UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(E)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to (S) 240.14a-11(c) or (S) 240.14a-12 |

Lionbridge Technologies, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

April 8, 2004

Dear Fellow Stockholder:

You are cordially invited to attend our Annual Meeting of Stockholders, which will be held this year on May 18, 2004, at 10:00 a.m., at our corporate headquarters located at 1050 Winter Street, Waltham, Massachusetts. The notice of meeting and proxy statement that follow describe the business to be conducted at that meeting.

Whether or not you plan to attend the meeting in person, it is important that your shares be represented and voted. After reading the enclosed Notice of Annual Meeting and Proxy Statement, I urge you to complete, sign, date and return your proxy ballot in the envelope provided.

For the Board of Directors,

Rory J. Cowan

Chairman, Chief Executive Officer and President

LIONBRIDGE TECHNOLOGIES, INC.

1050 WINTER STREET

WALTHAM, MASSACHUSETTS 02451

(781) 434-6000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2004

To the Stockholders of Lionbridge Technologies, Inc.:

Notice is hereby given that an Annual Meeting of Stockholders of Lionbridge Technologies, Inc., a Delaware corporation (“Lionbridge” or the “Company”), will be held at 10:00 a.m., local time, on May 18, 2004, at the Company’s corporate headquarters at 1050 Winter Street, Waltham, Massachusetts 02451, to consider and act upon the following proposals:

1. To elect two members to the Board of Directors to serve for a three-year term as Class II Directors.

2. To approve an amendment to the Company’s 1998 Stock Plan to increase the aggregate number of shares of Common Stock that may be issued pursuant to the plan to 11,722,032 shares from 9,722,032 shares, an increase of 2,000,000 shares; and

3. To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

The Board of Directors has fixed the close of business on March 29, 2004 as the record date for the determination of the Lionbridge stockholders entitled to notice of, and to vote at, the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. HOWEVER, TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.

You may revoke your proxy in the manner described in the accompanying Proxy Statement at any time before it has been voted at the Annual Meeting. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

Properly executed proxies will be voted in accordance with the specifications on the proxy card. A list of stockholders entitled to vote will be available for inspection at the offices of the Company, located at 1050 Winter Street, Waltham, Massachusetts, for a period of ten days prior to the Annual Meeting. Executed proxies with no instructions indicated thereon will be voted FOR the matters set forth in this Notice of Annual Meeting of Stockholders.

By Order of the Board of Directors,

MARGARET A. SHUKUR

Secretary

Waltham, Massachusetts

April 8, 2004

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE AND RETURN IT IN THE ENCLOSED POSTAGE-PREPAID ENVELOPE.

PROXY STATEMENT

April 8, 2004

INTRODUCTION

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Lionbridge Technologies, Inc., a Delaware corporation (“Lionbridge” or the “Company”), for use at the Company’s Annual Meeting of Stockholders to be held on Tuesday, May 18, 2004 (the “Annual Meeting”) at 10:00 a.m., local time, at the Company’s corporate headquarters at 1050 Winter Street, Waltham, MA 02451, or at any postponements or adjournments thereof. The purpose of the Annual Meeting is to elect two members to the Board of Directors of the Company to serve for a three-year term as Class II Directors (the “Class II Directors”), to increase the number of shares of Common Stock available for grant under the Plan to 11,722,032 shares from 9,722,032 shares, and to transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

The Lionbridge Board of Directors has approved the proposed amendment to the Plan to increase the number of shares of Common Stock available for grant under the Plan to 11,722,032 shares from 9,722,032 shares and recommends a vote FOR the approval of the amendment to the Plan.

This Proxy Statement and form of proxy will be mailed to stockholders on or about the date of the accompanying Notice.

Only stockholders of record at the close of business on March 29, 2004 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. As of the Record Date, an aggregate of 46,476,578 shares of Common Stock, $.01 par value per share (the “Common Stock”), of the Company were issued and outstanding. The holders of Common Stock are entitled to one vote per share on any proposal presented at the Annual Meeting. Stockholders may vote in person or by proxy. Execution of a proxy will not in any way affect a stockholder’s right to attend the Annual Meeting and vote in person. Any proxy may be revoked by the person giving it at any time before its exercise by (1) filing with the Secretary of the Company, before the taking of the vote at the Annual Meeting, a written notice of revocation bearing a later date than the proxy, (2) duly executing a later dated proxy relating to the same shares and delivering it to the Secretary of the Company before the taking of the vote at the Annual Meeting or (3) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice of revocation or subsequent proxy should be sent so as to be delivered to Lionbridge Technologies, Inc., 1050 Winter Street, Waltham, Massachusetts 02451, Attention: Secretary, at or before the taking of the vote at the Annual Meeting.

The representation in person or by proxy of at least a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to establish a quorum for the transaction of business at the Annual Meeting. Abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum. A broker “non-vote” occurs when a broker holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because, in respect of such other proposal, the broker does not have discretionary voting power and has not received instructions from the beneficial owner.

In the election of the Class II Directors, the two nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to vote at the Annual Meeting shall be elected as Directors. To

approve the amendment to the Plan and on all other matters being submitted to stockholders, the affirmative vote of a majority of the shares present, in person or represented by proxy, and voting on each such matter is required.

An automated system administered by the Company’s transfer agent tabulates the votes. The vote on each matter submitted to stockholders is tabulated separately. Abstentions are included in the number of shares present or represented and voting on each matter. Broker “non-votes” are not considered voted for the particular matter and have the effect of reducing the number of affirmative votes required to achieve a majority for such matter by reducing the total number of shares from which the majority is calculated.

The persons named as attorneys-in-fact in the proxies were selected by the Board of Directors and are officers of the Company. All properly executed proxies returned in time to be counted at the Annual Meeting will be voted. Any stockholder giving a proxy has the right to withhold authority to vote for any individual nominee to the Board of Directors by writing that nominee’s name in the space provided on the proxy. ALL SHARES REPRESENTED BY PROXIES WILL BE VOTED IN ACCORDANCE WITH THE STOCKHOLDERS’ INSTRUCTIONS, AND IF NO CHOICE IS SPECIFIED, THE SHARES REPRESENTED BY PROXIES WILL BE VOTED IN FAVOR OF THE MATTERS SET FORTH IN THE ACCOMPANYING NOTICE OF ANNUAL MEETING.

The Board of Directors knows of no other matter to be presented at the Annual Meeting. If any other matter should be presented at the meeting upon which a vote may properly be taken, shares represented by all proxies received by the Board of Directors will be voted with respect thereto in accordance with the judgment of the persons named as attorneys in the proxies.

2

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership of Management

The following table sets forth certain information regarding the beneficial ownership of Lionbridge’s Common Stock as of March 5, 2004 for (i) each director of Lionbridge, (ii) each named executive officer of Lionbridge and (iii) all of the directors and executive officers of Lionbridge as a group.

