Marvell and Cavium to Combine Creating an Infrastructure Solutions Powerhouse NOVEMBER 20, 2017 Filed by Marvell Technology Group Ltd. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Cavium, Inc. Commission File No. 001-33435 The following presentation was issued by Marvell Technology Group Ltd. and Cavium, Inc.

Cautionary Statement Regarding Forward Looking Statements This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Marvell and Cavium, including statements regarding the benefits of the transaction, the anticipated timing of the transaction and the products and markets of each company. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Cavium’s business and the price of its common stock and/or Marvell’s business and the price of its common shares, (ii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the merger agreement by the stockholders of Cavium, the approval of the issuance of Marvell shares in the transaction by the shareholders of Marvell, and the receipt of certain governmental and regulatory approvals, (iii) the failure of Marvell to obtain the necessary financing pursuant to the arrangements set forth in the debt commitment letters delivered pursuant to the merger agreement or otherwise, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (v) the effect of the announcement or pendency of the transaction on Cavium’s business relationships, operating results, and business generally, (vi) risks that the proposed transaction disrupts current plans and operations of Cavium or Marvell and potential difficulties in Cavium employee retention as a result of the transaction, (vii) risks related to diverting management’s attention from Cavium’s ongoing business operations, (viii) the outcome of any legal proceedings that may be instituted against Marvell or against Cavium related to the merger agreement or the transaction, (ix) the ability of Marvell to successfully integrate Cavium’s operations and product lines, (x) the ability of Marvell to implement its plans, forecasts, and other expectations with respect to Cavium’s business after the completion of the proposed merger and realize the anticipated synergies and cost savings in the time frame anticipated or at all, and identify and realize additional opportunities, and (xi) the risk of downturns in the highly cyclical semiconductor industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the businesses of Marvell and Cavium described in the “Risk Factors” section of their respective Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by either of them from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Marvell and Cavium assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Marvell nor Cavium gives any assurance that either Marvell or Cavium will achieve its expectations. This presentation includes EBITDA and measures derived from EBITDA, which is a non-GAAP financial measure as defined under SEC rules. EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Reconciliations of non-GAAP measures to GAAP are included at the end of this presentation.

