Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant [X] | |

| Filed by a Party other than the Registrant [ ] | | |

| | | |

| Check the appropriate box: | | |

| [ ] | | Preliminary Proxy Statement | [ ] | Soliciting Material Under Rule 14a-12 |

| [ ] | | Confidential, For Use of the

Commission Only (as permitted

by Rule 14a-6(e)(2)) | | |

| [X] | | Definitive Proxy Statement | |

| [ ] | | Definitive Additional Materials | |

| | tw telecom inc. | |

| | (Name of Registrant as Specified In Its Charter) | |

| | |

| | | |

| | (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | | No fee required. |

| [ ] | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | | | |

| [ ] | | Fee paid previously with preliminary materials: |

| [ ] | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | 1) | | Amount previously paid: |

| | | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | 3) | | Filing Party: |

| | | | | |

| | 4) | | Date Filed: |

| | | | |

Table of Contents

Table of Contents

10475 Park Meadows Drive

Littleton, Colorado 80124

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS |

April 28, 2014

To the Stockholders oftw telecom inc.:

We will hold the Annual Meeting of Stockholders oftw telecom inc. at the Embassy Suites, 1420 Stout Street, Denver, CO 80202, on June 5, 2014 at 9:00 a.m. MDT.

The purpose of the meeting is to:

| 1) | Elect seven directors; |

| 2) | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014; |

| 3) | Hold an advisory vote to approve our named executive officers’ compensation for 2013; |

| 4) | Approve the material terms of performance goals for our Amended and Restated 2000 Employee Stock Plan pursuant to Section 162(m) of the Internal Revenue Code; |

| 5) | Vote on a stockholder proposal requesting that our Board of Directors establish a policy requiring our Chairman to be an independent director, if properly presented at the Annual Meeting; and |

| 6) | Consider such other matters that properly come before the meeting and any adjournments or postponements thereof. |

Only stockholders of record of our common stock at the close of business on April 7, 2014 (the “Record Date”) are entitled to receive notice of and to vote at the meeting. Each share of common stock is entitled to one vote. A list of the stockholders entitled to vote will be available for examination at the meeting by any stockholder for any purpose relevant to the meeting. The list will also be available on the same basis for ten days prior to the meeting at our principal executive office, 10475 Park Meadows Drive, Littleton, Colorado 80124.

Our proxy statement and our 2013 annual report to stockholders are available at http://www.twtelecom.com/ proxy, which does not employ “cookies” or other tracking software that identify visitors to the site.

If you wish to vote shares held in your name in person at the meeting, please bring your proxy card or proof of identification to the meeting. If you hold your shares in street name (i.e, through a broker or other nominee), you

must request a proxy card from your broker in order to vote in person at the meeting.If you plan to attend in person, please register no later than June 3, 2014 by calling (303) 542-6894 or by sending an email to pr@twtelecom.com. You may also obtain directions to the site of the meeting by calling that telephone number or sending an email to that address. Each stockholder must present(i) valid picture identification, such as a driver’s license or passport, and(ii) proof of ownership, such as a copy of your proxy or voting instruction card or a copy of a brokerage or bank statement showing your share ownership as of the Record Date.

Cameras, recording devices, and other electronic devices will not be permitted at the meeting.

We have enclosed our 2013 annual report, including our Annual Report on Form 10-K for the year endedDecember 31, 2013, the proxy statement and proxy card with this notice of annual meeting of stockholders.

Please vote your shares via the Internet, by telephone, or by mail. The Board of Directors is soliciting your proxy.

Scan this QR Code to view digital

versions of our Proxy Statement

and 2013 Annual Report and

to vote via the Internet |

|

BY ORDER OF THE BOARD OF DIRECTORS

Tina A. Davis

Senior Vice President, General Counsel and

Secretary

PLEASE VOTE. YOUR VOTE IS IMPORTANT.

Table of Contents

| | |

| |

| LETTER FROM THE

CHAIRMAN & CEO April 28, 2014 Dear Fellow Stockholders, We will host our 2014 Annual Meeting of Stockholders on June 5, 2014 at 9:00 a.m. MDT in Denver, Colorado. |

| |

Your Vote Matters – Please Vote Your vote and support are very important to us. I am asking you to consider the five annual meeting proposals, our Board’s vote recommendations and the rationale for those recommendations, as described in detail in this proxy statement. These are all significant matters fortw telecom. I encourage you to sign and return your proxy card, or use telephone or Internet voting prior to the meeting, so that your shares will be represented and voted at the meeting. Continuous Improvement – in our Operations and our Disclosure tw telecom focuses on communicating clearly and transparently with our stockholders. We have enhanced the format of our proxy statement so that it is easier for you to read and navigate. We Value Your Feedback We welcome your input on our proxy statement, governance and executive compensation matters, or any other issues that you would like to convey, so please be sure to provide your feedback. Over the years your feedback has helped shape our disclosure, executive compensation, governance and our ongoing communications with our stockholders. 2013 in Review The last year has been a dynamic one, and I am proud of whattw telecomaccomplished including our industry-leading innovation, our ongoing strong growth and the path we are setting to continue growing our record of 37 consecutive quarters of sequential revenue growth. I invite you to also read our Annual Report, which further describes our 2013 accomplishments and our vision for the future in greater detail. As always, we value your ongoing feedback and support oftw telecom, and we remain committed to driving long-term value for our shareholders.

Larissa Herda,

Chairman and CEO

|

Table of Contents

| TABLE OF CONTENTS |

Table of Contents

| Proxy Statement |  |

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

June 5, 2014

General Information

| 1. | Why am I receiving these materials? |

We have sent you these proxy materials because the Board of Directors (also referred to as the “Board”) oftw telecom inc. (also referred to as the “Company,” “we,” “us,” and “our”) is soliciting your proxy to vote at the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) and at any postponements or adjournments of the Annual Meeting. The Annual Meeting will be held on June 5, 2014, at 9:00 a.m. mountain daylight time at the Embassy Suites, 1420 Stout St., Denver, CO 80202. If you held shares oftw telecom inc. common stock (the “Common Stock”)on the close of business on April 7, 2014 (the “Record Date”), you are invited to attend the Annual Meeting and vote on the proposals described below under the heading “What am I voting on?”

You do not need to attend the Annual Meeting to vote your shares. Instead, you may complete, sign, date, and return the enclosed proxy card. You may also vote over the Internet or by telephone. We have also enclosed our 2013 annual report, including our Annual Report on Form 10-K for the year ended December 31, 2013, the proxy statement and proxy card with this notice of annual meeting of stockholders. We anticipate the first mailing of this proxy statement to be on or about April 28, 2014.

There are five proposals scheduled to be voted on at the Annual Meeting:

| 1. | Elect seven directors. |

| |

| 2. | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014. |

| |

| 3. | Advisory vote to approve our named executive officers’ compensation for 2013. |

| |

| 4. | Approve the material terms of the performance goals for our Amended and Restated 2000 Employee Stock Plan (our “Stock Plan”) pursuant to Section 162(m) of the Internal Revenue Code (the “Code”). |

| 5. | Vote on a stockholder proposal requesting that our Board of Directors establish a policy requiring our Chairman to be an independent director, if properly presented at the Annual Meeting. |

You will also be able to consider such other matters that properly come before the meeting and any adjournments or postponements of the meeting.

| 3. | Who can vote at the Annual Meeting? |

If you were a holder of our Common Stock either as a stockholder of record or as the beneficial owner of shares held in street name as of the close of business on the Record Date of April 7, 2014, you may vote your shares at the Annual Meeting. As of the Record Date, there were

137,915,162 shares of our Common Stock outstanding. Each stockholder has one vote for each share of Common Stock held as of the Record Date. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name.

| Proxy Statement | | | 1 |

Table of Contents

| General Information(continued) |

| 4. | What does it mean to be a “stockholder of record”? |

If, on the Record Date, your shares of Common Stock were registered directly in your name with the Company’s transfer agent, Wells Fargo Shareowner Services, then you are a “stockholder of record.” As a stockholder of record, you may vote in person at the Annual Meeting or vote

by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card, or vote by telephone or Internet, to ensure your vote is counted.

| 5. | What does it mean to beneficially own shares in “street name”? |

If, on the Record Date, your shares of Common Stock were held in an account at a broker, bank, or other financial institution (we will refer to those organizations collectively as “broker”), then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that broker. The broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker on how to vote the shares in your account. As a beneficial owner, you are entitled to attend the Annual Meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request

and obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting.

