First BanCorp Investor Presentation February 2019 Exhibit 99.1

Forward-Looking Statements This presentation may contain “forward-looking statements” concerning the Corporation’s future economic, operational and financial performance. The words or phrases “expect,” “anticipate,” “intend,” “look forward,” “should,” “would,” “believes” and similar expressions are meant to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by such sections. The Corporation cautions readers not to place undue reliance on any such “forward-looking statements,” which speak only as of the date made, and advises readers that various factors, including, but not limited to, the following could cause actual results to differ materially from those expressed in, or implied by such forward-looking statements: the actual pace and magnitude of economic recovery in the regions impacted by the two hurricanes that affected the Corporation’s service areas during the third quarter of 2017 compared to management's current views on the economic recovery; uncertainties about how and when rebuilding will take place in the regions affected by the recent storms, including the rebuilding of the public infrastructure, such as Puerto Rico’s power grid, what level of government, private or philanthropic funds will be invested in the affected communities, how many dislocated individuals will return to their homes in both the short- and long-term, and what other demographic changes will take place; uncertainty as to the ultimate outcomes of actions taken, or those that may have to be taken, by the Puerto Rico government, or the oversight board established by the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) to address Puerto Rico’s financial problems, including the filing of a form of bankruptcy under Title III of PROMESA that provides a court debt restructuring process similar to U.S. bankruptcy protection; the ability of the Puerto Rico government or any of its public corporations or other instrumentalities to repay its respective debt obligations, including the effect of payment defaults on the Puerto Rico government general obligations, bonds of the Government Development Bank for Puerto Rico and certain bonds of government public corporations, and recent and any future downgrades of the long-term and short-term debt ratings of the Puerto Rico government, which could exacerbate Puerto Rico’s adverse economic conditions and, in turn, further adversely impact the Corporation; uncertainty about whether approvals by the New York FED will be provided for future payments of dividends to stockholders or for receiving dividends from FirstBank, or for making payments on trust preferred securities or subordinated debt, incurring, increasing or guaranteeing debt or repurchasing any capital securities, despite the consents that have enabled the Corporation to pay quarterly interest payments on the Corporation’s subordinated debentures associated with its trust preferred securities since the second quarter of 2016, and for future monthly dividends on the non-cumulative perpetual preferred stock, despite the consents that have enabled the Corporation to pay monthly dividends on its non-cumulative perpetual preferred stock since December 2016; a decrease in demand for the Corporation’s products and services and lower revenues and earnings because of the continued recession in Puerto Rico; uncertainty as to the availability of certain funding sources, such as brokered CDs; the Corporation’s reliance on brokered CDs to fund operations and provide liquidity; the risk of not being able to fulfill the Corporation’s cash obligations or resume paying dividends to the Corporation’s common stockholders in the future due to the Corporation’s need to receive regulatory approvals to declare or pay any dividends and to take dividends or any other form of payment representing a reduction in capital from FirstBank or FirstBank’s failure to generate sufficient cash flow to make a dividend payment to the Corporation; the weakness of the real estate markets and of the consumer and commercial sectors and their impact on the credit quality of the Corporation’s loans and other assets, which have contributed and may continue to contribute to, among other things, high levels of non-performing assets, charge-offs and provisions for loan and lease losses, and may subject the Corporation to further risk from loan defaults and foreclosures; the ability of FirstBank to realize the benefits of its deferred tax assets subject to the remaining valuation allowance; adverse changes in general economic conditions in Puerto Rico, the U.S., and the U.S. Virgin Islands and British Virgin Islands, including the interest rate environment, market liquidity, housing absorption rates, real estate prices, and disruptions in the U.S. capital markets, which reduced interest margins and affected funding sources, and has affected demand for all of the Corporation’s products and services and reduced the Corporation’s revenues and earnings, and the value of the Corporation’s assets, and may continue to have these effects; an adverse change in the Corporation’s ability to attract new clients and retain existing ones; the risk that additional portions of the unrealized losses in the Corporation’s investment portfolio are determined to be other-than-temporary, including additional impairments on the Puerto Rico government’s obligations; uncertainty about regulatory and legislative changes for financial services companies in Puerto Rico, the U.S., and the U.S. and British Virgin Islands, which could affect the Corporation’s financial condition or performance and could cause the Corporation’s actual results for future periods to differ materially from prior results and anticipated or projected results; changes in the fiscal and monetary policies and regulations of the U.S. federal government and the Puerto Rico and other governments, including those determined by the Federal Reserve Board, the New York Fed, the Federal Deposit Insurance Corporation (“FDIC”), government-sponsored housing agencies, and regulators in Puerto Rico and the U.S. and British Virgin Islands; the risk of possible failure or circumvention of controls and procedures and the risk that the Corporation’s risk management policies may not be adequate; the risk that the FDIC may increase the deposit insurance premium and/or require special assessments to replenish its insurance fund, causing an additional increase in the Corporation’s non-interest expenses; the impact on the Corporation’s results of operations and financial condition of acquisitions and dispositions; a need to recognize additional impairments on the Corporation’s financial instruments, goodwill or other intangible assets relating to acquisitions; the risk that downgrades in the credit ratings of the Corporation’s long-term senior debt will adversely affect the Corporation’s ability to access necessary external funds; the impact on the Corporation’s businesses, business practices and results of operations of a potential higher interest rate environment; uncertainty as to whether FirstBank will be able to satisfy its regulators regarding, among other things, its asset quality, liquidity plans, maintenance of capital levels and compliance with applicable laws, regulations and related requirements; and general competitive factors and industry consolidation. The Corporation does not undertake, and specifically disclaims any obligation, to update any “forward-looking statements” to reflect occurrences or unanticipated events or circumstances after the date of such statements, except as required by the federal securities laws.

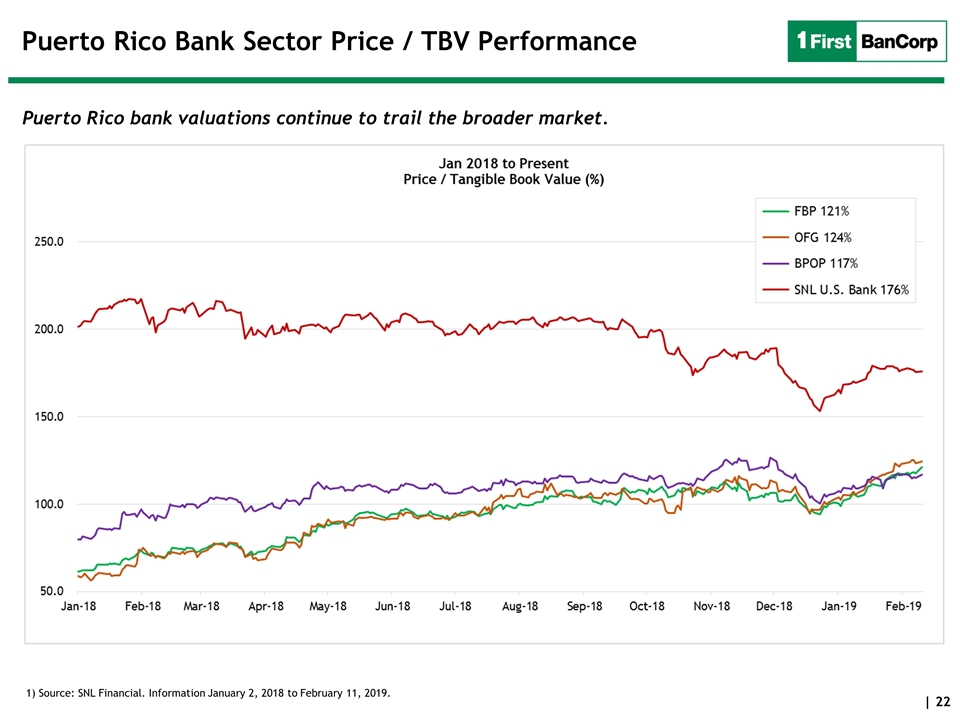

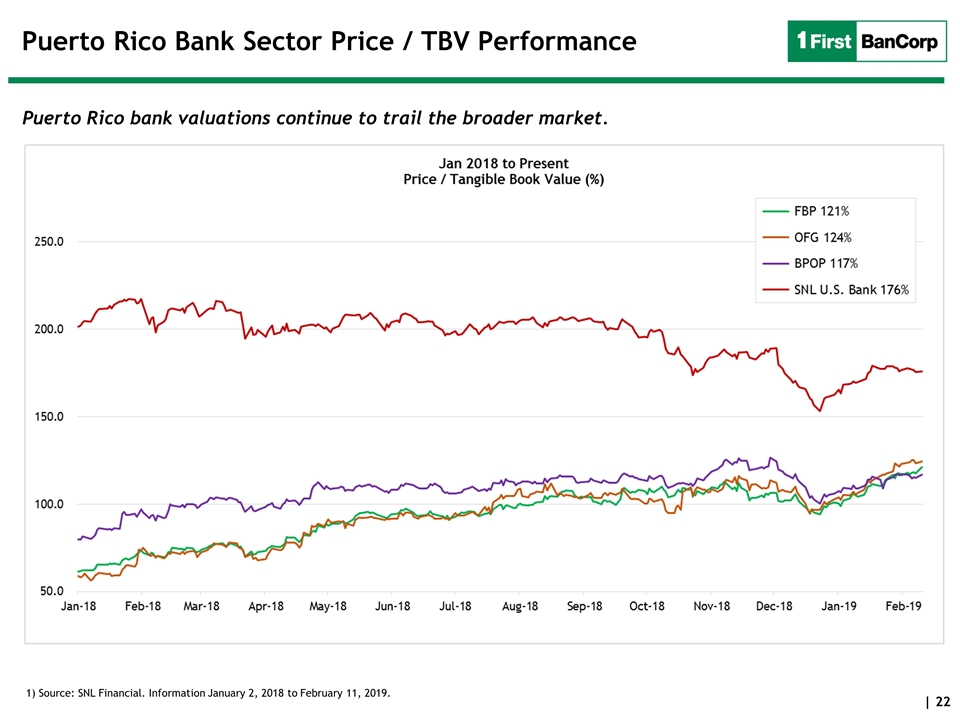

Compelling Value Proposition Our business model is diverse and scalable by segment (commercial, residential and consumer) and by unique markets (Puerto Rico, Southeast Florida & Eastern Caribbean). Our equity is valued at 121% of TBV (2/11/19) compared to the SNL bank index (176% of TBV). Our capital ratios are among top 4% of banks above $10 billion in assets. Successfully navigated challenging operating environment following a decade long recession. Recent economic data and inflow of funds are supporting post storm economic recovery in our markets. Leadership team is experienced, cohesive, and credible. Dedicated to enhancing shareholder value through superior service and products for all of our customers in all of our markets. Poised for organic and non-organic growth opportunities. Working with private and public partners we are well-prepared to drive balance sheet growth in Puerto Rico and consistent continued growth in Florida.

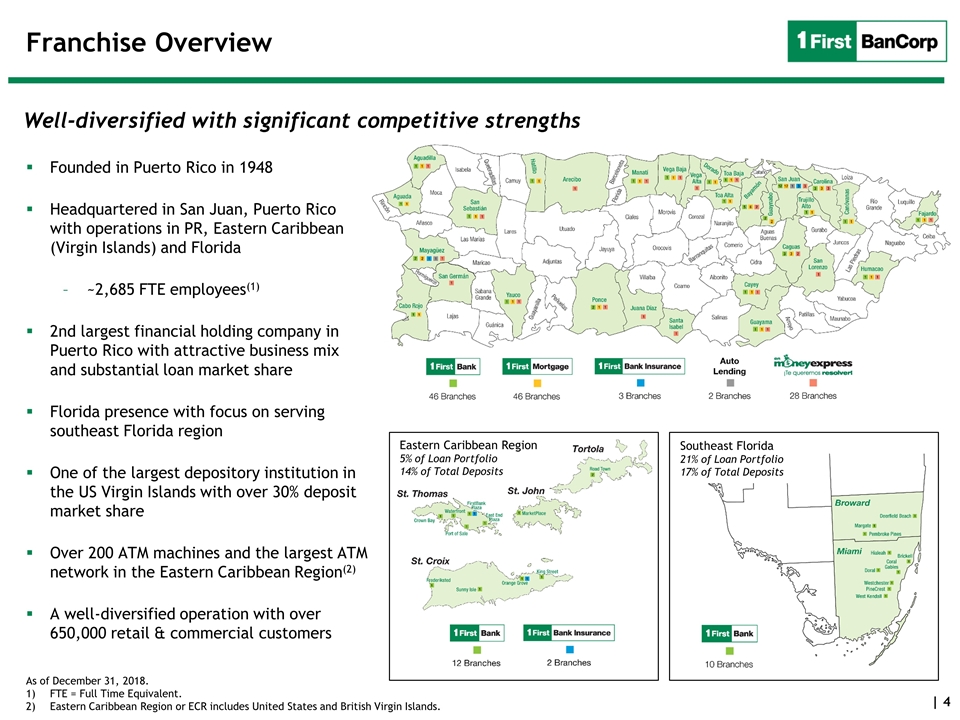

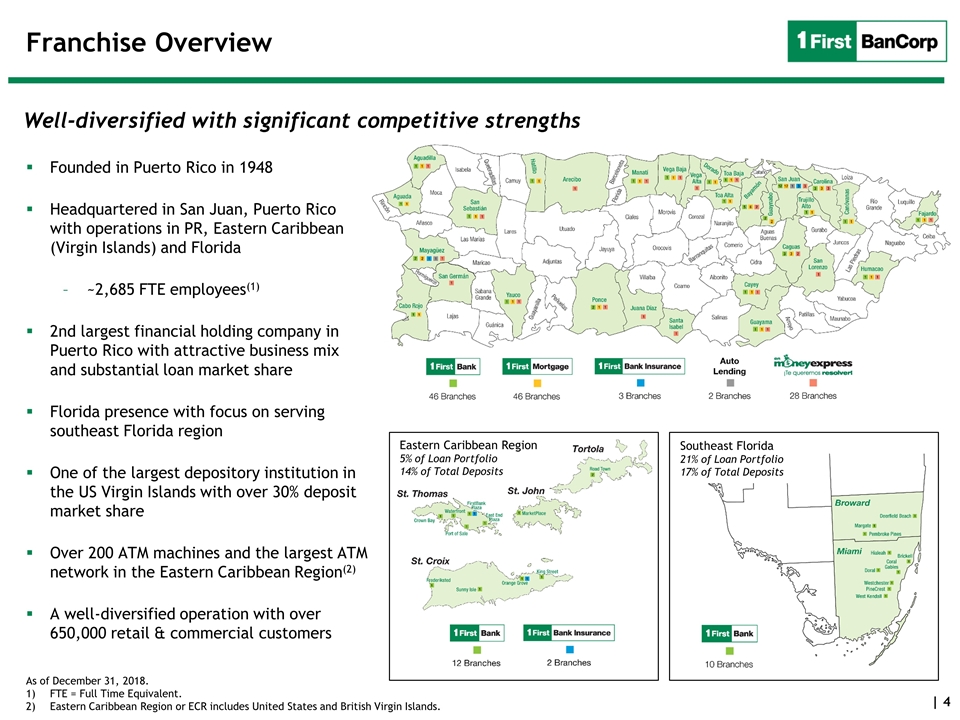

Franchise Overview Founded in Puerto Rico in 1948 Headquartered in San Juan, Puerto Rico with operations in PR, Eastern Caribbean (Virgin Islands) and Florida ~2,685 FTE employees(1) 2nd largest financial holding company in Puerto Rico with attractive business mix and substantial loan market share Florida presence with focus on serving southeast Florida region One of the largest depository institution in the US Virgin Islands with over 30% deposit market share Over 200 ATM machines and the largest ATM network in the Eastern Caribbean Region(2) A well-diversified operation with over 650,000 retail & commercial customers As of December 31, 2018. FTE = Full Time Equivalent. Eastern Caribbean Region or ECR includes United States and British Virgin Islands. Well-diversified with significant competitive strengths Eastern Caribbean Region 5% of Loan Portfolio 14% of Total Deposits Southeast Florida 21% of Loan Portfolio 17% of Total Deposits

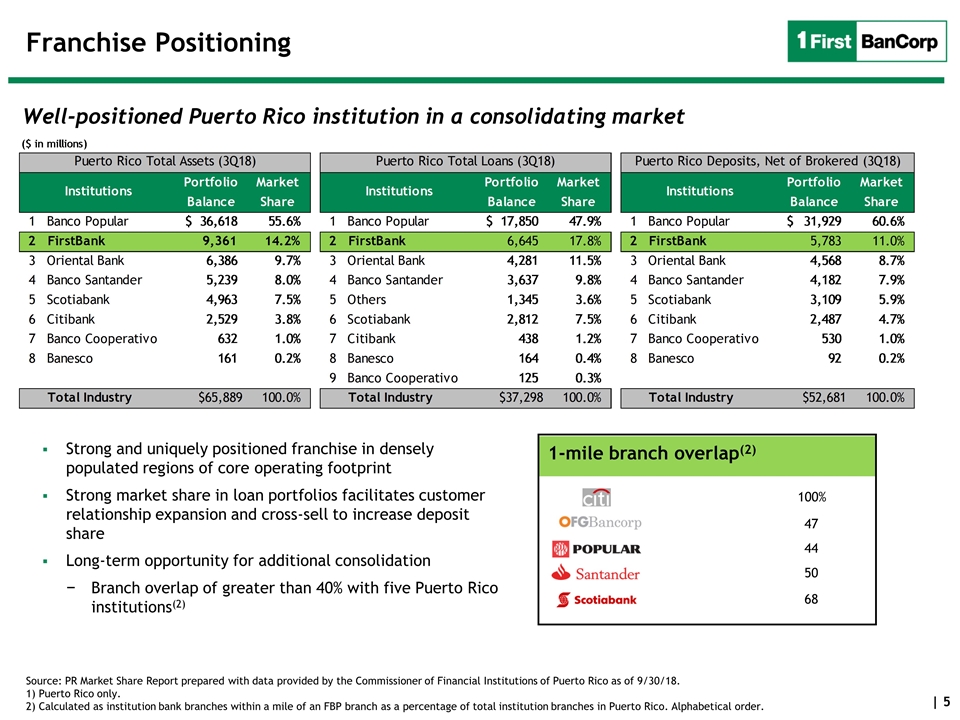

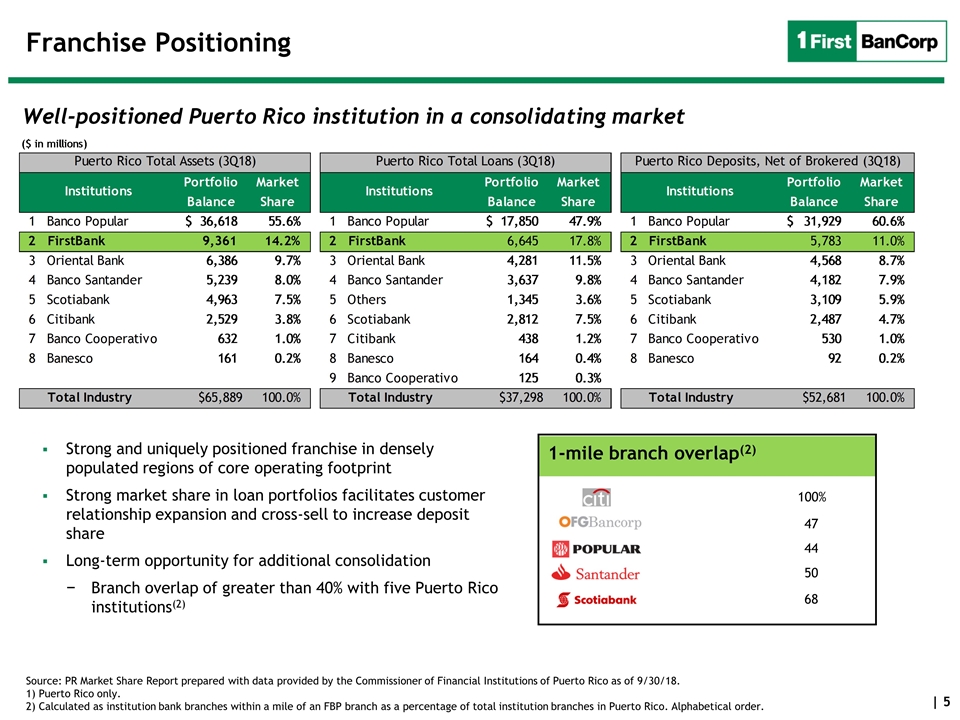

Franchise Positioning Well-positioned Puerto Rico institution in a consolidating market Well-positioned Puerto Rico institution in a consolidating market Source: PR Market Share Report prepared with data provided by the Commissioner of Financial Institutions of Puerto Rico as of 9/30/18. 1) Puerto Rico only. 2) Calculated as institution bank branches within a mile of an FBP branch as a percentage of total institution branches in Puerto Rico. Alphabetical order. Strong and uniquely positioned franchise in densely populated regions of core operating footprint Strong market share in loan portfolios facilitates customer relationship expansion and cross-sell to increase deposit share Long-term opportunity for additional consolidation Branch overlap of greater than 40% with five Puerto Rico institutions(2) 68 100% 50 44 47 1-mile branch overlap(2)

