UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2006

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 000-26933

LIONBRIDGE TECHNOLOGIES, INC.

(Exact Name of registrant as specified in its charter)

| | |

| DELAWARE | | 04-3398462 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

| |

| 1050 Winter Street, Waltham, MA | | 02451 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (781) 434-6000

Securities to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Exchange on Which Registered |

| Common Stock, $.01 Par Value | | Nasdaq Stock Market LLC |

Securities to be registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Exchange Act Rule 12b-2 (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, as of June 30, 2006, was approximately $220.9 million (based on the closing price of the registrant’s Common Stock on June 30, 2006, of $5.53 per share).

The number of shares outstanding of the registrant’s $.01 par value Common Stock as of February 28, 2007 was 60,106,434.

DOCUMENTS INCORPORATED BY REFERENCE

Lionbridge intends to file a proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended December 31, 2006. Portions of such proxy statement are incorporated by reference into Part III of this Report.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2006

TABLE OF CONTENTS

2

PART I

Except for the historical information contained herein, the matters discussed in this Annual Report on Form 10-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements involve risks and uncertainties. Lionbridge makes such forward-looking statements under the provision of the “Safe Harbor” section of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements should be considered in light of the factors described below in Item 1A “Risk Factors.” Actual results may vary materially from those projected, anticipated or indicated in any forward-looking statements. In this Annual Report on Form 10-K, the words “anticipates,” “believes,” “expects,” “intends,” “future,” “could,” and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. Unless the context otherwise requires, all references to “Lionbridge,” “we,” “our,” “us” or “our company” in this Annual Report on Form 10-K refer to Lionbridge Technologies, Inc., a Delaware corporation, and its subsidiaries.

About Lionbridge

Lionbridge is a leading provider of globalization, development and testing services that enable clients to develop, release, manage and maintain their enterprise content and technology applications globally. Lionbridge Global Language and Content (“GLC”) solutions enable the globalization and worldwide multilingual release of clients’ products, content and related technical support, training materials, and sales and marketing information. Globalization is the process of adapting content and products to meet the language and cultural requirements of users throughout the world. As part of its GLC solutions, Lionbridge also develops eLearning content and technical documentation. Lionbridge GLC solutions are based on the Company’s internet-architected language technology platform and global service delivery model which make the translation process more efficient for Lionbridge clients and translators.

Through its Global Development and Testing (“GDT”) solutions, Lionbridge develops, re-engineers and optimizes IT applications and performs testing to ensure the quality, interoperability, usability and performance of clients’ software, consumer technology products, web sites and content. Lionbridge’s testing services, which are offered under the VeriTest brand, also include product certification and competitive analysis. Lionbridge has deep domain experience developing, testing and maintaining applications in a cost-efficient, blended on-site and offshore model.

Lionbridge provides a full suite of globalization, testing and development outsourcing services to businesses in diverse end markets including technology, mobile and electronics, life sciences, consumer, publishing, manufacturing, automotive and government. Lionbridge’s solutions include product and content globalization; content and eLearning courseware development; interpretation services; application development and maintenance; software and hardware testing; product certification and competitive analysis. Lionbridge’s services enable global organizations to increase market penetration and speed adoption of global content and products, enhance return on enterprise application investments, increase workforce productivity and reduce costs.

Lionbridge provides the following core benefits to clients:

Global Scale. With approximately 4,300 employees worldwide, Lionbridge operates globalization, testing and development solution centers in 25 countries. Lionbridge leverages its global resources and proven program management capabilities to provide client delivery teams that are designed to have the optimal technical, linguistic and industry expertise and skills to meet each client’s specific needs. Lionbridge’s global infrastructure enables Lionbridge to deliver high-value, cost-effective services and to meet its clients’ budgetary and geographic requirements.

3

Hosted Internet-based Language Management Technology. Lionbridge globalization services utilize an internet-architected language technology platform. This platform includes a suite of applications that streamline the translation process and increase linguistic quality and consistency. This increased efficiency lowers translation costs, thereby affording clients greater freedom to be creative when preparing their source materials. A core component of this platform is Lionbridge’s Logoport™ technology, an internet-architected, hosted translation memory application that manages previously translated words, phrases and glossaries in real time and simplifies translation management. This advanced, industry standard-compatible application makes it easier for translators around the world to collaborate, share knowledge, and deliver consistent, high-quality results while enabling clients to better manage their language assets through the Lionbridge-hosted managed service platform. Lionbridge is also adding workflow capabilities and integrating portal and machine translation technology, into a comprehensive language management platform called Freeway™. This comprehensive hosted infrastructure is enabling Lionbridge to provide clients with high quality globalization services and highly efficient centralized language management processes.

Integrated Full-Service Offering. Lionbridge is able to serve as an outsourcing partner throughout a client’s product and content lifecycle from development and globalization to testing through maintenance. Clients can rely on Lionbridge’s comprehensive globalization services to develop, release and maintain their global content and technology applications for their customers, partners and employees throughout the world. Lionbridge’s testing services enable clients to improve product quality and reduce downstream support costs. This unified suite of solutions allows Lionbridge to serve as its clients’ single outsource provider for developing, releasing, testing and maintaining multilingual content and technology across global end markets. By outsourcing to a large-scale provider, organizations are able to focus on their core competencies, drive process improvements and speed the process of communicating large amounts of information to customers and employees throughout their global organization.

Lionbridge is a corporation, which was incorporated in Delaware in September 1996. Its principal executive offices are located at 1050 Winter Street, Waltham, Massachusetts 02451, its telephone number is (781) 434-6000, and its Web site iswww.lionbridge.com. Lionbridge makes available, free of charge, on its Web site its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. Lionbridge’s filings with the Securities and Exchange Commission are also available on the Web atwww.sec.gov.

Lionbridge Services

Lionbridge provides a full suite of language, content, development, testing and interpretation services. Our services include the following:

Global Language and Content Services (“GLC”)

Product Globalization. Lionbridge creates foreign language versions of its clients’ products and software applications, including the user interface, online help systems documentation and packaging. Through its internationalization, software localization and technical translation services, Lionbridge provides its clients with re-engineered and culturally adapted multilingual versions of their products and applications. Lionbridge’s product globalization services enable Lionbridge clients to release fully operable software applications, consumer devices and hardware products that are adapted to the cultural, linguistic and technical requirements of specific international markets.

As an example, Lionbridge provides localization services for a global mobile communications provider that releases dozens of new communication devices and related applications in more than 80 languages every year. Lionbridge localizes and tests software and related documentation, user interfaces and help screens. The Lionbridge process is integrated with and essential to the client’s worldwide product release cycle. As a result,

4

Lionbridge believes that it is reducing the time required for its client’s new products to reach international markets and reducing the client’s global release costs while increasing its customer satisfaction worldwide.

Content Globalization. Content globalization is the adaptation of internet, intranet, interactive, or marketing content to meet cultural, linguistic and business requirements of international markets. By globalizing content, organizations can more effectively communicate with their customers, partners and employees on a worldwide basis. Lionbridge provides multilingual content services which include translating and maintaining its clients’ web-based content, eLearning courseware and training materials, technical support databases, and sales and marketing information. By utilizing technology and integrating with its clients’ content management processes and systems, Lionbridge is able to manage the translation process in an automation-assisted manner for large volumes of content. Lionbridge combines technical writing and translation expertise, design and production capabilities, program management, standards-based automation technology and process optimization techniques to provide high-quality, client-specific solutions for multilingual content.

