Earnings Conference Call 3rd Quarter 2021 October 28, 2021

Forward-Looking Statements In addition to the historical information contained in this presentation, this presentation contains (and oral communications made by IDACORP, Inc. and Idaho Power Company may contain) statements, including, without limitation, earnings guidance and estimated key operating and financial metrics, that relate to future events and expectations and, as such, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, outlook, assumptions, or future events or performance, often, but not always, through the use of words or phrases such as “anticipates,” “believes,” “continues,” “could,” “estimates,” “expects,” “guidance,” “intends,” “potential,” “plans,” “predicts,” “projects,” “targets,” or similar expressions, are not statements of historical facts and may be forward-looking. Forward-looking statements are not guarantees of future performance and involve estimates, assumptions, risks, and uncertainties. Actual results, performance, or outcomes may differ materially from the results discussed in the statements. In addition to any assumptions and other factors and matters referred to specifically in connection with such forward-looking statements, factors that could cause actual results or outcomes to differ materially from those contained in forward-looking statements include the following: (a) the effect of decisions by state and federal regulators affecting Idaho Power's ability to recover costs and earn a return on investments; (b) changes to or the elimination of Idaho Power’s regulatory cost recovery mechanisms; (c) the impacts of the COVID-19 pandemic on the global and regional economy and Idaho Power’s business; (d) changes in customer growth rates, and related changes in loads; (e) abnormal or severe weather conditions, climate change, wildfires, droughts, earthquakes, and other natural phenomena; (f) advancement of technologies that reduce customer demand or the introduction of vulnerabilities to the power grid; (g) acts or threats of terrorist incidents, social unrest, acts of war, cyber or physical security attacks, the companies’ failure to secure data or comply with privacy laws or regulations; (h) the expense and risk of capital expenditures for utility infrastructure and ability to recover such costs; (i) variable hydrological conditions or over-appropriation of surface and groundwater; (j) the ability to acquire fuel, power, and electrical equipment from suppliers on reasonable terms; (k) disruptions or outages of Idaho Power’s generation or transmission systems or of any interconnected transmission system; (l) accidents, terrorist acts, fires, explosions, and mechanical breakdowns, that can damage the companies’ assets and subject the companies to third-party claims for damages; (m) increased purchased power costs and challenges associated with integrating intermittent renewable energy sources into Idaho Power's resource portfolio; (n) the failure to comply with state and federal laws, regulations, and orders; (o) changes in tax laws and the availability of tax credits; (p) adoption of or changes in, and costs of compliance with, laws, orders and regulations, and related litigation or proceedings, including those relating to the environment; (q) the inability to timely obtain and the cost of obtaining and complying with government permits and approvals; (r) failure to comply with mandatory reliability and security requirements; (s) the impacts of changes in economic conditions, including on customer demand; (t) the ability to obtain debt and equity financing when necessary and on reasonable terms; (u) changes in the method for determining LIBOR and the potential replacement of LIBOR; (v) the ability to buy and sell power, transmission capacity, and fuel in the markets and the availability to enter into, and success or failure of, financial and physical commodity hedges; (w) the magnitude of future benefit plan funding obligations; (x) the assumptions underlying the coal mine reclamation obligations at Bridger Coal Company and related funding requirements, and remediation costs associated with planned exits from coal plants; (y) the ability to continue to pay dividends and target-payout ratios, and contractual and regulatory restrictions on those dividends; (z) Idaho Power's concentration in one industry and one region, regional economic condition and regional legislation and regulation; (aa) employee and third-party vendor workforce factors, including potential unionization of the companies' workforce and the impacts of an aging workforce; and (bb) adoption of or changes in accounting policies, principles, or estimates. Any forward-looking statement speaks only as of the date on which such statement is made. New factors emerge from time to time and it is not possible for management to predict all such factors, nor can it assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Readers should also review the risks and uncertainties listed in IDACORP, Inc.'s and Idaho Power Company's most recent Annual Report on Form 10-K and Form 10-Q and other reports the companies file with the U.S. Securities and Exchange Commission, including (but not limited to) Part I, Item 1A - “Risk Factors” in the Form 10-K and Form 10-Q and Management's Discussion and Analysis of Financial Condition and Results of Operations and the risks described therein from time to time. IDACORP and Idaho Power disclaim any obligation to update publicly any forward-looking information, whether in response to new information, future events, or otherwise, except as required by applicable law.

