SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 27, 2008

Mod Hospitality, Inc.

(Exact name of registrant as specified in Charter)

| Nevada | 000-24723 | 88-0393257 |

(State or other jurisdiction of incorporation or organization) | (Commission File No.) | (IRS Employee Identification No.) |

11710 Old Georgetown Road, Suite 808, North Bethesda, MD 20852

(Address of Principal Executive Offices)

(301) 230-9674

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The Current Report on Form 8-K contains forward looking statements that involve risks and uncertainties, principally in the sections entitled "Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for us to predict all risk factors, nor can we address the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause our actual results to differ materially from those contained in any forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short term and long term business operations , and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Current Report on Form 8-K, and in particular, the risks discussed below and under the heading “Risk Factors” and those discussed in other documents we file with the Securities and Exchange Commission that are incorporated into this Current Report on Form 8-K by reference. The following discussion should be read in conjunction with our annual report on Form 10-K and our quarterly reports on Form 10-Q incorporated into this Current Report on Form 8-K by reference, and the consolidated financial statements and notes thereto included in our annual and quarterly reports. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Current Report on Form 8-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statement.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

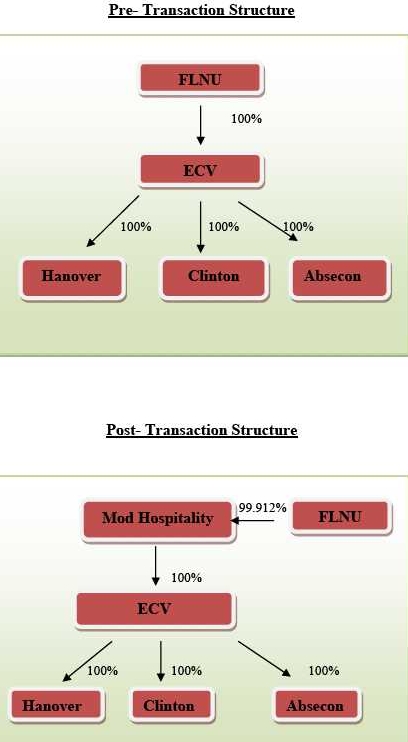

Item 1.01 Entry Into A Material Definitive Agreement

As more fully described in Item 2.01 below, on October 21, 2008, we underwent a reverse merger with ECV Holdings, Inc. (“ECV”), a Delaware corporation, pursuant to a share exchange agreement (the “Share Exchange Agreement”) with ECV and Flora Nutrients, Inc., a Nevada corporation and the sole shareholder of ECV (“FLNU”). The closing of the transaction took place on October 21, 2008 (the “Share Exchange Transaction”) and resulted in the acquisition of ECV. Pursuant to the terms of the Share Exchange Agreement, we acquired all of the outstanding common stock of ECV by issuing FLNU an aggregate of 50,000,000 shares representing 99.912% of our common stock outstanding. Since FLNU, the sole shareholder of ECV, will own 99.912% of the shares of our outstanding common stock upon the completion of the Share Exchange Transaction, ECV is the legal acquiree but the accounting acquirer in the reverse merger. Upon the completion of the Share Exchange Transaction, ECV (accounting acquirer, legal acquiree) will succeed to the business that we previously carried on, and will become the registrant. As a result, the historical financial statements presented going forward will be those of ECV (accounting acquirer, legal acquiree).

The Share Exchange Agreement contains customary terms and conditions for a transaction of this type, including representations, warranties and covenants, as well as provisions describing the consideration for the Acquisition, the process of exchanging the consideration and the effect of the acquisition.

This transaction is discussed more fully in Section 2.01 of this Current Report. This brief discussion is qualified by reference to the provisions of the Share Exchange Agreement which is attached in full to this report as Exhibit 10.1.

Item 2.01 Completion of Acquisition or Disposition of Assets

CLOSING OF SHARE EXCHANGE TRANSACTION

As described in Item 1.01 above, on October 21, 2008, we acquired all of the issued and outstanding common stock of ECV, a Delaware corporation, in accordance with the Share Exchange Agreement. The closing of the transaction took place on October 21, 2008 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Securities Exchange Transaction, we acquired all of the outstanding common stock of ECV from FLNU. In exchange, we issued FLNU 50,000,000 shares, or approximately 99.912% of our common stock outstanding. Since FLNU will own 99.912% of the shares of our outstanding common stock upon the completion of the Share Exchange Transaction, ECV is the legal acquiree but the accounting acquirer in the reverse merger. Upon the completion of the Share Exchange Transaction, ECV (accounting acquirer, legal acquiree) will succeed to the business that we previously carried on, and will become the registrant. As a result, the historical financial statements presented going forward will be those of ECV (accounting acquirer, legal acquiree).

ECV is a corporation formed on March 26, 2008 under the laws of Delaware. On April 4, 2008, ECV entered into a stock for membership interest agreement with East Coast Realty Ventures, LLC (“ECRV”) which owned all of the issued and outstanding capital (the “Membership Interest”) of ECRV Hanover LeaseCo, LLC (the “Hanover”), ECRV Clinton LeaseCo, LLC (the “Clinton”), and ECRV FM LeaseCo, LCC (the “Absecon”). Hanover, Clinton, and Absecon are limited liability companies organized under the law of the State of Delaware. As a result of the stock for membership interest transaction, ECV acquired 100% of the membership interest in Hanover, Clinton and Absecon by issuing Frederic Richardson 100,000 shares of its common stock.

Effective May 8, 2008, ECV entered into a share exchange agreement with Frederic Richardson, and FLNU, a non-reporting small public company listed on the Pink Sheets Grey Market, whereby, Frederic Richardson transferred to FLNU 100% of the issued and outstanding common stock of ECV, in exchange for 28,000,000 shares of common stock of FLNU, which represents 80% of FLNU’s outstanding common stock. As a result of the share exchange transaction, Hanover, Clinton and Absecon became the wholly owned subsidiaries of FLNU.

BUSINESS

BUSINESS OF MOD HOSPITALITY

We were originally organized in the State of Delaware in February 1993 under the name PLR, Inc. In November 1997, PLR changed its name to Integrated Carbonics Corp. and moved its domicile to the State of Nevada. On July 23, 1999, Integrated Carbonics Corp. changed its name to Urbana.ca, Inc. (“URBA”). During January 2000, URBA acquired 100% of the outstanding shares of Urbana.ca Enterprises Corp. ("Urbana.ca Enterprises"), E-Bill Direct Inc. ("E-Bill"), and Enersphere.com, Inc. ("Enersphere"), which are in the business of developing and marketing Internet-based products and services through the licensing of LocalNet portals and distribution of set-top boxes. Effective March 10, 2000, Urbana.ca Enterprises, Enersphere and E-Bill were amalgamated under the statutory laws of the Province of Ontario into a new company named Urbana Enterprises Corp (“Urbana Enterprises").

In March 2002, Urban Enterprise, a subsidiary of URBA filed bankruptcy and URBA had no operations. As a result of the bankruptcy, $3,357,861 of debt was relieved and the subsidiary was dissolved. URBA entered into an Exchange Agreement with Oxford Knight International, Inc. in October 2002 whereby URBA agreed to issue 1,970,000 shares of common stock to Oxford Knight International in consideration for 100% of the issued and outstanding shares of common stock of Fabricating Solutions, Inc., a Texas corporation, and Pitts and Spits, Inc., a Texas corporation, which were engaged in the sale of barbeque pits and fabricating solutions, respectively. The Exchange Agreement was subject to the approval of the Oxford shareholders.

