03

Spur Ventures Inc.

Annual Report 2003

Producing phosphate fertilizer for the world’s largest market

Spur Venturesaims to be the premier foreign owned, integrated fertilizer manufacturer in China, with plans to produce up to one million tonnes of high quality S-NPK fertilizer for domestic consumption by expanding its YSC facility in the central province of Hubei, China. These expansion plans include the development of the largest phosphate deposit in China, located near Yichang City.

China is the world’s fastest growing and largest phosphate fertilizer consumer and through its imports, accounts for 25% of global trade.

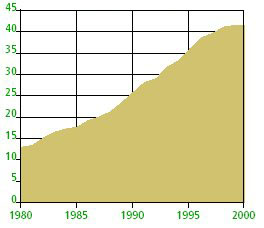

Phosphate usage in green agricultural areas

(thousand tonnes P2O5)

SOURCE: CHINA STATISTICS YEARBOOK 2003

Phosphate Rock and S-NPK Fertilizer

Phosphate rock (P2O5) is one of the essential ingredients of the phosphate based compound fertilizer being produced by Spur, called NPK.

NPK fertilizer provides three essential nutrients for agriculture. N is the chemical symbol for nitrogen, long known to be necessary for the synthesis of protein in all living organisms. Phosphorus is represented by the chemical symbol P, and is a component of a number of enzymes essential for plant growth. K is the symbol for potassium which acts as a catalyst to regulate certain cell functions, and which is incorporated in fertilizer in the form of soluble potash. In addition to the three most common fertilizer ingredients, sulphur (S) is also incorporated in the fertilizer we produce in small quantities, hence S-NPK.

Since the advent of mineral fertilizer, Chinese agriculture has predominately utilised DAP (di-ammonium phosphate) fertilizer, which contains only nitrogen and phosphorus. Modernisation of Chinese agriculture is causing consumption of NPK to increase much more rapidly than DAP.

A reference to “high quality” S-NPK fertilizer generally refers to the amount of chlorine. An amount of contained chlorine of less than 3% in fertilizer is generally considered high quality S-NPK, as high chlorine content has a negative impact on growth and quality of fruit, broad-leaf crops and grains.

The manufacture of NPK fertilizer begins with the mining and upgrading of phosphate rock. Phosphoric acid is produced by treatment of the phosphate rock with sulphuric acid producing phosphoric acid and gypsum, which is removed as a by-product. The phosphoric acid produced is then reacted with ammonia (NH3) to produce ammonium phosphate, containing both nitrogen (N) and P. The resulting product is then mixed with finely ground potash (K2O) to create the final NPK product.

Phosphate rock, ammonia and sulphuric acid are all available in China, although supply of phosphate rock is limited. Most potash is imported into China from Canada and Russia.

Canola field in Yichang. Canola growth requires high consumption of phosphate. |

Jetty on the Yangtze river in Yichang. |

SPUR VENTURES INC. •ANNUAL REPORT 2003

01

Spur Overview

- Chinese government is emphasizing investment in rural agriculture—demand is increasing for high quality fertilizer.

- China imports high quality fertilizer—domestic demand exceeds supply.

- Spur has acquired an operating 100,000 tpa fertilizer plant: staged expansion and improvement of a 100,000 tpa plant is cheaper and lower risk than building a greenfields 1,000,000 tpa plant.

- Spur has a large high-grade phosphate rock deposit with a feasibility study in place—enough phosphate rock to supply a 1,000,000 tpa plant for 30 years.

- Spur’s board and management have many years of experience in China.

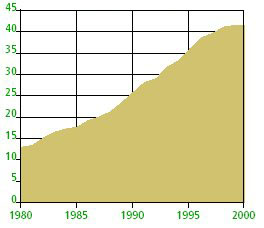

CHINESE TOTAL FERTILIZER CONSUMPTION

(in million tonnes nutrients)

- Annual growth in consumption of all fertilizers = 6.8%

- Equivalent to 100 million tonnes of fertilizer product in 2000

Spur has two separate but complementary projects: Spur’s first project is the Yichang Maple Leaf Chemicals Ltd. (YMC) joint venture which owns one of the largest phosphate deposits in China with a high-grade (21.2% P2O5) phosphate resource of over 400 million tonnes. Spur’s other project is Yichang Spur Chemicals Ltd. (YSC), which was created in December 2003 to acquire and expand an existing fertilizer plant located in central China.

Spur’s original strategy was to develop the YMC phosphate deposit and build an entirely new chemical complex on the Yangtze River to process the phosphate rock into 1,000,000 tonnes per annum (tpa) high quality NPK fertilizer. In 2003, when the existing YSC fertilizer plant became available, Spur seized the opportunity to immediately commence fertilizer production by purchasing a plant at a much lower cost and with lower risk than building a new plant from the ground up.

The YSC plant is being expanded in stages. At the time of acquisition, the YSC plant had a capacity of 100,000 tpa NPK fertilizer but was producing under capacity because phosphoric acid, a necessary component, had to be purchased and was difficult to obtain. In early 2004, Spur initiated an expansion to the plant that will enable the production of phosphoric acid from readily available phosphate rock and sulphuric acid. Phosphoric acid production is scheduled to begin in late 2004.

In the meantime, development continues on the YMC phosphate deposit. Once in production, YMC will supply phosphate rock as a raw material to the YSC plant.

02

SPUR VENTURES INC. •ANNUAL REPORT 2003

Chairman’s Report

It is with great pleasure that I report for the first time to the shareholders of Spur Ventures Inc.

The same compelling reasons that first inspired me to join the Company are even more apparent today. China is the largest consumer of fertilizer in the world at approximately 100 million tonnes per annum. The fastest growing segment of the fertilizer market is the phosphate based product, at approximately 59 million tonnes, which is growing at an estimated 10% per annum. In 2002 approximately 8 million tonnes of this product were imported, and growing.

China has one of the lowest ratios of arable land per capita in the world. It is a priority of the Chinese government to encourage the optimization of crop yield of all arable land. Spur’s strategy for participation in the growing Chinese fertilizer market is riding the convergence of some key policy initiatives by the Central Government, commenced in 2003. These include legal reforms which will grant legal title to an estimated 210 million farming households, the elimination of agricultural income taxes over the next 5 years, and the introduction of subsidies to domestic producers of certain fertilizer products.

In joint venture with state enterprise, Spur will contribute key management skills and scarce capital to the privatization of this sector. Rationalization of the numerous in-efficient high cost small plants across China is also a key objective under the present government policy, and Spur aims to participate in this process over the next few years as its business base and local management skills develop.

I believe that Spur’s strategy is the second generation model of foreign investment in China. The first being characterized by cheap labour in Chinese “factories to the world” set up typically in the coastal cities for the export market. This second generation model is focused in inland business regions, and participating in the key growth areas of the domestic economy. Whilst much is being written today by the world’s eminent economists about the risks of certain sectors of the burgeoning Chinese economy overheating, with consumption growth being exceeded by the weight of investment inflow, this is clearly not the case for the agricultural sector. Central government may well be taking steps to dampen economic activity in these overheating sectors, it is however providing direct stimulus to the agricultural sector.

Steven G. Dean

Chairman

03

SPUR VENTURES INC. •ANNUAL REPORT 2003

Motivated by these significant changes to the Chinese fertilizer sector landscape, in November, 2003 Spur revised its original strategy. Instead of aiming to build a greenfields facility, Spur acquired an interest in an existing production fertilizer facility with a view to fastracking its business strategy by simply expanding this plant and integrating it with the development of the phosphate deposits.

Our objective remains to build a fertilizer production facility with an annual capacity of 1 million tonnes, fully integrated with a captive source of phosphate rock as our key competitive advantage. However our new strategy will see us do so from an existing production facility of 100,000 tonnes, by staged expansions, with substantially reduced capital cost and risk as compared to the original plan.

This would however not be a balanced report without reference to the challenges of operating a commercial enterprise in China. The development of a competent and experienced management team is paramount, and is a high priority for Spur. Without exception, this is the single biggest challenge for all foreign investors in business in China. Identifying and hiring key individuals is a major current focus for Spur, and will drive our success or otherwise in building our business.

