CFS BANCORP, INC.

707 Ridge Road

Munster, Indiana 46321

(219) 836-2960

March 19, 2012

Dear Shareholder:

You are cordially invited to attend the 2012 Annual Meeting of Shareholders of CFS Bancorp, Inc. The meeting will be held at the Center for Visual and Performing Arts located at 1040 Ridge Road, Munster, Indiana 46321 on Tuesday, April 24, 2012 at 10:00 a.m., Central Time. The matters to be considered by shareholders at the meeting are described in the accompanying materials.

It is important that you are represented at the meeting regardless of the number of shares you own or whether you are able to attend the meeting in person. We urge you to vote today via the Internet, by telephone, or by completing, signing, and dating your proxy card and returning it in the postage-prepaid envelope provided even if you plan to attend the meeting. This will not prevent you from voting in person at the meeting but will ensure that your vote is counted in the event you are unable to attend the annual meeting.

On behalf of the Board of Directors and all the employees of Citizens Financial Bank, your continued support of and interest in CFS Bancorp, Inc. is sincerely appreciated.

Best regards,

ROBERT R. ROSS

Chairman of the Board

CFS BANCORP, INC.

707 Ridge Road • Munster, Indiana 46321

____________________________________

NOTICE OF THE 2012 ANNUAL MEETING OF SHAREHOLDERS

OF CFS BANCORP, INC.

____________________________________

| |

| Date: | Tuesday, April 24, 2012 |

| |

| Time: | 10:00 a.m., Central Time |

| |

| Place: | Center for Visual and Performing Arts |

1040 Ridge Road

Munster, Indiana 46321

| |

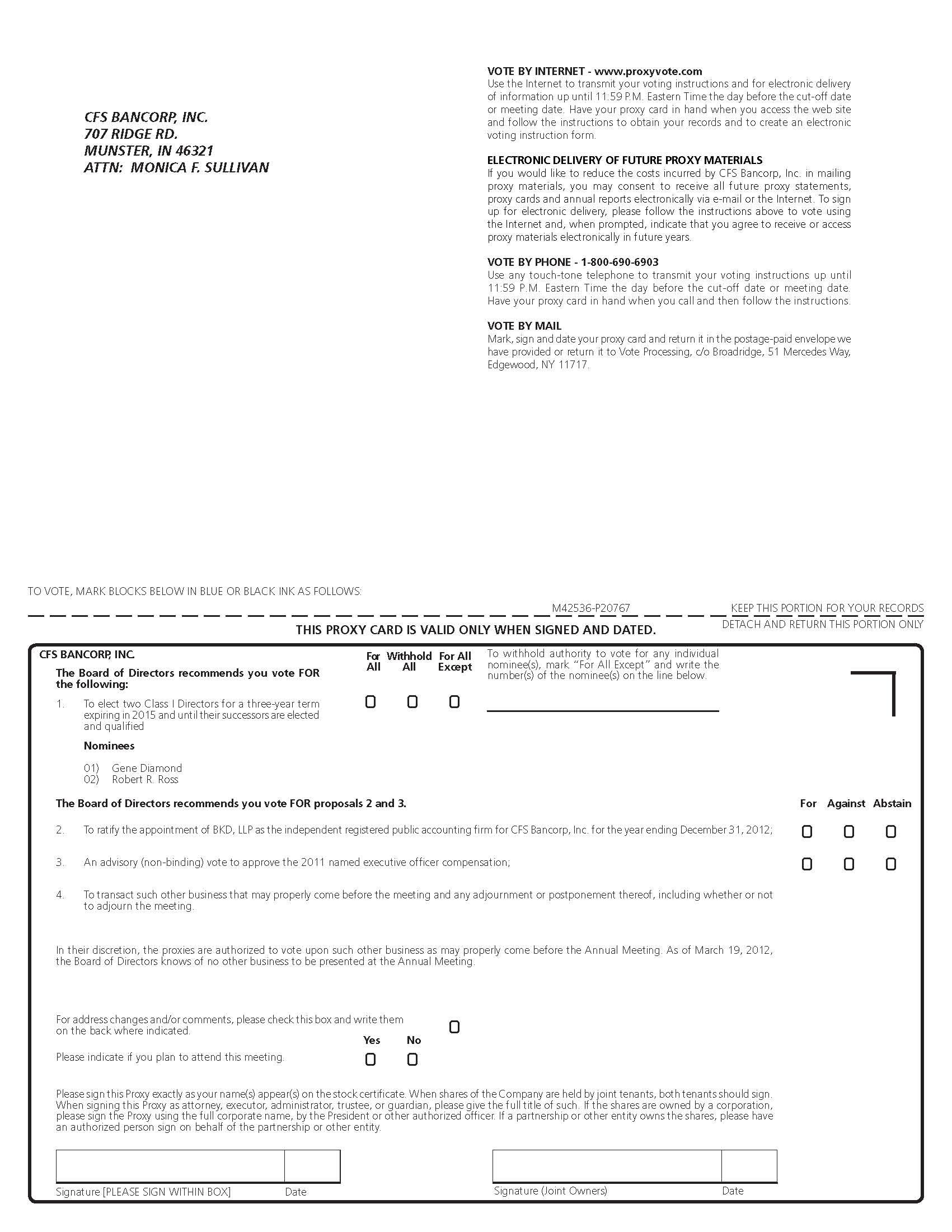

| Purposes: | 1. To elect two Class I Directors for a three-year term expiring in 2015 and until their successors are elected and qualified; |

| |

| 2. | To ratify the appointment of BKD, LLP as the independent registered public accounting firm for CFS Bancorp, Inc. for the year ending December 31, 2012; |

| |

| 3. | An advisory (non-binding) vote to approve the 2011 named executive officer compensation; and |

| |

| 4. | To transact such other business that may properly come before the meeting and any adjournment or postponement thereof, including whether or not to adjourn the meeting. |

| |

| Who Can Vote: | Shareholders at the close of business on March 2, 2012 are entitled to the notice of and to vote at the meeting and at any adjournments thereof. |

| |

| How You Can Vote: | You may vote in person or by proxy. Whether or not you plan to attend the meeting, you are urged to vote your shares via the Internet, by telephone, or by completing, signing, and dating the enclosed proxy card and returning it as soon as possible using the enclosed postage-prepaid envelope. Doing so will ensure you are represented at the meeting and allow your shares to be voted should anything prevent your attendance at the meeting. Your vote is important and greatly appreciated. |

By Order of the Board of Directors,

MONICA F. SULLIVAN

Vice President - Corporate Secretary

Munster, Indiana

March 19, 2012

Your Vote Is Important. Whether you own one share or many shares, your prompt cooperation in voting your proxy is greatly appreciated. Please vote your shares via the Internet, by telephone, or by completing, signing, dating, and returning the executed enclosed proxy card in the postage-prepaid envelope provided.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON APRIL 24, 2012. This proxy statement and our annual report on Form 10-K for the fiscal year ended December 31, 2011 are available at

https://materials.proxyvote.com/12525D.

CFS BANCORP, INC.

2012 ANNUAL MEETING PROXY STATEMENT

Table of Contents

|

| |

| | Page |

| Voting and Related Matters | |

| Proposal 1 – Election of Directors | |

| Director Nominees and Directors Continuing in Office | |

| Executive Officers | |

| Beneficial Ownership of Common Stock by Certain Shareholders | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| Corporate Governance | |

| Related Party Transactions | |

| Board Committees and Related Matters | |

| Executive Compensation | |

| Compensation Discussion and Analysis | |

| Summary Compensation Table | |

| Director Compensation | |

| Proposal 2 – Ratification of Independent Registered Public Accounting Firm | |

| Report of the Audit Committee | |

| Proposal 3 – Advisory (Non-Binding) Vote to Approve the 2011 Named Executive Officer Compensation | |

| Shareholder Proposals and Nominations | |

| Other Matters and Discretionary Voting | |

CFS BANCORP, INC.

____________________

PROXY STATEMENT

____________________

ANNUAL MEETING OF SHAREHOLDERS

April 24, 2012

VOTING AND RELATED MATTERS

This proxy statement is being furnished to the shareholders of CFS Bancorp, Inc. (Company or CFS) in connection with the solicitation of proxies by the Company’s Board of Directors relating to the 2012 annual meeting of shareholders of CFS to be held at the Center for Visual and Performing Arts located at 1040 Ridge Road, Munster, Indiana 46321 on Tuesday, April 24, 2012 at 10:00 a.m., Central Time.

