1 Third-Quarter 2024 Third Quarter Overall Net Sales $746.9M | 0.1% Diluted Earnings Per Share: $1.85 Adjusted Diluted Earnings Per Share: $1.85 Eric M. Green President and Chief Executive Officer Chair of the Board West Pharmaceutical Services, Inc. WST Q3 2024 Earnings Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development and operational performance. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under “Cautionary Statement” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, therefore you should not rely on these forward-looking statements as representing our views as of any date other than today. Non-U.S. GAAP Financial Measures Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non- U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Reconciliation of Non-U.S. GAAP Financial Measures” at the end of these materials for more information. “We are pleased to report solid third quarter results. Our West team across the globe continues to execute at a high-level, motivated by our purpose of improving patient lives. A key aspect of our strategy is West’s team of scientific thought leaders and technical experts who continue to drive strong partnership and close collaboration with our customers. This reinforces my confidence in West’s execution capabilities, as we continue to deliver our proven market-led strategy and attractive long-term potential.”

West Pharmaceutical Services, Inc. Eric M. Green President & CEO, Chair of the Board Bernard J. Birkett Senior VP & Chief Financial Officer Third-Quarter Results 2024 Analyst Conference Call 9 a.m. Eastern Time | October 24, 2024

3 West Analyst Conference Call 9 a.m. Eastern Time October 24, 2024 A webcast of today’s call can be accessed in the “Investors” section of the Company’s website: www.westpharma.com To participate on the call by asking questions to Management, please register in advance at: https://register.vevent.com/register/BI13834a517d804f6781f3 3c4642cc94ab Upon registration, all telephone participants will receive the dial-in number along with a unique PIN number that will be used to access the call. A replay of the conference call and webcast will be available on the Company’s website for 30 days. These presentation materials are intended to accompany today’s press release announcing the Company’s results for the third quarter 2024 and management’s discussion of those results during today’s conference call. WST Q3 2024 Earnings

4 Safe Harbor Statement This presentation and any accompanying management commentary contain “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about product development, operational performance and expectations regarding future events. Each of these statements is based on preliminary information, and actual results could differ from any preliminary estimates. We caution investors that the risk factors listed under our “Forward Looking Statements” in our press releases, as well as those set forth under the caption "Risk Factors" in our most recent Annual Report on Form 10-K as filed with the Securities and Exchange Commission and as revised or supplemented by our quarterly reports on Form 10-Q, could cause our actual results to differ materially from those estimated or predicted in the forward-looking statements. You should evaluate any statement in light of these important factors. Except as required by law or regulation, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, therefore you should not rely on these forward-looking statements as representing our views as of any date other than today. Certain financial measures included in these presentation materials, or which may be referred to in management’s discussion of the Company’s results and outlook, have not been calculated in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and therefore are referred to as non-U.S. GAAP financial measures. Non-U.S. GAAP financial measures should not be considered in isolation or as an alternative to such measures determined in accordance with U.S. GAAP. Please refer to “Reconciliation of Non-U.S. GAAP Financial Measures” at the end of these materials for more information. Cautionary Statement Under the Private Securities Litigation Reform Act of 1995 Non-U.S. GAAP Financial Measures Trademarks and registered trademarks used in this report are the property of West Pharmaceutical Services, Inc. or its subsidiaries, in the United States and other jurisdictions, unless noted otherwise. Daikyo Crystal Zenith® and Daikyo CZ® are registered trademarks of Daikyo Seiko, Ltd. Daikyo Crystal Zenith technologies are licensed from Daikyo Seiko, Ltd. Trademarks WST Q3 2024 Earnings

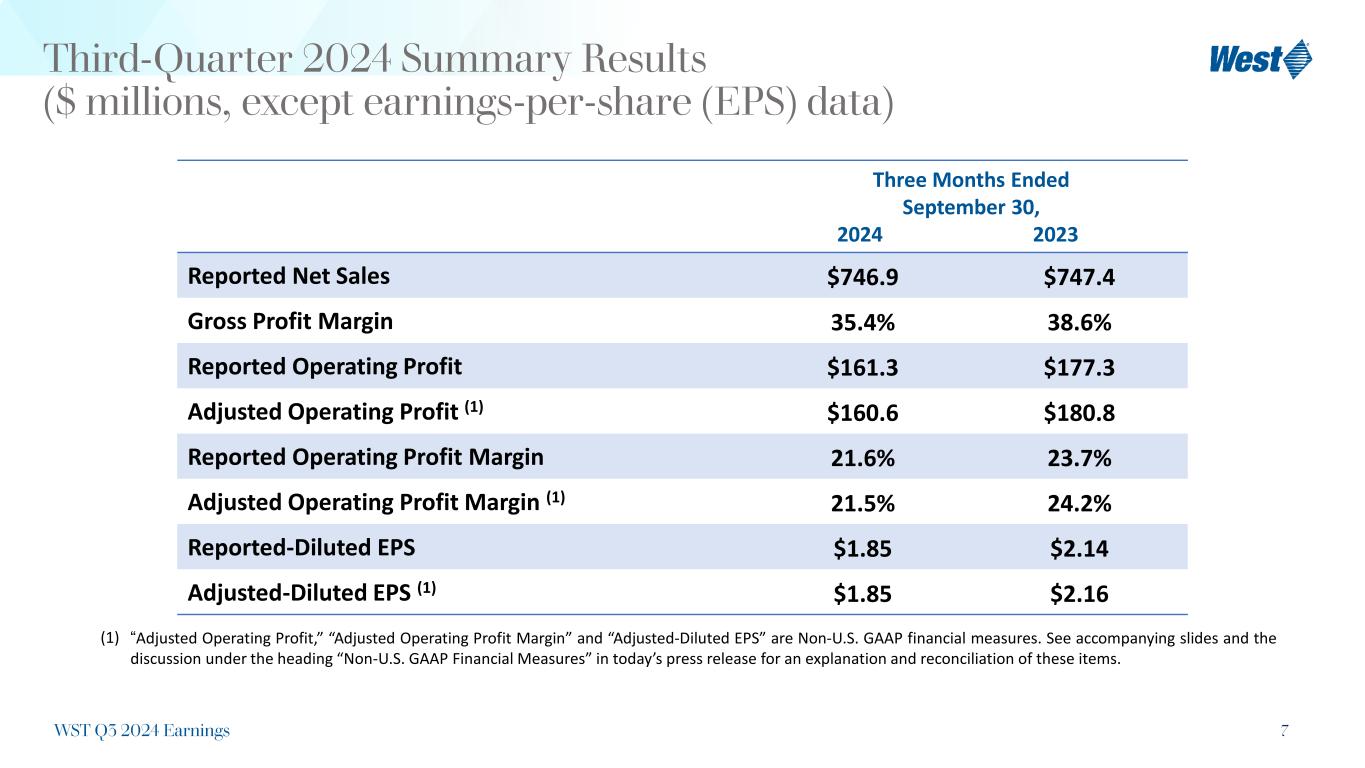

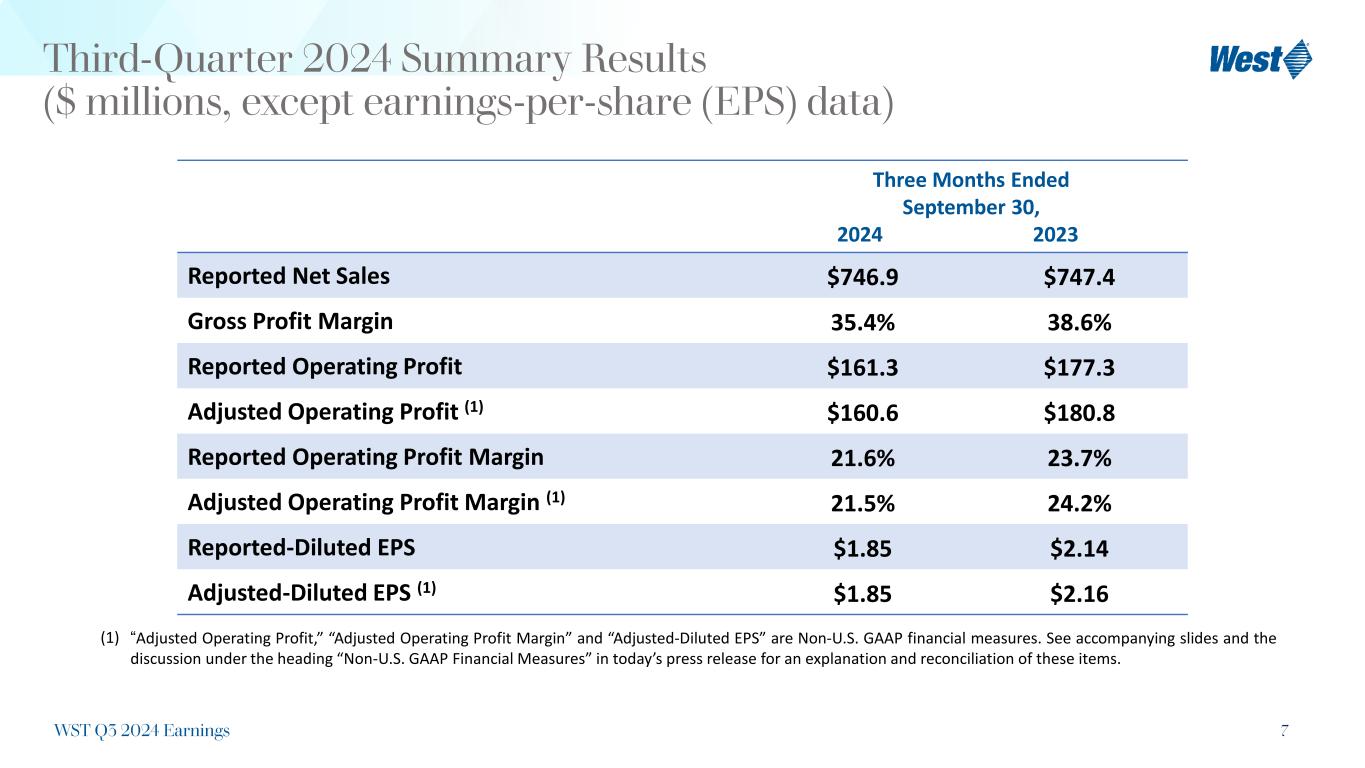

5 Financial Highlights WST Q3 2024 Earnings • Third quarter 2024 net sales of $746.9 million declined 0.1%; organic net sales declined 0.5% • Third quarter 2024 reported-diluted EPS of $1.85 compared to $2.14 in the same period last year; adjusted-diluted EPS of $1.85 compared to $2.16 in the same period last year

