- WST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

West Pharmaceutical Services (WST) 8-KRegulation FD Disclosure

Filed: 13 Mar 08, 12:00am

Investor Day 2008

Don Morel

Chairman and Chief Executive Officer

Agenda and Participants

Welcome and Introduction Don Morel

Market Overview Mike Schaefers

Growth Platforms John Paproski

Daikyo Crystal Zenith Platform Bernie Lahendro

Break

Operations Overview Steve Ellers

Long Term Outlook and Summary Don Morel

Q&A Mike Anderson

Certain statements in the following slides and certain statements that may be made by management of the Company orally during this

presentation contain some forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, that are based on management’s plans and assumptions. Such statements

give our current expectations or forecasts of future events; they do not relate strictly to historical or current facts. We have tried, wherever

possible, to identify such statements by using words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate” and other words

and terms of similar meaning in connection with any discussion of future operating or financial performance or condition. We cannot

guarantee that any forward-looking statement will be realized. If known or unknown risks or uncertainties materialize, or if underlying

assumptions are inaccurate, actual results could differ materially from past results and those expressed or implied in any forward-looking

statement. You should bear this in mind as you consider forward-looking statements. We undertake no obligation to publicly update forward-

looking statements, whether as a result of new information, future events or otherwise.

Important factors that may affect future results include the following: Sales demand and our ability to meet that demand; competition from

other providers in the Company’s businesses, including customers’ in-house operations, and from lower-cost producers in emerging markets,

which can impact unit volume, price and profitability; customers’ changing inventory requirements and manufacturing plans that alter existing

orders or ordering patterns for the products we supply to them; the timing, regulatory approval and commercial success of customer

products that incorporate our products, including relevant third-party reimbursement for prescription products, medical devices and

components and medical procedures in which those products are employed or consumed; average profitability, or mix, of products sold in

any reporting period; maintaining or improving production efficiencies and overhead absorption; the timeliness and effectiveness of capital

investments, particularly capacity expansions, including the effects of delays and cost increases associated with construction, availability

and cost of capital goods, and necessary internal, governmental and customer approvals of planned and completed projects, and the demand

for goods to be produced in new facilities; dependence on third-party suppliers and partners, including our Japanese partner Daikyo Seiko,

Ltd.; the availability and cost of skilled employees required to meet increased production, managerial, research and other needs of the

Company, including professional employees and persons employed under collective bargaining agreements; interruptions or weaknesses in

our supply chain, which could cause delivery delays or restrict the availability of raw materials and key bought-in components and finished

products; raw-material price escalation, particularly petroleum-based raw materials, and our ability to pass raw-material cost increases on to

customers through price increases; claims associated with product quality, including product liability, and the related costs of defending and

obtaining insurance indemnifying the Company for the cost of such claims; the cost and progress of development, regulatory approval and

marketing of new products as a result of the Company’s research and development efforts; the defense of self-developed or in-licensed

intellectual property, including patents, trade and service marks and trade secrets; dependence of normal business operations on information

and communication systems and technologies provided, installed or operated by third parties, including costs and risks associated with

planned upgrades to existing business systems; the relative strength of the U.S. dollar in relation to other currencies, particularly the Euro,

British Pound, and Japanese Yen; changes in tax law or loss of beneficial tax incentives; the conclusion of unresolved tax positions

consistent with currently expected outcomes; the timely execution and realization of savings anticipated by the restructuring plan for certain

operations and functions of The Tech Group, announced in December 2007; and,

Other risks and uncertainties detailed in West’s filings with the Securities and Exchange Commission, including our Registration Statement

on Form 10-K filed with the SEC on February 29, 2008. You should evaluate any statement in light of these important factors.

Safe Harbor Statement: Forward Looking Statements

Trademarks: All trademarks and registered trademarks used in this report are the property of West Pharmaceutical Services,

Inc., in the United States and other jurisdictions, unless otherwise noted.

Founded in 1923

HQ in Lionville, PA

Company Overview

Who we are

World’s premier manufacturer

of components and systems

for injectable drug delivery

Closure systems and prefillable

syringe components

Components for disposable systems

Devices and device sub-assemblies

Safety and administration systems

Record 2007 sales $1.02 billion

Market cap $1.3 billion

Diverse, Stable Customer Base

Company Estimated Market Share: 70% in Pharma; 70% in Device; 95% in

Biotech

West’s Competitive Advantage

World class technical and regulatory support

Global supply chain stability – multiple site sourcing

Protected IP: West’s components and systems

Unmatched experience/expertise: drug - material interface

Regulatory barrier to entry: NDA and ANDA filing must include reference to

all packaging/components in contact with the drug

1.

West Drug Master File (DMF) 1546 is confidential

2.

West DMF includes functionality data (multi-year studies)

3.

All primary package changes require new stability/functionality

studies for new filing

Engineering expertise in high-volume manufacturing and assembly

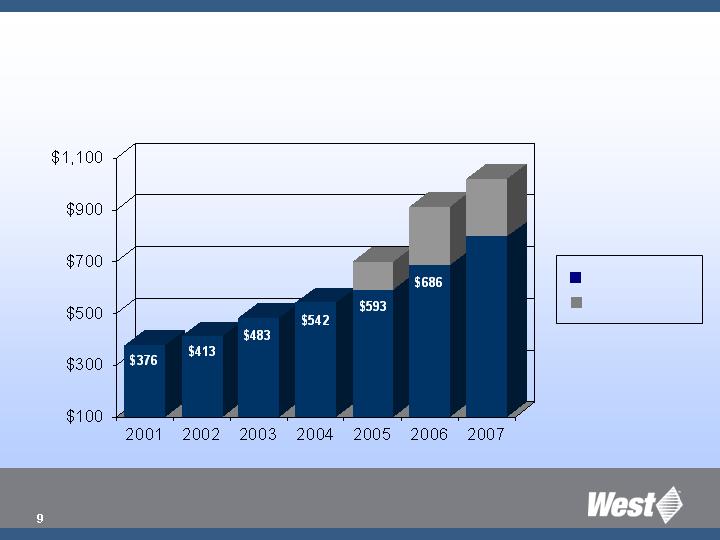

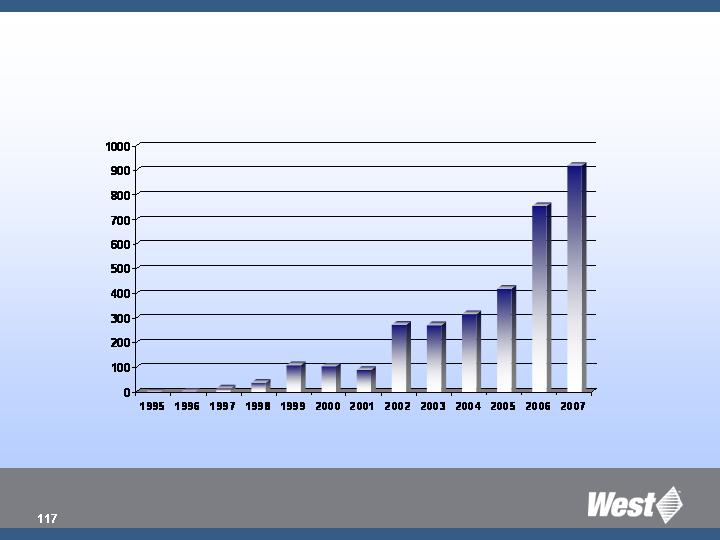

($ millions)

