Fourth Quarter 2020 Financial Results and Highlights February 3, 2021 Exhibit 99.3

Forward-Looking Statements This earnings supplement includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to our expectations regarding the impact of the COVID-19 pandemic on our business, opportunities in the marketplace, our cost structure, investment in and growth of our business, our realignment plans, the impact of the 2020 Fit for Growth Plan, the likelihood and potential terms of any settlement of and exit from our referenced large customer engagement in the financial services segment, our and our clients’ shift to digital solutions and services and our anticipated financial performance. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward- looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions, legal, reputational and financial risks resulting from cyberattacks, the effectiveness of business continuity plans during the COVID-19 pandemic, the impact of the COVID-19 pandemic, changes in the regulatory environment, including with respect to immigration and taxes, and the other factors discussed in our most recent Annual Report on Form 10-K, as updated by our most recent Quarterly Report on Form 10-Q, and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law. 2

Results Summary: Q4 2020 1 See “About Non-GAAP Financial Measures” at the end of this earnings supplement for more information and reconciliations to the most directly comparable GAAP financial measures, as applicable. 2 Cognizant made an offer in the fourth quarter to settle and exit a large customer engagement in the financial services segment in Continental Europe ("Anticipated Engagement Exit"). As a result of this offer, in the fourth quarter of 2020, we recorded a reduction of revenue of $107 million and additional expenses of $33 million, primarily related to the impairment of long-lived assets. REVENUE Down -2.3% Y/Y as reported and -3.0% Y/Y constant currency1 Q4 2020 includes -250bps impact from the offer made to settle and exit a large customer engagement2 and -120bps impact from exit of certain content services OPERATING MARGIN Q4 2020 includes -300bps impact from Anticipated Engagement Exit CASH FLOW 3 $4,284 $4,184 Q4 2019 Q4 2020 DILUTED EARNINGS PER SHARE Q4 2020 includes -$0.25 per share impact from Anticipated Engagement Exit 14.6% 11.1% Q4 2019 Q4 2020 17.0% 12.3% Q4 2019 Q4 2020 $938 $898 Q4 2019 Q4 2020 $845 $809 Q4 2019 Q4 2020 $0.72 $0.59 Q4 2019 Q4 2020 $1.07 $0.67 Q4 2019 Q4 2020 GAAP Operating Margin Adjusted Operating Margin1 GAAP Diluted EPS Adjusted Diluted EPS1 Operating Cash Flow Free Cash Flow1

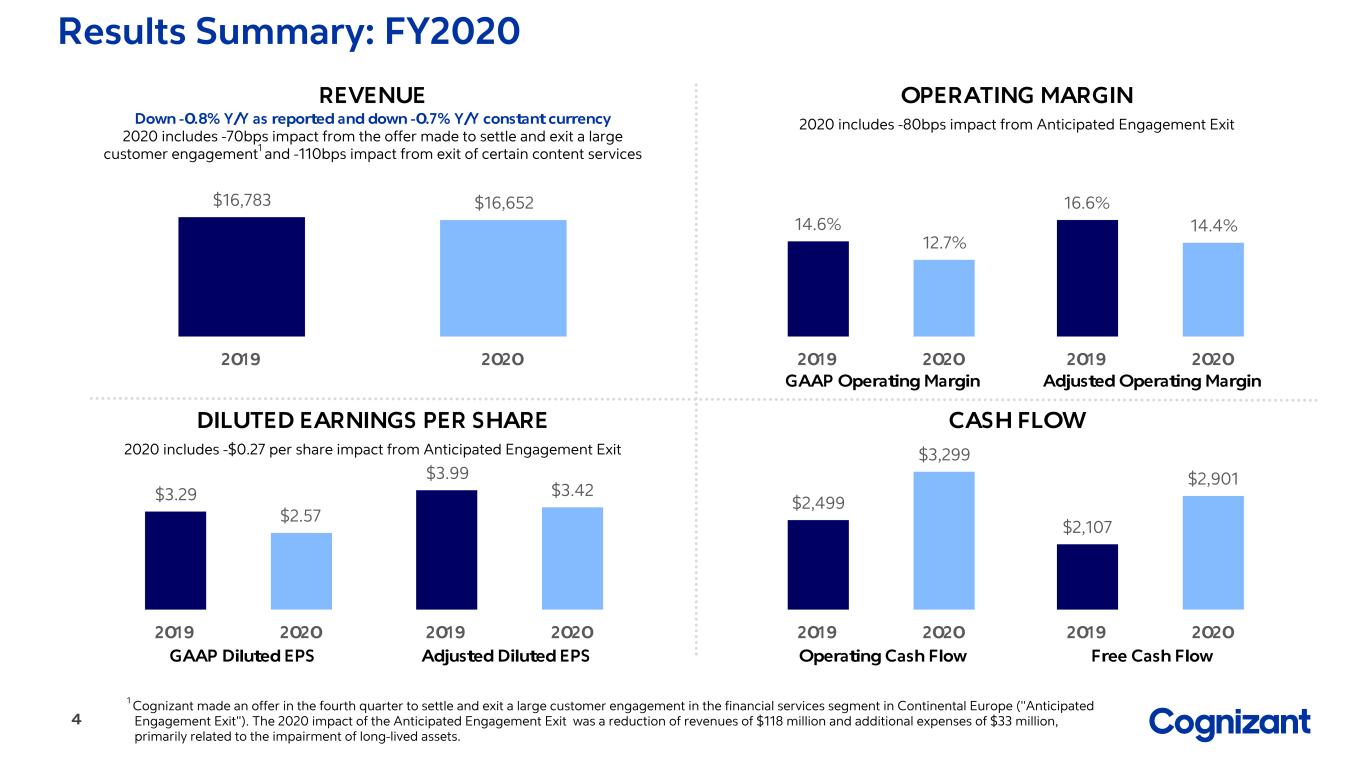

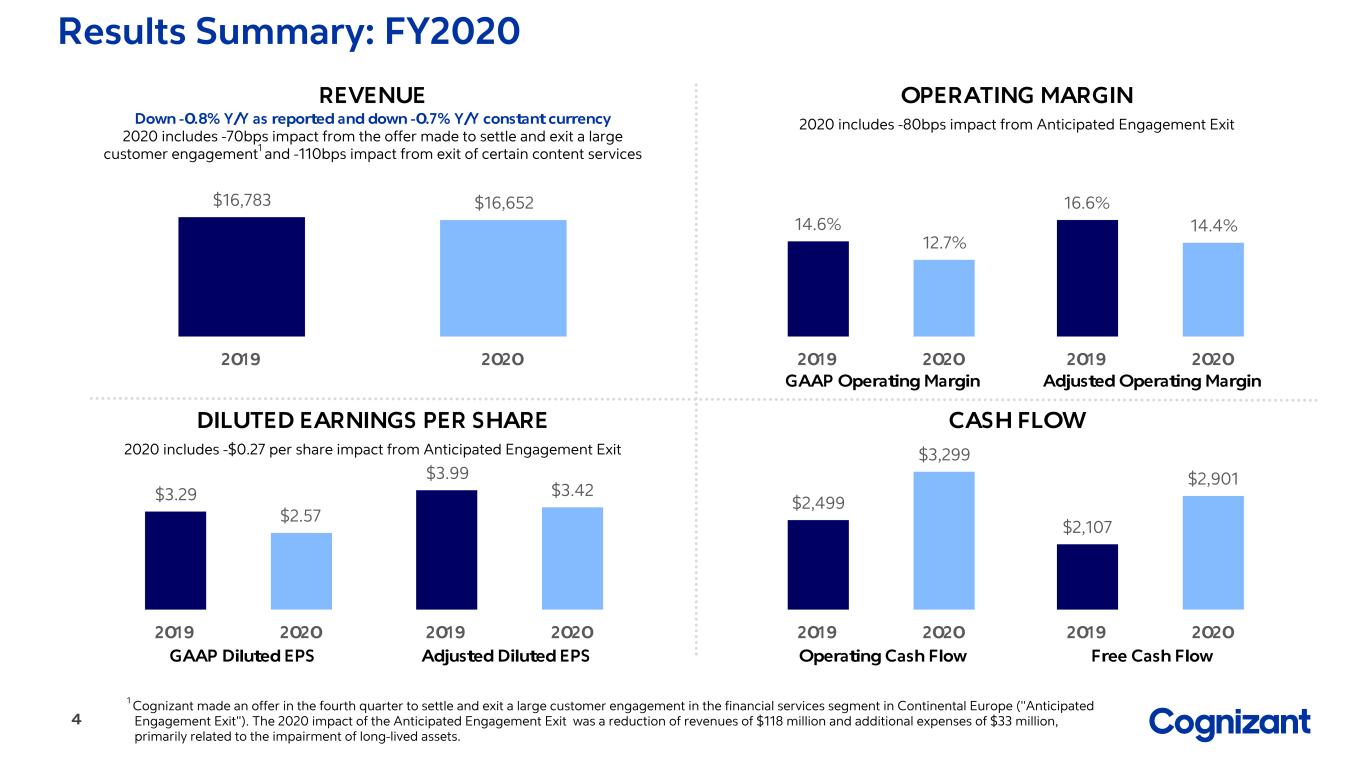

Results Summary: FY2020 REVENUE Down -0.8% Y/Y as reported and down -0.7% Y/Y constant currency 2020 includes -70bps impact from the offer made to settle and exit a large customer engagement1 and -110bps impact from exit of certain content services OPERATING MARGIN 2020 includes -80bps impact from Anticipated Engagement Exit CASH FLOW 4 $16,783 $16,652 2019 2020 DILUTED EARNINGS PER SHARE 2020 includes -$0.27 per share impact from Anticipated Engagement Exit 14.6% 12.7% 2019 2020 16.6% 14.4% 2019 2020 $2,499 $3,299 2019 2020 $2,107 $2,901 2019 2020 $3.29 $2.57 2019 2020 $3.99 $3.42 2019 2020 GAAP Operating Margin Adjusted Operating Margin GAAP Diluted EPS Adjusted Diluted EPS Operating Cash Flow Free Cash Flow 1 Cognizant made an offer in the fourth quarter to settle and exit a large customer engagement in the financial services segment in Continental Europe ("Anticipated Engagement Exit"). The 2020 impact of the Anticipated Engagement Exit was a reduction of revenues of $118 million and additional expenses of $33 million, primarily related to the impairment of long-lived assets.

$3,912 $4,006 $4,078 $4,129 $4,110 $4,141 $4,248 $4,284 $4,225 $4,000 $4,243 $4,184 $0.94 $1.05 $1.05 $0.98 $0.91 $0.94 $1.08 $1.07 $0.96 $0.82 $0.97 $0.67 Revenue Adjusted Diluted EPS Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 $ In Millions Except Per Share Amounts Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 ’19 Q3 ’19 Q4 ’19 Q1 ‘20 Q2 ‘20 Q3 ‘20 Q4 ‘20 Y/Y 10.3% 9.2% 8.3% 7.9% 5.1% 3.4% 4.2% 3.8% 2.8% (3.4%) (0.1%) (2.3%) Y/Y CC 8.2% 8.2% 9.0% 8.8% 6.8% 4.7% 5.1% 4.2% 3.5% (2.5%) (0.7%) (3.0%) GAAP DILUTED EPS $0.88 $0.78 $0.82 $1.12 $0.77 $0.90 $0.90 $0.72 $0.67 $0.67 $0.64 $0.59 ADJUSTED DILUTED EPS $0.94 $1.05 $1.05 $0.98 $0.91 $0.94 $ 1.08 $1.07 $0.96 $0.82 $0.97 $0.67 Revenue and GAAP & Adjusted Diluted EPS Revenue Growth and EPS 1 In Q4 2020 we recorded a reduction of revenue of $107 million, or -2.5 percentage points impact Y/Y, and additional expenses of $33 million, primarily related to the impairment of long-lived assets related to the Anticipated Engagement Exit. This impacted GAAP and Adjusted Diluted EPS by -$0.25. 1 1 5