Except as noted below, the address of each person listed on the table is c/o Lionbridge Technologies, Inc., 1050 Winter Street, Waltham, Massachusetts 02451.

| | | | | |

Name and Address of Beneficial Owner

| | Amount and

Nature of

Beneficial

Ownership(1)(2)

| | Percent of

Common

Stock

Outstanding(3)

| |

Rory J. Cowan(4) | | 3,272,492 | | 6.9 | % |

Edward A. Blechschmidt P.O. Box 71 Bryn Mawr, PA 19010 | | 9,275 | | * | |

Guy L. de Chazal(5) 68 Wheatley Rd Brookville New York, NY 11545 | | 56,290 | | * | |

Paul Kavanagh(6) “Arcachon” Strathmore Road, Killiney, Co. Dublin, Ireland | | 76,292 | | * | |

Claude P. Sheer(7) 240 Main Street Boxford, Massachusetts 01921 | | 24,959 | | * | |

Myriam Martin-Kail(8) | | 522,999 | | 1.1 | % |

Stephen J. Lifshatz(9) | | 450,044 | | 1.0 | % |

Paula Shannon (10) | | 134,342 | | * | |

Henri Broekmate (11) | | 11,482 | | * | |

All executive officers and directors as a group (9 persons)(12) | | 4,558,175 | | 9.5 | % |

| * | | Less than 1% of the outstanding shares of Common Stock. |

| (1) | | The persons identified in the table possess sole voting and investment power with respect to all shares shown as beneficially owned by them, except as noted in the footnotes below and subject to applicable community property laws. |

| (2) | | The inclusion herein of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. |

| (3) | | Based on 46,444,358 shares of Common Stock outstanding as of March 5, 2004. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to the shares of Common Stock. Shares of Common Stock subject to options currently exercisable or exercisable within 60 days after March 5, 2004 are deemed outstanding for computing the percentage ownership of the person holding these options, but are not deemed outstanding for computing the percentage ownership of any other person. |

3

| (4) | | Includes 525,000 shares deemed to be beneficially owned by Mr. Cowan pursuant to options exercisable within 60 days of March 5, 2004. Also includes (i) 10,000 shares of Common Stock subject to restrictions on disposition that lapse ratably on September 5, 2004, 2005, 2006 and 2007 and (ii) 24,624 shares of Common Stock subject to restrictions on disposition that lapse ratably on November 23, 2004 and August 23, 2005. |

| (5) | | Includes 6,875 shares deemed to be beneficially owned by Mr. de Chazal pursuant to options exercisable within 60 days of March 5, 2004. |

| (6) | | Includes 26,292 shares deemed to be beneficially owned by Mr. Kavanagh pursuant to options exercisable within 60 days of March 5, 2004. |

| (7) | | Represents 24,959 shares deemed to be beneficially owned by Mr. Sheer pursuant to options exercisable within 60 days of March 5, 2004. |

| (8) | | Represents 479,164 shares deemed to be beneficially owned by Ms. Martin-Kail pursuant to options exercisable within 60 days of March 5, 2004. Also includes (i) 5,000 shares of Common Stock subject to restrictions on disposition that lapse ratably on September 5, 2004, 2005, 2006 and 2007 and (ii) 9,850 shares of Common Stock subject to restrictions on disposition that lapse ratably on November 23, 2004 and August 23, 2005. |

| (9) | | Includes 316,184 shares deemed to be beneficially owned by Mr. Lifshatz pursuant to options exercisable within 60 days of March 5, 2004. Also includes (i) 7,500 shares of Common Stock subject to restrictions on disposition that lapse ratably on September 5, 2004, 2005, 2006 and 2007 and (ii) 9,644 shares of Common Stock subject to restrictions on disposition that lapse ratably on November 23, 2004 and August 23, 2005. |

| (10) | | Includes 96,250 shares deemed to be beneficially owned by Ms. Shannon pursuant to options exercisable within 60 days of March 5, 2004. Also includes (i) 5,000 shares of Common Stock subject to restrictions on disposition that lapse ratably on September 5, 2004, 2005, 2006 and 2007 and (ii) 7,592 shares of Common Stock subject to restrictions on disposition that lapse ratably on November 23, 2004 and August 23, 2005. |

| (11) | | Includes (i) 5,000 shares of Common Stock subject to restrictions on disposition that lapse ratably on September 5, 2004, 2005, 2006 and 2007 and (ii) 6,205 shares of Common Stock subject to restrictions on disposition that lapse ratably on November 23, 2004 and August 23, 2005. |

| (12) | | Includes 1,481,599 shares of Common Stock which the directors and executive officers as a group have the right to acquire pursuant to options exercisable within 60 days of March 5, 2004. Includes Also includes 79,210 shares of Common Stock subject to restrictions on disposition that lapse over time. |

4

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information regarding the beneficial ownership of Lionbridge’s Common Stock as of March 5, 2004 as to the persons and any groups, who, to the knowledge of the Company, beneficially owned more than 5% of the shares of Lionbridge Common Stock.

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership(1)(2)

| | Percent of Common Stock Outstanding (3)

| |

Westfield Partners(4) One Financial Center Boston, MA 02110 | | 4,845,000 | | 10.5 | % |

| | |

Goldman Sachs Asset Management, L.P.(5) 32 Old Slip New York, New York 10005 | | 3,707,737 | | 8.0 | % |

| (1) | | The persons identified in the table possess sole voting and investment power with respect to all shares shown as beneficially owned by them, except as noted in the footnotes below and subject to applicable community property laws. |

| (2) | | The inclusion herein of any shares of Common Stock deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. |

| (3) | | Based on 46,444,358 shares of Common Stock outstanding as of March 5, 2004. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to the shares of Common Stock. |

| (4) | | Information obtained from Schedule 13G filed by Westfield Capital Management Co. LLC on or about March 4, 2004. |

| (5) | | Information obtained from Schedule 13G filed by Goldman Sachs Asset Management, L.P. with the Securities and Exchange Commission on or about February 11, 2004. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and holders of more than 10% of the Company’s Common Stock (collectively, the “Reporting Persons”) to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock of the Company. Such persons are required by regulations of the Commission to furnish the Company with copies of all such filings. Based solely on a review of the forms and written representations received by the Company pursuant to Section 16(a) of the Securities Exchange Act of 1934, the Company believes that during the period January 1, 2003 through December 31, 2003, the Reporting Persons complied with all applicable Section 16(a) filing requirements.

5

ELECTION OF DIRECTORS

The Board of Directors of the Company is currently fixed at five members and divided into three classes. Each class serves for three years, with the terms of office of the respective classes expiring in successive years. The directors in Class III will be nominees for election to three-year terms at the 2005 Annual Meeting of Stockholders and the directors in Class I will be nominees for election to three-year terms at the 2006 Annual Meeting of Stockholders.

The present term of office for the directors in Class II (“Class II Directors”) expires at the Annual Meeting. Edward A. Blechschmidt was elected by the Board of Directors as a Class II Director in February 2003 to fill a vacancy, and Guy de Chazal was elected as a Class II Director in 1998, and both are nominees for re-election to a three-year term as a Class II Director. If re-elected each Class II Director nominee will be elected for a three-year term and until his successor has been duly elected and has qualified, or until his earlier resignation or removal.

Shares represented by all proxies received by the Board of Directors and not so marked as to withhold authority to vote for any individual nominee will be voted (unless one or more nominees is unable or unwilling to serve) FOR the election of the nominees for Class II Director. The Board of Directors knows of no reason why any such nominee should be unable or unwilling to serve, but if such should be the case, proxies will be voted for the election of some other person or the Board of Directors will fix the number of directors at a lesser number.

Set forth below, under “Management—Directors and Executive Officers”, is information with respect to the nominee for the Class II Director to be elected at the Annual Meeting and for each Class I Director and Class III Director whose term of office continues after the Annual Meeting. The Board of Directors unanimously recommends a vote FOR the Class II Director nominees.

MANAGEMENT

Directors and Executive Officers

The following table presents information about each of Lionbridge’s executive officers, senior managers and directors as of March 31, 2004

| | | | |

Name

| | Age

| | Position

|

Rory J. Cowan | | 51 | | Chairman of the Board, Chief Executive Officer, President and Class III Director |

Henri Broekmate | | 43 | | Senior Vice President, Global Client Services |

Stephen J. Lifshatz | | 45 | | Senior Vice President and Chief Financial Officer |

Myriam Martin-Kail | | 50 | | Senior Vice President and Chief Operating Officer |

Paula Barbary Shannon | | 44 | | Senior Vice President, Sales and Chief Sales Officer |

Edward A. Blechschmidt | | 51 | | Class II Director |

Guy L. de Chazal | | 56 | | Class II Director |

Paul Kavanagh | | 62 | | Class III Director |

Claude P. Sheer | | 53 | | Class I Director |

Rory J. Cowan founded Lionbridge in September 1996. Mr. Cowan served as Chairman and Chief Executive Officer of Stream International, Inc., a software and services provider, from May 1995 to June 1996.

