UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2003

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 0-30218

TIME WARNER TELECOM INC.

(Exact name of Registrant as specified in its charter)

| State of Delaware | | 84-1500624 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

10475 Park Meadows Drive Littleton, Colorado | | 80124 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 566-1000

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

The number of shares outstanding of Time Warner Telecom Inc.’s common stock as of October 31, 2003 was:

Time Warner Telecom Inc. Class A common stock—49,217,476 shares

Time Warner Telecom Inc. Class B common stock—65,936,658 shares

TIME WARNER TELECOM INC.

INDEX TO FORM 10-Q

TIME WARNER TELECOM INC.

CONSOLIDATED AND CONDENSED BALANCE SHEETS

| | | September 30,

2003

| | | December 31,

2002

| |

| | | (unaudited) | | | | |

| | | (amounts in thousands, except

share amounts) | |

| ASSETS | | | | | | | |

Current assets: | | | | | | | |

Cash and cash equivalents | | $ | 404,501 | | | 506,460 | |

Marketable debt securities | | | 60,031 | | | — | |

Receivables, less allowances of $17,084 and $21,946, respectively (a) | | | 48,081 | | | 59,989 | |

Prepaid expenses | | | 12,675 | | | 11,056 | |

Deferred income taxes | | | 24,808 | | | 21,961 | |

| | |

|

|

| |

|

|

Total current assets | | | 550,096 | | | 599,466 | |

| | |

|

|

| |

|

|

Property, plant, and equipment | | | 2,181,240 | | | 2,103,717 | |

Less accumulated depreciation | | | (803,825 | ) | | (647,826 | ) |

| | |

|

|

| |

|

|

| | | | 1,377,415 | | | 1,455,891 | |

| | |

|

|

| |

|

|

Deferred income taxes | | | 33,067 | | | 36,880 | |

Goodwill, net of accumulated amortization | | | 26,773 | | | 26,773 | |

Other assets, net of accumulated amortization (note 1) | | | 29,179 | | | 30,246 | |

| | |

|

|

| |

|

|

Total assets | | $ | 2,016,530 | | | 2,149,256 | |

| | |

|

|

| |

|

|

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | |

Current liabilities: | | | | | | | |

Accounts payable (b) | | $ | 36,973 | | | 39,194 | |

Deferred revenue | | | 33,228 | | | 42,659 | |

Current portion debt and capital lease obligations (note 2) | | | 34,076 | | | 26,005 | |

Accrued franchise, tax, and other fees | | | 75,583 | | | 72,018 | |

Other current liabilities | | | 133,119 | | | 178,115 | |

| | |

|

|

| |

|

|

Total current liabilities | | | 312,979 | | | 357,991 | |

| | |

|

|

| |

|

|

Long-term debt and capital lease obligations, less current portion (note 2) | | | 1,176,845 | | | 1,206,030 | |

Other long-term liabilities (note 1) | | | 6,346 | | | — | |

Stockholders’ equity (note 1): | | | | | | | |

Preferred stock, $0.01 par value, 20,000,000 shares authorized, no shares issued and outstanding | | | — | | | — | |

Class A common stock, $0.01 par value, 277,300,000 shares authorized, 49,169,096 and 48,990,768 shares issued and outstanding as of September 30, 2003 and as of December 31, 2002, respectively | | | 491 | | | 489 | |

Class B common stock, $0.01 par value, 162,500,000 shares authorized, 65,936,658 shares issued and outstanding as of September 30, 2003 and December 31, 2002 | | | 659 | | | 659 | |

Additional paid-in capital | | | 1,169,380 | | | 1,167,765 | |

Accumulated other comprehensive income, net of taxes | | | 1,905 | | | 389 | |

Accumulated deficit | | | (652,075 | ) | | (584,067 | ) |

| | |

|

|

| |

|

|

Total stockholders’ equity | | | 520,360 | | | 585,235 | |

| | |

|

|

| |

|

|

Total liabilities and stockholders’ equity | | $ | 2,016,530 | | | 2,149,256 | |

| | |

|

|

| |

|

|

| | |

(a) Includes receivables resulting from transactions with affiliates (note 3) | | $ | 4,127 | | | 5,840 | |

| | |

|

|

| |

|

|

(b) Includes payables resulting from transactions with affiliates (note 3) | | $ | 5,733 | | | 5,599 | |

| | |

|

|

| |

|

|

See accompanying notes.

1

TIME WARNER TELECOM INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |

| | | 2003

| | | 2002

| | | 2003

| | | 2002

| |

| | | (amounts in thousands, except share amounts) | |

| | | | |

Revenue (a): | | | | | | | | | | | | | | |

Dedicated transport services | | $ | 94,066 | | | 92,556 | | | $ | 269,420 | | | 280,170 | |

Switched services | | | 38,957 | | | 36,078 | | | | 115,281 | | | 110,007 | |

Data and Internet services | | | 25,700 | | | 23,410 | | | | 74,135 | | | 65,758 | |

Intercarrier compensation | | | 13,705 | | | 15,121 | | | | 41,377 | | | 64,525 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Total revenue | | | 172,428 | | | 167,165 | | | | 500,213 | | | 520,460 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Costs and expenses (a): | | | | | | | | | | | | | | |

Operating (exclusive of depreciation, amortization, and accretion shown separately below) | | | 66,631 | | | 70,799 | | | | 198,461 | | | 216,966 | |

Selling, general, and administrative | | | 31,162 | | | 56,293 | | | | 128,294 | | | 171,710 | |

Depreciation, amortization, and accretion | | | 56,408 | | | 61,763 | | | | 164,876 | | | 176,269 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Total costs and expenses | | | 154,201 | | | 188,855 | | | | 491,631 | | | 564,945 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Operating income (loss) | | | 18,227 | | | (21,690 | ) | | | 8,582 | | | (44,485 | ) |

Interest expense | | | (25,908 | ) | | (26,760 | ) | | | (78,520 | ) | | (78,435 | ) |

Interest income | | | 1,326 | | | 1,517 | | | | 4,648 | | | 4,317 | |

Investment gains (losses), net | | | 922 | | | (1,283 | ) | | | 922 | | | (3,240 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net loss before income taxes and cumulative effect of change in accounting principle | | | (5,433 | ) | | (48,216 | ) | | | (64,368 | ) | | (121,843 | ) |

Income tax expense | | | 225 | | | 150 | | | | 675 | | | 450 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net loss before cumulative effect of change in accounting principle | | | (5,658 | ) | | (48,366 | ) | | | (65,043 | ) | | (122,293 | ) |

Cumulative effect of change in accounting principle (note 1) | | | — | | | — | | | | 2,965 | | | — | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net loss | | $ | (5,658 | ) | | (48,366 | ) | | $ | (68,008 | ) | | (122,293 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Amounts per common share, basic and diluted: | | | | | | | | | | | | | | |

Loss before cumulative effect of change in accounting principle | | $ | (0.05 | ) | | (0.42 | ) | | $ | (0.57 | ) | | (1.07 | ) |

Cumulative effect of change in accounting principle (note 1) | | | — | | | — | | | | (0.02 | ) | | — | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Net loss | | $ | (0.05 | ) | | (0.42 | ) | | $ | (0.59 | ) | | (1.07 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Weighted average shares outstanding, basic and diluted | | | 114,936 | | | 114,827 | | | | 114,931 | | | 114,772 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

| | | | |

(a) Includes revenue and expenses resulting from transactions with affiliates (note 3): | | | | | | | | | | | | | | |

Revenue | | $ | 9,404 | | | 5,966 | | | $ | 24,758 | | | 21,828 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Operating expenses | | $ | 975 | | | 754 | | | $ | 2,755 | | | 2,239 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Selling, general, and administrative | | $ | 482 | | | 403 | | | $ | 1,397 | | | 1,197 | |

| | |

|

|

| |

|

| |

|

|

| |

|

|

See accompanying notes.