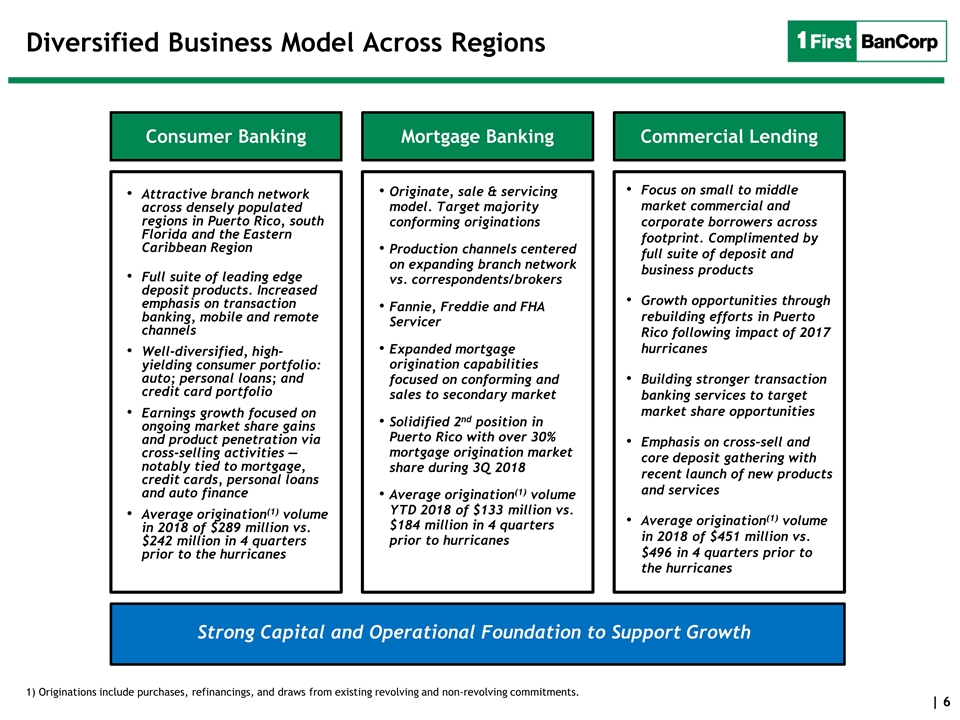

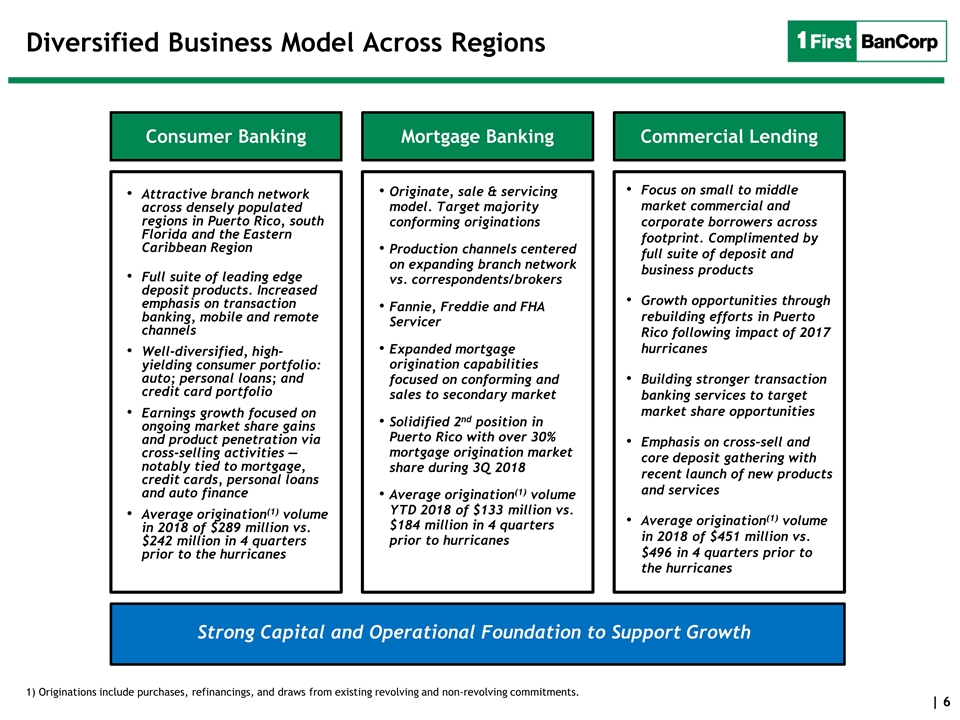

Diversified Business Model Across Regions Strong Capital and Operational Foundation to Support Growth 1) Originations include purchases, refinancings, and draws from existing revolving and non-revolving commitments. Consumer Banking Attractive branch network across densely populated regions in Puerto Rico, south Florida and the Eastern Caribbean Region Full suite of leading edge deposit products. Increased emphasis on transaction banking, mobile and remote channels Well-diversified, high-yielding consumer portfolio: auto; personal loans; and credit card portfolio Earnings growth focused on ongoing market share gains and product penetration via cross-selling activities —notably tied to mortgage, credit cards, personal loans and auto finance Average origination(1) volume in 2018 of $289 million vs. $242 million in 4 quarters prior to the hurricanes Mortgage Banking Originate, sale & servicing model. Target majority conforming originations Production channels centered on expanding branch network vs. correspondents/brokers Fannie, Freddie and FHA Servicer Expanded mortgage origination capabilities focused on conforming and sales to secondary market Solidified 2nd position in Puerto Rico with over 30% mortgage origination market share during 3Q 2018 Average origination(1) volume YTD 2018 of $133 million vs. $184 million in 4 quarters prior to hurricanes Commercial Lending Focus on small to middle market commercial and corporate borrowers across footprint. Complimented by full suite of deposit and business products Growth opportunities through rebuilding efforts in Puerto Rico following impact of 2017 hurricanes Building stronger transaction banking services to target market share opportunities Emphasis on cross-sell and core deposit gathering with recent launch of new products and services Average origination(1) volume in 2018 of $451 million vs. $496 in 4 quarters prior to the hurricanes

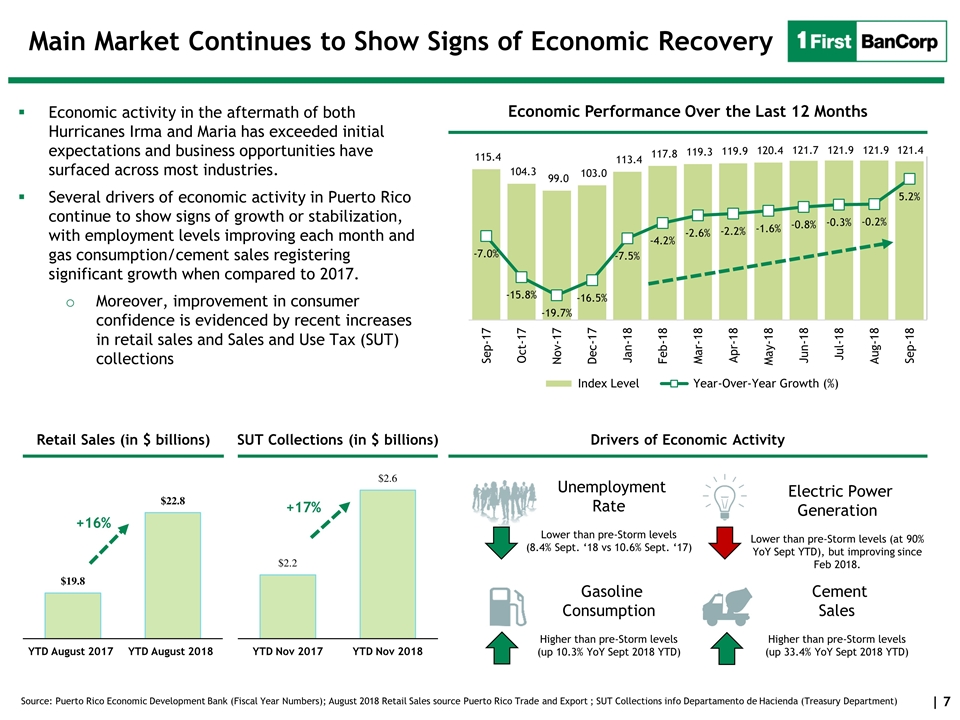

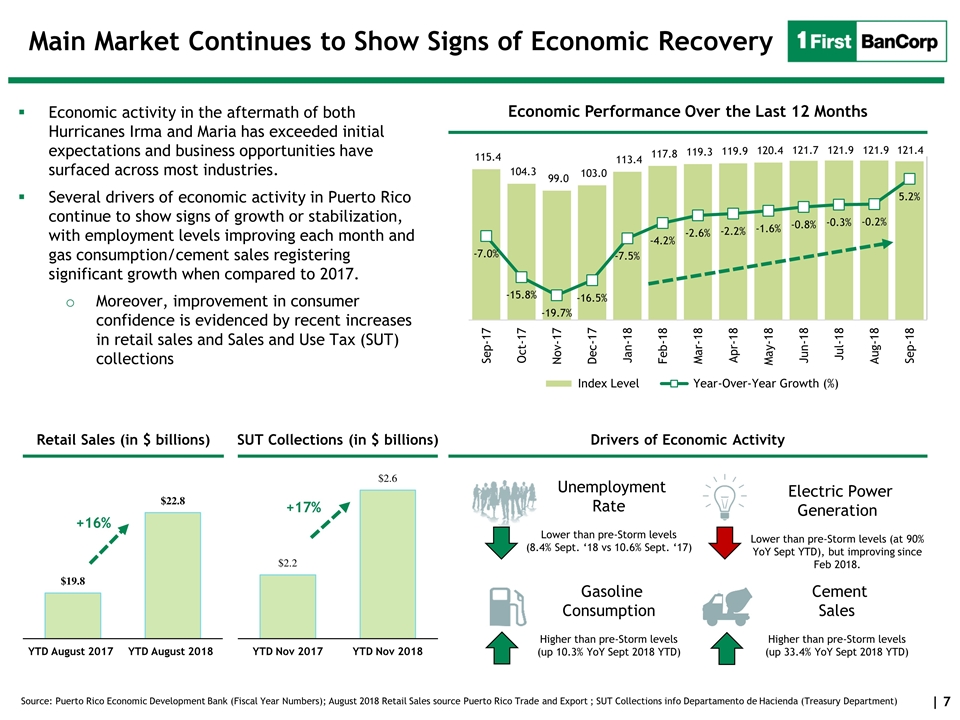

Main Market Continues to Show Signs of Economic Recovery Economic activity in the aftermath of both Hurricanes Irma and Maria has exceeded initial expectations and business opportunities have surfaced across most industries. Several drivers of economic activity in Puerto Rico continue to show signs of growth or stabilization, with employment levels improving each month and gas consumption/cement sales registering significant growth when compared to 2017. Moreover, improvement in consumer confidence is evidenced by recent increases in retail sales and Sales and Use Tax (SUT) collections Electric Power Generation Lower than pre-Storm levels (at 90% YoY Sept YTD), but improving since Feb 2018. Cement Sales Higher than pre-Storm levels (up 33.4% YoY Sept 2018 YTD) Gasoline Consumption Higher than pre-Storm levels (up 10.3% YoY Sept 2018 YTD) Unemployment Rate Lower than pre-Storm levels (8.4% Sept. ‘18 vs 10.6% Sept. ‘17) Drivers of Economic Activity Economic Performance Over the Last 12 Months Retail Sales (in $ billions) Source: Puerto Rico Economic Development Bank (Fiscal Year Numbers); August 2018 Retail Sales source Puerto Rico Trade and Export ; SUT Collections info Departamento de Hacienda (Treasury Department) SUT Collections (in $ billions) YTD Nov 2017 YTD Nov 2018 +16% YTD August 2017 YTD August 2018 +17%

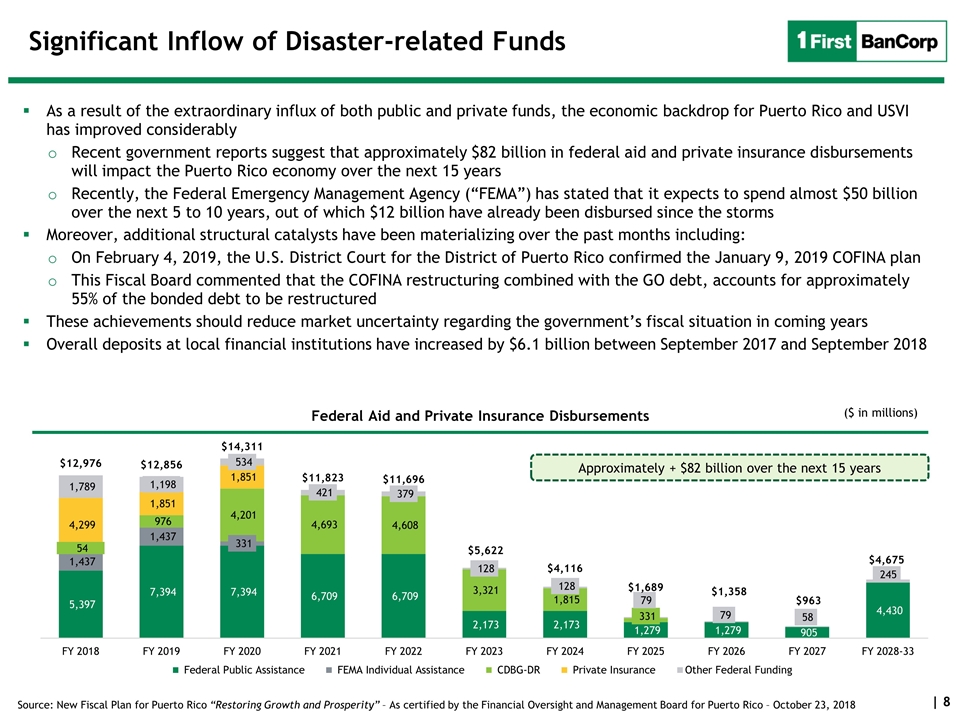

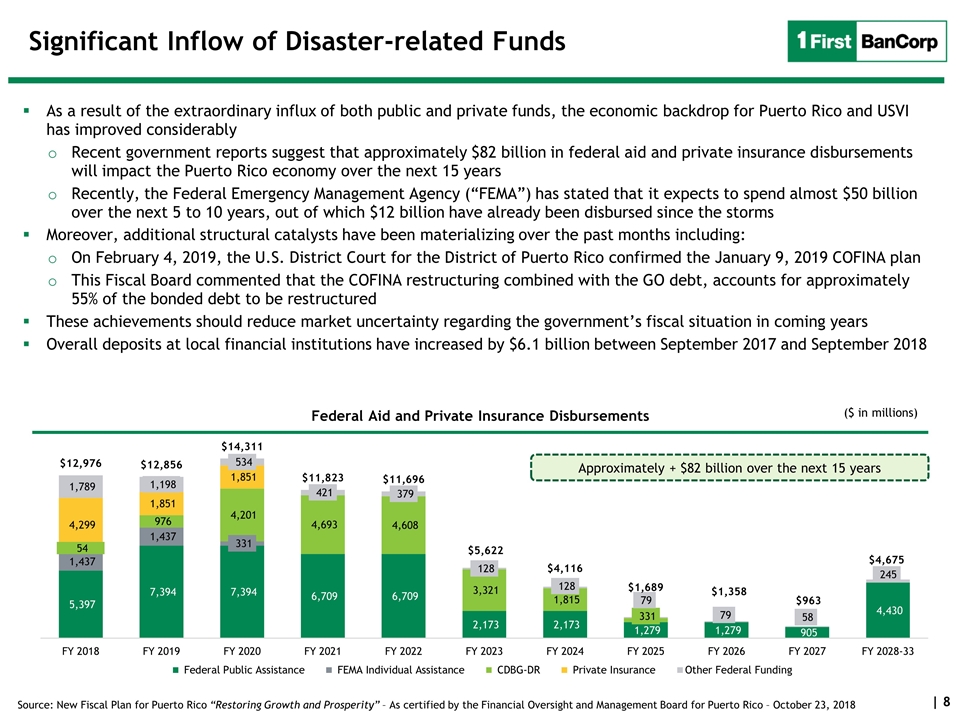

Significant Inflow of Disaster-related Funds As a result of the extraordinary influx of both public and private funds, the economic backdrop for Puerto Rico and USVI has improved considerably Recent government reports suggest that approximately $82 billion in federal aid and private insurance disbursements will impact the Puerto Rico economy over the next 15 years Recently, the Federal Emergency Management Agency (“FEMA”) has stated that it expects to spend almost $50 billion over the next 5 to 10 years, out of which $12 billion have already been disbursed since the storms Moreover, additional structural catalysts have been materializing over the past months including: On February 4, 2019, the U.S. District Court for the District of Puerto Rico confirmed the January 9, 2019 COFINA plan This Fiscal Board commented that the COFINA restructuring combined with the GO debt, accounts for approximately 55% of the bonded debt to be restructured These achievements should reduce market uncertainty regarding the government’s fiscal situation in coming years Overall deposits at local financial institutions have increased by $6.1 billion between September 2017 and September 2018 Federal Aid and Private Insurance Disbursements ($ in millions) Approximately + $82 billion over the next 15 years Source: New Fiscal Plan for Puerto Rico “Restoring Growth and Prosperity” – As certified by the Financial Oversight and Management Board for Puerto Rico – October 23, 2018

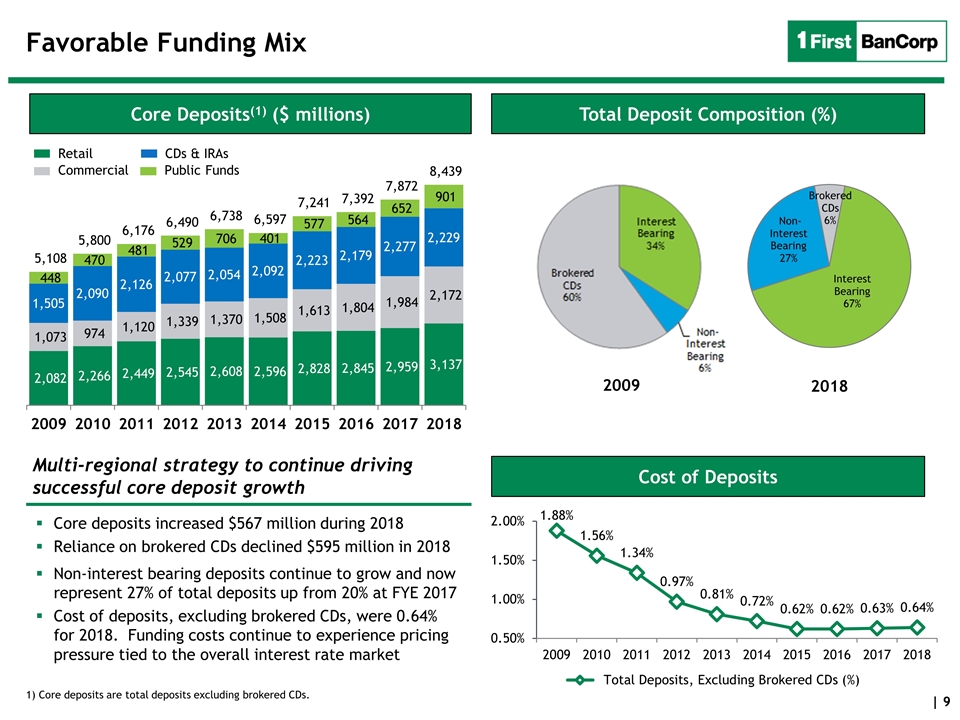

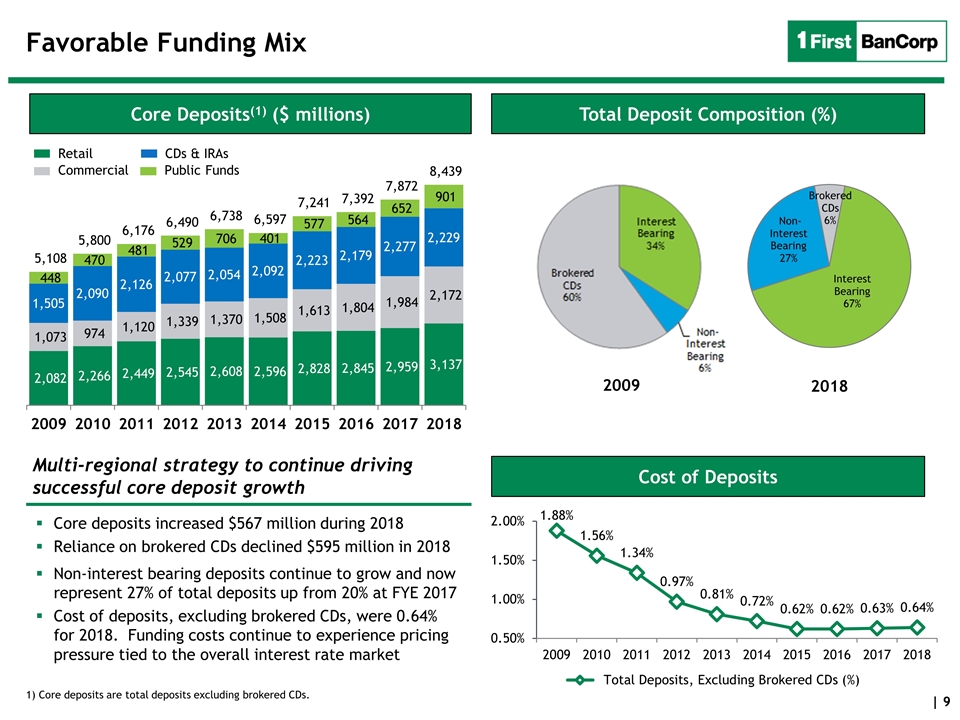

1) Core deposits are total deposits excluding brokered CDs. Favorable Funding Mix Total Deposit Composition (%) Core Deposits(1) ($ millions) Core deposits increased $567 million during 2018 Reliance on brokered CDs declined $595 million in 2018 Non-interest bearing deposits continue to grow and now represent 27% of total deposits up from 20% at FYE 2017 Cost of deposits, excluding brokered CDs, were 0.64% for 2018. Funding costs continue to experience pricing pressure tied to the overall interest rate market Multi-regional strategy to continue driving successful core deposit growth 2009 2018 Cost of Deposits Retail Commercial CDs & IRAs Public Funds

