UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C., 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:December 31, 2004

Commission File Number:0-29638

SPUR VENTURES INC.

(Exact Name of the Registrant as Specified in its Charter)

British Columbia, Canada

(Jurisdiction of Incorporation or Organization)

Suite 2684 – 1055 Dunsmuir Street,

Vancouver, British Columbia, Canada V7X 1L3

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act: NONE

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common stock, no par value (Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: NONE

The number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 39,889,328 Common Shares and no Preferred Shares.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: x No: ¨

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17: x Item 18 ¨

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Not applicable

TABLE OF CONTENTS

GENERAL

Unless the context otherwise requires, the “Registrant,” “our,” and the “Company” means Spur Ventures Inc.

The Registrant uses the Canadian dollar as its reporting currency. Unless otherwise indicated, all references in this document to “dollars” or “$” are expressed in Canadian dollars. Also, see Item 3 “Key Information” for more detailed currency and conversion information.

FORWARD LOOKING STATEMENTS

Some of the statements contained in this Report that are not historical facts, including, statements made in the sections entitled Item 3—“Key Information,” Item 4—“Information on the Company” and Item 5—“Operating and Financial Review and Prospects,” are statements of future expectations and other forward-looking statements under Section 21E of the Securities Exchange Act, that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in the statements. Actual results, performance or events may differ materially from those in the statements due to, without limitation, (i) general economic conditions, (ii) performance of financial markets, (iii) interest rate levels, (iv) currency exchange rates, (v) changes in laws and regulations, (vi) changes in the policies of central banks and/or foreign governments, and (vii) competitive factors, in each case on a global, regional and/or national basis. See Item 5—“Operating and Financial Review and Prospects.”

The forward looking statements contained herein are based on the Company's assumptions regarding world and Chinese economic and market conditions and the price of raw materials, including sulfur and potash. Among the factors that have a direct bearing on the Company's future results of operations and financial conditions are the successful development of the Company’s projects and a change in government regulations, leverage and debt service, competition, cost of certain raw materials, currency fluctuations and restrictions, technological changes, and other factors discussed herein. The Company's actual results of operations may vary significantly from the performance projected in the forward looking statements

3 of 31

GLOSSARY OF TERMS

The following terms, when used in this annual report, have the meanings specified below.

Beneficiation – A process to upgrade ores by removing unwanted minerals in the ores.

Development – Preparation of a mineral deposit for commercial production, including installation of plant and machinery.

Deposit – When mineralized material has been systematically drilled and explored so that a reasonable estimate of tonnage and economic grade can be made.

Dolomite – A rock composed of calcium and magnesium carbonate.

Doushantuo Group – A sub-geological period of Sinian, which is between 590 and 670 million years ago.

Fault – Rock masses, when subject to forces, develop cracks and fissures. The two adjacent rock masses divided by the fissures move in different directions creating displacement. This phenomenon is called a fault.

Feasibility Study– A feasibility study is one of a series of independent technical and economic evaluations on an investment project. It is designed to advance the project to a level of definition adequate to confidently demonstrate its technical and economic viability to potential joint venture partners, investors, and lending institutions. A preliminary feasibility study is based on many unverified assumptions about a project.

Fluor-apatite – A phosphate mineral containing fluorine.

Fold – When rock masses are subject to external forces, the strata or layers of the rock bend. This phenomenon is called a fold.

High-analysis fertilizer – Fertilizers that contain high percentage of nutrients. Take compound phosphate fertilizer NPK for example, greater than 45% of its weight is nutrient.

Metamorphism and metamorphic rock – Rocks are susceptible to changes in response to their geologic environments. The changes that rocks undergo to adjust themselves to their environments are metamorphism. The resultant rocks are metamorphic rocks.

Mineralized Material –A mineralized body which has been delineated by appropriately spaced drilling and/or underground sampling to support a sufficient tonnage and average grade of a mineral. Such a deposit does not qualify as a “reserve” until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors demonstrate a legal and economic feasibility.

Phosphate rock – A rock containing phosphate.

Pre-feasibility Study - A pre-feasibility study is a technical evaluation of an investment project to confirm the mineralized material, process route (the process by which mineralized material is converted to finished products) and plant capacity required to make the project economical and executable. A pre-feasibility study is based on many unverified assumptions about a project; whereas, a feasibility study is based on information that is based on a firm conceptual framework.

Purification – A process to remove impurities.

Reserve– That part of a mineral deposit, which can be economically and legally extracted or produced at the time of a reserve determination.

4 of 31

| | Probable (indicated) reserves– Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation; |

| | |

| | Proven (measured) reserves– Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

Room-and-pillar mining method – An underground mining method.

Run-of-mine ore – raw ore from a mine without any processing.

Sedimentary rocks – One of three types of rocks. It was formed through the consolidation of sediments.

Sinian period – A geological period between 590 and 670 million years ago.

Strata – Rock layers and their places in succession can be identified at a specific position in the sequence and do not recur. These rock layers are called strata.

YMC –Yichang Maple Leaf Chemicals Ltd., a Sino-Foreign Joint Venture company established under Chinese law, in which the Company holds a 72.18% equity interest.

YSC –Yichang Spur Chemicals Ltd., a Sino-Foreign Joint Venture company established under Chinese law, in which the Company holds a 78.72% equity interest.

5 of 31

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The selected financial data set forth below have been derived from our audited consolidated financial statements. Our consolidated financial statements for each of the five years ended December 31, 2004 have been audited by PricewaterhouseCoopers LLP, Chartered Accountants, independent auditors. The selected financial data should be read in conjunction with and are qualified by reference to the Consolidated Financial Statements and notes thereto for 2002, 2003 and 2004 included elsewhere in this Report.

Our financial statements have been prepared in accordance with generally accepted accounting standards in Canada and the notes to our financial statements provide a reconciliation to generally accepted accounting standards in the United States.

All amounts are shown in Canadian dollars.

Summary of Audited Annual Financial Statements of the Last Five Years.

All amounts are shown in Canadian dollars and prepared in accordance with Canadian GAAP.

| | Year

ended

12/31/2004 | Year

ended

12/31/2003 | Year

ended

12/31/2002 | Year

ended

12/31/2001 | Year

ended

12/31/2000 |

Sales

Natural gas income

Interest income

Other gain (loss)*

Net loss from continuing

operations

Basic and diluted loss per share

Total assets

Net assets

Long term obligations | 4,810,302

-

183,608

2,333

(2,633,513)

(0.07)

28,114,960

21,341,587

- |

-

38,845

10,340

(1,310,054)

(0.06)

7,194,380

7,155,764

- |

-

3,259

28,365

(245,872)

(0.01)

2,884,113

2,808,917

- |

-

19,299

132,881

(244,635)

(0.01)

3,128,433

3,054,789

- |

27,686

46,229

199,017

(49,281)

0.00

3,256,797

3,206,799

- |

6 of 31

| | Year

ended

12/31/2004 | Year

ended

12/31/2003 | Year

ended

12/31/2002 | Year

ended

12/31/2001 | Year

ended

12/31/2000 |

Capital stock

Weighed average shares

Cash dividends per common share | 27,550,651

34,667,716

- | 11,846,77

22,265,095

- | 6,231,555

17,949,328

- | 6,231,555

17,852,001

- | 6,138,930

17,673,078

- |

* Net gain on disposal of marketable securities.

