>> >> Philip J. Koen Chief Executive Officer May 31, 2006 Introducing SAVVIS NASDAQ: SVVS Exhibit 99.1 |

>> SAVVIS Proprietary & Confidential This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from SAVVIS’ expectations. Certain factors that could affect actual results are set forth as risk factors in SAVVIS’ SEC reports and filings, including its annual report on Form 10-K for the year ended December 31, 2005, as filed with the Securities and Exchange Commission on February 28, 2006, and all subsequent filings. The forward-looking statements in this document speak only as of the date of publication, April 24, 2006. SAVVIS assumes no obligation to update or supplement forward-looking statements. The presentation also includes references to certain non-GAAP financial measures that provide additional information for investors. In compliance with the SEC’s Regulation G, SAVVIS’ press release and filing on Form 8-K of today, April 24, 2006, include both the rationale for why non-GAAP information is important in describing operating performance, and the full reconciliation with corresponding GAAP numbers. Please Review SEC Filings Please Review SEC Filings |

>> SAVVIS Proprietary & Confidential Leader in IT infrastructure for business applications Core Competency in Integrated Managed Hosting and Network Solutions Global Service Infrastructure » 1.4 million sq ft of space across 25 data centers in US, Europe, and Asia » Customer Service and Operations Centers in US, Europe, and Asia » Tier 1 ISP with international fiber backbone » IP-VPN platform with 21,000+ managed end points in 45 countries » 5,200+ enterprise customers and 2,100+ employees worldwide Financial Results and Guidance $79 $667 2005 $100 – 110 $730 – 750 2006 Adjusted EBITDA ($M) Revenue ($M) Year Key Facts Key Facts |

>> SAVVIS Proprietary & Confidential Staffing » Recruiting, developing, and maintaining key skills Financial » High TCO and low ROI Security » Incidents and privacy Compliance » Expanding regulations, costs, and risks The Problem with IT The Problem with IT |

>> SAVVIS Proprietary & Confidential SAVVIS Transformation Methodology Data Centers Cross Connects Power Space Network Hosting Content Professional Services IP-VPN Internet Multicast IP Transit Bandwidth Caching Streaming Workflow Content Library Content Management Dynamic Capacity IT Security & Operations Monitoring & Management Servers, Storage, & Devices Monitoring Management Install & Test Remote Hands Security Migrations Compliance Program Mgmt SAVVIS – “Infrastructure as a Service” SAVVIS – “Infrastructure as a Service” |

