rlong@gaigroup.net

Direct: (216) 970-8624

November 5, 2010

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, D.C. 20549-7010

| | | | |

| Attention: | | Mr. Larry Spirgel

Assistant Director |

| | |

| | Re: | | Global-Tech Advanced Innovations Inc. Form 20-F for the fiscal year ended March 31, 2010 Filed August 31, 2010 File No. 001-14812 |

Dear Mr. Spirgel:

Global-Tech Advanced Innovations Inc. (the “Company”) is submitting this letter in response to the comments the Company received from the Staff of the U.S. Securities and Exchange Commission, Division of Corporation Finance (the “Staff”), dated October 26, 2010. For your convenience, we have repeated your comments initalics, and the Company’s responses are set forth immediately below the corresponding comment of the Staff.

Item 4. Information on the Company, page 10

Business Overview, page 10

SEC Comment #1:

We note from the disclosure at the bottom of page 13 that you have a close relationship with a certain CMOS sensor vendor. Please tell us whether you have binding contract for this relationship and, if so, explain why you have not filed it as a material contract.

Response:

From its inception through the early stages of its development, the Company’s complementary metal oxide semiconductor (CMOS) camera modules (“CCM’s”) business was dependent upon OmniVision as its sole supplier of sensors. This dependence was due in part to the small number of vendors selling this type of sensor. OmniVision was at the same time seeking to expand its business in China through the establishment of relationships with Chinese manufacturers. In addition to supplying the sensors necessary to the CCM business, the technical support provided by OmniVision in the early stages of development was a key component of the success of the Company’s CCM business. While the Company maintains a close relationship with OmniVision, it no longer relies on OmniVision as its sole supplier of sensors and there are no binding contracts or agreements between the Company and OmniVision. Instead, purchase orders are placed with vendors, including OmniVision, dependent upon, and in each instance, as needed by the Company.

Securities and Exchange Commission

November 4, 2010

Page 2 of 7

In response to the Staff Comment No. 1, the Company will revise future filings to include the following disclosure regarding its relationship with its sensor vendors:

“Partnership with vendors. The sensors and lenses utilized in CMOS cameras are highly specialized and are only available from a few vendors. While the Company has no binding agreements with its vendors, we have established a long-standing and mutually beneficial relationship with a major sensor company that views our PRC-based operations as an opportunity to access many of the PRC cellular phone manufacturers. It is by virtue of this relationship, as well as relationships with other vendors, that the Company receives valuable technical support essential to the business and product development programs. These relationships are critical to the development of new products and the expansion of existing product lines.”

Foreign Issuer Considerations, page 17

SEC Comment #2:

From the fourth paragraph we note you are “party to agreements with certain agencies of the government of China.” Please tell us in more detail what these agreements involve such as their subject matter, how they affect your business, and any material risks associated with the loss of those agreements. Please also explain whether you have filed these agreements as exhibits.

Response:

In exchange for conditional monetary grants, Dongguan Lite Array Company Limited (“DGL”), a subsidiary of the Company, entered into two research and development agreements with various agencies of the government of China.

The first of these agreements was entered into in December 2007 between the Guangdong Provincial Department of Science and Technology, Changchun University of Science and Technology (“Changchun”) and DGL. Pursuant to this agreement, DGL and Changchun engaged in a cooperative research and development project relating to automated production testing equipment for camera modules in exchange for an aggregate grant of RMB800,000 (approximately US$117,170), of which, DGL received RMB100,000 (approximately US$14,646), and Changchun received the remaining RMB700,000. This project was completed in December 2009. This agreement was not filed because it is not considered by the Company to be material to investors. Furthermore, filing this agreement would result in additional costs to us and would provide no meaningful information to investors.

The second agreement was entered into in October 2009 between the Guangdong Project Technology Research Center and DGL. Pursuant to this agreement, DGL is in the process of research and development of certain optical imaging products for multiple applications. DGL is still in negotiations with the Guangdong Project Technology Research Center as to the amount of the grant the Company is to receive pursuant to the agreement. This agreement was not filed because some of its terms are still being negotiated. Additionally, the Company does not anticipate that the grant amount will ultimately be material to investors. Furthermore, filing this agreement would result in additional costs to us and would provide no meaningful information to investors.

In response to the Staff Comment No. 3, the Company will remove the disclosure identified by the Staff in future filings to avoid confusion. In the event that the Company enters into material agreements with any agencies of the government of China in the future, the Company will provide the appropriate disclosure at such time.

