First BanCorp Investor Presentation June 2017 Exhibit 99.1

Forward-Looking Statements This presentation may contain “forward-looking statements” concerning the Corporation’s future economic, operating and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “look forward,” “should,” “would,” “believes,” “estimates” and similar expressions are meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions readers not to place undue reliance on any such “forward-looking statements,” which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ materially from those expressed in, or implied by such forward-looking statements: the ability of the Puerto Rico government or any of its public corporations or other instrumentalities to repay its respective debt obligations, including the effect of recent payment defaults on the Puerto Rico government general obligations, bonds of the Government Development Bank for Puerto Rico and certain bonds of government public corporations, and recent and any future downgrades of the long-term and short-term debt ratings of the Puerto Rico government, which could exacerbate Puerto Rico’s adverse economic conditions and, in turn, further adversely impact the Corporation; uncertainty as to the ultimate outcomes of actions resulting from the enactment by the U.S. government of the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) to address Puerto Rico’s financial problems; uncertainty about whether the Corporation will be able to continue to fully comply with the written agreement dated June 3, 2010 that the Corporation entered into with the Federal Reserve Bank of New York (the “New York Fed”), that, among other things, requires the Corporation to serve as a source of strength to FirstBank and that, except with the consent generally of the New York Fed and the Board of Governors of the Federal Reserve System (the “Federal Reserve Board”), prohibits the Corporation from paying dividends to stockholders or receiving dividends from FirstBank, making payments on trust preferred securities or subordinated debt and incurring, increasing or guaranteeing debt or repurchasing any capital securities and uncertainty whether such consent will be provided for future interest payments on the subordinated debt despite the consents that enabled the Corporation to pay all the accrued but deferred interest payments plus the interest for the second and third quarters of 2016 on the Corporation’s subordinated debentures associated with its trust preferred securities; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico; uncertainty as to the availability of certain funding sources, such as retail brokered certificates of deposit (CDs); the Corporation’s reliance on brokered CDs to fund operations and provide liquidity; the risk of not being able to fulfill the Corporation’s cash obligations or resume paying dividends to the Corporation’s stockholders in the future due to the Corporation’s need to receive approval from the regulators to declare or pay any dividends and to take dividends or any other form of payment representing a reduction in capital from FirstBank or FirstBank’s failure to generate sufficient cash flow to make a dividend payment to the Corporation; the weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets, which have contributed and may continue to contribute to, among other things, high levels of non-performing assets, charge-offs and provisions for loan and lease losses and may subject the Corporation to further risk from loan defaults and foreclosures; the ability of FirstBank to realize the benefits of its deferred tax assets subject to the remaining valuation allowance; adverse changes in general economic conditions in Puerto Rico, the U.S., and the U.S. Virgin Islands and British Virgin Islands, including the interest rate environment, market liquidity, housing absorption rates, real estate prices, and disruptions in the U.S. capital markets, which reduced interest margins and affected funding sources, has affected demand for all of the Corporation’s products and services and reduced the Corporation’s revenues and earnings, and the value of the Corporation’s assets, and may continue to have these effects; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be other-than-temporary, including additional impairments on the Puerto Rico government’s obligations; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, which could affect the Corporation’s financial condition or performance and could cause the Corporation’s actual results for future periods to differ materially from prior results and anticipated or projected results; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments, including those determined by the Federal Reserve Board, the New York Fed, the FDIC, government-sponsored housing agencies, and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact on the Corporation’s results of operations and financial condition of acquisitions and dispositions; a need to recognize impairments on the Corporation’s financial instruments, goodwill or other intangible assets relating to acquisitions; the risk that downgrades in the credit ratings of the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the impact on the Corporation’s businesses, business practices and results of operations of a potential higher interest rate environment; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws. Use of Non-GAAP Financial Measures: This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this presentation. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP.

Compelling Value Proposition Turnaround well underway highlighted by improving operating performance. Successfully navigating challenging operating environment; capturing market share and increasing profitability. Experienced, cohesive leadership team committed to enhancing shareholder value and maintaining our reputation as a highly regarded financial institution in all of the markets we serve. Scaling our franchise, achieving ongoing efficiency gains and improving our operating results are our clear priorities. Maintaining a strong capital base and managing risk remain central to our operating philosophy. Growth opportunities in Puerto Rico and U.S. mainland. Continued robust capital formation and profitability with increasing Tangible Book Value (TBV) and capital ratios; strong DFAST results in October 2016.

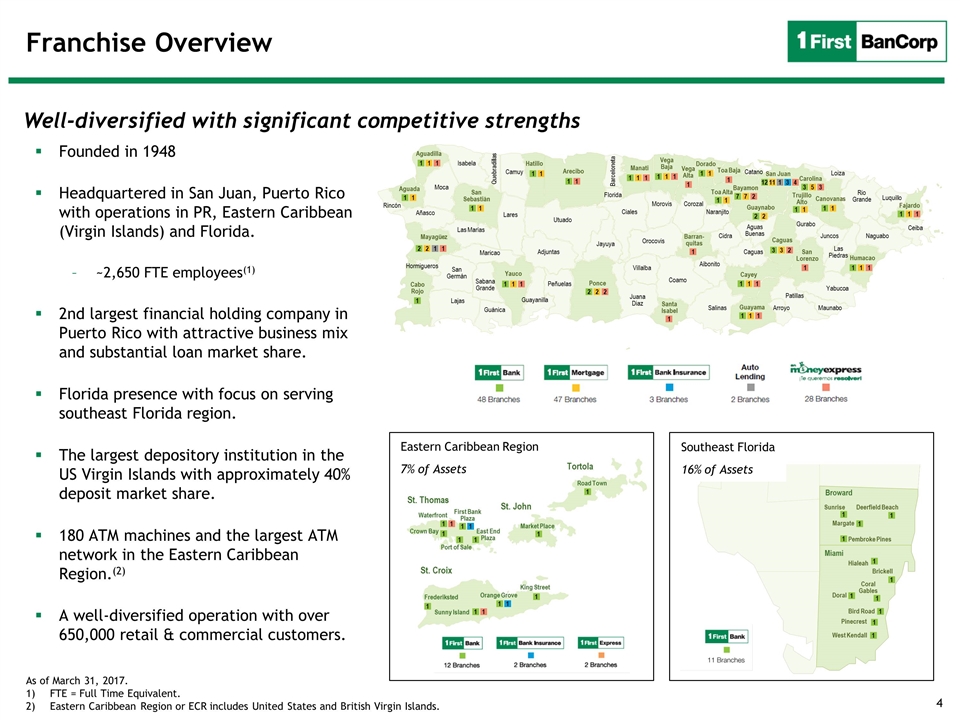

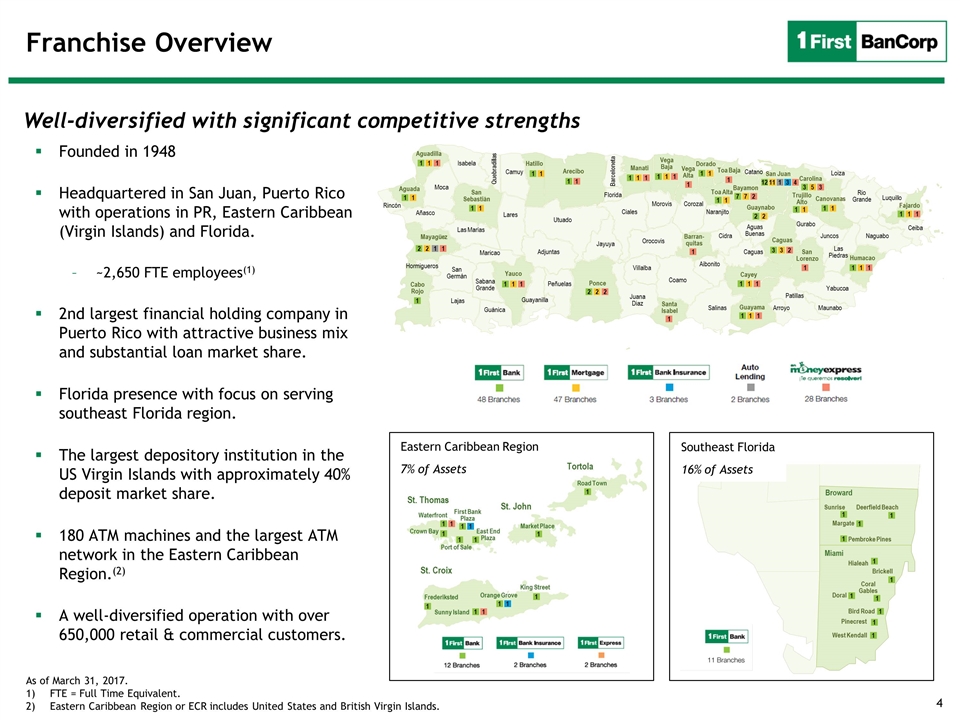

Franchise Overview Founded in 1948 Headquartered in San Juan, Puerto Rico with operations in PR, Eastern Caribbean (Virgin Islands) and Florida. ~2,650 FTE employees(1) 2nd largest financial holding company in Puerto Rico with attractive business mix and substantial loan market share. Florida presence with focus on serving southeast Florida region. The largest depository institution in the US Virgin Islands with approximately 40% deposit market share. 180 ATM machines and the largest ATM network in the Eastern Caribbean Region.(2) A well-diversified operation with over 650,000 retail & commercial customers. As of March 31, 2017. FTE = Full Time Equivalent. Eastern Caribbean Region or ECR includes United States and British Virgin Islands. Well-diversified with significant competitive strengths Eastern Caribbean Region 7% of Assets Southeast Florida 16% of Assets Aguadilla Aguada Rincón Moca Isabela Añasco Mayagüez Las Marías San Sebastián Hormigueros San Germán Lajas Cabo Rojo Guánica Sabana Grande Yauco Maricao Lares Quebradillas Camuy Hatillo Arecibo Utuado Adjuntas Peñuelas Guayanilla Ponce Juana Diaz Santa Isabel Coamo Villalba Orocovis Jayuya Ciales Morovis Corozal Naranjito Cidra Barran- quitas Aibonito Salinas Guayama Arroyo Patillas Maunabo Yabucoa Humacao Naguabo Las Piedras Juncos San Lorenzo Gurabo Ceiba Fajardo Luquillo Rio Grande Loiza Canovanas Carolina Trujillo Alto San Juan Guaynabo Bayamon Catano Toa Baja Aguas Buenas Caguas Caguas Cayey Toa Alta Dorado Vega Alta Vega Baja Manati Barceloneta Florida 1 2 2 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 7 7 2 12 11 1 3 4 3 5 3 1 1 1 1 2 2 1 1 1 1 1 1 1 1 1 1 3 3 2 1 1 1 1 1 1 1 1 2 2 2 Broward Miami Sunrise Margate Pembroke Pines Deerfield Beach Hialeah Brickell Coral Gables Doral Bird Road Pinecrest West Kendall 1 1 1 1 1 1 1 1 1 1 1 St. John St. Thomas Tortola St. Croix Frederiksted Sunny Island Orange Grove King Street Market Place East End Plaza First Bank Plaza Port of Sale Crown Bay Waterfront Road Town 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

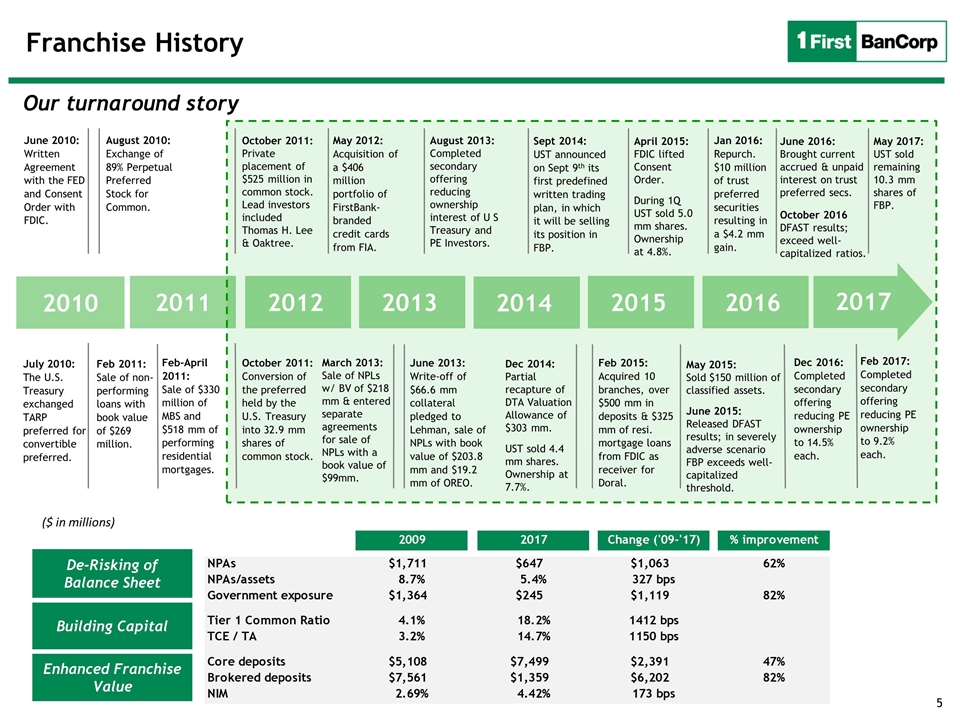

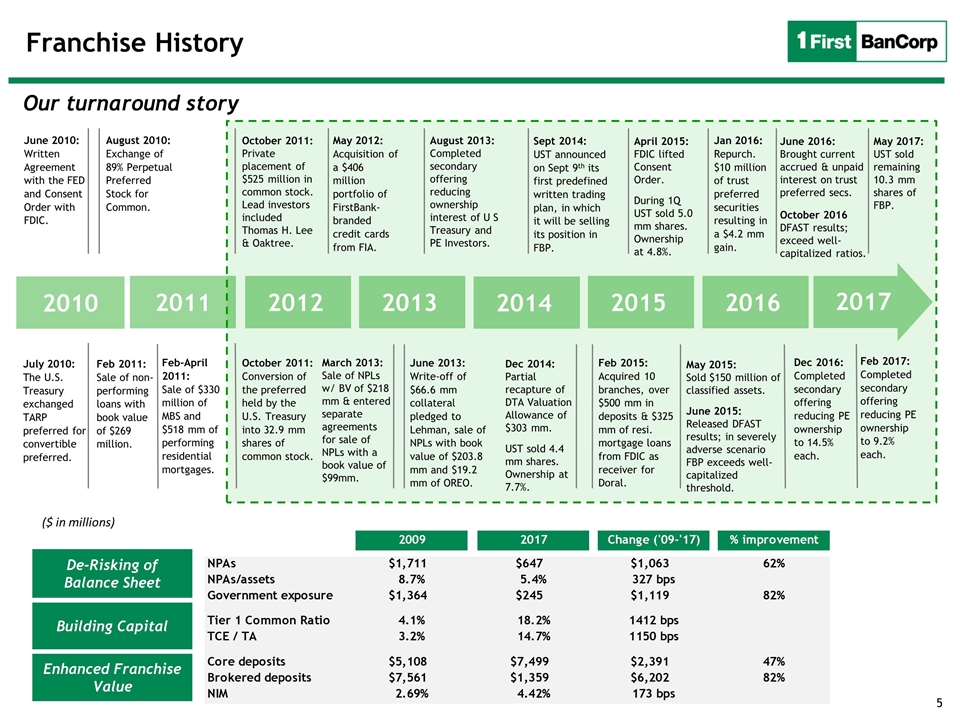

June 2010: Written Agreement with the FED and Consent Order with FDIC. July 2010: The U.S. Treasury exchanged TARP preferred for convertible preferred. August 2010: Exchange of 89% Perpetual Preferred Stock for Common. Feb 2011: Sale of non-performing loans with book value of $269 million. Feb-April 2011: Sale of $330 million of MBS and $518 mm of performing residential mortgages. March 2013: Sale of NPLs w/ BV of $218 mm & entered separate agreements for sale of NPLs with a book value of $99mm. 2010 2011 October 2011: Conversion of the preferred held by the U.S. Treasury into 32.9 mm shares of common stock. May 2012: Acquisition of a $406 million portfolio of FirstBank-branded credit cards from FIA. June 2013: Write-off of $66.6 mm collateral pledged to Lehman, sale of NPLs with book value of $203.8 mm and $19.2 mm of OREO. October 2011: Private placement of $525 million in common stock. Lead investors included Thomas H. Lee & Oaktree. August 2013: Completed secondary offering reducing ownership interest of U S Treasury and PE Investors. Sept 2014: UST announced on Sept 9th its first predefined written trading plan, in which it will be selling its position in FBP. ($ in millions) Dec 2014: Partial recapture of DTA Valuation Allowance of $303 mm. UST sold 4.4 mm shares. Ownership at 7.7%. Feb 2015: Acquired 10 branches, over $500 mm in deposits & $325 mm of resi. mortgage loans from FDIC as receiver for Doral. April 2015: FDIC lifted Consent Order. During 1Q UST sold 5.0 mm shares. Ownership at 4.8%. May 2015: Sold $150 million of classified assets. June 2015: Released DFAST results; in severely adverse scenario FBP exceeds well-capitalized threshold. Franchise History Our turnaround story De-Risking of Balance Sheet Building Capital Enhanced Franchise Value Jan 2016: Repurch. $10 million of trust preferred securities resulting in a $4.2 mm gain. June 2016: Brought current accrued & unpaid interest on trust preferred secs. October 2016 DFAST results; exceed well-capitalized ratios. 2017 2012 2013 2014 2015 Dec 2016: Completed secondary offering reducing PE ownership to 14.5% each. 2016 Feb 2017: Completed secondary offering reducing PE ownership to 9.2% each. May 2017: UST sold remaining 10.3 mm shares of FBP.