Leadership Presenting Today Lisa Grow IDACORP President & Chief Executive Officer Steve Keen IDACORP Senior Vice President & Chief Financial Officer 3

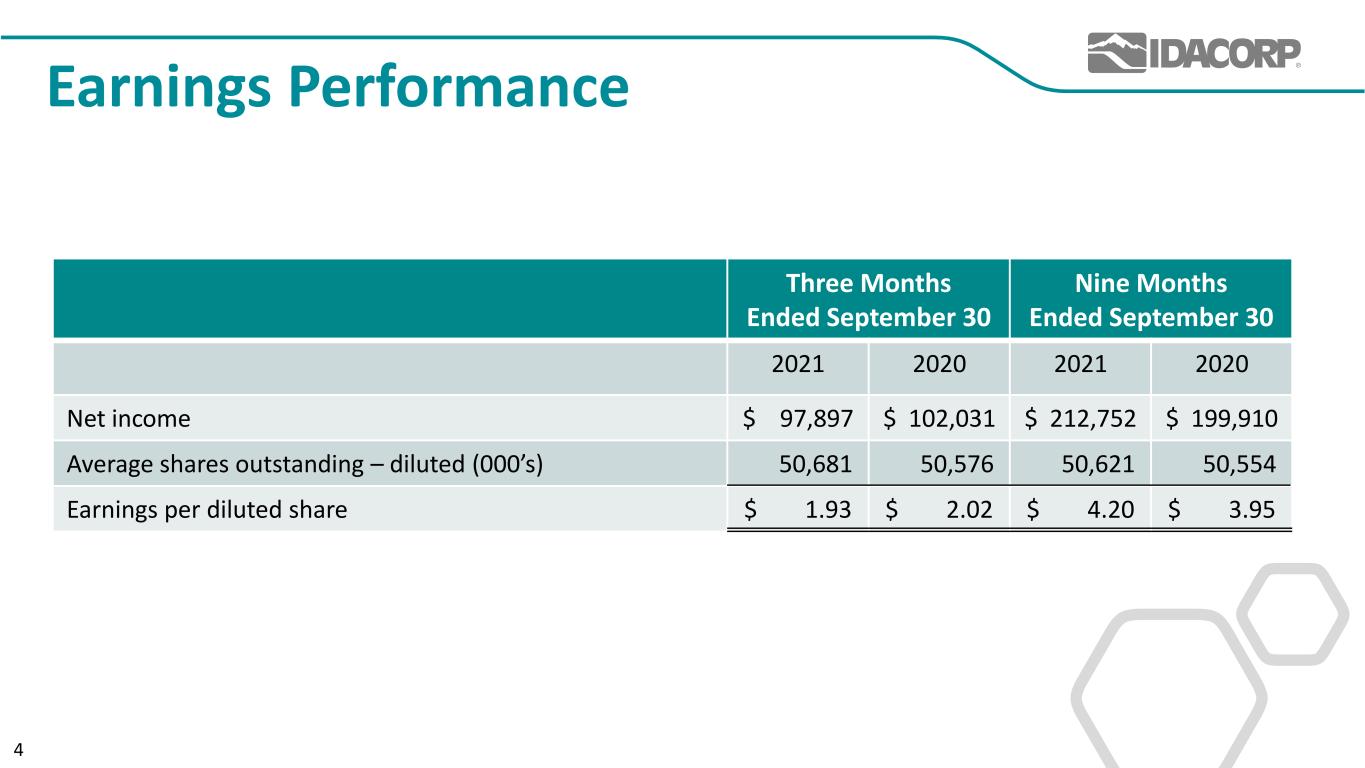

Three Months Ended September 30 Nine Months Ended September 30 2021 2020 2021 2020 Net income $ 97,897 $ 102,031 $ 212,752 $ 199,910 Average shares outstanding – diluted (000’s) 50,681 50,576 50,621 50,554 Earnings per diluted share $ 1.93 $ 2.02 $ 4.20 $ 3.95 Earnings Performance 4

2.9% Increasing Customer Growth Rate 540,000 550,000 560,000 570,000 580,000 590,000 600,000 2017 2018 2019 2020 Idaho Power Customer Growth Twelve Months Ended Sept. 30, 2021 5 Moody’s GDP Growth Projections Idaho Power’s Service Area: 2021: 6.1% 2022: 4.2%

