Cognizant to acquire Belcan Expanding advanced Engineering R&D capabilities while diversifying into high growth aerospace & defense sector June 10, 2024 © 2024 Cognizant Exhibit 99.2

Forward-looking statements © 2024 Cognizant2 This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which is necessarily subject to risks, uncertainties and assumptions as to future events that may not prove to be accurate. These statements include, but are not limited to, express or implied forward-looking statements relating to the anticipated growth of the ER&D services market; the benefits of the proposed transaction between us and Propulsion Holdings, LLC (“Belcan")(the indirect parent of Belcan, LLC), including the impact of the acquisition of Belcan on the business and prospects of both Cognizant and Belcan, including revenue, synergies, new business opportunities, growth, expansion and the anticipated impact of the transaction on our future financial and operating results; the expecting timing of the transaction closing; the combined company's plans, objectives, expectations and intentions, including the contemplated increase in Cognizant’s share repurchase plan; and other statements that are not historical facts. These statements are neither promises nor guarantees, but are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ materially from those expressed or implied include the risk that the revenue synergies and any cost savings from the transaction may not be fully realized or may take longer than anticipated to be realized; disruption to the parties' businesses as a result of the announcement and pendency of the transaction; the ability by each of Cognizant and Belcan to obtain required governmental approvals of the transaction on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect us after the closing of the transaction or adversely affect the expected benefits of the transaction; reputational risk and the reaction of each company's customers, suppliers, employees or other business partners to the transaction; the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; risks related to management and oversight of the expanded business and operations of Cognizant following the transaction due to the increased size and complexity of its business; the possibility of increased scrutiny by, and/or additional regulatory requirements of, governmental authorities as a result of the transaction; the risk that combining Belcan's business and operations into Cognizant will be more costly or difficult than expected, or that we are otherwise unable to successfully integrate Belcan's businesses with our own, including as a result of unexpected factors or events; and general competitive, economic, political and market conditions and other factors that may affect our future results or that of Belcan, including general economic conditions, the competitive and rapidly changing nature of the markets we compete in, the competitive marketplace for talent and its impact on employee recruitment and retention, our ability to successfully implement our NextGen program and the amount of costs, timing of incurring costs and ultimate benefits of such plans, our ability to successfully use AI-based technologies, legal, reputational and financial risks resulting from cyberattacks, changes in the regulatory environment, including with respect to immigration and taxes. Additional factors which could affect future results are discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. Cognizant undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

© 2024 Cognizant3 Engineering Better Outcomesintuition engineered Strengthening Cognizant’s leadership in IoT and Digital Engineering with Belcan’s deep ER&D capabilities and leadership in attractive A&D sector

Strategic rationale © 2024 Cognizant4 Significantly expands access to the sizable and fast-growing ER&D services market • The ~$190 billion Engineering, Research & Development (ER&D) services market is expected to grow at 10%+ CAGR through 2026 • Fully aligned with Cognizant’s strategy to lead at the confluence of industry and technology • Brings deep domain expertise in advanced engineering and model-based systems engineering • Complements Cognizant’s existing Internet of Things (IoT) and Digital Engineering capabilities Diversifies Cognizant into the highly attractive A&D sector with blue chip clients • Enables Cognizant to establish a leadership position in aerospace & defense (A&D) diversifying our client base and revenue mix • Sector has compelling tailwinds from increasing end customer demand and modernization needs • Brings an exceptional blue-chip client base; multi-decade, trusted relationships with category leaders that contribute sustainable growth Provides technical expertise needed to serve these customers with a highly skilled and accredited workforce • Technical and experienced associates that serve highly specialized sectors • 6,500+ engineers and technical consultants, 85% in North America • Workforce operates from near-site locations and can address full product lifecycle needs of clients Creates shareholder value through enhanced growth opportunities, compelling synergies and EPS accretion • Belcan’s revenue expected to grow faster than Cognizant’s • Expected to deliver over $100 million in annual revenue synergies within three years • Expected to be broadly neutral to EPS in full year 2025 and accretive in 2026 Source: Market data per Zinnov.

