South America:

4%

North America:

50%

Europe:

42%

Asia/Pacific:

4%

Market Dynamics Support Continued Growth

Aging population creates an increasing number of patients with chronic

illnesses such as diabetes and cancer

Biologic drugs (2006 Market: $56 billion*) continue to grow

Biologic drugs represent the fastest growing segment of the injectable

pharma market (13% CAGR projected through 2010)*

Injectables currently account for ~15% of the global drug delivery market**

Resurgence in vaccine research and development

China and India’s economic growth and growing demand for advanced

healthcare

Point-of-care shift: Hospital Specialty Clinic Home

Innovation initiatives address market opportunities

* Source: Datamonitor

** Source: Arrowhead Publishers

Four Strategic Growth Platforms

Advanced Injection Systems

Injectable Container Solutions

Prefillable Syringe Systems

Safety + Administration Systems

West’s Competitive Advantage

Unmatched experience/expertise: drug-material interface

Ability to source components from multiple locations globally

Protected IP: West’s components and systems

Regulatory barrier to entry: NDA and ANDA filing must include

reference to all packaging/components in contact with the drug

1.

West Drug Master File (DMF) 1546 is confidential

2.

West DMF includes functionality data (multi-year studies)

3.

All primary package changes require new stability/functionality

studies for new filing

Engineering expertise in high-volume manufacturing and assembly

Growth Platform 1 – Injectable Container Solutions

West FluroTec®

Components

Seal - Stopper - Vial

Daikyo Crystal Zenith® Vials

Estimated Market Size – $1.5 billion

CAGR – 4%

Source: Company estimate for vial systems only

West Spectra™ Seals

Growth Platform 2 – Safety and Administration Systems

Vial2Bag™

Mix2Vial™

MixJect™

Total Market – $1.5 billion

CAGR – 11%

Source: Greystone Associates and Company estimate

Project Orion

Market Dynamics Support West’s

Continued Growth

Increasing number of patients with chronic illnesses such as

diabetes and cancer

Increasing demand for biologics 2006 Market: $56 billion*

Biologic drugs represent the fastest growing segment of the

injectable pharma market (13% CAGR projected through 2010)*

Injectables currently account for ~15% of the global drug delivery

market**

Point-of-care shift: Hospital Specialty Clinic Home

Innovation initiatives address market opportunities

Emergence of delivery systems that combine the primary

drug container and delivery platform

* Source: Datamonitor

** Source: Arrowhead Publishers

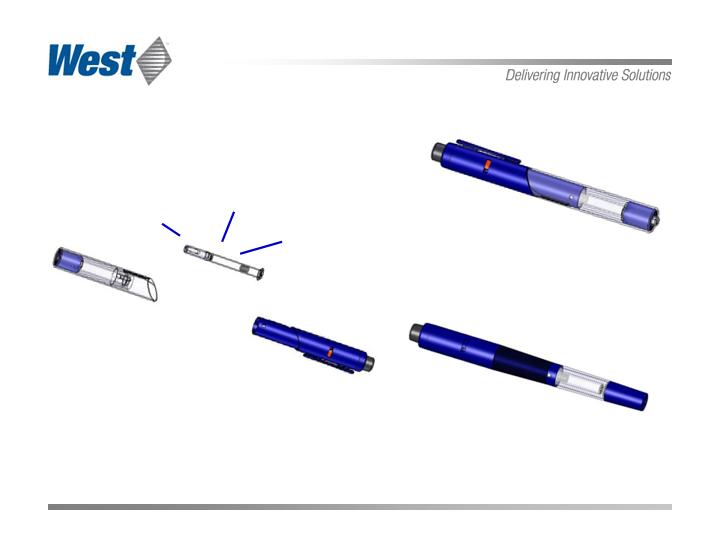

Convergence of Primary Containers and Delivery Systems

Auto Injectors

with Cartridges

Traditional Injection

System

Components for

Pen System Applications

Growth Platform 3 - Prefillable Syringe Systems

FluroTec® Plungers

Needle Shields – Tip Caps

Daikyo Crystal Zenith®

1mL LL Prefillable Syringe

Daikyo Crystal Zenith®

Staked Needle Syringe

Estimated Market Size – $900 million

CAGR – 8%

Source: Company estimates

West Advanced

Injection System

Platform 2

Staked Needle Prefillable Syringe

Growth Platform 4 - Advanced Injection Systems

Plunger

Primary Drug

Container

Lined

Seal

Platform 3

1mL Flanged Cartridge

Estimated Market Size - $210 million

CAGR – 8%

Source: Greystone Associates and Company estimates

Grow revenues and earnings despite reduced sales of certain products

Fundamental growth will offset lost revenue associated with Exubera, ESA drugs, etc.

Market segmentation and therapeutic category management

Lean operations

Sales mix shift toward higher value products

Generate Tech Group performance improvement

New Grand Rapids facility recovery from 2007 relocation and expansion

Execute restructuring of operating footprint

Shift product mix: focus on healthcare and proprietary products

Effectively manage global capacity expansion

Monitor relevant changes in demand, lead times

Timely availability of increased capacity

Continue investing for the future

Innovation programs

Begin to commercialize leading innovation programs

Geographic expansion plans - China, India

2008 Management Operating Priorities

Summary

Fundamental business drivers remain unchanged

Opportunities for growth remain very attractive

West’s competitive advantages uniquely position the Company to

capitalize on growth drivers in key market segments

Solid balance sheet

Seasoned, experienced Management Team

- Incentives closely tied to growth in shareholder value

Year-end call and 2008 outlook – February 21, 2008

Donald E. Morel, Jr., Ph.D.

Chairman and Chief Executive Officer

William J. Federici

Vice President and Chief Financial Officer

Investor Relations Contact:

Michael A. Anderson

Vice President and Treasurer

mike.anderson@westpharma.com

UBS Global Healthcare Conference

New York, NY

February 11, 2008

NYSE: WST

westpharma.com