Exhibit 99.2

Financial ResultsFourth Quarter & Fiscal Year 2019

2 Forward-Looking Statements This presentation may contain “forward-looking statements” concerning First BanCorp.’s (the “Corporation”) future economic, operational and financial performance. “Forward-looking statements” include, without limitation, statements relating to the impact the Corporation expects its proposed acquisition of Banco Santander Puerto Rico to have on the combined entity’s operations, financial condition, and financial results, and the Corporation’s expectations about its ability to successfully complete the transaction and integrate the combined businesses and the amount of cost savings and overall operational efficiencies the Corporation expects to realize as a result of the proposed acquisition. The words or phrases “expect,” “anticipate,” “intend,” “look forward,” “should,” “would,” “believes” and similar expressions are meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions readers not to place undue reliance on any such “forward-looking statements,” which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ materially from those expressed in, or implied by such forward-looking statements: the possibility that the proposed acquisition does not close when expected or at all or because required regulatory or other approvals (including bank regulatory approvals or antitrust clearances) and other conditions to closing are not received or satisfied on a timely basis or at all the failure to close for any other reason; that the businesses of the Corporation and Banco Santander Puerto Rico will not be integrated successfully; that the cost savings and any synergies from the proposed acquisition may not be fully realized or may take longer to realize than expected; disruption from the proposed acquisition making it more difficult to maintain relationships with employees, customers or other parties with whom the Corporation or Banco Santander Puerto Rico have business relationships; diversion of management time on merger-related issues; the reaction to the transaction of the Corporation’s or Banco Santander Puerto Rico’s customers, employees and counterparties and other factors, many of which are beyond the control of the Corporation and Banco Santander Puerto Rico; the actual pace and magnitude of economic recovery in the regions impacted by the two hurricanes that affected the Corporation’s service areas during the third quarter of 2017 compared to management’s current views on the economic recovery; uncertainties about how and when rebuilding will take place in the regions affected by the recent storms, including the rebuilding of the public infrastructure, such as Puerto Rico’s power grid, what level of government, private or philanthropic funds will be invested in the affected communities; how many dislocated individuals will return to their homes in both the short- and long-term, and what other demographic changes will take place; uncertainty as to the ultimate outcomes of actions taken, or those that may have to be taken, by the Puerto Rico government, or the oversight board established by the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) to address Puerto Rico’s financial problems, including the filing of a form of bankruptcy under Title III of PROMESA that provides a court debt restructuring process similar to U.S. bankruptcy protection; the ability of the Puerto Rico government or any of its public corporations or other instrumentalities to repay its respective debt obligations, including the effect of payment defaults on the Puerto Rico government general obligations, bonds of the Government Development Bank for Puerto Rico and certain bonds of government public corporations, and recent and any future downgrades of the long-term and short-term debt ratings of the Puerto Rico government, which could exacerbate Puerto Rico’s adverse economic conditions and, in turn, further adversely impact the Corporation; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico; uncertainty as to the availability of certain funding sources, such as brokered CDs; the Corporation’s reliance on brokered CDs to fund operations and provide liquidity; the weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets, which have contributed and may continue to contribute to, among other things, high levels of non-performing assets, charge-offs and provisions for loan and lease losses, and may subject the Corporation to further risk from loan defaults and foreclosures; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico; uncertainty as to the availability of certain funding sources, such as brokered CDs; the Corporation’s reliance on brokered CDs to fund operations and provide liquidity; the weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets, which have contributed and may continue to contribute to, among other things, high levels of non-performing assets, charge-offs and provisions for loan and lease losses, and may subject the Corporation to further risk from loan defaults and foreclosures; the ability of FirstBank Puerto Rico (“FirstBank”) to realize the benefits of its deferred tax assets subject to the remaining valuation allowance; adverse changes in general economic conditions in Puerto Rico, the U.S., and the U.S. Virgin Islands and British Virgin Islands, including the interest rate environment, market liquidity, housing absorption rates, real estate prices, and disruptions in the U.S. capital markets, which reduced interest margins and affected funding sources, and has affected demand for all of the Corporation’s products and services and reduced the Corporation’s revenues and earnings, and the value of the Corporation’s assets, and may continue to have these effects; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be other-than-temporary, including additional impairments on the Puerto Rico government’s obligations; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, which could affect the Corporation’s financial condition or performance and could cause the Corporation’s actual results for future periods to differ materially from prior results and anticipated or projected results; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments, including those determined by the Federal Reserve Board, the New York Fed, the Federal Deposit Insurance Corporation (“FDIC”), government-sponsored housing agencies, and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact on the Corporation’s results of operations and financial condition of acquisitions and dispositions; a need to recognize additional impairments on the Corporation’s financial instruments, goodwill or other intangible assets relating to acquisitions; the risk that downgrades in the credit ratings of the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the impact on the Corporation’s businesses, business practices and results of operations of a potential higher interest rate environment; uncertainty as to whether FirstBank will be able to satisfy its regulators regarding, among other things, its asset quality, liquidity plans, maintenance of capital levels and compliance with applicable laws, regulations and related requirements; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws.