2

TIME WARNER TELECOM INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | Nine Months Ended

September 30,

| |

| | | 2003

| | | 2002

| |

| | | (amounts in thousands) | |

Cash flows from operating activities: | | | | | | | |

Net loss | | $ | (68,008 | ) | | (122,293 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

Depreciation, amortization, and accretion | | | 164,876 | | | 176,269 | |

Cumulative effect of change in accounting principle | | | 2,965 | | | — | |

Investment (gains) losses, net | | | (922 | ) | | 3,240 | |

Stock-based compensation | | | 1,178 | | | 1,201 | |

Amortization of deferred debt issue costs | | | 3,386 | | | 3,440 | |

Changes in operating assets and liabilities: | | | | | | | |

Receivables and prepaid expenses | | | 10,219 | | | 8,804 | |

Accounts payable, deferred revenue, and other current liabilities | | | (52,503 | ) | | (50,571 | ) |

| | |

|

|

| |

|

|

Net cash provided by operating activities | | | 61,191 | | | 20,090 | |

| | |

|

|

| |

|

|

Cash flows from investing activities: | | | | | | | |

Capital expenditures | | | (84,787 | ) | | (92,096 | ) |

Purchases of marketable securities | | | (168,988 | ) | | (8,566 | ) |

Proceeds from maturity of marketable securities | | | 108,957 | | | 23,000 | |

Proceeds from sale of investment | | | 1,262 | | | — | |

Other investing activities | | | 111 | | | — | |

| | |

|

|

| |

|

|

Net cash used in investing activities | | | (143,445 | ) | | (77,662 | ) |

| | |

|

|

| |

|

|

Cash flows from financing activities: | | | | | | | |

Net proceeds from issuance of common stock upon exercise of stock options | | | 155 | | | 145 | |

Net proceeds from issuance of common stock in connection with employee stock purchase plan | | | 284 | | | 90 | |

Payment of capital lease obligations | | | (2,144 | ) | | (3,237 | ) |

Payment of debt obligations | | | (18,000 | ) | | — | |

| | |

|

|

| |

|

|

Net cash used in financing activities | | | (19,705 | ) | | (3,002 | ) |

| | |

|

|

| |

|

|

Decrease in cash and cash equivalents | | | (101,959 | ) | | (60,574 | ) |

Cash and cash equivalents at beginning of period | | | 506,460 | | | 365,600 | |

| | |

|

|

| |

|

|

Cash and cash equivalents at end of period | | $ | 404,501 | | | 305,026 | |

| | |

|

|

| |

|

|

| | |

Supplemental disclosures of cash flow information: | | | | | | | |

Cash paid for interest | | $ | 96,717 | | | 98,240 | |

| | |

|

|

| |

|

|

Cash paid for income taxes | | $ | 1,189 | | | 477 | |

| | |

|

|

| |

|

|

Cancellation of a capital lease obligation | | $ | 3,669 | | | — | |

| | |

|

|

| |

|

|

Addition of capital lease obligation | | $ | 1,729 | | | — | |

| | |

|

|

| |

|

|

See accompanying notes.

3

TIME WARNER TELECOM INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Nine Months Ended September 30, 2003

(Unaudited)

| | | Common Stock

| | Additional

paid-in

capital

| | Accumulated

other

comprehensive

income,

net of taxes

| | Accumulated

deficit

| | | Total

stockholders’

equity

| |

| | | Class A

| | Class B

| | | | |

| | | Shares

| | Amount

| | Shares

| | Amount

| | | | |

| | | (amounts in thousands) | |

| | | | | | | | |

Balance at January 1, 2003 | | 48,991 | | $ | 489 | | 65,937 | | $ | 659 | | 1,167,765 | | 389 | | (584,067 | ) | | 585,235 | |

Change in unrealized holding gain for available-for-sale securities, net of taxes | | — | | | — | | — | | | — | | — | | 1,516 | | — | | | 1,516 | |

Net loss | | — | | | — | | — | | | — | | — | | — | | (68,008 | ) | | (68,008 | ) |

| | | | | | | | | | | | | | | | | | | |

|

|

Comprehensive loss | | | | | | | | | | | | | | | | | | | (66,492 | ) |

| | | | | | | | | | | | | | | | | | | |

|

|

Shares issued for cash in connection with the exercise of stock options | | 28 | | | 1 | | — | | | — | | 154 | | — | | — | | | 155 | |

Shares issued for cash in connection with the Employee Stock Purchase Plan | | 150 | | | 1 | | | | | | | 283 | | | | | | | 284 | |

Stock based compensation | | — | | | — | | — | | | — | | 1,178 | | — | | — | | | 1,178 | |

| | |

| |

|

| |

| |

|

| |

| |

| |

|

| |

|

|

Balance at September 30, 2003 | | 49,169 | | $ | 491 | | 65,937 | | $ | 659 | | 1,169,380 | | 1,905 | | (652,075 | ) | | 520,360 | |

| | |

| |

|

| |

| |

|

| |

| |

| |

|

| |

|

|

See accompanying notes.

4

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS

September 30, 2003

(unaudited)

| 1. | Organization and Summary of Significant Accounting Policies |

Description of Business and Capital Structure

Time Warner Telecom Inc. (the “Company”), a Delaware corporation, is a fiber facilities-based provider of metropolitan and regional optical broadband networks and services to business customers in 44 metropolitan markets in the United States. The Company delivers broadband data, dedicated Internet access, and local and long distance voice services. The Company’s customers are principally telecommunications-intensive businesses, long distance carriers, Internet service providers (“ISPs”), wireless communications companies, incumbent local exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”), educational institutions, and governmental entities.

The Company has two classes of common stock outstanding, Class A common stock and Class B common stock. Holders of Class A common stock have one vote per share and holders of Class B common stock have ten votes per share. Each share of Class B common stock is convertible, at the option of the holder, into one share of Class A common stock. The Class B common stock is collectively owned by subsidiaries of Time Warner Inc. (“Time Warner”) and Advance Telecom Holdings Corporation and Newhouse Telecom Holdings Corporation (“Advance/Newhouse”). Holders of Class A common stock and Class B common stock generally vote together as a single class. However, some matters require the approval of 100% of the holders of the Class B common stock voting separately as a class, and some matters require the approval of a majority of the holders of the Class A common stock, voting separately as a class. As of September 30, 2003, the Class B stockholders held approximately 93% of the combined voting power of the outstanding common stock.

Basis of Presentation

The accompanying interim consolidated and condensed financial statements are unaudited, but in the opinion of management, reflect all adjustments necessary for a fair presentation of the results for the periods indicated. The results of operations for any interim period are not necessarily indicative of results for the full year. The accompanying financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2002.

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Basis of Consolidation

The consolidated and condensed financial statements include the accounts of the Company and all entities in which the Company has a controlling voting interest (“subsidiaries”). Significant intercompany accounts and transactions have been eliminated. Significant accounts and transactions with Time Warner and Advance/Newhouse and their affiliates are disclosed as related party transactions.

5

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

Investments

Marketable equity securities held by the Company are classified as available-for-sale. Accordingly, these securities are included in other assets at fair value. Unrealized holding gains and losses on securities classified as available-for-sale are carried, net of taxes, as a component of accumulated other comprehensive income in stockholders’ equity. Other equity investments that are not considered marketable securities and in which the Company’s ownership interest is less than 20% are generally carried at the lower of cost or net realizable value. Realized gains and losses are determined on a specific identification basis.

At September 30, 2003, the fair value of the Company’s available-for-sale securities totaled $3.5 million, and the aggregate unrealized holding gain, net of tax, on these securities was $1.9 million. The increase in the unrealized holding gain for available-for-sale securities was $1.5 million for the nine months ended September 30, 2003.

