West Coast Seminar

Las Vegas, Nevada

March 23, 2011

Forward-looking Statements

Certain statements contained in this presentation, including statements with respect to future earnings, outlook for 2011 key operating and financial metrics, ongoing

operations, and financial condition, are forward-looking statements within the meaning of federal securities laws and are intended to qualify for the safe harbor from

liability established by the Private Securities Litigation Reform Act of 1995. Any statements that express or involve discussions as to expectations, beliefs, plans,

objectives, assumptions, or future events or performance, often, but not always, through the use of words or phrases such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “targets,” “predicts,” “projects,” “may result,” “may continue,” or similar expressions, are not statements of historical facts and may be

forward-looking. Although IDACORP, Inc. (IDACORP) and Idaho Power Company (Idaho Power) believe that the expectations and assumptions reflected in these

forward-looking statements are reasonable, these statements involve a number of risks and uncertainties, and actual results may differ materially from the results

discussed in the statements. Factors that could cause actual results to differ materially from the forward-looking statements include the following: (a) the effect of

regulatory decisions by the Idaho Public Utilities Commission, the Oregon Public Utility Commission, and the Federal Energy Regulatory Commission affecting Idaho

Power’s ability to recover costs and/or earn a reasonable rate of return, including, but not limited to, the recovery or disallowance of costs that have been deferred,

financings, allowed rates of return, electricity pricing and price structures, acquisition and disposal of assets and facilities, and current or prospective wholesale and

retail competition; (b) changes in and compliance with state and federal laws, policies, and regulations, including new interpretations and enforcement initiatives by

regulatory and oversight bodies, including, but not limited to, the Federal Energy Regulatory Commission and Idaho and Oregon state regulatory commissions; (c)

changes in tax laws or new interpretations of tax laws, and the availability, use, and regulatory treatment of any tax credits; (d) litigation and regulatory proceedings, and

penalties, settlements, or awards that influence business and profitability; (e) changes in and costs of compliance with laws, regulations, and policies relating to the

environment, natural resources, and endangered species and the adoption of laws and regulations addressing the environment; (f) increases in capital expenditures and

potential reductions in generation capacity as a result of regulatory conditions that may be imposed on power generating plant license renewals, or the non-renewal of

such licenses; (g) global climate change and regional weather variations affecting customer demand and hydroelectric generation; (h) over-appropriation of surface and

groundwater in the Snake River Basin and the resulting impact on hydroelectric generation; (i) inability to obtain required permits and approvals, rights-of-way, and

siting, and risks related to contracting, construction, and start-up, for infrastructure development projects; (j) delays and cost increases in connection with the

construction or modification of generating facilities and other capital projects; (k) breakdown or failure of equipment, forced outages, availability of electrical

transmission capacity, and the availability of water for hydroelectric power generation, natural gas, coal, and diesel for power generation at thermal plants, and wind

conditions for wind power generation; (l) changes in costs and availability of materials, fuel, and commodities, and their impact on the ability to meet required load and

on the wholesale energy market in the western United States; (m) disruptions of Idaho Power’s transmission system or interconnected transmission systems; (n)

customer growth rates within Idaho Power’s service area; (o) the continuing effects of the weak economy, including decreased demand for electricity and reduced

revenue from sales of excess energy during periods of low wholesale market prices; (p) market prices and demand for energy; (q) reductions in credit ratings and the

resulting impact on access to capital markets; (r) results of financing efforts, including the ability to obtain financing or refinance existing debt when necessary or on

favorable terms; (s) increases in the costs associated with energy commodity and other derivative instruments; (t) general capital market conditions and government

regulation that affects the cost of capital, the ability to access the capital markets, and the amount of funding obligations for postretirement benefits; (u) weather and

other natural phenomena such as earthquakes, floods, droughts, lightning, wind, and fire and their impact on power demand and infrastructure; and (v) new accounting

or Securities and Exchange Commission or New York Stock Exchange requirements, or new interpretations or application of existing requirements. Any such forward-

looking statements should be considered in light of these factors and others noted in the companies’ Annual Report on Form 10-K for the year ended December 31, 2010

and other reports on file with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which such statement is made.

IDACORP and Idaho Power disclaim any obligation to update publicly any forward-looking information, whether in response to new information, future events, or

otherwise, except as required by applicable law.

1

Who We Are

Our Vision:

To be regarded as an exceptional utility.

Our Mission:

Prosper by providing reliable, responsible,

fair-priced energy services, today and tomorrow.