Agenda Fourth Quarter & FY 2019 Highlights Aurelio Alemán, President & Chief Executive OfficerFourth Quarter & FY 2019 Results of Operations Orlando Berges, Executive Vice President & Chief Financial OfficerQuestions & Answers 3

Fourth Quarter & FY 2019 Highlights

5 Fourth Quarter 2019 Highlights Profitability Net income of $36.4 million, or $0.16 per diluted share. Adjusted 4Q 2019 non-GAAP net income of $42.8 million, or $0.19 per diluted share, compared to adjusted $45.1 million in 3Q 2019.Adjusted pre-tax, pre-provision (“PTPP”) income of $72.1 million, compared to $70.8 million for 3Q 2019. Net interest income decreased $4.5 million compared to 3Q 2019. Loan Portfolio Loan originations and renewals grew $86.3 million to $1.1 billion.Loan portfolio grew $30.8 million.Consumer portfolio grew $81.9 million, or 3.7%, driven by increased consumer demand. Asset Quality Total NPAs declined $14.7 million to $317.4 million, or 2.5% of assets.Provision for loan and lease losses increased $1.1 million to $8.5 million. Core Deposits 4Q 2019 deposits, net of government and brokered CDs, increased by $261.2 million to $7.9 billion. 4Q 2019 Puerto Rico deposits, net of government and brokered, increased $179.6 million, while the Florida region increased $81.2 million.Brokered CDs decreased by $48.0 million to $435.1 million.Government deposits increased by $2.3 million to $1.1 billion. Capital Increased quarterly common dividend 67% to $0.05/share.4Q 2019 capital position: Total Risk Based Capital Ratio of 25.22%;Common Equity Tier 1 Capital Ratio of 21.60%Tier 1 Ratio Risk Based Capital Ratio of 22.00%; andLeverage Ratio of 16.15%.Tangible book value per common share of $9.92 compared to $9.79 in 3Q 2019.

Year-over-Year Improvement in All Key Franchise Metrics 6 Adjusted Net Income1($ in mm) Net Interest Income($ in mm) Adjusted PTPP Income1($ in mm) +21% +14% Loan Originations2($ in billions) +24% Core Deposits3($ in billions) +8% NPAs($ in mm) -32% TBV/Share1 +9% Brokered CDs($ in mm) -22% 1 See Exhibits for reconciliations2 Originations and renewals3 Core deposits are total deposits excluding brokered CDs +6%

Results of Operations

8 Results of Operations: Fourth Quarter Highlights ($ in thousands, except per share data) Select Financial Information

9 Key Highlights Net Interest Income ($ millions) Net interest income decreased $4.5 million in 4Q 2019. This decrease was mainly due to:A $5.4 million decrease in interest income on commercial and construction loans, primarily due to the effect in 3Q 2019 of the $3.0 million accelerated discount accretion from the payoff of a commercial mortgage loan. In addition, there was a decrease in interest income of approximately $1.1 million related to the downward repricing of variable rate commercial loans and a decrease of approximately $0.9 million associated with a $100.6 million decline in the total commercial and construction average loan balance. A $1.0 million decrease in interest income from interest-bearing cash balances, which consisted primarily of deposits maintained at the Federal Reserve Bank, mainly due to declines in the Federal Funds target rate. This decrease was partially offset by:A $1.6 million increase in interest income on consumer loans, primarily due to an increase of $84.0 million in the average balance of this portfolio.GAAP NIM was 4.70%, compared to 4.89% for 3Q 2019. The decrease was primarily due to the accelerated discount accretion in 3Q 2019 (10 basis points) and declines in interest rates. Results of Operations: Net Interest Income

10 Non-interest income for 4Q 2019 amounted to $24.4 million, compared to $21.4 million for 3Q 2019. The $3.0 million increase was primarily due to: A $2.1 million gain from the sale of a nonaccrual commercial mortgage loan held for sale.The 3Q 2019 effect of a $0.5 million OTTI charge on private label MBS. Results of Operations: Non-Interest Income Non-Interest Income ($ millions) $22.5 $24.4 $20.5 $22.2 $21.4 Key Highlights

