INVESTOR PRESENTATION NYSE: GNTY 1st QUARTER 2023

SAFE HARBOR STATEMENT ABOUT GUARANTY BANCSHARES, INC. Guaranty Bancshares, Inc. is the parent company for Guaranty Bank & Trust, N.A. Guaranty Bank & Trust has 32 banking locations across 26 Texas communities located within the East Texas, Dallas/Fort Worth, Houston and Central Texas regions of the state. As of March 31, 2023, Guaranty Bancshares, Inc. had total assets of $3.36 billion, total loans of $2.38 billion and total deposits of $2.62 billion. Visit www.gnty.com for more information. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell, a solicitation of an offer to sell, or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. NON-GAAP FINANCIAL MEASURES Guaranty reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures used in managing its business may provide meaningful information about underlying trends in its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Guaranty’s reported results prepared in accordance with GAAP. Please see “Reconciliation of Non-GAAP Measures” at the end of this presentation for a reconciliation to the nearest GAAP financial measure.

SAFE HARBOR STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Actual results may also be significantly impacted by the effects of the ongoing COVID-19 pandemic, including, among other effects: the impact of the public health crisis; the operation of financial markets; global supply chain disruptions; employment levels; market liquidity; the impact of various actions taken in response by the U.S. federal government, the Federal Reserve, other banking regulators, state and local governments; and the impact that all of these factors have on our borrowers, other customers, vendors and counterparties. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, other risks and uncertainties listed from time to time in our reports and documents filed with the Securities and Exchange Commission ("SEC"). We can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this presentation, and we do not intend, and assume no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law.

QUARTERLY HIGHLIGHTS Ty Abston CEO and Chairman of the Board Cappy Payne SR EVP and Company CFO Shalene Jacobson EVP and Bank CFO