Why am I receiving this proxy statement?

You are receiving a proxy statement because you owned shares of CFS common stock on March 2, 2012, which is the date that the Board of Directors has fixed as the record date (Record Date) for determining shareholders entitled to notice of and to vote at the annual meeting and any adjournment or postponement of the meeting. This proxy statement describes the matters on which we would like you to vote and provides information so that you can make an informed decision. The notice of annual meeting, proxy statement, and proxy card are being mailed to shareholders on or about March 19, 2012.

What will I be voting on?

| |

| • | Election of two Class I Directors for a term of three years (see Proposal 1 – Election of Directors) |

| |

| • | Ratification of BKD, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2012 (see Proposal 2 – Ratification of Independent Registered Public Accounting Firm) |

| |

| • | An advisory (non-binding) vote to approve the 2011 named executive officer compensation (see Proposal 3 – Advisory (Non-Binding) Vote to Approve the 2011 Named Executive Officer Compensation) |

What are the Board of Directors’ recommendations on how I should vote my shares?

The Board of Directors recommends that you vote your shares as follows:

| |

| Proposal 1 - | FOR the election of each of the Board’s nominees (Gene Diamond and Robert R. Ross) for a three-year term. |

| |

| Proposal 2 - | FOR the ratification of the appointment of BKD, LLP as our independent registered public accounting firm for 2012. |

| |

| Proposal 3 - | FOR approval of the 2011 named executive officer compensation. |

How will proxies be voted?

The shares represented by properly executed and returned proxies will be voted according to the instructions that you provide. If no instructions are provided, the persons named as proxies will vote FOR the election of Gene Diamond and Robert R. Ross as Directors, FOR Proposal 2, and FOR Proposal 3.

The Board of Directors does not know of any matter other than those stated in the notice of annual meeting and this proxy statement that may come before the annual meeting. If any other matters are properly presented for action at the annual meeting, or at any adjournment or postponement of the meeting, a signed proxy will confer discretionary authority to the persons named in the proxy to vote on those matters, including whether or not to adjourn the meeting. It is intended that the persons named as proxies will vote with respect to those matters as recommended by the Board of Directors of CFS or, if no recommendation is given, in their best judgment.

How do I vote?

You can vote either in person at the meeting or by proxy without attending the meeting via proxy card, the Internet, or by telephone. We encourage you to attend the meeting and urge you to vote by proxy even if you plan to attend so that we will know as soon as possible that enough votes will be present to establish a quorum for us to hold the meeting. If you attend the meeting in person, you may vote by ballot at the meeting even though you previously voted by proxy. Please contact Monica F. Sullivan, our Corporate Secretary, at (219) 836-2960 if you need directions to the annual meeting.

If you are the record holder of your shares, you can vote by completing, dating, and signing the enclosed proxy card and returning it in the enclosed postage-prepaid envelope. You also may vote your shares by following the instructions contained on the enclosed proxy card to vote via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate shareholders using a control number and allow shareholders the opportunity to confirm that their instructions have been properly recorded.

If your shares are held through a broker, bank, or other record holder, you may vote your shares by completing, dating, and signing the voting instruction form that you receive from your broker, bank, or other record holder. You may also be able to vote your shares via the Internet or by telephone in accordance with the instructions provided by your broker, bank, or other record holder.

Can I change my vote?

You have the right to revoke your proxy at any time before the meeting by (i) notifying Monica F. Sullivan, our Corporate Secretary, in writing at 707 Ridge Road, Munster, Indiana 46321 or (ii) delivering a later-dated proxy card. If you are a shareholder of record, you may also revoke your proxy by voting in person at the meeting. If you hold your shares through a broker, bank, or other record holder, please contact your broker or bank for procedures and documentation on how to change your vote.

How will shares in our 401(k) Retirement Plan be voted?

If you are a participant in the Citizens Financial Bank 401(k) Retirement Plan (401(k) Plan), you will receive a voting instruction card to use to provide voting instructions to Vanguard Fiduciary Trust Company, the trustee for the 401(k) Plan, for the shares allocated to your account under the 401(k) Plan as of the Record Date. Your voting instructions to the trustee should be completed, dated, signed, and returned in the envelope provided, or you may vote via the Internet or by telephone, by 11:59 p.m. Eastern Time on April 19, 2012. Please do not return your voting instructions to the Company. Your voting instructions relating to the shares allocated to your 401(k) Plan account will be kept confidential by the trustee and will not be disclosed to any of our directors, officers, or employees.

Unless the terms of the 401(k) Plan or the fiduciary duties of the trustee require otherwise, the trustee will vote the shares allocated to your account under the 401(k) Plan in accordance with your instructions received by the trustee in a timely manner. If you do not return your voting instruction card in a timely manner or if you return the voting instruction card unsigned or without indicating how you desire to vote the shares allocated to your 401(k) Plan account, the trustee will vote the shares allocated to your account in the same proportion and in the same manner as the shares with respect to which timely and proper instructions have been received.

What does it mean if I receive more than one proxy card?

If you hold your shares in multiple registrations, or in both your own name and through a broker or bank, you will receive a proxy card for each account. Please sign, date, and return all proxy cards you receive. If you choose to vote via the Internet or by telephone, please vote once for each proxy card you receive. Only your latest dated proxy card for each account will be voted.

How many votes do I have?

You have one vote for every share of CFS common stock that you owned on March 2, 2012.

How many shares are entitled to vote?

There were 10,923,204 shares of CFS common stock outstanding and entitled to vote at the annual meeting as of March 2, 2012. Each share is entitled to one vote. There is no cumulative voting.

How many votes must be present to hold the meeting?

A majority of the votes that can be cast must be present, in person or by proxy, for there to be a quorum to hold the meeting. Proxies received but marked as ABSTAIN and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining whether a quorum is present.

How many votes are needed for the proposals to pass?

Election of Directors (Proposal 1). Directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting in which a quorum is present. In other words, the two Director candidates receiving the highest number of FOR votes will be elected. Shareholders may vote FOR the election of nominees proposed by the Board, or to WITHHOLD authority to vote FOR one or more of the nominees being proposed. Votes to WITHHOLD and broker non-votes are not counted as a vote FOR or AGAINST that nominee. Brokers who hold shares in “street name” for customers who are the beneficial owners of such shares may not give a proxy to vote those shares for the election of directors absent specific instruction from their customers. See What is a broker non-vote? below.

Ratification of Independent Registered Public Accounting Firm (Proposal 2). The ratification of the appointment of BKD, LLP as our independent registered public accounting firm for the year ending December 31, 2012 will be approved if the votes cast FOR the proposal exceed those cast AGAINST it. A proxy card marked as ABSTAIN with respect to this proposal and broker non-votes will not count as a vote FOR or AGAINST the proposal. Brokers who hold shares in “street name” for customers who are the beneficial owners of such shares may give a proxy to vote those shares as to this proposal absent specific instructions from their customers.

Approval of the 2011 Named Executive Officer Compensation (Say-on-Pay) (Proposal 3). The approval of the proposal providing an advisory vote of our shareholders to approve our 2011 named executive officer compensation (also known as say-on-pay) requires that the votes cast FOR the proposal exceed those cast AGAINST the proposal. A vote to ABSTAIN and broker non-votes are not treated as a vote FOR or AGAINST, and thus will have no effect on the outcome of the vote. Brokers may not vote shares held by them FOR or AGAINST this proposal without specific instructions from the beneficial owner of the shares. This is an advisory vote, which means it is non-binding on either the Compensation Committee or our Board of Directors. The vote will provide our Board and our Compensation Committee with information relating to the opinions of our shareholders, which the Compensation Committee and the Board will consider as it makes determinations with respect to future action regarding our executive compensation.

What is a broker non-vote?

A broker non-vote occurs when a broker, bank, or other record holder (typically referred to as being held in “street name”) cannot vote on a particular matter because the broker or bank does not have discretionary voting power with respect to that matter and has not received voting instructions from the beneficial owner of the shares. Brokers and banks have the discretion to vote shares held in street name on routine matters, but not on non-routine matters. Routine matters include

the ratification of the appointment of our independent registered public accountant, but the election of Directors and the say-on-pay proposal are considered non-routine matters. Thus, if your shares are held in street name and you do not provide instructions to your broker as to how your shares are to be voted in the election of Directors or the say-on-pay proposal, your broker, bank, or other nominee will not be able to vote your shares on these matters at the annual meeting. We urge

you to provide instructions to your broker, bank, or other nominee so that your votes may be counted. You should vote your shares by following the instructions provided on the voting instruction form that you receive from your broker, bank, or other nominee.

