Exhibit 99.1

Investor Presentation March, 2005

Safe Harbor Statement . . .

Statements made during today’s presentation may include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to risks and uncertainties. These risks include the risks summarized in the Company’s filings with the SEC, including the section entitled “Risk Factors” in its Annual Report on Form 10-K and those set forth in Item 8.01 of its Current Report on Form 8-K dated February 3, 2005.

Time Warner Telecom Inc. is under no obligation, and expressly disclaims any obligation, to update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Comments and discussions related to financial performance and trends are based on the information from our fourth quarter 2004 earnings call and press release. Please see our Q4 2004 earnings release at www.twtelecom.com.

2

Company Overview

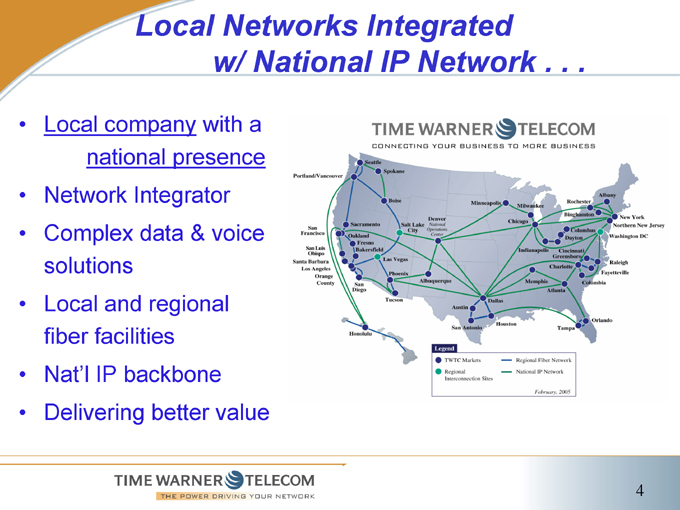

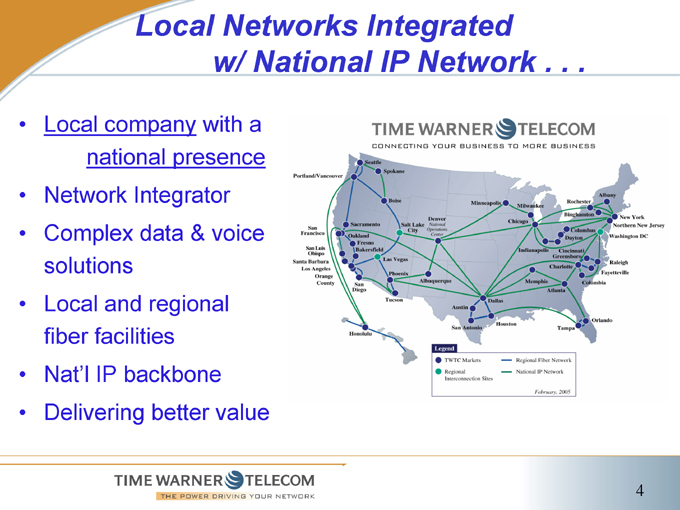

Local Networks Integrated w/ National IP Network . . .

Local company with a national presence Network Integrator Complex data & voice solutions Local and regional fiber facilities Nat’l IP backbone Delivering better value

4

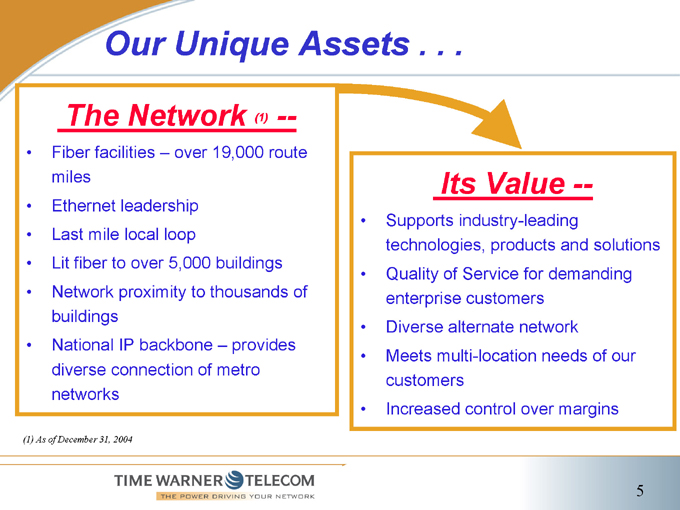

Our Unique Assets . .. .

The Network (1) —

Fiber facilities – over 19,000 route miles Ethernet leadership Last mile local loop Lit fiber to over 5,000 buildings Network proximity to thousands of buildings National IP backbone – provides diverse connection of metro networks

(1) As of December 31, 2004

Its Value —

Supports industry-leading technologies, products and solutions Quality of Service for demanding enterprise customers Diverse alternate network Meets multi-location needs of our customers Increased control over margins

5

Company Focus . . .

