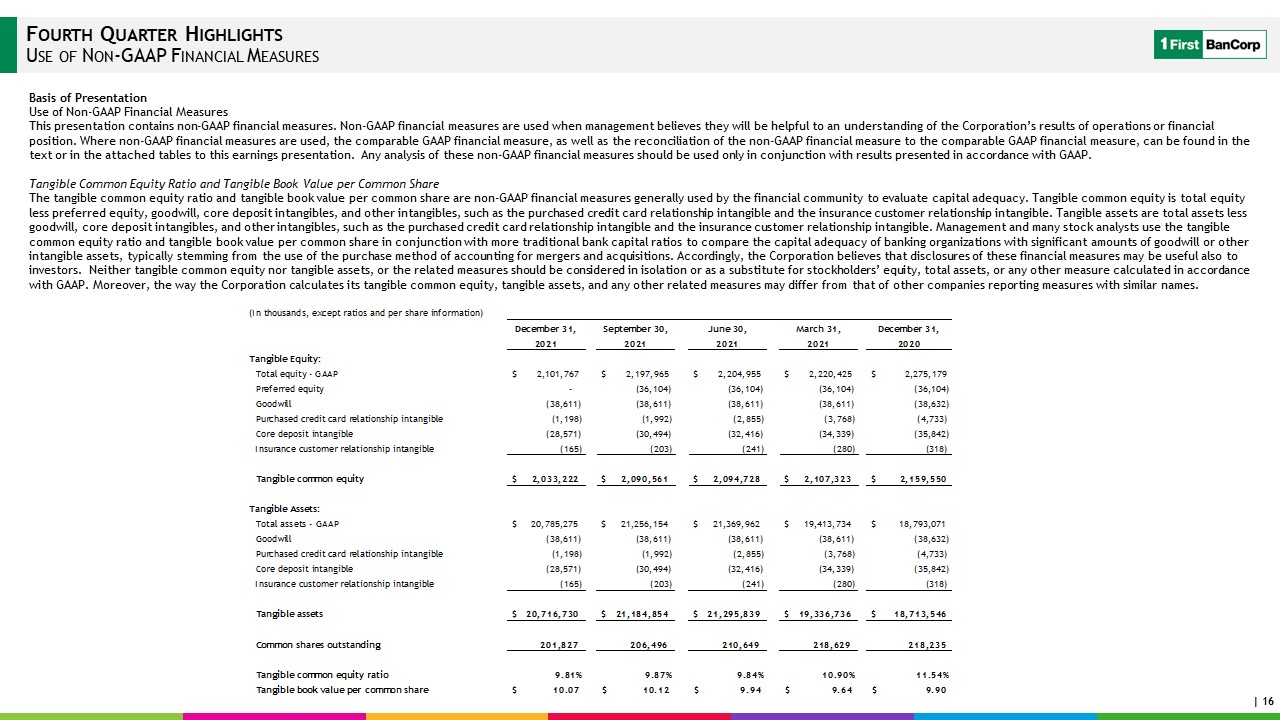

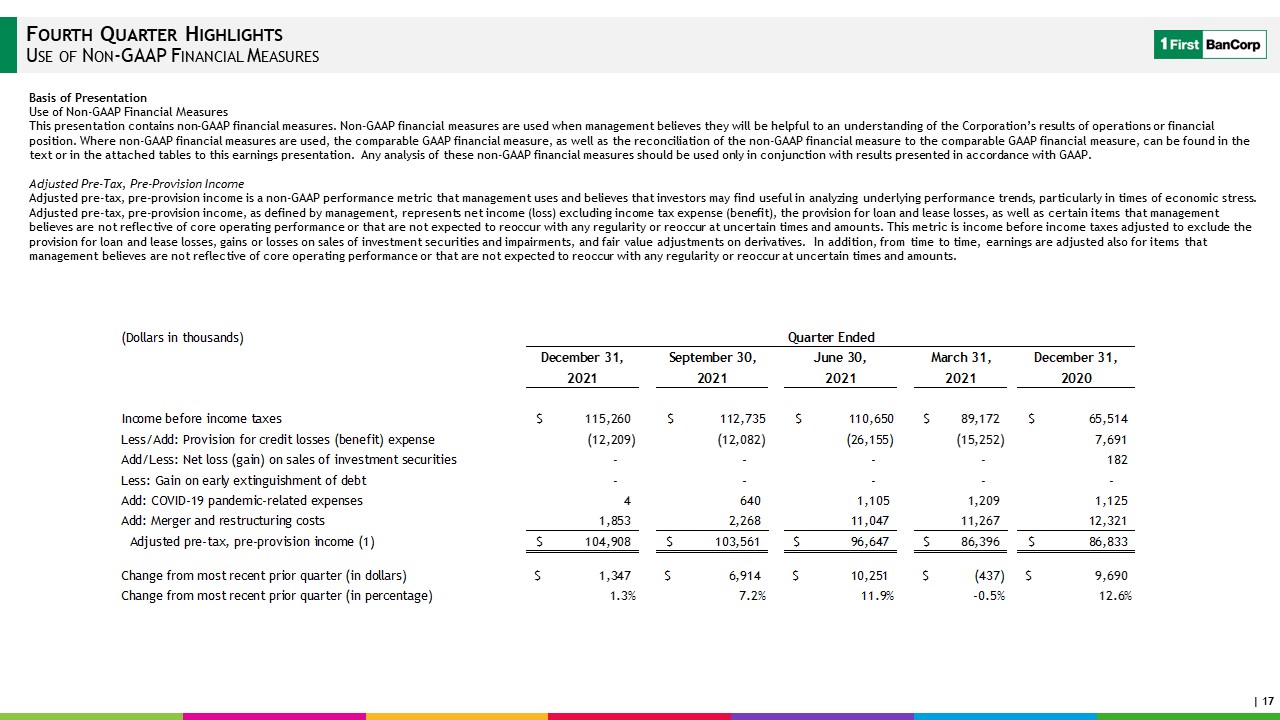

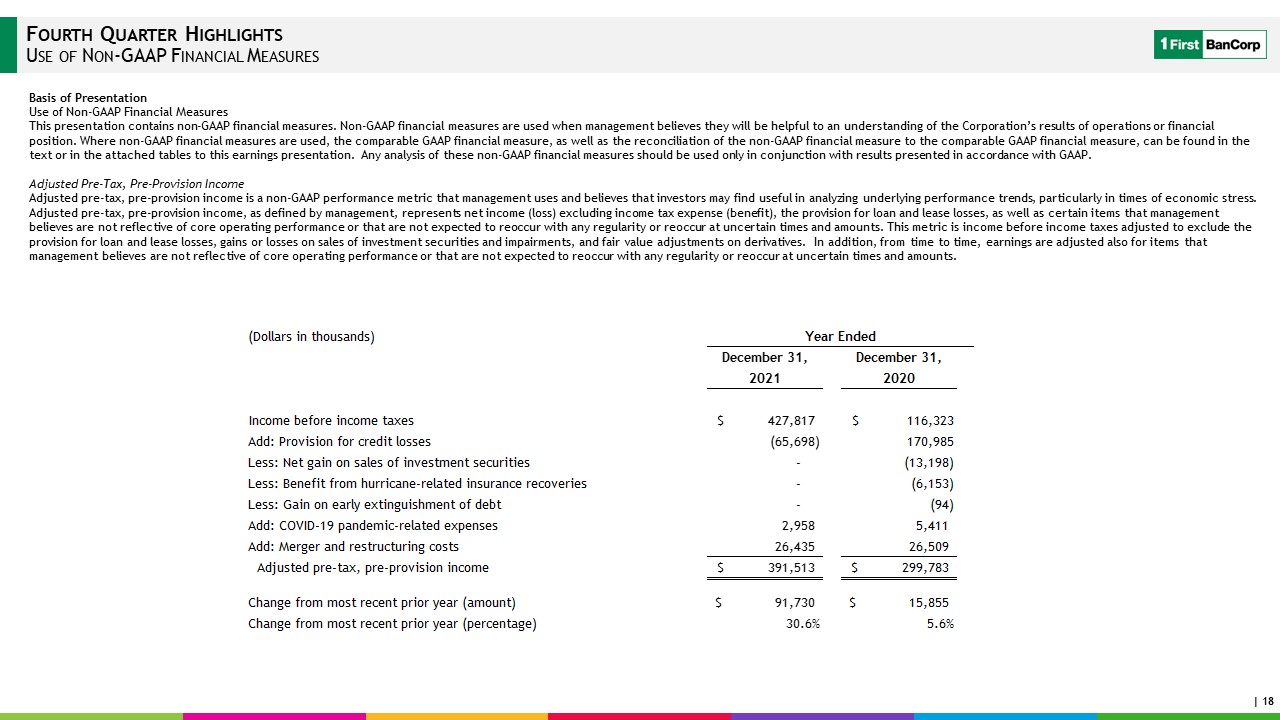

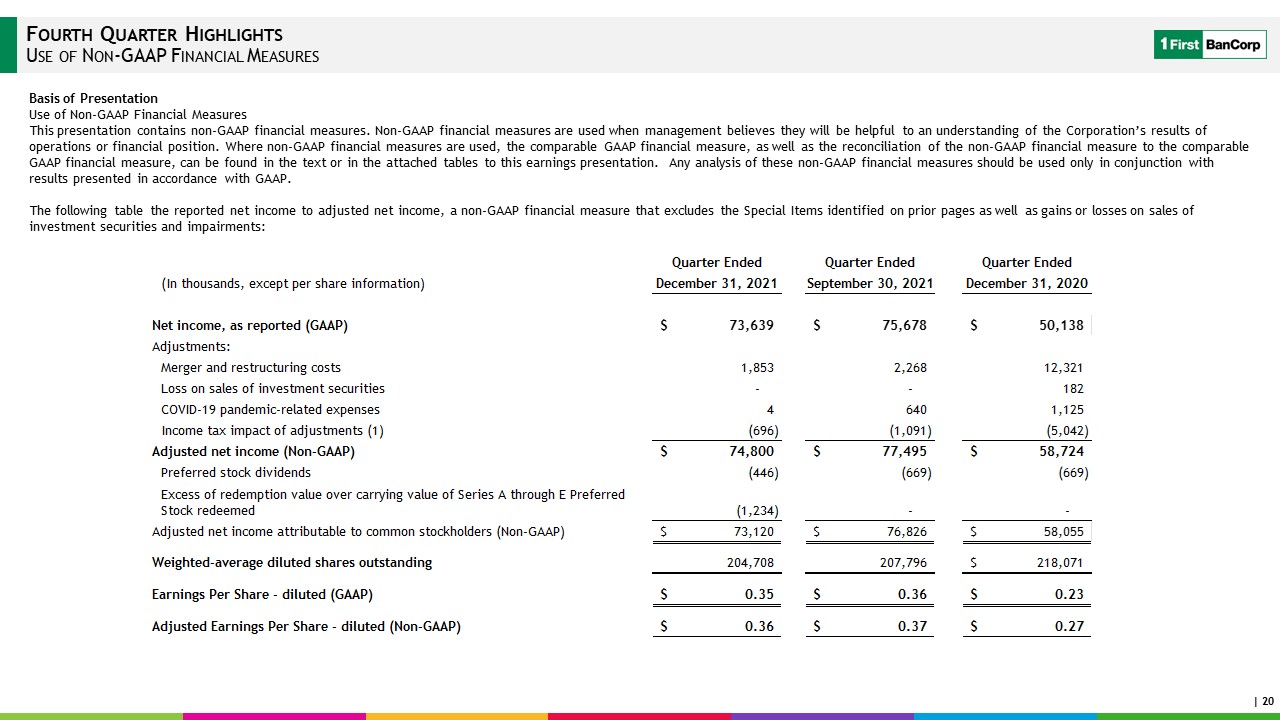

Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to the Corporation’s future economic, operational and financial performance and can be identified by the words or phrases “expect,” “anticipate,” “intend,” “should,” “would,” “believe” and similar expressions. First BanCorp (the “Corporation” or “Company”) cautions readers not to place undue reliance on such statements, which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ materially from those expressed in, or implied by, such statements: the severity, magnitude and duration of the COVID-19 pandemic, actions taken by governmental authorities in response thereto, and the impact of the pandemic on the Corporation’s business, operations, employees, credit quality, financial condition and net income; the Corporation’s ability to identify and prevent cyber-security incidents; risks associated with the Corporation’s recent acquisition of BSPR; uncertainty as to the ultimate outcomes of actions taken, or those that may be taken, by the Puerto Rico government, or the oversight board established by the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) to address the Commonwealth of Puerto Rico’s financial problems; changes in economic and business conditions, including those caused by the COVID-19 pandemic or other global or regional