Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

MARVELL TECHNOLOGY GROUP LTD.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

MARVELL TECHNOLOGY GROUP LTD.

[*], 2010

Dear Fellow Shareholders:

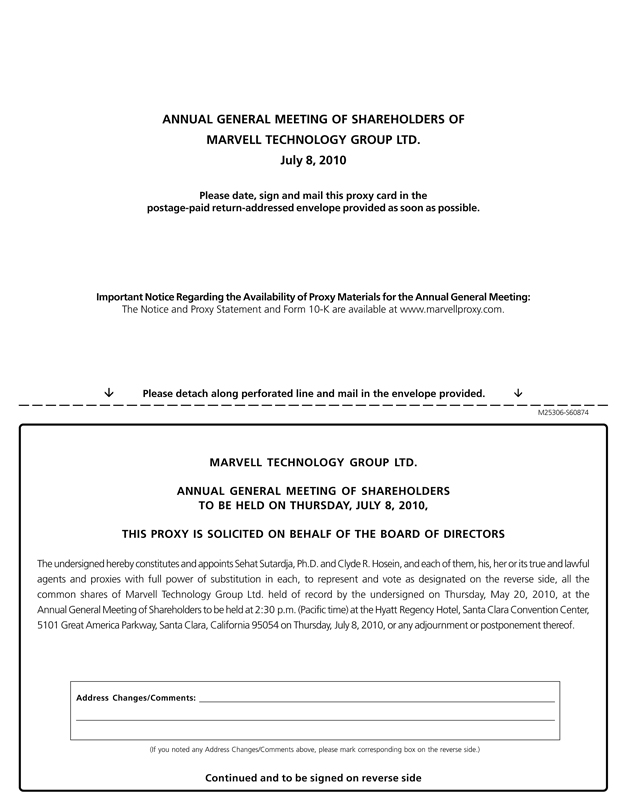

You are cordially invited to attend the 2010 annual general meeting of shareholders of Marvell Technology Group Ltd., a Bermuda company, scheduled to be held at the Hyatt Regency Hotel, Santa Clara Convention Center, 5101 Great America Parkway, Santa Clara, California 95054, on Thursday, July 8, 2010 at 2:30 p.m. Pacific time.

As described in the accompanying notice of annual general meeting of shareholders and proxy statement, shareholders will be asked to (1) vote on the election of two Class 1 directors; (2) approve an amendment to Bye-Law 12 of our Second Amended and Restated Bye-Laws (the “Existing Bye-Laws”) to provide for the declassification of our board of directors, which shall be phased-in over a period of three years, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year; (3) approve an amendment to Bye-Law 44 of the Existing Bye-Laws relating to our majority voting provisions in relation to the election of directors; (4) approve the Executive Performance Incentive Plan in order to provide for future bonus awards to certain key executives that are deductible under Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended; (5) approve an amendment to the Amended and Restated 1995 Stock Option Plan, as amended, to enable awards under the plan that comply with the exemptions from the deduction limitations imposed under Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, and make changes to reduce the amount of the annual evergreen; and (6) re-appoint PricewaterhouseCoopers LLP as our auditors and independent registered public accounting firm, and authorize the audit committee, acting on behalf of our board of directors, to fix the remuneration of the auditors and independent registered public accounting firm, in both cases for our fiscal year ending January 29, 2011. Directors and executive officers will be present at the annual general meeting to respond to any questions that our shareholders may have regarding the business to be transacted.

Your vote is important, regardless of the number of shares you own. Whether or not you plan to attend the annual general meeting in person, it is important that your shares be represented and voted at the meeting. After reading the accompanying notice and proxy statement, please submit your proxy or voting instructions. If you attend the meeting in person, by following the proper procedures, you may revoke your proxy and vote your shares in person.

All shareholders of record on May 20, 2010 are invited to attend the meeting. Only shareholders and persons holding proxies from shareholders may attend the annual general meeting. If you are a shareholder of record, please bring a form of personal identification to be admitted to the meeting. If your shares are held in the name of your broker, bank or other nominee and you plan to attend the meeting, you must present proof of your ownership of those shares as of the record date, such as a bank or brokerage account statement or letter, together with a form of personal identification, to be admitted to the meeting.

On behalf of our board of directors and all of our employees, I wish to thank you for your continued support.

Sincerely,

DR. SEHAT SUTARDJA

Chairman of the Board,

President and Chief Executive Officer

Table of Contents

MARVELL TECHNOLOGY GROUP LTD.

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON July 8, 2010

The 2010 annual general meeting of shareholders of Marvell Technology Group Ltd., a Bermuda company, is scheduled to be held on July 8, 2010, at 2:30 p.m. Pacific time. The annual general meeting of shareholders (the “annual general meeting”) will take place at the Hyatt Regency Hotel, Santa Clara Convention Center, 5101 Great America Parkway, Santa Clara, California 95054.

The purposes of the annual general meeting are:

1. To elect two Class 1 directors, who will hold office for a three-year term until the 2013 annual general meeting of shareholders or until their respective successors are duly elected and qualified;

2. To approve an amendment to Bye-Law 12 of the Second Amended and Restated Bye-Laws (the “Existing Bye-Laws”) to provide for the declassification of our board of directors, which shall be phased-in over a period of three years, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year;

3. To approve an amendment to Bye-Law 44 of the Existing Bye-Laws relating to our majority voting provisions in relation to the election of directors;

4. To approve the Executive Performance Incentive Plan in order to provide for future bonus awards to certain key executives that are deductible under Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended;

5. To approve an amendment to the Amended and Restated 1995 Stock Option Plan, as amended, to enable awards under the plan that comply with the exemptions from the deduction limitations imposed under Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended, and make changes to reduce the amount of the annual evergreen; and

6. To re-appoint PricewaterhouseCoopers LLP as our auditors and independent registered public accounting firm, and authorize the audit committee, acting on behalf of our board of directors, to fix the remuneration of the auditors and independent registered public accounting firm, in both cases for our fiscal year ending January 29, 2011.

If other matters properly come before the annual general meeting or any adjournment or postponement thereof, the persons named in the proxy card will vote the shares represented by all properly executed proxies in their discretion.

We will also lay before the meeting our audited financial statements for the fiscal year ended January 30, 2010 pursuant to the provisions of the Companies Act 1981 of Bermuda, as amended, and the Existing Bye-Laws as currently in effect.

The foregoing items of business are more fully described in the proxy statement accompanying this notice of annual general meeting. None of the proposals requires the approval of any other proposal to become effective.

We have established the close of business on May 20, 2010 as the record date for determining those shareholders entitled to notice of and to vote at the annual general meeting or any adjournment or postponement thereof. Only holders of common shares, par value $0.002 per share, as of the record date are entitled to notice of and to vote at the annual general meeting and any adjournment or postponement thereof. Execution of a proxy will not in any way affect your right to attend the annual general meeting and vote in person, and any person giving a proxy has the right to revoke it at any time before it is exercised. If you attend the meeting and desire to vote in person, your proxy will not be used.

Table of Contents

Your attention is directed to the accompanying proxy statement. Whether or not you plan to attend the annual general meeting in person, it is important that your shares be represented and voted at the annual general meeting.For specific voting instructions, please refer to the information provided in the following proxy statement, together with your proxy card or the voting instructions you receive by mail, e-mail or that are provided via the Internet.

This notice incorporates the accompanying proxy statement.

BY ORDER OF THE BOARD OF DIRECTORS

DR. SEHAT SUTARDJA

Chairman of the Board of Directors,

President and Chief Executive Officer

Santa Clara, California

[*], 2010

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE 2010 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 8, 2010.

Our Proxy Statement for the 2010 Annual General Meeting of Shareholders, a Letter from our Chairman

and our Annual Report on Form 10-K for the fiscal year ended January 30, 2010 are available at

http://www.marvellproxy.com.