2003 was a year when Spur made a strategic change in approach towards its business objectives, and now has a platform to launch into an exciting year of progress in 2004. I would like to thank management and the Board for their support and shareholders for their patience in our quest to establish a major integrated fertilizer facility in a key agricultural region of China.

April 20, 2004

Steven G. Dean

Chairman

04

SPUR VENTURES INC. •ANNUAL REPORT 2003

President’s Report—Operations

In 2003, a number of substantial changes took place which strengthened the outlook for Spur Ventures Inc. In mid year, Mr. Steven G. Dean, the newly appointed Chairman, and Ruston Goepel joined the Board of Directors. Shortly thereafter, Spur announced a plan to accelerate the production of fertilizer in China by acquiring a controlling interest in the Xinyuan plant, which was owned by Yichang Phosphorous Chemical Company (YPCC), our original joint venture partner. This plant was commissioned in 2000 and currently has the capacity to produce 100,000 tonnes per annum of sulphate NPK fertilizer. Spur Ventures proposed to inject new capital of US$2.5 million into the joint venture (YSC) in order to construct a phosphoric acid plant. Production capacity of this plant is planned for expansion to 300,000 tonnes per annum and ultimately, to 1.0 million tonnes per annum.

Simultaneously, negotiations began in November, 2003 to amend the original Yichang Maple Leaf Chemicals joint venture (YMC) relating to the phosphate deposits. Because of the newly developed strategy to stage the development of the project, necessary amendments and approvals were required.

In late 2003 Spur Ventures commissioned an independent engineering scoping study by Nanjing Chemical Industrial Design Institute. Their report, released in January 2004, confirmed the viability of Spur’s staged development plan. The economic model is encouraging and shareholders can access this report on the Spur website www.spur-ventures.com.

The operational performance of the Xinyuan plant will continue to be impacted by the lack of a stable supply of phosphoric acid until the new captive plant is commissioned late in 2004. Prices of key raw materials such as potash and sulphur have also increased dramatically in the first quarter of 2004 driven by extraordinarily high ocean freight rates. These freight rates have been squeezed temporarily due to the huge increase in shipping demand for bulk commodities around the world. It is expected that prices will trend back to normal historical levels as new freighter capacity is commissioned in late 2004.

Y.B. Ian He

President

05

SPUR VENTURES INC. •ANNUAL REPORT 2003

Rural China—The Next Wave

In September 2003, Credit Lyonnais—Asia produced an extensive special report entitled “Rural China—The Next Wave”.

“China has embarked on a series of policy & legal reforms involving rural land rights, the realization of which holds the potential to create the type of broad based, grass roots economic growth that is necessary to spark the engine of renewed rural productivity & consumption for 800 million rural Chinese people or1/7 of the worlds’ population. There are 210 million farm households earning the ownership rights to 130 million hectares of arable land. The land transfer has an estimated value of $500 billion. This wealth transfer will create numerous positive impacts on rural economic growth.

The transfer of land coupled with lower agriculture taxes has the potential to increase rural income and unleash unseen spending power. This stimulus can drive a virtuous cycle of broadening consumer base & consumption demand growth at several levels, from low to high end value consumer products. Credit Lyonnais believes the coming boom will dwarf earlier nationwide consumption booms. Clearly, the benefits to domestic fertilizer producers will be substantial. Worldwide institutional investor interest will develop in shares of emerging producing companies in China.”

Our operational objectives for the year 2004 are as follows:

- Close the acquisition of YSC. Due diligence—accounting, engineering and environmental—have been completed. Final closing audits will complete the process.

- Complete the restructuring of the YMC Joint Venture and proceed with the development of the phosphate deposits according to the new terms.

- Commence construction of the 60,000 tpa phosphoric acid plant at YSC and commence full production by Q4, 2004.

- Complete the feasibility study for expansion of the YSC fertilizer plant to 300,000 tonnes per annum.

- Implement the necessary changes in order that the YSC plant operates at full capacity and achieves profitability.

- Hire key management executives based in China and train existing personnel to Western style business practices.

Loading cargo on the Yangtze river at Yichang.

06

SPUR VENTURES INC. •ANNUAL REPORT 2003

Management looks forward to 2004 and beyond with optimism. There are no doubt many challenges ahead of us, but with the full support of our Board good progress will continue to be made toward our objectives in 2004. Spur Ventures has an excellent project, and the foundations of the management team to bring it all together.

April 20, 2004

Y.B. Ian He

President

Cherry orchard in Yichang.

Raising Farmers' Income Hailed

"As farmers have long been making up the majority of China's population, the entire country cannot be prosperous and powerful unless farmers get rich," a Chinese official claimed Monday. Chen Xiwen, deputy director of the office of the Central Financial Work Leading Group, hailed a document on policies for increasing farmers' income, issued Sunday by the Central Committee of the Communist Party of China, at a press conference held by the Information Office of the State Council. The so-called No. 1 Document in 2004 will not only help solve the difficulties the Chinese farmers are encountering to raise income, but yield new ideas to develop China's vast rural areas, the official said.

Chen pointed out that China's consumer demand could not be really spurred unless the rural people—accounting for 60 percent of the country's population—have strong enough purchasing power. Chen said the political achievements of Chinese officials should be measured neither by a high GDP growth rate nor those magnificent projects, but by whether they can increase farmers' income or better their livelihood.

In line with the new document, China will slash agricultural tax rates by one percentage point this year and abolish taxes on special farm produce, except tobacco leaves. Chen revealed that the central government's fiscal budget for rural development will increase nearly 30 billion yuan (3.61 billion US dollars) from last year to more than 150 billion yuan (18.07 billion US dollars) in 2004. The added money will be used mainly to support tax reforms, upgrade ecological conditions, develop education, health care and training for young people, build more basic facilities and speed up poverty reduction in rural areas. Source: Xinhua, Monday, February 09, 2004

07

SPUR VENTURES INC. • ANNUAL REPORT 2003

Management Team

Steven G. Dean

Director and Chairman

Steven G. Dean was most recently President of Teck Cominco Limited, a Canadian based diversified mining and refining company with world class assets in zinc, metallurgical coal, copper, gold and industrial minerals. In 1995, Mr. Dean founded PacMin Mining Corporation. Mr. Dean was a member of the founding management of the Normandy Poseidon Group, which become Normandy Mining Limited, one of the largest Australian based diversified miners producing gold, base metals and industrial minerals. Mr. Dean is Chairman of Amerigo Resources Ltd., a Canadian company with copper production operations near Santiago, Chile.

Robert G. Atkinson

Director and Vice-chairman

Mr. Atkinson has been in the investment industry for over 30 years. He is former President and CEO of Loewen Ondaatje McCutcheon & Co Ltd., one of Canada's most respected investment dealers. He now serves as Director of Trimin Capital Inc., Quest Capital Corp. and a number of other public companies. Mr. Atkinson received a B.Comm. degree from the University of British Columbia.

Y.B. Ian He

Director and President

Mr. Y.B. Ian He has 22 years of experience in the mineral industry. He joined Spur in 1995 leading Spur into Chinese fertilizer industry. Mr. He formerly served as a Senior Process Metallurgist with Process Research Associates Ltd., Vancouver, B.C. He holds a Ph.D. degree in mineral process engineering from the University of British Columbia.

David Cohen

Director

Mr. Cohen is the President and CEO of Northern Orion Explorations Inc. and a director of a number of public and private international companies. He started his professional career in 1981 with Anglo American Corporation in operations on the diamond and gold mines in South Africa. After a period in chemical plant design and project management he joined Fluor Daniel in 1991, a leading international engineering and construction firm as Director, Business Development, leading international business development activities in the petroleum and mining sectors from the Fluor Daniel offices in California and Colorado. Mr. Cohen is a chemical engineer by training with an MBA in international corporate finance.

David Black

Director

Mr. Black is a senior partner of DuMoulin Black, a specialized law firm established in 1966 providing corporate, securities and finance services to natural resource and commercial/industrial companies. He is a founding director of Southwestern Resources Corp. and sits on the board of several public companies.

08

SPUR VENTURES INC. •ANNUAL REPORT 2003

Ruston Goepel

Director

Mr. Goepel is Senior Vice President, Raymond James Ltd. He entered the investment business in 1968 specializing in institutional sales with Pemberton Securities Ltd. and Dominion Securities. In 1989 he was a founding partner and CEO of Goepel Shields & Partners, a national securities dealer which was acquired by Raymond James Inc. Tampa, Florida, the 8th largest U.S. brokerage firm, in January, 2001. Mr. Goepel is a Governor and Executive Committee Member of B.C. Business Council, and was the recipient of the Queen's Jubilee Medal for Business Leadership and Community Service.

