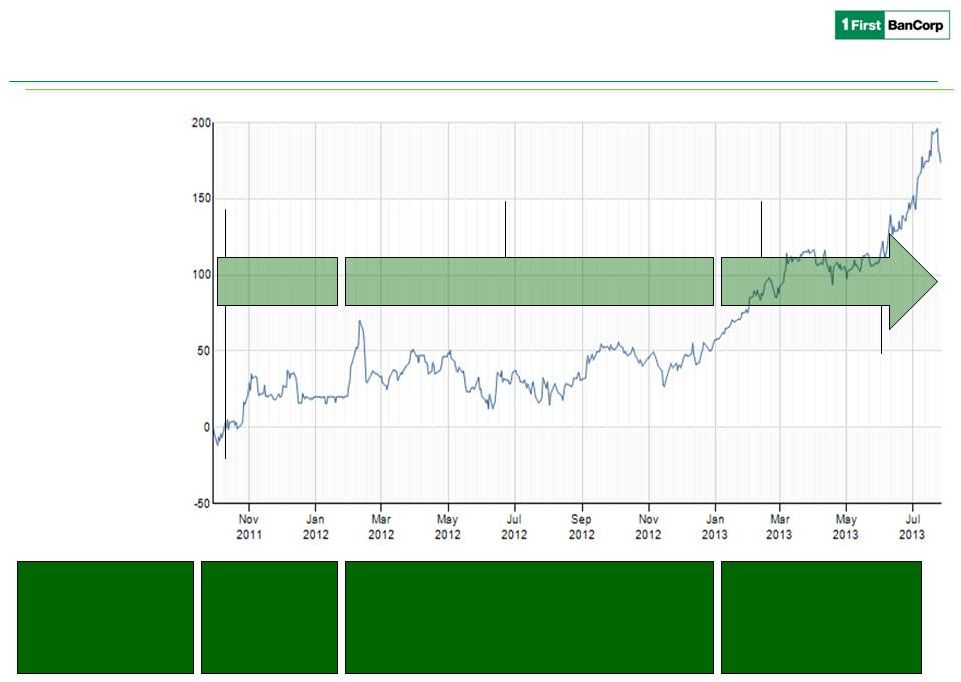

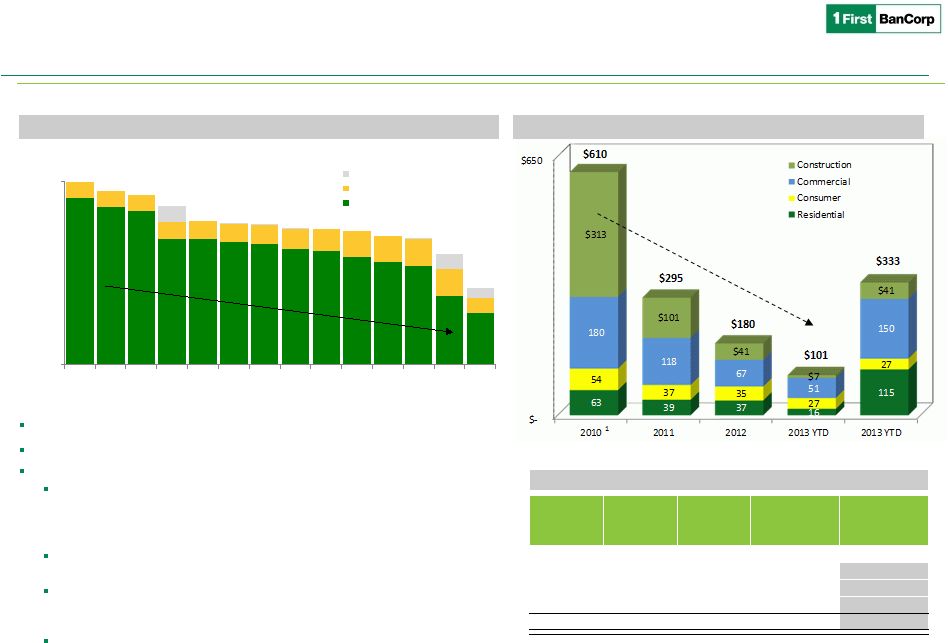

Franchise Overview Our Turnaround Story 2H 2011 2012 1H 2013 June 3, 2010, First BanCorp entered into the Written Agreement with the FED July 20, 2010, the U.S. Treasury exchanged TARP for preferred, which the FBP could compel conversion upon completion of capital raise August 30, 2010, completed exchange of 89% Series A-E Noncumulative Perpetual Preferred Stock for Common During 2010 & 2011, the Company initiated Strategic Plan focused on the following initiatives: org. restructuring, increasing capital, de-risking balance sheet, enhancing franchise value and the strength governance & risk mgmt January 7, 2011, one-for- fifteen reverse stock split of all outstanding shares of its common stock February 16, 2011, the Corporation sold loans with a book value of $270 million to a joint venture with Goldman & CPG On March 7, 2011, FBP continued de-risking and de-leveraging and sold approximately $330 million of MBS intended to be held to maturity. Compelled the conversion of the 424,174 shares of the Corporation’s Series G Preferred Stock, held by the U.S. Treasury, into 32.9 million shares of common stock During 2H 2011, continued deleveraging and de-risking strategies. October 2011, completed a $525 million capital raise and converted the UST to common stock. May 30, 2012, the Corporation reentered the credit card business with the acquisition of an approximate $406 million portfolio of FirstBank-branded credit cards from FIA. Post capital raise, the Company shifted from a defensive to offensive posture. The Company returned to profitability in 2012 and generated $179 million in pre-provision pre-tax income, a 38% increase compared to 2011. Through organic workouts the Company reduced NPAs by $99mm & NPLs by $165mm. During the first quarter of 2013, the Corporation entered into three separate agreements to sell classified and non-performing loans with an aggregate carrying value of approximately $309.7 million. June 2013, announced the write-off of $66.6 million collateral pledged to Lehman , the bulk sale of a non- performing pool of residential loans with book value of $203.8 million, as well as $19.2 million of OREO for $128.3 million in an all cash transaction. 2013 NPAs are down over $1 billion, or 58%, since the peak in Q1 10. Capital ratios strong: Total RBC Ratio 16.6%; Tier 1 Capital Ratio 15.3%; and Leverage Ratio 11.3%. DTA of $523 million. On October 7, 2011, the Corporation successfully completed a private placement of $525 million in shares of common stock - Lead investors include funds affiliated with Thomas H. Lee Partners & Oaktree Capital Management. 4 During 2011, as part of de- leveraging sold $518 million of performing residential mortgages. |