If you have any questions, or have any difficulty voting your shares, please contact our Legal Department at (408) 222-2500.

Table of Contents

Table of Contents

MARVELL TECHNOLOGY GROUP LTD.

Canon’s Court

22 Victoria Street

Hamilton HM 12

Bermuda

PROXY STATEMENT

FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

July 8, 2010

These proxy materials are furnished in connection with the solicitation by the board of directors of Marvell Technology Group Ltd., a Bermuda company, of proxies for use at our 2010 annual general meeting of shareholders (referred to herein as the “annual general meeting” or the “meeting”) scheduled to be held at 2:30 p.m. Pacific time on July 8, 2010 at the Hyatt Regency Hotel, Santa Clara Convention Center, 5101 Great America Parkway, Santa Clara, California 95054.

INFORMATION REGARDING THE ANNUAL GENERAL MEETING

General

This proxy statement has information about the meeting and was prepared by our management for Marvell Technology Group Ltd.’s board of directors. The proxy materials are being mailed on or about [*], 2010. No member of our board of directors is opposing any of the actions for which your vote is being solicited.

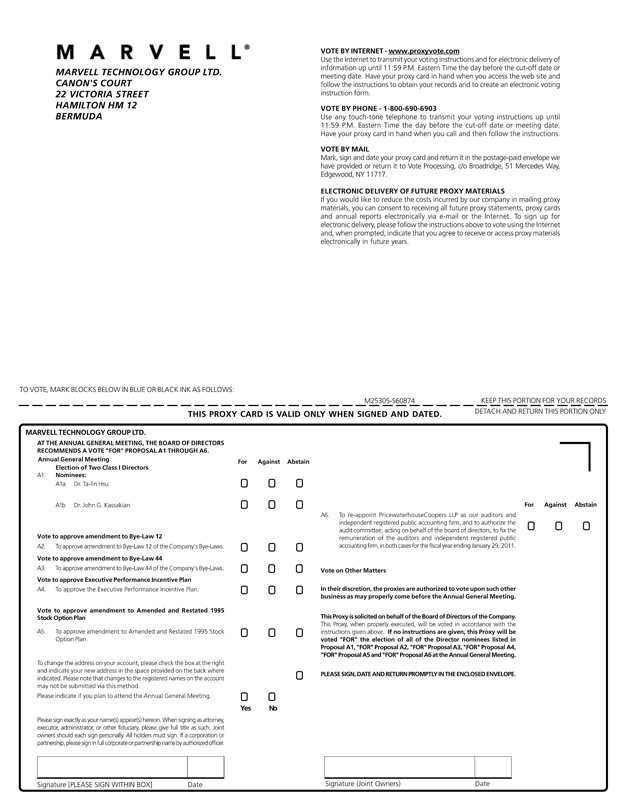

Your board of directors asks you to appoint Sehat Sutardja, Ph.D., our Chairman, President and Chief Executive Officer, and Clyde R. Hosein, our Chief Financial Officer and Secretary, as your proxy holders to vote your shares at the meeting. You make this appointment by properly completing the enclosed proxy as described below. If appointed by you, your shares represented by a properly completed proxy received by us will be voted at the meeting in the manner specified therein or, if no instructions are marked on the proxy, your shares will be voted as described below. Although management does not know of any other matter to be acted upon at the meeting, unless contrary instructions are given, shares represented by valid proxies will be voted by the persons named on the accompanying proxy card in the manner the proxy holders deem appropriate for any other matters that may properly come before the meeting.

We maintain our registered office in Bermuda at Canon’s Court, 22 Victoria Street, Hamilton HM 12, Bermuda. Our telephone number in Bermuda is (441) 296-6395. The mailing address of our business offices in Bermuda is Argyle House, 41A Cedar Avenue, Hamilton, HM 12, Bermuda.

Record Date and Shares Outstanding

The record date for the annual general meeting has been set as the close of business on May 20, 2010. Only shareholders of record as of such date will be entitled to notice of and to vote at the meetings. On the record date, there were [*] issued common shares, par value $0.002 per share (“common shares”). Each issued common share is entitled to one vote on the proposals to be voted on at the meeting. Shares held as of the record date include common shares that are held directly in your name as the shareholder of record and those shares held for you as a beneficial owner through a broker, bank or other nominee.

In this proxy statement, we sometimes refer to our group holding company, Marvell Technology Group Ltd., as “we,” “our,” “Marvell” or the “Company.” In this proxy statement, we refer to the fiscal year ended January 27, 2007 as fiscal 2007, the fiscal year ended February 2, 2008 as fiscal 2008, the fiscal year ended January 31, 2009 as fiscal 2009, the fiscal year ended January 30, 2010 as fiscal 2010 and the fiscal year ending January 29, 2011 as fiscal 2011.

1

Table of Contents

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL GENERAL MEETING

Q: What proposals will be considered at the meeting?

A: The specific proposals to be considered and acted upon at the annual general meeting are summarized in the accompanying Notice of Annual General Meeting of Shareholders and include (1) the election of two Class 1 directors, who will hold office for a three-year term until the 2013 annual general meeting of shareholders or until their successors are duly elected and qualified (see “Proposal No. 1 — Election of Directors” at page 8 of this proxy statement); (2) the approval of an amendment to Bye-Law 12 of our Second Amended and Restated Bye-Laws (the “Existing Bye-Laws”) to provide for the declassification of our board of directors, which shall be phased-in over a period of three years, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year (see “Proposal No. 2 — Approval of an Amendment to Bye-Law 12 of the Existing Bye-Laws” at page 44 of this proxy statement); (3) the approval of an amendment to Bye-Law 44 of our Existing Bye-Laws relating to our majority voting provisions in relation to the election of directors (see “Proposal No. 3 — Approval of an Amendment to Bye-Law 44 the Existing Bye-Laws” at page 46 of this proxy statement); (4) the approval of the Executive Performance Incentive Plan (the “Incentive Plan”) in order to provide for future bonus awards to certain key executives that are deductible under Section 162(m) of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) (see “Proposal No. 4 — Approval of the Executive Performance Incentive Plan” at page 47 of this proxy statement); (5) the approval of an amendment to the Amended and Restated 1995 Stock Option Plan, as amended (the “1995 Plan”), to enable awards under the plan that comply with the exemptions from the deduction limitations imposed under Section 162(m) of the Code (“Section 162(m)”), and make changes to reduce the amount of the annual evergreen (see “Proposal No. 5 — Approval of Amendment to the Amended and Restated 1995 Stock Option Plan” at page 51 of this proxy statement); and (6) the re-appointment of PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) as our auditors and independent registered public accounting firm, and authorization of the audit committee, acting on behalf of our board of directors, to fix the remuneration of the auditors and independent registered public accounting firm, in both cases for our fiscal year ending January 29, 2011 (see “Proposal No. 6 — Re-appointment of Auditors and Independent Registered Public Accounting Firm, and Authorization of the Audit Committee to Fix Remuneration” at page 59 of this proxy statement).

Attached to this proxy statement, asAnnex A is the text of the Third Amended and Restated Bye-Laws (the “Amended Bye-Laws”), which have been approved by our board of directors and will replace the Existing Bye-Laws if both Proposal No. 2 and Proposal No. 3 are approved by shareholders. If only one of such proposals is approved, this will be reflected in the final version of the Amended Bye-Laws. If neither proposal is approved, the Existing Bye-Laws will continue to govern our corporate actions.

If any other matters properly come before the meeting or any adjournment or postponement of the meeting, the persons named in the proxy card will vote the shares represented by all properly executed proxies in their discretion.