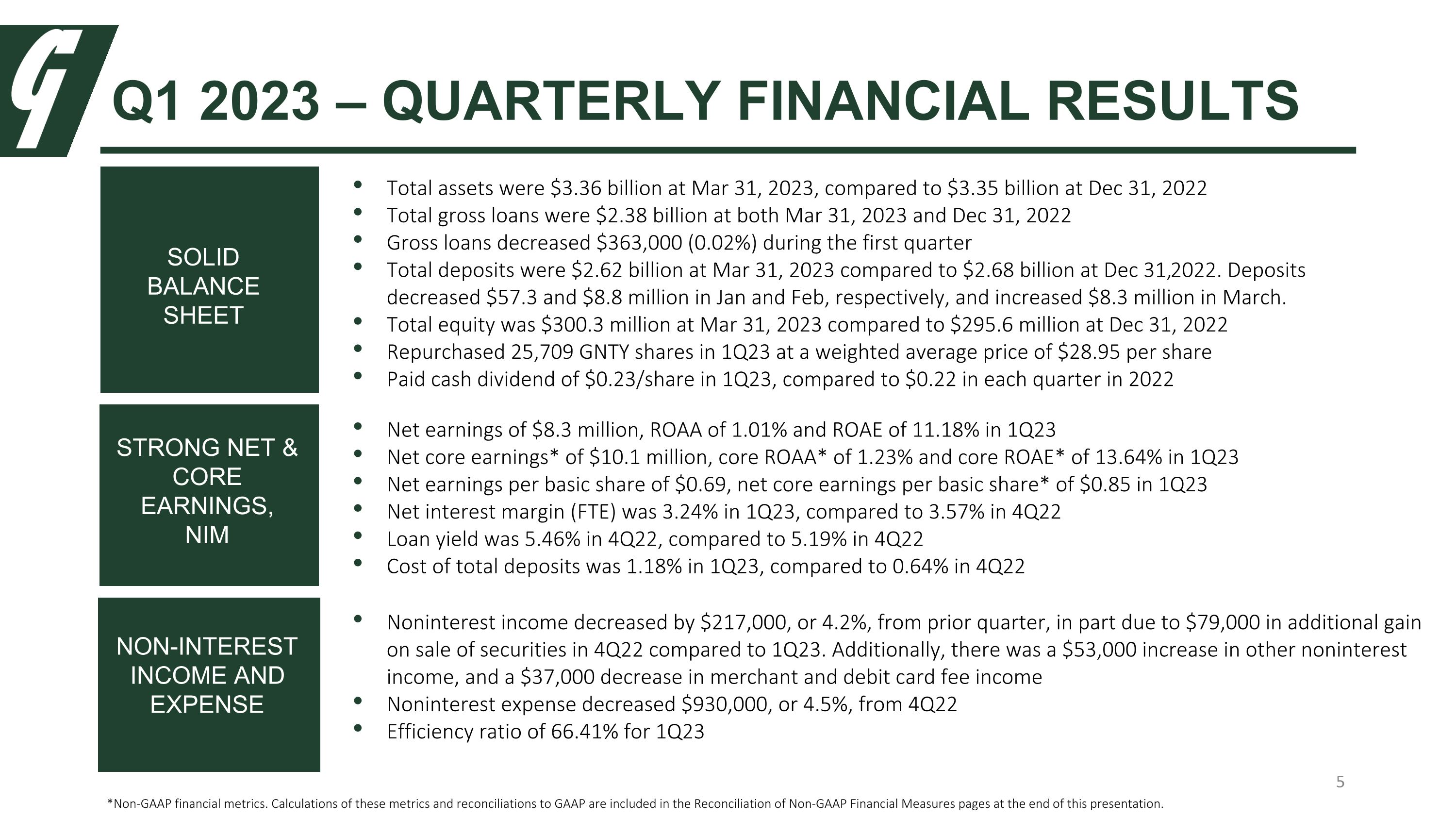

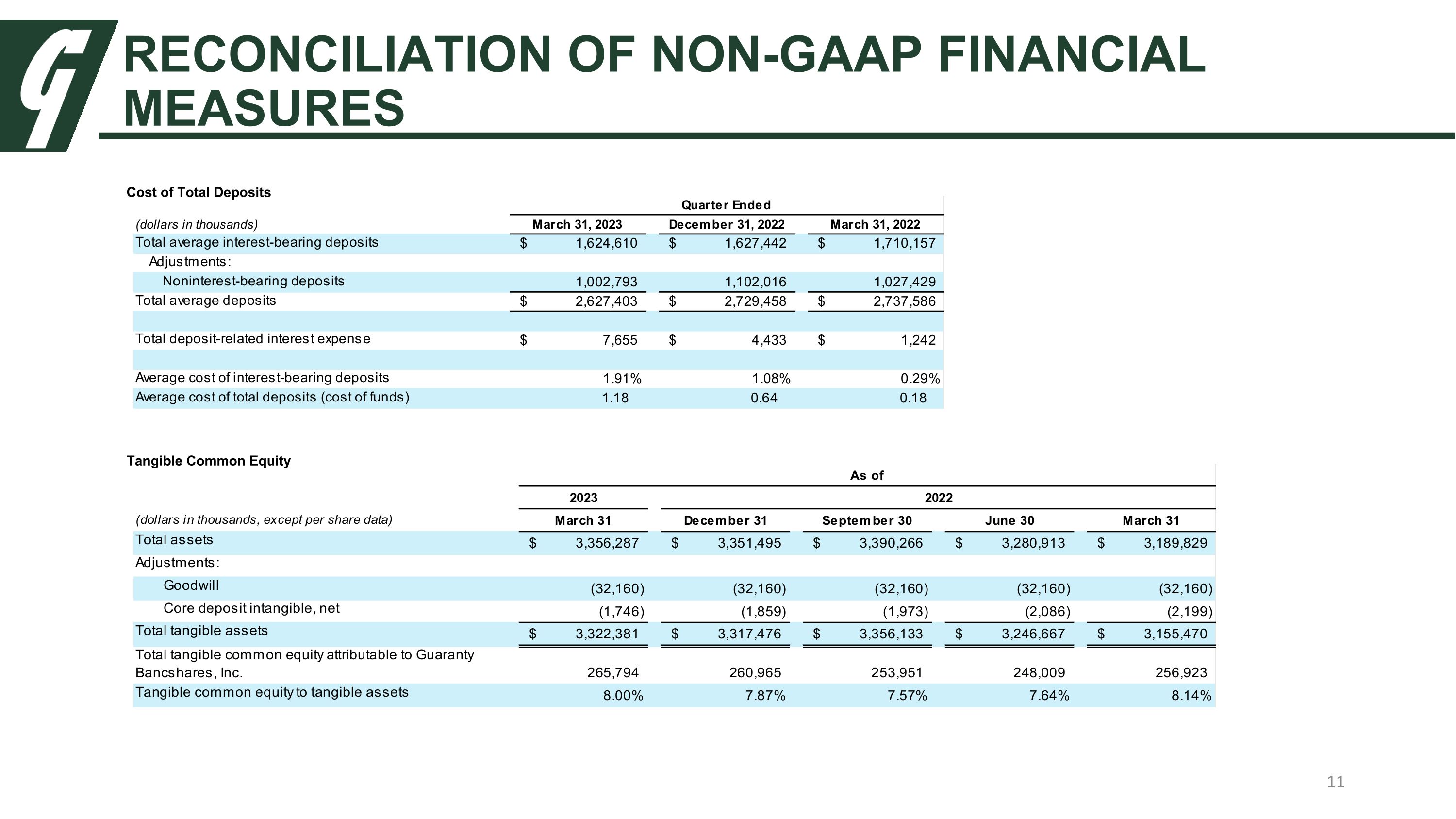

Q1 2023 – QUARTERLY FINANCIAL RESULTS STRONG NET & CORE EARNINGS, NIM SOLID BALANCE SHEET NON-INTEREST INCOME AND EXPENSE Total assets were $3.36 billion at Mar 31, 2023, compared to $3.35 billion at Dec 31, 2022 Total gross loans were $2.38 billion at both Mar 31, 2023 and Dec 31, 2022 Gross loans decreased $363,000 (0.02%) during the first quarter Total deposits were $2.62 billion at Mar 31, 2023 compared to $2.68 billion at Dec 31, 2022. Deposits decreased $57.3 and $8.8 million in Jan and Feb, respectively, and increased $8.3 million in March. Total equity was $300.3 million at Mar 31, 2023 compared to $295.6 million at Dec 31, 2022 Repurchased 25,709 GNTY shares in 1Q23 at a weighted average price of $28.95 per share Paid cash dividend of $0.23/share in 1Q23, compared to $0.22 in each quarter in 2022 Noninterest income decreased by $217,000, or 4.2%, from prior quarter, in part due to $79,000 in additional gain on sale of securities in 4Q22 compared to 1Q23. Additionally, there was a $53,000 