For example, Lionbridge is managing frequently changing content for a client’s global online search website and its online advertising program. Lionbridge is automating the process of extracting English language content from the client, routing it through translation memory technology and workflow processes and publishing the translated content directly to the client in an automated manner. As a result of this streamlined process, Lionbridge estimates that it is saving this client significant time and cost associated with the ongoing management of its multilingual search website and advertising programs.

Content Development. Content development is the creation, design and deployment of content and related assets including rich media, text, images, and animations. Lionbridge provides content development solutions, including eLearning courseware development, and production and integration of content within a technology platform. As part of this solution, Lionbridge creates content, develops and integrates applications for authoring and managing content, delivers courses, and tracks user interaction within an interactive content application.

For example, Lionbridge is working with a global publishing company to develop content and technology applications for the company’s education curricula. Lionbridge is creating and converting multimedia courseware, maintaining and updating web-based instructions and ensuring that the content adheres to local, state and national standards for each of the client’s international end markets. This multi-year engagement involves a dedicated team of content development, software engineering and program management personnel that work both onsite at the client and offshore at Lionbridge’s solution center in Mumbai, India. Lionbridge believes that this integrated solution is enabling Lionbridge’s client to reduce its costs and shorten time to market for its eLearning platforms.

Global Language and Content Services Delivery. By integrating language technology and skills, global resources, content creation expertise and skilled program management capabilities, Lionbridge provides a unified approach to developing, releasing and maintaining multilingual content and technology applications and offers a high-return solution for worldwide delivery and support.

Lionbridge maintains long-term, strategic relationships with an extensive network of third-party individual, local-country translators, including independent agencies and freelance professionals. Lionbridge also directly employs linguistic engineers, publishers, editors and translators. Lionbridge uses a combination of translation software as well as internal and external translators for its globalization services. This global network of employees and third-party translators allows Lionbridge to provide client delivery teams that have the appropriate combination of linguistic, technology and industry domain expertise, and local country presence, to meet each client’s specific needs. This flexible and scalable model also enables Lionbridge to manage large, complex client engagements while minimizing its fixed costs.

Lionbridge GLC services incorporate Freeway™, Lionbridge’s advanced internet-based language platform. Freeway supports efficient, high quality globalization and includes a collaboration portal for all project

5

participants, a repository connector to select, extract and route content for localization, and process automation tools. Freeway also includes Logoport™ which is Lionbridge’s proprietary, internet-architected translation memory application that simplifies translation management. This hosted application makes it easier for translators to collaborate, share knowledge, and deliver consistent, high-quality results. Lionbridge believes that its Freeway and Logoport technologies enable clients to better manage their language assets on a real-time basis. As a result, Lionbridge increases the quality of multilingual content, enables the globalization process to be more efficient and minimizes translation costs as client programs grow in scope and duration. This technology-based approach to client programs allows Lionbridge to increase its opportunities for recurring clients and enhances its ability for margin growth.

Lionbridge’s delivery of its GLC services is based on its Lionbridge Excellence in Operations (“LEO”) methodology. LEO is a framework to assure quality and on-time deliverables to customers, internal teams and external partners. LEO is a proven, repeatable process designed to ensure consistency around the world. A roadmap for effective service delivery, LEO offers a unified, systematic approach to adapting products and content to a target locale’s technical, linguistic and cultural expectations. Lionbridge’s LEO incorporates regional best practices and consolidates them into a standardized set of global processes to ensure repeatability, predictability and common expectations across various operating centers. LEO standardizes processes throughout every Lionbridge solution center, defines key activities, and specifies goals for each project. Lionbridge’s process-oriented approach to production enables Lionbridge to deliver high-quality applications and content across multiple technology platforms, languages and cultures in a timely fashion, while continually improving process and service delivery for Lionbridge clients.

Global Development and Testing Services (“GDT”)

Application Development and Maintenance (“ADM”). To support its clients’ global product releases, Lionbridge offers a scalable application development and maintenance solution that includes custom software development, application maintenance and code modernization. The core to this solution is Lionbridge’s global team approach that combines program managers either onsite at the client’s operation with application development and maintenance professionals located in service centers in India, Ireland and China. This global delivery model leverages Lionbridge’s worldwide infrastructure and enables Lionbridge to offer a high-quality, low-cost application development and maintenance solution that Lionbridge believes optimizes clients’ existing resources and reduces their cost of supporting business and IT applications.

For example, for a Fortune 500 provider of managed care and specialty healthcare insurance services, Lionbridge is modernizing several of the company’s back-end applications by migrating the applications to a newer more flexible technology platform. Concurrently, Lionbridge is enhancing and maintaining the client’s legacy systems with a combination of onsite program management and offshore code development, support and maintenance. Lionbridge believes that by using ADM services, the client will be able to better manage the deployment of new information technology systems and more cost-effectively manage its legacy claims processing, billing and other business-critical applications.

Testing. Lionbridge provides a variety of testing and certification services which are offered to clients under the VeriTest® brand. VeriTest services include performance testing, quality assurance, usability testing, globalization testing, certification and competitive analysis. Performance testing is the process of determining whether a website or application will perform and function appropriately when high usage levels occur, either through an increase in the number of users accessing the website or application, or through an increase in the complexity of activity conducted on the site or application at a given time. VeriTest quality assurance services verify that a client’s hardware, software, website, or internal application does not have bugs, glitches, or oversights that could impact the functionality, compatibility, interoperability or performance of that application. VeriTest usability testing is the process of determining the extent to which a client’s hardware, software, website, or internal application meets users’ expectations for ease of use. VeriTest globalization testing determines whether the product is ready for global release by ensuring that locale-dependent functions work as intended

6

within the local hardware and software environment of the end user. VeriTest services include product certification programs for many leading software, hardware and telecommunications companies, including Microsoft, Cingular, Novell, HP and EMC. These sponsoring companies retain VeriTest to develop and administer test criteria that independent software vendors must satisfy before they may display the sponsor’s logo (such as Microsoft’s Certified for Windows® Server) on their products. These certification tests confirm that software vendors’ applications properly interact with those of the platform vendor.

Lionbridge conducts its GDT and GLC services at its India facilities in Mumbai and Chennai. Lionbridge’s Mumbai, India operation has attained the Software Engineering Institute’s (“SEI”) Capability Maturity Model (“CMM”) Level 5 rating, the highest possible CMM rating from the SEI, a research and development center chartered to improve software engineering practices. Several of Lionbridge’s operations are also registered as ISO-9000 and ISO-9001 facilities.

Interpretation Services

Lionbridge provides interpretation services for government and business organizations that require experienced linguists to facilitate communication. Lionbridge provides interpretation communication services in more than 360 languages and dialects, including onsite interpretation, over-the-phone interpretation and interpreter testing, training, and assessment services.

For one government organization, Lionbridge provides telephonic interpretation services, onsite interpretation services and translation services during interviews of individuals seeking asylum or protection from removal to their home countries. As a result, Lionbridge believes that this government organization can promote greater reliability in understanding and evaluating claims. For a large healthcare information service provider, Lionbridge provides interpretation services that link patients with interpreters who translate the confidential communications between the patients and healthcare providers. Lionbridge believes that this enables the healthcare information provider to effectively and efficiently service its non-English speaking users which total approximately 500 per month.