Who pays for the proxy solicitation cost?

The Company will pay for expenses incurred for the solicitation of proxies. We contemplate that proxies will be solicited principally through the mail, but some of our Directors and officers, as well as certain of our employees, may solicit proxies personally or by telephone, fax, mail, or e-mail without receiving special compensation for these services. In addition to sending you these materials, you may also be solicited through Company press releases and postings on our website, www.citz.com.

Will I receive a copy of the annual report of CFS?

Our annual report on Form 10-K for the year ended December 31, 2011 is included with this proxy statement. The annual report includes our audited consolidated financial statements, along with other financial information and a list of exhibits, and we urge you to read it carefully. If any shareholder desires a copy of any exhibits filed as a part of the Form 10-K, we will furnish the exhibits upon request without charge.

Can I access CFS’ proxy materials and annual report electronically?

This proxy statement and our annual report on Form 10-K for the year ended December 31, 2011 are available at https://materials.proxyvote.com/12525D. We encourage all shareholders to elect to view future proxy statements and annual reports over the Internet instead of receiving paper copies in the mail. You may choose this option and save us the cost of producing and mailing these documents by:

| |

| • | following the instructions provided on your proxy card or voting instruction form; |

| |

| • | following the instructions provided when you vote over the Internet; or |

| |

| • | going to https://materials.proxyvote.com/12525D and following the instructions provided. |

If you choose to view future proxy statements and annual reports over the Internet, you will receive an e-mail message next year containing the Internet address to use to access our proxy statement and annual report. The e-mail also will include instructions for voting over the Internet. You will have the opportunity to opt out at any time by following the instructions on this same website. You do not have to elect Internet access each year.

What is “householding?”

We have adopted a procedure called “householding” which has been approved by the United States Securities and Exchange Commission (SEC). Under this procedure, a single copy of the annual report and the proxy statement will be sent to multiple shareholders sharing the same address and last name unless one of the shareholders at that address notifies us that they wish to receive individual copies. This procedure allows us to save on printing costs and related fees. Shareholders who participate in householding will continue to receive separate proxy cards. Householding will not affect dividend check mailings in any way. Beneficial owners can request information about householding from their banks, brokers, or other holders of record.

What if I want to receive a separate copy of the annual report and the proxy statement?

If you are a shareholder of record and you received a single copy of the annual report and the proxy statement at an address that you share with another shareholder, we will promptly deliver a separate copy at your request by writing Monica F. Sullivan, our Corporate Secretary, at 707 Ridge Road, Munster, Indiana 46321, calling her at (219) 836-2960, or e-mailing her at msullivan@citz.com. Shareholders of record who share an address and received multiple copies of the annual report and proxy statement may request householding of these materials by contacting Ms. Sullivan.

How do I revoke my consent to the householding program?

If you are a holder of record and share an address and last name with one or more other holders of record, and you wish to receive separate annual reports, proxy statements, and other disclosure documents in the future, you must revoke your consent by contacting Broadridge Corporate Issuer Solutions, Inc., either by calling toll free at (800) 542-1061 or by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. You will be removed from the householding program within 30 days of Broadridge’s receipt of your householding consent revocation.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker, or other holder of record to request information about householding.

PROPOSAL 1 - ELECTION OF DIRECTORS

The Corporate Governance and Nominating Committee unanimously recommended to the Board of Directors that Gene Diamond and Robert R. Ross should be nominated for election as Directors at the annual meeting. The Board accepted the committee’s recommendations and unanimously nominated Mr. Diamond and Mr. Ross for election as Directors. The proxies solicited will, unless otherwise directed, be voted for the election of the Board’s two nominees to serve as Class I Directors for a three-year term expiring in 2015 and until their successors are elected and qualified. Mr. Diamond and Mr. Ross have each consented to be named in this proxy statement as nominees and to serve if elected. All of the Directors of CFS are also Directors of Citizens Financial Bank, CFS’ wholly-owned federal savings bank (Bank). In addition, Daryl D. Pomranke became Chief Executive Officer of the Company and the Bank and was appointed to the Company’s Board of Directors effective December 30, 2011 to serve as a Class II Director with a two-year term expiring in 2013. Mr. Charles R. Webb and Mr. Frank D. Lester, former directors of the Company, are Directors of the Bank. There are no family relationships among any of our Directors or Named Executive Officers.

The Board of Directors has no reason to believe that either of the nominees are unable to serve or will not serve if elected. If for any reason a nominee becomes unable to serve or unwilling to serve if elected, proxies voted for that nominee may be voted with discretionary authority for a substitute or substitutes that shall be designated and nominated by the Board.

Pursuant to Indiana law and our Articles of Incorporation and By-laws, our Directors are elected to serve staggered terms and are divided into three classes, with each class being as nearly equal in number as possible, and with the term of office of one class expiring each year. Currently, six Directors serve on the Board of Directors, including two Class II Directors whose terms expire at the 2013 annual meeting, two Class III Directors whose terms expire at the 2014 annual meeting, and two Class I Directors whose terms expire at this annual meeting.

As described below under Board Committees and Related Matters — Consideration of Director Candidates, the Corporate Governance and Nominating Committee seeks a diverse group of Director candidates. Although the Company does not have a formal policy on diversity in board membership, the committee considers nominees who, together with our other Board members, have significant executive and financial experience and demonstrate, among other things, broad industry knowledge, the highest level of personal integrity, independence of judgment, loyalty, and willingness to serve and to commit the necessary amount of time to oversee the Company’s affairs. The committee also believes that the Board of Directors should be comprised of individuals with diverse business backgrounds and other differentiating characteristics that can provide a multi-faceted set of perspectives and experience to our Board. The committee applied these factors to our Board and determined that the six Directors, including the two Director nominees, have the breadth of relevant and diverse experience necessary to serve the best interests of our shareholders. In addition to these factors, the individual experience, qualifications, attributes, and/or skills that led the committee to conclude that each incumbent and Director nominee is qualified to serve on our Board is discussed in the following Director biographies.

The Board of Directors unanimously recommends that you vote FOR the two nominees listed below and on the enclosed proxy card.

DIRECTOR NOMINEES AND DIRECTORS CONTINUING IN OFFICE

|

| | | | | | | | | | |

| Name | | Age | | Position(s) Held With CFS | | Director Since | | Class | | Current Term Expires |

| NOMINEES FOR ELECTION AT THE 2012 ANNUAL MEETING |

| Gene Diamond | | 59 | | Director | | 1998 | | I | | 2012 |

| Robert R. Ross | | 66 | | Chairman of the Board | | 2004 | | I | | 2012 |

| | | | | | | | | | | |

| OTHER BOARD MEMBERS CONTINUING IN OFFICE |

| Gregory W. Blaine | | 63 | | Director | | 1998 | | III | | 2014 |

| John W. Palmer | | 51 | | Director | | 2010 | | II | | 2013 |

| Daryl D. Pomranke | | 51 | | Chief Executive Officer | | 2011 | | II | | 2013 |

| Joyce M. Simon | | 64 | | Director | | 2004 | | III | | 2014 |

Gene Diamond has been a Director of CFS since 1998 and the Bank since 1994. Mr. Diamond chairs our Compensation Committee and is a member of our Corporate Governance and Nominating Committee. Mr. Diamond serves as the Regional Chief Executive Officer of the Sisters of St. Francis Health Services, Inc., where he is responsible for the hospital group consisting of St. Margaret Mercy Healthcare Centers located in Hammond and Dyer, Indiana; St. Anthony Medical Center in Crown Point, Indiana; St. Anthony Memorial Health Centers in Michigan City, Indiana; and Franciscan Physicians Hospital in Munster, Indiana. From 2001 to 2004, Mr. Diamond served as the Regional Chief Operating Officer of the Sisters of St. Francis Health Services, Inc. Mr. Diamond previously served as Chief Executive Officer of St. Margaret Mercy Healthcare Centers from 1993 to 2004. Mr. Diamond’s experience as a Chief Executive Officer of a large employer provides our Board of Directors with an essential resource for human resources related issues. Mr. Diamond’s contemplative demeanor and common sense approach provide an added set of skills to our Board.

