Earnings Conference Call 3rd Quarter 2024 October 31, 2024 Exhibit 99.2

Forward-Looking Statements This presentation (and oral statements relating to this presentation) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical facts, that express or involve discussions of expectations, beliefs, plans, objectives, outlooks, assumptions, or future events or performance are forward-looking. Forward-looking statements are not guarantees of future performance, involve estimates, assumptions, risks, and uncertainties, and may differ materially from actual results, performance, or outcomes. Factors that may cause actual results or outcomes to differ materially from those contained in forward-looking statements include those listed in IDACORP, Inc.'s and Idaho Power Company's most recently filed periodic reports on Form 10-K and Form 10-Q, including (but not limited to) the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections, and in other reports the companies file with the U.S. Securities and Exchange Commission. Those factors also include the following, among others: • Decisions or actions by state and federal regulators affecting Idaho Power's ability to recover costs and earn a return on investment; • Changes to or elimination of Idaho Power’s regulatory cost recovery mechanisms; • Ability to timely obtain permits and construct, and expenses and risks of capital expenditures for, utility infrastructure, including the impacts of inflation, price volatility, supply chain constraints, and supplier and contractor delays and failure to satisfy project quality and performance standards; • Impacts of economic conditions, including an inflationary or recessionary environment and increased interest rates, on items such as operations and capital investments and changes in customer demand; • The rapid addition of new industrial and commercial customer load and the volatility of such new load demand, resulting in increased risks and costs of power demand potentially exceeding supply and of purchasing energy and capacity in the market or acquiring or constructing additional capacity and energy resources and the potential financial impacts of industrial customers not meeting forecasted power usage ramp rates or amounts; • Risks of operating an electric utility system, including compliance with regulatory obligations and potential liability for fires, outages, and personal injury or property damage; • Acts or threats of terrorism, cyber or physical security attacks, and other acts seeking to disrupt Idaho Power's operations or the electric power grid or compromise data; • Abnormal or severe weather conditions, wildfires, droughts, earthquakes, and other natural phenomena and natural disasters; • Ability to acquire equipment, materials, fuel, power, and transmission capacity on reasonable terms and prices; • Impacts of current and future governmental regulation and ability to timely obtain, and the cost of obtaining and complying with, government permits and approvals, licenses, and rights-of-way and siting for transmission and generation projects; • Ability to obtain debt and equity financing when necessary and on satisfactory terms; • Ability to continue to pay dividends and achieve target dividend-payout ratios, and contractual and regulatory restrictions on those dividends; and • Changing market dynamics due to the emergence of day ahead or other energy and transmission markets in the western United States. New factors emerge from time to time, and it is not possible for the companies to predict all such factors, nor can they assess the impact of any such factor on the business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. IDACORP and Idaho Power disclaim any obligation to update publicly any forward-looking information, whether in response to new information, future events, or otherwise, except as required by applicable law. 2

Presenting Today Lisa Grow IDACORP President & Chief Executive Officer Amy Shaw IDACORP Vice President of Finance, Compliance & Risk Brian Buckham IDACORP Senior Vice President, Chief Financial Officer & Treasurer 3

IDACORP Earnings Performance Three months ended September 30, Nine months ended September 30, 2024 2023 2024 2023 Net income (thousands) $ 113,605 $ 105,264 $ 251,298 $ 229,936 Weighted average common shares outstanding – diluted (thousands) 53,485 50,805 52,179 50,762 Diluted earnings per share $ 2.12 $ 2.07 $ 4.82 $ 4.53 4