Lever extensive local fiber networks Drive all segments of our business Achieve operational efficiencies

Deliver highest quality customer care and innovation

Expand service offerings

6

Product Overview

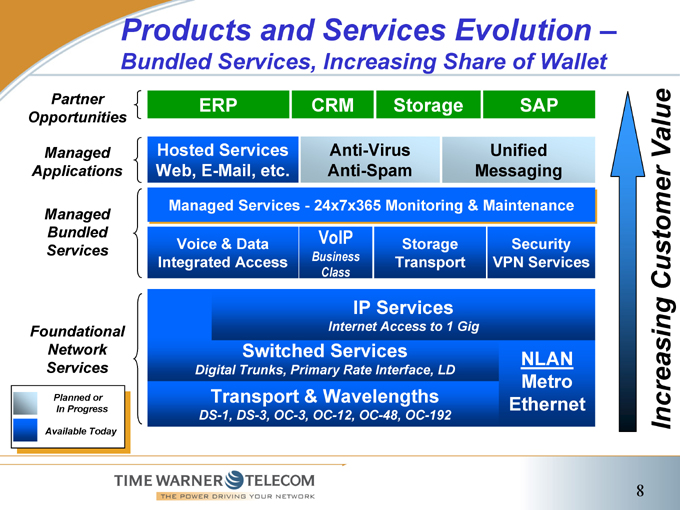

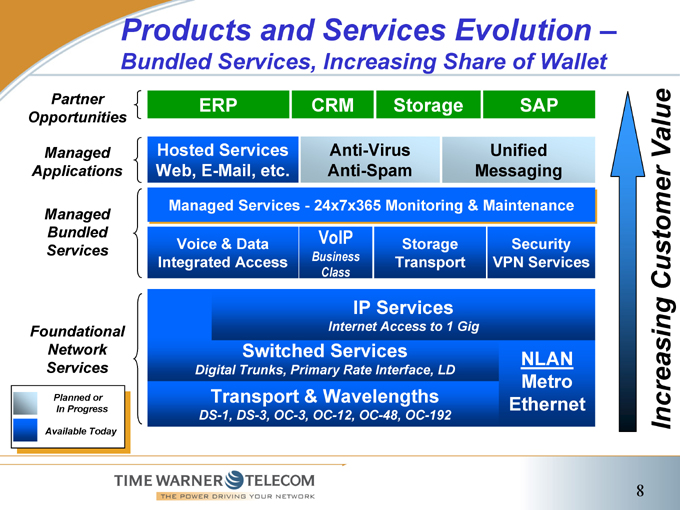

Products and Services Evolution –

Bundled Services, Increasing Share of Wallet

Partner Opportunities

Managed Applications

Managed Bundled Services

Foundational Network Services

ERP

CRM

Storage

SAP

Hosted Services Web, E-Mail, etc.