Robert R. Ross has been a Director of CFS and the Bank since 2004. Mr. Ross was appointed Chairman of the Board of Directors of each of the Company and the Bank effective December 30, 2011. Mr. Ross chairs our Audit Committee and is a member of our Corporate Governance and Nominating Committee and the Bank’s Asset Liability Management Committee. Mr. Ross has served as the President of Ross Consulting, a business and financial consulting firm, since 2004. Mr. Ross was an Audit Partner with PricewaterhouseCoopers LLP from 1982 to 2004. While a partner at PricewaterhouseCoopers, Mr. Ross served a variety of public companies including those in the financial and insurance services industries. His internal responsibilities at PricewaterhouseCoopers, among others, included risk management oversight for the Midwest Region Offices of the firm and development of the firm’s global independence policies. Mr. Ross has also served as a special accounting advisor to an independent counsel to the SEC in connection with certain investigative matters and has served as an instructor on the performance of integrated audits as prescribed by the Public Company Accounting Oversight Board. Mr. Ross’ experience as an Audit Partner provides our Board of Directors with a wealth of highly technical knowledge pertaining to public reporting, audit, accounting, risk management, and internal accounting control issues and procedures. Mr. Ross’ ability to serve on the Audit Committee based on his current and past experience is among the reasons he was selected for Board membership. Mr. Ross’ involvement in the Northwest Indiana business and not-for-profit communities provides us with added knowledge of this market and has resulted in a significant number of business referrals to the Bank during his tenure as a Director. Mr. Ross has prior experience as director on the boards of a number of not-for-profit entities and is also a Trustee Emeritus of Calumet College of St. Joseph located in Whiting, Indiana.

Gregory W. Blaine has been a Director of CFS and the Bank since 1998. Mr. Blaine served as our lead independent Director through December 30, 2011, when the Company appointed a non-executive Chairman of the Board. He also serves as a member of our Audit, Compensation, and Corporate Governance and Nominating Committees. Mr. Blaine is the former Chairman and Chief Executive Officer of TN Technologies, Inc., a digital marketing communications company, retiring in 1998. Mr. Blaine also served in various management roles with True North Communications, Inc., the parent company of

TN Technologies, from 1979 to 1998, including Director of Global Operating Systems, and a member of the Board of Directors of True North Communications from 1990 to 1997. Mr. Blaine’s experience as a member of the Board of Directors, Chief Executive Officer, and other senior management positions of a leading communications firm provides our Board of Directors with essential insight into management, marketing, and public relations matters affecting the Bank. His extensive management experience leads to thought provoking discussions with our Board and management.

John W. Palmer became a Director of CFS and the Bank in 2010. Mr. Palmer is a member of our Audit Committee. Mr. Palmer formerly practiced as a Certified Public Accountant and is the co-founder of PL Capital, LLC., an investment firm specializing in the banking industry. PL Capital focuses on publicly traded banks and thrifts with market capitalizations ranging from $20 million to $5 billion. Prior to co-founding PL Capital in 1996, Mr. Palmer was a director at KPMG LLP, an international public accounting firm, from 1983 to 1996. While at KPMG LLP, Mr. Palmer specialized in commercial banking, consumer finance, thrifts, mortgage banking, and discount brokerage serving public and privately held clients. He has experience with merger and acquisition transactions, public and private securities offerings, and numerous filings with the SEC and regulatory authorities including offerings to convert mutual thrift organizations to stock form companies. Mr. Palmer currently serves on the Board of HF Financial Corp., IDC and its subsidiary, Home Federal Bank. He serves on the Personnel, Compensation and Benefits Committee of HF Financial Corp., IDC and on the Risk Oversight Committee for Home Federal Bank. Mr. Palmer is the former Chairman of the Board of Directors of Security Financial Bancorp, Inc., a publicly-traded $200 million in assets thrift located in St. John, Indiana. Mr. Palmer also previously served as a director of Franklin Bancorp and its wholly-owned subsidiary Franklin Bank, N.A., a $700 million in assets commercial bank located in Southfield, Michigan, where he served on the audit, compensation, and loan committees of the board. Mr. Palmer also served as Chairman of the Strategic Planning Committee of Franklin Bancorp. He formerly served on the Board of Directors of Clever Ideas, Inc., a privately-held specialty finance company located in Chicago, Illinois, from 1998 to 2006. Mr. Palmer is an experienced businessperson and is familiar with financial statements.

Daryl D. Pomranke was appointed Chief Executive Officer and appointed to the Company’s Board of Directors effective December 30, 2011. Mr. Pomranke was appointed President and Chief Operating Officer of CFS and the Bank in April 2008, after joining CFS and the Bank as Executive Vice President and Chief Operating Officer in April 2007. Mr. Pomranke was elected as a Director of the Bank in June 2009. Prior to joining us, Mr. Pomranke was employed by Harris N.A. and its predecessor, Mercantile National Bank of Indiana, since 1998. Mr. Pomranke had various management roles and responsibilities at Harris N.A., including Regional Financial Services Officer, Chief Financial Officer, corporate development, corporate lending, cash management services, and strategic planning.

Joyce M. Simon has been a Director of CFS and the Bank since 2004. Ms. Simon chairs our Corporate Governance and Nominating Committee and is a member of our Compensation Committee. Ms. Simon has served as the Chief Financial Officer of the John G. Shedd Aquarium since 1992. Ms. Simon previously served as an Audit Partner with Ernst & Young LLP in Chicago, Illinois, from 1988 to 1991 where she served a variety of public companies including those in the financial services industry. Ms. Simon’s experience provides our Board of Directors with audit, accounting, risk management, and technology expertise. Her familiarity and experience with public company filing requirements and her ability to serve initially on our Audit Committee were among the reasons for her selection for board membership. Ms. Simon is extremely detail oriented, but her keen understanding of strategic versus tactical issues aids us in keeping discussions at the appropriate level.

EXECUTIVE OFFICERS

Below you will find information with respect to the principal occupations during the last five years of the current Executive Officers of CFS and the Bank who do not also serve as a Director of CFS. All Executive Officers are elected annually by our Board of Directors and serve until their successors are elected and qualified. There are no family relationships among any of our Directors or Executive Officers, and there are no arrangements or understandings between our Directors and any other person which resulted in the person being elected as an Executive Officer, other than our employment agreements with Messrs. Pomranke and Weberling.

Jerry A. Weberling, 60, joined CFS and the Bank as Executive Vice President – Chief Financial Officer in June, 2010. Prior to joining us, Mr. Weberling served as Senior Executive Vice President and Chief Financial Officer for MAF Bancorp, Inc. and MidAmerica Bank, FSB located in Downers Grove, Illinois, from 1990 to 2007. Mr. Weberling served on the boards of MAF Bancorp and MidAmerica Bank from 1998 to 2007. Prior to joining MidAmerica Bank in 1984, Mr. Weberling was a senior manager at KPMG LLP located in Chicago, Illinois, in the savings and loan, real estate, and mortgage banking practices.

Dale S. Clapp, 49, joined the Bank as Executive Vice President – Business Banking in April 2008. In December 2009, Mr. Clapp was appointed to Executive Vice President – Sales Management, and his responsibilities expanded to include retail sales and marketing. Prior to joining us, Mr. Clapp served as Senior Vice President and Regional Sales Manager of the business banking group at Harris N.A. (Northwest Indiana Region), and its predecessor, Mercantile National Bank of Indiana, since 1995. While at Harris N.A., Mr. Clapp was responsible for the Indiana business banking sales team, cash management group, and the business development of relationship managers. Prior to joining Mercantile National Bank of Indiana, Mr. Clapp was with Horizon Bank in Michigan City, Indiana, as Vice President of Business Banking where he was responsible for a group of three relationship managers.

Daniel J. Zimmer, 48, joined the Bank as Senior Vice President and Senior Credit Officer in December 2007 and is currently responsible for commercial and retail loan underwriting, loan documentation and processing, and the Bank’s loan management and collections group. Prior to joining us, Mr. Zimmer was the commercial loan credit manager at MidAmerica Bank in Downers Grove, Illinois, from 2006 to 2007 where he assisted with growing the commercial loan portfolio to $2.0 billion prior to MidAmerica’s sale to National City Corporation (now PNC Financial Services Group, Inc.). Mr. Zimmer was also the commercial loan credit manager at Standard Bank & Trust in Hickory Hills, Illinois, from 2004 to 2006 where he was responsible for underwriting loan requests in excess of $500,000, hiring and training analysts, and providing credit training classes to relationship managers.