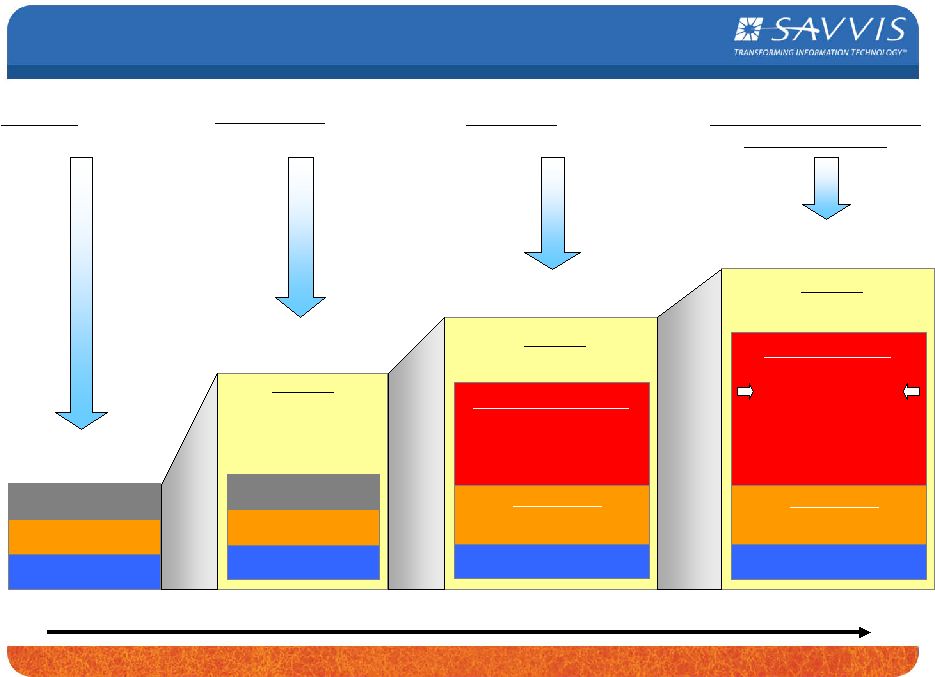

>> SAVVIS Proprietary & Confidential Space & Power Managed Hosting Managed IP ProServ Consulting Servers Storage Devices Operations Monitoring Management IP-VPN Space & Power Utility Hosting Managed IP ProServ Consulting STM Servers Storage Devices Operations Monitoring Management IP-VPN Internet Dynamic Capacity ProServ Space & Power Tier 1 Internet Access Customer Infrastructure Monitoring Management Install & Test Remote Hands STM Internet Customer wants to complement- their IT expertise Customer wants to maintain- operations Customer wants to outsource- their IT environment Customer wants maximum performance, scale, and value SAVVIS Offers Choice and Flexibility SAVVIS Offers Choice and Flexibility Improved Performance, Value, & Scale for Customers Space & Power Tier 1 Internet Access Customer Infrastructure Customer Owned Customer Managed SAVVIS Owned SAVVIS Managed SAVVIS Owned SAVVIS Managed Customer Owned SAVVIS Managed |

>> SAVVIS Proprietary & Confidential Customer Life Cycle Customer Life Cycle Customer Owned Customer Managed SAVVIS Owned SAVVIS Managed SAVVIS Owned SAVVIS Managed Customer Owned SAVVIS Managed Over 80% of new booked MRR comes from existing customers $50/sq. ft Up to $250/sq. ft Up to $1000/sq. ft Up to $2000/sq. ft * Inclusive of all services Space & Power Utility Hosting Managed IP ProServ Consulting STM Servers Storage Devices Operations Monitoring Management IP-VPN ProServ Space & Power Tier 1 Internet Access Customer Infrastructure Monitoring Management Install & Test Remote Hands Space & Power Managed Hosting Managed IP ProServ Consulting Servers Storage Devices Operations Monitoring Management IP-VPN Space & Power Tier 1 Internet Access Customer Infrastructure 5x 20x 40x |

>> SAVVIS Proprietary & Confidential Company » Fortune 100 global company with hundreds of business units Business Requirement » Year 1 Need more high quality data center space, but want to avoid capital expense » Year 2 Drive to operational excellence and streamlined processes » Year 4 Reduce costs through managed services » Today Improve time to market, reduce roll-out time of apps and websites from months to weeks SAVVIS Solution » Year 1 Colocation » Year 2 + ProServ » Year 4 + Managed security, backup, monitoring » Today + Utility servers and storage Customer Scenario – Growth Continuum Customer Scenario – Growth Continuum |

>> SAVVIS Proprietary & Confidential Company » Fortune 100 global consumer products company Business Requirement » Aggressively leverage the Web to target 14-25 year old buyers » Implement flexible capacity to support hundreds of interactive web sites SAVVIS Solution » Utility servers, storage, network » Professional services and operations » Multiple data centers » “Dial-up and dial-down” IT infrastructure » 5 year $40+ million contract Customer Scenario – Enterprise Compute Utility Customer Scenario – Enterprise Compute Utility |