6

Mr. Cowan was also the Chief Executive Officer of Interleaf, Inc. from October 1996 to January 1997. He was an Executive Vice President of R.R. Donnelley & Sons, a provider of commercial print and print-related services, from January 1991 to June 1996.

Henri Broekmatejoined Lionbridge in April 2001. Mr. Broekmate served as Executive Vice President, eBusiness, of TRADOS Corporation from July 2000 to April 2001 and as Chief Operating Officer of TRADOS Corporation from June 1998 to July 2000. Mr. Broekmate was elected as an Executive Officer of Lionbridge on January 29, 2004.

Stephen J. Lifshatz joined Lionbridge in January 1997. Mr. Lifshatz served as the Chief Financial Officer of The Dodge Group from May 1996 to January 1997. He served in a number of senior financial roles, including Chief Financial Officer of Marcam Corporation, a publicly traded software company, from May 1984 to May 1996.

Myriam Martin-Kail joined Lionbridge in December 1996. Ms. Martin-Kail served as European Director for Localization of Stream International, Inc. from April 1995 to December 1996 and Operations Manager, Dublin from September 1994 to September 1995.

Paula Barbary Shannon joined Lionbridge in November 1999. Ms. Shannon served as Vice President, Sales and Chief Marketing Officer of Alpnet Inc. from March 1996 through October 1999, and was with Berlitz International, Inc. from 1986 through 1996.

Edward A. Blechschmidtwas elected a director of Lionbridge on February 4, 2003. Mr. Blechschmidt was Chairman, Chief Executive Officer and President of Gentiva Health Services, a provider of specialty pharmaceutical and home health services, from March 2000 until July 2002. He served as President and Chief Operating Officer of the Olsten Corporation from October 1998 through March 2000, and was its Chief Executive from February 1999 through March 2000. From 1996 to 1998, Mr. Blechschmidt served as President and Chief Executive Officer of Siemens Nixdorf Americas and Siemens’ Pyramid Technology, as well as Executive Vice President and as a director of its parent company, Siemens Nixdorf Informationssysteme AG. Prior to joining Siemens, Mr. Blechschmidt served for more than 20 years with Unisys Corporation, a leading global provider of information technology and consulting services, including in the position of Chief Financial Officer. Mr. Blechschmidt is a director of Gentiva Health Services, HealthSouth Corporation, and Neoforma, Inc.

Guy L. de Chazal has been a director of Lionbridge since February 1998. Mr. de Chazal has been with Morgan Stanley since 1986, currently as a managing director of Morgan Stanley & Co. Incorporated and individual managing member of Morgan Stanley Venture Partners II, L.P.

Paul Kavanagh has been a director of Lionbridge since December 1996. Mr. Kavanagh has served as an industry consultant since January 1998. Mr. Kavanagh served as President Europe, Middle East and Africa of Stream International, Inc. from August 1995 to January 1998. From April 1992 to August 1995, Mr. Kavanagh was Managing Director Europe, Middle East and Africa of R.R. Donnelley & Sons. Mr. Kavanagh is retired President of Modus Media Europe.

Claude P. Sheer has been a director of Lionbridge since March 1999. Mr. Sheer has served as an industry analyst and consultant since April 1999 and is a partner of Barn Ventures L.L.C. Mr. Sheer served as Senior Advisor to and Chief Internet Strategist of Ziff Davis from November 1998 through April 1999. From 1980 to November 1998, Mr. Sheer served in a number of executive roles for Ziff Davis, including President, ZD Publishing; President, US Publications; and President, Business Media Group.

7

Lionbridge’s executive officers are elected by and serve at the discretion of the board of directors until their successors have been duly elected and qualified. There are no family relationships among any of its executive officers and directors.

Corporate Governance Principles

Lionbridge is committed to having sound corporate governance principles and has adopted Corporate Governance Guidelines and a Code of Ethics (referred to as the code of business conduct and ethics) that applies to all directors, officers and employees. Both the Corporate Governance Guidelines and the Code of Ethics are available on Lionbridge’s Web site at http://www.lionbridge.com/company/corporate-governance/guidelines.liox. The Company intends to disclose amendments to or waivers from a provision of the Code of Ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, by posting such information on its Web site available at http://www.lionbridge.com/company/corporate-governance/default.liox.

Board Independence; Meetings of the Board; Committees of the Board

During 2003, the Board of Directors met seven times (including in person and via teleconference meetings), the Audit Committee met seven times (including meetings to review the 2003 Annual Report on Form 10-K) and the Nominating and Compensation Committee met nine times. All directors attended more than 75% of the total number of meetings of the Board and the committees on which they serve.

The Board of Directors has an Audit Committee and a Nominating and Compensation Committee, both of which are comprised solely of independent directors. The Board has determined that each of the directors, with the exception of Mr. Cowan, who serves as Chief Executive Officer of the Company, is independent within the meaning of Lionbridge’s director independence standards and the director independence standards of the National Association of Securities Dealers, Inc. (“NASD”) Marketplace Rules as currently in effect.

The Audit Committee selects the independent auditors to be employed by the Company, reviews generally the internal and external audit plans and the results thereof, and reviews generally the Company’s internal controls with the auditors. The members of the Audit Committee are Messrs. Blechschmidt, de Chazal, Kavanagh and Sheer, all of whom are independent within the meaning of Lionbridge’s director independence standards, the director independence standards of the NASD Marketplace Rules as currently in effect, and the SEC’s director independence standards for audit committee members. In addition, Mr. Blechschmidt is financially sophisticated, as required by the NASD Marketplace Rules. Mr. de Chazal served as the Chairman of the Audit Committee from December 2002 until the election of Mr. Blechschmidt as a director and Chairman of the Audit Committee in February 2003, and he remains a member of the Audit Committee. The Board has determined in accordance with the rules of the Securities Exchange Commission that Mr. Blechschmidt is an audit committee financial expert. The Audit Committee Charter is included asAppendix A to this Proxy Statement and is available free of charge on Lionbridge’s Web site at http://www.lionbridge.com/company/corporate-governance/default.liox.

The Nominating and Compensation Committee has responsibility for the review and administration of the Company’s compensation and equity plans, including Lionbridge’s 1998 Stock Plan and 1999 Employee Stock Purchase Plan, for approving salaries and other incentive compensation for Lionbridge’s officers and executives, and for preparing the annual report on executive compensation required to be included in the Company’s proxy statement. In addition, the Nominating and Compensation Committee has responsibility for recommending

8

nominees for election as directors of the Company and for review of related Board development issues including succession planning and evaluation. Messrs. de Chazal, Kavanagh and Sheer are the members of the Nominating and Compensation Committee, all of whom are independent within the meaning of Lionbridge’s director independence standards, and the director independence standards of the NASD Marketplace Rules, and Mr. Sheer serves as its Chairman. The Nominating and Compensation Committees Charter is available free of charge on Lionbridge’s Web site at http://www.lionbridge.com/company/corporate-governance/default.liox.

Executive sessions of non-management directors are held at each Board meeting.

The Company does not formally require directors to attend the Company’s Annual Meeting of Stockholders but all directors are encouraged to do so. One director, Mr. Cowan, the Chief Executive Officer of the Company and a director, attended the 2003 Annual Meeting of Stockholders.