On April 11, 2003, URBA changed its name to PSPP Holdings, Inc. (“PSPP”). On April 16, 2003, PSPP executed a promissory note to Eric L. Goldstein in the amount of Two Hundred Thousand Dollars ($200,000.000). The loan was going to fund the purchase and or the operations of the high-end barbeque manufacturing division. PSPP defaulted on the note and Eric L. Goldstein exercised his right to take possession of his collateral which was 30,000,000 shares of common post roll back stock, and 1,000,000 shares of preferred stock that Oxford Knight International, Inc. held. The shares were delivered pursuant to the escrow agreement and the note was discharged. Subsequent to the Goldstein agreement, Piedmont Properties, Inc. and Ararat, LLC, negotiated the purchase of all the rights, title and interest to Goldstein's 30,000,000 shares of common and Oxford Knights 1,000,000 shares of preferred that Goldstein had acquired pursuant to the April 2003 Goldstein contract. With the failure to fund the barbeque manufacturing division PSPP ceased operations. In the first quarter of 2005 Mr. Litwak resigned as President and Director after appointing Kyle Gotshalk as President and Director.

In December 2005, we acquired all the shares of Dream Apartments TV for $58,100.00. Dream Apartments has not launched its programming to date and still intends to produce DVD's for apartment house applicants in the San Diego area initially and regionally in Southern California when fully developed. PSPP has made arrangements with Maximum Impact Productions of Carlsbad, California for the DVD sales and distribution.

In 2005 there was a reverse split of our common stock. A 1 for 100 share reverse split of the outstanding shares of stock of 61,761,530 shares resulted in 30,608,428 shares outstanding (30,000,000 shares were non-dilutable). In the first quarter of 2006, $1,072,066 in debt was forgiven reducing our liability.

On April 10, 2006, we acquired 100% of eSafe Cards, Inc., a debit card issuer. We issued 22,890,936 shares of common stock to UCHUB as part of the purchase price and agreed to fund Two Hundred Thousand Dollars ($200,000.000) of working capital to eSafe.

On November 16, 2007 UC HUB Group, Inc. entered into an agreement (the “Rescission Agreement”) with us, whereby we agreed to rescind our acquisition of eSAFE under that certain agreement (the “Acquisition Agreement”) dated April 10, 2006. Per the Rescission Agreement, UC HUB Group will received back 100% interest in eSAFE.

On April 29, 2008, we increased our authorized common stock from 80,000,000 shares to 175,000,000 shares by filing a Certificate of Change pursuant to NRS 78.209.

On August 11, 2008, we changed our name to Cynosure Holdings, Inc. by filing a Certificate of Amendment to Articles of Incorporation.

On August 11, 2008, the members of our Board of Directors were increased to six (6), and Mark T. Johnson and Marc D. Manoff, Esq. were appointed to the Board of Directors pursuant to the increase.

On August 21, 2008, we changed our name to Hybid Hospitality, Inc. by filing a Certificate of Amendment to the Articles of Incorporation.

On August 27, 2008, we changed our name to Mod Hospitality, Inc. by filing a Certificate of Amendment to the Articles of Incorporation.

Effective September 22, 2008, we completed a 1 for 10 reserve split of its common stock and changed our company name to Mod Hospitality, Inc. with a new symbol “MODY.”

BUSINESS OF ECV HOLDINGS

Hanover, Clinton and Absecon are limited liability companies organized in the State of Delaware. Hanover was organized on June 16, 2006, Clinton was organized on March 8, 2007, and Absecon was organized on May 10, 2007. As a result of a stock for membership interest transaction on April 4, 2008, ECV acquired the 100% of the membership interest in Hanover, Clinton and Absecon, and Hanover, Clinton and Absecon became the wholly-owned subsidiaries of ECV.

ECRV Hanover Hospitality LeaseCo, LLC

Hanover leases the Holiday Inn Express Flag from a property called the Holiday Inn Express BWI, a 159-room five-story hotel on a 4.60 acre lot located in Hanover, Maryland. Hanover owns the operation of the hotel, but leases the hotel building from the owner of the property. The hotel is located in a growing suburb of Baltimore, with excellent access to the Baltimore-Washington International Airport. The area benefits from good access to the major traffic arteries connecting the local area to the surrounding metropolitan area.

Facilities

All of the public space, including the guest registration, lobby, meeting space, sales and administrative offices are located on the first floor. The fitness center and outdoor pool are accessed from the first floor. The hotel contains a total of approximately 1,300 square feet of flexible meeting space that is functionally laid out. A free-standing restaurant building that is leased to Denny’s is located in the front portion of the site.

Guest Rooms

The guestroom facilities include 68 rooms with king-size beds, 87 rooms with double beds, and 4 suites. The overall quality and condition of the guestrooms have been accessed by an external appraiser as being in a range between “good” to “very good.” Each of the guestrooms features remote control television with cable, telephone, desk with chair, dresser, nightstands, lamps and lounge chair. Guestroom drapes, mattresses and bedspreads, carpeting and case goods are all in good overall condition.

Quality

The overall satisfaction index is increased by 0.1% from 86.7% May, 2008 to 86.8% this month. The InterContinental Hotels Group (“IHG”) monthly quality self-assessment for the month was completed and maintenance continues to conduct HoliKare (specific and consistent maintenance assessment designed by IHG) on all of the guest rooms as of June 30, 2008. IHG is primarily engaged in managing hotels owned by other parties and in franchising its hotel brands.

Improvements to the Property

In the six months period ended on June 30, 2009, Hanover has made many improvements to the hotel as follows:

| | · | A new video surveillance recorder was purchase from TechMark. |

| | · | Artwork for the breakfast bar area was purchased through Purchase Partners, Inc. |

| | · | Six side chairs for the breakfast bar area were purchased through Purchase Partners, Inc. |

| | · | An ice maker for the breakfast kitchen was purchased through Home Depot. |

Operations

Hanover began offering deeply discounted rates via opaque websites such as Priceline.com and Hotwire.com. This was executed in an effort to sell distressed room inventory, which increased occupancy and revenue per available room (“REVPAR”) , a ratio commonly used to measure financial performance in the hospitality industry and arguably the most important of all ratios used in the hospitality industry. As a result, 468 rooms were booked via the internet at an average daily rate of $62.00. For the six months ended on June 30, 2008, the total revenue generated via internet bookings was $28,826. This operation strategy was very effective in filling Hanover’s occupancy on weekends that are typically soft, in particular, the 4th of July. In addition to internet bookings, as of June 30, 2008, Hanover booked 609 government rooms, compared to 517 for the same period last year.

However, notwithstanding the hotel has been successful in increasing it occupancy by 257 rooms over the budget and by 193 rooms over the same period of last year, Hanover received less revenue than the budget due to the lower average daily room rate (the “ADR”), which is $12 lower than budget and $6.20 lower than the same period last year. In order to remedy this situation, the internet rates will be adjusted to find the optimum price points. The internet rates will be increased during the weekday and allow fewer weekday internet bookings, but offer deeper discount rates on the weekends in order to increase the weekend occupancy and REVPAR.

| | | Actual | | | Budget | | | Variance | | | Actual | | | Variance | |

| | | June 30, 2008 | | | June 30, 2007 | |

| Rooms Sold | | | 4,252 | | | | 3,995 | | | | 257 | | | | 4,059 | | | | 193 | |

| Occupancy | | | 89.14 | % | | | 83.75 | % | | | 5.39 | % | | | 85.09 | % | | | 4.05 | % |

| ADR | | | 112.25 | | | | 123.60 | | | | (11.35 | ) | | | 118.45 | | | | (6.20 | ) |

| REVPAR | | | 100.06 | | | | 103.76 | | | | (3.70 | ) | | | 100.79 | | | | (0.73 | ) |

| Room Rev | | | 477,301 | | | | 494,948 | | | | (17,647 | ) | | | 480,781 | | | | (3,480 | ) |

| | (1) | The information provided in the table above is unaudited. |

Operation Expenses: Actual v. Budget (Unaudited)