See Note 12 of Notes to Consolidated Financial Statements included as part of Item 15 of this Form 10-K for financial information relating to Lionbridge’s operating segments and geographic areas of operation.

Sales and Marketing

Substantially all of Lionbridge’s revenue has been generated through its dedicated direct sales force. Lionbridge currently has approximately 150 direct sales professionals based in the United States, Europe, Asia and India who sell the full range of Lionbridge services. The Lionbridge sales approach involves planning for an organization’s unique ongoing requirements, including future versions of products, and ongoing support, maintenance, and training, related to both technology products and content.

7

Clients

Lionbridge clients are predominantly Global 2000 companies in the technology, consumer, retail, industrial, life sciences, financial services and manufacturing industries. Lionbridge provided services in excess of $50,000 to approximately 450 clients worldwide for the year ended December 31, 2006. The following companies are representative Lionbridge clients, each of whom purchased more than $2.0 million in services from Lionbridge in the year ended December 31, 2006:

| | | | |

| Adobe | | Google | | Palm |

| Alcatel | | HP | | PTC |

| Autodesk | | Honeywell | | Pearson |

| Beverly Enterprises | | Lexmark | | Porsche |

| Business Objects | | Merck | | Samsung |

| Canon | | Microsoft | | Schneider Automation |

| Computer Associates | | Motorola | | Sony |

| U.S. Department Of Justice | | Nikon | | Thomson |

| EMC | | Nokia | | Volvo |

Expedia | | Omron | | |

General Electric | | Oracle | | |

In 2006 and 2005, Microsoft accounted for 22% and 20% of total revenue, respectively. No other client accounted for greater than 10% of total revenue in 2006 and 2005. In 2004, HP and Microsoft each accounted for 17% of total revenue. Lionbridge’s ten largest clients accounted for 49%, 51% and 59% of revenue in 2006, 2005 and 2004, respectively.

Competition

Lionbridge provides a broad range of solutions for worldwide delivery of technology and content to its clients. The market for its services is highly fragmented, and Lionbridge has many competitors. Additionally, many potential customers address their globalization requirements through in-house capabilities, while others outsource their globalization needs, most often to regional vendors of translation services with specific subject matter or language expertise, or utilize technology-based translation solutions. Lionbridge’s current competitors include the following:

| | · | | Existing and prospective clients’ internal globalization and testing departments; |

| | · | | Localization or translation services providers such as SDL International plc, Star AG, RWS Group, SDI Media Group and Translations.com and the multiple regional vendors of translation services specializing in specific languages in various geographic areas; |

| | · | | Information Technology consulting and software development and services organizations such as Tata Consultancy Services, Wipro Ltd., Infosys Technologies and Patni, Inc. that provide outsourced Application Development and Management and testing services. |

Lionbridge may also face competition from a number of other companies in the future, including some companies that currently seek localization services from it. Other potential entrants into Lionbridge’s market include India-based offshore development organizations that are providing a range of software development, testing and maintenance services for global technology companies that require localization of the products and applications they provide. As content management software is deployed internationally, these firms may be required to assist their customers with maintaining multilingual databases. While today these companies are often working with Lionbridge to assist in meeting their customers’ needs, it is possible that over time they will expand into offering competitive services.

8

From time to time, new companies may enter Lionbridge’s global language and content industry. Although Lionbridge builds unique applications on top of standard translation memory software licensed from third parties in its localization process, and to a lesser extent machine translation software also licensed from third parties, Lionbridge’s technology does not preclude or inhibit others from entering its market.

Lionbridge believes the principal competitive factors in providing its services include its proprietary, web-based language technology platform; its ability to provide clients a comprehensive set of services that address multiple phases of a client’s content and technology application lifecycle; its global infrastructure that supports cost effective, high quality client delivery worldwide; project management expertise; quality and speed of service delivery; vertical industry expertise; expertise and presence in certain geographic areas and corporate reputation. Lionbridge believes it has competed favorably with respect to these factors and has a strong reputation in its industry.

Intellectual Property Rights

Lionbridge’s success is dependent, in part, upon its proprietary methodologies and practices, including its Freeway and Logoport technologies, its proprietary testing practices and methodologies, and other intellectual property rights. Lionbridge has patents or patent applications pending relating to its language automation translation memory engine and Logoport technology and believes that the duration of these patents is adequate relative to the expected lives of their applications. Lionbridge relies on a combination of trade secret, license, nondisclosure and other contractual agreements, and copyright and trademark laws to protect its intellectual property rights. Existing trade secret and copyright laws afford Lionbridge only limited protection. Lionbridge enters into confidentiality agreements with its employees, contractors and clients, and limits access to and distribution of Lionbridge’s and Lionbridge’s clients’ proprietary information. Lionbridge cannot assure that these arrangements will be adequate to deter misappropriation of its proprietary information or that it will be able to detect unauthorized use and take appropriate steps to enforce its intellectual property rights.

Human Resources

As of December 31, 2006, Lionbridge had 4,295 full-time equivalent employees. Of these, 3,657 were consulting and service delivery professionals and 638 were management and administrative personnel performing sales, operations, marketing, process and technology, research and development, finance, accounting, and administrative functions.

As its workforce doubled in size following the acquisition of BGS in the latter part of 2005, Lionbridge concentrated in 2006 on further streamlining the organizational structure and workflow processes. Emphasis has been and continues to be placed on ensuring that roles are clearly defined, employees are trained in the use of tools and technology, and customer satisfaction is central to Lionbridge’s efforts. Lionbridge recognizes that one of its key competitive advantages is the global diversity of its workforce and continues to broaden the skills and internal job opportunities for its employees.

Lionbridge has employees in Norway who are represented by a labor union, and there are works councils in the Netherlands, France, Germany, Denmark, Finland, and Spain. Lionbridge has never experienced a work stoppage and believes that its employee relations are good.

9

This Annual Report on Form 10-K contains forward-looking statements which involve risks and uncertainties. Lionbridge’s actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including, without limitation, those set forth in the following risk factors and elsewhere in this Annual Report on Form 10-K. In addition to the other information included or incorporated by reference in this Annual Report on Form 10-K, the following risk factors should be considered carefully in evaluating Lionbridge and its business.

Lionbridge’s reliance on a small number of large clients and the delay or reduction of its clients’ product releases and production schedules or the loss of, or reduction in revenue from, a major client could negatively affect Lionbridge’s revenue and results of operations.

A significant portion of Lionbridge’s revenue is linked to the product release cycles and production schedules of its clients, and, in particular, to certain key clients. As a result, Lionbridge performs varying amounts of work for specific clients from year to year based on their product release cycles and production schedules. A major client in one year may not have use for a similar level of Lionbridge’s services in another year. In addition, Lionbridge derives a significant portion of its revenues from large projects and programs for a limited number of large clients. For the years ended December 31, 2006 and 2005, Lionbridge’s largest client accounted for 22% and 20% of its revenue, respectively, and its five largest clients accounted for approximately 40% of its revenue. As a result, the loss of any major client or a significant reduction in a large project’s scope could materially reduce Lionbridge’s revenue and cash flow, and adversely affect its ability to maintain profitability.

Pursuing and completing potential acquisitions could divert management attention and financial resources and may not produce the desired business results.