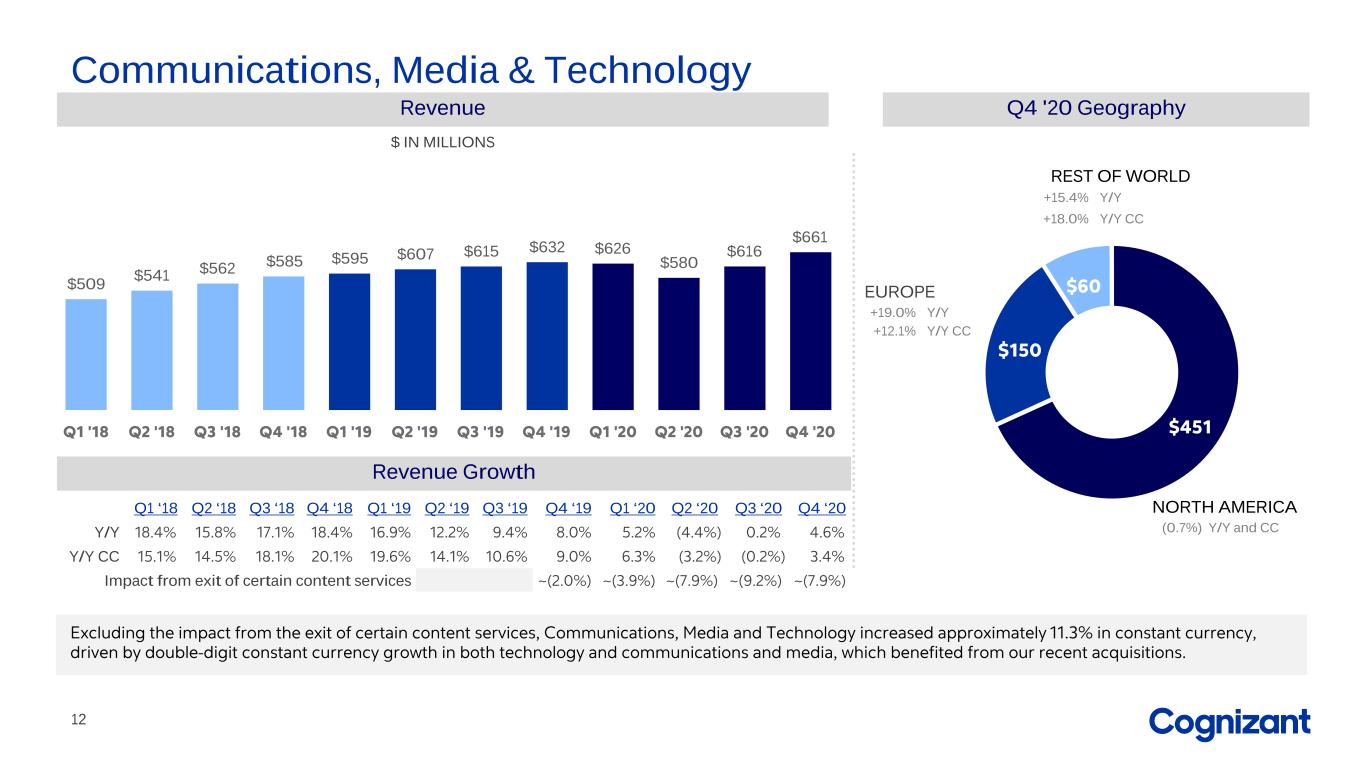

$3,206 $699 $279 $1,305 $1,270 $948 $661 Revenue Performance: Q4 2020 PRODUCTS & RESOURCES COMMUNICATIONS, MEDIA & TECHNOLOGY 1 HEALTHCARE FINANCIAL SERVICES 2 NORTH AMERICA EUROPE 2 REST OF WORLD Segments $ IN MILLIONS Geography $ IN MILLIONS +4.6% Y/Y +3.4% Y/Y CC (1.6%) Y/Y (2.4%) Y/Y CC +4.0% Y/Y +3.3% Y/Y CC (11.1%) Y/Y (11.4%) Y/Y CC (8.7%) Y/Y (12.6%) Y/Y CC +0.7% Y/Y +1.4% Y/Y CC (1.1%) Y/Y and CC 1 Our exit from certain content-related services negatively impacted Q4 2020 CMT revenue by approximately $50 million representing a negative ~7.9 percentage point impact to Y/Y growth in that segment. 2 The Q4 2020 impact of the Anticipated Engagement Exit was a reduction of revenues of $107 million, which negatively impacted our Financial Services revenue by ~7.3 percentage points Y/Y and our Europe revenue by ~14.0 percentage points Y/Y 6

$12,581 $2,988 $1,083 $5,621 $4,852 $3,696 $2,483 Revenue Performance: FY 2020 PRODUCTS & RESOURCES COMMUNICATIONS, MEDIA & TECHNOLOGY 1 HEALTHCARE NORTH AMERICA EUROPE 2 REST OF WORLD Segments $ IN MILLIONS Geography $ IN MILLIONS +1.4% Y/Y +1.6% Y/Y CC (2.0%) Y/Y (1.7%) Y/Y CC +3.3% Y/Y +3.1% Y/Y CC (4.2%) Y/Y (4.0%) Y/Y CC (0.5%) Y/Y (1.4%) Y/Y CC +2.8% Y/Y +6.4% Y/Y CC (1.1%) Y/Y and CC 1 Our exit from certain content-related services negatively impacted Q4 2020 CMT revenue by approximately $178 million representing a negative ~7.3 percentage point impact to Y/Y growth in that segment. 2 The 2020 impact of the Anticipated Engagement Exit was a reduction of revenues of $118 million, which negatively impacted our Financial Services revenue by ~2.0 percentage points Y/Y and our Europe revenue by ~3.9 percentage points Y/Y. FINANCIAL SERVICES 2 7

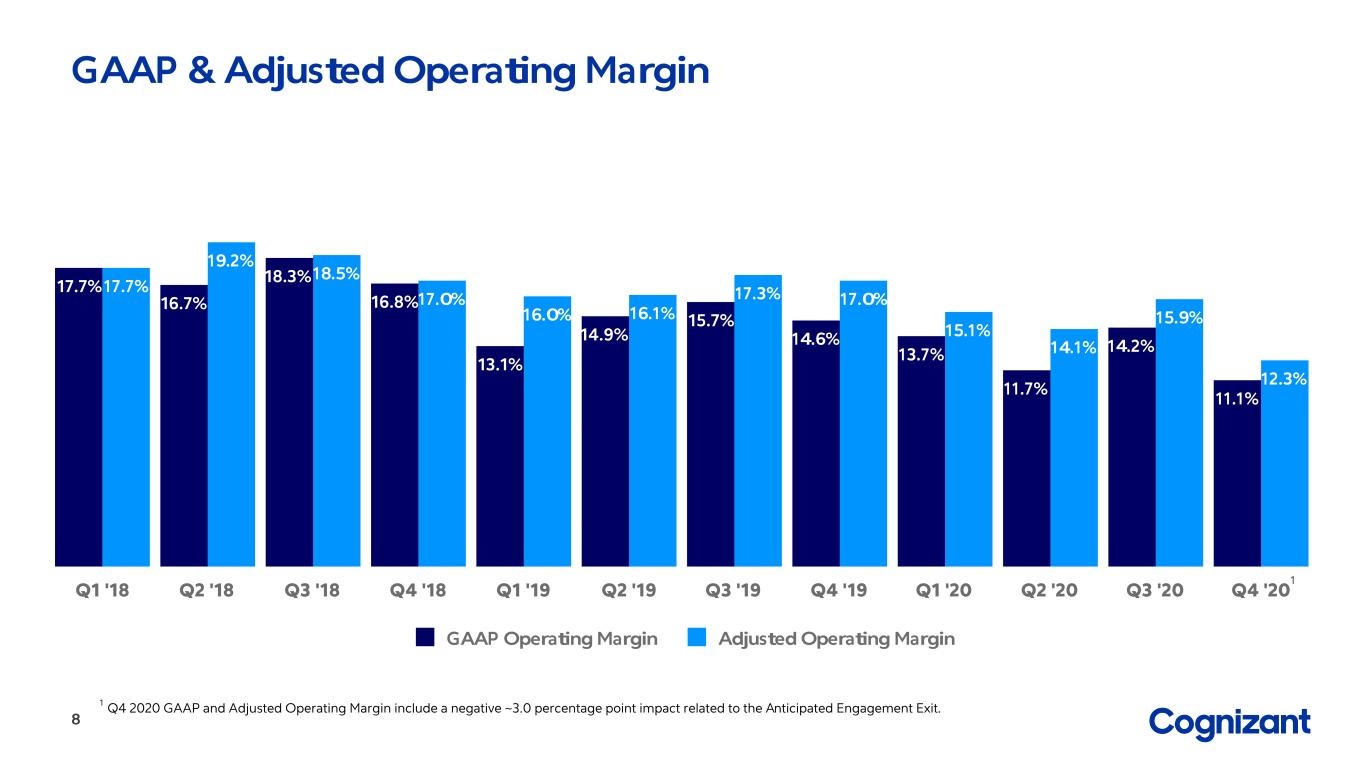

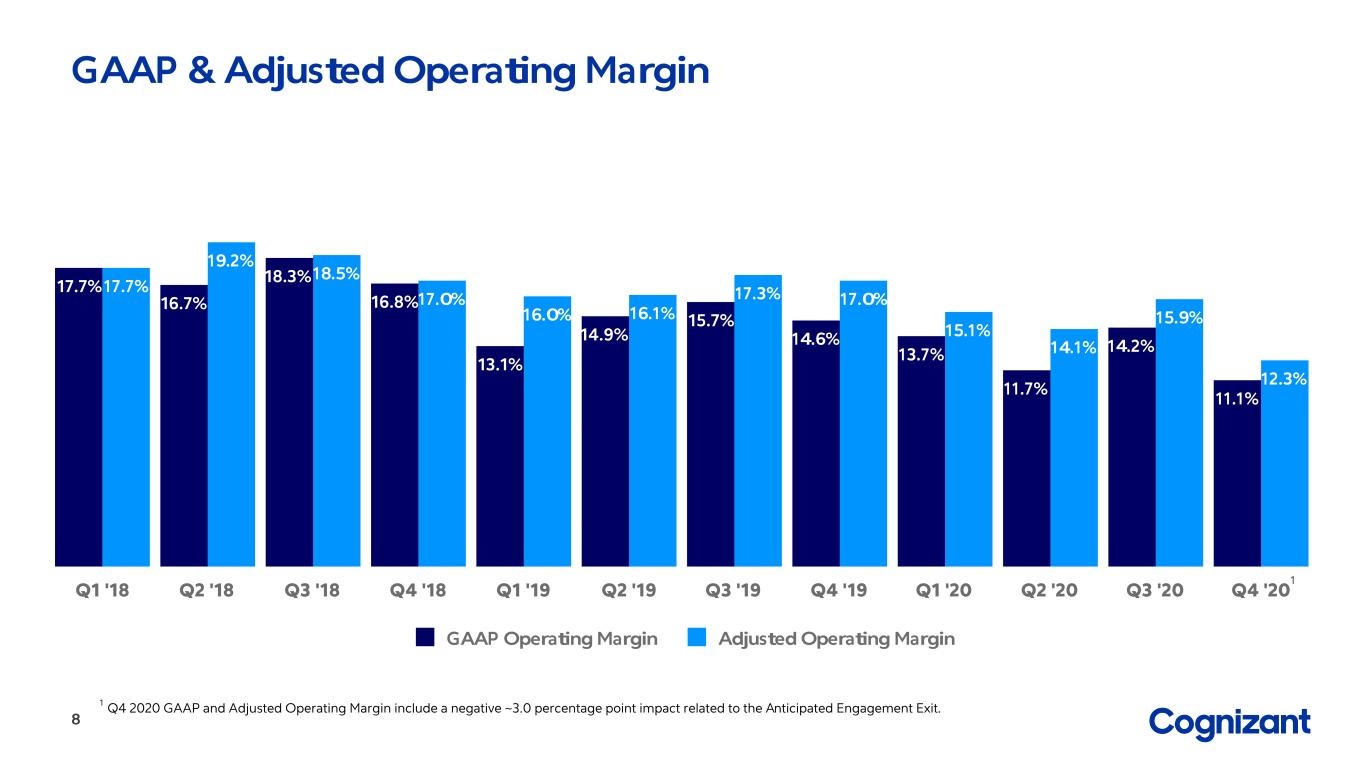

17.7% 16.7% 18.3% 16.8% 13.1% 14.9% 15.7% 14.6% 13.7% 11.7% 14.2% 11.1% 17.7% 19.2% 18.5% 17.0% 16.0% 16.1% 17.3% 17.0% 15.1% 14.1% 15.9% 12.3% GAAP Operating Margin Adjusted Operating Margin Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 GAAP & Adjusted Operating Margin 1 Q4 2020 GAAP and Adjusted Operating Margin include a negative ~3.0 percentage point impact related to the Anticipated Engagement Exit. 1 8