In addition, in accordance with Section 84 of the Companies Act 1981 of Bermuda, as amended (the “Companies Act”), and Bye-Law 73 of the Existing Bye-Laws, our audited financial statements for the fiscal year ended January 30, 2010 will be presented at the annual general meeting. These statements have been approved by our board of directors. There is no requirement under Bermuda law that these statements be approved by shareholders, and no such approval will be sought at the meeting.

Q: How does the board of directors recommend that I vote on the proposals?

A: At the annual general meeting, our board of directors unanimously recommends our shareholders vote:

| 1. | FOR the election of two Class 1 director nominees listed in Proposal No. 1, who will hold office for a three-year term until the 2013 annual general meeting of shareholders or until their respective successors are duly elected and qualified (see Proposal No. 1); |

2

Table of Contents

| 2. | FOR the approval of the amendment to Bye-Law 12 of our Existing Bye-Laws to provide for the declassification of our board of directors, which shall be phased-in over a period of three years, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year (see Proposal No. 2); |

| 3. | FOR the approval of the amendment to Bye-Law 44 of our Existing Bye-Laws relating to our majority voting provisions in relation to the election of directors (see Proposal No. 3); |

| 4. | FOR the approval of the Incentive Plan in order to provide for future bonus awards to certain key executives that are deductible under Section 162(m) (see Proposal No. 4); |

| 5. | FOR the approval of the amendment to the 1995 Plan to enable awards under the plan that comply with the exemptions from the deduction limitations imposed under Section 162(m), and make changes to reduce the amount of the annual evergreen (see Proposal No. 5); and |

| 6. | FOR the re-appointment of PricewaterhouseCoopers as our auditors and independent registered public accounting firm, and authorization of the audit committee, acting on behalf of our board of directors, to fix the remuneration of the auditors and independent registered public accounting firm, in both cases for our fiscal year ending January 29, 2011 (see Proposal No. 6). |

If other matters properly come before the annual general meeting or any adjournment or postponement thereof, the persons named in the proxy card will vote the shares represented by all properly executed proxies in their discretion.

Q: Who can vote?

A: The record date for the annual general meeting has been set as the close of business on May 20, 2010. Only shareholders of record as of such date will be entitled to notice of and to vote at the meeting. On the record date, there were [*] issued common shares. Each issued common share is entitled to one vote on the proposals to be voted on at the meeting. Shares held as of the record date include common shares that are held directly in your name as the shareholder of record and those shares held for you as a beneficial owner through a broker, bank or other nominee.

Q: What should I do now to vote?

A: You may vote your shares either by voting in person at the meeting or by submitting a completed proxy. The meeting will take place on July 8, 2010. After carefully reading and considering the information contained in this proxy statement including the documents attached hereto as annexes, please follow the instructions as summarized below depending on whether you are a shareholder of record or the beneficial owner of shares held in “street name.” Most of our shareholders hold their shares through a broker, bank or other nominee in “street name” rather than directly in their own name. As summarized below, there are some distinctions between the procedures for voting shares held of record and those owned beneficially.

Q: If I am a shareholder of record, how do I vote my shares?

A: If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered the shareholder of record with respect to those shares and the proxy materials have been sent directly to you. Follow the instructions on the enclosed proxy card for each proposal to be considered at the meeting. You may submit a proxy via the Internet or by telephone or by signing and dating the proxy card and mailing it in the addressed, postage pre-paid envelope provided (to which no postage need be affixed if mailed in the United States). The proxy holders named on the proxy card will vote your shares as you instruct. Please be aware that if you issue a proxy or give voting instructions over the Internet or by telephone, you may incur costs such as Internet access and telephone charges for which you will be responsible.

3

Table of Contents

Q: If my shares are held in “street name” by my broker, how do I vote my shares?

A: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and the proxy materials will either be forwarded to you by your broker, bank or other nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you must direct your broker, bank or other nominee on how to vote. If Internet or telephone voting is available to you, you can find voting instructions in the materials sent to you. If, however, you have elected to receive paper copies of our proxy materials from your broker, bank or other nominee, you will receive a voting instruction form. Please complete and return the enclosed voting instruction form and mail it in the addressed, postage pre-paid envelope provided (to which no postage need be affixed if mailed in the United States). Please be aware that if you issue a proxy or give voting instructions over the Internet or by telephone, you may incur costs such as Internet access and telephone charges for which you will be responsible.

Q: What happens if I do not cast a vote?

A: Many of our shareholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholders of record — If you are a shareholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the annual general meeting. However, if you sign and return the proxy card with no further instructions, your shares will be voted as set forth in the answer to the following question. With regard to the matters scheduled to come before the annual general meeting, a shareholder may also abstain from voting. An “abstention” occurs when a shareholder sends in a proxy with explicit instructions to decline to vote regarding a particular matter. Abstentions votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. However, abstentions are not considered negative votes under the Companies Act and the Existing Bye-Laws, and as such will not affect the calculation of the requisite vote with respect to any of the proposals at this year’s annual general meeting.

Beneficial owners — If you hold your shares in “street name” it is critical that you cast your vote if you want it to count in the election of directors (Proposal No. 1). The term “broker non-vote” refers to shares held by a broker or other nominee (for the benefit of its client) that are represented at the meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal and does not have discretionary authority to vote on that proposal. Brokers and nominees do not have discretionary voting authority on certain non-routine matters and accordingly may not vote on such matters absent instructions from the beneficial holder. If you hold your shares in “street name” or through a broker it is important that you give your broker your voting instructions.

In the past, if you held your shares in street name and you did not indicate how you wanted your shares voted in the election of directors, your broker, bank or other nominee was allowed to vote those shares on your behalf in the election of directors as they felt appropriate. Recent changes in regulation were made to take away the ability of your broker, bank or other nominee to vote your uninstructed shares in the election of directors on a discretionary basis. Thus, if you hold your shares in “street name” and you do not instruct your broker bank or other nominee how to vote in the election of directors, no votes will be cast on your behalf.

The proposals at the annual general meeting to amend the 1995 Plan (Proposal No. 5) and to approve the appointment of PricewaterhouseCoopers as our auditors and independent registered public accounting firm for the year ending January 29, 2011, and to authorize our board of directors to determine the auditors’ remuneration (Proposal No. 6) are considered routine matters for which brokerage firms may vote unvoted shares. The election of directors (Proposal No. 1) and the proposals to amend Bye-Law 12 (Proposal No. 2), to amend Bye-Law 44 (Proposal No. 3) and to approve the Incentive Plan (Proposal No. 4) are not considered routine matters for which brokerage firms may vote unvoted shares and it is important to us that you affirmatively vote for Proposal No. 1 through Proposal No.4.

4

Table of Contents

Q: How will my shares be voted by the proxy?

A: If you sign and return the proxy card but do not vote on a proposal, the proxy holders will vote for you on that proposal. Unless you instruct otherwise on the proxy card, the proxy holders will vote in the manner set forth below:

| 1. | FOR the election of two Class 1 director nominees listed in Proposal No. 1, who will hold office for a three-year term until the 2013 annual general meeting of shareholders or until their respective successors are duly elected and qualified (see Proposal No. 1); |

| 2. | FOR the approval of the amendment to Bye-Law 12 of the Existing Bye-Laws to provide for the declassification of our board of directors, which shall be phased-in over a period of three years, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year (see Proposal No. 2); |

| 3. | FOR the approval of the amendment to Bye-Law 44 of the Existing Bye-Laws relating to our majority voting provisions in relation to the election of directors (see Proposal No. 3); |

| 4. | FOR the approval of the Incentive Plan in order to provide for future bonus awards to certain key executives that are deductible under Section 162(m) (see Proposal No. 4); |

| 5. | FOR the approval of the amendment to the 1995 Plan to enable awards under the plan that comply with the exemptions from the deduction limitations imposed under Section 162(m), and make changes to reduce the amount of the annual evergreen (see Proposal No. 5); and |

| 6. | FOR the re-appointment of PricewaterhouseCoopers as our auditors and independent registered public accounting firm, and authorization of the audit committee, acting on behalf of our board of directors, to fix the remuneration of the auditors and independent registered public accounting firm, in both cases for our fiscal year ending January 29, 2011 (see Proposal No. 6). |

If other matters properly come before the annual general meeting or any adjournment or postponement thereof, the persons named in the proxy card will vote the shares represented by all properly executed proxies in their discretion.