The Company's financial statements have been prepared in accordance with Canadian GAAP

List below are the reconciled amounts under U.S. GAAP:

| | Year ended12/31/2004 | | Year ended12/31/2003 | | Year ended12/31/2002 | | Year ended12/31/2001 | | Year ended12/31/2000 | |

| Loss for the year - | | | | | | | | | | |

| under Canadian GAAP | (2,425,755 | ) | (1,310,054 | ) | (245,872 | ) | (244,635 | ) | (49,281 | ) |

| Feasibility study/technical evaluation | (62,204 | ) | (43,782 | ) | (311,185 | ) | (176,041 | ) | (1,048,689 | ) |

| Mineral property written off in year | | | 760,490 | | | | 151,807 | | | |

| Interest Expenses related to construction | 49,823 | | | | | | | | | |

| Deferred taxes | | | | | | | | | 98,438 | |

| Loss for the year - | | | | | | | | | | |

| under U.S. GAAP before | | | | | | | | | | |

| comprehensive income adjustments | (2,438,136 | ) | (593,346 | ) | (557,057 | ) | (268,869 | ) | (999,532 | ) |

| Adjustments to arrive at | | | | | | | | | | |

| comprehensive income | | | | | | | | | | |

| Marketable securities | (3,600 | ) | 3,600 | | | | | | | |

| Unrealized gain on marketable securities | | | | | | | (59,941 | ) | 59,941 | |

| Cumulative translation adjustment | 408,187 | | - | | - | | | | | |

| Comprehensive loss | (2,033,549 | ) | (589,746 | ) | (557,057 | ) | (328,810 | ) | (939,591 | ) |

| | | | | | | | | | | |

| Basic and diluted loss per common share | | | | | | | | | | |

| under U.S. GAAP | | | | | | | | | | |

| before comprehensive income adjustments | (0.07 | ) | (0.02 | ) | (0.03 | ) | (0.06 | ) | (0.05 | ) |

| Total assets – under U.S. GAAP | 26,006,711 | | 5,148,335 | | 321,360 | | 876,865 | | 1,029,463 | |

| Shareholders’ equity - under U.S. GAAP | 19,233,338 | | 5,109,719 | | 246,164 | | 803,221 | | 1,039,406 | |

Effects of Currency Translation and Conversion

The following table sets forth: (i) the rates of exchange for the Canadian dollar, expressed in U.S. dollars, in effect at each of the periods indicated; (ii) the average exchange rates in effect on the last day of each period; (iii) the high and low exchange rate during such periods, in each case based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York; and (iv) prices based for the period January 1 to December 31 yearly, and quoted in U.S. dollars.

| | 1st Half 2005(1) | 2004 | 2003 | 2002 | 2001 | 2000 |

| Rate at end of period | 0.8111 | 0.8310 | 0.7738 | 0.6331 | 0.6279 | 0.6666 |

| Average rate during period | 0.8095 | 0.7682 | 0.7135 | 0.6369 | 0.6458 | 0.6733 |

| High Rate | 0.8346 | 0.8493 | 0.7738 | 0.6618 | 0.6695 | 0.6973 |

| Low Rate | 0.7872 | 0.7158 | 0.6350 | 0.6199 | 0.625 | 0.6413 |

(1) as of June 24th, 20057 of 31

On June 17, 2005, the noon buying rate in New York City for cable transfer in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York as $0.8097 USD = $1.00 CDN.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following is a brief discussion of those distinctive or special characteristics of the Company’s operations and industry which may have a material impact on the Company’s business development, or constitute risk factors in respect of the Company’s financial performance.

China has an evolving legal structure. Many laws and regulations dealing with economic matters in general, and foreign investment in particular, have been promulgated, including changes to the Constitution of China to authorize foreign investment and to guarantee "the lawful rights and interests" of foreign investors in China. Nevertheless, China does not have a comprehensive system of laws, and the legal and judicial systems in China in respect of commercial laws are rudimentary. In addition, enforcement of existing laws may be uncertain and sporadic, and may be subject to domestic politics.

China has a volatile economy.Although the Chinese economy has experienced significant growth in the recent past, such growth has been uneven among various sectors of the economy and geographic regions. The central government has recently implemented measures to control inflation, which is intended to have the effect of significantly restraining economic expansion. Consequently, there can be no assurance that the government’s pursuit of economic reforms will not be curtailed. It is also possible that inflation in China will cause the cost of the Company’s products to be uneconomic for the rural farming community making up the Company’s market.

Investment in China can be adversely affected by significant political, economic and social uncertainties. Any change in laws and policies by the Chinese government could adversely affect the Company’s investment in China. The Chinese Government has been pursuing economic reform and open door policies since 1978. The general development pattern in the last 25 years shows that the political environment in China has been improving gradually. Circumstances such as a change in leadership, social or political disruption or unforeseen circumstances may affect significantly or encumber the Chinese government's abilities to pursue such policies.

Mineral and fertilizer prices have historically fluctuated substantially, and are affected by numerous factors beyond the Company’s control, including international, economic and political trends, expectations for inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and world wide production levels. The effects of these factors can not be accurately predicted. The economics of mining and fertilizer production are also affected by operating costs, variation in the grade of mined mineralized material and fluctuation in the price of fertilizer products.

Need to Obtain Permits and Licenses

The Company’s operations require governmental permits and licenses which may not be granted. The revision of the original YMC Joint Venture contract, for example, requires the approval of the Ministry of Commerce and the NDRC. Funds wired to YMC and ownership in the YMC phosphate deposits may be at risk, should the company not get the final approval from the government.

8 of 31

YMC 2004 business license renewal is still in application with Hubei Provincial Administration for Industry and Commerce (Hubei AIC), as the supplementary contract for registered capital reduction is being reviewed by the Ministry of Commerce (MofCom) and the National Development and Reform Commission (NDRC). The business license will be renewed when the supplementary contract is approved by the central government. Alternatively, the business license can be renewed once the 15% registered capital contribution is completed under the original YMC Joint Venture contract. With the total cash contribution of $15.7 million to YMC, investment to YSC and pre-YMC investments, the Company believes it has met the first 15% capital requirement under the original YMC Joint Venture contract. Hubei AIC has recently informed the Company that the investment to YSC ($3.3 million) can not be counted or transferred to YMC registered capital according to the laws and regulations of China and YMC original contract. The Company will need to contribute another $3.3 million in the near future to get the business license renewed under the original YMC Joint Venture contract. YMC was issued its business license on November 24, 2003 and under Chinese law and the YMC Joint Venture contract, the Company is obliged to contribute the first 15% of the its registered capital within 3 months of the issuance of its business license. Due to the application for the approval of the supplementary contract with the NDRC and MofCom, the Company had not paid its first 15% of the registered capital within the required 3 month time frame under the original YMC Joint Venture contract. Such a default has been known to MofCom and Hubei AIC which have verbally expressed their understanding and consent of the delay of the first 15% contribution by the Company. The Company was recently informed that Hubei AIC needs an extension of time for the Company to comply with the first 15% registered capital contribution to be issued by MofCom or a consent letter from Hubei provincial government. The Company has obtained verbal consent to such an extension of time from MofCom last year. The Company is working on obtaining the extension from the MofCom or the consent letter from Hubei provincial government.

Raw materials costs and transportation costs are rising.The continued rapid growth in the Chinese economy and the recovery of U.S. economy are driving up the prices of international commodities and transportation costs world wide. The profit of fertilizer producers are affected by rising raw material costs, increasing ocean freight and transportation costs within China.

The Company’s operations may encounter risks that are not insurable. The Company may become subject to liability for cave-ins, pollution or other hazards against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. The payment of such liabilities would reduce the funds available for exploration and mining activities. Payment of liabilities for which the Company does not carry insurance may have amaterial adverse effect on the financial position of the Company.

