EXHIBIT 99.1

REVISED ANNUAL INFORMATION FORM

OF

RUBICON MINERALS CORPORATION

Suite 1540 - 800 West Pender Street

Vancouver, British Columbia

V6C 2V6

April 11, 2011

(for the year ended December 31, 2010)

| CORPORATE STRUCTURE | 1 |

| | |

| Name, Address and Incorporation | 1 |

| | |

| Inter-Corporate Relationships | 1 |

| | |

| FORWARD-LOOKING STATEMENTS | 2 |

| | |

| CAUTION REGARDING ADJACENT OR SIMILAR MINERAL PROPERTIES | 4 |

| | |

| CAUTION REGARDING REFERENCE TO RESOURCES AND RESERVES | 4 |

| | |

| CAUTION REGARDING HISTORICAL RESULTS | 4 |

| | |

| DOCUMENTS INCORPORATED BY REFERENCE | 5 |

| | |

| DATE OF INFORMATION | 5 |

| | |

| CURRENCY | 5 |

| | |

| GLOSSARY OF TERMS | 5 |

| | |

| General | 9 |

| Resources/Reserves Definitions | 10 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 12 |

| | |

| 2008 | 12 |

| 2009 | 12 |

| 2010 | 13 |

| | |

| Significant Acquisitions | 14 |

| | |

| Subsequent Events | 15 |

| | |

| GENERAL DESCRIPTION OF THE BUSINESS | 16 |

| | |

| Specialized Skill and Knowledge | 16 |

| | |

| Competitive Conditions | 17 |

| | |

| Business Cycles | 17 |

| | |

| Changes to Contracts | 17 |

| | |

| Environmental Protection | 17 |

| | |

| Employees | 18 |

| | |

| Foreign Operations | 18 |

| | |

| Bankruptcy, Receivership or Similar Proceedings | 18 |

| | |

| Material Reorganization | 18 |

| | |

| Social or Environmental Policies | 18 |

| | |

| RISK FACTORS | 20 |

| | |

| Resource Exploration and Development is generally a Speculative Business | 20 |

| | |

| No Known Reserves | 21 |

| | |

| Title Risks | 21 |

| Aboriginal Title and Rights Claims | 21 |

| | |

| Uncertainty of Acquiring Necessary Permits and Licenses | 21 |

| | |

| Governmental Regulation | 22 |

| | |

| Market Price of Company’s Shares and Financing | 23 |

| | |

| Competition | 23 |

| | |

| Operating Hazards and Risks | 23 |

| | |

| Environmental Quality Requirements | 23 |

| | |

| General Developments | 24 |

| | |

| Management | 24 |

| | |

| Conflict of Interest | 25 |

| | |

| Limited Operating History: Losses | 25 |

| | |

| Shares Reserved for Future Issuance: Dilution | 25 |

| | |

| Occupier Liability and Environmental Hazard Risks | 25 |

| | |

| Future Litigation may impact the Company | 26 |

| | |

| MATERIAL MINERAL PROJECTS | 26 |

| | |

| Permitting Summary | 43 |

| | |

| Exploration Expenditures | 45 |

| | |

| 2010 Exploration | 45 |

| | |

| Qualified Person | 46 |

| | |

| OTHER PROJECTS | 46 |

| | |

| Other Red Lake projects (2008 –2010) | 46 |

| Adams Lake Property | 46 |

| East Bay Property | 46 |

| DMC Property | 46 |

| Humlin Property | 47 |

| Slate Bay Property | 47 |

| Wolf Bay Property | 47 |

| Advance Property | 47 |

| | |

| Partnered Projects | 47 |

| McCuaig JV Property | 47 |

| Red Lake North Property | 48 |

| Westend Property | 48 |

| English Royalty Division | 48 |

| | |

| US Projects | 48 |

| Alaska | 48 |

| Nevada and Utah | 49 |

| | |

| DIVIDEND RECORD AND POLICY | 49 |

| | |

| OTHER SHARE ISSUANCES | 49 |

| | |

| DESCRIPTION OF CAPITAL STRUCTURE | 50 |

| | |

| General Description of Capital Structure | 50 |

| | |

| CONSTRAINTS | 50 |

| | |

- iii -

| RATINGS | 51 |

| | |

| MARKET FOR SECURITIES | 51 |

| | |

| Trading Price and Volume | 51 |

| | |

| ESCROWED SECURITIES | 51 |

| | |

| DIRECTORS AND OFFICERS | 51 |

| | |

| Name, Occupation and Security Holding | 51 |

| | |

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS | 54 |

| | |

| Cease Trade Orders | 54 |

| | |

| Bankruptcies | 55 |

| | |

| Penalties and Sanctions | 55 |

| | |

| Conflicts of Interest | 55 |

| | |

| PROMOTERS | 56 |

| | |

| AUDIT COMMITTEE | 56 |

| | |

| Audit Committee Charter | 56 |

| | |

| Composition of the Audit Committee | 61 |

| | |

| Relevant Education and Experience | 61 |

| | |

| Reliance on Certain Exemptions | 62 |

| | |

| Reliance on the Exemption in Subsection 3.3(2) or Section 3.6 | 62 |

| | |

| Reliance on Section 3.8 | 63 |

| | |

| Audit Committee Oversight | 63 |

| | |

| Pre-Approval Policies and Procedures | 63 |

| | |

| External Auditor Service Fees (By Category) | 63 |

| | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 64 |

| | |

| Legal Proceedings | 64 |

| | |

| Regulatory Actions | 64 |

| | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 64 |

| | |

| TRANSFER AGENTS AND REGISTRARS | 64 |

| | |

| MATERIAL CONTRACTS | 65 |

| | |

| NAMES AND INTERESTS OF EXPERTS | 65 |

| | |

| ADDITIONAL INFORMATION | 66 |

| | |

REVISED ANNUAL INFORMATION FORM

THIS REVISED ANNUAL INFORMATION FORM, TOGETHER WITH THE DOCUMENTS INCORPORATED HEREIN BY REFERENCE, AMENDS AND SUPERSEDES THE ANNUAL INFORMATION FORM OF THE COMPANY PREVIOUSLY FILED ON SEDAR AND DATED MARCH 31, 2011.

CORPORATE STRUCTURE

Name, Address and Incorporation

Rubicon Minerals Corporation (“Rubicon” or the “Company”) was incorporated on March 4, 1996 under the Company Act (British Columbia) and was transitioned on June 23, 2005 under the Business Corporations Act (British Columbia) (the “BCBCA”). The shareholders of the Company also passed special resolutions to remove the pre-existing company provisions, to alter the Company’s authorized share structure to provide for an unlimited number of common shares and to adopt new Articles on June 23, 2005. The Company has a fiscal year end of December 31.

The Company’s head office is located at Suite 1540 - 800 West Pender Street, Vancouver, British Columbia V6C 2V6 and its registered office is located at Suite 2800 Park Place, 666 Burrard Street, Vancouver, British Columbia V6C 2Z7.

