Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2003, OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER 0-29375

SAVVIS COMMUNICATIONS CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| DELAWARE | 43-1809960 | |

(STATE OR OTHER JURISDICTION OF INCORPORATION OR ORGANIZATION) | (I.R.S. EMPLOYER IDENTIFICATION NO.) |

1 SAVVIS PARKWAY

TOWN & COUNTRY, MISSOURI 63017

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICE) (ZIP CODE)

(314-628-7000)

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $.01 per share

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates of the registrant as of June 30, 2003 was approximately $70,730,669 based upon the last reported closing sales price of $0.90 as reported on the Nasdaq SmallCap Market Index of such equity on such date.

The number of shares of the registrant’s common stock outstanding as of April 20, 2004 was 109,330,911.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

| Page | ||||

| PART III | ||||

Item 10. | 2 | |||

Item 11. | 6 | |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Matters | 13 | ||

Item 13. | 17 | |||

Item 14. | 22 | |||

| PART IV | ||||

Item 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 22 | ||

| 23 | ||||

Table of Contents

EXPLANATORY NOTE

The primary purpose of this Amendment is to provide information required by Items 10, 11, 12, 13 and 14 of Part III of this report which the registrant intended to incorporate by reference from the registrant’s proxy statement for the 2004 Annual Meeting of Stockholders.

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

The following table contains information regarding our executive officers and directors:

Name | Age | Position and Office | ||

| Robert A. McCormick | 38 | Chief Executive Officer and Chairman of the Board | ||

| John M. Finlayson | 49 | President, Chief Operating Officer and Director | ||

| Jeffrey H. Von Deylen | 40 | Chief Financial Officer and Director | ||

| Grier C. Raclin | 51 | Chief Legal Officer and Corporate Secretary | ||

| James D. Mori | 48 | Managing Director – Americas | ||

| Matthew A. Fanning | 50 | Managing Director – Strategic Accounts | ||

| John D. Clark | 39 | Director | ||

| Clifford H. Friedman | 44 | Director | ||

| Clyde A. Heintzelman | 65 | Director | ||

| Thomas E. McInerney | 62 | Director | ||

| James E. Ousley | 57 | Director | ||

| James P. Pellow | 42 | Director | ||

| Patrick J. Welsh | 60 | Director |

Set forth below is a brief description of the principal occupation and business experience of each of our directors and executive officers.

ROBERT A. McCORMICK has served as the Chairman of our board of directors since April 1999 and as our Chief Executive Officer since November 1999. Mr. McCormick served as Executive Vice President and Chief Technical Officer of Bridge Information Systems, Inc., now known as BIS Administration, Inc. (“Bridge”), a principal stockholder of our company, from January 1997 to December 1999, and held various engineering, design and development positions at Bridge from 1989 to January 1997. On February 15, 2001, Bridge’s U.S. operating subsidiaries filed a voluntary petition for relief under Chapter 11 of Title 11 of the United States Bankruptcy Code. Mr. McCormick was named Person of the Year by Service Provider Weekly in 2003 and Best Executive at the International Business Awards in 2004. Mr. McCormick attended the University of Colorado at Boulder.

JOHN M. FINLAYSON has served as our President and Chief Operating Officer since December 1999 and as a director of our company since January 2000. From June 1998 to December 1999, Mr. Finlayson served as Senior Vice President of Global Crossing Holdings, Ltd. and President of Global Crossing International, Ltd. Before joining Global Crossing, Mr. Finlayson was employed by Motorola, Inc. starting in 1994, most recently as Corporate Vice President and General Manager of the Asia Pacific Cellular Infrastructure Group from March 1998 to May 1998. Mr. Finlayson received a B.S. degree in Marketing from LaSalle University, a M.B.A. degree in Marketing and a post-M.B.A. certification in Information Management from St. Joseph University.

JEFFREY H. VON DEYLEN has served as our Chief Financial Officer and a director since March 2003, after joining us as Executive Vice President for Finance in January 2003. From August 2002 to January 2003, Mr. Von Deylen served as Vice President for Corporate Development and Financial Analyst at American Electric Power Company. From June 2001 to June 2002, Mr. Von Deylen served as Chief Financial Officer for KPNQwest N.V. (“KPNQwest”). In 2002 KPNQwest filed a petition for “surseance” (moratorium) in The Netherlands, which moratorium was converted into a bankruptcy shortly thereafter. Before joining KPNQwest, he was employed by Global TeleSystems Inc. (“GTS”) as Senior Vice President of Finance from October 1999 to May 2001. In 2001, GTS filed, in pre-arranged proceedings, a petition for “surseance” (moratorium), offering a composition, in The Netherlands and a voluntary petition for relief under Chapter 11 of Title 11 of the United States Bankruptcy Code, both in connection with the sale of the company to KPNQwest. From

2

Table of Contents

June 1998 until September 1999, Mr. Von Deylen served as Vice President and Corporate Controller of Qwest Communications International . Mr. Von Deylen received a B.S. degree in Accountancy from Miami University and holds a C.P.A. certification.

GRIER C. RACLIN has served as our Chief Legal Officer and Corporate Secretary since joining us in January 2003. Mr. Raclin is responsible for the company’s legal and regulatory affairs, as well facilities and procurement. Prior to joining SAVVIS, Mr. Raclin served as Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary 2000 to 2002 and as Senior Vice President of Corporate Affairs, General Counsel, and Corporate Secretary from 1997 to 2000 of Global TeleSystems Inc. (“GTS”). In 2001, GTS filed, in pre-arranged proceedings, a petition for “surseance” (moratorium), offering a composition, in The Netherlands and a voluntary petition for relief under Chapter 11 of Title 11 of the United States Bankruptcy Code, both in connection with the sale of the company to KPNQwest. Mr. Raclin earned his law degree from Northwestern University Law School in Chicago, Illinois; attended business school at the University of Chicago Executive Program; and earned his B.S. degree in philosophycum laude from Northwestern University.

JAMES D. MORI has served as our Managing Director – Americas since joining us in October 1999. Mr. Mori is responsible for our sales efforts in the United States, Canada and Latin/South America. Previously, Mr. Mori served as Area Director for Sprint Corporation from February 1997 to October 1999 and in various other sales leadership positions prior to that. Mr. Mori received a B.S. in business administration from the University of Missouri.

MATTHEW A. FANNING joined us in February 2000 and serves as our Managing Director – Strategic Accounts. Mr. Fanning oversees our relationships with Reuters and Moneyline, our two largest customers. Prior to joining SAVVIS, from March 1997 to February 2000, Mr. Fanning served as Vice President-Marketing and Sales for Comcast Corporation. Mr. Fanning earned his post-MBA certification in Information System Management and his MBA in Marketing from St. Joseph’s University. He received a B.A. in English Literature from St. Joseph’s College.

JOHN D. CLARK has served as a director of our company since April 2002. Mr. Clark is a general partner of Welsh, Carson, Anderson & Stowe, a private equity investment firm, and affiliated entities, which collectively are a principal stockholder of our company. Prior to joining Welsh, Carson, Anderson & Stowe in 2000, Mr. Clark was a general partner at Saunders, Karp & Megrue, a private equity firm, where he was employed from 1993 until 2000. Mr. Clark received a B.S. from Princeton University and a M.B.A. from Stanford University Graduate School of Business.

CLIFFORD H. FRIEDMAN has served as a director of our company since July 2002. Since August 1997, Mr. Friedman served as senior managing director of Constellation Ventures, a Bear Stearns asset management fund. Mr. Friedman earned a B.S. in Electrical Engineering and Computer Science and a M.S. in Electrophysics from Polytechnic Institute of New York, and a M.B.A. in Finance and Investments from Adelphi University.