Certain directors and officers may have conflicts of interest arising from similar positions they hold in other natural resource companies.It is possible that certain opportunities may be offered to both the Company and to such other companies, and further that such other companies may participate in the same opportunities in which the Company has an interest. In exercising their powers and performing their functions, the directors of the Company are required to act honestly and in good faith and in the best interest of the Company, and to exercise the care, diligence and skill of a reasonably prudent person.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

The Company was incorporated under the laws of the Province of British Columbia with the name “Braymart Development Corporation” on July 24, 1986. On July 31, 1987 the Company name was changed to “Spur Industries Corporation”. On September 22, 1987, the Company name was changed to “Spur Ventures Inc.” In December 1988, the Company conducted a public offering in Canada and became a reporting issuer under the British Columbia Securities Act. The Company was initially engaged in the prospecting and exploration of mineral and oil and gas properties in Canada. By early 1991, the exploration activities had ceased due to lack of capital. On July 31, 1991, the Vancouver Stock Exchange deemed the Company inactive and this status remained until February 16, 1996. In June 1994, a reorganization program was initiated to reactivate the

9 of 31

Company. The Company issued 900,000 units for proceeds of $135,000, with each unit comprising one common share and one warrant, exercisable into one additional share at $0.15. Between the years 1995 to 2002, the Company explored various opportunities in natural resources industry in China.

In early 2002, Spur commenced its application for a mining permit through its Chinese joint venture partner, Yichang Phosphorus Chemical Industry Company ('YPCC”).

In December 2002, Spur and YPCC signed a joint venture contract. The joint venture contract mandates both parties to set up a joint venture company, Yichang Maple Leaf Chemicals Ltd. (“YMC”), to develop the Yichang project. According to the contract, YMC was to be owned 90% by Spur and 10% by YPCC.

In November, 2003, the Company entered into an agreement with YPCC to purchase a 65 percent interest in a new joint venture called Yichang Spur Chemicals Ltd. (“YSC”). In December, 2003, the Company received government approval for the YSC Joint Venture. On April 20, 2004, the Company’s interest in YSC was finalized based on closing adjustments as at December 31, 2003 and final negotiations. The Company’s interest has been agreed at 72.18%, an increase from the previously announced 65%. YSC was formerly called Xinyuan Chemicals Ltd., but has been renamed and converted into a Sino-foreign Joint Venture company to accommodate the Company’s participation. The YSC Joint Venture owns a fertilizer plant in Yichang. The fertilizer plant has been operating substantially below its rated capacity of 100,000 tonnes of annual NPK production since being commissioned in 2000 due to shortages of phosphoric acid, a key ingredient for NPK fertilizer production. To earn its 72.18% interest in YSC, the Company agreed to contribute US$2,500,000 for construction of a 60,000 tpa phosphoric acid plant (the “acid plant”), and agreed to undertake the expansion of the fertilizer plant to 300,000 tpa. The Company advanced a first payment of US$1,250,000 ($1,658,534) in Q1 2004 and a second payment of US$1,250,000 in Q2 2004 for the construction of the acid plant.

As a result of the acquisition of an interest in the YSC Joint Venture, the terms of the original YMC Joint Venture were renegotiated since the new concept has the fertilizer plant being held and initially expanded under YSC. On April 20, 2004, the Company finalized the restructuring of the YMC Joint Venture, with the Company’s interest in YMC adjusted to 78.72% with YPCC holding 21.28% . The original development plan for YMC called for Spur to earn a 90% interest in YMC by developing a 1 million tpa fertilizer plant integrated with the phosphate mine, originally estimated to cost approximately US$325 million.

Under the new terms of the YMC Joint Venture, the Company is required to make a US$3,834,000 capital contribution into YMC within three months of receipt of Chinese government approval for the restructuring. This amount represents the estimated cost of commissioning a mining facility capable of producing sufficient phosphate rock to supply at least a 100,000 tpa NPK fertilizer facility.

The total investment to be made by the Company in YMC is US$25,561,000 over 5 years, of which only the initial US$3,834,000 is a firm commitment. The balance of US$21,727,000 is to be invested over five years on a best efforts basis, as follows:

a cumulative total of US$8,946,000 within two years of receipt of approval for the restructured agreement;

a cumulative total of US$16,614,000 within four years; and

the balance of US$25,561,000 within five years.

The US$25,561,000 represents the estimated minimum equity required to finance the total investment over the next five years to develop the phosphate mine and to expand the fertilizer plant from 300,000 tpa to 1 million tpa, estimated at US$93 million. The cost of mine development to supply a 1.2 million tpa mining rate is estimated at USD$29.8 million, including the value of YPCC’s contribution of the deposit, working capital and contingencies over the 5 year development period. The estimated capital cost of expanding the fertilizer plant from 300,000 tpa capacity to 1million tpa is approximately US$49.8 million, plus working capital, contingencies and capitalized interest during construction over the next 5 years for a total of US$63.1 million. The balance above the equity to be contributed by the Company is anticipated to be financed though debt and cash flow.

10 of 31

If there is a conflict between the investment circumstances or market conditions and the investment schedule, the Company shall be entitled to make necessary adjustment to the investment schedule.

During the year ended December 31, 2004, the Company incurred exploration and development costs of $62,204 (2003: $53,951) in relation to the YMC Joint Venture. As of December 31, 2004, the Company has capitalized exploration and development expenses of $2,108,249 in relation to the YMC Joint Venture.

While the Company is still working on getting the approval for reduction of capital from the Chinese central government, the Company has made several significant cash contributions in February and March 2005. Under the original contract, the government is obligated to transfer the mining license to YMC once the first 15% capital requirement is met. Hubei Provincial Administration for Industry and Commerce has recently informed the Company that the investment to YSC ($3.3 million) can not be counted or transferred to YMC registered capital according to the laws and regulations of China and YMC original contract. The Company will need to contribute another $3.3 million in the near future. The Company is currently pursuing the mining licenses transfer. Both the funds the Company contributed to YMC and the ownership in the phosphate deposits may be at risk, should the Company not get the approval for reduction of capital from the Chinese government eventually.

Although YMC is still waiting for the final approval of its restructuring from the Chinese government, the Company has decided to consolidate YMC into its 2004 financial statements, due to the significant investments it has made to YMC in the last quarter of 2004 and first quarter of 2005.

B. Business Overview

Yichang Integrated Phosphate Mining and Fertilizer Project

The Company’s Yichang phosphate mining and fertilizer project in China is held through two separate joint ventures, YMC and YSC, with YMC holding the mining rights and assets, and YSC owning an existing fertilizer facility in Yichang. It is the Company’s intention to merge the two joint ventures in the future, which will integrate phosphate rock mining with down stream chemical processing to produce high-analysis phosphate fertilizers for the China markets.

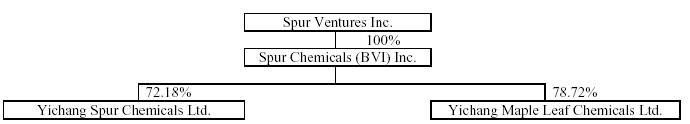

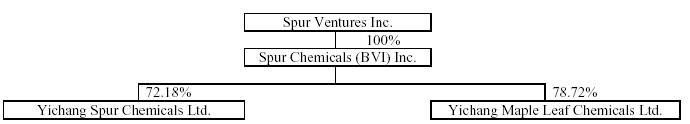

C. Organizational Structure

The following shows the structure of the Company’s material subsidiaries.

Spur Ventures Inc. was incorporated in British Columbia and is listed on TSX Venture Exchange; Spur Chemical was incorporated in British Virgin Island; Both Yichang Spur Chemicals Ltd. And Yichang Maple Leaf Chemicals Ltd. were joint ventures set up in China.

D. Property, Plants and Equipment

The extent and nature of the Company’s properties are summarized in the table below:

11 of 31

| Facility and location | Use and Size of Property | Owned/Leased & Term |

Suite 2684 – 1055 Dunsmuir

Street, Vancouver, BC, Canada

V7X 1L3 | Company head office

Approximately 1350 ft2 | Leased

Paying monthly |

Yichang phosphate deposits

Hubei, China | 110 km from Yichang City

Approximately 200 km2 | Owned by Chinese government

Optioned by the Company |

Yichang Maple Leaf Chemicals

office | #114-19 Building, Yanjiang Blvd.,

Yichang City, Hubei Province, P.