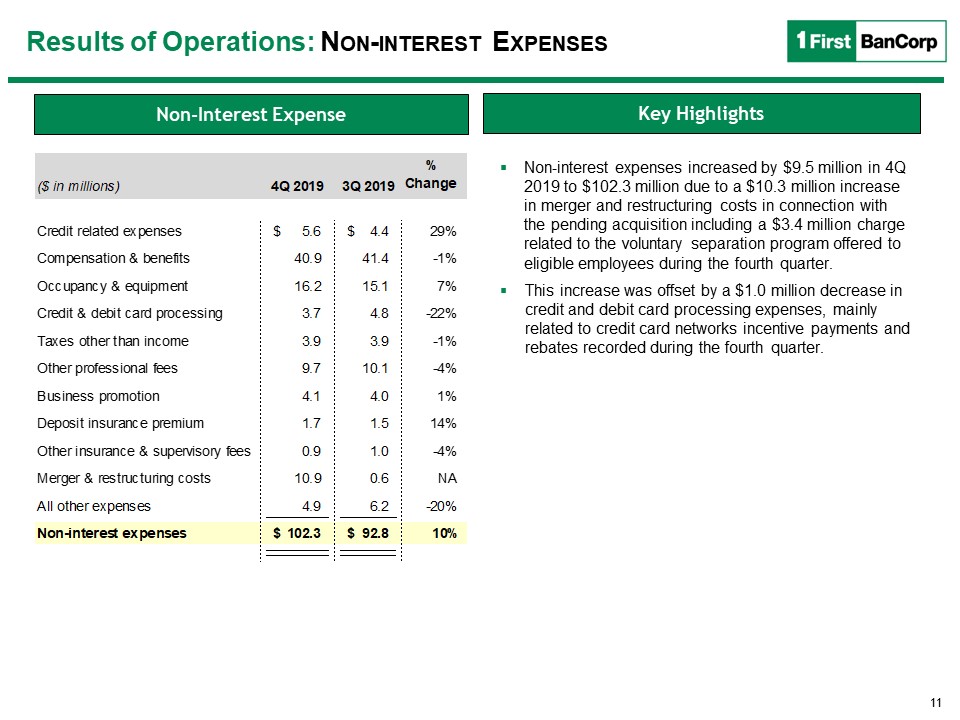

11 Results of Operations: Non-interest Expenses Non-interest expenses increased by $9.5 million in 4Q 2019 to $102.3 million due to a $10.3 million increase in merger and restructuring costs in connection with the pending acquisition including a $3.4 million charge related to the voluntary separation program offered to eligible employees during the fourth quarter.This increase was offset by a $1.0 million decrease in credit and debit card processing expenses, mainly related to credit card networks incentive payments and rebates recorded during the fourth quarter. Non-Interest Expense Key Highlights

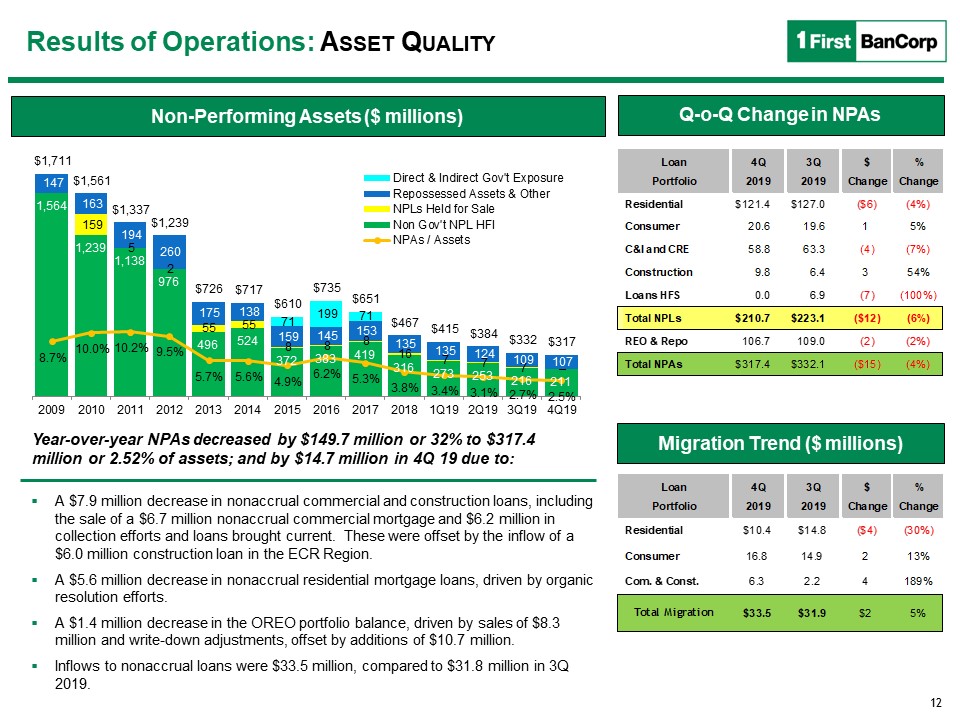

12 Non-Performing Assets ($ millions) A $7.9 million decrease in nonaccrual commercial and construction loans, including the sale of a $6.7 million nonaccrual commercial mortgage and $6.2 million in collection efforts and loans brought current. These were offset by the inflow of a $6.0 million construction loan in the ECR Region.A $5.6 million decrease in nonaccrual residential mortgage loans, driven by organic resolution efforts.A $1.4 million decrease in the OREO portfolio balance, driven by sales of $8.3 million and write-down adjustments, offset by additions of $10.7 million.Inflows to nonaccrual loans were $33.5 million, compared to $31.8 million in 3Q 2019. Year-over-year NPAs decreased by $149.7 million or 32% to $317.4 million or 2.52% of assets; and by $14.7 million in 4Q 19 due to: Results of Operations: Asset Quality Q-o-Q Change in NPAs Migration Trend ($ millions)