For the six months period ended on June 30, 2008, the actual expenses of many operation lines have exceeded the budget which is described as follows:

| · | The room department expense was $121,644, which is $13,539 over the budget of $108,051. |

| · | The housekeeping expense is over budget by $12,710. The majority of this overage was caused by housekeeping minutes running higher than usual due to low linen pars. |

| · | The expense of hiring temporary labor is $9,088 over budget. Some of the overage was caused by training the temporary staff and cleaning 257 rooms over the budgeted number of occupied rooms. |

| · | The laundry expense was $199 over budget due to the purchase of laundry destainer. |

| · | The linen replacement expense was over budget by $1,085 due to severe under par in linen which resulted in higher maid minutes. |

| · | The expense on cleaning supplies was over budget by $305, $187 of which was used to purchase a linen cart and $197 was spent on deck brushes for the bathroom shower walls. |

| · | The complimentary breakfast expense is over budget by $3,176 which was caused by serving the additional hot food items meet the IHG standards, and by serving several groups in house and additional 257 rooms over budget. |

| · | The courtesy car expense was over budget by $437 due to the increased cost of fuel. |

| · | Telephone expense was over budget by $280 because of the cost of long-distance calls. |

| · | The expense on maintenance contracts was over budget by $290 caused by the pay phone. |

| · | The expense on Suite Shoppe was over budget by $2,236 due to the under-budgeted inventory needs. |

| · | The Administrative and General (A & G) expense was over budget because some minor expenses were not budgeted, which includes, but is not limited to, purchase of Maryland labor law posters, Accounts Receivable and Accounts Payable mailings, IHG Chief Engineer workshop attended by the GM and Chief Engineer, IHG workshop attended by the Front Office Manager, subscriptions, minor legal fees, bank service charge, a one-time bad debt charge, credit card commissions paid to travel agent, cobra notification letters, and minor travel for property visits. |

| · | Repairs and maintenance expense was over the budget because the swimming pool cost was over-budgeted by paying an invoice from July, 2008 one month in advance. |

Market Opportunity

Located close to the Baltimore Airport, Hanover sees continuous demand from business and tourist travelers to the Greater Baltimore area. Baltimore is the largest city in the state of Maryland in the United States. Greater Baltimore is home to six Fortune 1000 companies, Constellation Energy, Grace Chemicals (in Columbia), Black & Decker (in Towson), Legg Mason, T. Rowe Price, and McCormick & Company (in Hunt Valley). Other companies that call Baltimore home include, Brown Advisory, Alex Brown, a subsidiary of Deutsche Bank (of Baltimore origin, and at the time of its acquisition, the oldest continuously-running investment bank in the United States), FTI Consulting, Vertis, Thomson Prometric, Performax, Sylvan Learning/Laureate Education, Under Armour, DAP, 180°, Old Mutual Financial Network, and Advertising.com.

In the past two decades, both the private and public sector has redirected investment into the city's center. Because of these efforts, downtown Baltimore has enjoyed revitalization. The Inner Harbor redevelopment, which includes a festival market on the waterfront, has received national attention. Further, Baltimore City has retained its status as an important port, educational and cultural center. Although it faces increasing competition from the Maryland counties that surround Washington, D.C., Baltimore City remains the financial, legal, corporate and political center of Maryland. The Baltimore metropolitan area that lies within 40 miles of the nation's capital has also benefited from the growth of the Washington, D.C. metropolitan area.

Today, the private sector economy is broad-based as the regional economy moves increasingly toward services, trade and technology-based employment. The manufacturing industry still maintains a presence, along with high-tech contractors, educational institutions, public utilities, retailers and financial institutions. Baltimore has shifted primarily to a service sector-oriented economy, with the largest employer no longer Bethlehem Steel but Johns Hopkins University and Johns Hopkins Hospital. Government employment is also a major factor in the local economy, with approcximately17% of the total jobs. As Baltimore City is only 40 miles from Washington, D.C., the city benefits from its proximity to the nation's capital and its enormous federal government presence and spending. There are two major federal government military installations in the region – Fort George G. Meade in Anne Arundel County and the U.S. Army Aberdeen Proving Grounds in Harford County. In addition, there is a government intelligence complex (National Security Agency) located adjacent to Fort Meade.

Competition

In 2008, no hotels have increased their guestroom supplies to the market where Hanover is located. Since there is continuous market demand for Hanover from business and tourist travelers to the Greater Baltimore area, Hanover does not encounter increasing competition in maintaining its market share and profitability.

ECRV Clinton LeaseCo, LLC The Clinton operates a private boutique hotel located in the Art Deco District in South Beach, Miami, Florida. The Art Deco District in South Beach is the primary attraction of Miami Beach, which makes up the lower third of the island of Miami Beach. The Clinton Hotel is a four-floor building with 88 guest rooms, locating on a 0.45 acres lot. Clinton has no franchise or licensing agreements. After a complete renovation, reconfiguration and expansion of the property in 2003, the building and facilities are in a very good condition. | |

The Clinton owns the operation of the hotel, but leases the hotel building from the owner of the property. In the year of 2007, Clinton focused its attention on completing the Pool Refurbishment Proposal with an aggregate cost of $37,000, in addition to conducting several deep cleaning projects. The public space, including the restaurant and bar, guest registration and lobby, retail shops, full-service Spa, and sales and administrative offices are located on the first floor. The meeting space of the Clinton Hotel as well as outdoor area is located on the fourth floor. In September, 2008, the Spa was moved all of its services to the first floor. Subsequently, the fitness center will be moved to the space vacated by the Spa. The Clinton Hotel features a small courtyard on the first floor between the lobby and restaurant, which includes a jetted swimming pool, wading pool and cabanas.

The restaurant has a new manager who has taken action to improve every aspect of the restaurant operations, including conveying a mandatory weekly meeting to evaluate cross-marketing opportunities and overall quality in product and service. The Spa actively participates in cross-marking with the hotel, and focuses on improve the quality of its products and overall marketability.

Guest Rooms

The guestroom facilities are in good overall quality and condition, including 6 rooms with king-size bed, 65 rooms with queen-size bed and 17 rooms with double beds. Each of the guestrooms features remote control televisions with cable, telephone, desk with chairs, loveseat, coffee table, dresser, nightstands, lamps, mini-bar, CD players, coffee makers, and spa-product bar. Some guestrooms have Jacuzzis on the balconies.

Revenue Generating Food, Beverage and Retail Outlets

The Clinton Hotel has one leased food and beverage outlet located on the first floor with access from both the hotel and Washington Avenue. In addition, approximately 5,500 square feet of retail and restaurant space are leased to third parties, which include two food and beverage outlets, one clothing store and one beauty salon and spa. These leases can generate approximately $63,000 per month.

Quality

The Clinton Hotel is currently rated 3.5 stars on Expedia and hope to increase its rate to 4 stars prior to the beginning of the third quarter. Currently the hotel is working with our market manager to regain the 1/2 star. The Clinton Hotel is maintaining its Expedia and Trip Advisor Satisfaction score at 4 out of 5 with 86% of all guests recommending the property. Strong points are service and room cleanliness, but conditional components of these scores are currently driving the overall scores down slightly. The conditional components consist of thin walls, old poorly installed carpet in hallways which will be replaced in October, and aging guest rooms. We have taken preventive maintenance measures to mitigate the guest room conditional items, but the product is beginning to show its age.

Aggressive preventive maintenance is the key in the hospitality industry. In order to fulfill this goal, we recently had to replace our Chief Engineer because he does not grasp and embrace the concept of aggressive preventive maintenance, and does not share the management team’s expectation for the quality and standard of our product.

Operations

Clinton Hotel has seen a continued demand in South Beach, which is evidenced by the fact that the occupancy of the six months ended on June 30, 2008 hit 88% as compared to the 82% for the same period last year.