BENEFICIAL OWNERSHIP OF COMMON STOCK

BY CERTAIN SHAREHOLDERS

The following table sets forth the beneficial ownership of the Company’s common stock, as of March 2, 2012, with respect to (i) each beneficial owner of more than 5% of our common stock; (ii) the Directors and Director nominees; (iii) each of the Named Executive Officers identified in this proxy statement, which includes certain persons who are required to be included but are no longer serving as an Executive Officer of the Company; and (iv) all Directors and Executive Officers as a group. At March 2, 2012, the Company had 10,923,204 shares of common stock that were issued and outstanding.

|

| | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Number of Common Shares Beneficially Owned (1) | | Options Exercisable | | Unvested Restricted Stock (2) | | Total Amount of Beneficial Ownership | | Total Percentage Ownership |

| Owners of More Than Five Percent: | | | | | | | | | | | |

PL Capital, LLC 20 E. Jefferson Ave., Suite 22 Naperville, IL 60540 | | 1,083,509 |

| (3) | | — |

| | — |

| | 1,083,509 |

| | 9.92 | % |

Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, TX 78746 | | 922,784 |

| (4) | | — |

| | — |

| | 922,784 |

| | 8.45 | % |

Citizens Financial Bank 401(k) Retirement Plan c/o Vanguard Fiduciary Trust Services | | 868,398 |

| (5) | | — |

| | — |

| | 868,398 |

| | 7.95 | % |

| | | | | | | | | | | | |

| Directors and Director Nominees: | | | | | | | | | | | |

| Gregory W. Blaine | | 30,241 |

| | | 16,000 |

| | 1,484 |

| | 47,725 |

| | * |

|

| Gene Diamond | | 63,953 |

| (6) | | 16,000 |

| | 1,484 |

| | 81,437 |

| | * |

|

| John W. Palmer | | 1,083,509 |

| (3) | | — |

| | — |

| | 1,083,509 |

| | 9.92 | % |

| Daryl D. Pomranke | | 38,568 |

| (7) | | — |

| | 20,585 |

| | 59,153 |

| | * |

|

| Robert R. Ross | | 15,199 |

| (8) | | 16,000 |

| | 1,484 |

| | 32,683 |

| | * |

|

| Joyce M. Simon | | 18,688 |

| (9) | | 16,000 |

| | 1,484 |

| | 36,172 |

| | * |

|

| | | | | | | | | | | | |

| Other Named Executive Officers: | | | | | | | | | | | |

| Jerry A. Weberling | | 68,169 |

| (10) | | — |

| | 13,490 |

| | 81,659 |

| | * |

|

| Dale S. Clapp | | 16,285 |

| (11) | | — |

| | 14,002 |

| | 30,287 |

| | * |

|

| Daniel J. Zimmer | | 8,749 |

| (12) | | — |

| | 10,853 |

| | 19,602 |

| | * |

|

| Thomas F. Prisby | | 276,062 |

| (13) | | 71,145 |

| | 3,774 |

| | 350,981 |

| | 3.19 | % |

| All Directors, Director nominees, and other Executive Officers of CFS as a group (10 persons) | | 1,619,423 |

| | | 135,145 |

| | 68,640 |

| | 1,823,208 |

| | 16.49 | % |

| |

| * | Represents less than 1% of the outstanding stock. |

| |

| (1) | Based upon filings made under the Securities Exchange Act of 1934 and information furnished by the Directors and Executive Officers named in this table. Unless otherwise indicated, the named beneficial owner has sole voting and dispositive power with respect to the shares. |

| |

| (2) | Shares of unvested restricted stock are included in the table because the recipient of the shares has the right to vote and receive any dividends declared and payable on such shares during such time as the shares remain unvested. Once shares of restricted stock are vested, the shares are included in the number of common shares beneficially owned. |

| |

| (3) | Based solely on information provided by Mr. Palmer regarding his beneficial ownership of the Company’s common stock as of March 2, 2012. Includes shares owned by PL Capital, LLC., Financial Edge Fund, L.P., Financial Edge–Strategic Fund, L.P., Goodbody/PL Capital, L.P., PL Capital/Focused Fund, L.P., PL Capital Advisors, LLC, Goodbody/PL Capital, LLC, John W. Palmer, Richard J. Lashley, Beth Lashley, Danielle Lashley, Irving A. Smokler, and Red Rose Trading Estonia OU. Certain of these parties have sole and/or shared voting and dispositive power with respect to these shares. |

| |

| (4) | Information included is based solely on a Schedule 13G/A filed with the SEC by Dimensional Fund Advisors LP on February 13, 2012. In the Schedule 13G/A, Dimensional Fund Advisors expressly disclaims beneficial ownership of these securities. |

| |

| (5) | The Citizens Financial Bank 401(k) Retirement Plan is governed by the terms of a written document adopted by our Board of Directors. Vanguard Fiduciary Trust Company acts as the trustee of the Citizens Financial Bank 401(k) Retirement Plan under the terms of a trust agreement with the Company. Under the terms, the shares held in the 401(k) Retirement Plan are voted in accordance with the instructions of the participating employees. If no instructions are received, the trustee votes the shares in proportion with the instructions that were received from other participants. Information provided is based on Schedule 13G/A filed with the SEC on February 1, 2012. |

| |

| (6) | Includes 1,237 shares held in an individual retirement plan for Mr. Diamond; 42,000 shares owned jointly with Mr. Diamond’s spouse; and 3,000 shares held by a private foundation established by Mr. Diamond. |

| |

| (7) | Includes 4,604 shares allocated to Mr. Pomranke’s account in the 401(k) Plan, 11,178 shares owed jointly with Mr. Pomranke’s spouse, and 1,000 shares owned by his adult children. |

| |

| (8) | Mr. Ross’ shares are owned jointly with his two adult children. |

| |

| (9) | Includes 15,972 shares held in a trust for Ms. Simon established by CFS to fund its obligations with respect to the Directors’ deferred compensation plan and 1,000 shares owned jointly with Ms. Simon’s spouse. |

| |

| (10) | Includes 7,469 shares allocated to Mr. Weberling’s account in the 401(k) Plan, 33,700 shares held in an individual retirement account, and 27,000 shares owned jointly with Mr. Weberling’s spouse. |

| |

| (11) | Includes 1,071 shares allocated to Mr. Clapp’s account in the 401(k) Plan and 2,693 shares owned jointly with Mr. Clapp’s spouse. |

| |

| (12) | Includes 2,819 shares allocated to Mr. Zimmer’s account in the 401(k) Plan. |

| |

| (13) | Mr. Prisby’s beneficial ownership is reported as of December 30, 2011, the date of his retirement from the Company. Includes 7,580 shares held in an individual retirement account; 42,005 shares allocated to Mr. Prisby’s account in the 401(k) plan; 27,269 shares held in a trust of which Mr. Prisby’s spouse, Cynthia M. Prisby, is the trustee and sole beneficiary; 58,967 shares owned by Sandra S. Prisby, Mr. Prisby’s adult daughter who resides in his household; 683 shares owned jointly by Mrs. Prisby and a third party; and 2,000 shares owned by a private charitable foundation established in 2002 by Mr. Prisby. Mr. Prisby disclaims beneficial ownership of the shares owned by Ms. Sandra Prisby. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (Exchange Act) requires certain of our officers and each of our Directors, as well as other persons who own more than ten percent of our outstanding common stock, to file reports detailing their stock ownership and certain changes in their stock ownership with the SEC.

We have reviewed the written statements provided to us by our officers who are required to file these reports and Directors regarding their CFS stock ownership. Based solely on a review of these reports and statements, we believe that our officers who are required to file these reports and Directors complied timely with those filing requirements for 2011.

CORPORATE GOVERNANCE

Director Independence

Our Board of Directors has affirmatively determined that a majority of our Directors are independent under the applicable NASDAQ rules. Our Independent Directors are Gregory W. Blaine, Gene Diamond, John W. Palmer, Robert R. Ross, and Joyce M. Simon.