$990 $185 $130 Financial Services NORTH AMERICA EUROPE1 REST OF WORLD Q1 ‘18 Q2 ‘18 Q3 ‘18 Q4 ‘18 Q1 ‘19 Q2 ‘19 Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 Q4 ‘20 Y/Y 6.2% 4.5% 2.6% 1.7% (1.7%) 0.3% 1.9% 1.2% 1.0% (5.2%) (1.5%) (11.1%) Y/Y CC 3.9% 3.5% 3.5% 2.8% 0.2% 1.7% 3.0% 1.5% 1.8% (4.3%) (2.2%) (11.4%) (5.1%) Y/Y (5.2%) Y/Y CC (38.1%) Y/Y (39.3%) Y/Y CC Revenue Revenue Growth $ IN MILLIONS $ IN MILLIONS Q4 '20 Geography (4.1%) Y/Y and CC $1,461 $1,469 $1,464 $1,451 $1,436 $1,473 $1,492 $1,468 $1,451 $1,396 $1,469 $1,305 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 The Anticipated Engagement Exit impacted total segment revenue growth by ~7.3 percentage points. In addition to this impact, we experienced declines in both banking and insurance. Growth in regional banks and retail banking was offset by continued softness within select global banking and insurance accounts. 1 Cognizant made an offer in the fourth quarter to settle and exit a large customer engagement in the financial services segment in Continental Europe ("Anticipated Engagement Exit"). As a result of this offer, in the fourth quarter of 2020, we recorded a reduction of revenue of $107 million. This negatively impacted the Y/Y growth rate for Financial Services by approximately 7.3 percentage points Y/Y and Financial Services revenue in Europe by approximately 35.8 percentage points Y/Y. 1 1 9

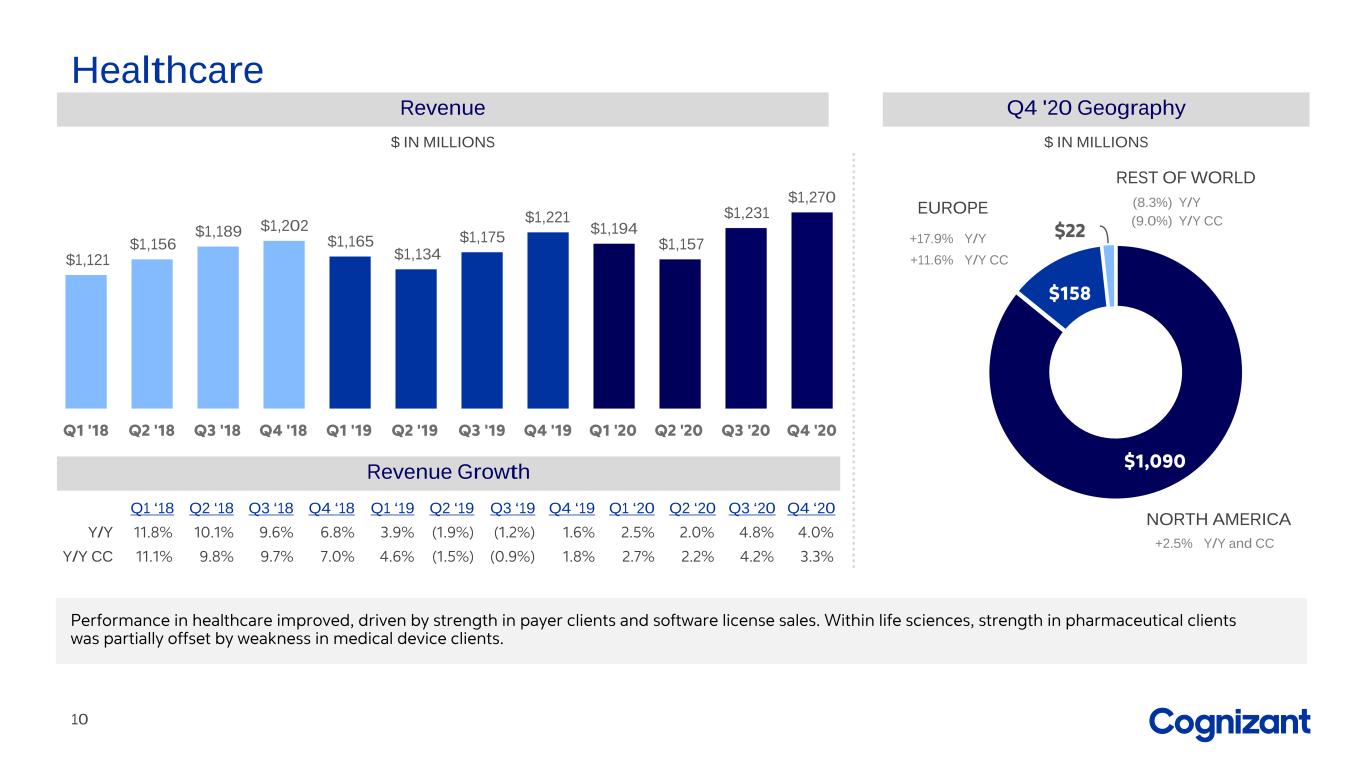

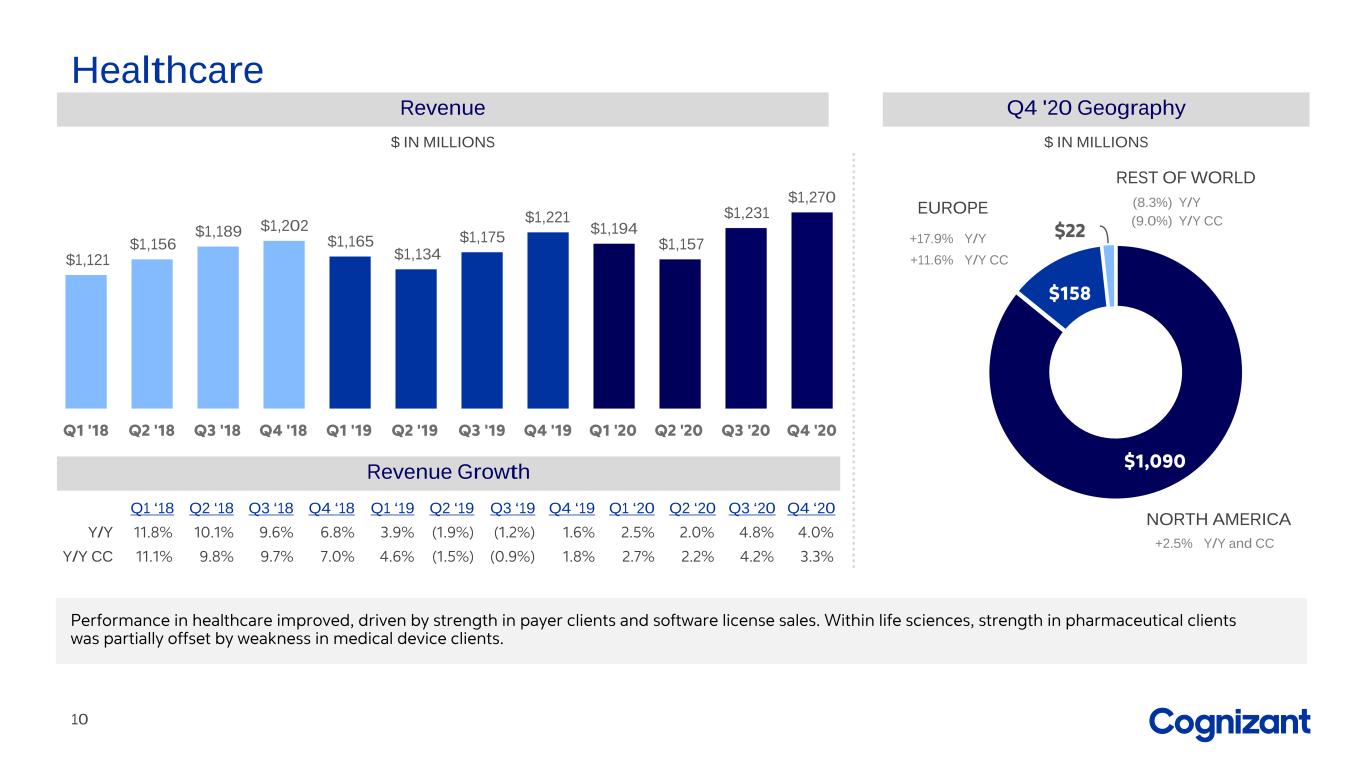

$1,090 $158 $22 Healthcare NORTH AMERICA EUROPE REST OF WORLD (8.3%) Y/Y (9.0%) Y/Y CC +17.9% Y/Y +11.6% Y/Y CC +2.5% Y/Y and CC Revenue Revenue Growth $ IN MILLIONS $ IN MILLIONS Q1 ‘18 Q2 ‘18 Q3 ‘18 Q4 ‘18 Q1 ‘19 Q2 ‘19 Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 Q4 ‘20 Y/Y 11.8% 10.1% 9.6% 6.8% 3.9% (1.9%) (1.2%) 1.6% 2.5% 2.0% 4.8% 4.0% Y/Y CC 11.1% 9.8% 9.7% 7.0% 4.6% (1.5%) (0.9%) 1.8% 2.7% 2.2% 4.2% 3.3% Q4 '20 Geography $1,121 $1,156 $1,189 $1,202 $1,165 $1,134 $1,175 $1,221 $1,194 $1,157 $1,231 $1,270 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Performance in healthcare improved, driven by strength in payer clients and software license sales. Within life sciences, strength in pharmaceutical clients was partially offset by weakness in medical device clients. 10