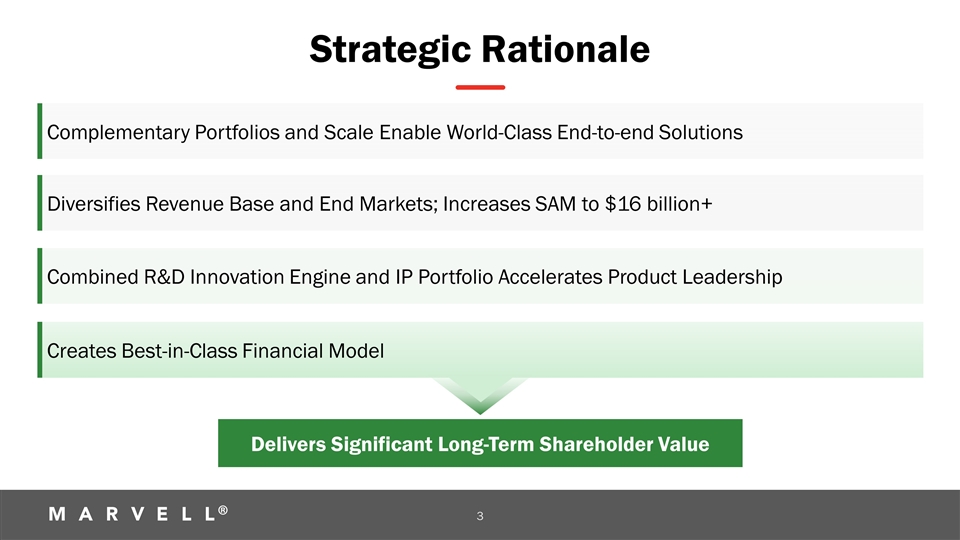

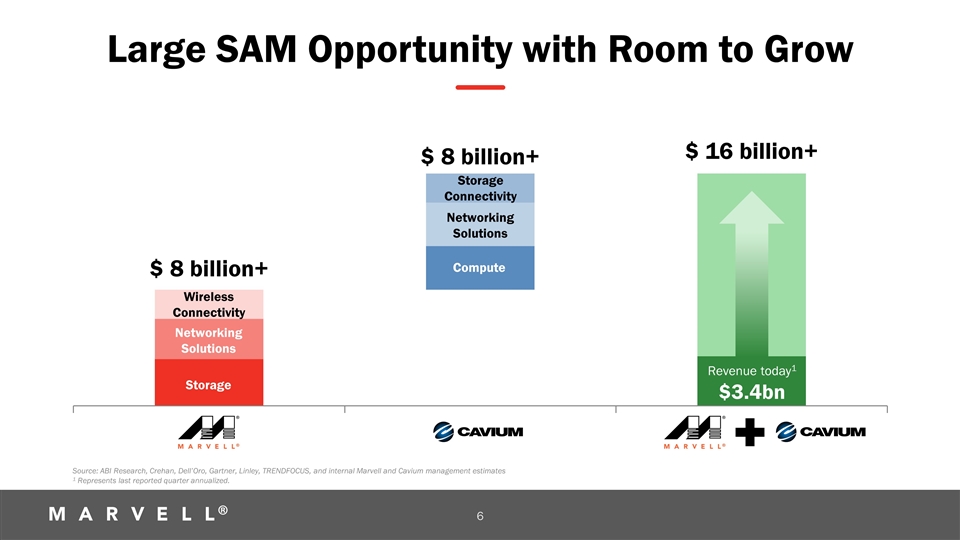

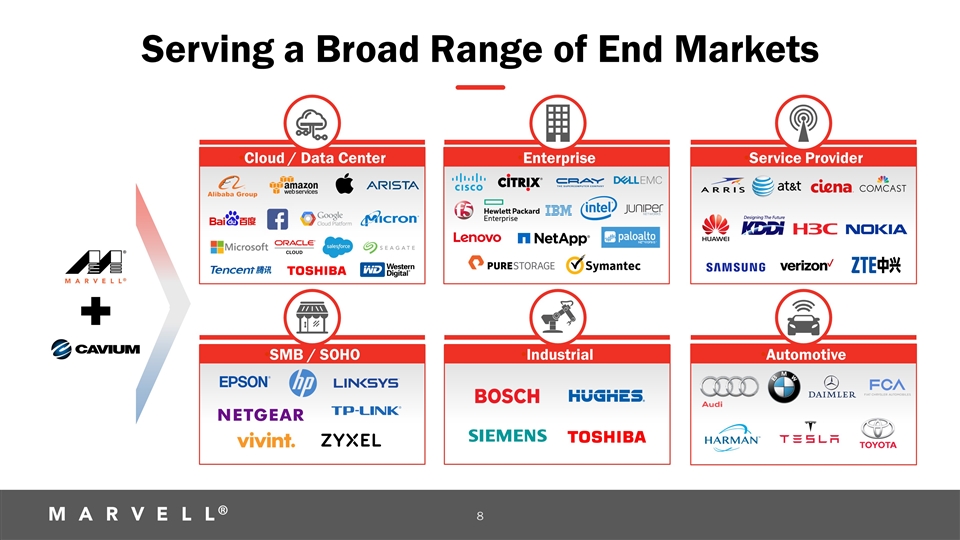

Strategic Rationale Delivers Significant Long-Term Shareholder Value Complementary Portfolios and Scale Enable World-Class End-to-end Solutions Diversifies Revenue Base and End Markets; Increases SAM to $16 billion+ Combined R&D Innovation Engine and IP Portfolio Accelerates Product Leadership Creates Best-in-Class Financial Model