>> SAVVIS Proprietary & Confidential Sources: Hosting forecast from “U.S. Web Hosting Services 2006-2010 Forecast” by IDC; May, 2006. IP-VPN forecast from “U.S. IP VPN Services 2006-2010 Forecast” by IDC; May, 2006. CDN forecast from Tier1 Research analysis delivered to SAVVIS in May, 2006. Market Opportunity for SAVVIS Market Opportunity for SAVVIS 16% 9,300 8,000 6,900 Hosting 37% 1,026 800 550 CDN 17% 14,273 12,291 10,464 Total 14% 3,947 3,491 3,014 IP-VPN CAGR 2007 (US$ in Millions) 2006 (US$ in Millions) 2005 (US$ in Millions) Market The markets for SAVVIS services are large and growing |

>> SAVVIS Proprietary & Confidential Source: Gartner Magic Quadrant for North American Web Hosting 2004 » Unique hosting portfolio spanning colocation, managed hosting, and utility hosting » Unique integrated IT solutions capability spanning networks, security, content, hosting, and professional services SAVVIS Competitive Landscape SAVVIS Competitive Landscape |

>> SAVVIS Proprietary & Confidential Hosting: $295M SAVVIS Services – 2005 Revenues SAVVIS Services – 2005 Revenues Network: $330M MANAGED: $212M UNMANAGED: $118M Content Distribution: $42M » Colocation » Managed Hosting » Utility Hosting » Storage » App and O/S Management » Security » ProServ » IP-VPN » Multicast » Internet » Cross Connects » Bandwidth » IP Transit » Streaming » Caching » Content Management » Workflow |

>> SAVVIS Proprietary & Confidential SAVVIS Vertical Focus SAVVIS Vertical Focus » Deutsche Bank » London Metals Exchange » MarketAxess » Merrill Lynch » Reuters » Scottrade » CBS Sportsline.com » Deluxe Laboratories » Discovery Communications » Fox Entertainment Group » J Walter Thompson » Technicolor » Albertson’s » Buy.com » EasyJet Airlines » eBay » Gucci » Loyalty Management UK » Advanced Bionics » American Dental Partners » Medtronic » Merck » Pfizer Health Solutions » Schering-Plough » Dept of the Treasury » General Services Admin » Voice of America / Radio Free Europe » Computer Sciences Corp » Northrop Grumman » Raytheon |

>> SAVVIS Proprietary & Confidential SAVVIS Growth Strategy SAVVIS Growth Strategy » Drive the transition of unmanaged colocation customers to managed hosting services » Position the SAVVIS network as a key element of an end-to-end integrated IT solution » Leverage our global infrastructure to target and grow multinational accounts » Position content management and distribution as a key element of an integrated business solution |

>> Financial Overview |

>> SAVVIS Proprietary & Confidential Diversified revenue; growth driven by core services » Double-digit growth in Hosting and Managed IP VPN » Visibility into revenue • Over 90% of revenue is recurring • Over 80% of new bookings from existing customers • Average contract length approximately two years Adjusted EBITDA growing with improving margins Operating cash-flow positive Improving capital structure Financial Highlights Financial Highlights |