Strong Sales Growth

Existing Business

Acquisitions

$107

$227

$797

$223

Global

Revenue

Breakdown

Based on 2007 sales

of approx $1 billion

South America:

$55.3 million

(5%)

North America:

$496.4 million

(49%)

Europe:

$430.6 million

(42%)

Asia/Pacific:

$37.8 million

(4%)

Our Long Term Objectives

Build on our global competitive advantages

to create multiple platforms

for sustainable growth

Four Strategic Growth Platforms

Injectable Container Solutions

Prefillable Syringe Systems

Advanced Injection Systems

Safety & Administration Systems

Future Growth Drivers

Aging population creates an increasing number of patients with chronic

illnesses such as diabetes and cancer

Biologic drug growth and a resurgence in vaccine research

Demand for ultra clean silicone free packaging and delivery systems

China, India economic growth and growing demand for advanced

healthcare

Point-of-care shift: Hospital Specialty Clinic Home

Convergence of the primary container and delivery device

West migration from component production to device systems

Tech business model shift to proprietary products

Source: Datamonitor

Convergence of Primary Containers

and Delivery Systems

Disposable

Syringe-based

Auto Injectors

Traditional Injection

System

Components for

Pen System Applications

Our Long-Term Objectives

Build on our global competitive advantages to create

multiple platforms for sustainable growth

Undergo selective geographic expansion

Continued investment in innovation and new manufacturing

technology

Five-year financial goals:

Average annual sales growth 7-9%

Average annual operating profit growth 10-12%

Mike Schaefers, Ph.D.

Vice President of Marketing, Europe

Global Pharmaceutical

Market Update

Global pharmaceutical market predicted to increase by 5-6% in

value in 2008 vs. 6-7% in 2007 driven by:

Aging populations

Strong economies

Introduction of new products

Geographic expansion

Patent expirations ($16 billion in 2007, $12 billion in 2008)

Reimbursement issues

Strong generic competition

IMS Global Insight Nov. 2007, Drug Benefits News, Nov. 2007

Global Pharmaceutical Market Update

Geographic expansion

Growth in emerging markets (China, India, Brazil, Turkey, Russia) accelerated at

12-13%

Trend toward specialty products vs. former mass market approach (i.e.

oncology vs. cardiovascular)

Specialty products expected to grow 14-15% in 2008

80% of the 29 new innovative medicines expected to launch in 2008 will be

specialist products

Global pharmaceutical packaging market growing 6.5% annually to 2011

IMS Global Insight Nov. 2007

Global Pharmaceutical Market Update

Paradigm shift in the pharmaceutical world

Fewer new drugs being launched!

FDA approved 60 new drugs between 2005-2007 (NME, novel biologics)

vs. 60 new drugs approved in 1996 alone

Agencies move towards risk assessment based approval process

Limited claims for newly approved drugs

More black box warnings

More clinical evidence required

FDA, The RPM Report; IMS Global Insights, Nov. 2007

Global Pharmaceutical Market Update

Paradigm shift in the pharmaceutical world

Drug makers cut back costs

Workforce

Inventory

Lean programs

Supply chain programs

Sourcing costs

Companies increase R&D spend and fill pipelines through M&A activities

(mainly biotech)

FDA, The RPM Report; IMS Global Insights, Nov. 2007

Global Pharmaceutical Market Update

Pharma/biotech customer trends

Integration of container/closure system into delivery system

Reduction of drug waste and improved operational throughput

High quality packaging to ensure drug stability

Value-added devices and systems for product/brand differentiation

Secure packaging

Global Pharmaceutical Market Update

Patient/caregiver trends

Point of care shift

Hospital specialty clinic/physician home

Dosage form migration

Increase patient compliance rates through enhanced application systems

i.e. safety systems, pens, auto-injectors

Patient convenience

Ease of use

Minimized pain

Increased focus on healthcare worker, patient safety

Global Pharmaceutical Market Update

Top therapeutic categories

Increasing number of patients with chronic illnesses such as diabetes,

cancer, AIID (RA, MS, etc.)

Resurgence of vaccine market

Emergence of high-value therapeutic vaccines

New technologies and delivery methods

Pandemic concerns

Top therapeutic categories (annual growth 05-10)

Oncology + 15%

Diabetes + 9%

AIID + 10%

Vaccines + 15%

Pharmaceutical & Diagnostic Innovation, 2006 Vo. 4, No. 10,IMS Global Insights, Nov. 2007

Global Pharmaceutical Market Update

Top therapeutic categories

Injectable products currently account for ~15% of global drug delivery

market

Significant growth expected through above mentioned therapeutic

categories

High number of injectable products in pipelines

Biologic drugs represent the fastest growing segment in injectable

pharma market (13% CAGR through 2010)