Organizational Structure, page 19

SEC Comment #3

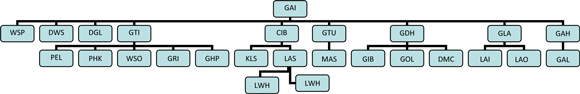

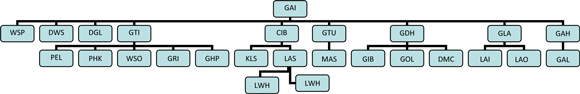

Please use a graphical presentation (such as a tree) to show your organizational structure so that investors may better understand your company.

Securities and Exchange Commission

November 4, 2010

Page 3 of 7

Response:

In response to Staff Comment No 3, the Company will revise future filings to include the following disclosure regarding the Company’s organization structure:

“Organizational structure.

The following charts set forth the significant subsidiaries owned, directly or indirectly, by the Company.

| | | | | | | | |

Name | | Abbreviation | | Principal Activities | | Place of Incorporation | | Percentage of Equity Interest Held |

| Global-Tech Advanced Innovations Inc. | | GAI | | Investment Holding | | British Virgin Islands | | |

| Global Appliances Holding Limited | | GAH | | Investment Holding | | British Virgin Islands | | 100.0 |

| Global Display Holdings Limited | | GDH | | Investment Holding | | British Virgin Islands | | 100.0 |

| Kwong Lee Shun Trading Company Limited | | KLS | | Management Services | | Hong Kong | | 100.0 |

| Global Rich Innovation Limited | | GRI | | Trading | | Hong Kong | | 100.0 |

| Wing Shing Overseas Limited | | WSO | | Inactive | | British Virgin Islands | | 100.0 |

| GT Investment (BVI) Limited | | GTI | | Investment Holding | | British Virgin Islands | | 100.0 |

| Consortium Investment (BVI) Limited | | CIB | | Investment Holding | | British Virgin Islands | | 100.0 |

| Global Optics Limited | | GOL | | Trading | | Hong Kong | | 100.0 |

| Dongguan Wing Shing Electrical Products Factory Company Limited | | DWS | | Manufacturing | | China | | 100.0 |

| Dongguan Lite Array Company Limited | | DGL | | Manufacturing | | China | | 100.0 |

| Dongguan Microview Medical Technology Company Limited | | DMC | | Research & Development | | China | | 100.0 |

| Global Auto Limited | | GAL | | Inactive | | Hong Kong | | 70.0 |

| Lite Array Holding Limited | | LAH | | Investment Holding | | British Virgin Islands | | 30.0 |

| Litewell Technology (HK) Limited | | LWH | | Design and trading of OLED production equipment and corresponding materials | | Hong Kong | | 30.0 |

Securities and Exchange Commission

November 4, 2010

Page 4 of 7

| | | | | | | | |

| Dongguan Litewell (OLED) Technology Limited | | DLW | | Research & Development | | China | | 30.0 |

| Global Household Products Limited | | GHP | | Trading | | Hong Kong | | 100.0 |

| Pentalpha Medical Limited | | PEL | | Inactive | | Hong Kong | | 100.0 |

| Pentalpha Hong Kong Limited | | PHK | | Inactive | | Hong Kong | | 100.0 |

| Global-Tech USA, Inc. | | GTU | | Investor Relations and Consulting | | United States | | 100.0 |

| Global Digital Imaging Limited | | GIB | | Trading | | British Virgin Islands | | 100.0 |

| MasterWerke Limited | | MAS | | Inactive | | United States | | 100.0 |

| Wing Shing Product (BVI) Company Limited | | WSP | | Inactive | | British Virgin Islands | | 100.0 |

| Global Lite Array (BVI) Limited | | GLA | | Investment Holding | | British Virgin Islands | | 76.75 |

| Lite Array OLED (BVI) Company | | LAO | | Inactive | | British Virgin Islands | | 76.75 |

Lite Array, Inc. | | LAI | | Administrative | | United States | | 76.75 |

Global-Tech is a holding company, which does not engage in daily business operations other than owning subsidiaries and holding investments in operating and trading companies. GT Investment (BVI) Limited is the immediate holding company of Wing Shing Overseas Limited, Pentalpha Hong Kong Limited, Pentalpha Medical Limited, Global Rich Innovation Limited and Global Household Products Limited.

Consortium Investment (BVI) Limited (“CIB”) is the immediate holding company of Lite Array Holdings Limited (“LAH”) and Kwong Lee Shun Trading Company Limited. On March 17, 2006, CIBL entered into an agreement with Anwell, a publicly listed company in Singapore, to form a joint venture company which Anwell invested in by purchasing a 70% interest in LAH. LAH is the holding company of Litewell Technology (HK) Limited and Dongguan Litewell (OLED) Technology Limited. LAH and its subsidiaries’ fiscal year end is December 31, which is different from the Company.