During the nine months ended September 30, 2002, the Company recognized a net loss of $3.2 million on investments. The net loss included a $2.6 million loss related to a marketable security whose decline in value was not temporary in nature and a $1.0 million impairment on an equity investment in a non-public company that is not considered a marketable security. These losses were partially offset by a $400,000 gain on the exchange of shares in a privately held company for shares in a publicly held company. During the nine months ended September 30, 2003, the Company recognized a net gain on the sale of securities of $922,000.

At September 30, 2003, the Company held $60.0 million of marketable debt securities which are classified as held to maturity investments and are carried at amortized cost. These securities primarily consist of discount notes and commercial paper that have a holding period of greater than 90 days. The estimated fair value of these securities is not materially different from the amortized cost.

Revenue

The Company’s revenue is derived primarily from business communications services, including dedicated transport, local switched voice, long distance, data and high-speed Internet access services, and intercarrier compensation, which is comprised of reciprocal compensation and switched access services. The Company’s customers are principally telecommunications-intensive businesses, long distance carriers, ISPs, wireless communications companies, ILECs, CLECs, educational institutions, and governmental entities.

Revenue for dedicated transport, data, Internet, and the majority of switched services is generally billed a month in advance on a fixed rate basis and recognized over the period the services are provided. Revenue for the majority of switched access services and long distance is generally billed on a transactional basis determined by customer usage with some fixed rate elements. The transactional elements of switched services are billed in arrears, and estimates are used to recognize revenue in the period earned.

The Company evaluates whether receivables are reasonably assured of collection based on certain factors, including the likelihood of billings being disputed by customers. In situations where a dispute is likely, revenue is not recognized until cash is collected. Reciprocal compensation is a component of intercarrier compensation revenue that represents compensation from local exchange carriers (“LECs”) for local exchange traffic originated by other LECs and terminated on the Company’s facilities. The Company recognizes reciprocal compensation revenue primarily on a cash basis except in those cases where the revenue is under dispute or at risk, in which case the Company defers recognition of the revenue until the outstanding issues are resolved. As of September 30, 2003 and December 31, 2002, the Company had deferred recognition of $10.4 million

6

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

and $12.8 million, respectively, in reciprocal compensation revenue for payments received associated with the pending disputes.

Receivables

The Company performs ongoing credit evaluations of significant customers’ financial conditions and has established an allowance for doubtful accounts based on the expected collectability of all receivables. In certain cases, the Company requires deposits from customers that it deems to represent a higher credit risk. A higher risk of collectability is assigned to certain customers with deteriorating financial conditions and customers in bankruptcy that continue service subsequent to filing bankruptcy, resulting in a greater allowance for doubtful accounts. Considerable management judgment is required in evaluating the collectability of receivables and establishing the related allowance for doubtful accounts. If the financial condition of the Company’s customers deteriorates, the Company’s bad debt expense and cash collections will be negatively impacted. The allowance for doubtful accounts was $17.1 million, or 26% of gross receivables at September 30, 2003, down from $21.9 million or 27% of gross receivables at December 31, 2002.

Significant Customers

The Company has substantial business relationships with a few large customers, including major long distance carriers. The Company’s top 10 customers accounted for 39% and 46% of the Company’s consolidated revenue for the nine months ended September 30, 2003 and 2002, respectively. WorldCom, Inc. (“WorldCom”), which filed for Chapter 11 bankruptcy protection in July 2002, accounted for 8% and 12% of the Company’s total revenue for the nine months ended September 30, 2003 and 2002, respectively. In September 2003, as part of the WorldCom bankruptcy proceedings, the bankruptcy court approved the terms of a settlement with the Company that resolved a number of open disputes and claims through June 30, 2003, including amounts payable to and from each party. As a result of the settlement, the Company recognized $5.2 million of previously deferred revenue and relieved $15.1 million in expenses in the third quarter of 2003. No customer accounted for 10% or more of total revenue in the nine months ended September 30, 2003, and WorldCom was the only customer that accounted for 8% or more of total revenue for the nine months ended September 30, 2002.

Income Taxes

As of September 30, 2003, the Company has recorded a deferred tax asset of $57.9 million, net of a valuation allowance of $165.6 million. The Company has concluded that it is more likely than not that the net deferred tax asset of $57.9 million will be realized because the Company could utilize tax-planning strategies to realize this amount. However, the Company believes there may be risks in realizing amounts in excess of the $57.9 million through utilization of available tax planning strategies. Accordingly, the Company has established a valuation allowance for amounts in excess of $57.9 million.

Asset Retirement Obligations

Effective January 1, 2003, the Company adopted the provisions of Financial Accounting Standards Board Statement No. 143,Accounting for Asset Retirement Obligations (“SFAS 143”). SFAS 143 requires that the estimated fair value of an asset retirement obligation be recorded when incurred. The associated asset retirement costs are capitalized as part of the carrying amount of the long-lived asset and depreciated over the asset’s estimated useful life. The Company has asset retirement obligations related to decommissioning of electronics in leased facilities and the removal of certain fiber and conduit systems. Considerable management judgment is required in estimating these obligations. Important assumptions include estimates of retirement costs, the timing of the

7

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

future retirement activities, and the likelihood of retirement provisions being enforced. Changes in these assumptions based on future information could result in adjustments to estimated liabilities.

In conjunction with the adoption of SFAS 143, the Company recorded a $5.9 million liability, an asset of $2.9 million in property, plant, and equipment, and a $3.0 million charge to earnings to account for the cumulative effect of the depreciation and accretion expense that would have been recorded had SFAS 143 been in effect in earlier periods. The asset retirement obligation increased from $5.9 million as of January 1, 2003 to $6.3 million as of September 30, 2003 due to the accretion of the liability. The pro forma effects of the application of SFAS 143 as if the statement had been in effect in earlier periods are presented below:

| | | Nine Months Ended

September 30,

| |

| | | 2003

| | | 2002

| |

| | | (amounts in thousands) | |

| | |

Actual loss, as reported | | $ | (68,008 | ) | | (122,293 | ) |

Add back cumulative effect of change in accounting principle | | $ | 2,965 | | | — | |

Less depreciation and accretion expense | | $ | — | | | (385 | ) |

| | |

|

|

| |

|

|

Pro forma loss | | $ | (65,043 | ) | | (122,678 | ) |

| | |

|

|

| |

|

|

Pro forma loss per share | | $ | (0.57 | ) | | (1.07 | ) |

| | |

|

|

| |

|

|

The pro forma asset retirement obligation as if SFAS 143 had been in effect in earlier periods is $5.4 million as of December 31, 2001 and $5.8 million as of September 30, 2002.

Segment Reporting

As of September 30, 2003, the Company operated in 44 metropolitan markets. The Company’s management makes decisions on resource allocation and assesses performance based on total revenue, EBITDA, which is operating income (loss) before depreciation, amortization and accretion, and capital spending of these operating locations. Each of the service areas offers similar products and services, has similar customers and networks, is subject to the same type of regulation, and is managed directly by the Company’s executives. As such, the Company has aggregated its service areas into one line of business for financial reporting purposes.

Loss Per Common Share and Potential Common Share

Basic loss per share for all periods presented herein was computed by dividing the net loss by the weighted average shares outstanding for the period.

The diluted loss per common share for all periods presented was computed by dividing the net loss attributable to common shares by the weighted average outstanding common shares for the period. Potential common shares related to stock options were not included in the computation of weighted average shares outstanding because their inclusion would be anti-dilutive.

Stock Option Accounting

The Company has elected to follow Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees (“APB 25”), and related interpretations in accounting for its employee stock options. Under APB 25, because the exercise price of the Company’s employee stock options is generally equal to the market price of the underlying stock on the date of the grant, no compensation expense is recognized. Financial Accounting Standards Board Statement No. 123,Accounting and Disclosure of Stock-Based Compensation (“SFAS 123”), establishes an alternative method of expense recognition for stock-based compensation awards to employees based on

8

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

estimated fair values. The Company elected not to adopt SFAS 123 for expense recognition purposes.