CLYDE A. HEINTZELMAN has served as a director of our company since December 1998, and is chairman of the board’s audit committee. Mr. Heintzelman served as the chairman of the board of Optelecom, Inc., from February 2000 to June 2003 and as its interim president and chief executive officer from June 2001 to January 2002. From November 1999 to May 2001, he was president of Net2000 Communications, Inc. On November 16, 2001, Net2000 Communications and its subsidiaries filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Bankruptcy Code. From December 1998 to November 1999, Mr. Heintzelman served as our president and chief executive officer. Mr. Heintzelman serves on the board of TeleCommunication Systems, Inc., where he chairs the compensation committee. Mr. Heintzelman received a B.A. in marketing from the University of Delaware and did graduate work at Wharton, the University of Pittsburgh, and the University of Michigan.

THOMAS E. McINERNEY has served as a director of our company since October 1999 and is a member of the board’s compensation committee. Since 1987, Mr. McInerney has been a general partner of Welsh, Carson, Anderson & Stowe, a private equity investment firm, and affiliated entities, which collectively are a principal stockholder of our company. He is a director of the following publicly-held companies: The BISYS Group, Centennial Communications Corporation, and ITC DeltaCom, Inc. Mr. McInerney also served as the chairman of the executive committee of the board of Bridge, which assumed the responsibilities of the chief executive officer of Bridge, from November 2000 until February 2001. Mr. McInerney received a B.A. from St. John’s University and attended New York University Graduate School of Business Administration.

JAMES E. OUSLEY has served as a director of our company since April 2002 and is a member of the board’s audit and compensation committees. Mr. Ousley served as the president and chief executive officer and director of Vytek Corporation from 2001 until April 2004. From 1999 to 2002, he also served as chairman, CEO and president of Syntegra

3

Table of Contents

Inc. (USA), a division of British Telecommunications. From September 1991 to August 1999, Mr. Ousley served as president and CEO of Control Data Systems. Mr. Ousley serves on the boards of ActivCard, Inc., Bell Microproducts, Inc., California Amplifier, Inc., Datalink, Inc., and Norstan, Inc. Mr. Ousley received a B.S. from the University of Nebraska.

JAMES P. PELLOW has served as a director of our company since April 2002 and is a member of the board’s audit committee. Mr. Pellow has served at St. John’s University as the executive vice president and treasurer since 1999 and from 1998 until 1999 as senior vice president and treasurer. From 1991 to 1998, Mr. Pellow served in various other senior positions at St. Johns University. Mr. Pellow serves on the board of Centennial Communications Corporation, where he chairs the audit committee. Mr. Pellow is a C.P.A. and received a B.B.A. and a M.B.A. from Niagara University.

PATRICK J. WELSH has served as a director of our company since October 1999 and is chairman of the board’s compensation committee. Mr. Welsh was a co-founder of the private equity investment firm Welsh, Carson, Anderson & Stowe. He has served as a general partner of Welsh, Carson, Anderson & Stowe and affiliated entities since 1979, which collectively are a principal stockholder of our company. Mr. Welsh received a B.A. from Rutgers University and a M.B.A. from the University of California at Los Angeles.

Pursuant to an investor rights agreement among us, entities and individuals affiliated with Welsh, Carson, Anderson & Stowe VIII, L.P. (“WCAS VIII”), Reuters Holdings Switzerland SA (“Reuters”), a group of funds affiliated with Constellation Ventures (the “Constellation Entities”) and various other entities, we agreed that, among other things, so long as WCAS VIII and its affiliates own voting stock representing more than 50% of the voting power represented by our outstanding voting stock, they have the right to nominate for election to the board of directors at least half of the members of the board. WCAS VIII and its affiliates owned, as of April 15, 2004, approximately 53% of our outstanding voting power, and accordingly have nominated Messrs. Welsh, McInerney, Clark, Finlayson, and Von Deylen for election to the board. Pursuant to the terms of the investor rights agreement, the Constellation Entities are entitled to nominate one person for election to our board of directors, and accordingly have nominated Mr. Friedman. For a more detailed description of the investor rights agreement, see “Item 13. Certain Relationships and Related Transactions — Transactions with Welsh, Carson” and “— Transactions with the Constellation Entities”.

Members of our board of directors are elected each year at our annual meeting of stockholders, and serve until the next annual meeting of stockholders and until their respective successors have been elected and qualified. Our officers are elected annually by our board of directors and serve at the board’s discretion.

Audit Committee

Our audit committee consists of Clyde A. Heintzelman, James E. Ousley and James P. Pellow. The board believes that Messrs. Heintzelman, Ousley and Pellow are, “independent directors,” as such term is defined in NASD’s Rule 4200(a)(15). In making this determination, the board considered that Mr. Pellow is the executive vice president and treasurer of St. John’s University and that Mr. McInerney, another of our directors and a general partner of Welsh, Carson, Anderson & Stowe, our principal stockholder, has made significant charitable contributions to St. John’s University in his individual capacity over the last several years. The board of directors determined, after considering the size of the contributions relative to the size of St. John’s University’s revenues and the fact that the contributions were made by Mr. McInerney personally and not by the company or Welsh, Carson, Anderson & Stowe, that the existence of such contributions would not interfere with Mr. Pellow’s exercise of independent judgment in carrying out his responsibilities as a director. Separately, the board has determined that Mr. Pellow, one of its independent directors, is an “audit committee financial expert” as defined by the rules and regulations of the U.S. Securities and Exchange Commission.

The responsibilities of our audit committee include:

| • | engaging an independent audit firm to audit our financial statements and to perform services related to the audit; |

| • | reviewing the scope and results of the audit with our independent auditors; |

| • | considering the adequacy of our internal accounting control procedures; and |

| • | considering auditors’ independence. |

The board of directors has adopted a written charter for the audit committee. The audit committee held thirteen meetings during fiscal year 2003.

4

Table of Contents

Compliance with Section 16 of the Securities Exchange Act.

Section 16(a) of the Securities and Exchange Act of 1934 requires directors and executive officers and persons who own more than 10% of a registered class of equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of our company. Such reporting persons are required by rules of the SEC to furnish us with copies of all Section 16(a) reports they file. To our knowledge, based solely upon a review of Section 16(a) reports furnished to us for fiscal year 2003 and written representations that no reports on Form 5 were required, we believe that our directors, executive officers and greater than ten percent stockholders complied with all Section 16(a) filing requirements applicable to them with respect to transactions during 2003, except that Mr. Pellow failed to file a Form 4 on a timely basis with respect to a purchase of shares of our common stock, Messrs. Fanning, Finlayson, Hokamp, McCormick, Costantino, and Mori failed to file Form 4s on a timely basis with respect to grants of stock options and Mr. Hokamp failed to file a Form 4 on a timely basis with respect to a sale of shares of our common stock. The required filings were made promptly after noting the failure to file.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all directors and employees, including our principal executive, financial and accounting officers. The Code of Business Conduct and Ethics is posted on our website at www.savvis.net. We intend to satisfy the requirements under Item 10 of Form 8-K regarding disclosure of amendments to, or waivers from, provisions of our Code of Business Conduct and Ethics that apply, by posting such information on our website.

5

Table of Contents

ITEM 11. EXECUTIVE COMPENSATION

The following table provides you with information about compensation earned during each of the last three fiscal years by our chief executive officer and the other four most highly compensated executive officers employed by us in fiscal year 2003, who we refer to as our named executive officers.