Consideration of Candidates for Director; Director Qualifications

As noted above, the Nominating and Compensation Committee has responsibility for recommending nominees for election as directors of the Company. Any stockholder may submit recommendations of candidates for election as directors for consideration by the Nominating and Compensation Committee in writing to the Chairman of the Committee at the executive offices of Lionbridge by December 4, 2004. Such recommendations must clearly indicate the candidate’s qualifications for service as a director and that such candidate’s qualifications meet or exceed the criteria for service as a director set forth in the Nominating and Compensation Committee Charter and Lionbridge’s Corporate Governance Guidelines. In particular, any candidate for consideration must have the following qualities or qualifications:

| | • | | Be an individual of the highest character and integrity; |

| | • | | Be free of any conflict of interest that would violate any applicable law or regulation or interfere with the proper performance of the responsibilities of a director; |

| | • | | Be willing and able to devote sufficient time to the affairs of the Company and be diligent in fulfilling the responsibilities of a director and Board committee member (including developing and maintaining sufficient knowledge of the Company and its industry); |

| | • | | Have broad experience in the industries which comprise the Company’s customer base or in the information technologies services industry; |

| | • | | Have the ability to provide insights and practical wisdom based on his or her experience and expertise; and |

| | • | | Have a commitment to enhancing stockholder value. |

As described in its Charter, the Nominating and Compensation Committee meets periodically to evaluate each new director candidate, irrespective of whether the candidate has been submitted by a stockholder or otherwise, and each incumbent director, before recommending that the Board nominate or re-nominate such individual for election or reelection as a director. The Nominating and Compensation Committee bases its decision whether to recommend a nominee to the Board of directors on the extent to which such individual meets the criteria described above and any additional criteria that may have been established by the Committee. The Committee is authorized to engage third parties, such as a director search firm, to aid in the identification of director candidates meeting the Committee’s criteria. In 2003, no third-party or firm was so engaged by the Committee. In addition,

9

the bylaws of the Company permit stockholders to nominate directors for consideration at an annual meeting of stockholders. See “Stockholder Proposals” for information regarding submission of proposals for consideration at next year’s annual meeting of stockholders.

Compensation of Directors

In January 2003, the Board adopted a director compensation policy with a cash and equity component. Upon joining the Board, non-employee directors holding less than 1% of the Company’s Common Stock are granted an option to purchase 20,000 shares of the Company’s Common Stock under Lionbridge’s 1998 Stock Plan. In addition, the non-employee directors also receive an annual option grant to purchase 7,500 shares of Common Stock under Lionbridge’s 1998 Stock Plan and an annual cash retainer in the amount of $5,000. In addition, directors serving on the Audit Committee receive an annual retainer of $2,500 and directors serving on the Nominating and Compensation Committee receive an annual retainer of $1,000. Each director is reimbursed for reasonable travel and other out-of-pocket expenses incurred in attending meetings of the Board of Directors or of any committee of the Board.

On January 31, 2003, each of Messrs. de Chazal, Kavanagh and Sheer received an annual option grant, at an exercise price of $2.03 per share, which was equal to the fair market value of Common Stock on the date of grant. In addition, on the same date, each of these directors was granted an option to purchase 10,000 shares of Common Stock (20,000 in the case of Mr. de Chazal) under Lionbridge’s 1998 Stock Plan, at an exercise price of $2.03 per share, which was equal to the fair market value of Common Stock on the date of grant, to represent the initial option grant such directors would have received had the director compensation policy adopted in 2003 been in place when such individuals joined the Lionbridge Board of Directors.

On February 4, 2003, upon joining the Lionbridge Board as a non-employee director, Mr. Blechschmidt received an initial option grant of an option to purchase 20,000 shares of Common Stock at an exercise price of $1.85 per share, which was equal to the fair market value of Common Stock on the date of grant.

10

EXECUTIVE COMPENSATION

Summary Compensation Table

The following Summary Compensation Table sets forth certain information with respect to the annual and long-term compensation of Lionbridge’s Chief Executive Officer and each of Lionbridge’s other highly compensated executive officers (the “named executive officers”) whose total compensation exceeded $100,000 for the fiscal years ended December 31, 2003, 2002 and 2001.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term Compensation Awards

|

Name And Principal Position

| | Year

| | Salary

| | Bonus (4)

| | Other Annual

Compensation

| | Restricted

Stock Awards ($)(2)

| | Stock

Options #

| | | All Other

Compensation ($)

|

Rory J. Cowan Chairman, Chief Executive Officer and President | | 2003

2002

2001 | | $

$

$ | 400,000

282,238

266,406 | | $

$

$ | 120,000

250,000

0 | | —

—

— | | $

$ | 77,900

—

180,000 | | 200,000

200,000

600,000 |

(3)

| | —

—

— |

Stephen J. Lifshatz Senior Vice President and Chief Financial Officer | | 2003

2002

2001 | | $

$

$ | 235,000

210,346

208,750 | | $

$

$ | 47,000

86,000

0 | | —

—

— | | $

$

$ | 58,425

—

54,000 | | 120,000

100,000

275,000 |

(3)

| | —

—

— |

| | | | | | | |

Myriam Martin-Kail Senior Vice President and Chief Operating Officer | | 2003

2002

2001 | | $

$

$ | 240,000

179,491

165,000 | | $

$

$ | 48,000

81,000

0 | | —

—

— | | $

$ | 38,950

—

80,100 | | 80,000

70,000

300,000 |

(3)

| | —

—

— |

| | | | | | | |

Paula Barbary Shannon (1) Senior Vice President and Chief Sales Officer | | 2003

2002 | | $

$ | 204,910

147,380 | | $

$ | 37,000

60,000 | | — | | $

| 38,950

— | | 80,000

140,000 |

(3) | | — |

| | | | | | | |

| (1) | | Ms. Shannon was elected as an executive officer of the Company on October 26, 2002. |

| (2) | | Represents the dollar value on September 5, 2003, the award date of restricted stock awards reflected for 2003. On such date, the fair market value of the Common Stock was $7.79. Messrs. Cowan and Lifshatz, and Ms. Martin-Kail and Ms. Shannon were awarded 10,000, 7,500, 5,000 and 5,000 shares of restricted stock, respectively. Restrictions with respect to 25% of these shares lapse on each one year anniversary from the grant date. As of December 31, 2003, the value of the Common Stock awarded to Messrs. Cowan and Lifshatz, and Ms. Martin-Kail and Ms. Shannon, using the value of the Common Stock as of December 31, 2003, was $96,100, $72,075, $48,050, and $48,050, respectively. Also represents the dollar value on January 2, 2002, the award date of restricted stock awards reflected for 2001. On such date, the fair market value of the Common Stock was $1.80. Messrs. Cowan and Lifshatz, and Ms. Martin-Kail were awarded 100,000, 30,000 and 44,500 shares of restricted stock, respectively. Restrictions with respect to 50% of these shares lapse one year from the grant date and restrictions with respect to the remaining 50% of these shares lapse two years from the grant date. As of December 31, 2003, the value of the Common Stock awarded to Messrs. Cowan and Lifshatz and Ms. Martin-Kail, using the value of the Common Stock as of December 31, 2003, was $961,000, $288,300, and $427,645, respectively. Dividends will not be paid to the shares of restricted stock. |

| (3) | | Includes stock options granted in July 2002 in exchange for those canceled in January 2002 pursuant to the Company’s Key Employee Voluntary Stock Option Exchange Program (the “Exchange Program”). Messrs. Cowan and Lifshatz, and Ms. Martin-Kail and Ms. Shannon each participated in the Exchange Program, and |

11

| | in July 2002 were granted options to purchase 100,000, 50,000, 20,000 and 90,000 shares of Common Stock, respectively, in exchange for their cancellation of stock options exercisable for the same number of shares in January 2002. |

| (4) | | Represents a cash bonus earned by such individual in the applicable fiscal year and paid during the next fiscal year. |

Option/SAR Grants In Last Fiscal Year

The following table sets forth certain information with respect to the stock options granted during the fiscal year ended December 31, 2003 to each named executive officer of Lionbridge listed in the Summary Compensation Table above. Lionbridge did not grant any stock appreciation rights in 2003.