Gordon D. Ewart

Director

Mr. Ewart has been in the investment industry for 35 years and is currently Chairman of Global (GMPC) Holdings Ltd. and director of a number of Canadian public companies. Mr. Ewart received his B.Sc. degree from Bishop's University.

Dongdong Huang

Director

Dongdong Huang is qualified as a lawyer in both Canada and China. He has been recognized as an authority on Chinese law in Canada and has acted for many public and private companies in their investments in China, and represents a number of large Chinese state enterprises in their business transactions in Canada.

Jeffrey Giesbrecht

Secretary

Jeffrey Giesbrecht is a member of the Law Society of British Columbia. He received a degree in Geological Engineering (Geophysics) in 1989, and has practiced corporate, mining and securities law since 1994.

09

SPUR VENTURES INC. •ANNUAL REPORT 2003

Management’s Responsibility for Financial Reporting

The accompanying consolidated financial statements of the company have been prepared by management in accordance with Canadian generally accepted accounting principles and include a summary prepared by management reconciling significant differences between Canadian and United States generally accepted accounting principles as they affect these financial statements. The financial statements contain estimates based on management’s judgement. Management maintains an appropriate system of internal controls to provide reasonable assurance that transactions are authorized, assets safeguarded, and proper records maintained.

The Audit Committee of the Board of Directors has met with the company’s independent auditors to review the scope and results of the annual audit and to review the consolidated financial statements and related financial reporting matters prior to submitting the consolidated financial statements to the Board for approval.

The company’s independent auditors, PricewaterhouseCoopers LLP, are appointed by the shareholders to conduct an audit in accordance with generally accepted auditing standards in Canada and the United States, and their report follows.

|  |

| Y.B. Ian He | James Zhang |

| President | Chief Financial Officer |

| April 29, 2004 | |

Independent Auditors’ Report

To the Shareholders of Spur Ventures Inc.

We have audited the consolidated balance sheets ofSpur Ventures Inc.(an exploration stage company) as at December 31, 2003 and 2002 and the consolidated statements of operations and deficit and cash flows for the years ended December 31, 2003, 2002 and 2001. These financial statements are the responsibility of the company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with generally accepted auditing standards in Canada and the United States. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the company as at December 31, 2003 and 2002 and the results of its operations and its cash flows for the years ended December 31, 2003, 2002 and 2001 in accordance with Canadian generally accepted accounting principles

Chartered Accountants

Chartered Accountants

Vancouver, British Columbia April 2, 2004

(except for note 12, which is at April 29, 2004)

10

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Consolidated Balance Sheets

As at December 31, 2003 and 2002 (expressed in Canadian dollars)

| | 2003 | | 2002 | |

| | $ | | $ | |

| | | | | |

| Assets | | | | |

| | | | | |

| Current assets | | | | |

| Cash and cash equivalents | 4,965,571 | | 5,899 | |

| Marketable securities (note 4) | 98,500 | | 95,000 | |

| Accounts receivable and prepaid expenses | 57,601 | | 20,461 | |

| Due from joint venture partner (note 7) | 200,000 | | 200,000 | |

| | 5,321,672 | | 321,360 | |

| Fixed assets- net | 26,663 | | — | |

| Mineral properties(note 3) | 1,846,045 | | 2,562,753 | |

| | 7,194,380 | | 2,884,113 | |

| | | | | |

| Liabilities | | | | |

| | | | | |

| Current liabilities | | | | |

| Bank overdraft | — | | 19,990 | |

| Accounts payable and accrued liabilities | 38,616 | | 55,206 | |

| | 38,616 | | 75,196 | |

| | | | | |

| Shareholders’ Equity | | | | |

| | | | | |

| Capital stock(note 5) | | | | |

| Authorized | | | | |

| 100,000,000 common shares without par value | | | | |

| 100,000,000 preferred shares without par value | | | | |

| Issued | | | | |

| 28,289,328 common shares (2002 - 17,949,328) | 11,846,776 | | 6,231,555 | |

| Stock options and warrants(note 5) | 41,680 | | — | |

| Deficit | (4,732,692 | ) | (3,422,638 | ) |

| | 7,155,764 | | 2,808,917 | |

| | 7,194,380 | | 2,884,113 | |

Commitments and contingencies (note 11)

Subsequent events (note 12)

Approved by the Board of Directors

|  |

| Director | Director |

The accompanying notes are an integral part of these consolidated financial statements.

11

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Consolidated Statements of Operations and Deficit

For the years ended December 31, 2003, 2002 and 2001 (expressed in Canadian dollars)

| | 2003 | | 2002 | | 2001 | |

| | $ | | $ | | $ | |

| | | | | | | |

| Expenses | | | | | | |

| Amortization | 5,178 | | — | | — | |

| Consulting fees | 255,243 | | 126,629 | | 71,421 | |

| Interest expense | 997 | | — | | — | |

| Loss on disposal of fixed asset | 9,082 | | — | | — | |

| Management fees | 27,833 | | 50,000 | | 50,000 | |

| Office and miscellaneous | 45,552 | | 24,011 | | 31,616 | |

| Printing and mailing | 13,582 | | (4,916 | ) | 8,560 | |

| Professional fees | 123,361 | | 68,416 | | 38,253 | |

| Rent | 31,009 | | 29,669 | | 32,683 | |

| Transfer agent and filing fees | 21,501 | | 7,702 | | 11,391 | |

| Travel, advertising and promotion | 68,190 | | 6,735 | | 29,340 | |

| Wage and benefits | 3,235 | | — | | — | |

| Writedown of mineral properties | 760,490 | | — | | 151,807 | |

| Writedown of marketable securities | 6,000 | | 7,000 | | 43,484 | |

| | 1,371,253 | | 315,246 | | 468,555 | |

| | | | | | | |

| Other income | | | | | | |

| Interest income | 38,845 | | 3,259 | | 19,299 | |

| Energy trust income | 10,867 | | 37,750 | | 71,740 | |

| Foreign exchange gain | 1,147 | | — | | — | |

| Net gain on disposal of marketable securities | 10,340 | | 28,365 | | 132,881 | |

| | 61,199 | | 69,374 | | 223,920 | |

| | | | | | | |

| Loss for the year | (1,310,054 | ) | (245,872 | ) | (244,635 | ) |

| Deficit - Beginning of year | (3,422,638 | ) | (3,176,766 | ) | (2,932,131 | ) |

| Deficit - End of year | (4,732,692 | ) | (3,422,638 | ) | (3,176,766 | ) |

| Basic and diluted loss per common share | (0.06 | ) | (0.01 | ) | (0.01 | ) |

| Weighted average number of | | | | | | |

| common shares outstanding | 22,265,095 | | 17,949,328 | | 17,852,001 | |

The accompanying notes are an integral part of these consolidated financial statements.

12

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Consolidated Statements of Cash Flows

For the years ended December 31, 2003, 2002 and 2001 (expressed in Canadian dollars)

| | 2003 | | 2002 | | 2001 | |

| | $ | | $ | | $ | |

| | | | | | | |

| Cash flows from operating activities | | | | | | |

| Energy trust income | 10,867 | | 37,750 | | 71,740 | |

| Interest received | 38,845 | | 3,312 | | 19,497 | |

| Interest paid | (997 | ) | (81 | ) | (507 | ) |

| Amortization | 5,178 | | — | | — | |

| Cash paid to suppliers and employees | (625,823 | ) | (334,960 | ) | (247,719 | ) |

| | (571,930 | ) | (293,979 | ) | (156,989 | ) |

| | | | | | | |

| Cash flows used in investing activities | | | | | | |

| Feasibility study, project development | (43,782 | ) | (311,185 | ) | (176,041 | ) |

| Purchase of fixed assets | (40,922 | ) | — | | — | |

| Net purchase of marketable securities | (100,000 | ) | (236,250 | ) | (994,325 | ) |

| Amounts due from joint venture partner | — | | (200,000 | ) | — | |

| Disposal of marketable securities | 100,840 | | 655,565 | | 1,002,028 | |

| | (83,864 | ) | (91,870 | ) | (168,338 | ) |

| | | | | | | |

| Cash flows from financing activities | | | | | | |

| Issue of common shares | 5,635,456 | | — | | 92,625 | |

| | | | | | | |

| Increase (decrease) in cash and cash equivalents | 4,979,662 | | (385,849 | ) | (232,702 | ) |

| Cash and cash equivalents - Beginning of year | (14,091 | ) | 371,758 | | 604,460 | |

| Cash and cash equivalents - End of year | 4,965,571 | | (14,091 | ) | 371,758 | |

The accompanying notes are an integral part of these consolidated financial statements.