R. China | Leased

Paying monthly

Owned by JV partner YPCC |

| Yichang fertilizer plant | Yichang Town, Yidu City, Yichang

Municipality, Hubei Province, P.

R. China | Owned by YSC |

Project history and status

| | 1996 | Project approval from Yichang Prefecture Government, |

| | 1997 | Project approval from Hubei Provincial Government, |

| | 1997 | Project approval from Ministry of Chemical Industry, |

| | 1998 | Project approval from State Planning Commission, |

| | 1999 | Final project approval from the State Council (Chinese Cabinet), |

| | 2001 | Regulatory approval for the environmental study, |

| | 2002 | Regulatory approval for the feasibility study, |

| | Nov. 2003 | Provisional Business License Issued for YMC, |

| | Dec. 2003 | Provisional Business License Issued for YSC |

| | Apr. 2004 | Acquisition of Xinyuan closed. |

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The Company’s consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles (GAAP). These consolidated financial statements differ in material respects from U.S. GAAP. The difference is disclosed in note 17 of the audited financial statements. These consolidated financial statements include the accounts of the Company, its 72.18% owned joint venture company, Yichang Spur Chemicals Ltd. (YSC), since the date of acquisition, its 78.72% owned joint venture company which is awaiting approval of the Chinese authorities and which was consolidated commencing in the fourth quarter of 2004, Yichang Maple Leaf Chemicals Ltd. (YMC) and its wholly owned subsidiaries, Spur Chemicals (BVI) Inc. and International Phosphate Mining Corporation (International Phosphate). International Phosphate was incorporated to carry out mineral exploration and development programs in China. All significant inter-company transactions and accounts have been eliminated.

In the opinion of management, all adjustments of a normal recurring nature necessary for a fair presentation have been included. The information contained in this annual report should be read in conjunction with the Company’s latest annual consolidated financial statements and the notes thereto.

A. Operating Results

The Company’s activities in the last five years can be divided into three different projects: (1) oil and gas investments in Canada, (2) the Yichang integrated phosphate fertilizer project in China, and (3) the Golmud potash projects in China. The expenditures incurred in the Yichang integrated phosphate fertilizer project are itemized in the table below:

12 of 31

| | Year

2004 | Year

2003 | Year

2002 |

Yichang Phosphate Project -

Net balance | $2,108,249 | $2,046,045 | $2,752,584 |

The following makes reference to loss for the year under Canadian GAAP and US GAAP. A reconciliation for loss for the year under Canadian GAAP and US GAAP is shown in Note 17 of the Consolidated Financial Statements for the years ended December 31, 2004, 2003, and 2002.

Year Ended December 31, 2004 and Subsequent Events

Overall Performance

Appointment of CEO Dr. Robert J. Rennie.The Company appointed its first Chief Executive Officer Dr. Robert J. Rennie on March 3, 2005. Dr. Rennie has over 20 years of experience in the fertilizer business first in R&D with Esso Chemical and then with Agrium Inc. where he lead the successful growth of Agrium’s retail and wholesale investments in Argentina. Dr. Rennie retired from Agrium as Vice President, South America and VP of Corporate Relations. His industry and international experience will be a great benefit to Spur as it develops its fertilizer business in China.

Operation.The company continues to focus on developing an integrated fertilizer business at planned stages and has been able to achieve operating cash breakeven and retain a key customer base while operating at 30% of current production capacity and facing challenges including rising raw material costs, pre-expansion maintenance and remediation costs and electricity shortage.

Phosphoric Acid Plant.The construction and commissioning of a 60,000 tonnes per annum phosphoric acid plant was successfully completed in March 2005. The original budget for the phosphoric acid plant and related infrastructure was $5.57 million. In the course of detailed engineering it was determined that significant additional plant foundation was required due to poor soil conditions. In addition, the continued rapid growth in the Chinese economy has resulted in significant increases in the price of raw materials including steel and cement. The final estimated construction cost is $6.85 million, bringing the project within 23% of the original budget under difficult conditions. Construction took approximately 6 months, a substantially shorter timeframe than forecast, and significantly shorter than what would have been achievable in North America.

Phosphate mineral deposits mining license.The restructuring of the YMC Joint Venture was completed on April 20, 2004. Although the Company has received the restructuring approval from the Yichang municipal government and Hubei provincial government, the Company is still working on getting the final approvals from the Chinese central government. In the mean time, the company has made several significant cash contributions to YMC registered capital account. According to the original agreement, once the Company meets the first 15% capital requirement, the government is obligated to transfer the mining licenses to YMC. Hubei Provincial Administration for Industry and Commerce has recently informed the Company that the investment to YSC ($3.3 million) can not be counted or transferred to YMC registered capital according to the laws and regulations of China and YMC original contract. The Company will need to contribute another $3.3 million in the near future. The Company is currently pursuing the mining licenses transfer.

Cash Position.As of March 31, 2005, the Company had cash and cash equivalents of $12.3 million, of which $1.4 million is held in a Canadian bank. There is $10.9 million held in YMC registered capital account in China. The Company has complete control of the usage of the YMC registered capital account.

13 of 31

During the year ended December 31, 2004, the Company focused on developing an integrated fertilizer business in China. The phosphoric acid supply has been not reliable, because of limited availability. The company was working on the solution to build a 60,000 tonnes phosphoric acid plant for captive phosphoric acid supply. In the meantime, the company operates at a low capacity to keep operating cash flow breakeven and maintain a key customer base. Operating performance has been squeezed by rising raw materials prices and electricity shortage experienced in Yichang area in winter; however, the company’s cash basis continues to be breakeven and it has been able to increase its fertilizer product prices to the extent to which the market will bear.

During the year ended December 31, 2004, the loss of $2,425,755 increased from $1,310,054 during the year of 2003 primarily due to $1,257,040 in the non-cash stock-based compensation expenses during the period in accordance with new Stock Based Compensation Accounting Standards, and an increase in consulting fees from $255,243 in 2003 to $355,112 in 2004. The increase in consulting fees is due to the acquisition of YSC and the renegotiation of the YMC Joint Venture and the engagement of additional officers and directors as the Company expands towards its objectives. The increase in other expenses was mainly due to the incorporation of the operational results of YSC since the date of acquisition. The Company’s earnings from interest income increased to $183,608 in 2004 from $38,845 in 2003.

Year Ended December 31, 2003

The Company incurred a loss for the year of $1,310,054. The Company incurred a loss for the year under US GAAP of $589,746. The difference between the loss under Canadian GAAP and under US GAAP is due to the write off of exploration expenditures of $760,490.

In November, 2003, the Company entered into an agreement with YPCC to purchase a 72.18% interest in a new joint venture called Yichang Spur Chemicals Ltd. (“YSC”). In December, 2003, the Company received government approval for the YSC Joint Venture.

Year Ended December 31, 2002

The Company incurred a loss for the year of $245,872. The Company incurred a loss for the year under US GAAP of $557,057. The difference between the loss under Canadian GAAP and under US GAAP is due to the write off of exploration expenditures of $311,185.

The following events occurred on the Company’s Yichang phosphate project in 2002:

Following the completion of feasibility study on the Yichang phosphate project, Spur commissioned Jacobs Engineering Inc. to examine the project implementation and reconfiguration alternatives. The study was completed in April 2002. In the study, Jacobs proposed a two-phased project implementation plan. Phase I will involve the construction of an NPK fertilizer production facility, a river jetty and associated infrastructure to produce approximately 1.1 million t/y high-analysis phosphate fertilizer NPK by outsourcing phosphoric acid. Phase II will be started, when Phase I is in production, by backward integrating Phase I facilities into phosphate rock mining and phosphoric acid production. The reconfiguration reduces the initial capital requirement to approximately $120 million (including working capital) from the original $341 million.

