Exhibit 99.2

Financial Results First Quarter 2014 First BanCorp

Forward‐Looking Statements This presentation contains “forward‐looking statements” concerning First BanCorp’s (the “Corporation”) future economic performance. The words or phrases “would be,” “will allow,” “intends to,” “will likely result,” “are expected to,” “expect,” “anticipate,” “look forward,” “should,” “believes” and similar expressions are meant to identify “forward‐looking statements” within the meaning of Section 27A of the Private Securities Litigation Reform Act of 1995, and are subject to the safe harbor created by such section. The Corporation wishes to caution readers not to place undue reliance on any such “forward‐looking statements,” which speak only as of the date made, and to advise readers that various factors, including, but not limited to, uncertainty about whether the Corporation and FirstBank Puerto Rico (“FirstBank” or “the Bank”) will be able to fully comply with the written agreement dated June 3, 2010 that the Corporation entered into with the Federal Reserve Bank of New York (the “FED”) and the order dated June 2, 2010 (the “Order”)that FirstBank entered into with the FDIC and the Office of the Commissioner of Financial Institutions of Puerto Rico that, among other things, require FirstBank to maintain certain capital levels and reduce its special mention, classified, delinquent and non‐performing assets; the risk of being subject to possible additional regulatory actions; uncertainty as to the availability of certain funding sources, such as retail brokered CDs; the Corporation’s reliance on brokered CDs and its ability to obtain, on a periodic basis, approval from the FDIC to issue brokered CDs to fund operations and provide liquidity in accordance with the terms of the Order; the risk of not being able to fulfill the Corporation’s cash obligations or resume paying dividends to the Corporation’s stockholders in the future due to the Corporation’s inability to receive approval from the FED to receive dividends from FirstBank or FirstBank’s failure to generate sufficient cash flow to make a dividend payment to the Corporation; the strength or weakness of the real estate markets and of the consumer and commercial credit sectors and their impact on the credit quality of the Corporation’s loans and other assets, including the Corporation’s construction and commercial real estate loan portfolios, which have contributed and may continue to contribute to, among other things, the high levels of non‐performing assets, charge‐offs and the provision expense and may subject the Corporation to further risk from loan defaults and foreclosures; adverse changes in general economic conditions in the United States and in Puerto Rico, including the interest rate scenario, market liquidity, housing absorption rates, real estate prices and disruptions in the U.S. capital markets, which may reduce interest margins, impact funding sources and affect demand for all of the Corporation’s products and services and the value of the Corporation’s assets; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico and the current fiscal problems and budget deficit of the Puerto Rico government; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the United States and the U.S. and British Virgin Islands, which could affect the Corporation’s financial performance and could cause the Corporation’s actual results for future periods to differ materially from prior results and anticipated or projected results; uncertainty about the effectiveness of the various actions undertaken to stimulate the United States economy and stabilize the United States’ financial markets, and the impact such actions may have on the Corporation’s business, financial condition and results of operations; changes in the fiscal and monetary policies and regulations of the federal government, including those determined by the Federal Reserve System, the FDIC, government‐sponsored housing agencies and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may further increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non‐interest expense; risks of not being able to recover the assets pledged to Lehman Brothers Special Financing, Inc.; the impact on the Corporation’s results of operations and financial condition associated with acquisitions and dispositions; a need to recognize additional impairments on financial instruments or goodwill relating to acquisitions; risks that downgrades in the credit ratings of the Corporation’s long‐term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the impact of the Dodd‐Frank Wall Street Reform and Consumer Protection Act on the Corporation’s businesses, business practices and cost of operations; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward‐looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements except as required by the federal securities laws. Investors should refer to the Corporation’s Annual Report on Form 10‐K for the year ended December 31, 2012 for a discussion of such factors and certain risks and uncertainties to which the Corporation is subject. 2

Agenda �� First Quarter 2014 Highlights: Aurelio Alemán, President & Chief Executive Officer �� First Quarter Results of Operations: Orlando Berges, Executive Vice President & Chief Financial Officer �� Summary �� Questions & Answers 3