13

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Notes to Consolidated Statements of Cash Flows

December 31, 2003, 2002 and 2001 (expressed in Canadian dollars)

1. Nature of operations

The main focus of the company is on the business of developing an integrated fertilizer business in China. The recoverability of the amounts shown as mineral properties is dependent upon the existence of economically recoverable reserves, the ability of the company to obtain the necessary financing to complete the exploration and development of the properties, and upon future profitable production or proceeds from the disposition of the properties.

For the year ended December 31, 2003, the company had a loss of $1,310,054 (2002 - loss of $245,872), working capital of $5,283,056 (2002 - $246,164) and a deficit of $4,732,692 (2002 - deficit of $3,422,638). In addition, the company had a cash balance of $4,965,571 (2002 - overdraft of $14,091).

Management acknowledges that if the Yichang phosphate property proves to be successful then it will require significant equity and debt financing. Management believes that it can successfully raise financing for this project; however, there is no assurance that the company will be successful in raising this financing. Management considers that the company has sufficient funding to meet its obligations and maintain administrative and operational expenditures for at least the next 12 months.

In addition, although the company has entered into preliminary agreements to secure the title of the mineral properties, these agreements are subject to contribution of capital by the company to earn its interest in the properties.Although these arrangements are in accordance with industry standards for the stage of exploration of such properties, these procedures do not guarantee the company’s title. Property title may also be subject to unregistered prior agreements and regulatory requirements before title can be guaranteed by the company.

2. Significant accounting policies

Accounting principles

These consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles (GAAP). These consolidated financial statements differ in material respects from U.S. GAAP, as disclosed in note 10.

Principles of consolidation

These consolidated financial statements include the accounts of the company and its wholly owned subsidiaries, Spur Ventures (BVI) Inc., International Phosphate Mining Corporation (International Phosphate) and Kunlun Potash Ltd. (Kunlun Potash). International Phosphate and Kunlun Potash were incorporated to carry out mineral exploration and development programs in China.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of revenues and expenditures during the reporting period. Actual results could differ from those reported.

Marketable securities

Marketable securities are carried at the lower of cost and market value.

Income taxes

The company follows the asset and liability method for accounting for income taxes. Under this method, future income tax assets and liabilities are determined based on the differences between the tax basis of assets and liabilities and the amounts reported in the financial statements. The future tax assets or liabilities are calculated using the tax rates for the periods in which the differences are expected to be settled. Future tax assets are recognized to the extent that they are considered more likely than not to be realized.

Cash and cash equivalents

Cash and cash equivalents consist of cash and short-term deposits maturing within 90 days of the original date of acquisition. To limit its exposure, the company deposits its funds with large financial institutions.

Mineral properties

The company records its interest in mineral properties at cost. Exploration and development expenditures relating to properties that have economically recoverable reserves or significant mineralization requiring additional exploration, as well as interest and costs to finance those expenditures, are deferred and will be amortized against future production following commencement of commercial production, or written off if the properties are sold, allowed to lapse, or abandoned.

Management of the company regularly reviews the net carrying value of each mineral property. Where information is available and conditions suggest impairment, estimated future net cash flows from each property are calculated using estimated future prices, proven and probable reserves, and operating, capital and reclamation costs on an undiscounted basis. Reductions in the carrying value of each property would be recorded to the extent the net book value of the investment exceeds the estimated future cash flows.

Where estimates of future net cash flows are not available and where other conditions suggest impairment, management assesses if carrying value can be recovered.

Management’s estimates of mineral prices, recoverable proven and probable reserves, and operating, capital and reclamation costs are subject to certain risks and uncertainties which may affect the recoverability of mineral property costs. Although management has made its best estimate of these factors, it is possible that changes could occur in the near term, which could adversely affect management’s estimate of the net cash flow to be generated from its properties.

The acquisition of title to mineral properties is a detailed and time-consuming process. The company has taken steps, in accordance with industry standards, to verify title to mineral properties in which it has an interest. Although the company has taken every precaution to ensure that legal title to its properties is properly recorded in the name of the company, there can be no assurance that such title will ultimately be secured.

Loss per common share

Loss per common share is calculated using the weighted average number of common shares issued and outstanding during the year. The effect of exercise of share options and warrants would be anti-dilutive.

Translation of foreign currencies

All of the company’s foreign subsidiaries are considered fully integrated operations. Monetary assets and liabilities are translated at the exchange rate in effect at the balance sheet date and non-monetary assets and liabilities at the exchange rates in effect at the time of acquisition or issue. Income and expenses are translated at exchange rates in effect at the time of the transactions. Exchange gains or losses arising on translation are included in loss for the year.

Financial instruments

The carrying values of cash and cash equivalents, accounts receivable and prepaid expenses, and accounts payable and accrued liabilities approximate their fair values due to the short periods to maturity. The fair value of investments is disclosed in note 4.

Stock option plan

The company has adopted the new Canadian standard for accounting for stock-based compensation. As permitted by the standard, the company has elected not to follow the fair value method of accounting for stock options granted. Under this method, no compensation expense is recognized when the options are granted pursuant to the plan. Any consideration paid by employees and directors on exercise of stock options is credited to share capital. If stock options are repurchased from employees and directors, the excess of the consideration paid over the carrying amount of the stock options is charged to deficit.

Compensation expense is determined when stock options are issued to non-employees and non-directors and is determined as the fair value of the option at the date of grant using an option-pricing model and is credited to stock options and warrants within shareholders’ equity.

3. Mineral properties

| | 2003 | | 2002 | |

| | | | | |

| Mineral property expenditures | | | | | | |

| Yichang phosphate | $ | 1,846,045 | | $ | 2,562,753 | |

Yichang phosphate

In 1996, the company entered into a preliminary agreement with Yichang Phosphorous Chemical Industries Group Co. Under the agreement, the company has obtained an exclusive right to develop the Yichang phosphate deposit, which is located in Hubei province in China. The company can earn a 90% interest in the property by taking the property to production. The Chinese government will earn a 10% interest by contributing land and the mineral rights.

14

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

In 1999, the company completed the preliminary feasibility study report conducted jointly by the Northern China Chemical Mine Planning and Design Institute and China Wuhuan Chemical Engineering Corp.Final project approval was also received from the Chinese government.

In November 2000, a feasibility study and an environmental impact assessment study were completed.

During 2001, the China Environment Protection Bureau approved the environmental study of the Yichang project. Letters of intent were signed with China Merchant Bank and China Agriculture Bank, contingent upon equity financing, to provide US$47 million bank loans and partial working capital line.

In April 2002, the feasibility study was updated by Jacobs Engineering Corporation. In early 2002, the company commenced its application for a mining permit through its joint venture partner, Yichang Phosphorus Chemical Industries Company (Yichang). Preliminary approval (stage one) of the application has been received from the Chinese Ministry of Land and Resources. Stage two of the application is in progress.

In 2002, the company engaged Triennex Pty Ltd. of South Africa to arrange total project financing based on a pre-arranged success fee. In December 2002, the company signed separately with four banks in Yichang, that they will provide bank loans to the Yichang project.

In December 2002, the company and its joint venture partner Yichang signed a joint venture contract that will result in the setting up of a joint venture company, Yichang Maple Leaf Chemicals Company, which is to undertake the development of the Yichang phosphate project.

In December 2003, the company entered into a letter of intent with Yichang Phosphorus Chemical Industries Group Co. to acquire approximately a 65% interest in an existing fertilizer facility owned by Xinyuan Chemicals Ltd. in Yichang.The Xinyuan plant has the capacity to produce 100,000 tonnes per annum of sulphate-based NPK fertilizer. During 2003, $760,490 of deferred mineral property expenditures was written off, being the amount deferred in relation to the Jacobs Engineering Corporation study on the development of a plant, which due to the purchase of an existing fertilizer facility will no longer be required.