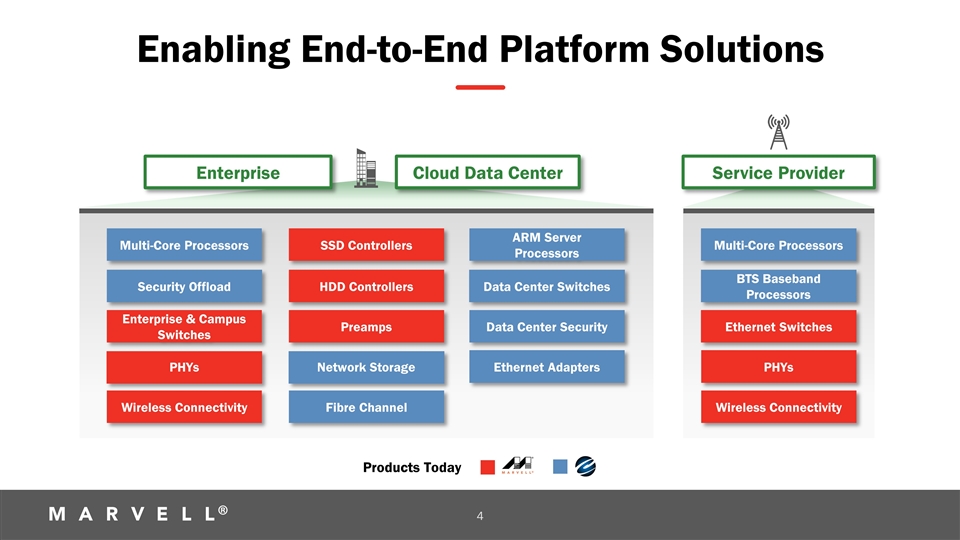

Cloud Data Center Enabling End-to-End Platform Solutions Service Provider Wireless Connectivity Products Today Multi-Core Processors Enterprise PHYs Ethernet Switches Multi-Core Processors Enterprise & Campus Switches Wireless Connectivity PHYs ARM Server Processors Data Center Security Data Center Switches Ethernet Adapters Fibre Channel SSD Controllers HDD Controllers Network Storage Preamps BTS Baseband Processors Security Offload

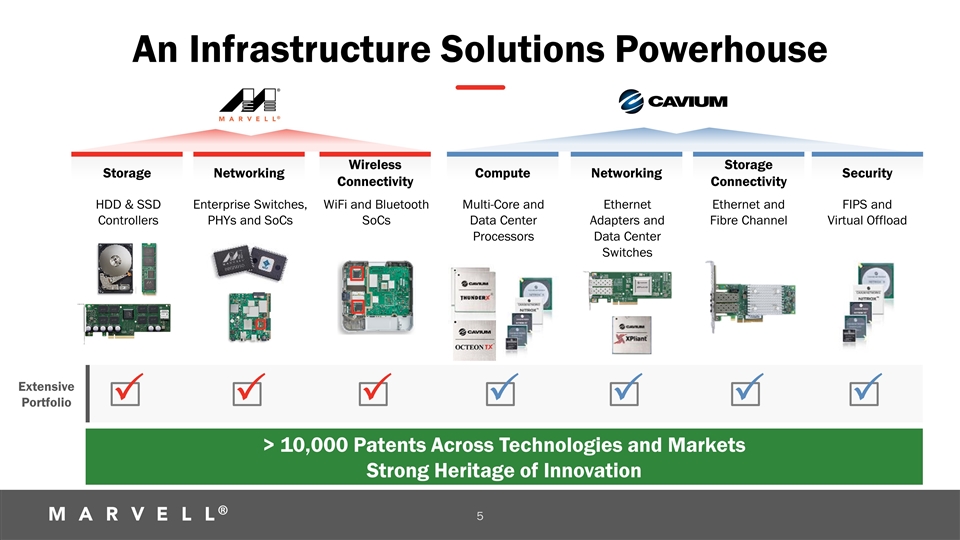

An Infrastructure Solutions Powerhouse Extensive Portfolio Storage HDD & SSD Controllers P Storage Wireless Connectivity WiFi and Bluetooth SoCs P Wireless Connectivity Storage Connectivity Ethernet and Fibre Channel P Enterprise Switches, PHYs and SoCs Networking Solutions P Networking Ethernet Adapters and Data Center Switches P Network Adapters Networking Multi-Core and Data Center Processors P Network Processors Compute Security P FIPS and Virtual Offload > 10,000 Patents Across Technologies and Markets Strong Heritage of Innovation

Large SAM Opportunity with Room to Grow Storage Networking Solutions Wireless Connectivity Compute Networking Solutions Storage Connectivity Revenue today1 $3.4bn Source: ABI Research, Crehan, Dell’Oro, Gartner, Linley, TRENDFOCUS, and internal Marvell and Cavium management estimates 1 Represents last reported quarter annualized.