Arrowhead Publishers; Datamonitor

Global Pharmaceutical Market Update

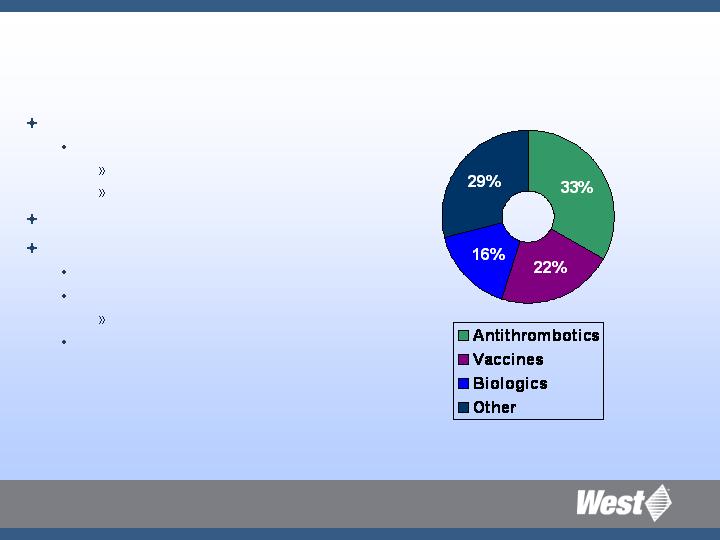

Strategic Growth Platforms

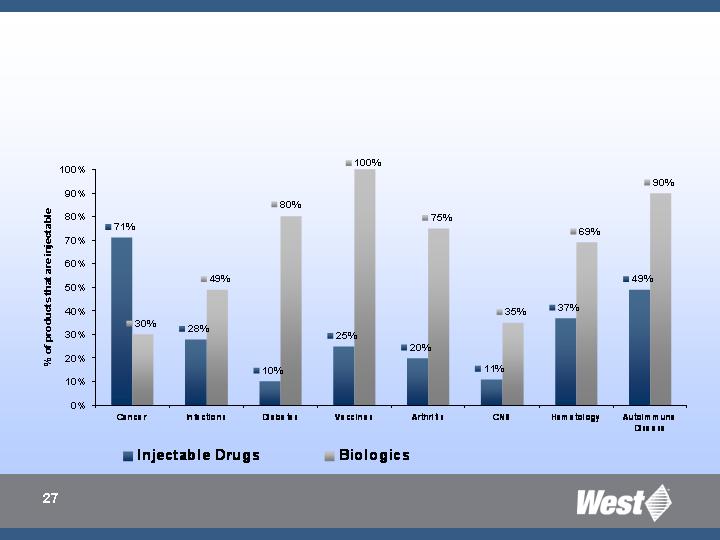

Therapeutic Targets and

West’s Strategic Growth Platforms

Percentage of injectable products by therapeutic

category and biological injectables

(awaiting approval and in clinical trials in US – all forms)

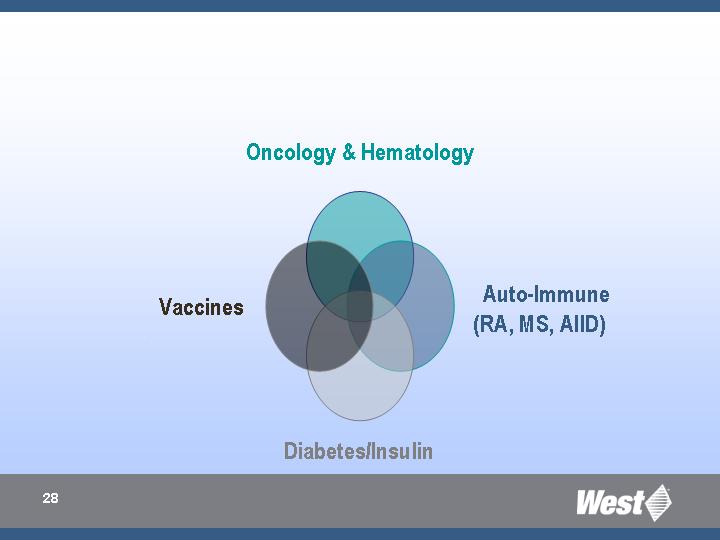

West’s Therapeutic Targets

West’s Therapeutic Targets

Rationale

Current presence in targeted categories/ segments

Future annual growth rates per therapeutic category

Number of products in pipeline per therapeutic category

Percentage of injectable products in pipeline

Need for high-value products and enhanced packaging systems

Growth opportunities through advanced application and administration

systems

Therapeutic Targets and West Strategic Platforms

A Perfect Match

High value products for container

closures systems

Enhanced packaging systems

Advanced application and

administration systems

Needle safety systems

Stability of demanding pharma-

ceuticals/biopharmaceuticals

Need for product/brand differentiation

Secure and tamper evident

packaging (ID, anticounterfeiting)

Healthcare worker/patient safety

Trend towards self-administration

Improved patient compliance

West Strategic Platform Offerings

Therapeutic Target Requirements

Four Strategic Growth Platforms

Injectable Container Solutions

Prefillable Syringe Systems

Advanced Injection Systems

Safety & Administration Systems

Injectable Container Solutions

Prefillable Syringe Systems

Unique silicone-free syringe systems for demanding

biopharmaceuticals

Daikyo Crystal Zenith RU syringes

Daikyo Crystal Zenith is a registered trademark of Daikyo Seiko, Ltd.

Safety and Administration Systems

West´s reconstitution, administration and safety systems

Project Orion

MixJect

West Advanced Injection Systems

Syringe and cartridge-based autoinjector systems

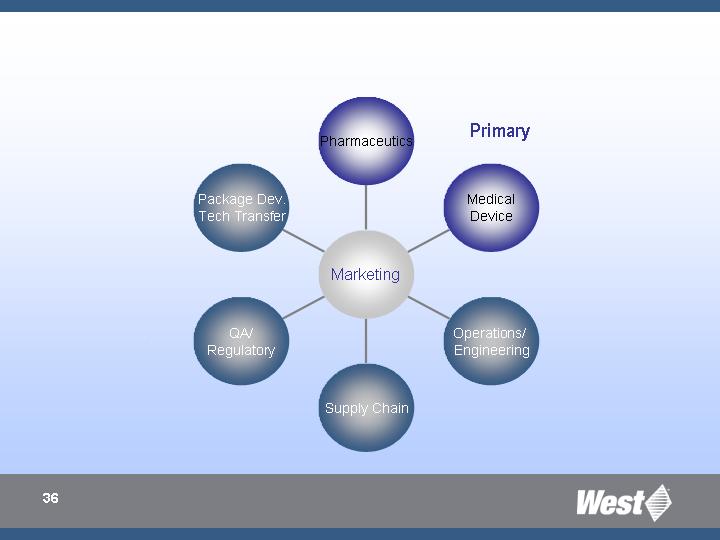

Customer Account Penetration for

Strategic Platform Products

Secondary

Top Therapeutic Categories

and West’s Position

Westar RS/RU

Westar Lined Seals RS

Envision

VeriSure

Safety & Administration Systems

Advanced Injection Systems

Stability of biotechnologically derived

insulin drugs

High-quality container/closure

systems

Ease of use

Suitability for home administration

Switch from vial/syringe combinations to

pen injectors

West Offerings

Requirements

Diabetes/Insulin

Examples of West

Participation in Insulin Market

Top Therapeutic Categories

and West’s Position

FluroTec stoppers and plungers

Envision

VeriSure

Westar RS/RU

Daikyo Crystal Zenith RU syringe

Safety & Administration Systems

Advanced Injection Systems

High-quality packaging for stability of high

value therapeutic vaccines

Trend towards prefillable syringe

applications

Healthcare worker and patient safety

Minimized pain

Advanced delivery methods

West Offerings

Requirements

Vaccines

Top Therapeutic Categories

and West’s Position

FluroTec stoppers and plungers

Westar RS/RU

Envision

VeriSure

Daikyo Crystal Zenith RU syringe

Safety & Administration Systems

Advanced Injection Systems

Stability of demanding pharmaceutical/

biopharmaceutical compounds

Need for silicone-oil-free packaging

Reduction of drug waste

Break resistant packaging

Trend towards self-administration

Healthcare worker safety

Patient compliance

West Offerings

Requirements

Oncology/Hematology

Top Therapeutic Categories

and West’s Position

FluroTec stoppers and plungers

Westar RS/RU

Westar lined seals RS

Envision

VeriSure

Daikyo Crystal Zenith RU syringe

Safety & Administration Systems

Advanced injection systems

Stability of demanding biopharmaceutical

compounds

Reduction of drug waste

Need for silicone-oil-free packaging

Trend towards prefillable syringe

applications

Trend towards self-administration

Ease of use and patient compliance

Product / brand differentiation

West Offerings

Requirements

Autoimmune (RA, MS, AIID)

Generics

Are generics/biogenerics a threat for West?