As part of its growth strategy, Lionbridge intends to continue pursuing and making selected acquisitions of complementary businesses. Lionbridge does not have specific personnel dedicated solely to pursuing and making acquisitions. As a result, if Lionbridge pursues any acquisition, its management, in addition to their operational responsibilities, could spend a significant amount of time and management and financial resources to pursue and integrate the acquired business with its existing business. To fund the purchase price of an acquisition, Lionbridge might use capital stock, cash or a combination of both. Alternatively, Lionbridge may borrow money from a bank or other lender. If it uses capital stock, Lionbridge’s stockholders will experience dilution. If it uses cash or debt financing, Lionbridge’s financial liquidity may be reduced. In addition, from an accounting perspective, an acquisition may involve amortization of significant amounts of other intangible assets that could adversely affect Lionbridge’s ability to maintain profitability.

Despite the investment of these management and financial resources, an acquisition, including our 2005 acquisition of Bowne Global Solutions (“BGS”), may not produce the revenue, earnings or business synergies that Lionbridge anticipated or may produce such synergies less rapidly than anticipated for a variety of reasons, including:

| | · | | difficulties in the assimilation of the operations, operational systems deployments, technologies, services, products and personnel of the acquired company; |

| | · | | failure of acquired technologies and services to perform as expected; |

| | · | | risks of entering markets in which Lionbridge has no, or limited, prior experience; |

| | · | | effects of any undisclosed or potential legal or tax liabilities of the acquired company; |

| | · | | compliance with additional laws, rules or regulations that Lionbridge may become subject to as a result of an acquisition that might restrict Lionbridge’s ability to operate; and |

| | · | | the loss of key employees of the acquired company. |

10

Lionbridge may not be able to successfully address these problems. Lionbridge’s future operating results may depend to a significant degree on Lionbridge’s ability to successfully integrate acquisitions and manage operations while controlling expenses and cash outflows.

Lionbridge may have difficulty in identifying and competing for acquisition opportunities.

Lionbridge’s business strategy includes the pursuit of strategic acquisitions. While Lionbridge currently does not have commitments or agreements with respect to any acquisitions, it regularly explores potential acquisitions of strategically complementary businesses or operations. Lionbridge may not be able to identify suitable acquisition candidates and it can expect to face competition from other companies for potential acquisition candidates, making it more difficult to acquire suitable companies on favorable terms.

Lionbridge’s results of operations could be negatively affected by potential fluctuations in foreign currency exchange rates.

Lionbridge conducts a large portion of its business in international markets. Although a majority of Lionbridge’s contracts with clients are denominated in U.S. dollars, 67% and 57% of its costs and expenses for the years ended December 31, 2006 and 2005, respectively, were denominated in foreign currencies. In addition, 23% and 19% of the Company’s assets were subject to foreign currency exchange fluctuations as of December 31, 2006 and 2005, respectively, while 6% of its liabilities were subject to foreign currency exchange fluctuations as of December 31, 2006 and 2005. The principal foreign currency applicable to our business is the Euro. In addition, Lionbridge has assets and liabilities denominated in currencies other than the functional currency of the relative entity. As a result, Lionbridge is exposed to foreign currency exchange fluctuations. Management has implemented a hedging program to partially hedge its exposure to foreign currency assets or liabilities, primarily with respect to the Euro. Management regularly reviews the hedging program and will make adjustments as necessary. Lionbridge’s hedging activities may not prove favorable or effective against the adverse impact resulting from unfavorable movement in foreign currency exchange rates, which could adversely affect the Company’s financial condition or results of operations.

Lionbridge may not be able to successfully complete the integration of BGS or to achieve the anticipated benefits of the BGS acquisition.

The integration of BGS into Lionbridge involves a number of risks and presents financial, managerial and operational challenges, and the final phase of integration activities has not yet been completed. In particular, we may have difficulty, and may incur unanticipated expenses related to, integrating technology and financial reporting systems without diverting the attention of management and other personnel from revenue generating activities. We may also face difficulties in retaining and growing certain BGS customer relationships. Failure to successfully complete the integration of BGS may have a material adverse effect on our business, financial condition and results of operations.

Lionbridge may not realize the anticipated benefits of past or future acquisitions and integration of these acquisitions may interrupt the Company’s business and management.

Lionbridge has made significant acquisitions in the past and expects to continue to make acquisitions as part of our long-term business strategy. Most recently, Lionbridge completed the acquisition of BGS in September 2005. Lionbridge may not realize the anticipated benefits of this or any other acquisition, or Lionbridge may not realize the anticipated benefits as quickly as originally anticipated. In particular, the process of integrating acquired companies into the Company’s existing business may result in unforeseen difficulties and delays. These risks include:

| | · | | difficulty in integrating the operations and personnel of the acquired company; |

| | · | | difficulty in maintaining controls, procedures and policies during the transition and integration; |

11

| | · | | difficulty in integrating the acquired company’s accounting, financial reporting systems, human resources and other administrative systems; |

| | · | | delays or difficulty to achieve the financial and strategic goals for the acquired and combined businesses on the original timetable. |

Mergers and acquisitions are inherently risky and if Lionbridge does not fully complete the integration of acquired businesses successfully and in a timely manner, the Company may not realize the anticipated benefits of the acquisitions to the extent anticipated, or as rapidly as anticipated, which could adversely affect Lionbridge’s business, financial condition or results of operations.

Potential fluctuations in Lionbridge’s quarterly results make financial forecasting difficult and could affect its common stock trading price.

As a result of fluctuations in Lionbridge’s revenues tied to foreign currency fluctuations, its clients’ activities and release cycles, customer and vendor pricing pressures,the three-to nine-month length of its typical sales cycle, historical growth, acquisition activity, the emerging nature of the markets in which it competes, global economic conditions and other factors outside its control, Lionbridge believes that quarter-to-quarter comparisons of its results of operations are not necessarily meaningful. You should not rely on the results of any one quarter as an indication of Lionbridge’s future performance. Lionbridge may not experience revenue increases in future years comparable to the revenue increases in some prior years. There have been quarters in the past in which Lionbridge’s results of operations have fallen below the expectations of securities analysts and investors and this may occur in the future. If in a future quarter Lionbridge’s results of operations were to fall below the expectations of securities analysts and investors, the trading price of its common stock would likely decline.

Fluctuations in the mix of customer demand for the Company’s various types of service offerings could impact Lionbridge’s financial performance and impact Lionbridge’s ability to forecast performance.

Customer demand for the range of the Company’s service offerings varies from time to time and is not predictable, due to fluctuations in customer needs, changes in the customer industries and general economic conditions. As a result, the mix of services provided by Lionbridge to its customers varies at any given time, both within a quarter and from quarter to quarter. These variations in service mix impact gross margins and the predictability of gross margins for any period. Therefore, Lionbridge believes that quarter-to-quarter comparisons of its results of operations are not necessarily meaningful. You should not rely on the results of any one quarter as an indication of Lionbridge’s future performance. Lionbridge may not experience profitability or margin increases in future years comparable to those experienced in some prior years. There have been quarters in the past in which Lionbridge’s results of operations have fallen below the expectations of securities analysts and investors and this may occur in the future. If in a future quarter Lionbridge’s results of operations were to fall below the expectations of securities analysts and investors, the trading price of its common stock would likely decline.

Lionbridge’s financial performance may be impacted by its ability to transition service execution to its lower cost operational sites, the timing of such transition, and customer acceptance of such transition.