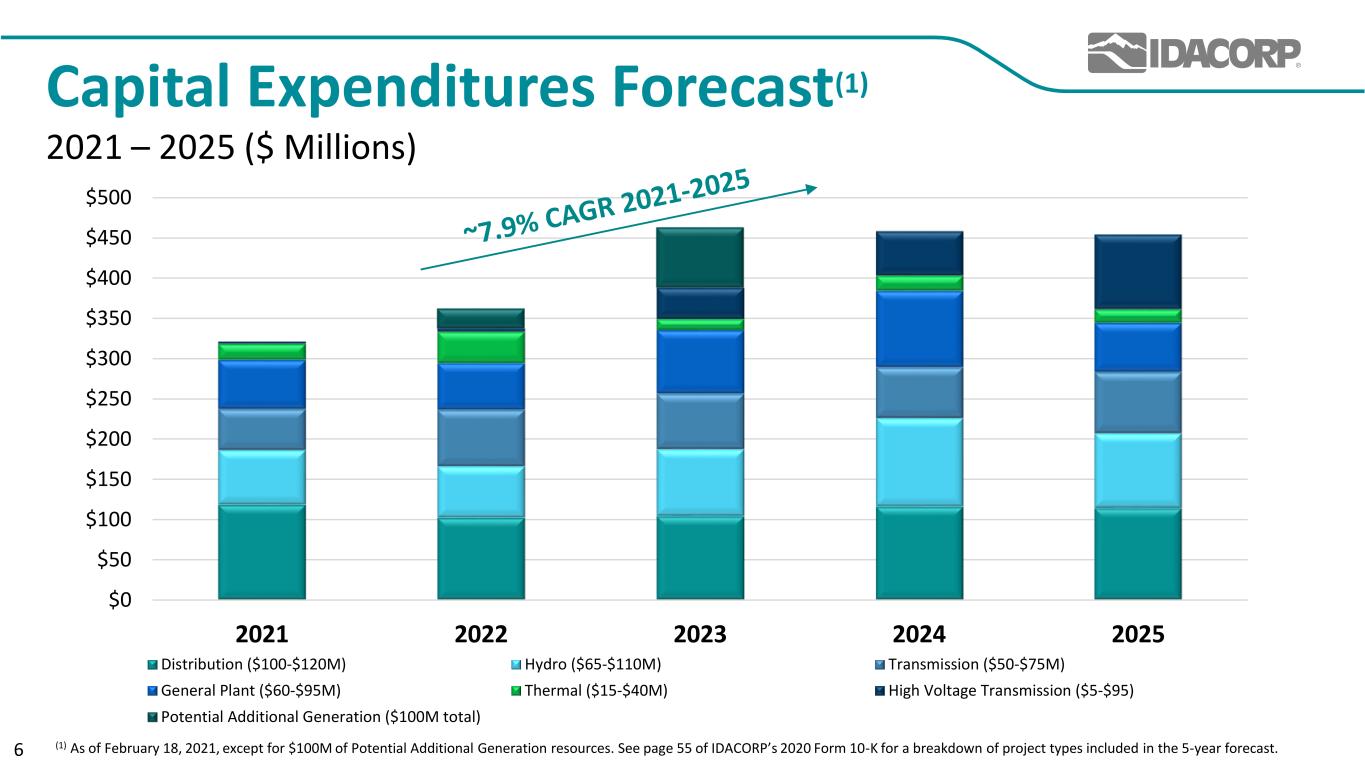

Capital Expenditures Forecast(1) 2021 – 2025 ($ Millions) $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2021 2022 2023 2024 2025 Distribution ($100-$120M) Hydro ($65-$110M) Transmission ($50-$75M) General Plant ($60-$95M) Thermal ($15-$40M) High Voltage Transmission ($5-$95) Potential Additional Generation ($100M total) (1) As of February 18, 2021, except for $100M of Potential Additional Generation resources. See page 55 of IDACORP’s 2020 Form 10-K for a breakdown of project types included in the 5-year forecast.6