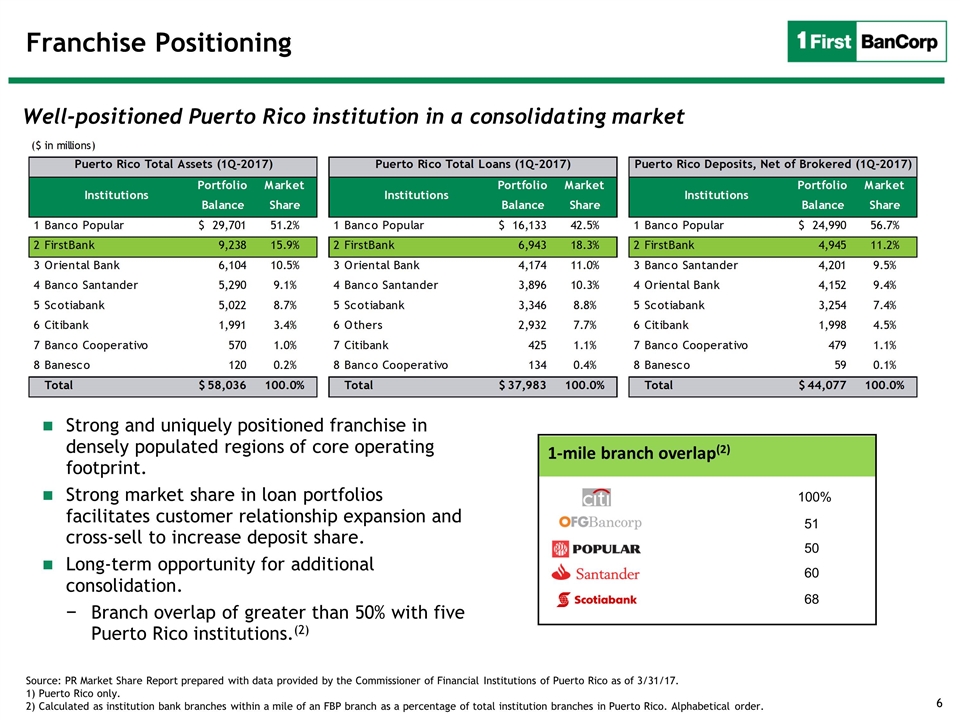

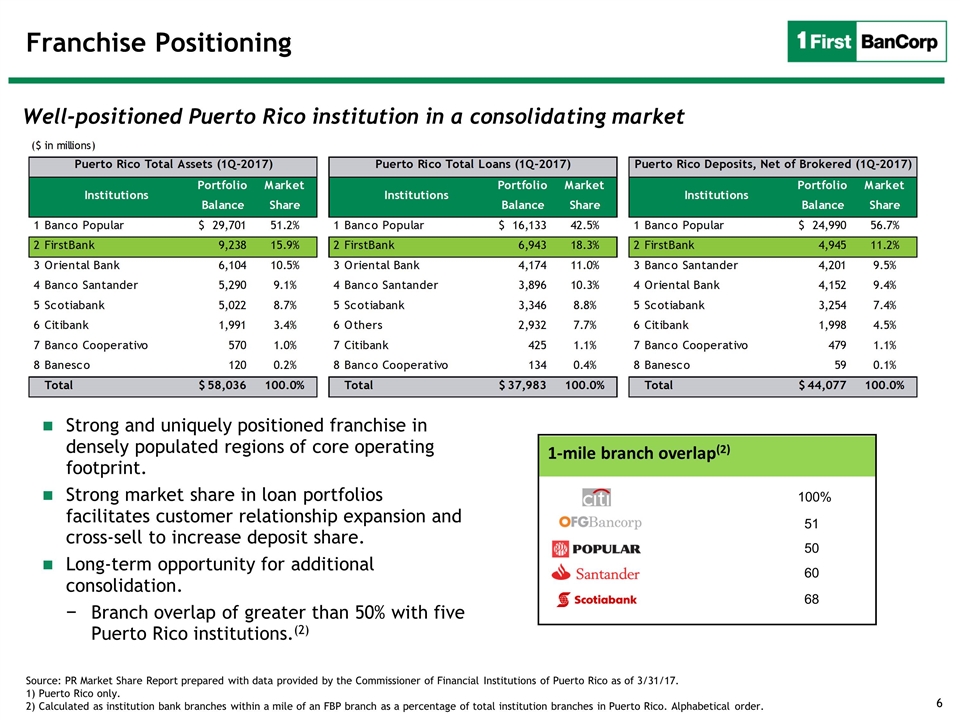

Franchise Positioning Well-positioned Puerto Rico institution in a consolidating market Source: PR Market Share Report prepared with data provided by the Commissioner of Financial Institutions of Puerto Rico as of 3/31/17. 1) Puerto Rico only. 2) Calculated as institution bank branches within a mile of an FBP branch as a percentage of total institution branches in Puerto Rico. Alphabetical order. Strong and uniquely positioned franchise in densely populated regions of core operating footprint. Strong market share in loan portfolios facilitates customer relationship expansion and cross-sell to increase deposit share. Long-term opportunity for additional consolidation. Branch overlap of greater than 50% with five Puerto Rico institutions.(2) (5) 1-mile branch overlap(2) 68 100% 60 50 51 ($ in millions) Puerto Rico Total Assets (1Q-2017) Puerto Rico Total Loans (1Q-2017) Puerto Rico Deposits, Net of Brokered (1Q-2017) Puerto Rico Branches (1Q-2017) Institutions Portfolio Balance Market Share Institutions Portfolio Balance Market Share Institutions Portfolio Balance Market Share Institutions Portfolio Balance Market Share 1 Banco Popular $29,701 0.51177030344131369 1 Banco Popular $16,132.964 0.42474278664457521 1 Banco Popular $24,990 0.56695966010552845 1 Banco Popular 171 0.53437500000000004 2 FirstBank 9,238.2080000000005 0.15918118956984517 2 FirstBank 6,943.1588468000009 0.18279695142850177 2 FirstBank 4,945.3620000000001 0.11219770942852327 2 FirstBank 48 0.15 3 Oriental Bank 6,103.92 0.10517507796308216 3 Oriental Bank 4,173.8360000000002 0.10988723049511841 3 Banco Santander 4,200.5789999999997 9.5% 3 Oriental Bank 48 0.15 4 Banco Santander 5,289.5990000000002 9.1% 4 Banco Santander 3,895.9969999999998 0.10257238673184327 4 Oriental Bank 4,151.8680000000004 9.4% 4 Banco Santander 28 8.7% 5 Scotiabank 5,021.8410000000003 8.7% 5 Scotiabank 3,345.7139999999999 8.8% 5 Scotiabank 3,254.2000000000003 7.4% 5 Scotiabank 22 6.9% 6 Citibank 1,991.840000000001 3.4% 6 Others 2,932.309999999995 7.7% 6 Citibank 1,997.9359999999999 4.5% 6 Citibank 1 .3% 7 Banco Cooperativo 570.47 .98296220667373566 7 Citibank 425.31599999999997 1.1% 7 Banco Cooperativo 478.56599999999997 1.9% 6 Banco Cooperativo 1 .3% 8 Banesco 119.68 .2% 8 Banco Cooperativo 133.886 .4% 8 Banesco 58.698999999999998 .1% 6 Banesco 1 .3% Total $58,035.802000000003 100.0% Total $37,982.902846799996 1.0000000000000002 Total $44,077.21 0.99999999999999989 Total 320 1.0000000000000002

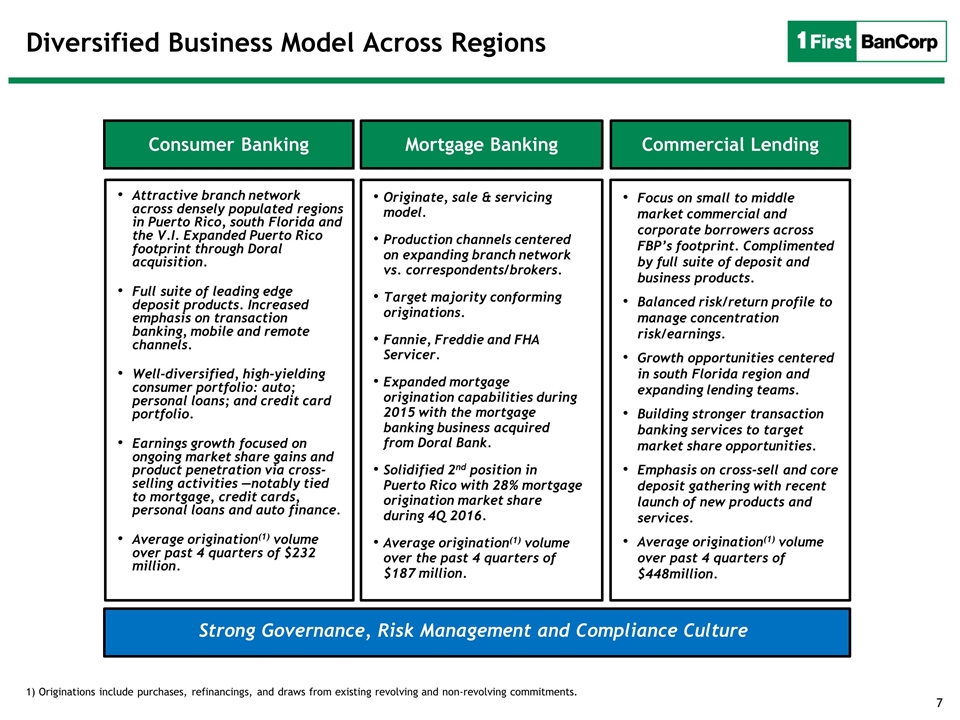

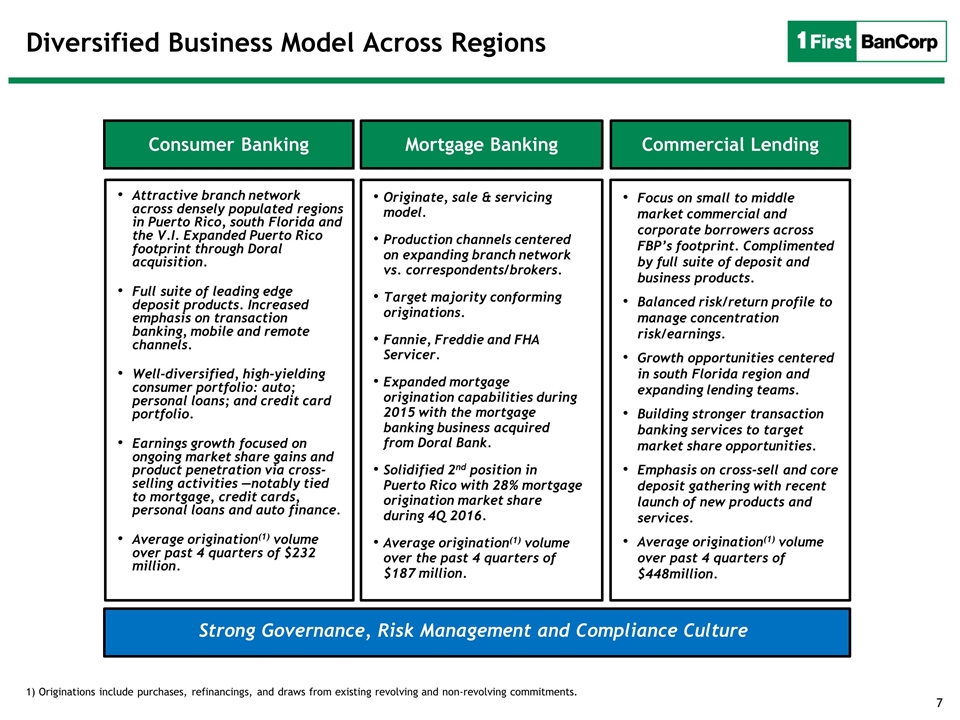

Diversified Business Model Across Regions Consumer Banking Mortgage Banking Commercial Lending Focus on small to middle market commercial and corporate borrowers across FBP’s footprint. Complimented by full suite of deposit and business products. Balanced risk/return profile to manage concentration risk/earnings. Growth opportunities centered in south Florida region and expanding lending teams. Building stronger transaction banking services to target market share opportunities. Emphasis on cross-sell and core deposit gathering with recent launch of new products and services. Average origination(1) volume over past 4 quarters of $448million. Originate, sale & servicing model. Production channels centered on expanding branch network vs. correspondents/brokers. Target majority conforming originations. Fannie, Freddie and FHA Servicer. Expanded mortgage origination capabilities during 2015 with the mortgage banking business acquired from Doral Bank. Solidified 2nd position in Puerto Rico with 28% mortgage origination market share during 4Q 2016. Average origination(1) volume over the past 4 quarters of $187 million. Attractive branch network across densely populated regions in Puerto Rico, south Florida and the V.I. Expanded Puerto Rico footprint through Doral acquisition. Full suite of leading edge deposit products. Increased emphasis on transaction banking, mobile and remote channels. Well-diversified, high-yielding consumer portfolio: auto; personal loans; and credit card portfolio. Earnings growth focused on ongoing market share gains and product penetration via cross-selling activities —notably tied to mortgage, credit cards, personal loans and auto finance. Average origination(1) volume over past 4 quarters of $232 million. Strong Governance, Risk Management and Compliance Culture 1) Originations include purchases, refinancings, and draws from existing revolving and non-revolving commitments.

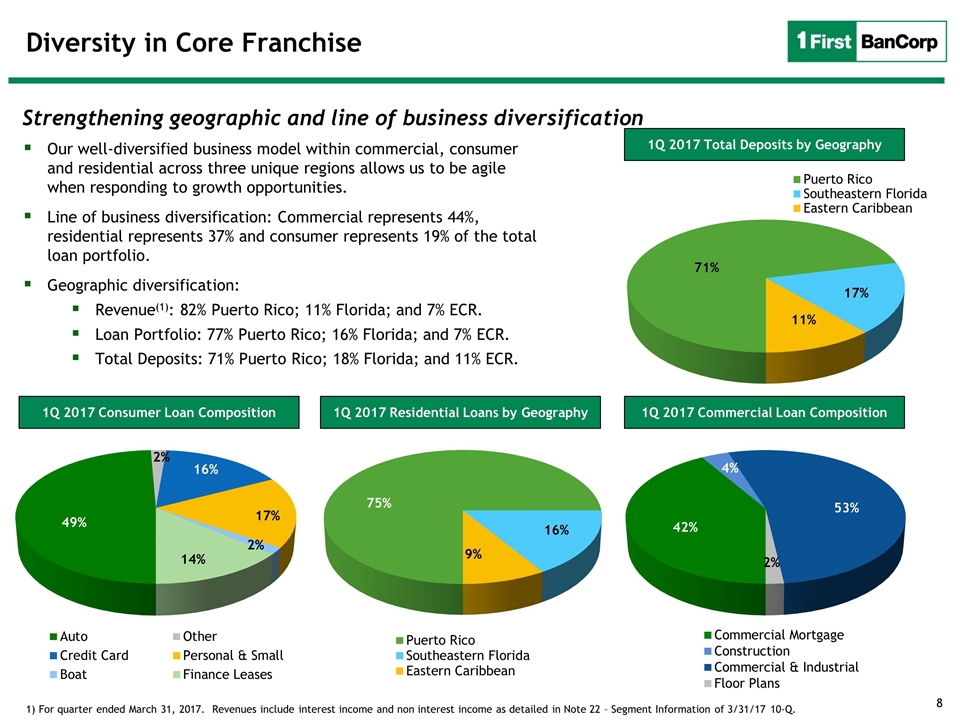

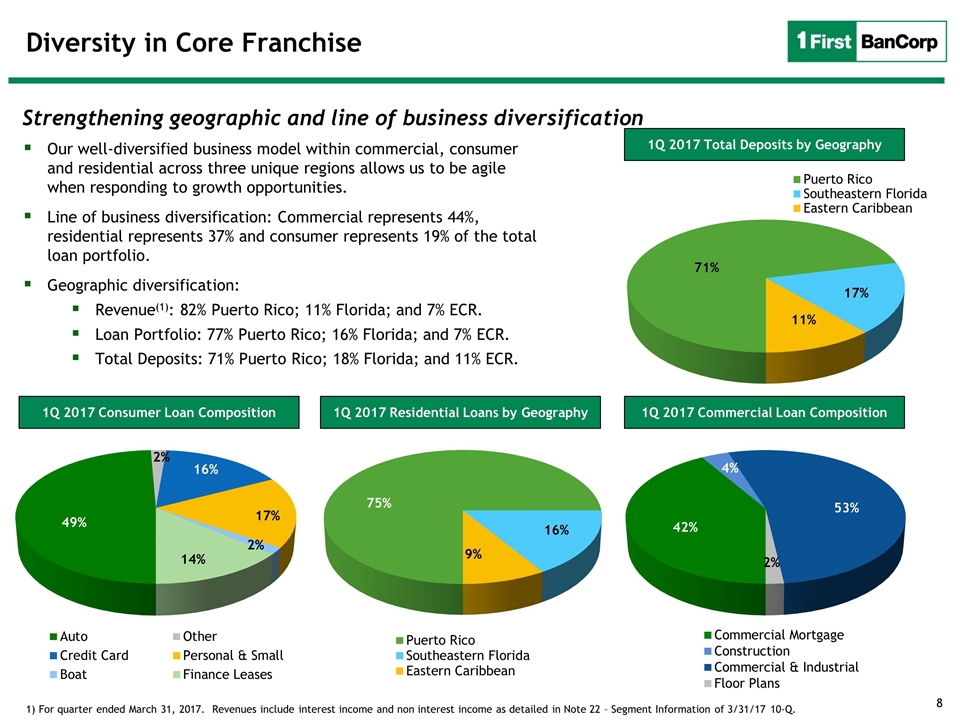

Our well-diversified business model within commercial, consumer and residential across three unique regions allows us to be agile when responding to growth opportunities. Line of business diversification: Commercial represents 44%, residential represents 37% and consumer represents 19% of the total loan portfolio. Geographic diversification: Revenue(1): 82% Puerto Rico; 11% Florida; and 7% ECR. Loan Portfolio: 77% Puerto Rico; 16% Florida; and 7% ECR. Total Deposits: 71% Puerto Rico; 18% Florida; and 11% ECR. Diversity in Core Franchise Strengthening geographic and line of business diversification 1Q 2017 Total Deposits by Geography 1) For quarter ended March 31, 2017. Revenues include interest income and non interest income as detailed in Note 22 – Segment Information of 3/31/17 10-Q. 1Q 2017 Consumer Loan Composition 1Q 2017 Residential Loans by Geography 1Q 2017 Commercial Loan Composition