Inter-Corporate Relationships

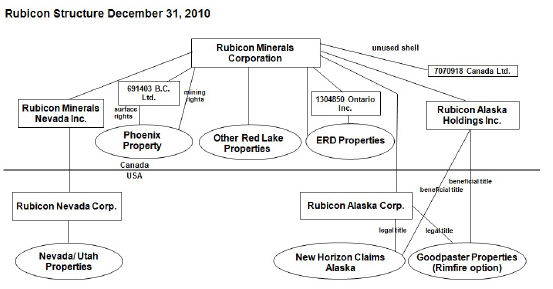

Rubicon owns, directly or indirectly, 100% of the issued and outstanding shares of the following seven (7) subsidiaries:

691403 BC Ltd. was incorporated under the BCBCA on March 31, 2004 and holds Rubicon’s interest in certain surface patents on the Phoenix Gold Property (as defined in the Glossary of Terms, below) in Red Lake, Ontario. This is the only material subsidiary of Rubicon.

1304850 Ontario Inc., was incorporated under the Business Corporations Act (Ontario) (the “OBCA”) on September 14, 1998 and holds certain mineral properties that were acquired pursuant to the English Royalty Division agreement entered into in March, 2003 (see the section titled “Non-Material Project – English Royalty Division”).

7070918 Canada Ltd. was incorporated under the Canada Business Corporations Act on October 31, 2008, for the purposes of holding certain mineral titles, but is now inactive and holds no assets.

Rubicon Minerals Nevada Inc. was incorporated under the BCBCA on May 1, 2007 and holds a 100% interest in Rubicon Nevada Corp.

Rubicon Nevada Corp. was incorporated under the laws of the State of Nevada, on May 14, 2007 and holds all of the Company’s Nevada - Utah properties.

Rubicon Alaska Holdings Inc. was incorporated under the OBCA on January 12, 2006 and holds beneficial title to all of the Company’s Alaskan properties.

Rubicon Alaska Corp., was incorporated under the laws of the State of Alaska on December 19, 2006, and holds legal title to all of the Company’s Alaskan properties.

The following chart illustrates the Company’s structure, including subsidiaries as described above (collectively the “Subsidiaries”) (subsequent to December 31, 2010, the Rimfire option was terminated. See “Our Projects - US Projects”):

FORWARD-LOOKING STATEMENTS

This Revised Annual Information Form (“AIF”), together with the documents incorporated by reference herein, amends and supersedes the Annual Information Form filed by the Company on SEDAR and dated March 31, 2011. The AIF and the documents incorporated by reference herein contain “forward-looking information” within the meaning of securities legislation, including the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation, and are collectively referred to herein as “forward-looking statements”. These forward-looking statements are made as of the date of this AIF or, in the case of documents incorporated by reference herein, as of the date of such documents. Other than as specifically required by applicable securities laws, the Company does not intend, and does not assume any obligation, to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results or otherwise.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and represent management’s best judgement based on facts and assumptions that management considers reasonable, including that the demand for gold and base

metal deposits develops as anticipated, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labour disturbances, interruption in transportation or utilities, or adverse weather conditions, and that there are no material unanticipated variations in the cost of energies or supplies. The Company makes no representation that reasonable business people in possession of the same information would reach the same conclusions.

Forward-looking statements, in this document, include, but are not limited to, statements regarding costs and timing of the development of new deposits, success of exploration and development activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of exploration operations, environmental risks, unanticipated reclamation expenses, title disputes or claims. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, future prices of gold and other metals; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; actual results of reclamation activities; conclusions of future economic evaluations; changes in project parameters as plans continue to be refined; failure of plant, equipment, or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays and other risks related to joint venture operations; timing and receipt of regulatory approvals of operations; the ability of the Company and other relevant parties to satisfy regulatory requirements; the availability of financing for proposed transactions and programs on reasonable terms; the ability of third-party service providers to deliver services on reasonable terms and in a timely manner; and delays in the completion of development or construction activities. Other factors that could cause the actual results to differ include market prices, results of exploration, availability of capital and financing on acceptable terms, inability to obtain required regulatory approvals, unanticipated difficulties or costs in any rehabilitation which may be necessary, market conditions and general business, economic, competitive, political and social conditions. Additional factors are discussed in the section titled “Risk Factors” below. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there may be other factors which cause actual results to differ. Accordingly, readers should not place undue reliance on forward-looking statements.

Although management of the Company has attempted to identify important factors (which it believes are reasonable) that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Forward-looking statements contained herein are made as of the date of this AIF and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

CAUTION REGARDING ADJACENT OR SIMILAR MINERAL PROPERTIES

This AIF contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the US Securities and Exchange Commission (the “SEC”) set forth in the SEC’s Industry Guide 7 strictly prohibit information of this type in documents filed with the SEC. The Company is exempt from the requirements of Industry Guide 7 pursuant to the Canada-U.S. Multi-Jurisdictional Disclosure System. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties.

CAUTION REGARDING REFERENCE TO RESOURCES AND RESERVES

National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The disclosure in this AIF, including the documents incorporated herein by reference, uses terms that comply with reporting standards in Canada. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource”, “inferred mineral resource” “probable mineral reserve” and “proven mineral reserve” are defined in and required to be used by the Company by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into mineral reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility studies, pre-feasibility studies or other economic studies, except in prescribed cases, such as in a preliminary economic assessment under certain circumstances. It cannot be assumed that all or any part of the measured mineral resources, indicated mineral resources, or inferred mineral resources will ever be upgraded to a higher category.

Accordingly, information contained in this AIF and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTION REGARDING HISTORICAL RESULTS

Historical results of operations and trends that may be inferred from the discussion and analysis in this AIF may not necessarily indicate future results from operations. In particular, the current

state of the global securities markets may cause significant reductions in the price of the Company’s securities and render it difficult or impossible for the Company to raise the funds necessary to continue operations. See “Risk Factors – Price Fluctuations: Share Price Volatility”.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are specifically incorporated by reference into and form an integral part of the AIF and may also be obtained online on the SEDAR website at www.sedar.com:

| (a) | News Release dated March 31, 2011, announcing amended inferred mineral resource and geological potential estimates, and filed on SEDAR on March 31, 2011; and |

| (b) | Technical Report, dated effective April 11, 2011, containing the amended inferred mineral resource and geological potential estimates, prepared by Geoex Limited (“Amended Report”), and filed on SEDAR on April 11, 2011. |

DATE OF INFORMATION

All information in this AIF is as of December 31, 2010, unless otherwise indicated.

CURRENCY

All dollar amounts are expressed in Canadian Dollars, unless otherwise indicated.

GLOSSARY OF TERMS

The following technical terms may be used in this AIF, and may appear capitalized or in lower case, without any difference in meaning.

“anomaly” – any departure from the norm which may indicate the presence of mineralization in the underlying bedrock.

“Archean” - geological ages older than 2.4 billion years.

“arsenopyrite” - a sulphide of arsenic and iron having the chemical formula FeAsS.

“assay” - An analysis to determine the presence, absence or quantity of one or more chemical components.

“Au” - gold.

“basalts” - A fine-grained igneous rock dominated by dark-colored minerals, consisting of plagioclase feldspars (over 50 percent) and ferromagnesian silicates.