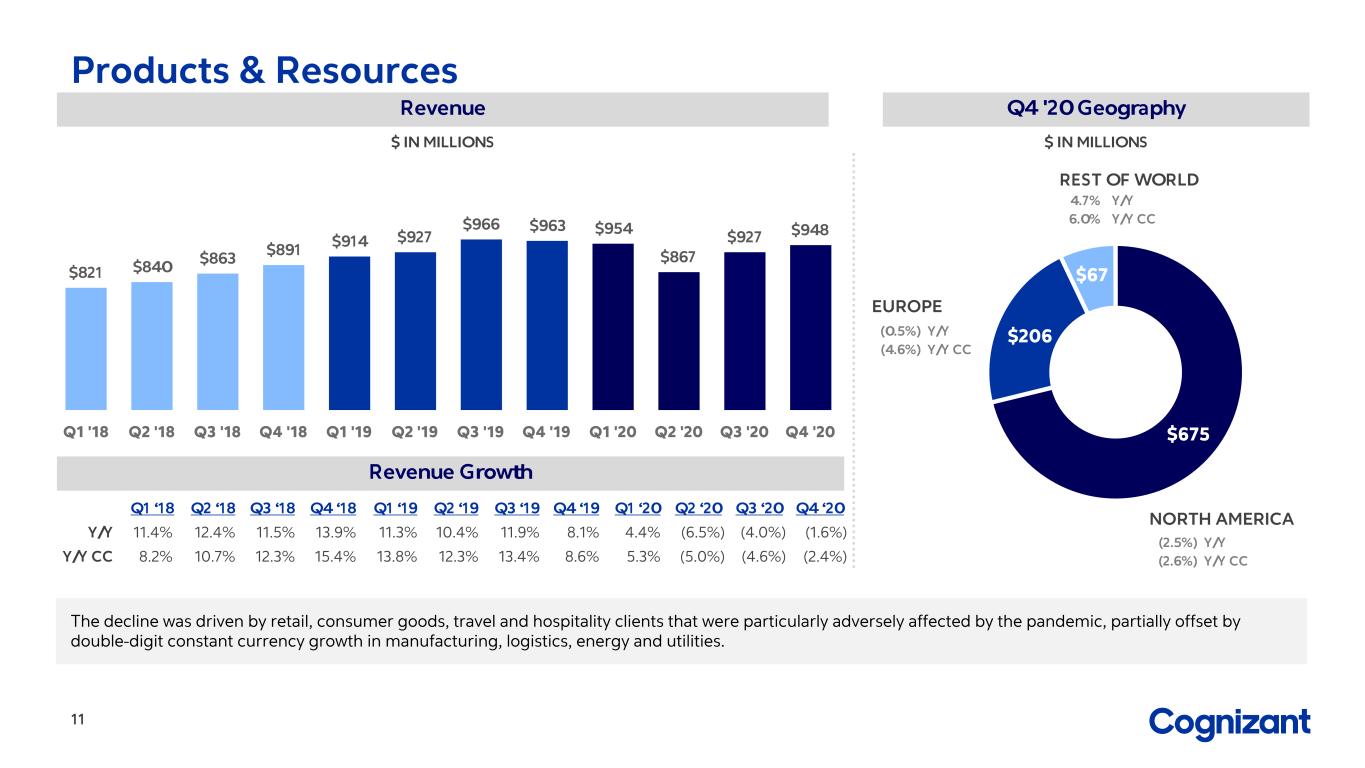

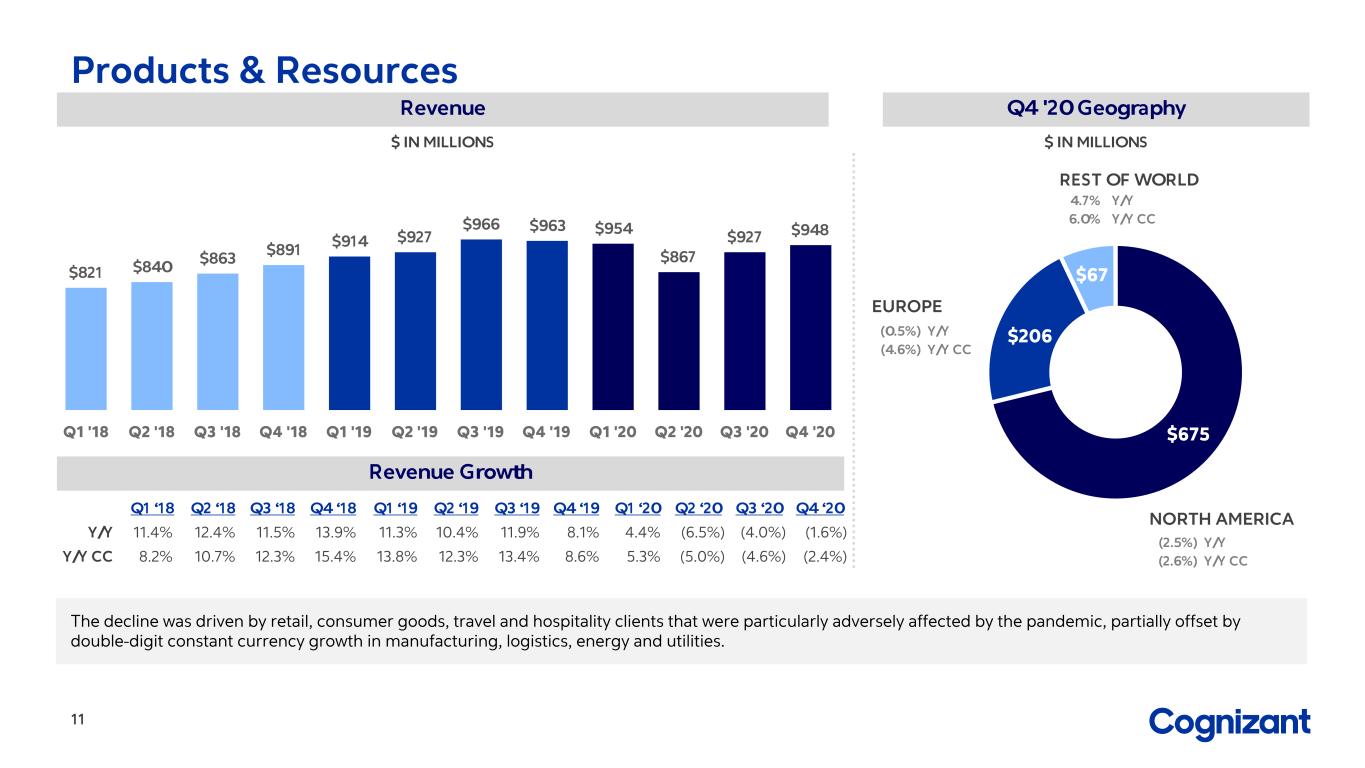

$675 $206 $67 NORTH AMERICA EUROPE Products & Resources The decline was driven by retail, consumer goods, travel and hospitality clients that were particularly adversely affected by the pandemic, partially offset by double-digit constant currency growth in manufacturing, logistics, energy and utilities. (2.5%) Y/Y (2.6%) Y/Y CC (0.5%) Y/Y (4.6%) Y/Y CC 4.7% Y/Y 6.0% Y/Y CC REST OF WORLD Revenue Revenue Growth $ IN MILLIONS $ IN MILLIONS Q1 ‘18 Q2 ‘18 Q3 ‘18 Q4 ‘18 Q1 ‘19 Q2 ‘19 Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 Q4 ‘20 Y/Y 11.4% 12.4% 11.5% 13.9% 11.3% 10.4% 11.9% 8.1% 4.4% (6.5%) (4.0%) (1.6%) Y/Y CC 8.2% 10.7% 12.3% 15.4% 13.8% 12.3% 13.4% 8.6% 5.3% (5.0%) (4.6%) (2.4%) Q4 '20 Geography $821 $840 $863 $891 $914 $927 $966 $963 $954 $867 $927 $948 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 11

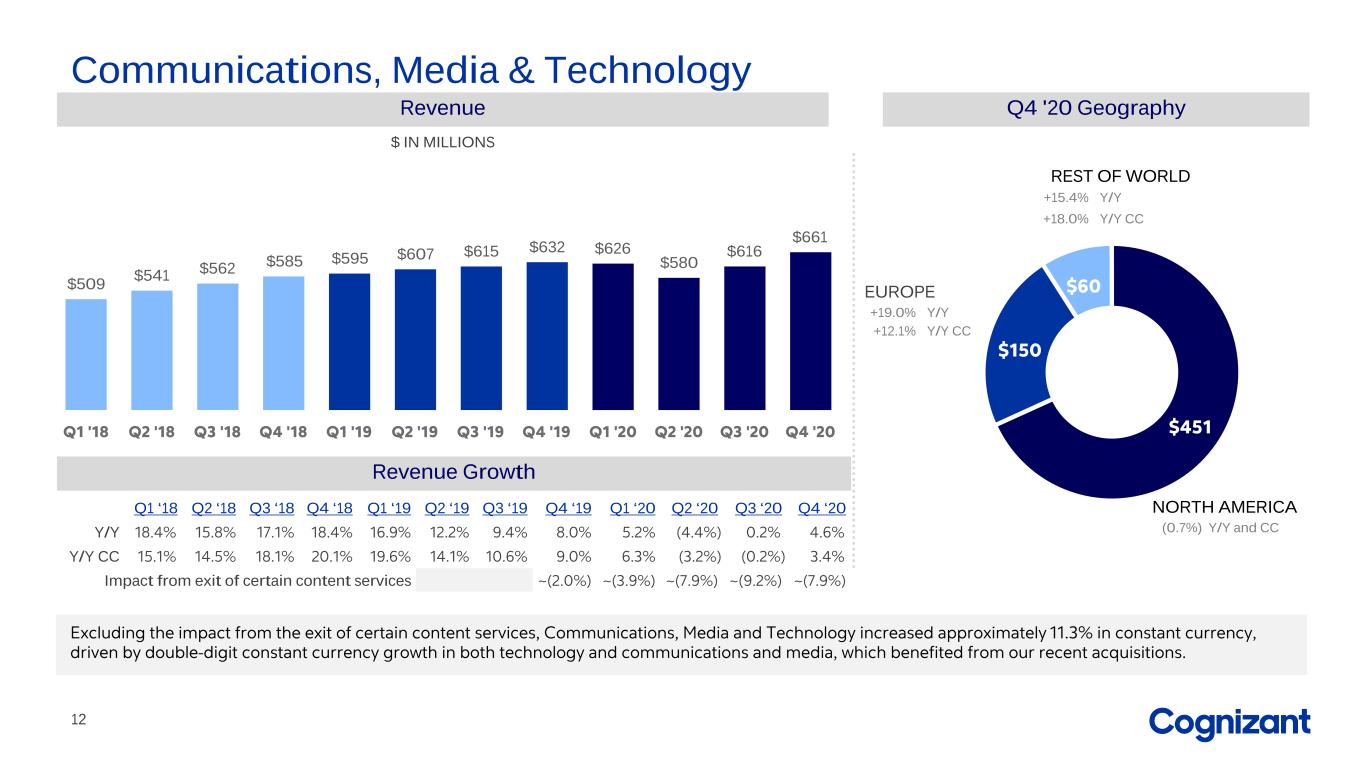

$451 $150 $60$509 $541 $562 $585 $595 $607 $615 $632 $626 $580 $616 $661 Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Communications, Media & Technology NORTH AMERICA REST OF WORLD +15.4% Y/Y +18.0% Y/Y CC +19.0% Y/Y +12.1% Y/Y CC (0.7%) Y/Y and CC EUROPE Revenue Revenue Growth $ IN MILLIONS Q1 ‘18 Q2 ‘18 Q3 ‘18 Q4 ‘18 Q1 ‘19 Q2 ‘19 Q3 ‘19 Q4 ‘19 Q1 ‘20 Q2 ‘20 Q3 ‘20 Q4 ‘20 Y/Y 18.4% 15.8% 17.1% 18.4% 16.9% 12.2% 9.4% 8.0% 5.2% (4.4%) 0.2% 4.6% Y/Y CC 15.1% 14.5% 18.1% 20.1% 19.6% 14.1% 10.6% 9.0% 6.3% (3.2%) (0.2%) 3.4% Impact from exit of certain content services ~(2.0%) ~(3.9%) ~(7.9%) ~(9.2%) ~(7.9%) Q4 '20 Geography Excluding the impact from the exit of certain content services, Communications, Media and Technology increased approximately 11.3% in constant currency, driven by double-digit constant currency growth in both technology and communications and media, which benefited from our recent acquisitions. 12