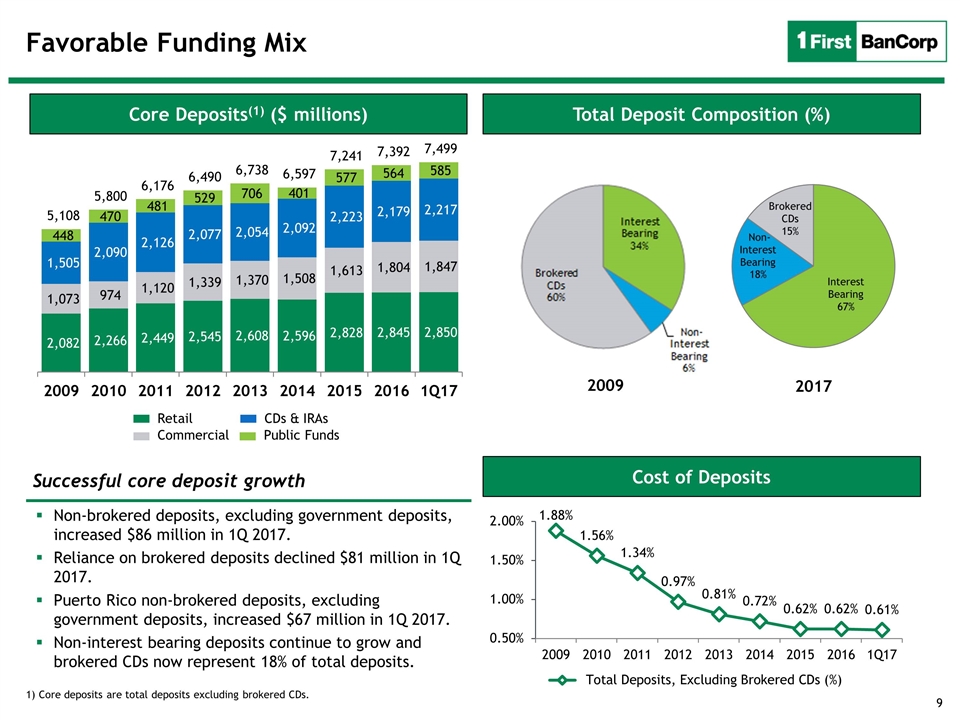

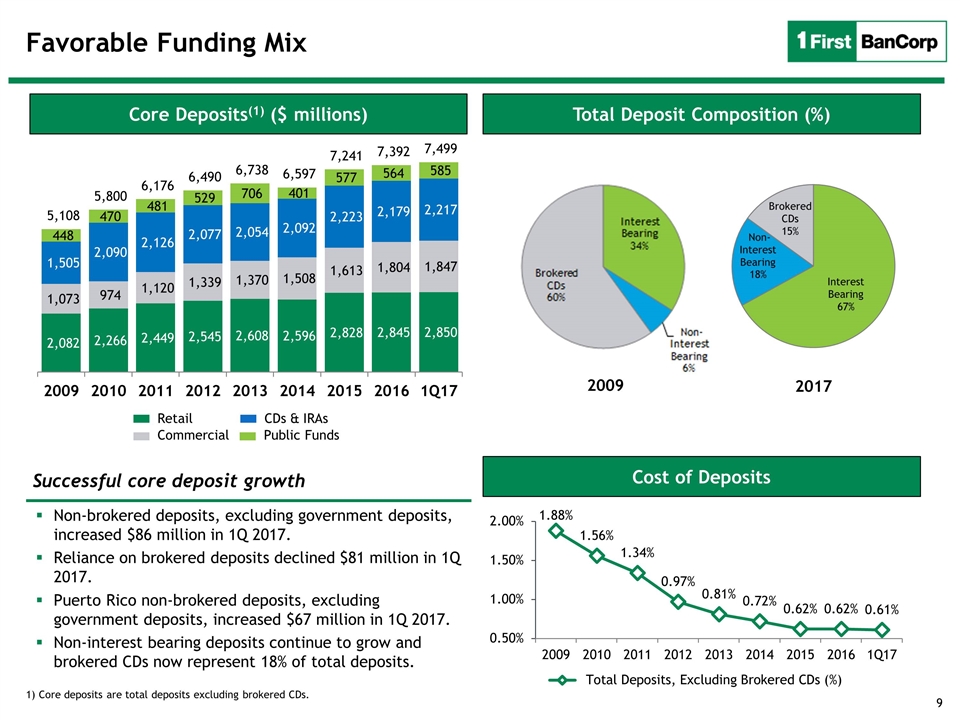

Total Deposit Composition (%) Core Deposits(1) ($ millions) 1) Core deposits are total deposits excluding brokered CDs. Non-brokered deposits, excluding government deposits, increased $86 million in 1Q 2017. Reliance on brokered deposits declined $81 million in 1Q 2017. Puerto Rico non-brokered deposits, excluding government deposits, increased $67 million in 1Q 2017. Non-interest bearing deposits continue to grow and brokered CDs now represent 18% of total deposits. Successful core deposit growth Retail Commercial CDs & IRAs Public Funds 2009 2017 Cost of Deposits Favorable Funding Mix

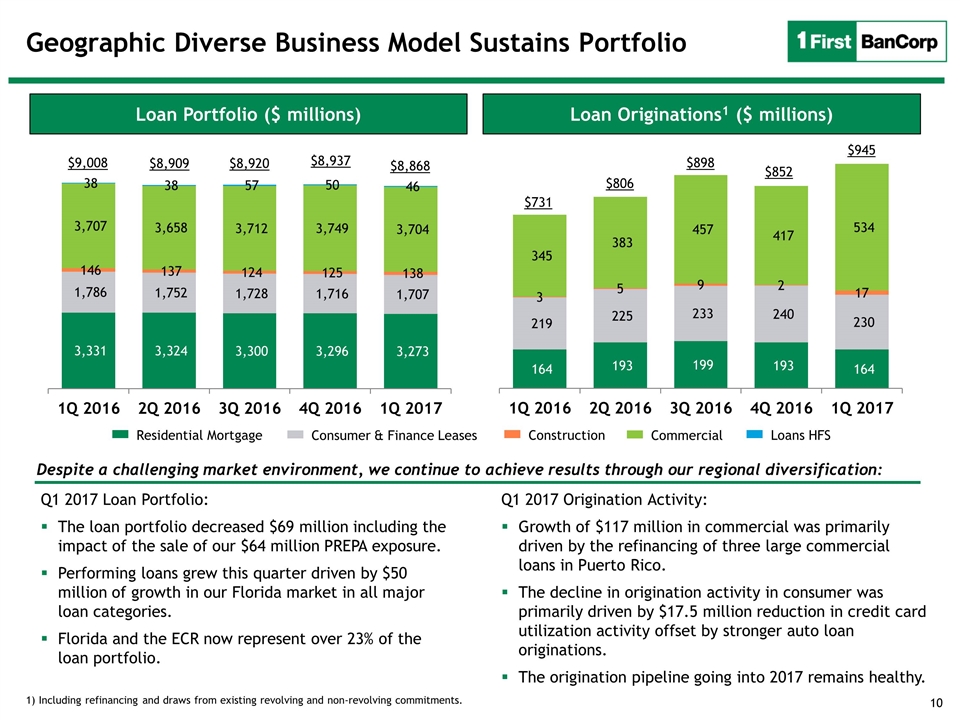

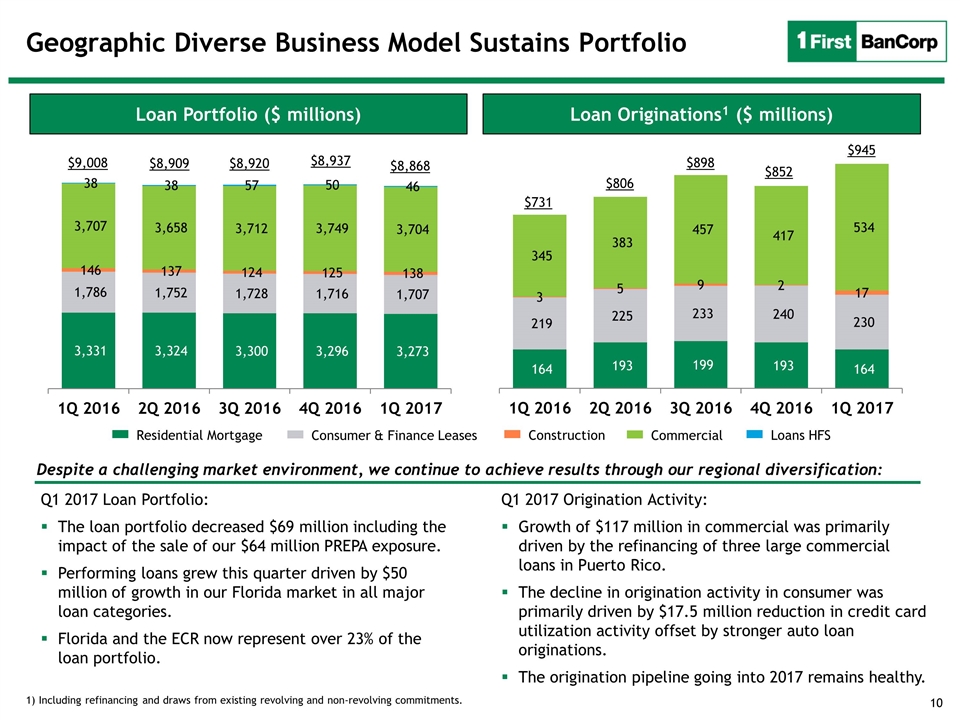

Geographic Diverse Business Model Sustains Portfolio 1) Including refinancing and draws from existing revolving and non-revolving commitments. Loan Originations1 ($ millions) Loan Portfolio ($ millions) Residential Mortgage Consumer & Finance Leases Construction Commercial Loans HFS Despite a challenging market environment, we continue to achieve results through our regional diversification: Q1 2017 Loan Portfolio: The loan portfolio decreased $69 million including the impact of the sale of our $64 million PREPA exposure. Performing loans grew this quarter driven by $50 million of growth in our Florida market in all major loan categories. Florida and the ECR now represent over 23% of the loan portfolio. Q1 2017 Origination Activity: Growth of $117 million in commercial was primarily driven by the refinancing of three large commercial loans in Puerto Rico. The decline in origination activity in consumer was primarily driven by $17.5 million reduction in credit card utilization activity offset by stronger auto loan originations. The origination pipeline going into 2017 remains healthy. $898 $9,008 $731 $8,909 $806 $8,920 $8,937 $8,868 $852 $945

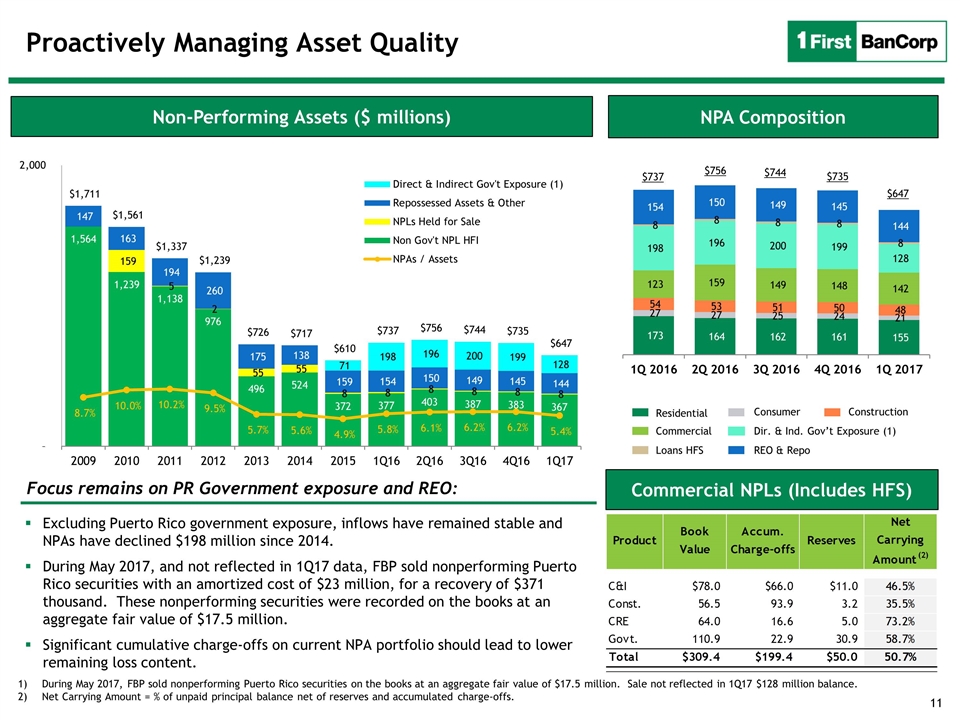

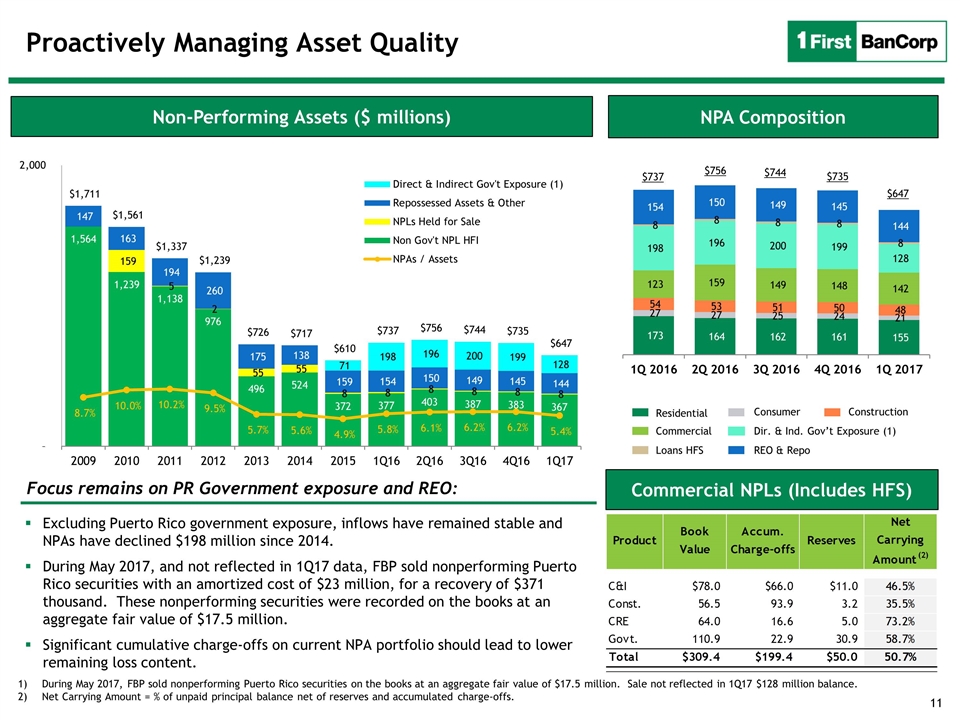

Non-Performing Assets ($ millions) Excluding Puerto Rico government exposure, inflows have remained stable and NPAs have declined $198 million since 2014. During May 2017, and not reflected in 1Q17 data, FBP sold nonperforming Puerto Rico securities with an amortized cost of $23 million, for a recovery of $371 thousand. These nonperforming securities were recorded on the books at an aggregate fair value of $17.5 million. Significant cumulative charge-offs on current NPA portfolio should lead to lower remaining loss content. Focus remains on PR Government exposure and REO: Proactively Managing Asset Quality Commercial NPLs (Includes HFS) NPA Composition Residential Consumer Construction Commercial Loans HFS REO & Repo $647 $756 $737 Dir. & Ind. Gov’t Exposure (1) $744 During May 2017, FBP sold nonperforming Puerto Rico securities on the books at an aggregate fair value of $17.5 million. Sale not reflected in 1Q17 $128 million balance. Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. $735

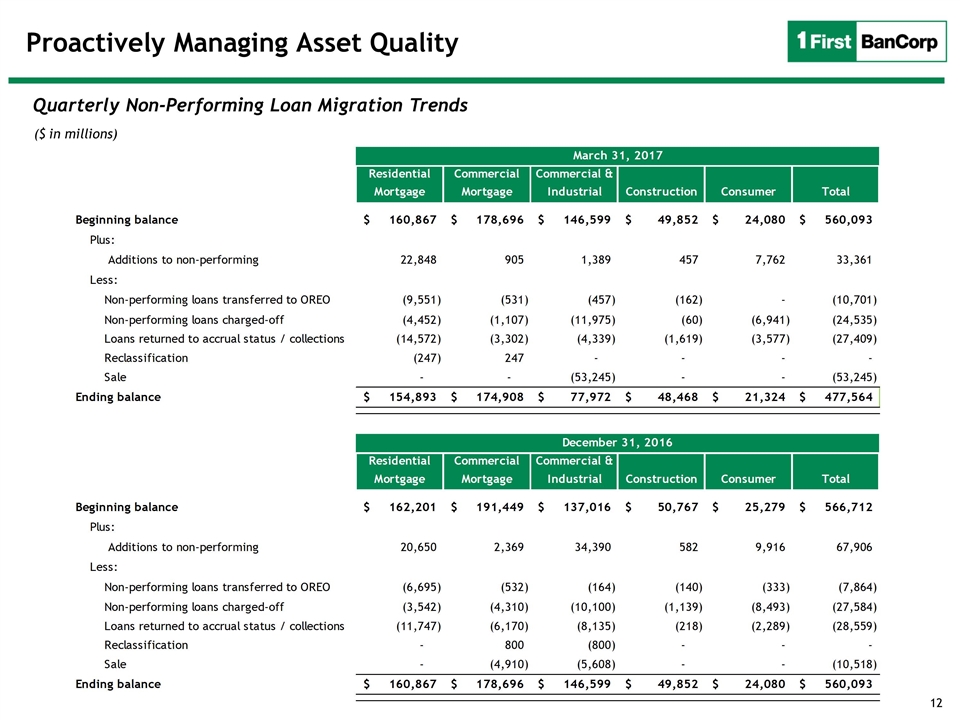

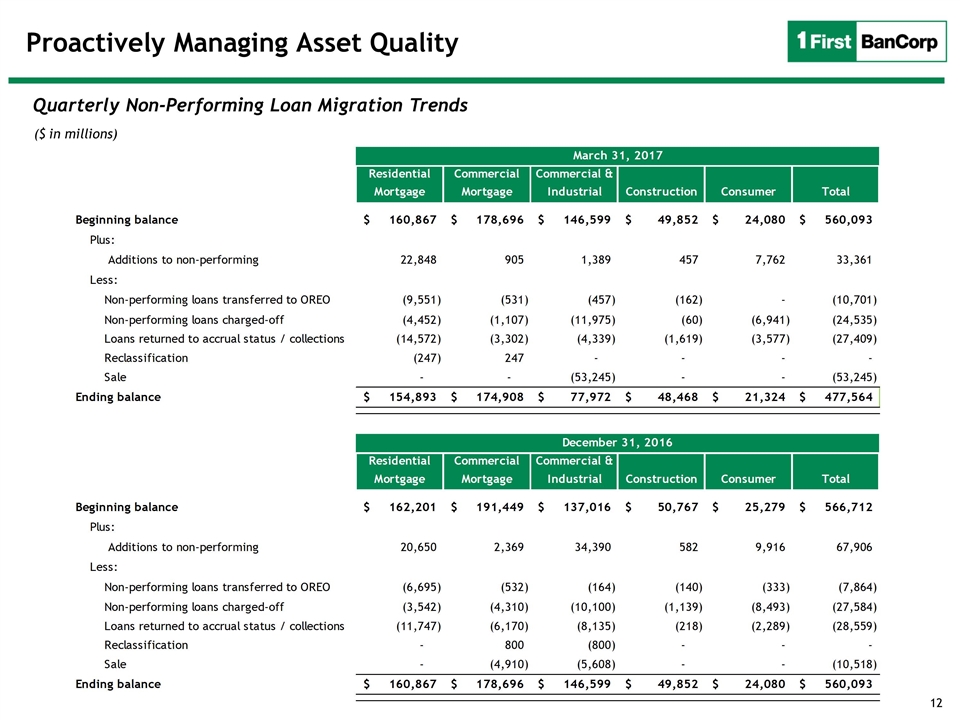

Proactively Managing Asset Quality Quarterly Non-Performing Loan Migration Trends ($ in millions)