13 Key Highlights Net Charge-Offs ($ millions) Net charge-offs for 4Q 2019 were $18.9 million, or an annualized 0.84% of average loans, compared to $13.8 million, or an annualized 0.61% of average loans, in 3Q 2019. The increase of $5.1 million in net charge-offs was mainly related to a $2.7 million increase in consumer, primarily due to higher average balances, and $1.5 million increase in residential due to loans evaluated for impairment based on delinquency and LTVs. Allowance coverage ratio to total loans held for investment of 1.72% compared to 1.85% in 3Q 2019. The ratio of the allowance to NPLs held for investment was 73.6% as of 4Q 2019 compared to 76.6% as of 3Q 2019. 4Q 19 Commercial NPLs (Includes HFS) *Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. Results of Operations: Net Charge-offs $24 $12 $19 $24 $14 4Q 2018

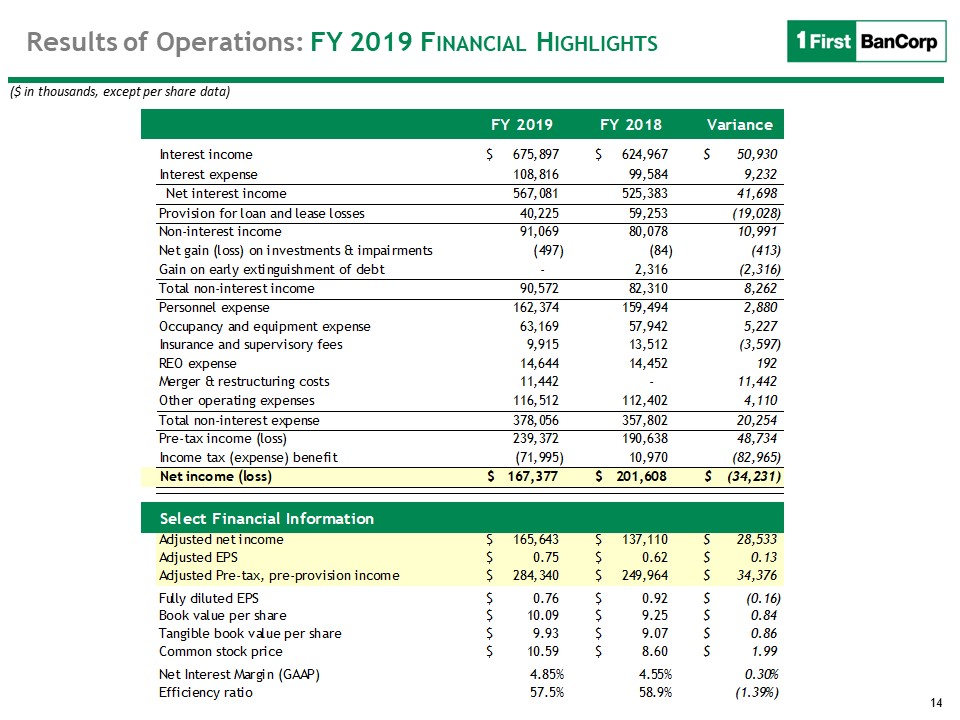

14 Results of Operations: FY 2019 Financial Highlights ($ in thousands, except per share data) Select Financial Information