West's Generic/Biogeneric Strategy

$12 billion of brand name drugs will go generic in 2008

West addresses challenge through multiple activities

Focus on therapeutic targets (specialty injectable drugs) growing faster than any

other category

Proactive support of lifecycle management activities at pharma/biotech

companies

Product/brand differentiation through innovative packaging, application and

administration systems

West´s Generic/Biogeneric Strategy

West addresses challenge through multiple activities

Growth opportunities through generic/biogeneric companies by

addressing their drug packaging needs

Primarily using originator’s container/closure system

Frequent outsourcing of value-added services to suppliers

Biogenerics forced to offer application and delivery systems

Summary

Major programs directly address market needs

Focus on strongly growing therapeutic categories diabetes/insulin,

vaccines, oncology and AIID

Importance of injectable and biological products within these categories

Growing need for high value container/closure and packaging systems

Growth opportunities through advanced application and administration

systems

Perfect match between requirements of targeted therapeutic categories

and West strategic platforms

Growth opportunities through generic/biogeneric markets

John Paproski

Vice President, Innovation

Growth Platforms

Innovation Focus

Bring unique value added solutions to the growing need

for combining injectable drug containers

with delivery systems

For 2008

Prepare three major products for broad market

introduction

Q2 – Ready-to-Use Daikyo Crystal Zenith luer lock syringe system

Q3 – Disposable auto injector for prefillable syringes

Q4 – Orion prefillable syringe safety system

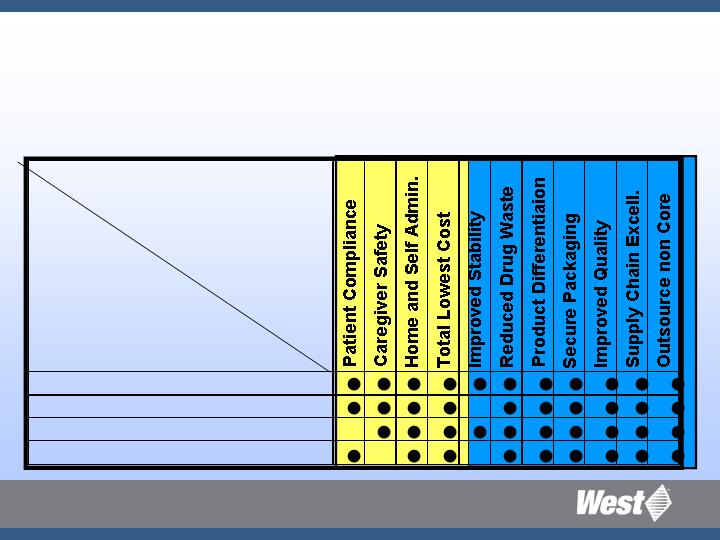

Injectable Pharma Market Needs

Patient/Caregiver Focused

Increasing patient compliance rates

Patient and clinician convenience

Minimize pain and needle fear

Healthcare worker and patient safety

Sharps exposure

Blood-borne pathogen transmission (HIV, Hepatitis)

Unintended drug exposure

Home and self-administration

Provide cost effective reimbursement

Injectable Pharma Market Needs

Pharma Company Focused

Improve drug stability

Reduce drug waste

Integrate with existing filling operations

Reliable supply

Differentiate brands

Enabling delivery methods

Secure packaging

Risk mitigation

Outsourcing non-core competencies

West Innovation Model

Creating proprietary products that serve

our existing injectable customers

Regulatory hurdles for our customers

Slow time to market

Long product lives

Patent protected

Operate like start-up business units

Manufactured primarily by The Tech Group

or our partner, Daikyo

Provide high-value system solutions

West Sources of Innovation

Entrepreneurs

In-license intellectual property

Acquire small companies

Established products

Knowledgeable people

Intellectual property

Internal idea development

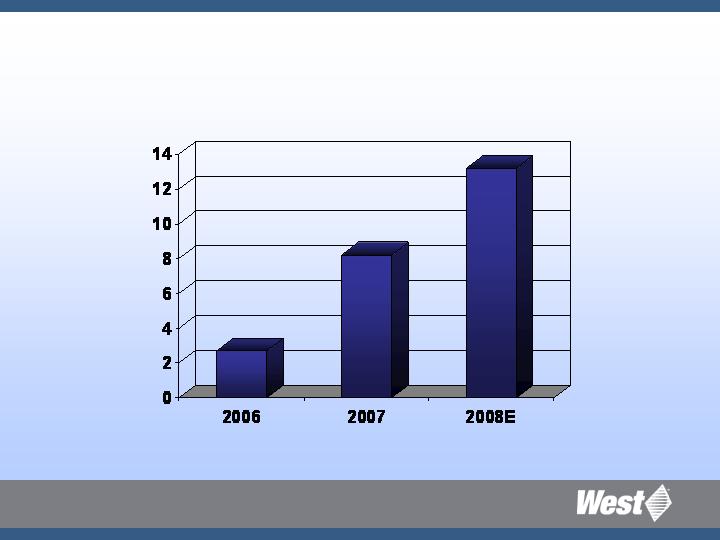

Innovation Spending

$ millions

Strategic Platforms: Target Markets

$1.5B

4%

9B

Injectable Containers

$1.5B

11%

5.2B

Safety &

Administration

$210M

8-12%

70M

Advanced Injection

Systems

$900M

8-12%

1.8B

Prefilled Syringe

Total Market

Sales

CAGR

(Unit)