Lionbridge’s business strategy includes the transition of customer service execution to its Global Delivery Centers located in India, China, Poland and Slovakia. The rate at which such services may be transitioned and the timing of any transition is difficult to predict and is dependent on customer demand for such services and customer acceptance of such any such transition. Accordingly, changes in the location of service execution may not produce the anticipated financial benefit and the Company may not realize the anticipated benefits of service execution in its Global Delivery Centers to the extent anticipated, or as rapidly as anticipated, all of which could adversely affect Lionbridge’s business, financial condition or results of operations.

12

Goodwill and other intangible assets represent a significant portion of Lionbridge’s assets; any impairment of Lionbridge’s goodwill will adversely impact its net income.

At December 31, 2006, Lionbridge had goodwill and other intangible assets of approximately $167.9 million, net of accumulated amortization, which represented approximately 52.2% of its total assets. Lionbridge’s goodwill is subject to an impairment test on an annual basis and is also tested whenever events and circumstances indicate that goodwill or intangible assets may be impaired. Any excess goodwill carrying value resulting from the impairment test must be written off in the period of determination. Intangible assets (other than goodwill) are generally amortized over a one to five-year period, with the exception of various customer relationships acquired in the BGS transaction that are amortized over a twelve-year period. In addition, Lionbridge will continue to incur non-cash charges in connection with the amortization of its intangible assets other than goodwill over the remaining useful lives of such assets. Future determinations of significant write-offs of goodwill as a result of an impairment test or any accelerated amortization of other intangible assets could have a significant impact on Lionbridge’s net income and affect its ability to achieve or maintain profitability.

If Lionbridge does not respond to future advances in technology and changes in customer demands, its business and results of operations may be adversely affected.

The demand for Lionbridge’s services will be substantially affected, in large part, by future advances in technology and changes in customer demands. Lionbridge’s success will also depend on its ability to address the increasingly sophisticated and varied needs of its existing and prospective clients. Lionbridge cannot assure you that there will be a demand for its services in the future. Lionbridge’s success in servicing its clients will be largely dependent on its development of strategic business solutions and methodologies in response to technological advances and client preferences. For example, Lionbridge’s services are based on a hosted internet-based language technology platform, a core component of which is Lionbridge’s Logoport technology.

Lionbridge may be unable to continue to grow at its historical growth rates or to manage its growth effectively.

Growth is a key component of increasing the value of Lionbridge. Since its inception, Lionbridge’s business has grown significantly and it anticipates additional future growth. Recently, Lionbridge focused some of its expansion efforts on leveraging the solution centers in India, China, Poland and Slovakia while concurrently restructuring certain western European operations. This realignment has placed and may continue to place significant demands on management and operational resources. In order to manage growth effectively, Lionbridge must continue to evolve its operational systems. Additional growth may further strain Lionbridge’s management and operational resources. As a result of these concerns, Lionbridge cannot be sure that it will continue to grow, or, if it does grow, that it will be able to maintain its overall historical growth rate.

Lionbridge’s business may be harmed by defects or errors in the services it provides to its clients.

Many of the services Lionbridge provides are critical to its clients’ businesses. While Lionbridge maintains general liability insurance, including coverage for errors and omissions, defects or errors in the services it provides could interrupt its clients’ abilities to provide services to their end users resulting in delayed or lost client revenue. This could damage Lionbridge’s reputation through negative publicity, make it difficult to attract new, and retain existing customers and cause customers to terminate their contracts and seek damages. Lionbridge may incur additional costs to correct errors or defects. Lionbridge cannot assure you that its general liability and errors and omissions insurance coverage will be available in amounts sufficient to cover one or more large claims, or that the insurer will not disclaim coverage as to any future claims.

13

If Lionbridge fails to hire and retain professional staff, its ability to obtain and complete its projects could suffer.

Lionbridge’s potential failure to hire and retain qualified employees could impair its ability to complete existing projects and bid for or obtain new projects and, as a result, could have a material adverse effect on its business and revenue. Lionbridge’s ability to grow and increase its market share largely depends on its ability to hire, train, retain and manage highly skilled employees, including project managers and technical, sales and marketing personnel. In addition, Lionbridge must ensure that its employees maintain their technical expertise and business skills. Lionbridge cannot assure you that it will be able to attract a sufficient number of qualified employees or that it will successfully train and manage the employees it hires to allow Lionbridge to carry out its operating plan.

Difficulties presented by international economic, political, legal, health, accounting and business factors could negatively affect Lionbridge’s business in international markets.

A strategic advantage of Lionbridge’s operations is its ability to conduct business in international markets. Lionbridge conducts business and has operations and clients throughout the world. As a result, Lionbridge’s business is subject to political and economic fluctuations in various countries and to more cost-intensive social insurance and employment laws and regulations, particularly in Europe. In addition, as Lionbridge continues to employ and retain personnel throughout the world and to comply with various employment laws, it may face difficulties in integrating such personnel on a cost-efficient basis. As Lionbridge aligns its worldwide workforce, it may face difficulties and expense in reducing its workforce in certain high cost countries and regions, including Europe. To date, Lionbridge has been able to successfully staff its international operations, but if Lionbridge seeks to expand its operations, it may become more difficult to manage its international business. In addition, Lionbridge’s ability to engage individual interpreters and translators as contractors rather than employees may be impacted by changes in employment laws, regulations and interpretations in certain jurisdictions, which may expose Lionbridge to additional costs and expenses. Lionbridge’s and its clients’ abilities to conduct business may also be affected by wars, political unrest, terrorism, natural disasters or the impact of diseases such as avian influenza. Furthermore, as a result of operating in international markets, Lionbridge is subject to longer payment cycles from many of its customers and may experience greater difficulties in timely accounts receivable collections. If Lionbridge fails to manage these operations successfully, its ability to service its clients and grow its business will be seriously impeded.

Lionbridge competes in highly competitive markets.

The markets for Lionbridge’s services are very competitive. Lionbridge cannot assure you that it will compete successfully against its competitors in the future. If Lionbridge fails to be competitive with these companies in the future, it may lose market share and its revenue could decline.

There are relatively few barriers preventing companies from competing with Lionbridge. Although Lionbridge owns proprietary technology, Lionbridge does not own any patented or other technology that, by itself, precludes or inhibits others from entering its market. As a result, new market entrants also pose a threat to Lionbridge’s business. In addition to Lionbridge’s existing competitors, Lionbridge may face further competition in the future from companies that do not currently offer globalization or testing services. Lionbridge may also face competition from internal globalization and testing departments of its current and potential clients. Technology companies, information technology services companies, business process outsourcing companies, web consulting firms, technical support call centers, hosting companies and content management providers may choose to broaden their range of services to include globalization or testing as they expand their operations internationally. Lionbridge cannot assure you that it will be able to compete effectively with potential future competitors.

14

Lionbridge will continue to depend on intellectual property rights to protect its proprietary technologies, although it may not be able to successfully protect these rights.