6 Biologics is the fastest growing sub- segment of injectable medicines. West is the market leader in this injectable segment. We are investing in growth capital expansions of our network, to support global volume growth of injectable drugs especially with regulatory changes. Driving Operational Excellence with LEAN programs, automation and capital expansion within our existing infrastructure We are leveraging our HVP Proprietary portfolio with our Glass partners to offer comprehensive integrated systems. Our Growth Drivers in the Near- and Mid-Term HVP mix-shift with new drug launches, growth of recently launched drugs and conversion of existing commercialized drugs driven by regulatory changes Revenue/Market Growth Margin Expansion WST Q3 2024 Earnings

7 Third-Quarter 2024 Summary Results ($ millions, except earnings-per-share (EPS) data) Three Months Ended September 30, 2024 2023 Reported Net Sales $746.9 $747.4 Gross Profit Margin 35.4% 38.6% Reported Operating Profit $161.3 $177.3 Adjusted Operating Profit (1) $160.6 $180.8 Reported Operating Profit Margin 21.6% 23.7% Adjusted Operating Profit Margin (1) 21.5% 24.2% Reported-Diluted EPS $1.85 $2.14 Adjusted-Diluted EPS (1) $1.85 $2.16 “Adjusted Operating Profit,” “Adjusted Operating Profit Margin” and “Adjusted-Diluted EPS” are Non-U.S. GAAP financial measures. See accompanying slides and the discussion under the heading “Non-U.S. GAAP Financial Measures” in today’s press release for an explanation and reconciliation of these items. (1) WST Q3 2024 Earnings

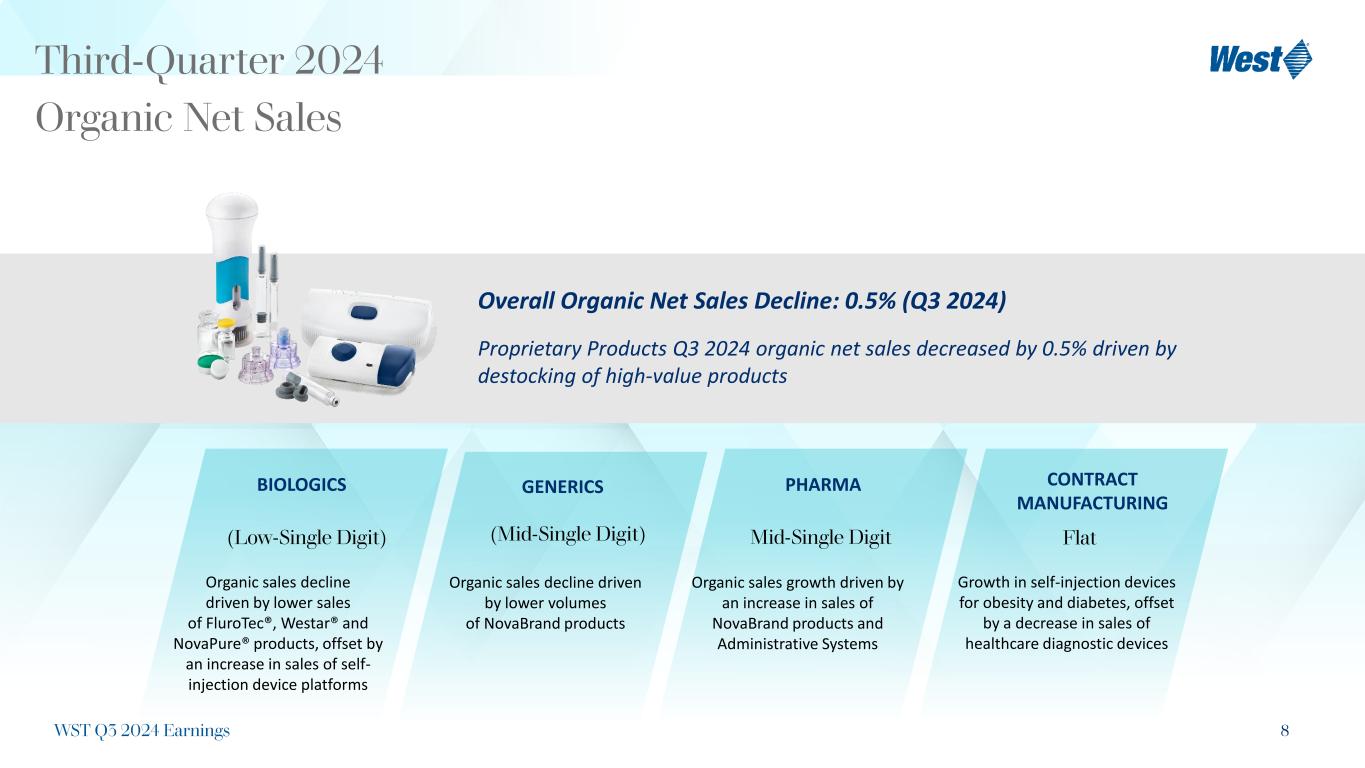

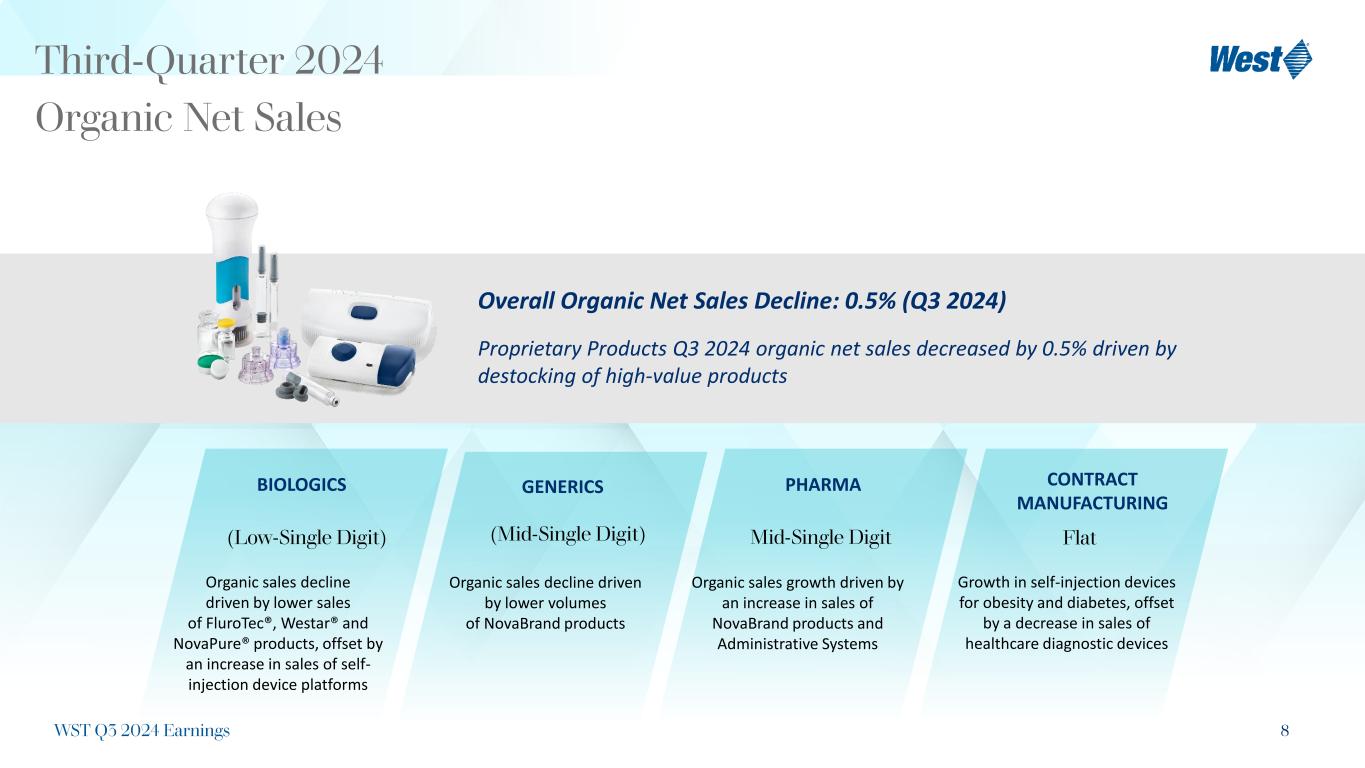

8 Overall Organic Net Sales Decline: 0.5% (Q3 2024) Proprietary Products Q3 2024 organic net sales decreased by 0.5% driven by destocking of high-value products BIOLOGICS GENERICS PHARMA Organic sales decline driven by lower sales of FluroTec®, Westar® and NovaPure® products, offset by an increase in sales of self- injection device platforms Organic sales decline driven by lower volumes of NovaBrand products Organic sales growth driven by an increase in sales of NovaBrand products and Administrative Systems CONTRACT MANUFACTURING Growth in self-injection devices for obesity and diabetes, offset by a decrease in sales of healthcare diagnostic devices (Low-Single Digit) (Mid-Single Digit) FlatMid-Single Digit Third-Quarter 2024 Organic Net Sales WST Q3 2024 Earnings