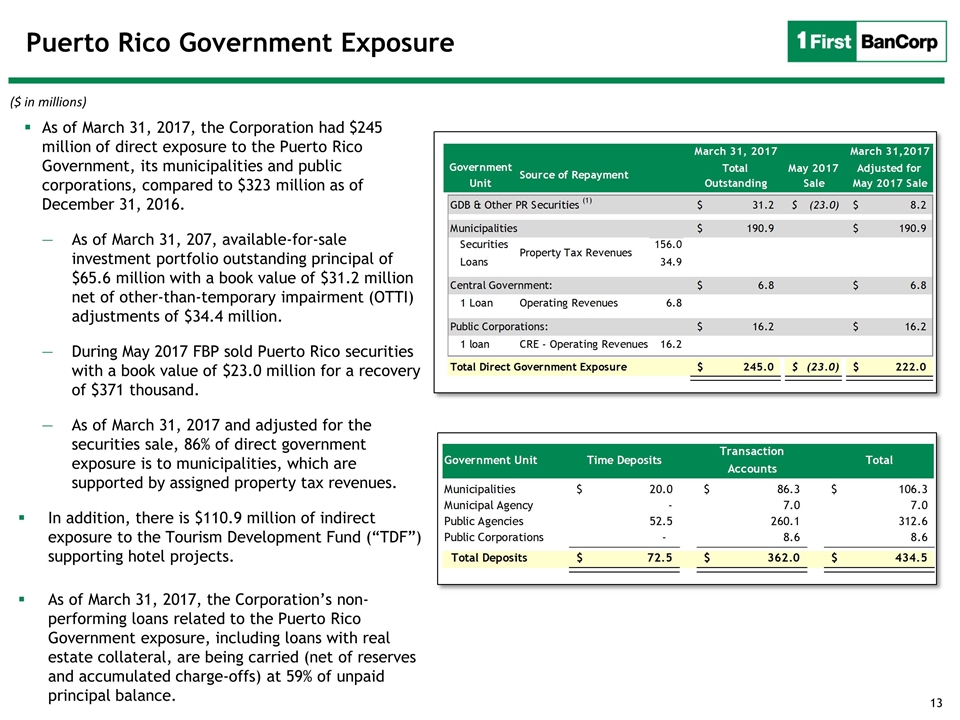

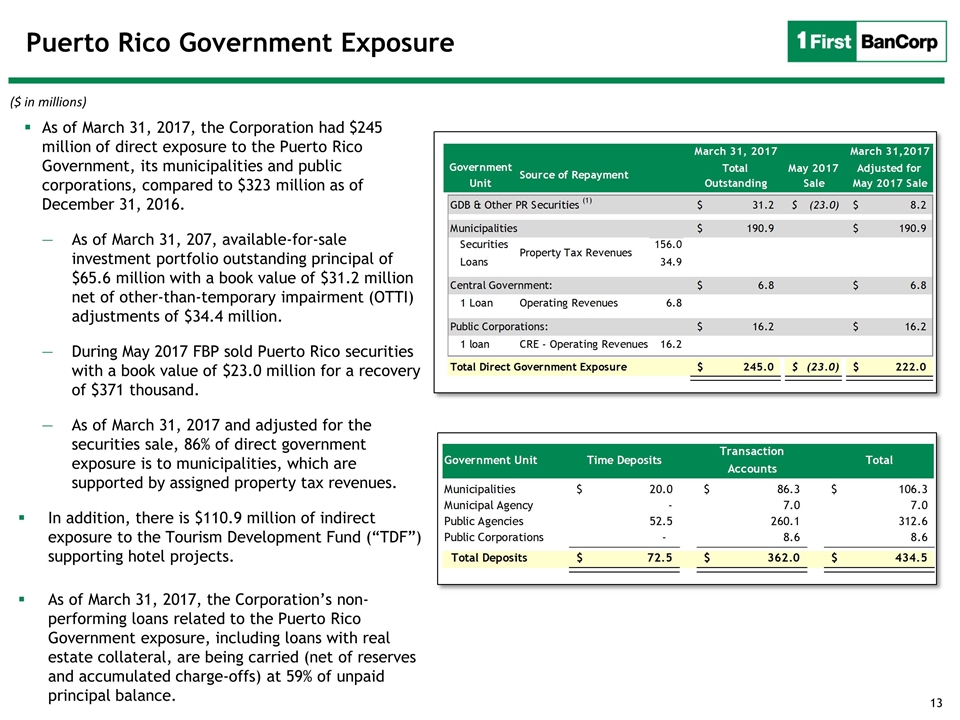

Puerto Rico Government Exposure ($ in millions) As of March 31, 2017, the Corporation had $245 million of direct exposure to the Puerto Rico Government, its municipalities and public corporations, compared to $323 million as of December 31, 2016. As of March 31, 207, available-for-sale investment portfolio outstanding principal of $65.6 million with a book value of $31.2 million net of other-than-temporary impairment (OTTI) adjustments of $34.4 million. During May 2017 FBP sold Puerto Rico securities with a book value of $23.0 million for a recovery of $371 thousand. As of March 31, 2017 and adjusted for the securities sale, 86% of direct government exposure is to municipalities, which are supported by assigned property tax revenues. In addition, there is $110.9 million of indirect exposure to the Tourism Development Fund (“TDF”) supporting hotel projects. As of March 31, 2017, the Corporation’s non-performing loans related to the Puerto Rico Government exposure, including loans with real estate collateral, are being carried (net of reserves and accumulated charge-offs) at 59% of unpaid principal balance.

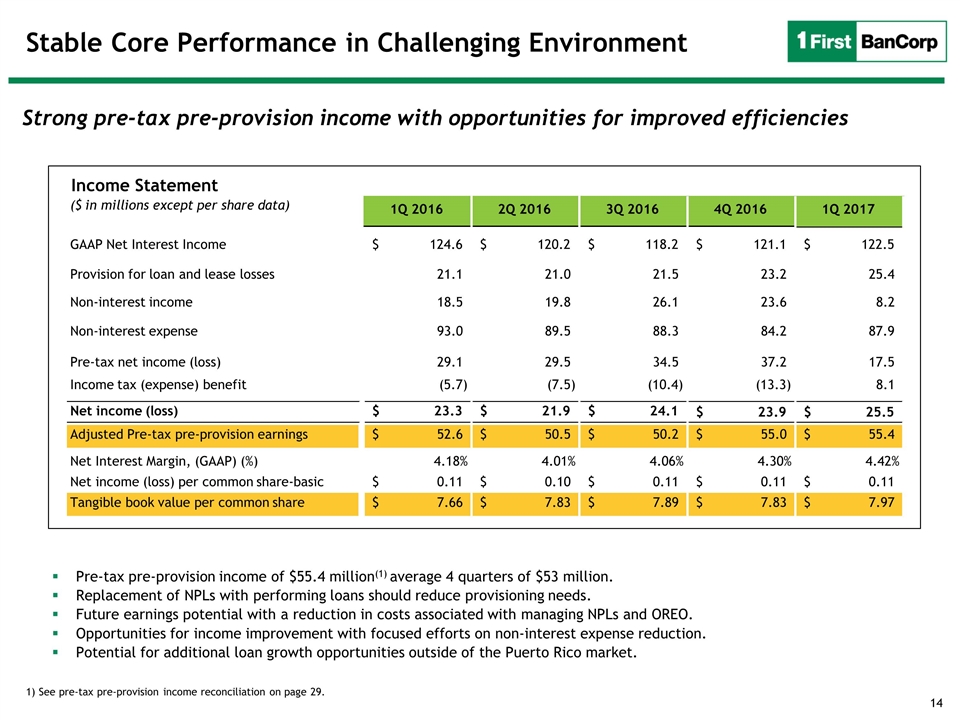

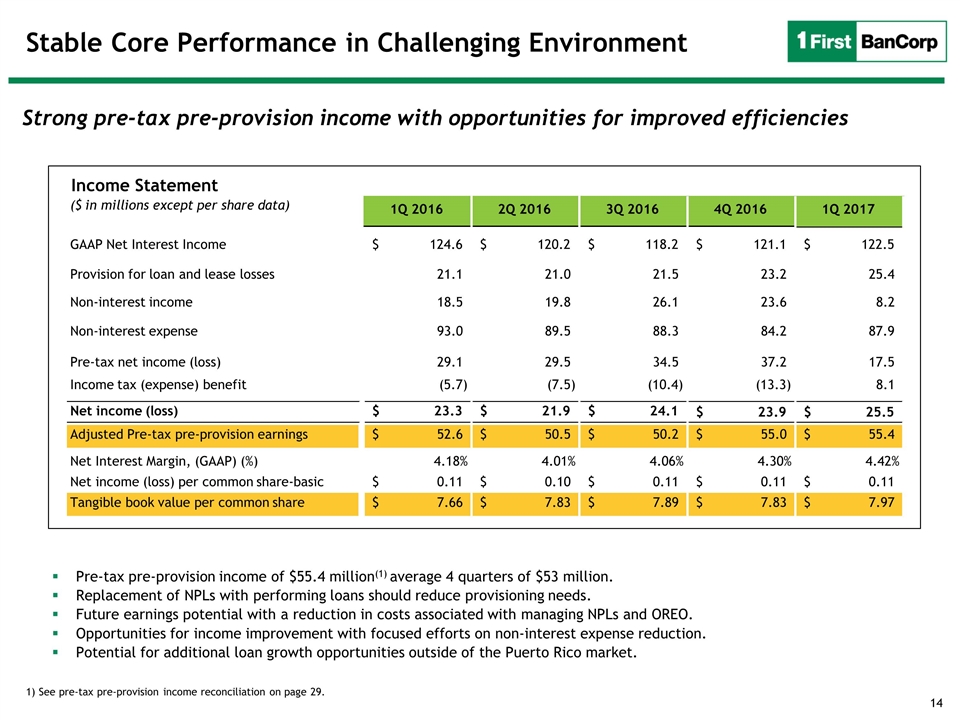

Stable Core Performance in Challenging Environment Pre-tax pre-provision income of $55.4 million(1) average 4 quarters of $53 million. Replacement of NPLs with performing loans should reduce provisioning needs. Future earnings potential with a reduction in costs associated with managing NPLs and OREO. Opportunities for income improvement with focused efforts on non-interest expense reduction. Potential for additional loan growth opportunities outside of the Puerto Rico market. Strong pre-tax pre-provision income with opportunities for improved efficiencies 1) See pre-tax pre-provision income reconciliation on page 29. Income Statement ($ in millions except per share data) 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 GAAP Net Interest Income 124.6 $ 120.2 $ 118.2 $ 121.1 $ 122.5 $ Provision for loan and lease losses 21.1 21.0 21.5 23.2 25.4 Non-interest income 18.5 19.8 26.1 23.6 8.2 Non-interest expense 93.0 89.5 88.3 84.2 87.9 Pre-tax net income (loss) 29.1 29.5 34.5 37.2 17.5 Income tax (expense) benefit (5.7) (7.5) (10.4) (13.3) 8.1 Net income (loss) 23.3 $ 21.9 $ 24.1 $ 23.9 $ 25.5 $ Adjusted Pre-tax pre-provision earnings 52.6 $ 50.5 $ 50.2 $ 55.0 $ 55.4 $ Net Interest Margin, (GAAP) (%) 4.18% 4.01% 4.06% 4.30% 4.42% Net income (loss) per common share-basic 0.11 $ 0.10 $ 0.11 $ 0.11 $ 0.11 $ Tangible book value per common share 7.66 $ 7.83 $ 7.89 $ 7.83 $ 7.97 $

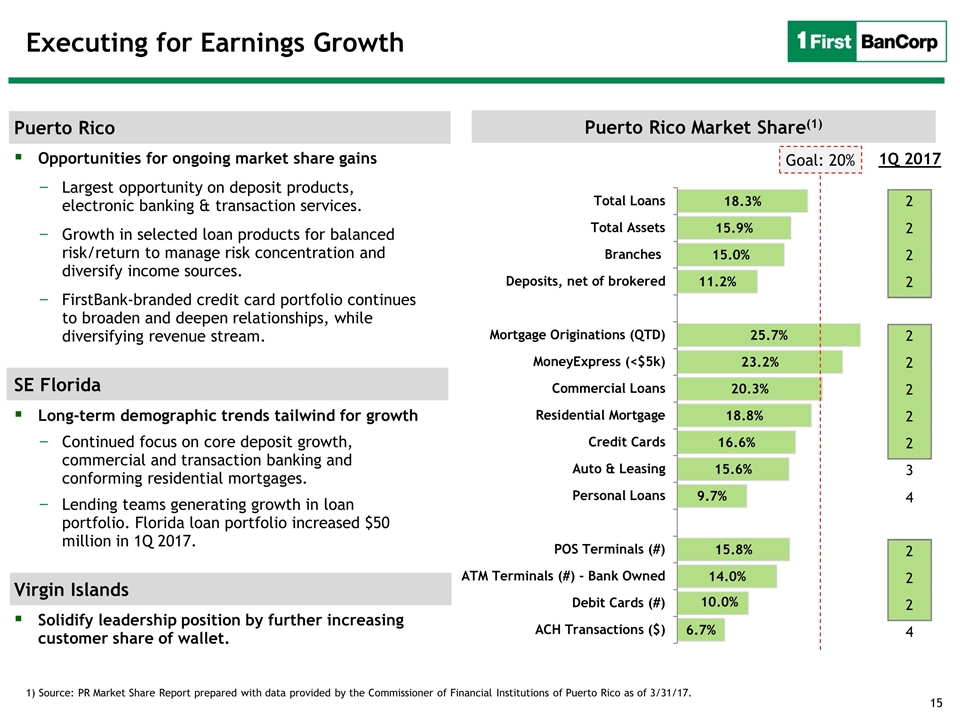

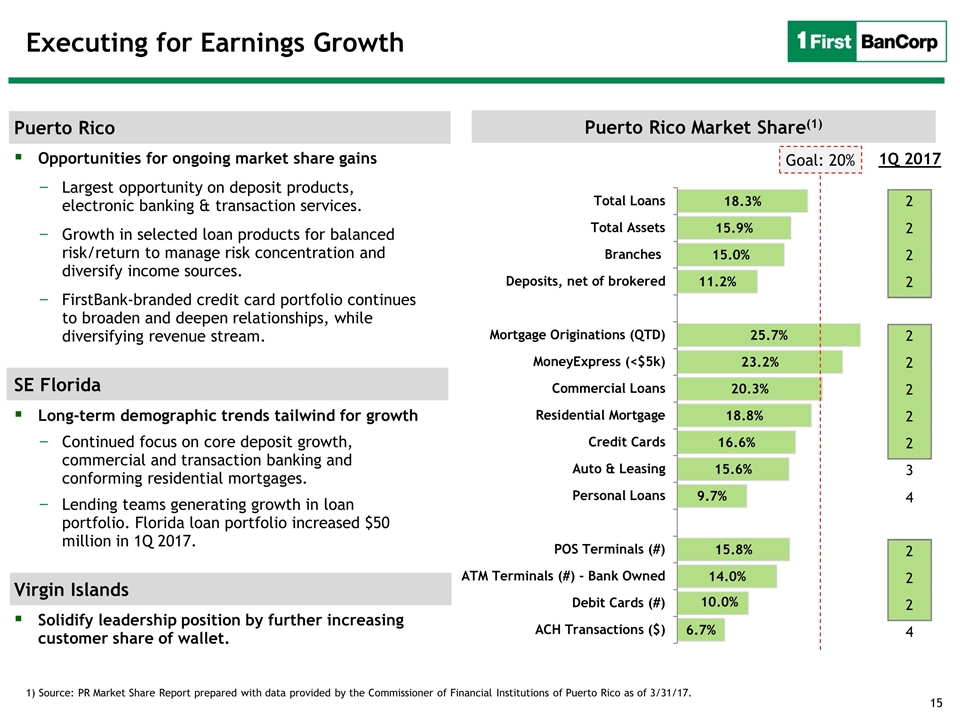

Executing for Earnings Growth Puerto Rico Opportunities for ongoing market share gains Largest opportunity on deposit products, electronic banking & transaction services. Growth in selected loan products for balanced risk/return to manage risk concentration and diversify income sources. FirstBank-branded credit card portfolio continues to broaden and deepen relationships, while diversifying revenue stream. SE Florida Long-term demographic trends tailwind for growth Continued focus on core deposit growth, commercial and transaction banking and conforming residential mortgages. Lending teams generating growth in loan portfolio. Florida loan portfolio increased $50 million in 1Q 2017. Virgin Islands Solidify leadership position by further increasing customer share of wallet. Puerto Rico Market Share(1) 1) Source: PR Market Share Report prepared with data provided by the Commissioner of Financial Institutions of Puerto Rico as of 3/31/17. Puerto Rico Market Share(1) 1Q 2017 Goal: 20% Q12017 2 2 2 2 2 2 2 2 2 3 4 2 2 2 4