increase in other noninterest income, and a $37,000 decrease in merchant and debit card fee income Noninterest expense decreased $930,000, or 4.5%, from 4Q22 Efficiency ratio of 66.41% for 1Q23 Net earnings of $8.3 million, ROAA of 1.01% and ROAE of 11.18% in 1Q23 Net core earnings* of $10.1 million, core ROAA* of 1.23% and core ROAE* of 13.64% in 1Q23 Net earnings per basic share of $0.69, net core earnings per basic share* of $0.85 in 1Q23 Net interest margin (FTE) was 3.24% in 1Q23, compared to 3.57% in 4Q22 Loan yield was 5.46% in 4Q22, compared to 5.19% in 4Q22 Cost of total deposits was 1.18% in 1Q23, compared to 0.64% in 4Q22 *Non-GAAP financial metrics. Calculations of these metrics and reconciliations to GAAP are included in the Reconciliation of Non-GAAP Financial Measures pages at the end of this presentation.

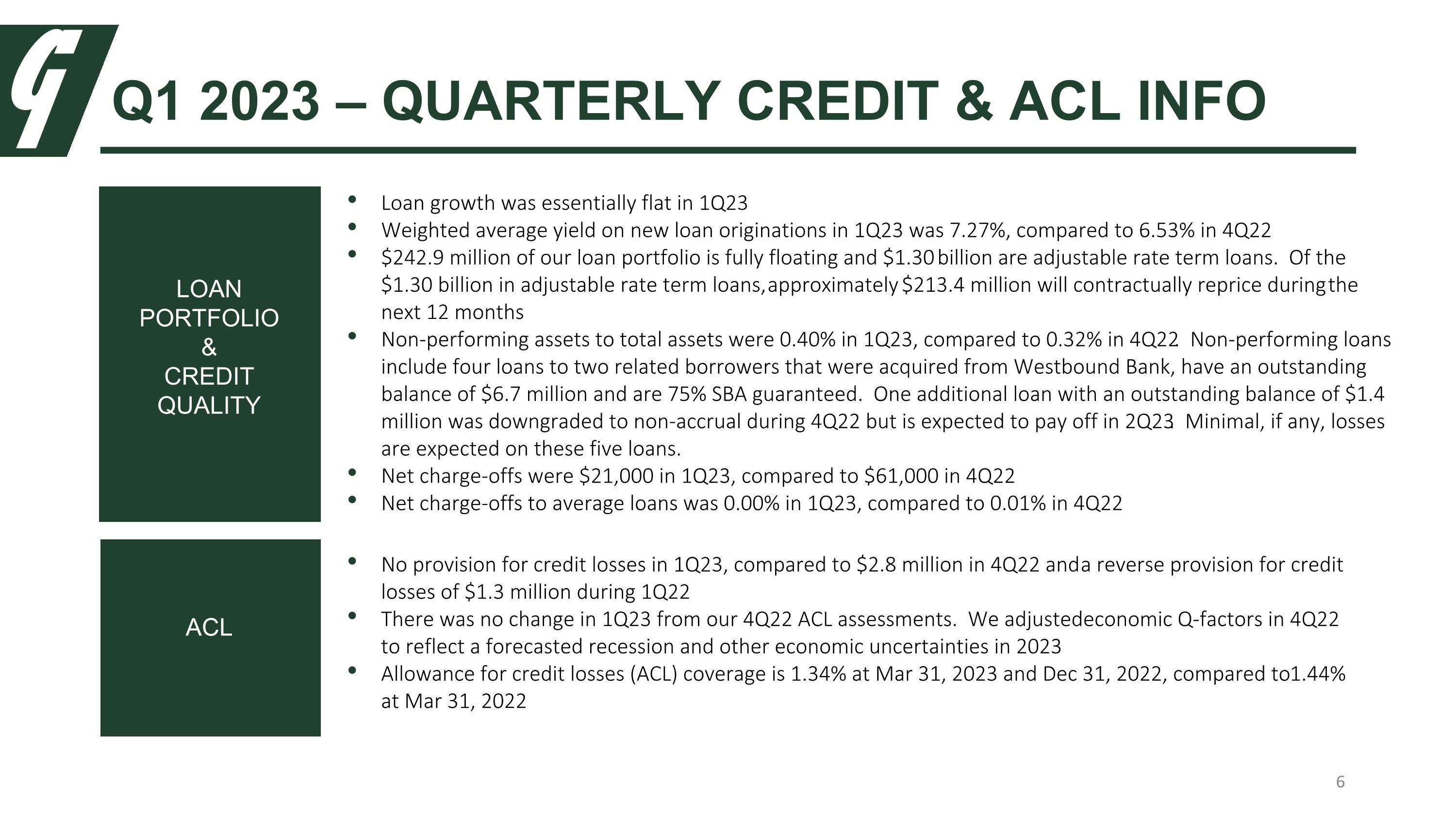

ACL No provision for credit losses in 1Q23, compared to $2.8 million in 4Q22 and a reverse provision for credit losses of $1.3 million during 1Q22 There was no change in 1Q23 from our 4Q22 ACL assessments. We adjusted economic Q-factors