Stock Option Grants In Fiscal Year 2003

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted

| | Percentage of Total

Options Granted to

Employees in Fiscal

Year

| | | Exercise

Price

per

Share(1)

| | Expiration

Date

| | Potential Realizable Value at Assumed Rates of Stock

Price Appreciation for

Option Term(2)

|

| | | | | | 5%

| | 10%

|

Rory J. Cowan Chairman, Chief Executive Officer and President | | 200,000 | | 13.6 | % | | $ | 9.82 | | 11/20/2013 | | $ | 1,235,249 | | $ | 3,130,220 |

Stephen J. Lifshatz Senior Vice President and Chief Financial Officer | | 120,000 | | 8.16 | % | | $ | 9.82 | | 11/20/2013 | | $ | 741,089 | | $ | 1,878,066 |

Myriam Martin-Kail Chief Operating Officer | | 80,000 | | 5.44 | % | | $ | 9.82 | | 11/20/2013 | | $ | 494,060 | | $ | 1,252,044 |

Paula Barbary Shannon Senior Vice President, Sales and Chief Sales Officer | | 80,000 | | 5.44 | % | | $ | 9.82 | | 11/20/2013 | | $ | 494,060 | | $ | 1,252,044 |

| | | | | | |

| (1) | | The exercise price equals the fair market value of the Common Stock as of the grant date as determined by Lionbridge’s board of directors. All options become exercisable over four years from the date of grant at the rate of 25% on the first anniversary of the grant date, and 12.5% every six months thereafter. |

| (2) | | Amounts reported in these columns represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. These assumptions are not intended to forecast future appreciation of Lionbridge’s stock price. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock. Actual gains, if any, on stock option exercises and Common Stock holdings are dependent on the timing of such exercise and the future performance of Lionbridge’s Common Stock. Lionbridge cannot assure that the rates of appreciation assumed in this table can be achieved or that the amounts reflected will be received by the individuals. This table does not take into account any appreciation in the price of the Common Stock since the date of grant. |

12

Aggregate Option Exercises And Year-End Values

The following table sets forth certain information with respect to the options exercised by each named executive officer of Lionbridge listed in the Summary Compensation Table above during the year ended December 31, 2003 or held by such persons at December 31, 2003.

Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

| | | | | | | | | | | | | | | |

Name

| | Shares Acquired On Exercise (#)

| | Value Realized ($)(1)

| | Number of Securities

Underlying Unexercised

Options at December 31, 2003

| | Value of Unexercised In-The-Money Options at

December 31, 2003(2)

|

| | | | Exercisable (#)

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Rory J. Cowan | | 0 | | | 0 | | 491,667 | | 575,000 | | $ | 3,703,747 | | $ | 2,853,047 |

Stephen J. Lifshatz | | 46,138 | | $ | 133,270 | | 269,309 | | 275,691 | | $ | 2,009,403 | | $ | 1,206,410 |

Myriam Martin-Kail | | 45,000 | | $ | 447,750 | | 431,664 | | 246,250 | | $ | 3,504,851 | | $ | 1,231,591 |

Paula Barbary Shannon | | 65,000 | | $ | 497,600 | | 60,625 | | 239,375 | | $ | 410,867 | | $ | 1,228,270 |

| (1) | | Amounts calculated by subtracting the aggregate exercise price of the options from the market value of the underlying Common Stock on the date of exercise, and do not reflect amounts actually received by the named executive officers. |

| (2) | | Amounts calculated by subtracting the exercise price of the options from the fair market value of the underlying Common Stock as quoted on The NASDAQ Stock Market of $9.61 per share on December 31, 2003, multiplied by the number of shares underlying the options, and do not reflect amounts that may be actually received by the named executive officers upon exercise of options. |

Employment, Non-Competition and Change of Control Agreements

Rory J. Cowan entered into an employment agreement with Lionbridge on December 23, 1996. Mr. Cowan’s employment agreement provides for a two-year term with automatic one-year renewals. Under the terms of his employment agreement, if Lionbridge terminates Mr. Cowan’s employment other than for cause, he is entitled to receive twelve monthly severance payments, each in an amount equal to his then current monthly base compensation (i.e., one-twelfth of Mr. Cowan’s base salary). If Mr. Cowan is terminated for cause, he will not be entitled to any severance payments or other benefits except as required by law.

Stephen J. Lifshatz entered into an employment agreement with Lionbridge on February 11, 1997. Mr. Lifshatz’s employment agreement provides for a one-year term with automatic one-year renewals. If Lionbridge terminates Mr. Lifshatz’s employment other than for cause, he is entitled to receive six monthly severance payments, each in an amount equal to his then current monthly base compensation (i.e., one-twelfth of Mr. Lifshatz’s base salary). If Mr. Lifshatz is terminated for cause, he will not be entitled to any severance payments or other benefits except as required by law.

Myriam Martin-Kail entered into an employment agreement with Lionbridge on February 24, 1997, effective as of January 1, 1997. Under the terms of her employment agreement, if Lionbridge terminates Ms. Martin-Kail’s employment, she is entitled to receive twelve monthly severance payments, each in an amount equal to her then current monthly base compensation (i.e., one-twelfth of Ms. Martin-Kail’s base salary).

13

Mr. Broekmate and Ms. Shannon, under Lionbridge’s severance policy for Executive Officers, would receive three monthly severance payments, each in an amount equal to his or her then currently monthly base compensation, if Lionbridge terminates his or her employment other than for cause.

Each Executive Officer entered into a non-competition agreement with Lionbridge upon the commencement of his or her employment. The agreements provide that such Executive Officer will not, during the course of his or her employment and the twelve months following the date of the termination of his or her employment with Lionbridge, (1) engage or otherwise have a financial interest in any business activity which is in competition with any of the products or services being provided by Lionbridge, (2) solicit Lionbridge’s employees or (3) solicit or do business with any present or past customer of Lionbridge’s, or any prospective customer of Lionbridge’s, in connection with any business activity which would be in violation of the non-competition agreement.

In July 2003, the Board of Directors of the Company approved the adoption of a Change of Control Plan. Under the terms of the Change of Control Plan, if the employment of any executive officer is terminated without cause or for good reason within 18 months, for Messrs. Cowan and Lifshatz, or one year, for Mr. Broekmate, Ms. Martin-Kail and Ms. Shannon, of a change of control of Lionbridge, then the executive officer is entitled to severance benefits as follow: (a) a lump sum cash payment equal to 150% for Messrs. Cowan and Lifshatz, and 100%, for Mr. Broekmate, Ms. Martin-Kail and Ms. Shannon, of the executive’s then current base salary and target bonus; (b) if the executive’s termination occurs after June 30 of the then current fiscal year, payment of a pro rata portion of the executive’s target bonus for the year of termination; and (c) continuance, at Lionbridge’s expense, of the executive’s health and related welfare benefits for a period of 18 months, for Messrs. Cowan and Lifshatz, and one year, for Mr. Broekmate, Ms. Martin-Kail and Ms. Shannon, following the executive’s termination. The Plan further provides that, upon a change of control of Lionbridge, (i) 100% of any unvested stock options held by Mr. Cowan and 50% of any unvested stock options held by Messrs. Broekmate, Lifshatz, Ms. Martin-Kail and Ms. Shannon shall vest and become immediately exercisable and (ii) the remaining 50% of the unvested stock options held by Messrs. Broekmate and Lifshatz, Ms. Martin-Kail and Ms. Shannon will vest and become exercisable on the earlier of six months following the change of control or on the date such executive’s employment is terminated without cause or for good reason.