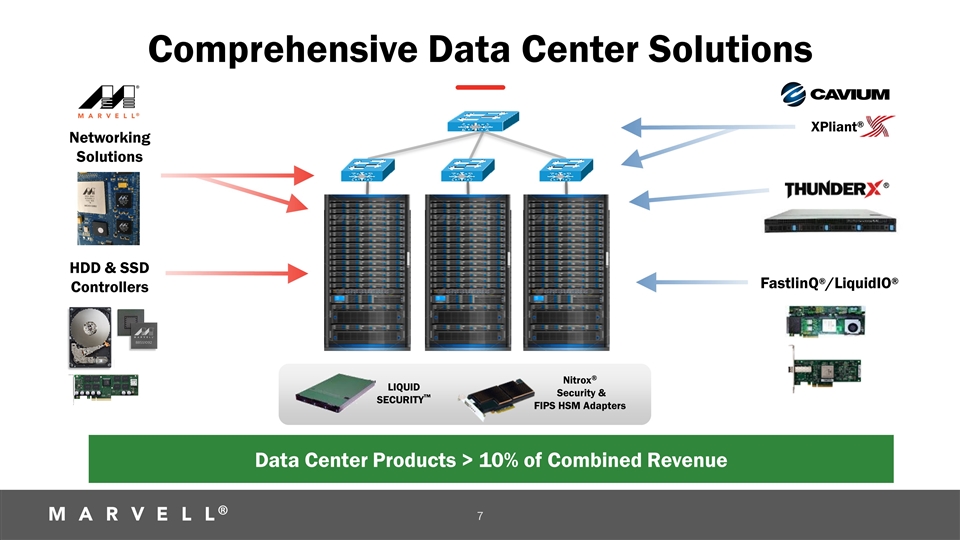

Comprehensive Data Center Solutions LIQUID SECURITY™ Nitrox® Security & FIPS HSM Adapters XPliant® ® FastlinQ®/LiquidIO® Data Center Products > 10% of Combined Revenue HDD & SSD Controllers Networking Solutions

Serving a Broad Range of End Markets SMB / SOHO Cloud / Data Center Enterprise Industrial Service Provider Automotive

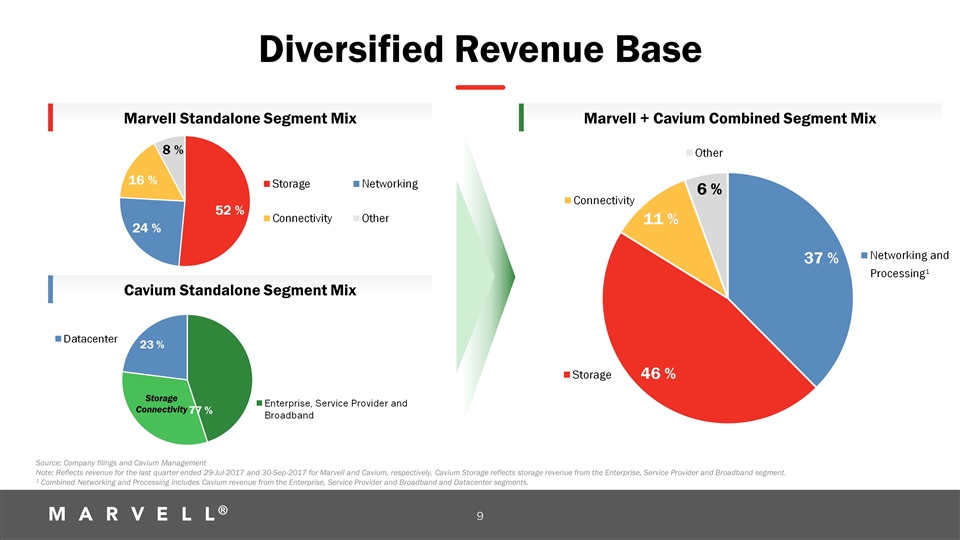

Marvell + Cavium Combined Segment Mix Marvell Standalone Segment Mix Cavium Standalone Segment Mix Diversified Revenue Base Source: Company filings and Cavium Management Note: Reflects revenue for the last quarter ended 29-Jul-2017 and 30-Sep-2017 for Marvell and Cavium, respectively. Cavium Storage reflects storage revenue from the Enterprise, Service Provider and Broadband segment. 1 Combined Networking and Processing includes Cavium revenue from the Enterprise, Service Provider and Broadband and Datacenter segments. Storage Connectivity