Summary Compensation Table (1)

Name and Principal Position | Year | Salary | Bonus | Long-Term Compensation Awards | All Other Compensation (2) | |||||||||||

Securities Options | ||||||||||||||||

Robert A. McCormick | 2003 2002 2001 | $ | 400,000 400,000 400,000 | $ | 0.00 88,658 260,760 | (6) (3) (4) | — 4,734,965 450,050 | (3) (5) | $ | 2,400 2,400 2,400 | | |||||

John M. Finlayson | 2003 2002 2001 | | 400,000 400,000 400,000 | $ | 0.00 73,882 217,300 | (6) (3) (4) | — 4,084,553 379,210 | (3) (5) | | 2,400 2,400 2,400 | | |||||

Jeffrey H. Von Deylen(7) | 2003 | 233,502 | 100,000 | (6) | 1,000,000 | 75,419 | (9) | |||||||||

Grier C. Raclin(8) | 2003 | 245,000 | 171,500 | (6) | 1,000,000 | 2,400 | ||||||||||

James D. Mori | 2003 2002 2001 | | 218,000 218,000 218,000 | | 25,000 29,553 86,920 | (6) (3) (4) | — 1,170,486 185,020 | (3) (5) | | 2,400 2,400 2,400 | | |||||

| (1) | In accordance with the rules of the SEC, the compensation described in this table does not include medical, group life insurance or other benefits received by the executive officers that are available generally to all salaried employees and various perquisites and other personal benefits received by the executive officers, which do not exceed the lesser of $50,000 or 10% of any officer’s salary and bonus disclosed in this table. |

| (2) | Consists of matching contributions made under our 401(k) plan in the amount of $2,400. |

| (3) | Bonuses for fiscal year 2002 were paid partially in cash and the remainder were paid in stock option grants. The cash portion of the bonuses was awarded in April 2003. The stock option grants were awarded in June 2003. These options were fully vested when granted and had an aggregate discount amount (the difference between the fair market value per share of our common stock and the exercise price on the grant date) of $132,988 for Mr. McCormick, $110,823 for Mr. Finlayson and $44,329 for Mr. Mori. Mr. McCormick was granted options for 340,994 shares of common stock at an exercise price of $.39 per share; Mr. Finlayson was granted options for 284,162 shares of common stock at an exercise price of $.39 per share; and Mr. Mori was granted options for 113,665 shares of common stock at an exercise price of $.39 per share. |

| (4) | Cash bonuses for fiscal year 2001 were awarded in October 2002. |

| (5) | These options were granted subject to the approval by our stockholders of an amendment to our stock option plan increasing the number of shares issuable under the plan. As we did not submit the amendment to our stock option plan to a vote of our stockholders within the prescribed time period, these options lapsed on January 23, 2002 pursuant to their terms. |

6

Table of Contents

| (6) | Cash bonuses for fiscal year 2003 were awarded in February 2004 and paid in April 2004. |

| (7) | Mr. Von Deylen joined our company in January 2003. |

| (8) | Mr. Raclin joined our company in January 2003. |

| (9) | Includes $73,019 in moving expenses paid by us for Mr. Von Deylen’s relocation expenses. |

Option Grants in Last Fiscal Year

The following table shows grants of stock options to each of our named executive officers during 2003. The percentages in the table below are based on options to purchase a total of 9,324,845 shares of our common stock granted to all our employees and directors in 2003. The numbers are calculated based on the requirements of the SEC and do not reflect our estimate of future stock price growth.

Options Granted In 2003

| Individual Grants | Grant Date Value(2) | ||||||||||||||

Name | Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees in 2003 | Exercise Price per Share(1) | Expiration Date | |||||||||||

Robert A. McCormick | 340,994 | 3.7 | % | $ | 0.39 | 6/25/2013 | $ | 237,161 | |||||||

John M. Finlayson | 284,162 | 3.0 | % | $ | 0.39 | 6/25/2013 | $ | 197,635 | |||||||

Jeffrey H. Von Deylen | 1,000,000 | 10.7 | % | 750,000/ $ 250,000/ $ | 0.40 1.49 | (3) | 1/2/2013 | $ | 264,000 | (3) | |||||

Grier C. Raclin | 1,000,000 | 10.7 | % | 750,000/ $ 250,000/ $ | 0.40 1.49 | (3) | 1/2/2013 | $ | 263,025 | (3) | |||||

James D. Mori | 113,665 | 1.2 | % | $ | 0.39 | 6/25/2013 | $ | 79,054 | |||||||

| (1) | Options were granted to Messrs. McCormick, Finlayson, and Mori under one grant, were fully vested when granted, and had a discounted exercise price (such price being 50% of the fair market value per share of our common stock on the date of grant, June 25, 2003). Options were granted to Messrs. Von Deylen and Raclin in the amount of 1,000,000 each, under two separate grants, containing different vesting schedules. The first tranche of options granted to Mr. Von Deylen and Mr. Raclin in the amount of 750,000 each have a four-year vesting schedule and are valued at the fair market value determined as of the date of grant, January 2, 2003. The second tranche of options granted to Mr. Von Deylen and Mr. Raclin in the amount of 250,000 each have a three-year vesting schedule beginning in January 2003. Additionally, the fair market value will be determined one year after the grant date of January 2, 2003. |

| (2) | Options were valued under the Black-Scholes option pricing methodology, which produces a per share option price ranging from $0.35 to $0.70, using the following assumptions and inputs: expected option life ranging from 3 to 4 years, expected price volatility ranging from 146% to 151%, dividend yield of zero, and an interest rate ranging from 2% to 3% based on the 3-year and 5-year Treasury yield curve rates. The actual value, if any, the employee may realize from these options will depend solely on the gain in stock price over the exercise price when the options are exercised. |

| (3) | Per footnote 1 above, the 250,000 options each granted to Mr. Von Deylen and Mr. Raclin could not be valued until January 2, 2004. As of that date, this tranche of Mr. Von Deylen’s options was valued at $78,000 and Mr. Raclin’s at $77,400. |

7

Table of Contents

Aggregate Option Exercises in 2003 and Fiscal Year-End Option Values

The following table sets forth as of December 31, 2003, for each of our named executive officers:

| • | the total number of shares received upon exercise of options during 2003; |

| • | the value realized upon that exercise; |

| • | the total number of unexercised options to purchase our common stock; and |

| • | the value of such options which were in-the-money at December 31, 2003. |

Name | Shares Exercise | Value Realized | Number of Securities Underlying December 31, 2003 | Value of Unexercised In-the-Money Options at | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

Robert A. McCormick | — | — | 1,248,490 | 3,827,469 | $ | 1,866,492 | $ | 5,722,066 | |||||||

John M. Finlayson | — | — | 1,066,607 | 3,302,108 | $ | 1,594,577 | $ | 4,936,651 | |||||||

Jeffrey H. Von Deylen | — | — | — | 1,000,000 | $ | 0 | $ | 1,495,000 | |||||||

Grier C. Raclin | — | — | — | 1,000,000 | $ | 0 | $ | 1,495,000 | |||||||

James D. Mori | 113,665 | $ | 132,768 | 297,247 | 873,239 | $ | 444,384 | $ | 1,305,492 | ||||||

| (1) | These values have been calculated on the basis of the last reported sale price of our common stock on the Nasdaq SmallCap Market as reported on December 31, 2003 of $1.50. |

Director Compensation

Directors who are also employees of our company or are affiliated with one of our principal stockholders do not receive additional compensation for serving as a director. During 2003, each director who was not an employee of our company and who was not affiliated with one of our principal stockholders received an annual retainer of $10,000. In addition, we pay the non-employee/non-affiliated directors as follows for their attendance at board and committee meetings: $1,500 per board meeting attended in person; $750 per committee meeting attended in person; and $250 per board and committee meeting attended by telephone. Accordingly, in 2003 in addition to the annual retainer, we paid the following directors the following amounts for meetings they attended: Mr. Pellow, $14,000; Mr. Ousley, $17,000; and Mr. Heintzelman, $13,750.

Arrangements with Executive Officers

Arrangement with Mr. McCormick. On April 2, 2001, we entered into an agreement with Mr. McCormick, which agreement ratified the terms of Mr. McCormick’s employment arrangements. The agreement provided that Mr. McCormick would serve as our Chairman and Chief Executive Officer effective as of January 3, 2000. Under this agreement, as amended, Mr. McCormick is entitled to a base salary of $450,000 per year. In addition, he is eligible to receive a discretionary annual incentive bonus, which is targeted at 70% of his base salary, but can be greater or less, based on his personal and overall corporate performance. Mr. McCormick is entitled to benefits commensurate with those available to other senior executives.