14

NOMINATING AND COMPENSATION COMMITTEE REPORT ON EXECUTIVE

COMPENSATION

This report is submitted by the Nominating and Compensation Committee. The Nominating and Compensation Committee during fiscal year 2003 was comprised of Messrs. de Chazal, Kavanagh and Sheer, all of whom are non-employee directors, with Mr. Sheer serving as its Chairman. Pursuant to authority delegated by the Board of Directors and the Nominating and Compensation Committee Charter, the Nominating and Compensation Committee has responsibility for the review and administration of the Company’s compensation and equity plans, including the Lionbridge’s 1998 Stock Plan and 1999 Employee Stock Purchase Plan, for approving salaries and other incentive compensation for Lionbridge’s officers and executives, and for preparing the annual report on executive compensation required to be included in the Company’s proxy statement. In addition, the Committee has responsibility for recommending nominees for election as directors of the Company and review of related Board development issues including succession planning and evaluation.

Compensation Philosophy

The goal of Lionbridge is to attract and retain qualified executives in a competitive industry. To achieve this goal, the Nominating and Compensation Committee applies the philosophy that compensation of executive officers, specifically including that of the Chief Executive Officer, should be linked to revenue growth, operating results and earnings per share performance.

Under the supervision of the Nominating and Compensation Committee, Lionbridge has developed and implemented compensation policies. The Nominating and Compensation Committee’s executive compensation policies are designed to (i) enhance profitability of Lionbridge and stockholder value, (ii) integrate compensation with Lionbridge’s annual and long-term performance and strategic goals, (iii) reward corporate performance, (iv) recognize individual initiative, achievement and hard work, and (v) assist Lionbridge in attracting and retaining qualified executive officers. Currently, compensation under the executive compensation program is comprised of cash compensation in the form of annual base salary, bonus, and long-term incentive compensation in the form of stock options and restricted stock awards.

In 2003, the Committee undertook an extensive review and analysis of the Company’s executive compensation practices with an independent compensation consultant. In connection with this assessment, the Committee reviewed long and short-term cash and equity compensation for each of the executive officers as well as other senior managers, relative to practices of companies in a comparison group comprised of other like-sized services companies and of competitor companies (the “Comparison Group”) prepared by its compensation consultant. The Committee concluded, based on this review, that the base salaries and equity compensation of its executive officers were in line with the competitive salary and compensation ranges for the Comparison Group.

Based on the analysis presented by the Committee’s compensation consultant of practices in place at several of the companies in the Comparison Group, the Committee approved the adoption of a Change of Control Plan for the Company’s key employees, including the executive officers. The Plan provides for severance benefits if the employment of an executive officer is terminated without cause or for good reason within a specified time period following a change of control of Lionbridge. The Change of Control Plan and the benefit levels applicable for each executive officer are described in this Proxy Statement under “Executive Compensation – Employment, Non-Competition and Change of Control Arrangements”.

15

Shortly after the end of the year, the Committee conducted a review of the retention value of each executive officer’s equity compensation and determined that it was appropriate to provide an additional retention award, in the form of restricted stock, to each such executive officer. Accordingly, in February 2004, the Committee approved the award of restricted stock to each of the executive officers.

Base Salary

In setting cash compensation for the Chief Executive Officer and reviewing and approving the cash compensation for all other officers, the Committee annually conducts a review of salaries relative to competitor companies and this year, relative to the Comparison Group. The Committee’s policy is to fix base salaries at levels comparable to the amounts paid to senior executives with comparable qualifications, experience and responsibilities at other companies of similar size and engaged in a similar business to that of Lionbridge. In addition, the base salaries take into account Lionbridge’s relative performance as compared to comparable companies, including those in the Comparison Group. In 2003, the Committee used data and analysis prepared by its independent compensation consultant in connection with this assessment. Based on its review of this analysis, the Committee concluded that the base salaries of its executive officers, most recently adjusted in November 2002, were in line with the competitive salary and compensation ranges for the Comparison Group and accurately reflected the qualifications, experience and responsibilities of each executive officer. Accordingly, base salaries for the executive officers were not adjusted in 2003.

Bonus Compensation

In addition to salary compensation, the Nominating and Compensation Committee recommended the continuation of the bonus program adopted by the Board of Directors in the previous year, whereby senior executives recommended by the Chief Executive Officer and approved by the Nominating and Compensation Committee for inclusion in the program receive bonus compensation based on a percentage of base salary. The purpose of the bonus program is to motivate and reward participants relative to corporate, business and individual performance. The program for 2003 provided for cash awards based partly on achievement of corporate-wide financial objectives relating to revenue and various profitability measures, including profit before tax, earnings per share and EBITDA, and partly on meeting performance targets and objectives established at the beginning of 2003 for the business or function for which the participant was responsible. The cash bonus awards listed in the Summary Compensation Table above reflect payouts under the bonus program which correspond to the level of corporate, business and individual performance achieved, as determined by the Committee. In setting the level of payout for executive officers, the Committee considered multiple factors, including the level of achievement of stated financial and strategic objectives and the completion of strategic initiatives, including the acquisition of Mentorix Technologies, Inc.

In addition, in September 2003 the Committee approved the award of restricted stock to key employees of the Company, including each of the executive officers, in recognition of such individual’s role in the Company’s achievement of positive operating results during the second quarter of 2003, the completion of a public offering of Common Stock of the Company and the strategic acquisition of Mentorix Technologies, Inc. These restricted stock awards are reflected in the Summary Compensation Table.

Stock Options

The Nominating and Compensation Committee relies on incentive compensation in the form of stock options to retain and motivate executive officers and employees. Incentive compensation in the form of stock

16

options is designed to provide long-term incentives to executive officers and other employees, to encourage the executive officers and other employees to remain with Lionbridge and to enable them to develop and maintain a stock ownership position in Lionbridge’s Common Stock.

Lionbridge’s 1998 Stock Plan permits the Nominating and Compensation Committee to administer the granting of stock options to eligible employees, including executive officers. Options generally become exercisable based upon a vesting schedule tied to years of future service to Lionbridge. The value realizable from exercisable options is dependent upon the extent to which Lionbridge’s performance is reflected in the market price of Lionbridge’s Common Stock at any particular point in time. Equity compensation in the form of stock options is designed to provide long-term incentives to executive officers and other employees. The Nominating and Compensation Committee approves the granting of options in order to motivate these employees to maximize shareholder value. Generally, options are granted to officers and employees at fair market value on the date of grant and vest over a four-year period.

Option grants to employees are based on such factors as initiative, achievement and performance. In administering grants to executive officers, the Nominating and Compensation Committee evaluates each officer’s total equity compensation package, and in 2003 reviewed the analysis prepared by its independent compensation consultant relative to compensation levels at the Comparison Group companies. The Nominating and Compensation Committee generally reviews the option holdings of each of the executive officers, including their vesting and exercise prices and the then current value of any unvested options. The Nominating and Compensation Committee considers equity compensation to be an integral part of a competitive executive compensation package and an important mechanism to align the interests of management with those of Lionbridge’s stockholders.

In determining the size of stock option awards to executive officers and other senior managers in 2003, the Committee identified the particular challenges and goals facing the Company at this time and the need to provide adequate long-term incentives to these key executives to meet these challenges and goals. Among the challenges and goals identified by the Committee are the following:

| | • | | growth in the number of employees as a result of the Mentorix acquisition and the challenges of managing 2000 employees; |

| | • | | the strategic goal of implementing an integrated off-shore services model; |

| | • | | the expanded revenue base and the challenges of maintaining and further expanding that base; and |

| | • | | the challenges of maintaining operating profitability and increasing shareholder value. |

Mr. Cowan’s Compensation

The cash compensation program for the Chief Executive Officer of Lionbridge is designed to reward performance that enhances shareholder value. Mr. Cowan’s compensation package is comprised of base pay, bonus and stock options, and is in part based on Lionbridge’s revenue growth, profitability and growth in earnings per share. As noted above, in 2003, the Nominating and Compensation Committee engaged an independent compensation consultant to assess executive compensation, including the compensation of the Chief Executive Officer.