To achieve this occupancy rate, discounting of room rates consistent with market discounting was applied. This discounting is reflected in the REVPAR of $89.17 as of June 30, 2008, compared to $91.80 as of June 30, 2007.

| | | Actual | Budget | Variance | Actual | Variance |

| | | June 30, 2008 | June 30, 2007 |

| Rooms Sold | | 4,252 | | 3,995 | | 257 | 4,059 | 193 |

| Occupancy | | 89.14% | | 83.75% | | 5.39% | 85.09% | 4.05% |

| ADR | | 112.25 | | 123.60 | | (11.35) | 118.45 | (6.20) |

| REVPAR | | 100.06 | | 103.76 | | (3.70) | 100.79 | (0.73) |

| Room Rev | | 477,301 | | 494,948 | | (17,647) | 480,781 | (3,480) |

| | (1) | The information provided in the table above is audited. |

Operation Expenses: Actual v. Budget (Unaudited)

Hitting the budget mark in Rooms Profit was a challenge as a result of the softer than desired Average Daily Room Rate. Operational efficiencies were difficult to achieve, despite that the cost per occupied room numbers (CPOR) was largely in line with targets.

| | Actual | Budget | Variance |

| Labor | 55,331 | 50,495 | 4,836 |

| Expenses | 24,746 | 27,952 | (3,206) |

| Total | 80,077 | 78,447 | 1,630 |

| | (1) | The information provided in the table above is unaudited. |

Expenses were largely well-controlled with no significant variances from the budget. Repairs and maintenance expenses were very well controlled, which were under-budget if the occupancy rate is taken into considerations. Labor on a CPOR basis was in line with the budget, but as a percentage of revenue, the labor cost was high. This is inevitable in an environment where the rate is low and the volume is high.

Market Opportunity

Located in the South Beach, the Clinton Hotel embraces the great market opportunity for hospitality industry. Considered one of the most desirable locations in North America, the South Beach area has become a world-renowned destination for its beach, shopping and business amenities. The South Beach becomes a magnet for fashion, music and entertainment industry celebrities. Leasure visitors from all over the world are drawn to the area’s cosmopolitan atmosphere, chic restaurants, hip nightclubs and world-renowned beaches.

According to a survey conducted by the Greater Miami Convention and Visitors Bureau, South Beach attracts approximately 7,000,000 visitors on an annual basis, which makes it rank the second most popular tourist destination in Florida after Walt Disney World. The latest visitor statistics indicate that 4.7 million people had overnight accommodations in Miami Beach. The average length of stay in Miami Beach is approximately six (6) nights and the average travel size is roughly two (2) people.

Since the early 1990s, the desirability of the area has been enhanced greatly. The near-term outlook is for continued redevelopment on a select basis. The South Miami Beach area has become a world-renowned destination for its beach, shopping, and business amenities, and is considered one of the most desirable locations in North America. Therefore, despite the fact that domestic hospitality industry has declined significantly caused by the economic downturn in the U.S., there is continuous strong market demand for Clinton Hotel.

Competition

The occupancy rate of Clinton Hotel reached 88% as of June 30, 2008, which represents a 6% increase from the hotel occupancy rate for the same period last year. Notwithstanding there has been a strengthening in terms of market demand, the Clinton Hotel is facing challenges to sell its guestrooms at the desired price because some hotels in the South Beach has increased their guestroom supplies.

As of June 30, 2008, there has been additional guestroom supply in the market compared to the supply in the same period in 2007. Specifically, the Angler added 50 rooms, the Gansevoort South 334 rooms, the Tides 45 rooms and the Fontainebleau Sprtrento 256 rooms. Additional supply affects Clinton’s ability to maintain or increase its market share and profitability.

Marketing

Due to the downturn in the American economy, domestic hospitality industry has declined significantly. Although international tourism has increased, due to the steep decline in the dollar’s value, this increase may not be enough to mitigate the loss of domestic tourists’ dollars. This is a disturbing trend which will be monitored and addressed by aggressive marketing and the implementation of technology designed specifically to price rooms at highly competitive prices. In order to maintain the growth of Clinton Hotel, Clinton has taken the following marketing strategies.

Extranet Accounts

The first move is to create a strong relationship with the account managers from all the extranet accounts with the goal of having Clinton Hotel featured on the front page of the websites such as Expedia, Orbitz, Hotels.com, Travelocity, etc. This gives the Clinton Hotel an immediate exposure to potential guests and put the guests in contact with the quality of the Clinton Hotel product.

Clinton Hotel Web Site

Clinton Hotel has created a strong website that always offers potential guests the best rate available through any internet sites, which will encourage guests to book directly from the Clinton Hotel Web Site and avoid the fees charged by third-party websites. In addition, the Clinton Hotel offers a frequent guest program for return guest that extends a 10% off the lowest rate on future reservations booked directly through the in-house reservation department of Clinton Hotel, which encourages the guests to always consider Clinton Hotel when they visit South Beach.

To maintain the website, the Clinton Hotel has hired a top website designer, and the search engine of the website is updated daily so the hotel will be featured when a guest logs onto any Southbeach.com site. In addition, the Clinton Hotel has purchased several sites, including www.clintonsouthbeach.com and www.clintonhotel.com, which will take potential guests directly to the Clinton Hotel Webpage.

Press

Before the opening of the Clinton Hotel, the management team worked together with strong public relations firms to create extensive media exposure of the hotel in the process of designing the property or organizing events held in the hotel. In addition, the management team has maintained a great relationship with the Greater Miami Convention, Visitors Bureau, and their representatives in different countries who have referred many influential writers and columnist to the hotel. These writers and columnists have written many great reviews about the Clinton Hotel in magazines such as Travel + Leisure, Lodging Hospitality, Spa Finders and much more, As a result, with minimum cost, property of our size could not afford, which have contributed to increasing the visibility of the Clinton Hotel.

Travel Agents and FITs

Over the past 3 years, Clinton has established strong relationship with a large variety of travel agents. Even though travel agents, as a source of business, are becoming less important due to the effect of internet, they play an important role in maintaining the steady growth of the hotel. Due to our strong relationship with travel agents, they have continued introducing guests to the Clinton Hotel, because it offers a product comparable to the most “designer” type of hotels, such as Delano, Shore Club, etc at a much more reasonable rate but with friendly attitude toward all guests. The Clinton Hotel is now listed in the brochures of the major travel agents such as Liberty Travel.

ECRV FM LeaseCo, LLC [Absecon]

Facilities

The site of Absecon, the Fairfield Inn, is located in Absecon, New Jersey. Absecon owns the operation of the Fairfield Inn, but leases the hotel building from the owner of the property. Constructed in 1985, the site is improved with a six-story hospitality facility with 200 guestrooms and totaling approximately 92,000 square feet. The subject facility is located on an approximate 5.31 acre lot. Amenities include an outdoor swimming pool, laundry facility, lobby and dining area, exercise room, and two meeting rooms. Surface parking can accommodate 200 vehicles.

A Property Improvement Plan (PIP), dated October 2007, totals $1,105,000. The PIP includes funds for common area refurbishment, employee area refurbishment, guestroom refurbishment, and exterior improvements. Management assumes that the items in the provided PIP will be accomplished in the short term; therefore, no immediate repair funds for these items are included in this report. In addition, the reserve analysis is based on the expected completion of these items in the short term. The lending institution also waved the industry standard requirement of a 4% capital expenditure escrow for the first two years.

Quality

The hotel was inspected, by Marriott on May 30, 2008. It received a score of 83%, which put the hotel in the yellow performance classification with Marriott. The inspection has been reviewed by management and all the necessary steps to make all of the corrections needed will be performed.