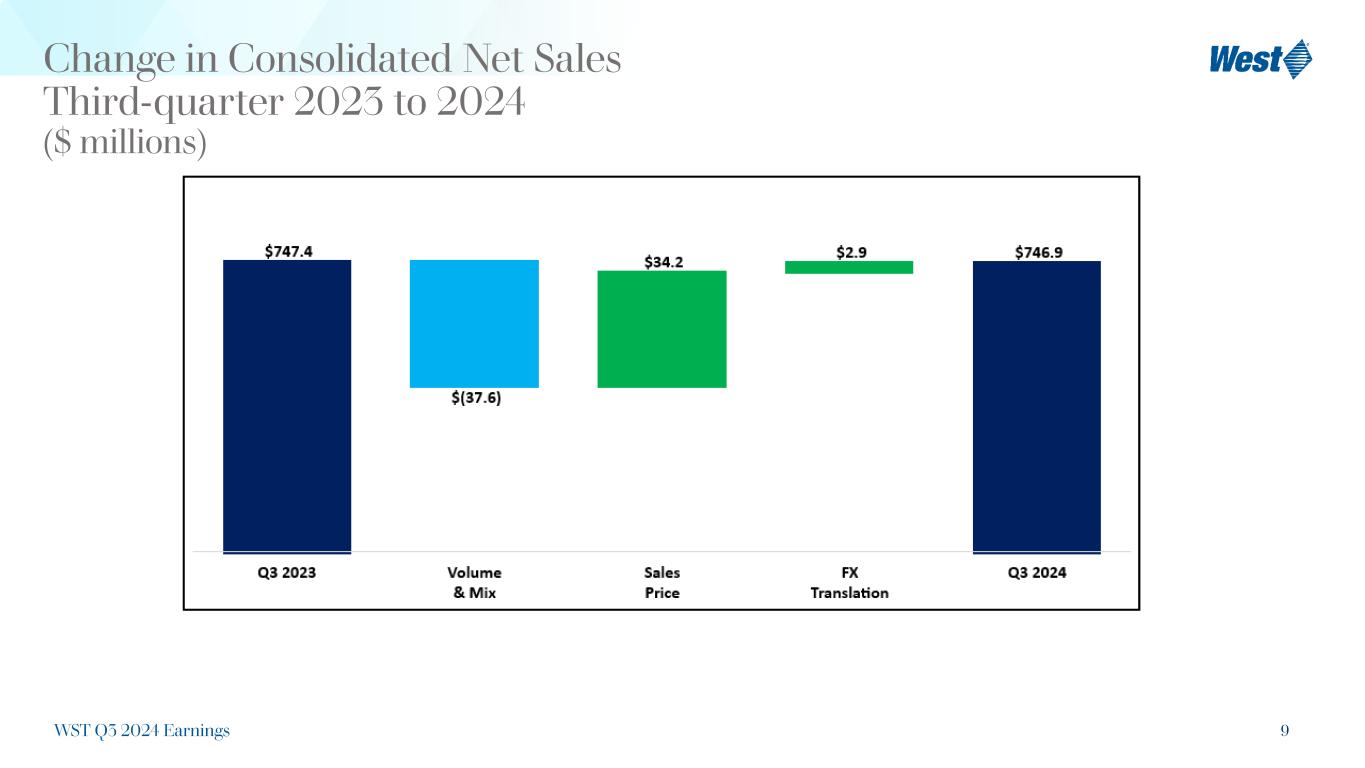

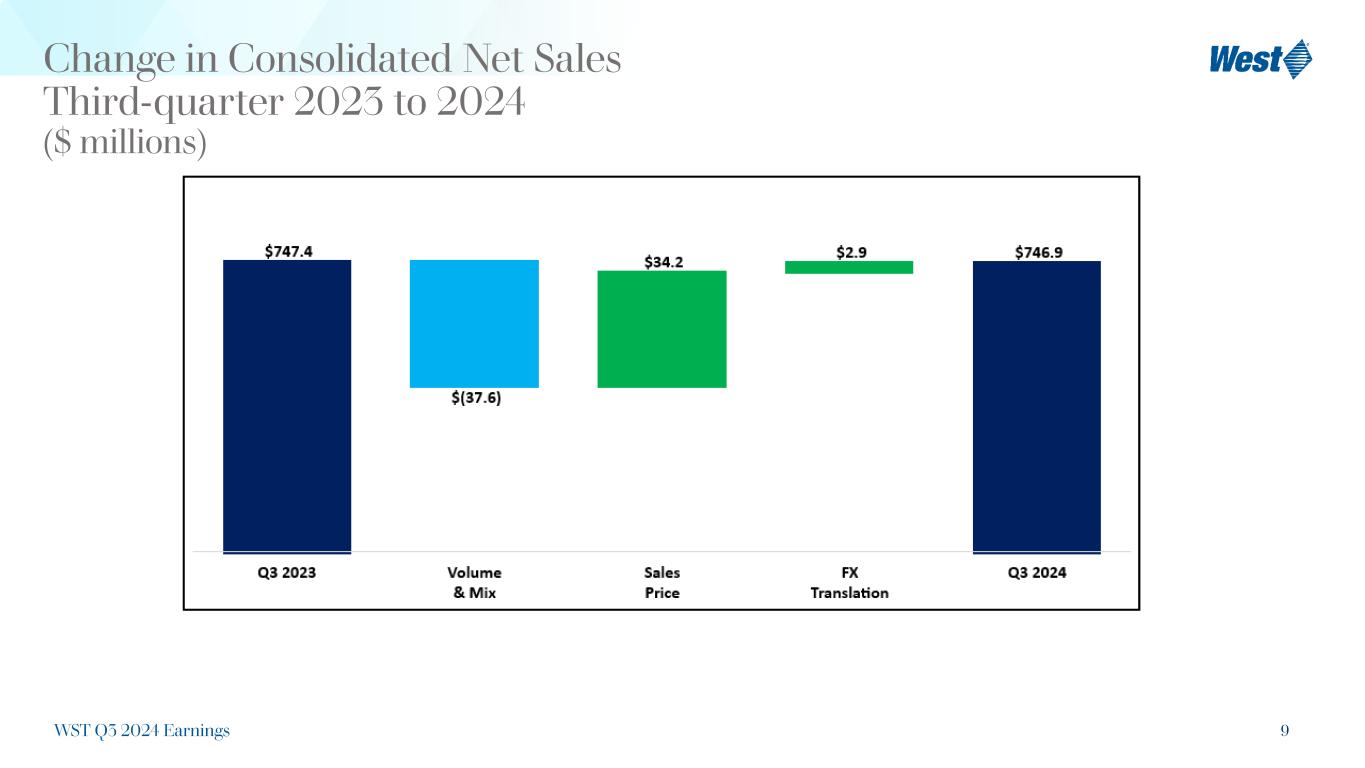

9 Change in Consolidated Net Sales Third-quarter 2023 to 2024 ($ millions) WST Q3 2024 Earnings

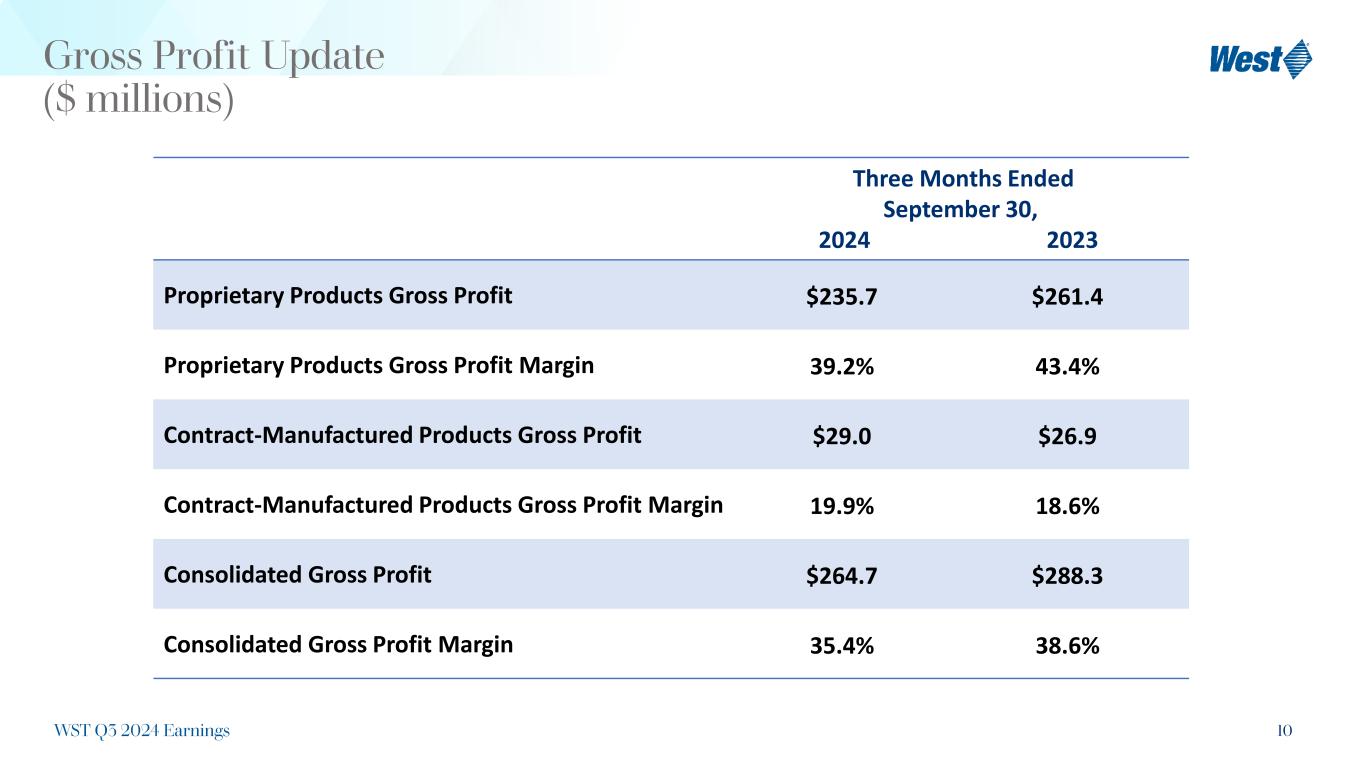

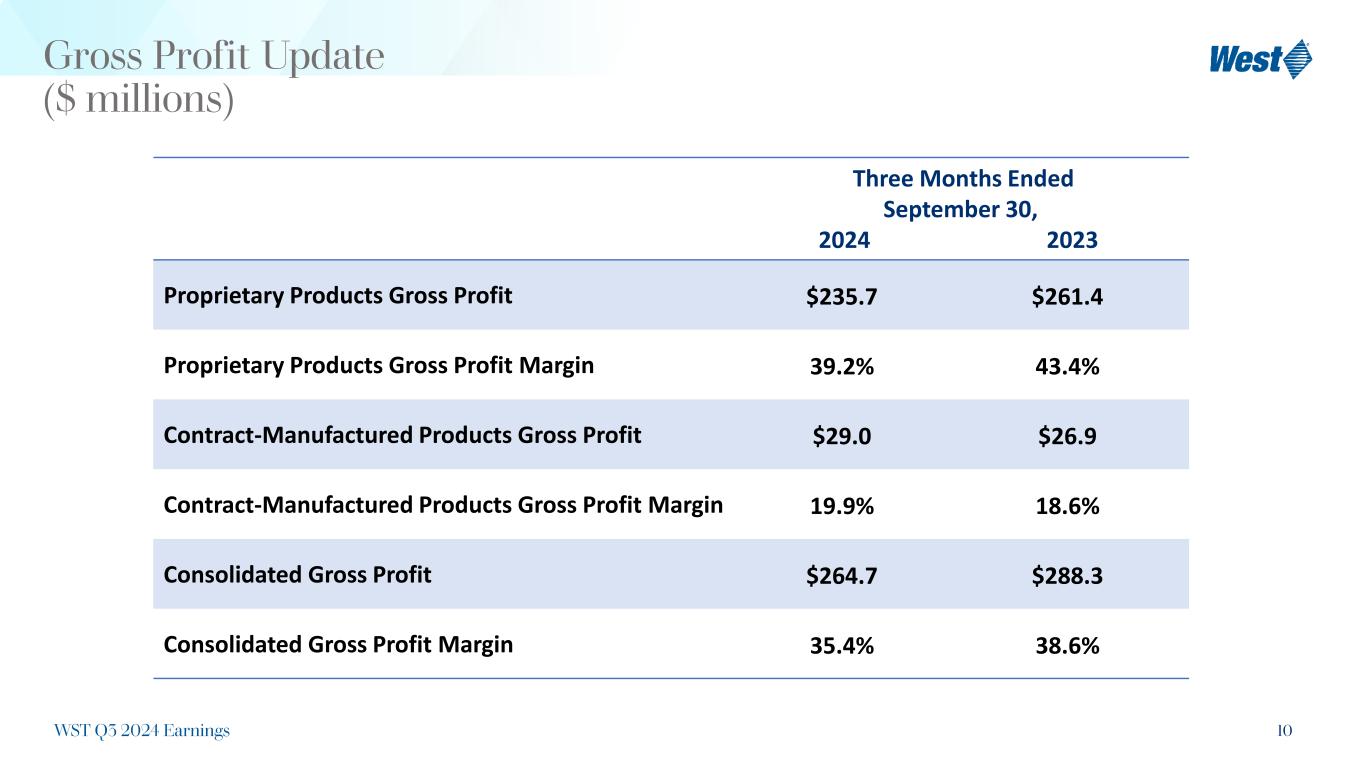

10 Gross Profit Update ($ millions) Three Months Ended September 30, 2024 2023 Proprietary Products Gross Profit $235.7 $261.4 Proprietary Products Gross Profit Margin 39.2% 43.4% Contract-Manufactured Products Gross Profit $29.0 $26.9 Contract-Manufactured Products Gross Profit Margin 19.9% 18.6% Consolidated Gross Profit $264.7 $288.3 Consolidated Gross Profit Margin 35.4% 38.6% WST Q3 2024 Earnings

11 Cash Flow and Balance Sheet Metrics ($ millions) Cash Flow Items YTD Q3 2024 YTD Q3 2023 Depreciation and Amortization $114.7 $101.4 Operating Cash Flow $463.3 $537.4 Capital Expenditures $272.1 $253.3 Free Cash Flow $191.2 $284.1 Financial Condition September 30, 2024 December 31, 2023 Cash and Cash Equivalents $490.9 $853.9 Debt $202.6 $206.8 Equity $2,752.1 $2,881.0 Working Capital $1,034.1 $1,264.6 WST Q3 2024 Earnings