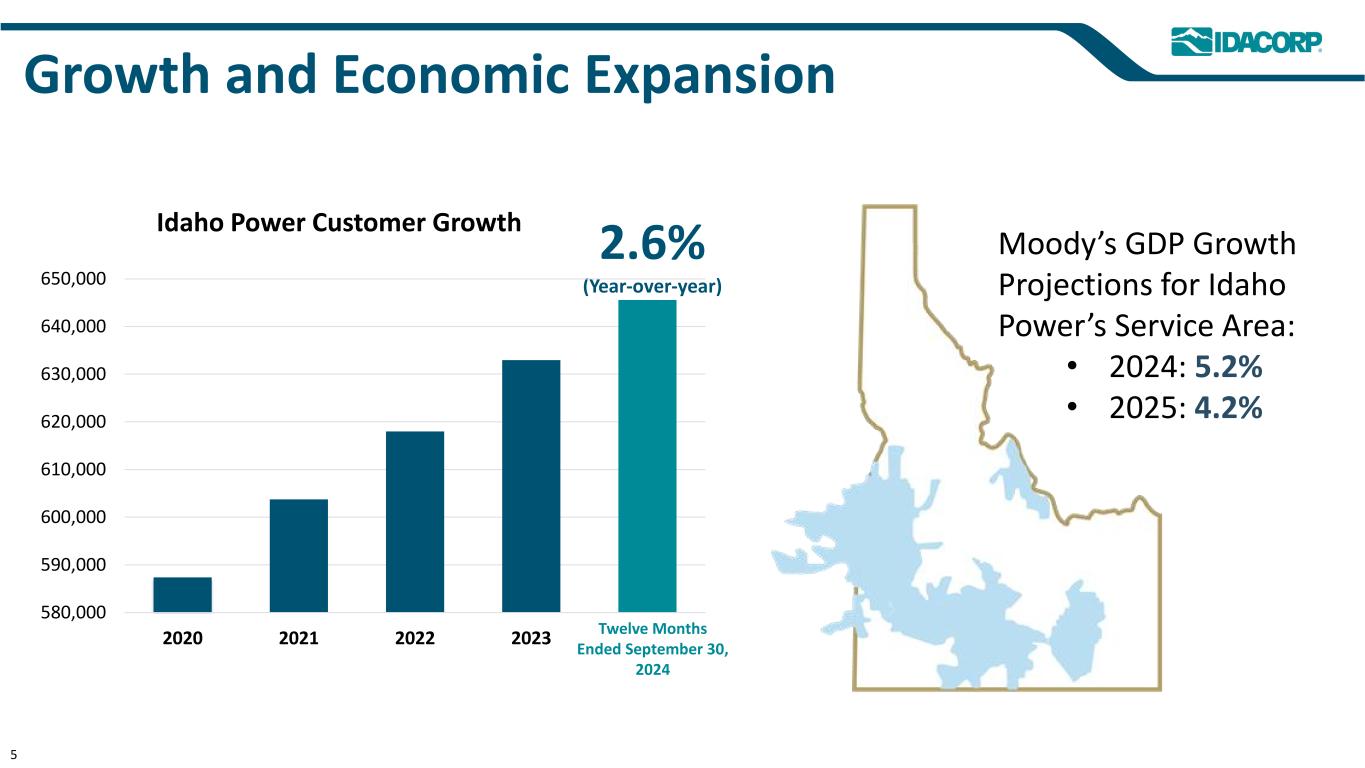

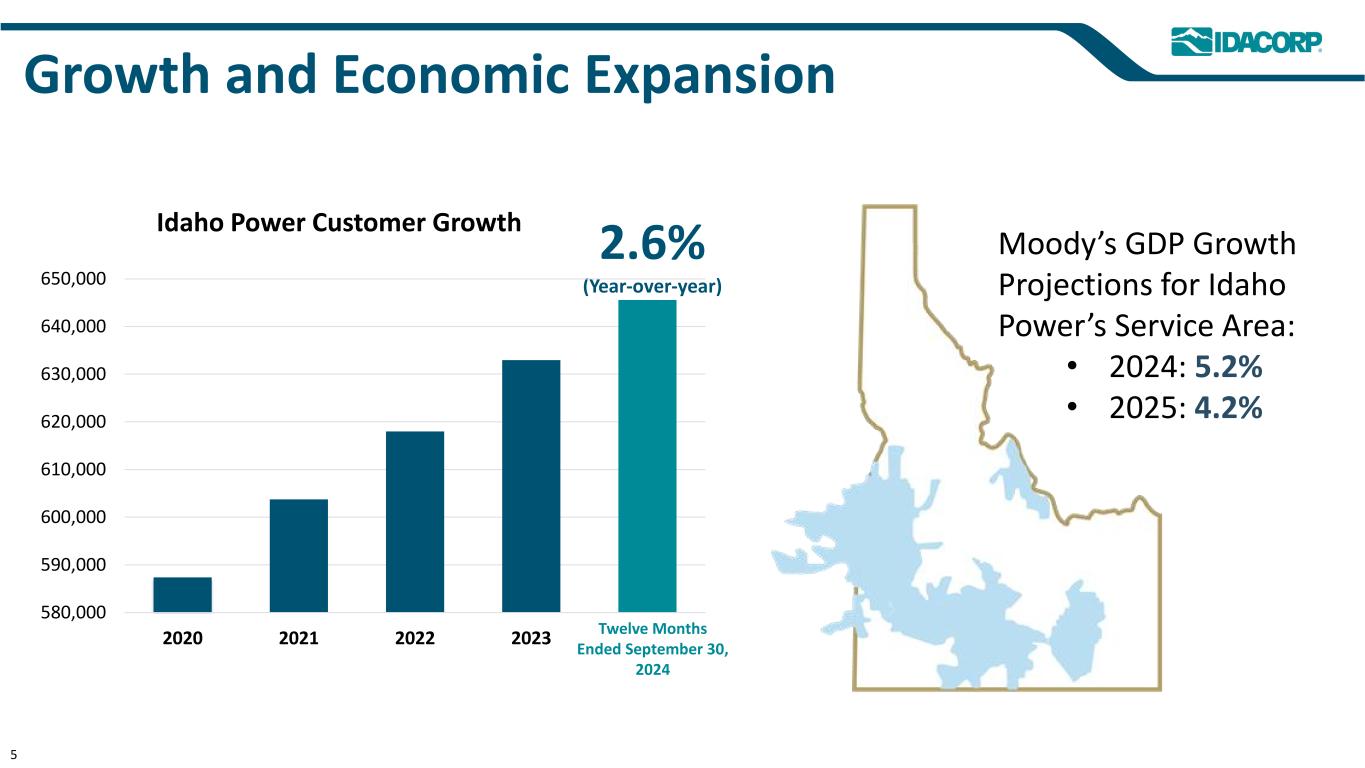

Growth and Economic Expansion Moody’s GDP Growth Projections for Idaho Power’s Service Area: • 2024: 5.2% • 2025: 4.2% 5 2.6% (Year-over-year) Idaho Power Customer Growth 580,000 590,000 600,000 610,000 620,000 630,000 640,000 650,000 2020 2021 2022 2023 Twelve Months Ended September 30, 2024

RFP Update(1)(2) Resource Owned or Contracted 2023 Battery Storage Solar 120 MW Owned 40 MW PPA(3) 2024 Battery Storage Solar 96 MW Owned 100 MW PPA 2025 Battery Storage 77 MW Owned; 150 MW ESA 2026 Battery Storage Energy and Capacity 200 MW Owned 200 MW Market Purchase 2027(4) Wind 300 MW PPA; 300 MW Owned 2028 and later Evaluating Bids TBD 6 (1)Distribution site battery storage is excluded. (2)Although not included in Idaho Power’s RFP process, solar PPA's for 200 MW, 125 MW, 320 MW are scheduled to come online in 2025, 2026, and 2027, respectively. Each project has been allocated to customers as part of the Clean Energy Your Way (CEYW) program. (3)Allocated to customers as part of the CEYW program. (4)Idaho Power continues to evaluate additional bids to meet its energy and capacity needs.

Oregon General Rate Case • Filed with the OPUC in December 2023 • In September 2024, the OPUC issued an order approving settlement stipulations • Rates became effective October 15, 2024 – Increase of $6.7 million, or 12.14%, in total Oregon jurisdictional revenue – 9.5% Oregon-jurisdiction ROE – 7.302% Oregon-jurisdiction overall rate of return • Settlement stipulations do not preclude Idaho Power from filing another general rate case or other limited issue proceeding in Oregon at any time in the future Idaho and Oregon Rate Case Activity 7 Idaho Limited-Issue Rate Case • Filed with the IPUC in May 2024 • Requested rate increase effective January 1, 2025 • Idaho Power requested an increase of $99.3 million, or 7.31%, in annual Idaho jurisdictional revenue • The limited-issue request focuses on revenue requirements for incremental forecasted year- end 2024 plant additions and O&M labor costs • Idaho Power did not request any changes to other aspects of the settlement stipulation approved by the IPUC for Idaho Power's 2023 Idaho general rate case