Improvements to the Property

Recently, the Clinton has completed the following improvements to the hotel property:

| | · | Curved shower rods were installed in the bathrooms. |

| | · | Management began to replace light bulbs in the bathrooms with brighter ones. |

| | · | Preventative maintenance was continued in rooms. |

| | · | Deep cleaning of rooms was continued. |

| | · | New pool furniture was purchased at the expense of $5,847. |

| | · | Carpets were cleaned in 85% of the rooms, 15% will be cleaned later. |

Operations

| | Actual | Budget | Variance | Last Year | Variance |

| | June 30, 2008 | June 30, 2007 | |

| Rooms Sold | 2,664 | 4,100 | | (1,436) | 3,856 | (1,192) |

| Occupancy | 44.40% | 68.33% | | -23.93% | 64.27% | -19.87% |

| ADR | 84.31 | 94.88 | | (10.57) | 91.23 | (6.92) |

| REVPAR | 37.43 | 64.83 | | (27.40) | 58.63 | (21.20) |

| Room Rev | 224,593 | 389,000 | | (164,407) | 351,786 | (127,193) |

| (1) | The information provided in the table above is unaudited. |

In June 2008, REVPAR was down by 36.2% as compared to last year. There was a decrease in ADR by 7.1% and a decrease in occupancy by 31.3%. This can be attributed to the new room supply in the Atlantic City Market and a decline in market demand.

Operation Expenses: Actual v. Budget (Unaudited)

For the six months ended on June 30, 2008, expenses have largely been under control within the budget. The Rooms Department incurred cost by ordering new lien, irons and iron boards, and new equipment. Specifically, the department spent $2,539 ordering linen replacement in May, and the supply, as of June 2008, had not been delivered. In addition, additional irons and ironing boards were ordered as guest room supplies. In order to improve the overall quality and condition of the breakfast area, a new dishwasher was purchased.

With respect to the telephone and internet expense, a minor amount of $175 was used to provide additional phone support to Resource Tech, and the cost was well within the budget. In addition, $550 was paid to Resource Technology for HSIA service (wireless high-speed internet access designed for the Hotel industry).

During the six months period ended on June 30, 2008, very minimal unbudgeted expenses accrued due to repairs and maintenance. Except that the expense on maintenance contract was slightly over budget for Fire Sprinkler testing, the expenses on elevator maintenance, flowers for landscaping, swimming pool maintenance and testing per state requirements were slighted under budget.

Minor miscellaneous expenses accrued for which there was no budget. These expenses include two months cell phone expense for an employee, replacement of cell phone charges for guests, “Go To Meeting” annual fee, payroll processing fees, and additional trips to the bank.

Market Condition

Atlantic City has seen a dramatic decline since June of last year. The casinos have shown an 11% decrease in money won by the casinos, which translates into significant drops in revenue, occupancy, and room rates.

According to the latest STAR report, Absecon is still maintaining its fair share of the market, but the market is still in a declining mode. REVPAR has decreased in the Midscale Tract (Absecon’s tract) by 12% year to date.

The casinos reported an 11% decrease in revenue for the six months period ended on June 30, 2008, compared to the same period last year. The only casinos that reported an increase or stayed level with last year were Harrah’s Resort and Borgata. They are the two closest casinos to the hotel and both have added sleeping rooms.

In addition, the local economy is being hurt tremendously by the high gas price. Families who used to come to the Jersey Shore are cutting their trips down to 2-3 days. This has had an enormous negative impact on Absecon’s weekdays.

The lack of an effective group sales effort by the previous Director of Sales (from previous ownership) is still impacting the hotel operated by Absecon. As of June 30, 2008, group sales have decreased by 43%, compared to the same period last year. Of the 3,600 room nights, the Absecon is down to 2,600 from last year, which provided revenue of $4,250,000.

Competition

During the month of May 2008, 3,300 new hotel rooms were opened in the Atlantic City Market. The Water Club by Borgata opened 2,002 new rooms and Harrah’s Resort opened 800 new rooms. Both of them are located at the Marina area. In addition, a new Marriott Courtyard was opened in Atlantic City three blocks from the Trump Taj Mahal with 206 new rooms, and a full-service Holiday Inn opened on the boardwalk with 330 rooms. These new additional guestroom supplies will adversely affect Absecon’s market share and profits.

Marketing

In order to maintain its profitability and market share, Absecon’s management team has initiated an aggressive sales campaign into the feeder cities. The Director of Sales is also planning sales trips into New York, Philadelphia, and Baltimore.

The management team is also working towards obtaining a contract with Spirit Airlines for their flight crews. They are also in negotiations to land the lodging contract for the construction crew for the new Revel Casino.

As the hotel can maintain its revenue on weekends, the management term plans to launch a very aggressive rate strategy to generate weekday (Sunday through Thursday) business. The hotel will begin offering a $69 rate during the week and an advance purchase rate of 25% off. Advance purchase reservations are non-cancelable or changeable. Guests pay for the room for the entire length of their stay at the time of booking. This offering rate was started in mid-June, 2008 and the offering has been received very well.

DESCRIPTION OF PROPERTIES

| | · | The hotel operated by Hanover has its address at 7482 Ridge Road, Hanover, Maryland which is close to the Baltimore Airport. The hotel is located in a growing suburb of Baltimore, with excellent access to the Baltimore-Washington International Airport. The area benefits from good access to the major traffic arteries connecting the local area to the surrounding metropolitan area. The hotel contains a total of approximately 1,300 square feet of flexible meeting space that is functionally laid out. A free-standing restaurant building that is leased to Denny’s is located in the front portion of the site. |

| | · | The hotel operated by Clinton has an address at 825-835 Washington Avenue, Miami Beach, Florida. The Clinton Hotel is a four-floor building with 88 guest rooms, locating on a 0.45 acres lot. After a complete renovation, reconfiguration and expansion of the property in 2003, the building and facilities are in a very good condition. Clinton has no franchise or licensing agreements. |

| | · | The hotel operated by Absecon is located at 405 East Absecon Boulevard (A.k.a. U.S. Highway 30), Absecon, New Jersey. Constructed in 1985, the site is improved with a six-story hospitality facility with 200 guestrooms and totaling approximately 92,000 square feet. The subject facility is located on an approximate 5.31 acre lot. Amenities include an outdoor swimming pool, laundry facility, lobby and dining area, exercise room, and two meeting rooms. Surface parking can accommodate 200 vehicles. |

DESCRIPTION OF LEGAL PROCEEDING

There is no pending ligation against either ECV or the three subsidiaries, Hanover, Absecon and Clinton.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risk Related to Our Business

WE HAVE LIMITED OPERATING HISTORY AND FACE MANY OF THE RISKS AND DIFFICULTIES FREQUENTLY ENCOUNTERED IN NEW AND RAPIDLY EVOLVING MARKET.

We have only two years of limited operating history. We also face many of the risks and difficulties encountered in new and rapidly evolving markets. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by small developing companies. Since we have a limited operating history, we cannot assure you that our business will be profitable or that we will ever generate sufficient revenues to meet our expenses and support our anticipated activities.

THE MARKETS IN WHICH WE OPERATE ARE HIGHLY COMPETITIVE AND FRAGMENTED, AND WE MAY NOT BE ABLE TO MAINTAIN OUR MARKET SHARE.

We operate in highly competitive markets and expect competitions to persist and intensify in the future. Several hotels in South Beach and Absecon have increased their guestroom supplies to the market, which will adversely affect the market demand for the guestrooms of our hotels. We also face the risk that new competitors with greater resources than us will enter the markets. Competition among hotels can lead to a reduction in room rates which will hurt our profitability and slow our growth.