“Banded Iron Formation” – Iron Formation that shows marked banding, generally of iron-rich minerals and chert or fine-grained quartz.

“base metal” - A metal, such as copper, lead, nickel, zinc or cobalt.

“belt” - A specific elongate area defined by unique geologic characteristics.

“breccia” - Rock fragmented into angular components.

“carbonate” - A rock composed principally of calcium carbonate (CaCO3).

“clastic” - Consisting of fragments of minerals, rocks, or organic structures that have been moved individually from their places of origin.

“copper” – A ductile, malleable base metal with a myriad of uses in construction (piping, wire) and electronics due to its high electrical and thermal conductivity and good resistance to corrosion.

“diamond drilling/drill hole” - A method of obtaining a cylindrical core of rock by drilling with a diamond impregnated bit.

“dip” - The angle at which a stratum is inclined from the horizontal.

“duplex structures” – A structural complex consisting of a roof thrust at the top and a floor thrust fault at the base, within which a suite of more steeply dipping imbricated thrust faults thicken and shorten the intervening panel of rock.

“F2 Gold Zone” - is composed of high grade gold mineralization and a lower grade sulphide-rich zone, which currently has a strike length of approximately 700 m (2,300 ft) and a depth extent of 1,101 m (3,612 ft) below surface and remains open along strike and at depth. The zone appears to at least partly correlate with a large Titan 24 chargeability anomaly. The anomaly extends laterally from the F2 Gold Zone for over 1,500 m (approximately 5,000 ft), and to depths up to 750 m (approximately 2,500 ft) – the current depth limit of the survey. As for the setting and style of this zone, it is similar in many respects to the high-grade zones present at the nearby Red Lake Gold Mine. The F2 Gold Zone is 420 m southeast of the existing shaft and is entirely independent from the previous gold resource of the McFinley Gold Deposit.

“fabric” - The spatial arrangement and orientation of the components (crystals, particles, cement) of a sedimentary rock. The complete spatial and geometrical configuration of all those components that make up a deformed rock. It covers such terms as texture, structure, and preferred orientation.

“fault” - A fracture in a rock along which there has been relative movement between the two sides either vertically or horizontally.

“feldspar” – a group of common rock-forming minerals that includes microcline, orthoclase, plagioclase and others.

“felsic” - light-coloured silicate minerals such as quartz, feldspar and feldspathoids.

“ferromagnesian silicate” - Silicate in which positive ions are dominated by iron, magnesium, or both.

“finite strain” – the overall change in shape of the body or shape of a volume of rock.

“fold” - Bend, flexure, or wrinkle in rock produced when rock was in a plastic state.

“footwall” – the rock on the underside of a vein or ore structure.

“formation” - A body of rock identified by lithological characteristics and stratigraphic position.

“geochemistry/geochemical” - Study of variation of chemical elements in rocks or soil.

“geology/geological” – Study of the Earth’s history and life, mainly as recorded in rocks.

“geophysical” - Study of the Earth by quantitative physical methods, either by surveys conducted on the ground, in the air (by fixed wing aircraft or helicopter) or in a borehole or drill hole.

“gold” – A heavy, soft, ductile, malleable precious metal used in jewelry, dentistry, electronics and as an investment.

“g/t” – grams per metric tonne, = 0.0292 troy ounce per short ton.

“igneous” – A classification of rocks formed from the solidification from a molten state.

“intercalated” - said of layered material that exists or is introduced between layers of a different character; esp. said of relatively thin strata of one kind of material that alternates with thicker strata of some other kind, such as beds of shale intercalated in a body of sandstone.

“intrusive” – a body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

“komatiitic” - Magnesium-rich ultramafic volcanic rock of high temperature origin.

“mafic” - An igneous rock composed chiefly of dark iron and manganese silicate minerals.

“magma” - Naturally occurring silicate melt, which may contain suspended silicate crystals, dissolved gases, or both. These conditions may be met in general by a mixture containing as much as 65 percent crystals but no more than 11 percent dissolved gases.

“magnetic survey” - A geophysical survey conducted on the Earth’s surface that measures variations in the Earth's magnetic field caused by variations in rock type or geological structures. |

“manganese” - A gray-white, hard, brittle metallic element. Symbol, Mn. Manganese does not occur uncombined in nature, but its minerals are widely distributed. Pyrolusite (MnO2) and rhodochrosite (MnCO3) are the most common minerals. The discovery of large quantities of

manganese nodules on the ocean floor, containing about 24% manganese, holds promise as a source of manganese. Used to form many important alloys, esp. with steel, aluminum, and antimony; used in dry cells and glass, and in the preparation of oxygen, chlorine, and medicines.

“mapping” – The art and science of recording geological observations on a map.

“metamorphic” - Pertaining to the process of metamorphism or to its results.

“mineralization” - The concentration of metals and their chemical compounds within a body of rock.

“ore” - Rock containing mineral(s) or metals that can be economically extracted to produce a profit.

“outcrop” - An exposure of bedrock at the surface.

“oz/ton” – troy ounce per short ton = 34.2857 grams per metric tonne.

“plagioclase” - Any of a group of feldspars containing a mixture of sodium and calcium feldspars, distinguished by their extinction angles; crystal; triclinic.

“polyphase” - In deformation, having or undergoing two or more phases of deformation, such as a polyphase deformation.

“porphyry” - A rock consisting of larger crystals embedded in a more compact finer grained groundmass.

“prospecting” – The art and science of searching for mineral deposits.

“quartz” - A mineral composed of silicon dioxide.

“sediment” - Solid material that has settled down from a state of suspension in a liquid. More generally, solid fragmental material transported and deposited by wind, water or ice, chemically precipitated from solution, or secreted by organisms, and that forms in layers in loose unconsolidated form.

“sedimentary” - Pertaining to or containing sediment or formed by its deposition.

“sericite” - A white, fine-grained potassium mica occurring in small scales as an alteration product of various aluminosilicate minerals, having a silky luster, and found in various metamorphic rocks or in the wall rocks, fault gouge, and vein fillings of many ore deposits.

“shear zone” - An area of rock which has failed or sheared in response to applied stress. |

“silicate” - A compound whose crystal structure contains SiO4 tetrahedra, either isolated or joined through one or more of the oxygen atoms to form groups, chains, sheets, or three-dimensional structures with metallic elements. Silicates were once classified according to hypothetical oxyacids of silicon.

“silicification” - The introduction of, or replacement by, silica, generally resulting in the formation of fine-grained quartz, chalcedony, or opal, which may fill pores and replace existing minerals.

“soil sampling” - Systematic collection of soil samples at a series of different locations in order to study the distribution of soil geochemical values.

“strain” - Change in the shape or volume of a body as a result of stress; a change in relative configuration of the particles of a substance.

“stratigraphy” - Strictly, the description of bedded rock sequences; used loosely, the sequence of bedded rocks in a particular area.

“strike” - Direction or trend of a geologic structure.

“structure/structural” - Pertaining to geological structure, i.e., folds, faults, etc.

“sulphide” - A group of minerals in which one or more metals are found in combination with sulfur/rock that has been sulphidized.

