29

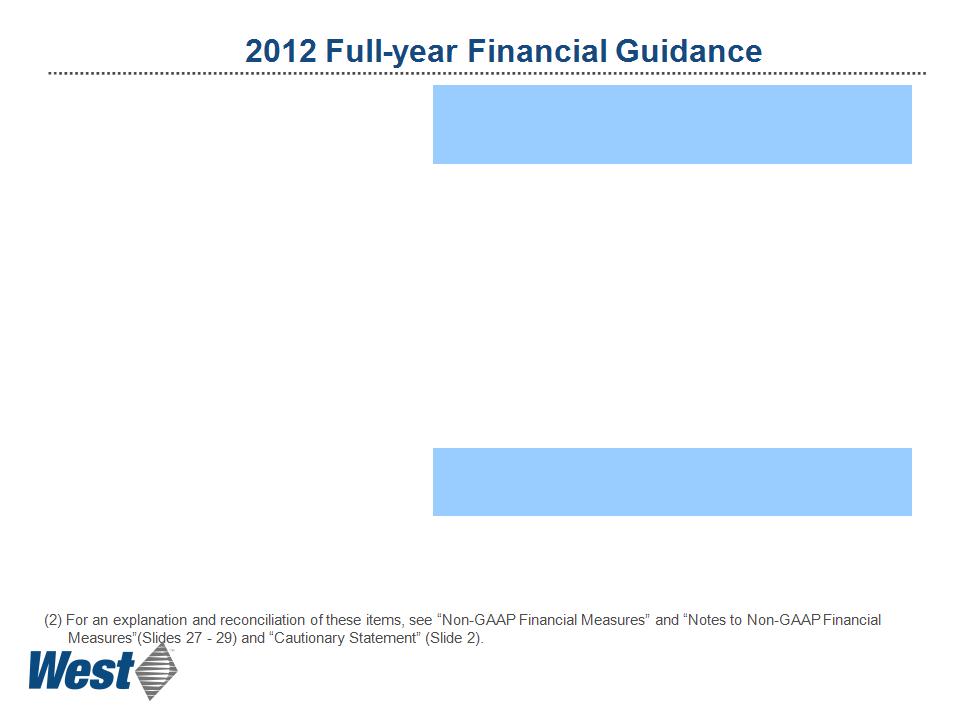

| Full Year 2012 Guidance (a) |

| Diluted Earnings Per Share |

Adjusted guidance | $2.37 to $2.55 |

Restructuring, net of tax | (0.05) to (0.03) |

Reported guidance | $2.32 to $2.52 |

(continued from prior slide)

Acquisition-related contingencies: During the three and twelve months ended December 31, 2011, we increased the liability for

contingent consideration related to our 2010 acquisition of technology used in our SmartDose™ electronic patch injector system by $0.2

million and $0.5 million, respectively. During the twelve months ended December 31, 2011, we also reduced the liability for contingent

consideration related to our July 2009 eris™ safety syringe system acquisition by $0.8 million, bringing the liability balance to zero. This

reduction reflects our assessment that none of the contractual operating targets will be achieved over the earnout period, which ends in

2014.

During the twelve months ended December 31, 2010, we reduced the liability for contingent consideration related to our July 2009 eris™

acquisition by $1.8 million to reflect our revised assessment of fair value, as affected by a reduction in the probability of attaining certain

milestones over the next four years.

Special separation benefits: During the three and twelve months ended December 31, 2011, we incurred special separation benefits of

$0.8 million and $2.9 million, respectively, related to the retirement of our former President and Chief Operating Officer. These costs

consisted primarily of stock-based compensation expense and a settlement loss related to one of our non-qualified defined benefit

pension plans. The respective equity compensation arrangements were amended to allow certain of his awards to continue to vest over

the original vesting period instead of being forfeited upon separation, resulting in a revaluation of the awards and acceleration of

expense.

Discrete tax items: During the three and twelve months ended December 31, 2011, we recognized discrete tax charges of $0.6 million

and $1.4 million, respectively, the majority of which resulted from changes in certain international tax rates that affected our deferred tax

carrying values and the finalization of prior year tax returns.

During the three and twelve months ended December 31, 2010, we recognized $1.1 million in net discrete tax benefits, the majority of

which resulted from the reversal of liabilities for unrecognized tax benefits.

•Reconciliation of 2012 Adjusted Guidance to 2012 Reported Guidance is as follows:

(a) Guidance includes various currency exchange rate assumptions, most significantly the Euro at $1.32 for 2012. Actual results will vary as a result of variability of

exchange rates.

SUPPLEMENTAL INFORMATION AND NOTES TO NON-GAAP FINANCIAL MEASURES