THE DOWNTURN OF THE OVERALL ECONOMY OF THE U.S. HAS SIGNIFICANTLY REDUCED DOMESTIC TOURISM. EVEN THOUGH CURRENTLY INTERNATIONAL TOURISM WILL HELP TO OFFSET THE DOWNTICK IN DOMESTIC HOSPITALITY BUSINESS, THERE IS NO ASSURANCE THAT THE INTERNATIONAL TOURISM WILL MAINTAIN ITS CURRENT STRENGTH, AND CONTINUOUSLY MITIGATE THE LOSS OF DOMESTIC TOURISM IN THE FUTURE.

The hospitality industry is always susceptible to global economics. At this point in time, the American economy is a huge risk for the hospitality industry. Due to the downturn of the U.S. economy, domestic tourism has declined significantly. At Clinton Hotel, international tourism, in the height of its travel season, is showing strength, and based upon the strengthening of the booking pace in June and August, 2008, the growth in international travel will help to offset the lackluster domestic demand and our loss due to the additional guestroom supplies by other hotels in the area. However, although international tourism has increased, this increase may not be enough to mitigate the loss of domestic tourists’ dollars due to the steep decline in the dollar’s value. Moreover, no international tourism will contribute to offsetting the lackluster domestic market demand for the two hotels operated by Hanover and Absecon respectively.

THE FUTURE OF THE COMMERCIAL REAL ESTATE LENDING IS UNCLEAR. THERE IS NO ASSURANCE THAT WE MAY CONTINUE OUR LEASES WITH THE OWNERS OF THE HOTEL PROPERTY.

Hanover, Clinton and Absecon only own the operations of the three hotels, while leasing the building space from the owners of the real estate. The operations have no ownership of the buildings’ financing or responsibility for capital items, real estate taxes, or property insurance. Whether the companies can continue the operations of the hotels depends upon whether they may renew their leases with the owners of the property.

THE SOARING ENERGY COSTS WILL INCREASE THE COST OF GUEST SERVICE AND CONSEQUENTLY REDUCE OUR PROFITABILITY.

The soaring energy costs can adversely affect every point of guest service from check-in at the front desk to ascent in an elevator, from the utilization of meeting space to food and beverage operations and safety. To a great extent, the profitability of our hotels will rely upon our hotel owners and managers’ ability to continuously reevaluate their energy risk management strategies including alternative sources, disaster recovery plans, financing, and hedging strategies. Due to the volatility of the energy market, there is no assurance that the energy risk management strategies adopted by our manager will be the effective.

THERE IS NO ASSURANCE THAT OUR MANAGERS CAN MITIGATE THE LOSS IN THE EVENT THAT THE PARTIES TO OUR CONTRACTS FAIL TO HONOR THEIR CONTRACTUAL OBLIGATIONS.

In the hospitality industry, there has been an sharp increase in the utilization of outsourcing arrangements for items such as procurement services, network and other data host sites, and food and beverage. Hotel owners and managers need to measure and monitor the risk to their organizations should these business partners not be in a position to honor their contractual obligations. However, there is no assurance that the hotel owners and managers will always take the most effective measures.

Risk Related to Our Industry

THE HOTEL INDUSTRY IS HIGHLY COMPETITIVE, AND OUR PROPERTIES ARE SUBJECT TO ALL THE OPERATING RISKS COMMON TO THE HOTEL INDUSTRY.

Our properties are subject to all the operating risks common to the hotel

industry. These risks include:

| | · | changes in general economic conditions; |

| | · | decreases in the level of demand for rooms and related services; |

| | · | cyclical over-building in the hotel industry; |

| | · | restrictive changes in zoning and similar land use laws and regulations or in health, safety and environmental laws, rules and regulations; |

| | · | the inability to obtain property and liability insurance to fully protect against all losses or to obtain such insurance at reasonable rates; and |

| | · | changes in travel patterns. |

In addition, the hotel industry is highly competitive. Our properties compete with other hotel properties in their geographic markets, and some of our competitors may have substantially greater marketing and financial resources than we do.

WITH THE INCREASED RISK OF TERRORISM, THE RISK OF A PANDEMIC HAS PRESENTED ITSELF TO ALL INDUSTRIES AND THE HOSPITALITY INDUSTRY IN PARTICULAR.

Due to the increased risk of terrorism, the risk of a pandemic has presented itself to all industries. If a pandemic were to strike, it will likely impact the hotel industry more than others, as this tourism market relies on people travelling for business, pleasure, and recreation. The lack of assessing and planning for such an occasion presents the most important risk to the industry. Changes in the risk access in the insurance market in recent years mean that there is often very limited or no protection against many of the risks that can come with a pandemic. Traditionally, cover for loss of business is related to a material or tangible event, such as fire. The illness or absence of staff usually falls outside the usual insurance coverage, which leaves assessing and planning for such an event, the only line of defense. There is no assurance that our hotel owners and managers can take the effective risk assessment and control plans in the event of terrorism attack.

Risk Related to Our Common Stock

OUR COMMON STOCK ARE CLASSIFIED AS A “PENNY STOCK” AS THAT TERM IS GENERALLY DEFINED IN THE SECURITIES EXCHANGE ACT OF 1934 TO MEAN EQUITY SECURITIES WITH A PRICE OF LESS THAN $5.00. OUR COMMON STOCK WILL BE SUBJECT TO RULES THAT IMPOSE SALES PRACTICE AND DISCLOSURE REQUIREMENTS ON BROKER-DEALERS WHO ENGAGE IN CERTAIN TRANSACTIONS INVOLVING A PENNY STOCK.

We are subject to the penny stock rules adopted by the Securities and Exchange Commission that require brokers to provide extensive disclosure to its customers prior to executing trades in penny stocks. These disclosure requirements may cause a reduction in the trading activity of our Common Stock, which in all likelihood would make it difficult for our stockholders to sell their securities.

Rule 3a51-1 of the Securities Exchange Act of 1934 establishes the definition of a "penny stock," for purposes relevant to us, as any equity security that has a minimum bid price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to a limited number of exceptions which are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our Common Stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person's account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

| | · | the basis on which the broker or dealer made the suitability determination, and |

| | · | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our common stock, if and when our common stock becomes publicly traded. In addition, the liquidity for our common stock may decrease, with a corresponding decrease in the price of our common stock. Our common stock are subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their common stock.

THE MARKET FOR PENNY STOCKS HAS EXPERIENCED NUMEROUS FRAUDS AND ABUSES WHICH COULD ADVERSELY IMPACT SUBSCRIBERS TO OUR STOCK.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| | · | control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

| | · | manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

| | · | “boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons; |

| | · | excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and |

| | · | wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

We believe that many of these abuses have occurred with respect to the promotion of low price stock companies that lacked experienced management, adequate financial resources, an adequate business plan and/or marketable and successful business or product.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS

We make forward-looking statements in Management’s Discussion and Analysis of Financial Condition and Results of Operations and elsewhere in this report based on the beliefs and assumptions of our management and on information currently available to us. Forward-looking statements include information about our possible or assumed future results of operations which follow under the headings “Business and Overview,” “Liquidity and Capital Resources,” and other statements throughout this report preceded by, followed by or that include the words “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions.

Forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expressed in these forward-looking statements, including the risks and uncertainties described below and other factors we describe from time to time in our periodic filings with the U.S. Securities and Exchange Commission (the “SEC”). We therefore caution you not to rely unduly on any forward-looking statements. The forward-looking statements in this report speak only as of the date of this report, and we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Company Overview

ECV is committed to finding unique and profitable hotel operations throughout the world. ECV exploits the changing real estate market with new financing structures and finds quality assets to which it can bring superior cost management and revenue generation skills. In addition, ECV structures its acquisitions without tying itself to any one investor or external financing.

ECV plans to focus on the top three tier franchise and boutique operations throughout the country. It currently owns the operation of a boutique hotel in the Art Deco District of Miami, South Beach, Florida and branded hotel operations in the North East. Each of these operations is organized as a limited liability corporation Clinton, Hanover and Absecon which are owned by ECV.