“ultramafic” - igneous rocks consisting mainly of ferromagnesian minerals to the exclusion of quartz, feldspar and feldspathoids.

“tailings” - Material rejected from a mill after most of the recoverable valuable minerals have been extracted.

“tholeiitic” - type of basaltic rock that is characterized by the presence of low-calcium pyroxenes in addition to clinopyroxene and calcic plagioclase.

“Uchi Subprovince” - The Uchi Subprovince is a Neoarchean volcanic sequence in Manitoba, Canada. It is the southern margin of the North Caribou terrane and comprises a number of greenstone belts, which contains volcanic rocks that record some 280 million years of volcanism.

“vein” - A thin sheet-like intrusion into a fissure or crack, commonly bearing quartz /a small vein or cluster of veins.

“volcanic” - Descriptive of rocks originating from volcanic activity.

General

“2010 Circular” means the Management Information Circular dated April 23, 2010 for the Company’s 2010 Annual Meeting held on May 31, 2010 and filed on SEDAR on May 11, 2010. |

“AIF” means this Revised Annual Information Form which, together with the documents incorporated herein by reference, amends and supersedes the Annual Information Form of the Company previously filed on SEDAR and dated March 31, 2011.

“Company” or “Rubicon” means Rubicon Minerals Corporation.

“NI 43-101” means National Instrument 43-101 - Standards of Disclosure for Mineral Projects issued by the Canadian Securities Administrators.

“NI 51-102” means National Instrument 51-102, Continuous Disclosure Obligations, issued by the Canadian Securities Administrators.

“NI 52-110” means National Instrument 52-110, Audit Committees, issued by the Canadian Securities Administrators.

“NYSE Amex” means the NYSE American stock exchange.

“Phoenix Gold Project” means project activities associated with the Phoenix Gold Property. |

“Phoenix Gold Property” describes the property located in Bateman Township in the Red Lake District of Northwestern Ontario, approximately six kilometres north of the operating Red Lake Gold Mine, as further described under the heading “Material Mineral Projects” herein.

“Preliminary Feasibility Study” is a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and an effective method of mineral processing has been determined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and environmental factors and the evaluation of other relevant factors which are sufficient for a Qualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve.

“Qualified Person” – in relation to a NI 43-101 technical report - an individual who

| | 1. | is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; |

| | 2. | has experience relevant to the subject matter of the mineral project and the technical report; and |

| | 3. | is in good standing with a professional association and, in the case of a foreign association listed in Appendix A to NI 43-101, has the corresponding designation of Appendix A to NI 43-101. |

“TSX” means the Toronto Stock Exchange.

“TSX-V” means the TSX Venture Exchange.

Resources/Reserves Definitions

“Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

“Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

“Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

“Mineral Reserve” is the economically mineable material derived from a Measured and/or Indicated Mineral Resource. It is inclusive of diluting materials and allows for losses that may occur when the material is mined. Appropriate assessments, which may include feasibility studies, have been carried out, including consideration of and modification by, realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. These assessments demonstrate at the time of reporting that extraction is reasonably justified. Mineral Reserves are subdivided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves.

“Mineral Resource” a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

“Probable Mineral Reserve” is the economically mineable material derived from a Measured and, in some circumstances, an Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. It is estimated with a lower level of confidence than a Proven Mineral Reserve. It is inclusive of diluting materials and allows for losses that may occur when the material is mined. Appropriate assessments, which may include feasibility studies, have been carried out and, including consideration of and modification by, realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. These assessments demonstrate at the time of reporting that extraction is reasonably justified.

“Proven Mineral Reserve” is the economically mineable material derived from a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. It is estimated with a high level of confidence. It is inclusive of diluting materials and allows for losses that may occur when the material is mined. Appropriate assessments, which may include feasibility studies, have been carried out, including consideration of and modification by realistically assumed mining, metallurgical, economic, marketing, legal, environmental, social and governmental factors. These assessments demonstrate at the time of reporting that extraction is reasonably justified.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

2008

| Exploration and Development |

In February of 2008, the Company discovered the F2 Gold System at its Phoenix Gold Property which has been the focus of exploration and development for the Company since discovery. Subsequent to the initial F2 discovery, during the first quarter of 2008, Quantec Geoscience of Toronto, Canada, was contracted to complete 25 line-km of Titan 24 geophysical surveys covering the F2 Gold System and remaining gold zones on the Property. The survey was completed in two phases: the first phase was initiated in February with a line spacing of approximately 500��m (1,640 ft) (Lines 1 to 5), and then the survey spacing was in-filled to approximately 250 m (820 ft) (Lines 10 to 50) in March. From January to December in 2008, the Company completed 46,665.5 metres of drilling on the Property with the majority (34,566 metres) focused on the F2 Gold System. A total of $12.2 million in expenditures were incurred on exploration and development on the property in 2008.

Financing

On November 18, 2008, the Company completed concurrent brokered and non-brokered private placements, raising gross aggregate proceeds of $10,200,930. Pursuant to the brokered offering, the Company issued 4,500,000 flow-through common shares (the “FT Shares”) at a price of $1.35 per FT Share and 3,296,300 common shares at a price of $1.10 per share, for gross proceeds of $9,700,930 (the “2008 Brokered Offering”). GMP Securities L.P. acted as lead agent in connection with the 2008 Brokered Offering, along with a syndicate of agents that included Research Capital Corporation and TD Securities Inc. The Company also issued 370,370 FT Shares at a price of $1.35 per FT Share to certain insiders and employees of the Company as well as other qualified investors, for gross proceeds of $500,000.

2009

| Exploration and Development |

In 2009, rehabilitation of existing underground levels was completed and the hoist and shaft were successfully re-commissioned. Rubicon continued drilling from surface and commenced underground drilling in June from the 122 metre level at its Phoenix Gold Property. A total of 69,654 metres of drilling were completed on the Phoenix Property in 2009. The majority of the drilling (61,632 metres) was carried out on the F2 Gold System from the underground 122 metre

level (400 foot level) from three drill stations on the F2 Gold System, which was supplemented by drilling with two rigs from surface. Shaft sinking to a depth of 305 metres (1,001 feet) was commenced. The total drilling and underground development costs were $23.1 million. Positive results continued the trend established in 2008, confirming further expansion of the F2 Gold Zone. During the first quarter of 2009, the Company initiated programs to rehabilitate and dewater the historic shaft and underground workings under an Advanced Exploration permit that was previously secured on February 27, 2009.

In order to reach its goals, the Company initiated engineering studies, environmental studies and applications to utilities supporting advanced exploration and preparing the Phoenix Gold Property for exploitation.

Financing

On March 5, 2009, the Company closed a $40 million bought deal private placement financing for common shares. As a result, the Company announced plans to expand and accelerate its 2009 exploration program to 80,000 metres with further emphasis on underground drilling and associated development work. During May 2009, the Company received an additional $16.4 million from the exercise of warrants. This was followed in July 2009 by the Company’s announcement of plans for up to an additional 20,000 metres of drilling property wide to test additional drill targets. During the summer of 2009, the Company assessed its plans for its Phoenix Gold Property based on the successful results received to that time. As confirmed in its October 8, 2009 NI 43-101 technical report, it was determined that an expanded scope and budget for drilling was warranted. On November 12, 2009, the Company closed a public offering for net proceeds of $82 million. The use of proceeds included an additional 120,000 metres of drilling on the F2 Gold Zone during the period 2010 and 2011 and underground excavation (drifting) to directly access parts of the gold system. The Company indicated its plans to take a bulk sample as part of the program subject to results from local delineation drilling.