Exhibits

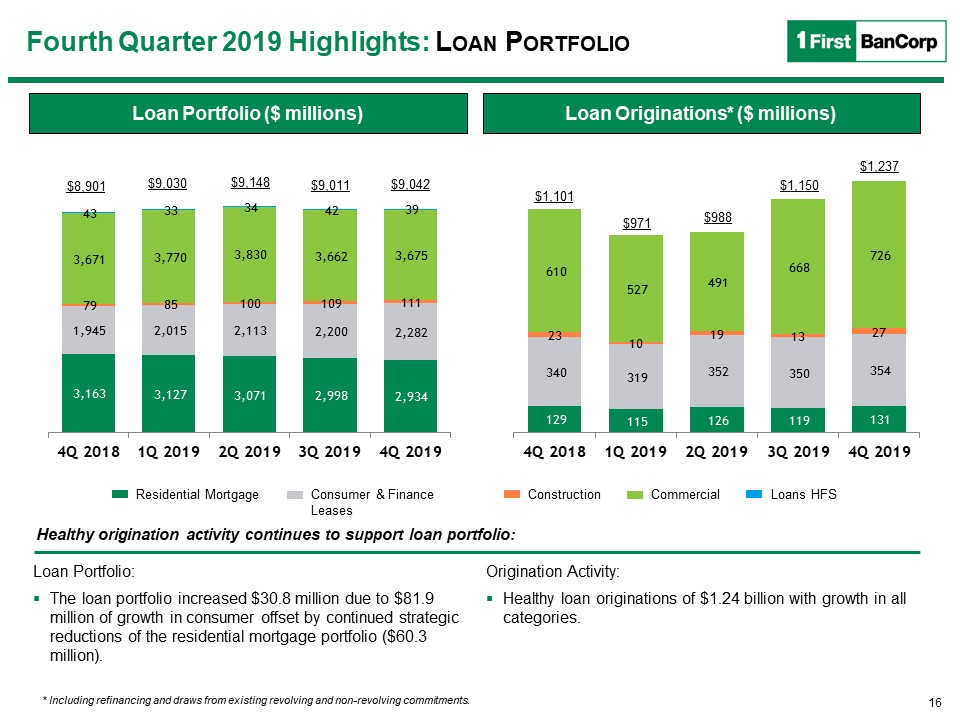

16 Loan Originations* ($ millions) Loan Portfolio ($ millions) Residential Mortgage Consumer & Finance Leases Construction Commercial Loans HFS Healthy origination activity continues to support loan portfolio: * Including refinancing and draws from existing revolving and non-revolving commitments. Fourth Quarter 2019 Highlights: Loan Portfolio $9,042 $9,030 $1,101 $9,148 $9,011 $1,150 Loan Portfolio:The loan portfolio increased $30.8 million due to $81.9 million of growth in consumer offset by continued strategic reductions of the residential mortgage portfolio ($60.3 million). Origination Activity:Healthy loan originations of $1.24 billion with growth in all categories. $8,901 $988 $971 $1,237

17 Total Deposit Composition (%) Core Deposits* ($ millions) * Core deposits are total deposits excluding brokered CDs. Continue improving deposit mix; core deposits increased over $260 million in 4Q 2019. Fourth Quarter 2019 Highlights: Deposit Mix Retail Commercial CDs & IRAs Public Funds $8,439 $8,666 Overall deposits, excluding brokered CDs and government deposits, increased by $261.2 million in 4Q 2019, reflecting an increase of $179.6 million in Puerto Rico and $81.2 million in the Florida region.Government deposits increased by $2.3 million in 4Q 2019.Brokered CDs decreased by $48.0 million in 4Q 2019 to $435.1 million, representing 5% of total deposits. $8,650 $8,561 $8,913

18 Fourth Quarter 2019 Highlights: Capital Position Capital Ratios (%) Total stockholders’ equity amounted to $2.2 billion as of December 31, 2019, an increase of $27.5 million from September 30, 2019. The increase was mainly driven by the earnings generated in the fourth quarter and a $1.6 million increase in the fair value of available-for-sale investment securities recorded as part of “Other comprehensive income,” partially offset by common and preferred stock dividends declared in the fourth quarter of 2019 totaling $11.6 million. Capital Ratios (%)

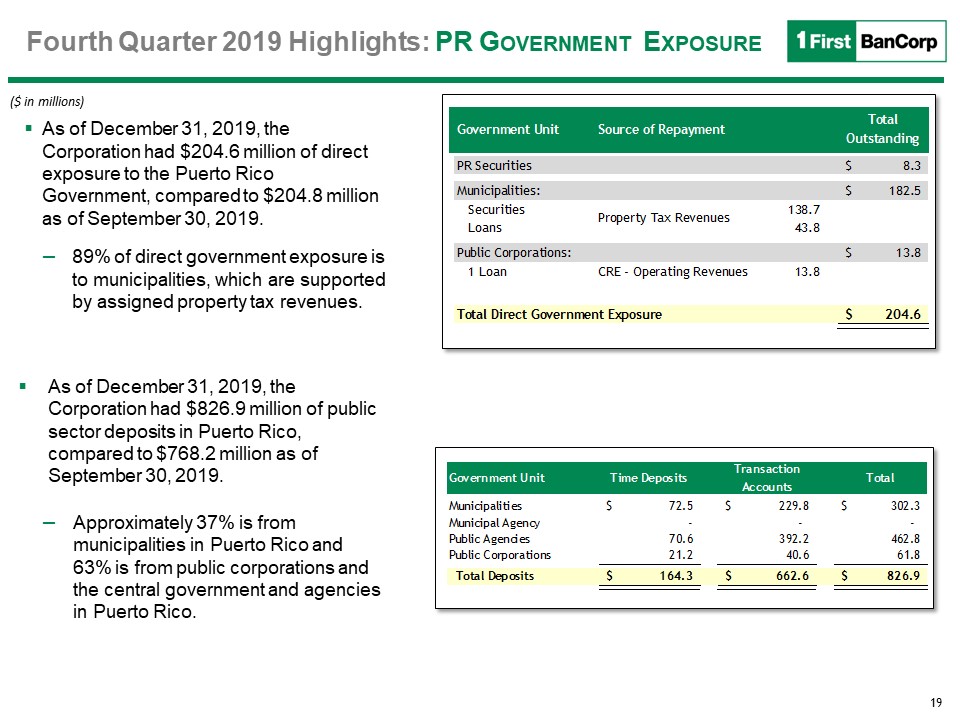

19 Fourth Quarter 2019 Highlights: PR Government Exposure ($ in millions) As of December 31, 2019, the Corporation had $204.6 million of direct exposure to the Puerto Rico Government, compared to $204.8 million as of September 30, 2019. 89% of direct government exposure is to municipalities, which are supported by assigned property tax revenues. As of December 31, 2019, the Corporation had $826.9 million of public sector deposits in Puerto Rico, compared to $768.2 million as of September 30, 2019.Approximately 37% is from municipalities in Puerto Rico and 63% is from public corporations and the central government and agencies in Puerto Rico.