In early 2002, Spur commenced its application for mining permit through its Chinese joint venture partner, YPCC. The application involves two stages. Stage one is to file an application to delineate the area covering the mineral deposits and to designate the deposits for development by Spur and YPCC. The Chinese Ministry of Land and Mineral Resources gave its approval to this application in February 2003. In stage two, an independent valuation will be conducted on the mineral property to give it a deemed value as part of YPCC’s contribution to the Yichang project.

In December 2002, Spur and YPCC signed joint venture contract. The joint venture contract mandates the both parties to set up a joint venture company, Yichang Maple Leaf Chemicals Company, to develop the Yichang

14 of 31

project. According to the contract, Yichang Maple Leaf Chemicals Company is owned 90% by Spur and 10% by YPCC.

B. Liquidity and Capital Resources

The following table presents major Company financial data in summary form for the periods of 2004 and 2003 and for the first quarter of 2005:

| Year | Current assets | Total assets | Current liabilities |

| Q1 2005 | $14,088,644 | $26,557,049 | $4,321,512 |

| 2004 | $16,776,067 | $28,114,960 | $5,802,275 |

| 2003 | $5,121,672 | $7,194,380 | $38,616 |

There were no long-term liabilities in the above-mentioned periods.

As of March 31, 2005, the Company had a net working capital of $9,767,132, compared to $10,973,792 at December 31, 2004. During the period, a capital contribution of $12,880,000 was made to the YMC Joint Venture, which, together with the contribution of $2,816,000 made in prior periods. Depending upon the timing of expansion plans for its projects and the receipt of approval for the restructuring of YMC and the availability of bank financing in China, the current working capital and cash position of the Company will provide sufficient liquidity to meet the Company’s year 2005 operating requirements.

Starting in the second quarter of fiscal 2004, the Company generates revenue through phosphate fertilizer production. In June 2004, the Company raised $15,446,084 net cash through a brokered private placement. As of December 31, 2004, the Company had a net working capital of $10,973,792, compared to $5,283,056 at December 31, 2003. During the period, a capital contribution of $2,316,430 was made to the YMC Joint Venture, which, together with the contribution of $500,000 made in prior periods, is consolidated in the attached balance sheet.

As at December 31, 2003, the Company had no long-term liabilities and had accounts payable and current accrued liabilities of $38,616 against cash and other current assets of $5,321,672.The increase in current assets was attributed to a partial subscription of a $2.5 million private placement, which was closed on May 13, 2003. Management acknowledges that if the Yichang phosphate property proves to be successful then it will require significant equity and debt financing. There is no assurance that the company will be successful in raising this finance.

Management considers that the company has sufficient funding to meet its obligations and maintain administrative and operational expenditures for at least the next 12 months. The Company’s working capital will be used to finance the Company’s effort of evaluating financing alternatives for the Yichang projects. When necessary, the Company may in the future conduct equity financing to supplement its working capital to advance the Yichang project. For the future major project financing, the Company will rely on any or a combination of the equity financing, bank loans, and participation of strategic partners.

C. Research and Development, Patents and Licenses

Not applicable.

15 of 31

D. Trend Information

Not applicable.

E. Off Balance Sheet Arrangements

The company has no off balance sheet arrangement.

F. Tabular Disclosure of Contractual Obligations

| | Payments due by Period (1) |

| Contractual Obligation | Total | Less than 1

Year | 1-3 Years | 3-5 Years | More than 5

Years |

| Bank loan with Industry & Commerce Bank of China | 2,187,069 | 2,187,069 | Nil | Nil | Nil |

| Bank loan with Agricultural Bank of China | 1,033,615 | 1,033,615 | Nil | Nil | Nil |

| Obligations to YSC Partner (estimated) | $748,996 | $748,996 | Nil | Nil | Nil |

| Rent on Office Head office | $46,730 | $15,577 | $31,153 | Nil | Nil |

| Rent on YMC office | $2,629 | $2,629 | Nil | Nil | Nil |

(1) From December 31, 2004

G. Safe Harbor

The safe harbor provided in Section 27A of the Securities Act and Section 21E of the Exchange Act (“statutory safe harbors”) shall apply to forward-looking information provided to Item 5.E and F, provided that the disclosure is made by: and issuer; a person acting on behalf of the issuer; an outside reviewer retained by the issuer making a statement on behalf of the issuer; or an underwriter, with respect to information provided by the issuer or information derived from information provided by issuer.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

A. Directors and Senior Management

Certain biographical information about each director and executive officer of the Company is set forth below:

Steven G. Dean, Age 45 -Director and Chairman of the Board since June 2003.

Mr. Dean is a Fellow of the Institute of Chartered Accountants of Australia, a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Canadian Institute of Mining, Metallurgy and Petroleum. He has extensive experience in mining, most recently as President of Teck Cominco Limited until his retirement in July 2002. He is also Chairman of Amerigo Resources Ltd., a copper production company with a tailings re-treatment facility near Santiago, Chile whose shares are traded on the Toronto Stock Exchange.

Robert J. Rennie, Age 55 –Chief Executive Officer and Director since March 2005

Dr. Rennie joined the Company as its first Chief Executive Officer in March of 2005 after taking early retirement from Agrium Inc. He served in several roles in Agrium including Vice President of New Products R&D and finally as Vice President of South America and Vice President of Corporate Affairs. He led Agrium’s entry into Argentina building the world’s largest single train urea plant, a joint venture with Spain’s Repsol-

16 of 31

YPF. He also turned around Agrium’s struggling retail business, Agroservicios Pampeanos. When he retired the South American operations accounted for 25% of Agrium’s profitability and were its most profitable corporate entities. Mr. Rennie serves as Vice Chairman of the Agriculture Committee of IFA and on the Board of Directors of the Alberta Agriculture Research Institute and the Latin American Research Centre of the University of Calgary. Dr. Rennie holds a PhD from the University of Minnesota.

John Van Brunt, Age 62 – Director and Vice Chairman since July 2004

Mr. Van Brunt was Chief Executive Officer of Agrium the world’s largest producer of nitrogen fertilizers until his retirement in 2003. He did the initial IPO of Cominco Fertilizers in 1993 building the company through mergers and acquisitions from $250M US sales to $3.0 Billion as it became known as Agrium Inc. At the time of his retirement he was Vice Chairman of the Agrium Board. Mr. Van Brunt is currently the Chairman of Paris-based International Fertilizer Industry Association and Chairman of the Board of Directors of The Fertilizer Institute in Washington.

Robert G. Atkinson, Age 65– Director since March 1996, Vice Chairman since June 2003

Mr. Atkinson has been in the investment industry for over 30 years. He is former President and CEO of Loewen Ondaatje McCutcheon & Co Ltd., a Canadian investment dealer. He now serves as Director of Trimin Capital Inc., a Toronto Stock Exchange listed holding company. Mr. Atkinson also serves as a Director of Quest Capital Corp, a Toronto Stock Exchange listed company whose business emphasis is in merchant banking. Quest Capital Corp. is the Company’s largest shareholder. Mr. Atkinson received a B.Comm. degree from the University of British Columbia in 1963.

David Cohen, Age 43 – Director since June 2003

He is the President and CEO of Northern Orion Resources Inc. and a director of a number of public and private international companies. He started his professional career in 1981 with Anglo American Corporation in operations on the diamond and gold mines in South Africa. After a period in chemical plant design and project management he joined Fluor Daniel in 1991, a leading international engineering and construction firm as Director, Business Development, leading international business development activities in the petroleum and mining sectors from the Fluor Daniel offices in California and Colorado. Mr. Cohen is a chemical engineer by training with an MBA in international corporate finance.

David Black, Age 64 – Director since June 2000

Mr. Black is a retired corporate and securities lawyer and an associate counsel of DuMoulin Black, a law firm established in 1966 providing corporate, securities and finance services to natural resource and commercial/industrial companies.

Ruston Goepel, Age 63 - Director since June 2003

Mr. Goepel is Senior Vice President, Raymond James Ltd. He entered the investment business in 1968. In 1989 he was a founding partner and CEO of Goepel Shields & Partners, a national securities dealer which was acquired by Raymond James Inc. Tampa, Florida, a large U.S. brokerage firm, in January, 2001.