FIRST QUARTER 2014 Highlights

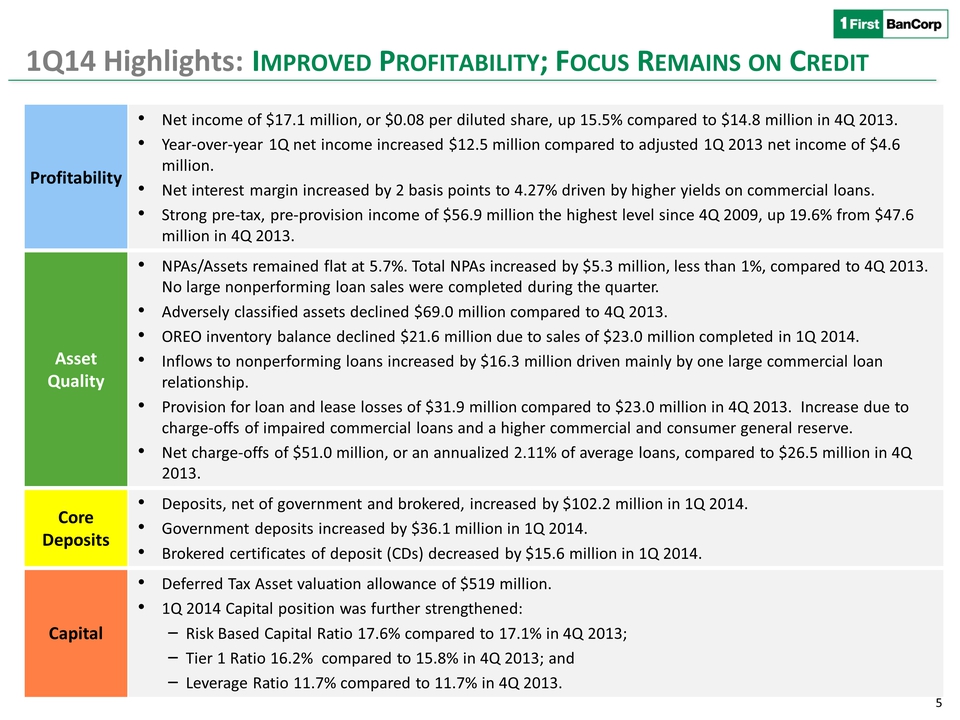

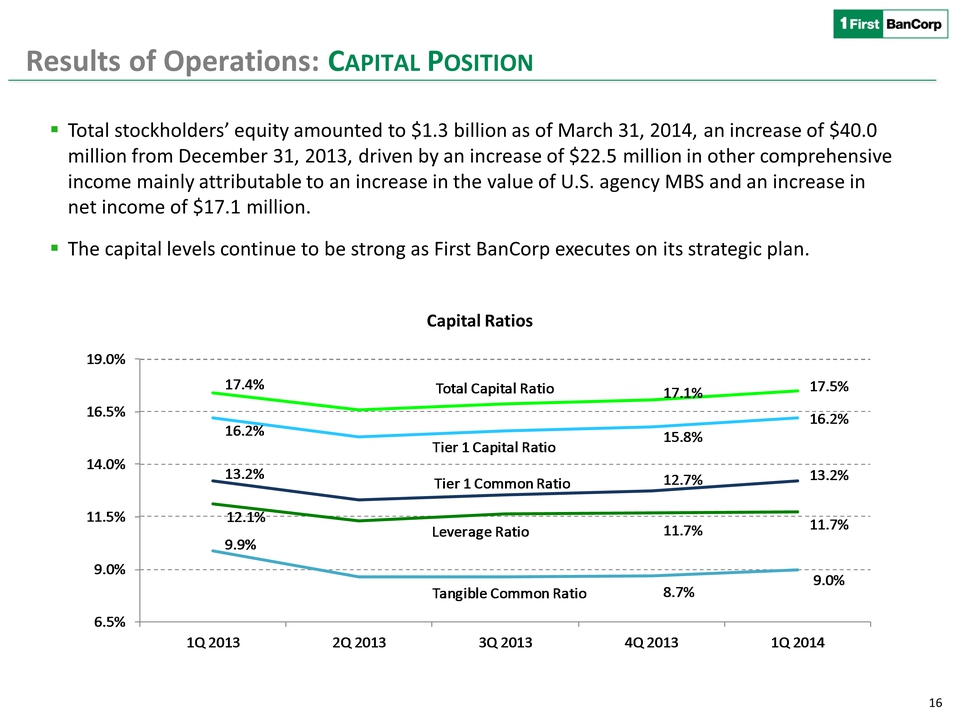

Profitability • Net income of $17.1 million, or $0.08 per diluted share, up 15.5% compared to $14.8 million in 4Q 2013. • Year‐over‐year 1Q net income increased $12.5 million compared to adjusted 1Q 2013 net income of $4.6 million. • Net interest margin increased by 2 basis points to 4.27% driven by higher yields on commercial loans. • Strong pre‐tax, pre‐provision income of $56.9 million the highest level since 4Q 2009, up 19.6% from $47.6 million in 4Q 2013. Asset Quality • NPAs/Assets remained flat at 5.7%. Total NPAs increased by $5.3 million, less than 1%, compared to 4Q 2013. No large nonperforming loan sales were completed during the quarter. • Adversely classified assets declined $69.0 million compared to 4Q 2013. • OREO inventory balance declined $21.6 million due to sales of $23.0 million completed in 1Q 2014. • Inflows to nonperforming loans increased by $16.3 million driven mainly by one large commercial loan relationship. • Provision for loan and lease losses of $31.9 million compared to $23.0 million in 4Q 2013. Increase due to charge‐offs of impaired commercial loans and a higher commercial and consumer general reserve. • Net charge‐offs of $51.0 million, or an annualized 2.11% of average loans, compared to $26.5 million in 4Q 2013. Core Deposits • Deposits, net of government and brokered, increased by $102.2 million in 1Q 2014. • Government deposits increased by $36.1 million in 1Q 2014. • Brokered certificates of deposit (CDs) decreased by $15.6 million in 1Q 2014. Capital • Deferred Tax Asset valuation allowance of $519 million. • 1Q 2014 Capital position was further strengthened: ‒ Risk Based Capital Ratio 17.6% compared to 17.1% in 4Q 2013; ‒ Tier 1 Ratio 16.2% compared to 15.8% in 4Q 2013; and ‒ Leverage Ratio 11.7% compared to 11.7% in 4Q 2013. 1Q14 Highlights: IMPROVED PROFITABILITY; FOCUS REMAINS ON CREDIT 5

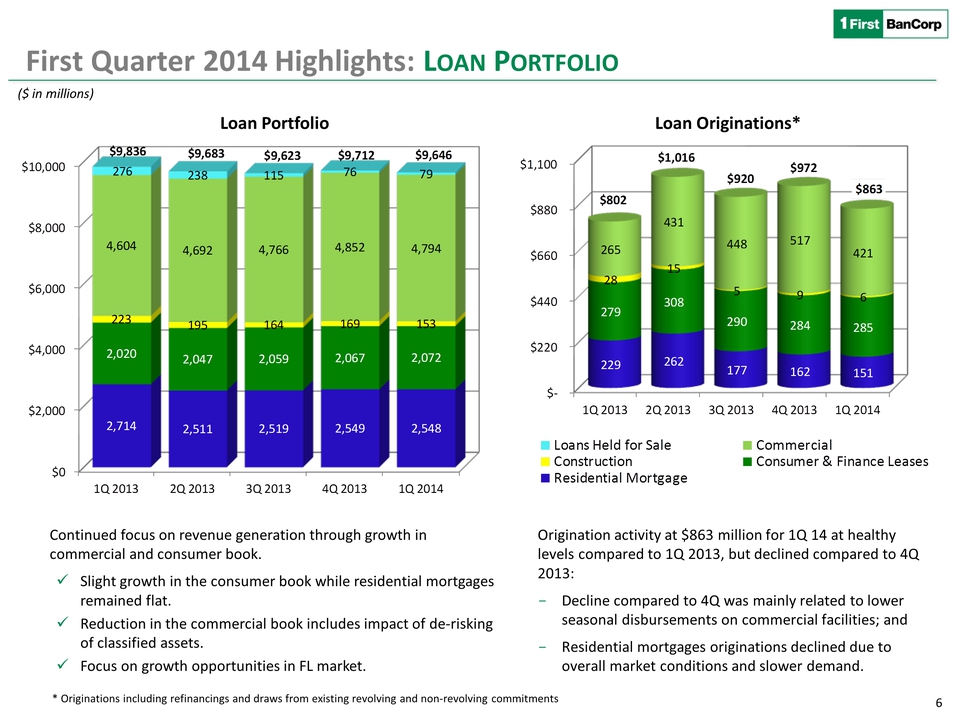

6 First Quarter 2014 Highlights: LOAN PORTFOLIO Origination activity at $863 million for 1Q 14 at healthy levels compared to 1Q 2013, but declined compared to 4Q 2013: - Decline compared to 4Q was mainly related to lower seasonal disbursements on commercial facilities; and - Residential mortgages originations declined due to overall market conditions and slower demand. ($ in millions) Loan Originations* Continued focus on revenue generation through growth in commercial and consumer book. �� Slight growth in the consumer book while residential mortgages remained flat. �� Reduction in the commercial book includes impact of de‐risking of classified assets. �� Focus on growth opportunities in FL market. * Originations including refinancings and draws from existing revolving and non‐revolving commitments Loan Portfolio Loans Held for Sale Commercial Construction Consumer & Finance Leases Residential Mortgage $10,000 $8,000 $6,000 $4,000 $2,000 $0 $1,100 $880 $660 $440 $220 $- 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Loans Held For Sale Construction Residential Mortgage Commercial Consumer & Finance Leases $9,836 $9,6 $9,623 $9,712 $9,646 276 238 115 76 79 4,604 4,692 4,852 4,794 223 195 164 169 153 2,020 2,047 2,059 5,067 2,072 2,714 2,511 2,519 2,549 2,548 $802 $1,016 $920 $972 $863 265 28 279 229 431 15 308 262 448 5 290 177 517 9 284 162 421 6 285 151

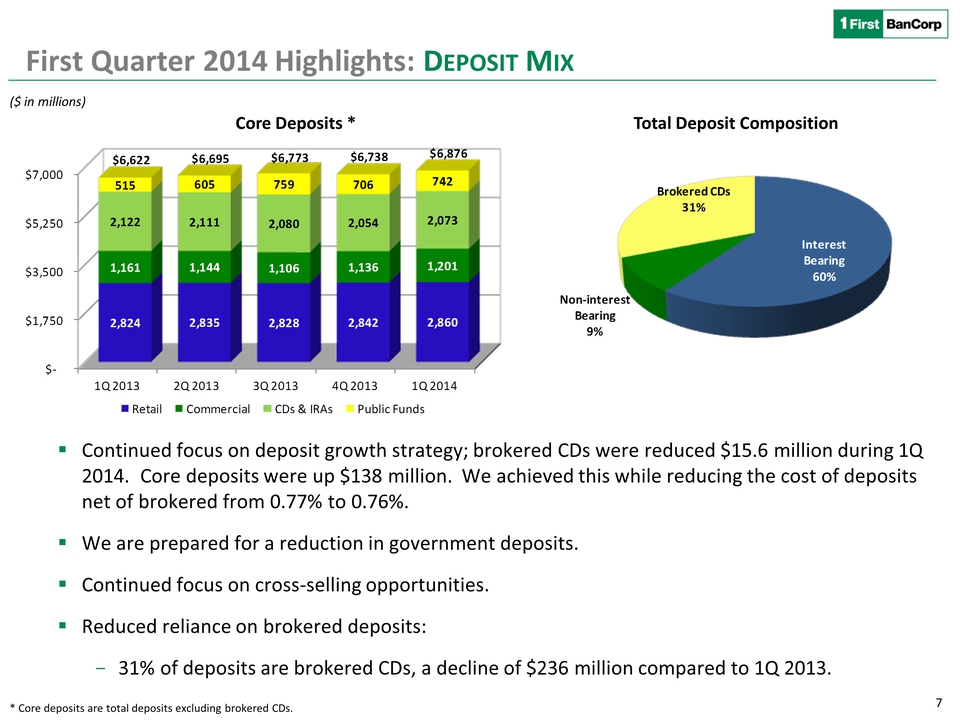

�� Continued focus on deposit growth strategy; brokered CDs were reduced $15.6 million during 1Q 2014. Core deposits were up $138 million. We achieved this while reducing the cost of deposits net of brokered from 0.77% to 0.76%. �� We are prepared for a reduction in government deposits. �� Continued focus on cross‐selling opportunities. �� Reduced reliance on brokered deposits: - 31% of deposits are brokered CDs, a decline of $236 million compared to 1Q 2013. 7 ($ in millions) Core Deposits * Total Deposit Composition First Quarter 2014 Highlights: DEPOSIT MIX * Core deposits are total deposits excluding brokered CDs. Retail Commercial CDs & IRAs Public Funds Non-interest Bearting 9% Brokered CDs 31% Interest Bearing 60% $7,000 $5,250 $3,500 $1,750 $- 515 2,122 1,161 2,824 605 2,111 1,144 2,836 759 706 742 2,080 2,054 2,073 1,106 1,136 1,201 2,828 2,842 2,860 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 $6,622 $6,695 $6,773 $6,738 $6,876