Under the rules that govern brokers, your broker is not permitted to vote on your behalf on any matter to be considered at the Annual Meeting (other than the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014) unless you provide specific instructions to the broker as to how to vote.As a result, we encourage you to communicate your voting decisions to your broker before the date of the Annual Meeting to ensure that your vote will be counted.

| 6. | What if I return the proxy card to the Company but do not make

specific selections? |

If you return a signed, dated, proxy card to the Company without making any voting selections, the Company will vote your shares “FOR” the Board of Directors’ nominees (Proposal 1), “FOR” ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm (Proposal 2), “FOR” approval of the compensation of our named executive officers for 2013 (Proposal 3), “FOR” approval of the material terms of the performance goals for our Stock Plan pursuant to Section 162(m) of the Code (Proposal 4), and “AGAINST” approval

of the stockholder proposal requesting that our Board of Directors establish a policy requiring our Chairman to be an independent director (Proposal 5).

The persons appointed as proxy holders will use their discretion on other matters that may properly come before the Annual Meeting, or any postponements or adjournments of the Annual Meeting. If a nominee cannot or will not serve as a director, the Board of Directors or proxy holders will vote for another nominee in their discretion.

| 7. | How are votes counted? |

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “FOR,” “AGAINST,” abstentions and broker non-votes. Abstentions and broker non-votes will have no effect on the election of directors. Abstentions as to all other

matters to come before the meeting will be counted as votes against those matters. Broker non-votes as to those other matters will not be counted as votes for or against and will not be included in calculating the number of votes necessary for approval of those matters.

| 8. | What is the voting requirement to approve each of the proposals? |

Proposal One–Election of Directors

Board Recommendation: For Each Nominee

Election of the nominees to the Board requires a plurality of the votes cast at the meeting by the holders of shares of our common stock.

Proposal Two–Ratification of Appointment of Independent Auditors

Board Recommendation: For the Proposal

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014 requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on the matter.

2 | | |  | Proxy Statement |

Table of Contents

| General Information(continued) |  |

Proposal Three–Approval of the Compensation of our Named Executive Officers for 2013 on an Advisory Basis

Board Recommendation: For the Proposal

Approval of the resolution to approve the compensation of our named executive officers for 2013 requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on the matter.

Proposal Four–Approve the Material Terms of the Performance Goals for our Stock Plan

Board Recommendation: For the Proposal

Approval of the resolution to approve the material terms of the performance goals for our Stock Plan pursuant to

Section 162(m) of the Code requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on the matter.

Proposal Five–Stockholder Proposal to Establish a Policy Requiring that our Chairman be an Independent Director

Board Recommendation: Against the Proposal

The stockholder proposal to require that our Board Chairman be an independent director requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on this matter.

| 9. | How many shares must be present or represented to conduct business at

the Annual Meeting? |

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum is present if at least a majority in total voting power of our outstanding capital stock as of the record date is present in person or by proxy. The votes of stockholders who fail to vote by proxy or

attend the meeting will not count toward determining a quorum. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business.

| 10. | How do I vote my shares of Common Stock? |

You can vote your shares via the Internet, by telephone, by mail or in person at the meeting. Instructions for voting by all of these means are set forth on the proxy card which accompanies this proxy statement. To vote by mail, complete and sign your proxy card and return it in the enclosed business reply envelope.

Your proxy will be voted in accordance with the instructions contained therein. Unless otherwise stated, all shares represented by your delivered proxy will be voted as noted above under “What if I return the proxy card to the Company but do not make specific selections?” If your shares are held in street name or through a benefit or compensation plan, your broker or your plan trustee should give you instructions for voting your shares.

| 11. | May I change my vote or revoke my proxy? |

Yes. You may change your vote or revoke your proxy by:

- Delivering a signed, written revocation letter, dated later than your proxy, by June 4, 2014 to Tina Davis, Secretary, at 10475 Park Meadows Drive, Littleton, Colorado 80124.

- Delivering a signed proxy, dated later than the first one, to Wells Fargo Shareowner Services, either in person to 1110 Centre Point Curve, Suite 101, Mendota Heights, Minnesota 55120-4100 or by mail to P.O. Box 64854, St. Paul, Minnesota 55164-0854.

- Attending the meeting and vote in person or by proxy. Attending the meeting alone will not revoke your proxy.

- Re-voting by Internet or telephone within the time periods provided on the proxy card if you voted by the Internet or by telephone.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on June 5, 2014. This proxy statement and our 2013 annual report to stockholders are available at http://www.twtelecom.com/proxy, which does not employ “cookies” or other tracking software that identify visitors to the site.

| Proxy Statement | | | 3 |

Table of Contents

| General Information(continued) |

| 12. | How will proxies be solicited and who will pay the cost of soliciting proxies? |

The solicitation of proxies by our Board is to be made principally by mail. Arrangements will be made with banks, brokers, custodians, nominees, and fiduciaries to forward

solicitation materials to beneficial owners of the shares held of record by those persons. We will pay the costs of soliciting proxies from stockholders.

| 13. | How can I find out the results of the Annual Meeting? |

Preliminary voting results will be announced at the Annual Meeting. We will publish final results in a Current Report on Form 8-K that we expect to file with the Securities and Exchange Commission (the “SEC”) within four business

days of the Annual Meeting. After the Form 8-K is filed, you may obtain a copy by visiting the SEC’s website at www.sec.gov or visiting our website.

PLEASE VOTE. YOUR VOTE IS IMPORTANT.

4 | | |  | Proxy Statement |

Table of Contents

| Executive Proxy Summary |  |

Executive Proxy Summary

Below are our 2013 performance highlights, governance changes, executive compensation highlights and the proxy proposals with our Board of Directors’ vote recommendations.

| 2013 Performance Highlights |

| Financial | Strategic and Operational | Balance Sheet |

- 6.4% Annual Revenue Growth

- 35.3% Annual M-EBITDA Margin

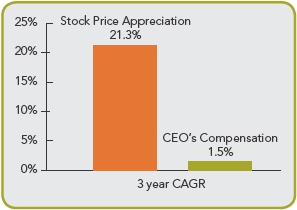

- Three Year compound annualgrowth rate(1) as of 12/31/13

- 7.1% Revenue - 6.0% M-EBITDA(2) - 21.3% Equity Appreciation - Delivered $36.5 million of AnnualNet Income

| - Expanded our Intelligent Networkcapabilities

- Demonstrated our ConstellationPlatform® prototype

- Launched other new features,services and capabilities

- Expanded our sales force by 16%

- Announced a strategic marketexpansion to five new and in overone-third of existing markets

| - Opportunistically refinanced over70% of debt(3), improved terms andrates and extended maturities

- Utilized nearly $1 billion in cashfor share repurchases and to settleconvertible debt