4. Marketable securities

| | 2003 | | 2002 | |

| | | | | |

| Energy trusts | $ | 98,500 | | $ | 95,000 | |

Energy trusts

The company initially acquired energy trust units in 2001, and during 2002 and 2003 the company both acquired and disposed of a number of these units. At December 31, 2003, the remaining units held had a cost of $101,100 (2002 - $102,000) and, consistent with its accounting policy, the company has recognized a loss of $1,500 (2002 - $7,000) as a result of writing these investments down to their market value during the year. The trusts were sold in January 2004 for a small profit.

5. Capital stock

Authorized

100,000,000 common shares without par value

100,000,000 preferred shares without par value, issuable in series and with special rights and restrictions to be determined on issuance

Issued

| | Number of | | | |

| | common | | | |

| | shares | | Amount | |

| | | | | |

| December 31, 2001 and 2002 | 17,949,328 | | $ 6,231,555 | |

| Exercise of stock options | 300,000 | | 210,000 | |

| Private placement | 5,370,000 | | 2,800,000 | |

| Exercise of warrants | 4,670,000 | | 2,802,000 | |

| Commission and finders’ fee | — | | (196,779 | ) |

| December 31, 2003 | 28,289,328 | | 11,846,776 | |

Stock options

Under the 2003 Employee Stock Option Plan, the company may grant options to its directors, officers, and service providers for up to 4,589,865 common shares or such additional amount as may be approved from time to time by the shareholders of the company. Under the plan, the exercise price of each option equals the market price of the company’s stock on the date of grant and an option’s maximum term is 10 years. The directors of the company may determine and impose terms upon which each option shall become vested in respect of option shares. All options outstanding at the fiscal year-end are currently vested.

A summary of the company’s options at December 31, 2003 and 2002 and the changes for the years then ended is presented below:

| | | | 2003 | | | | 2002 | |

| | | | Weighted | | | | Weighted | |

| | | | average | | | | average | |

| | Options | | exercise | | Options | | exercise | |

| | outstanding | | price $ | | outstanding | | price $ | |

| | | | | | | | | |

| At January 1 | 1,000,000 | | 0.90 | | 1,325,000 | | 0.90 | |

| Granted | 3,185,000 | | 0.79 | | — | | — | |

| Exercised | (300,000 | ) | 0.75 | | — | | — | |

| Cancelled/expired | — | | — | | (325,000 | ) | 0.90 | |

| At December 31 | 3,885,000 | | 0.77 | | 1,000,000 | | 0.90 | |

The following table summarizes information about the options outstanding and exercisable at December 31, 2003:

| | | | | | Weighted | | | |

| | | | | | average | | Weighted | |

| | | | Options | | remaining | | average | |

| | Exercise | | outstanding | | contractual | | exercise | |

| | price | | and | | life | | price | |

| | $ | | exercisable | | (years) | | $ | |

| | | | | | | | | |

| | 0.79-0.90 | | 3,885,000 | | 3.86 | | 0.77 | |

The company has elected not to follow the fair value method of accounting for stock options granted to employees and directors. Accordingly, no compensation expense is recorded on the grant of share options to employees and directors where the exercise price is equal to the market price at the date of grant. Had the company followed the fair value method of accounting, the company would have recorded a compensation expense of $1,715,463 (2002 - $nil) in respect of granted stock options to directors and employees.The fair value of the options granted has been calculated using the Black-Scholes option pricing method, using the following assumptions:

| risk-free interest rate | 4.44% per annum | |

| expected life | 5 years | |

| expected volatility | 86% | |

| dividend yield | — | |

Pro forma information determined under the fair value method of accounting for stock options is as follows:

| | 2003 | | 2002 | |

| | | | | |

| Loss for the year | | | | | | |

| As reported | $ | (1,310,054 | ) | $ | (245,872 | ) |

| Compensation expense | | (1,715,463 | ) | | — | |

| Pro forma loss for the year | | (3,025,517 | ) | | (245,872 | ) |

| Basic and diluted loss per share | | | | | | |

| As reported | | (0.06 | ) | | (0.01 | ) |

| Pro forma | | (0.14 | ) | | (0.01 | ) |

Options granted to consultants in the year have been calculated using the Black-Scholes model and based on the same assumptions.A charge of $21,445 (2002 - $nil) has been expensed in the year and credited to fair value of options and warrants within shareholders’ equity.

15

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Notes to Consolidated Statements of Cash Flows

December 31, 2003, 2002 and 2001 (expressed in Canadian dollars)

5. Capital stock (continued)

Warrants

In connection with private placements, the company issued warrants as follows:

| | | | 2003 | | | | 2002 | |

| | | | Weighted | | | | Weighted | |

| | | | average | | | | average | |

| | Warrants | | exercise | | Warrants | | exercise | |

| | outstanding | | price $ | | outstanding | | price $ | |

| Outstanding - Beginning | | | | | | | | |

| of year | — | | — | | — | | — | |

| Granted | 5,370,000 | | 0.63 | | — | | — | |

| Exercised | (4,670,000 | ) | 0.60 | | — | | — | |

| Expired | — | | — | | — | | — | |

| Outstanding - End of year | 700,000 | | 0.81 | | — | | — | |

Of the outstanding warrants, 400,000 with an exercise price of $0.60 expire in May 2005 and 300,000 with an exercise price of $1.10 expire in July 2005. Included in the warrants, are 70,000 warrants issued as a finders fee. These have been valued at $20,235 using the Black-Scholes model, and credited to stock options and warrants within shareholders’ equity.

6. Related party transactions

Included in expenses are the following amounts paid to companies with common directors:

| | 2003 | | 2002 | | 2001 | |

| | | | | | | |

| Consulting fees (a) | $ | 255,243 | | $ | 76,129 | | $ | 71,261 | |

| Management fees (b) | | 27,833 | | | 50,000 | | | 50,000 | |

| Legal fees (c) | | 27,511 | | | 13,549 | | | 10,591 | |

| | | 310,587 | | | 139,678 | | | 131,852 | |

a) Directors of the company receive consulting fees for their management services. A total of $255,243 was paid in 2003 (2002 - $76,129; 2001 - $71,261).

b) Management fees of $27,833 (2002 - $50,000; 2001 - $50,000) were paid to companies owned by a director.

c) Legal fees of $27,511 (2002 - $13,549; 2001 - $10,591) were paid to a law firm of which a director is a partner.

7. Due from joint venture partner

|

In 2002, the company advanced $200,000 to its joint venture partner Yichang that was to be converted into an investment in the joint venture company Yichang Maple Leaf Chemicals Company, or returned to the company. During 2003, the joint venture company received regulatory approval for the mining rights the joint venture will undertake and the company continues to negotiate the final terms of the joint venture.

|

8. Segmented information

|

Management considers the exploration of phosphate and potash interests in China to be the company’s principal activity.All of the expenditures incurred in China in respect of this activity to date have been capitalized.

|

| | | | | | 2003 | |

| | Canada | | China | | Consolidated | |

| | | | | | | |

| Current assets | $ | 5,321,672 | | $ | — | | $ | 5,321,672 | |

| Fixed assets - net | | 26,663 | | | — | | | 26,663 | |

| Mineral properties | | — | | 1,846,045 | | | 1,846,045 | |

| Total assets | | 5,348,335 | | 1,846,045 | | | 7,194,380 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | 2002 | |

| | Canada | | China | | Consolidated | |

| | | | | | | |

| Current assets | $ | 321,360 | | $ | — | | $ | 321,360 | |

| Mineral properties | | — | | 2,562,753 | | | 2,562,753 | |

| Total assets | | 321,360 | | 2,562,753 | | | 2,884,113 | |

9. Income taxes

A reconciliation of the combined Canadian federal and provincial income taxes at statutory rates and the company’s effective income tax expense is as follows:

| | 2003 | | 2002 | |

| | | | | |

| Income tax provision at statutory rates | $ | (235,917 | ) | $ | (51,528 | ) |

| Increase in taxes from: | | | | | | |

| Non-deductible items | | 2,882 | | | 1,338 | |

| Benefit of losses not recognized | | 233,035 | | | 50,190 | |

| | | — | | | — | |

The company has a potential future tax asset of $491,056 (2002 - $505,000) that arises principally from non-capital tax losses available for carry-forward. Management believes the realization of income tax benefits related to these losses is not more likely than not to occur, and therefore, no future income tax asset has been recognized.