Transaction highlights © 2024 Cognizant5 Key transaction terms & financing • Cognizant signed a definitive agreement to acquire Belcan for a total purchase price of approximately $1.29 billion, subject to customary adjustments, comprised of ⎻ $1.19 billion in cash consideration ⎻ Fixed 1.47 million shares of Cognizant class A common stock, with a current value of $97 million based on Cognizant’s closing share price on Friday, June 7th • Cash consideration expected to be funded through a mix of cash on hand and debt • Cognizant intends to increase its share repurchase plan to maintain current share count guidance of 497 million for the full year 2024 Integration approach • Belcan to continue to operate under the Belcan name, as an operating unit of Cognizant • CEO Lance Kwasniewski expected to continue to lead Belcan and, together with a dedicated Cognizant leadership team, scale our ER&D capabilities • Dedicated integration program office to ensure execution against strategic and financial goals for the transaction Timing & approvals • Expected to close in third quarter of 2024, subject to regulatory approvals and other closing conditions

Belcan provides advanced ER&D services to fast-growing commercial aerospace, defense and space clients, among others © 2024 Cognizant6 Exposure to attractive sectors • Commercial aerospace, defense and space comprise 76% of revenue • All top 10 aerospace & defense ER&D spenders are active clients Blue chip clients, scaled relationships • 27 of the top 30 clients are Global 2000 companies or US Federal Government • 70% of revenue from top 15 clients Long-term visibility • Strong, multi-year client relationships; 20-50+ year anchor client tenure Emerging capabilities in Industrials and Automotive Highly skilled: 6,500+ experienced engineers and technical consultants with deep domain expertise Client-oriented: 85% based in North America (remainder in UK, India, Poland, and Mexico) who operate from near-site locations Advanced ER&D services with deep domain expertise in advanced engineering and model-based systems engineering Supports clients’ full product lifecycle engineering needs by delivering mission critical innovation capabilities Suite of services (% of revenue) • Product engineering: 45% • Systems & software: 34% • Manufacturing & supply chain: 21% Belcan has an exceptional client base … … that it serves with highly technical ER&D services … … which require a skilled and accredited workforce … … due to the nature of Belcan’s clients’ products Exceptionally high-value machines that cannot fail (unit costs ranging from $10M to $1B+) Highly complex (e.g., millions of parts in commercial aircraft) and exposed to harsh environments (e.g., operating temperatures of 3,000°F in jet engine) Significant lifecycle requirement (from design to production to sustainment) – must operate for 30-50+ years Rapid increase in digital systems and software throughout products (e.g., modern aircraft have tens of millions lines of code) Over $800M annualized revenue(1) 8% revenue CAGR over last 2 years Note: (1) Based on annualizing expected 2024E revenue contribution.