2010

From January 1, 2010 to December 31, 2010, the Company completed a total of 155,134 metres of drilling and 3,907 metres of underground development at a total cost of $57.9 million. A total of 135,819 metres of this drilling was focussed on the F2 Gold System.

In January of 2010, Rubicon entered into an Exploration Accommodation Agreement with the Lac Seul First Nation covering certain of Rubicon’s Ontario exploration properties, including the Phoenix Gold Property, which are located on lands considered by the Lac Seul First Nation to be its traditional territory. Rubicon secured the support of Lac Seul First Nation for the Phoenix Gold Project in return for certain benefits and accommodations. Consultations with First Nations whose traditional territory includes Red Lake continue.

In April of 2010, the Company was awarded the Northwestern Ontario Developer of the Year award. The award was presented by the Northwest Ontario Prospectors Association ("NWOPA") and recognizes “an outstanding Northwestern Ontario developer or development project during the previous calendar year.” The award recognizes the collective efforts and achievements of our staff at the Phoenix Gold Project.

On July 12, 2010, the Company announced that preliminary metallurgical test work performed on several composite samples from the Phoenix Gold Project returned gold recoveries averaging 93.8%, an absence of any refractory gold component, despite the presence of appreciable sulphide minerals in the sampled gold zones and contained low arsenic content. The samples are amenable to standard gravity and carbon-in-leach treatments. The Company considers these results highly encouraging and believes they bode well for optimization of both future capital and operating costs. Results are preliminary in nature and considerably more sample material and test work is required to further characterize and optimize the F2 Gold System metallurgy.

On September 29, 2010, the Company filed a short form prospectus to qualify the secondary offering by Evanachan Limited (“Evanachan”) and McEwen Trading LP (together, the “Selling Shareholders”) of an aggregate of 45,714,357 common shares of the Company at a price of $4.16 per share (with this offering referred to as the “Secondary Offering”). The Selling Shareholders were entities owned or controlled by Robert R. McEwen, who had beneficial ownership of the shares owned by Evanachan and control and direction over the shares owned by McEwen Trading. The Company was not entitled to any of the proceeds from the sale of such shares. All expenses incurred in connection with the preparation and filing of the short form prospectus were paid by GMP Securities L.P. (the “Underwriter”). The Selling Shareholders previously held 21.4% of the issued and outstanding common shares of the Company. After giving effect to the Secondary Offering, the Selling Shareholders confirmed that neither of them any longer owned any of the issued and outstanding common shares of the Company. The Secondary Offering closed on October 5, 2010. See “Material Contracts”.

In connection with the Secondary Offering, a NI 43-101 technical report was filed that summarized of the Company’s exploration work completed on the Property up to July 31, 2010. The report recommended that the Company continue to pursue its current exploration program (approximately $27.6 million remained to be spent between July 31, 2010 and the end of Q1 2011) and consider undertaking a preliminary resource and/or assessment of the geological potential prior to commencing its next phase of exploration and development.

Further third party studies were initiated by the Company in 2010. A paste fill study was conducted in parallel with the mining study (initially commenced in 2009) and was completed at the end of September 2010.

On November 29, 2010, the Company announced the first inferred gold resource and geological potential estimates for the Phoenix Gold Project, F2 Gold System. The estimates were prepared by Geoex Limited ("Geoex") based on 166,886 metres of diamond drilling in 237 drill holes carried out between February 27, 2008 (the date of the initial discovery of the F2 Gold System) and July 31, 2010. Readers are cautioned not to rely on the estimates or any other related written disclosure contained in the November 29, 2010 announcement or the technical report prepared by Geoex and filed on SEDAR on January 11, 2011, in support of such disclosure. (See “General Development of the Business—Subsequent Events”).

On December 15, 2010, the Company announced that its Phoenix Gold Project team was awarded the Association for Mineral Exploration, British Columbia Colin Spence Award for excellence in global mineral exploration. The award was given for their role in the discovery and development of the F2 Gold Deposit in Red Lake Ontario.

On December 21, 2010, the Company announced the commencement of taking a bulk sample within the core area of the F2 Gold System.

Significant Acquisitions

The Company has not made any significant acquisitions during the financial year ended December 31, 2010 that would require the Company to file a Form 51-102F4 Business Acquisition Report under Part 8 of NI 51-102.

Subsequent Events

On January 11, 2011, the Company’s technical report bearing an effective date of July 31, 2010, was filed on SEDAR (“January 11, 2011 Technical Report”). It contained the Company’s initial mineral resource and geological potential estimates for the F2 Gold System. Readers are cautioned that the estimates contained in the January 11, 2011 Technical Report were amended and superseded by estimates announced by the Company on March 31, 2011.

On February 14, 2011, the Company announced that as the result of a review by the British Columbia Securities Commission (the “BCSC”) of the Company’s January 11, 2011 Technical Report, the Company expected to file an amended technical report for the Phoenix Gold Project.

On March 31, 2011, as a result of the BCSC review, the Company announced amended inferred mineral resource and geological potential estimates for the F2 Gold System. The amended estimates replace and supersede the estimates announced by the Company on November 29, 2010 and contained in the January 11, 2011 Technical Report. The amended estimates were prepared by Peter George of Geoex Limited, the Company’s independent QP and author (the “Author”) of the January 11, 2011 Technical Report. The summary of the amended polygonal model inferred mineral resource estimate (using a 5 g/t gold cut-off and 10 grams x metre product (core length), surface to 1200 metres below surface) is as follows:

| | • | 5,500,000 inferred tonnes; |

| | • | 20.34 g/t inferred gold grade and 3,597,000 inferred ounces of gold, both on an uncapped basis; and |

| | • | 17.29 g/t inferred gold grade and 3,057,000 inferred ounces of gold, both on a capped basis (using a 10-5-2 capping strategy). |

The summary of the amended block model validation inferred mineral resource estimate (using a 5 g/t cut off, surface to 1200 metres below surface) is as follows:

| | • | 6,017,000 inferred tonnes; |

| | • | 16.49 g/t inferred gold grade and 3,190,000 inferred ounces of gold, both on an uncapped basis; and |

| | • | 15.69 inferred gold grade and 3,035,000 inferred ounces of gold, both on a capped basis (using a 10-5-2 capping strategy). |

Inferred resources are too speculative to have economic considerations applied to them, and there is no certainty that the inferred resources will be converted to measured and indicated resources.