- avoided up to 20 million shares of potential equity dilution - executed $416 million of share repurchases |

| Key 2013 Governance Changes |

- Expanded Lead Director duties to enhance the Lead Director position. With the expanded duties our Lead Directorposition includes all duties recommended by Institutional Shareholder Services (“ISS“), as described on page 26

|

| America’s 100 Most Trustworthy Companies |

- Recognized by Forbes and GMI Ratings as one of America’s 100 Most Trustworthy Companies, based on reviews of governance and accounting of over 8,000 public companies

|

| 2013 Executive Compensation |

| Key Considerations and Highlights | | |

- Pay for Performance – 3 year CAGR – Stock Appreciation 21.3%

- Total direct compensation of CEO, COO, CFO and CAO essentially flat vs. 2012

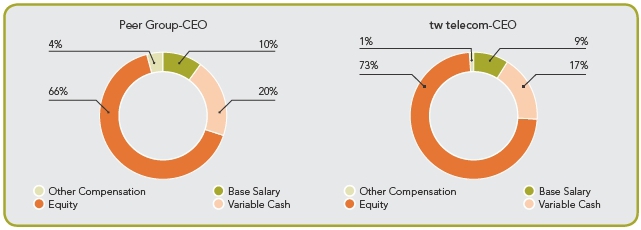

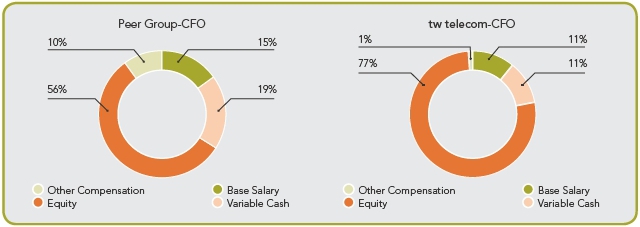

- Base Salaries – Targeted Below Peer Median

- Annual Incentive Awards – For 2013, awarded at target amounts based on Company and individual performance

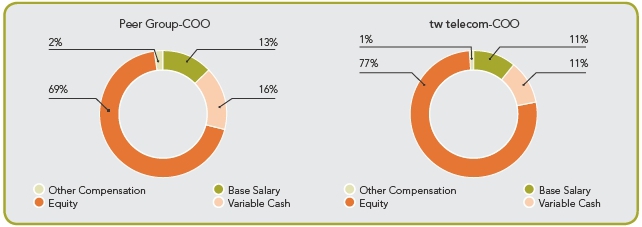

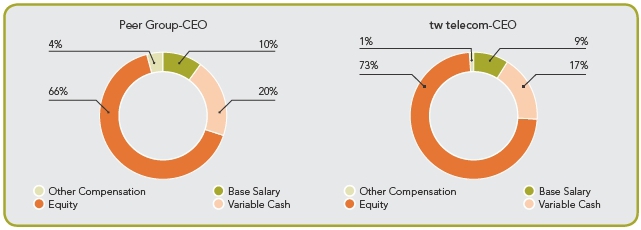

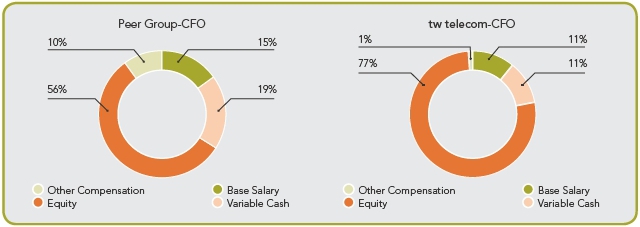

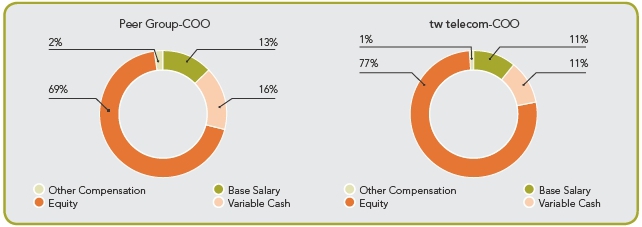

- Equity Awards – Higher % of total direct compensation than peers, putting more compensation at risk and consistent with stockholder input

| | - Company financial results compare favorably to peer results for 2013 revenue growth and EBITDA margin

- Peer Selections – Based on who we compete with for our talent and customers

- Regression of large peers’ data for comparability was statistically validated

|

| (1) | We refer to a compound annual growth rate as a “CAGR.” |

| (2) | Modified EBITDA, a non-GAAP financial measure, is reconciled to net income, the most comparable U.S. GAAP measure, in Appendix A. |

| (3) | Of Total Debt Outstanding as of 12/31/12. |

| |

| Proxy Statement | | | 5 |

Table of Contents

| Executive Proxy Summary(continued) |

The following table provides summary information about each director nominee. See “Proposal 1–Election of Directors” for more information regarding relevant experience and expertise.

| Name | Age | Director

Since | Principal Occupation | Independent | Audit

Committee | Compensation

Committee | Nominating

and

Governance

Committee | Areas of Expertise |

Larissa L.

Herda | 55 | 1998 | Chairmanand Chief

Executive Officer of

tw telecom | | | | | - Public Company CEO

- Telecom Industry

- Regulatory Leadership

- Federal Committees

- Capital Markets

- Cybersecurity

|

Gregory J.

Attorri | 55 | 2006 | Founder, GJA Advisory

Services LLC; and

Adjunct Professor

at Villanova School

of Business | ü |  | |  | - Telecom and CableIndustry

- Investment Banking

- Capital Markets

- Mergers & Acquisitions

- Corporate Governance

|

Irene M.

Esteves | 55 | Nominee | Former CFO of Time

Warner Cable Inc. | ü | | | | - Public CompanyCFO Experience

- Cable Industry

- Large Cap Experience

- Strategic Leadership

- Capital Markets

- Mergers & Acquisitions

|

Spencer B.

Hays Lead

Independent

Director | 69 | 2007;

1999-2006 | Retired Senior Vice

President and Deputy

General Counsel of

Time Warner Inc. | ü | | |  | - Media and Cable Industry

- Large Cap Experience

- Corporate Governance

- Mergers & Acquisitions

- Corporate Law

- Corporate Ethics andCompliance

|

Kevin W.

Mooney* | 56 | 2005 | President, General

Markets Division,

Blackbaud, Inc. | ü |  |  | | - Public Company CEO &CFO Experience

- Software and TelecomIndustry

- Strategic Leadership

- Capital Allocation

- Mergers & Acquisitions

- Risk Management

|

Kirby G.

Pickle | 57 | 2007 | Chief Executive Officer

of Dental Holding

Corporation | ü | |  | | - Public Company CEO Experience

- Technology Industry

- Strategic Leadership

- Mergers & Acquisitions

- Enterprise Perspective

- Capital Allocation

|

Roscoe C.

Young, II | 63 | 2005 | Managing Director,

Laurelwood Partners Chief Executive Officer

and President of Young

Kinsley Technology

Group | ü |  |  | | - Telecom CEO Experience

- Telecom Industry

- Mergers & Acquisitions

- Sales and Operations Leadership

- Executive Compensation

|

Number of Meetings in 2013 | | 9 | 5 | 6 | |

| | * | | Audit Committee Financial Expert |  | | Member |

| |  | | Chairman | ü | | Independent Under NASDAQ Listing Rules |

6 | | |  | Proxy Statement |

Table of Contents

| Executive Proxy Summary(continued) |  |

| Executive Summary of Proxy Proposals |

Proposal 1–Election of Directors

We have nominated all six incumbent directors to serve another one year term. After a comprehensive review of her experience, abilities and qualifications, we have also nominated Irene M. Esteves to be elected to a one year term. Our Board increased its size to seven directors concurrently with its approval of the new nominee, effective upon her election at our Annual Meeting. These nominees were selected based on a variety of factors, including their experience, knowledge, industry expertise, diversity of perspective, judgment and strategic vision. With the exception of Larissa Herda, our Chairman and Chief Executive Officer, all nominees are independent under the NASDAQ Listing Rules. We believe all nominees are well qualified and that our incumbent directors have been actively involved in their positions. We invite you to review their qualifications beginning on page 9.Our Board recommends that you vote FOR the election of these director nominees.