FIRST QUARTER 2014 Results of Operations

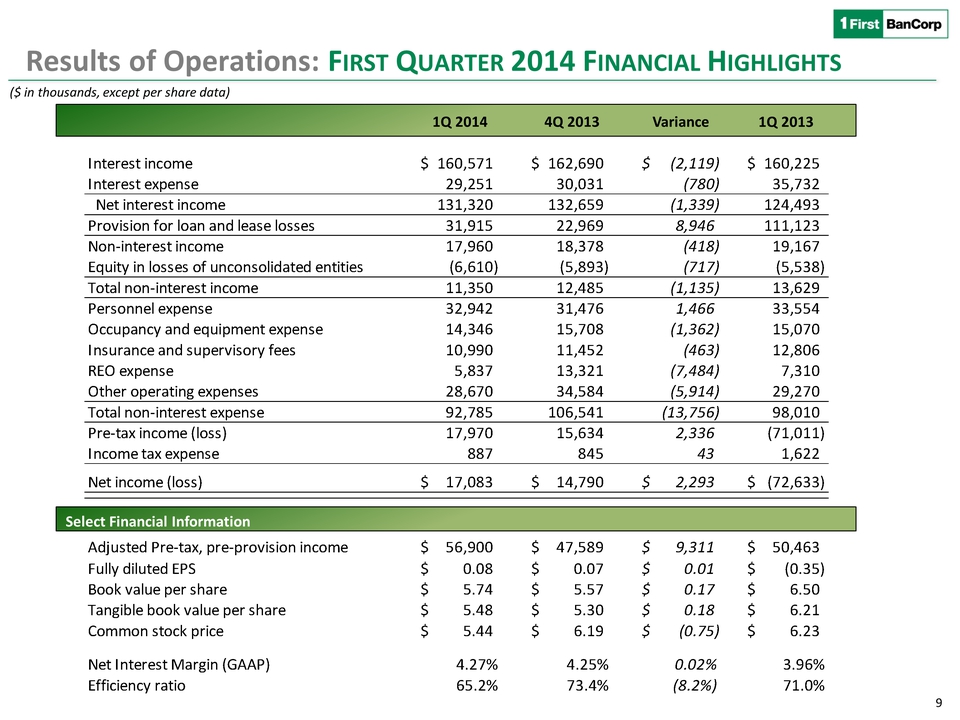

Interest income 160,571 $ 162,690 $ (2,119) $ 160,225 $ Interest expense 29,251 30,031 (780) 35,732 Net interest income 131,320 132,659 (1,339) 124,493 Provision for loan and lease losses 31,915 22,969 8,946 111,123 Non‐interest income 17,960 18,378 (418) 19,167 Equity in losses of unconsolidated entities (6,610) (5,893) (717) (5,538) Total non‐interest income 11,350 12,485 (1,135) 13,629 Personnel expense 32,942 31,476 1,466 33,554 Occupancy and equipment expense 14,346 15,708 (1,362) 15,070 Insurance and supervisory fees 10,990 11,452 (463) 12,806 REO expense 5,837 13,321 (7,484) 7,310 Other operating expenses 28,670 34,584 (5,914) 29,270 Total non‐interest expense 92,785 106,541 (13,756) 98,010 Pre‐tax income (loss) 17,970 15,634 2,336 (71,011) Income tax expense 887 845 43 1,622 Net income (loss) 17,083 $ 14,790 $ 2,293 $ (72,633) $ Adjusted Pre‐tax, pre‐provision income 56,900 $ 47,589 $ 9,311 $ 50,463 $ Fully diluted EPS 0.08 $ 0.07 $ 0.01 $ (0.35) $ Book value per share 5.74 $ 5.57 $ 0.17 $ 6.50 $ Tangible book value per share 5.48 $ 5.30 $ 0.18 $ 6.21 $ Common stock price 5.44 $ 6.19 $ (0.75) $ 6.23 $ Net Interest Margin (GAAP) 4.27% 4.25% 0.02% 3.96% Efficiency ratio 65.2% 73.4% (8.2%) 71.0% 9 ($ in thousands, except per share data) Select Financial Information 1Q 2014 4Q 2013 Variance Results of Operations: FIRST QUARTER 2014 FINANCIAL HIGHLIGHTS 1Q 2013

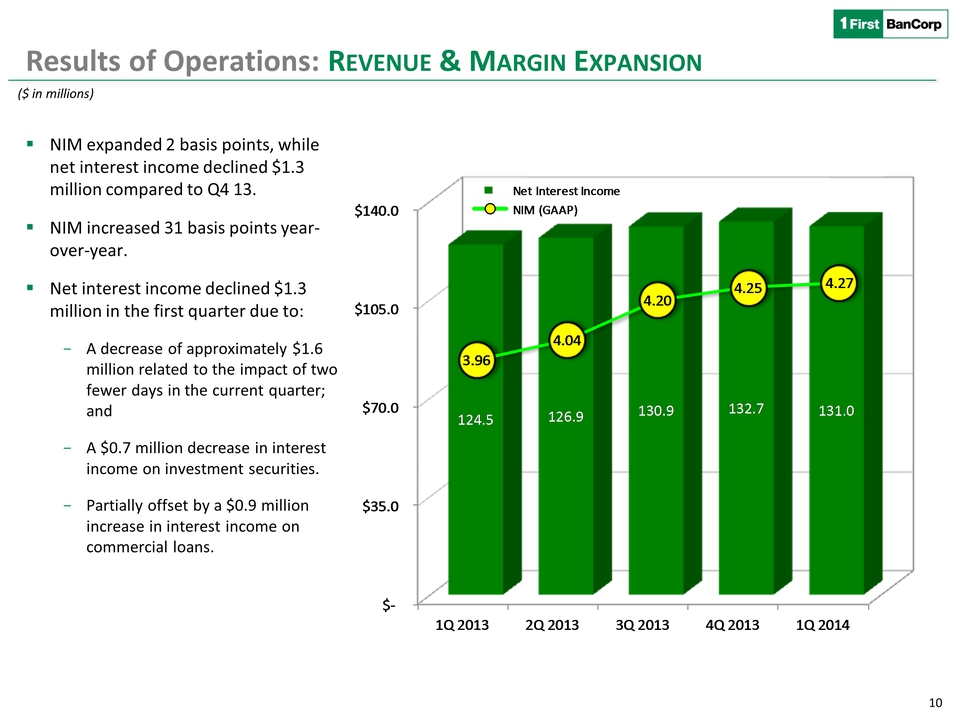

10 Results of Operations: REVENUE & MARGIN EXPANSION �� NIM expanded 2 basis points, while net interest income declined $1.3 million compared to Q4 13. �� NIM increased 31 basis points year-over‐year. �� Net interest income declined $1.3 million in the first quarter due to: - A decrease of approximately $1.6 million related to the impact of two fewer days in the current quarter; and - A $0.7 million decrease in interest income on investment securities. - Partially offset by a $0.9 million increase in interest income on commercial loans. ($ in millions) 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 $140.0 $105.0 $70.0 $35.0 $- 124.5 126.9 130.9 132.7 131.0 3.96 4.04 4.20 4.25 4.27 Net Interest Income NIM (GAAP)