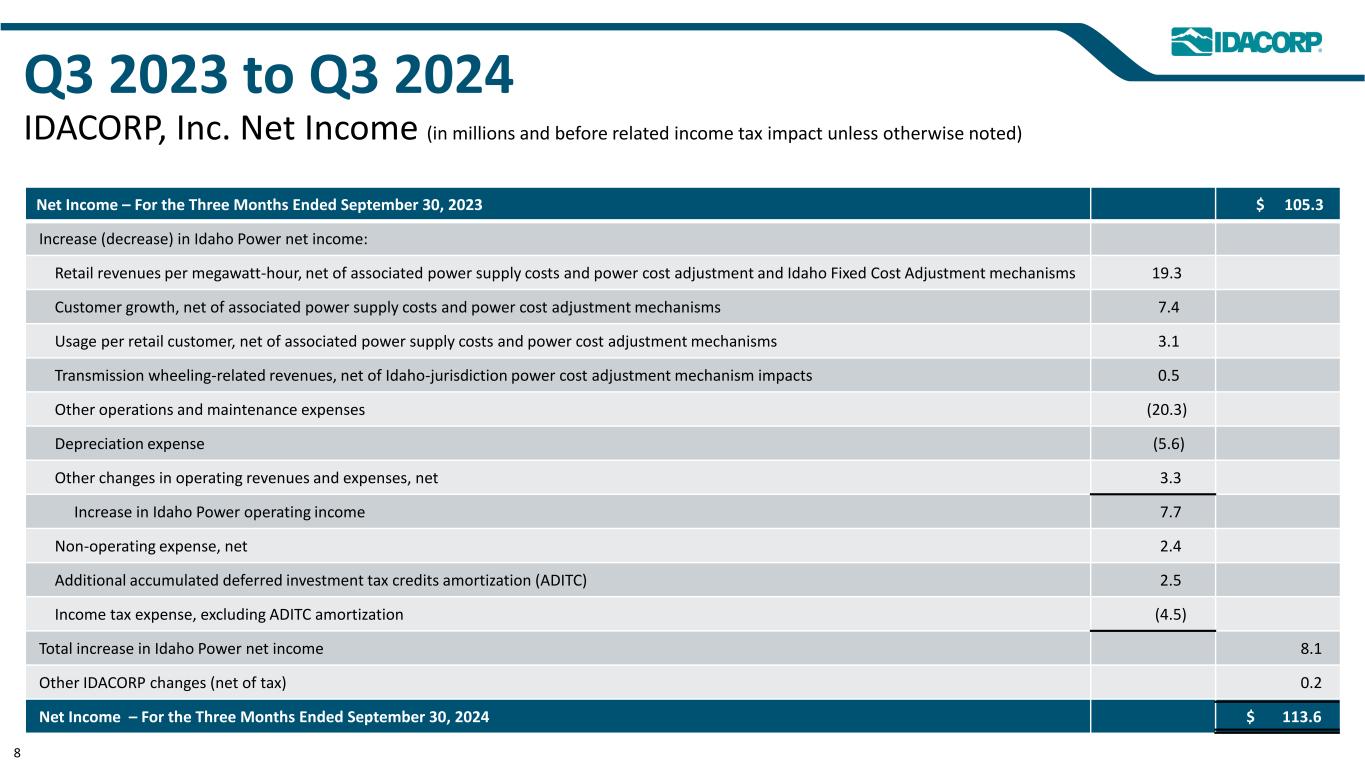

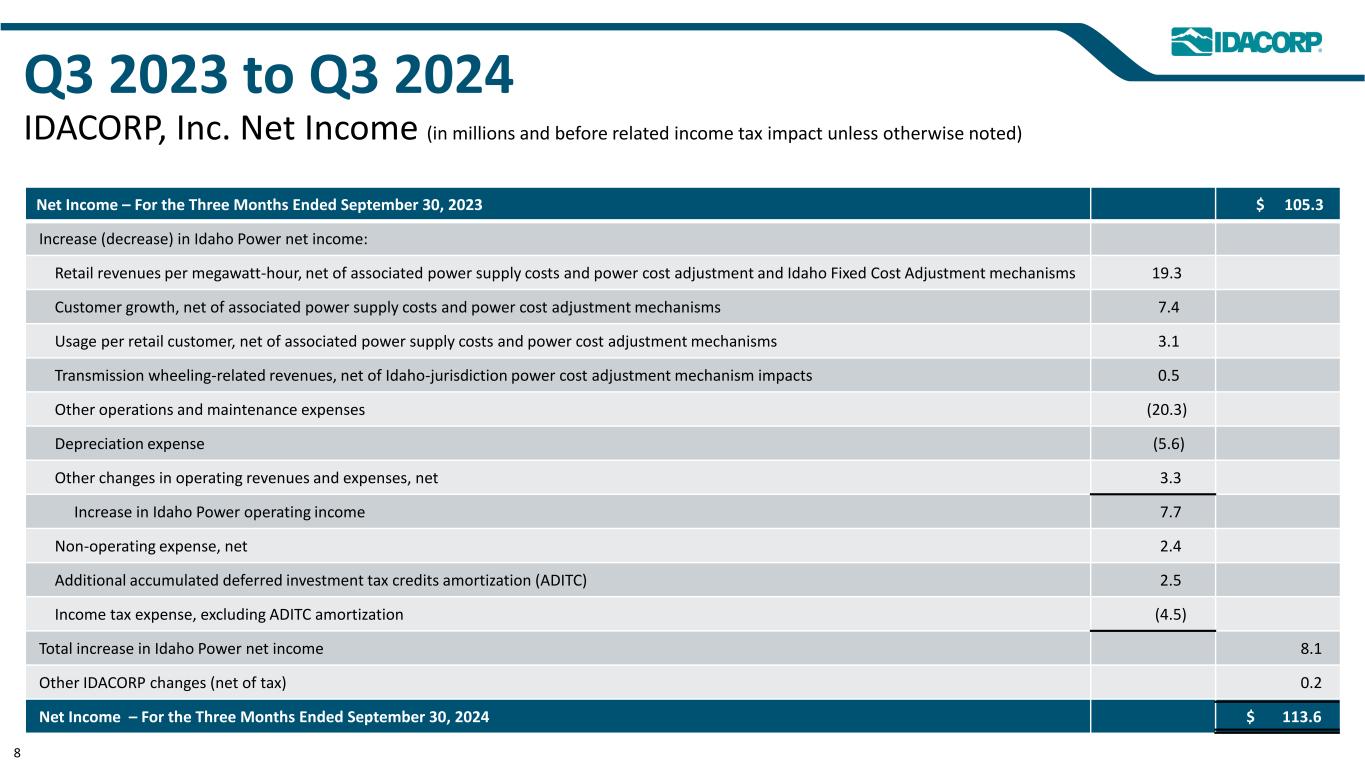

Q3 2023 to Q3 2024 IDACORP, Inc. Net Income (in millions and before related income tax impact unless otherwise noted) 8 Net Income – For the Three Months Ended September 30, 2023 $ 105.3 Increase (decrease) in Idaho Power net income: Retail revenues per megawatt-hour, net of associated power supply costs and power cost adjustment and Idaho Fixed Cost Adjustment mechanisms 19.3 Customer growth, net of associated power supply costs and power cost adjustment mechanisms 7.4 Usage per retail customer, net of associated power supply costs and power cost adjustment mechanisms 3.1 Transmission wheeling-related revenues, net of Idaho-jurisdiction power cost adjustment mechanism impacts 0.5 Other operations and maintenance expenses (20.3) Depreciation expense (5.6) Other changes in operating revenues and expenses, net 3.3 Increase in Idaho Power operating income 7.7 Non-operating expense, net 2.4 Additional accumulated deferred investment tax credits amortization (ADITC) 2.5 Income tax expense, excluding ADITC amortization (4.5) Total increase in Idaho Power net income 8.1 Other IDACORP changes (net of tax) 0.2 Net Income – For the Three Months Ended September 30, 2024 $ 113.6