Proposal 2–Ratification of Appointment of our Independent Auditors

Ernst & Young LLP has served as our independent registered public accounting firm since the organization of our operations and has significant experience relative to our business.Our Board recommends that you vote FOR ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014.

Proposal 3–Advisory Vote to Approve our Executives’ Compensation for 2013

In accordance with applicable rules, stockholders have the opportunity for a non-binding advisory vote on the compensation of our named executive officers in 2013as disclosed in this proxy statement. We encourage you to review our executive compensation disclosure and compensation discussion and analysisbeginning on page 32.Our Board recommends that you vote FOR approval of our Executives’ Compensation for 2013.

Proposal 4–Approve the Material Terms of Performance Goals for our Stock Plan

We are asking you to approve the material terms of performance goals, as amended by our Board, for our stock plan in order to preserve the tax deductibility of any future performance-based equitythat may be granted to certain of our executive officers.Our Board recommends that you vote FOR this proposal.

| Proposal 5– | Stockholder Proposal to Establish a Policy Requiring that our Chairman be

an Independent Director |

We received a stockholder proposal requesting that our Board establish a policy requiring our Chairman to be an “independent director.” Under current NASDAQ governance standards, the proposal would prevent an executive officer from serving as our Chairman for at least three years after he or she ceases to be an employee, unreasonably limiting succession options and precluding the optimal utilization of knowledge and expertise. Specifically, this proposal would preclude our current Chairman and Chief Executive Officer, Larissa Herda, who has a strong track record of performance and played a pivotal role in our growth and development, from serving as Chairman for a period of three years, even if she no longer serves as our Chief Executive Officer. A similar proposal by the same proponent was defeated at our 2013 and 2012 annual meetings by a wide margin, evidencing strong stockholder support for our current Board structure.Our Board recommends that you vote AGAINST the proposal.

| Proxy Statement | | | 7 |

Table of Contents

| Proposal 1–Election of Directors |

| Proposal 1–Election of Directors |

Our Board recommends that you voteFORall seven director nominees.

Our Board currently has six directors and has increased the Board’s size to seven directors concurrently with its approval of a new nominee, effective upon our new nominee’s election at our Annual Meeting. Our Nominating and Governance Committee nominated the seven nominees for our Board listed below. All six of our directors currently serving on our Board have been nominated for re-election and, if re-elected, their terms will continue until the next Annual Meeting of Stockholders or until their successors are duly elected and qualified.

Our Nominating and Governance Committee has also nominated Irene M. Esteves as a director nominee after a comprehensive review of her background, experience, skills and qualifications. The Nominating and Governance Committee believes that Ms. Esteves’ cable industry experience, experience in the financial services industry and strong executive leadership background will complement and enhance the collective expertise of our Board, contribute additional diversity, perspective and strategic vision, and that she will have the ability to work effectively with our existing board members. If elected, Ms. Esteves’ term will continue until the next Annual Meeting of Stockholders or until her successor is duly elected and qualified. Each nominee has consented to serve on the Board until the next Annual Meeting of Stockholders or until his or her successor is duly elected and qualified. If any nominee is unable to serve as a director, the Board may designate a substitute nominee and the proxy holders will vote all valid proxies for the election of the substitute nominee.

Our common stock is listed on the NASDAQ Global Select Market and we are subject to NASDAQ corporate governance rules. Those rules generally require the majority of the board of directors of listed issuers to be composed of independent directors. Our Board has determined that all nominees except for Larissa Herda, our Chairman and CEO, are independent under the definition of independence set forth in Rule 5605(a)(2) of the NASDAQ Listing Rules.

Under our by-laws, the seven nominees who receive the greatest number of votes cast for the election of directors will be elected as our directors. However, under our Director Resignation Policy, in an uncontested election, any director nominee who fails to receive a greater number of votes “for” his or her election than votes “withheld” from

his or her election must tender his or her resignation. The Nominating and Governance Committee will promptly evaluate any such resignation and make a recommendation to the Board, in the Company’s and our stockholders’ best interests, whether the resignation should be accepted or other action taken. (See “Corporate Governance Information—Director Nomination Process—Director Resignation Policy.”)

We believe that our Board functions effectively as a group and has a strong mix of executive, finance, capital markets, industry, corporate governance and strategic expertise, including as described below:

| DIRECTORS’ SKILLS AND QUALIFICATIONS |

| cable industry | investment banking |

| capital allocation | media industry |

| capital markets | mergers and acquisitions |

| corporate governance | public company CEO

experience |

| corporate law | public company CFO

experience |

| cybersecurity | regulatory leadership |

| diversity | risk management |

| enterprise focus | sales and operations

leadership |

| executive compensation | software industry |

| financial expertise | technology industry |

| financial services industry | telecom industry |

On the following pages, we have noted certain individual skills and qualifications that contributed to our Nominating and Governance Committee’s recommendation and the Board’s nomination of the individual director nominees. We believe these skills and qualifications will contribute to the strong performance and effectiveness of our Board as well as strong working relationships among the members.

8 | | |  | Proxy Statement |

Table of Contents

| Proposal 1–Election of Directors(continued) |  |

| Larissa L. Herda (55) |

| |

Chairman & CEO

Chairman since 2001 Areas of Expertise - Public Company CEO

- Telecom Industry

- Regulatory Leadership

- Federal Committees

- Capital Markets

- Cybersecurity

| | Director since July 1998 Chairman - Chairman of the Company since June 2001

- Chief Executive Officer of the Company since June 1998

- President of the Company from June 1998 to January 2014

- Senior Vice President, Sales of the Company from March 1997 to June 1998

Currently Serving As: - Chair of FCC’s Communications, Security, Reliability and Interoperability Council

- Member of the President’s National Security Telecommunications Advisory Committee

- Chairman of the Board of the Denver Branch of the Federal Reserve Bank of Kansas City

Ms. Herda’s day-to-day knowledge of us, gained from 16 years of managing us, depth of experience with customers, investors, regulators, bankers and legislators, over 25 years of experience in the telecommunications industry and strong leadership skills uniquely qualify her as a Board member and Chairman. She is actively involved in regulatory and legislative matters, including her engagement with FCC Commissioners and staff and members of the U.S. Congress and her service on the Federal committees and board discussed above. Ms. Herda also serves on the advisory board for the Center for Education in Social Responsibility at the University of Colorado’s Leeds School of Business. Each of these activities support the Company’s and the community’s interests. Under Ms. Herda’s direction, we have grown to approximately $1.6 billion in annual revenue, a 28-fold increase from $55.4 million in 1997, expanded our fiber network footprint to include 75 existing and five planned new markets, built a leading national IP network, created a culture of innovation resulting in deployment of industry-leading services, including our Intelligent Network and advanced Ethernet services, and completed four acquisitions. |

| Gregory J. Attorri (55) |

| |

Independent Director

Nominating and

Governance

Committee Chair

Audit Committee Areas of Expertise - Telecom and Cable Industry

- Investment Banking

- Capital Markets

- Mergers & Acquisitions

- Corporate Governance

| | Director since April 2006 Chairman of Nominating and Governance Committee Member of Audit Committee - Founder, GJA Advisory Services LLC, a provider of financial advisory services since July 2009

- Adjunct Professor at Villanova School of Business since January 2010, teaching courses, including corporate governance, in their MBA program