20 NPL Migration ($ in 000)

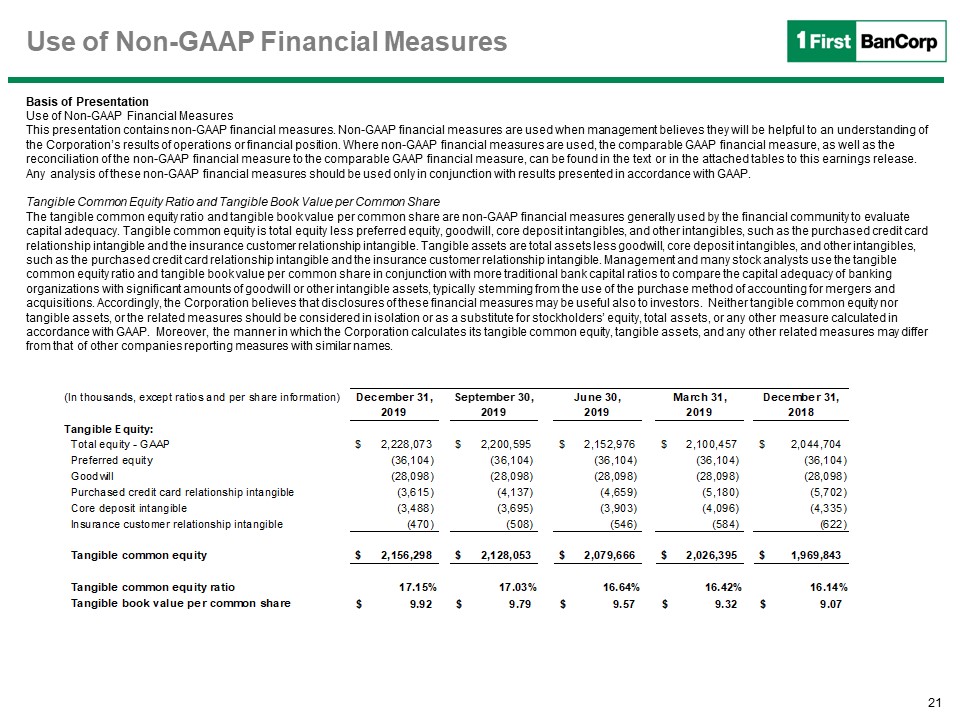

21 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP financial measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Tangible assets are total assets less goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosures of these financial measures may be useful also to investors. Neither tangible common equity nor tangible assets, or the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity, tangible assets, and any other related measures may differ from that of other companies reporting measures with similar names.

22 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Pre-Tax, Pre-Provision IncomeAdjusted pre-tax, pre-provision income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted pre-tax, pre-provision income, as defined by management, represents net income (loss) excluding income tax expense (benefit), the provision for loan and lease losses, as well as certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is income before income taxes adjusted to exclude the provision for loan and lease losses, gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives. In addition, from time to time, earnings are adjusted also for items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts.

23 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. The financial results include the following significant items that management believes are not reflective of core operating performance, are not expected to reoccur with any regularity or may reoccur at uncertain times and in uncertain amounts (the “Special Items”):Quarter ended December 31, 2019Merger and restructuring costs of $10.9 million ($6.8 million after-tax) in connection with the previously announced stock purchase agreement with Santander Holdings USA, Inc., to acquire Banco Santander Puerto Rico (“BSPR”) and related restructuring initiatives. Merger and restructuring costs primarily included advisory, legal, valuation, and other professional service fees associated with the pending acquisition of BSPR, as well as a $3.4 million charge related to a voluntary separation program (the “VSP”) offered to eligible employees during the fourth quarter of 2019 in connection with initiatives to capitalize on expected operational efficiencies from the acquisition. A total of 54 employees elected to participate in the VSP on or before December 6, 2019, the due date established for participation in the program, which represented a participation rate of 53% of eligible employees, with employment separations occurring no later than February 29, 2020. A $0.7 million ($0.5 million after-tax) benefit resulting from hurricane-related insurance recoveries related to repairs and maintenance costs incurred on facilities in the Virgin Islands region.Quarter ended September 30, 2019A $3.0 million ($1.8 million after-tax) positive effect in earnings related to the accelerated discount accretion from the payoff of a commercial mortgage loan.A $0.4 million ($0.2 million after-tax) benefit resulting from hurricane-related insurance recoveries related to repairs and maintenance costs incurred on facilities in the U.S. Virgin Islands.A $0.5 million OTTI charge on private label MBS recorded in the tax-exempt international banking entity subsidiary. Merger and restructuring costs of $0.6 million ($0.4 million after-tax) associated with the pending acquisition of BSPR.