At December 31, 2003, the company has estimated non-capital losses for tax purposes of $1,233,000 (2002 - $1,117,000) with expiry dates as shown below:

| 2004 | | $ | 327,000 | |

| 2005 | | | 98,000 | |

| 2006 | | | 182,000 | |

| 2008 | | | 117,000 | |

| 2009 | | | 113,000 | |

| 2010 | | | 396,000 | |

| | | | 1,233,000 | |

10.Differences between Canadian and U.S. generally accepted accounting principles

a) The company’s consolidated financial statements have been prepared in accordance with generally accepted accounting principles in Canada. The material measurement differences between GAAP in Canada and the United States that would have an effect on these financial statements are as follows:

| | 2003 | | 2002 | |

| | | | | |

| Marketable securities - under Canadian GAAP | $ | 98,500 | | $ | 95,000 | |

| Adjusted for fair market value | | 3,600 | | | — | |

| Marketable securities - under U.S. GAAP | | 102,100 | | | 95,000 | |

| Mineral properties - under Canadian GAAP | | 1,846,045 | | | 2,562,753 | |

| Feasibility study/technical evaluation | (1,846,045 | ) | | (2,562,753 | ) |

| Mineral properties - under U.S. GAAP | | — | | | — | |

| Capital stock - under Canadian GAAP | 11,846,776 | | | 6,231,555 | |

| Compensatory escrow release value | | 697,500 | | | 697,500 | |

| Flow-through share premium | | (135,000 | ) | | (135,000 | ) |

| Capital stock - under U.S. GAAP | 12,409,276 | | | 6,794,055 | |

| Deficit - under Canadian GAAP | (4,732,692 | ) | | (3,422,638 | ) |

| Feasibility study/technical evaluation | (1,846,045 | ) | | (2,562,753 | ) |

| Compensatory escrow release value | | (697,500 | ) | | (697,500 | ) |

| Deferred taxes | | 135,000 | | | 135,000 | |

| Fair market value of marketable securities | | 3,600 | | | — | |

| Deficit - under U.S. GAAP | (7,137,637 | ) | | (6,547,891 | ) |

16

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

The impact on the consolidated statements of operations and deficit would be as follows:

| | 2003 | | 2002 | | 2001 | |

| | | | | | | |

| Loss for the year - | | | | | | | | | |

| under Canadian GAAP | $ | (1,310,054 | ) | $ | (245,872 | ) | $ | (244,635 | ) |

| Feasibility study/technical evaluation | | (43,782 | ) | | (311,185 | ) | | (176,041 | ) |

| Mineral property written off in year | | 760,490 | | | — | | | 151,807 | |

| Marketable securities | | 3,600 | | | — | | | — | |

| Loss for the year - | | | | | | | | | |

| under U.S. GAAP before | | | | | | | | | |

| comprehensive income adjustments | | (589,746 | ) | | (557,057 | ) | | (268,869 | ) |

| Adjustments to arrive at | | | | | | | | | |

| comprehensive income | | | | | | | | | |

| Unrealized recovery on investments | | — | | | — | | | (59,941 | ) |

| Comprehensive loss | | (589,746 | ) | | (557,057 | ) | | (328,810 | ) |

| Loss per common share - | | | | | | | | | |

| under U.S. GAAP before | | | | | | | | | |

| comprehensive income adjustments | | 0.02 | | | 0.03 | | | 0.06 | |

b) Income taxes

Under U.S. GAAP, the sale of flow-through shares results in a deferred credit being recognized for the excess of the purchase price paid by investors over the fair value of common shares without the flow-through feature. The fair value of the shares is recorded as equity. When the tax deductibility of the qualifying expenditures is renounced, a temporary difference arises with the natural gas interests. A deferred tax liability is established in the amount of the tax benefit foregone, and tax expense is recorded for the difference between the deferred tax liability and the premium received upon issuance of the flow-through shares. This deferred tax liability reverses due to loss carry-forwards available.

c) Accounting for stock-based compensation

For U.S. GAAP purposes, the company accounts for stock-based compensation arrangements using the intrinsic value method prescribed in Accounting Principles (APB) Opinion No. 25, “Accounting for Stock Issued to Employees”. Accordingly, since options are granted at exercise prices that are at or above the quoted market value of the company’s common shares at the date of grant, there is no compensation cost to be recognized by the company. As such, for each of the years in the three-year period ended December 31, 2003, there are no differences in accounting for stock options.

d) Mineral property expenditures

Mineral property expenditures are accounted for in accordance with Canadian GAAP as disclosed in note 2. For U.S. GAAP purposes, the company expenses expenditures relating to unproven mineral properties as they are incurred. When proven and probable reserves are indicated as a bankable feasibility study for a property, subsequent exploration and development costs of the property are capitalized. The capitalized costs of such properties would then be measured periodically, to ensure that the carrying value can be recovered on an undiscounted cash flow basis. If the carrying value cannot be recovered on this basis, the mineral properties would be written down to net recoverable value on a discounted cash flow basis.

e) Issue of escrow shares

U.S. GAAP requires that compensation expense be recorded for the excess of the quoted market price over the price granted to employees and directors under escrow share agreements that are based on more than mere passage of time and require performance.The compensation expense is recorded when the shares become eligible for release. Under Canadian GAAP, no compensation expense is recorded for such escrow share agreements.

f) Supplemental cash flow information

Under U.S. GAAP, the direct method of presenting the consolidated statements of cash flows for 2003, 2002 and 2001 would not show exploration expenditures under investing activities. These balances of $43,782, $311,185 and $176,041, respectively, would instead be included in cash paid to suppliers and employees under operating activities.This would result in totals for 2003, 2002 and 2001 for cash paid to suppliers and employees of $669,605, $646,145 and $423,760, respectively.

g) Recent accounting pronouncements

The Canadian Institute of Chartered Accountants (CICA) has issued amendments to Section 3870 - “Stock-based Compensation and Other Stock-based Payments”, which require an expense to be recognized in the financial statements for all forms of employee stock-based compensation, including stock options. The company will be required to adopt the standard on January 1, 2004, which will result in compensation expense on stock options granted to directors and employees, previously only disclosed on a pro forma basis, to be charged to earnings.

h) Marketable securities

For U.S. GAAP purposes, unrealized gains and losses for available-for-sale securities are included in comprehensive income, a separate component of shareholders’ equity, except where the decline in value is other than temporary in which case Canadian and U.S. GAAP are the same.

11. Commitments and contingencies

a) In November 2003, the company entered into an agreement with a Chinese partner to acquire a 65% interest in a joint venture company, Yichang Spur Chemicals Ltd. (YSC). YSC acquired a 100% interest in an existing fertilizer facility in Yichang, China.The company must make the initial investment in YSC of US$1.25 million (paid January 6, 2004) within 10 days of the issuance of a business license (the license was issued on December 23, 2003) and will make a further payment of US$1.25 million (subject to a final net asset valuation based on the audited financial statements) within 90 days of the first installment.The company has also committed to pay interest on the existing debt of one of the YSC partners for the upcoming years 2004 to 2008 of US$128,307 per year.

The acquisition is expected to be completed in April 2004.

b) During the upcoming years, the company has the following rental commitments:

12. Subsequent events

In January 2004, the company paid the first installment of US$1.25 million to acquire an existing fertilizer facility in Yichang. The acquisition was completed in April 2004 and the funds are currently held in trust to be disbursed as the company’s management consider necessary.

On April 27, 2004, the company announced the agreed restructuring of the terms of the Yichang Maple Leaf Chemicals Company joint venture. The estimated investment for the development of 700,000 tonnes of fertilizer plus the mine development and associated infrastructure has been reduced to US$93 million (from US$325 million) over the next five years. Accordingly, the company’s interest will be adjusted to 79%.

In April 2004, closing was finalized on the YSC acquisition. After completion of final due diligence and audit of the accounts of the Xinyuan Plant, the company’s ownership has been agreed at 72%, an increase from the percentage previously anticipated of 65%.