Q: How are votes counted?

A: Each share will be entitled to one vote. There is no cumulative voting in the election of directors. All votes will be tabulated by the inspector of election appointed for the meeting, who will count the votes, determine the existence of a quorum, validity of proxies and ballots, and certify the results of the voting.

Q: What if I plan to attend the meeting in person?

A: To help ensure your shares are voted, we recommend that you submit your proxy or voting instruction form anyway. If you are a shareholder of record, please bring a form of personal identification to be admitted to the meeting. If your shares are held in the name of your broker, bank or other nominee and you plan to attend the meeting, you must present proof of your ownership of those shares as of the record date, such as a bank or brokerage account statement or letter, together with a form of personal identification, to be admitted to the meeting.

Q: How can I change or revoke my vote after I grant my proxy?

A: Subject to any rules your broker, bank or other nominee may have, you may change your proxy instructions at any time before your proxy is voted at the annual general meeting.

Shareholders of record — If you are a shareholder of record, you may change your vote by (1) delivering a written notice of revocation or a duly executed proxy card to the Secretary of Marvell at Argyle House, 41A Cedar Avenue, Hamilton, HM 12, Bermuda, prior to the commencement of the meeting, in either case dated later than the prior proxy relating to the same shares, or (2) attending the annual general meeting and voting in person (although attendance at the annual general meeting will not, by itself, revoke a proxy). Any written notice of

5

Table of Contents

revocation or subsequent proxy card must be received by our Secretary prior to the taking of the vote at the annual general meeting.

Beneficial owners — If you are a beneficial owner of shares held in “street name,” you may change your vote (1) by submitting new voting instructions to your broker, bank or other nominee, or (2) if you have obtained, from the broker, bank or other nominee who holds your shares, a legal proxy giving you the right to vote the shares, by attending the annual general meeting and voting in person.

In addition, a shareholder of record or a beneficial owner who has voted via the Internet or by telephone may also change his, her or its vote by making a timely and valid later Internet or telephone vote no later than 11:59 p.m. Eastern time the day before the annual general meeting.

Q: Are proxy materials available on the Internet?

A: The U.S. Securities and Exchange Commission (the “SEC”) has adopted rules to allow proxy materials to be posted on the Internet and to provide only a Notice of Internet Availability of Proxy Materials to shareholders. For this proxy statement, we have chosen to follow the SEC’s full set delivery option, and therefore, although we are posting this proxy statement online, we are also mailing a full set of our proxy materials to our shareholders.The proxy materials, including this proxy statement, are available at www.marvellproxy.com.

Q: What if other matters come up at the meeting?

A: The matters described in this proxy statement are the only matters that we know will be voted on at the meeting. If other matters are properly presented and you have executed a proxy, the proxy holders will vote your shares in the manner the proxy holders deem appropriate.

Q: What quorum is required for action at the meeting?

A: The presence, in person or by proxy, of two or more persons holding at least a majority of the voting power of the shares issued and entitled to vote is necessary to constitute a quorum at the meeting. Abstentions and broker non-votes are counted for the purpose of determining the presence or absence of a quorum for the transaction of business. In the event there are not sufficient shares present for a quorum at the time of the annual general meeting, the annual general meeting will stand adjourned for one week or otherwise as may be determined by our board of directors in accordance with our Existing Bye-Laws in order to permit the further solicitation of proxies.

Q: What vote is required to approve each proposal?

A: The nominees for director receiving the affirmative vote of a simple majority of the votes cast in person or by proxy at the annual general meeting will be elected. The approval of the amendments to Bye-Law 12 and Bye-Law 44 of the Existing Bye-Laws, the Incentive Plan, the amendment to the 1995 Plan and the appointment of PricewaterhouseCoopers as our auditors and independent registered public accounting firm for the year ending January 29, 2011, and authorization of our board of directors to determine the auditors’ remuneration each requires the affirmative vote of a simple majority of the votes cast in person or by proxy at the annual general meeting in order to be approved. Abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on the outcome of the nominees or proposals.

Q: Does any shareholder own a majority of Marvell’s shares?

A: No.

Q: What does it mean if I receive more than one set of proxy materials?

A: If you receive more than one set of proxy materials, it means that you have multiple accounts with brokers or our transfer agent. Please vote all of these shares. We encourage you to have all your shares registered in the same name and address. You may do this by contacting your broker or the transfer agent.

6

Table of Contents

Q: May shareholders ask questions at the annual general meeting?

A: Yes. Representatives of Marvell will answer shareholders’ questions of general interest following the formal agenda of the annual general meeting. In order to give a greater number of shareholders an opportunity to ask questions, individuals or groups will be allowed to ask only one question and no repetitive or follow-up questions will be permitted.

Q: Who is making and paying for this proxy solicitation?

A: This proxy is solicited on behalf of our board of directors. We will pay the cost of distributing this proxy statement and related materials. We have hired Georgeson, Inc. to assist in the distribution of proxy materials and the solicitation of proxies for an initial fee estimated at $10,000, plus an additional fee per shareholder for shareholder solicitations. We will bear the cost of soliciting proxies. We will also reimburse brokers for their reasonable out-of-pocket expenses for forwarding proxy materials to beneficial owners of shares or other persons for whom they hold shares. To the extent necessary in order to ensure sufficient representation at its meeting, we or the proxy solicitor may solicit the return of proxies by personal interview, mail, telephone, facsimile, Internet or other means of electronic transmission. The extent to which this will be necessary depends upon how promptly proxies are returned. We urge you to send in your proxy without delay.

Q: How can I find out the results of the voting at the annual general meeting?

A: Preliminary voting results will be announced at the meeting. Final voting results will be published in our Current Report on Form 8-K filed with the SEC within four business days of the meeting. If the final voting results are not available within four business days after the meeting, we will provide the preliminary results in the Form 8-K and the final results in an amendment to the Form 8-K within four business days after the final voting results are known to us.

Q: Whom should I call if I have questions about the annual general meeting?

A: You should contact either of the following:

Jeff Palmer

Vice President, Investor Relations

Marvell Semiconductor, Inc.

5488 Marvell Lane

Santa Clara, CA 95054

Fax: (408) 222-1917

Phone: (408) 222-8373

or

The proxy solicitor:

Georgeson, Inc.

199 Water Street, 26th Floor

New York, NY 10038

Fax: (212) 440-9009

Phone: (212) 440-9800

or toll-free (within the United States) (866) 729-6811

PRESENTATION OF FINANCIAL STATEMENTS

In accordance with Section 84 of the Companies Act and Bye-Law 73 of the Existing Bye-Laws, our audited financial statements for the fiscal year ended January 30, 2010 will be presented at the annual general meeting. These statements have been approved by our board of directors. There is no requirement under Bermuda law that these statements be approved by shareholders, and no such approval will be sought at the meeting.

7

Table of Contents

ELECTION OF CLASS 1 DIRECTORS

Nominees

The Existing Bye-Laws provide for not less than two directors or such number in excess thereof as our board of directors may determine. The number of directors is currently fixed at seven and there are currently seven members serving on our board of directors.