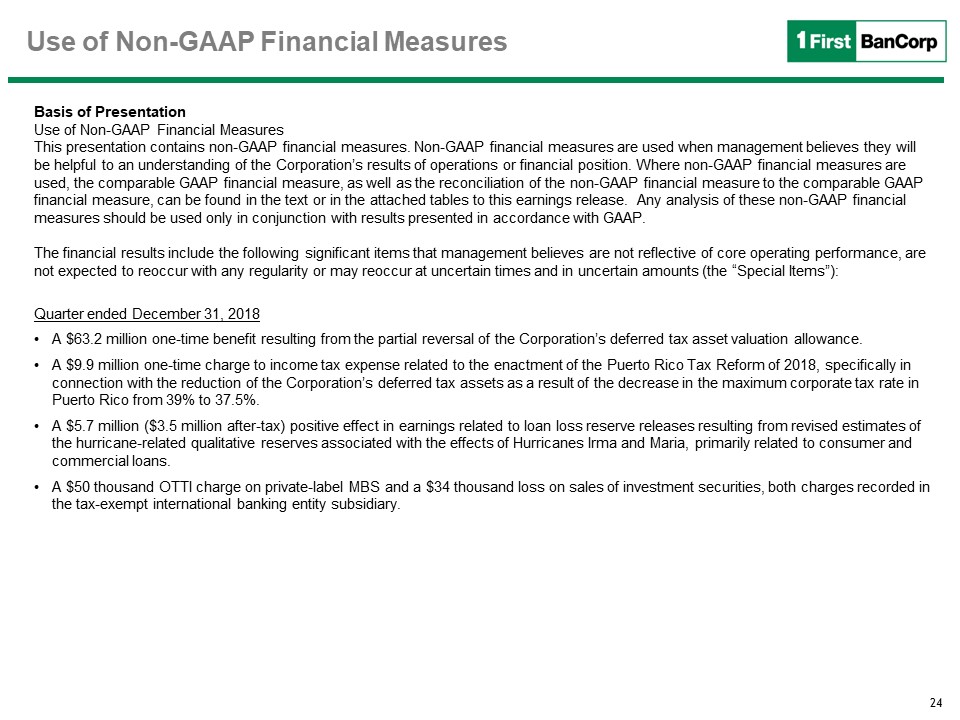

24 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. The financial results include the following significant items that management believes are not reflective of core operating performance, are not expected to reoccur with any regularity or may reoccur at uncertain times and in uncertain amounts (the “Special Items”):Quarter ended December 31, 2018A $63.2 million one-time benefit resulting from the partial reversal of the Corporation’s deferred tax asset valuation allowance.A $9.9 million one-time charge to income tax expense related to the enactment of the Puerto Rico Tax Reform of 2018, specifically in connection with the reduction of the Corporation’s deferred tax assets as a result of the decrease in the maximum corporate tax rate in Puerto Rico from 39% to 37.5%.A $5.7 million ($3.5 million after-tax) positive effect in earnings related to loan loss reserve releases resulting from revised estimates of the hurricane-related qualitative reserves associated with the effects of Hurricanes Irma and Maria, primarily related to consumer and commercial loans.A $50 thousand OTTI charge on private-label MBS and a $34 thousand loss on sales of investment securities, both charges recorded in the tax-exempt international banking entity subsidiary.

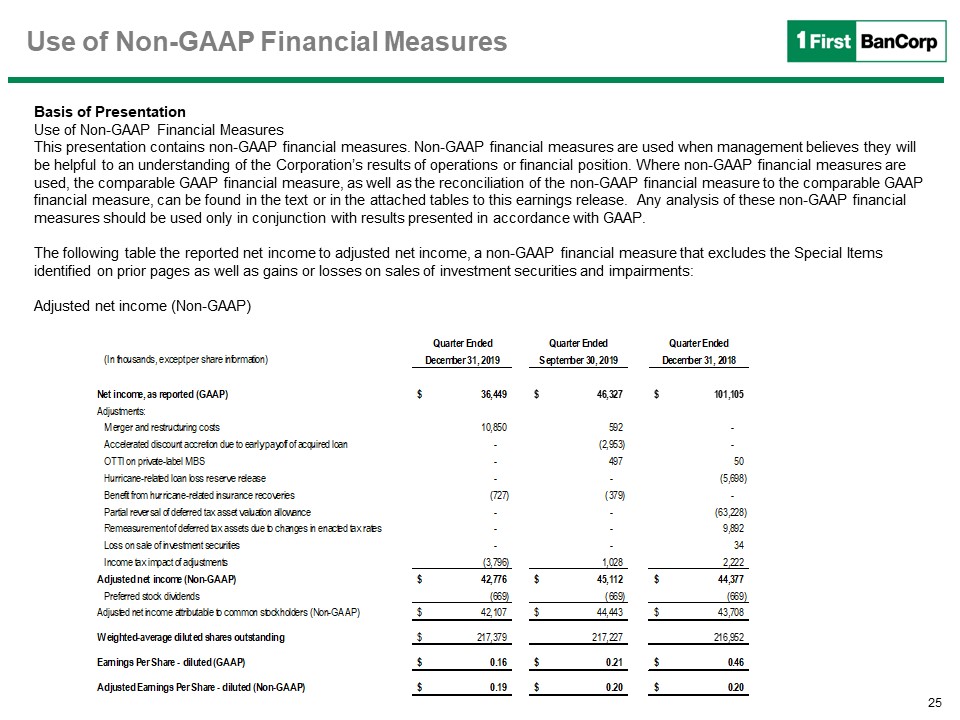

25 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. The following table the reported net income to adjusted net income, a non-GAAP financial measure that excludes the Special Items identified on prior pages as well as gains or losses on sales of investment securities and impairments:Adjusted net income (Non-GAAP)

