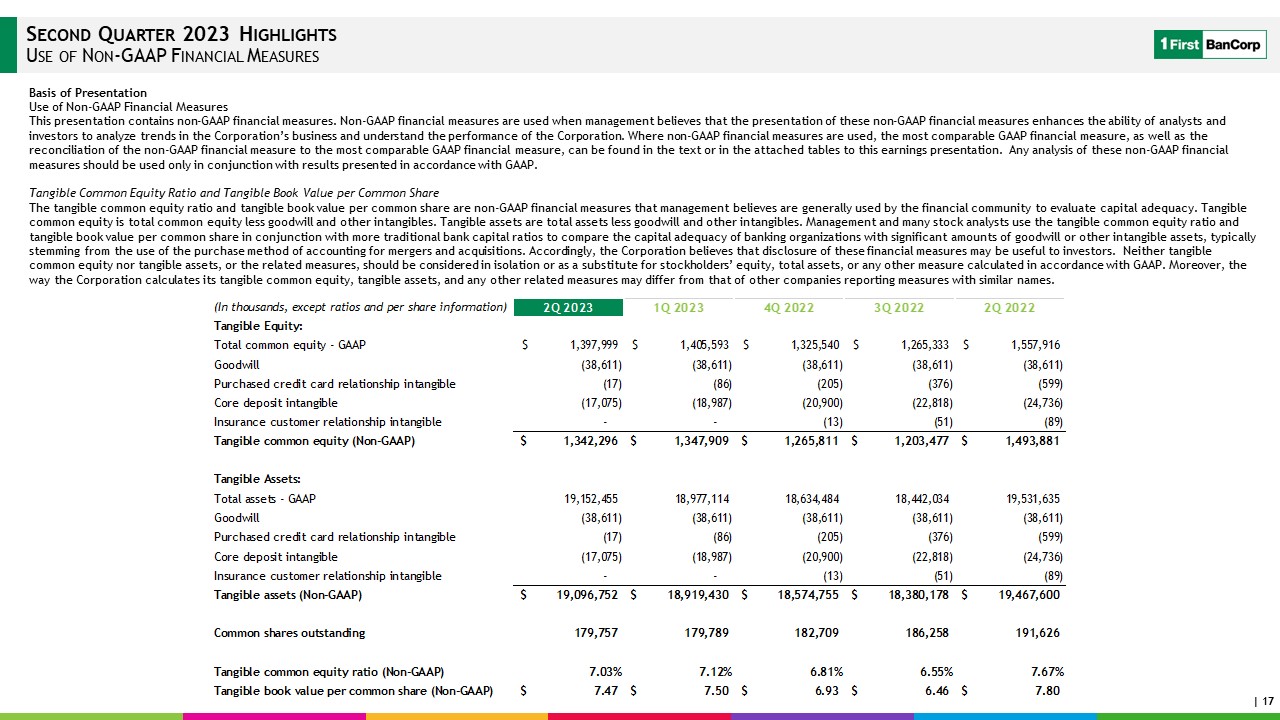

Forward Looking Statements This presentation contains “forward-looking statements” concerning the Corporation’s future economic, operational and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “should,” “would,” “will,” “plans,” “forecast,” “believe” and similar expressions are meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date hereof, and advises readers that any such forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties, estimates and assumptions by us that are difficult to predict. Various factors, some of which are beyond our control, including, but not limited to, the uncertainties more fully discussed in Part I, Item 1A, “Risk Factors” of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022, Part II Item 1A, “Risk Factors” of the Corporation’s Quarterly Report on Form 10Q for the quarterly period ended March 31, 2023, and the following, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements: the impacts of rising interest rates and inflation on the Corporation, including a decrease in demand for new loan originations and refinancings, increased competition for borrowers, attrition in deposits, a reduction in the fair value of the Corporation’s debt securities portfolio, and an increase in non-interest expenses; volatility in the financial services industry, which could result in, among other things, bank deposit runoffs and liquidity constraints; uncertainty as to the ability of FirstBank to retain its core deposits and generate sufficient cash flow through its wholesale funding sources; adverse changes in general economic conditions in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, including in the interest rate environment, unemployment rates, market liquidity, housing absorption rates, real estate markets and U.S. capital markets; general competitive factors, as well as the implementation of strategic growth opportunities and ability to continue to invest in capital projects; uncertainty as to the implementation of the debt restructuring plan of Puerto Rico and the Fiscal Plan for Puerto Rico as certified on April 3,2023 by the Financial Oversight and Management Board for Puerto Rico, or any revisions to it, on our clients and loan portfolios, and any potential impact from future economic or political developments and tax regulations in Puerto Rico; the impact of government financial assistance for hurricane recovery and other disaster relief on economic activity in Puerto Rico; the timing of sales of properties from our other real estate owned (“OREO”) portfolio; any adverse change in the Corporation’s ability to attract and retain clients and gain acceptance from current and prospective customers for new products and services, including those related to the offering of digital banking and financial services; the impacts of applicable legislative, tax or regulatory changes on the Corporation’s financial condition or performance; and the effect of continued changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments. The Corporation does not undertake, and specifically disclaims any obligation to update any “forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws. Non-GAAP Financial Measures In addition to the Corporation’s financial information presented in accordance with GAAP, management uses certain “non-GAAP” financial measures” within the meaning of Regulation G promulgated by the SEC, to clarify and enhance understanding of past performance and prospects for the future. Please refer to pages 17-18 for a reconciliation of GAAP to non-GAAP measures and calculations.