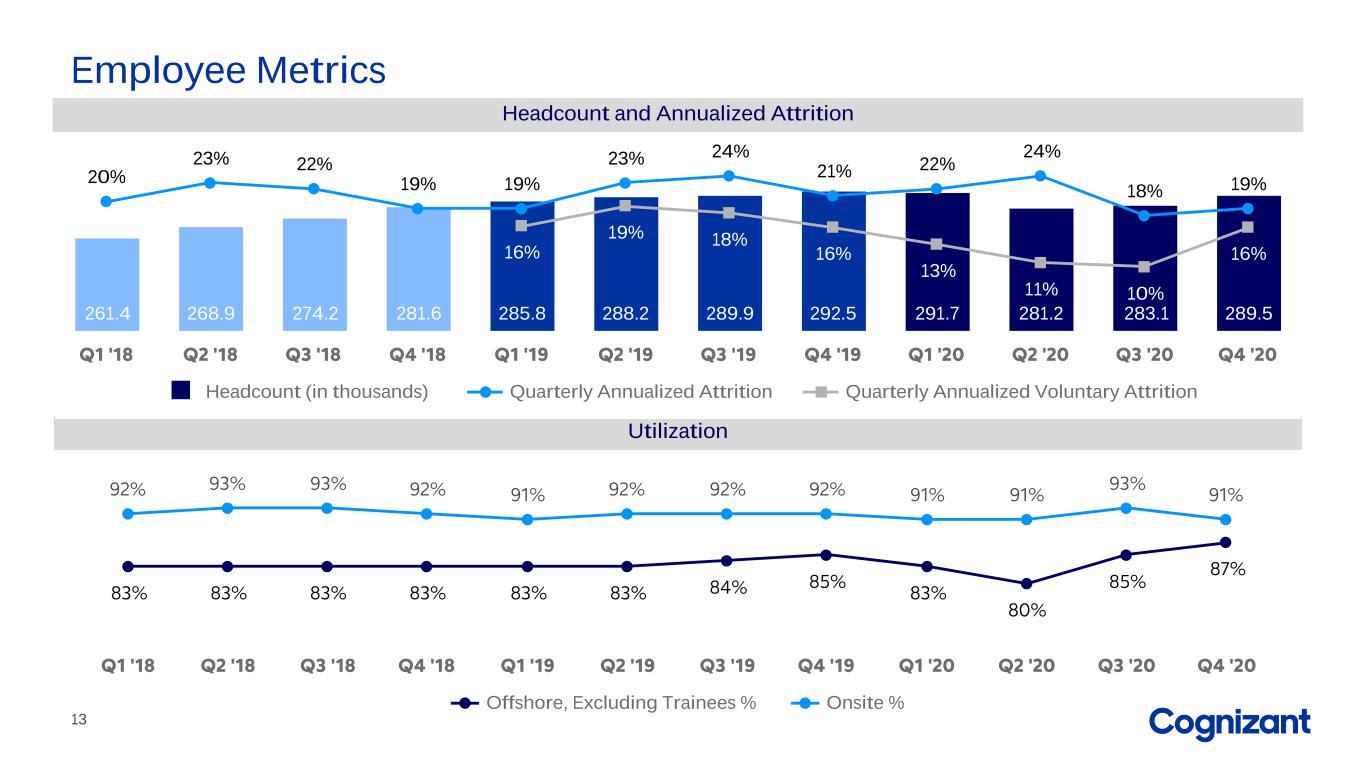

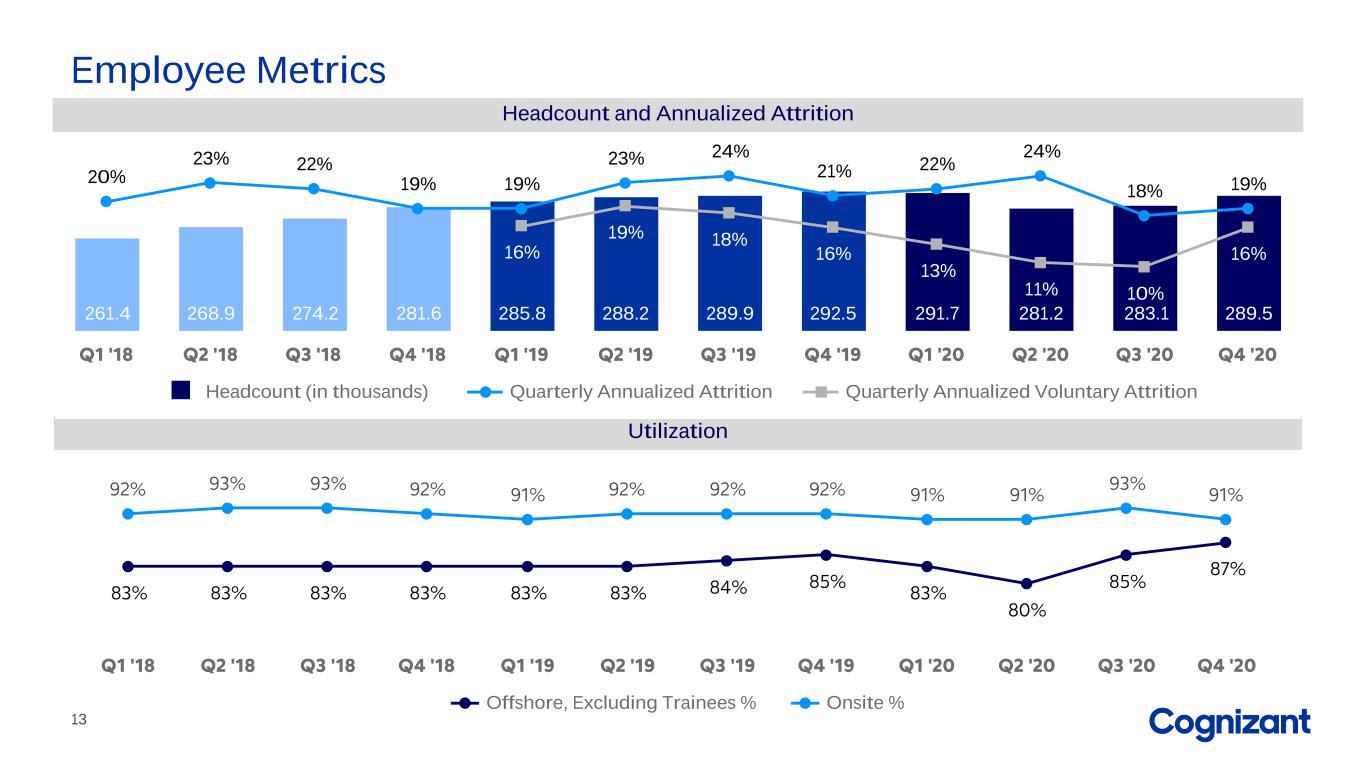

83% 83% 83% 83% 83% 83% 84% 85% 83% 80% 85% 87% 92% 93% 93% 92% 91% 92% 92% 92% 91% 91% 93% 91% Offshore, Excluding Trainees % Onsite % Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Employee Metrics Headcount and Annualized Attrition NUMBER OF EMPLOYEES IN THOUSANDS Utilization 261.4 268.9 274.2 281.6 285.8 288.2 289.9 292.5 291.7 281.2 283.1 289.5 20% 23% 22% 19% 19% 23% 24% 21% 22% 24% 18% 19% 16% 19% 18% 16% 13% 11% 10% 16% Headcount (in thousands) Quarterly Annualized Attrition Quarterly Annualized Voluntary Attrition Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 13

$468 $453 $480 $1,111 $617 $1,123 $1,261 $2,247 $1,621 FY2018 FY2019 FY2020 Cash Flow, Balance Sheet & Capital Allocation $ IN MILLIONS Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 ’20 Q2 ’20 Q3 ’20 Q4 ’20 OPERATING CASH FLOW $388 $640 $862 $702 $269 $575 $717 $938 $497 $979 $925 $898 FREE CASH FLOW $292 $549 $768 $606 $163 $479 $620 $845 $385 $886 $821 $809 CASH AND SHORT-TERM INVESTMENTS1 $4,989 $4,247 $4,763 $4,511 $3,668 $3,003 $3,077 $3,424 $4,282 $4,582 $4,575 $2,724 TOTAL DEBT $773 $749 $724 $745 $746 $746 $747 $738 $2,468 $2,459 $2,450 $701 $ IN MILLIONS 1 Q1 ’18 to Q4 ’19 cash and short-term investments included restricted time deposits in India. Beginning in 2020 these restricted time deposits were classified as long- term investments and therefore are no longer included in cash and short-term investments. $ 74 $121 $121 $120 $118 $86 $403 $580$511 $248 $788 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Annual Quarterly Acquisitions Share Repurchases Dividends $74 $54 14

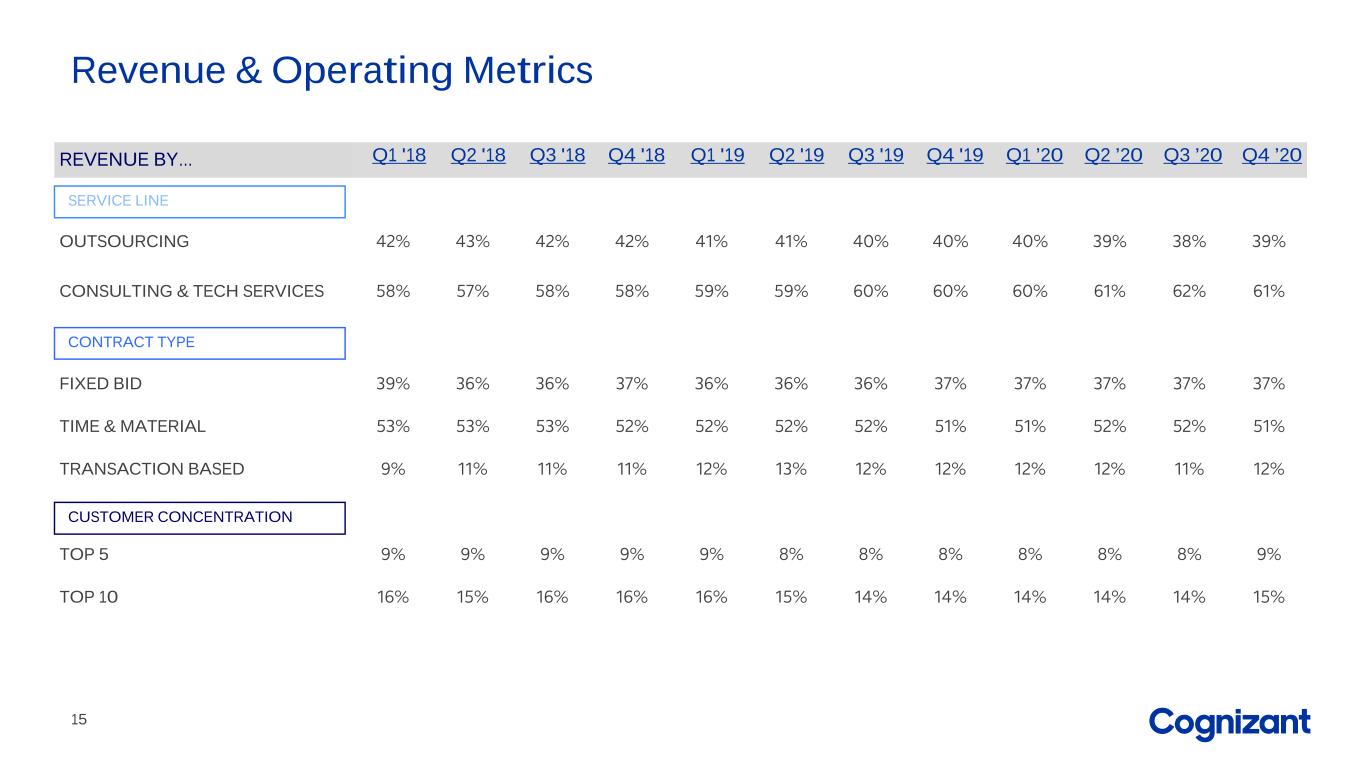

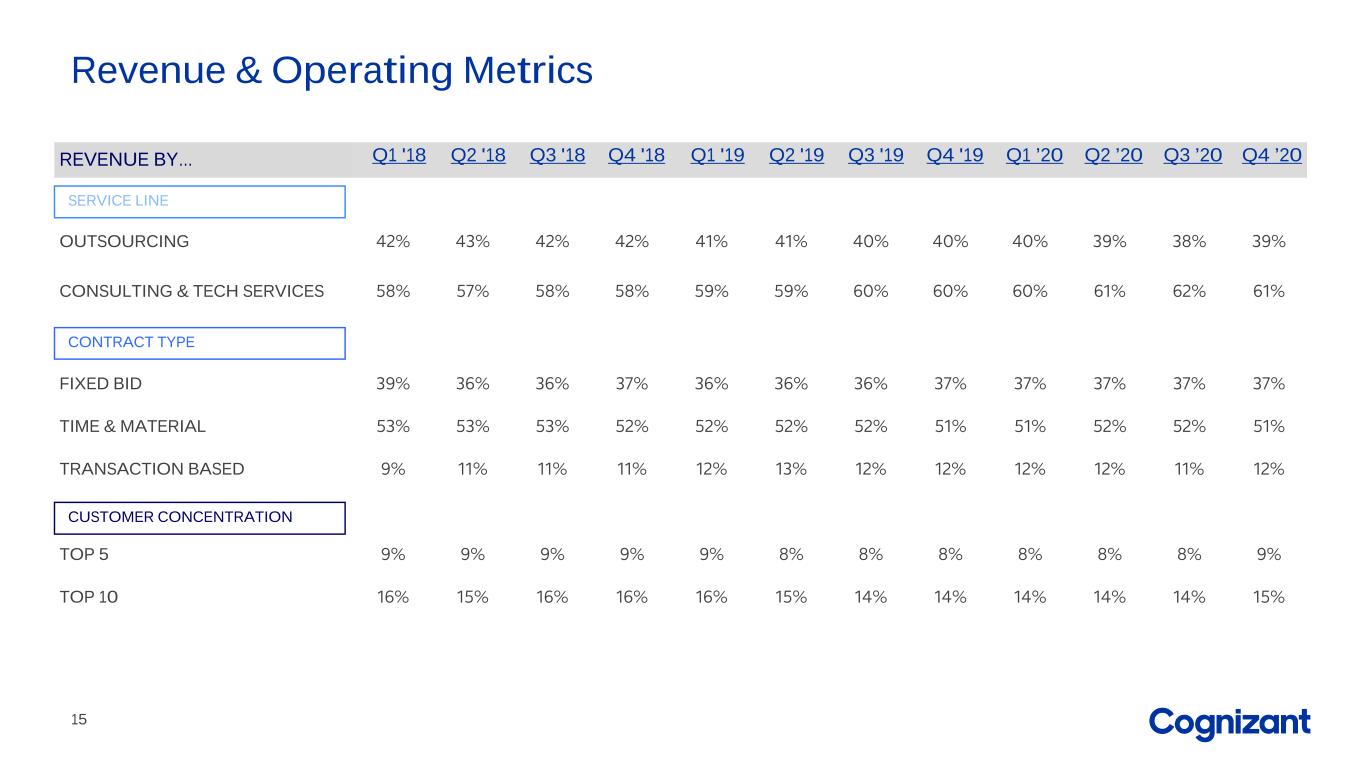

REVENUE BY… Q1 '18 Q2 '18 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 ’20 Q2 ’20 Q3 ’20 Q4 ’20 OUTSOURCING 42% 43% 42% 42% 41% 41% 40% 40% 40% 39% 38% 39% CONSULTING & TECH SERVICES 58% 57% 58% 58% 59% 59% 60% 60% 60% 61% 62% 61% FIXED BID 39% 36% 36% 37% 36% 36% 36% 37% 37% 37% 37% 37% TIME & MATERIAL 53% 53% 53% 52% 52% 52% 52% 51% 51% 52% 52% 51% TRANSACTION BASED 9% 11% 11% 11% 12% 13% 12% 12% 12% 12% 11% 12% TOP 5 9% 9% 9% 9% 9% 8% 8% 8% 8% 8% 8% 9% TOP 10 16% 15% 16% 16% 16% 15% 14% 14% 14% 14% 14% 15% Revenue & Operating Metrics CUSTOMER CONCENTRATION CONTRACT TYPE SERVICE LINE 15