Board Composition and Committees

Our Board of Directors is currently comprised of six members. Our Board has an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee. Our Bank Board has an Executive Committee. Our Board may establish additional committees from time to time. The duties of the Executive Committee are set forth in the board resolutions that authorized the committee. The charters for our Audit, Compensation, and Corporate Governance and Nominating Committees are available for review on our website at www.citz.com – Investor Relations – Governance Documents. See Board Committees and Related Matters below. Prior to the retirement of our former Chairman and Chief Executive Officer, Thomas F. Prisby, the Board had appointed a Lead Independent Director, and Mr. Blaine served in that role. However, since Mr. Ross is deemed to be an independent director and chairman, the Board eliminated the role of lead director upon his appointment.

Corporate Governance Guidelines and Code of Conduct and Ethics

Our Board of Directors has adopted Corporate Governance Guidelines that, along with our Articles of Incorporation, By-laws, and Charters of our various Board committees, provide the foundation for our governance. Among other things, our Corporate Governance Guidelines address the composition, functions, responsibilities, and committees of our Board; minimum qualifications for Directors; Director independence requirements; the appointment of a Lead Independent Director, if considered necessary; limitations as to service on other boards; access to management; Director compensation, orientation, and development; management succession and review; and annual Board and committee evaluations.

We have a code of conduct and ethics (Code of Ethics) applicable to all Directors, Executive Officers, and employees. We will disclose in a current report on Form 8-K filed with the SEC the nature of any amendment to the Code of Ethics (other than technical, administrative, or other non-substantive amendments), our approval of any material departure from a provision of the Code of Ethics, and our failure to take action within a reasonable period of time regarding any material departure from a provision of the Code of Ethics that has been made known to any of our Executive Officers.

Our Corporate Governance Guidelines and Code of Ethics are available on our website at www.citz.com – Investor Relations – Governance Documents. Copies are also available to any shareholder upon written request to Monica F. Sullivan, Corporate Secretary, at 707 Ridge Road, Munster, Indiana 46321.

Risk Oversight Process

Our Board of Directors administers risk oversight of CFS and the Bank through the Audit Committee. The committee oversees the risk management function and the internal audit function. The Senior Vice President - Risk Management and Vice President - Internal Audit functionally reports to the committee and administratively reports to our Chief Executive Officer. As provided in its charter, the committee monitors the appointment, compensation, and oversight of the Senior Vice President - Risk Management and Vice President - Internal Audit and periodically reviews the organizational structure and qualifications of the risk management department and internal audit. The head of the risk management and internal audit departments assists in the preparation of the agenda for each Audit Committee meeting and regularly attends such meetings.

The Audit Committee provides regular risk management updates to the full Board of Directors. Additionally, the Board reviews risk management policies annually and receives monthly risk management and internal audit reports. The committee meets in executive session, without management present, with the head of the risk management and internal audit departments on a periodic basis. The Board also oversees the management of risks associated with its compensation and corporate governance practices through regular reports from its Compensation and Corporate Governance and Nominating Committees. A Compensation Risk Assessment Committee was appointed by the Compensation Committee in January 2010. The Compensation Risk Assessment Committee consists of members of senior management of the human resources, risk management, and internal audit functions and is charged with providing the Compensation Committee with an annual assessment of the risks associated with our corporate compensation plans and practices with a particular focus on incentive compensation arrangements.

Director Attendance

We do not have a formal policy regarding Director attendance at our annual meetings of shareholders. However, absent unavoidable extenuating circumstances, all of our Directors are expected to attend our annual meetings of shareholders and to be available to meet with shareholders before and after the meeting. We typically schedule a board meeting in conjunction with the annual meeting. All of our Directors attended our 2011 annual meeting.

During 2011, our Board of Directors met 13 times either in person or via conference calls. No Director attended fewer than 75% of the aggregate total number of meetings held during their service period and the total number of meetings held by all committees during their service period.

Executive Sessions

Executive sessions of our Board of Directors are those at which only non-employee Directors are present. The independent directors of the board met in executive session five times during 2011.

Shareholder Communications with our Board of Directors

Shareholders may correspond with the Chairman or any other member of our Board of Directors by writing a letter addressed to his or her attention in care of Monica F. Sullivan, Corporate Secretary at 707 Ridge Road, Munster, Indiana 46321. All correspondence addressed in this manner will remain sealed and will only be opened by the person to whom it is addressed. Employees and others who wish to contact a specific member of our Board or our Audit Committee to report complaints or concerns with respect to accounting, internal accounting controls, or auditing matters may do so confidentially by directing correspondence to the attention of the member, in care of our Vice President – Internal Audit at 707 Ridge Road, Munster, Indiana 46321.

RELATED PARTY TRANSACTIONS

Except as described below with respect to loans made by the Bank, all related party transactions for Directors, Executive Officers, and five percent shareholders must be approved by the Board of Directors, with any related Director recusing him or herself from any discussions and abstaining from voting on the matter. In October 2010, the Board of Directors adopted a Related Party Transaction Policy to establish a procedure by which the Company identifies, reviews, and approves certain transactions between the Company, its subsidiaries, including but not limited to the Bank, and those persons deemed to be “Related Parties.” Related party transactions are evaluated on a case-by-case basis in accordance with this policy and the applicable provisions of our Code of Ethics.

The Bank may, in accordance with federal regulations, extend credit to its Directors, officers, and employees, as well as members of their immediate families, in the ordinary course of business under substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank. These loans are made in accordance with the Bank’s underwriting guidelines and do not involve more than the normal risk of collectibility or present other unfavorable features. In addition, all loans made by the Bank to Directors in excess of $500,000 must be approved in advance by the Bank’s Board of Directors.

The Bank employs Michael P. Prisby, the son of Thomas F. Prisby, our former Chairman and Chief Executive Officer, as its Vice President and Corporate Investment Officer. Mr. Michael Prisby’s compensation and benefits for 2011 and 2010 totaled $195,735 and $213,461, respectively. Through July 31, 2010, the Bank also employed Sandra S. Prisby, the daughter of Thomas F. Prisby, as its Vice President of Corporate Strategic Planning and Sales Performance Management. Ms. Prisby’s compensation and benefits for 2010 totaled $155,932, which includes amounts paid in connection with her agreed separation of employment.

On November 18, 2010, CFS Bancorp, Inc. and its banking subsidiary, Citizens Financial Bank, entered into a Standstill Agreement (the Agreement) with PL Capital, LLC, John W. Palmer, Richard J. Lashley, and certain affiliates thereof (PL Capital Parties). Mr. Palmer was elected to the Company’s Board of Directors at its 2010 Annual Meeting of Shareholders as a result of the proxy contest conducted by the PL Capital Parties seeking to elect Mr. Palmer to the Board. Under the terms of the Agreement, the PL Capital Parties agree that from the date of the Agreement and continuing through the first business day following the date on which the Company’s 2012 Annual Meeting of Shareholders is held, among other things, (1) to vote the shares of the Company’s common stock beneficially owned by them in favor of the Directors nominated by the Board for election at the Company’s 2011 Annual Meeting of Shareholders and the 2012 Meeting; (2) to vote the shares of the Company’s common stock beneficially owned by them in accordance with the recommendation of the Company’s Board with respect to any other proposal not involving the election of directors at any annual or special meeting of shareholders of the Company held during the Standstill Period; and (3) not to bring any shareholder proposals before the 2011 Meeting or the 2012 Meeting.

Furthermore, the PL Capital Parties agreed not to (1) initiate any acquisition of assets of the Company; (2) form, join, or participate in a group (as defined under federal securities laws), other than the group involving PL Capital Parties, for the purpose of acquiring, holding, voting, or disposing of the Company’s securities; (3) seek to control management of the Company; (4) seek to remove any member of the Board; (5) participate in the solicitation of proxies or consents of shareholders of the Company; (6) seek a change in control of management of the Company; (7) call or seek to call a special meeting of shareholders of the Company; or (8) assist, induce, or encourage any other person to take any of the above actions.

In view of the agreement of the PL Capital Parties to the terms summarized above and as further set forth in the Agreement, in 2011 the Company reimbursed the PL Capital parties for a portion of their out-of-pocket expenses incurred in connection with their efforts to nominate and elect Mr. Palmer to the Board at the 2010 meeting in an amount equal to $150,000.

BOARD COMMITTEES AND RELATED MATTERS

Audit Committee

The Audit Committee is comprised solely of independent members of our Board of Directors, as defined by NASDAQ listing standards and SEC rules and regulations. The members of the committee are Messrs. Ross (Chairman), Blaine, and Palmer. Our Board has determined that all members of this committee are financially literate and that Mr. Ross is an “Audit Committee financial expert” as defined by the SEC. The committee met five times during 2011. The committee’s charter can be viewed on our website at www.citz.com – Investor Relations – Governance Documents.