2

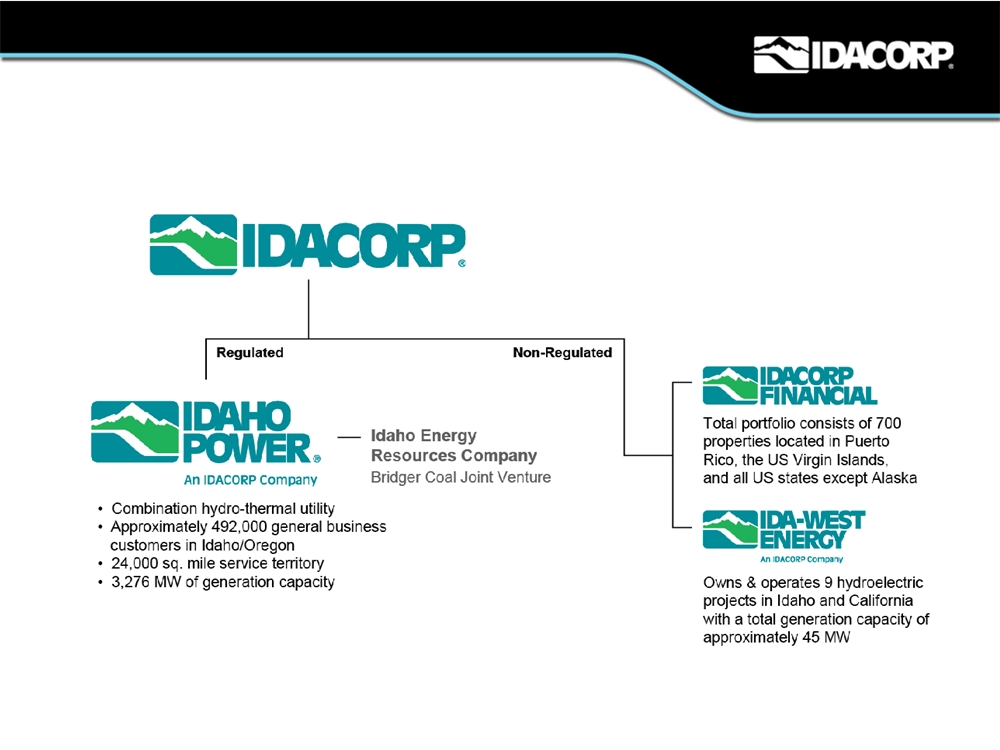

Organization Structure

3

Idaho Power Service Area

4

Idaho Power Core Business

5

Strengths

95 Years of Tradition

Strong Hydroelectric Base

Active Regulatory Strategy

Growing Customer Base

Culture of Integrity

Future of Growth

6

IDACORP

Subsidiary Contributions - Net Income

(in millions except for per diluted share amounts)

2007

2008

2009

2010

Idaho Power Company

$

76.6

$

94.1

$

122.6

$

140.6

Other (Net)