Based on its review of this analysis, the Committee concluded that Mr. Cowan’s base salary, most recently adjusted in November 2002, was in line with the competitive salary and compensation ranges for chief executive

17

officers in the Comparison Group and accurately reflected Mr. Cowan’s qualifications, experience and responsibilities as Chief Executive Officer. Accordingly, Mr. Cowan’s base salary was not adjusted in 2003. In November 2002, the Committee set Mr. Cowan’s target bonus for 2003 at 75% of base salary. As noted in the Summary Compensation Table, Mr. Cowan participates in the bonus plan described above and received a cash award under the program in an amount equal to 30% of his base salary, an amount the Nominating and compensation Committee determined as appropriate recognition for Mr. Cowan’s considerable accomplishments as Chief Executive Officer during 2003.

On November 20, 2003, Mr. Cowan was also awarded a stock option to purchase 200,000 shares of Common Stock, at an exercise price of $9.82, the then fair market value of the Company’s Common Stock. In determining the amount and vesting schedule of Mr. Cowan’s options, the Committee noted the Company’s performance during 2003 under Mr. Cowan’s leadership, as well as the challenges facing Mr. Cowan as Chief Executive Officer of a dynamic services company in the localization and testing industries. All of Mr. Cowan’s options carry a term of ten years and are exercisable at the rate of 25% after one year from the date of grant and 12.5% every six months thereafter.

As noted above, in recognition of the Company’s achievements and performance during 2003 under Mr. Cowan’s leadership, Mr. Cowan received an award of 10,000 shares of restricted stock in September 2003, as reflected in the Summary Compensation Table above.

The Nominating and Compensation Committee is satisfied that the executive officers of Lionbridge are dedicated to achieving significant improvements in the long-term financial performance of Lionbridge and that the compensation policies and programs implemented and administered have contributed and will continue to contribute toward achieving this goal.

Deductibility of Executive Compensation

In general, under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), Lionbridge cannot deduct, for federal income tax purposes, compensation in excess of $1,000,000 paid to certain executive officers. This deduction limitation does not apply, however, to compensation that constitutes “qualified performance-based compensation” within the meaning of Section 162(m) of the Code and the regulations promulgated thereunder. Lionbridge has considered the limitations on deductions imposed by Section 162(m) of the Code, and it is Lionbridge’s present intention that, for so long as it is consistent with its overall compensation objective, substantially all tax deductions attributable to executive compensation will not be subject to the deduction limitations of Section 162(m) of the Code.

Respectfully Submitted by the Nominating and Compensation Committee:

Guy L. de Chazal

Paul Kavanagh

Claude P. Sheer, Chairman

18

Compensation Committee Interlocks And Insider Participation

Messrs. de Chazal, Kavanagh and Sheer comprised the Nominating and Compensation Committee for fiscal year 2003 and Mr. Sheer served as its Chairman. No member of the Nominating and Compensation Committee was at any time during the past year an officer or employee of Lionbridge or any of its subsidiaries, was formerly an officer of Lionbridge or any of its subsidiaries, nor had any relationship with Lionbridge requiring disclosure herein.

No executive officer of Lionbridge served as a member of a compensation committee (or other board committee performing similar functions or, in the absence of any such committee, the entire board of directors) of another corporation, one of whose executive officers served on Lionbridge’s Nominating and Compensation Committee. No executive officer of Lionbridge served as a director of another corporation, one of whose executives served on the Nominating and Compensation Committee. No executive officer of Lionbridge served as a member of a compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another corporation, one of whose executive officers served as a director of Lionbridge.

EQUITY COMPENSATION PLAN INFORMATION

| | | | | | | |

| | | (A)

| | (B)

| | (C)

|

Plan Category

| | Number of securities to be

issued upon exercise of

outstanding options, warrants and rights

| | Weighted-average exercise

price of outstanding options,

warrants and rights

| | Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in column (A))

|

Equity compensation plans approved by security holders | | 9,403,553 | | $ | 4.62 | | 318,479 |

Equity compensation plans not approved by security holders | | 0 | | | | | |

Total | | 9,403,553 | | $ | 4.62 | | 318,479 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In accordance with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, during 2002, Rory Cowan, the Chief Executive Officer and a director of the Company, established a written plan which provides for the automatic sale of a specified number of shares of Common Stock in accordance with the guidelines of the written plan. Mr. Cowan’s plan, which expired in February 2003, provided for the sale of 10,000 shares per month provided the stock price is at or above $2.43 per month.

19

AUDIT COMMITTEE REPORT

The Audit Committee is composed of Messrs. Blechschmidt (Chairman), de Chazal, Kavanagh and Sheer, none of whom is an officer or employee of the Company. Each member of the Audit Committee is “independent” as defined in Rule 4200(a)(15) of the National Association of Securities Dealers’ listing standards. The Audit Committee operates under a written charter adopted by the Board of Directors. The Audit Committee has adopted a policy requiring that the provision of audit and permitted non-audit services by any outside auditor be approved in advance by the Committee.

The Audit Committee has reviewed the audited financial statements of the Company at December 31, 2003 and 2002, and for each of the three years in the period ended December 31, 2003, and has discussed them with both management and PricewaterhouseCoopers LLP, the Company’s independent auditors. The Audit Committee has also discussed with the independent accountants the matters required to be discussed by Codification on Statements on Auditing Standards No. 61 (Communication with Audit Committees).

The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and has discussed with PricewaterhouseCoopers LLP that firm’s independence. Based on the above procedures, the Audit Committee concluded that it would be reasonable to recommend, and on that basis did recommend, to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2003.

Respectfully Submitted by the Audit Committee:

Edward A. Blechschmidt, Chairman

Guy L. de Chazal

Paul Kavanagh

Claude Sheer

20

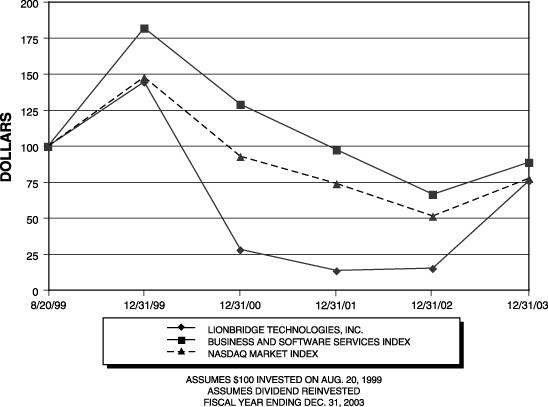

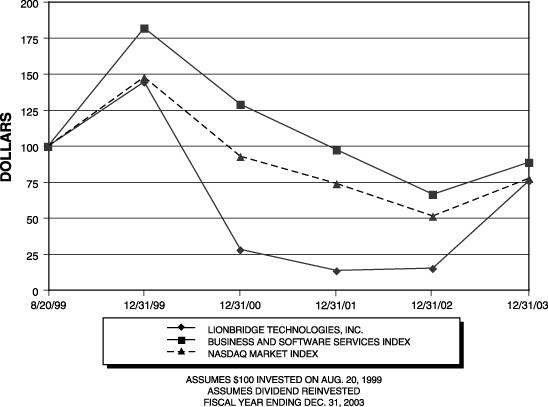

STOCK PERFORMANCE GRAPH

The following graph compares the percentage change in the cumulative total stockholder return on Lionbridge’s Common Stock during the period from Lionbridge’s initial public offering on August 20, 1999 through December 31, 2003, with the cumulative total return of the NASDAQ Composite Index and the Media General Business and Software Services Index (“Business and Software Services Index”). The comparison assumes $100 was invested on August 20, 1999 in Common Stock and in each of the foregoing indices and assumes dividends, if any, were reinvested.

| (1) | | Prior to August 20, 1999, the Company’s Common Stock was not publicly traded. Comparative data is provided only for the period since that date. This graph is not “soliciting material”, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference in any filing of Lionbridge under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

| (2) | | The stock price information shown on the graph is not necessarily indicative of future price performance. Information used on the graph was obtained from Media General Financial Services, Inc., a source believed to be reliable, but Lionbridge is not responsible for any errors or omissions in such information. |

21

PROPOSAL: AMENDMENT TO THE 1998 STOCK PLAN

Proposed Amendment

The 1998 Stock Plan (the “Plan”) was adopted by the Board of Directors in January 1998, approved by the Company’s stockholders in May 1998 and amended by the Company’s stockholders in October 2000 and May 2002. A maximum of 9,722,032 shares of Common Stock is currently reserved for issuance under the Plan. In January 2004, the Board of Directors adopted an amendment to the Plan which is the subject of this proposal. The Board of Directors has approved and recommends to the stockholders that they approve an amendment to the Plan that will increase the aggregate number of shares authorized for issuance under the Plan by 2,000,000 shares.