In connection with his employment, Mr. McCormick received options to purchase 750,000 shares of our common stock at an exercise price of $.50 per share, 500,000 of which were granted on July 22, 1999 and 250,000 of which were granted on December 30, 1999. All of these options vested on the date of their grant. Mr. McCormick will have the right to exercise all options for one year after the termination of his employment, unless his employment was terminated for cause.

In the event we terminate Mr. McCormick’s employment without cause or if he terminates his employment for good reason, he will be entitled to receive a lump sum severance payment equal to his then current base annual salary, which will not be less than his highest annual salary paid by us. In the event of a change in control of our company, Mr. McCormick has agreed to remain with our company for a period of up to twelve months if the new management requests him to do so. A change of control, as defined in the agreement, includes a merger or consolidation of the company or a subsidiary with another company as a result of which more than fifty percent of the outstanding shares of the company

8

Table of Contents

after the transaction are owned by stockholders who were not stockholders of the company before the transaction. We will reimburse Mr. McCormick for any parachute payment taxes he would incur under the Internal Revenue Code of 1986, which we refer to as the Internal Revenue Code or Code, as a result of such a change in control. We may terminate Mr. McCormick’s employment for cause at any time without notice, in which case he will not be entitled to any severance benefits.

Arrangement with Mr. Finlayson. On December 28, 1999, we entered into an agreement with Mr. Finlayson pursuant to which he agreed to serve as our President and Chief Operating Officer effective December 31, 1999. Under this agreement, as amended, Mr. Finlayson is entitled to a base salary of $420,000 per year. In addition, he is eligible to receive a discretionary annual incentive bonus, which is targeted at 60% of his base salary, but can be greater or less, based on his personal and overall corporate performance. Mr. Finlayson will be entitled to benefits commensurate with those available to other senior executives.

In connection with his employment, Mr. Finlayson received options to purchase 650,000 shares of our common stock at an exercise price of $.50 per share, all of which have vested. Mr. Finlayson will have the right to exercise all options for one year after the termination of his employment unless his employment was terminated for cause.

In the event we terminate Mr. Finlayson’s employment without cause or if he terminates his employment for good reason, he will be entitled to receive a lump sum severance payment equal to his then current base annual salary, which will not be less than his highest annual salary paid by us. In the event of a change in control of our company, Mr. Finlayson has agreed to remain with our company for a period of up to twelve months if the new management requests him to do so. A change in control, as defined in the agreement, includes a merger or consolidation of the company or a subsidiary with another company as a result of which more than fifty percent of the outstanding shares of the company after the transaction are owned by stockholders who were not stockholders of the company before the transaction. We will reimburse Mr. Finlayson for any parachute payment taxes he would incur under the Internal Revenue Code as a result of such a change in control. We may terminate Mr. Finlayson’s employment for cause at any time without notice, in which case he will not be entitled to any severance benefits.

Arrangement with Mr. Von Deylen. On January 2, 2003, we entered into an agreement with Mr. Von Deylen pursuant to which he became our Chief Financial Officer. Under this agreement, as amended, Mr. Von Deylen is entitled to an annual base salary of $275,000. In addition, he is eligible to receive a discretionary annual incentive bonus, which is targeted at 50% of his base salary, but can be greater or less, based on his personal and overall corporate performance. On January 2, 2003 we granted Mr. Von Deylen options to purchase 750,000 shares of our common stock at an exercise price of $.40 per share, which will vest over four years and options to purchase 250,000 shares of our common stock at an exercise price of $1.49 per share, which will vest over three years commencing in January 2004. In the event of a change of control, which is defined as a company other than Welsh, Carson taking ownership of more than 50% of our voting shares, all granted options will immediately vest. Mr. Von Deylen has also agreed in the event of a change in control to remain with our company for a period of up to six months if the new management requests him to do so. Under this agreement, Mr. Von Deylen is entitled to benefits commensurate with those available to executives of comparable rank.

In the event we terminate Mr. Von Deylen’s employment without cause, Mr. Von Deylen will be entitled to receive his then current base salary for a period of one year, a lump sum payment equal to his pro rated target bonus and any unpaid bonus from the prior year. In addition, the vesting of Mr. Von Deylen’s options will accelerate by one year, and he will have the right to exercise all vested options for a period of twelve months from the date of termination, unless he becomes employed elsewhere during that period, in which case he would only be entitled to exercise his options immediately. Mr. Von Deylen will receive a similar payment if he were to resign as a result of being forced to relocate without his consent from the metropolitan area in which he was living at the time of his resignation, or if he were to be reassigned to a position entailing materially reduced responsibilities or opportunities for compensation.

Arrangement with Mr. Raclin. On January 6, 2003, we entered into an agreement with Mr. Raclin pursuant to which he became our Chief Legal Officer and Corporate Secretary, effective January 1, 2003. Under this agreement, as amended, Mr. Raclin is entitled to an annual base salary of $250,000. In addition, he is eligible to receive a discretionary annual incentive bonus, which is targeted at 50% of his base salary, but can be greater or less, based on his personal and overall corporate performance. For 2003, the agreement provides that Mr. Raclin will receive a bonus equal to no less than 70% of his 2003 annual base salary, which was $245,000, which such bonus he received in April 2004. On January 2, 2003 we granted Mr. Raclin options to purchase 750,000 shares of our common stock at an exercise price of $.40 per share, which will vest over four years and options to purchase 250,000 shares of our common stock at an exercise price of $1.49 per share, which will vest over three years commencing in January 2004. In the event of a change of control, which is defined as a company other than Welsh, Carson taking ownership of more than 50% of our voting shares, all granted

9

Table of Contents

options will immediately vest. We will reimburse Mr. Raclin for any parachute payment taxes he would incur under the Internal Revenue Code as a result of such change of control. Under this agreement, Mr. Raclin is entitled to benefits, including severance, commensurate with those available to executives of comparable rank.

In the event we terminate Mr. Raclin’s employment without cause or for other than performance reasons, Mr. Raclin will be entitled to receive benefits at a level not less than those received by other similarly situated senior executive employees of the company, which will at least include a lump sum payment of his then current base salary for a period of one year, the pro rata portion of the prior year’s bonus, and three months’ notice. In addition, all granted options will immediately vest. and he will have the right to exercise all vested options for a period of twelve months from the date of termination. Mr. Raclin will receive a similar payment if he were to resign as a result of being forced to relocate without his consent from the metropolitan area in which he was living at the time of his resignation, or if he were to be reassigned to a position entailing materially reduced responsibilities or opportunities for compensation.

Arrangement with Mr. Mori. On September 30, 1999, we entered into an agreement with Mr. Mori pursuant to which he became our Executive Vice President and General Manager for Americas effective October 1, 1999; in 2003 we changed Mr. Mori’s title to Managing Director – Americas. Under this agreement, as amended, Mr. Mori is entitled to an annual base salary of $225,000. In addition, he is eligible to receive a discretionary annual incentive bonus, which is targeted at 50% of his base salary, but can be greater or less, based on his personal and overall corporate performance. On October 29, 1999 and December 30, 1999, we granted Mr. Mori options to purchase 225,000 shares and 75,000 shares of our common stock, respectively, each at an exercise price of $.50 per share. All of these options have vested. Under this agreement, Mr. Mori is entitled to benefits commensurate with those available to executives of comparable rank.

In the event we terminate Mr. Mori’s employment without cause after the second anniversary of his employment, and either we are not a public company or we are a public company and our shares on the date of termination trade at a price less than $15 per share, Mr. Mori will be entitled to receive a payment of $450,000. Mr. Mori will receive a similar payment if he were to resign as a result of an acquisition of more than 30% of our voting shares by an entity other than Bridge, if he were to be forced to relocate without his consent from the St. Louis metropolitan area, or if he were to be reassigned to a position entailing materially reduced responsibilities or opportunities for compensation.