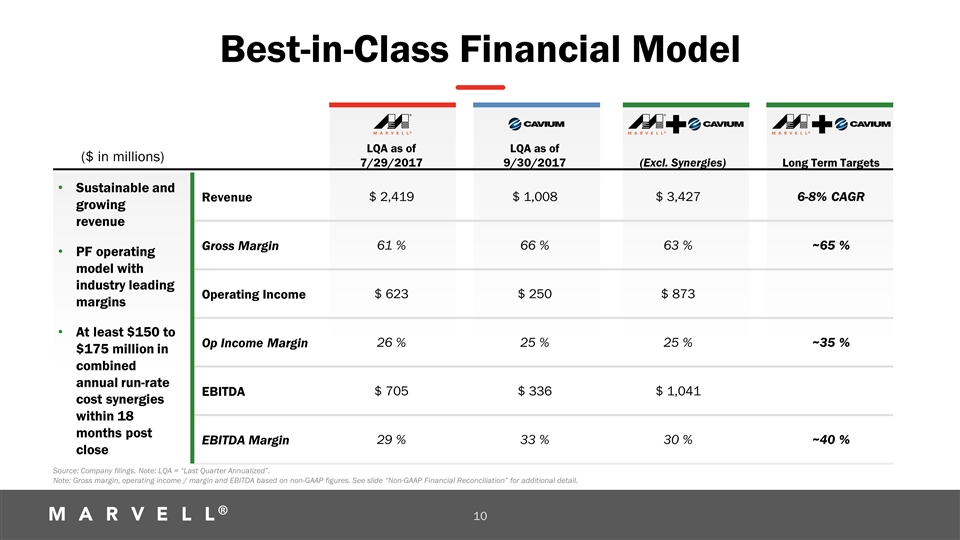

Best-in-Class Financial Model ($ in millions) LQA as of 7/29/2017 LQA as of 9/30/2017 (Excl. Synergies) Long Term Targets Revenue $ 2,419 $ 1,008 $ 3,427 6-8% CAGR Gross Margin 61 % 66 % 63 % ~65 % Operating Income $ 623 $ 250 $ 873 Op Income Margin 26 % 25 % 25 % ~35 % EBITDA $ 705 $ 336 $ 1,041 EBITDA Margin 29 % 33 % 30 % ~40 % Sustainable and growing revenue PF operating model with industry leading margins At least $150 to $175 million in combined annual run-rate cost synergies within 18 months post close Source: Company filings. Note: LQA = “Last Quarter Annualized”. Note: Gross margin, operating income / margin and EBITDA based on non-GAAP figures. See slide “Non-GAAP Financial Reconciliation” for additional detail.