in 4Q22 to reflect a forecasted recession and other economic uncertainties in 2023 Allowance for credit losses (ACL) coverage is 1.34% at Mar 31, 2023 and Dec 31, 2022, compared to 1.44% at Mar 31, 2022 LOAN PORTFOLIO & CREDIT QUALITY Loan growth was essentially flat in 1Q23 Weighted average yield on new loan originations in 1Q23 was 7.27%, compared to 6.53% in 4Q22 $242.9 million of our loan portfolio is fully floating and $1.30 billion are adjustable rate term loans. Of the $1.30 billion in adjustable rate term loans, approximately $213.4 million will contractually reprice during the next 12 months Non-performing assets to total assets were 0.40% in 1Q23, compared to 0.32% in 4Q22. Non-performing loans include four loans to two related borrowers that were acquired from Westbound Bank, have an outstanding balance of $6.7 million and are 75% SBA guaranteed. One additional loan with an outstanding balance of $1.4 million was downgraded to non-accrual during 4Q22 but is expected to pay off in 2Q23. Minimal, if any, losses are expected on these five loans. Net charge-offs were $21,000 in 1Q23, compared to $61,000 in 4Q22 Net charge-offs to average loans was 0.00% in 1Q23, compared to 0.01% in 4Q22 Q1 2023 – QUARTERLY CREDIT & ACL INFO