- President and Chief Operating Officer of Waller Capital Corporation, a media, communications and digital information-focused investment bank, from July 2006 to March 2009

Mr. Attorri has extensive knowledge of the capital markets and extensive experience in mergers and acquisitions, focused particularly on the communications industry, from 20 years in investment banking, including positions with Merrill Lynch, Morgan Stanley, Wachovia Securities and Waller Capital, as well as a broad perspective on the communications industry. These insights have been particularly valuable in discussions of our strategy and capital and liquidity needs. |

| Proxy Statement | | | 9 |

Table of Contents

| Proposal 1–Election of Directors(continued) |

| Irene M. Esteves (55) |

| |

Independent Director

Nominee Areas of Expertise - Public Company CFO Experience

- Cable Industry

- Large Cap Experience

- Strategic Leadership

- Capital Markets

- Mergers & Acquisitions

| | Director Nominee for 2014 - Executive Vice President and Chief Financial Officer of Time Warner Cable Inc. from July 2011 to May 2013

- Executive Vice President, Chief Financial Officer of XL Group plc from May 2010 to June 2011

- Senior Executive Vice President, Chief Financial Officer of Regions Financial Corporation from April 2008 to February 2010

Ms. Esteves is an experienced public company executive, having served most recently as Chief Financial Officer of Time Warner Cable Inc., with oversight over all finance functions, including treasury, accounting, internal audit, strategic financial planning, mergers and acquisitions and investor relations. Ms. Esteves previously served on the boards of Timberland Co. and Johnson Diversey Inc. With over 20 years of experience overseeing global finance, risk management, finance operations, human resources and corporate strategy for prominent U.S. and global companies, including Time Warner Cable Inc., Ms. Esteves will bring a strong history of strategic leadership, additional diversity and valuable cable industry perspective to the Board. |

| Spencer B. Hays (69) |

| |

Lead Independent

Director

Nominating and

Governance Committee Areas of Expertise - Media and Cable Industry

- Large Cap Experience

- Corporate Governance

- Mergers & Acquisitions

- Corporate Law

- Corporate Ethics and Compliance

| | Director since April 2007; also October 1999 to September 2006 Lead Director Member of Nominating and Governance Committee - Retired

- Senior Vice President and Deputy General Counsel of Time Warner Inc., from January 2001 to March 2006

- Vice President and Deputy General Counsel of Time Warner Inc., from its formation in 1990 to January 2001

As a senior corporate attorney with over 25 years of experience with a large public company that started our business and took us public, Mr. Hays has extensive knowledge of our history and broad experience in a wide array of issues confronting public companies, including corporate governance, executive compensation, mergers and acquisitions, finance, securities and business law, corporate compliance and problem-solving in general. |

10 | | |  | Proxy Statement |

Table of Contents

| Proposal 1–Election of Directors(continued) |  |

| Kevin W. Mooney (56) |

| |

Independent Director

Audit Committee Chair

Compensation

Committee Areas of Expertise - Public Company CEO & CFO Experience

- Software and Telecom Industry

- Strategic Leadership

- Capital Allocation

- Mergers & Acquisitions

- Risk Management

| | Director since August 2005 Chairman of Audit Committee Member of Compensation Committee - President, General Markets Division, Blackbaud, Inc., a leading provider of software and professional services to the not-for-profit market, since October 2009. Chief Commercial Officer of Blackbaud, Inc., from July 2008 to October 2009

- Chief Commercial Officer of Travelport GDS, a privately held provider of IT infrastructure and distribution services to the travel industry, from August 2007 to July 2008

- Chief Financial Officer of Worldspan, L.P., a privately held transaction processing firm, from March 2005 to July 2007

- Communications consultant from August 2003 to March 2005

- Chief Executive Officer, Chief Operating Officer, Chief Financial Officer and Controller of Cincinnati Bell Inc. from April 1996 to July 2003

Mr. Mooney has extensive experience in telecommunications operations and, as a former chief financial officer of a public telecommunications company, in accounting matters. His background is well suited for his position as Chairman of our Audit Committee and as our Audit Committee financial expert. He also brings enterprise perspective from his experience with a non-telecommunications enterprise organization and his expertise in IT infrastructure and software.

|

| Kirby G. Pickle (57) |

| |

Independent Director

Compensation

Committee Areas of Expertise - Public Company CEO Experience

- Technology Industry

- Strategic Leadership

- Mergers & Acquisitions

- Enterprise Perspective

- Capital Allocation

| | Director since January 2007 Member of Compensation Committee - Chief Executive Officer of Dental Holding Corporation, a privately held international network of full service dental laboratories that provides oral restoration products to dentists, since February 2008

- Managing Partner, Bridge Creek Partners, LLP, a privately held consulting firm, from July 2006 to January 2008

- Chairman of KMC Telecom Holdings, a provider of telecommunications infrastructure and services, from June 2005 to July 2006

- Chief Executive Officer of DSL.net, Inc., a publicly held broadband and VOIP service provider, from January 2004 to January 2005

- Chief Executive Officer of Velocita Corp., a telecommunications construction company, from October 2000 to January 2004

With his experience as chief executive officer and chairman of several public and private companies and and knowledge of a broad spectrum of industries, including the telecommunications industry, Mr. Pickle brings to our Board a combination of high-tech, telecommunications and enterprise business perspectives.

|

| Proxy Statement | | | 11 |

Table of Contents

| Proposal 1–Election of Directors (continued) |

| Roscoe C. Young, II (63) |

| |

Independent Director

Compensation

Committee Chair

Audit Committee Areas of Expertise - Telecom CEO Experience

- Telecom Industry

- Mergers & Acquisitions

- Sales and Operations Leadership

- Executive Compensation

| | Director since May 2005 Chairman of Compensation Committee Member of Audit Committee - Chief Executive Officer and President of Young Kinsley Technology Group, a provider of engineering and construction solutions to wireless operators, since 2013.

- Managing Director, Laurelwood Partners, a telecommunications consulting and restructuring company, since January 2007

- Chief Executive Officer and Chief Operating Officer of KMC Telecom Holdings, a provider of telecommunications infrastructure and services, from June 2001 to December 2006

With 34 years in the telecommunications industry, including his experience as chief executive officer and chief operating officer of a telecommunications company and his service as Vice President Network Services of Ameritech Corporation, Mr. Young brings telecommunications sales and operations perspective to our Board. With over six years of service as the chairman of our Compensation Committee, Mr. Young also has considerable expertise in executive compensation matters.

|

Vote Required

Election of the nominees to the Board requires a plurality of the votes cast at the meeting by the holders of shares of our common stock.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THESE NOMINEES.

12 | | |  | Proxy Statement |

Table of Contents

Proposal 2–Ratification of Appointment of

Independent Auditors |  |

| Proposal 2–Ratification of Appointment of Independent Auditors |

Board Recommendation: Our Board recommends that you voteFOR ratification of appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014.

We ask that you approve the following resolution on the appointment of our independent registered public accounting firm:

“RESOLVED, that the stockholders ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2014.”

Ernst & Young LLP has served as our independent registered public accounting firm since the organization of our predecessor, Time Warner Telecom LLC. Prior to that time, Ernst & Young LLP audited our accounts as a division of Time Warner Entertainment Company, L.P. The Audit Committee approved the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014. We expect that a representative of Ernst & Young LLP will attend the Annual Meeting, respond to appropriate questions, and be given an opportunity to speak.

Stockholder approval is not required for the appointment of Ernst & Young LLP because our Audit Committee has the responsibility for selecting our independent auditors. Nevertheless, we are submitting the appointment for approval at the Annual Meeting as a matter of good governance practice. If stockholders do not approve this appointment, the Audit Committee will consider the appropriate action.