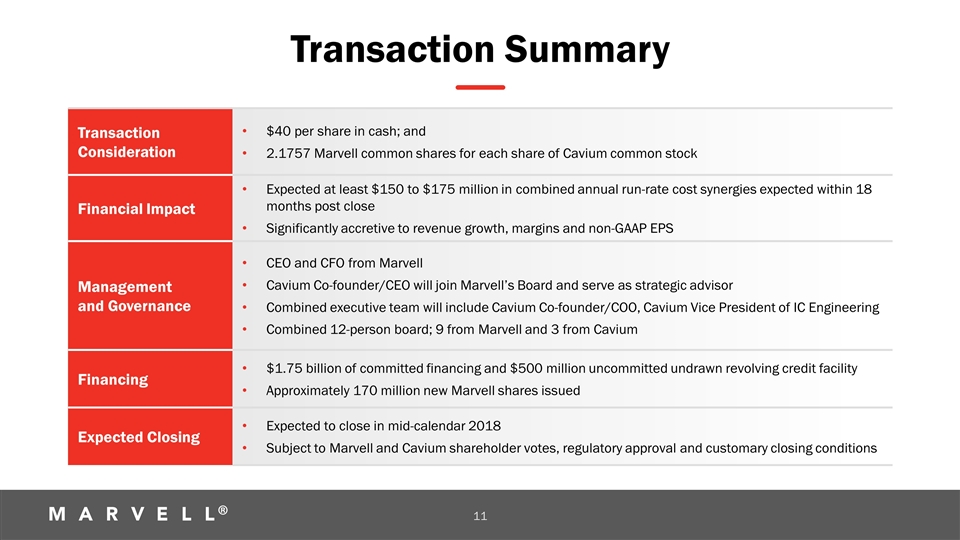

Transaction Summary Transaction Consideration $40 per share in cash; and 2.1757 Marvell common shares for each share of Cavium common stock Financial Impact Expected at least $150 to $175 million in combined annual run-rate cost synergies expected within 18 months post close Significantly accretive to revenue growth, margins and non-GAAP EPS Management and Governance CEO and CFO from Marvell Cavium Co-founder/CEO will join Marvell’s Board and serve as strategic advisor Combined executive team will include Cavium Co-founder/COO, Cavium Vice President of IC Engineering Combined 12-person board; 9 from Marvell and 3 from Cavium Financing $1.75 billion of committed financing and $500 million uncommitted undrawn revolving credit facility Approximately 170 million new Marvell shares issued Expected Closing Expected to close in mid-calendar 2018 Subject to Marvell and Cavium shareholder votes, regulatory approval and customary closing conditions

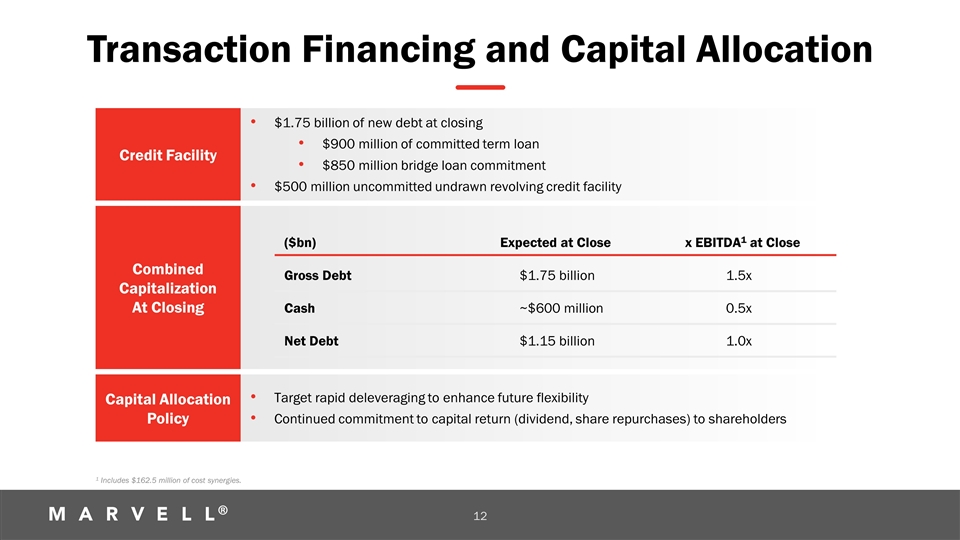

Transaction Financing and Capital Allocation Credit Facility $1.75 billion of new debt at closing $900 million of committed term loan $850 million bridge loan commitment $500 million uncommitted undrawn revolving credit facility Combined Capitalization At Closing Capital Allocation Policy Target rapid deleveraging to enhance future flexibility Continued commitment to capital return (dividend, share repurchases) to shareholders ($bn) Expected at Close x EBITDA1 at Close Gross Debt $1.75 billion 1.5x Cash ~$600 million 0.5x Net Debt $1.15 billion 1.0x 1 Includes $162.5 million of cost synergies.