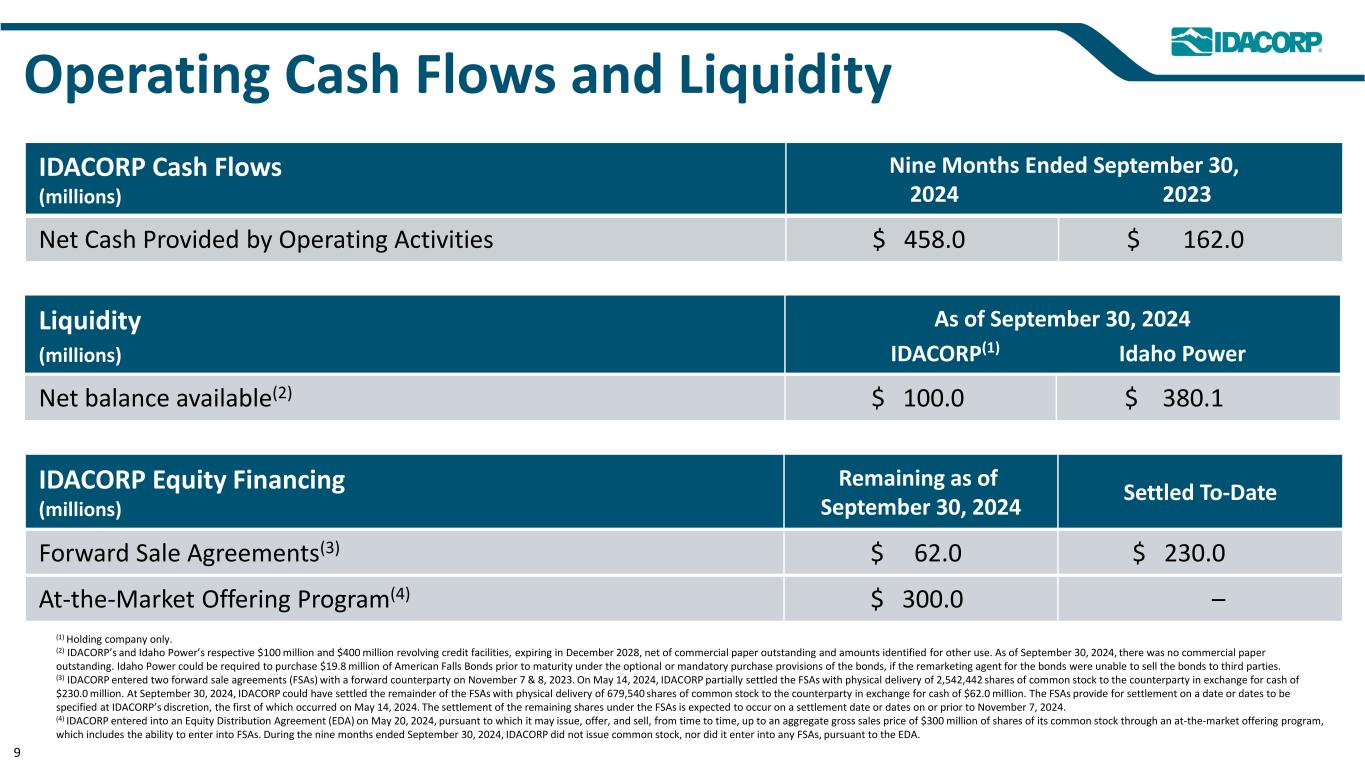

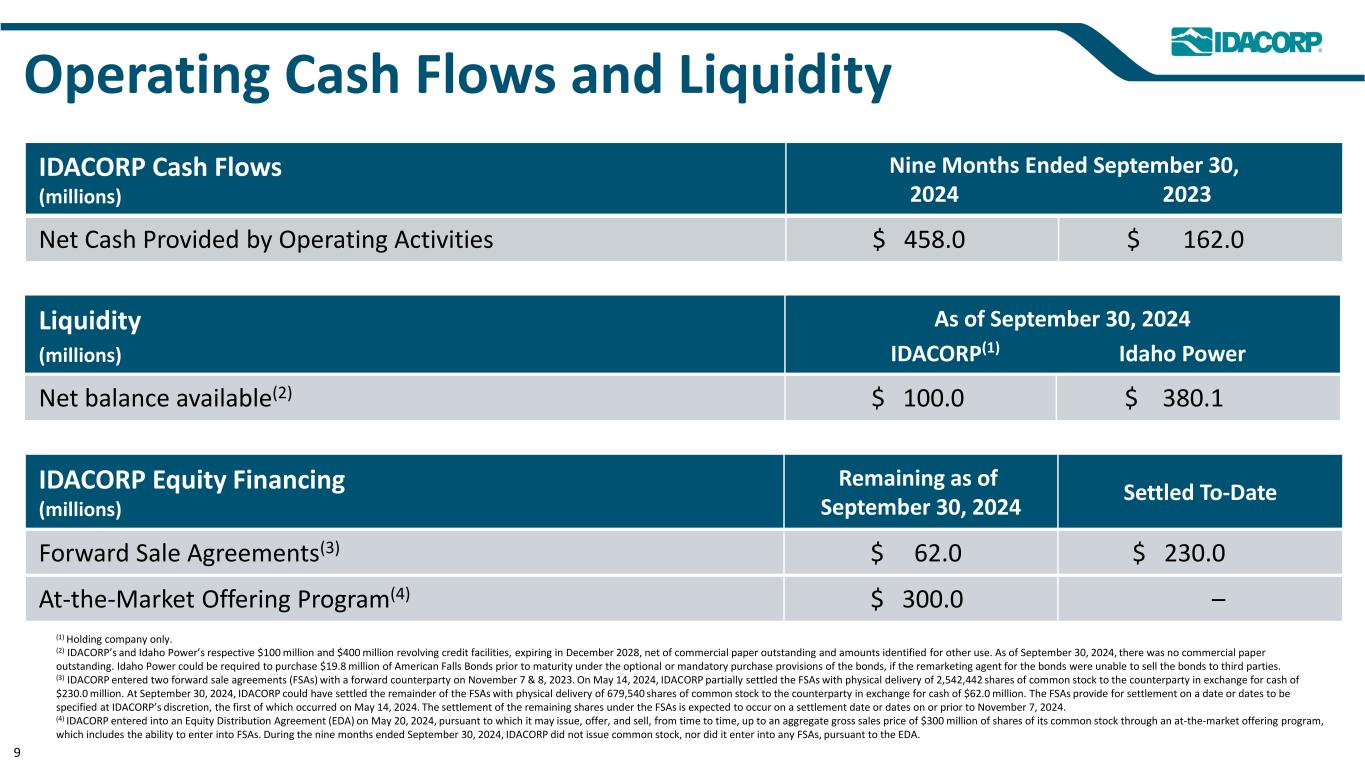

Liquidity (millions) As of September 30, 2024 IDACORP(1) Idaho Power Net balance available(2) $ 100.0 $ 380.1 Operating Cash Flows and Liquidity (1) Holding company only. (2) IDACORP’s and Idaho Power’s respective $100 million and $400 million revolving credit facilities, expiring in December 2028, net of commercial paper outstanding and amounts identified for other use. As of September 30, 2024, there was no commercial paper outstanding. Idaho Power could be required to purchase $19.8 million of American Falls Bonds prior to maturity under the optional or mandatory purchase provisions of the bonds, if the remarketing agent for the bonds were unable to sell the bonds to third parties. (3) IDACORP entered two forward sale agreements (FSAs) with a forward counterparty on November 7 & 8, 2023. On May 14, 2024, IDACORP partially settled the FSAs with physical delivery of 2,542,442 shares of common stock to the counterparty in exchange for cash of $230.0 million. At September 30, 2024, IDACORP could have settled the remainder of the FSAs with physical delivery of 679,540 shares of common stock to the counterparty in exchange for cash of $62.0 million. The FSAs provide for settlement on a date or dates to be specified at IDACORP’s discretion, the first of which occurred on May 14, 2024. The settlement of the remaining shares under the FSAs is expected to occur on a settlement date or dates on or prior to November 7, 2024. (4) IDACORP entered into an Equity Distribution Agreement (EDA) on May 20, 2024, pursuant to which it may issue, offer, and sell, from time to time, up to an aggregate gross sales price of $300 million of shares of its common stock through an at-the-market offering program, which includes the ability to enter into FSAs. During the nine months ended September 30, 2024, IDACORP did not issue common stock, nor did it enter into any FSAs, pursuant to the EDA. 9 IDACORP Cash Flows (millions) Nine Months Ended September 30, 2024 2023 Net Cash Provided by Operating Activities $ 458.0 $ 162.0 IDACORP Equity Financing (millions) Remaining as of September 30, 2024 Settled To-Date Forward Sale Agreements(3) $ 62.0 $ 230.0 At-the-Market Offering Program(4) $ 300.0 –