Anti-Virus Anti-Spam

Unified Messaging

Managed Services—24x7x365 Monitoring & Maintenance

Voice & Data Integrated Access

VoIP

Business Class

Storage Transport

Security VPN Services

IP Services

Internet Access to 1 Gig

Switched Services

Digital Trunks, Primary Rate Interface, LD

Transport & Wavelengths

DS-1, DS-3, OC-3, OC-12, OC-48, OC-192

NLAN Metro Ethernet

Increasing Customer Value

Planned or In Progress

Available Today

8

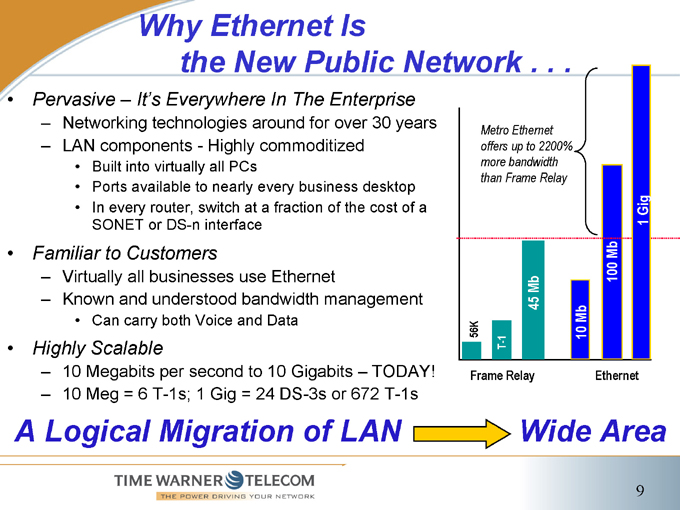

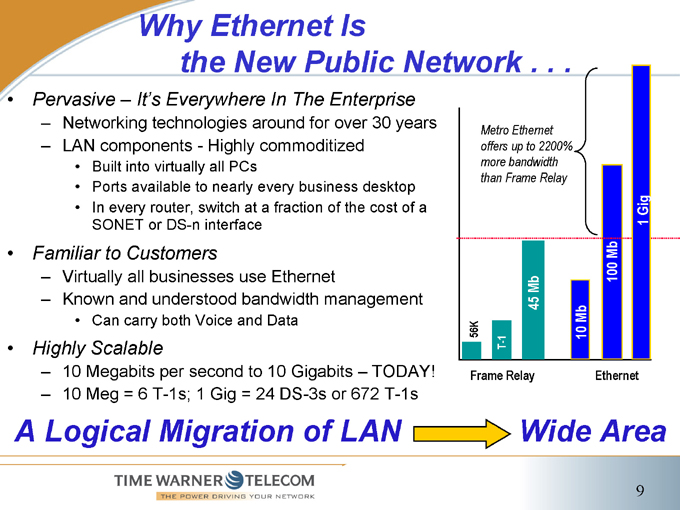

Why Ethernet Is the New Public Network . . .

Pervasive – It’s Everywhere In The Enterprise

Networking technologies around for over 30 years LAN components - Highly commoditized

Built into virtually all PCs

Ports available to nearly every business desktop In every router, switch at a fraction of the cost of a SONET or DS-n interface

Familiar to Customers

Virtually all businesses use Ethernet

Known and understood bandwidth management

Can carry both Voice and Data

Highly Scalable

10 Megabits per second to 10 Gigabits – TODAY! 10 Meg = 6 T-1s; 1 Gig = 24 DS-3s or 672 T-1s

Metro Ethernet offers up to 2200% more bandwidth than Frame Relay

56K

T-1

45 Mb

10 Mb

100 Mb

1 Gig

Frame Relay

Ethernet

A Logical Migration of LAN

Wide Area

9

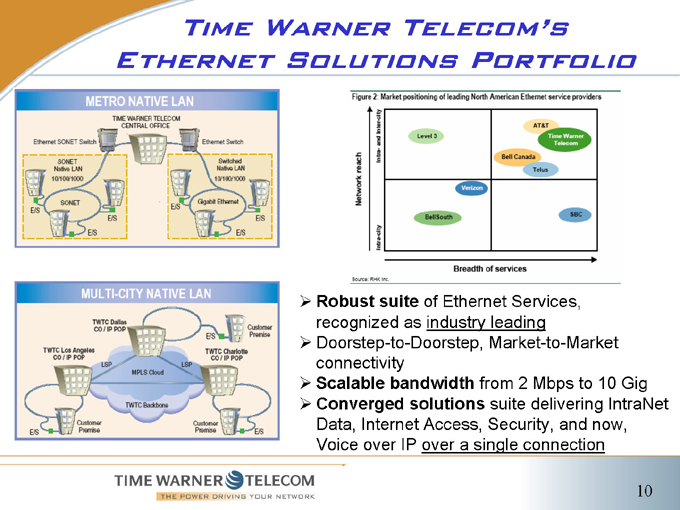

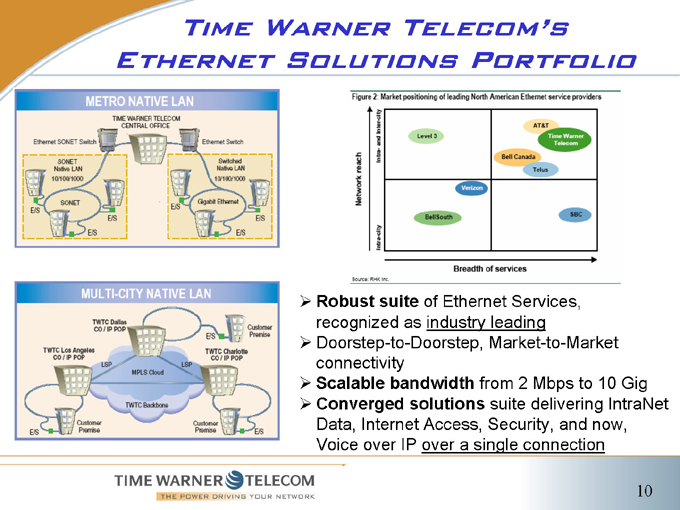

Time Warner Telecom’s Ethernet Solutions Portfolio

Robust suite of Ethernet Services, recognized as industry leading Doorstep-to-Doorstep, Market-to-Market connectivity Scalable bandwidth from 2 Mbps to 10 Gig Converged solutions suite delivering IntraNet Data, Internet Access, Security, and now, Voice over IP over a single connection