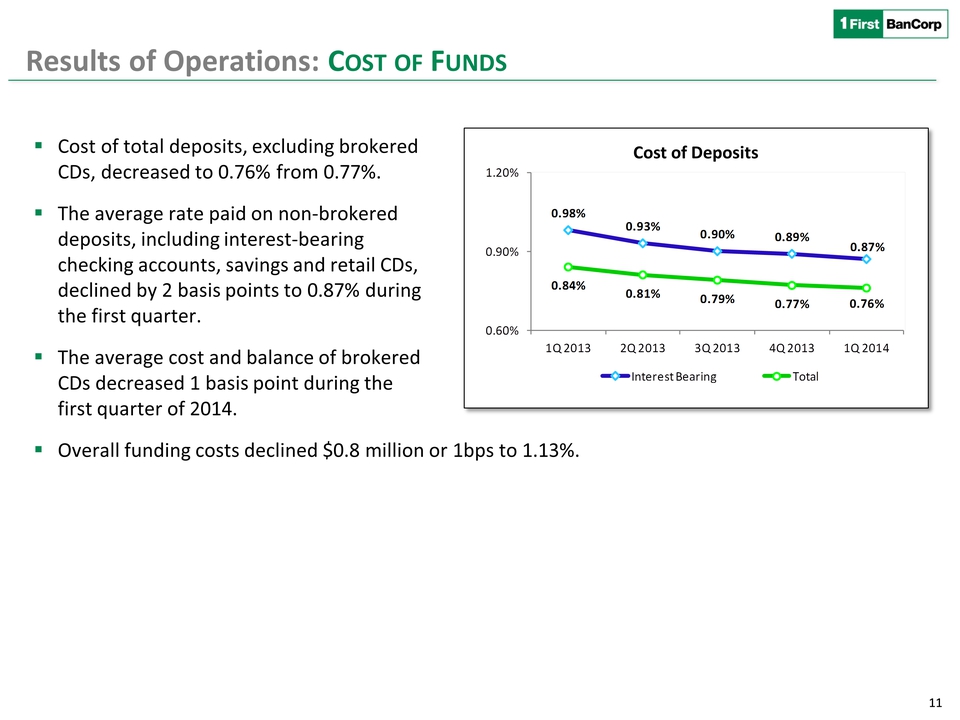

11 Results of Operations: COST OF FUNDS �� Cost of total deposits, excluding brokered CDs, decreased to 0.76% from 0.77%. �� The average rate paid on non‐brokered deposits, including interest‐bearing checking accounts, savings and retail CDs, declined by 2 basis points to 0.87% during the first quarter. �� The average cost and balance of brokered CDs decreased 1 basis point during the first quarter of 2014. �� Overall funding costs declined $0.8 million or 1bps to 1.13%. Cost of Deposits 0.98% 0.93% 0.90% 0.89% 0.87% 0.84% 0.81% 0.79% 0.77% 0.76% 0.60% 0.90% 1.20% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Interest Bearing Total

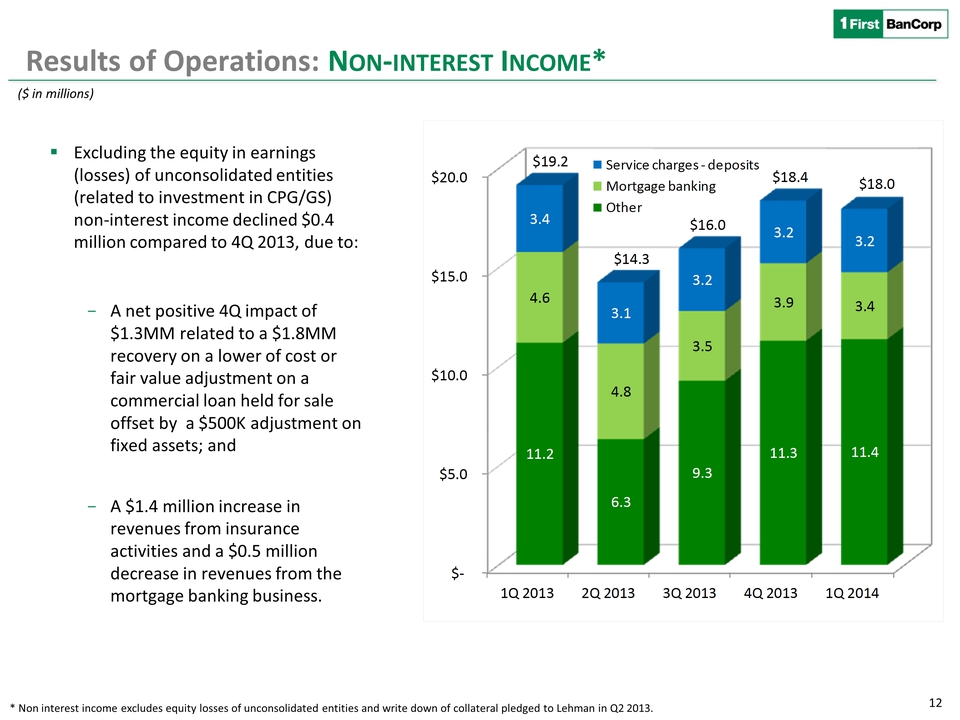

12 Results of Operations: NON‐INTEREST INCOME* �� Excluding the equity in earnings (losses) of unconsolidated entities (related to investment in CPG/GS) non‐interest income declined $0.4 million compared to 4Q 2013, due to: - A net positive 4Q impact of $1.3MM related to a $1.8MM recovery on a lower of cost or fair value adjustment on a commercial loan held for sale offset by a $500K adjustment on fixed assets; and - A $1.4 million increase in revenues from insurance activities and a $0.5 million decrease in revenues from the mortgage banking business. * Non interest income excludes equity losses of unconsolidated entities and write down of collateral pledged to Lehman in Q2 2013. ($ in millions) 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 $20.0 $15.0 $0.0 $5.0 $- 3.4 4.6 11.2 3.1 4.8 6.3 3.2 3.5 9.3 3.2 3.9 11.3 3.4 11.4 Service charges – deposits Mortgage banking Other $19.2 $14.3 $16.0 $18.4 $18.0