The Audit Committee’s primary function is to provide oversight of the integrity of our financial statements, the qualifications and independence of our independent auditors, the performance of our risk management and internal audit function, and our compliance with certain applicable accounting, legal, and regulatory requirements. In addition, among other responsibilities, the committee also appoints, oversees the performance of, and approves the fees of our independent auditors; reviews and discusses with management and the independent auditors our annual audited and quarterly financial statements; reviews with management and the independent auditors the adequacy and effectiveness of our internal controls, including our disclosure controls and procedures; discusses with management our major financial risk exposures and monitors the steps taken to control such risks; assures that we maintain a risk management and internal audit function; periodically reviews critical accounting policies, accounting treatments, and material written communications between management and the independent auditors; annually reviews the committee’s charter and evaluates the committee’s performance; reviews and recommends any changes to our Code of Ethics; and prepares the committee report for inclusion in our annual meeting proxy statement.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee is comprised solely of independent members of our Board of Directors, as defined by NASDAQ listing standards. The members of the committee are Ms. Simon (Chairman), and Messrs. Blaine, Diamond, and Ross. The committee met five times in 2011. The committee’s charter can be viewed on our website at www.citz.com – Investor Relations – Governance Documents.

The primary responsibilities of the Corporate Governance and Nominating Committee are to assist our Board of Directors by identifying individuals who are qualified to serve as Directors of our Company; recommending to our Board the slate of Director nominees for election at each annual meeting of shareholders; recommending to our Board any matters relating to the size and membership of our Board’s committees; reviewing and recommending changes to our by-laws as they relate to corporate governance matters and our corporate governance principles and policies; and overseeing the evaluation process of our Board. Additional responsibilities include, among others, reviewing possible candidates for election to our Board; determining the qualifications that the committee will consider when evaluating potential Director nominees; assessing the needs for any new standing committees of our Board; and annually reviewing the committee’s charter and evaluating the committee’s performance.

Executive Committee

The members of the Executive Committee of the Bank’s Board of Directors consist of the CEO and any two of the Independent Directors. The CEO serves as Chairman of the Executive Committee. All three members are required to constitute a quorum at any meeting of the committee. The committee is authorized to exercise the power of the Board of Directors between board meetings. The committee mainly exists for the purpose of reviewing and implementing business policies and making business decisions that need to be made but do not require or merit discussion and review by the full Board or that involve time sensitive matters where it is not practical to gather the full Board. The committee did not meet during 2011.

Consideration of Director Candidates

Role of Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee makes a recommendation to the Board of Directors each year of individuals to be nominated for election as Directors at our annual meeting of shareholders. In the event vacancies occur on the Board during the year, the committee also may make recommendations of persons to fill these vacancies. After considering the committee’s recommendations, the Board ultimately determines the Director nominations or the appointments to fill vacancies.

The Corporate Governance and Nominating Committee will consider candidates for Board membership suggested by the committee’s members, by other members of our Board of Directors, and by our shareholders. For existing Directors to be nominated for re-election at an annual meeting, the committee will consider, among other things, the Director’s performance on our Board, his or her attendance record at Board and committee meetings, the needs of our Company, and the ability of the Director to continue to satisfy our established Director qualifications.

With respect to new members of our Board of Directors, the Corporate Governance and Nominating Committee will consider the needs of our Company as well as whether the potential candidate satisfies our Director qualifications. When the committee determines a need exists, the committee will recommend new Directors to replace existing Directors, to add new members to our Board in the event the size of our Board is increased, or to fill vacancies. In the case of new Directors, after the committee has identified a prospective Director nominee and has conducted an initial evaluation of the candidate, the committee will interview the candidate. If the committee believes the candidate would be an appropriate addition to our Board, the committee will recommend to the full Board that the individual be considered for a Director position. Our Board then determines whether to nominate the person for election at an annual meeting of shareholders or be appointed to fill a vacancy on our Board.

Suggestions by Shareholders. The Corporate Governance and Nominating Committee will consider suggestions by our shareholders of individuals to serve on our Board of Directors in connection with the committee’s recommendations to the full Board of Director nominees for election at the annual meeting. Because we believe our Board works best when operated in a spirit of collegiality, mutual respect, and trust, unsolicited recommendations regarding potential Director candidates may be subject to additional scrutiny and reliable references will be required for all prospective members. The committee will take special care to insure that potential candidates do not possess undisclosed motives for seeking the nomination, conflicting loyalties to special interest groups, or a desire to represent a distinct subset of our shareholders.

Any shareholder desiring to make a suggestion to the Corporate Governance and Nominating Committee of a possible Director nominee should follow the procedures set forth in Article V, Section 14 of our by-laws which are summarized under Shareholder Proposals and Nominations. A complete copy of our amended and restated by-laws is available to our shareholders free of charge upon written request to Monica F. Sullivan, Corporate Secretary at 707 Ridge Road, Munster, Indiana 46321.

Qualifications of Directors. Given the nature of our business, the Corporate Governance and Nominating Committee seeks to recruit and retain Directors with significant executive and financial experience. Additional qualities, among others, that the committee considers important include:

| |

| • | ability and willingness to apply sound independent business judgment; |

| |

| • | overall business experience and skills, including high-level leadership experience in business or administrative activities; |

| |

| • | breadth of knowledge about issues affecting our business; |

| |

| • | ability and willingness to contribute special competencies to our Board of Directors; |

| |

| • | judgment, knowledge, and viewpoints that are likely to enhance our Board’s ability to manage our business affairs; |

| |

| • | loyalty and concern for our continued long-term success and welfare; |

| |

| • | awareness of a Director’s vital part in corporate citizenship and image; |

| |

| • | commitment to investing the time necessary to prepare for and attend meetings of our Board of Directors; |

| |

| • | willingness to assume fiduciary responsibility; and |

| |

| • | ability to represent the best interests of all shareholders. |

We believe that the backgrounds and qualifications of our Directors, considered as a group, should provide a significant breadth of experience, knowledge, and abilities that will enhance the quality of our Board’s deliberations and decisions and that will assist our Board of Directors in fulfilling its responsibilities. While we do not have a specific policy with regard to consideration of diversity in identifying Director nominees, the Corporate Governance and Nominating Committee will take into consideration each candidate’s contribution to our Board’s overall diversity. We broadly construe diversity to mean a variety of perspectives, skills, opinions, experiences, and backgrounds, such as gender, race, and ethnicity differences, as well as other differentiating characteristics.

Compensation Committee

The Compensation Committee is comprised solely of independent members of our Board of Directors, as defined by NASDAQ listing standards. The members of the committee are Messrs. Diamond (Chairman) and Blaine and Ms. Simon. The committee held eight meetings in 2011. The committee charter can be viewed on our website at www.citz.com – Investor Relations – Governance Documents.

The Compensation Committee, among other responsibilities, designs, implements, and approves the compensation and benefit programs for our Executives; evaluates the performance of our Chief Executive Officer; reviews and recommends to the Board the base salary and short- and long-term compensation of the Officers named in the Summary Compensation Table of this proxy statement including our Chief Executive Officer (our Named Executive Officers, or NEOs); administers certain of the benefit plans in which our NEOs and Directors participate; reviews and makes recommendations to our Board regarding any employment, change-in-control, or severance agreements for NEOs; annually reviews and reports to our Board on the implementation and development of a succession plan for the Chief Executive Officer and contingencies for all Vice Presidents and above; and annually reviews the committee’s charter and evaluates the committee’s performance.

Compensation Committee Interlocks and Insider Participation

There were no Compensation Committee interlocks during 2011, which generally means that no Executive Officer of CFS served as a Director or member of the Compensation Committee of another entity, one of whose Executive Officers served as a Director or member of our Compensation Committee.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

Our overall compensation program and the amounts paid or provided to certain of our executive officers are described in the remainder of this Compensation Discussion and Analysis and the accompanying tables and narrative below. This information makes up the executive compensation which our shareholders are being asked to approve in Proposal 3 - Advisory (Non-Binding) Vote to Approve the 2011 Named Executive Officer Compensation at the Annual Meeting.