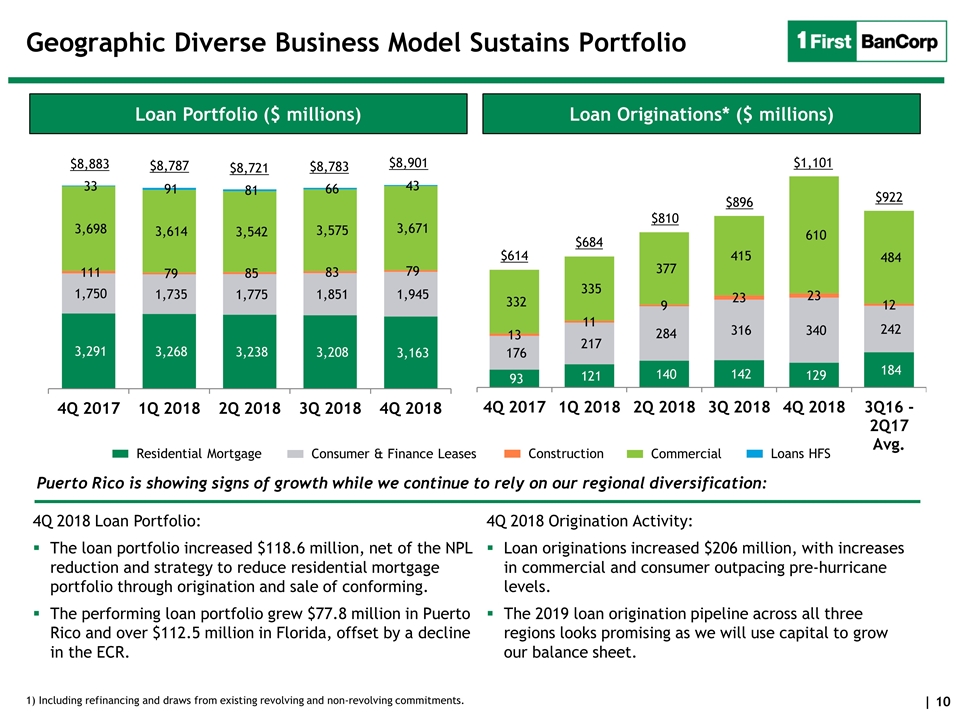

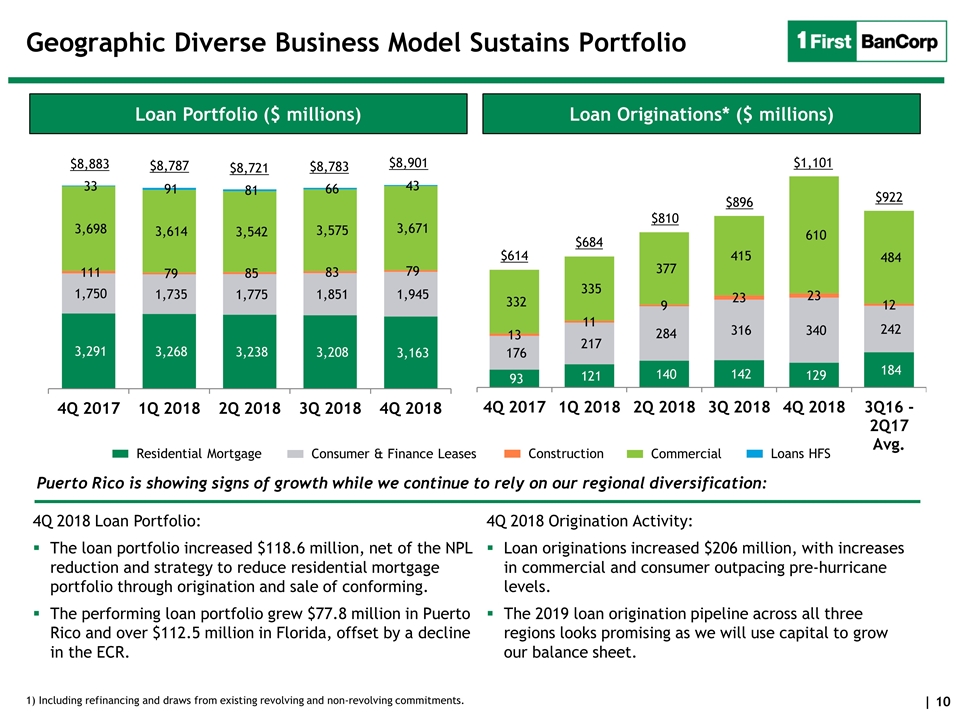

Geographic Diverse Business Model Sustains Portfolio 1) Including refinancing and draws from existing revolving and non-revolving commitments. Loan Originations* ($ millions) Loan Portfolio ($ millions) Residential Mortgage Consumer & Finance Leases Construction Commercial Loans HFS Puerto Rico is showing signs of growth while we continue to rely on our regional diversification: $8,783 $8,883 $1,101 $8,787 $8,721 $810 4Q 2018 Loan Portfolio: The loan portfolio increased $118.6 million, net of the NPL reduction and strategy to reduce residential mortgage portfolio through origination and sale of conforming. The performing loan portfolio grew $77.8 million in Puerto Rico and over $112.5 million in Florida, offset by a decline in the ECR. 4Q 2018 Origination Activity: Loan originations increased $206 million, with increases in commercial and consumer outpacing pre-hurricane levels. The 2019 loan origination pipeline across all three regions looks promising as we will use capital to grow our balance sheet. $8,901 $684 $614 $922 $896

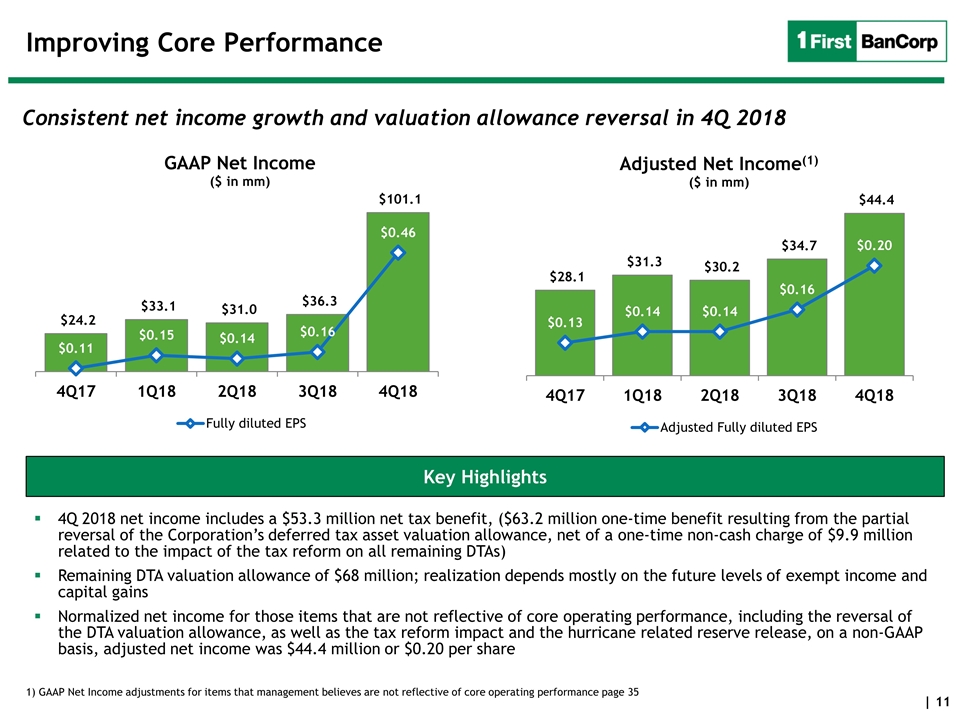

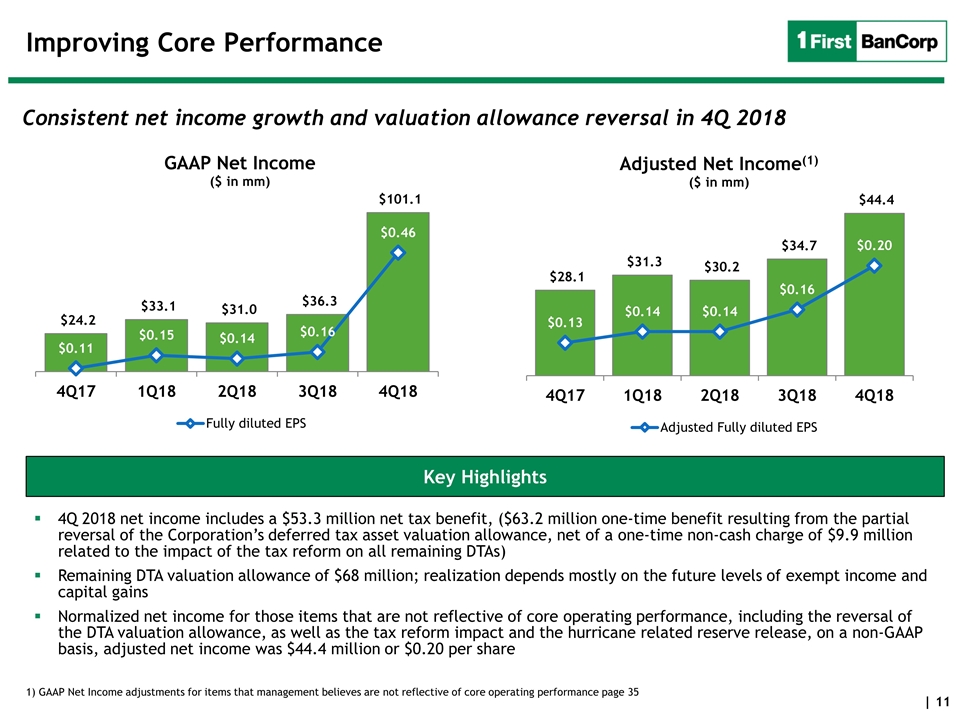

Improving Core Performance 4Q 2018 net income includes a $53.3 million net tax benefit, ($63.2 million one-time benefit resulting from the partial reversal of the Corporation’s deferred tax asset valuation allowance, net of a one-time non-cash charge of $9.9 million related to the impact of the tax reform on all remaining DTAs) Remaining DTA valuation allowance of $68 million; realization depends mostly on the future levels of exempt income and capital gains Normalized net income for those items that are not reflective of core operating performance, including the reversal of the DTA valuation allowance, as well as the tax reform impact and the hurricane related reserve release, on a non-GAAP basis, adjusted net income was $44.4 million or $0.20 per share Consistent net income growth and valuation allowance reversal in 4Q 2018 1) GAAP Net Income adjustments for items that management believes are not reflective of core operating performance page 35 Key Highlights

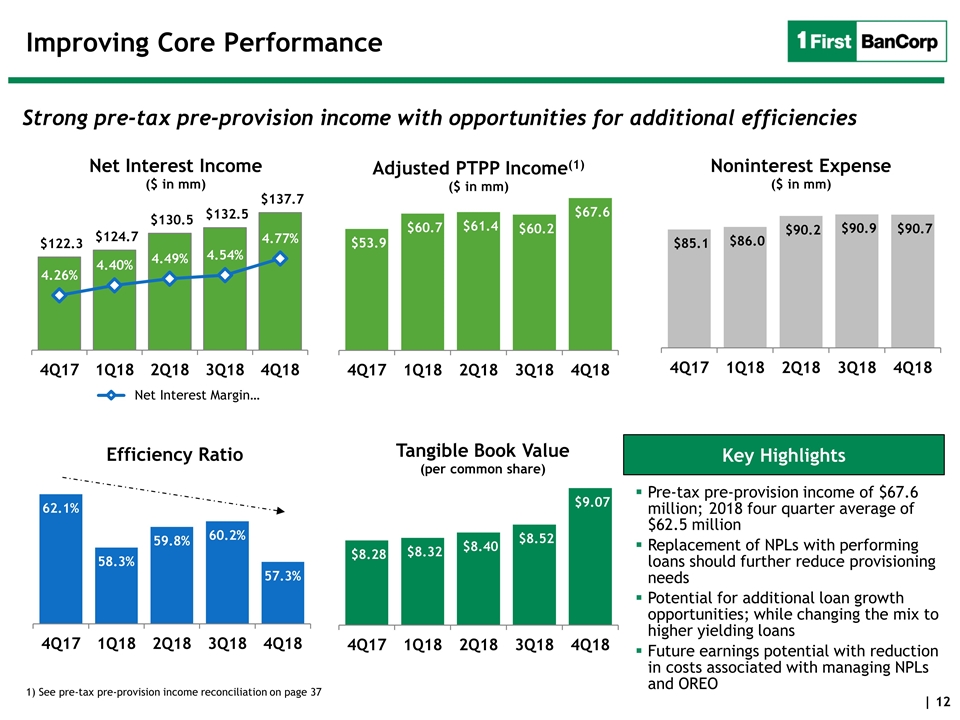

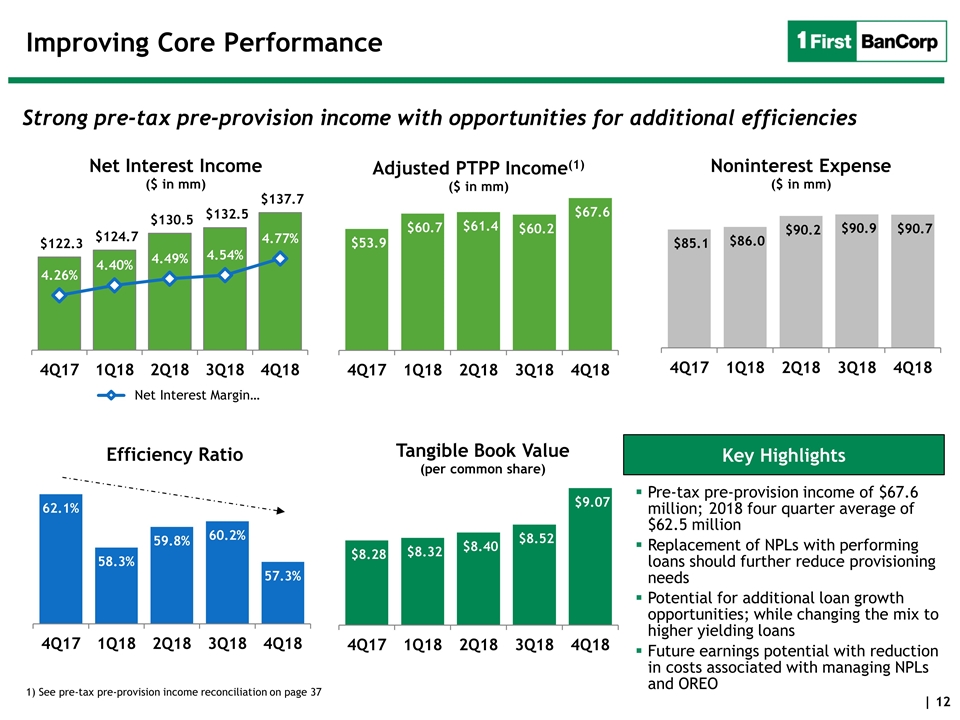

Improving Core Performance Pre-tax pre-provision income of $67.6 million; 2018 four quarter average of $62.5 million Replacement of NPLs with performing loans should further reduce provisioning needs Potential for additional loan growth opportunities; while changing the mix to higher yielding loans Future earnings potential with reduction in costs associated with managing NPLs and OREO Strong pre-tax pre-provision income with opportunities for additional efficiencies 1) See pre-tax pre-provision income reconciliation on page 37 Key Highlights

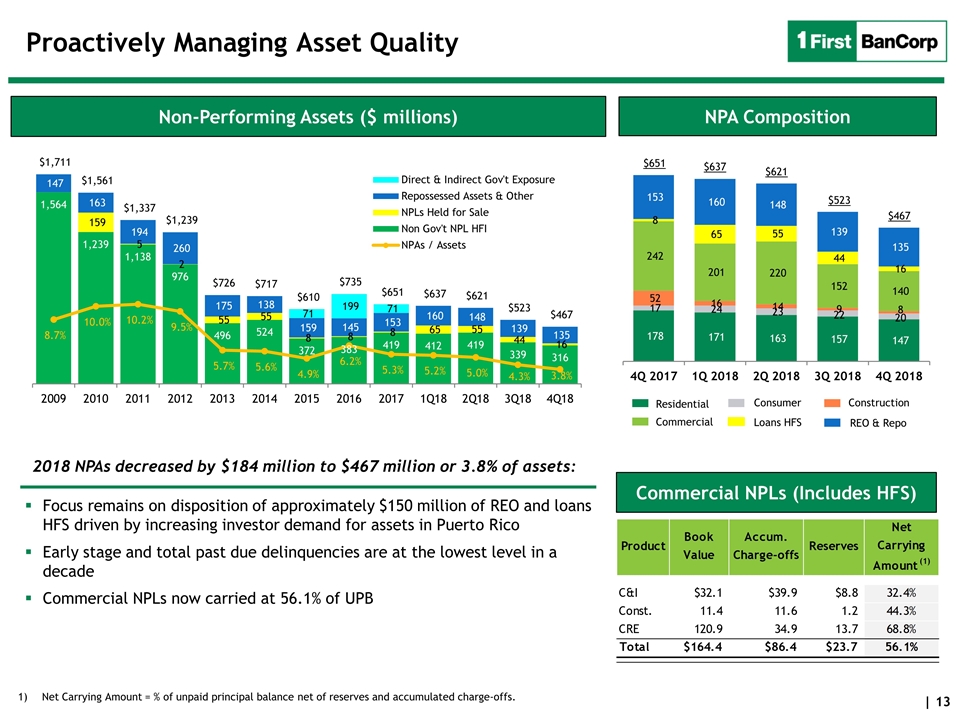

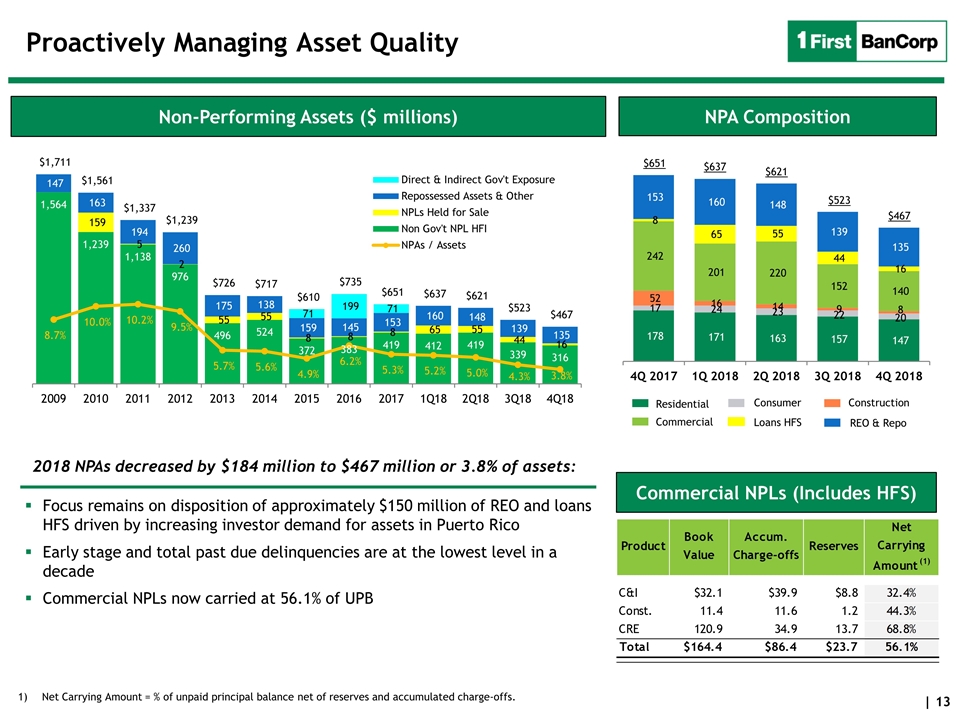

Proactively Managing Asset Quality Commercial NPLs (Includes HFS) NPA Composition Residential Consumer Construction Commercial Loans HFS REO & Repo $621 $467 $523 $651 Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. $637 Non-Performing Assets ($ millions) Focus remains on disposition of approximately $150 million of REO and loans HFS driven by increasing investor demand for assets in Puerto Rico Early stage and total past due delinquencies are at the lowest level in a decade Commercial NPLs now carried at 56.1% of UPB 2018 NPAs decreased by $184 million to $467 million or 3.8% of assets:

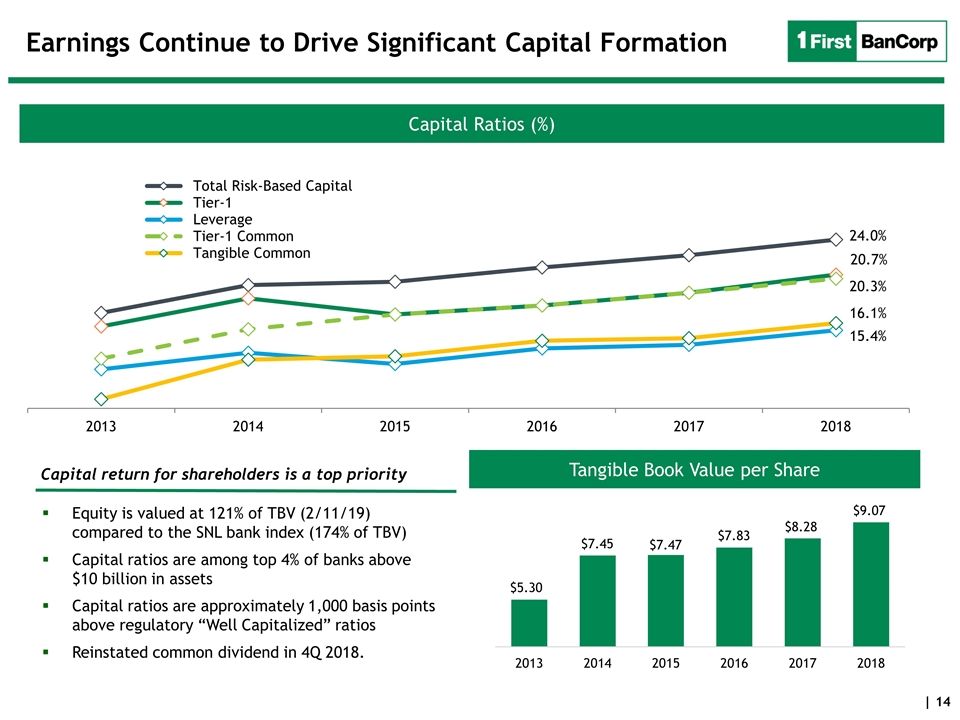

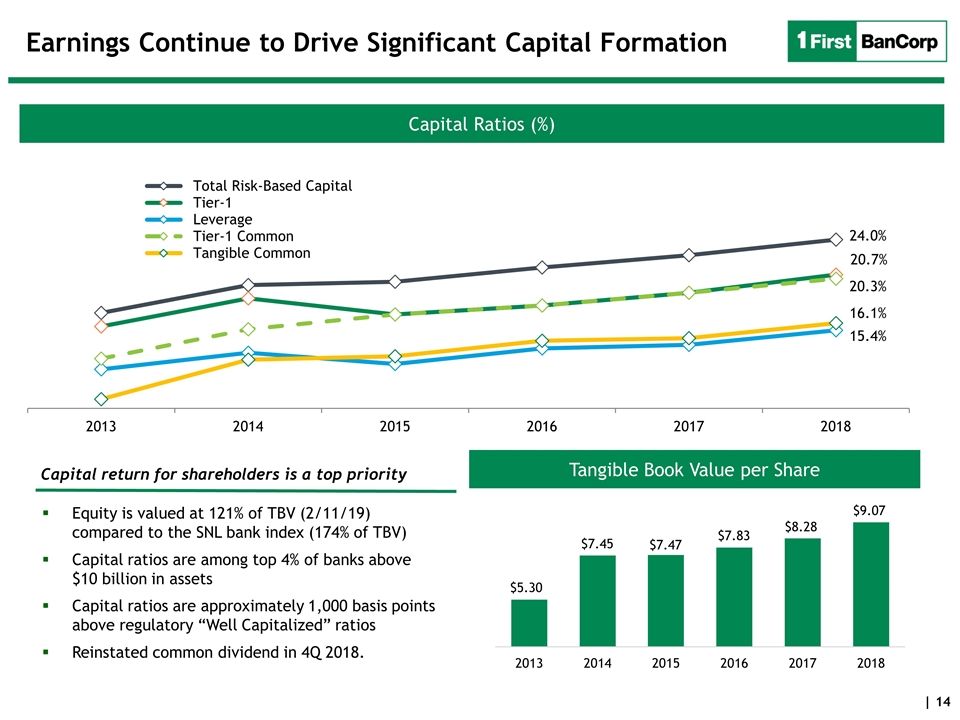

Earnings Continue to Drive Significant Capital Formation Tangible Book Value per Share Capital Ratios (%) Equity is valued at 121% of TBV (2/11/19) compared to the SNL bank index (174% of TBV) Capital ratios are among top 4% of banks above $10 billion in assets Capital ratios are approximately 1,000 basis points above regulatory “Well Capitalized” ratios Reinstated common dividend in 4Q 2018. Capital return for shareholders is a top priority

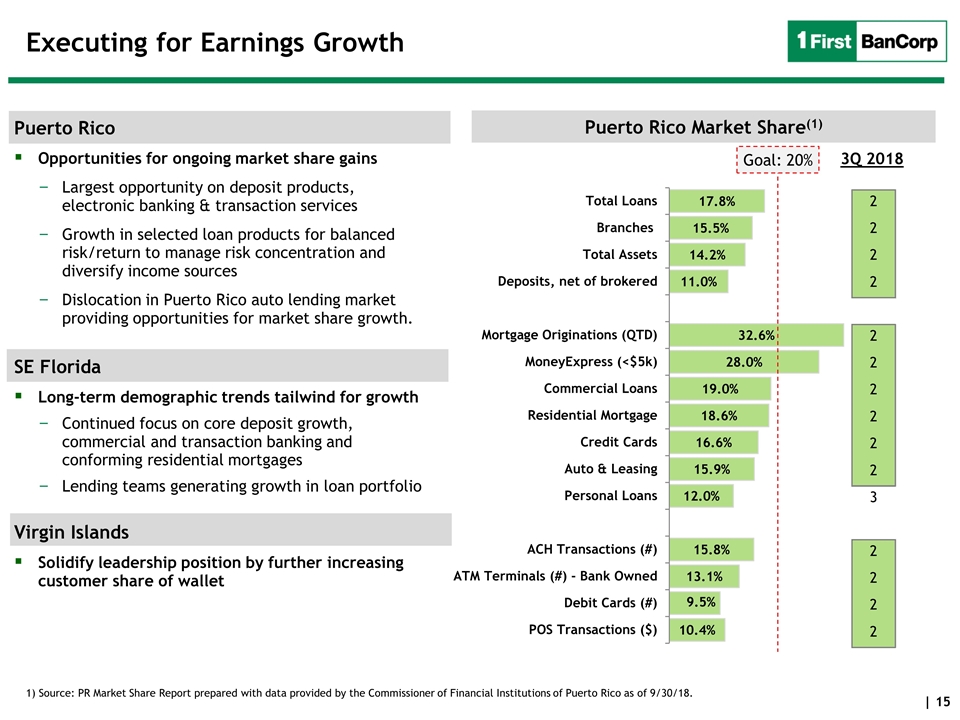

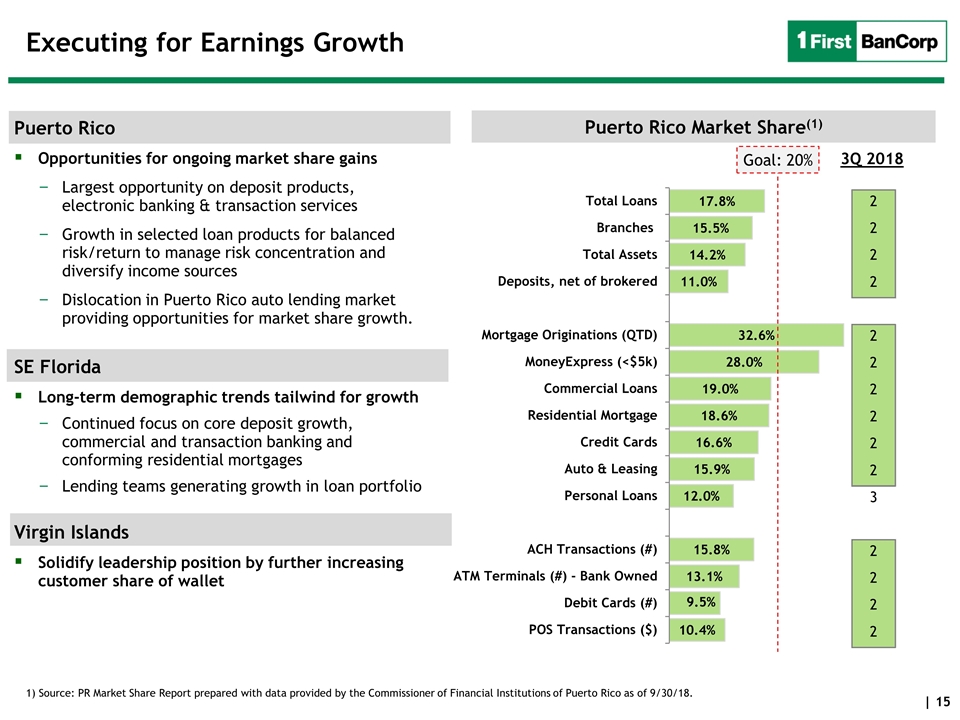

Executing for Earnings Growth Puerto Rico Opportunities for ongoing market share gains Largest opportunity on deposit products, electronic banking & transaction services Growth in selected loan products for balanced risk/return to manage risk concentration and diversify income sources Dislocation in Puerto Rico auto lending market providing opportunities for market share growth. SE Florida Long-term demographic trends tailwind for growth Continued focus on core deposit growth, commercial and transaction banking and conforming residential mortgages Lending teams generating growth in loan portfolio Virgin Islands Solidify leadership position by further increasing customer share of wallet Puerto Rico Market Share(1) 1) Source: PR Market Share Report prepared with data provided by the Commissioner of Financial Institutions of Puerto Rico as of 9/30/18. Puerto Rico Market Share(1) 3Q 2018 Goal: 20% Q12017 2 2 2 2 2 2 2 2 2 2 3 2 2 2 2

Stronger Franchise: Proven Success Implementing Strategic Plan Our business model is diverse and scalable by segment (commercial, residential and consumer) and by unique markets (Puerto Rico, Southeast Florida & Eastern Caribbean). Our equity is valued at 121% of TBV (2/11/19) compared to the SNL bank index (176% of TBV). Our capital ratios are among top 4% of banks above $10 billion in assets. Successfully navigated challenging operating environment following a decade long recession. Recent economic data and inflow of funds are supporting post storm economic recovery in our markets. Leadership team is experienced, cohesive, and credible. Dedicated to enhancing shareholder value through superior service and products for all of our customers in all of our markets. Poised for organic and non-organic growth opportunities. Working with private and public partners we are well-prepared to drive balance sheet growth in Puerto Rico and consistent continued growth in Florida.

Exhibits

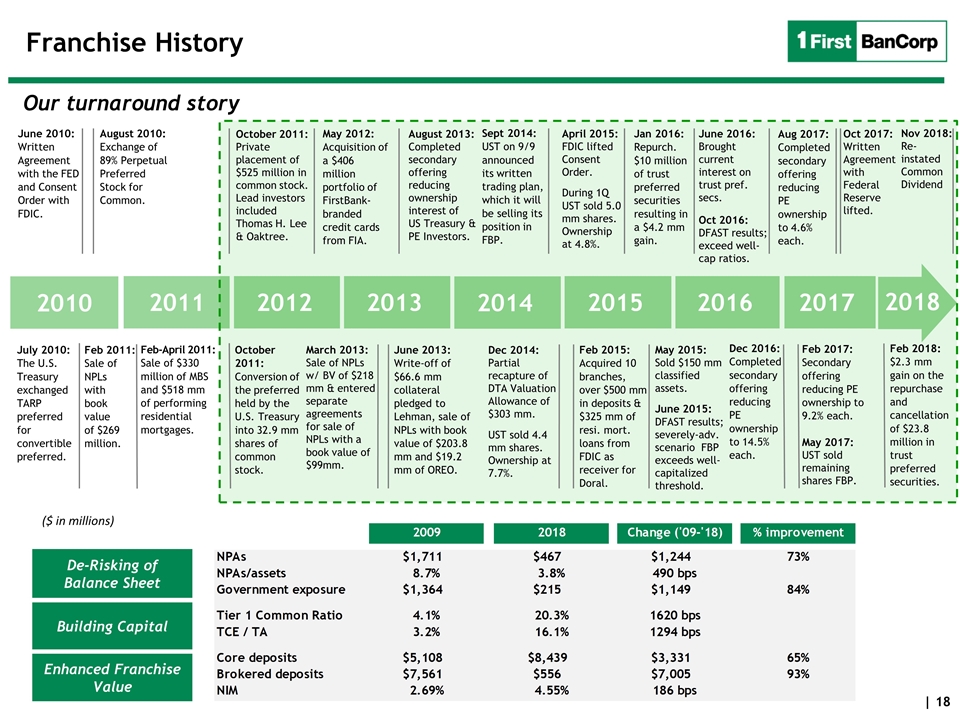

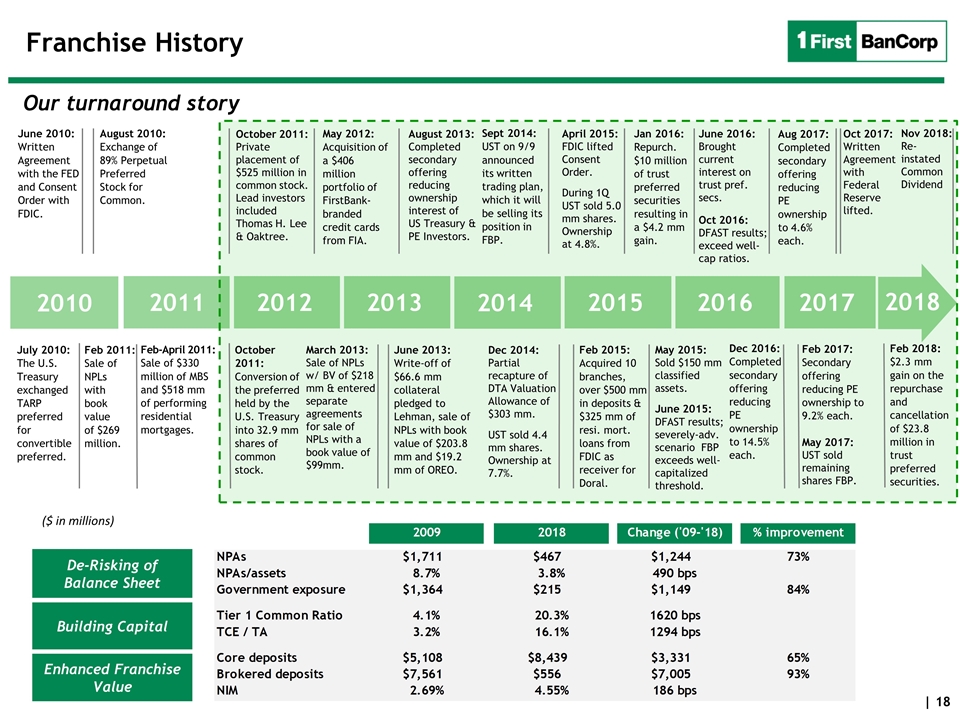

Franchise History Our turnaround story De-Risking of Balance Sheet Building Capital Enhanced Franchise Value June 2010: Written Agreement with the FED and Consent Order with FDIC. July 2010: The U.S. Treasury exchanged TARP preferred for convertible preferred. August 2010: Exchange of 89% Perpetual Preferred Stock for Common. Feb 2011: Sale of NPLs with book value of $269 million. Feb-April 2011: Sale of $330 million of MBS and $518 mm of performing residential mortgages. March 2013: Sale of NPLs w/ BV of $218 mm & entered separate agreements for sale of NPLs with a book value of $99mm. 2010 2011 October 2011: Conversion of the preferred held by the U.S. Treasury into 32.9 mm shares of common stock. May 2012: Acquisition of a $406 million portfolio of FirstBank-branded credit cards from FIA. June 2013: Write-off of $66.6 mm collateral pledged to Lehman, sale of NPLs with book value of $203.8 mm and $19.2 mm of OREO. October 2011: Private placement of $525 million in common stock. Lead investors included Thomas H. Lee & Oaktree. August 2013: Completed secondary offering reducing ownership interest of US Treasury & PE Investors. Sept 2014: UST on 9/9 announced its written trading plan, which it will be selling its position in FBP. ($ in millions) Dec 2014: Partial recapture of DTA Valuation Allowance of $303 mm. UST sold 4.4 mm shares. Ownership at 7.7%. Feb 2015: Acquired 10 branches, over $500 mm in deposits & $325 mm of resi. mort. loans from FDIC as receiver for Doral. April 2015: FDIC lifted Consent Order. During 1Q UST sold 5.0 mm shares. Ownership at 4.8%. May 2015: Sold $150 mm classified assets. June 2015: DFAST results; severely-adv. scenario FBP exceeds well-capitalized threshold. Jan 2016: Repurch. $10 million of trust preferred securities resulting in a $4.2 mm gain. June 2016: Brought current interest on trust pref. secs. Oct 2016: DFAST results; exceed well-cap ratios. 2012 2013 2014 2015 Dec 2016: Completed secondary offering reducing PE ownership to 14.5% each. 2016 Feb 2017: Secondary offering reducing PE ownership to 9.2% each. May 2017: UST sold remaining shares FBP. Oct 2017: Written Agreement with Federal Reserve lifted. Aug 2017: Completed secondary offering reducing PE ownership to 4.6% each. 2017 2018 Feb 2018: $2.3 mm gain on the repurchase and cancellation of $23.8 million in trust preferred securities. Nov 2018: Re-instated Common Dividend