Lionbridge relies on its proprietary technology to enhance some of its service offerings. Lionbridge’s policy is to enter into confidentiality agreements with its employees, outside consultants and independent contractors. Lionbridge also uses patent, trademark, trade secret and copyright law in addition to contractual restrictions to protect its technology. Notwithstanding these precautions, it may be possible for a third party to obtain and use Lionbridge’s proprietary technology without authorization. Although Lionbridge holds registered or pending United States patents and foreign patents covering certain aspects of its technology, it cannot be sure of the level of protection that these patents will provide. Lionbridge may have to resort to litigation to enforce its intellectual property rights, to protect trade secrets or know-how, or to determine their scope, validity or enforceability. Enforcing or defending its proprietary technology is expensive, could cause diversion of Lionbridge’s resources and may not prove successful. The laws of other countries may afford Lionbridge little or no effective protection of its intellectual property rights.

The intellectual property of Lionbridge’s customers may be damaged, misappropriated, stolen or lost while in Lionbridge’s possession, subjecting it to litigation and other adverse consequences.

In the course of providing globalization and testing services to Lionbridge’s customers, Lionbridge takes possession of or is granted access to certain intellectual property of such customers, including unreleased versions of software and source code. In the event such intellectual property is damaged, misappropriated, stolen or lost, Lionbridge could suffer:

| | · | | claims under indemnification provisions in customer agreements or other liability for damages; |

| | · | | delayed or lost revenue due to adverse customer reaction; |

| | · | | negative publicity; and |

| | · | | litigation that could be costly and time consuming. |

Lionbridge has an accumulated deficit and may not be able to continue to achieve operating profit.

For the years ended December 31, 2006, 2005 and 2004, Lionbridge achieved operating profits of $15.0 million, $1.3 million, and $7.2 million, respectively. However, prior to 2003, since inception, Lionbridge incurred substantial losses and may incur losses in the future. Lionbridge has an accumulated deficit of $107.7 million as of December 31, 2006. Lionbridge intends to continue to invest in internal expansion, infrastructure, select acquisitions and its sales and marketing efforts. Lionbridge cannot assure you that it will continue to achieve operating profits in the future or will generate net income in the future.

Changes in, or interpretations of, tax rules and regulations may adversely affect Lionbridge’s effective tax rates.

Lionbridge is subject to income taxes in both the U.S. and numerous foreign jurisdictions. Significant judgment is required in determining our worldwide provision for income taxes. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Lionbridge is subject to the continual examination by tax authorities in certain jurisdictions and the Company regularly assesses the likelihood of outcomes resulting from these examinations to determine the adequacy of our provision for income taxes. Although Lionbridge believes its tax estimates are reasonable, the final determination of tax audits could be materially different than what is reflected in historical income tax provisions and accruals, and could result in a material effect on the Company’s income tax provision, net income, or cash flows in the period or periods for which that determination is made could result. If additional taxes are assessed, the possibility exists for an adverse impact on Lionbridge’s financial results.

15

In addition, unanticipated changes in Lionbridge’s tax rates could affect its future results of operations. Lionbridge’s future effective tax rates could be unfavorably affected by changes in tax laws or the interpretation in tax laws, by unanticipated decreases in the amount of revenues in countries with low statutory tax rates, or by changes in the valuation of the Company’s deferred tax assets or liabilities.

The adoption in June 2006 by the Financial Accounting Standards Board (“FASB”) of FASB Interpretation No. (FIN) 48, Accounting for Uncertainty in Income Taxes – An Interpretation of FASB Statement No. 109, prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. FIN 48 will be effective beginning in the first quarter of 2007. While the Company currently estimates that the cumulative effect of adopting FIN 48 will be immaterial to its consolidated financial statements, it is possible that the final determination of the tax positions of any one of its subsidiaries, particularly those acquired from BGS, could be materially different than what is reflected in the Company’s historical financial statements, and depending on the number of subsidiaries impacted and the extent of any difference, could result in a material effect on the Company’s financial position, results of operations, or cash flows.

Changes in accounting policies may affect Lionbridge’s reported earnings and operating income.

Generally accepted accounting principles and accompanying accounting pronouncements, implementation guidelines and interpretations for many aspects of our business, including revenue recognition are highly complex and involve subjective judgments. Changes in these rules, their interpretation, or their application relative to changes in the Company’s services or business could significantly change Lionbridge’s reported earnings and could add significant volatility to these measures, without a comparable underlying change in cash flow from operations. Lionbridge’s application of applicable accounting guidance involves interpretation and judgment, and may, as a result, delay the timing of revenue recognition or accelerate the costs associated with deferred revenue.

| Item 1B. | Unresolved Staff Comments |

None.

Lionbridge maintains solution centers in North America, South America, Europe and Asia. Lionbridge’s headquarters and principal administrative, finance, legal, sales and marketing, investor relations and information technology operations are located in Waltham, Massachusetts. Its principal operational facilities are located as follows:

| | · | | North America—Bellevue, Washington; Boise, Idaho; Boulder, Colorado; Framingham, Massachusetts; Los Angeles, California; New York, New York; Oakdale, Minnesota; San Francisco, CA; Washington, D.C.; and Montreal, Canada |

| | · | | South America—Brazil, Chile |

| | · | | Europe—Belgium, Denmark, England, Finland, France, Germany, Ireland, Italy, The Netherlands, Norway, Portugal, Poland, Slovakia, Spain |

| | · | | Asia—China, India, Japan, Korea, Singapore, Taiwan |

16

On or about July 24, 2001, a purported securities class action lawsuit captioned “Samet v. Lionbridge Technologies, Inc. et al.” (01-CV-6770) was filed in the United States District Court for the Southern District of New York (the “Court”) against the Company, certain of its officers and directors, and certain underwriters involved in the Company’s initial public offering. The complaint in this action asserted, among other things, that omissions regarding the underwriters’ alleged conduct in allocating shares in Lionbridge’s initial public offering to the underwriters’ customers. In March 2002, the United States District Court for the Southern District of New York entered an order dismissing without prejudice the claims against Lionbridge and its officers and directors (the case remained pending against the underwriter defendants).

On April 19, 2002, the plaintiffs filed an amended complaint naming as defendants not only the underwriter defendants but also Lionbridge and certain of its officers and directors. The amended complaint asserts claims under both the registration and antifraud provisions of the federal securities laws relating to, among other allegations, the underwriters’ alleged conduct in allocating shares in the Company’s initial public offering and the disclosures contained in the Company’s registration statement. The Company understands that various plaintiffs have filed approximately 1,000 lawsuits making substantially similar allegations against approximately 300 other publicly-traded companies in connection with the underwriting of their public offerings. On July 15, 2002, the Company, together with the other issuers named as defendants in these coordinated proceedings, filed a collective motion to dismiss the complaint on various legal grounds common to all or most of the issuer defendants. In October 2002, the claims against officers and directors were dismissed without prejudice. In February 2003, the Court issued its ruling on the motion to dismiss, ruling that the claims under the antifraud provisions of the securities laws could proceed against the Company and a majority of the other issuer defendants.

In June 2003, Lionbridge elected to participate in a proposed settlement agreement with the plaintiffs in this litigation. If ultimately approved by the Court, this proposed settlement would result in the dismissal, with prejudice, of all claims in the litigation against Lionbridge and against any other of the issuer defendants who elect to participate in the proposed settlement, together with the current or former officers and directors of participating issuers who were named as individual defendants. The proposed settlement does not provide for the resolution of any claims against underwriter defendants, and the litigation as against those defendants is continuing. The proposed settlement provides that the class members in the class action cases brought against the participating issuer defendants will be guaranteed a recovery of $1 billion by insurers of the participating issuer defendants. If recoveries totaling $1 billion or more are obtained by the class members from the underwriter defendants, however, the monetary obligations to the class members under the proposed settlement will be satisfied.