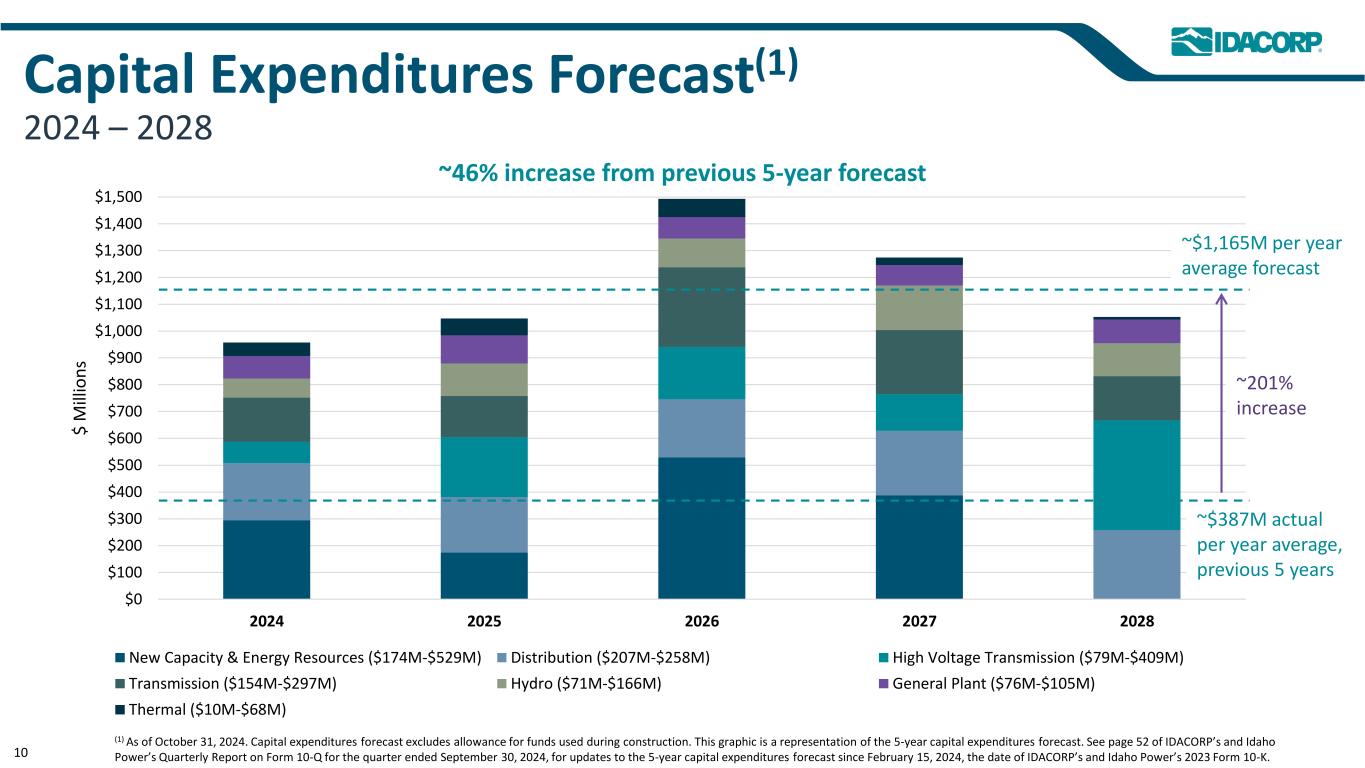

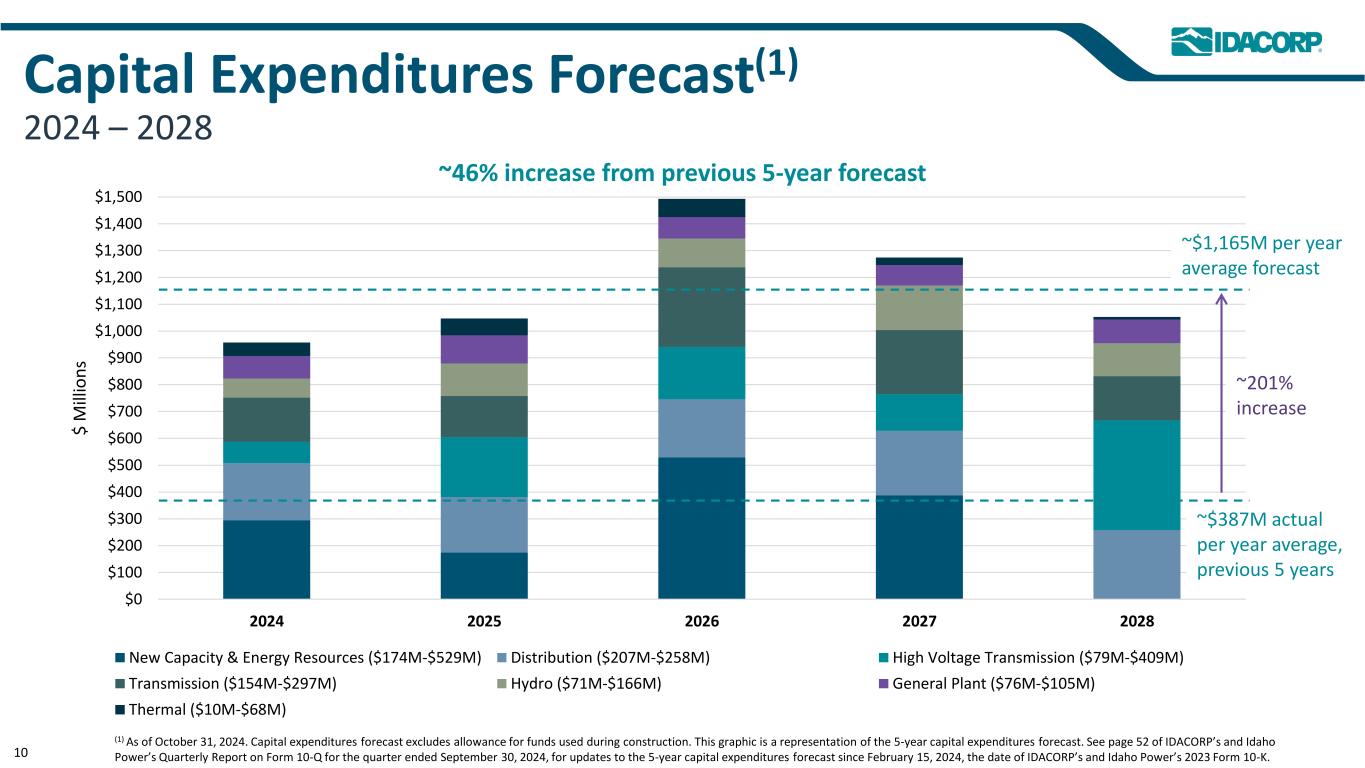

Capital Expenditures Forecast(1) 2024 – 2028 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 2024 2025 2026 2027 2028 $ M ill io n s New Capacity & Energy Resources ($174M-$529M) Distribution ($207M-$258M) High Voltage Transmission ($79M-$409M) Transmission ($154M-$297M) Hydro ($71M-$166M) General Plant ($76M-$105M) Thermal ($10M-$68M) (1) As of October 31, 2024. Capital expenditures forecast excludes allowance for funds used during construction. This graphic is a representation of the 5-year capital expenditures forecast. See page 52 of IDACORP’s and Idaho Power’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, for updates to the 5-year capital expenditures forecast since February 15, 2024, the date of IDACORP’s and Idaho Power’s 2023 Form 10-K. ~46% increase from previous 5-year forecast ~$387M actual per year average, previous 5 years ~201% increase ~$1,165M per year average forecast 10