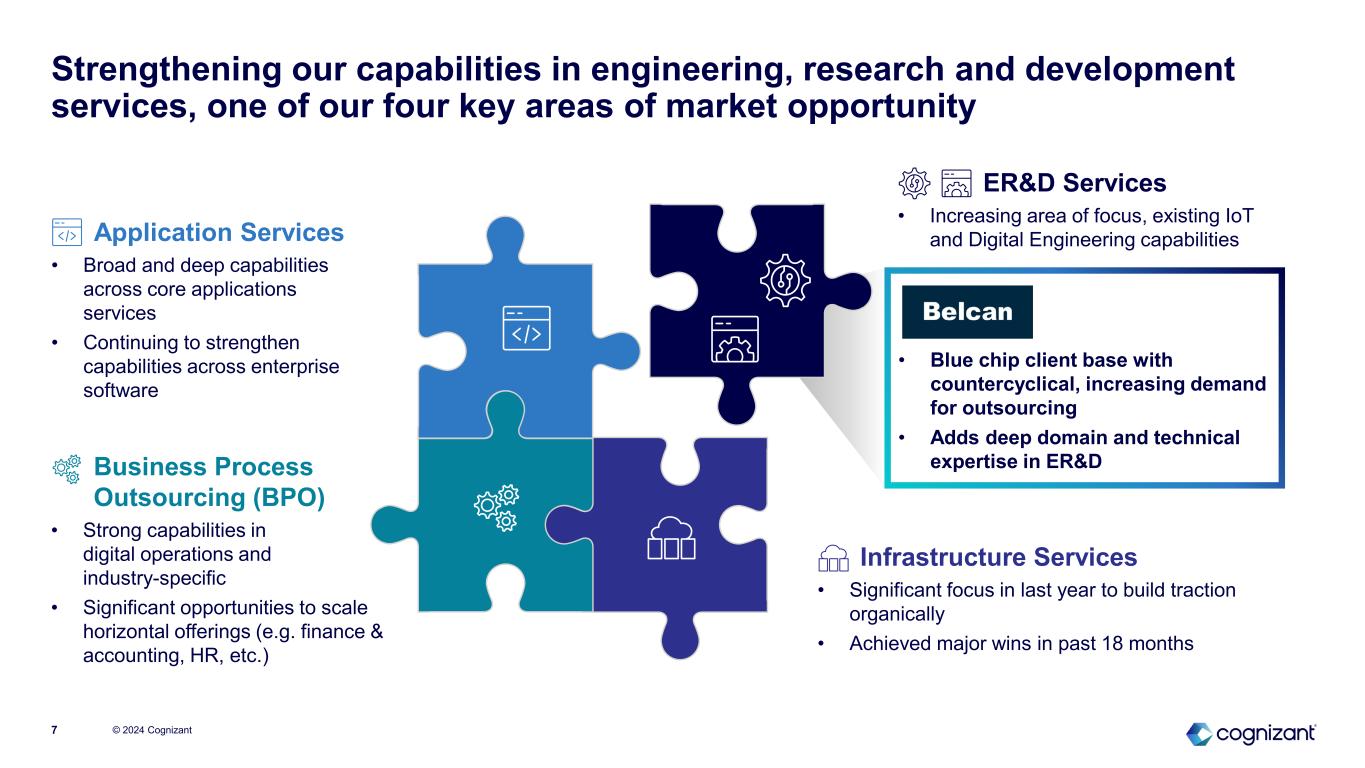

Strengthening our capabilities in engineering, research and development services, one of our four key areas of market opportunity © 2024 Cognizant7 Business Process Outsourcing (BPO) • Strong capabilities in digital operations and industry-specific • Significant opportunities to scale horizontal offerings (e.g. finance & accounting, HR, etc.) Infrastructure Services • Significant focus in last year to build traction organically • Achieved major wins in past 18 months Application Services • Broad and deep capabilities across core applications services • Continuing to strengthen capabilities across enterprise software ER&D Services • Increasing area of focus, existing IoT and Digital Engineering capabilities • Blue chip client base with countercyclical, increasing demand for outsourcing • Adds deep domain and technical expertise in ER&D

Expands our access to high growth, attractive markets with multiple tailwinds © 2024 Cognizant8 2023 2026E Belcan’s overall TAM expected to grow at 10%+ … (ER&D services total addressable market) ~$255B Multiple Growth Drivers • A&D tailwinds from increased commercial airline passenger traffic, new aircraft designs, sustainability goals, defense spending and satellite launches and other space programs • Outsourced share of ~$2.0 trillion global ER&D spend expected to increase • Demand for outsourced engineers outstripping supply, particularly in aerospace • New technologies are also driving demand for outsourced ER&D services … with Belcan weighted towards higher growth sectors Aerospace & defense 12-13% Industrials and others 9-11% 76% 24% ~$190B ER&D services subsector 2023-26E CAGR % of Belcan revenue Source: Market data per Zinnov.

Note: (1) Based on annualizing expected 2024E revenue contribution. Source: Market data per Zinnov. Advances Cognizant’s long-term strategic priorities © 2024 Cognizant9 ► Belcan expected to grow revenue faster than Cognizant with annualized revenue of over $800 million(1) ► Exposure to ~$190 billion ER&D services market, expected to grow at 10%+ CAGR through 2026 ► Establish a leadership position in the attractive A&D sector with long- standing, blue-chip client base ► Over $100 million of anticipated annual revenue synergies within three years through cross-selling services and scaling global delivery Accelerate revenue growth Employer of choice Operational excellence ► 6,500+ engineers and technical consultants ► Belcan is an employer of choice in ER&D services in North America ► Highly technical and experienced associates operate from near-site locations and can address full product lifecycle needs of clients ► Like-minded culture focused on employee growth and satisfaction ► Belcan’s clients will gain access to Cognizant’s full suite of technology services, while Cognizant’s clients could benefit from Belcan’s engineering skills ► Agile workforce operates close to client sites ► Cost synergies expected through SG&A savings from central function modernization and efficiencies over time 1 32