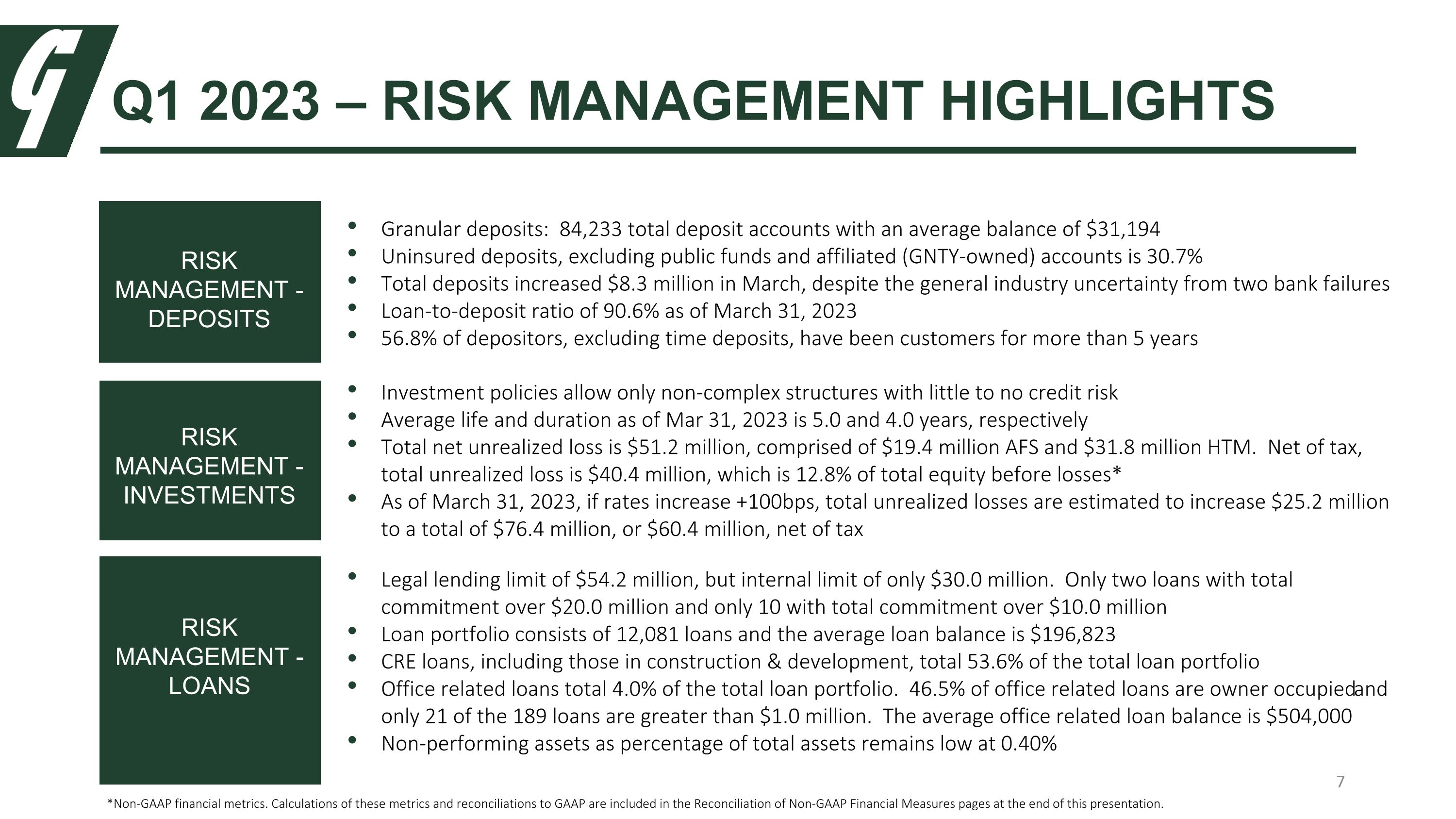

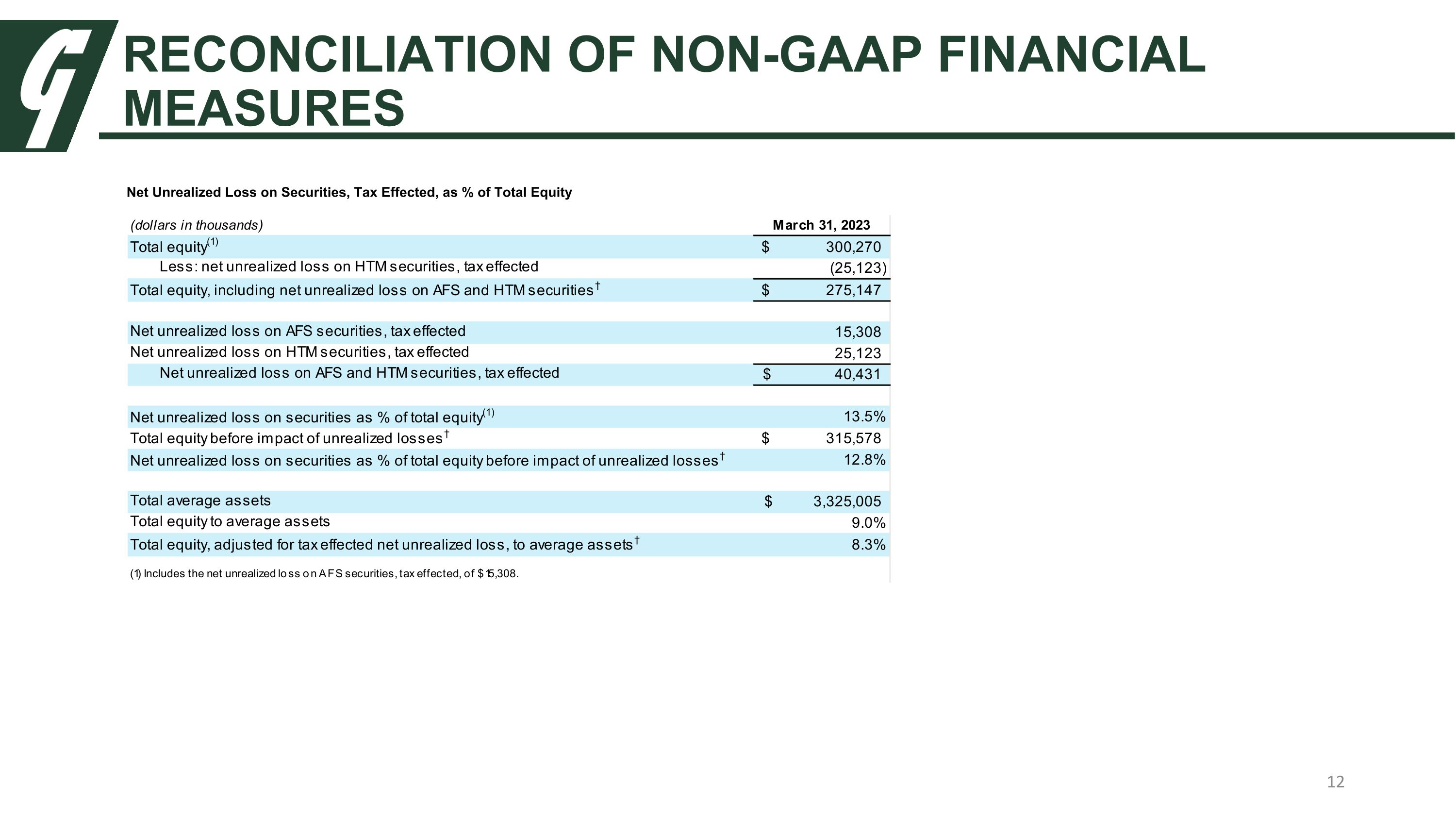

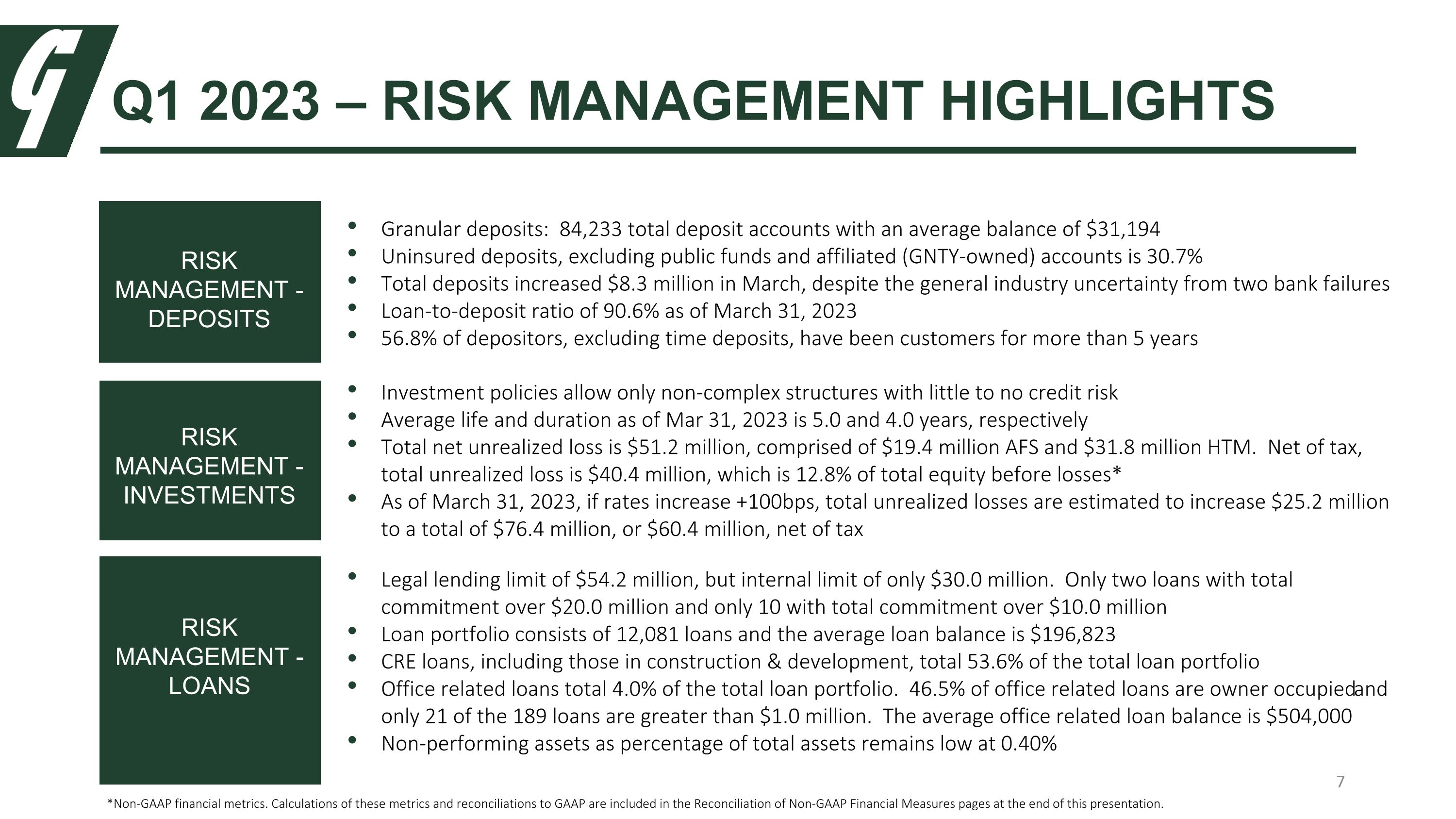

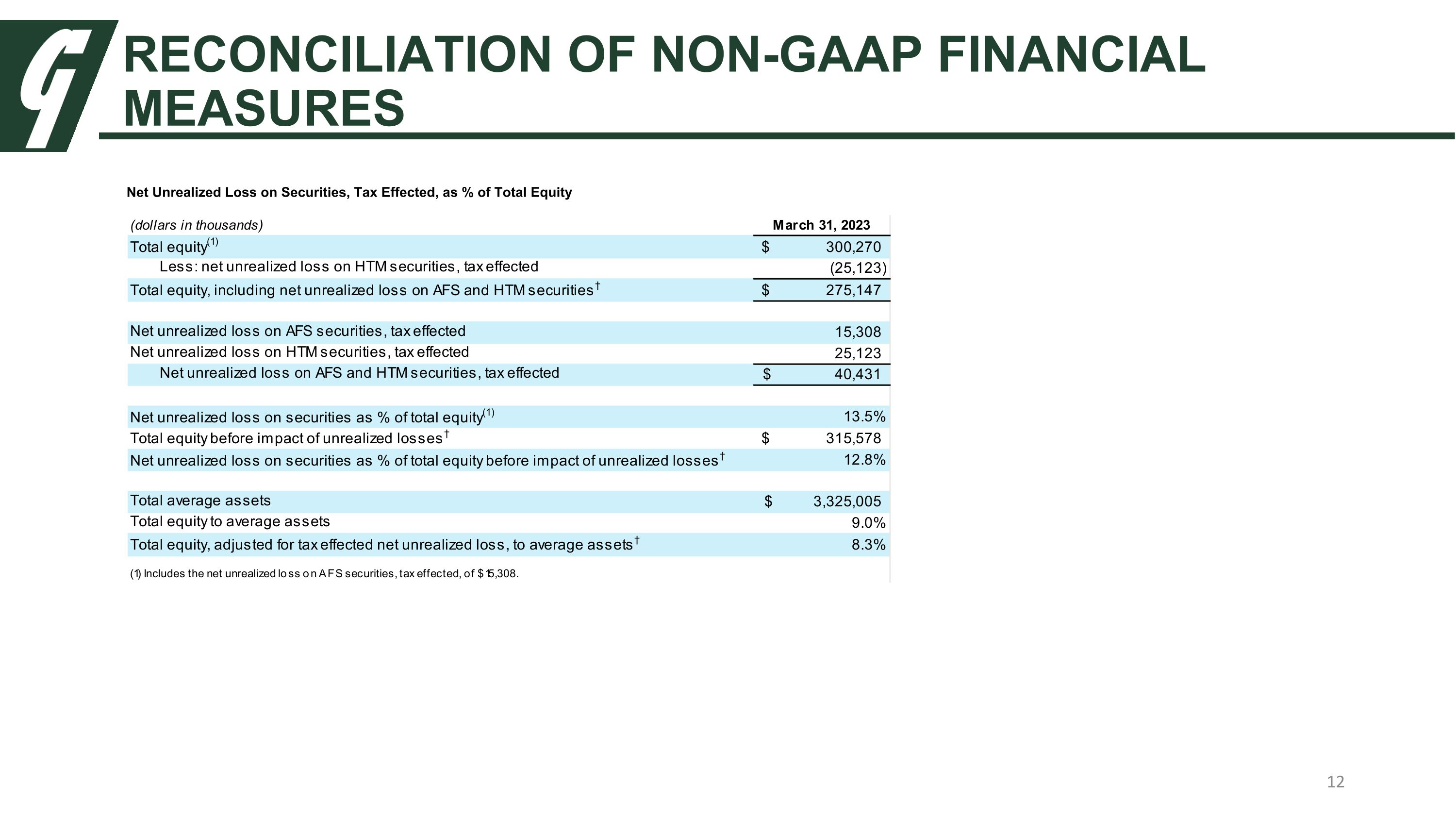

RISK MANAGEMENT - DEPOSITS Granular deposits: 84,233 total deposit accounts with an average balance of $31,194 Uninsured deposits, excluding public funds and affiliated (GNTY-owned) accounts is 30.7% Total deposits increased $8.3 million in March, despite the general industry uncertainty from two bank failures Loan-to-deposit ratio of 90.6% as of March 31, 2023 56.8% of depositors, excluding time deposits, have been customers for more than 5 years Q1 2023 – RISK MANAGEMENT HIGHLIGHTS RISK MANAGEMENT - INVESTMENTS Investment policies allow only non-complex structures with little to no credit risk Average life and duration as of Mar 31, 2023 is 5.0 and 4.0 years, respectively Total net unrealized loss is $51.2 million, comprised of $19.4 million AFS and $31.8 million HTM. Net of tax, total unrealized loss is $40.4 million, which is 12.8% of total equity before losses* As of March 31, 2023, if rates increase +100bps, total unrealized losses are estimated to increase $25.2 million to a total of $76.4 million, or $60.4 million, net of tax Legal lending limit of $54.2 million, but internal limit of only $30.0 million. Only two loans with total commitment over $20.0 million and only 10 with total commitment over $10.0 million Loan portfolio consists of 12,081 loans and the average loan balance is $196,823 CRE loans, including those in construction & development, total 53.6% of the total loan portfolio Office related loans total 4.0% of the total loan portfolio. 46.5% of office related loans are owner occupied and only 21 of the 189 loans are greater than $1.0 million. The average office related loan balance is $504,000 Non-performing assets as percentage of total assets remains low at 0.40% RISK MANAGEMENT - LOANS *Non-GAAP financial metrics. Calculations of these metrics and reconciliations to GAAP are included in the Reconciliation of Non-GAAP Financial Measures pages at the end of this presentation.