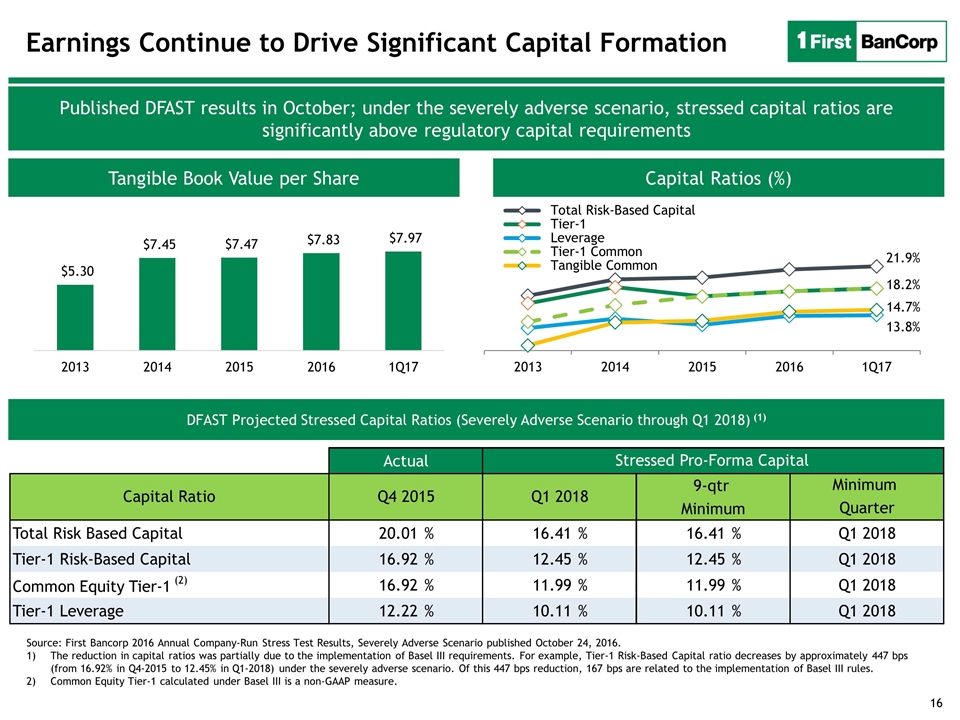

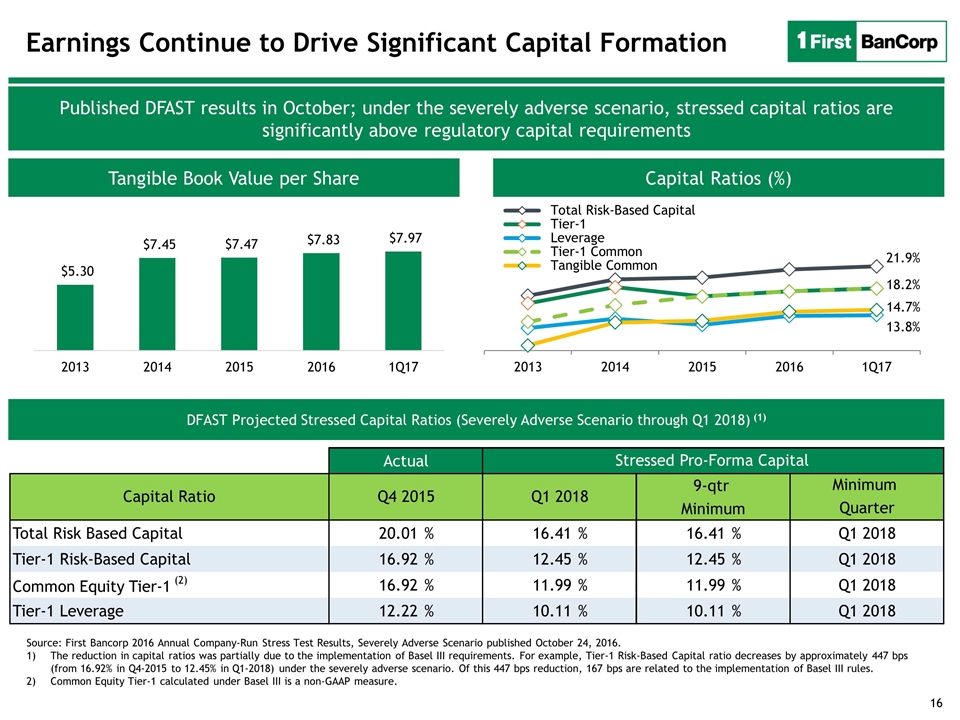

Earnings Continue to Drive Significant Capital Formation Tangible Book Value per Share Capital Ratios (%) Published DFAST results in October; under the severely adverse scenario, stressed capital ratios are significantly above regulatory capital requirements DFAST Projected Stressed Capital Ratios (Severely Adverse Scenario through Q1 2018) (1) Source: First Bancorp 2016 Annual Company-Run Stress Test Results, Severely Adverse Scenario published October 24, 2016. The reduction in capital ratios was partially due to the implementation of Basel III requirements. For example, Tier-1 Risk-Based Capital ratio decreases by approximately 447 bps (from 16.92% in Q4-2015 to 12.45% in Q1-2018) under the severely adverse scenario. Of this 447 bps reduction, 167 bps are related to the implementation of Basel III rules. Common Equity Tier-1 calculated under Basel III is a non-GAAP measure. Actual 9-qtr Minimum Minimum Quarter Total Risk Based Capital 20.01 % 16.41 % 16.41 % Q1 2018 Tier-1 Risk-Based Capital 16.92 % 12.45 % 12.45 % Q1 2018 Common Equity Tier-1 (2) 16.92 % 11.99 % 11.99 % Q1 2018 Tier-1 Leverage 12.22 % 10.11 % 10.11 % Q1 2018 Stressed Pro-Forma Capital Capital Ratio Q4 2015 Q1 2018

Stronger Franchise: Proven Success Implementing Strategic Plan Turnaround well underway highlighted by improving operating performance. Successfully navigating challenging operating environment; capturing market share and increasing profitability. Experienced, cohesive leadership team committed to enhancing shareholder value and maintaining our reputation as a highly regarded financial institution in all of the markets we serve. Scaling our franchise, achieving ongoing efficiency gains and improving our operating results are our clear priorities. Maintaining a strong capital base and managing risk remain central to our operating philosophy. Growth opportunities in Puerto Rico and U.S. mainland. Continued robust capital formation and profitability with increasing TBV and capital ratios; strong DFAST results in October 2016.

Exhibits

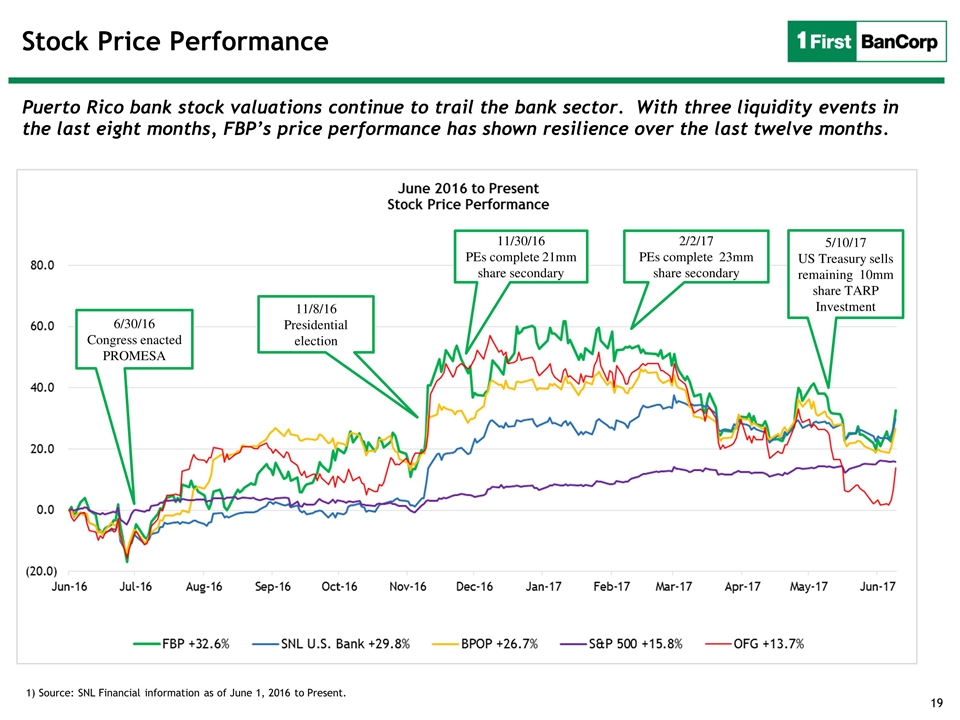

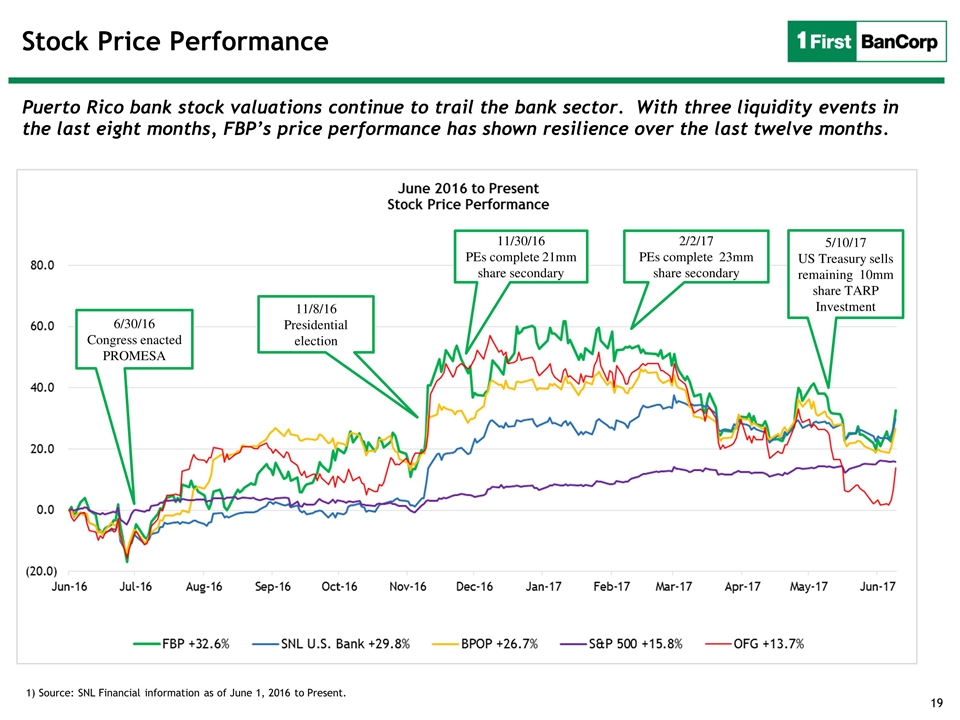

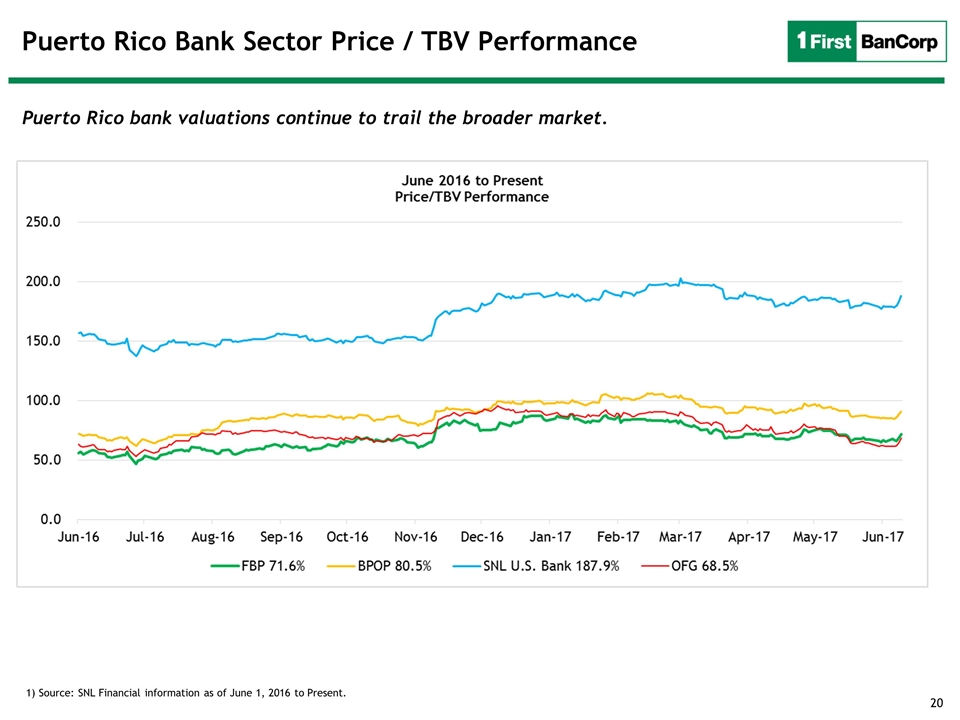

Stock Price Performance 19 6/30/16 Congress enacted PROMESA 11/30/16 PEs complete 21mm share secondary 2/2/17 PEs complete 23mm share secondary 5/10/17 US Treasury sells remaining 10mm share TARP Investment 11/8/16 Presidential election Puerto Rico bank stock valuations continue to trail the bank sector. With three liquidity events in the last eight months, FBP’s price performance has shown resilience over the last twelve months. 1) Source: SNL Financial information as of June 1, 2016 to Present.

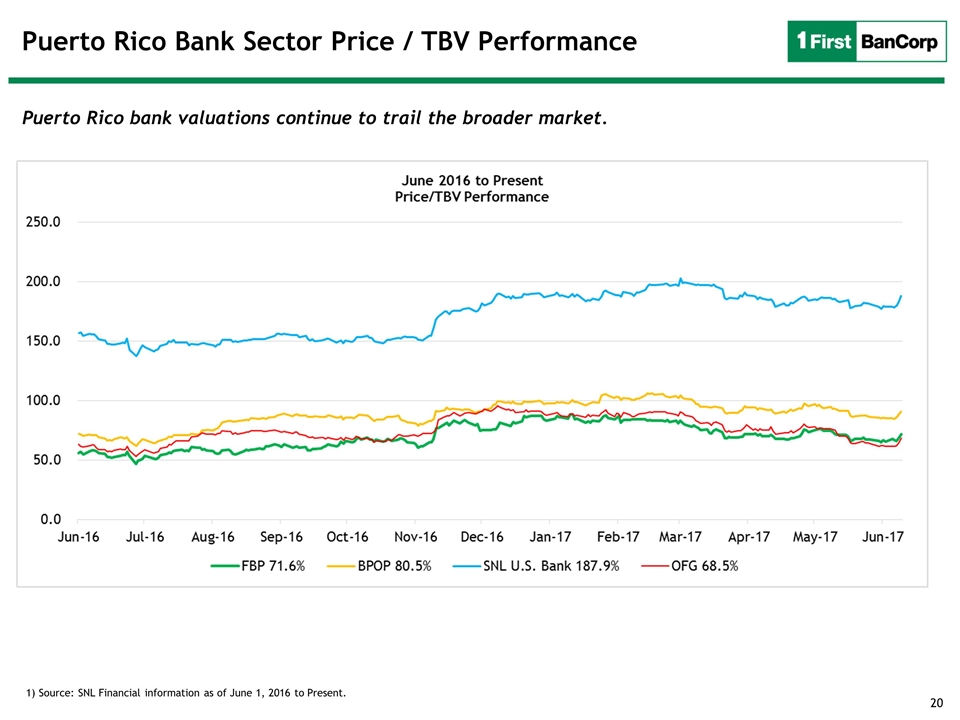

Puerto Rico Bank Sector Price / TBV Performance 20 Puerto Rico bank valuations continue to trail the broader market. 1) Source: SNL Financial information as of June 1, 2016 to Present.