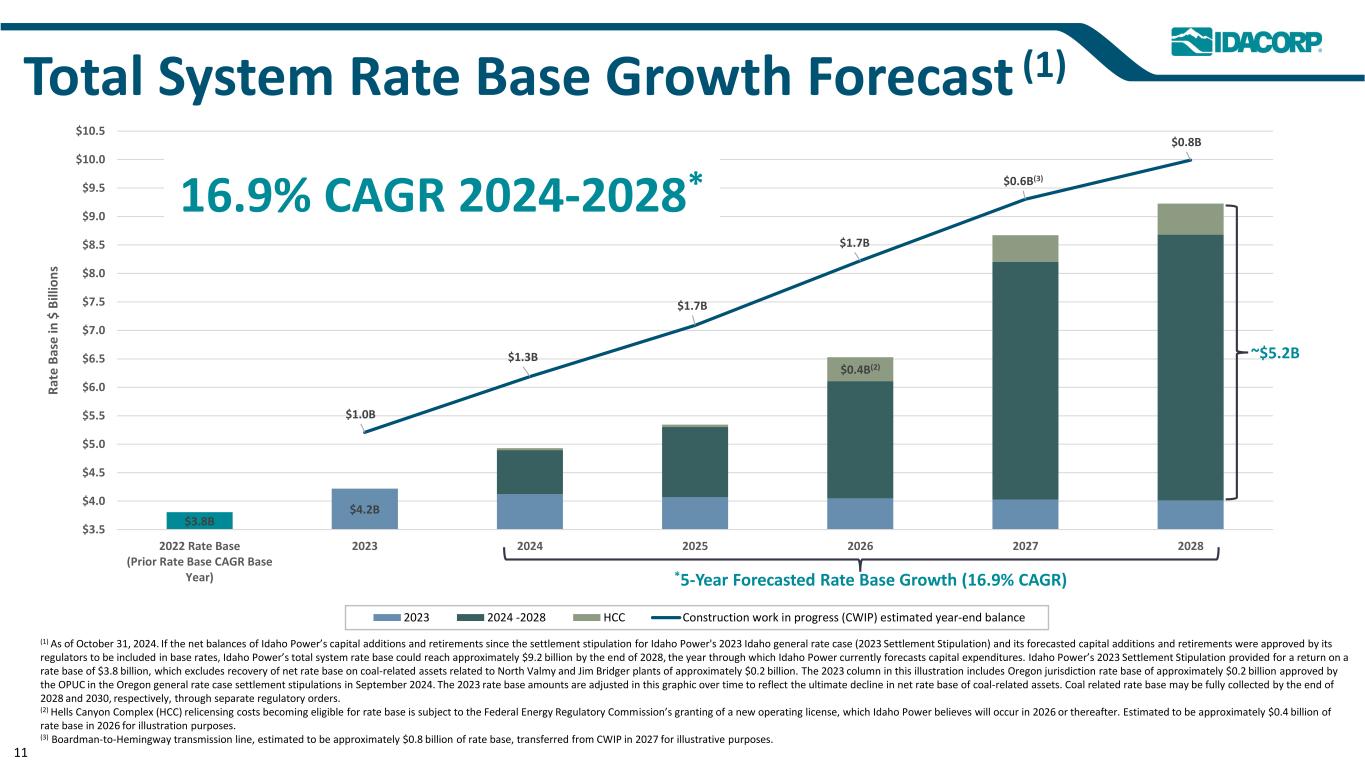

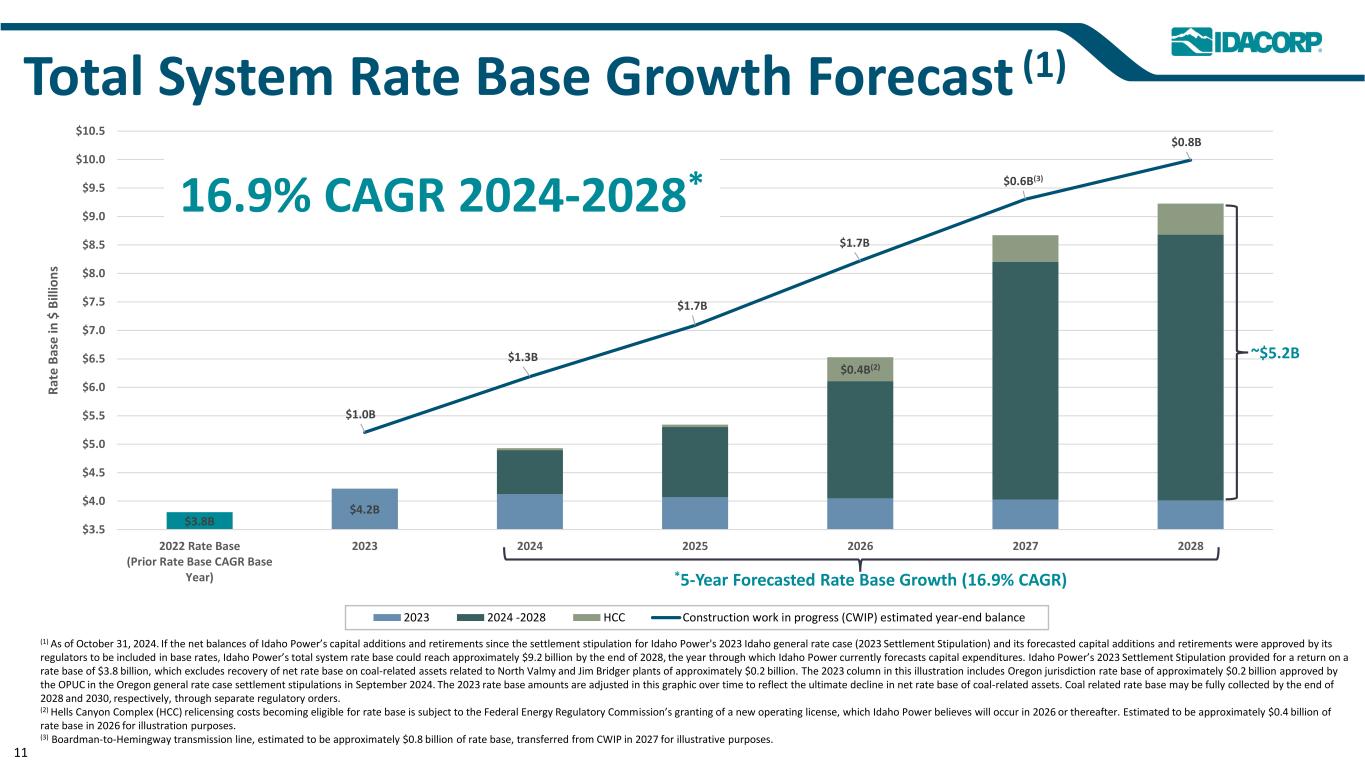

$3.8B $4.2B $0.4B(2) $1.0B $1.3B $1.7B $1.7B $0.6B(3) $0.8B $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 $7.0 $7.5 $8.0 $8.5 $9.0 $9.5 $10.0 $10.5 2022 Rate Base (Prior Rate Base CAGR Base Year) 2023 2024 2025 2026 2027 2028 R at e B as e in $ B ill io n s 2023 2024 -2028 HCC Construction work in progress (CWIP) estimated year-end balance Total System Rate Base Growth Forecast (1) (1) As of October 31, 2024. If the net balances of Idaho Power’s capital additions and retirements since the settlement stipulation for Idaho Power's 2023 Idaho general rate case (2023 Settlement Stipulation) and its forecasted capital additions and retirements were approved by its regulators to be included in base rates, Idaho Power’s total system rate base could reach approximately $9.2 billion by the end of 2028, the year through which Idaho Power currently forecasts capital expenditures. Idaho Power’s 2023 Settlement Stipulation provided for a return on a rate base of $3.8 billion, which excludes recovery of net rate base on coal-related assets related to North Valmy and Jim Bridger plants of approximately $0.2 billion. The 2023 column in this illustration includes Oregon jurisdiction rate base of approximately $0.2 billion approved by the OPUC in the Oregon general rate case settlement stipulations in September 2024. The 2023 rate base amounts are adjusted in this graphic over time to reflect the ultimate decline in net rate base of coal-related assets. Coal related rate base may be fully collected by the end of 2028 and 2030, respectively, through separate regulatory orders. (2) Hells Canyon Complex (HCC) relicensing costs becoming eligible for rate base is subject to the Federal Energy Regulatory Commission’s granting of a new operating license, which Idaho Power believes will occur in 2026 or thereafter. Estimated to be approximately $0.4 billion of rate base in 2026 for illustration purposes. (3) Boardman-to-Hemingway transmission line, estimated to be approximately $0.8 billion of rate base, transferred from CWIP in 2027 for illustrative purposes. 16.9% CAGR 2024-2028* *5-Year Forecasted Rate Base Growth (16.9% CAGR) ~$5.2B 11