Our board of directors is currently divided into three classes, with Class 1 having two members, Class 2 having three members and Class 3 having two members. One class of our board of directors is elected by the shareholders each year. Each class serves staggered three-year terms, which means that as a general matter only one class of directors is elected at each annual general meeting of shareholders with the other classes continuing for the remainder of their respective terms. At the annual general meeting, shareholders will be asked to vote on the election of two Class 1 directors. The nominees for Class 1 director elected at the annual general meeting will hold office for a three-year term until the 2013 annual general meeting of shareholders or until their successors are duly elected and qualified. Directors may only be removed for cause by a special resolution of our shareholders, pursuant to the terms of the Existing Bye-Laws.

In the event the shareholders approve Proposal No. 2, Bye-Law 12 of the Amended Bye-Laws will provide that our board of directors will no longer be divided into three classes. However, this process will be phased-in for current members of our board of directors who are serving three-year terms, starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year. This means that each current director, including any directors elected at this meeting, will be allowed to serve out his current term. Any new director appointed by our board of directors starting with the election of directors at the annual general meeting of shareholders for the 2011 calendar year will be elected to a one year term and will be required to stand for reelection at each annual general meeting of shareholders thereafter. Assuming that each of the current directors remains on our board of directors and that Proposal No. 2 is approved, the following table sets forth when each current director will be required to stand for reelection:

2010 Annual General Meeting | 2011 Annual General Meeting | 2012 Annual General Meeting | 2013 Annual General Meeting and thereafter | |||

Dr. Ta-lin Hsu Dr. John G. Kassakian | Kuo Wei (Herbert) Chang Dr. Juergen Gromer Arturo Krueger | Kuo Wei (Herbert) Chang Dr. Juergen Gromer Arturo Krueger Dr. Pantas Sutardja Dr. Sehat Sutardja | Kuo Wei (Herbert) Chang Dr. Juergen Gromer Dr. Ta-lin Hsu Dr. John G. Kassakian Arturo Krueger Dr. Pantas Sutardja Dr. Sehat Sutardja |

Our nominees for the Class 1 directors are Dr. Ta-lin Hsu and Dr. John G. Kassakian. Biographical information for the nominees can be found on page 9 of this proxy statement. We have been advised that Dr. Ta-lin Hsu and Dr. John G. Kassakian are willing to be named as such herein and each of them is willing to serve as a director if elected. However, if either Dr. Ta-lin Hsu and/or Dr. John G. Kassakian should be unable to serve as director, the proxy holders may vote for a substitute nominee recommended by the nominating and governance committee and approved by our board of directors.

Board Recommendation and Required Vote

Our board of directors unanimously recommends that you vote FOR the nominees for director identified above.

Unless authority to do so is withheld, the proxy holders named in the proxy card will vote the shares represented thereby FOR the election of each such nominee. Assuming the presence of a quorum, the required

8

Table of Contents

vote is the affirmative vote of at least a majority of votes cast and entitled to vote at the annual general meeting. Abstentions and broker non-votes will be entirely excluded from the vote and will have no effect on the outcome. If the proposal for the appointment of a director nominee does not receive the required affirmative vote of a simple majority of the votes cast, then the director will not be appointed and the position on our board of directors that would have been filled by the director nominee will become vacant. Our board of directors has the ability to fill the vacancy upon the recommendation of the nominating and governance committee, in accordance with the Existing Bye-Laws, with that director subject to election by our shareholders at the next following annual general meeting of shareholders.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD

Directors and Nominees

The following table sets forth information with respect to our directors, including each of our nominees, as of April 30, 2010. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led our board of directors to the conclusion that he should serve as a director, we also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us and our board of directors. Finally, we value their significant experience on other public company boards of directors and board committees.

Name of Director or Nominee | Age | Class of Director | Term Expires | Background | ||||

Sehat Sutardja, Ph.D. | 48 | 3 | 2012 | Dr. Sehat Sutardja, one of our co-founders, has served as the President, Chief Executive Officer and Co-Chairman of our board of directors since our inception in 1995, and Chairman of our board of directors since 2003. Dr. Sehat Sutardja holds one private company directorship. Dr. Sehat Sutardja is widely regarded as one of the pioneers of the modern semiconductor age. His breakthrough designs and guiding vision have helped transform numerous industry segments, from data storage to the high performance, low power chips now driving the growing global markets for mobile computing and telephony. His lifetime passion for electronics began early; he became a certified radio repair technician at age 13 and electronics have been a major part of his life ever since. Dr. Sehat Sutardja’s understanding of our employees and products since founding Marvell have positioned him well to serve as our Chairman, President and Chief Executive Officer and as a director.

Dr. Sehat Sutardja holds a BS from Iowa State University, and a MS and Ph.D. in Electrical Engineering and Computer Science from the University of California at Berkeley. Dr. Sehat Sutardja was elected as a Fellow to the IEEE in 2007 and holds over 150 U.S. patents. Dr. Sehat Sutardja is the brother of Dr. Pantas Sutardja. | ||||

Pantas Sutardja, Ph.D. | 47 | 3 | 2012 | Dr. Pantas Sutardja, one of our co-founders, has served as Vice President and a director since our inception in 1995. Dr. Pantas Sutardja was appointed Chief Technology Officer in 2000 and Chief Research and Development Officer in August 2007. Dr. Pantas | ||||

9

Table of Contents

Name of Director or Nominee | Age | Class of Director | Term Expires | Background | ||||

Sutardja served as our Acting Chief Operating Officer from September 2007 until June 2008. As a co-founder, director and officer of Marvell since inception, Dr. Pantas Sutardja is a valuable contributor to our board of directors.

Dr. Pantas Sutardja holds a BS, MS and Ph.D. in Electrical Engineering and Computer Science from the University of California at Berkeley. Dr. Pantas Sutardja is the brother of Dr. Sehat Sutardja. | ||||||||

Kuo Wei (Herbert) Chang(1)(3) | 48 | 2 | 2011 | Kuo Wei (Herbert) Chang has served as a director since November 1996. Mr. Chang has served as a venture fund manager for more than 15 years and has been the President of InveStar Capital, Inc. since April 1996 and Chief Executive Officer of C Squared Management Corporation since April 2004, and is currently a Managing Member of Growstar Associates, Ltd., which is the General Partner and the Fund Manager of VCFA Growth Partners, L.P. The companies with which Mr. Chang is involved focus on investing in companies in the semiconductor, telecommunications and networking, software, and/or Internet industries. Mr. Chang’s leadership roles at both large and startup technology companies make him an important member of our board of directors. In addition, Mr. Chang has served as a member of our board of directors for 13 years, which allows him to draw on many years of experience in dealing with our business and technology-related issues. Mr. Chang serves as a director for Monolithic Power Systems, Inc. and a number of private companies.

Mr. Chang received a BS in geology from National Taiwan University and an MBA from National Chiao Tung University in Taiwan. | ||||

Juergen Gromer, Ph.D. (1)(2)(3) | 65 | 2 | 2011 | Dr. Juergen Gromer has served as a director since October 2007. Dr. Gromer is the retired President of Tyco Electronics Ltd. (“Tyco”), an electronics company, a position which he held from April 1999 until December 31, 2007. Dr. Gromer formerly held senior management positions from 1983 to 1998 at AMP Incorporated (acquired by Tyco in April 1999) including Senior Vice President of Worldwide Sales and Services, President of the Global Automotive Division, Vice President of Central and Eastern Europe and General Manager of AMP. Dr. Gromer has over 20 years of AMP and Tyco experience, serving in a wide variety of regional and global assignments, which makes Dr. Gromer a valuable contributor to our board of directors. Dr. Gromer is also Chairman of the Board of the Society of Economic Development of the District Bergstrasse/Hessen, a member of the Advisory Board of Commerzbank and a director of the Board and Vice | ||||

10

Table of Contents

Name of Director or Nominee | Age | Class of Director | Term Expires | Background | |||||

President of the American Chamber of Commerce in Germany. Dr. Gromer also brings considerable directorial, financial and governance experience to our board of directors, as he is currently serving on the boards of Tyco and WABCO Holdings Inc, and has served as a director of RWE Rhein Ruhr in the past five years.