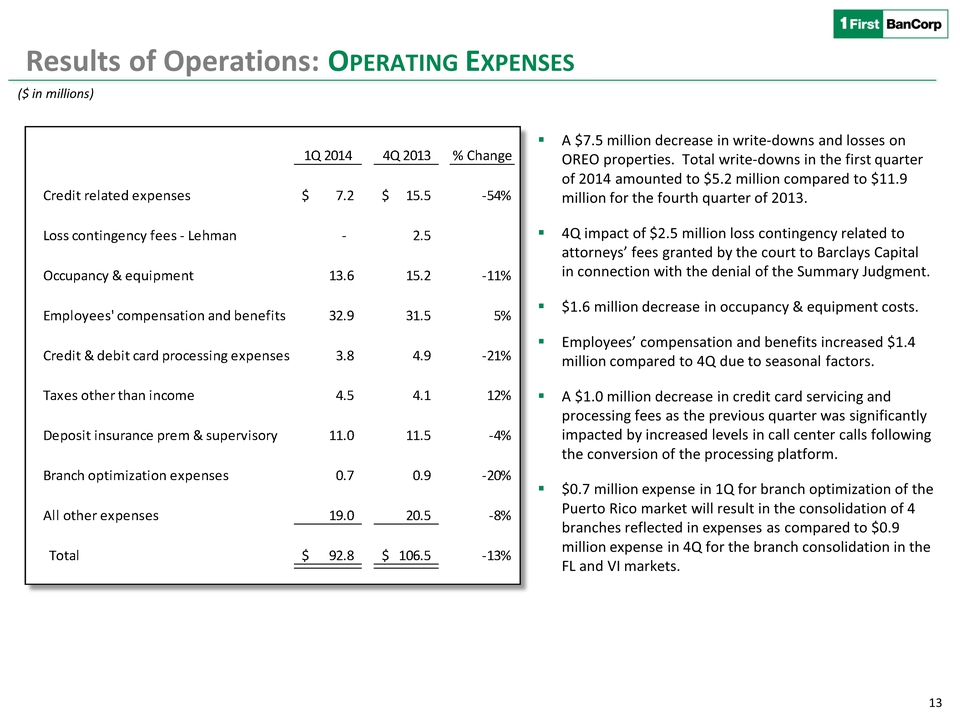

13 Results of Operations: OPERATING EXPENSES �� A $7.5 million decrease in write‐downs and losses on OREO properties. Total write‐downs in the first quarter of 2014 amounted to $5.2 million compared to $11.9 million for the fourth quarter of 2013. �� 4Q impact of $2.5 million loss contingency related to attorneys’ fees granted by the court to Barclays Capital in connection with the denial of the Summary Judgment. �� $1.6 million decrease in occupancy & equipment costs. �� Employees’ compensation and benefits increased $1.4 million compared to 4Q due to seasonal factors. �� A $1.0 million decrease in credit card servicing and processing fees as the previous quarter was significantly impacted by increased levels in call center calls following the conversion of the processing platform. �� $0.7 million expense in 1Q for branch optimization of the Puerto Rico market will result in the consolidation of 4 branches reflected in expenses as compared to $0.9 million expense in 4Q for the branch consolidation in the FL and VI markets. ($ in millions) 1Q 2014 4Q 2013 % Change Credit related expenses 7.2 $ 15.5 $ ‐54% Loss contingency fees ‐ Lehman ‐ 2.5 Occupancy & equipment 13.6 15.2 ‐11% Employees' compensation and benefits 32.9 31.5 5% Credit & debit card processing expenses 3.8 4.9 ‐21% Taxes other than income 4.5 4.1 12% Deposit insurance prem & supervisory 11.0 11.5 ‐4% Branch optimization expenses 0.7 0.9 ‐20% All other expenses 19.0 20.5 ‐8% Total 92.8 $ 106.5 $ ‐13%

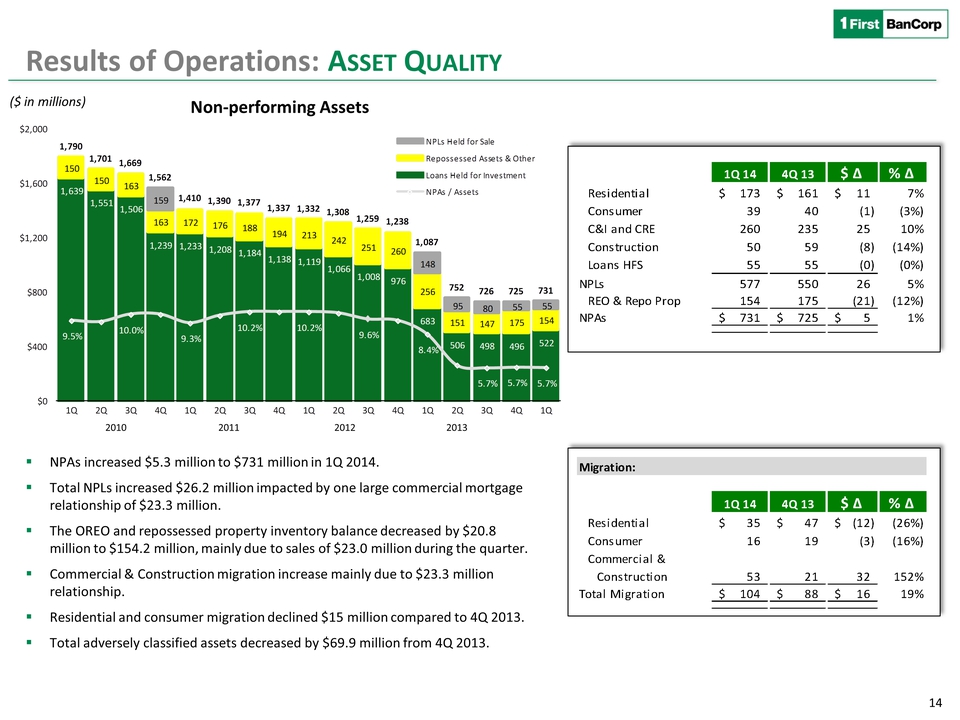

2010 2011 2012 2013 14 Results of Operations: ASSET QUALITY �� NPAs increased $5.3 million to $731 million in 1Q 2014. �� Total NPLs increased $26.2 million impacted by one large commercial mortgage relationship of $23.3 million. �� The OREO and repossessed property inventory balance decreased by $20.8 million to $154.2 million, mainly due to sales of $23.0 million during the quarter. �� Commercial & Construction migration increase mainly due to $23.3 million relationship. �� Residential and consumer migration declined $15 million compared to 4Q 2013. �� Total adversely classified assets decreased by $69.9 million from 4Q 2013. ($ in millions) Non‐performing Assets 1,639 1,551 1,506 1,239 1,233 1,208 1,184 1,138 1,119 1,066 1,008 976 683 506 498 496 522 150 150 163 163 172 176 188 194 213 242 251 260 256 151 147 175 154 159 148 95 80 55 55 1,790 1,701 1,669 1,562 1,410 1,390 1,377 1,337 1,332 1,308 1,259 1,238 1,087 752 726 725 731 9.5% 10.0% 9.3% 10.2% 10.2% 9.6% 8.4% 5.7% 5.7% 5.7% $0 $400 $800 $1,200 $1,600 $2,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q NPLs Held for Sale Repossessed Assets & Other Loans Held for Investment NPAs / Assets 1Q 14 4Q 13 $ ∆ % ∆ Residential 173 $ 161 $ 11 $ 7% Consumer 39 40 (1) (3%) C&I and CRE 260 235 25 10% Construction 50 59 (8) (14%) Loans HFS 55 55 (0) (0%) NPLs 577 550 26 5% REO & Repo Prop 154 175 (21) (12%) NPAs 731 $ 725 $ 5 $ 1% Migration: 1Q 14 4Q 13 $ ∆ % ∆ Residential 35 $ 47 $ (12) $ (26%) Consumer 16 19 (3) (16%) Commercial & Construction 53 21 32 152% Total Migration 104 $ 88 $ 16 $ 19%