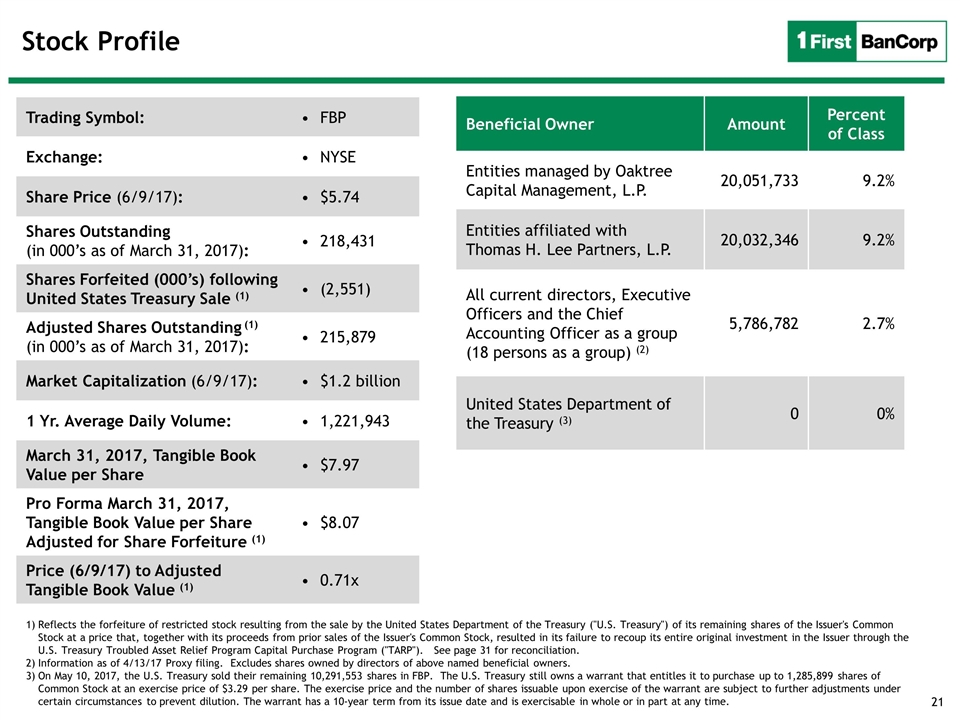

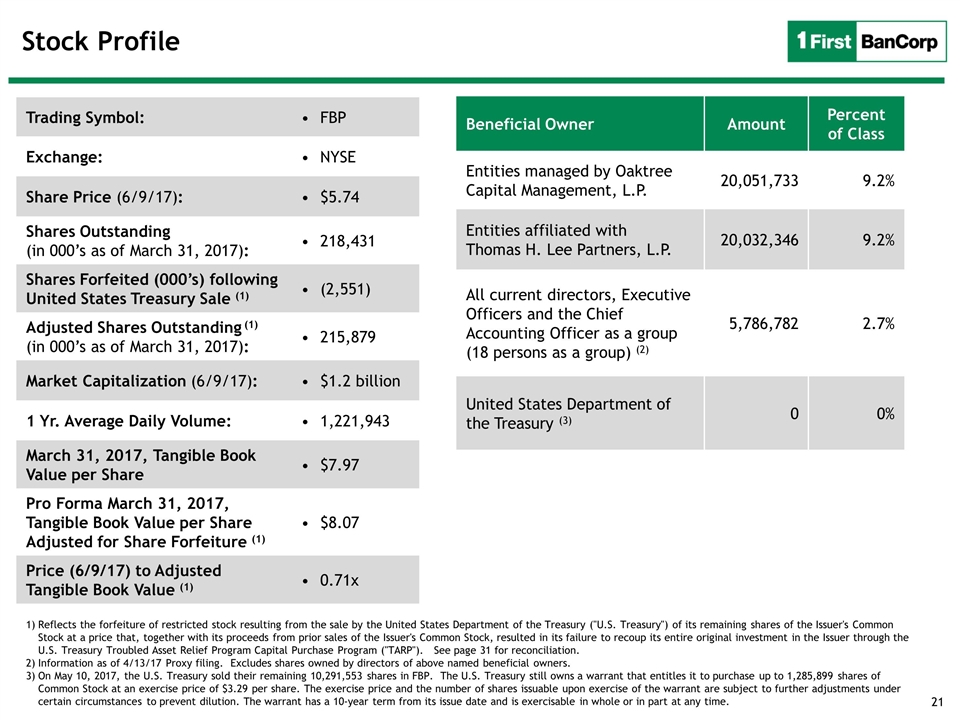

Stock Profile Trading Symbol: FBP Exchange: NYSE Share Price (6/9/17): $5.74 Shares Outstanding (in 000’s as of March 31, 2017): 218,431 Shares Forfeited (000’s) following United States Treasury Sale (1) (2,551) Adjusted Shares Outstanding (1) (in 000’s as of March 31, 2017): 215,879 Market Capitalization (6/9/17): $1.2 billion 1 Yr. Average Daily Volume: 1,221,943 March 31, 2017, Tangible Book Value per Share $7.97 Pro Forma March 31, 2017, Tangible Book Value per Share Adjusted for Share Forfeiture (1) $8.07 Price (6/9/17) to Adjusted Tangible Book Value (1) 0.71x Reflects the forfeiture of restricted stock resulting from the sale by the United States Department of the Treasury ("U.S. Treasury") of its remaining shares of the Issuer's Common Stock at a price that, together with its proceeds from prior sales of the Issuer's Common Stock, resulted in its failure to recoup its entire original investment in the Issuer through the U.S. Treasury Troubled Asset Relief Program Capital Purchase Program ("TARP"). See page 31 for reconciliation. Information as of 4/13/17 Proxy filing. Excludes shares owned by directors of above named beneficial owners. On May 10, 2017, the U.S. Treasury sold their remaining 10,291,553 shares in FBP. The U.S. Treasury still owns a warrant that entitles it to purchase up to 1,285,899 shares of Common Stock at an exercise price of $3.29 per share. The exercise price and the number of shares issuable upon exercise of the warrant are subject to further adjustments under certain circumstances to prevent dilution. The warrant has a 10-year term from its issue date and is exercisable in whole or in part at any time. Beneficial Owner Amount Percent of Class Entities managed by Oaktree Capital Management, L.P. 20,051,733 9.2% Entities affiliated with Thomas H. Lee Partners, L.P. 20,032,346 9.2% All current directors, Executive Officers and the Chief Accounting Officer as a group (18 persons as a group) (2) 5,786,782 2.7% United States Department of the Treasury (3) 0 0% 21

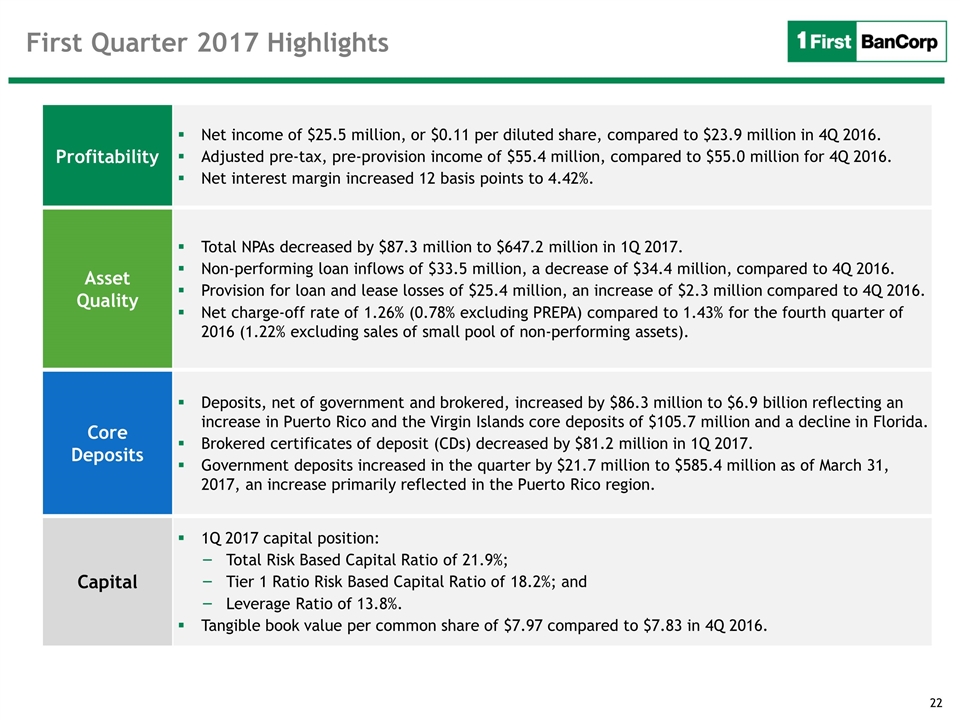

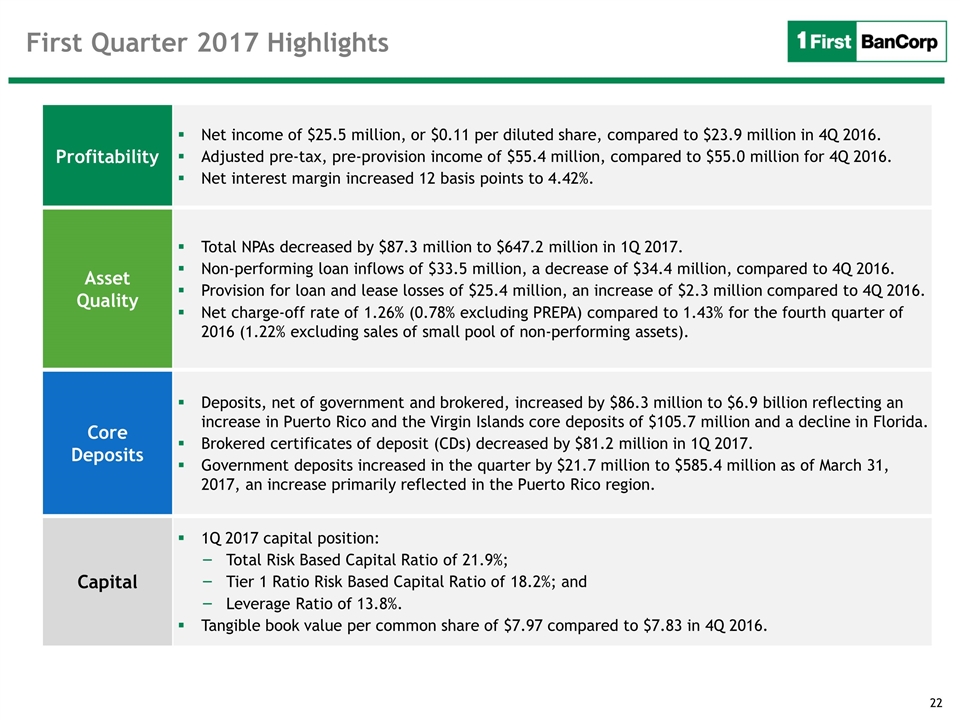

Profitability Net income of $25.5 million, or $0.11 per diluted share, compared to $23.9 million in 4Q 2016. Adjusted pre-tax, pre-provision income of $55.4 million, compared to $55.0 million for 4Q 2016. Net interest margin increased 12 basis points to 4.42%. Asset Quality Total NPAs decreased by $87.3 million to $647.2 million in 1Q 2017. Non-performing loan inflows of $33.5 million, a decrease of $34.4 million, compared to 4Q 2016. Provision for loan and lease losses of $25.4 million, an increase of $2.3 million compared to 4Q 2016. Net charge-off rate of 1.26% (0.78% excluding PREPA) compared to 1.43% for the fourth quarter of 2016 (1.22% excluding sales of small pool of non-performing assets). Core Deposits Deposits, net of government and brokered, increased by $86.3 million to $6.9 billion reflecting an increase in Puerto Rico and the Virgin Islands core deposits of $105.7 million and a decline in Florida. Brokered certificates of deposit (CDs) decreased by $81.2 million in 1Q 2017. Government deposits increased in the quarter by $21.7 million to $585.4 million as of March 31, 2017, an increase primarily reflected in the Puerto Rico region. Capital 1Q 2017 capital position: Total Risk Based Capital Ratio of 21.9%; Tier 1 Ratio Risk Based Capital Ratio of 18.2%; and Leverage Ratio of 13.8%. Tangible book value per common share of $7.97 compared to $7.83 in 4Q 2016. First Quarter 2017 Highlights

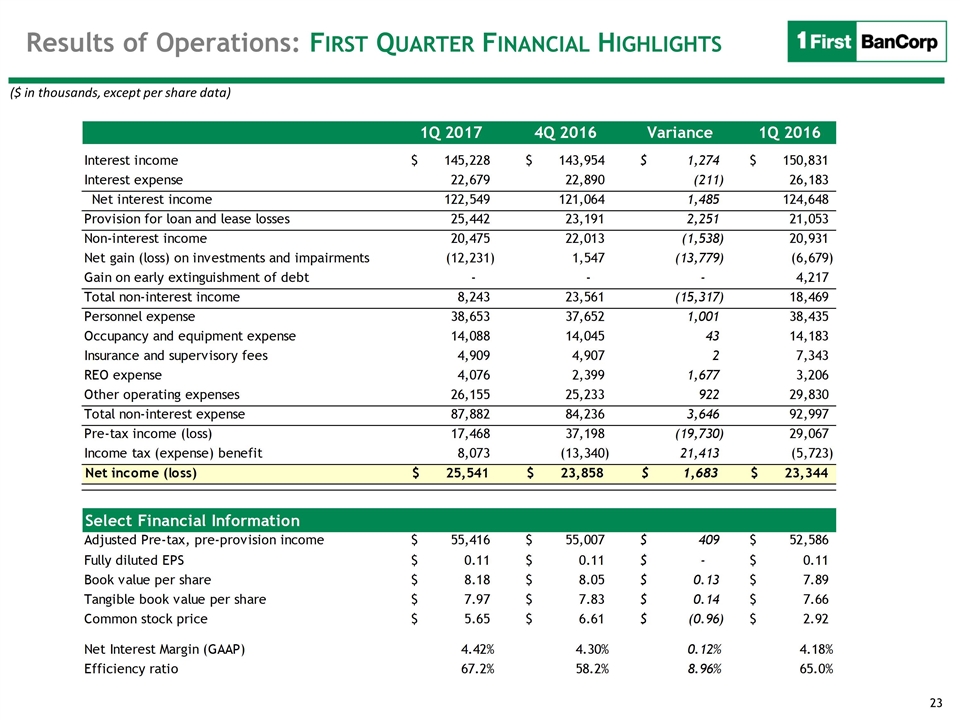

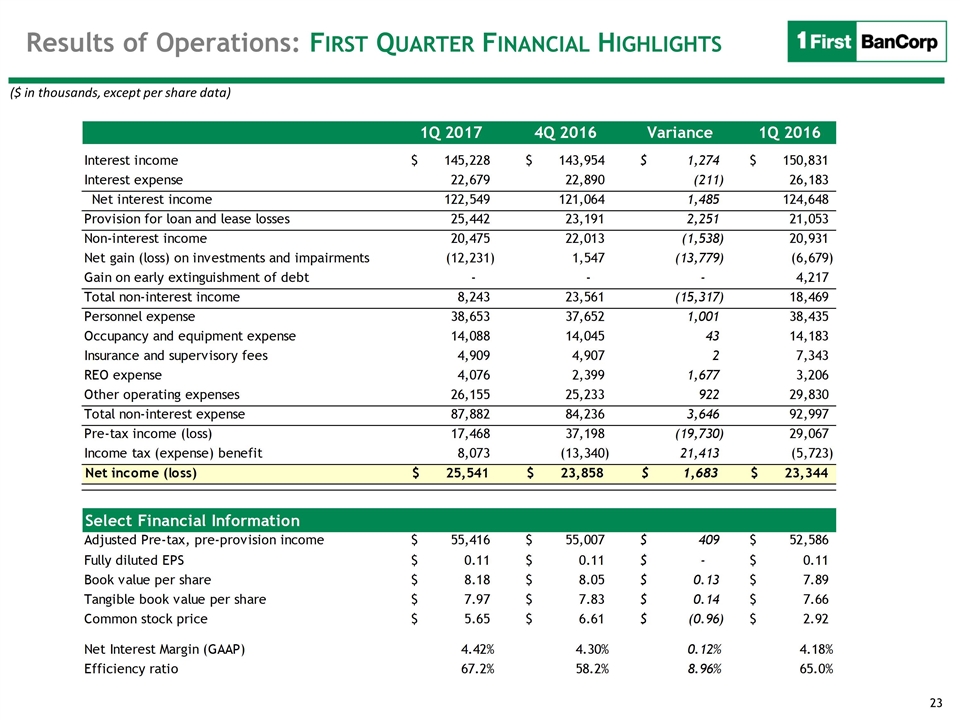

Results of Operations: First Quarter Financial Highlights ($ in thousands, except per share data) Select Financial Information

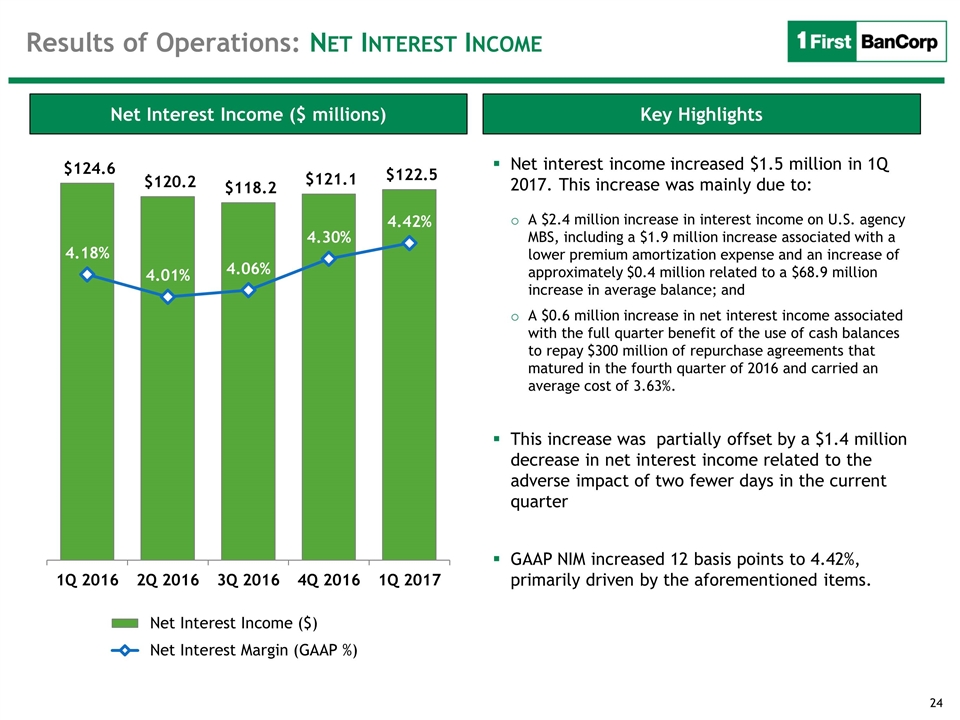

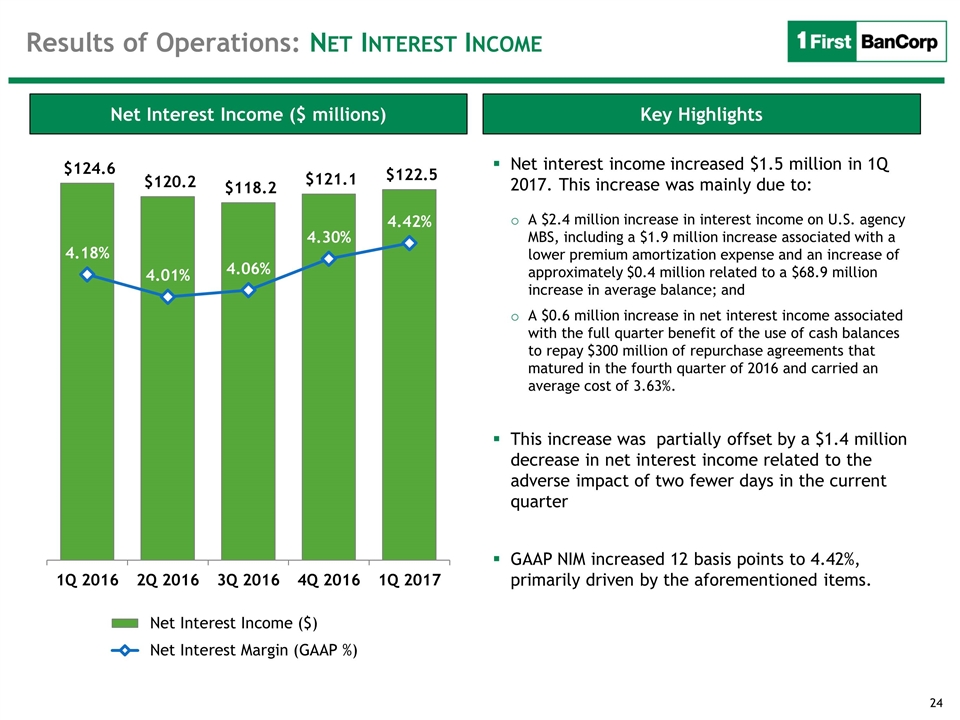

Key Highlights Net Interest Income ($ millions) Net interest income increased $1.5 million in 1Q 2017. This increase was mainly due to: A $2.4 million increase in interest income on U.S. agency MBS, including a $1.9 million increase associated with a lower premium amortization expense and an increase of approximately $0.4 million related to a $68.9 million increase in average balance; and A $0.6 million increase in net interest income associated with the full quarter benefit of the use of cash balances to repay $300 million of repurchase agreements that matured in the fourth quarter of 2016 and carried an average cost of 3.63%. This increase was partially offset by a $1.4 million decrease in net interest income related to the adverse impact of two fewer days in the current quarter GAAP NIM increased 12 basis points to 4.42%, primarily driven by the aforementioned items. Results of Operations: Net Interest Income