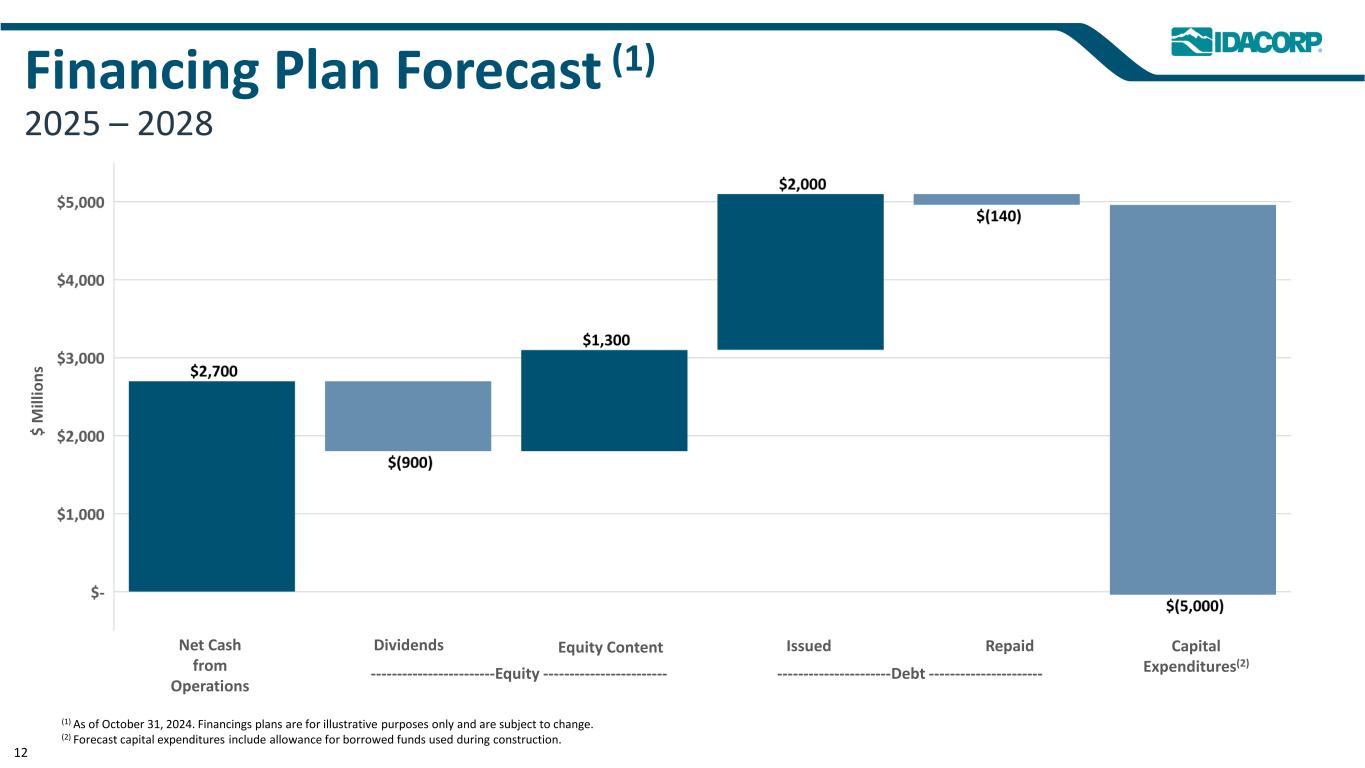

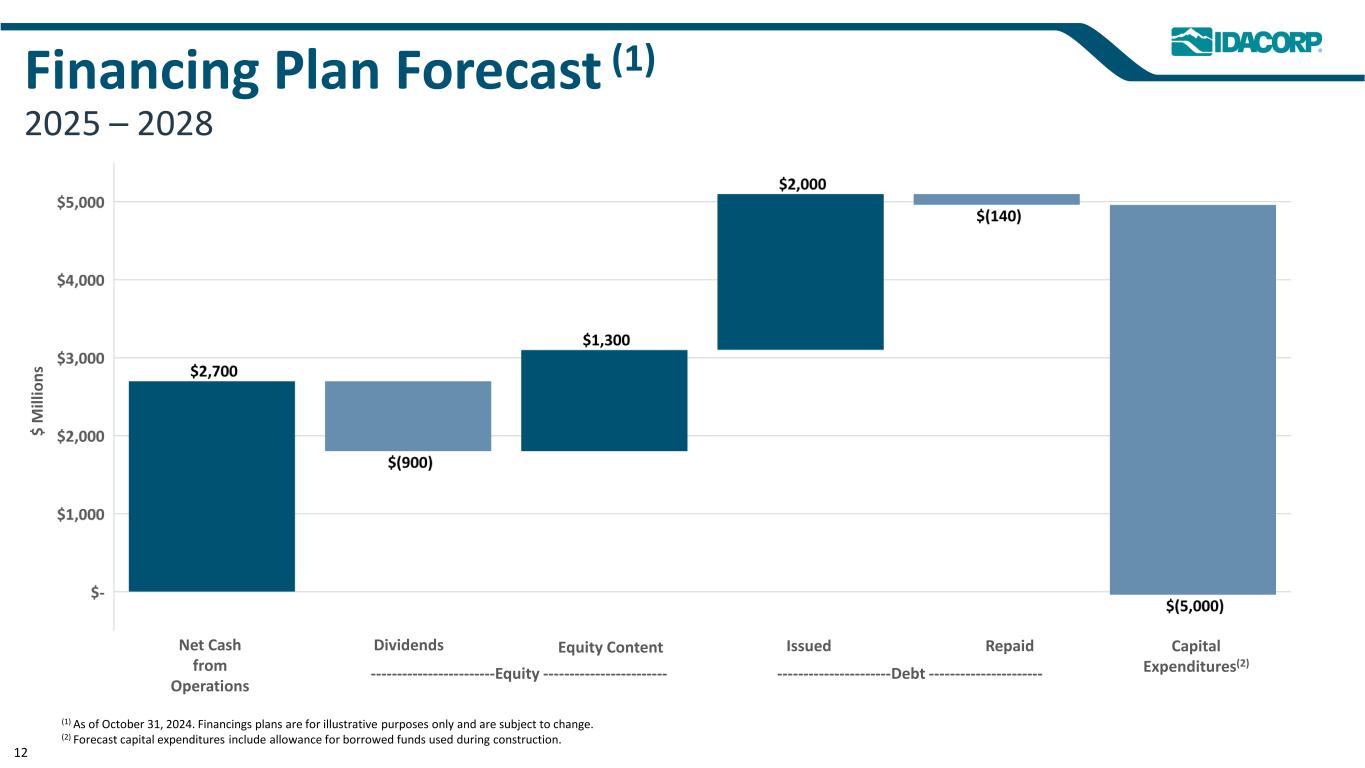

Net Cash from Operations Issued Repaid Capital Expenditures(2) Dividends ----------------------Debt ---------------------- Equity Content ------------------------Equity ------------------------ $ M ill io n s 12 (1) As of October 31, 2024. Financings plans are for illustrative purposes only and are subject to change. (2) Forecast capital expenditures include allowance for borrowed funds used during construction. Financing Plan Forecast (1) 2025 – 2028