2020 Fit for Growth Protect and optimize the core Drive efficiency, tooling, delivery optimization, protect renewals, strengthen industry mix and scale internationally Reduce duplication and simplify delivery Reinvest in sales, branding, talent and automation tools Eliminate costs to fund growth investment Streamline operating model Drive efficiency, scalability and empowerment Improve role clarity and accountability Invest and reskill to accelerate momentum in data, digital engineering, cloud and IoT Leverage core business to win in digital battlegrounds 2020 Fit for Growth Plan Updates Initial Q4 2019 Estimate Program Update as of Sep 30 Total restructuring charges $150-200M ~$200M Gross Annualized savings $500-550M $520-550M Transformation actions # of employees impacted 10-12K ~14-15K Targeted reskilling and training ~5K ~4-5K Net headcount exits 5-7K ~10-11K Content services actions Headcount exit ~6K 4.5K Annualized revenue loss $240-270M $225M1 Final Program Achievement $220M ~$530M ~16K ~5K ~11K Complete Complete 1 The work associated with our decision to exit certain portions of our content related business is now complete. This decision will impact our Y/Y metrics through Q2 2021.16

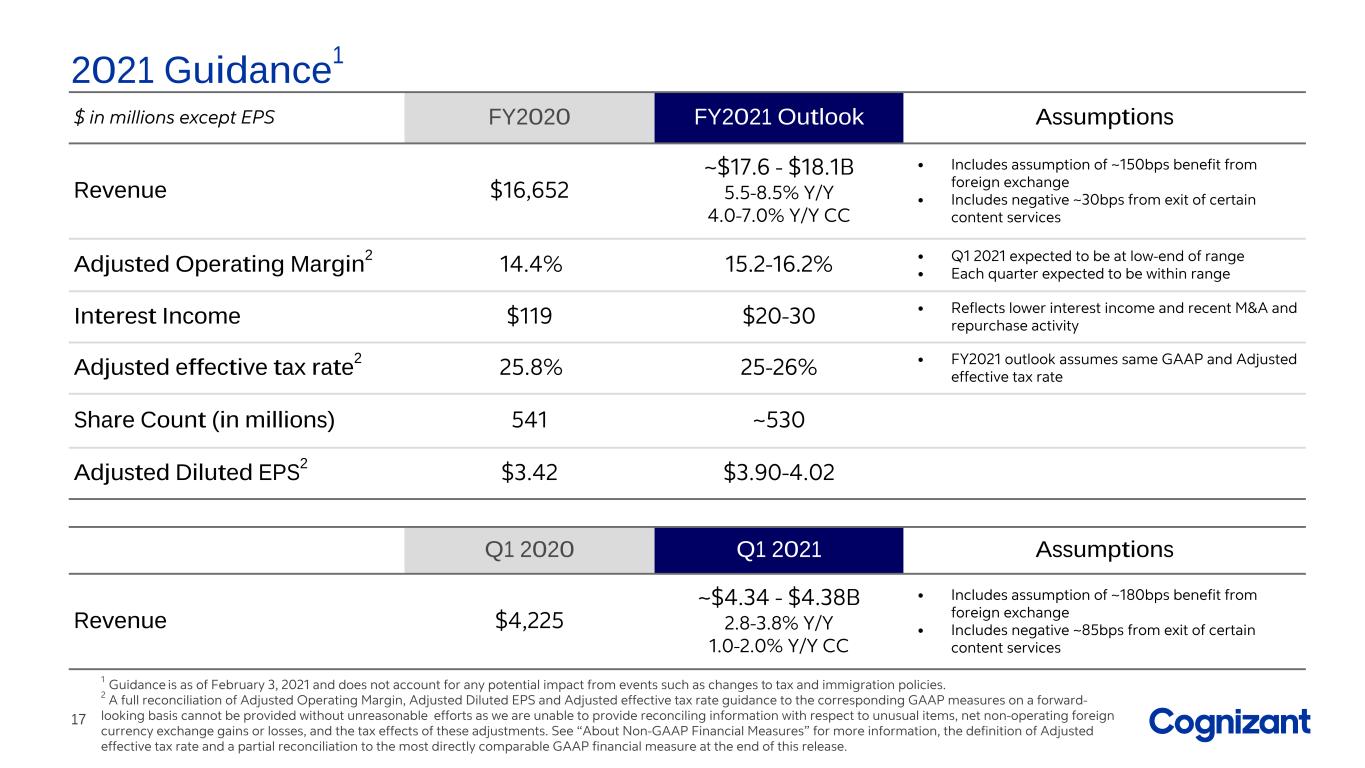

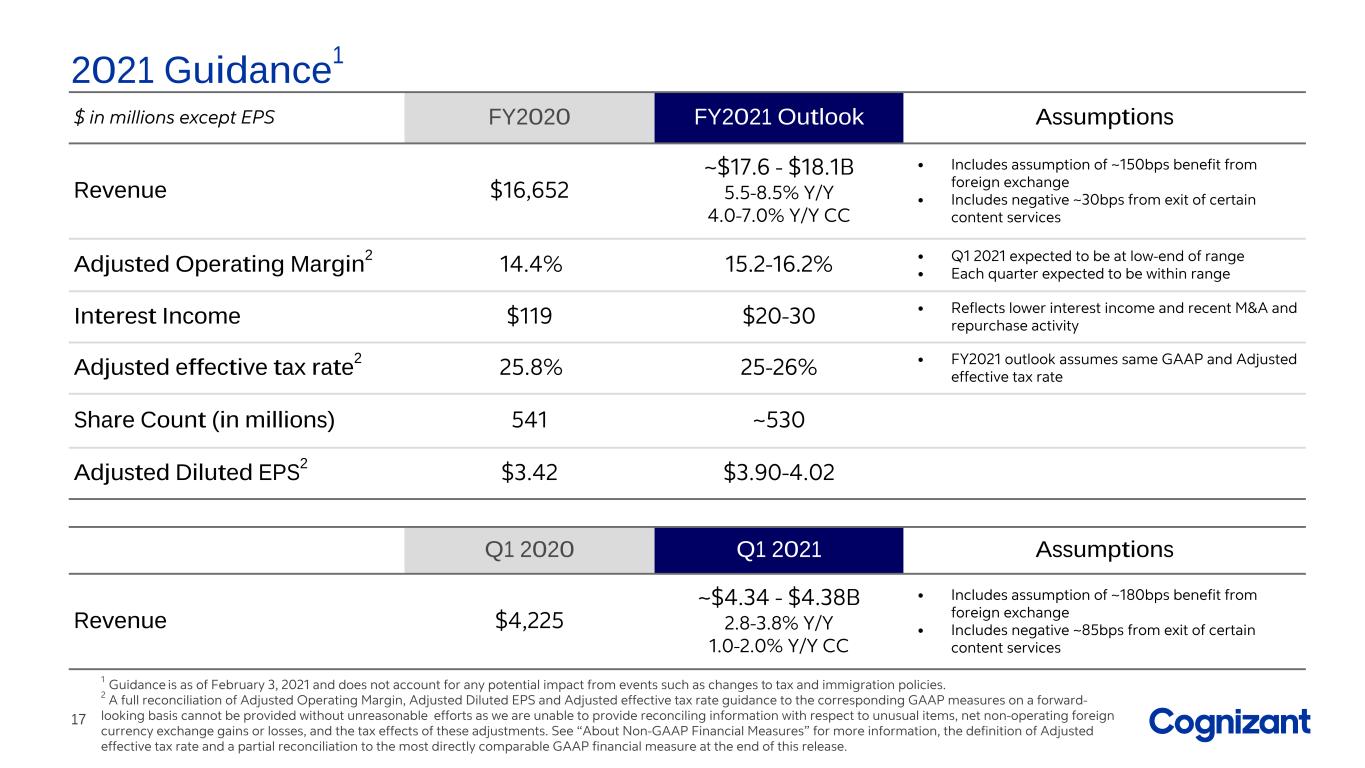

2021 Guidance1 1 Guidance is as of February 3, 2021 and does not account for any potential impact from events such as changes to tax and immigration policies. 2 A full reconciliation of Adjusted Operating Margin, Adjusted Diluted EPS and Adjusted effective tax rate guidance to the corresponding GAAP measures on a forward- looking basis cannot be provided without unreasonable efforts as we are unable to provide reconciling information with respect to unusual items, net non-operating foreign currency exchange gains or losses, and the tax effects of these adjustments. See “About Non-GAAP Financial Measures” for more information, the definition of Adjusted effective tax rate and a partial reconciliation to the most directly comparable GAAP financial measure at the end of this release. $ in millions except EPS FY2020 FY2021 Outlook Assumptions Revenue $16,652 ~$17.6 - $18.1B 5.5-8.5% Y/Y 4.0-7.0% Y/Y CC • Includes assumption of ~150bps benefit from foreign exchange • Includes negative ~30bps from exit of certain content services Adjusted Operating Margin2 14.4% 15.2-16.2% • Q1 2021 expected to be at low-end of range• Each quarter expected to be within range Interest Income $119 $20-30 • Reflects lower interest income and recent M&A and repurchase activity Adjusted effective tax rate2 25.8% 25-26% • FY2021 outlook assumes same GAAP and Adjusted effective tax rate Share Count (in millions) 541 ~530 Adjusted Diluted EPS2 $3.42 $3.90-4.02 Q1 2020 Q1 2021 Assumptions Revenue $4,225 ~$4.34 - $4.38B 2.8-3.8% Y/Y 1.0-2.0% Y/Y CC • Includes assumption of ~180bps benefit from foreign exchange • Includes negative ~85bps from exit of certain content services 17

APPENDIX: About Non-GAAP Financial Measures

To supplement our financial results presented in accordance with GAAP, this earnings supplement includes references to the following measures defined by the Securities and Exchange Commission as non-GAAP financial measures: Adjusted Income From Operations, Adjusted Operating Margin, Adjusted Diluted EPS, free cash flow, Adjusted effective tax rate, and constant currency revenue growth. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. In addition, these non-GAAP financial measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of our non-GAAP financial measures to the corresponding GAAP measures should be carefully evaluated. Our non-GAAP financial measures, Adjusted Operating Margin, Adjusted Income From Operations and Adjusted Diluted EPS exclude unusual items. Additionally, Adjusted Diluted EPS excludes net non-operating foreign currency exchange gains or losses and the tax impact of all the applicable adjustments. The income tax impact of each item is calculated by applying the statutory rate and local tax regulations in the jurisdiction in which the item was incurred. Free cash flow is defined as cash flows from operating activities net of purchases of property and equipment. Constant currency revenue growth is defined as revenues for a given period restated at the comparative period’s foreign currency exchange rates measured against the comparative period's reported revenues. Adjusted effective tax rate reflects a tax rate commensurate with our non-GAAP Adjusted EPS. We believe providing investors with an operating view consistent with how we manage the Company provides enhanced transparency into our operating results. For our internal management reporting and budgeting purposes, we use various GAAP and non-GAAP financial measures for financial and operational decision- making, to evaluate period-to-period comparisons, to determine portions of the compensation for our executive officers and for making comparisons of our operating results to those of our competitors. Therefore, it is our belief that the use of non-GAAP financial measures excluding certain costs provides a meaningful supplemental measure for investors to evaluate our financial performance. Accordingly, we believe that the presentation of our non-GAAP measures, when read in conjunction with our reported GAAP results, can provide useful supplemental information to our management and investors regarding financial and business trends relating to our financial condition and results of operations. A limitation of using non-GAAP financial measures versus financial measures calculated in accordance with GAAP is that non-GAAP financial measures do not reflect all of the amounts associated with our operating results as determined in accordance with GAAP and may exclude costs that are recurring such as our net non-operating foreign currency exchange gains or losses. In addition, other companies may calculate non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures as a comparative tool. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from our non-GAAP financial measures to allow investors to evaluate such non-GAAP financial measures. About Non-GAAP Financial Measures 19