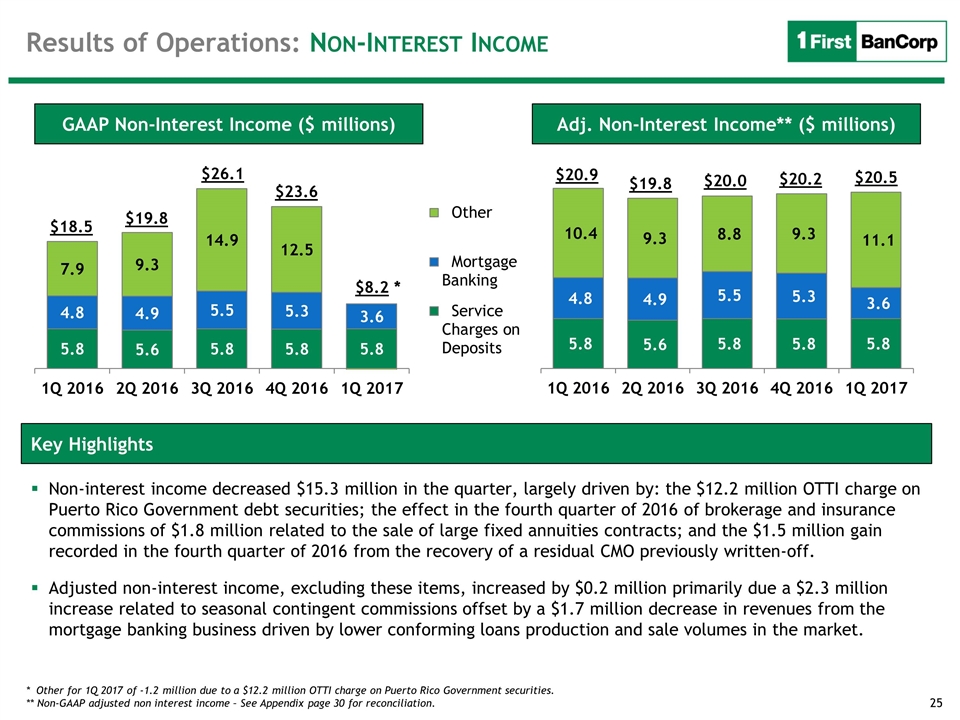

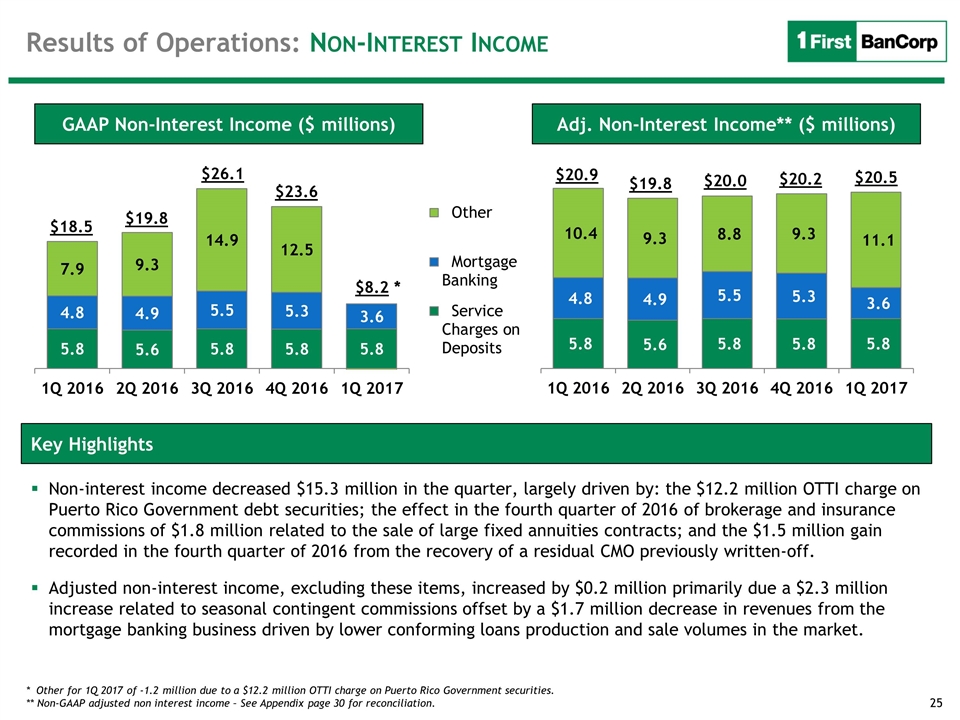

Key Highlights Adj. Non-Interest Income** ($ millions) * Other for 1Q 2017 of -1.2 million due to a $12.2 million OTTI charge on Puerto Rico Government securities. ** Non-GAAP adjusted non interest income – See Appendix page 30 for reconciliation. Non-interest income decreased $15.3 million in the quarter, largely driven by: the $12.2 million OTTI charge on Puerto Rico Government debt securities; the effect in the fourth quarter of 2016 of brokerage and insurance commissions of $1.8 million related to the sale of large fixed annuities contracts; and the $1.5 million gain recorded in the fourth quarter of 2016 from the recovery of a residual CMO previously written-off. Adjusted non-interest income, excluding these items, increased by $0.2 million primarily due a $2.3 million increase related to seasonal contingent commissions offset by a $1.7 million decrease in revenues from the mortgage banking business driven by lower conforming loans production and sale volumes in the market. Results of Operations: Non-Interest Income $20.0 $20.9 $19.8 $20.2 GAAP Non-Interest Income ($ millions) $26.1 $18.5 $19.8 $23.6 $8.2 * $20.5

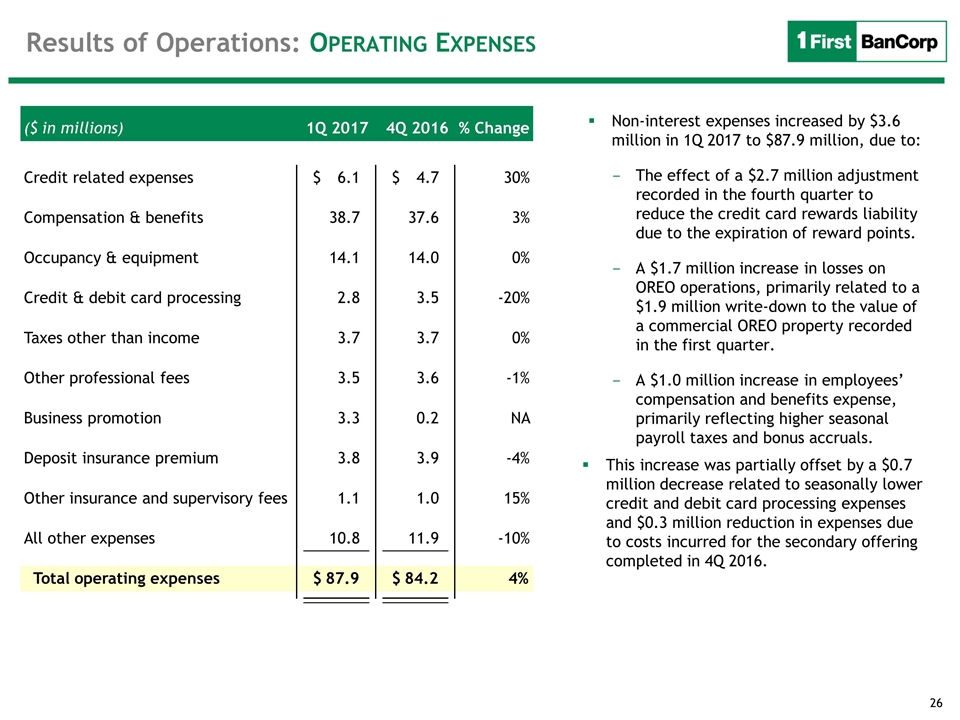

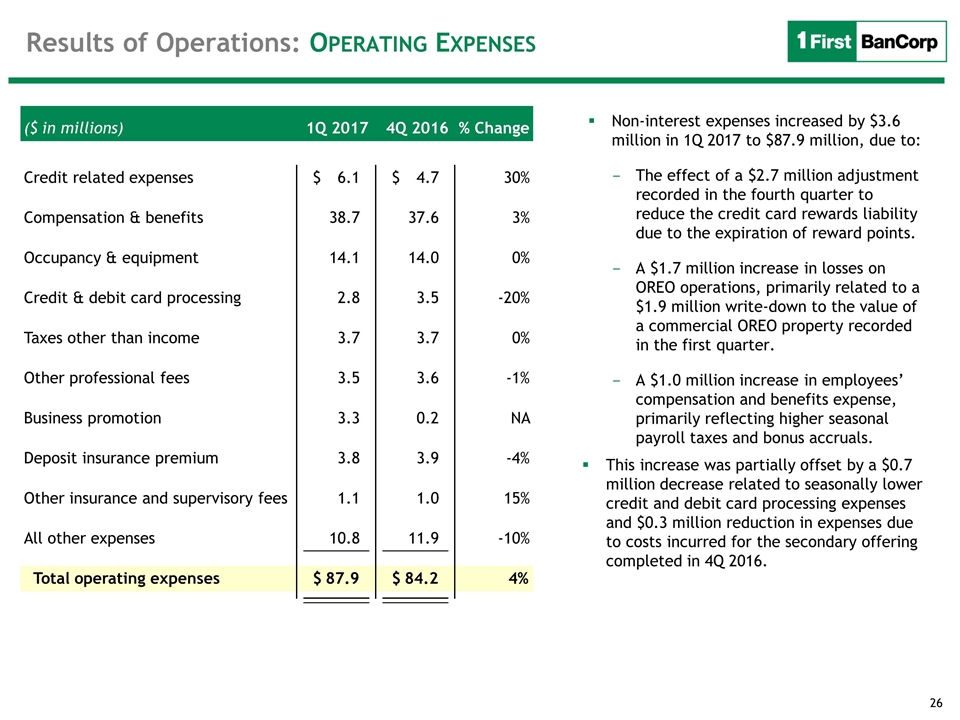

Results of Operations: Operating Expenses Non-interest expenses increased by $3.6 million in 1Q 2017 to $87.9 million, due to: The effect of a $2.7 million adjustment recorded in the fourth quarter to reduce the credit card rewards liability due to the expiration of reward points. A $1.7 million increase in losses on OREO operations, primarily related to a $1.9 million write-down to the value of a commercial OREO property recorded in the first quarter. A $1.0 million increase in employees’ compensation and benefits expense, primarily reflecting higher seasonal payroll taxes and bonus accruals. This increase was partially offset by a $0.7 million decrease related to seasonally lower credit and debit card processing expenses and $0.3 million reduction in expenses due to costs incurred for the secondary offering completed in 4Q 2016. ($ in millions) 4Q 2016 Credit related expenses 6.1 $ 4.7 $ 30% Compensation & benefits 38.7 37.6 3% Occupancy & equipment 14.1 14.0 0% Credit & debit card processing 2.8 3.5 -20% Taxes other than income 3.7 3.7 0% Other professional fees 3.5 3.6 -1% Business promotion 3.3 0.2 NA Deposit insurance premium 3.8 3.9 -4% Other insurance and supervisory fees 1.1 1.0 15% All other expenses 10.8 11.9 -10% Total operating expenses 87.9 $ 84.2 $ 4% % Change 1Q 2017

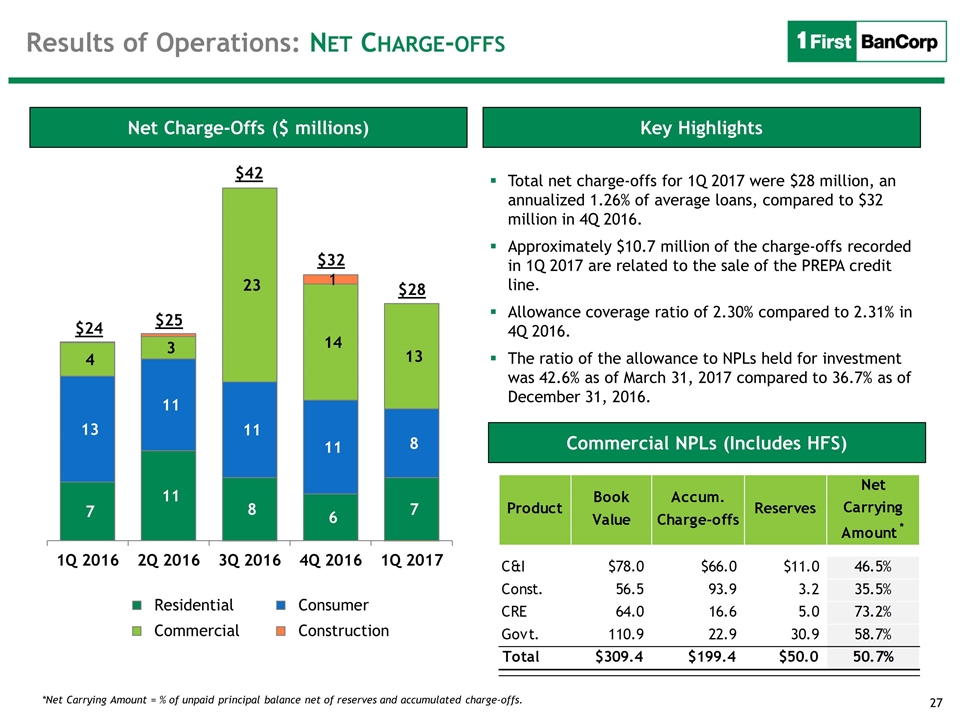

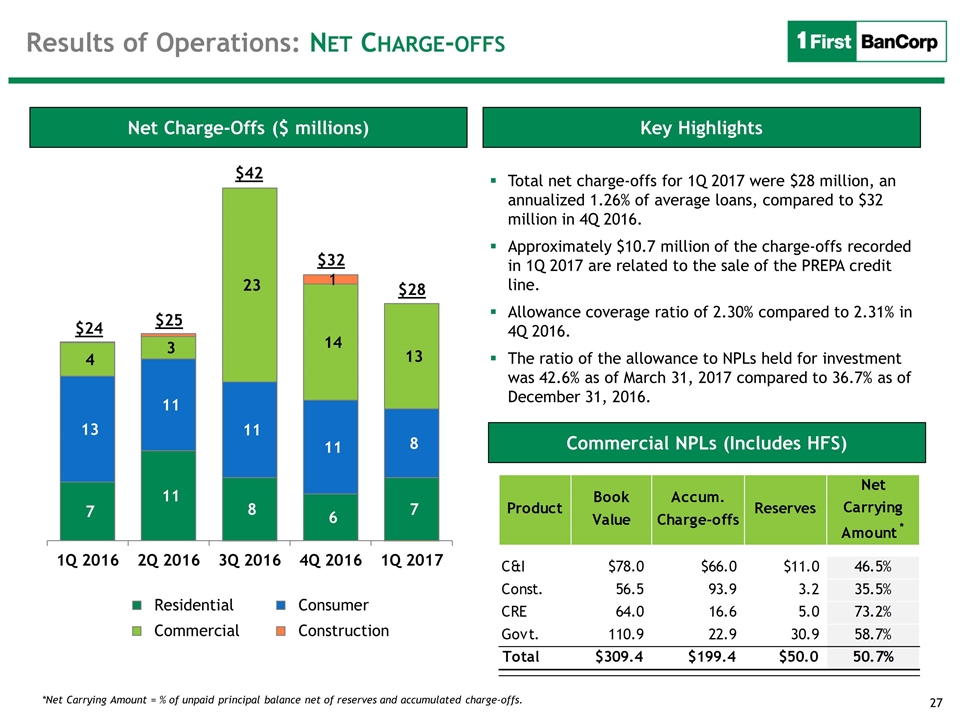

Key Highlights Net Charge-Offs ($ millions) Total net charge-offs for 1Q 2017 were $28 million, an annualized 1.26% of average loans, compared to $32 million in 4Q 2016. Approximately $10.7 million of the charge-offs recorded in 1Q 2017 are related to the sale of the PREPA credit line. Allowance coverage ratio of 2.30% compared to 2.31% in 4Q 2016. The ratio of the allowance to NPLs held for investment was 42.6% as of March 31, 2017 compared to 36.7% as of December 31, 2016. Commercial NPLs (Includes HFS) *Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. Results of Operations: Net Charge-offs $42 $25 $24 $32 $28