Total

Market

Units

Strategic

Platform

Injectable Container Solutions

Market focus: high-value drugs

Drug stability

Reduced waste

Universal processing and filling

West innovations

Ready-to-Use Daikyo Crystal Zenith vial

system

Ready-to-Use Daikyo Crystal Zenith bulk

bio processing containers

Advanced Injection Systems

Market focus: high-value drugs

Self administration

Home administration

Use standard prefillable syringes

West innovations

Disposable auto-injector: Q3 2008

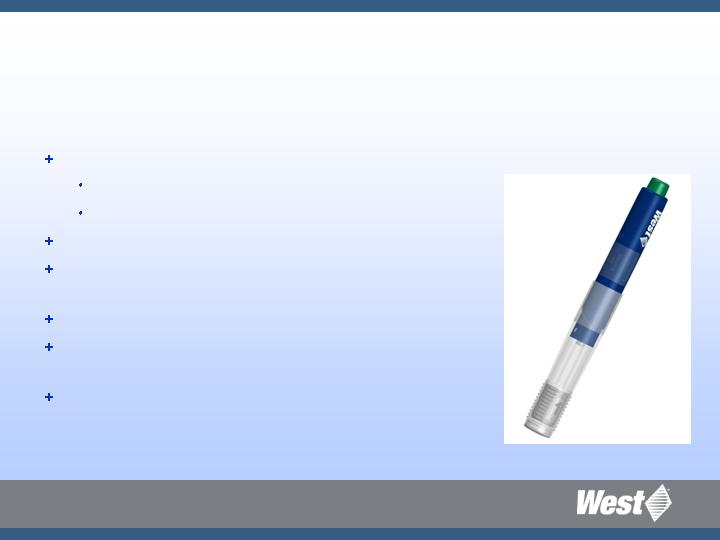

Advanced Injection Systems

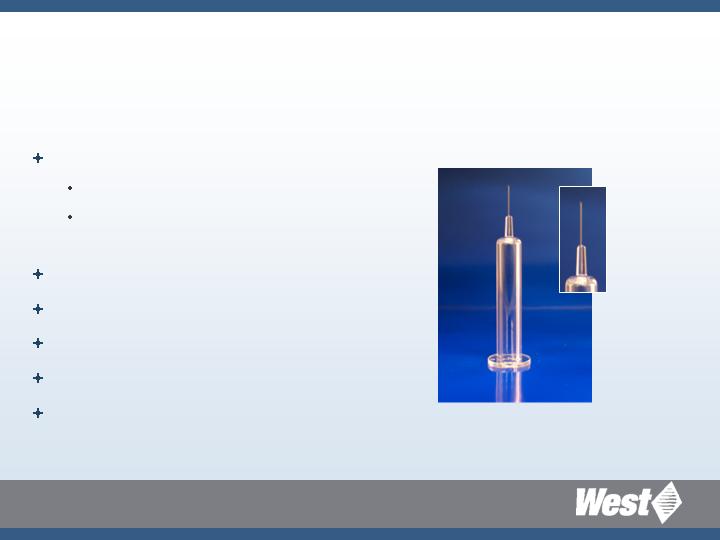

Single Use: Disposable Auto Injector for Staked Needle PFS

Utilizes 1ml long prefilled syringe format

Staked needle with rigid needle shield

Glass or CZ compatible

Full visibility of drug contents

Automatic insertion, delivery and retraction

of the needle

Single push-button activation

Designed for simple assembly of the syringe

into the Auto-Injector

A robust system designed to overcome PFS

variability issues

Auto Injection System Animation

AUTO INJECTION SYSTEM

VIDEO

Safety and Administration Systems

Market focus: entire injectable market

Needle-phobia

Patient and caregiver safety

OSHA and local EU legislation

Patient and caregiver convenience

West innovations

Reconstitution and transfer systems

Vial adaptors

Transfer aids

Safety needles

Project Orion passive safety system Q4

Kitting

Project Orion: What Does It Offer?

Passive, automatic needle cover

Compact design

Simple and easy to use

Compatible with any standard luer

lock syringe

Minimize patient fear! Minimal amount

of needle exposed

Project Orion

ORION VIDEO

Safety Test

SAFETY VIDEO

Prefillable Syringe Systems

Global PFS units

1.8B units

North America .3M units

Europe (E5) 1.5B units

CAGR 8-12%

Biologic market needs

Drug waste

Drug stability

Silicone, tungsten, adsorption

User convenience and self- administration

Prefillable Syringe Systems

RU Daikyo Crystal Zenith luer lock

syringe: Q2 2008

RU Daikyo Crystal Zenith staked

needle: 2009

Platform to Market Alignment

STRATEGIC

PLATFORMS

MARKET

NEEDS

Patient or

Healthcare Worker

Pharmaceutical Customer

Injectable Container Systems

Safety and Administration Sys.

Prefillable Syringe Systems

Advanced Injection Systems

Value of West Products in the

Injectable Drug Package

Daikyo Crystal Zenith

Syringe System with

Orion

West auto injector

with Daikyo

Crystal Zenith

syringe

Bernie Lahendro

Vice President

and General Manager

Daikyo Crystal Zenith® Products

Daikyo Seiko, Ltd.

Daikyo

Family-owned business since 1954

Approximately 500 employees and approximately $110 million U.S.D.

Market leader in Japan for pharmaceutical closures

Daikyo and West Partnership

West purchased 25% of Daikyo Seiko Ltd. in 1973

Technology transfer and marketing agreement signed in 1992 with additional 10

year agreements signed in 1997 & 2007

Daikyo has developed and transferred to West state of the art materials and

processes such as:

B2, Flurotec, Daikyo Crystal Zenith

Flurotec material and B2 process technologies have been transferred to West

Ready-to-Use Crystal Zenith development programs are a cooperative effort of

Daikyo and West

Custom formulated COP resin

developed for pharmaceutical use

Coupled with Flurotec laminated

elastomers for low extractables with

no silicone oil

100% vision inspected

Platform for development of new

innovative products

Daikyo Crystal Zenith

Properties of Daikyo Crystal Zenith

Cyclic Polyolefin

Custom formulated for better break resistance,

scratch resistance and steam sterilizability

Exclusivity for Daikyo/West

High transparency

Colorless

Approved In All Major Markets

Japan

10 syringes: contrast media (5) MRI (2), hyaluronic

acid (2), calcitonin (1 - PEPTIDE)

3 vials: Fluconazole, oncology, anticoagulant

API container (one liter bottle)