Audit, Audit-Related, Tax and All Other Fees

The following is a description of the fees billed to us by Ernst & Young LLP for the years ended December 31, 2012 and 2013.

| Year Ended

December 31, |

| 2012 | 2013 |

| Audit fees | $ 572,140 | $ 621,201 |

| Audit–related fees | 13,340 | – |

| Tax fees | 3,941 | 5,500 |

| All other fees | – | – |

The Audit Committee has delegated to the Chairman of the Audit Committee the authority to review and pre-approve audit and permissible non-audit services to be performed by our independent registered public accounting firm in accordance with applicable rules and standards of the SEC, PCAOB, and the American Institute of Certified Public Accountants, and associated fees between Audit Committee meetings if the full Audit Committee is not available to provide such review and approval. The Chairman promptly reports any decisions to pre-approve audit and non-audit services and fees to the full Audit Committee. All of the fees shown above for 2012 and 2013 were approved in advance by or on behalf of the Audit Committee. The audit fees in 2012 and 2013 include fees for services required to be performed by our independent registered public accounting firm, including the audit of the financial statements and internal control over financial reporting, reviews of quarterly financial information, consents and other procedures related to debt offerings. The audit–related fees in 2012 shown above were incurred for transaction support services performed by Ernst & Young LLP. The tax fees in 2012 and 2013 were incurred for tax consultation services in connection with multi-jurisdictional tax issues.

Vote Required

Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2014 requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on this matter.

OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE

APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR 2014.

| Proxy Statement | | | 13 |

Table of Contents

| Proposal 3–Advisory Vote to Approve

Compensation of our Named Executive Officers |

| Proposal 3– | Advisory Vote to Approve Compensation of Our Named

Executive Officers |

Board Recommendation: Our Board recommends that you voteFOR the approval of the resolution to approve the compensation of our Named Executive Officers for 2013 on an advisory basis.

We ask that you approve the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers for 2013, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in the proxy statement, is hereby APPROVED.”

Under the rules of the SEC, we are required to provide you with the opportunity to cast an advisory vote on the 2013 compensation for our Named Executive Officers as set forth in the compensation tables beginning on page 55. This proposal is frequently referred to as a “say-on-pay” vote.

We describe our executive compensation program in the Compensation Discussion and Analysis, or CD&A, related compensation tables and other narrative executive compensation disclosures, all of which are found in this proxy statement. In particular, we encourage you to review the CD&A, beginning on page 32, which describes our executive compensation program in detail.

The main objectives of our compensation program are attracting and retaining high caliber executives, paying for performance, rewarding the achievement of challenging business goals and aligning our named executive officers’ interests with those of our stockholders through a strong emphasis on equity-based compensation.

Since the vote on this proposal is advisory, it is not binding on us. Nonetheless, consistent with our record of responsiveness to our stockholders, our Compensation Committee, which is responsible for recommending the overall design of the compensation of our named executive officers and certain other senior management personnel, will consider our stockholders’ concerns, taking into account the outcome of the vote when making future executive compensation recommendations.

Vote Required

Approval of the resolution to approve the compensation of our named executive officers requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on this matter.

OUR BOARD RECOMMENDS THAT YOU VOTE“FOR”THE APPROVAL OF THE RESOLUTION

TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

14 | | |  | Proxy Statement |

Table of Contents

Proposal 4–Approve the Material Terms of

Performance Goals for our Stock Plan |  |

| Proposal 4– | Approve the Material Terms of Performance Goals for our

Stock Plan |

Board Recommendation: Our Board recommends that you voteFOR the proposal to approve the material terms of the performance goals for our Amended and Restated 2000 Employee Stock Plan pursuant to Section 162(m) of the Internal Revenue Code.

We are asking you to approve the material terms of performance goals for our Stock Plan in order to preserve our ability to grant awards in the future that meet the requirements for qualified performance-based compensation under Section 162(m) of the Internal Revenue Code (“Section 162(m)”). We must obtain stockholder approval every five years for these qualified performance-based compensation goals under Section 162(m). We recently amended the Stock Plan to add additional pre-established performance goals. These amended performance goals, which our Compensation Committee may use in the future to measure Company performance in any equity awards granted to our executive officers, are described below under “Material Terms of Performance Goals.”

Overview

Section 162(m) generally limits the federal income tax deduction for compensation paid to any person who serves as chief executive officer or who is one of the three other most highly compensated executive officers, other than the chief financial officer, of a publicly held corporation (each such person, a “Covered Employee”) to $1 million per fiscal year, with an exception for qualified performance-based compensation that is disclosed to and approved by stockholders at least once every five years. Stockholder approval of this proposal is expected to meet that requirement.

While our Board may or may not decide to award compensation to Covered Employees intended to meet the qualified performance-based compensation exception under Section 162(m), we believe that it is important to retain our ability to utilize the qualified performance-based compensation exception. Because five years have elapsed since our stockholders approved the material terms of the performance goals under the Stock Plan in conjunction with approval of the amended Stock Plan in 2009, we are asking our stockholders to approve the material terms of the performance goals, as recently amended.

If our stockholders do not approve this proposal, any incentive compensation awarded under the plan to our Covered Employees may not be fully deductible in the future due to Section 162(m). Even if our stockholders approve the material terms of the performance goals, there can be no assurance that particular awards granted in the future to Covered Employees based on the pre-established performance goals specified in the Stock Plan will be deductible under the qualified performance-based compensation exception or otherwise.

Material Terms of Performance Goals

Eligibility and Participation.All full-time employees of the Company and its subsidiaries, and part-time employees who are benefits eligible as determined by the Company, are eligible to receive awards under the Stock Plan. The Compensation Committee has discretion to limit awards to employees in certain key positions or to employees who have achieved a particular performance rating, and may choose to do so in the future. Non-employee directors are eligible to receive nonqualified stock options or stock awards as the Board may approve, but not incentive stock options. Consultants are eligible to receive nonqualified stock options and stock appreciation rights, but not incentive stock options or stock awards. We have not made any equity awards to eligible consultants.

Performance Awards.The Compensation Committee may grant awards under the Stock Plan that require the issuance of common stock, or grant shares of restricted stock or restricted stock units (“RSUs”), or that vest contingent on the satisfaction of specified performance goals over a specified performance period as established in writing at the time of grant. Once a performance award is granted, the Compensation Committee may not increase the payout due upon the attainment of applicable performance goals, but has the power to reduce any such payout.

| Proxy Statement | | | 15 |

Table of Contents

| Proposal 4–Approve the Material Terms of

Performance Goals for our Stock Plan(continued) |

Pre-established Performance Goals.The performance goals in the Stock Plan are one or more of the following, individually or in combination, applied to either the Company as a whole or to a business unit or subsidiary, either individually or in any combination, and measured either annually or cumulatively over a period of years, expressed in absolute amounts, on a per share basis (basic or diluted), relative to one or more other performance metrics, as a growth rate or change from preceding periods, relative to a forecast, or as a comparison to the performance of specified companies or a published or special index (including stock market indices) or other external measures:

| (a) | cash flow, levered or unlevered as defined in our earnings releases; | | (t) | pre-tax earnings; |

| (b) | earnings per share; | | (u) | cost control; |

| (c) | Modified EBITDA as defined in our earnings releases; | | (v) | sales; |

| (d) | return on equity; | | (w) | capital expenditures; |

| (e) | total stockholder return; | | (x) | new product innovation; |

| (f) | share price performance; | | (y) | market share; |

| (g) | return on capital; | | (z) | service revenue; |

| (h) | return on assets or net assets; | | (aa) | operating expense; |

| (i) | revenue; | | (bb) | balance of cash, cash equivalents and

marketable securities; |

| (j) | income or net income; | | (cc) | days sales outstanding; |

| (k) | operating income or net operating income; | | (dd) | revenue from specified products or product

categories; |

| (l) | operating profit or net operating profit; | | (ee) | industry standing or recognition; |

| (m) | operating margin, Modified EBITDA margin,

or profit margin; | | (ff) | employee retention; |

| (n) | return on operating revenue; | | (gg) | growth in customer base; |

| (o) | return on invested capital; | | (hh) | equity appreciation; |

| (p) | product release schedules; | | (ii) | network expansion implementation; |

| (q) | working capital; | | (jj) | launch or enhancement of systems; and |

| (r) | ratio of debt to stockholders’ equity; | | (kk) | measures of customer satisfaction. |

| (s) | customer retention; | | | |

We recently added the performance goals described in (y) through (kk) based on the Board’s assessment of our business strategy. As soon as practicable after the end of each performance period under any outstanding performance-based awards, the Compensation Committee must determine the amount of each award to be paid to each participant and certify its determination in writing.