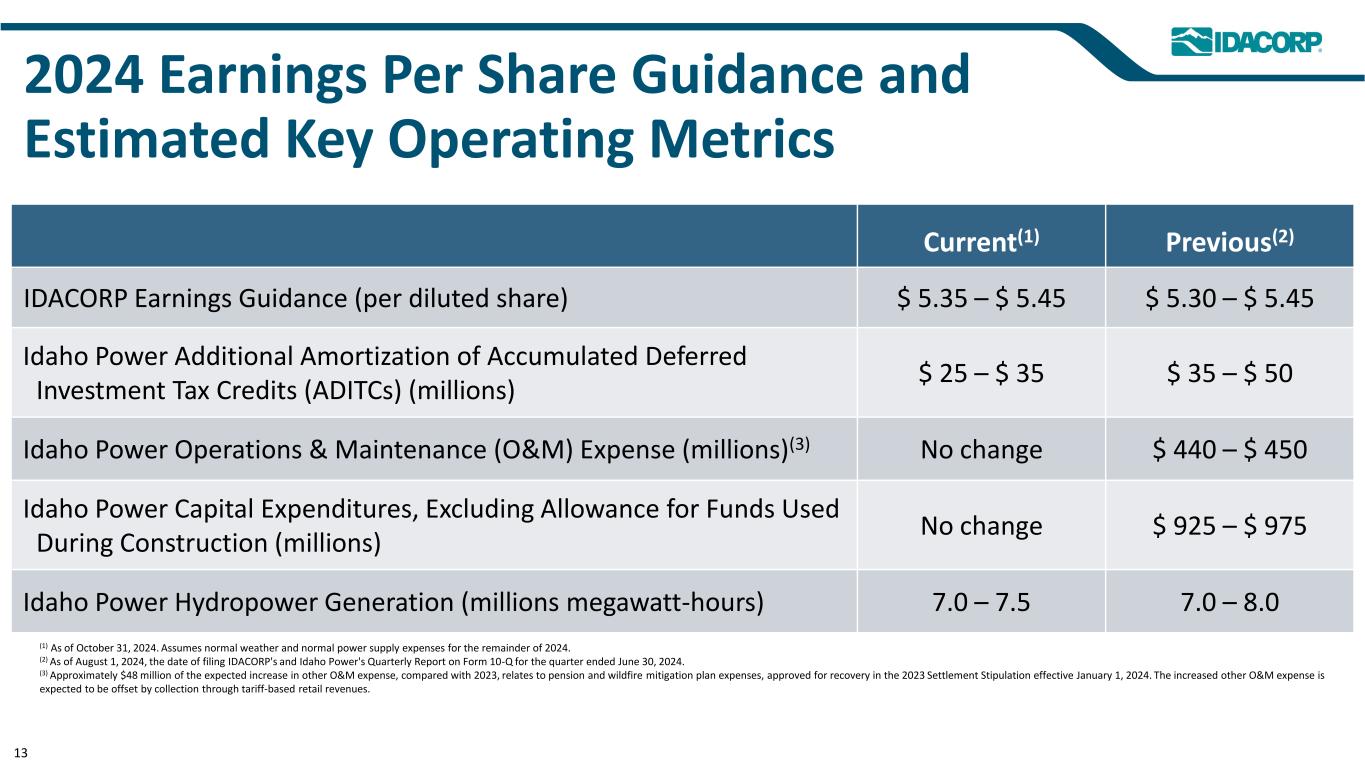

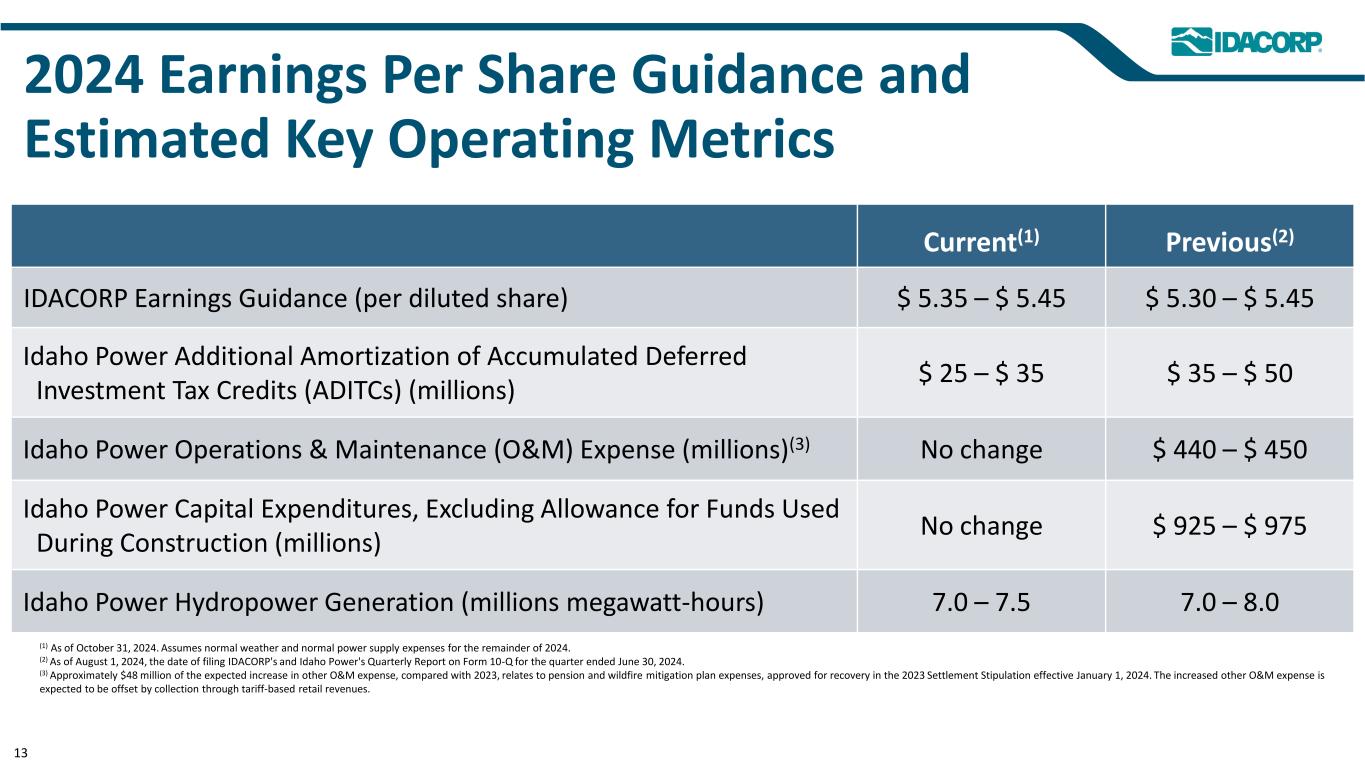

2024 Earnings Per Share Guidance and Estimated Key Operating Metrics Current(1) Previous(2) IDACORP Earnings Guidance (per diluted share) $ 5.35 – $ 5.45 $ 5.30 – $ 5.45 Idaho Power Additional Amortization of Accumulated Deferred Investment Tax Credits (ADITCs) (millions) $ 25 – $ 35 $ 35 – $ 50 Idaho Power Operations & Maintenance (O&M) Expense (millions)(3) No change $ 440 – $ 450 Idaho Power Capital Expenditures, Excluding Allowance for Funds Used During Construction (millions) No change $ 925 – $ 975 Idaho Power Hydropower Generation (millions megawatt-hours) 7.0 – 7.5 7.0 – 8.0 (1) As of October 31, 2024. Assumes normal weather and normal power supply expenses for the remainder of 2024. (2) As of August 1, 2024, the date of filing IDACORP's and Idaho Power's Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. (3) Approximately $48 million of the expected increase in other O&M expense, compared with 2023, relates to pension and wildfire mitigation plan expenses, approved for recovery in the 2023 Settlement Stipulation effective January 1, 2024. The increased other O&M expense is expected to be offset by collection through tariff-based retail revenues. 13

Contact Information Amy I. Shaw Vice President of Finance, Compliance & Risk (208) 388-5611 AShaw@idahopower.com Investors & Analysts Jordan Rodriguez Corporate Communications (208) 388-2460 JRodriguez@idahopower.com Media