Pro forma information regarding net income and earnings per share is required by SFAS 123 and has been determined as if the Company had accounted for its employee stock options under the fair value method of SFAS 123. The fair value for these options was estimated at the date of grant using a Black-Scholes option pricing model with the following weighted-average assumptions: risk-free interest rate of 3.0% in each of the nine months ended September 30, 2003 and 2002; dividend yield of 0.0% during each period; volatility factor of the expected market price of the Company’s common stock of 1.22 and 1.26 for the nine months ended September 30, 2003 and 2002, respectively; and a weighted-average expected life of the options of five years during each period.

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options, which have no vesting restrictions and are fully transferable. In addition, option valuation models require the input of highly subjective assumptions including expected stock price characteristics significantly different from those of traded options. Because changes in the subjective input assumptions can materially affect the fair value estimate, in management’s opinion, the existing models do not necessarily provide a reliable single measure of the fair value of the Company’s employee stock options.

The weighted-average fair value of options granted for the nine months ended September 30, 2003 and 2002 was $4.80 and $3.31, respectively. For purposes of pro forma disclosures, the estimated fair value of the options is amortized to expense over the options’ vesting period. The Company’s pro forma net loss and pro forma net loss per share, as if the Company had used the fair value accounting provisions of SFAS 123, are shown below:

| | | Three months ended

September 30,

| | | Nine months ended

September 30,

| |

| | | 2003

| | | 2002

| | | 2003

| | | 2002

| |

| | | (amounts in thousands, except per share amounts) | |

| | | | |

Net loss | | $ | (5,658 | ) | | (48,366 | ) | | $ | (68,008 | ) | | (122,293 | ) |

Add back expense calculated under APB 25 | | | 132 | | | 132 | | | | 395 | | | 395 | |

Less expense calculated under SFAS 123 | | | (14,509 | ) | | (15,718 | ) | | | (44,956 | ) | | (52,843 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Pro forma net loss | | | (20,035 | ) | | (63,952 | ) | | | (112,569 | ) | | (174,741 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

Pro forma basic and diluted loss per share | | $ | (0.17 | ) | | (0.56 | ) | | $ | (0.98 | ) | | (1.52 | ) |

| | |

|

|

| |

|

| |

|

|

| |

|

|

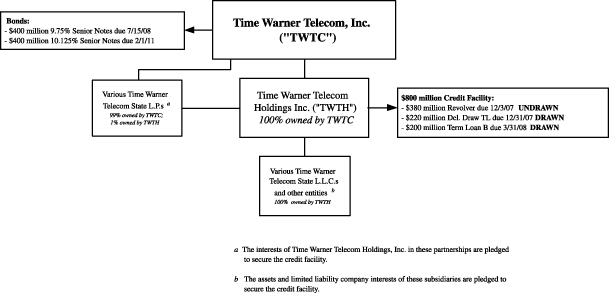

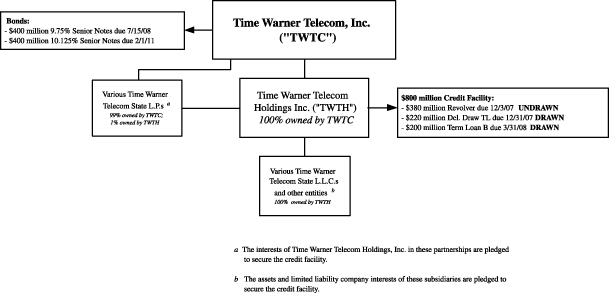

| 2. | Long-Term Debt and Capital Lease Obligations |

Long-term debt and capital lease obligations are summarized as follows:

| | | September 30,

2003

| | | December 31,

2002

| |

| | | (amounts in thousands) | |

| | |

9 3/4% Senior Notes | | $ | 400,000 | | | 400,000 | |

10 1/8% Senior Notes | | | 400,000 | | | 400,000 | |

Credit facility | | | 402,000 | | | 420,000 | |

Capital lease obligations | | | 8,921 | | | 12,035 | |

| | |

|

|

| |

|

|

| | | $ | 1,210,921 | | | 1,232,035 | |

Less current portion of debt and capital lease obligations | | | (34,076 | ) | | (26,005 | ) |

| | |

|

|

| |

|

|

| | | $ | 1,176,845 | | | 1,206,030 | |

| | |

|

|

| |

|

|

9

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

The $400 million 9 3/4% Senior Notes due July 2008 (the “9 3/4% Senior Notes”) are unsecured, unsubordinated obligations of the Company. Interest on the 9 3/4% Senior Notes is payable semi-annually on January 15 and July 15. Interest expense, including amortization of deferred debt issue costs, relating to the 9¾% Senior Notes totaled approximately $30 million in each of the nine-month periods ended September 30, 2003 and 2002. At September 30, 2003, the estimated fair market value of the $400 million of 9¾% Senior Notes was approximately $396 million.

The $400 million 10 1/8% Senior Notes due February 2011 (the “10 1/8% Senior Notes”) are unsecured, unsubordinated obligations of the Company. Interest on the 10 1/8% Senior Notes is payable semi-annually on February 1 and August 1. Interest expense, including amortization of deferred debt issue costs, relating to the 10 1/8% Senior Notes totaled approximately $31 million in each of the nine-month periods ended September 30, 2003 and 2002. At September 30, 2003, the estimated fair market value of the $400 million of 10 1/8% Senior Notes was at par.

Neither the 9 3/4% Notes nor the 10 1/8% Notes have been listed on any securities exchange or inter-dealer automated quotation system, and the estimated market value is based on indicative pricing published by investment banks. While the Company believes these approximations to be reasonably accurate at the time published, indicative pricing can vary widely depending on the volume traded by any given investment bank.

The 9 3/4% Senior Notes and the 10 1/8% Senior Notes are governed by indentures that contain certain restrictive covenants. These restrictions affect, and in many respects significantly limit or prohibit, among other things, the ability of the Company to incur indebtedness, make prepayments of certain indebtedness, pay dividends, make investments, engage in transactions with stockholders and affiliates, issue capital stock of subsidiaries, create liens, sell assets, and engage in mergers and consolidations.

In December 2000, the Company entered into an amended and restated credit facility (the “Credit Facility”) providing for an aggregate $1 billion in borrowings. In October 2002, the Company and its lenders further amended the Credit Facility and reduced the total commitments of the lenders from $1 billion to $800 million. The amended Credit Facility consists of the following components:

| | • | | A $380 million senior secured revolving credit facility. This facility decreases to $361 million on December 31, 2004, $304 million on December 31, 2005, and $190 million on December 31, 2006, with a final maturity of December 31, 2007. Interest is calculated based on a specified Eurodollar rate plus a margin of 1.75 to 2.75%. As of September 30, 2003, no amounts were outstanding under this facility. |

| | • | | A $200 million term loan. Amortization of principal began March 31, 2003 and continues quarterly until March 31, 2008. Through September 30, 2003, principal payments on this facility totaled $1.5 million. Interest is computed utilizing a specified Eurodollar rate plus 4.0%, which totaled 5.1% on September 30, 2003, and is payable at least quarterly. As of September 30, 2003, $198.5 million was outstanding under this facility. |

| | • | | A $220 million senior delayed draw loan facility. Amortization of principal began March 31, 2003 and continues quarterly until December 31, 2007. Through September 30, 2003, principal payments on this facility totaled $16.5 million. Interest is computed based on a specified Eurodollar rate plus a margin of 1.75 to 2.75%, which totaled 2.9% on September 30, 2003 and is payable at least quarterly. As of September 30, 2003, $203.5 million was outstanding under this facility. |

10

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

The Company is required to pay commitment fees on a quarterly basis ranging from 0.5% to 1.0% per annum on the undrawn available commitment of the Credit Facility. Commitment fee expense was $2.2 million for the nine months ended September 30, 2003 and has been classified as a component of interest expense in the accompanying consolidated and condensed statements of operations.