Other subsequent events are recorded in note 4.

17

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

Management Discussion and Analysis

for the year ended December 31, 2003 (expressed in Canadian dollars)

The following discussion of the financial position of Spur Ventures Inc. (the “Company”) and the results of operations for the years ended December 31, 2003 and 2002 are to be read in conjunction with the audited consolidated financial statements and related notes for the periods then ended.

The accompanying audited consolidated financial statements and related notes are presented in accordance with Canadian generally accepted accounting principles. These statements together with the following management’s discussion and analysis, dated May 3, 2004, are intended to provide investors with a reasonable basis for assessing the financial performance of the Company as well as certain forward-looking statements relating to the potential future performance. Additional information on the Company can be found in the Company’s Annual Information Form (“AIF”), filed in form 20F, and filed with Canadian regulators on SEDAR at www.sedar.com and with the United States Securities and Exchange Commission at www.sec.gov.

All of the financial information presented herein is expressed in Canadian dollars, unless otherwise indicated.

1. Overall performance

During the fiscal year ended December 31, 2003, the Company focused on developing an integrated fertilizer business in China. Through two Sino Foreign Joint Ventures, Spur plans to build a business capable of producing 1.0 million tonnes per annum of S-NPK fertilizer in planned stages.

Currently, the Company has no production or operational activities. In 2003, the Company raised $5.62 million by the issuance of shares through two private placements and the exercise of warrants.

The primary asset of the Company is a 79 percent interest in a joint venture called Yichang Maple Leaf Chemicals Company (YMC) which owns a high-grade phosphate deposit of over 400 million tonnes.

During the year, the Company entered into an agreement to purchase a 65 percent interest in a new joint venture called Yichang Spur Chemicals Ltd. (YSC), which has acquired a 100,000 tonnes per year fertilizer facility in Yichang. To earn its interest, the Company has agreed to contribute US$2.5 million for the construction of a 60,000 tonnes per year phosphoric acid plant.

Set forth below is a discussion of the operations and financial condition of the Company for the applicable period.

2. Results of operations

Fiscal Year Ended December 31, 2003 and 2002

The loss for year ended December 31, 2003 was $1,310,054 versus $245,872 in December 31, 2002. The increase in the loss was primarily due to consulting fees ($255,243, for a net increase of $128,614), professional fees ($68,190, for a net increase of $54,945) and travel costs ($123,361, for a net increase of $61,455). These three items all related to the increase in due diligence relating to the purchase of Xinyuan Chemicals and represented 34% of the net loss for the period. In addition, $760,490 of deferred mineral property expenditures was written off (see Note 5).

The Company’s earnings from interest income increased from $3,259 in the year 2002 to $38,845 in the year of 2003. This increase has been offset by the reduction in the Energy Trust income ($10,867 in year 2003 and $37,750 in year 2002) and gain on disposal of marketable securities ($10,340 in year 2003 and $28,365 in year 2002).

The Company’s activities during 2003 were primarily directed towards the two joint venture projects in China:YMC (79% owned by the Company) and YSC (to be 72% owned by the Company).

3. Results of operations

For the Years Ended December 31, 2003, 2002 and 2001

(expressed in Canadian dollars)

| | | | Year ended | | Year ended | | Year ended | |

| | | | Dec. 31 | | Dec. 31 | | Dec. 31 | |

| | | | 2003 | | 2002 | | 2001 | |

| | | | | | | | | |

| Expenses | | | | | | | | |

| Consulting Fees | | | | $ | 255,243 | | $ | 126,629 | | $ | 71,421 | |

| Office/Miscellaneous | | | | | 45,552 | | | 24,011 | | | 31,616 | |

| Professional Fees | | | | | 123,361 | | | 68,416 | | | 38,253 | |

| Management Fees | | | | | 27,833 | | | 50,000 | | | 50,000 | |

| Rent | | | | | 31,009 | | | 29,669 | | | 32,683 | |

| Write down of mineral property | | | 760,490 | | | 0 | | | 151,807 | |

| Other | | | | | 127,765 | | | 16,521 | | | 92,775 | |

| | | | | | 1,371,253 | | | 315,246 | | | 468,555 | |

| | | | | | | | | | | | | |

| Income | | | | | | | | | | | | |

| Other income | | | | | 61,199 | | | 69,374 | | | 223,920 | |

| Loss for the Year | | | | | (1,310,054 | ) | | (245,872 | ) | | (244,635 | ) |

| Basic loss per share | | | | | (0.06 | ) | | (0.01 | ) | | (0.01 | ) |

| Diluted loss per share | | | | | (0.06 | ) | | (0.01 | ) | | (0.01 | ) |

| Weighted average number | | | | | | | | | | | |

| of common shares outstanding | | 22,265,095 | | 17,949,328 | | 17,852,001 | |

| Cash and cash equivalents | | | | 5,064,071 | | | 80,909 | | | 1,015,717 | |

| Total Assets | | | | | 7,194,380 | | | 2,884,113 | | | 3,128,433 | |

| Total Liabilities | | | | | 38,616 | | | 75,196 | | | 73,644 | |

| | | | | | | | | | | | | |

| Summary of quarterly results | | | | | | | | | | |

| (expressed in Canadian dollars) | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Qtr. ended | | Qtr. ended | | Qtr. ended | | Qtr. ended | |

| | Dec. 31 | | | Sept. 30 | | | Jun. 30 | | | Mar. 31 | |

| | | 2003 | | | 2003 | | | 2003 | | | 2003 | |

| | | | | | | | | | | | | |

| Total revenues | $ | 17,387 | | $ | 26,737 | | $ | 14,700 | | $ | 2,375 | |

| Net income (loss) | | (980,665 | ) | | (137,670 | ) | | (101,590 | ) | | (90,129 | ) |

| Earnings (loss) per share | | (0.03 | ) | | (0.01 | ) | | (0.00 | ) | | (0.01 | ) |

| Diluted earnings (loss) | | | | | | | | | | | | |

| per share | | (0.03 | ) | | (0.01 | ) | | (0.00 | ) | | (0.01 | ) |

| | | | | | | | | | | | | |

| | Qtr. ended | | Qtr. ended | | Qtr. ended | | Qtr. ended | |

| | | Dec. 31 | | | Sept. 30 | | | Jun. 30 | | | Mar. 31 | |

| | | 2002 | | | 2002 | | | 2002 | | | 2002 | |

| | | | | | | | | | | | | |

| Total revenues | $ | 912 | | $ | 31,738 | | $ | 17,964 | | $ | 18,760 | |

| Net income (loss) | | (101,780 | ) | | (43,149 | ) | | (65,447 | ) | | (35,496 | ) |

| Earnings (loss) per share | | (0.01 | ) | | 0.00 | | | 0.00 | | | 0.00 | |

| Diluted earnings (loss) | | | | | | | | | | | | |

| per share | | (0.01 | ) | | 0.00 | | | 0.00 | | | 0.00 | |

4. Liquidity and capital resources

The Company has financed its operations principally through the sale of its equity securities. As the Company did not have production or producing mineral properties in the year 2003, the only revenue sources are interest income earned from amounts on deposit, and dividend income from investments. Income earned is dependent on the amount of funds available for deposit or investment and changes in interest rates and return on the investment. The Company’s management expect that the amount of interest or dividend income will be decreased as the Company continues business activities in phosphate mineral exploring and NPK production expansion projects and other commitment to its joint ventures in China, unless 1): the Company is able to obtain additional funds through the sales of its equity securities. 2): the Company’s joint ventures start making positive cash in-flow from productions and sales.

During the reporting period, the company had completed two separate private placements. Through the contribution from private placements and exercised warrants, the Company raised $5,602,000 net cash.

18

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

As at December 31, 2003, the Company had a net working capital of $5,283,056, compared to $246,164 at December 31, 2002. The current working capital and cash position provides it with sufficient liquidity to meet the Company’s year 2004 operating requirements. The success of the Yichang projects will depend on management’s ability to raise more capital and/or bank or private loan facilities.

The cash is held in a term deposit with a Canadian chartered bank.

5. Mineral properties

As of December 31, 2003, the Company had recorded $1,846,045 as Mineral Properties on the balance sheet, compared to $2,562,753 as of December 31, 2002.