Michael Chen, Age 35 – Chief Financial Officer since October 2004

Mr. Chen has more than 10 years of financial management experience with large multi-national corporations in the United States, Canada and China, principally with Honeywell International Inc. and Goodrich Corporation, two U.S. Fortune 500 companies. Mr. Chen is a Certified Public Accountant in the U.S. and has a degree in International Finance from Beijing University and an MBA from the University of Arizona.

Y.B. Ian He, Age 43 – President and Director since August 1995

Mr. He joined the Company in 1995 serving as President and leading the Company into the Chinese mineral and fertilizer industries. Prior to joining the Company, Mr. He served as a Senior Process Metallurgist with Process Research Associates Ltd. in Vancouver. He also serves as a Director of Jinshan Gold Mines Inc., a mineral exploration company listed on TSX Venture Exchange. Mr. He obtained a Ph.D. degree from the University of British Columbia.

17 of 31

Dongdong Huang, Age 47 - Vice President, Corporate Relations and Director since May 2004

Dr. Huang is a qualified lawyer in China and British Columbia, Canada, with extensive experience in negotiating, structuring and managing joint ventures between North American and Chinese interests by working with some of the largest law firms in Canada such as Tory Tory, Fasken Martineau, and Smith Lyons since 1986. He is recognized as an authority on Chinese law in Canada and represents many public companies from North America in their business transactions in China. Mr. Huang obtained his B.A. from Wuhan University, LL.B. from York University, and LL.M. and LL.D. from University of Ottawa.

B. Compensation

The following sets forth for the fiscal year ended December 31, 2004 the compensation of each of the directors and executive officers of the Company who received compensation and all of the executive officers and directors as a group. All amounts are shown in Canadian dollars.

| Individual | Position | Compensation |

| Steven Dean | Chairman, Director | $120,000 |

| John Van Brunt | Vice Chairman, Director | $25,000 |

| Robert G. Atkinson | Vice Chairman, Director | $60,000 |

| Y. B. Ian He | President, Director | $96,000 |

| David Cohen | Director | $20,000 |

| Michael Chen | Chief Financial Officer | $34,406 |

| Dongdong Huang | VP Corporate and Legal, Director | $57,500 |

| James Zhang | Former CFO | $22,500 |

| Executive Officers & Directors as a Group | | $435,406 |

The Company and its subsidiaries have no employment contracts with any director or executive officer. The Company and its subsidiaries have no compensatory plan or arrangement in respect of compensation received or that may be received by any director or executive officer in the Company's most recently completed or current financial year to compensate such executive officers in the event of the termination of employment (resignation, retirement, change of control) or in the event of a change in responsibilities following a change in control, where with respect to a director or executive officer the value of such compensation exceeds $100,000.

The Board of Directors of the Company adopted a Stock Option Plan for the granting of stock options to the officers, employees and Directors (the “Stock Option Plan”) on June 10, 1997. The amendments to the Stock Option Plan were approved in the Company’s annual general meeting on June 18, 2001 and June 22, 2005. The maximum number of Common Shares, which may be issued pursuant to options granted under the amended Stock Option Plan, is 8,000,000 shares in the capital of the Company. The Company may grant additional stock options, subject to all necessary regulatory approvals. Under the current TSX Venture Exchange policies, member approval is not required for the grant of stock options if granted in accordance with the policy. However, TSX Venture Exchange policy requires that any amendments to stock options granted be approved by a majority of the members at the annual general meeting excluding insiders and their associates.

The following table sets forth information concerning individual grants of options to purchase securities of the Company made during the most recently completed financial year to the Directors and management of the company: |

18 of 31

| Name of Optionees | Number of

Options

Granted | % of Total

Options

Granted in

2004 | Exercise or

Base Price

($/share) | Date of Grant | Expiration Date |

| Robert Atkinson | 200,000 | 10.81 | $1.50 | July 23, 2004 | July 23, 2009 |

| Steven Dean | 600,000 | 32.43 | $1.50 | July 23, 2004 | July 23, 2009 |

| Ruston Goepel | 200,000 | 10.81 | $1.50 | July 23, 2004 | July 23, 2009 |

| David Cohen | 200,000 | 10.81 | $1.50 | July 23, 2004 | July 23, 2009 |

| Dongdong Huang | 200,000 | 10.81 | $1.50 | July 23, 2004 | July 23, 2009 |

| John van Brunt | 250,000 | 13.51 | $1.50 | July 23, 2004 | July 23, 2009 |

| Michael Chen | 200,000 | 10.81 | $1.50 | Oct.12, 2004 | Oct. 12, 2009 |

| Total | 1,850,000 | 100 | | | |

During the most recently completed financial year, no stock options were re-priced under the Stock Option Plan.

As of June 17, 2005, the latest record date of the Company, the Company had issued and outstanding the following non-assignable stock options to purchase common shares at the purchase price shown. All prices are stated in Canadian dollars:

| Name of Optionee | Number of Shares | Purchase Price | Expiration Date |

| Robert Atkinson | 350,000 | $0.90 | June 18, 2006 |

| Robert Atkinson | 1,600,000 | $0.60 | May 6, 2008 |

| Robert Atkinson | 200,000 | $1.50 | July 23, 2009 |

| Ian He | 350,000 | $0.90 | June 18, 2006 |

| Ian He | 300,000 | $0.60 | May 6, 2008 |

| Steven Dean | 335,000 | $1.20 | June 19, 2008 |

| Steven Dean | 600,000 | $1.50 | July 23, 2009 |

| Ruston Goepel | 100,000 | $1.20 | June 19, 2008 |

| Ruston Goepel | 200,000 | $1.50 | July 23, 2009 |

| David Cohen | 200,000 | $1.20 | June 19, 2008 |

| David Cohen | 200,000 | $1.50 | July 23, 2009 |

| David Black | 50,000 | $0.90 | Oct. 18, 2005 |

| David Black | 100,000 | $0.60 | May 6, 2008 |

| Dongdong Huang | 200,000 | $1.50 | July 23, 2009 |

| John van Brunt | 250,000 | $1.50 | July 23, 2009 |

| Gong (Michael) Chen | 200,000 | $1.50 | October 12, 2009 |

| Robert Rennie | 500,000 | $1.80 | March 1, 2010 |

| Total | 5,735,000 | | |

As of June 17, 2005 the latest record date of the Company, the total options outstanding and exercisable is 5,735,000 shares, among which 500,000 options have an exercise price of $1.80, 1,850,000 options have an exercise price of $1.50, 635,000 options have an exercise price of $1.20, 850,000 options have an exercise price of $0.90 per share, and 2,200,000 options have an exercise price of $0.60 per share.

The purpose of granting such options is to assist the Company in compensating, attracting, retaining and motivating the Directors of the Company and to closely align the personal interests of such persons to that of the

19 of 31

shareholders. Stock options are a significant component of the compensation received by the Directors and serve to provide incentive to such individuals to act in the best interests of the Company and its shareholders.

The Company does not provide or set aside any funds for pension, retirement, or similar benefits for officers and directors. Officers and directors may receive options to purchase shares. No officer or director has been appointed to his or her position pursuant to any arrangement or understanding between him and any other person.

C. Board Practices

In accordance with the Articles of the Company the number of directors shall be such number not less than one as the Company by ordinary resolution may from time to time determine and each director shall hold office until the next annual general meeting following his or her election or until his or her successor is elected. The Company has eight directors.

The officers of the Company are elected by the Board of Directors as soon as possible following each annual general meeting and shall hold office for such period and on such terms as the board may determine. There are no service contracts between the Company and any of its directors providing for benefits upon termination of their employment or service.

There are three committees under the Board: Corporate Governance and Nominating Committee, Audit Committee and Compensation Committee. They all consist of three independent directors.