Borrowings under the Credit Facility are secured by substantially all of the assets of the Company, except for certain assets with respect to which the grant of a security interest is prohibited by governing agreements. The Credit Facility requires the Company to prepay outstanding loans when its cash flow exceeds certain levels and with the proceeds received from a number of specified events or transactions, including certain asset sales and insurance recoveries for assets not replaced. In addition, obligations under the Credit Facility are subject to various covenants that limit the Company’s ability to borrow and incur liens on its property, pay dividends or make other distributions, and make capital expenditures.

The Credit Facility also contains financial covenants, including a leverage ratio, an interest coverage ratio, and a debt service coverage ratio, as well as cross default provisions. Under the cross default provisions, the Company is deemed to be in default under the Credit Facility if the Company has defaulted under any of the other material outstanding obligations, including the 9 3/4% Senior Notes or the 10 1/8% Senior Notes. As of September 30, 2003, the Company was in compliance with all covenants under the Credit Facility and other debt agreements.

| 3. | Related Party Transactions |

In the normal course of business, the Company engages in various transactions with Time Warner and its affiliates, including Time Warner Cable and affiliates of Advance/Newhouse, generally on negotiated terms among the affected units that, in management’s opinion, result in reasonable allocations of joint costs between the parties.

The Company benefits from its relationship with Time Warner Cable, both through access to local rights-of-way and construction cost sharing. The Company has similar arrangements with a subsidiary (“TWE-A/N Subsidiary”) of the Time Warner Entertainment-Advance/Newhouse partnership (“TWE-A/N”), a partnership owned by affiliates of the Company’s Class B Stockholders that owns certain cable systems in Florida and Indiana and is managed by affiliates of Advance/Newhouse. Twenty-three of the Company’s 44 markets use fiber optic capacity licensed from Time Warner Cable or TWE-A/N Subsidiary. Under the terms of those agreements, if the Company wishes to license fiber optic capacity in addition to the capacity initially licensed in 1998, the Company must pay Time Warner Cable or TWE-A/N Subsidiary an amount equal to the Company’s allocable share of the total cost of constructing the route in question, plus permitting and supervision fees as a license fee. Under those agreements, the Company licenses discrete fibers and attaches its own electronics so that the Company’s networks are functionally separate from the licensor’s. Pursuant to the licensing arrangements, the Company paid Time Warner Cable $1.6 million and $2.0 million for the nine months ended September 30, 2003 and 2002, respectively, and TWE-A/N Subsidiary $46,000 for the nine months ended September 30, 2003. The Company pays the license fee at the time the network is constructed. These fees are capitalized to property, plant, and equipment and amortized over their useful lives as depreciation and amortization expense. As of September 30, 2003, the Company’s property, plant, and equipment included $183.4 million in licenses of fiber optic capacity pursuant to the agreements.

Under the licensing arrangements, the Company reimburses Time Warner Cable and TWE-A/N Subsidiary for facility maintenance and pole and conduit rental costs. The reimbursements to Time Warner Cable aggregated $2.4 and $2.2 million for the nine month periods ended September 30, 2003 and 2002, respectively, and to TWE-A/N Subsidiary aggregated $385,000 for the nine

11

TIME WARNER TELECOM INC.

NOTES TO CONSOLIDATED AND CONDENSED FINANCIAL STATEMENTS - continued

months ended September 30, 2003, and are a component of operating expenses in the consolidated statements of operations. In certain cases the Company’s operations are co-located with Time Warner Cable’s or TWE-A/N Subsidiary’s facilities and are allocated a charge for various overhead expenses. Under the terms of leases and subleases for these facilities, allocations for rent payable to Time Warner Cable or TWE-A/N Subsidiary are typically based on square footage and allocations for utility charges are based on actual usage. Such charges from Time Warner Cable aggregated $1.4 and $1.2 million for the nine months ended September 30, 2003 and 2002, respectively, and from TWE-A/N Subsidiary aggregated $7,000 for the nine months ended September 30, 2003, and are a component of selling, general, and administrative expenses in the consolidated and condensed statements of operations. The rates charged by these affiliates for rent and utilities do not differ materially from charges the Company incurs in locations where the Company is not co-located with Time Warner Cable or TWE-A/N Subsidiary.

Time Warner and its affiliates and TWE-A/N Subsidiary also purchase services from the Company. Revenue from Time Warner and its affiliates, including dedicated transport services, switched services, and data and Internet services, aggregated $24.6 million and $21.8 million for the nine months ended September 30, 2003 and 2002, respectively. Revenue from TWE-A/N Subsidiary totaled $150,000 for the nine months ended September 30, 2003.

| 4. | Commitments and Contingencies |

Pending legal proceedings are substantially limited to litigation incidental to the business of the Company. In the opinion of management, the ultimate resolution of these matters will not have a material adverse effect on the Company’s financial statements.

Management routinely reviews the Company’s exposure to liabilities incurred in the normal course of its business operations. Where a probable contingency exists and the amount can be reasonably estimated, the Company records the estimated liability. Considerable judgment is required in analyzing and recording such liabilities, and actual results could vary from the estimates.

12

TIME WARNER TELECOM INC.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations

The following discussion and analysis provides information concerning the results of operations and financial condition of Time Warner Telecom Inc. and should be read in conjunction with the accompanying financial statements and notes thereto. Additionally, the following discussion and analysis should be read in conjunction withManagement’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements included in Part II of our Annual Report on Form 10-K for the year ended December 31, 2002.

Cautions Concerning Forward Looking Statements

This document contains certain “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding, among other items, our expected financial position, business, and financing plans. These forward-looking statements are based on management’s current expectations and are naturally subject to risks, uncertainties, and changes in circumstances, certain of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements.

The words “believe,” “plan,” “target,” “expect,” “intend,” and “anticipate,” and expressions of similar substance identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, those expectations may not prove to be correct. Important factors that could cause actual results to differ materially from the expectations described in this report are set forth under “Risk Factors” in Item 1 and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2002 and elsewhere in this report. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Overview

We are a leading fiber facilities-based provider of metropolitan and regional optical broadband networks and services to business customers. We deliver broadband data, dedicated Internet access, and local and long distance voice services. As of September 30, 2003, we served customers in 44 metropolitan areas in 22 states in the United States.

Time Warner Cable began our business in 1993. In May 1999, our predecessor limited liability company was reconstituted as a Delaware corporation under the name Time Warner Telecom Inc. and the outstanding limited liability company interests were converted into common stock of the newly formed corporation. In May 1999, we completed our initial public offering of 20,700,000 shares of Class A common stock at a price of $14 per share.

We have two classes of common stock outstanding, Class A common stock and Class B common stock. Holders of Class A common stock have one vote per share, and holders of Class B common stock have ten votes per share. Each share of Class B common stock is convertible, at the option of the holder, into one share of Class A common stock. The Class B common stock is collectively owned by subsidiaries of Time Warner Inc., Advance Telecom Holdings Corporation, and Newhouse Telecom Holdings Corporation. Holders of Class A common stock and Class B common stock generally vote together as a single class. However, some matters require the approval of 100% of the holders of the Class B common stock voting separately as a class, and some matters require the approval of a majority of the holders of the Class A common stock, voting separately as a class. As of September 30, 2003, the Class B stockholders held approximately 93% of the combined voting power of the outstanding common stock.

13

TIME WARNER TELECOM INC.