US

3 vials: acyclovir and oncology, 1 syringe for

hyaluronic acid; several pending for oncology,

cancer vaccine

Europe

1 syringe: hyaluronic acid

3 vials: oncology; several pending for oncology,

contrast imaging, blood plasma

Daikyo Crystal Zenith Syringe Systems

Sizes available from 0.25 mL to 150 mL

Daikyo Crystal Zenith 1mL-S

RU Luer Lock Syringe System

Daikyo Crystal Zenith barrel

Polypropylene rod

Flurotec laminated piston

Flurotec lamination inside nozzle cap

Silicone oil free

100% vision inspected

Daikyo Crystal Zenith RU Syringe System

Features and Benefits

Provides market differentiation

Less adsorption/absorption

Predictable piston release and travel forces

Suitable for high viscosity products

Ultra low extractables

Reduces aggregation issues

No need for added silicone oil

Tungsten-free

Can be incinerated, eliminating disposal issues

related to blood borne pathogens

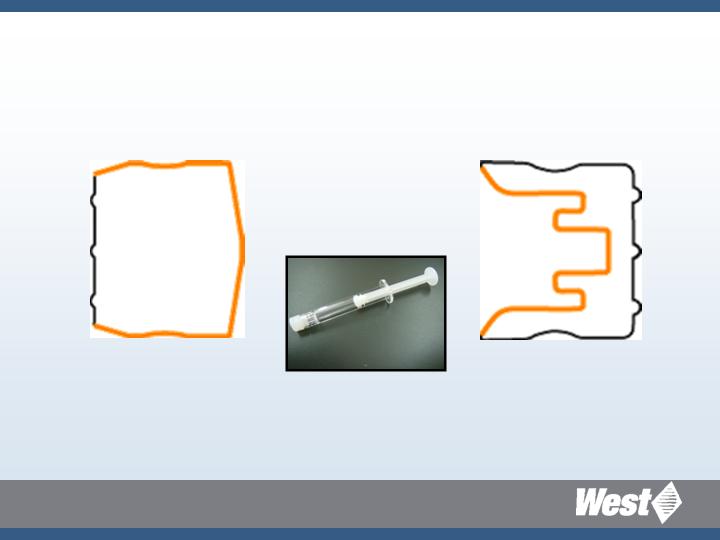

Flurotec Coverage Syringe

Complete coverage of

inert film on drug

contact surfaces

Orange color indicates Flurotec® film coverage

Formula D-21-6-1 Ultra clean chlorobutyl

Plunger

Tip Cap

Daikyo Crystal Zenith 1ml LL-S

RU Syringe Systems

Ready for sampling

Launch April 2008

Sterilization:

Assembled syringes:

E-beam

Pistons: steam

Tubs and nests manufactured in

clean rooms

10 * 10 nest format for standardized

filling machines

Nested or bulk pistons

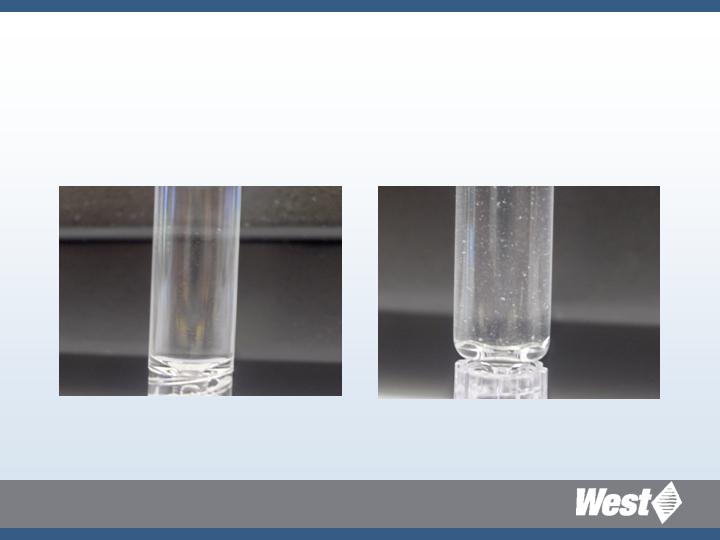

Model Antibody

Higher extent of aggregation in glass

compared to Daikyo Crystal Zenith ®

Crystal Zenith

Glass

With Permission of the University of Kansas

Targeted Therapeutic Categories

Luer Lock Syringes

Large Molecules

Oncology

New Vaccines

Ophthalmic - Macular

Degeneration/Cataract

Surgery

Cosmeceuticals

Anti-Parkinsons

Anti-Alzheimers

Daikyo Crystal Zenith

Ready-to-Use Staked Needle Syringe

(in development)

Silicone oil-free container

Reduced variability

Consistent piston release and

travel forces

Tungsten free

Glue free

Break resistant

Tight dimensional tolerances

Design flexibility of plastics

Targeted Therapeutic Categories

Staked Needle Syringes

Large Molecules

ESA

Auto-Immune,

MS

Anti-

Rheumatics

Hepatitis C

Daikyo Crystal Zenith® Summary

First in silicone oil free prefillable syringes

Break resistant

Ultra low levels extractables/leachables/particulate

100% vision inspected (all components of syringe)

Zero defects for the high quality markets (Japan)

Protein aggregation - dramatic reductions

Tungsten, glue, silicone oil free staked needle syringes

Reduced need to reformulate

Low temperature storage opportunity

Steve Ellers

President & Chief Operating Officer

Delivering Innovative Solutions

Create profitable and sustainable growth platform

Strengthen market leadership position

Maintain strong financial condition

Strategic Objectives

Business Perspective

Market Position

Profit Margin

Operations

Pipeline

Sales

Business Perspective

Losing share

Market Position

Declining

Profit Margin

Aged & inadequate

factories

Operations

Re-launch old

products

Pipeline

Losing share

Sales

1995 - 2001

Business Perspective

Gaining momentum

Losing share

Market Position

Strong incremental gains

Declining

Profit Margin

Upgrade & catch-up

expansions

Aged & inadequate

factories

Operations

New product launches

Re-launch old

products

Pipeline

Listening and reacting to

customer

Losing share

Sales

2002 - 2006

1995 - 2001

Business Perspective

Leading market in

injectable container

solutions

Gaining momentum

Losing share

Market Position

Funding growth

strategies compress

margins

Strong incremental gains

Declining

Profit Margin

Centers of Excellence

Upgrade & catch-up

expansions

Aged & inadequate

factories

Operations

Innovation & new

growth platforms

New product launches

Re-launch old

products

Pipeline

Creating solutions &

advising customers

Listening and reacting to

customer

Losing share

Sales

2007 - 2012

2002 - 2006

1995 - 2001

Market Knowledge Identifies Market Needs

Manufacturing Strategy

Capital Expenditures

Product Launches

Strengthen Sales and Market Penetration

Market segments

Diabetes, oncology, vaccines and generics

Long-term contracts

BD, Braun, Hospira, Consort, Covidien, Novo

Value-added (revenues 2x unit growth)

FluroTec, Westar, Daikyo, Envision, Spectra

2008 Product Pipeline

Q4

Q4

RSV (Daikyo)

Q4 ‘07

Q4

Envision

- - -

Q2

Inhalation/Nasal Lab Testing

Q2

Q2

RU Crystal Zenith Syringe System (1 mL LL)