The summary of the amended geological potential, exclusive of inferred mineral resources, surface to 1500 metres below surface, is as follows:

| | • | a range of 1,670,000 to 4,360,000 tonnes; |

| | • | a range of 21.2 to 29.2 g/t gold grade and a range of 1,300,000 to 5,600,000 ounces of gold, both on an uncapped basis; and |

| | • | a range of 16.9 to 23.2 g/t gold grade and a range of 800,000 to 4,300,000 ounces of gold, both on a capped basis (using a 10-5-2 capping strategy). |

A 10% upside and 20% downside potential for both tonnes and grade has been incorporated to address the possible uncertainty of the geological potential estimate. The potential tonnages, grades and ounces set forth in the analysis of geological potential are conceptual in nature, as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource. Geological potential estimates are separate from inferred resource estimates.

On April 11, 2011, the Company announced the filing of a NI 43-101 compliant technical report (the “Amended Report”) containing the amended inferred mineral resource and geological potential estimates and confirmed that the amended estimates contained therein amend and supersede the estimates announced by the Company on November 29, 2010 and which were the subject of the January 11, 2011 Technical Report.

For more details, please refer to sections of this AIF entitled “Material Mineral Projects” and “Documents Incorporated By Reference”, namely the Company’s news release dated March 31, 2011, and the Amended Report.

GENERAL DESCRIPTION OF THE BUSINESS

The Company is a mineral exploration company engaged in the acquisition, exploration, and development of gold and base-metal exploration properties both through Company-funded and partner-funded exploration. The Company is also involved in the investment in other mineral exploration and resource companies. The financial success of the Company is dependent upon its ability to discover economically exploitable mineralization.

The Company controls over 65,000 acres of exploration ground in the Red Lake gold camp, in the province of Ontario. At present, the Company’s main focus is on advanced exploration of its 100% owned Phoenix Gold Property. See “Material Mineral Projects”. The Company has also acquired land packages in Alaska and Nevada, United States; however, at present, the Company is not dependent to any material extent on foreign operations. The Company does not have any assets or mineral properties that are in production or that contain a mineral reserve. Please refer to the sections of this AIF entitled “General Development of the Business--Subsequent Events”

and to “Material Mineral Projects” for a description of the Company’s amended inferred mineral resource and geological potential estimates.

Specialized Skill and Knowledge

All aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, logistical planning and implementation of exploration programs, treasury, accounting and legal. While periods of increased activity in the resource mining industry can make it more difficult to locate competent employees and consultants in such fields, the Company has been able to locate and retain such employees and consultants and believes it will continue to be able to do so.

Competitive Conditions

The resource industry is intensely competitive in all of its phases, and the Company competes with many companies possessing greater financial and technical facilities than itself. Competition could adversely affect the Company’s ability to acquire suitable producing properties or prospects for exploration in the future. See “Risk Factors”.

Business Cycles

The mineral exploration business is subject to mineral price cycles. The marketability of minerals and mineral concentrates and the ability to finance the Company on favourable terms is also affected by worldwide economic cycles.

Changes to Contracts

It is not expected that the Company’s business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

Environmental Protection

The Company conducts exploration activities in the Canadian province of Ontario and the states of Alaska and Nevada in the United States. Such activities are subject to various laws, rules and regulations governing the protection of the environment, including, in some cases, posting of reclamation bonds. In Canada, extensive environmental legislation has been enacted by federal and provincial governments. Such legislation imposes rigorous standards on the mining industry to reduce or eliminate the effects of wastes generated by extraction and processing operations and subsequently deposited on the ground or emitted into the air or water. All phases of the Company’s operations are subject to environmental regulation in the jurisdictions in which it operates. Environmental legislation is evolving in a manner which requires stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed properties and a heightened degree of responsibility for companies and their officers, directors and employees. If environmental assessments are triggered, they can cause delay to the decision as to whether or not the relevant exploration property will be placed into production. To the best of the Company’s knowledge, all of the Company’s activities are in compliance in all material respects with applicable environmental legislation. There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company’s operations. The cost of compliance with changes in governmental regulations has the potential to preclude entirely the economic development of a property.

The financial and operational effects of environmental protection requirements on the Company’s capital expenditures, earnings and competitive position have not been significant in

the year ended December 31, 2010, and are not expected to become significant until and unless the Company develops a mine on one of its exploration properties.

As at December 31, 2010, the Company has deposited $493,000 with the Ministry of Northern Development, Mines and Forestry (“MNDMF”) as financial assurance for future estimated remediation costs associated with the on-going development of the Phoenix Project. Subsequent to December 31, 2010 the Company deposited a further $955,360 with the MNDMF, for further future estimated remediation costs.

Employees

As of the date of this AIF, the Company has fifty (50) full-time employees. The Company also relies on consultants to carry on many of its activities and, in particular, to supervise work programs on its mineral properties.

Foreign Operations

The Company is not carrying on foreign operations to any material extent. Although it has exploration properties in Nevada, Utah and Alaska, the Company’s main focus is on exploration of its Phoenix Gold Property in Ontario, Canada.

Bankruptcy, Receivership or Similar Proceedings

There has been no bankruptcy, receivership, or similar proceedings against the Company or any of its subsidiaries, or any voluntary bankruptcy, receivership or similar proceedings by the Company or any of its subsidiaries within the three most recently completed financial years and up to the date of this AIF, and none are proposed for the current financial year.

Material Reorganization

There has been no material reorganization of the Company within the past three (3) financial years or completed during the current financial year and no material reorganization has been proposed for the current financial year.

Social or Environmental Policies

The Company is and has been carrying out exploration in Canada, principally in Ontario. Such activities are subject to various laws, rules and regulations governing the protection of the environment, including posting of reclamation bonds. Management has adopted and is committed to a Health, Safety and Environmental (“HS&E”) Policy designed to ensure that it continues to comply with or exceeds all environmental regulations currently applicable to it. To the best of the Company’s knowledge, all of the Company’s activities are in compliance in all material respects with applicable environmental legislation. The HS&E Policy is provided below:

| “Health, Safety and Environmental Policy |

| • | “Rubicon Minerals Corporation is committed to eliminating injury and illness in the workplace, and to ensuring the well being of the environment and the communities in areas where the Company operates. To achieve these objectives the Company will: |

| • | Provide staff with the resources to identify, manage and minimize health and safety risks to employees, contractors and communities where the Company operates. |

| • | Assess existing and potential project related risks and avoid, manage or mitigate these risks during all project stages and emergency situations. |

| • | Meet or surpass legislative obligations and organizational conformance requirements. |

| • | Monitor performance, compare against recognized industry standards, seek continual improvement through the implementation of management systems and report on performance to stakeholders in a timely manner. |

| • | Oblige management, employees, contractors and suppliers to be aware of compliance obligations and promote a commitment to health, safety and environment at all levels. |

| • | Monitor, investigate and report on accidents and incidents in a manner that encourages continuous learning and improvement of health, safety and environmental performance. |

| • | Establish capacity to deal with emergency situations and update plans and procedures to reflect the experience gained from every test, incident, or accident. |

| • | Promote safe, healthy and environmentally conscientious behaviour as a Company core value and encourage this behaviour both in and away from the workplace.” |

In addition, Rubicon entered into an Exploration Accommodation Agreement with the Lac Seul First Nation covering certain of Rubicon’s Ontario exploration properties that are located on lands considered by the Lac Seul First Nation to be its traditional territory. See “General Description of the Business - Three Year History - 2010”.