Since 1997, we have focused exclusively on business customers, including carriers and governmental entities, and expanded into switched and data services as well as geographic areas beyond the Time Warner Cable footprint. From our inception through 2001, we constructed networks in 29 markets. In January 2001, we expanded our geographic coverage by acquiring substantially all of the assets of GST Telecommunications, Inc. (“GST”), which added networks in 15 western markets. We operate in metropolitan areas that have high concentrations of medium- and large-sized businesses. Our customers are principally telecommunications-intensive businesses, long distance carriers, Internet service providers (“ISPs”), wireless communications companies, incumbent local exchange carriers (“ILECs”), competitive local exchange carriers (“CLECs”), educational institutions, and governmental agencies. Our revenue is derived primarily from business communications services, including dedicated transport, local switched voice, long distance, data, and high-speed Internet access services.

As of September 30, 2003, our networks spanned 18,039 route miles and contained 889,401 fiber miles. We offered service to 14,516 buildings served entirely by our facilities (on-net) or through the use of another carrier’s facilities to provide a portion of the link (off-net) in 22 states. We continue to expand our footprint within our existing markets by connecting our network into additional buildings. We have also selectively interconnected existing service areas within regional clusters with fiber optic facilities that we own or lease and we provide on-net inter-city switched services that provide customers a virtual presence in a remote city.

Our annual revenue increased from $55.4 million in 1997 to $737.7 million in 2001. In early 2001, general economic conditions and the downturn in the telecommunications sector began to negatively impact our revenue. Our revenue decreased 6% in 2002, to $695.6 million from 2001 and dropped 4% in the first nine months of 2003, to $500.2 million as compared to the first nine months of 2002. The decline in revenue resulted from customer disconnects, including service disconnections by WorldCom, Inc., (“WorldCom”) and from a decrease in intercarrier compensation, as more fully explained later in this section.

Revenue from our largest customer, WorldCom, which filed for Chapter 11 bankruptcy protection in July 2002, totaled $19.3 million and $60.9 million for the three and nine months ended September 30, 2002, respectively, and declined to $13.1 million and $39.8 million for the three and nine months ended September 30, 2003, respectively. Revenue for the three and nine months ended September 30, 2003 includes $5.2 million resulting from a settlement with WorldCom that is discussed below. As of September 30, 2003, we believe that we have already received all significant service disconnections relating to WorldCom’s bankruptcy proceedings; however, changes in their future business operations may result in further loss of revenue to us. In September 2003, as part of the WorldCom bankruptcy proceedings, the bankruptcy court approved the terms of a settlement with us that resolved a number of open disputes and claims (the “WorldCom Settlement”), including amounts payable to and from each party. The settlement provides for the continued effectiveness of the Master Capacity Agreement under which WorldCom purchases services from us. WorldCom agreed to make a payment of $2 million to cure previous defaults under that contract. The settlement terms include a general release of all claims and causes of action between the parties and settles all disputes through June 30, 2003. As a result of the settlement, we recognized $5.2 million in deferred revenue and relieved $15.1 million in expenses in the third quarter of 2003 that had previously been recorded because of uncertainties created by the bankruptcy process. The settlement also provided us an allowed damage claim against WorldCom for contract rejections that would have been payable after the confirmation of WorldCom’s bankruptcy plan. Subsequent to September 30, 2003, we sold this allowed damage claim to a third party for approximately $7 million in cash and, as a result, expect to recognize this amount in revenue in the fourth quarter of 2003.

We continue to experience high levels of customer disconnects. Throughout 2002, we lost monthly revenue of approximately $14 million due to customer disconnects and bankruptcies; however, we were able to replace most of this revenue with new sales. Disconnects in the first nine months of 2003 resulted in the loss of $10.3 million in monthly revenue, including $3.5 million related to WorldCom, as compared to disconnects of $10.2 million in monthly revenue in the first nine months of 2002, including approximately $500,000 from WorldCom. We anticipate that customers will continue to disconnect services due to network

14

TIME WARNER TELECOM INC.

optimization, cost cutting, business contractions, and additional customer bankruptcies or other customer financial difficulties, but we cannot predict the total impact on revenue from these disconnects.

Our revenue and margins may also be reduced as a result of price-cutting by other CLECs and telecommunications service providers. In particular, CLECs that are in bankruptcy or are emerging from Chapter 11 bankruptcy under a plan of reorganization have reduced debt levels and may reduce prices in order to increase their short-term revenue. Revenue growth and margins may also be adversely impacted by pricing pressure on our more mature products, especially as existing contracts expire, and we negotiate renewals.

Customers that have filed for bankruptcy or have experienced other financial difficulties have impacted our bad debt expense over the past two years. Bad debt expense as a percentage of revenue increased from 3% in 2000 to 5% in 2002. Due to successful collection efforts and a reduction in receivable write-offs, our bad debt expense, excluding the impact of the WorldCom Settlement of $15.1 million, decreased to 2% of revenue for the first nine months of 2003 compared to 5% in the first nine months of 2002. The improved collections and reduced receivable write-offs experienced in 2003 were the result of added controls, including more stringent credit reviews on new and existing customers, collecting deposits on higher risk accounts, more aggressive collection efforts, and a reduction in bankruptcy-related write-offs. Although we have experienced an improvement in bad debt expense in the first nine months of 2003, there is no assurance that this trend will continue.

In response to the impact of the downturn in the telecommunications sector and revenue performance that began in 2001, we have undertaken several cost reduction measures. These measures include increased focus on collection of receivables, as discussed above, and network grooming activities to reduce costs paid to other carriers. Additionally, in October 2001 we consolidated our network operations centers, resulting in the elimination of approximately 200 positions, and we implemented further workforce reductions in April and August 2002 that eliminated approximately 360 positions. Our combined operating and selling, general, and administrative costs, excluding the impact of the WorldCom Settlement of $15.1 million, decreased $46.8 million for the nine months ended September 30, 2003, as compared to the same period of 2002.

Although our cost containment efforts have been successful in improving our margins, we are also focusing on expanding our reach in existing markets and further leveraging our fiber networks. We plan to expand our revenue base by increasing customer and building penetration and using available network capacity in our existing markets rather than through geographic expansion into additional markets. In an effort to diversify our revenue base and become less reliant on carrier customers, we are focusing our expanded sales efforts and our suite of data and Internet products on enterprise (non-carrier) customers. To further this strategy, in early 2003, we launched several initiatives including increasing our sales force, launching new data and Internet protocol (“IP”) products, and expanding our networks in existing markets. New products include a broad array of data transmission services that enable customers to create their own internal networks and access external networks using Internet and Ethernet protocols. We have increased the size of our sales force by 28% in the first nine months of 2003 to a total of 289 account executives from 225 at December 31, 2002. By adding buildings to our fiber network our sales force will have access to a growing base of potential customers. Revenue from data and Internet services for the nine months ended September 30, 2003 grew 13% compared to the same period in 2002, and excluding WorldCom disconnects and the WorldCom Settlement, grew 41% over the comparable period in 2002. Enterprise customer revenue, a component of our total revenue, represented approximately 45% of our total revenue for the nine months ended September 30, 2003 compared to approximately 35% for the comparable period in 2002. Revenue from carrier customers represented 46% and 52% of our total revenue for the nine months ended September 30, 2003 and 2002, respectively.

15

TIME WARNER TELECOM INC.

Intercarrier Compensation Revenue and Expense

Intercarrier compensation revenue consists of reciprocal compensation and switched access. Reciprocal compensation represents compensation from a local exchange carrier (“LEC”) for local exchange traffic originated on their facilities and terminated on our facilities. Reciprocal compensation rates are established by interconnection agreements between the parties based on federal and state regulatory and judicial rulings. A 2001 Federal Communications Commission (“FCC”) ruling reduced rates and capped the number of minutes for which ISP-bound traffic can be compensated. This ruling further reduced rates in late June 2003. As a result, and because of reduced traffic terminating to our ISP customers, we have experienced a decline in our reciprocal compensation revenue. Reciprocal compensation represented 4% and 5% of revenue for the nine months ended September 30, 2003 and 2002, respectively.