Dr. Gromer received his undergraduate degree and Ph.D. in Physics from the University of Stuttgart, Germany. | |||||||||

Ta-lin Hsu, Ph.D.(3) | 67 | 1 | * | 2010 | Dr. Hsu has served as a director since November 2009. Dr. Hsu is the founder and chairman of H&Q Asia Pacific. Prior to founding H&Q Asia Pacific in 1986, Dr. Hsu was a general partner at Hambrecht & Quist. Before joining Hambrecht & Quist, Dr. Hsu worked at IBM for 12 years. In his last position in senior management, Dr. Hsu held corporate responsibility for all of IBM’s advanced research in mass storage systems and technology. Dr. Hsu serves on the boards of a number of private companies. He currently serves as a member of the Board of Directors of Advanced Semiconductor Engineering, Inc., a semiconductor packaging and testing company, and has served as a director of Semiconductor Manufacturing International Corporation, a semiconductor foundry company, in the past five years. He is also Vice Chairman of the Board of Give2Asia, a member of the Council of Foreign Relations and a member of the Advisory Board of the Haas School of Business at the University of California at Berkeley. Dr. Hsu brings years of service in the high technology and semiconductor industries, as well as his executive leadership and management experience.

Dr. Hsu received his undergraduate degree in Physics from National Taiwan University and his Ph.D. in Electrical Engineering from the University of California at Berkeley. | ||||

John G. Kassakian, Sc.D. (1)(2) | 67 | 1 | * | 2010 | Dr. John G. Kassakian has served as a director since July 2008. Dr. Kassakian has been a member of the faculty of Electrical Engineering at the Massachusetts Institute of Technology (“MIT”) since 1973 and has served as Director of the MIT Laboratory for Electromagnetic and Electronic Systems from 1991 to 2009. Dr. Kassakian is the founding President of the IEEE Power Electronics Society, and is the recipient of the IEEE Centennial Medal, the IEEE William E. Newell Award, the IEEE Power Electronics Society’s Distinguished Service Award and the IEEE Millennium Medal. Dr. Kassakian’s expertise in the semiconductor field and academic experience in the technology sector make Dr. Kassakian a valuable contributor to our board of directors. | ||||

11

Table of Contents

Name of Director or Nominee | Age | Class of Director | Term Expires | Background | ||||

| Dr. Kassakian is a member of the National Academy of Engineering. Dr. Kassakian holds S.B., S.M., E.E. and Sc.D. degrees from MIT. | ||||||||

Arturo Krueger(1)(2)(3) | 70 | 2 | 2011 | Arturo Krueger has served as a director since August 2005. Mr. Krueger has more than 40 years of experience in the international semiconductor industry and acquired a wealth of experience in complex systems architecture, semiconductor design and development, operations, and international marketing, as well as general management of a large company. Since his retirement in February 2001, Mr. Krueger has been a consultant to automobile manufacturers and to semiconductor companies serving the automotive and telecommunication markets and is serving on several advisory boards. Mr. Krueger joined Motorola in 1996 as a systems engineer and last served prior to his retirement as Corporate Vice President and General Manager of Motorola Corporation’s Semiconductor Products Sector for Europe, Middle East and Africa from January 1998 until February 2001. During his time at Motorola, Mr. Krueger served as the director of the Advanced Architectural and Design Automation Lab. Mr. Krueger brings a deep understanding of the modern semiconductor industry, the complex world of microelectronic systems design and architectures, and the financial aspects of running a large company. Mr. Krueger remains very active serving on several advisory boards, as well as in different industrial associations. Mr. Krueger also brings considerable directorial and governance experience to our board of directors, as he is currently serving on the board of QuickLogic Corporation, a semiconductor company.

Mr. Krueger holds a MS in Electrical Engineering from the Institute of Technology in Switzerland and has studied Advanced Computer Science at the University of Minnesota. | ||||

| * | Nominee for election. |

| (1) | Member of the nominating and governance committee. |

| (2) | Member of the executive compensation committee. |

| (3) | Member of the audit committee. |

Except as noted above, there are no family relationships among any of our directors and executive officers.

12

Table of Contents

Corporate Governance Guidelines and Practices, Board Leadership Structure, Risk Management, Meetings, Independence and Compensation of our Board of Directors

Corporate Governance Guidelines and Practices

Our board of directors has adopted a set of corporate governance guidelines and practices to establish a framework within which it will conduct its business. The corporate governance guidelines and practices can be found on our website atwww.marvell.com/investors/governance.jsp. The corporate governance guidelines and practices were last revised on April 29, 2010. The corporate governance guidelines and practices provide, among other things, that:

| • | in the absence of a non-executive Chairman of the Board, our board of directors shall designate a lead independent director who, among other duties, is responsible for presiding over executive sessions of independent directors; |

| • | a majority of the directors must be independent; |

| • | our board of directors shall appoint all members of the board committees; |

| • | the nominating and governance committee screens and recommends board candidates to our board of directors; |

| • | the audit committee, executive compensation committee and nominating and governance committee must consist solely of independent directors; and |

| • | the independent directors shall meet regularly in executive session without the presence of the non-independent directors or members of our management. |

We also provide our directors annual training events on issues facing us and on subjects that would assist the directors in discharging their duties.

Our board of directors may modify the corporate governance guidelines and practices from time to time, as appropriate. Our independent directors have appointed Mr. Krueger to serve as the lead independent director for our board of directors. The duties of the lead independent director are set forth as follows in our corporation governance guidelines and practices:

| • | develop the agenda for, and moderate executive sessions of, meetings of our independent directors; |

| • | help promote good communication between the independent directors and the Chairman of the Board and/or the Chief Executive Officer; |

| • | chair the meetings of our board of directors in the absence of the Chairman of the Board; |

| • | make recommendations to the Chairman of the Board regarding the appropriate schedule of board meetings, seeking to ensure that the independent directors can perform their duties responsibly while not interfering with the flow of our operations; |

| • | jointly with the Chairman of the Board, set agendas for board meetings and make recommendations to the Chairman of the Board regarding the structure of board meetings; |

| • | make recommendations to the Chairman of the Board in assessing the quality, quantity and timeliness of the flow of information from our management that is necessary for the independent directors to effectively and responsibly perform their duties; and |

| • | coordinate with the nominating and governance committee and corporate counsel to promote a thorough annual self-assessment by our board of directors and its committees. |

Board Leadership Structure

Our board of directors believes that our Chief Executive Officer is best situated to serve as Chairman of the Board, because he is the director most familiar with our business and industry, and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Independent directors and

13

Table of Contents

management have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from outside the company and industry, while the Chief Executive Officer brings company-specific experience and expertise. Our board of directors believes that the combined role of Chairman of the Board and Chief Executive Officer promotes strategy development and execution, and facilitates information flow between management and our board of directors, which are essential to effective governance.

One of the key responsibilities of our board of directors is to develop strategic direction and hold management accountable for the execution of strategy once it is developed. Our board of directors believes the combined role of Chairman of the Board and Chief Executive Officer, together with an independent lead director having the duties described above, is in the best interest of shareholders because it provides the appropriate balance between strategy development and independent oversight of management.

Risk Management

Our board of directors has an active role, as a whole and also at the committee level, in overseeing management of our risks. Our board of directors regularly reviews information regarding our credit, liquidity and operations, as well as the risks associated with each. Our executive compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements as well as our compensation plans that generally apply to all employees. The audit committee oversees management of financial and legal compliance risks. The nominating and governance committee manages risks associated with the independence of our board of directors and potential conflicts of interest. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire board of directors is regularly informed through committee reports about such risks.