10

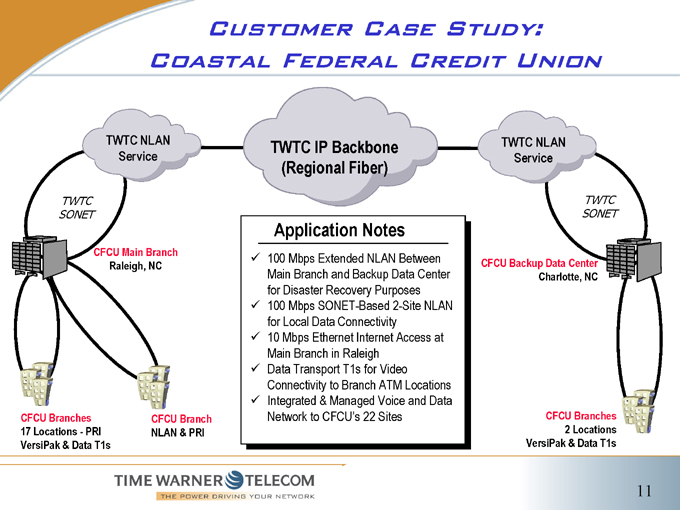

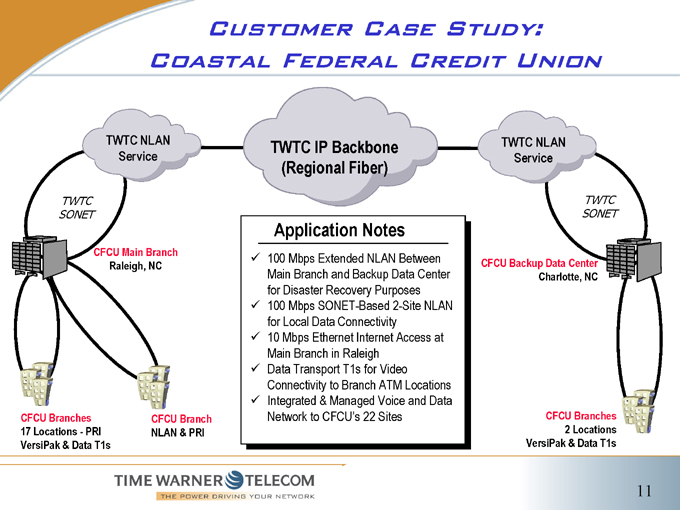

Customer Case Study: Coastal Federal Credit Union

TWTC NLAN

Service

TWTC IP Backbone (Regional Fiber)

TWTC NLAN

Service

TWTC SONET

CFCU Main Branch Raleigh, NC

CFCU Branches 17 Locations - PRI VersiPak & Data T1s

CFCU Branch NLAN & PRI

Application Notes

100 Mbps Extended NLAN Between Main Branch and Backup Data Center for Disaster Recovery Purposes

100 Mbps SONET-Based 2-Site NLAN for Local Data Connectivity

10 Mbps Ethernet Internet Access at Main Branch in Raleigh

Data Transport T1s for Video Connectivity to Branch ATM Locations

Integrated & Managed Voice and Data Network to CFCU’s 22 Sites

TWTC SONET

CFCU Backup Data Center Charlotte, NC

CFCU Branches 2 Locations VersiPak & Data T1s

11

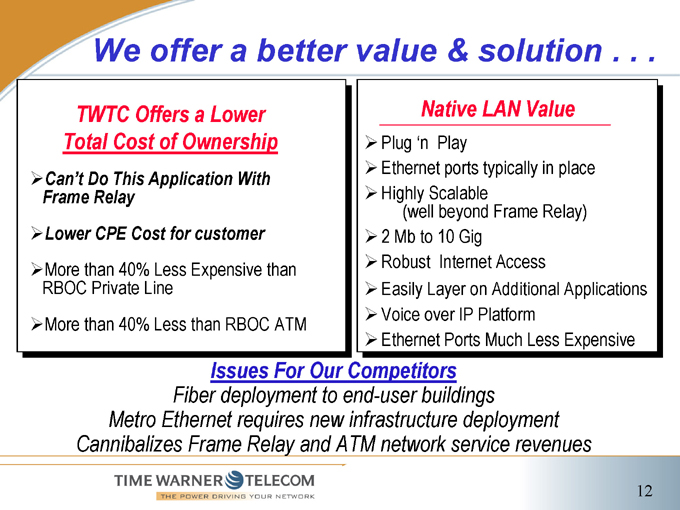

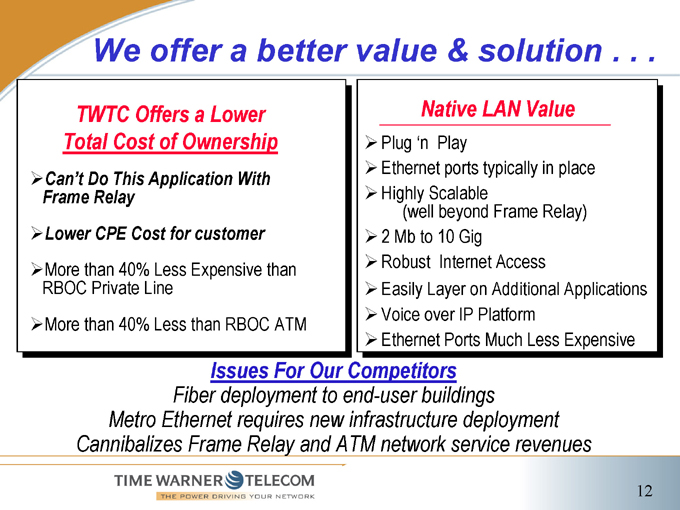

We offer a better value & solution . . .