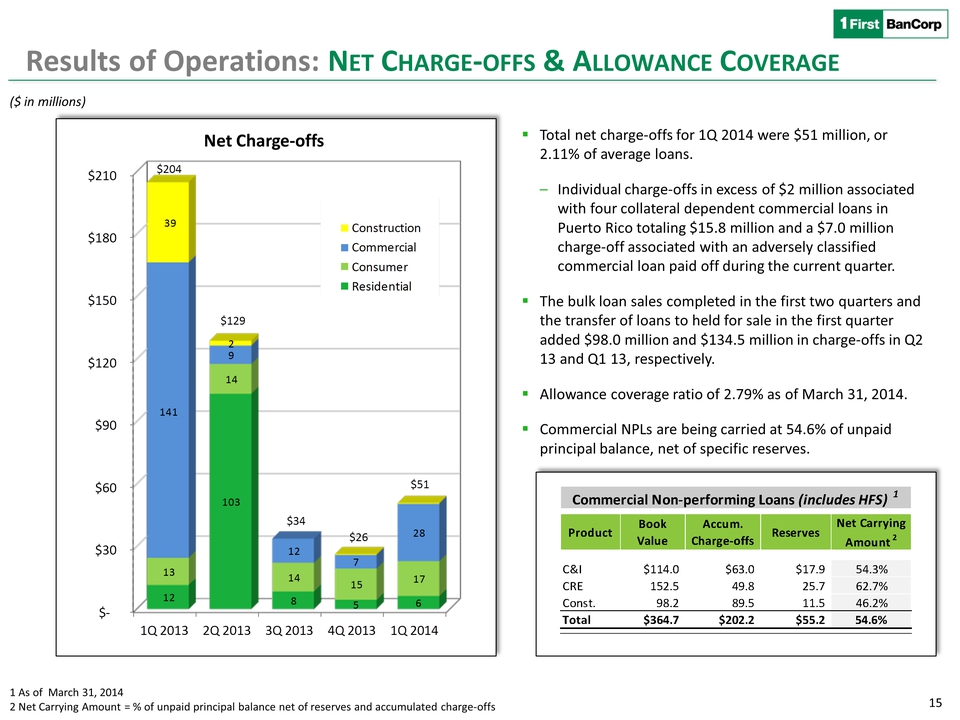

15 Results of Operations: NET CHARGE‐OFFS & ALLOWANCE COVERAGE ($ in millions) �� Total net charge‐offs for 1Q 2014 were $51 million, or 2.11% of average loans. – Individual charge‐offs in excess of $2 million associated with four collateral dependent commercial loans in Puerto Rico totaling $15.8 million and a $7.0 million charge‐off associated with an adversely classified commercial loan paid off during the current quarter. �� The bulk loan sales completed in the first two quarters and the transfer of loans to held for sale in the first quarter added $98.0 million and $134.5 million in charge‐offs in Q2 13 and Q1 13, respectively. �� Allowance coverage ratio of 2.79% as of March 31, 2014. �� Commercial NPLs are being carried at 54.6% of unpaid principal balance, net of specific reserves. Net Charge‐offs Product Book Value Accum. Charge‐offs Reserves Net Carrying Amount 2 C&I $114.0 $63.0 $17.9 54.3% CRE 152.5 49.8 25.7 62.7% Const. 98.2 89.5 11.5 46.2% Total $364.7 $202.2 $55.2 54.6% Commercial Non‐performing Loans (includes HFS) 1 1 As of March 31, 2014 2 Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge‐offs Construction Commercial Consumer Residental 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Net Charge-offs $210 $180 $150 $120 $90 $60 $30 $- 39 141 13 12 2 9 14 103 8 7 15 5 28 17 6 $204 $129 $34 $26 $51

16 Results of Operations: CAPITAL POSITION �� Total stockholders’ equity amounted to $1.3 billion as of March 31, 2014, an increase of $40.0 million from December 31, 2013, driven by an increase of $22.5 million in other comprehensive income mainly attributable to an increase in the value of U.S. agency MBS and an increase in net income of $17.1 million. �� The capital levels continue to be strong as First BanCorp executes on its strategic plan. Capital Ratios 17.4% Total Capital Ratio 17.1% 17.5% 16.2% Tier 1 Capital Ratio 15.8% 16.2% 12.1% Leverage Ratio 11.7% 11.7% 13.2% Tier 1 Common Ratio 12.7% 13.2% 9.9% Tangible Common Ratio 8.7% 9.0% 6.5% 9.0% 11.5% 14.0% 16.5% 19.0% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014

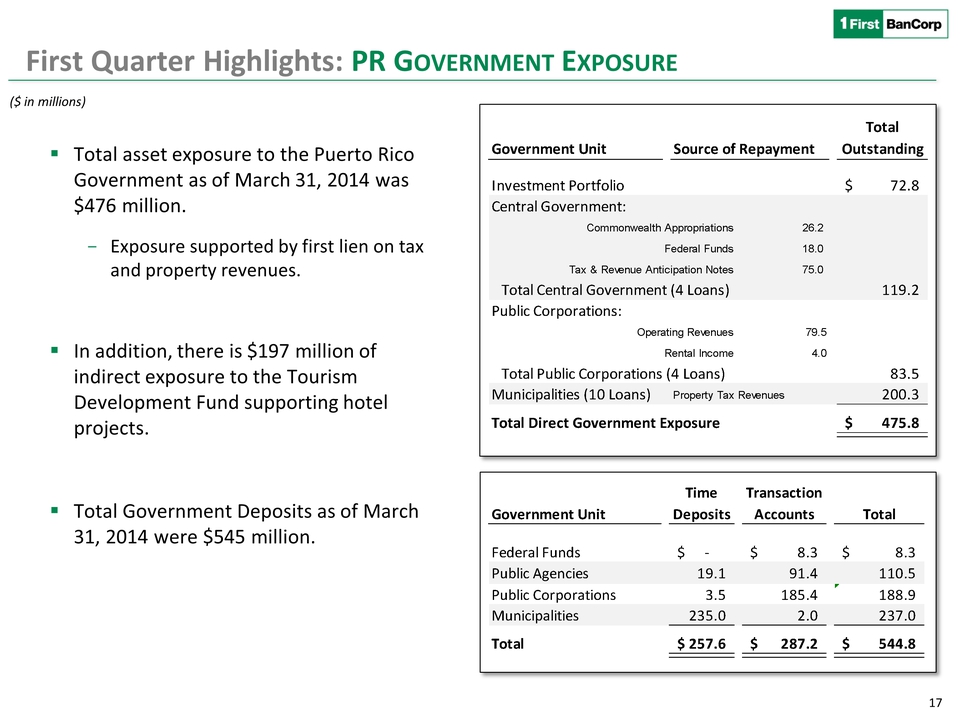

17 First Quarter Highlights: PR GOVERNMENT EXPOSURE ($ in millions) �� Total asset exposure to the Puerto Rico Government as of March 31, 2014 was $476 million. - Exposure supported by first lien on tax and property revenues. �� In addition, there is $197 million of indirect exposure to the Tourism Development Fund supporting hotel projects. �� Total Government Deposits as of March 31, 2014 were $545 million. Total Government Unit Source of Repayment Outstanding Investment Portfolio 72.8 $ Central Government: Commonwealth Appropriations 26.2 Federal Funds 18.0 Tax & Revenue Anticipation Notes 75.0 Total Central Government (4 Loans) 119.2 Public Corporations: Operating Revenues 79.5 Rental Income 4.0 Total Public Corporations (4 Loans) 83.5 Municipalities (10 Loans) Property Tax Revenues 200.3 Total Direct Government Exposure 475.8 $ Time Transaction Government Unit Deposits Accounts Total Federal Funds ‐ $ 8.3 $ 8.3 $ Public Agencies 19.1 91.4 110.5 Public Corporations 3.5 185.4 188.9 Municipalities 235.0 2.0 237.0 Total 257.6 $ 287.2 $ 544.8 $

FIRST QUARTER 2014 Q&A

EXHIBITS

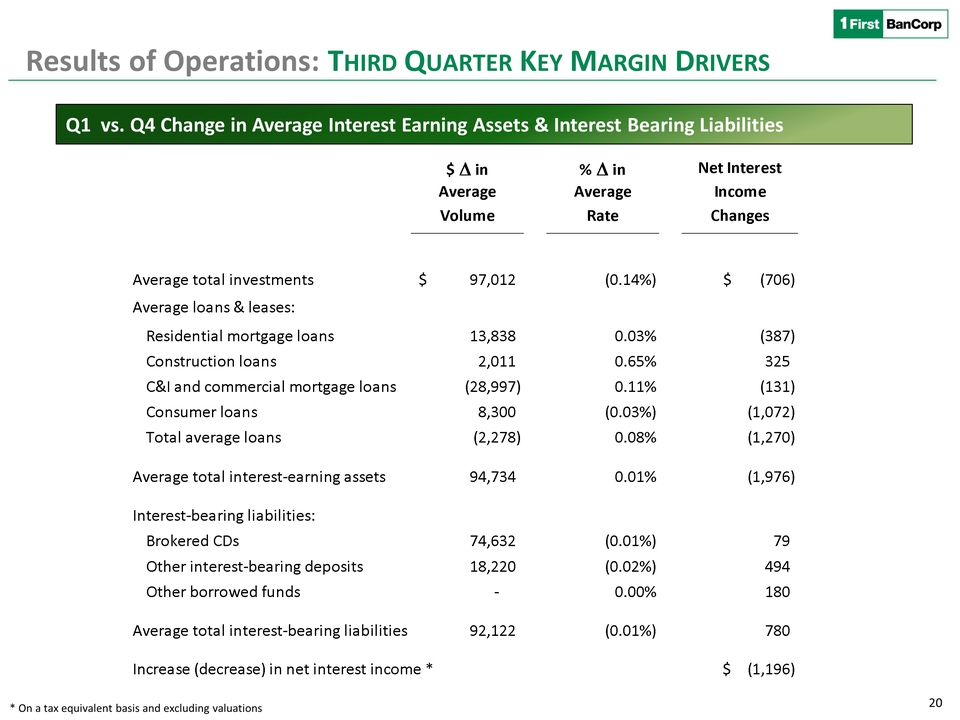

20 Results of Operations: THIRD QUARTER KEY MARGIN DRIVERS Q1 vs. Q4 Change in Average Interest Earning Assets & Interest Bearing Liabilities * On a tax equivalent basis and excluding valuations $ ∆ in % ∆ in Average Average Volume Rate Average total investments 97,012 $ (0.14%) (706) $ Average loans & leases: Residential mortgage loans 13,838 0.03% (387) Construction loans 2,011 0.65% 325 C&I and commercial mortgage loans (28,997) 0.11% (131) Consumer loans 8,300 (0.03%) (1,072) Total average loans (2,278) 0.08% (1,270) Average total interest‐earning assets 94,734 0.01% (1,976) Interest‐bearing liabilities: Brokered CDs 74,632 (0.01%) 79 Other interest‐bearing deposits 18,220 (0.02%) 494 Other borrowed funds ‐ 0.00% 180 Average total interest‐bearing liabilities 92,122 (0.01%) 780 Increase (decrease) in net interest income * (1,196) $ Net Interest Income Changes