Consistent with its continuing consultation with First Nations whose traditional territory includes Red Lake, Rubicon developed its Aboriginal Policy. The principles of Rubicon’s Aboriginal Policy are provided below:

| • | Rubicon management endeavors to develop and operate sustainable projects that meet high economic, environmental and social standards. |

| • | We respect and value the communities that neighbor our projects, and recognize the unique status of the First Nations and the Métis Nation of Ontario as the original members of those communities. |

| • | Whenever our operations might affect First Nations or the Métis Nation of Ontario, Rubicon seeks to develop enduring relationships with those First Nations and the Métis Nation of Ontario built upon trust and respect. |

| • | develop and maintain mutually beneficial relationships with First Nations and the Métis Nation of Ontario communities in the areas of our operations. |

| • | initiate and maintain ongoing, transparent and good faith communications with First Nations and the Métis Nation of Ontario in the area of our exploration projects. |

| • | consult with First Nations and the Métis Nation of Ontario communities in the areas of our projects to inform them of our plans and to listen and understand their interests. |

| • | respect the traditional knowledge, cultural practices, and culturally-significant sites of First Nations and the Métis Nation of Ontario |

RISK FACTORS

An investment in the common shares of the Company is highly speculative and subject to a number of risks. An investor should carefully consider the risk factors described below, together with all of the other information included or incorporated by reference in this AIF. The risks described below are not the only ones which may affect the Company. Additional risks that the Company currently does not foresee or believes to be immaterial may become important factors that affect the Company’s business. If any of the following risks occur, or if others occur, the Company’s business, operating results and financial condition could be materially adversely affected and investors may lose all of their investment. Details of the risk factors identified under this heading and “Forward-Looking Statements” in this AIF should be carefully reviewed and evaluated by prospective investors before purchasing the common shares of the Company.

The Company is subject to a number of risks due to the nature of its business and the present stage of development of business. The following factors should be considered:

Resource Exploration and Development is generally a Speculative Business

Resource exploration and development is a speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting both from the failure to discover mineral deposits and from finding mineral deposits which, though present, are insufficient in size and grade at the then prevailing market conditions to return a profit from production. The marketability of natural resources which may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations, the proximity and capacity of natural resource markets, government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

The Company has no mineral producing properties at this time. Only those mineral deposits that the Company can economically and legally extract or produce, based on a comprehensive evaluation of cost, grade, recovery and other factors, are considered “mineral reserves.” The Company has not defined or delineated any proven or probable mineral reserves on any of its properties. Although the resource estimates contained in the Amended Report (incorporated by reference herein) have been prepared by a Qualified Person, these amounts are inferred resource and geological potential estimates only and no assurance can be given that any particular level of recovery of gold, silver or other minerals from mineralized material will in fact be realized or that an identified mineralized deposit will ever qualify as a commercially mineable (or viable)

reserve. See “Forward-Looking Statements”, “Caution regarding Reference to Resources and Reserves”, “General Development of the Business—Subsequent Events” and “Material Mineral Projects” in this AIF.

Extensive development of any of the Company’s properties will only follow upon obtaining satisfactory exploration results and successful economic studies. Mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines. There is no assurance that the Company’s mineral exploration activities will result in the discovery of a body of commercial ore on any of its properties. Several years may pass between the discovery of a deposit and its exploitation. Most exploration projects do not result in the discovery of commercially mineable mineralized deposits.

No Known Reserves

The Company’s properties are in the exploration stage and are without a known body of commercial ore. The Company does not have any mineral reserves on its properties.

Title Risks

The confirmation of title to resource properties is a very detailed and time-consuming process. Title to, and the area of, the mineral interests held by the Company may be disputed. There is no guarantee that such title will not be challenged or impaired. There may be challenges to the title of the properties in which the Company may have an interest, which, if successful, could result in the loss or reduction of the Company’s interest in the properties.

Although title to its material property has been reviewed by independent counsel and an opinion of title obtained by or on behalf of the Company, no assurances can be given that there are no title defects affecting the properties. Title insurance generally is not available for mining claims and other types of mineral tenure in Canada and the Company’s ability to ensure that it has obtained secure title to individual mineral properties may be severely constrained.

Although a legal boundary survey exists on its Phoenix Gold Property, Rubicon has not conducted surveys of all of its other mineral interests in which it holds direct or indirect interests; therefore, the precise area and location of such claims may be in doubt. Accordingly, the properties may be subject to prior unregistered liens, agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, Rubicon may be unable to conduct work on the properties as permitted or to enforce its rights with respect to its properties.

Aboriginal Title and Rights Claims

Aboriginal title and rights may be claimed with respect to Crown properties or other types of tenure with respect to which mining rights have been conferred. The Company is not aware of any treaty land entitlement claims or Aboriginal land claims having been formally asserted or any legal actions relating to Aboriginal issues having been instituted with respect to the Phoenix Gold Property. There can be no assurance that treaty or Aboriginal rights will not be asserted in the future in respect of the Phoenix Gold Property, or any of the Company’s other properties. In addition, other parties may dispute the Company’s title to its properties and its properties may be subject to prior unregistered agreements or transfers or land claims by Aboriginal peoples, and title may be affected by undetected encumbrances or defects or government actions.

Uncertainty of Acquiring Necessary Permits and Licenses

The operations of the Company will require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects, on reasonable terms or at all. Delays or a failure to obtain such licenses and permits, or a failure to comply with the terms of any such licenses and permits that the Company does obtain, could have a material adverse effect on the Company.

Legislation and regulations implemented by the MNDMF and the Ministry of Natural Resources (“MNR”) directly affect the mining industry in the province of Ontario where the Company holds some of its mineral claims. The Company can carry out exploration work including drilling, trenching, heavy mineral studies, airborne geophysical surveys, extensive use of off road vehicles, establishment of a camp or other activities capable of causing ground disturbance, water quality impairments or disruption to wildlife or wildlife habitat, provided that it complies with applicable provincial and federal acts and regulations in so doing.

The Acts and Regulations which guide exploration activity in Ontario include the Mining Act, the Public Lands Act, the Forest Fires Prevention Act, Lakes and Rivers Improvement Act, Crown Forest Sustainability Act, Fish and Wildlife Conservation Act, Occupational Health and Safety Act, Health Protection and Promotion Act, Environmental Protection Act, Ontario Water Resources Act and the regulations to the Gasoline Handling Act.

Although the Company currently holds all approvals which it requires in order to carry out its current drilling and underground program on the Phoenix Gold Property, the Company cannot be certain that it will receive the necessary permits on acceptable terms to conduct further exploration and to develop such property. The failure to obtain such permits, or delays in obtaining such permits, could increase the Company’s costs and delay its activities, and could adversely affect the operations of the Company.

Governmental Regulation

Exploration activities on the Company’s properties are affected to varying degrees by: (i) government regulations relating to such matters as environmental protection, health, safety and labour; (ii) mining law reform; (iii) restrictions on production, price controls, and tax increases; (iv) maintenance of claims; (v) tenure; and (vi) expropriation of property. There is no assurance that future changes in such regulation, if any, will not adversely affect the Company’s operations. Changes in such regulation could result in additional expenses and capital expenditures, availability of capital, competition, reserve uncertainty, potential conflicts of interest, title risks, dilution, and restrictions and delays in operations, the extent of which cannot be predicted.