The following discussion, tables, and narrative focus on compensation paid or provided to those individuals who served as our Chief Executive Officer during 2011 (presently Mr. Pomranke, and formerly Mr. Prisby), our Chief Financial Officer (Mr. Weberling), and the two other executive officers who were the most highly compensated of our other executives and have decision making authority (Messrs. Clapp and Zimmer). We, at times, refer to these individuals as our named executive officers or NEOs.

2011 Performance and Compensation Decisions

Our performance in 2011 was adversely impacted by the economic environment as we reported a net loss for the year. As a result:

| |

| • | We did not pay any cash incentive bonuses to our executive officers for 2011; |

| |

| • | We made limited market and performance-based salary adjustments in February 2011 affecting Messrs. Pomranke, Weberling, Clapp, and Zimmer; and |

| |

| • | As we have in prior years, we made performance- and service-based long-term incentive awards to Messrs. Pomranke, Weberling, Clapp, and Zimmer for incentive and retention purposes and to further align their interests with that of our shareholders. |

In addition, in connection with Mr. Prisby’s retirement, we successfully transitioned the role of Chief Executive Officer to Mr. Pomranke. We entered into a retirement agreement with Mr. Prisby to secure his continued assistance with transitional matters and reaffirmation of his obligations with respect to non-competition, non-solicitation, and confidentiality covenants, in return for certain payments. For a discussion of this agreement, see Retirement Agreement below.

Compensation Philosophy and Objectives

The Compensation Committee of our Board of Directors administers our overall Executive Compensation Program. We seek to reward our NEOs with a total compensation package that is competitive and aligned with the financial and non-financial business goals supporting our business strategy. When deemed appropriate, our Compensation Committee will seek input from its compensation consultant, the Hay Group, with respect to competitive practice.

Our compensation philosophy and objectives have guided several important compensation-related decisions, including:

| |

| • | A significant portion of each NEO’s total compensation (up to 45% for 2011) is contingent upon, and variable with, achievement of corporate, business unit, and/or individual performance objectives; |

| |

| • | Equity awards are made to closely align the interests of our executives with our shareholders; and |

| |

| • | Employment and change-in-control agreements with our NEOs are designed to promote continuity and stability of management. |

Elements of Executive Compensation

The major components of our executive compensation program for NEOs are comprised of the following elements:

| |

| • | performance-based annual cash incentives; |

| |

| • | long-term equity-based awards; |

| |

| • | service-based cash retention awards; and |

| |

| • | retirement, other benefits, and perquisites. |

Base Salary

We believe that base salary is a key element in attracting and retaining the necessary executive talent and must be both competitive and reflective of an executive’s responsibilities and inherent value to CFS. Individual salaries for NEOs are reviewed annually, and if warranted, adjusted to take into account such factors as individual performance, promotions, increased responsibilities, industry conditions, market competition, and financial performance, and advice from the Hay Group. In addition, the minimum base salaries of Messrs. Pomranke and Weberling provided for in their individual employment agreements are taken into consideration. For a discussion of these agreements, see Employment Agreements below.

In February 2011, our then Chief Executive Officer recommended and the Compensation Committee approved modest increases for Messrs. Pomranke, Weberling, Clapp, and Zimmer. These increases were based on the Committee’s assessment of performance and the market positioning of each executive officer’s base salary relative to earlier data provided by the Hay Group. Mr. Prisby’s base salary was not increased based on a comparison to market.

In connection with Mr. Pomranke’s appointment as Chief Executive Officer of the Company and the Bank, effective January 1, 2012, Mr. Pomranke’s annual base salary was increased to $290,000. On January 20, 2012, the Compensation Committee approved annual base salary increases for the other three NEOs, Messrs. Weberling, Clapp, and Zimmer. On February 27, 2012, Mr. Pomranke and the other NEOs declined to accept the approved base salary increases as they believe it is in the best interests of the Company and its shareholders and employees to delay any compensation increases until additional progress is made in executing the Company’s Strategic Growth and Diversification Plan.

Performance-based Annual Cash Incentive Awards

In January 2011, we established a targeted cash incentive (a percentage of average base compensation) and set performance objectives for each NEO for the fiscal year.

In establishing performance objectives, the Committee considered input from management, concerning: operating forecasts and industry outlooks; specific performance objectives; measurability of performance objectives; and alignment of performance objectives with the overall strategic plan and budget of CFS. The performance objectives for 2011 were position specific and included corporate, business unit, and/or individual performance objectives that varied depending on the NEO.

After performance objectives were established for each NEO, a weighted percentage was assigned to each objective relative to the impact it would have in achieving our strategic objectives and the respective NEO’s ability to impact the execution of the particular performance measure. Under the Cash Incentive Plan, the Committee determines in February of the following year whether awards are earned and therefore paid. The Compensation Committee determined that the Company must be profitable in order for the NEOs annual cash incentives determined under the plan to be earned and paid. Because we incurred at net loss for 2011, no cash incentive bonuses were earned.

Long-term Equity-based Incentive Awards

We believe that long-term equity-based compensation can be an effective means of creating a link between the compensation provided to specified employees, including our NEOs, and gains realized by our shareholders on their investment in CFS common stock. We utilize both performance- and service-based equity compensation as a way to align the interests of our employees with the interests of our shareholders. We believe these awards encourage employees to create shareholder value through the prospect of higher stock values, thereby increasing the value of their award.

During 2011, a total of 11,818 performance-based restricted stock awards were granted to our NEOs as follows: Mr. Pomranke – 5,667 shares; Mr. Weberling – 2,587 shares; Mr. Clapp – 2,134 shares; and Mr. Zimmer – 1,430 shares. Mr. Prisby was not awarded shares of performance-based restricted stock.

The performance-based restricted stock awards granted in 2011 were subject to the achievement of a performance objective relating to our 2011 fiscal year, as well as service-based vesting requirements. We decided to use a one-year performance period because of the difficulty of establishing performance targets for more than a single year due to the present challenging and uncertain economic conditions. If the performance objective was achieved, the awards were earned.

If earned, the awards would then vest at a rate of 33% on May 1, 2013, 33% on May 1, 2014, and 34% on May 1, 2015 only if the NEO continued to be employed by us on the applicable vesting dates. If the NEO is not employed by us on a vesting date, the unvested portion of an earned award is forfeited.

We established diluted earnings per share as the corporate performance objective for the 2011 performance-based restricted stock awards. The percentage of the 2011 performance-based restricted stock awards earned by the NEOs was based on the level of diluted earnings per share achieved by the Company as of December 31, 2011 relative to the established targets of diluted earnings per share. The following table shows the performance targets and the percentage of the award that would be earned for achieving various levels of performance. If we achieve performance between two targets, we perform a mathematical interpolation to calculate the bonus payout percentage.

|

| | | | |

2011 Diluted Earnings Per Share Targets | | % of Award Earned |

| $(.27) | | — | % | |

| .37 | | 50 |

| |

| .44 | | 75 |

| |

| .61 | | 100 |

| |

Our net loss per share for the year ended December 31, 2011 was $(.98), below the threshold amount. Consequently, all of the 2011 performance-based restricted stock awards were considered unearned and forfeited.

During 2011, a total of 7,879 service-based restricted stock awards were granted to our NEOs as follows: Mr. Pomranke – 3,778 shares; Mr. Weberling – 1,725 shares; Mr. Clapp – 1,423 shares; and Mr. Zimmer – 953 shares. The 2011 service-based restricted stock awards will vest at a rate of 33% on May 1, 2013, 33% on May 1, 2014, and 34% on May 1, 2015, only if the NEO continues to be employed by us on the applicable vesting dates.

In connection with Mr. Pomranke’s appointment as CEO, effective January 1, 2012, Mr. Pomranke was awarded 20,000 options to purchase shares of the Company’s common stock at an exercise price of $4.40 per share, the closing price of the Company’s common stock on that date. The options vest ratably over four years on each anniversary date of the award.

In February 2012, the Compensation Committee approved the granting of 7,446 performance-based restricted stock awards to our NEOs as follows: Mr. Weberling – 3,132 shares; Mr. Clapp – 2,583 shares; Mr. Zimmer – 1,731 shares. Mr. Pomranke was not awarded shares of performance-based restricted stock.

In February 2012, the Compensation Committee approved the granting of 4,964 service-based restricted stock awards to our NEOs as follows: Mr. Weberling – 2,088 shares; Mr. Clapp – 1,722 shares; Mr. Zimmer – 1,154 shares. Mr. Pomranke was not awarded shares of service-based restricted stock.

401(k) Retirement Plan