D. Employees

The employees of the company for year 2004, 2003, and 2002 by location are as follows:

| Location | Year

2004 | Year

2003 | Year

2002 |

| Canada | 1 | | |

| China | 135 | 7 | 3 |

| Total | 136 | 7 | 3 |

The increase in the employee number in China was attributable to the acquisition of Xinyuan Chemicals and the commencement of YSC Joint Venture in April 2004.

E. Share Ownership

The Company is authorized to issue an unlimited number of common shares without par value, of which 40,597,662 are issued and outstanding, and an unlimited number of preferred shares without par value, of which none are issued.

As of June 17, 2005 the latest record date of the Company, the all directors, officers and employees of the Company as a group own and control 5.2% of the Company’s common shares outstanding and will own and control 16.9% of the Company’s common shares upon exercise of outstanding options.

20 of 31

| Identity of Owner | Amount Owned

and Controlled(1) | Percent of Class |

| Now Outstanding | Fully Diluted |

| Steven G. Dean | 915,000 | 2.25 % | 1.76 % |

| Y.B. Ian He | 557,120 | 1.37 % | 1.07 % |

| Robert G. Atkinson | 457,050 | 1.13 % | 0.88 % |

| Ruston Goepel | 170,000 | 0.42 % | 0.33 % |

| W. David Black | 10,000 | 0.02 % | 0.02 % |

| 1. | Shares beneficially owned, directly or indirectly, or over which control or direction is exercised, as at June 17, 2005 based upon information furnished to the Company by individual directors. Unless otherwise indicated, such shares are held directly. |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

A. Major Shareholders

The Company is not owned or controlled, either directly or indirectly, by any other corporation or by any government. There are no arrangements, known to the Company, the operation of which may at a future date result in a change of control of the Company. Set forth below is information concerning ownership of shares of the Companies voting securities, as of latest recording date on June 17, 2005. All directors and officers of the Company as a group own 5.2% of the Company’s common shares outstanding. There is no single shareholder who has more than 5% of common shares outstanding.

| Identity of Owner | Amount Owned and

Controlled | Percent of Class |

| Now Outstanding | Fully Diluted |

| Officers & Directors as a group | 2,109,170 | 5.20 % | 4.05 % |

B. Related Party Transactions

During the year ended December 31, 2004, the Company paid a total of $310,112 to a director and companies controlled by four directors (2003 - $255,243). The Company also paid consulting fees of $22,500 (2003: $nil) to an ex-officer. The Company paid management fees of $nil (2003: $27,833) to a company controlled by a director and legal fees of $25,542 (2003: $nil) to two officers and one legal firm associated with a director.

During the three-month period ended March 31, 2005, the Company paid consulting fees of $39,500 (2004: $97,500) to 2 companies controlled by directors (2004: 5). The Company also paid consulting fees of $3,745 (2004: $nil) to a company controlled by an officer.

Up to June 17, 2005 the Company knows of no officer or director of the Company, and no associate of an officer or director of the Company, has been indebted to the Company.

C. Interests of Experts and Counsel

Not applicable.

21 of 31

ITEM 8. FINANCIAL INFORMATION

A. Consolidated Financial Statements and Other Financial Information

The following financial statements of Spur Ventures Inc. are attached as Exhibit 99.1 in this Annual Report:

Management Responsibility for Financial Reporting

Auditors’ Report.

Consolidated Balance Sheet at December 31, 2004 and 2003.

Consolidated Statement of Operations and Deficit for the years ended December 31, 2004, 2003 and 2002.

Consolidated Statement of Cash Flows for the years ended December 31, 2004, 2003 and 2002.

Notes to Consolidated Financial Statements

The Company has neither declared nor paid any dividends to date on its outstanding shares. The Company intends to retain any future earnings to finance the development of its properties, and accordingly, does not anticipate paying any dividends in the foreseeable future.

B. Significant Changes

On March 3, 2005, the Company appointed its first Chief Executive Officer Dr. Robert J. Rennie. Prior to joining the Company, Dr. Rennie was the Vice President of South American and Vice President of Corporate Affairs at Agrium.

ITEM 9. THE OFFER AND LISTING

An annual report filed on Form 20-F requires the following information:The principal trading market for the Company’s Common Shares is the TSX Venture Exchange (TSX-V) under the symbol “SVU”. The following tables set forth for the periods indicated the high and low sales prices per share of the Company’s Common Shares on the TSX-V.

TSX Venture Exchange (in Canadian Dollars)

| Year | Period | High | Low |

| 2000 | 1 year | 1.08 | 0.60 |

| 2001 | 1 year | 1.05 | 0.27 |

| 2002 | Quarter 1 | 0.77 | 0.32 |

| Quarter 2 | 0.75 | 0.55 |

| Quarter 3 | 0.57 | 0.30 |

| Quarter 4 | 0.55 | 0.25 |

| 2003 | Quarter 1 | 0.75 | 0.33 |

| Quarter 2 | 1.25 | 0.60 |

| Quarter 3 | 1.30 | 0.82 |

| Quarter 4 | 1.78 | 0.80 |

| 2004 | Quarter 1 | 1.93 | 1.41 |

| Quarter 2 | 1.89 | 1.30 |

| Quarter 3 | 1.70 | 1.31 |

22 of 31

| Year | Period | High | Low |

| 2004 | Quarter 4 | 1.80 | 1.20 |

| 2005 | January | 1.45 | 1.24 |

| February | 1.95 | 1.36 |

| March | 1.90 | 1.51 |

| April | 1.83 | 1.53 |

| May | 1.79 | 1.57 |

ITEM 10. ADDITIONAL INFORMATION

A. Share Capital

Not applicable.

B. Memorandum and Articles of Association

The Article of Association of the Company has been filed as Exhibit 1.0 to the Company’s Registration Statement on Form 20-F (Registration No. 0-29638), filed with the Securities and Exchange Commission. The Articles of Association were approved by shareholders on June 17, 2004.

C. Material Contracts

Not applicable.

D. Exchange Controls

There are no government laws,decrees or regulations in Canada relating to restrictions on the import/export of capital, or affecting the remittance of interest, dividends or other payments to non-residential holders of the Company's shares. Any such remittances to United States residents, however, may be subject to a 15% tax pursuant to Article X of the reciprocal tax treaty between Canada and the United States. The applicable rate is dependent on the type of entity receiving the dividends. See Item 7 - Taxation, below.

Except as provided in the Investment Canada Act (the "Act"), there are no limitations under the laws of Canada, the Province of British Columbia or in the charter or any other constituent documents of the Corporation on the right of foreigners to hold and/or vote the shares of the Company.

The Act, which became effective on June 30, 1985, requires a non-Canadian making an investment to acquire control, directly or indirectly, of a Canadian business, to file a notification or an application for review with Investment Canada. An application for review must be filed if the investor is not a citizen or resident of a World Trade Organisation member country, and the investment is over $50,000,000 or, if the investor is a citizen or resident of a World Trade Organisation member country and the investment is over $179,000,000. For all acquisitions of a Canadian business which does not meet the threshold criteria for filing an application for review, the Act requires the investor to file a notification.

The provisions of the Act are complex, and the above is a limited summary of the main provision of the Act. Any non-Canadian citizen contemplating an investment to acquire control of the Company should consult professional advisors as to whether and how the Act might apply.

23 of 31

For purposes of the Act, direct acquisition of control means a purchase of the voting interests of a corporation, partnership, joint venture or trust carrying on a Canadian business, or any purchase of all or substantially all of the assets used in carrying on a Canadian business. An indirect acquisition of control means a purchase of the voting interest of a corporation, partnership, joint venture or trust, whether a Canadian or foreign entity, which controls a corporation, partnership, joint venture or trust company carrying on a Canadian business in Canada.

The Act requires a non-Canadian making an investment to acquire control of a Canadian business, the gross assets of which exceed certain defined threshold levels, to file an application for review with Investment Canada, the federal agency created by the Act.