Compensation Committee Interlocks and Insider Participation

Messrs. McInerney and Welsh are general partners of WCAS VIII and affiliated entities, which collectively owned, as of April 15, 2004, 53% of our outstanding voting stock. Entitles affiliated with WCAS VIII were also principal stockholders of Bridge. See “Item 13. Certain Relationships and Related Transactions — Transactions with Welsh Carson” and “—Transactions with Bridge”.

In 2003, none of our executive officers served as a director or member of the compensation committee of another entity whose executive officers had served on our board of directors or on our compensation committee.

Compensation Committee Report on Executive Compensation for 2003

Our compensation committee reviews, analyzes and recommends compensation programs to our board of directors and administers and grants awards under our 1999 stock option plan and our 2003 incentive compensation plan. During 2003, the compensation committee consisted of Messrs. Thomas E. McInerney, Patrick J. Welsh and James E. Ousley. None of these directors are current or former employees of our company.

Compensation Policies Toward Executive Officers

The compensation committee has structured its compensation policies to achieve the following goals:

| • | attract, motivate and retain experienced and qualified executives; |

| • | increase the overall performance of the company; |

| • | increase stockholder value; and |

| • | increase the performance of individual executives. |

To achieve these objectives, the compensation program for our executive officers consists principally of three elements: base salary, cash bonuses and/or stock and long-term incentive compensation in the form of participation in our 1999 stock option plan and our 2003 incentive compensation plan.

10

Table of Contents

The compensation committee seeks to provide competitive salaries based upon individual performance together with cash and/or bonuses awarded based on our overall performance relative to corporate objectives, taking into account individual contributions, teamwork and personal and corporate performance levels. In addition, it is our policy to grant stock options, restricted stock, and/or other incentive compensation awards linked to the performance of our common stock to executives upon their commencement of employment and periodically thereafter in order to strengthen the alliance of interest between such executives and stockholders and to give executives the opportunity to reach the top compensation levels of the competitive market depending on our performance. The following describes in more specific terms the elements of compensation that implement the compensation committee’s compensation policies, with specific reference to compensation reported for 2003:

Base Salaries. Base salaries of executives are initially determined by evaluating the responsibilities of the position, the experience and knowledge of the individual, and the competitive marketplace for executive talent, including a comparison to base salaries for comparable positions at peer public companies in the same geographic region. To ensure retention of qualified management, we have entered into employment agreements with each of our named executive officers. The terms of such agreements were the results of arms-length negotiations between us and each executive officer. You can find further information regarding the employment agreements of the named executive officers under the heading “Arrangements with Executive Officers,” above. The agreements establish the base salary for each officer during the term of the agreement. We will review the salaries for the executives annually and, if appropriate, adjust based on individual performance, increases in general levels of compensation for executives at comparable firms and our overall financial results.

Bonuses. The compensation committee also considers the payment of cash bonuses as part of its compensation program. Annual cash bonuses reflect a policy of requiring a certain level of company financial and operational performance for the prior fiscal year before any cash bonuses are earned by executive officers. In general, the compensation committee has tied potential bonus compensation to performance factors, including the executive officer’s efforts and contributions towards obtaining company objectives and the company’s overall growth. In 2003, incentive compensation was determined primarily based on defined EBITDA targets. For 2004, the compensation committee has established revenue and cash balance targets as the primary factors for determining executive incentive compensation. The employment agreements of each of the executive officers provide that each of these employees will be entitled to a bonus consisting of cash in an amount determined before the conclusion of each fiscal year.

Stock Awards. A third component of executive officers’ compensation is our 1999 stock option plan and 2003 incentive compensation plan, pursuant to which we grant executive officers and other employees options to purchase shares of our common stock, restricted or unrestricted stock, stock units, or other stock-based awards. The compensation committee grants stock awards to executives in order to align their interests with the interests of our stockholders. Stock awards are considered by the compensation committee to be an effective long-term incentive because the executives’ gains are linked to increases in the stock value that in turn provides stockholder gains.

The compensation committee generally grants stock awards to new executive officers and other key employees upon their commencement of employment with us and periodically thereafter. The stock awards generally are granted at an exercise price equal to the market price of our common stock at the date of the grant. The full benefit of the awards is realized upon appreciation of the stock price in future periods, thus providing an incentive to create value for our stockholders through appreciation of stock price. We believe that stock awards have been helpful in attracting and retaining skilled executive personnel. In 2003, we granted a total of 2,738,821 stock options to our executive officers. For grants made to Messrs. McCormick, Finlayson and Mori, the per share option exercise price of such options was equal to an aggregate discount amount (the difference between the fair market value per share of our common stock and the exercise price on the grant date, June 25, 2004). For the grant of stock options made to Messrs. Von Deylen and Raclin, the per share option exercise price of the first tranche (750,000 options) of such options was equal to the fair market value of our common stock at the date of grant and the per share option exercise price of the second tranche (250,000 options) of such options was equal to the fair market value of our common stock on the date one year after the date of grant.

Other. We have a contributory retirement plan for our employees (including executive officers) age 21 and over. Employees are eligible to begin participation on a quarterly basis. This 401(k) plan provides that each participant may contribute up to 15% of his or her salary (not to exceed the annual statutory limit). We generally make matching contributions to each participant’s account equal to 50% of the participant’s contribution up to 6% of the participant’s annual compensation, but in a total amount not to exceed $2,400 per year.

11

Table of Contents

Chief Executive Officer Compensation

The executive compensation policy described above has been applied in setting Mr. McCormick’s 2003 compensation. Mr. McCormick generally participates in the same executive compensation plans and arrangements available to the other executives. Accordingly, his compensation consists of annual base salary, annual bonus, and long-term equity-linked compensation. The compensation committee’s general approach in establishing Mr. McCormick’s compensation is to be competitive with peer companies. In addition, the specific 2003 compensation elements for Mr. McCormick’s compensation were determined in light of his level of responsibility, performance, current salary and other compensation awards and performance of the company. Mr. McCormick’s compensation during the year ended December 31, 2003 included $400,000 in base salary. Mr. McCormick did not receive a bonus for 2003 because the company did not meet the EBITDA performance targets established by the compensation committee as the primary factor for determining the chief executive officer’s incentive compensation. For 2004, the compensation committee has established revenue and cash balance targets as the primary factors for determining his incentive compensation, which it has targeted at 70% of his base salary. Mr. McCormick’s incentive compensation for 2004 may be greater or less than 70% of this base salary, based on whether such targets are met or exceeded. The committee has set Mr. McCormick’s base salary for 2004 at $460,000. Mr. McCormick’s base salary for 2003 was consistent with the compensation committee’s policy of being competitive with the compensation of chief executive officers of peer companies. In addition, we granted Mr. McCormick options to purchase 340,994 shares of common stock in 2003 at an average exercise price of $.39 per share which vested immediately upon the grant date.

Compensation Deductibility Policy

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any fiscal year to the corporation’s chief executive officer and four other most highly compensated executive officers as of the end of any fiscal year. However, the statute exempts qualifying performance-based compensation from the deduction limit if specified requirements are met. The board of directors and the compensation committee reserve the authority to award non-deductible compensation in circumstances they deem appropriate. In 2003, stock options granted by the compensation committee under our 1999 stock option plan and 2003 incentive compensation plan did not satisfy the requirements for exemption under Section 162(m) as qualifying performance-based compensation.

Submitted by the Compensation Committee for fiscal year 2003,

Thomas E. McInerney, Patrick J. Welsh and James E. Ousley

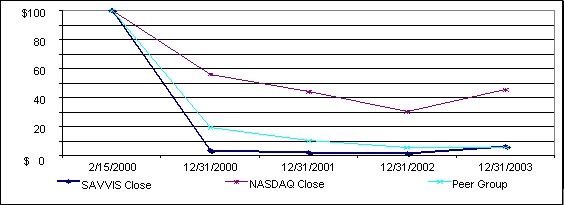

Stockholder Return Performance Graph

The following graph compares the total stockholder return on our common stock since our initial public offering on February 14, 2000 with the total return of the Nasdaq Composite Index and our peer group for the same period. Our peer group consists of the following publicly traded companies that have common stock listed on the Nasdaq National Market: InterNap Network Services Corporation; Infonet Services Corp.; Interland, Inc.; and Equant N.V.