Switched access represents the connection between a long distance carrier’s point of presence and an end user’s premises provided through our switching facilities. Historically, the FCC has regulated the access rates imposed by the ILECs, while the access rates of CLECs have been less regulated. In June 2001, the FCC began regulating CLECs’ interstate switched access charges. Our rates were reduced pursuant to that order and will continue to decline through June 2004 to parity with the rates of the ILEC in each of our service areas. In addition, when a CLEC enters a new market, its access charges may be no higher than the ILEC’s. The order does not affect the rates stipulated in our contracts with certain long distance carriers, although certain contracts provide for access rate reductions in relation to volume commitments. We experienced mandatory rate decreases in June 2003 and expect that switched access revenue will continue to decline as a percentage of revenue due to future mandated and contractual rate reductions. Switched access revenue represented 4% and 5% of total revenue for the nine months ended September 30, 2003 and 2002, respectively.

Regulatory uncertainty surrounds the appropriate intercarrier compensation rates applicable to voice-over-IP traffic that originates and terminates in different local service areas. The FCC is expected to open a proceeding to resolve the uncertainty. In the interim, the uncertainty may incent carriers to hand off voice traffic to us or other carriers as IP traffic which could contribute to incrementally higher intercarrier compensation expense to us.

Related Parties

In the normal course of business, we engage in various transactions with affiliates of our Class B Stockholders, generally on negotiated terms among the numerous affected operating units that, in management’s view, result in reasonable arms-length terms. We benefit from our relationship with Time Warner Cable both through access to local rights-of-way and construction cost sharing. We have similar arrangements with TWE-A/N Subsidiary. TWE-A/N Subsidiary owns certain cable systems in Florida and Indiana that were previously owned by a partnership owned by affiliates of our Class B Stockholders and is currently managed by affiliates of Advance Telecom Holdings Corporation and Newhouse Telecom Holding Corporation. We have constructed 23 of our 44 metropolitan networks substantially through the use of fiber capacity licensed from Time Warner Cable or TWE-A/N Subsidiary. As of September 30, 2003, our property, plant, and equipment included $183.4 million in licenses of fiber capacity pursuant to the capacity license agreements. We pay the license fee at the time the network is constructed and capitalize the cost of fiber under the license agreements to property, plant, and equipment. These costs are amortized over the useful life as depreciation and amortization expense. We reimburse Time Warner Cable and TWE-A/N Subsidiary for facility maintenance and pole rental costs on an ongoing basis. These maintenance and pole rental costs are included in our operating expenses. We believe that certain regulatory decisions regarding the pole rental rates that are passed through to us under the capacity license agreements pose a risk that our expense for these items could increase over time. Our selling, general, and administrative expenses include charges from affiliates of Time Warner Inc. and from TWE-A/N Subsidiary for office rent, and from Time Warner Cable for overhead charges for limited administrative functions it performs for us. We also benefit from discounts available to Time Warner Inc. and its affiliates by aggregating our purchases of long distance services, car rental services, overnight delivery services, and wireless usage with those of Time Warner Inc. Revenue for services we provide to Time Warner Inc. and its affiliates and TWE-A/N Subsidiary was $24.8 million for the nine months ended September 30, 2003. Operating and selling, general, and administrative expenses for expenses paid to Time Warner Cable and TWE-A/N Subsidiary totaled $4.2 million for the nine months ended September 30, 2003.

16

TIME WARNER TELECOM INC.

Critical Accounting Policies

We prepare our financial statements in accordance with accounting principles generally accepted in the United States, which require us to make estimates and assumptions. We believe that, of our significant accounting policies described in Note 1 to the consolidated and condensed financial statements included herein, the following involve a higher degree of judgment and complexity and are therefore considered critical.

Revenue Recognition. We generally bill our customers in advance for dedicated transport, data, Internet, and the majority of switched services on a fixed rate basis and recognize the revenue over the period the services are provided. We generally bill intercarrier compensation and long distance on a transactional basis determined by customer usage with some fixed rate elements. We bill the transactional elements of switched services in arrears and use estimates to recognize revenue in the period earned.

As part of the revenue recognition process, we evaluate whether receivables are reasonably assured of collection based on certain factors, including the likelihood of billings being disputed by customers. In situations where a dispute is likely, we generally defer recognition until cash is collected. We recognize reciprocal compensation revenue primarily on a cash basis, except in those cases where the payment is under dispute or at risk, in which case we defer recognition until the outstanding issues are resolved. We utilize the cash basis because changes in, and interpretations of, regulatory rulings create disputes and often result in significant delays in payment. As of September 30, 2003 and December 31, 2002, we had deferred recognition of $10.4 million and $12.8 million, respectively, in reciprocal compensation revenue for payments received associated with pending disputes. We recognized $3.9 million and $13.9 million of revenue resulting from the settlement of reciprocal compensation disputes in the nine months ended September 30, 2003 and 2002, respectively.

Receivables. We estimate the collectability of our receivables by performing ongoing credit evaluations of our customers’ financial conditions, and provide an allowance for doubtful accounts based on the expected collectability of all receivables. We assign a higher risk of collectability to certain customers with deteriorating financial conditions and customers in bankruptcy that continue service subsequent to filing bankruptcy, resulting in a greater allowance for doubtful accounts. Our policy is to write off receivables from bankrupt customers for services provided prior to their bankruptcy filing, to file pre-petition claims with the bankruptcy courts and to reserve a portion of prior collections which could be challenged as preferential payments under bankruptcy laws. We continue to carry post-filing receivable balances when these customers continue purchasing services following their bankruptcy filings, but we assign a higher risk of collectability to these accounts and provide a correspondingly greater allowance for doubtful accounts. Evaluating the collectability of receivables and establishing the related allowance for doubtful accounts requires considerable management judgment. Our allowance for doubtful accounts is based on the best information available to us and is re-evaluated and adjusted when additional information becomes available. If the financial condition of our customers deteriorates, our bad debt expense and cash collections will be negatively impacted. Our provision for bad debts, excluding the impact of the WorldCom Settlement, totaled $10.6 million and $23.8 million for the nine months ended September 30, 2003 and 2002, respectively. The allowance for doubtful accounts was $17.1 million and $21.9 million at September 30, 2003 and December 31, 2002, respectively.

Impairment of Long-Lived Assets. We periodically review the carrying amounts of property, plant and equipment and intangible assets to determine whether current events or circumstances warrant adjustments to the carrying amounts. As part of this review, we analyze the projected undiscounted cash flows associated with our property, plant, and equipment and intangible assets. Considerable management judgment is necessary in establishing the assumptions required to complete these projections. Although we believe these estimates to be reasonable, actual results could vary significantly from these estimates and our estimates could change based on market conditions. Variances in results or estimates could result in changes to the carrying value of our assets including, but not limited to, incurring additional impairment charges for some of these assets in future periods. In the fourth quarter of 2002, we incurred a $213 million impairment charge primarily related to the long haul network acquired from GST, and, to a lesser extent, certain local network assets. No additional charges have been recorded subsequent to December 31, 2002.

17

TIME WARNER TELECOM INC.

Deferred Taxes. Significant management judgment is required in determining our provision for income taxes and in determining whether deferred tax assets will be realized in full or in part. The deferred tax asset primarily represents the tax benefit of net operating loss carryforwards and timing differences between book and tax recognition of certain revenue and expense items. When it is more likely than not that all or some portion of deferred tax assets will not be realized, we are required to establish a valuation allowance for the amount of the deferred tax assets that we determine not to be realizable. As of September 30, 2003, our deferred tax asset is $57.9 million, net of a valuation allowance of $165.6 million. We have concluded that it is more likely than not that the net deferred tax asset of $57.9 million will be realized because we could utilize tax-planning strategies to realize this amount. However, we believe there may be risks in realizing amounts in excess of the $57.9 million through utilization of available tax planning strategies. Accordingly, we have established a valuation allowance for amounts in excess of $57.9 million. Our treatment of deferred taxes and our tax planning strategies are based on certain assumptions that we believe are reasonable. However, actual results could vary significantly from current assumptions and could result in changes to the accounting treatment of these items, including, but not limited to, the necessity to record a greater valuation allowance.