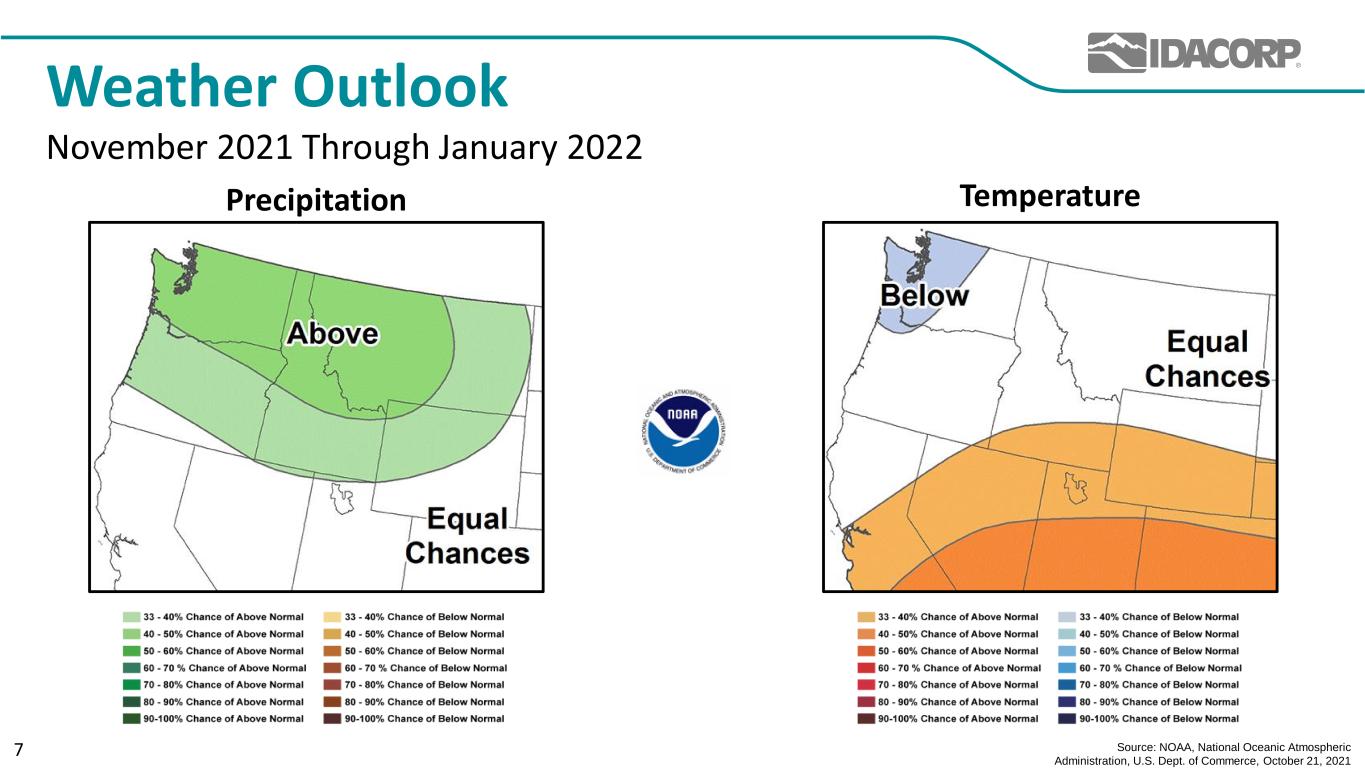

Precipitation Weather Outlook November 2021 Through January 2022 Source: NOAA, National Oceanic Atmospheric Administration, U.S. Dept. of Commerce, October 21, 2021 7 Temperature