This graph assumes that $100 was invested in our common stock, in the Nasdaq Composite Index and in our peer group on February 15, 2000, and that all dividends were reinvested.

12

Table of Contents

The points on the graph represent the following numbers:

| February 15, 2000 | December 31, 2000 | December 31, 2001 | December 31, 2002 | December 31, 2003 | |||||||||||

SAVVIS | $ | 100.00 | $ | 3.65 | $ | 2.38 | $ | 1.67 | $ | 6.23 | |||||

Nasdaq National Market | $ | 100.00 | $ | 55.88 | $ | 44.12 | $ | 30.21 | $ | 45.32 | |||||

Peer Group | $ | 100.00 | $ | 19.19 | $ | 10.26 | $ | 5.47 | $ | 5.59 | |||||

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Ownership of Our Voting Stock

The following table provides you with information about the beneficial ownership of shares of our voting stock as of April 15, 2004, by:

| • | each person or group that, to our knowledge, beneficially owns more than 5% of the outstanding shares of a class of voting stock; |

| • | each of our directors and executive officers; and |

| • | all of our directors and executive officers as a group. |

The persons named in the table have sole voting and investment power with respect to all shares of voting stock shown as beneficially owned by them, subject to community property laws where applicable and unless otherwise noted in the notes that follow. Shares of common stock subject to options, warrants and convertible preferred stock currently exercisable or convertible, or exercisable or convertible within 60 days of April 15, 2004, are deemed outstanding for purposes of computing the percentage beneficially owned by the person or entity holding such securities but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person or entity. Percentage of beneficial ownership is based on 109,184,693 shares of common stock and 202,477 shares of Series A preferred stock outstanding as of the close of business on April 15, 2004.

The “Total Voting Power” column reflects each listed individual’s or entity’s percent of actual ownership of all voting securities of our company. As a result, this column excludes any shares of common stock subject to options and warrants, as holders of those securities will not be entitled to vote with respect to such securities unless such securities are exercised.

Unless otherwise indicated below, the address for each listed director and executive officer is SAVVIS Communications Corporation, 1 Savvis Parkway, Town & Country, Missouri 63017.

| Common Stock | Series A Preferred Stock(1) | (%) | |||||||||||||

Name of Beneficial Owner | # of shares | % of class | (%) | % of class | |||||||||||

5% Stockholder | |||||||||||||||

Welsh, Carson, Anderson & Stowe | 238,171,704 | (2) | 72 | % | 133,332 | (3) | 66 | % | 53 | % | |||||

Reuters Holdings Switzerland SA | 68,997,939 | (4) | 39 | % | 40,870 | 20 | % | 15 | % | ||||||

BIS Administration, Inc. (5) | 45,483,702 | 42 | % | — | — | 10 | % | ||||||||

Constellation Entities. | 38,615,717 | (6) | 27 | % | 20,000 | (7) | 10 | % | 9 | % | |||||

General Electric Capital Corporation | 6,970,928 | (8) | 6 | % | — | — | 2 | % | |||||||

Nortel Networks, Inc. | 6,431,505 | (9) | 6 | % | — | — | — | % | |||||||

Executive Officers and Directors | |||||||||||||||

Robert A. McCormick | 2,565,986 | (10) | 2 | % | — | — | * | ||||||||

John M. Finlayson | 2,242,651 | (11) | 2 | % | — | — | * | ||||||||

Jeffrey H. Von Deylen | 87,500 | (12) | * | — | — | * | |||||||||

Grier C. Raclin | 92,500 | (13) | * | — | — | * | |||||||||

James D. Mori | 894,494 | (14) | * | — | — | * | |||||||||

Clyde A. Heintzelman | 45,000 | (15) | * | — | — | * | |||||||||

Patrick J. Welsh | 240,167,341 | (16) | 72 | % | 134,555 | (17) | 67 | % | 54 | % | |||||

Thomas E. McInerney | 240,010,596 | (18) | 72 | % | 134,422 | (19) | 66 | % | 54 | % | |||||

John D. Clark | 200,571,493 | (20) | 66 | % | 116,115 | (21) | 57 | % | 45 | % | |||||

James E. Ousley | 35,000 | (22) | * | * | * | * | |||||||||

James P. Pellow | 45,000 | (23) | * | * | * | * | |||||||||

Clifford Friedman | 0 | — | — | — | — | ||||||||||

All executive officers and directors as a group (12 persons) | 248,698,820 | 74 | % | 135,655 | 67 | % | 56 | % | |||||||

| * | Less than one percent. |

| (1) | As of April 15, 2004, holders of Series A preferred stock were entitled to an aggregate of approximately 338,585,577 votes. |

13

Table of Contents

| (2) | Includes 21,051,162 shares of common stock held by Welsh, Carson, Anderson & Stowe VI, L.P., which we refer to as WCAS VI, 15,781,975 shares beneficially held by Welsh, Carson, Anderson & Stowe VII, L.P., which we refer to as WCAS VII, 65,357 shares beneficially held by WCAS Information Partners, L.P., which we refer to as WCAS IP, 667,761 shares held by WCAS Capital Partners II, L.P., which we refer to as WCAS CP II, 200,554,798 shares beneficially held by WCAS VIII, and 50,651 shares beneficially held by WCAS Management Corporation, which we refer to as WCAS Management. 16,415,204 of the shares beneficially owned by WCAS VI, 12,306,409 of the shares beneficially owned by WCAS VII, 194,304,798 of the shares beneficially owned by WCAS VIII and all of the shares beneficially owned by WCAS Management are issuable upon the conversion of the shares of Series A preferred stock, including accrued and unpaid dividends through April 15, 2004, issued by us to these entities under securities purchase agreements dated as of March 6, 2002 and September 18, 2002. The respective sole general partners of WCAS VI, WCAS VII, WCAS IP, WCAS CP II and WCAS VIII are WCAS VI Partners, L.P., WCAS VII Partners, L.P., WCAS INFO Partners, WCAS CP II Partners and WCAS VIII Associates, LLC. |

Does not include the common stock that will be issued upon conversion of the company’s outstanding Series B convertible preferred stock that will become convertible upon stockholder approval.

The individual general partners of each of these partnerships include some or all of Bruce K. Anderson, Russell L. Carson, John D. Clark, Anthony J. de Nicola, D. Scott Mackesy, Thomas E. McInerney, Robert A. Minicucci, James R. Matthews, Paul B. Queally, Jonathan M. Rather, Sanjay Swani and Patrick J. Welsh. The individual general partners who are also directors of the company are Thomas E. McInerney, Patrick J. Welsh and John D. Clark. Each of the foregoing persons may be deemed to be the beneficial owner of the common stock owned by the limited partnerships of whose general partner he or she is a general partner. The address of Welsh, Carson, Anderson & Stowe is 320 Park Avenue, New York, NY 10022.