TWTC Offers a Lower Total Cost of Ownership

Can’t Do This Application With Frame Relay

Lower CPE Cost for customer

More than 40% Less Expensive than RBOC Private Line

More than 40% Less than RBOC ATM

Native LAN Value

Plug ‘n Play

Ethernet ports typically in place

Highly Scalable

(well beyond Frame Relay)

2 Mb to 10 Gig

Robust Internet Access

Easily Layer on Additional Applications

Voice over IP Platform

Ethernet Ports Much Less Expensive

Issues For Our Competitors

Fiber deployment to end-user buildings Metro Ethernet requires new infrastructure deployment Cannibalizes Frame Relay and ATM network service revenues

12

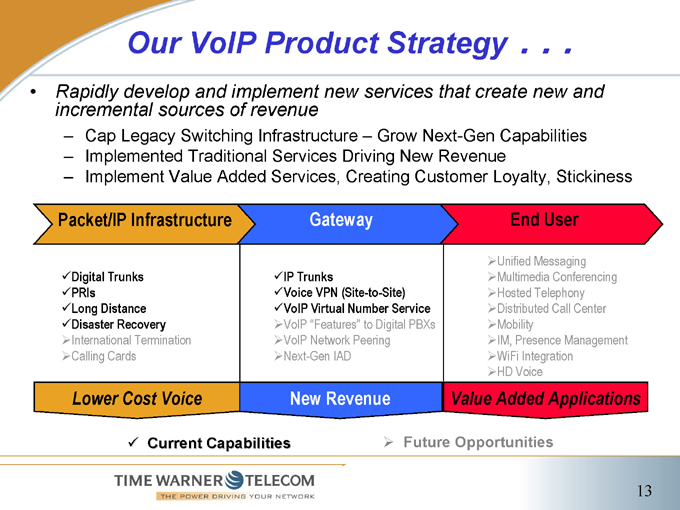

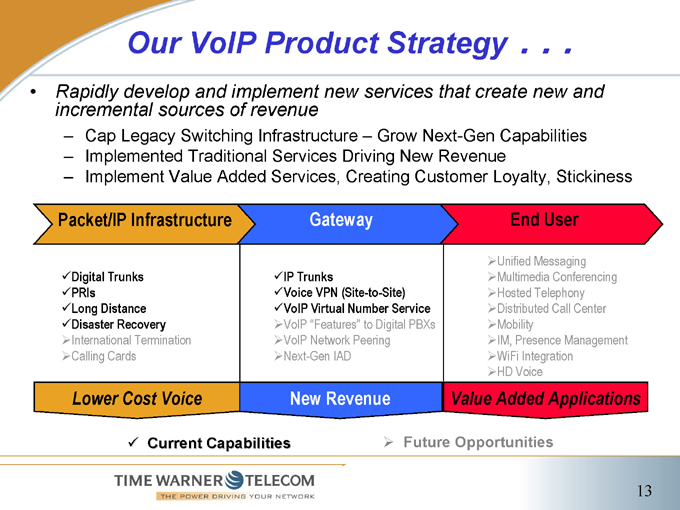

Our VoIP Product Strategy . . .

Rapidly develop and implement new services that create new and incremental sources of revenue

Cap Legacy Switching Infrastructure – Grow Next-Gen Capabilities Implemented Traditional Services Driving New Revenue Implement Value Added Services, Creating Customer Loyalty, Stickiness

Packet/IP Infrastructure

Gateway

End User

Digital Trunks PRIs Long Distance Disaster Recovery

International Termination Calling Cards

IP Trunks

Voice VPN (Site-to-Site) VoIP Virtual Number Service

VoIP “Features” to Digital PBXs VoIP Network Peering Next-Gen IAD

Unified Messaging Multimedia Conferencing Hosted Telephony Distributed Call Center Mobility IM, Presence Management WiFi Integration HD Voice