Q&A

Additional Information and Where to Find It This document relates to a proposed transaction between Marvell and Cavium. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Marvell intends to file a registration statement on Form S-4 with the SEC, which will include a document that serves as a prospectus of Marvell and a joint proxy statement of Cavium and Marvell referred to as a joint proxy statement/prospectus. A joint proxy statement/prospectus will be sent to all Cavium stockholders and all Marvell shareholders. Each party also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of Cavium and investors and security holders of Marvell are urged to read the registration statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Marvell or Cavium through the website maintained by the SEC at www.sec.gov. The documents filed by Marvell with the SEC also may be obtained free of charge at Marvell’s website at www.marvell.com or upon written request to Marvell at 5488 Marvell Lane, Santa Clara, CA 95054. The documents filed by Cavium with the SEC also may be obtained free of charge at Cavium’s website at www.cavium.com or upon written request to 2315 North First Street, San Jose, CA 95131. For more information, investors are encouraged to visit http://MarvellCavium.transactionannouncement.com. Marvell, Cavium and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Cavium’s stockholders and from Marvell’s shareholders in connection with the proposed transaction. Information about Cavium’s directors and executive officers and their ownership of Cavium’s common stock is set forth in Cavium’s proxy statement for its 2017 Annual Meeting of Stockholders on Schedule 14A filed with the SEC on April 27, 2017. To the extent that holdings of Cavium’s securities have changed since the amounts printed in Cavium’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information about Marvell’s directors and executive officers is set forth in Marvell’s proxy statement for its 2017 Annual Meeting of Shareholders on Schedule 14A filed with the SEC on May 3, 2017. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

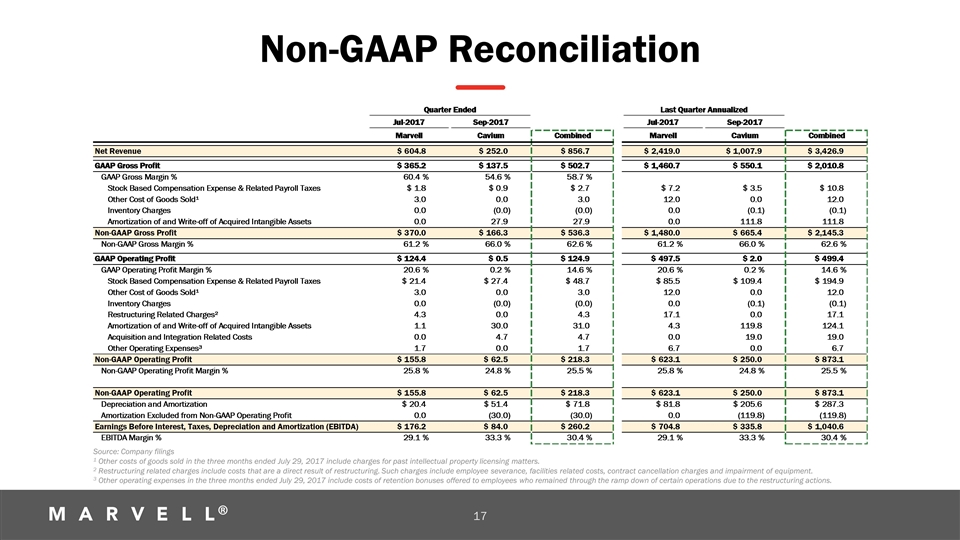

Non-GAAP Reconciliation The following information provides reconciliations of non-GAAP financial measures, which are presented in the accompanying presentation, to the most comparable financial measures calculated and presented in accordance with accounting principles generally accepted in the U.S. (“GAAP”). The companies have provided non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in the accompanying presentation that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for, or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented in the presentation. The non-GAAP financial measures in the accompanying presentation may differ from similar measures used by other companies. The following tables reconcile the non-GAAP measure of earnings before interest, taxes, depreciation and amortization (“EBITDA”) referred to in this presentation to the most directly comparable GAAP measure reflected in the companies’ financial statements.

Non-GAAP Reconciliation Source: Company filings 1 Other costs of goods sold in the three months ended July 29, 2017 include charges for past intellectual property licensing matters. 2 Restructuring related charges include costs that are a direct result of restructuring. Such charges include employee severance, facilities related costs, contract cancellation charges and impairment of equipment. 3 Other operating expenses in the three months ended July 29, 2017 include costs of retention bonuses offered to employees who remained through the ramp down of certain operations due to the restructuring actions.