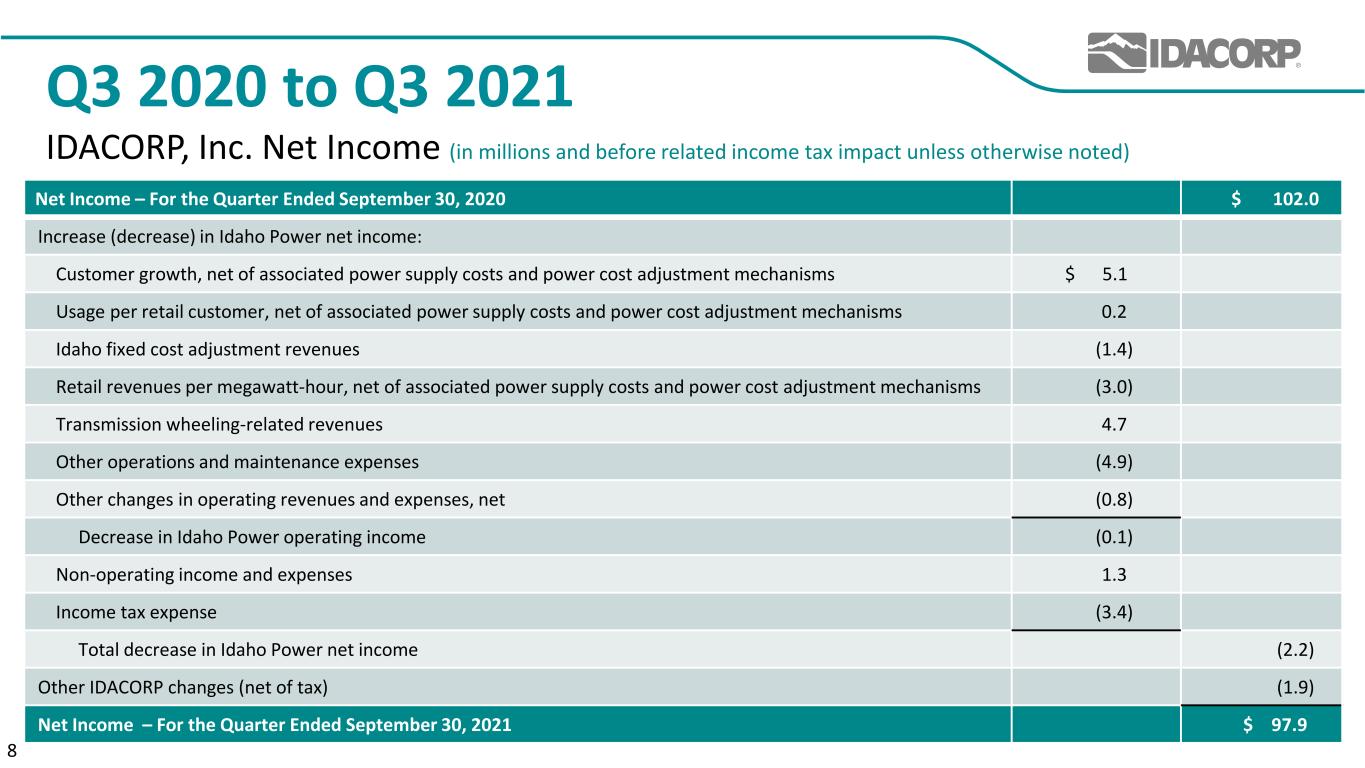

Q3 2020 to Q3 2021 IDACORP, Inc. Net Income (in millions and before related income tax impact unless otherwise noted) Net Income – For the Quarter Ended September 30, 2020 $ 102.0 Increase (decrease) in Idaho Power net income: Customer growth, net of associated power supply costs and power cost adjustment mechanisms $ 5.1 Usage per retail customer, net of associated power supply costs and power cost adjustment mechanisms 0.2 Idaho fixed cost adjustment revenues (1.4) Retail revenues per megawatt-hour, net of associated power supply costs and power cost adjustment mechanisms (3.0) Transmission wheeling-related revenues 4.7 Other operations and maintenance expenses (4.9) Other changes in operating revenues and expenses, net (0.8) Decrease in Idaho Power operating income (0.1) Non-operating income and expenses 1.3 Income tax expense (3.4) Total decrease in Idaho Power net income (2.2) Other IDACORP changes (net of tax) (1.9) Net Income – For the Quarter Ended September 30, 2021 $ 97.9 8