The proposed settlement contemplates that any amounts necessary to fund the settlement or settlement-related expenses would come from participating issuers’ directors and officers’ liability insurance policy proceeds, as opposed to funds of the participating issuer defendants themselves. A participating issuer defendant could be required to contribute to the costs of the settlement if that issuer’s insurance coverage were insufficient to pay that issuer’s allocable share of the settlement costs. Lionbridge expects that its insurance proceeds will be sufficient for these purposes and that it will not otherwise be required to contribute to the proposed settlement.

Consummation of the proposed settlement is conditioned upon obtaining approval by the Court. On September 1, 2005, the Court preliminarily approved the proposed settlement and directed that notice of the terms of the proposed settlement be provided to all class members. Thereafter, the Court held a fairness hearing on April 24, 2006, at which objections to the proposed settlement were heard. After the fairness hearing, the Court took under advisement whether to grant final approval to the proposed settlement.

On December 5, 2006, the U.S. Court of Appeals for the Second Circuit issued a decision inIn re Initial Public Offering Securities Litigation that six purported class action lawsuits containing allegations substantially

17

similar to those asserted against the Company may not be certified as class actions due, in part, to the Appeals Court’s determination that individual issues of reliance and knowledge would predominate over issues common to the proposed classes. On January 8, 2007, the plaintiffs filed a petition seeking rehearingen banc of the Second Circuit Court of Appeals’ December 5, 2006 ruling. U.S. District Judge Scheindlin has ordered that all proceedings in the consolidated cases brought against the Company and against the roughly 300 other issuers sued in substantially similar cases (including proceedings relating to the proposed settlement) will be stayed pending the ruling by the Court of Appeals on whether to entertain that petition for rehearing. As a result, in part, of that filing, the impact, if any, of the Court of Appeals’ ruling on the viability of the proposed settlement cannot yet be determined.

If the proposed settlement described above is not consummated, Lionbridge intends to continue to defend the litigation vigorously. Moreover, if the proposed settlement is not consummated, the Company believes that the underwriters may have an obligation to indemnify Lionbridge for the legal fees and other costs of defending this suit. While Lionbridge cannot guarantee the outcome of these proceedings, the Company believes that the final result of this lawsuit will have no material effect on its consolidated financial condition, results of operations, or cash flows.

The California Employment Development Department investigated the classification by Lionbridge Global Solutions II, Inc. of certain of its interpreters as independent contractors for the period from October 1, 2001 through December 31, 2004. On January 28, 2005, the Employment Development Department issued a “Notice of Assessment” determining such interpreters to be common law employees and assessing personal income taxes in the amount of $20,824 and state disability insurance taxes in the amount of $8,213 for the fourth quarter of 2001. Bowne & Co., Inc., under the terms of the Agreement and Plan of Merger between it and the Company dated as of June 27, 2005, is obligated to indemnify the Company for such taxes and penalties incurred for periods on or prior to September 1, 2005. In early January 2007, the Company reached a settlement of this matter with the California Employment Development Department, and the cash amount paid by Lionbridge for resolution of the claims asserted was fully reimbursed to Lionbridge by Bowne & Co., Inc. pursuant to the indemnity obligations stated above.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None.

18

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

As of February 28, 2007, there were 504 holders of record of Lionbridge’s common stock. Lionbridge’s common stock is listed and traded on the Nasdaq Global Market under the symbol “LIOX”.

The following table sets forth, for the periods indicated, the range of high and low sales prices for the common stock for the past eight quarters, all as reported by the Nasdaq Global Market of the Nasdaq Stock Market L.L.C. The quotations represent interdealer quotations, without adjustments for retail mark ups, mark downs, or commissions, and may not necessarily represent actual transactions.

| | | | | | |

| | | High | | Low |

| 2006 | | | | | | |

First Quarter | | $ | 8.55 | | $ | 6.61 |

Second Quarter | | $ | 8.50 | | $ | 4.94 |

Third Quarter | | $ | 8.06 | | $ | 4.81 |

Fourth Quarter | | $ | 8.05 | | $ | 5.62 |

| | |

| 2005 | | | | | | |

First Quarter | | $ | 7.00 | | $ | 5.25 |

Second Quarter | | $ | 7.19 | | $ | 3.87 |

Third Quarter | | $ | 7.79 | | $ | 6.33 |

Fourth Quarter | | $ | 7.43 | | $ | 5.88 |

During 2006, the Company purchased 76,218 restricted shares from employees to cover withholding taxes due from the employees at the time the shares vested. The following table provides information about Lionbridge’s purchases of equity securities for the year ended December 31, 2006:

| | | | | |

Period | | Total Number of

Shares Purchased | | Average Price

Paid Per Share |

February 1, 2006 – February 28, 2006 | | 39,969 | | $ | 7.12 |

March 1, 2006 – March 31, 2006 | | 24,870 | | $ | 7.77 |

June 1, 2006 – June 30, 2006 | | 1,190 | | $ | 6.78 |

August 1, 2006 – August 31, 2006 | | 280 | | $ | 7.14 |

September 1, 2006 – September 30, 2006 | | 9,724 | | $ | 7.18 |

December 1, 2006 – December 31, 2006 | | 185 | | $ | 6.21 |

| | | | | |

| | 76,218 | | | |

| | | | | |

In addition, upon the termination of employees during the year ended December 31, 2006, 39,466 unvested restricted shares were forfeited. The following table provides information about Lionbridge’s forfeited restricted shares for the year ended December 31, 2006:

| | |

Period | | Total Number of

Shares Forfeited |

January 1, 2006 – January 31, 2006 | | 388 |

March 1, 2006 – March 31, 2006 | | 716 |

April 1, 2006 – April 30, 2006 | | 125 |

June 1, 2006 – June 30, 2006 | | 2,866 |

July 1, 2006 – July 31, 2006 | | 6,848 |

August 1, 2006 – August 31, 2006 | | 26,023 |

October 1, 2006 – October 31, 2006 | | 2,500 |

| | |

| | 39,466 |

| | |

19

Lionbridge has not paid any cash dividends on its common stock and currently intends to retain any future earnings for use in its business.

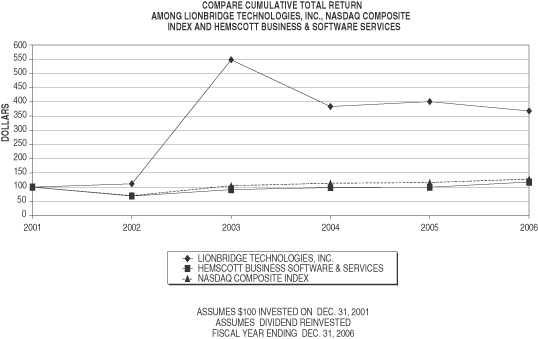

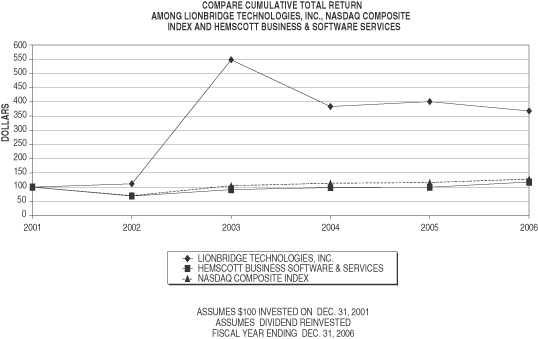

The following chart compares the total return on a cumulative basis of $100 invested in Lionbridge’s common stock on December 31, 2001 to the Nasdaq Composite Index and the Hemscott Business Software & Services Index.