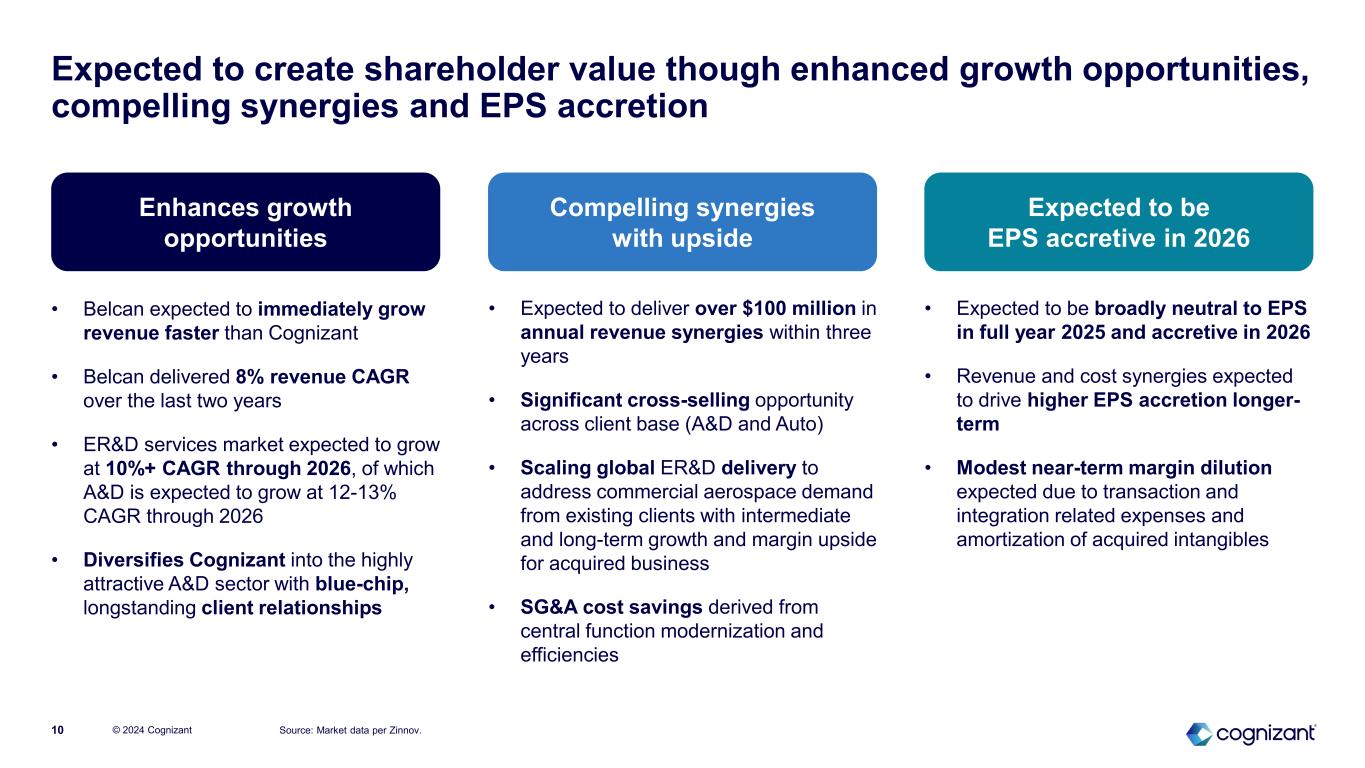

Expected to create shareholder value though enhanced growth opportunities, compelling synergies and EPS accretion © 2024 Cognizant10 Source: Market data per Zinnov. Enhances growth opportunities Compelling synergies with upside Expected to be EPS accretive in 2026 • Expected to deliver over $100 million in annual revenue synergies within three years • Significant cross-selling opportunity across client base (A&D and Auto) • Scaling global ER&D delivery to address commercial aerospace demand from existing clients with intermediate and long-term growth and margin upside for acquired business • SG&A cost savings derived from central function modernization and efficiencies • Expected to be broadly neutral to EPS in full year 2025 and accretive in 2026 • Revenue and cost synergies expected to drive higher EPS accretion longer- term • Modest near-term margin dilution expected due to transaction and integration related expenses and amortization of acquired intangibles • Belcan expected to immediately grow revenue faster than Cognizant • Belcan delivered 8% revenue CAGR over the last two years • ER&D services market expected to grow at 10%+ CAGR through 2026, of which A&D is expected to grow at 12-13% CAGR through 2026 • Diversifies Cognizant into the highly attractive A&D sector with blue-chip, longstanding client relationships

Thank you © 2024 Cognizant11