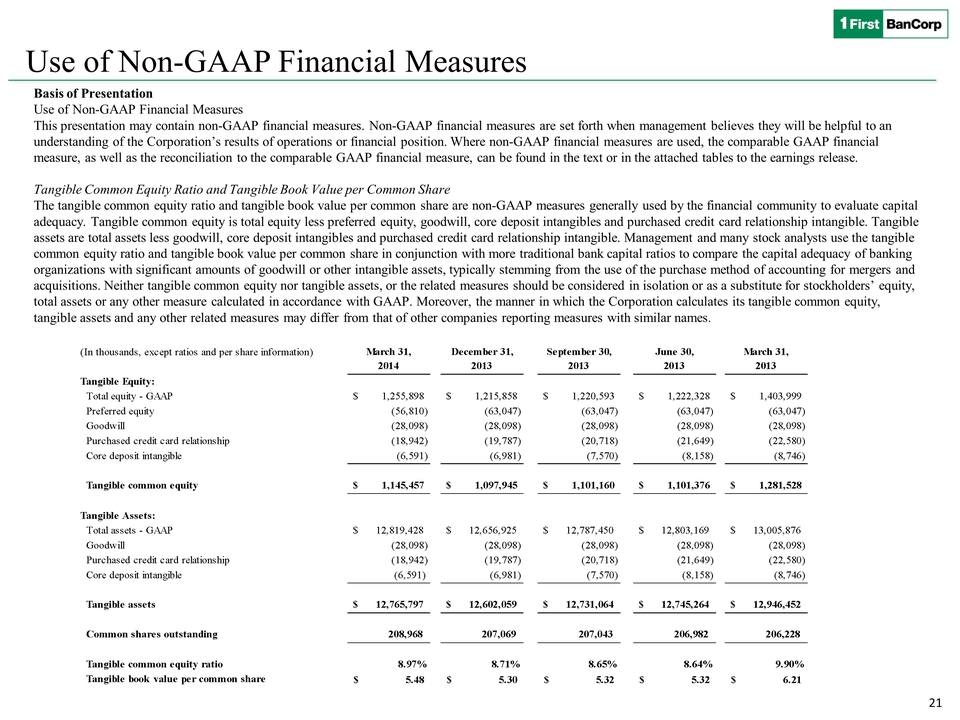

21 Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation may contain non-GAAP financial measures. Non-GAAP financial measures are set forth when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the text or in the attached tables to the earnings release. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles and purchased credit card relationship intangible. Tangible assets are total assets less goodwill, core deposit intangibles and purchased credit card relationship intangible. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Neither tangible common equity nor tangible assets, or the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity, tangible assets and any other related measures may differ from that of other companies reporting measures with similar names. (In thousands, except ratios and per share information) March 31, December 31, September 30, June 30, March 31, 2014 2013 2013 2013 2013 Total equity - GAAP $ 1,255,898 $ 1,215,858 $ 1,220,593 $ 1,222,328 $ 1,403,999 Preferred equity (56,810) (63,047) (63,047) (63,047) (63,047) Goodwill (28,098) (28,098) (28,098) (28,098) (28,098) Purchased credit card relationship (18,942) (19,787) (20,718) (21,649) (22,580) Core deposit intangible (6,591) (6,981) (7,570) (8,158) (8,746) Tangible common equity $ 1,145,457 $ 1,097,945 $ 1,101,160 $ 1,101,376 $ 1,281,528 Total assets - GAAP $ 12,819,428 $ 12,656,925 $ 12,787,450 $ 12,803,169 $ 13,005,876 Goodwill (28,098) (28,098) (28,098) (28,098) (28,098) Purchased credit card relationship (18,942) (19,787) (20,718) (21,649) (22,580) Core deposit intangible (6,591) (6,981) (7,570) (8,158) (8,746) Tangible assets $ 12,765,797 $ 12,602,059 $ 12,731,064 $ 12,745,264 $ 12,946,452 Common shares outstanding 208,968 207,069 207,043 206,982 206,228 Tangible common equity ratio 8.97% 8.71% 8.65% 8.64% 9.90% Tangible book value per common share 5.48 $ 5.30 $ 5.32 $ 5.32 $ 6.21 $ Tangible Equity: Tangible Assets:

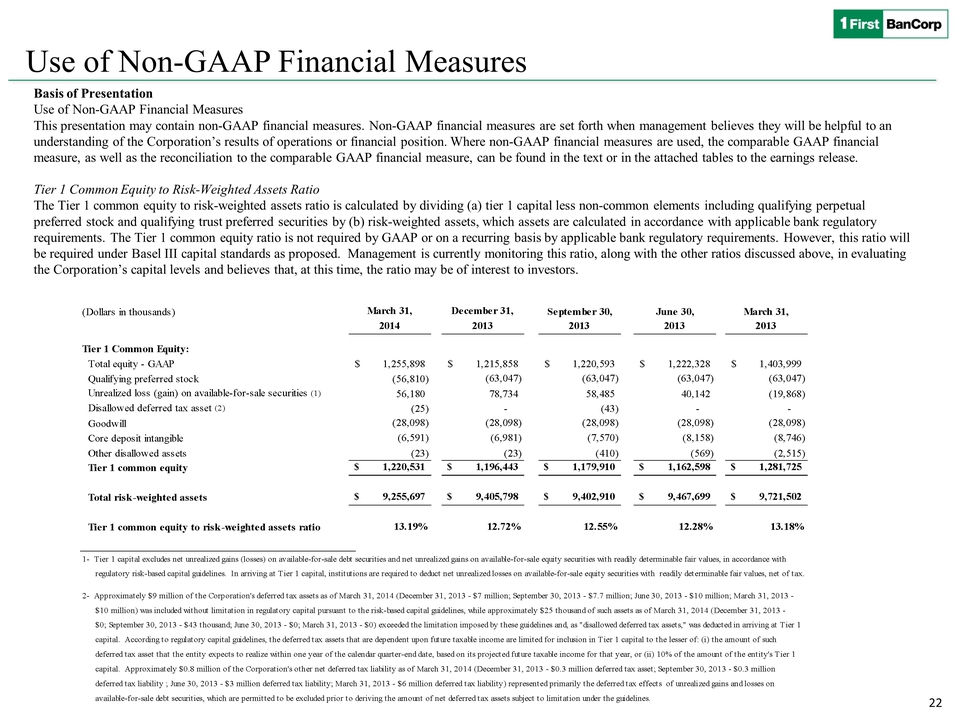

22 Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation may contain non-GAAP financial measures. Non-GAAP financial measures are set forth when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the text or in the attached tables to the earnings release. Tier 1 Common Equity to Risk-Weighted Assets Ratio The Tier 1 common equity to risk-weighted assets ratio is calculated by dividing (a) tier 1 capital less non-common elements including qualifying perpetual preferred stock and qualifying trust preferred securities by (b) risk-weighted assets, which assets are calculated in accordance with applicable bank regulatory requirements. The Tier 1 common equity ratio is not required by GAAP or on a recurring basis by applicable bank regulatory requirements. However, this ratio will be required under Basel III capital standards as proposed. Management is currently monitoring this ratio, along with the other ratios discussed above, in evaluating the Corporation’s capital levels and believes that, at this time, the ratio may be of interest to investors. (Dollars in thousands) March 31, December 31, September 30, June 30, March 31, 2014 2013 2013 2013 2013 Total equity - GAAP 1,255,898 $ 1,215,858 $ 1,220,593 $ 1,222,328 $ 1,403,999 $ Qualifying preferred stock (56,810) (63,047) (63,047) (63,047) (63,047) Unrealized loss (gain) on available-for-sale securities (1) 56,180 78,734 58,485 40,142 (19,868) Disallowed deferred tax asset (2) (25) - (43) - - Goodwill (28,098) (28,098) (28,098) (28,098) (28,098) Core deposit intangible (6,591) (6,981) (7,570) (8,158) (8,746) Other disallowed assets (23) (23) (410) (569) (2,515) Tier 1 common equity $ 1,220,531 $ 1,196,443 $ 1,179,910 $ 1,162,598 $ 1,281,725 Total risk-weighted assets $ 9,255,697 $ 9,405,798 $ 9,402,910 $ 9,467,699 $ 9,721,502 Tier 1 common equity to risk-weighted assets ratio 13.19% 12.72% 12.55% 12.28% 13.18% Tier 1 Common Equity: 1- Tier 1 capital excludes net unrealized gains (losses) on available-for-sale debt securities and net unrealized gains on available-for-sale equity securities with readily determinable fair values, in accordance with regulatory risk-based capital guidelines. In arriving at T ier 1 capital, institutions are required to deduct net unrealized losses on available-for-sale equity securities with readily determinable fair values, net of tax. 2- Approximately $9 million of the Corporation's deferred tax assets as of March 31, 2014 (December 31, 2013 - $7 million; September 30, 2013 - $7.7 million; June 30, 2013 - $10 million; March 31, 2013 - $10 million) was included without limitation in regulatory capital pursuant to the risk-based capital guidelines, while approximately $25 thousand of such assets as of March 31, 2014 (December 31, 2013 - $0; September 30, 2013 - $43 thousand; June 30, 2013 - $0; March 31, 2013 - $0) exceeded the limitation imposed by these guidelines and, as "disallowed deferred tax assets," was deducted in arriving at Tier 1 capital. According to regulatory capital guidelines, the deferred tax assets that are dependent upon future taxable income are limited for inclusion in Tier 1 capital to the lesser of: (i) the amount of such deferred tax asset that the entity expects to realize within one year of the calendar quarter-end date, based on its projected future taxable income for that year, or (ii) 10% of the amount of the entity's Tier 1 capital. Approximately $0.8 million of the Corporation's other net deferred tax liability as of March 31, 2014 (December 31, 2013 - $0.3 million deferred tax asset; September 30, 2013 - $0.3 million deferred tax liability ; June 30, 2013 - $3 million deferred tax liability; March 31, 2013 - $6 million deferred tax liability) represented primarily the deferred tax effects of unrealized gains and losses on available-for-sale debt securities, which are permitted to be excluded prior to deriving the amount of net deferred tax assets subject to limitation under the guidelines.

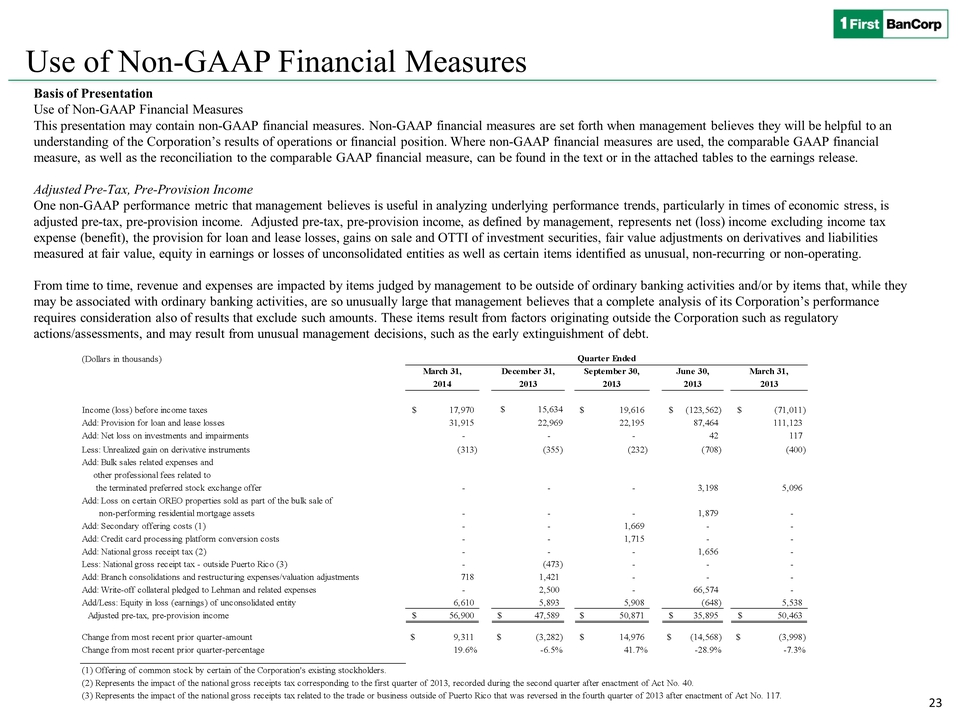

23 Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation may contain non-GAAP financial measures. Non-GAAP financial measures are set forth when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation to the comparable GAAP financial measure, can be found in the text or in the attached tables to the earnings release. Adjusted Pre-Tax, Pre-Provision Income One non-GAAP performance metric that management believes is useful in analyzing underlying performance trends, particularly in times of economic stress, is adjusted pre-tax, pre-provision income. Adjusted pre-tax, pre-provision income, as defined by management, represents net (loss) income excluding income tax expense (benefit), the provision for loan and lease losses, gains on sale and OTTI of investment securities, fair value adjustments on derivatives and liabilities measured at fair value, equity in earnings or losses of unconsolidated entities as well as certain items identified as unusual, non-recurring or non-operating. From time to time, revenue and expenses are impacted by items judged by management to be outside of ordinary banking activities and/or by items that, while they may be associated with ordinary banking activities, are so unusually large that management believes that a complete analysis of its Corporation’s performance requires consideration also of results that exclude such amounts. These items result from factors originating outside the Corporation such as regulatory actions/assessments, and may result from unusual management decisions, such as the early extinguishment of debt. (Dollars in thousands) March 31, December 31, September 30, June 30, March 31, 2014 2013 2013 2013 2013 Income (loss) before income taxes 17,970 $ $ 15,634 19,616 $ (123,562) $ (71,011) $ Add: Provision for loan and lease losses 31,915 22,969 22,195 87,464 111,123 Add: Net loss on investments and impairments - - - 42 117 Less: Unrealized gain on derivative instruments (313) (355) (232) (708) (400) Add: Bulk sales related expenses and other professional fees related to the terminated preferred stock exchange offer - - - 3,198 5,096 Add: Loss on certain OREO properties sold as part of the bulk sale of non-performing residential mortgage assets - - - 1,879 - Add: Secondary offering costs (1) - - 1,669 - - Add: Credit card processing platform conversion costs - - 1,715 - - Add: National gross receipt tax (2) - - - 1,656 - Less: National gross receipt tax - outside Puerto Rico (3) - (473) - - - Add: Branch consolidations and restructuring expenses/valuation adjustments 718 1,421 - - - Add: Write-off collateral pledged to Lehman and related expenses - 2,500 - 66,574 - Add/Less: Equity in loss (earnings) of unconsolidated entity 6,610 5,893 5,908 (648) 5,538 Adjusted pre-tax, pre-provision income 56,900 $ 47,589 $ 50,871 $ 35,895 $ 50,463 $ Change from most recent prior quarter-amount 9,311 $ (3,282) $ 14,976 $ (14,568) $ (3,998) $ Change from most recent prior quarter-percentage 19.6% -6.5% 41.7% -28.9% -7.3% (1) Offering of common stock by certain of the Corporation's existing stockholders. (2) Represents the impact of the national gross receipts tax corresponding to the first quarter of 2013, recorded during the second quarter after enactment of Act No. 40. (3) Represents the impact of the national gross receipts tax related to the trade or business outside of Puerto Rico that was reversed in the fourth quarter of 2013 after enactment of Act No. 117. Quarter Ended