During 2003, $760,490 of deferred mineral property expenditures was written off, being the amount deferred in relation to the Jacobs Engineering feasibility study on the development of a plant, which due to the purchase of an existing fertilizer facility will no longer be required.

Since 1996, the Company has been working on the YMC fertilizer mining projects with its joint venture partner Yichang Phosphorous Chemical Industries Group (YPCC).The Company received exclusive rights to develop the Phosphate deposits in Yichang China.

YPCC is the Company’s equity partner in both the YMC and YSC joint ventures in China.

6.Off-balance sheet arrangements

|

YSC has committed to take over the existing loans and liabilities of the former operators of the fertilizer plant, called Xinyuan Chemicals. In addition, the Company also agreed to pay for the interest of a loan borrowed by one of the equity partners of the joint ventures for the upcoming years 2004 to 2008 of approximately US$128,307 per year.

|

7.Transactions with related parties

|

Included in expenses are the following amounts paid to companies with common directors:

|

| | | 2003 | | | 2002 | | | 2001 | |

| | | | | | | | | | |

| Consulting fees (a) | $ | 255,243 | | $ | 76,129 | | $ | 71,261 | |

| Management fees (b) | | 27,833 | | | 50,000 | | | 50,000 | |

| Legal fees (c) | | 27,511 | | | 13,549 | | | 10,591 | |

| | | 310,587 | | | 139,678 | | | 131,852 | |

a) Directors of the company receive consulting fees for their management services. A total of $255,243 was paid in 2003 (2002 - $76,129; 2001 - $71,261).

b) Management fees of $27,833 (2002 - $50,000; 2001 - $50,000) were paid to companies owned by a director.

c) Legal fees of $27,511 (2002 - $13,549; 2001 - $10,591) were paid to a law firm of which a director is a partner.

8. Proposed transactions

The Company has entered into an agreement to purchase acquire a 65% interest YSC which was incorporated in November 2003. YSC acquired a NPK fertilizer plant located in Yichang, China, which has been operating at approximately 50% of its rated capacity of 100,000 tonnes of annual NPK production capacity since being commissioned in 2000. Shortages of phosphoric acid have caused the plant to operate below rated capacity.

Under the joint venture agreement, the Company will invest approximately US$2.5 million into the joint venture to earn its 65% interest. The US$2.5 million will be used to construct a 60,000 tonne per year phosphoric acid plant.

9. Subsequent events

On January 6, 2004, the Company advanced the first installment in the amount of $1,658,534 to YSC under the joint venture agreement.

On March 12, 2004, YSC began the construction of the 60,000 tons per year phosphoric acid plant. The project is expected to finish in approximately nine months.

On April 20, 2004, the Company finalized the restructuring of the YMC joint venture. The original development plan for YMC called for Spur to earn 90% interest in YMC by spending approximately US$325 million.

As a result of the acquisition of the interest in YSC announced in November 2003, the terms were re-negotiated since the new concept has the fertilizer plant being held and expanded under YSC. Accordingly, Spur’s interest in YMC will be adjusted to 79% with YPCC holding 21%. Spur’s interest in YSC has been increased to 72%, an increase from the previously announced 65%.

10. Fourth quarter

The Company entered into a joint venture to form Yichang Spur Chemicals (“YSC”), with Yichang Phosphorous Chemical Industry Group (“YPCC”), a Chinese state owned enterprise and Yuanfeng, a privately owned company. By agreeing to finance additional investment in YSC, the Company will acquire a 65% controlling interest in an existing fertilizer facility in Yichang, Hubei Province, China. The establishment of YSC was subject to final government approvals, which was subsequently received on December 23, 2003.

On May 13, 2003, the Company issued 5,000,000 warrants exercisable into common shares at a price of $0.60 per share. All but 400,000 warrants were exercised during the fourth quarter.

11. Share capital data

Authorized Capital:

100,000,000 common shares without par value

100,000,000 preferred shares without par value

Issued and Outstanding:

28,889,328 common shares

Warrants Outstanding:

300,000 warrants exercisable at $1.10 per share with expiry date of July 15, 2005.

400,000 warrants exercisable at $0.60 per share with expiry date of May 13, 2005.

12. Other information

| | Year ended | | Year ended | |

| | Dec. 31 | | Dec. 31 | |

| | 2003 | | 2002 | |

| | | | | |

| Expenses | | | | | | |

| Consulting Fees | $ | 255,243 | | $ | 126,624 | |

| Office/Miscellaneous | | 45,552 | | | 24,011 | |

| Professional Fees | | 123,361 | | | 68,416 | |

| Management Fees | | 27,833 | | | 50,000 | |

| Rent | | 31,009 | | | 29,669 | |

| Write down of mineral property | | 760,490 | | | 0 | |

| Other | | 127,765 | | | 16,526 | |

| | | 1,371,253 | | | 315,246 | |

SPUR VENTURES INC.(AN EXPLORATION STAGE COMPANY)•ANNUAL REPORT 2003

19

Corporate Data

DIRECTORS: Steven G. Dean

Y.B. Ian He

Robert G. Atkinson

David Cohen

Ruston Goepel

David Black

Dongdong Huang

Gordon D. Ewart OFFICERS: Steven G. Dean

Chairman Y.B. Ian He

President Robert G. Atkinson

Vice-chairman Jeffrey Giesbrecht

Secretary | SHARES LISTED: TSX Venture Exchange

(Symbol SVU)

Shares Issued: 28.6 million

Fully Diluted: 34.0 million

(at December 31, 2003) HEAD OFFICE: 2684 Four Bentall Centre

Box 49298 1055

Dunsmuir Street

Vancouver BC V7X 1L3 CONTACT: Robert G. Atkinson,

Vice-chairman

604.697.6205

rga@imag.net

Jeffrey Giesbrecht,

Secretary

604.697.6201

jg@amerigoresources.com WEBSITE: www.spur-ventures.com | TRANSFER AGENT: Computershare Trust Company

Vancouver, British Columbia LEGAL COUNSEL: DuMoulin Black

Vancouver, British Columbia AUDITORS: PricewaterhouseCoopers LLP

Vancouver, British Columbia ANNUAL GENERAL MEETING: The Annual General Meeting of the Shareholders will be held at the Kensington Room, 4th Floor, Hyatt Regency Hotel, 655 Burrard Street, Vancouver British Columbia on June 17, 2004 at 10:30 A.M. |

20

SPUR VENTURES INC. •ANNUAL REPORT 2003

CAUTIONARY NOTES

These materials include a review of Spur Ventures Inc.’s operations in China. Readers are cautioned that certain statements regarding expansions of the operations are based on estimates and projections and are not definitive. No representation or prediction is intended as to the results of the expansions, all of which is subject to fertilizer margins sufficient to justify any expansions.

These materials include certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Other than statements of historical fact, all statements in this material, including, without limitation, statements regarding potential mineralization and resources, estimated or potential future production, and future plans and objectives of the Company, are forward-looking statements that involve various known and unknown risks, uncertainties and other factors. There can be no assurance that such statements will prove to be accurate. Actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date of these materials. Important factors that could cause actual results to differ materially from the Company’s expectations include, among others, the availability of financing, availability of raw materials such as potash and phosphate rock, fertilizer prices, conclusions of any scoping, pre-feasibility or feasibility studies and changes in project parameters, as well as those factors discussed under the heading “Risk Factors” and elsewhere in the Company’s documents filed from time to time with the TSX Venture Exchange, Canadian or U.S. securities regulators and other regulatory authorities. All subsequent written and oral forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by this notice.

Certain information referenced in this Annual Report is based on a feasibility study prepared by Jacobs Engineering Inc. of Lakeland, Florida dated October, 2000, the executive summary of which is available on the Company’s website. Readers are encouraged to review that report for detail on the phosphate deposit held by the Company through the YMC joint venture. In addition, certain information relating to the YSC phosphate fertilizer plant is based on a scoping study prepared by Najing Chemical Industrial Design Institute dated December, 2003, the executive summary of which is available on SEDAR and on the Company’s website. Readers are encouraged to review that report for detail on the projected cost, timing and operating costs of the phased expansion of the YSC joint venture fertilizer plant.

TERRAIN DESIGN INC.©2004 • PRINTED IN CANADA BY GENERATION PRINTING

www.spur-ventures.com

SVU:TSX-V