Q4

Q2

West RU Ready Pack System

Europe

North

America

Targeted Market Launches

2008 Product Pipeline

Q4

Q4

Orion SQ

Q2

TBD

Westar RS Lined Seals

Q3

Q3

Auto-injector (P2 version)

Q2

Q2

RU PFS Plunger (non-nested)

- - -

Q2

Kitting Capability to Support SAS

Q2

Q2

Vented Vial Adapter

Europe

North

America

Targeted Commercial Introduction

Sales & Pipeline

Core – Growth Platforms

Injectable Container Solutions

Safety & Admin System

Prefillable Syringe System

Advanced Injection System

Safety

Orion

Medimop

Market Needs

Silicone-free

Daikyo Crystal Zenith

PFS

Systems Solution

Westar® - RU

Lined Seals

Ready Pack

Kitting

Reconstitution

Regulatory

Verisure

CCS

TrimTec®

Material Science/drug contact

Quality

Vision Inspection

cGMP

Demographics/Convenience

Auto-injectors

Reconstitution

Close to our Knitting

Creative Access to New

Products and Solutions

Target

Mkt. Launch/ Comm.

Intro

Partners

Action

Market Need

Creative Access to New

Products and Solutions

CAGR 20%

Medimop

Acquire

Reconstitution

Target

Mkt. Launch/ Comm.

Intro

Partners

Action

Market Need

Creative Access to New

Products and Solutions

Q4

Salvus Tech

License

Safety

CAGR 20%

Medimop

Acquire

Reconstitution

Target

Mkt. Launch/ Comm.

Intro

Partners

Action

Market Need

Creative Access to New

Products and Solutions

Q2

Daikyo

Partner

PFS in RU Crystal

Zenith

Q4

Salvus Tech

License

Safety

CAGR 20%

Medimop

Acquire

Reconstitution

Target

Mkt. Launch/ Comm.

Intro

Partners

Action

Market Need

Creative Access to New

Products and Solutions

Q3

Pharma-Pen

Acquire &

in-house Develop

Auto-injector

Q2

Daikyo

Partner

PFS in RU Crystal

Zenith

Q4

Salvus Tech

License

Safety

CAGR 20%

Medimop

Acquire

Reconstitution

Target

Mkt. Launch/ Comm.

Intro

Partners

Action

Market Need

Market Knowledge Identifies Market Needs

Manufacturing Strategy

Capital Expenditures

Product Launches

Manufacturing Strategy

Focused factories – Centers of Excellence

Pharma and device facilities

Products manufactured to a global quality standard

Vision inspection

Six Sigma

Westar RS & RU

cGMP facilities with DMF registrations and FDA audits

Multiple site sourcing

Project Atlas

SAP and MES systems integration

Operate as cost centers

Market Knowledge Identifies Market Needs

Manufacturing Strategy

Capital Expenditures

Product Launches

Investments in Operations

Europe and Asia Expansion Projects

China Greenfield

China plastics in Qingpu

USA Expansions

IT Project Atlas – SAP and MES

Jurong,

Singapore

Bodmin,

England

Kovin,

Serbia

LeNouvion,

France

Eschweiler,

Germany

Jersey Shore,

Pennsylvania

Clearwater,

Florida

Kinston,

North Carolina

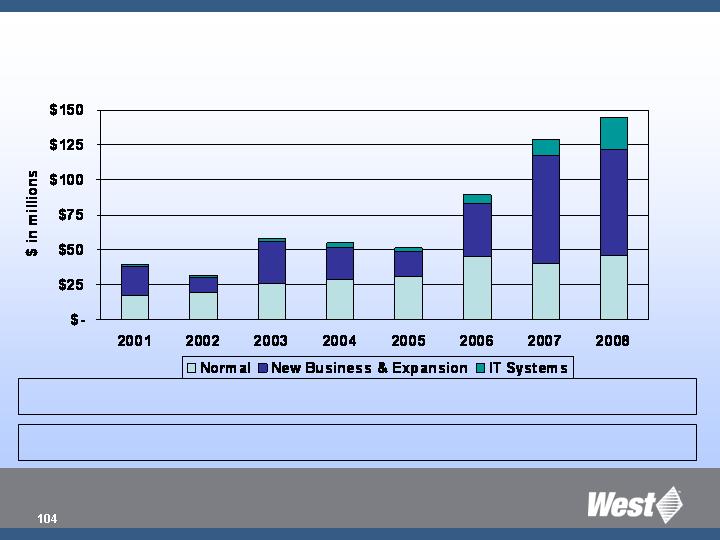

Capital

as % of sales 10% 8% 12% 10% 7% 10% 13% 14%

Depreciation

as % of sales 7%7% 6% 6% 6% 5% 5% 6%

Operations Record Levels of CAPEX

Manufacturing Processes

Rubber

Compounding Molding Trimming Finishing

Specialty products

Metal

TrimTec

Compounding

Molding

Trimming

Washing/Finishing

Vision Inspection

Metals

TrimTec

Market Knowledge Identifies Market Needs

Manufacturing Strategy

Capital Expenditures

Product Launches

Product Launch Process

Match need in market with West product

Target specific customers

Secure development partnerships

Sampling

Machine trials

Stability tests

Regulatory assistance

Analytical Labs

Product Launch Process

Plan – Initiate Launch Campaign

CAPEX investments

Promotion

Training

Sample kits

Broad market - product launch (2 - 3 years later)

Market experience

Market acceptance/regulatory approval

Customer ramp-ups

Product Launches

Westar RS

Elastomer components

Seals

Westar Units Sold in North America

(in millions)

Product Launches

Drive development through superior positioning

FluroTec

Unrivaled

barrier

coating

Westar

State of the art

ready-to-sterilize

elastomer closures

Flip-Off CCS

Prewashed and

sterilized Flip-Off

seals

West Spectra

Covert and overt

security for product

authentication

Branding of Value-Added

Products & Services

West Analytical Services

Tech Restructuring

(December 2007)

Pfizer decision to abandon Exubera

Need to right-size operations

Accelerate transition to IP-based systems supplier

Tech Restructuring Activities

Close Erie, PA tool shop

Right size SG&A and Engineering

Mexico - transfers

Mold moves to create “focused factories”