Global Display Holdings Limited is the immediate holding company of Global Optics Limited and Global Digital Imaging Limited.

Global Lite Array (BVI) Limited is the immediate holding company of Lite Array OLED (BVI) Company Limited and Lite Array, Inc.

Global-Tech USA, Inc. is an immediate holding company of MasterWerke Ltd.

Dongguan Microview Medical Technology Company Limited was incorporated in China on June 18, 2009.”

Notes to Consolidated Financial Statements, page F-11

Note 12, Land Use Rights, net

SEC Comment #4:

We note you are endeavoring to obtain land use certificates in the near future. Please tell us by when you should have those certificates and explain the remaining material steps to be taken before you receive the certificates.

Securities and Exchange Commission

November 4, 2010

Page 5 of 7

Response:

The issuance of land use certificates by the Donnguan local government is limited by an annual quota set each year by the local government. This quota varies year to year and is not made available to the public. Accordingly, it is not possible for the Company to provide an accurate timeframe for granting of the certificates as it is also unknown how many other applicants (if any) there are with similar requests pending with the Dongguan local government. At such time as the certificates are provided to the Company, the Company will be required to pay a certificate fee of between RMB80 and RMB200 per square meter, which in the aggregate will total between approximately RMB1,872,000 and RMB4,680,000 (between approximately US$274,285 and US$685,715).

In response to the Staff Comment No. 4, the Company will revise future filings to include the following disclosure in the event that the land use certificates have not been received by the Company as of the time of such filings:

“LAND USE RIGHTS, NET

Land use rights represent prepayments under operating leases for land use for a predetermined time period. They are charged to the consolidated statement of operations over the lease periods on a straight-line basis. The Company has the rights to use certain pieces of land located in China and has obtained or is in the process of obtaining the land use rights certificates covering a substantial portion of such lands. On August 26, 2006, the Company entered into a supplementary agreement with the Dongguan local government regarding the use of a piece of land with a total area of 45,208 square meters which the Company had occupied. Pursuant to the supplementary agreement, the Company has vacated a portion of this land (13,698 square meters in aggregate), which was previously used as a recreational area, and has arranged to use the remaining portion of the land (31,510 square meters) until August 6, 2043. However, the Company had to pay monthly fees of RMB59,248 (approximately US$8,680) to the local government for the period from January 1, 2008 to December 31, 2008 and RMB193,048 (approximately US$28,285) from January 1, 2009 onwards until August 6, 2043. Up to March 31, 2010, the Company has obtained a sizable portion of its land use rights certificates covering 131,400 square meters out of a total area of 207,300 square meters. The application of certain property ownership certificates as further detailed in note 11 to the financial statements will commence only after the land use rights certificates for the relevant pieces of land have been obtained. Subsequent to the balance sheet date, the Company obtained an additional land use right certificates covering 52,500 square meters, bringing the aggregate total area to 183,900 square meters. The Company is in the process of obtaining the remaining land use rights and property ownership certificates. However, no definitive timeframe has been provided by the Dongguan local government as to when the certificates will be provided to the Company. At such time as the certificates are provided to the Company, the Company will be required to pay a certificate fee of between RMB80 and RMB200 per square meter, which in the aggregate will total between approximately RMB1,872,000 and RMB4,680,000 (between approximately US$274,285 and US$685,715).”

In addition to responding to the foregoing comments, we have provided herewith as Attachment 1 a statement from the Company acknowledging that:

| | • | | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Securities and Exchange Commission

November 4, 2010

Page 6 of 7

We hope that this letter is responsive to your comments. Should you require further information or if there are any questions concerning the responses set forth above, please do not hesitate to contact me at (216) 970-8624.

Very truly yours,

| | |

/s/ Ryan L. Long |

| Ryan L. Long |

|

| cc: John C.K. Sham |

Securities and Exchange Commission

November 4, 2010

Page 7 of 7

Attachment 1

Acknowledgment

Global-Tech Advanced Innovations Inc. (“Global-Tech) hereby acknowledges that:

| | • | | Global-Tech is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | Global-Tech may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | |

| Global-Tech Advanced Innovations Inc. |

| |

| By: | | /s/ John C.K. Sham |

| | John C.K. Sham |

| | President and Chief Executive Officer |

| |

| Dated: | | November 5, 2010 |