Lower Cost Voice

New Revenue

Value Added Applications

Current Capabilities

Future Opportunities

13

Financial Overview

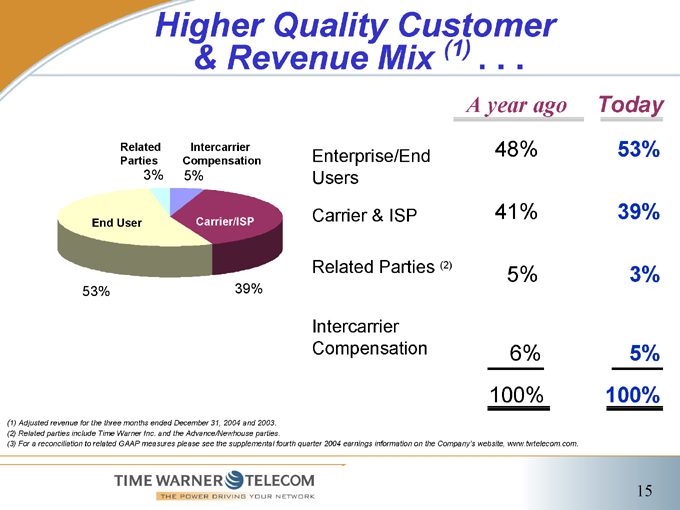

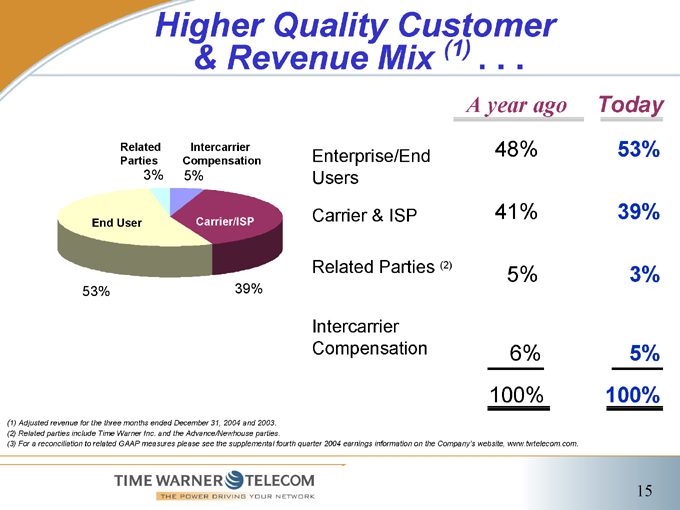

Higher Quality Customer & Revenue Mix (1) . . .

Related Intercarrier Parties Compensation

3% 5%

End User

Carrier/ISP

53%

39%

A year ago Today

Enterprise/

End 48% 53%

Users

Carrier & ISP 41% 39%

Related Parties (2) 5% 3%

Intercarrier

Compensation 6% 5%

100% 100%

(1) Adjusted revenue for the three months ended December 31, 2004 and 2003. (2) Related parties include Time Warner Inc. and the Advance/Newhouse parties.

(3) For a reconciliation to related GAAP measures please see the supplemental fourth quarter 2004 earnings information on the Company’s website, www.twtelecom.com.

15

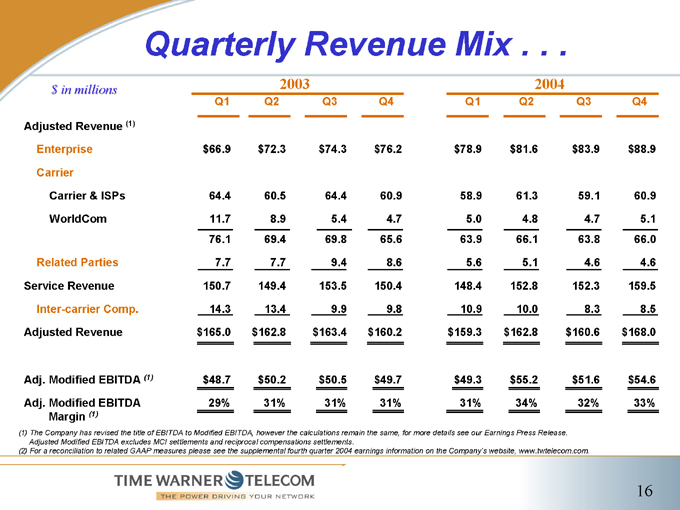

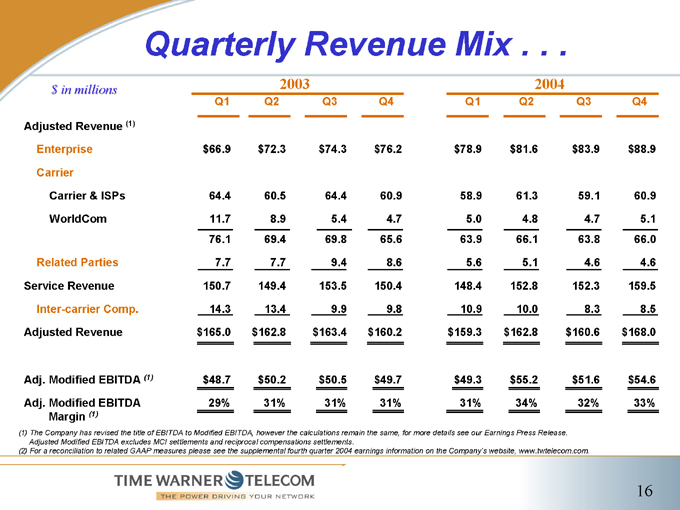

Quarterly Revenue Mix . . .