Reconciliations of Non-GAAP Financial Measures Please refer to page 22, 23 and 24 of this earnings supplement for corresponding Non-GAAP notes. (in millions, except per share amounts) Three Months Ended: Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020 GAAP income from operations $ 693 $ 670 $ 745 $ 693 $ 539 $ 619 $ 669 $ 626 $ 579 $ 467 $ 603 $ 465 Realignment charges(a) 1 — 11 7 2 49 65 53 20 12 8 2 2020 Fit for Growth Plan restructuring charges(b) — — — — — — — 48 35 59 43 36 COVID-19 charges(c) — — — — — — — — 6 25 21 13 Incremental accrual related to the India Defined Contribution Obligation(d) — — — — 117 — — — — — — — Initial funding of Cognizant U.S. Foundation(e) — 100 — — — — — — — — — — Adjusted income from operations $ 694 $ 770 $ 756 $ 700 $ 658 $ 668 $ 734 $ 727 $ 640 $ 563 $ 675 $ 516 GAAP operating margin 17.7 % 16.7 % 18.3 % 16.8 % 13.1 % 14.9 % 15.7 % 14.6 % 13.7 % 11.7 % 14.2 % 11.1 % Realignment charges — — 0.2 0.2 — 1.2 1.6 1.3 0.5 0.3 0.2 — 2020 Fit for Growth Plan restructuring charges — — — — — — — 1.1 0.8 1.5 1.0 0.9 COVID-19 charges — — — — — — — — 0.1 0.6 0.5 0.3 Incremental accrual related to the India Contribution Obligation — — — — 2.9 — — — — — — — Initial funding of Cognizant U.S. Foundation — 2.5 — — — — — — — — — — Adjusted operating margin 17.7 % 19.2 % 18.5 % 17.0 % 16.0 % 16.1 % 17.3 % 17.0 % 15.1 % 14.1 % 15.9 % 12.3 % GAAP diluted earnings per share $ 0.88 $ 0.78 $ 0.82 $ 1.12 $ 0.77 $ 0.90 $ 0.90 $ 0.72 $ 0.67 $ 0.67 $ 0.64 $ 0.59 Effect of above adjustments, pre-tax — 0.17 0.02 0.01 0.20 0.09 0.12 0.18 0.11 0.18 0.13 0.10 Effect of non-operating foreign currency exchange (gains) loss, pre-tax(f) 0.06 0.14 0.21 (0.14) (0.01) (0.03) 0.09 0.08 0.19 — — 0.02 Tax effect of above adjustments(g) — (0.04) 0.01 (0.01) (0.05) (0.02) (0.03) (0.05) (0.01) (0.03) (0.06) (0.04) Tax on Accumulated Indian Earnings (h) — — — — — — — — — — 0.26 — Effect of the equity method investment impairment(i) — — — — — — — 0.10 — — — — Effect of the India Tax Law(j) — — — — — — — 0.04 — — — — Effect of net incremental income tax expense related to the Tax Reform Act(k) — — (0.01) — — — — — — — — — Adjusted diluted earnings per share $ 0.94 $ 1.05 $ 1.05 $ 0.98 $ 0.91 $ 0.94 $ 1.08 $ 1.07 $ 0.96 $ 0.82 $ 0.97 $ 0.67 20

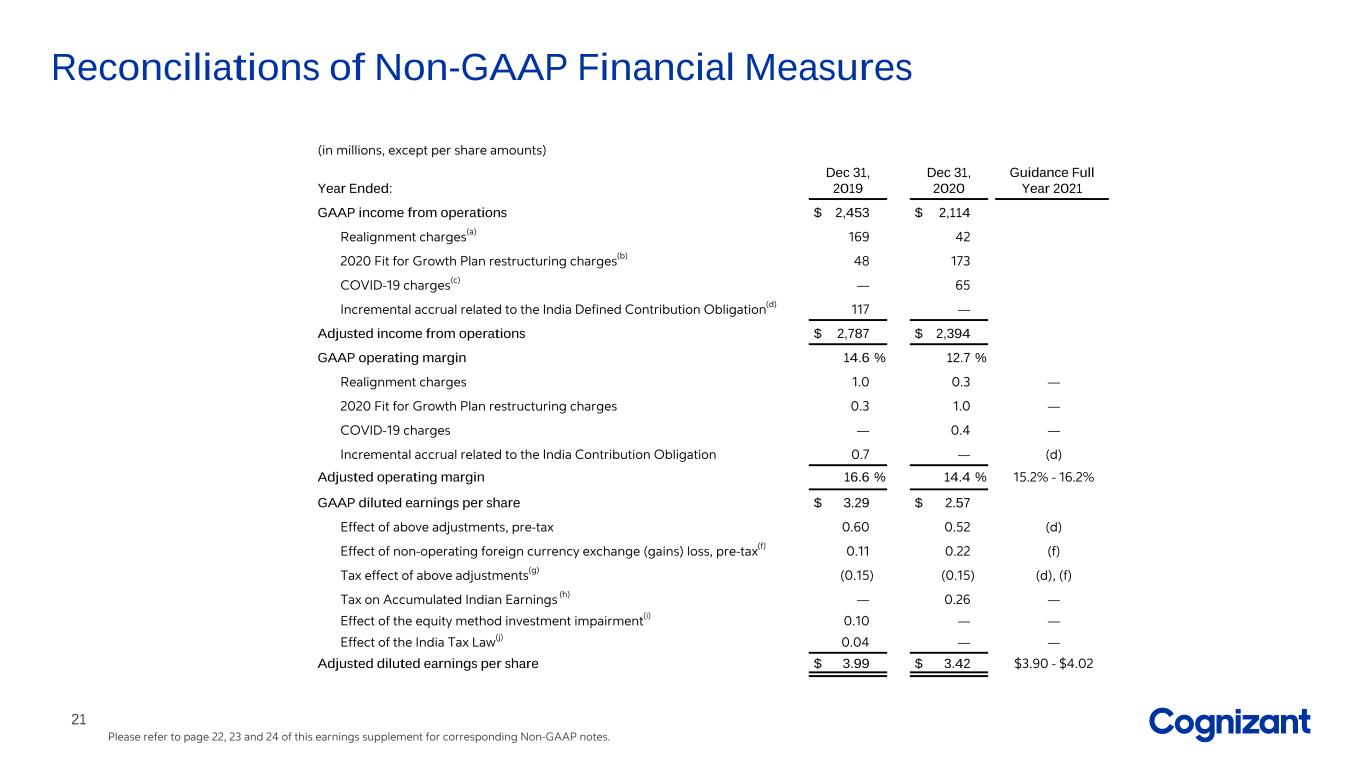

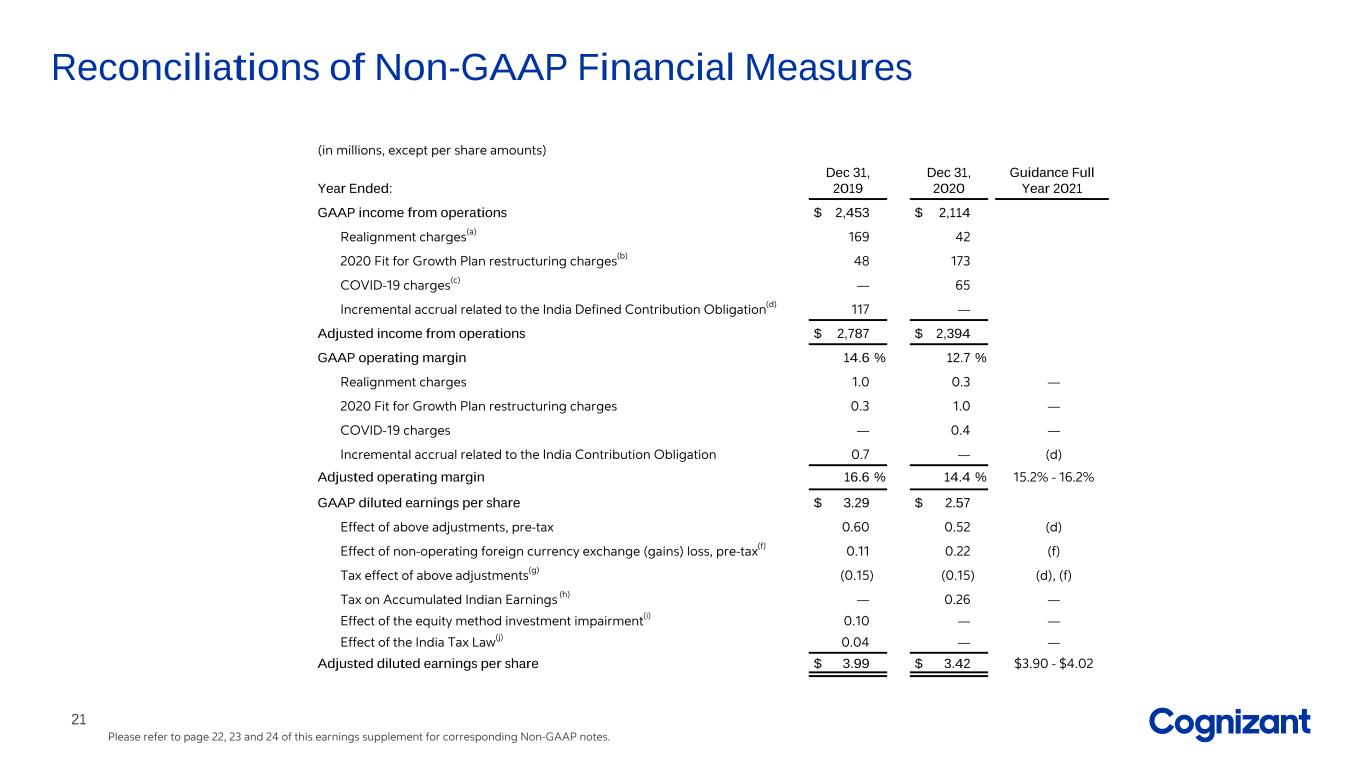

Reconciliations of Non-GAAP Financial Measures Please refer to page 22, 23 and 24 of this earnings supplement for corresponding Non-GAAP notes. (in millions, except per share amounts) Year Ended: Dec 31, 2019 Dec 31, 2020 Guidance Full Year 2021 GAAP income from operations $ 2,453 $ 2,114 Realignment charges(a) 169 42 2020 Fit for Growth Plan restructuring charges(b) 48 173 COVID-19 charges(c) — 65 Incremental accrual related to the India Defined Contribution Obligation(d) 117 — Adjusted income from operations $ 2,787 $ 2,394 GAAP operating margin 14.6 % 12.7 % Realignment charges 1.0 0.3 — 2020 Fit for Growth Plan restructuring charges 0.3 1.0 — COVID-19 charges — 0.4 — Incremental accrual related to the India Contribution Obligation 0.7 — (d) Adjusted operating margin 16.6 % 14.4 % 15.2% - 16.2% GAAP diluted earnings per share $ 3.29 $ 2.57 Effect of above adjustments, pre-tax 0.60 0.52 (d) Effect of non-operating foreign currency exchange (gains) loss, pre-tax(f) 0.11 0.22 (f) Tax effect of above adjustments(g) (0.15) (0.15) (d), (f) Tax on Accumulated Indian Earnings (h) — 0.26 — Effect of the equity method investment impairment(i) 0.10 — — Effect of the India Tax Law(j) 0.04 — — Adjusted diluted earnings per share $ 3.99 $ 3.42 $3.90 - $4.02 21