The Company’s management relies on equity awards as an essential part of the compensation packages necessary for the Company to attract and retain experienced officers and employees. In addition, the Company believes that equity awards are a key element in encouraging employee loyalty to Lionbridge and aligning employee interests directly with those of Lionbridge stockholders. The Board of Directors believes that the proposed amendment is essential to permit the Company’s management to continue to provide long-term, equity-based incentives to present and future key employees. In particular, the significant growth in the number of employees eligible for equity awards as a result of the Company’s acquisition of Mentorix Technologies, Inc., an eLearning content development business in India, necessitates an increase in the size of the 1998 Stock Plan so the Company can continue to attract and retain exceptional employees by providing equity awards competitive with those of companies with which Lionbridge competes for talent. The Company expects that this additional authorization of shares under the 1998 Stock Plan will be sufficient to meet its requirements for equity-based compensation for its key employees through 2005.

As of January 1, 2004, only 318,479 shares remained authorized for issuance under the Plan. If the increase in the number of shares authorized for issuance under the Plan is not approved, the Company may become unable to provide suitable long-term equity-based incentives to present and future employees. The Company has not at the present time determined who will receive options to purchase the additional shares of Common Stock that will be authorized for issuance under the Plan, if the amendment is approved.

Description of the 1998 Stock Plan The Plan is intended to provide for the grant of stock-based awards to Company employees, officers, directors and consultants. The text of the Plan, amended as proposed above, is attached to this Proxy Statement asAppendix B. The following is a summary of the Plan and should be read together with the full text of the Plan.

The Plan has a total of 9,722,032 shares of Common Stock reserved for issuance, and the fair market value of each share of Common Stock as of March 15, 2004 was $9.35. As of January 1, 2004, there were approximately 1,700 persons eligible to receive stock-based awards under the Plan. Under the Plan, Lionbridge may grant options that are intended to qualify as incentive stock options within the meaning of Section 422 of the Code, options not intended to qualify as incentive stock options (non-qualified stock options), as well as other stock-based awards and opportunities to make direct purchases of stock. Incentive stock options may be granted only to employees of Lionbridge. In general, options granted pursuant to the Plan must be exercised within ten years of the original grant date and become exercisable over a period of four years as follows: 25% on the first anniversary of the date of grant and 12.5% every six months thereafter. The maximum number of shares with respect to which options, awards or purchase rights may be granted to any employee under the Plan shall not exceed 2,333,334 shares of Common Stock during any fiscal year of Lionbridge.

22

The Plan is administered by the Nominating and Compensation Committee. Subject to the provisions of the Plan, the Nominating and Compensation Committee has the authority to select the persons to whom options, awards or purchase rights are granted and determine the terms of each option, award or purchase right, including the number of shares of Common Stock subject to the option or award. Payment of the exercise price of an option or award or purchase rights may be made in cash or check or, if approved by the Nominating and Compensation Committee, shares of Common Stock, a promissory note, an assignment of Common Stock proceeds or any combination of the foregoing. Incentive stock options are not assignable or transferable except by wills or the laws of descent or distribution. Non-qualified stock options and other awards or purchase rights are assignable or transferable to the extent set forth in the agreement relating to the non-qualified stock option, award or purchase right.

The Board of Directors may terminate or amend the Plan at any time, except that stockholder approval is required for certain changes to the Plan. Option agreements may be modified, amended or rescinded only by written agreement signed by the Company and the participant. The Plan expires at the end of the day on January 26, 2008. After that date, no further awards may be granted under the Plan, but awards previously granted may extend beyond that date. As amended, the Plan would authorize the issuance of up to 11,722,032 shares of Common Stock (subject to adjustment for capital changes) pursuant to the exercise of options or other awards granted under the Plan.

Federal Income Tax Consequences

The following general rules are currently applicable for United States federal income tax purposes upon the grant and exercise of options to purchase shares of Common Stock pursuant to the Plan:

Incentive Stock Options. The following general rules are applicable under current federal income tax law to an incentive stock option (“ISO”) granted under the Plan.

1. In general, no taxable income results to the optionee upon the grant of an ISO or upon the issuance of shares to him or her upon the exercise of the ISO, and no corresponding federal tax deduction is allowed to the Company upon either grant or exercise of an ISO.

2. If shares acquired upon exercise of an ISO are not disposed of within (i) two years following the date the option was granted or (ii) one year following the date the shares are issued to the optionee pursuant to the ISO exercise (the “Holding Periods”), the difference between the amount realized on any subsequent disposition of the shares and the exercise price will generally be treated as capital gain or loss to the optionee.

3. If shares acquired upon exercise of an ISO are disposed of before the Holding Periods are met (a “Disqualifying Disposition”), then in most cases the lesser of (i) any excess of the fair market value of the shares at the time of exercise of the ISO over the exercise price or (ii) the actual gain on disposition will be treated as compensation to the optionee and will be taxed as ordinary income in the year of such disposition.

4. In any year that an optionee recognizes ordinary income as the result of a Disqualifying Disposition of stock acquired by exercising an ISO, the Company generally should be entitled to a corresponding deduction for federal income tax purposes.

5. Any excess of the amount realized by the optionee as the result of a Disqualifying Disposition over the sum of (i) the exercise price and (ii) the amount of ordinary income recognized under the above rules will be treated as capital gain.

23

6. Capital gain or loss recognized by an optionee upon a disposition of shares will be long-term capital gain or loss if the optionee’s holding period for the shares exceeds one year.

7. An optionee may be entitled to exercise an ISO by delivering shares of the Company’s Common Stock to the Company in payment of the exercise price, if the optionee’s ISO agreement so provides. If an optionee exercises an ISO in such fashion, special rules will apply.

8. In addition to the tax consequences described above, the exercise of an ISO may result in additional tax liability to the optionee under the alternative minimum tax rules. The Code provides that an alternative minimum tax (at a maximum rate of 28%) will be applied against a taxable base which is equal to “alternative minimum taxable income”, reduced by a statutory exemption. In general, the amount by which the value of the Common Stock received upon exercise of the ISO exceeds the exercise price is included in the optionees’ alternative minimum taxable income. A taxpayer is required to pay the higher of his or her regular tax liability or the alternative minimum tax. A taxpayer that pays alternative minimum tax attributable to the exercise of an ISO may be entitled to a tax credit against his or her regular tax liability in later years.

9. Special rules may apply if the stock acquired is subject to vesting, or is subject to certain restrictions on resale under Federal securities laws applicable to directors, officers or 10% stockholders.

Non-Qualified Stock Options. The following general rules are applicable under current federal income tax law to an option that does not qualify as an ISO (“Non-Qualified Stock Option”) granted under the Plan:

1. The optionee generally does not realize any taxable income upon the grant of a Non-Qualified Stock Option, and the Company is not allowed a federal income tax deduction by reason of such grant.