$ in millions 2003 2004

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Adjusted Revenue (1)

Enterprise $ 66.9 $ 72.3 $ 74.3 $ 76.2 $ 78.9 $ 81.6 $ 83.9 $ 88.9

Carrier

Carrier & ISPs 64.4 60.5 64.4 60.9 58.9 61.3 59.1 60.9

WorldCom 11.7 8.9 5.4 4.7 5.0 4.8 4.7 5.1

76.1 69.4 69.8 65.6 63.9 66.1 63.8 66.0

Related Parties 7.7 7.7 9.4 8.6 5.6 5.1 4.6 4.6

Service Revenue 150.7 149.4 153.5 150.4 148.4 152.8 152.3 159.5

Inter-carrier Comp. 14.3 13.4 9.9 9.8 10.9 10.0 8.3 8.5

Adjusted Revenue $ 165.0 $ 162.8 $ 163.4 $ 160.2 $ 159.3 $ 162.8 $ 160.6 $ 168.0

Adj. Modified EBITDA (1) $ 48.7 $ 50.2 $ 50.5 $ 49.7 $ 49.3 $ 55.2 $ 51.6 $ 54.6

Adj. Modified EBITDA 29% 31% 31% 31% 31% 34% 32% 33%

Margin (1)

(1) The Company has revised the title of EBITDA to Modified EBITDA, however the calculations remain the same, for more details see our Earnings Press Release.

Adjusted Modified EBITDA excludes MCI settlements and reciprocal compensations settlements.

(2) For a reconciliation to related GAAP measures please see the supplemental fourth quarter 2004 earnings information on the Company’s website, www.twtelecom.com.

16

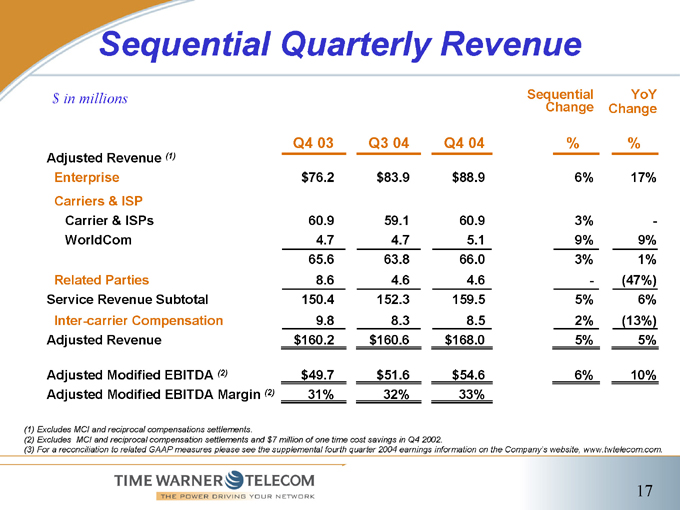

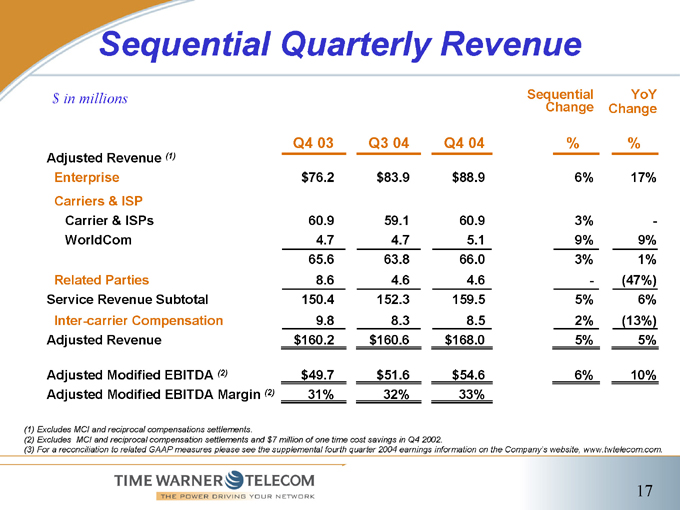

Sequential Quarterly Revenue

$ in millions Sequential YoY

Change Change

Q4 03 Q3 04 Q4 04 % %

Adjusted Revenue (1)

Enterprise $ 76.2 $ 83.9 $ 88.9 6% 17%

Carriers & ISP

Carrier & ISPs 60.9 59.1 60.9 3% -

WorldCom 4.7 4.7 5.1 9% 9%

65.6 63.8 66.0 3% 1%

Related Parties 8.6 4.6 4.6 - (47%)

Service Revenue Subtotal 150.4 152.3 159.5 5% 6%

Inter-carrier Compensation 9.8 8.3 8.5 2% (13%)

Adjusted Revenue $ 160.2 $ 160.6 $ 168.0 5% 5%

Adjusted Modified EBITDA (2) $ 49.7 $ 51.6 $ 54.6 6% 10%

Adjusted Modified EBITDA Margin (2) 31% 32% 33%

(1) Excludes MCI and reciprocal compensations settlements.

(2) Excludes MCI and reciprocal compensation settlements and $7 million of one time cost savings in Q4 2002.

(3) For a reconciliation to related GAAP measures please see the supplemental fourth quarter 2004 earnings information on the Company’s website, www.twtelecom.com.