| | | | | | | | | | | | |

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 |

LIONBRIDGE TECHNOLOGIES, INC. | | 100.00 | | 111.42 | | 548.26 | | 383.78 | | 400.91 | | 367.79 |

HEMSCOTT BUSINESS SOFTWARE & SERVICES | | 100.00 | | 68.33 | | 91.08 | | 98.38 | | 99.54 | | 117.94 |

NASDAQ COMPOSITE INDEX | | 100.00 | | 69.75 | | 104.88 | | 113.70 | | 116.19 | | 128.12 |

The Stock Performance Graph furnished shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 6. | Selected Consolidated Financial Data |

The selected consolidated financial data as of December 31, 2006 and 2005 and for each of the three years in the period ended December 31, 2006 have been derived from the audited consolidated financial statements of Lionbridge which appear as part of Item 15 of this Form 10-K. The selected consolidated financial data as of December 31, 2004, 2003, and 2002 and for the years ended December 31, 2003 and 2002 have been derived from audited consolidated financial statements of Lionbridge that are not included in this Form 10-K.

The historical results presented are not necessarily indicative of future results. Moreover, on September 1, 2005, Lionbridge acquired BGS. As a result, revenue and operating expenses for the years ended December 31, 2005 and 2006 increased substantially, as more fully discussed in Item 7. As a result of these increases, comparison of the year ended December 31, 2005 and 2006 to prior years, and even between these two years, is less useful. You should read the data set forth below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included in this Form 10-K.

20

| | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2003 | | 2002 | |

| | | (In thousands, except per share data) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 418,884 | | | $ | 236,262 | | | $ | 154,101 | | | $ | 141,706 | | $ | 118,319 | |

Operating expenses: | | | | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of depreciation and amortization shown separately below) | | | 277,814 | | | | 153,929 | | | | 95,787 | | | | 85,877 | | | 71,510 | |

Sales and marketing | | | 30,483 | | | | 20,725 | | | | 14,388 | | | | 13,087 | | | 11,798 | |

General and administrative | | | 74,286 | | | | 46,922 | | | | 31,000 | | | | 29,963 | | | 29,806 | |

Research and development | | | 2,811 | | | | 1,646 | | | | 392 | | | | 615 | | | 1,199 | |

Depreciation and amortization | | | 5,536 | | | | 3,525 | | | | 2,928 | | | | 3,298 | | | 3,027 | |

Amortization of acquisition-related intangible assets | | | 8,696 | | | | 2,791 | | | | 127 | | | | 470 | | | 528 | |

Merger, restructuring and other charges | | | 4,232 | | | | 5,448 | | | | 2,313 | | | | 943 | | | — | |

| | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 403,858 | | | | 234,986 | | | | 146,935 | | | | 134,253 | | | 117,868 | |

| | | | | | | | | | | | | | | | | | | |

Income from operations | | | 15,026 | | | | 1,276 | | | | 7,166 | | | | 7,453 | | | 451 | |

Interest expense: | | | | | | | | | | | | | | | | | | | |

Interest on outstanding debt | | | 7,712 | | | | 2,556 | | | | — | | | | 1,893 | | | 3,189 | |

Accretion of discount on debt and deferred financing costs | | | 858 | | | | 310 | | | | — | | | | 356 | | | 610 | |

Accelerated recognition of discount and deferred financing costs on early repayment of debt | | | 2,129 | | | | — | | | | — | | | | 2,139 | | | — | |

Interest income | | | 427 | | | | 519 | | | | 385 | | | | 89 | | | 35 | |

Other (income) expense, net | | | 3,779 | | | | 587 | | | | (100 | ) | | | 288 | | | 1,534 | |

| | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 975 | | | | (1,658 | ) | | | 7,651 | | | | 2,866 | | | (4,847 | ) |

Provision for (benefit from) income taxes | | | 5,877 | | | | 2,255 | | | | 511 | | | | 334 | | | (62 | ) |

| | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (4,902 | ) | | $ | (3,913 | ) | | $ | 7,140 | | | $ | 2,532 | | $ | (4,785 | ) |

| | | | | | | | | | | | | | | | | | | |

Net income (loss) per share:(1) | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (0.08 | ) | | $ | (0.08 | ) | | $ | 0.15 | | | $ | 0.07 | | $ | (0.15 | ) |

Diluted | | $ | (0.08 | ) | | $ | (0.08 | ) | | $ | 0.14 | | | $ | 0.06 | | $ | (0.15 | ) |

Weighted average number of shares outstanding: | | | | | | | | | | | | | | | | | | | |

Basic | | | 58,997 | | | | 50,515 | | | | 46,548 | | | | 37,406 | | | 31,632 | |

Diluted | | | 58,997 | | | | 50,515 | | | | 49,361 | | | | 40,551 | | | 31,632 | |

| (1) | See Note 2 to Lionbridge’s consolidated financial statements for an explanation of the basis used to calculate net income (loss) per share. |

| | | | | | | | | | | | | | | |

| | | December 31, |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 |

| | | (In thousands) |

Balance Sheet Data: | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 27,354 | | $ | 25,147 | | $ | 38,450 | | $ | 29,496 | | $ | 10,916 |

Working capital | | | 60,893 | | | 57,182 | | | 49,961 | | | 38,838 | | | 6,734 |

Total assets | | | 321,500 | | | 319,977 | | | 113,388 | | | 105,990 | | | 58,164 |

Long-term debt, less current portion and discounts | | | 77,855 | | | 90,268 | | | — | | | — | | | 24,728 |

Capital lease obligations, less current portion | | | 150 | | | 177 | | | 15 | | | 167 | | | 110 |

Stockholders’ equity | | | 156,688 | | | 149,735 | | | 87,466 | | | 77,630 | | | 1,714 |

21

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion contains forward-looking statements which involve risks and uncertainties. Lionbridge makes such forward-looking statements under the provision of the “Safe Harbor” section of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements should be considered in light of the factors described above in Item 1A “Risk Factors.” Actual results may vary materially from those projected, anticipated or indicated in any forward-looking statements. In this Item 7, the words “anticipates,” “believes,” “expects,” “intends,” “future,” “could,” and similar words or expressions (as well as other words or expressions referencing future events, conditions, or circumstances) identify forward-looking statements. The following discussion and analysis should be read in conjunction with “Selected Consolidated Financial Data” and the accompanying consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K.

Overview

Founded in 1996, Lionbridge is a leading provider of globalization, development and testing services that enable clients to develop, release, manage and maintain their enterprise content and technology applications globally. Lionbridge Global Language and Content (“GLC”) solutions enable the globalization and worldwide multilingual release of clients’ products, content and related technical support, training materials, and sales and marketing information. Globalization is the process of adapting content and products to meet the language and cultural requirements of users throughout the world. As part of its GLC solutions, Lionbridge also develops eLearning content and technical documentation. Lionbridge GLC solutions are based on the Company’s internet-architected language technology platform and global service delivery model which make the translation process more efficient for Lionbridge clients and translators.