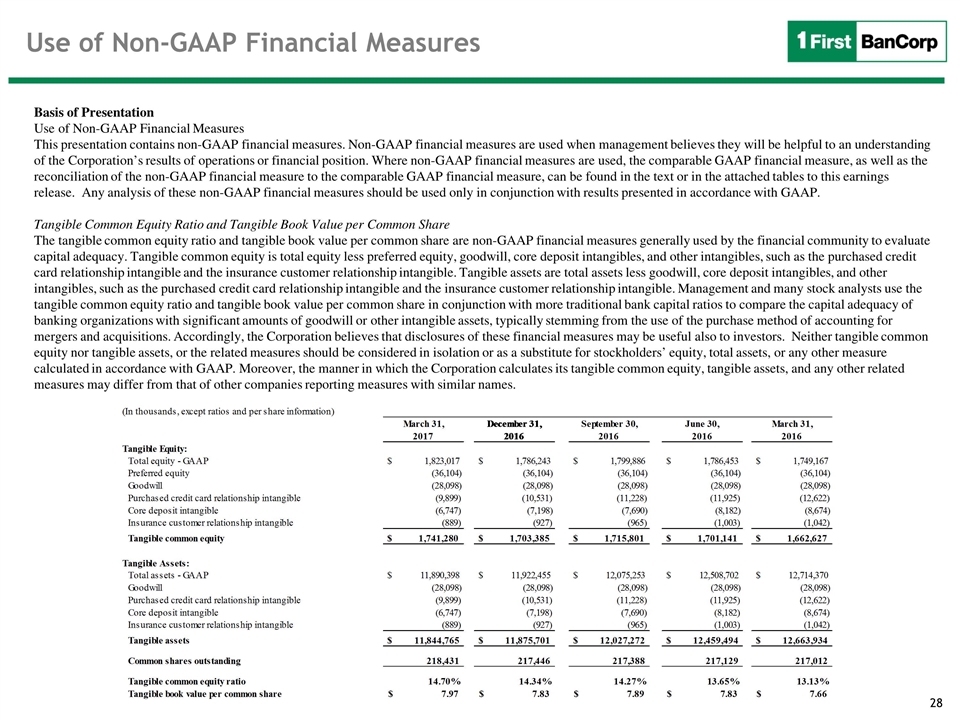

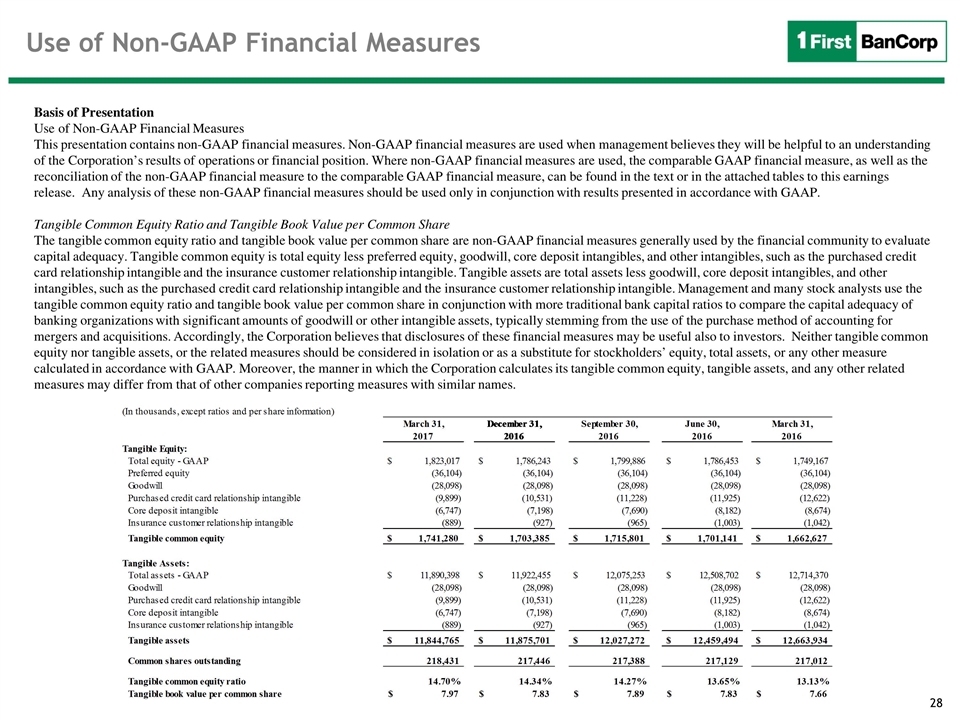

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP financial measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Tangible assets are total assets less goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosures of these financial measures may be useful also to investors. Neither tangible common equity nor tangible assets, or the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity, tangible assets, and any other related measures may differ from that of other companies reporting measures with similar names.

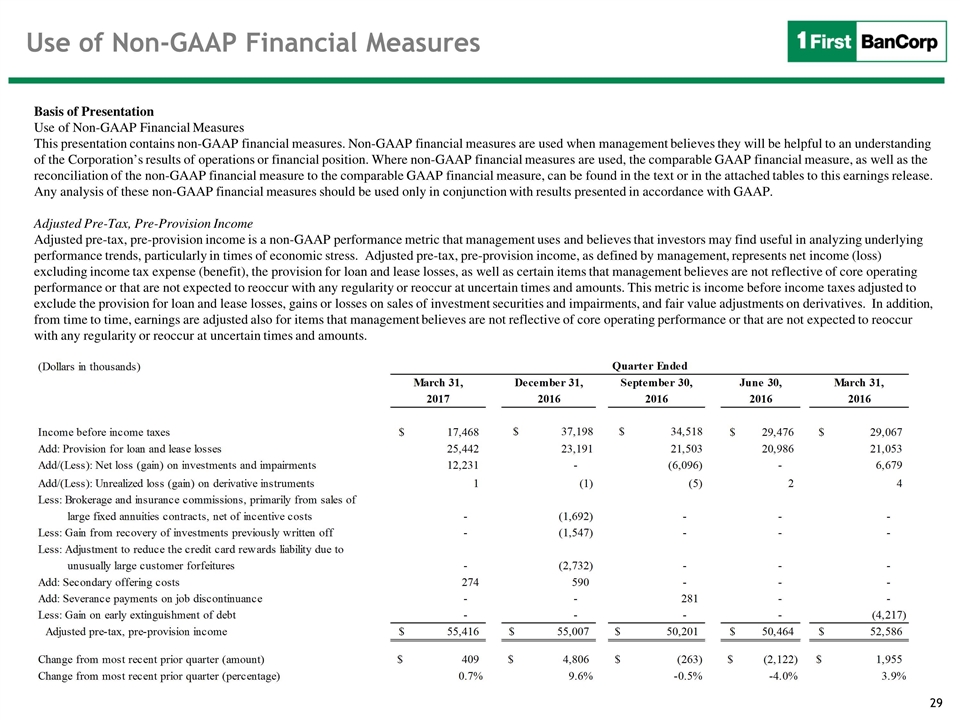

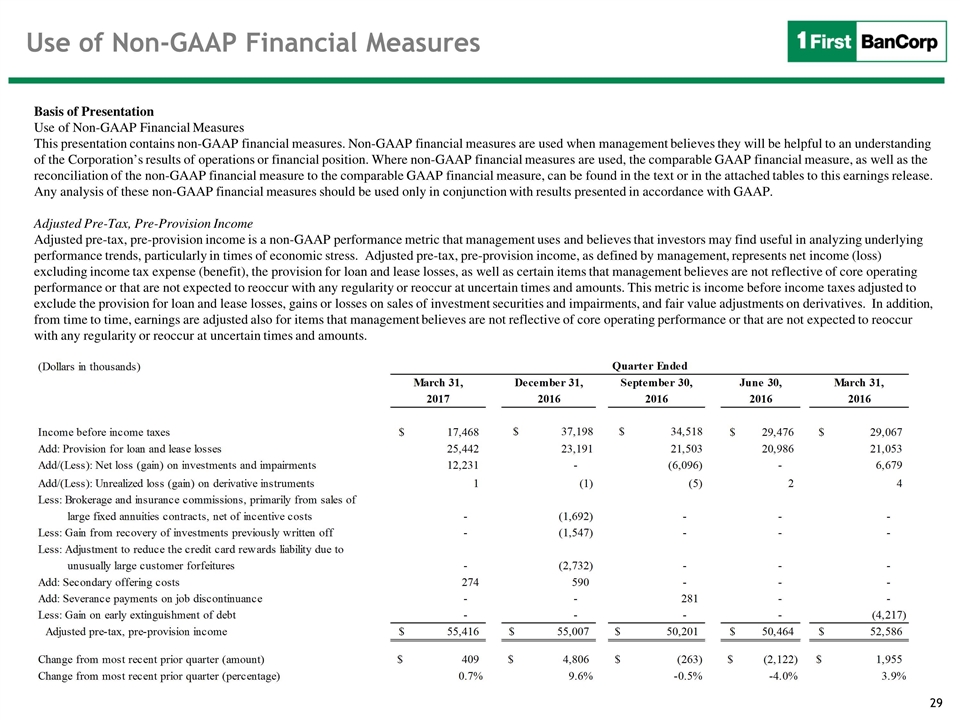

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Pre-Tax, Pre-Provision Income Adjusted pre-tax, pre-provision income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted pre-tax, pre-provision income, as defined by management, represents net income (loss) excluding income tax expense (benefit), the provision for loan and lease losses, as well as certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is income before income taxes adjusted to exclude the provision for loan and lease losses, gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives. In addition, from time to time, earnings are adjusted also for items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts.

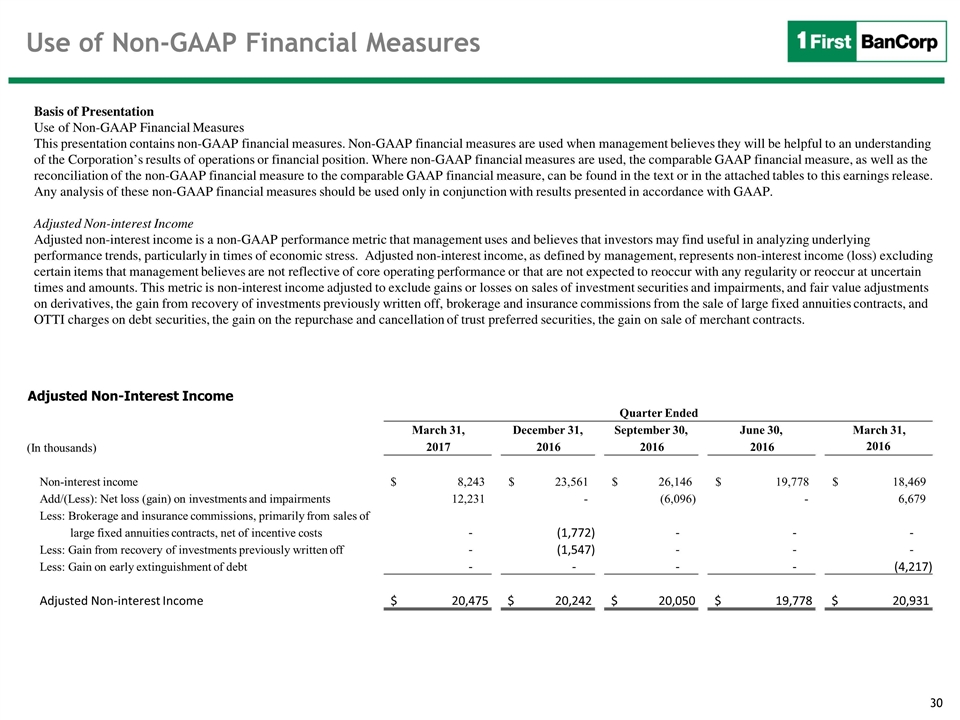

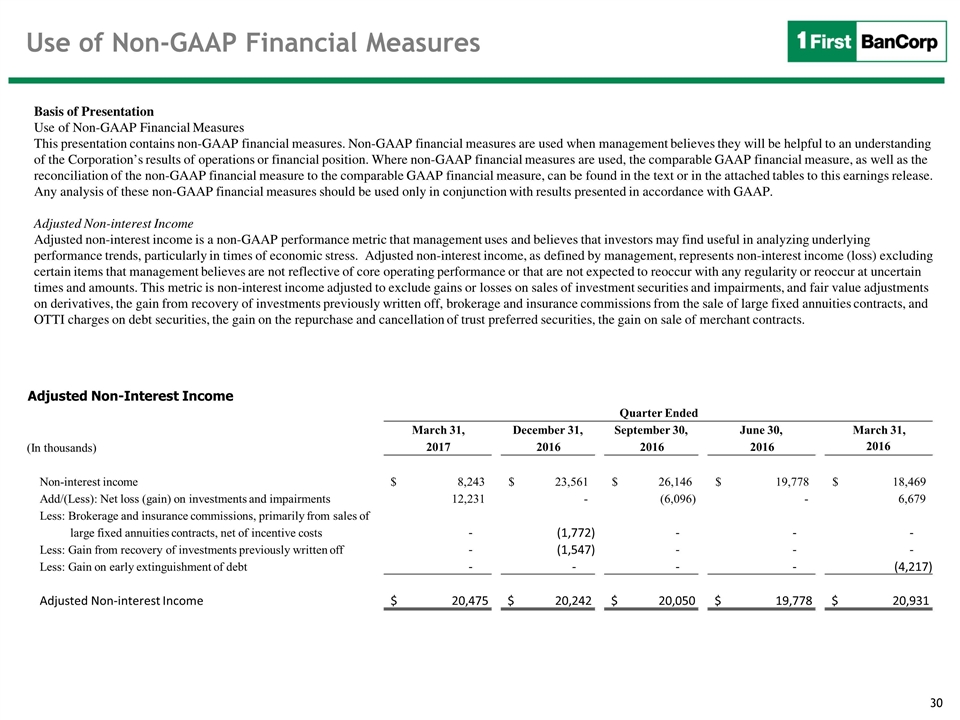

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Non-interest Income Adjusted non-interest income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted non-interest income, as defined by management, represents non-interest income (loss) excluding certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is non-interest income adjusted to exclude gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives, the gain from recovery of investments previously written off, brokerage and insurance commissions from the sale of large fixed annuities contracts, and OTTI charges on debt securities, the gain on the repurchase and cancellation of trust preferred securities, the gain on sale of merchant contracts. Adjusted Non-Interest Income March 31, December 31, September 30, June 30, March 31, (In thousands) 2017 2016 2016 2016 2016 Non-interest income 8,243 $ 23,561 $ 26,146 $ 19,778 $ 18,469 $ Add/(Less): Net loss (gain) on investments and impairments 12,231 - (6,096) - 6,679 Less: Brokerage and insurance commissions, primarily from sales of large fixed annuities contracts, net of incentive costs - (1,772) - - - Less: Gain from recovery of investments previously written off - (1,547) - - - Less: Gain on early extinguishment of debt - - - - (4,217) Adjusted Non-interest Income 20,475 $ 20,242 $ 20,050 $ 19,778 $ 20,931 $ Quarter Ended

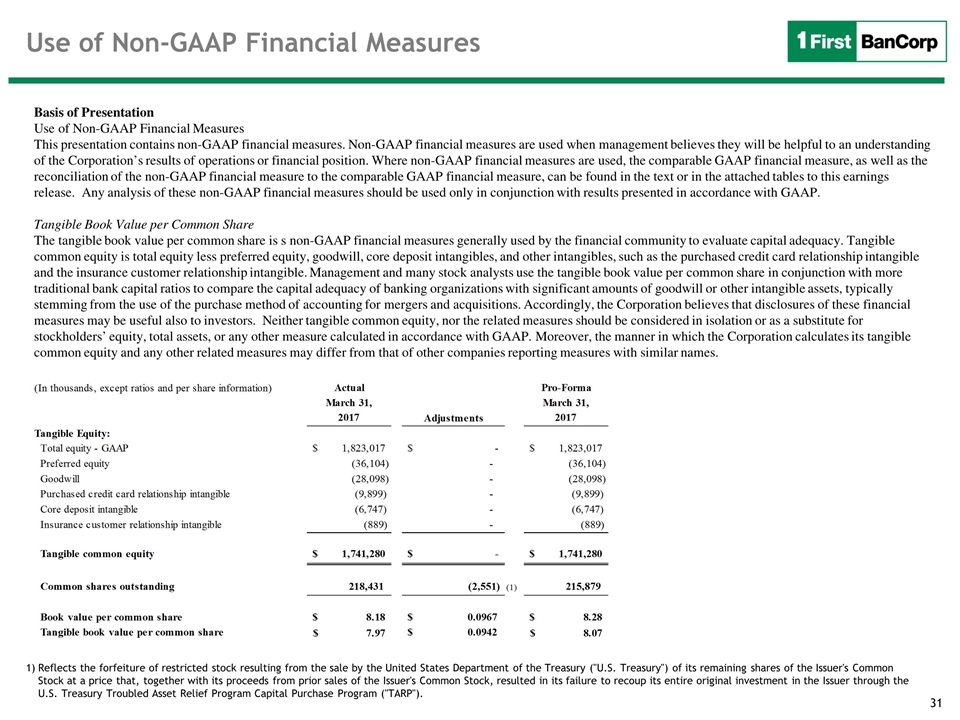

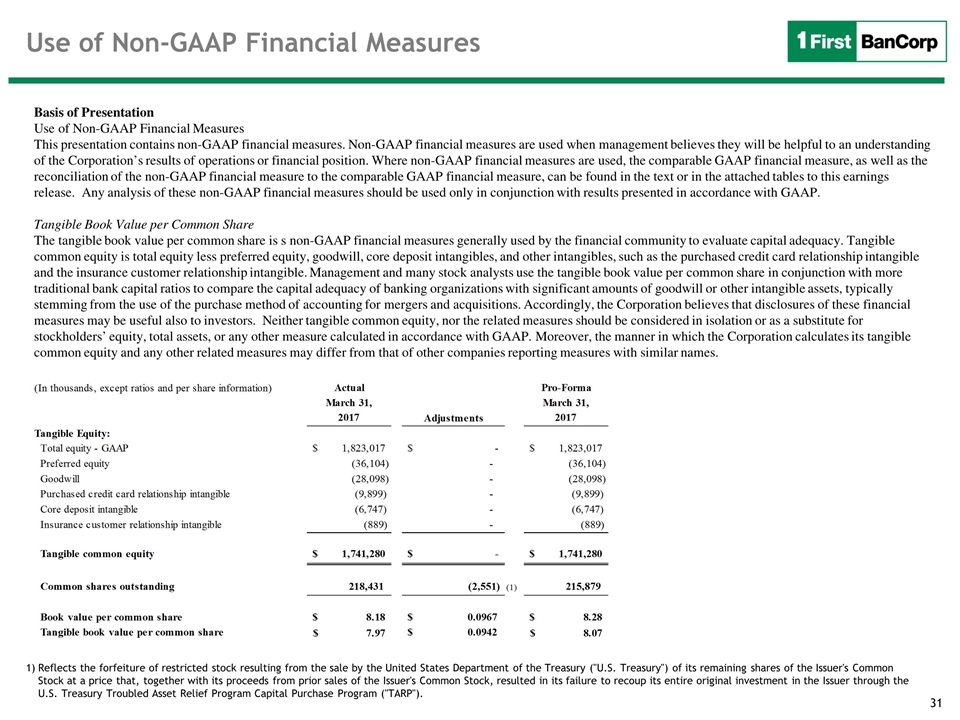

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Tangible Book Value per Common Share The tangible book value per common share is s non-GAAP financial measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Management and many stock analysts use the tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosures of these financial measures may be useful also to investors. Neither tangible common equity, nor the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity and any other related measures may differ from that of other companies reporting measures with similar names. Reflects the forfeiture of restricted stock resulting from the sale by the United States Department of the Treasury ("U.S. Treasury") of its remaining shares of the Issuer's Common Stock at a price that, together with its proceeds from prior sales of the Issuer's Common Stock, resulted in its failure to recoup its entire original investment in the Issuer through the U.S. Treasury Troubled Asset Relief Program Capital Purchase Program ("TARP").