26 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures To supplement the Corporation’s financial statements presented in accordance with GAAP, the Corporation uses, and believes that investors would benefit from disclosure of, non-GAAP financial measures that reflect adjustments to net income to exclude items that management identifies as Special Items because management believes they are not reflective of core operating performance, are not expected to reoccur with any regularity or may reoccur at uncertain times and in uncertain amounts. the following non-GAAP financial measures for the fourth and third quarters of 2019, the fourth quarter of 2018, and the years ended December 31, 2019 and 2018 that reflect the described items that were excluded for one of those reasons:Adjusted net income for the years ended December 31, 2019 and 2018 reflect the following exclusions:Merger and restructuring costs of $11.4 million in 2019 related to transaction costs and restructuring initiatives in connection with the pending acquisition of BSPR.Total benefit of $1.9 million and $0.5 million in 2019 and 2018, respectively, resulting from hurricane-related insurance recoveries related to impairments, repairs and maintenance costs incurred on facilities affected by Hurricanes Irma and Maria.Reserve releases of $6.4 million and $16.9 million in 2019 and 2018, respectively, related to the hurricane-related qualitative reserves associated with the effect of Hurricanes Irma and Maria.The exclusion of hurricane-related expenses of $2.8 million in 2018.Expense recovery of $2.3 million in 2019 related to an employee retention benefit payment received by the Bank under the Disaster Tax Relief and Airport Extension Act of 2017, as amended.The accelerated discount accretion of $3.0 million resulting from the early payoff of an acquired commercial mortgage loan in 2019.OTTI charges of $0.5 million and $0.1 million on private-label MBS recorded in 2019 and 2018, respectively.Tax benefit of $63.2 million resulting from the partial reversal of the Corporation’s deferred tax asset valuation allowance in 2018.Exclusion of the one-time charge to tax expense of $9.9 million in 2018 related to the enactment of the Puerto Rico Tax Reform of 2018.Loss of $34 thousand on sales of U.S. agencies MBS and bonds in 2018.Gain of $2.3 million on the repurchase and cancellation of $23.8 million in trust-preferred securities in 2018.

27 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures To supplement the Corporation’s financial statements presented in accordance with GAAP, the Corporation uses, and believes that investors would benefit from disclosure of, non-GAAP financial measures that reflect adjustments to net income to exclude items that management identifies as Special Items because management believes they are not reflective of core operating performance, are not expected to reoccur with any regularity or may reoccur at uncertain times and in uncertain amounts. the following non-GAAP financial measures for the fourth and third quarters of 2019, the fourth quarter of 2018, and the years ended December 31, 2019 and 2018 that reflect the described items that were excluded for one of those reasons:Adjusted net income for the years ended December 31, 2019 and 2018 reflect the following exclusions:The tax related effects of all of the pre-tax items mentioned in the bullets on the prior page as follows:Tax benefit of $4.3 million in 2019 related to merger and restructuring costs in connection with the pending acquisition of BSPR (calculated based on the statutory tax rate of 37.5% for 2019).Tax expense of $0.7 million and $0.2 million in 2019 and 2018, respectively, related to the benefit of hurricane-related insurance recoveries (calculated based on the statutory tax rate of 37.5% for 2019 and 39% for 2018).Tax expense of $2.4 million and $6.6 million in 2019 and 2018, respectively, related to reserve releases associated with the hurricane-related qualitative reserve (calculated based on the statutory tax rate of 37.5% for 2019 and 39% for 2018).Tax benefit of $1.1 million in 2018 related to hurricane-related expenses (calculated based on the statutory tax rate of 39% for 2018).Tax expense of $1.1 million in 2019 related to the accelerated discount accretion from the payoff of an acquired commercial mortgage loan (calculated based on the statutory tax rate of 37.5% for 2019).No tax benefit was recorded for the OTTI charges on private-label MBS recorded in 2019 and 2018 and for the loss on sales of U.S. agencies MBS and bonds in 2018. Those charges were recorded at the tax-exempt international banking entity subsidiary level.The employee retention benefit recognized in 2019 will not be treated as taxable income by virtue of the Disaster Tax Relief and Airport Extension Act of 2017.The gain realized on the repurchase and cancellation of trust-preferred securities in 2018 recorded at the holding company level, had no effect on the income tax expense in 2018.

28 Use of Non-GAAP Financial Measures Basis of PresentationUse of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. The following table the reported net income to adjusted net income, a non-GAAP financial measure that excludes the Special Items identified on prior pages as well as gains or losses on sales of investment securities and impairments:Adjusted net income (Non-GAAP)