5.7

4.3

1.8

2.2

$

82.3

$

98.4

124.4

$

142.8

Total

Weighted average outstanding shares - diluted

44.3

45.4

47.2

48.3

Earnings per diluted share

$

1.86

$

2.17

$

2.64

$

2.95

7

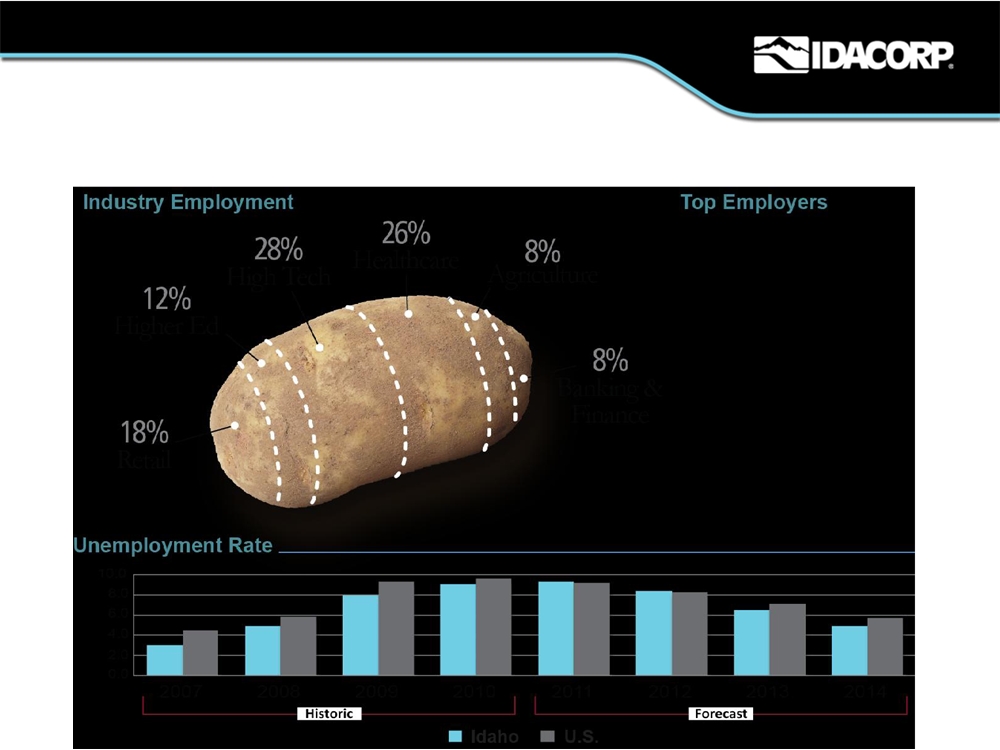

Idaho Economic Brief

More Than Just Potatoes

(Excluding Government)

8

ecember 2010

Generation Carbon Emissions

Idaho Power's CO

2

Emissions

Source: Benchmarking Air Emissions of the 100 Largest Electric Power Producers in the United States - 2008. Released by the Ceres Investor Coalition, the

Natural Resources Defense Council, the Public Service Enterprise Group Inc. and PG&E Corporation in June 2010.

9

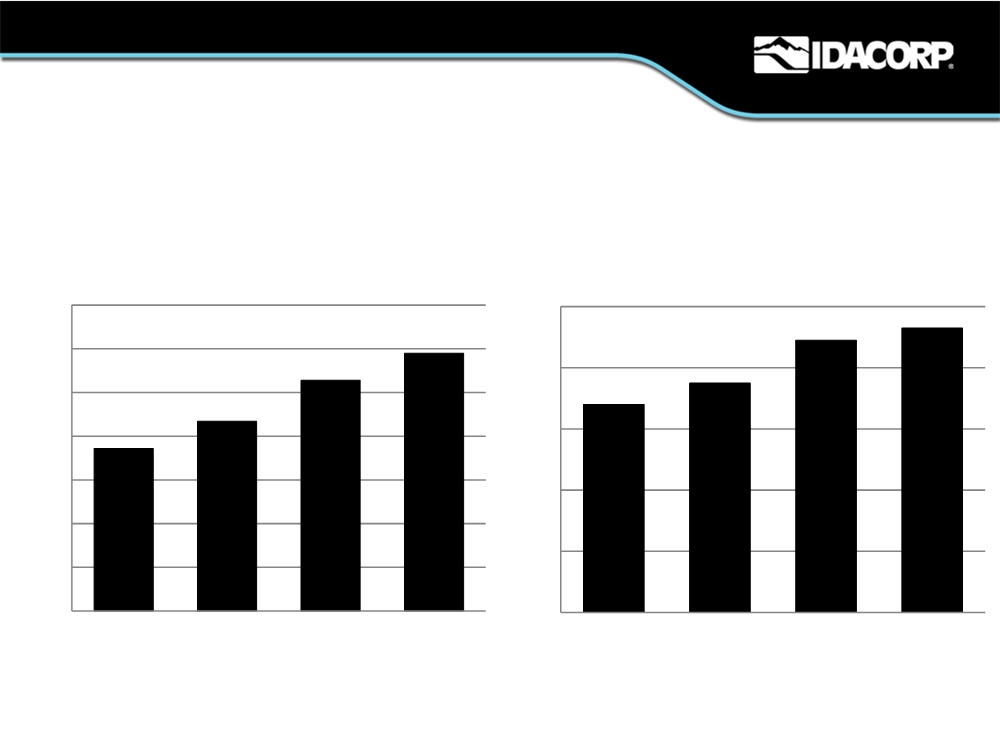

Low Rates for Customers

Residential and Industrial

(cents / kilowatt-hour)

Residential

Industrial

$0.14

$0.09

$0.12

$0.07

$0.10

$0.05

$0.08

$0.03

$0.06

$0.04

$0.01

2004

2005

2006

2007

2008

2009

2010

2004

2005

2006

2007

2008

2009

2010

Idaho Power

National Average*

Idaho Power

National Average *

*

Source: Edison Electric Institute “Typical Bills and Average Rates Report” 12 months ending 6/30/10

10

Our Future

Drivers for Continued Success

11

Estimated Capital Requirements

(Millions of Dollars)

2011

2012 - 2013

Ongoing capital expenditures

$

190 - 192

$ 402 - 413

Langley Gulch

126 - 130

33 - 37

Other major projects

4 - 8

20 - 25

Total

$

320 - 330

$

455 - 475

Idaho Power’s estimated cash requirements for construction, excluding AFUDC for 2011 through 2013

12

Langley Gulch

300 MW Combined Cycle Natural Gas Power Plant

On schedule & within the budget of $427 million

Expected in-service - June 2012

Heat rate - approximately 6,750 Btu/Kwh

Gas burn rate - approximately 1,800 MMBtu/h

13

Boardman to Hemingway

299 mile, 500-kV transmission line

Estimated cost $820 million, including AFUDC

IPC expected ownership between 30% - 50%

Expected in service mid 2016

14

April 2010

Spring Outlook

March Through May 2011

Precipitation

Temperature

15

Source: NOAA, National Oceanic Atmospheric Administration, U.S. Dept of Commerce

Questions?