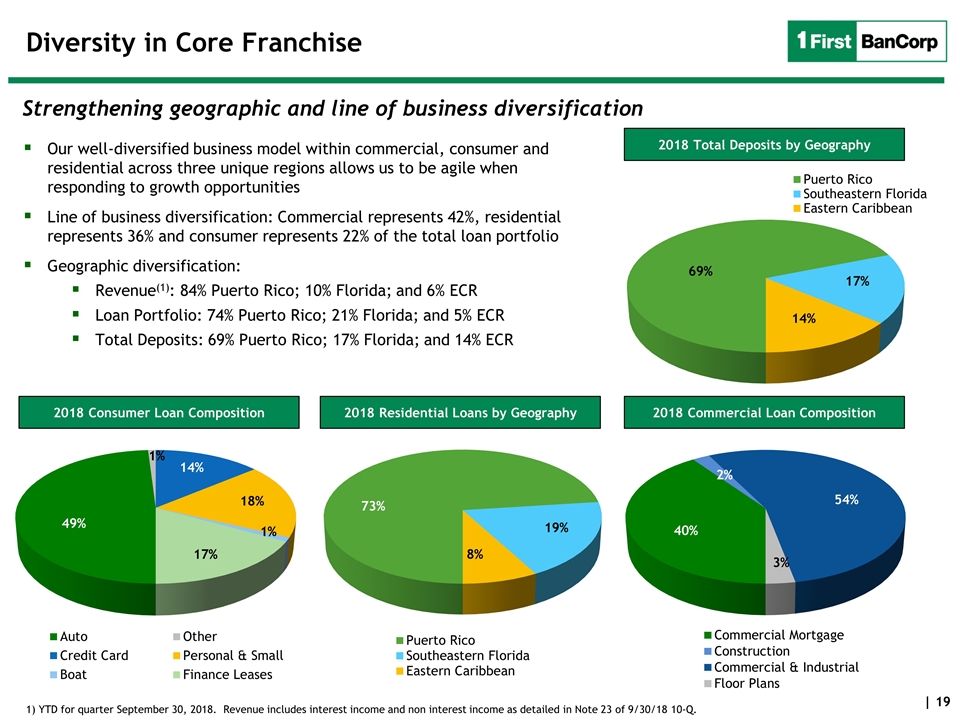

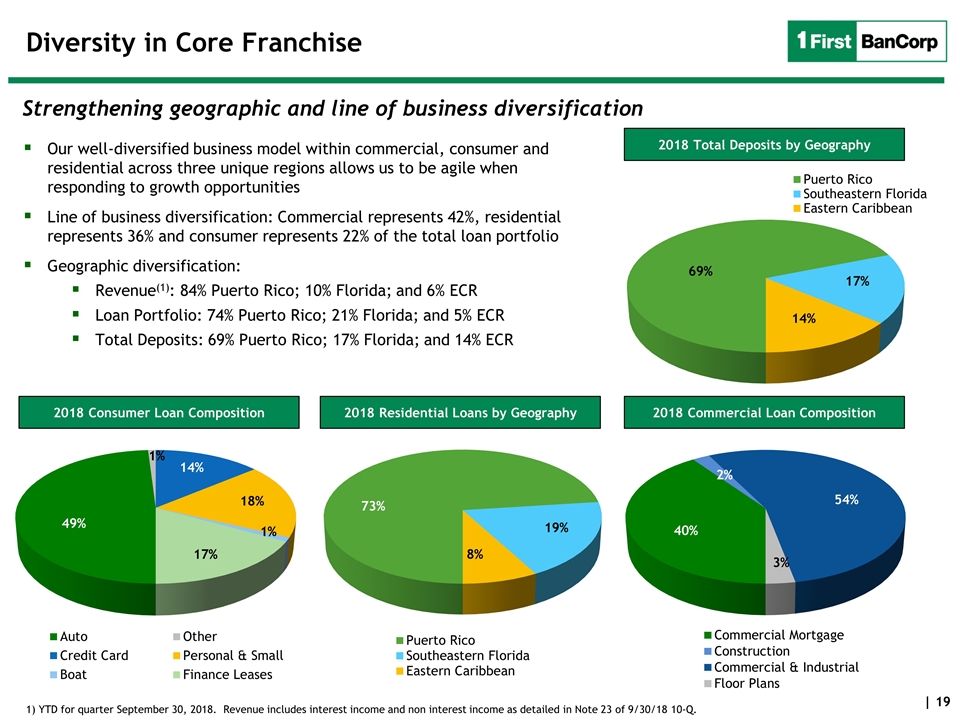

Our well-diversified business model within commercial, consumer and residential across three unique regions allows us to be agile when responding to growth opportunities Line of business diversification: Commercial represents 42%, residential represents 36% and consumer represents 22% of the total loan portfolio Geographic diversification: Revenue(1): 84% Puerto Rico; 10% Florida; and 6% ECR Loan Portfolio: 74% Puerto Rico; 21% Florida; and 5% ECR Total Deposits: 69% Puerto Rico; 17% Florida; and 14% ECR Diversity in Core Franchise Strengthening geographic and line of business diversification 2018 Total Deposits by Geography 1) YTD for quarter September 30, 2018. Revenue includes interest income and non interest income as detailed in Note 23 of 9/30/18 10-Q. 2018 Consumer Loan Composition 2018 Residential Loans by Geography 2018 Commercial Loan Composition

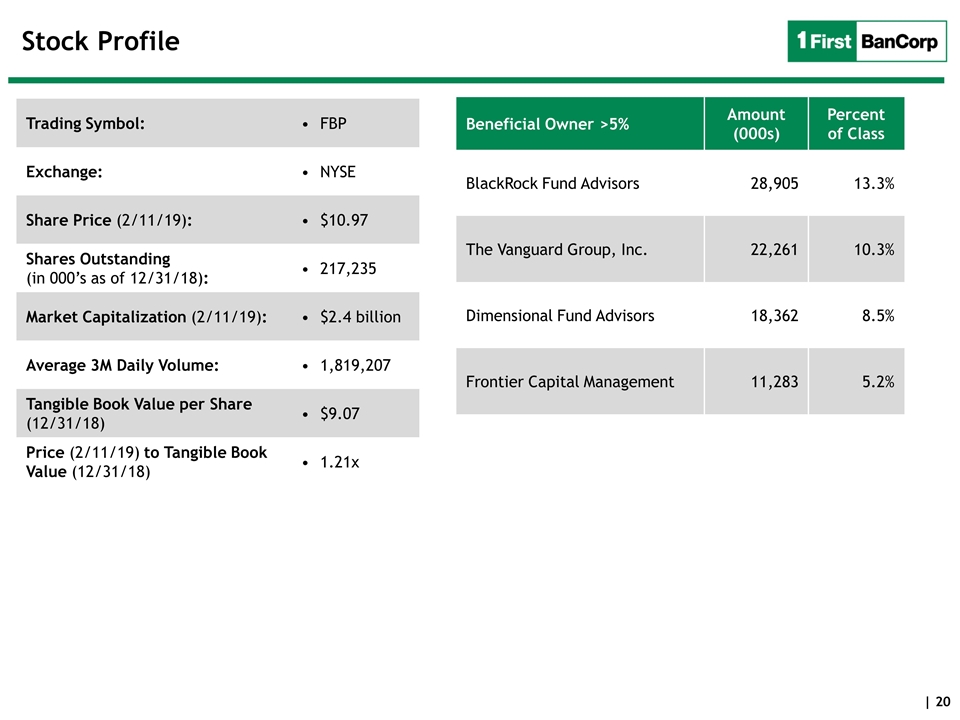

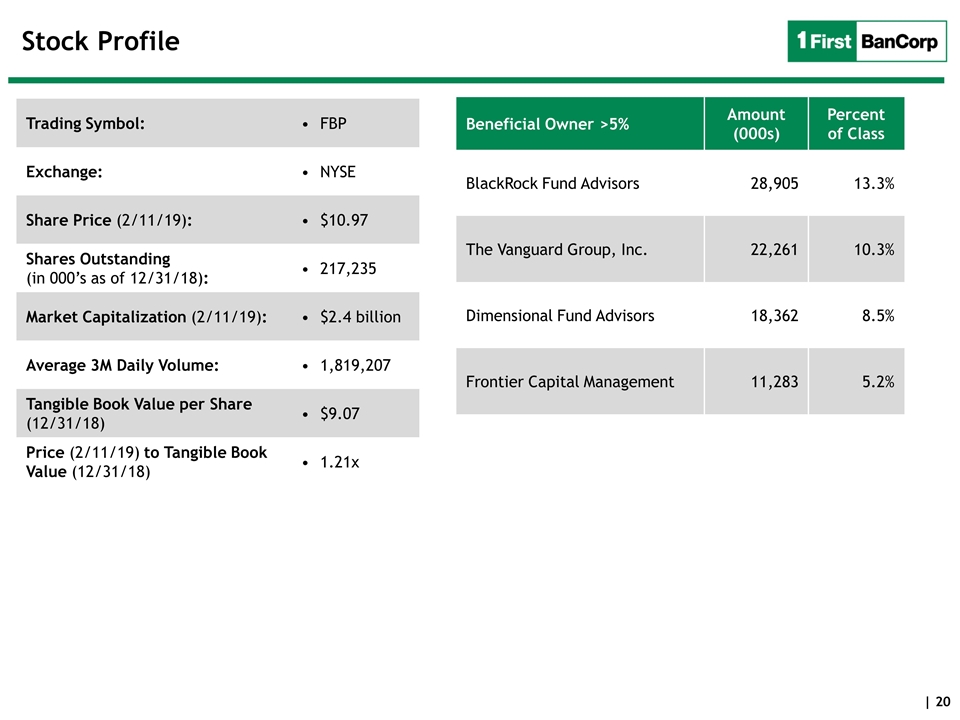

Stock Profile Trading Symbol: FBP Exchange: NYSE Share Price (2/11/19): $10.97 Shares Outstanding (in 000’s as of 12/31/18): 217,235 Market Capitalization (2/11/19): $2.4 billion Average 3M Daily Volume: 1,819,207 Tangible Book Value per Share (12/31/18) $9.07 Price (2/11/19) to Tangible Book Value (12/31/18) 1.21x Beneficial Owner >5% Amount (000s) Percent of Class BlackRock Fund Advisors 28,905 13.3% The Vanguard Group, Inc. 22,261 10.3% Dimensional Fund Advisors 18,362 8.5% Frontier Capital Management 11,283 5.2%

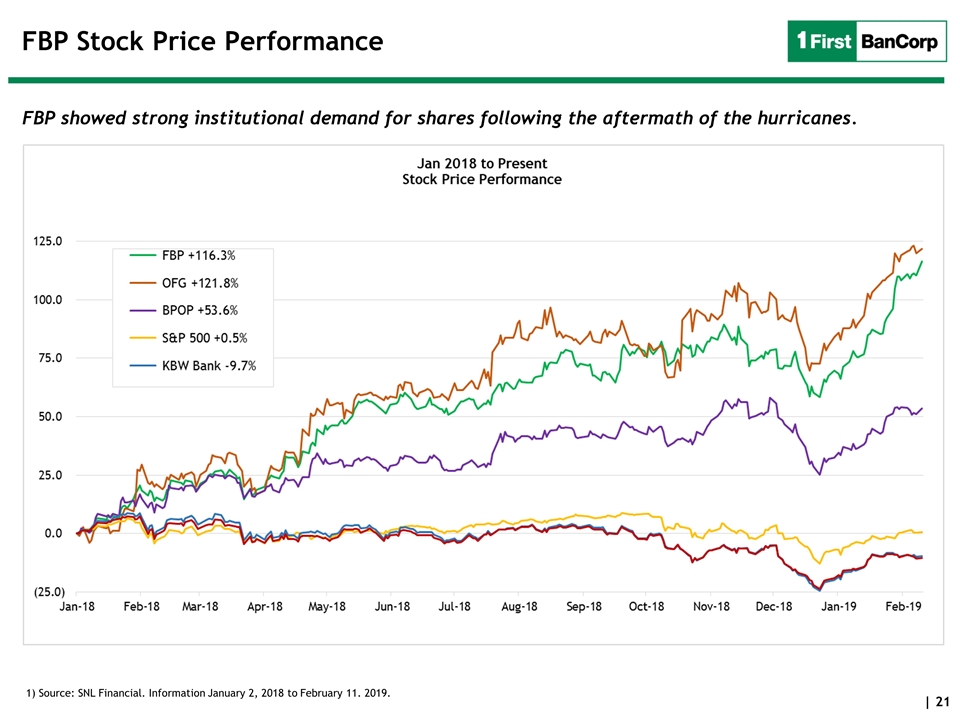

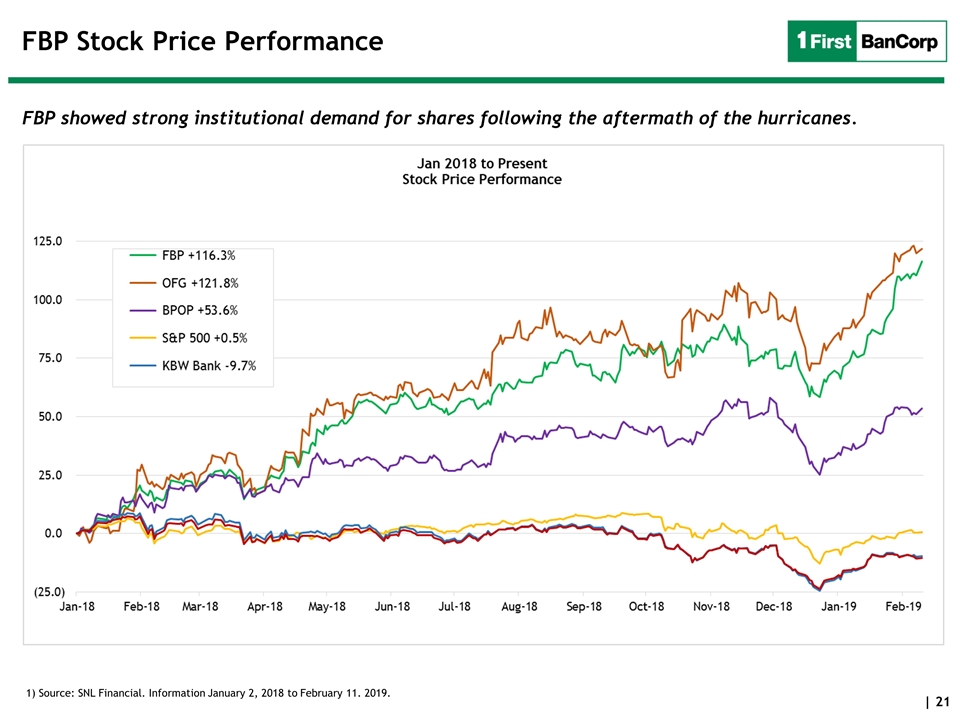

FBP Stock Price Performance FBP showed strong institutional demand for shares following the aftermath of the hurricanes. 1) Source: SNL Financial. Information January 2, 2018 to February 11. 2019.

Puerto Rico Bank Sector Price / TBV Performance Puerto Rico bank valuations continue to trail the broader market. 1) Source: SNL Financial. Information January 2, 2018 to February 11, 2019.

Fourth Quarter 2018 Results

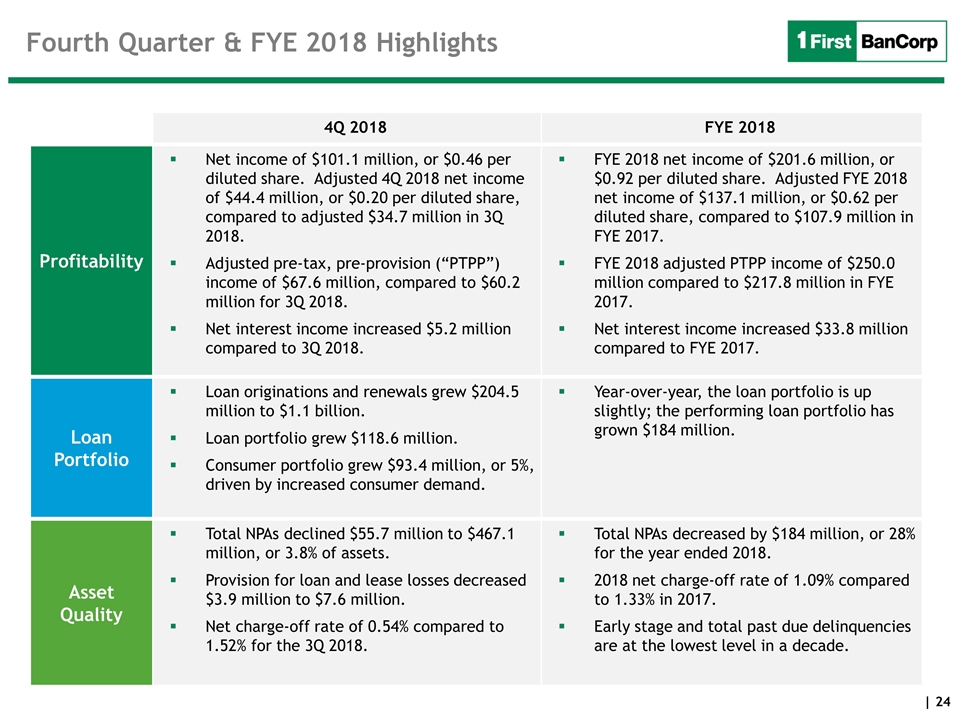

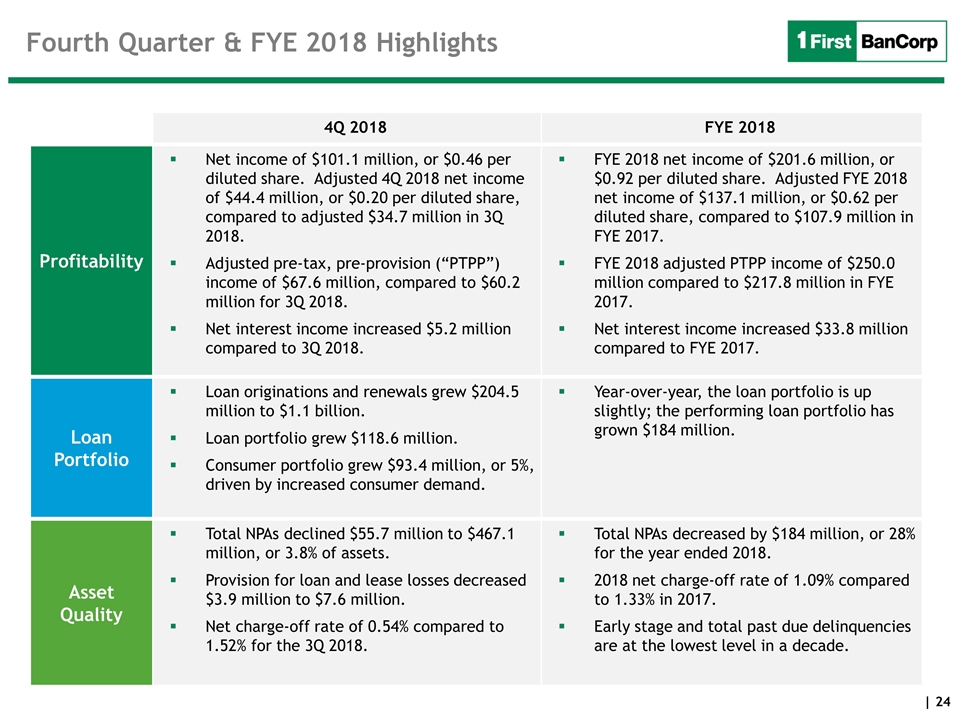

Fourth Quarter & FYE 2018 Highlights 4Q 2018 FYE 2018 Profitability Net income of $101.1 million, or $0.46 per diluted share. Adjusted 4Q 2018 net income of $44.4 million, or $0.20 per diluted share, compared to adjusted $34.7 million in 3Q 2018. Adjusted pre-tax, pre-provision (“PTPP”) income of $67.6 million, compared to $60.2 million for 3Q 2018. Net interest income increased $5.2 million compared to 3Q 2018. FYE 2018 net income of $201.6 million, or $0.92 per diluted share. Adjusted FYE 2018 net income of $137.1 million, or $0.62 per diluted share, compared to $107.9 million in FYE 2017. FYE 2018 adjusted PTPP income of $250.0 million compared to $217.8 million in FYE 2017. Net interest income increased $33.8 million compared to FYE 2017. Loan Portfolio Loan originations and renewals grew $204.5 million to $1.1 billion. Loan portfolio grew $118.6 million. Consumer portfolio grew $93.4 million, or 5%, driven by increased consumer demand. Year-over-year, the loan portfolio is up slightly; the performing loan portfolio has grown $184 million. Asset Quality Total NPAs declined $55.7 million to $467.1 million, or 3.8% of assets. Provision for loan and lease losses decreased $3.9 million to $7.6 million. Net charge-off rate of 0.54% compared to 1.52% for the 3Q 2018. Total NPAs decreased by $184 million, or 28% for the year ended 2018. 2018 net charge-off rate of 1.09% compared to 1.33% in 2017. Early stage and total past due delinquencies are at the lowest level in a decade.