17

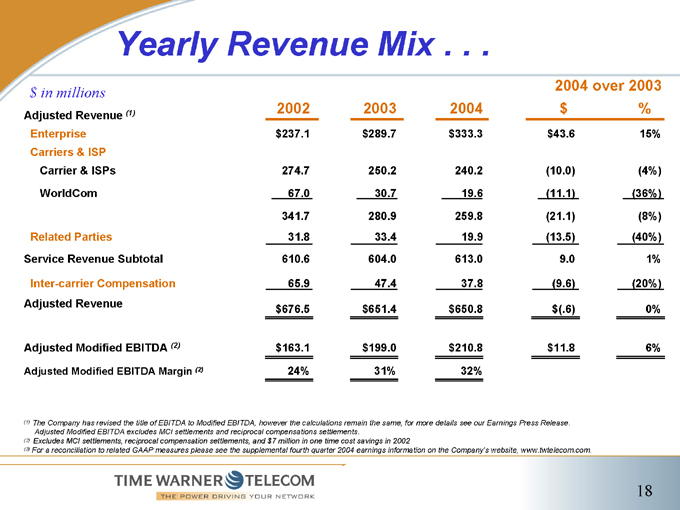

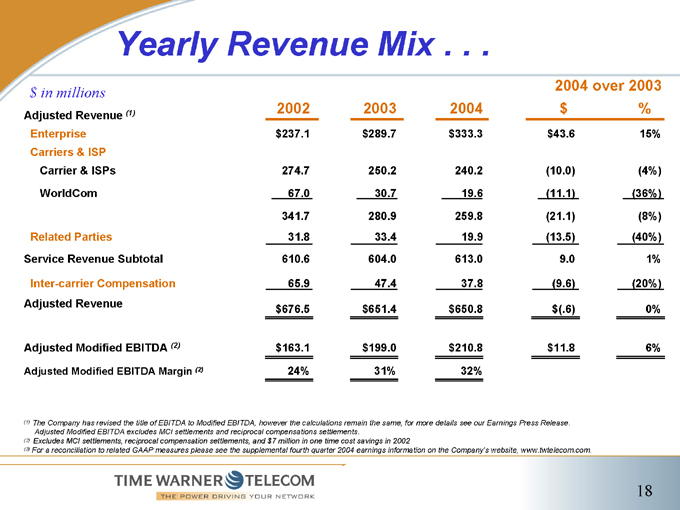

Yearly Revenue Mix . .. .

2004 over 2003

$ in millions

2002 2003 2004 $ %

Adjusted Revenue (1)

Enterprise $ 237.1 $ 289.7 $ 333.3 $ 43.6 15%

Carriers & ISP

Carrier & ISPs 274.7 250.2 240.2 (10.0) (4%)

WorldCom 67.0 30.7 19.6 (11.1) (36%)

341.7 280.9 259.8 (21.1) (8%)

Related Parties 31.8 33.4 19.9 (13.5) (40%)

Service Revenue Subtotal 610.6 604.0 613.0 9.0 1%

Inter-carrier Compensation 65.9 47.4 37.8 (9.6) (20%)

Adjusted Revenue

$ 676.5 $ 651.4 $ 650.8 $ (.6) 0%

Adjusted Modified EBITDA (2) $ 163.1 $ 199.0 $ 210.8 $ 11.8 6%

Adjusted Modified EBITDA Margin (2) 24% 31% 32%

(1) The Company has revised the title of EBITDA to Modified EBITDA, however the calculations remain the same, for more details see our Earnings Press Release.

Adjusted Modified EBITDA excludes MCI settlements and reciprocal compensations settlements.

(2) Excludes MCI settlements, reciprocal compensation settlements, and $7 million in one time cost savings in 2002

(3) For a reconciliation to related GAAP measures please see the supplemental fourth quarter 2004 earnings information on the Company’s website, www.twtelecom.com.

18

Capital Expenditures .. . .

Investing in the future

Building expansions

Network and new product expansions Information Technology and Corporate Infrastructure

Guidance for 2005 $160 to $175 million in capital expenditures

19

Market Consolidation . . .

AT&T

Our revenue has been stable and our long-term view is that is will remain stable Represents about 7%(1) of our 2004 adjusted revenue; about half is in SBC’s territory

MCI

Represents less than 3%(2) of our 2004 adjusted revenue; with little overlap in Qwest or Verizon territories

Wireless

Expect some disconnects in 2005

(1) Excludes Intercarrier Compensation

(2) Excludes Intercarrier Compensation and MCI Bankruptcy settlement

(3) For a reconciliation to related GAAP measures please see the supplemental fourth quarter 2004 earnings information on the Company’s website, www.twtelecom.com.

20

Financial Summary . .. .

Growing enterprise revenue with high value-added customer solutions

Relatively stable carrier business

Strong Modified EBITDA Margins: 33% in the Q4 2004

Focused on capital efficiencies by leveraging the network

Strong liquidity

21

Questions & Answers