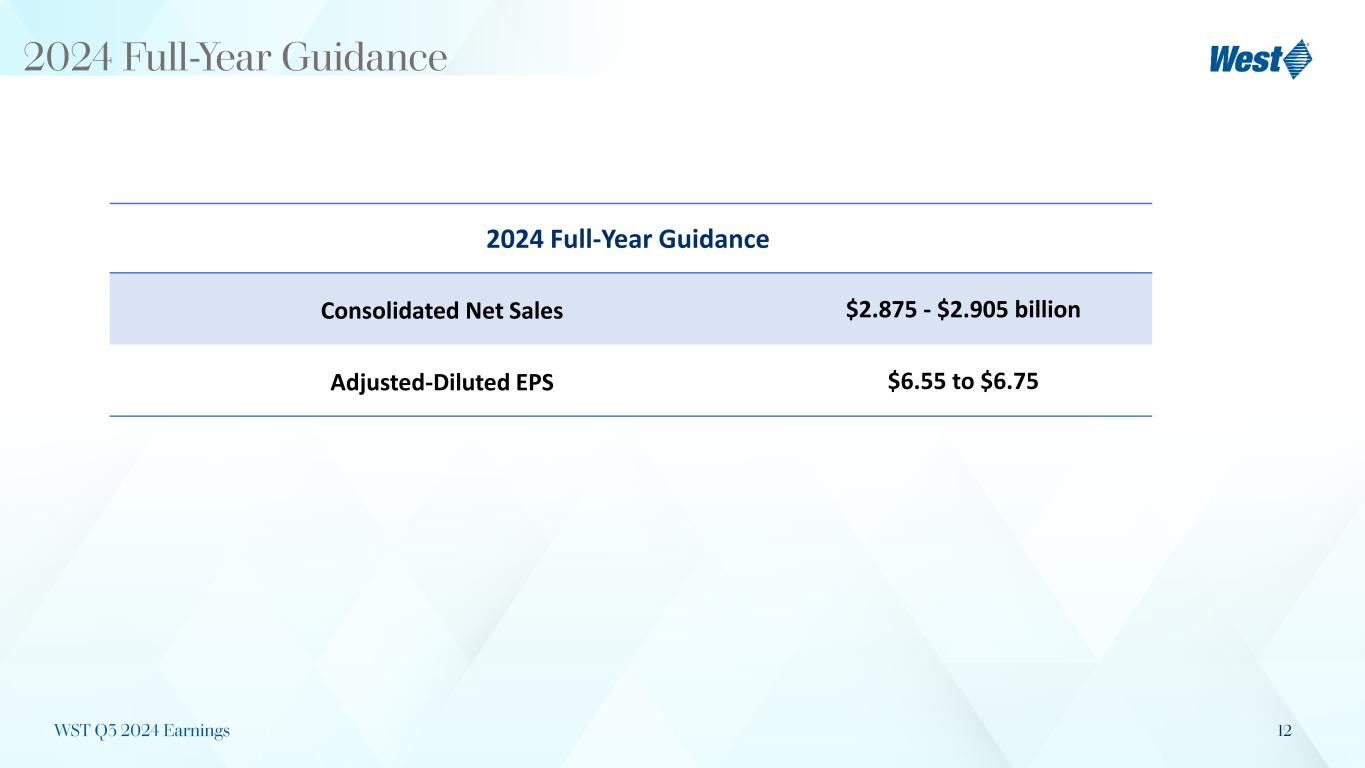

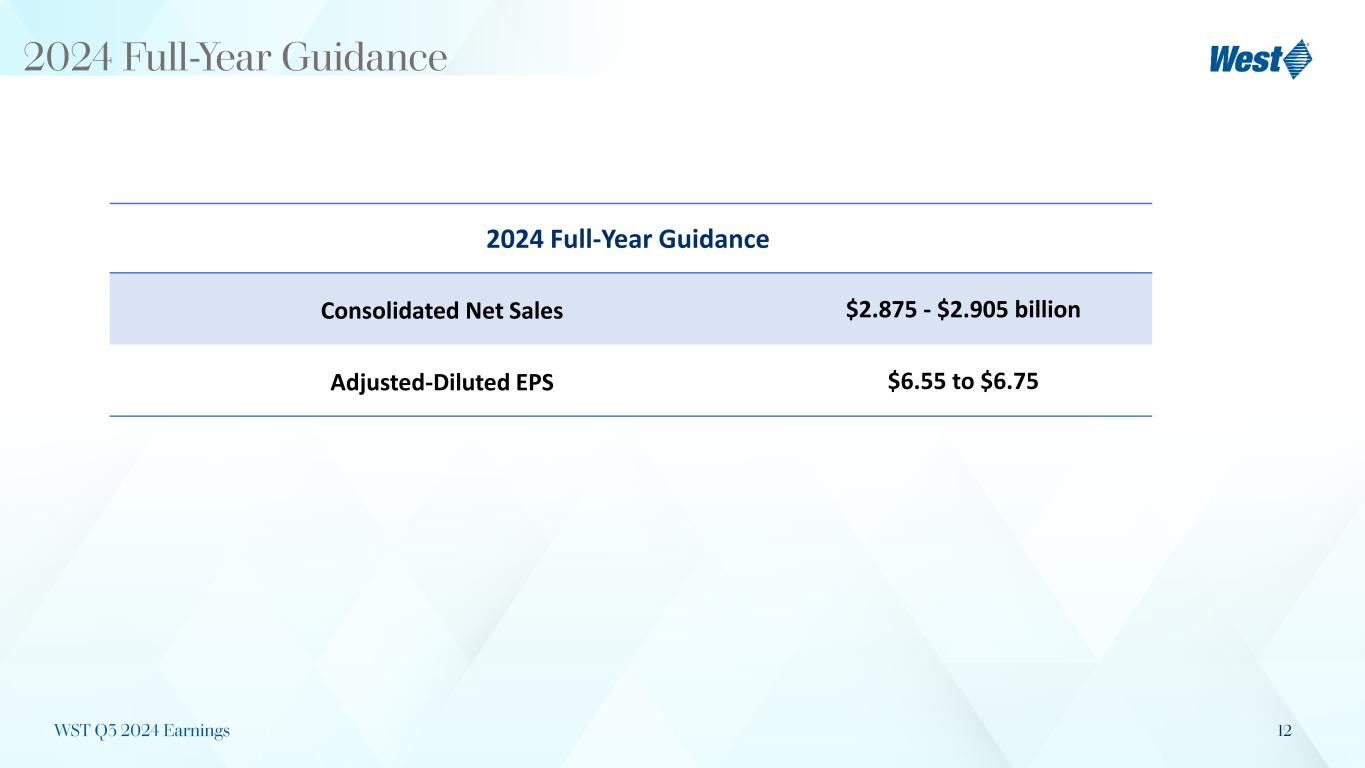

12 2024 Full-Year Guidance WST Q3 2024 Earnings 2024 Full-Year Guidance Consolidated Net Sales $2.875 - $2.905 billion Adjusted-Diluted EPS $6.55 to $6.75

13 Delivering Unique Value for Customers to Meet the Changing Market Needs Significant Capital Investments for Future Growth Making a difference to improve patients’ lives WST Q3 2024 Earnings

14 Eric M. Green President & Chief Executive Officer, Chair of the Board Bernard J. Birkett Senior VP & Chief Financial Officer John Sweeney VP, Investor Relations Q & A WST Q3 2024 Earnings

15 Notes to Non-U.S. GAAP Financial Measures The Non-U.S. GAAP financial measures are incorporated into our discussion and analysis as management uses them in evaluating our results of operations and believes that this information provides users a valuable insight into our overall performance and financial position. A reconciliation of these adjusted Non-U.S. GAAP financial measures to the comparable U.S. GAAP financial measures is included in the accompanying tables. For the purpose of aiding the comparison of our year-over-year results, we may refer to net sales and other financial results excluding the effects of changes in foreign currency exchange rates. Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. We may also refer to financial results excluding the effects of unallocated items. The re-measured results excluding effects from currency translation, the impact from acquisitions and/or divestitures, and the effects of unallocated items are not in conformity with U.S. GAAP and should not be used as a substitute for the comparable U.S. GAAP financial measures. WST Q3 2024 Earnings