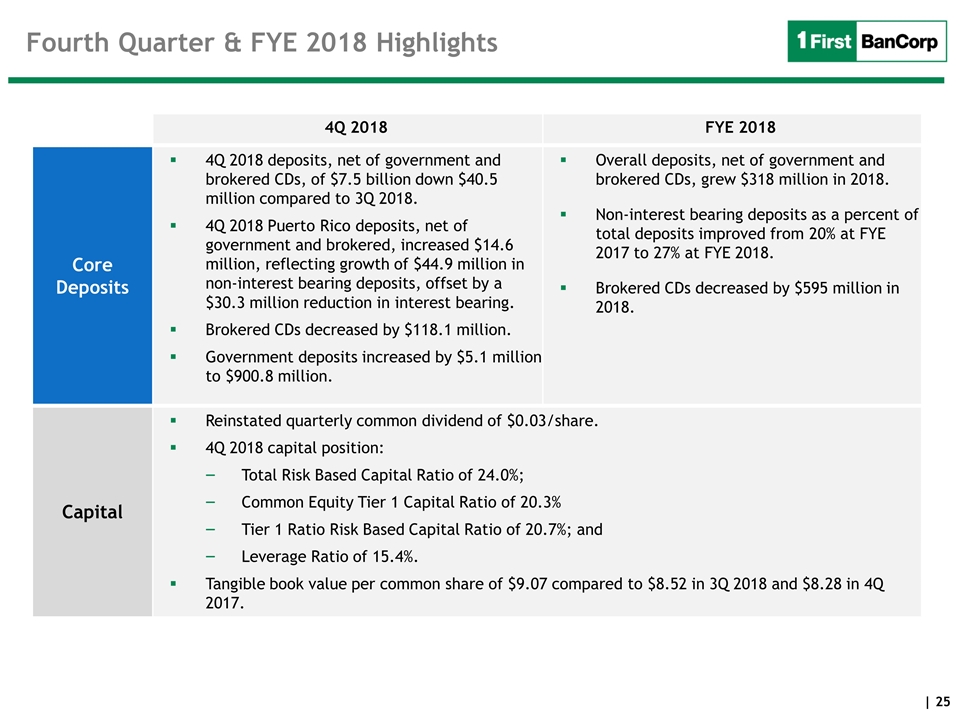

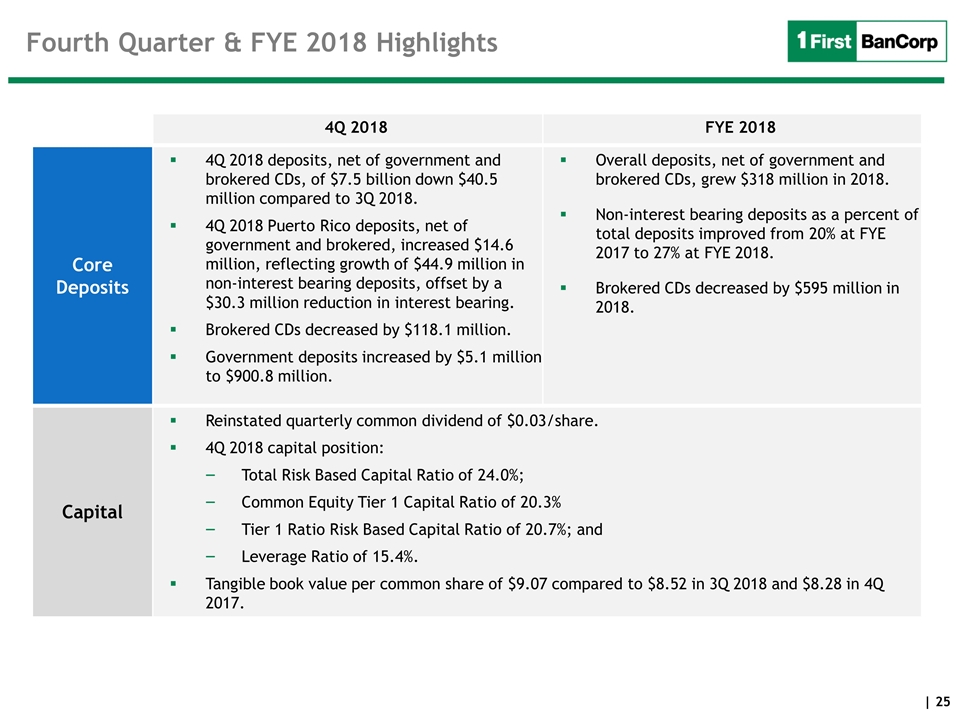

Fourth Quarter & FYE 2018 Highlights 4Q 2018 FYE 2018 Core Deposits 4Q 2018 deposits, net of government and brokered CDs, of $7.5 billion down $40.5 million compared to 3Q 2018. 4Q 2018 Puerto Rico deposits, net of government and brokered, increased $14.6 million, reflecting growth of $44.9 million in non-interest bearing deposits, offset by a $30.3 million reduction in interest bearing. Brokered CDs decreased by $118.1 million. Government deposits increased by $5.1 million to $900.8 million. Overall deposits, net of government and brokered CDs, grew $318 million in 2018. Non-interest bearing deposits as a percent of total deposits improved from 20% at FYE 2017 to 27% at FYE 2018. Brokered CDs decreased by $595 million in 2018. Capital Reinstated quarterly common dividend of $0.03/share. 4Q 2018 capital position: Total Risk Based Capital Ratio of 24.0%; Common Equity Tier 1 Capital Ratio of 20.3% Tier 1 Ratio Risk Based Capital Ratio of 20.7%; and Leverage Ratio of 15.4%. Tangible book value per common share of $9.07 compared to $8.52 in 3Q 2018 and $8.28 in 4Q 2017.

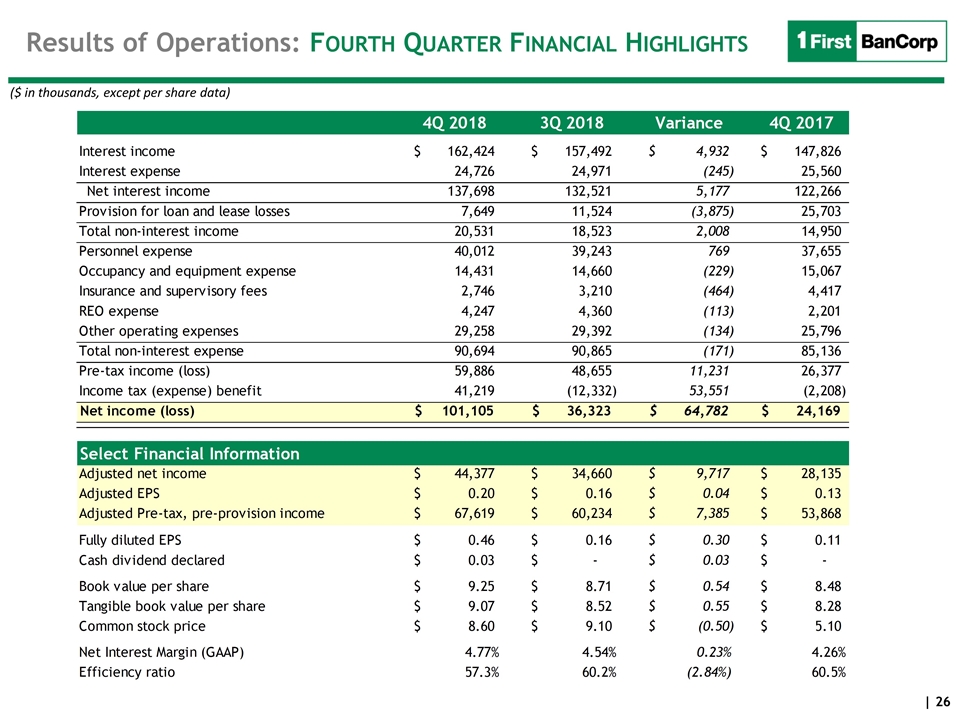

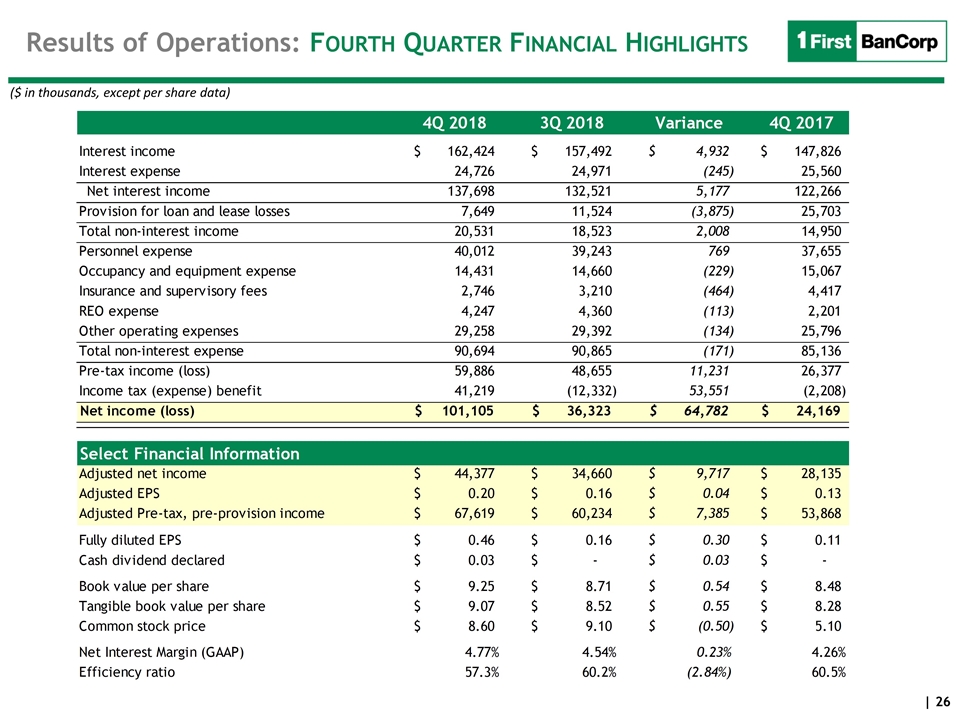

Results of Operations: Fourth Quarter Financial Highlights ($ in thousands, except per share data) Select Financial Information

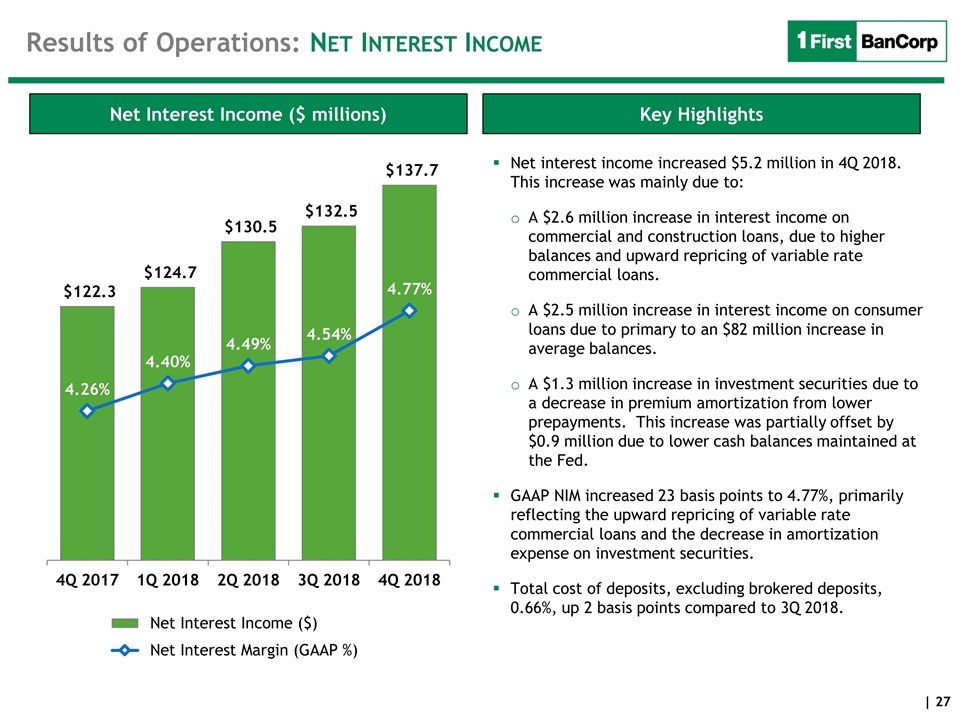

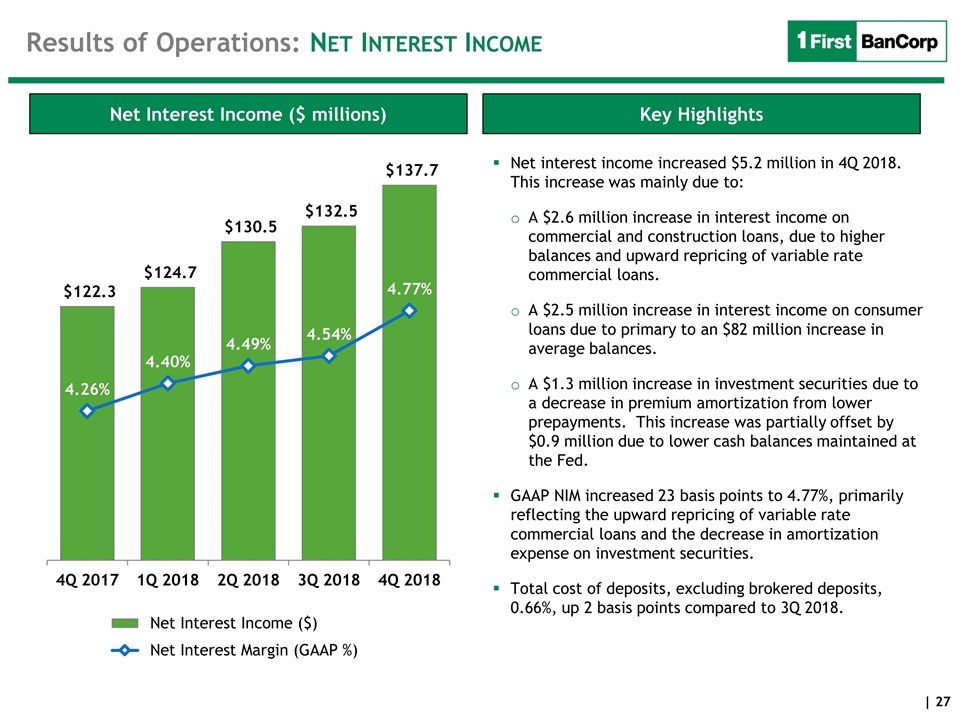

Key Highlights Net Interest Income ($ millions) Net interest income increased $5.2 million in 4Q 2018. This increase was mainly due to: A $2.6 million increase in interest income on commercial and construction loans, due to higher balances and upward repricing of variable rate commercial loans. A $2.5 million increase in interest income on consumer loans due to primary to an $82 million increase in average balances. A $1.3 million increase in investment securities due to a decrease in premium amortization from lower prepayments. This increase was partially offset by $0.9 million due to lower cash balances maintained at the Fed. GAAP NIM increased 23 basis points to 4.77%, primarily reflecting the upward repricing of variable rate commercial loans and the decrease in amortization expense on investment securities. Total cost of deposits, excluding brokered deposits, 0.66%, up 2 basis points compared to 3Q 2018. Results of Operations: Net Interest Income

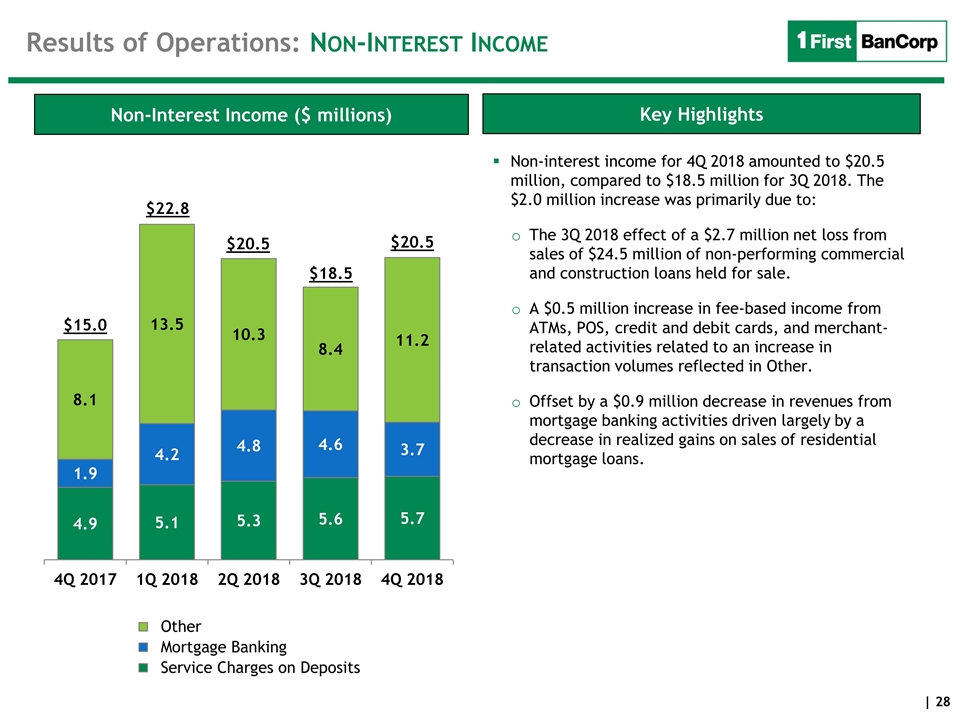

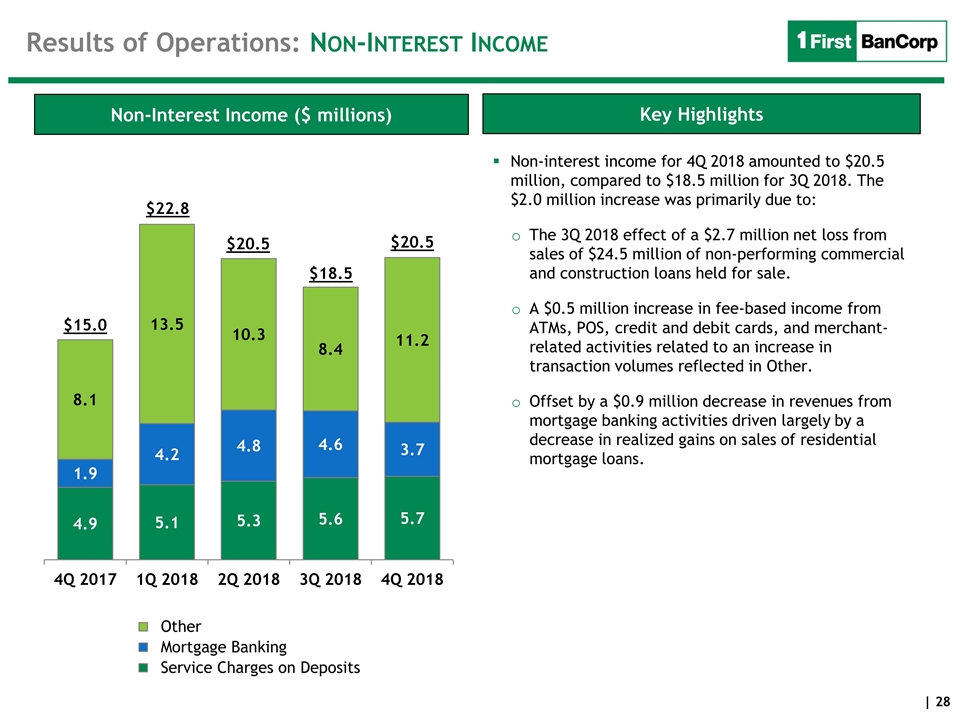

Non-interest income for 4Q 2018 amounted to $20.5 million, compared to $18.5 million for 3Q 2018. The $2.0 million increase was primarily due to: The 3Q 2018 effect of a $2.7 million net loss from sales of $24.5 million of non-performing commercial and construction loans held for sale. A $0.5 million increase in fee-based income from ATMs, POS, credit and debit cards, and merchant-related activities related to an increase in transaction volumes reflected in Other. Offset by a $0.9 million decrease in revenues from mortgage banking activities driven largely by a decrease in realized gains on sales of residential mortgage loans. Results of Operations: Non-Interest Income Non-Interest Income ($ millions) $15.0 $18.5 $20.5 $22.8 $20.5 Key Highlights

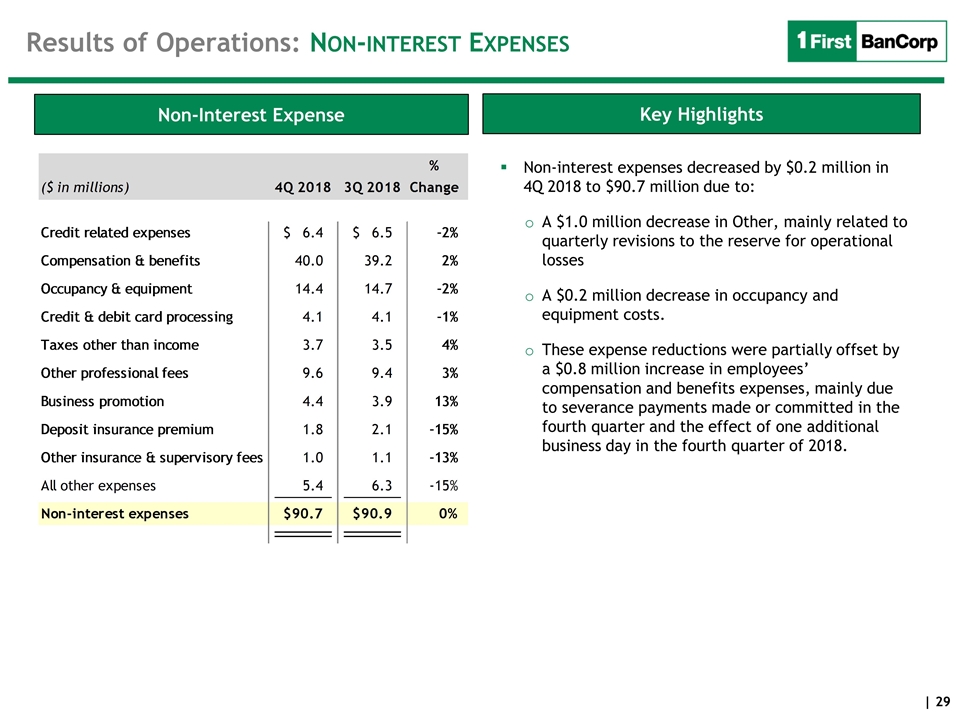

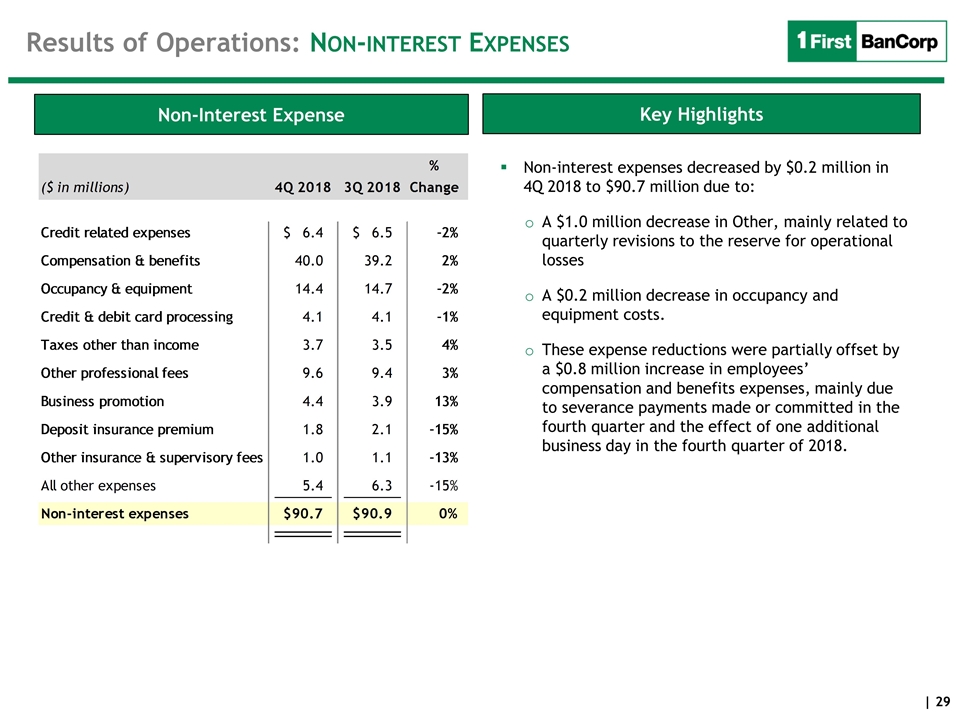

Results of Operations: Non-interest Expenses Non-interest expenses decreased by $0.2 million in 4Q 2018 to $90.7 million due to: A $1.0 million decrease in Other, mainly related to quarterly revisions to the reserve for operational losses A $0.2 million decrease in occupancy and equipment costs. These expense reductions were partially offset by a $0.8 million increase in employees’ compensation and benefits expenses, mainly due to severance payments made or committed in the fourth quarter and the effect of one additional business day in the fourth quarter of 2018. Non-Interest Expense Key Highlights