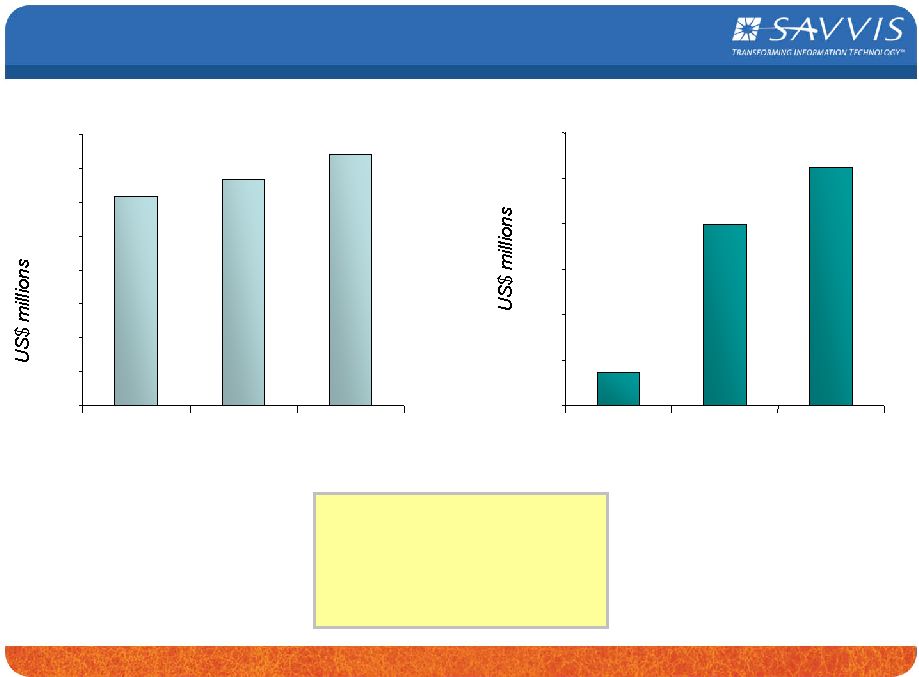

>> SAVVIS Proprietary & Confidential Total Revenue 616.8 667.0 740.0 0 100 200 300 400 500 600 700 $800 2004 2005 2006 Outlook (Midpoint) Adjusted EBITDA 14.4 79.3 105.0 0 20 40 60 80 100 $120 2004 2005 2006 Outlook (Midpoint) Adjusted EBITDA Margin » 2004: 2% » 2005: 12% » 2006 (Midpoint): 14% Improving Revenue and Adjusted EBITDA Improving Revenue and Adjusted EBITDA |

>> SAVVIS Proprietary & Confidential Hosting revenue: anticipated >$350 million in 2006 » Significant growth opportunity from repricing colo » Strengthening adoption of managed hosting services Managed IP VPN: anticipated >$215 million in 2006 » Selectively targeting global organizations » Offer clients reliability, security and global footprint Revenue Growth Opportunity Revenue Growth Opportunity |

>> SAVVIS Proprietary & Confidential Grow revenue 10-15% annually Target Adjusted EBITDA margin 25% Target Adjusted EBITDA flow-through margin 40-50% Long-term targets are subject to risks and uncertainties as described in SAVVIS’ Form 10-K filed with the U.S. Securities and Exchange Commission. Long-term Targets Long-term Targets |

>> SAVVIS Proprietary & Confidential Anticipated share count: 50 million shares of common, post-split and exchange » 1-for-15 reverse split June 6 » 37 million to be issued in exchange for Preferred (late June/early July) Paid down $16 million on revolving credit facility in Q1 » Variable rate at 7.6% at 3/31/06 » $42 million drawn; $32 million available Subordinated note, 15% PIK, $267 million at 3/31/06 Debt to Adjusted EBITDA ratios solid » At 2006 outlook midpoint, total debt/Adjusted EBITDA 3.5x » Adjusted EBITDA/interest 2.0x; Adjusted EBITDA/cash interest 7.7x Operating cash flow positive; $49.6 million cash at 3/31/06 Capital Structure Overview Capital Structure Overview |

>> SAVVIS Proprietary & Confidential 2006 total revenue $730-750 million » Hosting revenue growth 20-25% » Managed IP VPN revenue growth 14-18% » Reuters contributing 12-13% of total revenue (vs. 15% in 2005) 2006 Adjusted EBITDA $100-110 million 2006 cash capital expenditures $60-70 million » ~70% success-driven (revenue-generating); ~30% maintenance » $5-6 million for commission of IDC in Santa Clara Positive cash flow *Financial outlook is based on information current as of May 31, 2006, and is subject to risks and uncertainties as described in SAVVIS’ Form 10-K filed with the U.S. Securities and Exchange Commission. Financial Outlook* Financial Outlook* |

>> Thank You |