Hanover, Clinton and Absecon have neither ownership of the hotel buildings’ financing nor responsibility for capital items, real estate taxes, or building insurance, but Hanover, Clinton and Absecon perform management of these items, which give the real estate investors a low-maintenance real estate investment.

Under separate management agreements, Hanover, Clinton and Absecon have engaged the services of Park Place Hospitality, Inc (“PPHG”) to run the operations of the hotels. PPHG’s base of operations is located in Charlotte, North Carolina.

Business Plan

In this slower demand environment, ECV is working aggressively to enhance property-level house profit margins by reviewing room amenities and adjusting room rates. ECV continues to implement new technology, develop new sales promotions, and improve our properties to increase property-level revenue, rather than simply discounting room rates.

ECV’s plan of operation includes for the next twelve months fee generation from management agreements on three hotels. The operations will include selling equity participation on future hotel acquisitions. ECV plans to raise additional capital through a formal registration of equity contributions from its principal shareholder. Currently there are no planned acquisitions. ECV does not plan to sell any of its assets or operations at this time.

ECV believes that in spite of recent economic downturns the market for hotel lodging is stable in the markets in which ECV maintains the operations of the hotels. The American Hotel & Lodging Association stated that 2007 was the best year ever for the U.S. lodging industry. Spurred on by the weak U.S. dollar that has induced foreign travelers to the United States and consumers within the United States to travel within its borders. Additionally, peak construction of new hotels in markets where we maintain properties such as Miami have slowed significantly since the fourth quarter of 2007 which has led to a potential supply and demand imbalance. However, areas such as Baltimore have shown decreases in demand as they are not "trendy" vacation areas and occupancy rates are projected to decline in through 2009. However, average daily room rates have increased and are projected to do so through 2009. Gaming revenues have increased in areas such as Atlantic City and lodging in such places has not been affected by the current economic instability.

Results of Operation

ECV Holdings Inc. and Subsidiaries |

| Consolidated Statements of Operations |

| | | | | | | | | | |

| | | months ended June 30, 2008 Unaudited | | | For the period (1) from (Inception) to December 31, 2007 Audited | | | For the period June 6, 2006 (Inception) to December 31, 2006 Audited | |

| Revenue | | | | | | | | | |

| Rooms | | $ | 2,996,922 | | | $ | 6,918,220 | | | $ | 1,407,774 | |

| Food and beverage | | | 28,929 | | | | 159,782 | | | | 27,289 | |

| Other income | | | 256,295 | | | | 475,044 | | | | 44,747 | |

| Total operating revenue | | | 3,282,146 | | | | 7,553,046 | | | | 1,479,810 | |

| Operating expenses | | | | | | | | | | | | |

| Rooms | | $ | 781,605 | | | | 1,967,157 | | | | 386,752 | |

| Food and beverage | | | 8,454 | | | | 56,188 | | | | 9,754 | |

| Rent | | | 743,533 | | | | 3,125,214 | | | | 391,351 | |

| Management and franchise fees | | | 342,260 | | | | 894,287 | | | | 224,464 | |

| General and administrative | | | 257,495 | | | | 585,532 | | | | 117,824 | |

| Depreciation and amortization | | | 180,531 | | | | 233,863 | | | | 14,708 | |

| Other expenses | | | 579,843 | | | | 1,234,273 | | | | 205,171 | |

| Total operating expenses | | | 2,893,721 | | | | 8,096,514 | | | | 1,350,024 | |

| Income (loss) from operations | | | 388,426 | | | | (543,468 | ) | | | 129,786 | |

| Other income (expenses) | | | | | | | | | | | | |

| Interest income | | | 531 | | | | 5,383 | | | | 1,819 | |

| Interest expense | | | (7,072 | ) | | | (66,836 | ) | | | - | |

| Total other (income) expense | | | (51,352 | ) | | | (61,453 | ) | | | 1,819 | |

| Income (loss) before provision for income taxes | | | 337,074 | | | | (604,921 | ) | | | 131,605 | |

| Provision for income taxes | | | - | | | | - | | | | - | |

| Net income (loss) | | $ | 337,074 | | | | (604,921 | ) | | | 131,605 | |

Capital Liquidity and Resources

The cash flow generated through operations will be sufficient to sustain current level operations of ECV and its three subsidiaries, Hanover, Clinton, and Absecon, for at least the next twelve months. The table set forth below reflects the cash flow on June 30, 2008, and December 31, 2007 and 2006. ECV Holdings and its three subsidiaries generated cash flow from operating activities provided by $972,385 for the six months ended June 30, 2008, cash flows used in operating activities of $(218,117) for the period (1) from (Inception) to December 31, 2007 and cash flows provided by operating activities of $232,937 for the period June 6, 2006 (Inception) to December 31, 2006.

| ECV Holdings Inc. and Subsidiaries |

| Consolidated Balance Sheets |

| | | For the six months ended | | | For the period (1) from (Inception) to December 31, 2007 Audited | | | For the period June 6, 2006 (Inception) to December 31, 2006 Audited | |

| Current assets | | | | | | | | | |

| Cash | | $ | 1,483,728 | | | $ | 806,806 | | | $ | 334,586 | |

| Accounts receivable | | | 122,758 | | | | 107,821 | | | | - | |

| Prepaid expenses | | | 33,452 | | | | 134,490 | | | | 106,012 | |

| Ledger accounts | | | 48,287 | | | | 179,025 | | | | - | |

| Inventory | | | 1,469 | | | | - | | | | - | |

| Total current assets | | | 1,689,694 | | | | 1,228,142 | | | | 440,598 | |

| | | | | | | | | | | | | |

| Fixed assets | | | | | | | | | | | | |

| Construction in progress (PIP) | | | 295,669 | | | | - | | | | - | |

| Furniture and fixtures | | | 3,720,925 | | | | 3,727,591 | | | | 220,625 | |

| Less: accumulated depreciation | | | (605,956 | ) | | | (233,863 | ) | | | (14,708 | ) |

| Total fixed assets | | | 3,410,639 | | | | 3,493,728 | | | | 205,917 | |

| | | | | | | | | | | | | |

| Other assets | | | | | | | | | | | | |

| Escrow reserves | | | - | | | | (54,956 | ) | | | 17,723 | |

| Franchise fee, net | | | 135,900 | | | | 144,500 | | | | 64,500 | |

| Deposits | | | 41,103 | | | | 17,412 | | | | -- | |

| Total other assets | | | 177,003 | | | | 106,956 | | | | 82,223 | |

| Total assets | | | 5,277,336 | | | | 4,828,826 | | | | 728,738 | |

| | | | | | | | | | | | | |

| Current liabilities | | | | | | | | | | | | |

| Accounts payable and accrued expenses | | | 948,456 | | | $ | 948,456 | | | $ | 69,761 | |

| Management fees payable | | | 37,029 | | | | 35,164 | | | | 10,933 | |

| Taxes payable, rooms | | | 67,828 | | | | 69,214 | | | | 69,484 | |

| Taxes payable, other | | | 273,511 | | | | 146,138 | | | | 10,389 | |

| Total liabilities | | | 1,426,995 | | | | 693,021 | | | | 192,636 | |

| | | | | | | | | | | | | |

| Long term liabilities | | | | | | | | | | | | |

| Advances from shareholder | | | 260,000 | | | | 260,000 | | | | - | |

| | | | | | | | | | | | | |

| Total liabilities | | | 1,686,995 | | | | 953,021 | | | | 192,636 | |

| Commitments and contingencies | | | - | | | | - | | | | - | |

| Commitments and contingencies | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stockholders' equity | | | | | | | | | | | | |

| Capital stock | | | - | | | | - | | | | - | |

| Additional paid-in capital | | | 4,338,797 | | | | 4,349,121 | | | | 404,497 | |

| Accumulated deficit | | | (748,456 | ) | | | (473,316 | ) | | | 131,605 | |

| Total stockholders' equity | | | 3,590,341 | | | | 3,875,805 | | | | 536,102 | |

| Total liabilities and stockholders' equity | | | 5,277,336 | | | $ | 4,828,826 | | | $ | 728,738 | |