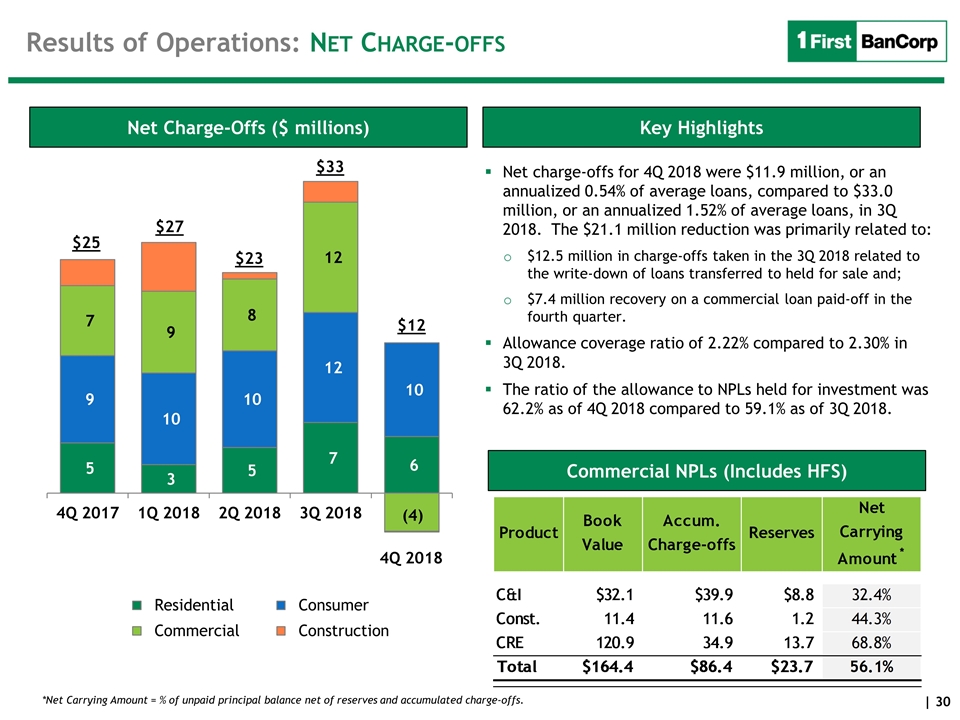

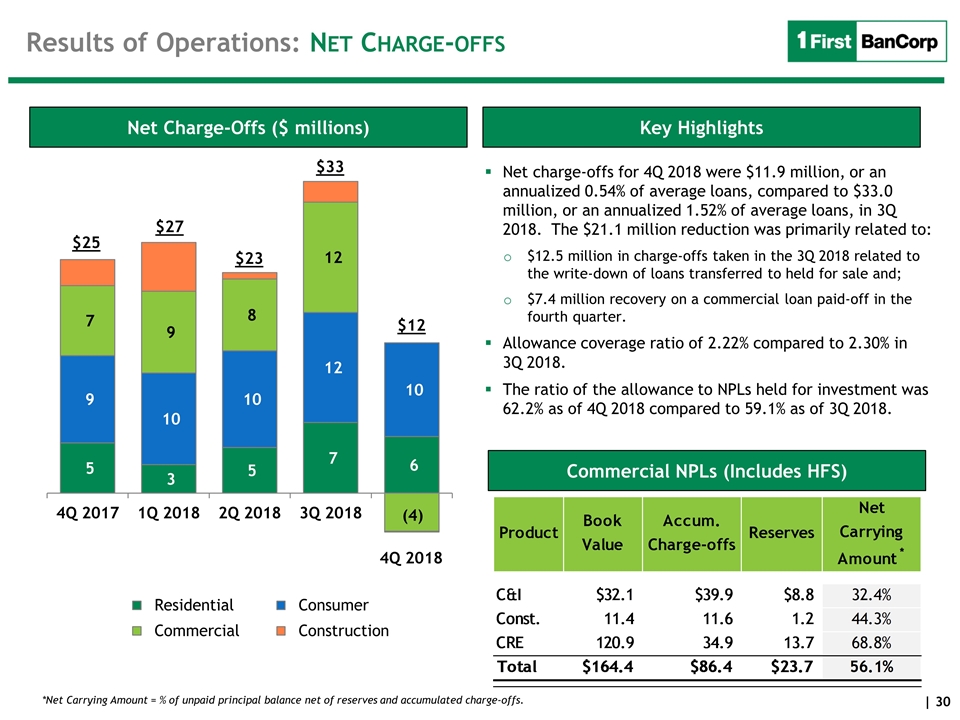

Key Highlights Net Charge-Offs ($ millions) Net charge-offs for 4Q 2018 were $11.9 million, or an annualized 0.54% of average loans, compared to $33.0 million, or an annualized 1.52% of average loans, in 3Q 2018. The $21.1 million reduction was primarily related to: $12.5 million in charge-offs taken in the 3Q 2018 related to the write-down of loans transferred to held for sale and; $7.4 million recovery on a commercial loan paid-off in the fourth quarter. Allowance coverage ratio of 2.22% compared to 2.30% in 3Q 2018. The ratio of the allowance to NPLs held for investment was 62.2% as of 4Q 2018 compared to 59.1% as of 3Q 2018. Commercial NPLs (Includes HFS) *Net Carrying Amount = % of unpaid principal balance net of reserves and accumulated charge-offs. Results of Operations: Net Charge-offs $25 $12 $33 $27 $23 4Q 2018

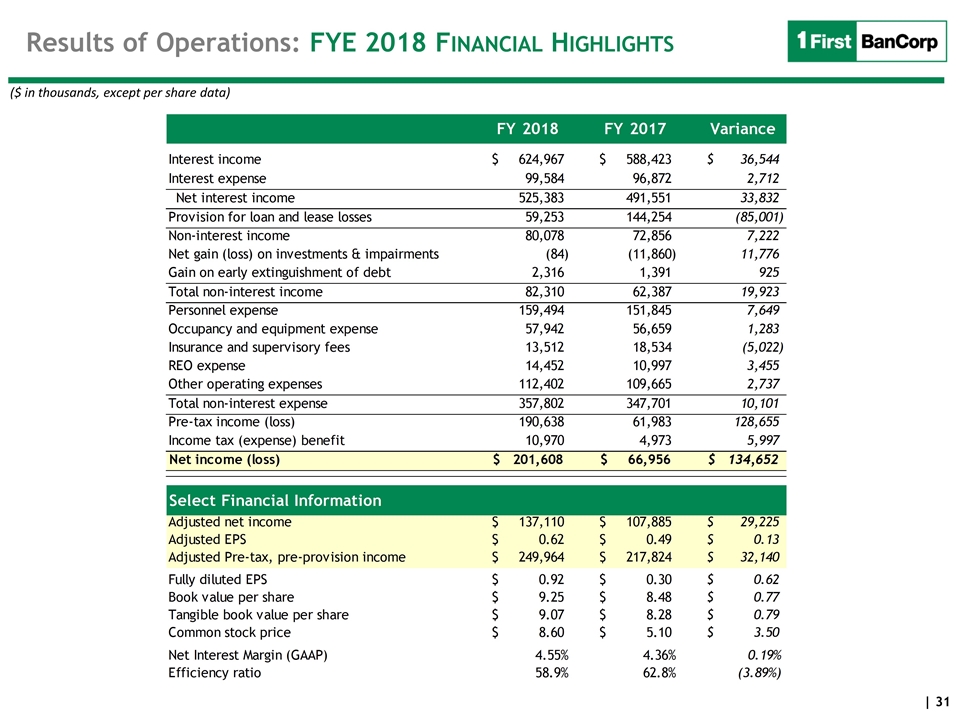

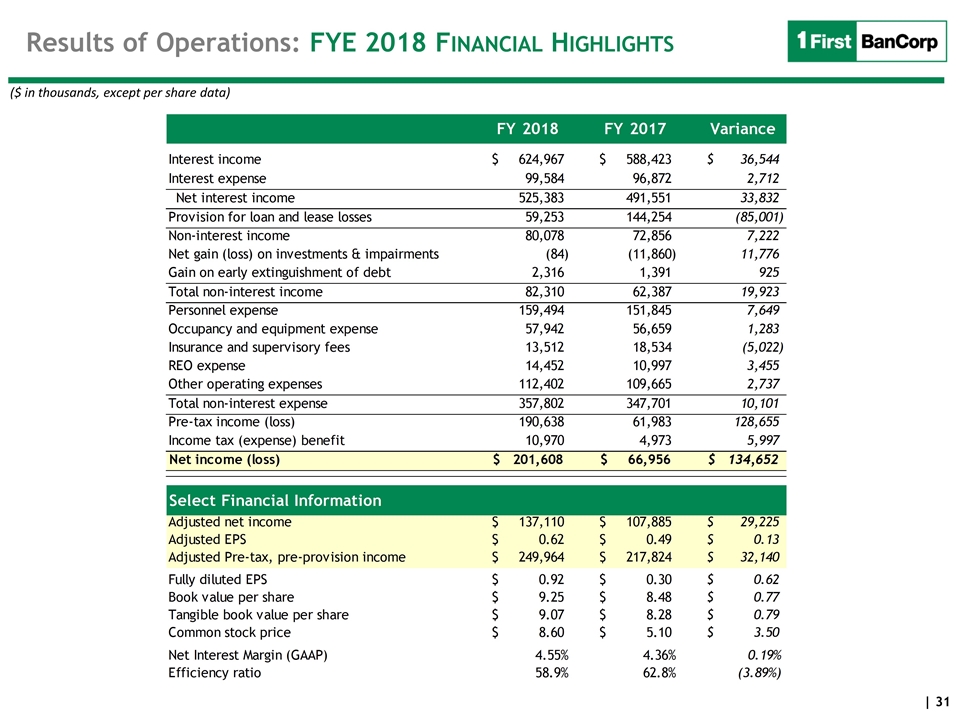

Results of Operations: FYE 2018 Financial Highlights ($ in thousands, except per share data) Select Financial Information

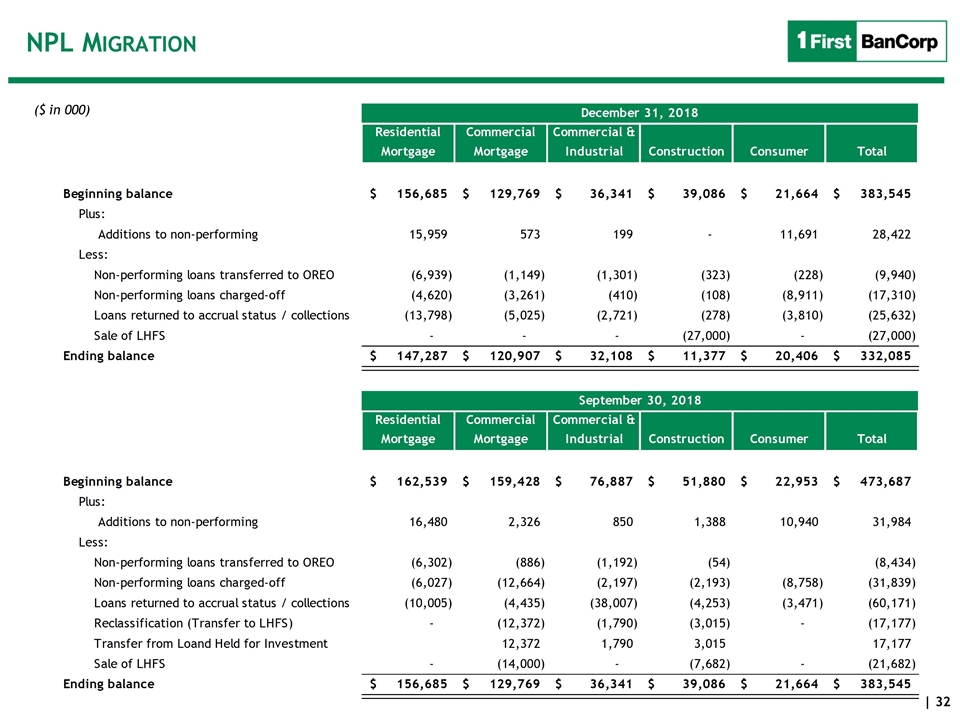

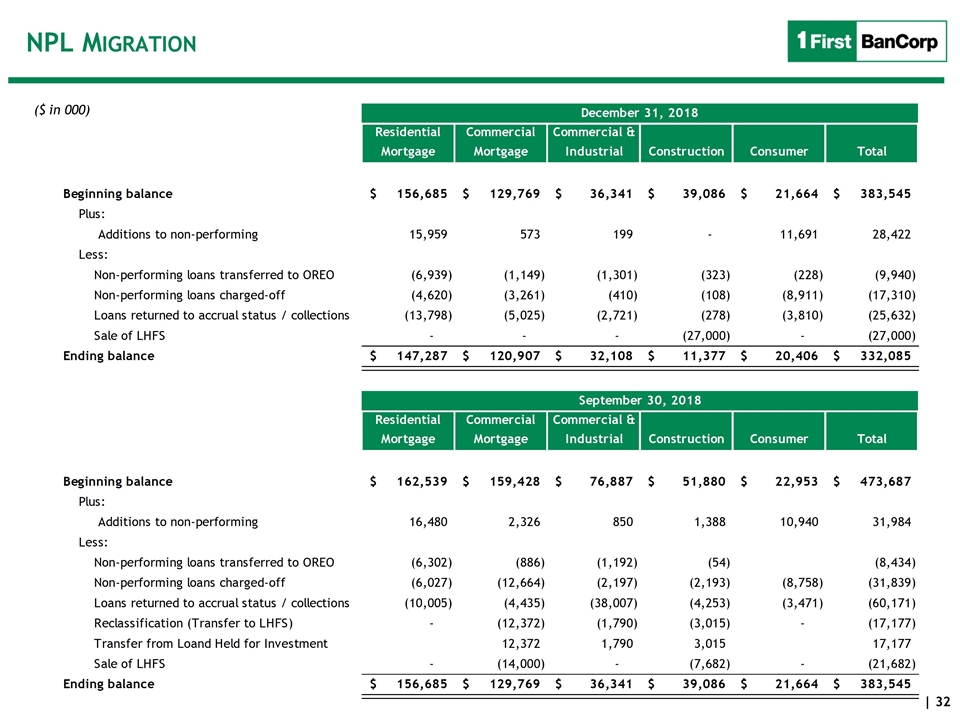

NPL Migration ($ in 000)

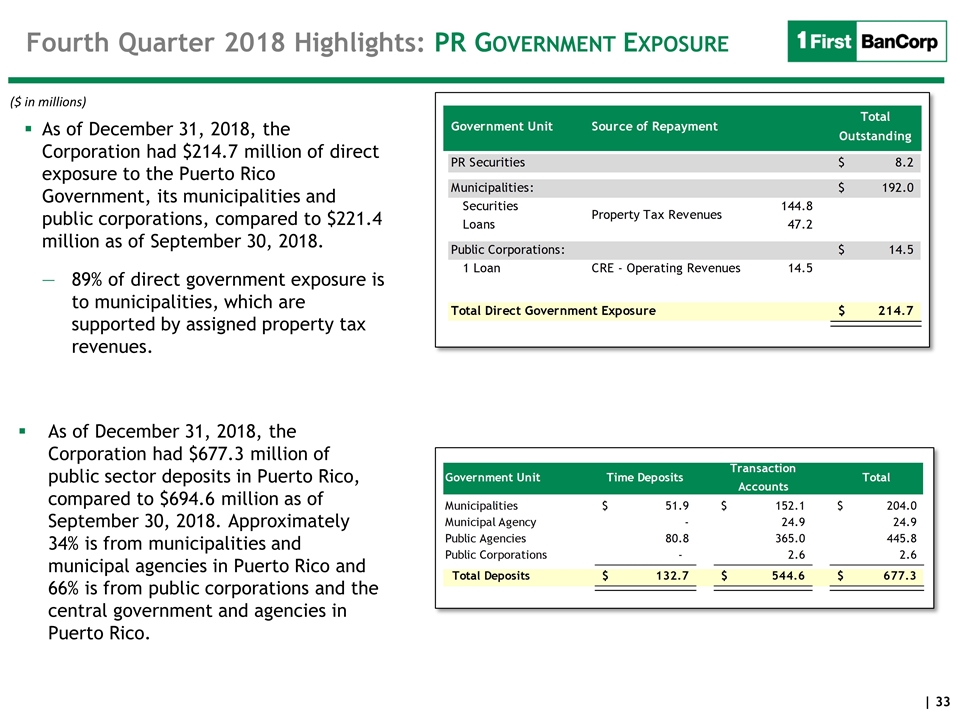

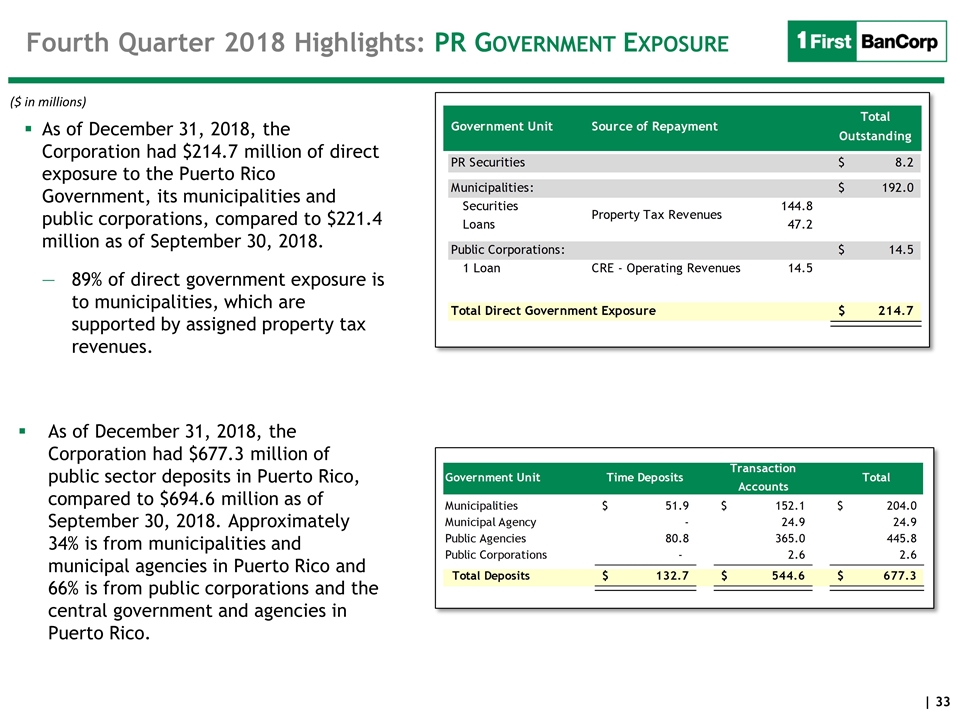

Fourth Quarter 2018 Highlights: PR Government Exposure ($ in millions) As of December 31, 2018, the Corporation had $214.7 million of direct exposure to the Puerto Rico Government, its municipalities and public corporations, compared to $221.4 million as of September 30, 2018. 89% of direct government exposure is to municipalities, which are supported by assigned property tax revenues. As of December 31, 2018, the Corporation had $677.3 million of public sector deposits in Puerto Rico, compared to $694.6 million as of September 30, 2018. Approximately 34% is from municipalities and municipal agencies in Puerto Rico and 66% is from public corporations and the central government and agencies in Puerto Rico.