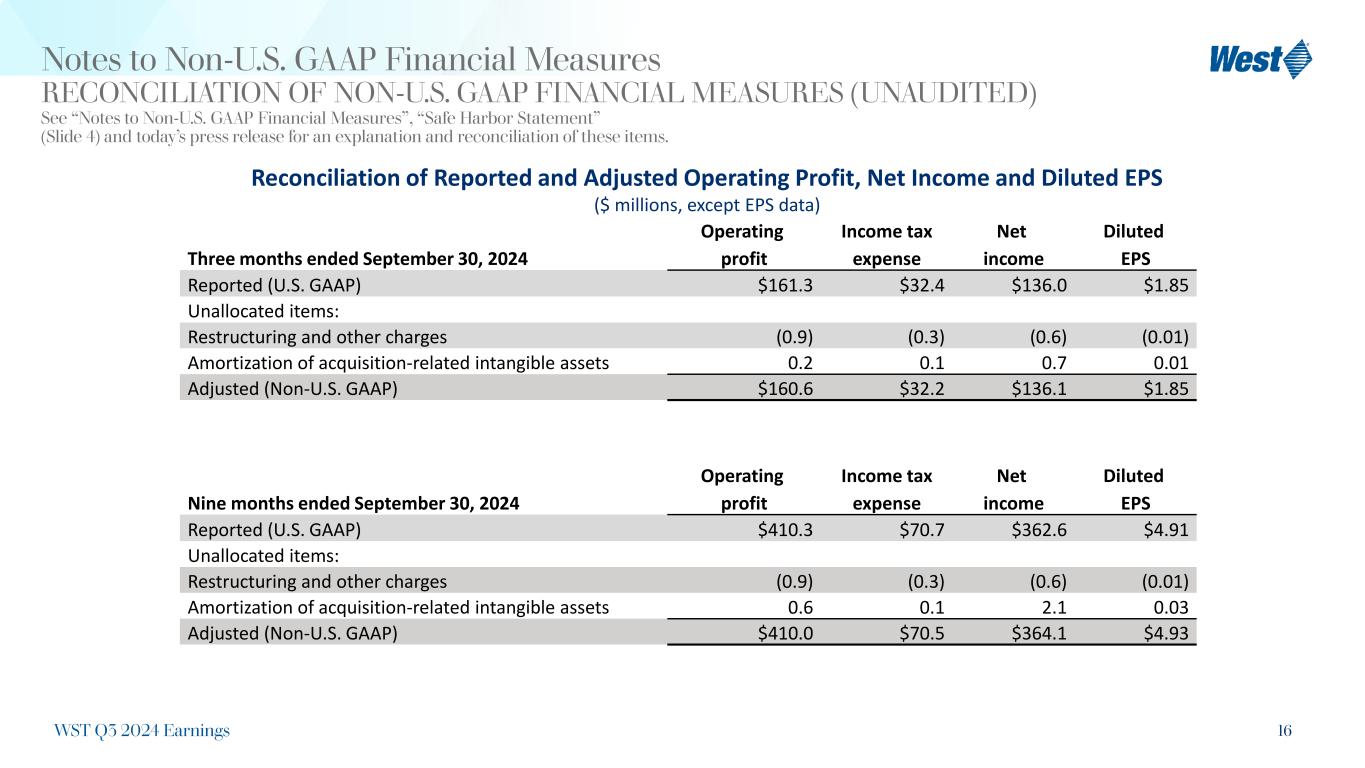

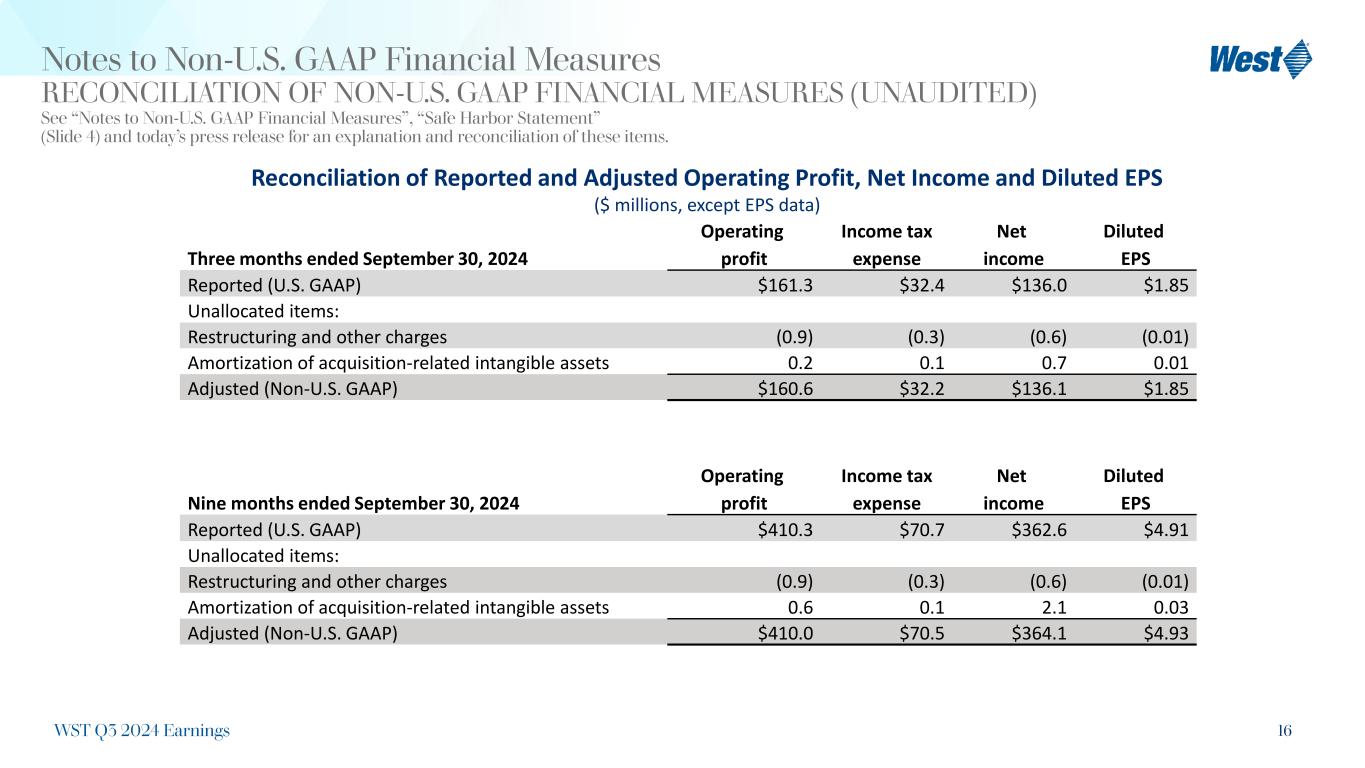

16 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended September 30, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $161.3 $32.4 $136.0 $1.85 Unallocated items: Restructuring and other charges (0.9) (0.3) (0.6) (0.01) Amortization of acquisition-related intangible assets 0.2 0.1 0.7 0.01 Adjusted (Non-U.S. GAAP) $160.6 $32.2 $136.1 $1.85 Nine months ended September 30, 2024 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $410.3 $70.7 $362.6 $4.91 Unallocated items: Restructuring and other charges (0.9) (0.3) (0.6) (0.01) Amortization of acquisition-related intangible assets 0.6 0.1 2.1 0.03 Adjusted (Non-U.S. GAAP) $410.0 $70.5 $364.1 $4.93 WST Q3 2024 Earnings

17 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported and Adjusted Operating Profit, Net Income and Diluted EPS ($ millions, except EPS data) Three months ended September 30, 2023 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $177.3 $29.4 $161.3 $2.14 Unallocated items: Amortization of acquisition-related intangible assets 0.2 0.1 0.7 0.01 Legal settlement - (0.9) (2.9) (0.04) Cost investment impairment 3.3 - 3.3 0.05 Adjusted (Non-U.S. GAAP) $180.8 $28.6 $162.4 $2.16 Nine months ended September 30, 2023 Operating profit Income tax expense Net income Diluted EPS Reported (U.S. GAAP) $515.1 $87.8 $456.4 $6.05 Unallocated items: Restructuring and other charges 0.1 (0.3) 0.4 - Amortization of acquisition-related intangible assets 0.6 0.1 2.1 0.03 Legal settlement - (0.9) (2.9) (0.04) Cost investment impairment 3.3 - 3.3 0.05 Loss on disposal of plant 11.6 (0.7) 12.3 0.16 Adjusted (Non-U.S. GAAP) $530.7 $86.0 $471.6 $6.25 WST Q3 2024 Earnings