Grand Rapids turnaround

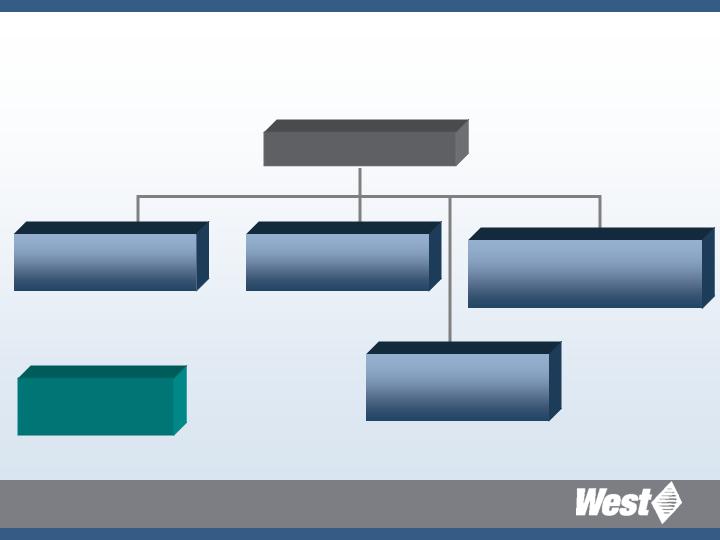

Strategic Business Units

Organize SBU’s around markets

Consumer

Health Care

Device Systems

General Managers with P&L responsibilities

Improved profitability

Allocation of resources

Provide integrated approach to serve customers

Invest CAPEX based on market/strategic plan

Shed unprofitable business

Tech Group Synergies

Manufactured

by Tech

Product/ Market

Partner

Growth Platform

Tech Group Synergies

Reconstitution

Medimop

Safety & Admin.

Systems

Manufactured

by Tech

Product/ Market

Partner

Growth Platform

Tech Group Synergies

Orion Safety Needle

Salvus Tech

Safety & Admin.

Systems

Reconstitution

Medimop

Safety & Admin.

Systems

Manufactured

by Tech

Product/ Market

Partner

Growth Platform

Tech Group Synergies

Orion Safety Needle

Salvus Tech

Safety & Admin.

Systems

Unique Silicone Oil

Free, Tungsten Free

Syringe System

Daikyo Crystal

Zenith

Prefillable Syringe

Systems

Reconstitution

Medimop

Safety & Admin.

Systems

Manufactured

by Tech

Product/ Market

Partner

Growth Platform

Tech Group Synergies

Orion Safety Needle

Salvus Tech

Safety & Admin.

Systems

Auto Injector

In-house with

Pharma-Pen

Advanced Injection

Unique Silicone Oil

Free, Tungsten Free

Syringe System

Daikyo Crystal

Zenith

Prefillable Syringe

Systems

Reconstitution

Medimop

Safety & Admin.

Systems

Manufactured

by Tech

Product/ Market

Partner

Growth Platform

Tech Direction

Transition to proprietary intellectual property (IP)

Synergies with Innovation and core Pharmaceutical Systems

Conversion from component to systems provider

Summary

Strengthen market leadership position

Grow faster than market

Record number of product introductions

Sufficient cash flow to fund CAPEX and R&D

Accelerate innovation activities:

In-house R&D

Licensing

Strategic partnering

Acquisitions

Attractive opportunities to expand geographically

Synergies of core business with Tech and Innovation create a bright

future

Summary

Delivering Innovative Solutions

Don Morel

Chairman and Chief Executive Officer

Grow revenues and earnings

despite reduced sales of certain products

Organic growth and sales mix will offset lost revenue

associated with Exubera, ESA drugs etc.

Offset cost increases (raw materials, labor, energy) with lean

programs, operating efficiencies and pricing

Generate Tech Group performance improvement

New Grand Rapids facility recovery from 2007 relocation and

expansion

Execute restructuring of operating footprint

Shift product mix: focus on healthcare and proprietary products

Effectively manage global capacity expansion

Monitor relevant changes in demand, lead times

Timely availability of increased capacity

Management Operating Priorities

2008 - 2012

Continue Investing for the future

Innovation programs

Aggressive launch schedule

Geographic expansion plans - China, India

IT Platforms

Management Operating Priorities

2008 - 2012

Investment Considerations

Established foundation for sustainable growth

Significant barriers to entry

Favorable growth drivers in key market segments

Global, diverse customer base

Global manufacturing capability

Strong, experienced management team

Strong corporate governance

2008 Annual Guidance

Revenue estimated between $1.05 and $1.07 billion

Estimated adjusted earnings per diluted share is between $2.40

and $2.50. This estimate:

Excludes anticipated restructuring costs of an approximately $8.6 million

Includes exchange rate assumption of $1.40/1 Euro

Includes between $50 million and $60 million of lower revenue estimates

compared to 2007 and associated with specific customer products,

including Exubera®, ESA drugs and diagnostic device components, which

should adversely impact operating profit by approximately 35% of the

revenue impact

2008 Annual Guidance

Lower revenues from those specified products will have a much

more pronounced impact on periodic comparisons to 2007

during the first half of 2008

Specified products contributed earnings per diluted share of $0.14 in the

first quarter and $0.11 in the second quarter of 2007, as those periods

predated events affecting sales of those products

Impact on comparisons should diminish through the year as other sales

growth is expected to begin to offset and ultimately exceed revenue

losses

Five-Year Financial Goals

Expect average annual sales growth of between 7% and 9%, excluding

acquisitions

Growth in existing products, supported by capacity expansions, in the near- term

New products and geographic expansion contribute significantly beginning in

2010.

Operating profit growth should average between 10% and 12% per year

Sales mix should continue to improve on existing products,

Lean operations, ability to pass on commodity and energy costs, and operating

leverage are expected to protect and improve margins,

New products are expected to further enhance sales mix and profitability.

Five-Year Financial Goals

Continue to manage balance sheet and capital conservatively

Maintain net debt to total capital ratio between 30% and 40%,

excluding acquisitions

Acquisition activity focused on complementary, proprietary

products

Summary

Working through short-term revenue challenges

Long term business drivers remain in place

Strategic Product Platforms create sustainable growth opportunities

West’s competitive advantages uniquely position the Company to

capitalize on these opportunities:

Daikyo partnership

Global manufacturing footprint

Proprietary technology and systems

Strong regulatory barriers

Industry leading knowledge on drug – material interface

Solid balance sheet

Management incentives directly linked to value creation

GAAP and Adjusted EPS

2007

Diluted earnings per share from continuing operations

As reported $2.06

Restructuring, impairment and other charges 0.54

Tax adjustments/settlements (0.23)

As Adjusted $2.37

Our reported 2007 results include the impact of restructuring charges, an impairment loss on our

customer contract intangible asset with Nektar for the Exubera® device, and our provisions for

Brazilian tax issues which collectively totaled $26.4 million pre-tax ($19.4 million net of tax, or $0.54

per diluted share). Our 2007 results also include the recognition of discrete tax benefits totaling $8.2

million ($0.23 per diluted share).

Adjusted results are intended to aid investors in understanding the Company’s results absent non-

recurring or unusual events and are non-GAAP financial measures.

Investor Day 2008