Reconciliations of Non-GAAP Financial Measures Notes: (a) During the fourth quarter of 2020, we incurred $2 million of realignment charges, solely related to professional fees. For the full year 2020, we incurred $42 million of realignment charges that include $27 million of professional fees and $15 million in employee retention costs. The total costs related to the realignment are reported in "Restructuring charges" in our consolidated statements of operations. We do not expect to incur additional costs related to this plan. (b) During the fourth quarter of 2020, we incurred restructuring charges as part of our 2020 Fit for Growth Plan that includes $24 million in employee separation costs and $12 million in facility exit costs and other charges. For the full year 2020, we incurred $127 million in employee separation costs, $41 million in facility exit and other costs, and $5 million in employee retention costs. These charges include $3 million and $23 million of costs incurred related to our exit from certain content-related services for the fourth quarter of 2020 and full year 2020, respectively. The total costs related to the 2020 Fit for Growth Plan are reported in "Restructuring charges" in our consolidated statement of operations. We do not expect to incur additional costs related to this plan. (c) During 2020, we incurred costs in response to the COVID-19 pandemic, including a one-time bonus to our employees at the designation of associate and below in both India and the Philippines, costs to enable our employees to work remotely and provide medical staff and extra cleaning services for our facilities. Most of the costs related to the pandemic are reported in "Cost of revenues" in our consolidated statement of operations. (d) During the first quarter of 2019, a ruling of the Supreme Court of India in interpreting certain statutory defined contribution obligations of employees and employers (the "India Defined Contribution Obligation") altered historical understandings of such obligations, extending them to cover additional portions of the employee's income. As a result, the ongoing contributions of our affected employees and the Company have increased. In the first quarter of 2019, we accrued $117 million with respect to prior periods, assuming retroactive application of the Supreme Court's ruling. There is significant uncertainty as to how the liability should be calculated as it is impacted by multiple variables, including the period of assessment, the application with respect to certain current and former employees and whether interest and penalties may be assessed. Since the ruling, a variety of trade associations and industry groups have advocated to the Indian government, highlighting the harm to the information technology sector, other industries and job growth in India that would result from a retroactive application of the ruling. It is possible that the Indian government will review the matter and there is a substantial question as to whether the Indian government will apply the Supreme Court's ruling on a retroactive basis. As such, the ultimate amount of our obligation may be materially different from the amount accrued. The incremental accrual related to the India Defined Contribution Obligation is reported in "Selling, general, and administrative expenses" in our consolidated statement of operations. (e) During the second quarter of 2018, we provided $100 million of initial funding to Cognizant U.S. Foundation. This cost is reported in "Selling, general, and administrative expenses" in our consolidated statement of operations. (f) Non-operating foreign currency exchange gains and losses, inclusive of gains and losses related to foreign exchange forward contracts not designated as hedging instruments for accounting purposes, are reported in "Foreign currency exchange gains (losses), net" in our consolidated statement of operations.Non-operating foreign currency exchange gains and losses are subject to high variability and low visibility and therefore cannot be provided on a forward-looking basis without unreasonable efforts. 22

Reconciliations of Non-GAAP Financial Measures (g) Presented below are the tax impacts of each of our non-GAAP adjustments to pre-tax income: Three Months Ended Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020 Tax impacts of non-GAAP adjustments: Realignment charges $ — $ — $ 3 $ 2 $ — $ 13 $ 17 $ 13 $ 5 $ 3 $ 2 $ 1 2020 Fit for Growth restructuring charges — — — — — — — 13 9 16 11 9 COVID-19 charges — — — — — — — — 2 6 6 3 Incremental accrual related to the India Defined Contribution Obligation — — — — 31 — — — — — — — Cognizant U.S. Foundation funding — 28 — — — — — — — — — — Foreign currency exchange gain and losses (1) (8) (6) 3 1 — (2) — (10) (8) 15 9 The effective tax rate related to each of our non-GAAP adjustments varies depending on the jurisdiction in which such income and expenses are generated and the statutory rates applicable in those jurisdictions. Year Ended Dec 31, 2019 Dec 31, 2020 Tax impacts of non-GAAP adjustments: Realignment charges $ 43 $ 11 2020 Fit for Growth restructuring charges 13 45 COVID-19 charges — 17 Incremental accrual related to the India Defined Contribution Obligation 31 — Foreign currency exchange gain and losses (1) 6 Year Ended Guidance Dec 31, 2020 FY 2021 GAAP effective tax rate 33.6 % Effect of adjustments to income from operations, pre-tax (4.0) (d) Effect of non-operating foreign currency exchange (gains) losses, pre-tax (1.3) (f) Tax effect of above adjustments 3.1 (d), (f) Tax on Accumulated Indian Earnings (5.6) — Adjusted effective tax rate 25.8 % 25% - 26% 23

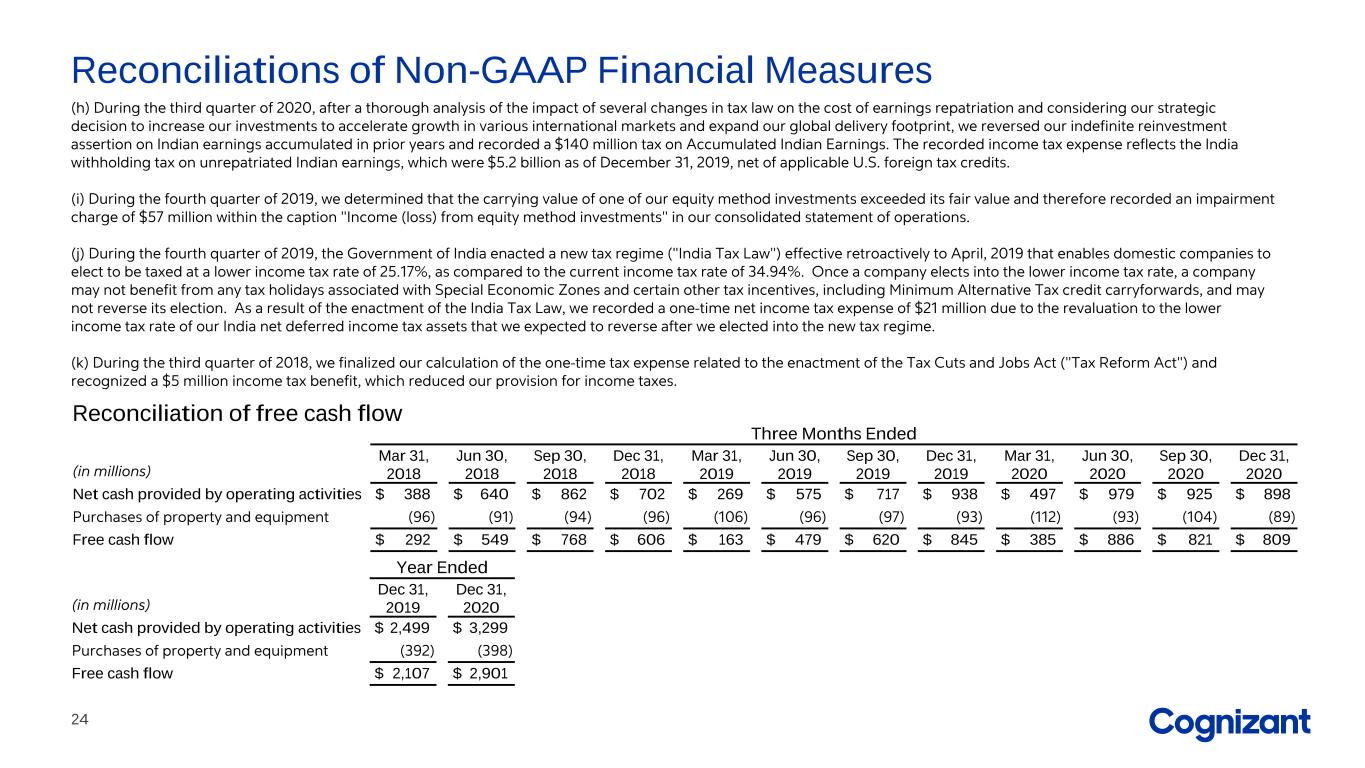

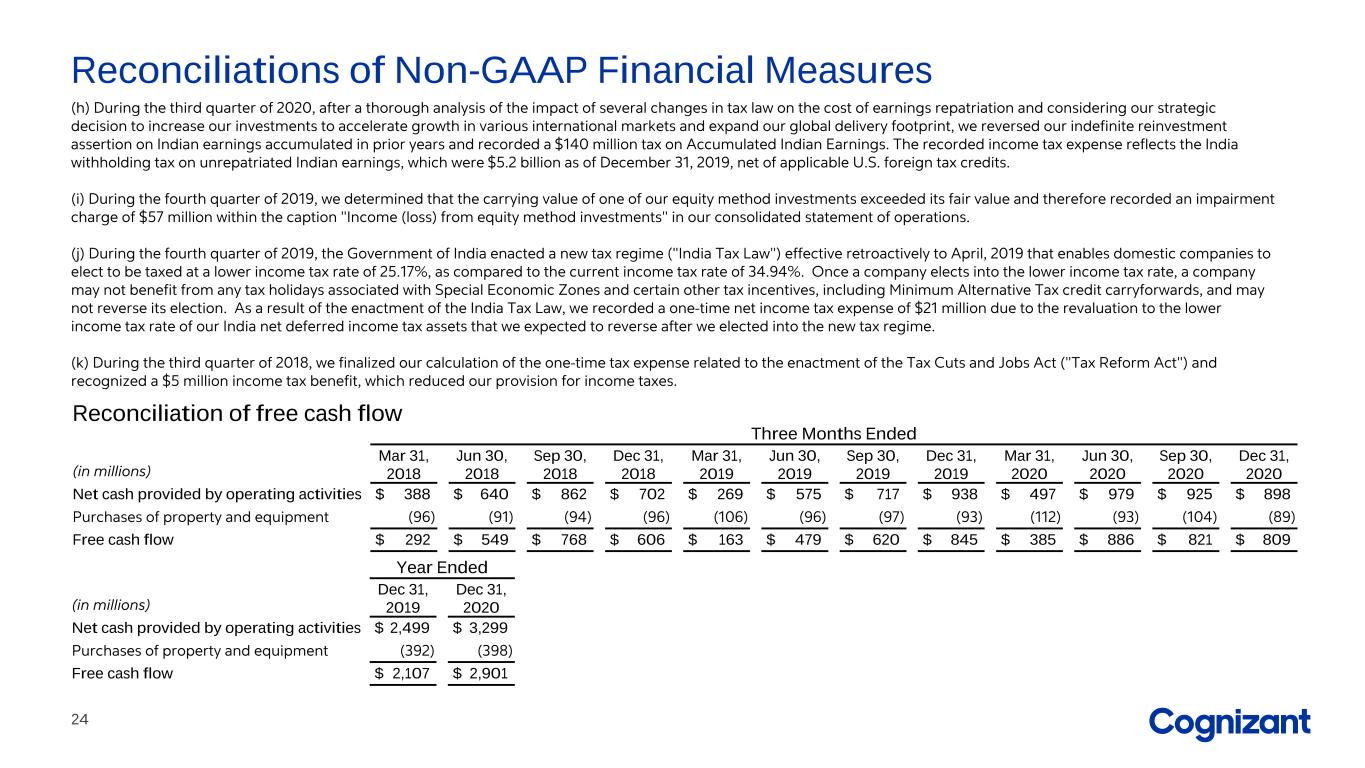

Reconciliations of Non-GAAP Financial Measures (h) During the third quarter of 2020, after a thorough analysis of the impact of several changes in tax law on the cost of earnings repatriation and considering our strategic decision to increase our investments to accelerate growth in various international markets and expand our global delivery footprint, we reversed our indefinite reinvestment assertion on Indian earnings accumulated in prior years and recorded a $140 million tax on Accumulated Indian Earnings. The recorded income tax expense reflects the India withholding tax on unrepatriated Indian earnings, which were $5.2 billion as of December 31, 2019, net of applicable U.S. foreign tax credits. (i) During the fourth quarter of 2019, we determined that the carrying value of one of our equity method investments exceeded its fair value and therefore recorded an impairment charge of $57 million within the caption "Income (loss) from equity method investments" in our consolidated statement of operations. (j) During the fourth quarter of 2019, the Government of India enacted a new tax regime ("India Tax Law") effective retroactively to April, 2019 that enables domestic companies to elect to be taxed at a lower income tax rate of 25.17%, as compared to the current income tax rate of 34.94%. Once a company elects into the lower income tax rate, a company may not benefit from any tax holidays associated with Special Economic Zones and certain other tax incentives, including Minimum Alternative Tax credit carryforwards, and may not reverse its election. As a result of the enactment of the India Tax Law, we recorded a one-time net income tax expense of $21 million due to the revaluation to the lower income tax rate of our India net deferred income tax assets that we expected to reverse after we elected into the new tax regime. (k) During the third quarter of 2018, we finalized our calculation of the one-time tax expense related to the enactment of the Tax Cuts and Jobs Act ("Tax Reform Act") and recognized a $5 million income tax benefit, which reduced our provision for income taxes. Reconciliation of free cash flow Three Months Ended (in millions) Mar 31, 2018 Jun 30, 2018 Sep 30, 2018 Dec 31, 2018 Mar 31, 2019 Jun 30, 2019 Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020 Net cash provided by operating activities $ 388 $ 640 $ 862 $ 702 $ 269 $ 575 $ 717 $ 938 $ 497 $ 979 $ 925 $ 898 Purchases of property and equipment (96) (91) (94) (96) (106) (96) (97) (93) (112) (93) (104) (89) Free cash flow $ 292 $ 549 $ 768 $ 606 $ 163 $ 479 $ 620 $ 845 $ 385 $ 886 $ 821 $ 809 Year Ended (in millions) Dec 31, 2019 Dec 31, 2020 Net cash provided by operating activities $ 2,499 $ 3,299 Purchases of property and equipment (392) (398) Free cash flow $ 2,107 $ 2,901 24