16

Appendix

General Business Energy

Sales & Revenues

By Customer Class

General Business Energy Sales

General Business Revenues

(MWh’s - Thousands)

($millions)

16,000

$1,000

14,542

14,544

$ 883.8

$ 870.4

13,948

13,513

$900

14,000

$ 784.3

$800

$ 668.3

12,000

$700

10,000

$600

8,000

$500

$400

6,000

$300

4,000

$200

2,000

$100

$0

0

2007

2008

2009

2010

2007

2008

2009

2010

Residential

Commercial

Industrial

Irrigation

Residential

Commercial

Industrial

Irrigation

A1

General Business Customers

500,000

492,073

489,927

490,000

487,165

481,651

480,000

471,779

470,000

460,000

457,146

450,000

440,000

430,000

2005

2006

2007

2008

2009

2010

General Business Customers (1.5% CAGR 2005-2010)

A2

Earnings Per Diluted Share &

Return on Year-End Equity

(Period-End)

Earnings Per Diluted Share

Return on Year-End Equity

$3.50

10%

9.3%

$3.00

8.9%

$2.95

8%

$2.50

$2.64

7.5%

6.8%

6%

$2.00

$2.17

$1.86

$1.50

4%

$1.00

2%

$0.50

$0.00

0%

2007

2008

2009

2010

2007

2008

2009

2010

A3

Liquidity

As of December 31, 2010

($ Million)

IDACORP

Idaho Power

(1)

5-Year Line of Credit Facility

- Expires April 2012

$

100

$

300

Plus:

Cash

7

224

Less: Commercial Paper Outstanding

(67)

0

Total

$

37

$

524

(1)

$24.2 million identified for Port of Morrow and American Falls bonds that holder may put to Idaho Power.

A4

Credit Ratings

Standard and Poor’s

Moody’s

Idaho Power

IDACORP

Idaho Power

IDACORP

Corporate Credit Rating /

Long-Term Issuer Rating

BBB

BBB

Baa1

Baa2

Senior Secured Debt

A-

None

A2

None

Senior Unsecured Debt

BBB

None

Baa1

None

Short-Term Tax-Exempt Debt

BBB/A-2

None

Baa1/VMIG-2

None

Commercial Paper Senior Unsecured

A-2

A-2

P-2

P-2

Credit Facility

None

None

Baa1

Baa2

Senior Unsecured Rating Outlook

Stable

Stable

Stable

Stable

Date of Last Action

February 24, 2010

March 30, 2010

These security ratings reflect the views of the rating agencies. An explanation of the significance of these ratings may be obtained from

each rating agency. Such ratings are not a recommendation to buy, sell or hold securities. Any rating can be revised upward or downward

or withdrawn at any time by a rating agency if it decides that the circumstances warrant the change. Each rating should be evaluated

independently of any other rating.

A5

Brownlee Reservoir Inflows

18.0

17.0

16.0

14.0

12.0

11.3

10.0

10.7

10.1

9.2

8.0

8.5

8.1

7.3

6.9

6.0

6.2

4.0

2.0

0.0

2006

2007

2008

2009

2010

Million Acre-Feet (MAF)

Million MWh Hydroelectric Generation (Annual - All IPC Plants)*

* At February 23, 2011, the estimate of 2011 hydroelectric generation was 7.5 to 9.5 MMWh

A6

Key Financial & Operating

Metrics and 2011 Earnings Guidance

2011 Estimate

(1)

2010 Actual

Idaho Power Operations & Maintenance Expense (millions)

$300 - $310

$294

Idaho Power Capital Expenditures (millions)

$320 - $330

$341

Idaho Power Hydroelectric Generation (million MWh)

7.5

- 9.5

7.3

Non-Regulated Subsidiary Earnings and

$0 - $3

$2

Holding Company Expenses (millions)

2011 Earnings Guidance

(1)

$2.80 - $2.95 per diluted share

(1)

As of February 23, 2011

A7

For Additional Information

Lawrence F. Spencer

Director of Investor Relations

(208) 388-2664

LSpencer@idacorpinc.com

Steven R. Keen

Vice President Finance and Treasurer

(208) 388-2600

Darrel T. Anderson

Executive Vice President-Administrative Services

and Chief Financial Officer

(208) 388-2650

WWW.IDACORPINC.COM

WWW.IDAHOPOWER.COM