Meetings of our Board of Directors; Attendance

There were nine meetings of our board of directors in fiscal 2010, which included seven in-person meetings at the U.S. headquarters of our U.S. operating subsidiary. Each director attended at least 75% of the total number of meetings of the board of directors and committees on which such director served. The independent directors meet in executive sessions without the presence of the non-independent directors or members of our management at least twice per year during regularly scheduled board of director meeting days and otherwise from time to time as deemed necessary or appropriate.

Although directors are encouraged to attend annual general meetings of shareholders, we do not have a formal policy requiring such attendance. Dr. Sehat Sutardja and Dr. Pantas Sutardja attended the 2009 annual general meeting of shareholders.

Director Independence

Our board of directors has determined that, among current directors with continuing terms and the director nominees standing for reelection, each of Mr. Chang, Dr. Gromer, Dr. Hsu, Dr. Kassakian and Mr. Krueger are “independent” as such term is defined by the rules and regulations of the NASDAQ Stock Market (“Nasdaq”) and the rules and regulations of the SEC. To be considered independent, our board of directors must affirmatively determine that neither the director, nor any member of his or her immediate family, has had any direct or indirect material relationship with us within the previous three years.

Our board of directors considered relationships, transactions and/or arrangements with each of the directors and concluded that none of the non-employee directors, or any of his immediate family members, has or has had within the previous three years any relationship with us that would impair his independence.

Compensation of Directors

Directors who are also employees of the company do not receive any additional compensation for their services as directors. Our non-employee directors each receive $1,000 per board meeting attended in person and $250 per board meeting attended telephonically. However, the fee for attendance, whether in person or

14

Table of Contents

telephonic, at a regularly scheduled board meeting as set forth on the board calendar is $1,000. Our non-employee directors also receive an annual retainer of $40,000. The lead independent director receives an additional annual retainer of $20,000. If they serve on such committees, our non-employee directors also receive $7,500 for annual service on the audit committee, and $5,000 for annual service on the executive compensation and nominating and governance committees. Each non-employee director also receives $1,000 per committee meeting attended in person and $250 per meeting attended telephonically. In addition, the chair of the audit committee receives an additional cash retainer of $7,500 per year and chairs of the other committees of our board of directors receive an additional cash retainer of $2,500 per year. In addition to the retainer and meeting fees, non-employee directors are reimbursed for travel and other reasonable out-of-pocket expenses related to attendance at board of directors and committee meetings.

In addition, under our 2007 Directors’ Stock Incentive Plan (the “2007 Director Plan”), each new non-employee director receives an option to purchase 50,000 shares upon joining our board of directors. This option vests over a period of three years, with 1/3 vesting each year thereafter provided that the non-employee director remains a director through such period. In addition, under the 2007 Director Plan, each “eligible outside director” is granted an option to purchase an additional 12,000 shares on the date of our annual general meeting of shareholders, provided that on such date the director has served on our board of directors for at least six months prior to the date of such annual general meeting of shareholders. Each of our current independent directors is considered an eligible outside director. This option fully vests on the earlier of the next annual general meeting of shareholders or the one year anniversary of the option grant date. All options held by non-employee directors will vest in full upon a change of control. The exercise price per share for each option is equal to the fair market value on the date of grant.

Director Compensation Table — Fiscal 2010

The following table details the total compensation paid to our non-employee directors in fiscal 2010.

| Fees Earned or Paid in Cash ($) | Option Awards ($)(1)(2) | All Other Compensation ($) | Total ($) | |||||

Kuo Wei (Herbert) Chang | 74,750 | 63,480 | — | 138,230 | ||||

Dr. Juergen Gromer | 97,500 | 63,480 | — | 160,980 | ||||

Dr. Ta-lin Hsu(3) | 9,110 | 370,235 | — | 379,345 | ||||

Dr. John G. Kassakian | 72,250 | 63,480 | — | 135,730 | ||||

Arturo Krueger | 105,623 | 63,480 | — | 169,103 |

| (1) | With the exception of ignoring the impact of the forfeiture rate relating to service based vesting conditions, these amounts represent the aggregate grant date fair value of option awards for fiscal 2010. These amounts do not represent the actual amounts paid to or realized by the non-employee directors for these awards during fiscal 2010. |

| (2) | The following table provides the number of shares subject to outstanding options held at January 30, 2010 for each non-employee director, as applicable: |

Name | Number of Shares Underlying Unexercised Options (#) | |

Kuo Wei (Herbert) Chang | 252,000 | |

Dr. Juergen Gromer | 74,000 | |

Dr. Ta-lin Hsu | 50,000 | |

Dr. John G. Kassakian | 62,000 | |

Arturo Krueger | 136,000 |

| (3) | Dr. Hsu was appointed to our board of directors effective as of November 18, 2009. |

15

Table of Contents

Committees of our Board of Directors

Our board of directors has a standing audit committee, executive compensation committee and a nominating and governance committee. Our board of directors has adopted written charters for each of these committees, copies of which are available on our website atwww.marvell.com/investors/committees.jsp. Each of the committee charters is reviewed annually by the respective committee, which may recommend appropriate changes for approval by our board of directors.

Audit Committee | ||

Number of Members: | Four | |

Current Members: | Dr. Juergen Gromer, Chairman Kuo Wei (Herbert) Chang Dr. Ta-lin Hsu Arturo Krueger | |

Recent Changes: | During fiscal 2010, the audit committee was comprised of Dr. Gromer, Mr. Chang and Mr. Krueger. Dr. Hsu was appointed as a member of the audit committee effective as of April 29, 2010. | |

Number of Meetings in Fiscal 2010: | 11 | |

Functions: | The audit committee’s responsibilities are generally to assist our board of directors in fulfilling its responsibility to oversee management’s conduct of our accounting and financial reporting processes. The audit committee also, among other things, appoints our independent registered public accounting firm, oversees our internal audit function and those of its independent registered public accounting firm, reviews and discusses with management and our independent registered public accounting firm the adequacy and effectiveness of our internal control over financial reporting as reported by management. The audit committee meets quarterly and at such additional times as are necessary or advisable. | |

Qualifications: | Our board of directors has determined that each member of the audit committee meets the applicable independence and financial literacy requirements of Nasdaq and the SEC. Our board of directors has determined that Dr. Gromer is an “audit committee financial expert” as required by applicable Nasdaq and SEC rules. | |

Executive Compensation Committee | ||

Number of Members: | Three | |

Current Members: | Dr. Juergen Gromer, Chairman Dr. John G. Kassakian Arturo Krueger | |

Number of Meetings in Fiscal 2010: | 15 | |

Functions: | The executive compensation committee has the authority to approve salaries and bonuses and other compensation matters for our executive officers, is responsible for administering equity award programs for non-executive employees, reviews and recommends changes to our incentive compensation and other equity based plans and administers executive officer compensation within the terms of any applicable company compensation plans. | |

16

Table of Contents

Qualifications: | Our board of directors has determined that each member of the executive compensation committee meets the applicable independence requirements of Nasdaq and the SEC. In addition, each member of the executive compensation committee is an “outside director” under Section 162(m), and a “non-employee director” under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). | |

Nominating and Governance Committee | ||

Number of Members: | Four | |

Current Members: | Arturo Krueger, Chairman Kuo Wei (Herbert) Chang Dr. Juergen Gromer Dr. John G. Kassakian | |

Number of Meetings in Fiscal 2010: | 9 | |

Functions: | The nominating and governance committee is responsible for developing and implementing policies and practices relating to corporate governance and practices, including reviewing and monitoring implementation of our corporate governance guidelines. The nominating and governance committee also makes recommendations to our board of directors regarding the size and composition of our board of directors and its committees and screens and recommends candidates for election to our board of directors. In addition, the nominating and governance committee reviews, ratifies and/or approves related party transactions. The nominating and governance committee also reviews periodically with the Chairman and the Chief Executive Officer the succession plans relating to positions held by executive officers. | |

Qualifications: | Our board of directors has determined that each member of the nominating and governance committee meets the applicable independence requirements of Nasdaq and the SEC. | |

Role of Compensation Consultants

Under its charter, the executive compensation committee has the authority to retain outside legal counsel and other advisors. Pursuant to that authority, the executive compensation committee retained Mercer (US) Inc. (“Mercer”) as its independent compensation consultant in April 2009 to replace Compensia, Inc. (“Compensia”). During fiscal 2010, we did not engage Mercer or Compensia for any additional services beyond their work performed for the executive compensation committee.