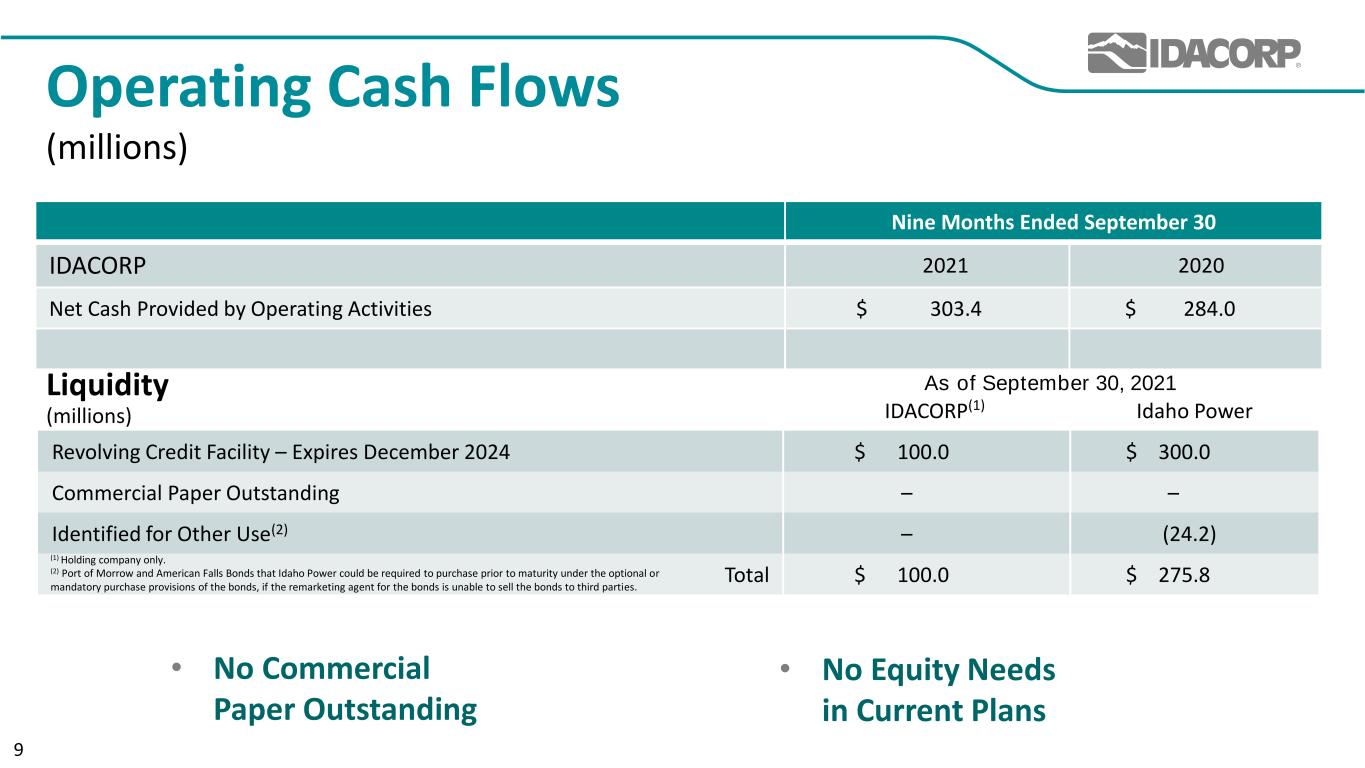

Operating Cash Flows (millions) IDACORP(1) Idaho Power Revolving Credit Facility – Expires December 2024 $ 100.0 $ 300.0 Commercial Paper Outstanding – – Identified for Other Use(2) – (24.2) Total $ 100.0 $ 275.8 (1) Holding company only. (2) Port of Morrow and American Falls Bonds that Idaho Power could be required to purchase prior to maturity under the optional or mandatory purchase provisions of the bonds, if the remarketing agent for the bonds is unable to sell the bonds to third parties. Nine Months Ended September 30 IDACORP 2021 2020 Net Cash Provided by Operating Activities $ 303.4 $ 284.0 • No Equity Needs in Current Plans • No Commercial Paper Outstanding Liquidity (millions) As of September 30, 2021 9

Current(1) Previous(2) IDACORP Earnings Per Diluted Share Guidance $ 4.80 – $ 4.90 $ 4.60 – $ 4.80 Idaho Power Additional Amortization of Accumulated Deferred Investment Tax Credits No change None Idaho Power Operations & Maintenance Expense No change $ 345 – $ 355 Idaho Power Capital Expenditures, Excluding Allowance for Funds Used During Construction No change $ 320 – $ 330 Idaho Power Hydropower Generation (MWh) 5.4 – 5.7 5.0 – 6.0 2021 Earnings Per Share Guidance & Estimate Key Operating Metrics (Millions Except for Per Share Amounts) (1) As of October 28, 2021. (2) As of July 29, 2021, the date of filing IDACORP’s and Idaho Power’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2021. 10

Contact Information Justin S. Forsberg Director of Investor Relations & Treasury (208) 388-2728 JForsberg@idacorpinc.com Webcast and presentation on WWW.IDACORPINC.COM Jordan Rodriguez Corporate Communications (208) 388-2460 JRodriguez@idahopower.com Investors & Analysts Media