MANAGEMENT

Current Management

The following table sets forth the names and ages of our directors, executive officers, and key employees as of the date of this Form 8-K. Each executive officer holds his officer until he resigns, is removed by the Board, or his successor is elected and qualified.

| Name | | Age | | Position |

Frederic Richardson Sarah E. Jackson, CPA Adrienne Venson Linda Russell Mark D. Manoff, Esq. Mark T. Johnson | | 48 41 54 55 44 39 | | President, CEO & Chairman CFO, Treasurer & Director COO, Secretary, & Director CAO & Director General Counsel, & Director Public Relations & Director |

Frederic Richardson, 48, CEO, President and Chairman

Frederic Richardson is an owner of several hotel operations. Mr. Richardson was responsible for raising over $1.5 billion in debt and equity financing for private and public projects since 1985. He has extensive experience in investment banking and real estate investments. Mr. Richardson has served as a chairman and majority shareholder of seven publicly traded companies and has owned and operated two national FHA, VA, Full Eagle Mortgage companies, one of which he took public in 1999. Mr. Richardson is a member of the Building Owners and Managers Association International (BOMA), Apartment Building Association (AOBA), and the Tenant in Common Association. Mr. Richardson received his Bachelor of Arts in Economics from the University of Maryland and an MBA in Finance from American University and is a Chartered Life Underwriter.

Sarah E. Jackson, 41, CFO, Treasurer and Director

Sarah E. Jackson, CPA has extensive real estate accounting experience. She began her real estate accounting career with Lendlease Real Estate Investments, Inc. at that time when it was the largest real estate investment company in the world. While with Lendlease, she was the lead accountant and analyst for a REIT consisting of class AAA office buildings in New York, Chicago, and San Francisco and was responsible for explaining all transactions to Australian market pundits. She was chosen to implement FAS 133 and on the company’s US training committee. Ms. Jackson then moved into the banking industry, where she became Vice President of credit administration for a national bank and heavily involved in risk management. Ms. Jackson has consulted for some of the biggest companies in the real estate and mortgage industries including Fannie Mae and Wells Fargo. Ms. Jackson received a BA in English Literature and Philosophy from Gustavus Adolphus College and a BS and Masters of Accountancy from Denver University.

Andrienne Venson, 54, COO & Director

Adrienne Venson has over 20 years successful Fortune 25 corporate experience in Investor Revenue Assurance, Sales, and Project Management. She is a merger synergy and Six Sigma specialist. She is responsible for oversight of broker and investor processing and equity sourcing. She is the Director of Marketing and promotional communications for hospitality properties and new projects, as well as contract, property and vendor management. She has successfully managed numerous business projects resulted in revenue increases through process re-engineering, system development and implementation. She received a BS in Urban and Regional planning from the University of Illinois.

Linda Russell, 55, CAO & Director

Linda Russell has 25 years experience in the financial management analysis field. While directing financial presentations for business marketing executives in a Fortune 50 company she managed results and projections for over $2 Billion in expense and capital funding, created analyses which fostered expenditures at 4% under budget. Additionally, Ms. Russell managed capitalized equipment supporting 700 marketing managers and negotiated 33% additional equipment for clients. She has also directed financial assurance, budgeting and business planning processes for a $1 Billion national public business while analyzing business cases, developing forecasts, and preparing financial views to assess performance targets in support of earnings objectives. More recently, Ms. Russell has designed and implemented real estate investment solutions and directs investment analysis and due diligence for real estate investments. Ms. Russell received her Master’s degree in Finance from George Washington University and a B.B.A in Actuarial Science from Temple University.

Marc D. Manoff, Esq., 44, General Counsel, Secretary and Director

Marc D. Manoff, Esq. is a principal of The Law Offices of Marc D. Manoff, headquartered outside of Philadelphia, PA. He received his Juris Doctorate from the National Law Center at George Washington University and his Bachelor of Science from Albright College. After becoming partner at two of the larger firms in the Philadelphia region, Mr. Manoff founded The Law Offices of Marc D. Manoff and specializes in entrepreneurial law, where he often wears the dual hats of lawyer and business consultant to entrepreneurs and growing business, providing advice on topics ranging from corporate structure and financing to employment matters. Mr. Manoff currently sits on the boards of several regional companies and serves as general counsel for a number of growing technology companies.

Mark T. Johnson, 39, Public Relations & Director

Mark T. Johnson is a principal of M.J. Advanced Corporate Communications, Inc., a multi-million dollar investor relations firm. Mr. Johnson completed his studies for a Bachelor of Science from Towson University in Finance and Economics and held Series 7, Series 62, Series 63, and Series 24 brokerage licenses. Previously, Mr. Johnson served as a regional manager for Thorne Industries and as a Senior Broker and Vice-President of several regional brokerage firms.

Family Relationships

There are no family relationships between any of our directors or executive officers and any other directors or executive officers.

Code of Ethics

We currently do not have a code of ethics that applies to our officers, employees and directors.

EXECUTIVE COMPENSATION

The following summary compensation table reflects all compensation for fiscal years of 2008 and 2007 to Mod Hospitality’s principal executive officer, principal financial officer, etc.

Summary Compensation Table – Mod Hospitality

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ( $) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Non-qualified Deferred Compensation Earnings ($) | All Other Compensation ( $) | Total ($) |

| Kyle Gotshalk (1) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| [President] | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cherish Adams (2) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| [CFO] | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Larry Wilcox (3) | 2007 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| [President] | | | | | | | | | |

| Mary Radomsky (4) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| [Secretary & Treasurer] | | | | | | | | | |

| Teresa Palumbo (5) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| [President] | | | | | | | | | |

| Frederic Richardson (6) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sarah Jackson (7) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Adrienne Venson (8) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Linda Russell (9) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Mark D. Manoff (10) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Mark T. Johnson (11) | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| (1) | Kyle Gotshalk became our president in 2005, and resigned in February, 2008. He was granted a 1,000,000 shares in 2007. |

| (2) | Cherish Adams became our CFO in 2005 and resigned February, 2008. He did not receive any stock award, but was granted 1,000,000 shares in 2007. |

| (3) | Larry Wilcox became our director in 2006 and resigned in November, 2007. |

| (4) | Mary Radomsky became our secretary and treasurer in February, 2008 and resigned in July, 2008. |

| (5) | Teresa Palumbo became our president in February, 2008 and resigned in July, 2008. |

| (6) | Frederic Richardson became our President, CEO and a member of the Board of Director in July 2008. |

| (7) | Sarah Jackson became our CFO, Treasurer, and Director in July, 2008. |

| (8) | Adrienne Venson became our COO and Director in July, 2008. |

| (9) | Linda Russell became our CAO and Director in July, 2008. |

| (10) | Mark D. Manoff became our General Counsel, Secretary and Director on August 11, 2008. |

| (11) | Mark T. Johnson became our Manager of Public Relations and Director on August 11, 2008. |

Summary Compensation Table – ECV

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ( $) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Non-qualified Deferred Compensation Earnings ($) | All Other Compensation ( $) | Total ($) |

| Frederic Richardson | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sarah E. Jackson, CPA | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Adrienne Venson | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Linda Russell | 2008 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Director Compensation

Our directors will not receive a fee for attending each board of directors meeting or meeting of a committee of the board of directors. All directors will be reimbursed for their reasonable out-of-pocket expenses incurred in connection with attending board of director and committee meetings.

Certain Relationships and Related Transactions