Regulatory and Other Contingencies. We are subject to regulatory proceedings, lawsuits, and other claims, including proceedings under laws and government regulations related to rights-of-way, employment, customer agreements, and other matters. We are required to assess the likelihood of any adverse judgments or outcomes to these matters, as well as potential ranges of probable losses. A determination of the amount of reserves required, if any, for these contingencies is based on a careful analysis of individual issues with the assistance of legal and regulatory counsel. These determinations are often made early in the course of a proceeding when we do not know all of the relevant facts and involve difficult predictions of probable outcomes. Since these matters are inherently unpredictable, the reserves we establish may prove to be either too high or too low. Also, the required reserves may change in the future due to new developments or changes in regulatory rulings.

Stock Options. We have elected to follow Accounting Principles Board Opinion No. 25,Accounting for Stock Issued to Employees (“APB 25”), and related interpretations in accounting for our employee stock options. Under APB 25, because the exercise price of our employee stock options is generally equal to the market price of the underlying stock on the date of the grant, no compensation expense is recognized. Financial Accounting Standards Board (“FASB”) Statement No. 123,Accounting and Disclosure of Stock-Based Compensation (“SFAS 123”), establishes an alternative method of expense recognition for stock-based compensation awards to employees based on estimated fair values. We have not elected to adopt SFAS 123 for expense recognition purposes. The FASB has announced that it plans to require fair value accounting for stock options in the future, likely beginning in 2005. However, the methodology to establish fair value for this purpose has not yet been finalized. While the impact of adopting the expense provisions of SFAS 123 would be material to our results of operations, we cannot predict the impact that a new standard would have on our results of operations. We do not anticipate that a new accounting standard would have an impact on our cash flows.

18

TIME WARNER TELECOM INC.

Results of Operations

The following table sets forth certain data from our unaudited consolidated and condensed financial statements presented in thousands of dollars and expressed as a percentage of total revenue. You should read this table together with our consolidated and condensed financial statements, including the notes thereto, appearing elsewhere in this report:

| | | Three Months Ended September 30,

| | | Nine Months Ended September 30,

| |

| | | 2003

| | | 2002

| | | 2003

| | | 2002

| |

| | | (amounts in thousands, except per share amounts) | |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue(1): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Dedicated transport services | | $ | 94,066 | | | 55 | % | | | 92,556 | | | 55 | % | | $ | 269,420 | | | 54 | % | | | 280,170 | | | 54 | % |

Switched services | | | 38,957 | | | 22 | % | | | 36,078 | | | 22 | % | | | 115,281 | | | 23 | % | | | 110,007 | | | 21 | % |

Data and Internet services | | | 25,700 | | | 15 | % | | | 23,410 | | | 14 | % | | | 74,135 | | | 15 | % | | | 65,758 | | | 13 | % |

Intercarrier compensation | | | 13,705 | | | 8 | % | | | 15,121 | | | 9 | % | | | 41,377 | | | 8 | % | | | 64,525 | | | 12 | % |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Total Revenue | | | 172,428 | | | 100 | % | | | 167,165 | | | 100 | % | | | 500,213 | | | 100 | % | | | 520,460 | | | 100 | % |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Costs and expenses(2): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating (exclusive of depreciation, amortization, and accretion shown separately below) | | | 66,631 | | | 39 | % | | | 70,799 | | | 40 | % | | | 198,461 | | | 39 | % | | | 216,966 | | | 42 | % |

Selling, general, and administrative | | | 31,162 | | | 18 | % | | | 56,293 | | | 34 | % | | | 128,294 | | | 26 | % | | | 171,710 | | | 33 | % |

Depreciation, amortization, and accretion | | | 56,408 | | | 33 | % | | | 61,763 | | | 37 | % | | | 164,876 | | | 33 | % | | | 176,269 | | | 34 | % |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Total costs and expenses | | | 154,201 | | | 89 | % | | | 188,855 | | | 113 | % | | | 491,631 | | | 98 | % | | | 564,945 | | | 109 | % |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Operating Income (Loss) | | | 18,227 | | | 11 | % | | | (21,690 | ) | | (13 | )% | | | 8,582 | | | 2 | % | | | (44,485 | ) | | (9 | )% |

Interest expense | | | (25,908 | ) | | 8 | % | | | (26,760 | ) | | (16 | )% | | | (78,520 | ) | | (16 | )% | | | (78,435 | ) | | (15 | )% |

Interest income | | | 1,326 | | | (15 | )% | | | 1,517 | | | 1 | % | | | 4,648 | | | 1 | % | | | 4,317 | | | 1 | % |

Investment gains, (losses) net | | | 922 | | | 1 | % | | | (1,283 | ) | | (1 | )% | | | 922 | | | — | % | | | (3,240 | ) | | (1 | )% |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Net loss before income taxes and cumulative effect of change in accounting principle | | | (5,433 | ) | | (3 | )% | | | (48,216 | ) | | (29 | )% | | | (64,368 | ) | | (13 | )% | | | (121,843 | ) | | (23 | )% |

Income tax expense | | | 225 | | | — | | | | 150 | | | — | | | | 675 | | | — | | | | 450 | | | — | |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Loss before cumulative effect of change in accounting principle | | | (5,658 | ) | | (3 | )% | | | (48,366 | ) | | (29 | )% | | | (65,043 | ) | | (13 | )% | | | (122,293 | ) | | (23 | )% |

Cumulative effect of change in accounting principle | | | — | | | — | | | | — | | | — | | | | 2,965 | | | 1 | % | | | — | | | — | |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Net loss | | $ | (5,658 | ) | | (3 | )% | | | (48,366 | ) | | (29 | )% | | $ | (68,008 | ) | | (14 | )% | | | (122,293 | ) | | (23 | )% |

| | |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

| |

|

|

| |

|

|

Basic and diluted loss per share | | $ | (0.05 | ) | | | | | $ | (0.42 | ) | | | | | $ | (0.59 | ) | | | | | $ | (1.07 | ) | | | |

| | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | | |

|

|

| | | |

Weighted average shares outstanding, basic and diluted | | | 114,936 | | | | | | | 114,827 | | | | | | | 114,931 | | | | | | | 114,772 | | | | |

| | | | | | | | |

EBITDA(1),(2),(3) | | $ | 74,635 | | | 43 | % | | | 40,073 | | | 24 | % | | $ | 173,458 | | | 35 | % | | | 131,784 | | | 25 | % |

Net cash provided by (used in) operating activities | | | (1,093 | ) | | | | | | 11,554 | | | | | | | 61,192 | | | | | | | 20,090 | | | | |

Net cash used in investing activities | | | (25,896 | ) | | | | | | (22,559 | ) | | | | | | (143,445 | ) | | | | | | (77,662 | ) | | | |

Net cash used in financing activities | | | (6,456 | ) | | | | | | (1,046 | ) | | | | | | (19,706 | ) | | | | | | (3,002 | ) | | | |

| (1) | Includes revenue resulting from transactions with affiliates of $9.4 million and $6.0 million for the three months ended September 30, 2003 and 2002, respectively, and $24.8 million and $21.8 million for the nine months ended September 30, 2003 and 2002, respectively. |

| (2) | Includes expenses resulting from transactions with affiliates of $1.5 million and $1.2 million for the three months ended September 30, 2003 and 2002, respectively, and $4.2 million and $3.4 million for the nine months ended September 30, 2003 and 2002, respectively. |

19

TIME WARNER TELECOM INC.

| (3) | “EBITDA” is defined as operating income (loss) before depreciation, amortization, and accretion expense. The reconciliation between net loss and EBITDA is as follows: |

| | | Three Months Ended

September 30,

| | | Nine Months Ended

September 30,

| |