As a result of the Canada - U.S. Free Trade Agreement, the Act was amended in January 1989 to provide distinct threshold levels for Americans who acquire control of a Canadian business. A "Canadian business" is defined in the Act as a business carried on in Canada that has a place of business in Canada, an individual or individuals in Canada who are employed or self-employed in connection with the business, and assets in Canada used in carrying on the business.

An American, as defined in the Investment Act, includes: an individual who is an American national or a lawful permanent resident of the United States; a government or government agency of the United States; an American-controlled entity, corporation or limited partnership; and a corporation, limited partnership or trust which is not controlled in fact through ownership of its voting interests in which two-thirds of its board of directors, general partners or trustees, as the case may be, are any combination of Canadians and Americans.

The following investments by a non-Canadian are subject to review by Investment Canada:

1. All direct acquisitions of control of Canadian businesses with assets of $5 million or more;

2. All indirect acquisitions of control of Canadian businesses with assets of $50 million or more, if such assets represent less than 50% of the value of the assets of the entities, the control of which is being acquired; and

3. All indirect acquisitions of control of Canadian businesses with assets of $5 million or more, if such assets represent more than 50% of the value of the assets of the entities, the control of which is being acquired.

Review by Investment Canada is required when investments by Americans exceed $150 million for direct acquisitions of control. For purposes of the Act, direct acquisition of control means a purchase of voting interest in a corporation, partnership, joint venture or trust carrying on a Canadian business, or any purchase of all of or substantially all of the assets used in carrying on a Canadian business; and indirect acquisition of control means: a purchase of the voting interest of a corporation, partnership, joint venture or trust, whether a Canadian or foreign entity, which controls a corporation, partnership, joint venture or trust carrying on a Canadian business in Canada.

The acquisition of certain Canadian businesses is excluded from the higher threshold set out for Americans. These excluded businesses include oil, gas, uranium, financial services (except insurance); transportation services and cultural services (i.e.: the publication, distribution or sale of books, magazines, periodicals (other than printing or typesetting businesses, music in print or machine readable form, radio, television, cable and satellite services; the publications, distributions, sale and exhibitions of film or video recordings or audio or video music recordings). Direct or indirect acquisitions of control of these excluded businesses are reviewable at the $5 million and $50 million thresholds.

A non-Canadian shall not implement an investment reviewable under the Act unless the investment has been reviewed and the Minister responsible for Investment Canada is satisfied or is deemed to be satisfied that the investment is likely to be of net benefit to Canada. The factors to be taken into account include:

24 of 31

1. The effect of the investment on the legal and economic activities in Canada, including the effect on employment and resource processing, on the utilisation of particular components and services produced in Canada, and on exports from Canada;

2. The degree and significance of participation by Canadians in the Canadian business;

3. The effect of the investment on productivity, industrial efficiency, technological development, product innovation and product variety in Canada;

4. The effect of the investment on competition within an industry or industries in Canada; and likely to be significantly affected by the investment; and

5. The compatibility of the investment with national industrial economic or cultural policies enunciated by the federal government or legislation of the legislature or government of any province.

If the Minister is not satisfied that the investment is likely to be a net benefit to Canada, the non-Canadian shall not implement the investment or, if the investment has been implemented, shall divest itself of control of the business that is the subject of the investment. A non-Canadian or American making the following investments: (i) an investment to establish a new Canadian business; or, (ii) an investment to acquire control of a Canadian business which investment is not subject to review under the Act; must notify Investment Canada, within prescribed time limits, of such investments.

E. Taxation

The discussion under this heading summarizes the principal Canadian federal income tax consequences of acquiring, holding and disposing of common shares of the Registrant for a shareholder of the Registrant who is not resident in Canada and who is resident in the United States. It is based on the current provisions of the Income Tax Act (Canada) (the "Tax Act") and the regulations thereunder. The provisions of the Tax Act are subject to income tax treaties to which Canada is a party, including the Canada-United States Income Tax Convention (1980) (the Convention). This discussion is general only and is not a substitute for independent advice from a shareholder's own tax advisor.

Generally, dividends paid by Canadian corporations to non-resident shareholders are subject to a withholding tax of 25% of the gross amount of such dividends. However, Article X of the reciprocal tax treaty between Canada and the United States reduced to 15% the withholding tax on the gross amount of dividends paid to residents of the United States. A further 9% reduction, in 1996, and a 10% reduction in 1997 and thereafter, in the withholding tax rate on the gross amount of dividends is applicable when a US corporation owns at least 10% of the voting stock of the Canadian corporation paying the dividends.

A non-resident who holds shares of the Company as capital property will not be subject to tax on capital gains realised on the disposition of such shares unless such shares are "taxable Canadian Property” within the meaning of theIncome Tax Act (Canada)("Tax Act'), and no relief is afforded under any applicable tax treaty. The shares of the Company would be taxable Canadian property of a non-resident ifat any time during the five year period immediately preceding a disposition by the non-resident of such shares (a) not less than 25% of the issued shares of any class of the Company belonged to the non-resident (b) the person with whom the nonresident dealt did not deal at arm's length, or (c) to the non-resident and any person with whom the non-resident did not deal at arm's length.

As a foreign corporation with US shareholders, the Company could be treated as a passive foreign investment Corporation ("PFIC"), as definedin Section 1296 of the Internal Revenue Code. This determination is dependent upon the percentage of the Company's passive income, or the percentage of the Company's assets, which are producing passive income. US shareholders owning shares of a PFIC may defer the U.S. tax with respect to that investment until the US holder disposes of the PFIC stock or receives certain distributions. At

25 of 31

that time, the U.S. holder is subject to US tax, plus interest, based on the value of the tax deferral for the period during which the shares of the PFIC are owned, in addition to treatment of any gain realised on the disposition of the shares of the PFIC as ordinary income rather than as a capital gain.

Gain from a disposition of PFIC stock or certain distributions are treated as income earned ratably over the period during which the shareholder has held the stock. That portion allocable to the current year and to years when the corporation was not a PFIC is included in the shareholder's gross income in the year of distribution as ordinary income, rather than as a capital gain. That portion of the distribution or disposition which is not allocable to the current year is subject to deferred U.S. tax (the amount of tax that wouldhave been owed if the allocated amount had been included in income in the earlier year), plus interest.

However, if the U.S. shareholder makes a timely election to treat a PFIC as a qualified electing fund ("QEF") with respect to such shareholder's interest therein, the above-described rules generally will not apply. Instead, the electing U.S. shareholder would include annually in his gross income his pro-rata share of the PFIC's earnings and profits and any net capital gain, regardless of whether such income or gain was actually distributed. A U.S. Holder of a QEF can, however, elect to defer the payment of United States Federal Income tax on such income inclusions income not currently received. Special rules apply to U.S. shareholders who own their interests in a PFIC through intermediate entities or persons.

F. Dividend and Paying Agents

Not applicable.

G. Statement by Experts

Not applicable.

H. Documents on Display

Documents referred to in this annual report on Form 20-F that have been filed with the SEC are available for review and copying at the SEC’s public reference room located at 450 Fifth Street, NW, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms and their copy charges.

I. Subsidiary Information

Not applicable.

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

Not applicable.

26 of 31

PART II

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

Not applicable.

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

Not applicable.

ITEM 15. CONTROL AND PROCEDURES

Based on their evaluation as of December 31, 2004, the Company’s Chief Executive Officer and Chief Financial Officer have concluded that the Company’s disclosure controls and procedures (as defined in 13a-14(c) and 15d-14(c) under the Securities and Exchange Act 1934) are effective to ensure that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized, and reported within the time period specified in Securities and Exchange Commission rules and forms. There were no significant changes in the Company’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective action with regard to significant deficiencies and material weaknesses.

ITEM 16. RESERVED

A. Audit Committee Financial Expert