Participant Award Limits.No performance award or grant of performance-based RSUs may entitle the holder to more than 2,000,000 shares or units in any calendar year based on the attainment of the foregoing performance goals.

This description of the material terms of the performance goals is a summary of the relevant provisions of the Stock Plan and is qualified in its entirety by reference to the relevant terms of the Stock Plan, which will be filed as an exhibit to our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014. You may receive a copy of the Stock Plan by directing a written request to the Company’s Secretary at 10475 Park Meadows Drive, Littleton, Colorado 80124, Attn: Corporate Secretary. We urge you to carefully read Sections 6 and 14 of the Stock Plan, as the discussion above is only a summary of these provisions.

While the Compensation Committee intends to maximize the deductibility of executive compensation for our Covered Employees when consistent with other compensation goals, we may pay compensation that is not fully deductible if the Compensation Committee believes it is in our best interest to do so.

Vote Required

Approval of the proposal to approve the material terms of the amended performance goals for our Stock Plan pursuant to Section 162(m) requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on this matter.

OUR BOARD RECOMMENDS THAT YOU VOTE“FOR”THE PROPOSAL TO APPROVE THE

MATERIAL TERMS OF THE PERFORMANCE GOALS FOR OUR STOCK PLAN.

16 | | |  | Proxy Statement |

Table of Contents

Proposal 5–Stockholder Proposal

Regarding Independent Chairman |  |

| Proposal 5– | Stockholder Proposal Regarding Independent Chairman |

Board Recommendation: Our Board recommends that you voteAGAINST the proposal to require that our Board Chairman be an independent member of the Board.

Gerald Armstrong, 621 Seventeenth Street, Suite 2000, Denver, CO 80293-2001, a beneficial owner of 12,500 shares of our common stock, has advised us that he intends to submit the proposal set forth in italics below at the Annual Meeting.

“Resolution:

That the shareholders of tw telecom inc. request its Board of Directors to adopt a policy, and amend the by-laws as necessary, to require the Chairman of the Board of Directors to be an independent member of the Board of Directors.

This policy should not be implemented to violate any contractual obligation and should specify: (a) how to select a new “independent” chairman if the current chairman ceases to be independent during the time between annual meetings of shareholders; and, (b) that compliance is excused if no independent director is available and willing to serve as chairman.

Stockholder Statement:

The proponent of this proposal believes that the Board of Directors will provide greater oversight of management with an “independent chairman.”

In the past few years, our board- consisting of six members-consists of five non-management members which is so few that it is impossible to attain significant rotation of members for an “audit committee” or “nominating and governance committee,” a practice that violates the standards of good governance practices.

The proponent believes that an “independent” chairman would not allow this and would establish a “majority” voting system to replace the current “plurality” vote standard and to require a “majority” of the votes cast in any meeting to be elected a director.

The current “plurality” voting standard allows nominees to be elected with as little as a single affirmative vote even when a substantial majority of votes are “withheld” from any nominee.

Our Board has failed to create a “plan of succession” in the event that the current Chairman, President and Chief Executive Officer should leave and our current board members seem to be without credentials of service on boards of other public corporations and seem inexperienced in dealing with corporate governance issues. Its fees have been among the highest of NASDAQ listed “National Market” corporations and the compensation for the Chairman, President and Chief Executive Officer was $9,623,102 during 2012.

The Millstein Center for Corporate Governance and Performance at the Yale School of Management and the Chairmen’s Forum endorsed policies requesting U.S. public companies to separate the role of the chairman of the board and CEO. An independent chairman “curbs conflicts of interest, promotes oversight of risk, manages the relationship between the board and the CEO, serves as a conduit for regular communication with shareowners, and is the logical next step in the development of an independent board,” the policy notes.

Norges Bank Investment Management, has stated in support of a similar proposal:

“The roles of Chairman of the Board and CEO are fundamentally different and should not be held by the same person. There should be a clear division of responsibilities between these positions to insure a balance of power and authority on the Board….”

If you agree, please vote “FOR” this proposal.”

| Proxy Statement | | | 17 |

Table of Contents

| Proposal 5–Stockholder Proposal Regarding

Independent Chairman(continued) |

Company Response to Stockholder Proposal

Our Board believes that our CEO is best suited to serve as Chairman because she is most familiar with our business, strategy, industry and operations and is therefore in the best position to identify priorities for our Board, oversee the assembly of background materials and preside at Board meetings. We also believe that combining the positions of Chairman and CEO facilitates smooth Board functioning and information flow and does not compromise the independent oversight of our Board, which otherwise is composed entirely of independent directors who meet frequently in executive session.

Ms. Herda’s long-standing practice of actively engaging with investors on a quarterly basis provides a valuable conduit for the communication of stockholders’ interests to the full Board and results in her meeting with, and soliciting feedback from, a large number of existing investors as well as potential new investors throughout the year. During this active and personal engagement with major investors, none has ever requested to change the Board’s leadership structure as specifically suggested by the proponent. In fact, our stockholders rejected similar proposals by Mr. Armstrong at the 2012 and 2013 Annual Meetingby a wide margin, evidencing their support for the current Board leadership structure.

Our Board believes that the decision as to who should serve as Chairman is the proper responsibility of the Board, which is uniquely positioned best to evaluate the optimal governance structure of the Board. Our Board members possess considerable experience and intimate knowledge of our Company’s needs and the operation of our Board. Further, our Board wishes to retain the flexibility to select the director best suited to serve as Chairman based on the then relevant circumstances and criteria.

Under current NASDAQ governance standards, the proponent’s proposal would prevent a CEO or other executive officer from serving as Chairman for at least three years after he or she ceases to be an employee of the Company. The proposal would unreasonably limit succession planning alternatives and may deprive the Company and its stockholders of the opportunity to benefit optimally from the unique knowledge and experience of a former CEO or executive officer. Specifically, this proposal would preclude our current Chairman and CEO, Larissa Herda, who has a strong track record of performance and played a pivotal role in our growth and development, from serving as our Chairman for a period of three years, even if she no longer serves as our CEO.

A recent study of 309 companies that separated the CEO and board chairman positions showed that CEO-chairman separation tends to reverse a company’s performance, with the performance of low performing firms generally benefiting from the separation and high performing firms generally suffering.(1) Given the Company’s strong long-term financial, operational and strategic results, including for 2013, we believe that a change to our board leadership structure is unwarranted and could risk adversely impacting our future performance.