| (3) | Includes 9,828 shares of Series A preferred stock held by WCAS VI, 7,368 shares of Series A preferred stock held by WCAS VII, 116,105 shares of Series A preferred stock held by WCAS VIII, and 31 shares of Series A preferred stock held by WCAS Management. |

| (4) | Consists of 68,997,938 shares of common stock issuable upon the conversion of the shares of our Series A preferred stock, including accrued and unpaid dividends through April 15, 2004, acquired by Reuters on March 18, 2002 upon conversion of its 12% convertible senior secured notes due 2005, including accrued and unpaid interest. Such shares of Series A convertible preferred stock are convertible at any time at the holder’s option. According to Schedule 13D filed by Reuters on March 20, 2002, Reuters has both shared voting power and shared disposition power with Reuters Group PLC over the common stock issuable upon the conversion of its shares of our Series A preferred stock. The principal executive offices of Reuters are located at 153 route de Thonon, 1245 Collange-Bellerive, Switzerland. Reuters is an indirect subsidiary of Reuters Group PLC, a public limited liability company registered in England and Wales with its principal executive offices located at 85 Fleet Street, London EC4P 4AJ, England. |

| (5) | The address of BIS Administration, Inc. is c/o Scott Peltz, American Express Tax & Business Services, 1 South Wacker Drive, Suite 800, Chicago, IL 60606-3392. Bridge will distribute all of the shares of our common stock it owns to its secured creditors. |

14

Table of Contents

| (6) | Includes 17,295,022 shares of common stock beneficially held by Constellation Venture Capital II, L.P., which we refer to as CVC II, 8,176,542 shares beneficially held by Constellation Venture Capital Offshore II, L.P., which we refer to as CVC Offshore, 6,851,942 shares beneficially held by The BSC Employee Fund IV, L.P., which we refer to as BSC Fund, and 382,662 shares held by CVC II Partners, L.L.C., which we refer to as CVC II Partners. All of the shares beneficially owned by these entities are issuable upon the conversion of the shares of Series A preferred stock, including accrued and unpaid dividends through April 15, 2004, issued by us to these entities under a securities purchase agreement dated as of June 28, 2002. According to Schedule 13D filed by the Constellation Entities on July 9, 2002, the Constellation Entities have both shared voting power and shared dispositive power with Constellation Ventures Management II, LLC (with respect to 32,323,508 shares of common stock) and Bear Stearns Asset Management Inc. over the common stock issuable upon conversion of their shares of our Series A preferred stock. The address of the Constellation Entities is 383 Madison Avenue, New York, New York 10179. |

Includes 1,362,262 shares issued pursuant to a performance warrant to CVC II, 644,036 shares issued pursuant to a performance warrant to CVC Offshore, 539,695 shares issued pursuant to a performance warrant to BSC Fund and 30,222 shares issued pursuant to a performance warrant to CVC II Partners.

Includes 1,762,614 shares of common stock subject to warrants that are currently exercisable by CVC II, 833,310 shares of common stock subject to warrants that are currently exercisable by CVC Offshore, 698,304 shares of common stock subject to warrants that are currently exercisable by BSC Fund and 39,105 shares of common stock subject to warrants that are currently exercisable by CVC II Partners.

Does not include the common stock that will be issued upon conversion of the company’s outstanding Series B convertible preferred stock that will become convertible upon stockholder approval.

| (7) | Includes 10,576 shares of Series A preferred stock held by CVC II, 5,000 shares of Series A preferred stock held by CVC Offshore, 4,190 shares of Series A preferred stock held by BSC Fund, and 234 shares of Series A preferred stock held by CVC II Partners. |

| (8) | Consists of 6,970,928 shares of common stock received pursuant to a “cashless exercise” on March 1, 2004 of a warrant held by GECC. |

| (9) | Consists of 6,431,505 shares of common stock subject to warrants that are currently exercisable. |

| (10) | Includes 2,155,986 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (11) | Includes 1,849,051 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004 and 37,500 shares of common stock held in trust for the benefit of Mr. Finlayson’s children. |

| (12) | Includes 87,500 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (13) | Includes 92,500 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004 and 1,200 shares of common stock held by his wife. |

| (14) | Includes 594,494 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (15) | Includes 45,000 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (16) | Includes 238,106,347 shares held by Welsh, Carson, Anderson & Stowe, as described in note 2 above. Also includes 2,045,994 shares issuable upon the conversion of the shares of Series A preferred stock individually held by Mr. Welsh, including accrued and unpaid dividends through April 15, 2004, and 15,000 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (17) | Includes 133,332 shares of Series A preferred stock held by Welsh, Carson, Anderson & Stowe, as described in note 3 above. |

15

Table of Contents

| (18) | Includes 238,171,704 shares held by Welsh, Carson, Anderson & Stowe, as described in note 2 above. Also includes 1,823,892 shares issuable upon the conversion of the shares of Series A preferred stock held by Mr. McInerney, including accrued and unpaid dividends through April 15, 2004, and 15,000 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (19) | Includes 133,332 shares of Series A preferred stock held by Welsh, Carson, Anderson & Stowe, as described in note 3 above. |

| (20) | Includes 200,554,798 shares of Series A preferred stock held by WCAS VIII, as described in note 2 above. Includes 16,695 shares issuable upon the conversion of the shares of Series A preferred stock held by Mr. Clark, including accrued and unpaid dividends through April 15, 2004. |

| (21) | Includes 116,105 shares held by WCAS VIII, as described in note 3 above. |

| (22) | Includes 30,000 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

| (23) | Includes 30,000 shares of common stock subject to options that are exercisable within 60 days of April 15, 2004. |

Equity Compensation Plan Information

The following table provides information as of December 31, 2003 with respect to shares of our common stock that may be issued under our existing equity compensation plans, including our 1999 stock option plan, our 2003 incentive compensation plan, our employee stock purchase plan and other arrangements with investors and distributors.

| A | B | C | |||||||

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) | ||||||

Equity compensation plans approved by security holders | 39,292,148 | (1) | $ | 1.10 | 25,574,039 | (2) | |||

Equity compensation plans not approved by security holders | 10,000,000 | (3) | $ | 0.75 | 7,500,000 | (4) | |||

| (1) | Consists entirely of shares of common stock underlying outstanding options granted under our 1999 stock option plan and our 2003 incentive compensation plan. |

| (2) | Includes 4,718,191 shares of common stock available for issuance under our 1999 stock option plan, 6,000,000 shares of common stock available for issuance under our employee stock purchase plan which was approved by our stockholders in 2002 but which we have not yet implemented and 14,855,848 shares of common stock available for issuance under our 2003 incentive compensation plan. |

| (3) | Consists entirely of shares of common stock subject to warrants that we issued to the Constellation Entities. The warrants become exercisable upon the Constellation Entities meeting certain performance criteria relating to assisting the company in securing new customers. |

| (4) | Consist entirely of shares of common stock underlying warrants which are issuable to Moneyline Networks, LLC upon Moneyline Networks, LLC meeting certain performance criteria relating to its distribution of our services under a distribution agreement. |

On June 28, 2002, we issued performance warrants to the Constellation Entities to purchase 10,000,000 shares in the aggregate of our common stock at $0.75 per share. The Constellation Entities will earn the right to exercise the

16

Table of Contents

warrants if they meet certain criteria related to aiding our company in acquiring new business. The warrants may be exercised in whole or in part at any time prior to January 28, 2007. As of April 15, 2004, warrants to purchase 6,666,666 shares of common stock had vested and, of that amount, 3,333,333 have been exercised.

On October 1, 2002, we agreed to issue performance warrants to Moneyline Networks, LLC to purchase 7,500,000 shares in the aggregate of our common stock at $0.75 per share. Moneyline Networks, LLC will earn the right to receive the warrants if it meets certain criteria related to its distribution of our services under a distribution agreement. The warrants may be exercised in whole or in part at any time prior to five years from the date of issuance of the warrants.

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Welsh, Carson. Three of our directors, Messrs. McInerney, Welsh and Clark are general partners of investment entities that are affiliated with Welsh, Carson, Anderson & Stowe (“Welsh, Carson”). These entities collectively own approximately 53% of our outstanding voting stock as of April 15, 2004. Entities affiliated with Welsh Carson were also principal stockholders of Bridge, our former parent and, until September 2001, our largest customer.