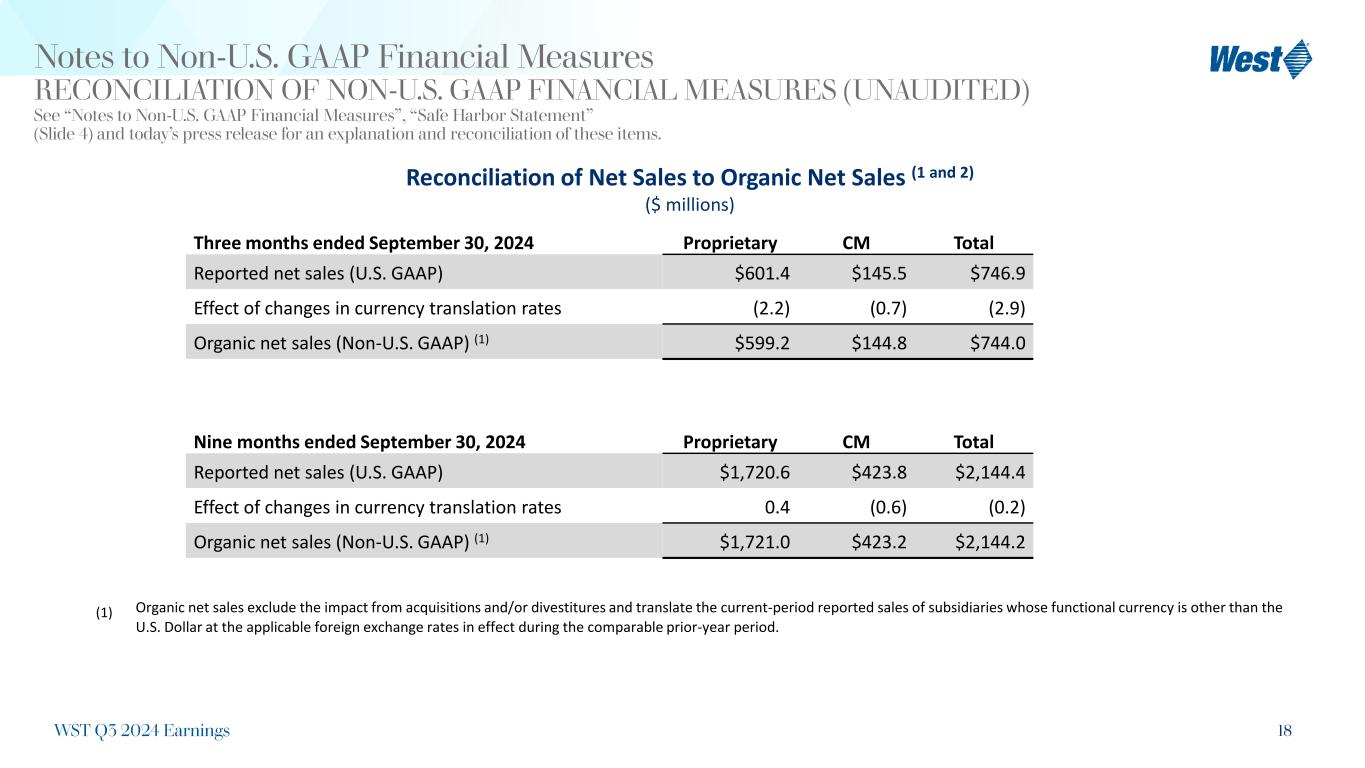

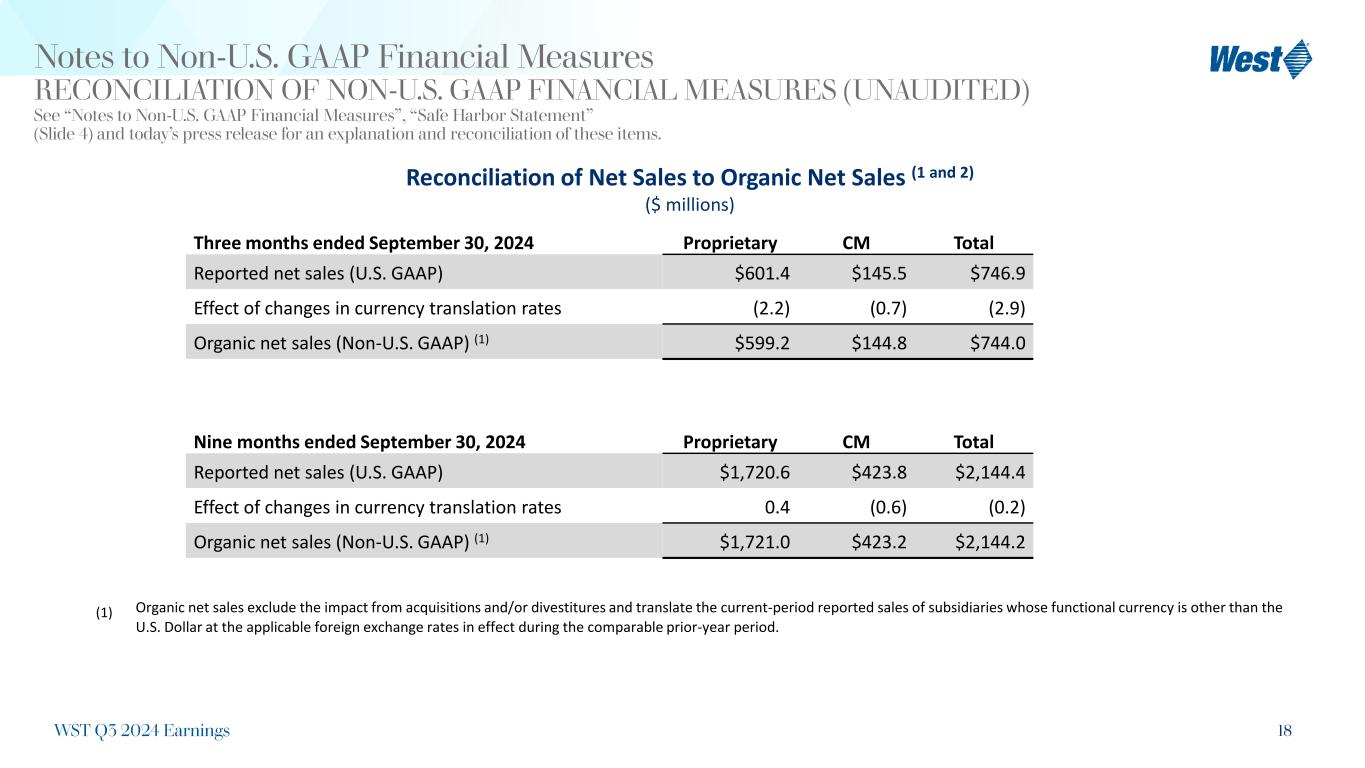

18 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Organic Net Sales (1 and 2) ($ millions) Organic net sales exclude the impact from acquisitions and/or divestitures and translate the current-period reported sales of subsidiaries whose functional currency is other than the U.S. Dollar at the applicable foreign exchange rates in effect during the comparable prior-year period. (1) Three months ended September 30, 2024 Proprietary CM Total Reported net sales (U.S. GAAP) $601.4 $145.5 $746.9 Effect of changes in currency translation rates (2.2) (0.7) (2.9) Organic net sales (Non-U.S. GAAP) (1) $599.2 $144.8 $744.0 Nine months ended September 30, 2024 Proprietary CM Total Reported net sales (U.S. GAAP) $1,720.6 $423.8 $2,144.4 Effect of changes in currency translation rates 0.4 (0.6) (0.2) Organic net sales (Non-U.S. GAAP) (1) $1,721.0 $423.2 $2,144.2 WST Q3 2024 Earnings