Our Nominating and Governance Committee and full Board continually review and analyze our Board leadership structure and have repeatedly concluded that the separation of the Chairman and CEO functions would not be in our best interests or the best interests of our stockholders for the following reasons:

Strong Independent Stewardship

The ultimate objective of our Board structure should be independent stewardship and alignment with stockholder interests. Our Board believes that the interests of stockholders are served through the active involvement of our independent directors in the oversight of the Company, but does not believe that requiring an independent chairman is necessary to accomplish that goal. Rather, our Board achieves independent oversight through:

- a super-majority (five out of six current directors and six out of seven nominees) of independent directors;

- standing Board committees (Audit, Compensation and Nominating and Governance) composed entirely of independent directors;

- robust governance policies as described under “Corporate Governance Information” on page 20; and

- strong oversight of our risk management, key strategic initiatives, executive compensation, succession planning and financial reporting.

Experienced and Highly Engaged Board

Our Board does not need and would not benefit from changes theoretically intended to enhance the relations between our independent directors and our CEO. A significant benefit of thesize and tenure of our Board is that all of our independent directors are fully and regularly engaged as directors and involved in setting Board agendas, with open access to our management for purposes of fulfilling their oversight responsibilities.

| (1) | Krause, R & Semadeni, M. 2012. Apprentice, Departure, and Demotion: An Examination of the Three Types of CEO-Board Chair Separation.Academy of Management Journal. |

| (continued) |

18 | | |  | Proxy Statement |

Table of Contents

Proposal 5–Stockholder Proposal Regarding

Independent Chairman(continued) |  |

Independent Lead Director

Our Board has established an independent Lead Director position in response to current governance trends as described under “Corporate Governance Information—Board Leadership Structure.” The Board has determined that the Lead Director position:

- Augments the effective independent Board functioning that already exists;

- Mitigates any potential conflict that may arise by combining the Chairman and CEO positions; and

- Enables performance of the duties that might otherwise be performed by a non-executive chairman if needed.

In 2013, our Board adopted expanded Lead Director duties to enhance the Lead Director position. With the expanded duties our Lead Director position includesall duties recommended by ISS. See ”Corporate Governance Information—Board Leadership Stucture” for a discussion of these expanded duties.

Strong Stockholder Support

Our Board has consistently received strong stockholder voting support in director elections. Our stockholders have supported our current Board leadership structure by rejecting the proponent’s similar proposals at the 2012 and 2013 Annual Meetings by a wide margin.

Proponent’s Inaccuracies

We note a number of inaccuracies in the proponent’s supporting statement:

- Proponent’s assertion that given the size of our Board it is “impossible” to attain rotation of Committee membership on the Audit and Nominating and Governance Committees is flawed. Clearly with five independent directors, our Board has the ability to rotate Committee memberships. The Nominating and Governance Committee and the full Board regularly reviews the Committee Structure and to date has concluded that the existing structure operates effectively and efficiently and is not constrained by the size of the Board.

- Contrary to the proponent’s assertion, the Board annually conducts a detailed succession planning process and has succession plans that would be implemented if Ms. Herda or one of the other executive officers leaves his or her position.

- The proponent’s suggestion that the Board members are inexperienced in dealing with corporate governance issues is similarly inaccurate. Our current Board has a total of 68 years of public company board experience. All of our Board members spend considerable time reviewing and considering governance issues and have expertise in this area.

- The proponent’s assertion that an independent chairman would “establish a ‘majority’ voting system to replace the current ‘plurality’ vote standard” illogically ties our Board structure to our requirements for director elections, when, in fact, these are two separate matters. His argument ignores our Director Resignation Policy, which addresses the possibility of a Board nominee receiving less than a majority of the votes (see “Director Resignation Policy” on page 22). Further, in the past three years, the average percentage of votes in favor of our directors has been 98% of votes cast and no director has received less than 96% of such votes.

Our Board as presently composed and structured has been high functioning, highly effective and has served our stockholders well in building shareholder value. Our Board believes that adoption of a policy requiring the election of an independent Chairman would unnecessarily encumber our Board’s functions, would not enhance the Board’s independence or its effectiveness or the flow of information to the Board that now exists and therefore is not in the best interests of our stockholders.

Vote Required

Adoption of the stockholder proposal to require that our Board Chairman be an independent director requires the affirmative vote of a majority of our outstanding shares that are present in person or by proxy and entitled to vote on this matter.

OUR BOARD RECOMMENDS THAT YOU VOTE“AGAINST”THE PROPOSAL TO REQUIRE

THAT OUR BOARD CHAIRMAN BE AN INDEPENDENT DIRECTOR.

(continued)

| Proxy Statement | | | 19 |

Table of Contents

| Corporate Governance Information |

| Our Corporate Governance Framework |

Our approach to corporate governance embraces independence, transparency, engagement and accountability to ensure that we protect the interests of the Company and our shareholders while continuing to drive shareholder value. Our corporate governance framework includes the following features:

Board Independence | - Six of seven director nominees are independent under NASDAQ standards

- All standing committee members are independent

|

| Independent Lead Director | - An independent lead director is elected by our independent directors and is available for consultation with major stockholders, as appropriate

|

| Continuity | - Board continuity results in effective collaboration

|

| Aligned Interests | - Stock ownership guidelines for directors equal to five times the annual cash retainer

- Director compensation contains a significant equity component

- Policies that prohibit hedging and pledging of our stock by directors

|

| Transparency | - Transparency through publicly disclosed Corporate Governance Guidelines and Guidelines for Directors

|

| Highly Engaged Board | - 98% composite average director attendance at all Board and committee meetings in 2013

|

Board Oversight of

Risk and Strategy | - Active Audit Committee oversight of risk management and cyber-security risk with annual full Board review

- Frequent updates from management regarding progress on financial, operational and strategic execution ensures that our Board stays informed

|

| Accountability | - All directors stand for election annually

- No super-majority voting requirements

- Director resignation policy is applicable to uncontested director elections

- Each common share is entitled to one vote

- Active stockholder outreach program

|

| Succession Planning | - Detailed succession planning for our CEO and other executive officers on an annual basis

|

The Board is responsible for oversight of the management and direction of our Company and for establishing high level corporate policies. In addition, the Board and various committees of the Board regularly meet to receive and discuss operating, strategic and financial reports presented by senior management as well as reports by experts and other advisers.

Directors regularly participate in corporate review sessions to keep them abreast of our business, technology and operations, as well as risk, risk mitigation and investment opportunities. On an annual basis, the Board conducts a detailed succession planning process that includes a thorough review of succession plans for our CEO and other executive officers.

Our directors are elected annually. The size of our Board is governed by our by-laws, which provide that the Board may set the number of directors by resolution. The Board has determined that our Board will be composed of seven members after the completion of our Annual Meeting.

Our directors participate in director education programs on topics of current interest presented by our subject matter experts and advisers and attend accredited external director education in order to ensure that our Board is well informed on the latest governance trends and issues.

20 | | |  | Proxy Statement |

Table of Contents

| Corporate Governance Information(continued) |  |

| Director Nomination Process |

Our directors have a critical role in guiding our strategic direction and overseeing our management. The Nominating and Governance Committee considers skilled and experienced candidates with the following qualifications:

| Minimum Qualifications | |

- Requisite knowledge, skills and experience to understand our business

| - The absence of conflicts of interest that would impair the individual’s ability to exercise independent judgment and otherwise discharge his or her fiduciary obligations

|

- The highest personal and professional ethics and integrity

| - Sufficient time to devote to the individual’s responsibilities as a Board member

|

| - Ability to meet NASDAQ and other requirements with respect to independence and financial literacy

|

- Ability to represent the interests of all stockholders, rather than advancing the interests of any particular stockholder group or constituency

| |

| Additional Qualifications and Considerations |

- Significant senior management or leadership experience, including public company experience

| |

| |

- History of effective collaboration

| - Demonstrated ability to interact in a dynamic environment

|

Stockholder Nominees