Forward-Looking Information

Certain statements contained in this presentation, including statements with respect to future earnings, ongoing operations, and financial conditions, are forward-

looking statements within the meaning of federal securities laws and are intended to qualify for the safe harbor from liability established by the Private Securities

Litigation Reform Act of 1995. Although IDACORP and Idaho Power Company believe that the expectations and assumptions reflected in these forward-looking

statements are reasonable, these statements involve a number of risks and uncertainties, and actual results may differ materially from the results discussed in the

statements. Factors that could cause actual results to differ materially from the forward-looking statements include: the effect of regulatory decisions by the Idaho

Public Utilities Commission, the Oregon Public Utility Commission and the Federal Energy Regulatory Commission affecting our ability to recover costs and/or

earn a reasonable rate of return including, but not limited to, the disallowance of costs that have been deferred; changes in and compliance with state and federal

laws, policies and regulations including new interpretations by oversight bodies, which include the Federal Energy Regulatory Commission, the North American

Electric Reliability Corporation, the Western Electricity Coordinating Council, the Idaho Public Utilities Commission and the Oregon Public Utility Commission,

of existing policies and regulations that affect the cost of compliance, investigations and audits, penalties and costs of remediation that may or may not be

recoverable through rates; changes in tax laws or related regulations or new interpretations of applicable law by the Internal Revenue Service or other taxing

jurisdictions; litigation and regulatory proceedings, including those resulting from the energy situation in the western United States, and penalties and settlements

that influence business and profitability; changes in and compliance with laws, regulations and policies including changes in law and compliance with

environmental, natural resources and endangered species laws, regulations and policies and the adoption of laws and regulations addressing greenhouse gas

emissions, global climate change, and energy policies; global climate change and regional weather variations affecting customer demand and hydroelectric

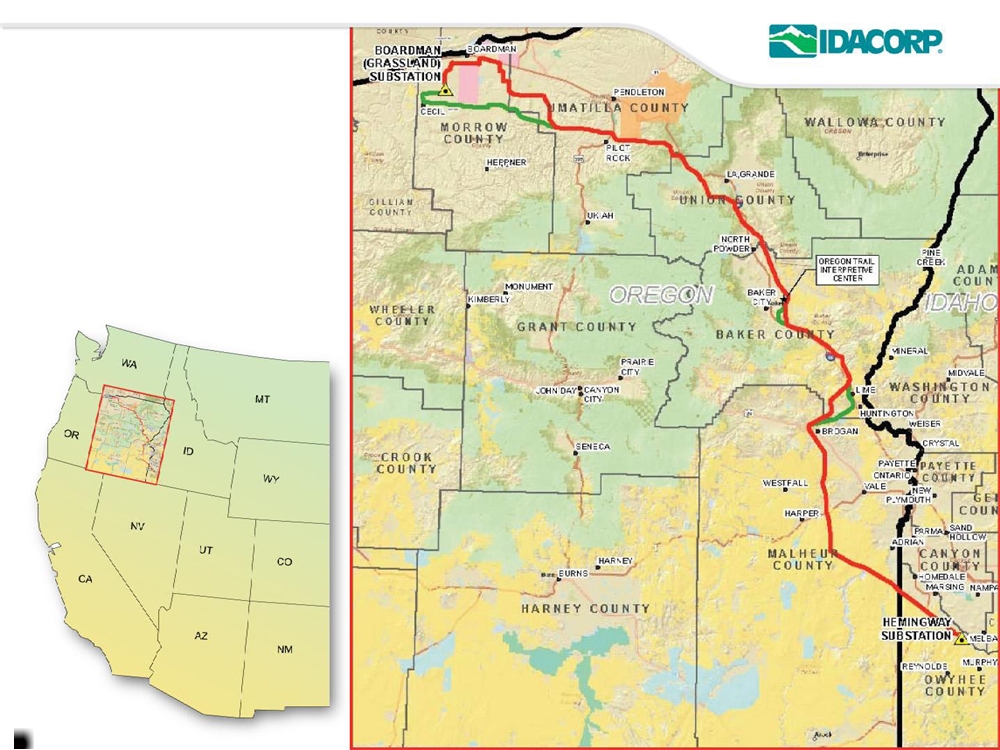

generation; over-appropriation of surface and groundwater in the Snake River Basin resulting in reduced generation at hydroelectric facilities; construction of

power generation, transmission and distribution facilities, including an inability to obtain required governmental permits and approvals, rights-of-way and siting,

and risks related to contracting, construction and start-up; operation of power generating facilities, including performance below expected levels, breakdown or

failure of equipment, availability of electrical transmission capacity and the availability of water, natural gas, coal, diesel and their associated delivery

infrastructures; changes in operating expenses and capital expenditures, including costs and availability of materials, fuel and commodities; blackouts or other

disruptions of Idaho Power Company’s transmission system or the western interconnected transmission system; population growth rates and other demographic

patterns; market prices and demand for energy, including structural market changes; increases in uncollectible customer receivables; fluctuations in sources and

uses of cash; results of financing efforts, including the ability to obtain financing or refinance existing debt when necessary or on favorable terms, which can be

affected by factors such as credit ratings, volatility in the financial markets and other economic conditions; actions by credit rating agencies, including changes in

rating criteria and new interpretations of existing criteria; changes in interest rates or rates of inflation; performance of the stock market, interest rates, credit

spreads and other financial market conditions, as well as changes in government regulations, which affect the amount and timing of required contributions to

pension plans and the reported costs of providing pension and other postretirement benefits; increases in health care costs and the resulting effect on medical

benefits paid for employees; increasing costs of insurance, changes in coverage terms and the ability to obtain insurance; homeland security, acts of war or

terrorism; natural disasters and other natural risks, such as earthquake, flood, drought, lightning, wind and fire; adoption of or changes in critical accounting

policies or estimates; and new accounting, Securities and Exchange Commission or New York Stock Exchange requirements, or new interpretation or application

of existing requirements. Any such forward-looking statements should be considered in light of such factors and others noted in the companies’ Annual Report on

Form 10-K for the year ended December 31, 2009, Quarterly Report on Form 10-Q for the quarter ended March 31, 2010 and other reports on file with the

Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made. New factors emerge from time

to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any

factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.