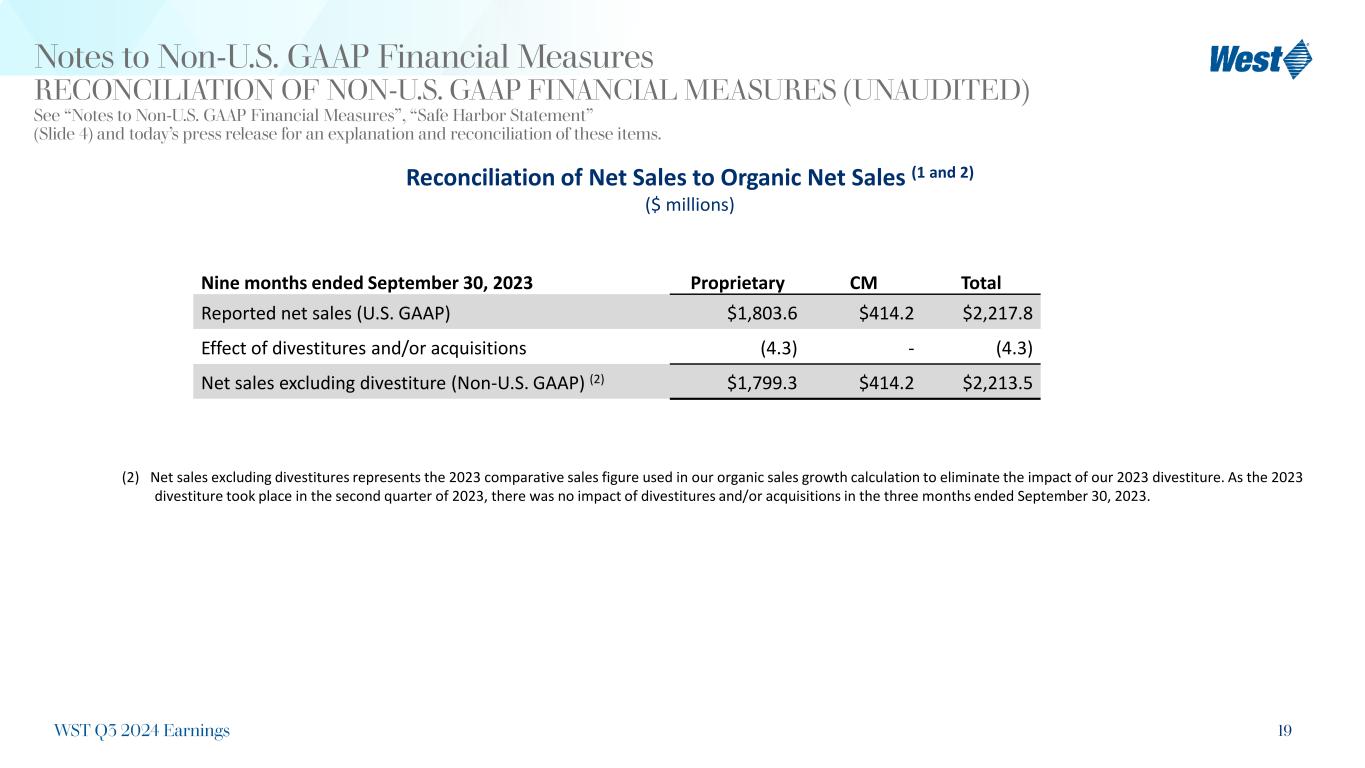

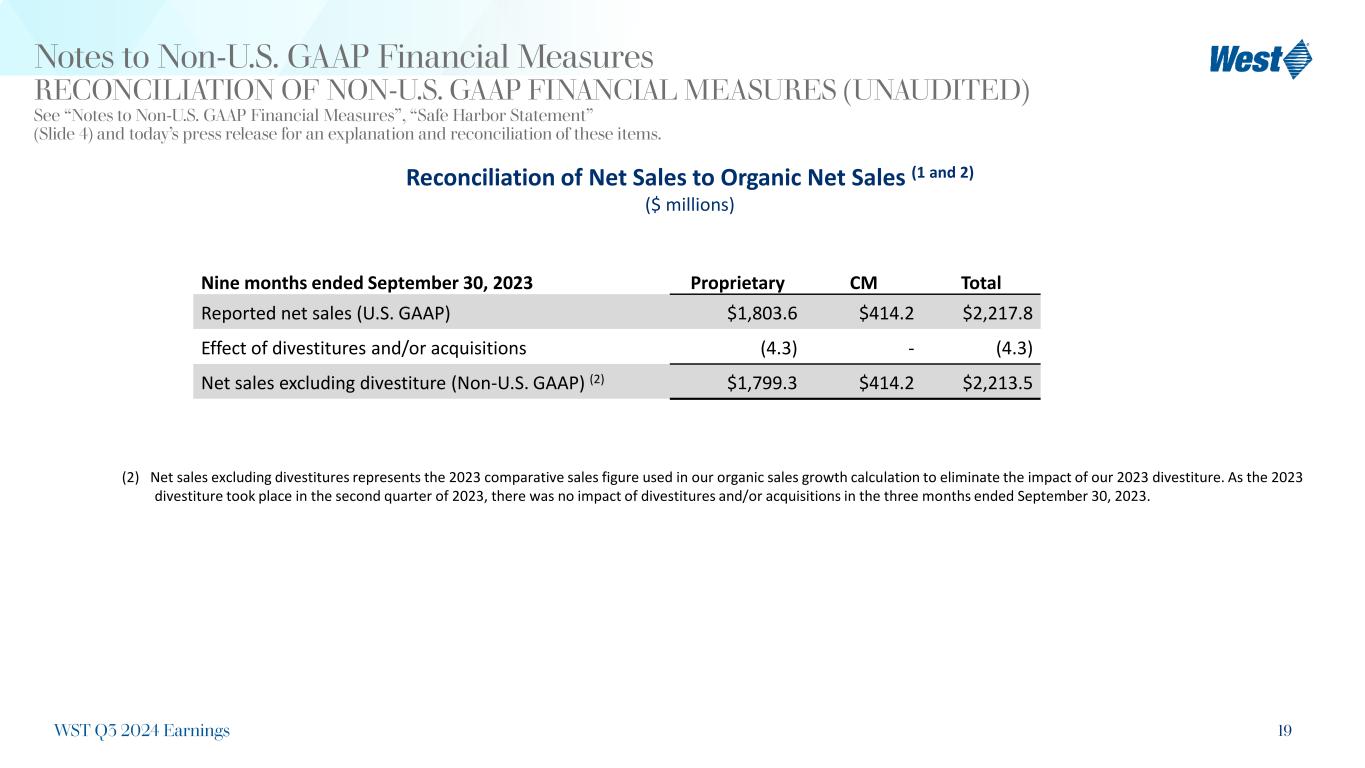

19 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Net Sales to Organic Net Sales (1 and 2) ($ millions) (2) Net sales excluding divestitures represents the 2023 comparative sales figure used in our organic sales growth calculation to eliminate the impact of our 2023 divestiture. As the 2023 divestiture took place in the second quarter of 2023, there was no impact of divestitures and/or acquisitions in the three months ended September 30, 2023. Nine months ended September 30, 2023 Proprietary CM Total Reported net sales (U.S. GAAP) $1,803.6 $414.2 $2,217.8 Effect of divestitures and/or acquisitions (4.3) - (4.3) Net sales excluding divestiture (Non-U.S. GAAP) (2) $1,799.3 $414.2 $2,213.5 WST Q3 2024 Earnings