The executive compensation committee has retained Mercer to provide information, analyses and advice regarding executive compensation, as described below. The Mercer consultant who performs these services reports to the Chairman of the executive compensation committee. Mercer provided the following services to us during fiscal 2010:

| • | Evaluated the competitive positioning of our named executive officers’ base salaries, annual incentive and long-term incentive compensation relative to our primary peer companies and the broader industry to support fiscal 2011 decision-making; |

| • | Advised on fiscal 2011 target award levels within the annual and long-term incentive program and, as needed, on actual compensation actions; |

17

Table of Contents

| • | Advised on the compensation of certain non-executive officers for fiscal 2011 at the direction of the executive compensation committee; |

| • | Assessed the alignment of company compensation levels relative to our performance against our primary peer companies and relative to the executive compensation committee’s articulated compensation philosophy; |

| • | Advised on the fiscal 2011 performance measures and performance targets for the annual and long-term incentive programs; and |

| • | Assisted with the preparation of the “Compensation Discussion and Analysis” for this proxy statement. |

Compensia provided the following services to us during fiscal 2010:

| • | Advised on the compensation of certain non-executive officers for fiscal 2010 at the direction of the executive compensation committee; and |

| • | Assisted with the preparation of the “Compensation Discussion and Analysis” for last year’s proxy statement. |

Since Mercer was retained after April 2009, it did not play any role in establishing the compensation for named executive officers for fiscal 2010. All of the decisions with respect to determining the amount or form of executive and director compensation under our executive and director compensation programs are made by the executive compensation committee alone and may reflect factors and considerations other than the information and advice provided by Compensia or Mercer.

Additional information concerning the compensation policies and objectives established by the executive compensation committee and the respective roles of our Chief Executive Officer and the compensation consultant in assisting with the determination of compensation for each of the executive officers named in the Summary Compensation Table, referred to in this proxy statement as our “named executive officers,” is included under the heading “Executive Compensation.”

Nominations for Election of Directors

The nominating and governance committee identifies, recruits and recommends to our board of directors, and our board of directors approves, director nominees for election at each annual general meeting of shareholders and new directors for election by our board of directors to fill vacancies that may arise. Under the Existing Bye-Laws, any director appointed by our board of directors would need to be reappointed by shareholders at our next annual general meeting of shareholders or by our board of directors following the annual general meeting.

The nominees for election at this annual general meeting were unanimously recommended and approved by the nominating and governance committee and our board of directors, respectively. The nominating and governance committee will consider proposals for nomination from shareholders that are made in writing to our Secretary at Argyle House, 41A Cedar Avenue, Hamilton, HM 12, Bermuda that are timely and that contain sufficient background information concerning the nominee to enable proper judgment to be made as to his or her qualifications. For general information regarding shareholder proposals and nominations, see “Future Shareholder Proposals and Nominations for the 2011 Annual General Meeting” on page 61.

Director Qualifications

The nominating and governance committee believes that the following specific, minimum qualifications must be met by a nominee for the position of director:

| • | the highest personal and professional ethics and integrity; |

| • | the ability to work together with other directors, with full and open discussion and debate as an effective, collegial group; |

18

Table of Contents

| • | current knowledge and experience in our business or operations, or contacts in the community in which we do business and in the industries relevant to our business, or substantial business, financial or industry-related experience; and |

| • | the willingness and ability to devote adequate time to our business. |

We are required to have at least one member of our board of directors who meets the criteria for an “audit committee financial expert” as defined by Nasdaq and the SEC, and to have a majority of independent directors who meet the definition of “independent director” under applicable Nasdaq and SEC rules. We also believe it is appropriate for certain key members of management to participate as members of our board of directors. Other than the foregoing there are no stated minimum criteria for director nominees.

When making its determination whether a nominee is qualified for the position of director, the nominating and governance committee may also consider such other factors as it may deem are in the best interests of the company and its shareholders, such as the following qualities and skills:

| • | relationships that may affect the independence of the director or conflicts of interest that may affect the director’s ability to discharge his or her duties; |

| • | diversity of experience and background of the proposed director, including the need for financial, business, academic, public sector or other expertise on our board of directors or its committees; and |

| • | the fit of the individual’s skills and experience with those of the other directors and potential directors in comparison to the needs of the company. |

When evaluating a candidate for nomination, the nominating and governance committee does not assign specific weight to any of these factors or believe that all of the criteria necessarily apply to every candidate.

Identifying and Evaluating Nominees for Director

The nominating and governance committee reviews the appropriate skills and characteristics required of directors in the context of the current composition of our board of directors. Candidates considered for nomination to our board of directors may come from several sources, including current and former directors, professional search firms and shareholder nominations. It is the policy of the nominating and governance committee to solicit and consider annually recommendations for candidates to our board of directors from our shareholders who hold 5% or more of our outstanding common shares as of December 31 of each year and to review with such shareholders the nominating process and the results of their prior recommendations.

A shareholder seeking to recommend a prospective nominee for the nominating and governance committee’s consideration should submit the candidate’s name and qualifications to our Secretary at Argyle House, 41A Cedar Avenue, Hamilton, HM 12, Bermuda. The nominating and governance committee will consider candidates recommended by shareholders in the same manner as candidates recommended to the nominating and governance committee from other sources. Nominees for director are evaluated by the nominating and governance committee, which may retain the services of a professional search firm to assist them in identifying or evaluating potential nominees.

Shareholder Communications with our Board of Directors

At present, our Chairman and Chief Executive Officer is responsible for maintaining effective communications with our shareholders, customers, employees, communities, suppliers, creditors, governments and corporate partners. It is the policy of our board of directors that management speaks for the company. This policy does not preclude independent directors from meeting with shareholders, but management, where appropriate, should be present at such meetings.

19

Table of Contents

Nonetheless, our board of directors has established a process for shareholders to send communications to our directors. If you wish to communicate with our board of directors or individual directors, you may send your communication in writing to: General Counsel, Marvell Semiconductor, Inc., 5488 Marvell Lane, Santa Clara, California 95054. You must include your name and address in the written communication and indicate whether you are a shareholder of Marvell. The General Counsel (or other officer acting in such capacity) will compile all such communications and will forward them to the appropriate director or directors or committee of our board of directors based on the subject matter or to the director or directors to whom such communications is addressed.

EXECUTIVE COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The executive compensation committee for fiscal 2010 consisted of the following members: Dr. Gromer, Dr. Kassakian and Mr. Krueger. None of the current or former members of the executive compensation committee who served during fiscal 2010 is a current or former officer or employee of us or our subsidiaries, or had any relationship with us not otherwise disclosed herein under applicable SEC rules. In addition, to our knowledge, there are no executive compensation committee interlocks between us and other entities, involving our executive officers or directors who serve as executive officers or directors of such other entities.

20

Table of Contents

Compensation Discussion and Analysis