The Company is at the exploration stage on all of its properties. Exploration on the Company’s properties requires responsible best exploration practices to comply with company policy, government regulations, maintenance of claims and tenure. The Company is required to be registered to do business and have a valid prospecting license (required to prospect or explore for minerals on Crown Mineral Land or to stake a claim) in any Canadian province or U.S. State in which it is carrying out work. Mineral exploration primarily falls under provincial jurisdiction. However, the Company is also required to follow the regulations pertaining to the mineral exploration industry that fall under federal jurisdiction, such as the Fisheries Act (Canada).

If any of the Company’s projects are advanced to the development and production stage, those operations will also be subject to various laws and regulations concerning development, production, taxes, labour standards, environmental protection, mine safety and other matters.

Market Price of Company’s Shares and Financing

Since the Fall of 2008, worldwide securities markets, particularly those in the United States and Canada, have experienced an increased level of price and volume volatility, and the market price of securities of many companies have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. In particular, the price of the Company’s common shares fluctuated from a high of $6.50 to a low of $3.24 per share during the financial year ended December 31, 2010. There can be no assurance that fluctuations in the price of the Company’s common shares will not continue to occur. See “Market for Securities: Trading Price and Volume”. As a consequence, despite the Company’s past success in securing significant equity financing, market forces may render it difficult or impossible for the Company to secure investors to purchase new shares issued at a price which will not lead to severe dilution to existing shareholders, or at all. Therefore, there can be no assurance that significant fluctuations in the trading price of the common shares of the Company will not occur, or that such fluctuations will not materially adversely impact the Company’s ability to raise equity funding without significant dilution to its existing shareholders.

Competition

The resource industry is intensively competitive in all of its phases, and the Company competes with many companies possessing greater financial resources and technical facilities. Competition could adversely affect the Company’s ability to acquire suitable producing properties or prospects for exploration in the future.

Operating Hazards and Risks

Mineral exploration involves many risks. The operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to surface and underground exploration, any of which could result in work stoppages and damage to persons or property or the environment and possible legal liability for any and all damage. Fires, power outages, labour disruptions, flooding, unexpected ground conditions and the inability to obtain suitable or adequate machinery, equipment or labour are some of the risks involved in the conduct of exploration programs.

Environmental Quality Requirements

United States

Federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations. Although some mines continue to be approved in the United States, the process is increasingly cumbersome, time-consuming, and expensive, and the cost and uncertainty associated with the permitting process could have a material effect on exploring, and mining our U.S. properties. Compliance with statutory environmental quality requirements described above may require significant capital investments, significantly affect our earning power, or cause material changes in our intended activities. Environmental standards imposed by federal, state, or local governments may be changed or become more stringent in the

future, which could materially and adversely affect our proposed activities. As a result of these matters, our U.S. operations could be suspended or cease entirely.

In the United States, federal legislation and regulations adopted and administered by the U.S. Environmental Protection Agency, Forest Service, Bureau of Land Management, Fish and Wildlife Service, Mine Safety and Health Administration, and other federal agencies, and legislation such as the Federal Clean Water Act, Clean Air Act, National Environmental Policy Act, Endangered Species Act, and Comprehensive Environmental Response, Compensation, and Liability Act, have a direct bearing on U.S. exploration and mining operations. These regulations will make the process for preparing and obtaining approval of a plan of operations much more time-consuming, expensive, and uncertain. Plans of operation will be required to include detailed baseline environmental information and address how detailed reclamation performance standards will be met. In addition, all activities for which plans of operation are required will be subject to a new standard of review by the Bureau of Land Management, which must make a finding that the conditions, practices or activities do not cause substantial irreparable harm to significant scientific, cultural, or environmental resource values that cannot be effectively mitigated.

The Company is able to conduct its exploration within the provisions of the applicable environmental legislation without undue constraint on its ability to carry on efficient operations. The estimated annual cost of environmental compliance for all properties held by the Company in the exploration stage is minimal and pertains primarily to carrying out diamond drilling, trenching or stripping. Environmental hazards may exist on the Company’s properties, which hazards are unknown to the Company at present, which have been caused by previous or existing owners or operators of the properties.

Ontario

Legislation and regulations implemented by the MNDMF and the MNR directly affect the mining industry in the Province of Ontario where the Company holds its material mineral claims. The Company can carry out exploration work including drilling, trenching, heavy mineral studies, airborne geophysical surveys, extensive use of off road vehicles, establishment of a camp or other activities capable of causing ground disturbance, water quality impairments or disruption to wildlife or wildlife habitat, provided that it complies with applicable provincial and federal acts and regulations in so doing. The Company remains current with evolving legislation, including the modernization of Ontario’s Mining Act and the regulation thereunder to maintain regulatory compliance.

General Developments

The mineral exploration and development business is intensely competitive and as such the Company must maintain and enhance its high technical abilities in order to compete in raising capital and delivering exploration results.

Management

The Company is dependent upon a number of key directors, officers and employees: David W. Adamson, President and Chief Executive Officer; William J. Cavalluzzo, Vice-President, Investor Relations; Glenn Kumoi, Vice-President General Counsel and Corporate Secretary, Matthew Wunder, Vice-President, Exploration, Claude Bouchard, Vice-President, Operations

and Robert Lewis, Chief Financial Officer. The loss of any one or more of the named officers and employees could have an adverse effect on the Company. The Company has entered into management contracts with Messrs. Adamson, Cavalluzzo, Bouchard, Kumoi, Wunder and Lewis. See “Directors and Officers”. The Company does not maintain key person insurance on any of its management members.

Conflict of Interest

Certain directors of the Company are directors of, or may become associated with, other natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. Such a conflict poses the risk that the Company may enter into a transaction on terms which place the Company in a worse position than if no conflict existed. The officers and directors of the Company are required by law to act honestly and in good faith with a view to the best interests of the Company and its shareholders and to disclose any interest which they may have in any project or opportunity of the Company, but each officer or director has the identical obligation to other companies for which such officer or director serves as an officer or director.

Limited Operating History: Losses

The Company has no experience in mining or processing of metals. The Company has experienced, on a consolidated basis, losses of $24,049,706, $556,329; and $2,399,763 in the years ended December 31, 2010, 2009 and 2008, respectively. The Company has no mineral properties in development or production and has no revenues from operations. The Company does not anticipate it will earn any material revenue in 2011 and anticipates it will incur losses for the foreseeable future. There can be no assurance that the Company will operate profitably in the future, if at all. As at December 31, 2010, the Company’s deficit was $46,709,395.

Shares Reserved for Future Issuance: Dilution

As at December 31, 2010, there were 7,578,000 options outstanding at a weighted average price of $2.82 per share and no warrants outstanding.

As at December 31, 2010, an additional 190,000 options, contingent on shareholder approval, were outstanding at a weighted average exercise price of $3.75 per share.