On February 16, 2001, we entered into a securities purchase agreement and related agreements and documents with two investment entities and several individuals affiliated with Welsh, Carson. Pursuant to the terms of the securities purchase agreement, the entities and individuals affiliated with Welsh, Carson purchased $20,000,000 aggregate principal amount of our 10% convertible senior secured notes due 2006. Subject to the terms of the notes, the holders of the notes had the right, at their option at any time, to convert all or any portion of the unpaid principal amount of the notes, together with accrued interest, into such number of shares of our common stock as is obtained by dividing the total amount so to be converted by the conversion price of $1.3125.

On March 18, 2002, several investment entities and several individuals affiliated with Welsh, Carson purchased 117,200 shares of our Series A convertible preferred stock at a purchase price of $1,000 per share in exchange for all of our 10% convertible senior secured notes held by them, together with accrued and unpaid interest, indebtedness of our company acquired from one of our equipment vendors and cash, all pursuant to the terms of a securities purchase agreement, dated as of March 6, 2002.

The Series A convertible preferred stock accrues dividends at the rate of 11.5% per annum and accrued dividends compound quarterly. Each share of Series A convertible preferred stock is convertible at the holder’s option into a whole number of shares of common stock which is equal to the accreted value of the share plus all accrued and unpaid dividends on the share through the conversion date divided by the conversion price, which initially is $0.75 per share. The holders of Series A convertible preferred stock are entitled to vote together as one class with the holders of the common stock on all matters submitted to the vote of stockholders. In addition, we may not take specified actions without the prior vote or consent of at least 66 2/3 % of the outstanding shares of Series A convertible preferred stock, voting as a separate class.

In connection with the issuance of the Series A convertible preferred stock, on March 6, 2002, we entered into an investor rights agreement with Welsh, Carson and affiliated entities and individuals, Reuters, and various other investors. As a result, the registration rights agreement with Bridge and WCAS VIII, dated as of February 7, 2000, the registration rights agreement with various Welsh, Carson entities and individuals, dated as of February 20, 2001, and the registration rights agreement with Reuters, dated as of May 16, 2001 (as described below), were terminated. Under the investor rights agreement, we granted the Welsh, Carson entities and individuals, Reuters and the other investors customary registration rights with respect to the shares of common stock issuable upon conversion of the Series A convertible preferred stock and warrants issued to two of the other investors, including demand registration rights and piggy back registration rights. In addition, under the investor rights agreement, we granted some investors the right to purchase all or any part of its pro rata share of any securities that we may from time to time propose to sell and issue, with specified exceptions. Finally, under the investor rights agreement, so long as WCAS VIII or its permitted transferees, or any other investors that may in the future become a party to the investor rights agreement, owns Series A convertible preferred stock representing at least 10% of our outstanding voting power, or WCAS VIII and its affiliates, or any other investor that may in the future become a party to the investor rights agreement, own capital stock representing at least 5% of our outstanding voting power, they have the right to nominate for election to the board a number of directors equal to the total number of members of the board of directors multiplied by the percentage of the outstanding voting stock represented by the voting stock owned by such investor, rounded down to the nearest whole number. Accordingly, since WCAS VIII and its affiliates own voting stock representing more than 50% of the voting power represented by the outstanding voting stock, they currently have the right to appoint at least half of the members of the board. In addition, WCAS VIII and its affiliates are entitled to nominate at least one director for election to the board as long as they own in the aggregate voting stock representing at least 5% of

17

Table of Contents

the total voting power of all our outstanding voting stock. If an investor ceases to own a sufficient number of shares of our voting stock to entitle it to nominate the number of directors it then has on the board of directors, it must use its best efforts to promptly cause the resignation of one or more of its designated directors. The right to nominate directors will cease upon the earlier to occur of the date on which no shares of Series A convertible preferred stock are outstanding and the date on which WCAS VIII and its permitted transferees own Series A convertible preferred stock representing less than 10% of our then outstanding voting power or capital stock representing less than 5% of our outstanding voting power.

Pursuant to a letter agreement, dated as of March 6, 2002, we paid WCA Management Corporation a fee of $1.1 million on October 9, 2002 as consideration for the strategic financial and advisory services rendered by it in connection with the securities purchase agreement dated as of March 6, 2002 and the restructuring of some of our debt arrangements. We also reimbursed WCA Management Corporation for all reasonable out-of-pocket expenses incurred by it or its affiliates in connection with the securities purchase agreement and the debt restructurings. Messrs Welsh and McInerney, directors of our company, are two of the four stockholders of WCA Management Corporation.

In September 2002, pursuant to the terms of the securities purchase agreement, entities and individuals affiliates with Welsh Carson purchased an additional $20 million of our Series A convertible preferred stock for a purchase price of $20 million in cash.

Pursuant to an amended and restated securities purchase agreement, dated February 9, 2004, we sold and issued to entities and individuals affiliated with Welsh Carson $127.5 million aggregate principal amount of Series A subordinated notes (the “Notes”) and warrants to purchase shares of our Series B convertible Preferred Stock (the “Series B Preferred”) that were convertible into approximately 82.5 million shares of our common stock in conjunction with the financing of our acquisition of certain assets of Cable & Wireless USA, Inc. and Cable & Wireless Internet Services, Inc. (together with certain of their subsidiaries, “Cable & Wireless America”). Interest on the Notes accrues at the rate of 12.5% during the first 360 days and thereafter at 15%. Interest is payable semi-annually in kind. The Notes are due on January 30, 2009. The common stock issuable upon conversion of the Series B Preferred will not have been registered under the Securities Act and, therefore, may not be transferred or sold except pursuant to an effective registration statement or pursuant to an exemption from the registration requirements of the Securities Act. We granted WCAS VIII demand and piggy-back registration rights and we granted the other financing parties piggy-back registration rights only. The warrants were exercised pursuant to a “cashless” exercise and, as a result, outstanding shares of Series B Preferred held by entities and individuals affiliated with Welsh Carson are convertible into approximately 41.7 million shares of our common stock. The Series B Preferred automatically converts into common shares upon stockholder approval. As consideration for strategic and financial advisory services rendered by WCA Management Corporation in connection with our acquisition of the Cable & Wireless America assets, we have agreed to pay a fee of $1,275,000. We also agreed to reimburse WCA Management Corporation for all reasonable out-of-pocket expenses incurred by it and its affiliates in connection with such acquisition and the financing thereof. Messrs. Welsh and McInerney, directors of our company, are two of the four stockholders of WCA Management Corporation.

Transactions with Reuters.During the period of May through September of 2001, pending the acquisition by Reuters of certain of Bridge’s assets, Reuters purchased $37,500,000 aggregate principal amount of our 12% convertible senior secured notes due 2005. In connection with this transaction, we granted Reuters customary registration rights with respect to the shares of our common stock issuable upon conversion of the notes, including demand registration rights and piggy-back registration rights under a registration rights agreement dated as of May 16, 2001. On May 16, 2001, we also executed a side letter granting Reuters and its successors, assigns and affiliates the right, for so long as they hold any of our notes or preferred stock or common stock comprising or convertible into at least 5% of our outstanding voting stock, among other things, to (1) designate an observer to attend all meetings of our board of directors and any board committees, and (2) to nominate and elect such number of directors, but not fewer than one, equal to the product of the percentage of the voting power held by Reuters on a fully-diluted, as-converted basis, multiplied by the number of seats on the registrant’s board of directors (rounded down to the nearest whole number). In accordance with the terms of this letter, Reuters appointed an observer in 2001 to attend all meetings of our board of directors and audit committee, until March 31, 2004, when Reuters elected to suspend its board representation rights.

On March 18, 2002, in connection with the purchase by entities and individuals affiliated with Welsh, Carson of 117,200 of our shares of Series A convertible preferred stock, all of our 12% convertible senior secured notes due 2005 held by Reuters, together with accrued and unpaid interest, in an aggregate amount of approximately $40.9 million, were converted into 40,870 shares of Series A convertible preferred stock in accordance with the terms of such notes. In addition, the existing registration rights agreement with Reuters was terminated and replaced with the investor rights agreement. See above under “— Transactions with Welsh, Carson.”

18

Table of Contents