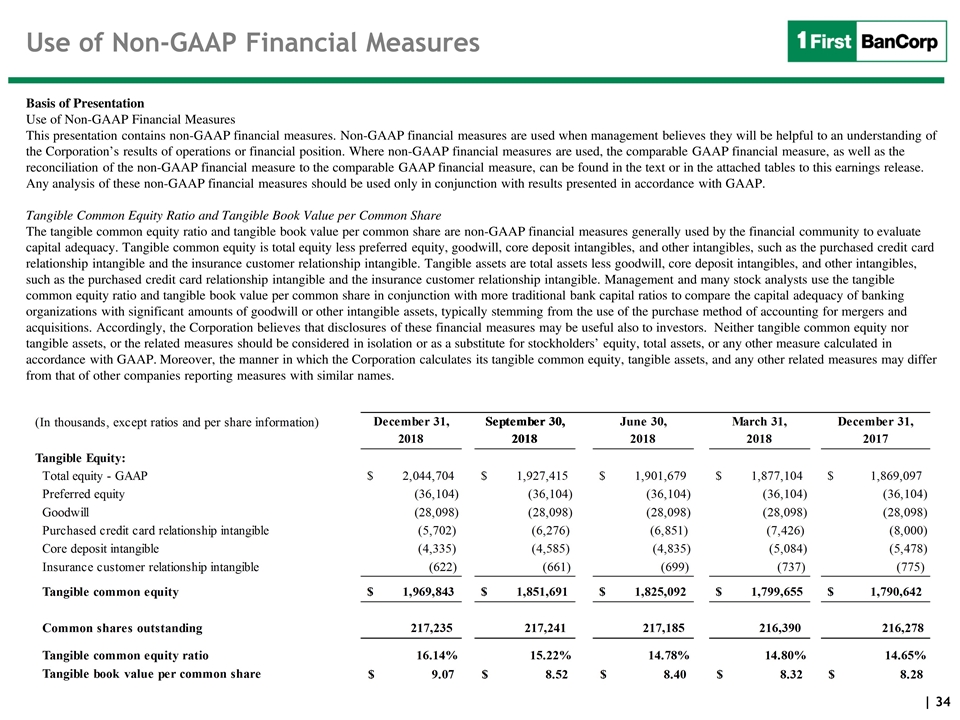

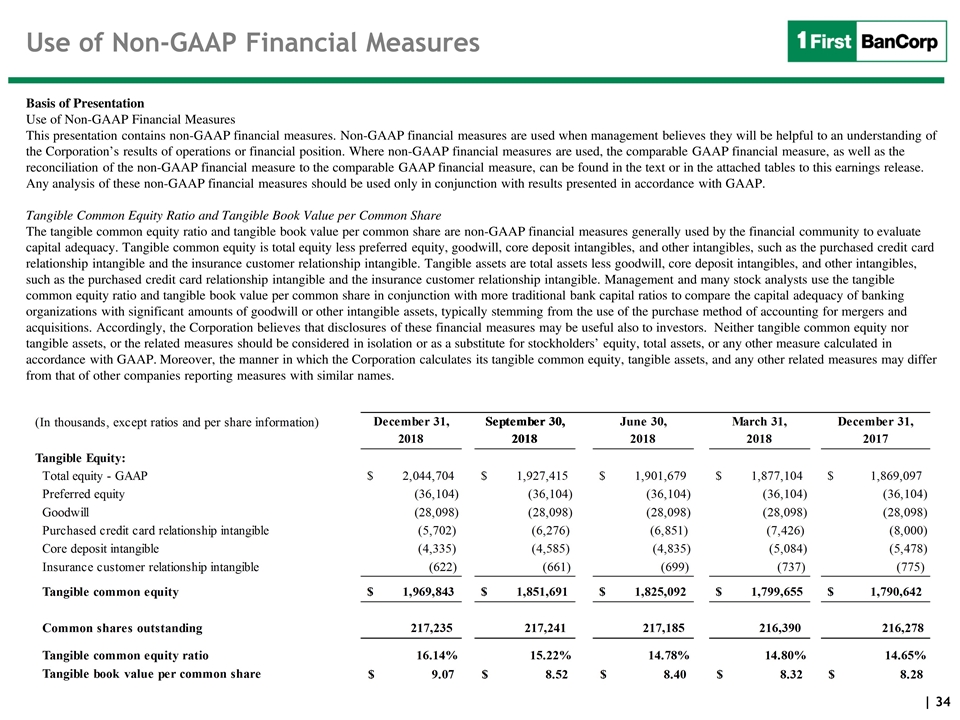

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Tangible Common Equity Ratio and Tangible Book Value per Common Share The tangible common equity ratio and tangible book value per common share are non-GAAP financial measures generally used by the financial community to evaluate capital adequacy. Tangible common equity is total equity less preferred equity, goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Tangible assets are total assets less goodwill, core deposit intangibles, and other intangibles, such as the purchased credit card relationship intangible and the insurance customer relationship intangible. Management and many stock analysts use the tangible common equity ratio and tangible book value per common share in conjunction with more traditional bank capital ratios to compare the capital adequacy of banking organizations with significant amounts of goodwill or other intangible assets, typically stemming from the use of the purchase method of accounting for mergers and acquisitions. Accordingly, the Corporation believes that disclosures of these financial measures may be useful also to investors. Neither tangible common equity nor tangible assets, or the related measures should be considered in isolation or as a substitute for stockholders’ equity, total assets, or any other measure calculated in accordance with GAAP. Moreover, the manner in which the Corporation calculates its tangible common equity, tangible assets, and any other related measures may differ from that of other companies reporting measures with similar names.

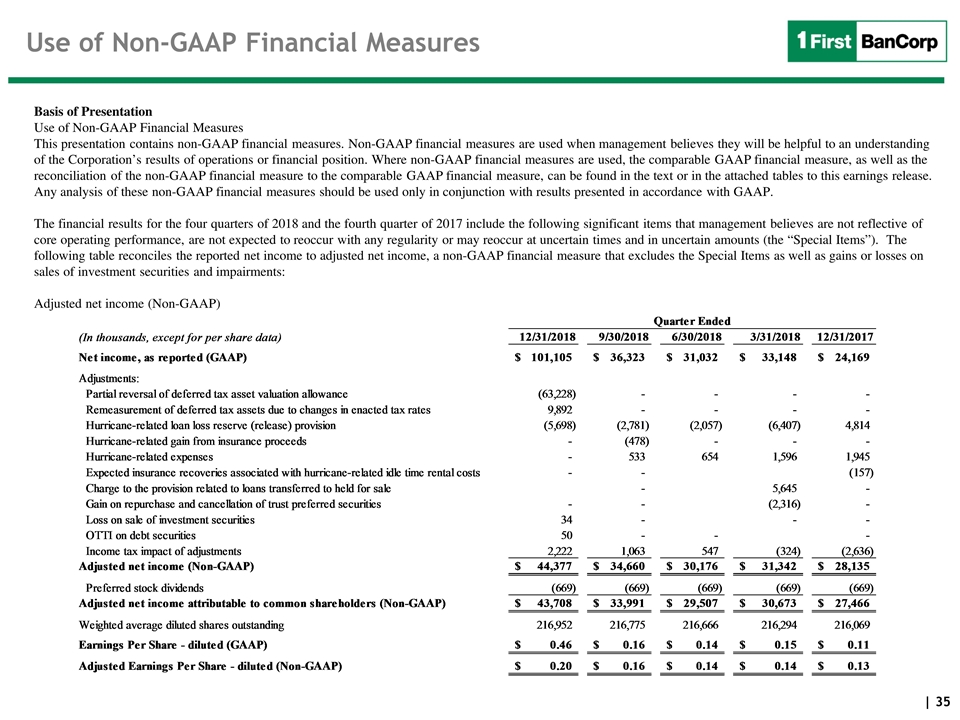

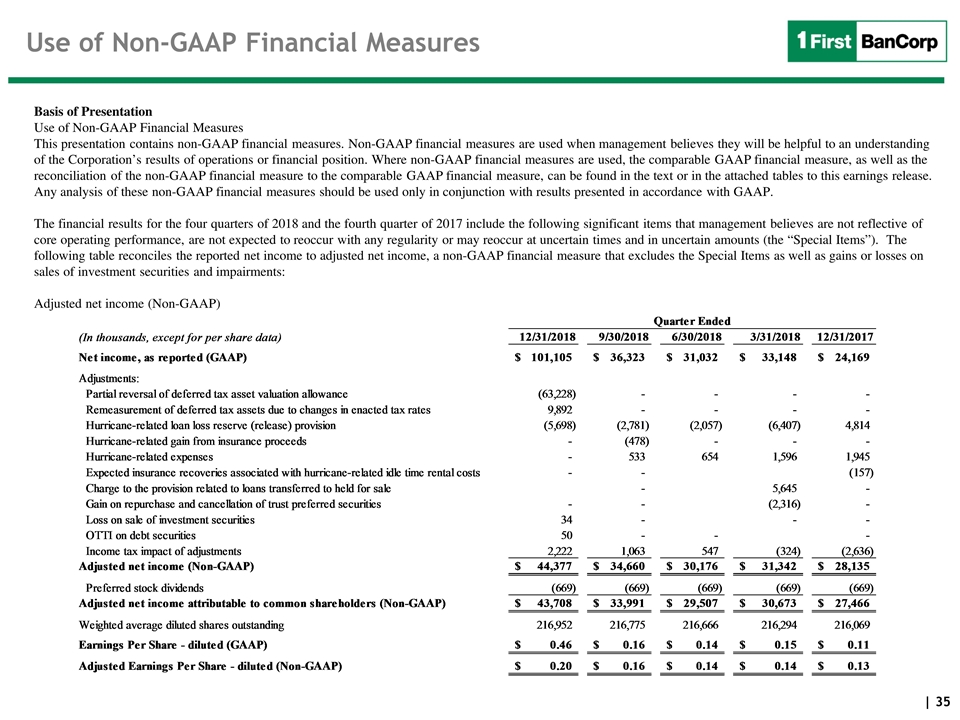

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. The financial results for the four quarters of 2018 and the fourth quarter of 2017 include the following significant items that management believes are not reflective of core operating performance, are not expected to reoccur with any regularity or may reoccur at uncertain times and in uncertain amounts (the “Special Items”). The following table reconciles the reported net income to adjusted net income, a non-GAAP financial measure that excludes the Special Items as well as gains or losses on sales of investment securities and impairments: Adjusted net income (Non-GAAP)

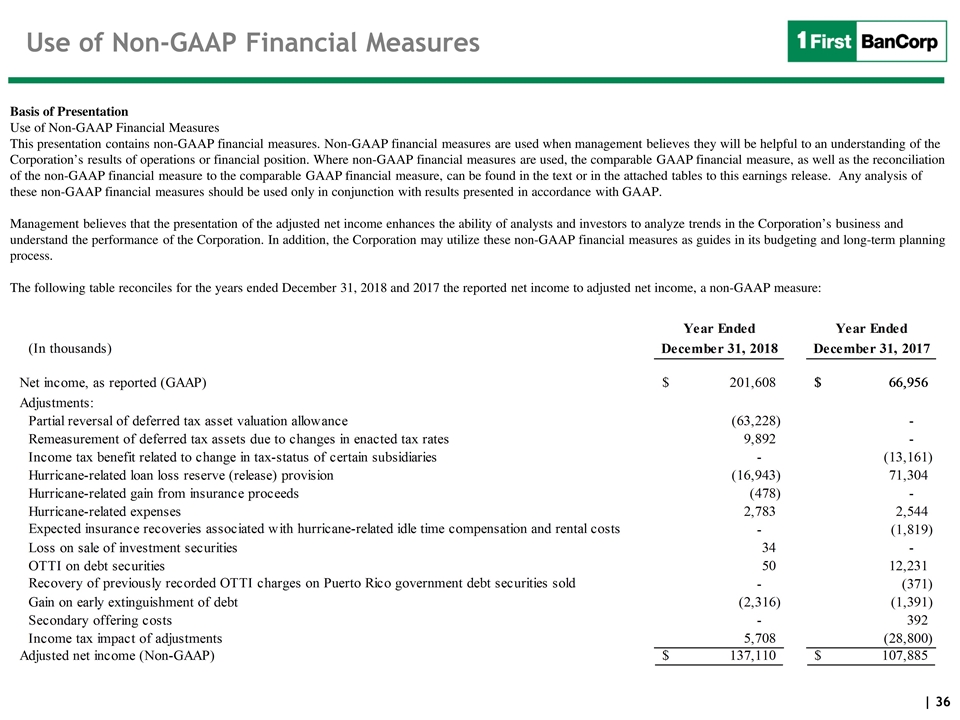

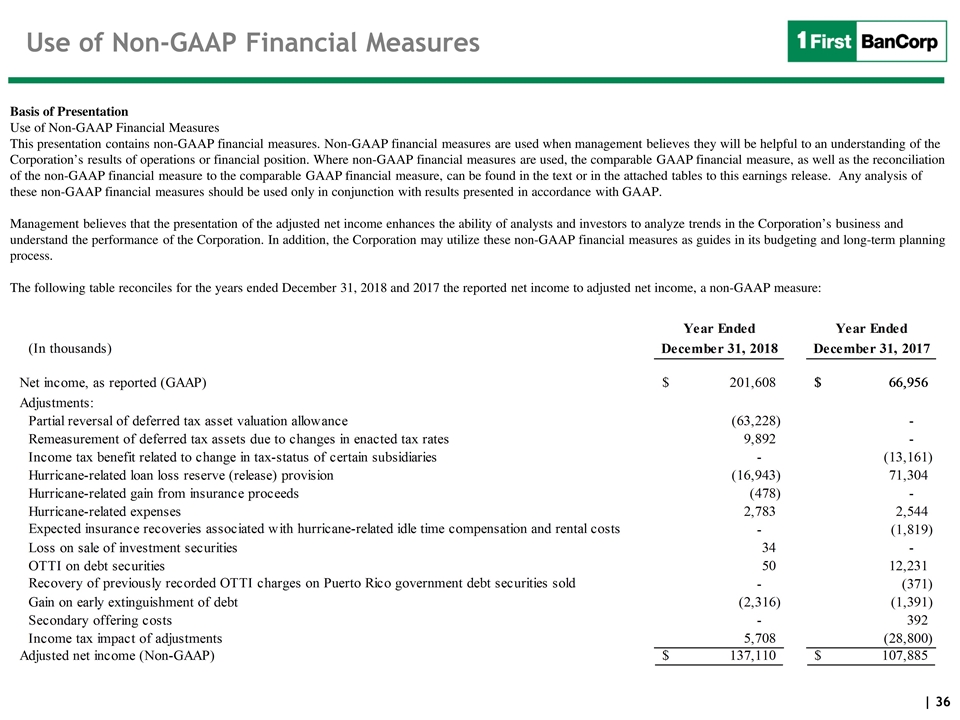

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Management believes that the presentation of the adjusted net income enhances the ability of analysts and investors to analyze trends in the Corporation’s business and understand the performance of the Corporation. In addition, the Corporation may utilize these non-GAAP financial measures as guides in its budgeting and long-term planning process. The following table reconciles for the years ended December 31, 2018 and 2017 the reported net income to adjusted net income, a non-GAAP measure:

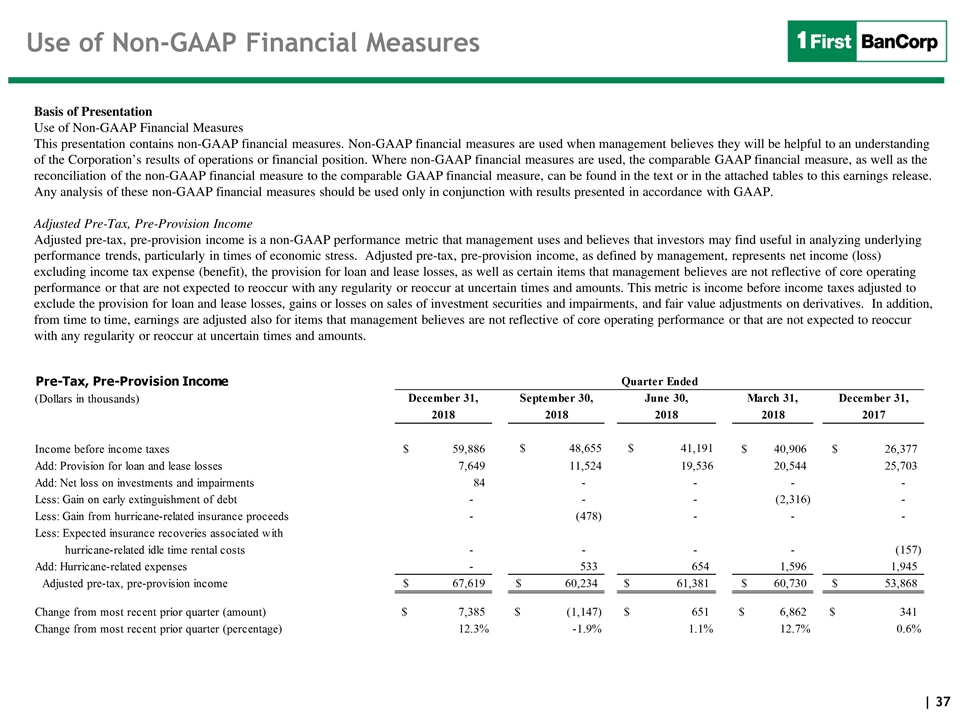

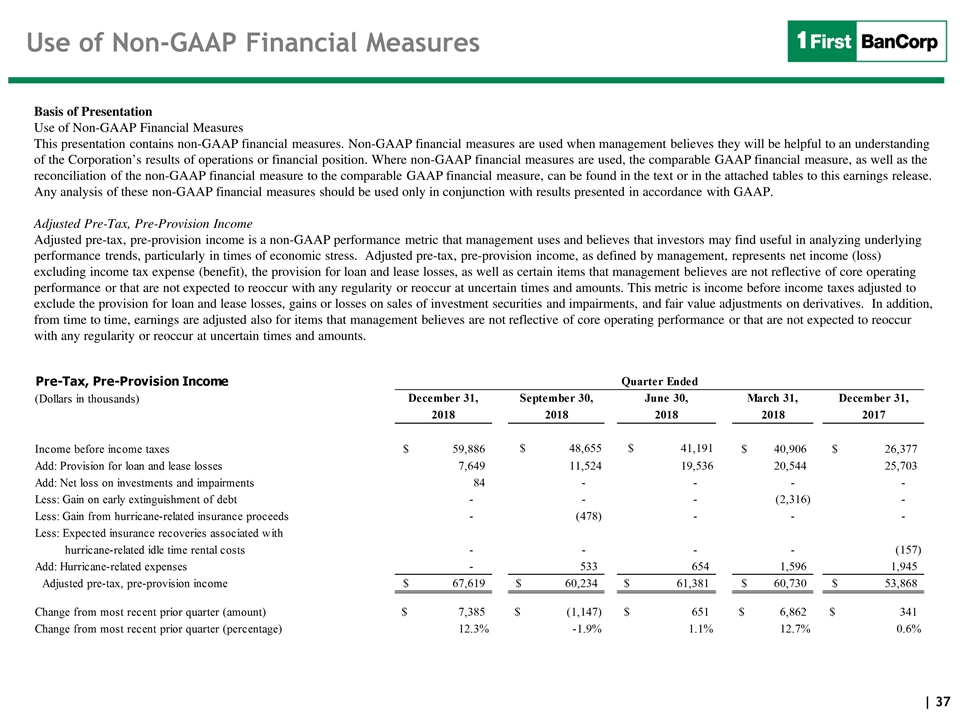

Use of Non-GAAP Financial Measures Basis of Presentation Use of Non-GAAP Financial Measures This presentation contains non-GAAP financial measures. Non-GAAP financial measures are used when management believes they will be helpful to an understanding of the Corporation’s results of operations or financial position. Where non-GAAP financial measures are used, the comparable GAAP financial measure, as well as the reconciliation of the non-GAAP financial measure to the comparable GAAP financial measure, can be found in the text or in the attached tables to this earnings release. Any analysis of these non-GAAP financial measures should be used only in conjunction with results presented in accordance with GAAP. Adjusted Pre-Tax, Pre-Provision Income Adjusted pre-tax, pre-provision income is a non-GAAP performance metric that management uses and believes that investors may find useful in analyzing underlying performance trends, particularly in times of economic stress. Adjusted pre-tax, pre-provision income, as defined by management, represents net income (loss) excluding income tax expense (benefit), the provision for loan and lease losses, as well as certain items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts. This metric is income before income taxes adjusted to exclude the provision for loan and lease losses, gains or losses on sales of investment securities and impairments, and fair value adjustments on derivatives. In addition, from time to time, earnings are adjusted also for items that management believes are not reflective of core operating performance or that are not expected to reoccur with any regularity or reoccur at uncertain times and amounts.