health crises as well as past or future natural disasters, that directly or indirectly affect the financial health of the Corporation’s customer base; the impact of a slowing economy, increased unemployment or underemployment and the continued economic recession in Puerto Rico; uncertainty as to the availability of certain funding sources; the deteriorating weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets; the impact of changes in accounting standards or assumptions in applying those standards; the ability of FirstBank to realize the benefits of its net deferred tax assets; the ability of FirstBank to generate sufficient cash flow to make dividend payments to the Corporation; adverse changes in general economic conditions in Puerto Rico, the U.S., the U.S. Virgin Islands, and the British Virgin Islands, and disruptions in the U.S. capital markets; uncertainty related to the effect of the discontinuation of the London Interbank Offered Rate at the end of 2021; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be credit-related; uncertainty about legislative, tax or regulatory changes that affect financial services companies in Puerto Rico, the U.S., and the U.S. and British Virgin Islands; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments; the risk of possible failure or circumvention of the Corporation’s internal controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; increased costs and losses or an adverse effect to our reputation; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact of business acquisitions and dispositions; the impact of any of these uncertainties on the Corporation’s capital and declaration of dividends by the Corporation’s Board of Directors; uncertainty as to whether FirstBank will be able to continue to satisfy its regulators regarding, among other things, its asset quality, liquidity plans, maintenance of capital levels and compliance with applicable laws, regulations, and related requirements; and general competitive factors and industry consolidation. For a discussion of such uncertainties and risks to which the Corporation is subject, please refer to the Corporation’s annual report on Form 10-K for the year ended December 31, 2020, as well as its other filings with the Securities and Exchange Commission (the “SEC”). The Corporation does not undertake, and specifically disclaims any obligation, to update any forward-looking statements after the date of such statements, except as required by law.Non-GAAP Financial MeasuresIn addition to the Corporation’s financial information presented in accordance with GAAP, management uses certain “non-GAAP” financial measures” within the meaning of Regulation G promulgated by the SEC, to clarify and enhance understanding of past performance and prospects for the future. Please refer to pages 16-20 for a reconciliation of GAAP to non-GAAP measures and calculations for the quarter ended December 31, 2021.