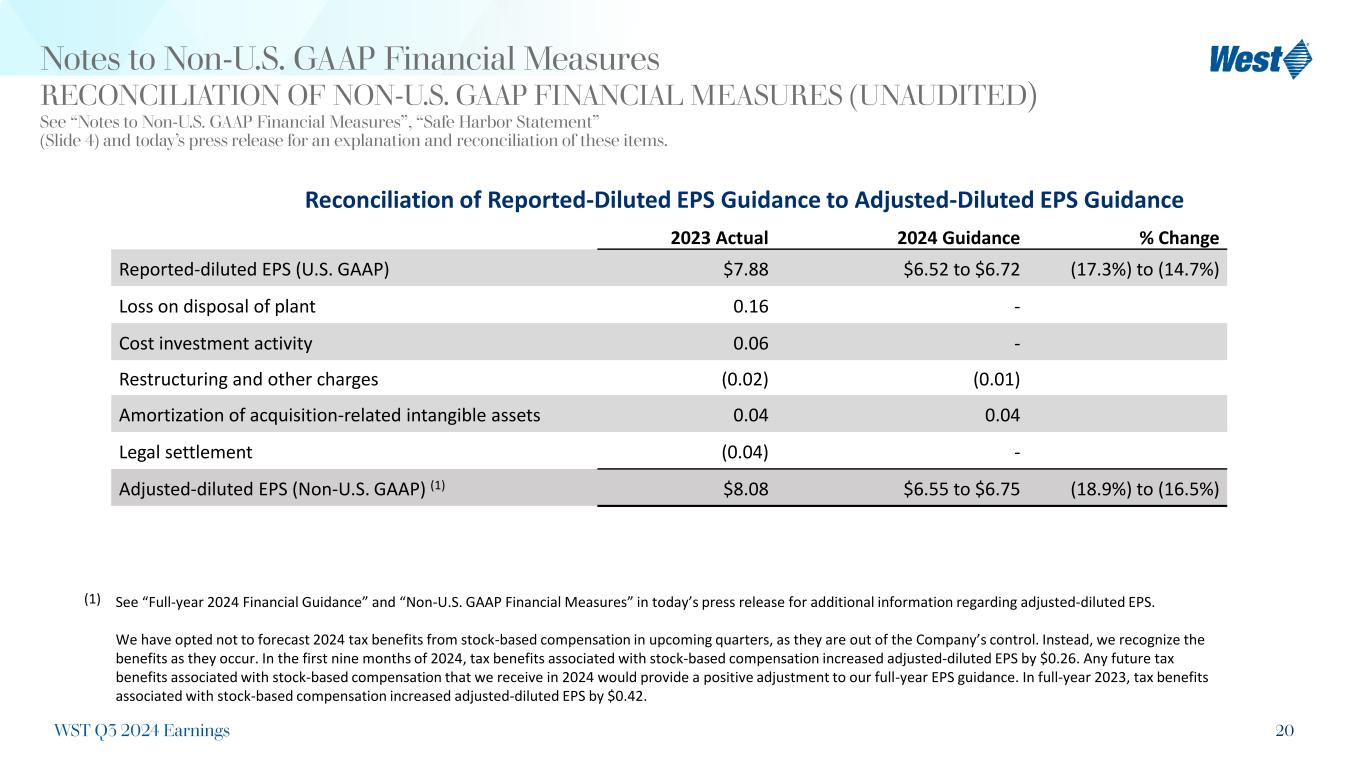

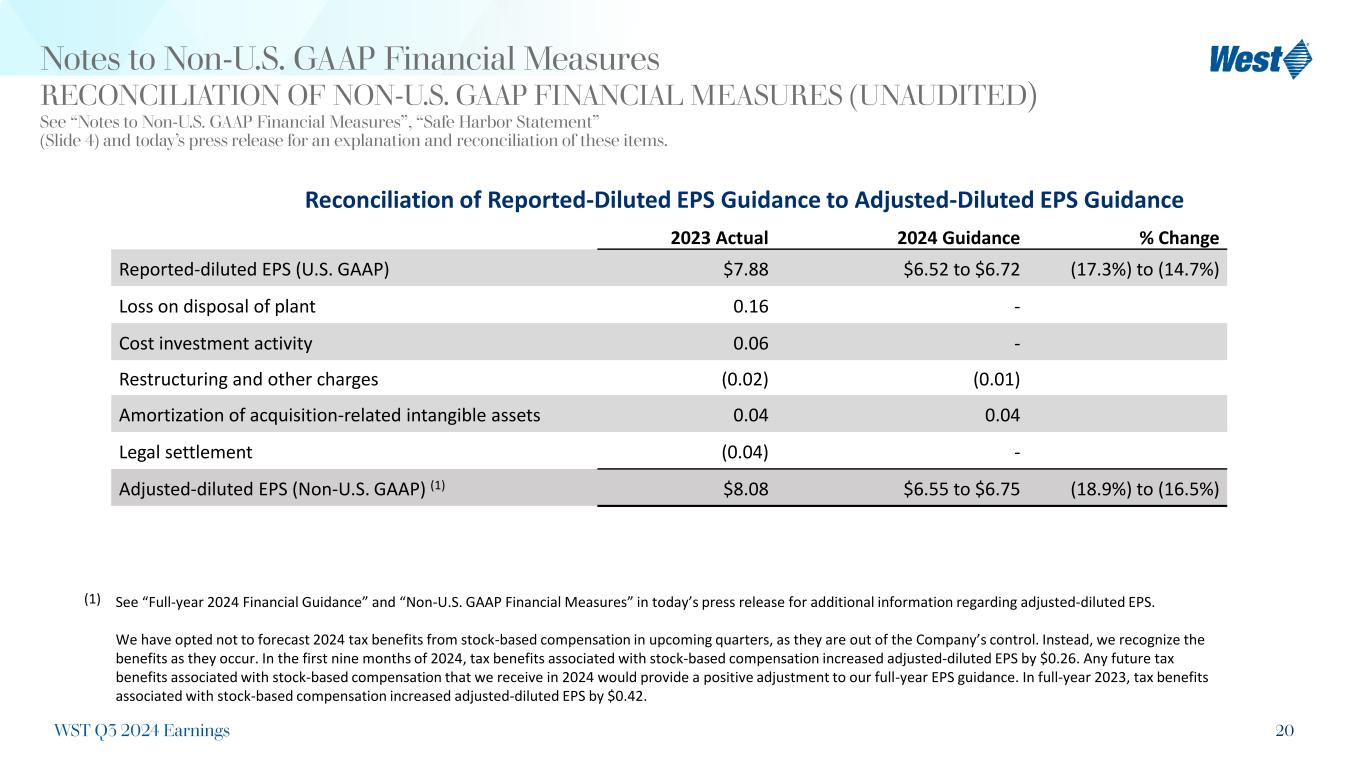

20 Notes to Non-U.S. GAAP Financial Measures RECONCILIATION OF NON-U.S. GAAP FINANCIAL MEASURES (UNAUDITED) See “Notes to Non-U.S. GAAP Financial Measures”, “Safe Harbor Statement” (Slide 4) and today’s press release for an explanation and reconciliation of these items. Reconciliation of Reported-Diluted EPS Guidance to Adjusted-Diluted EPS Guidance 2023 Actual 2024 Guidance % Change Reported-diluted EPS (U.S. GAAP) $7.88 $6.52 to $6.72 (17.3%) to (14.7%) Loss on disposal of plant 0.16 - Cost investment activity 0.06 - Restructuring and other charges (0.02) (0.01) Amortization of acquisition-related intangible assets 0.04 0.04 Legal settlement (0.04) - Adjusted-diluted EPS (Non-U.S. GAAP) (1) $8.08 $6.55 to $6.75 (18.9%) to (16.5%) (1) See “Full-year 2024 Financial Guidance” and “Non-U.S. GAAP Financial Measures” in today’s press release for additional information regarding adjusted-diluted EPS. We have opted not to forecast 2024 tax benefits from stock-based compensation in upcoming quarters, as they are out of the Company’s control. Instead, we recognize the benefits as they occur. In the first nine months of 2024, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.26. Any future tax benefits associated with stock-based compensation that we receive in 2024 would provide a positive adjustment to our full-year EPS guidance. In full-year 2023, tax benefits associated with stock-based compensation increased adjusted-diluted EPS by $0.42. WST Q3 2024 Earnings