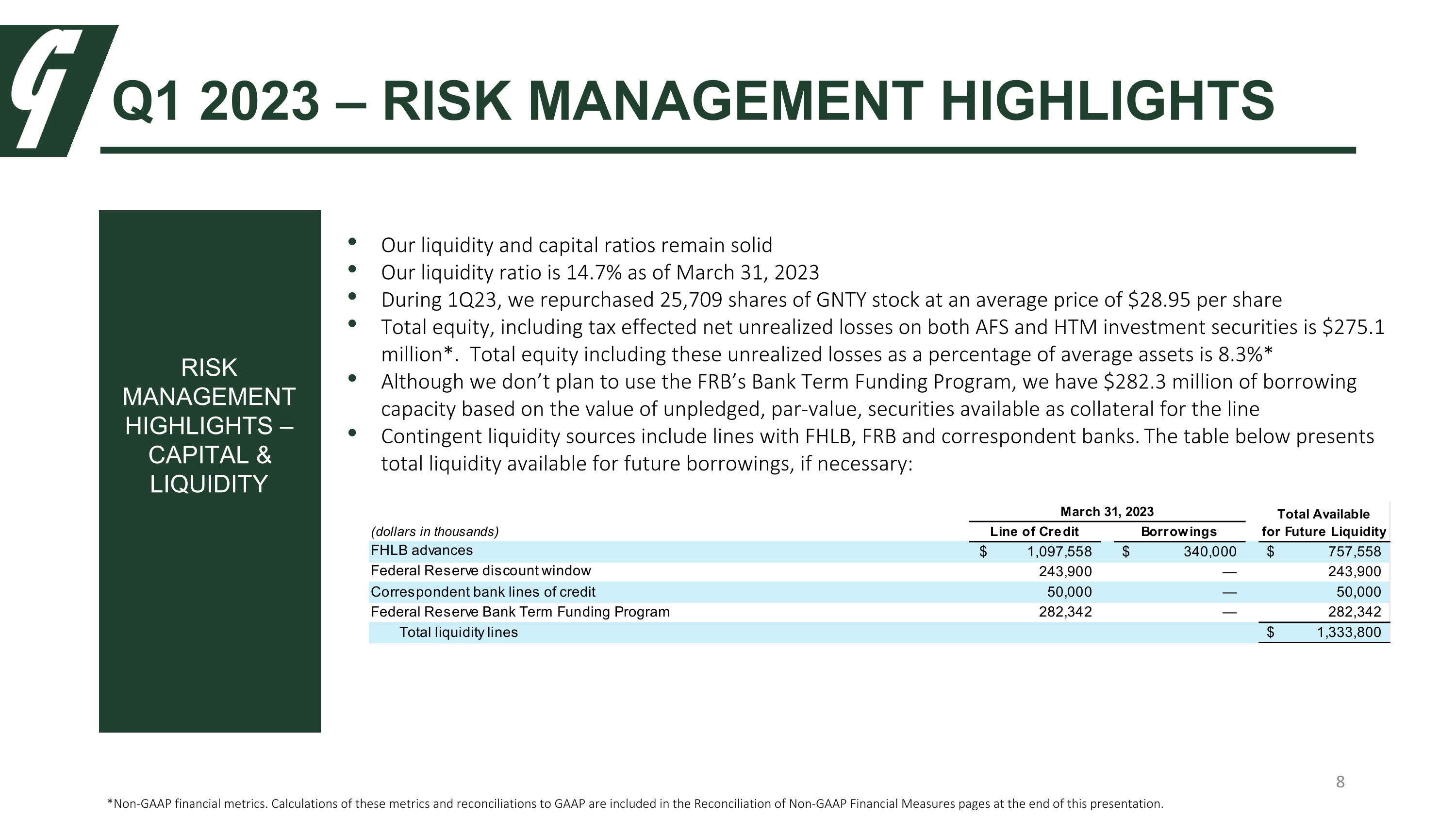

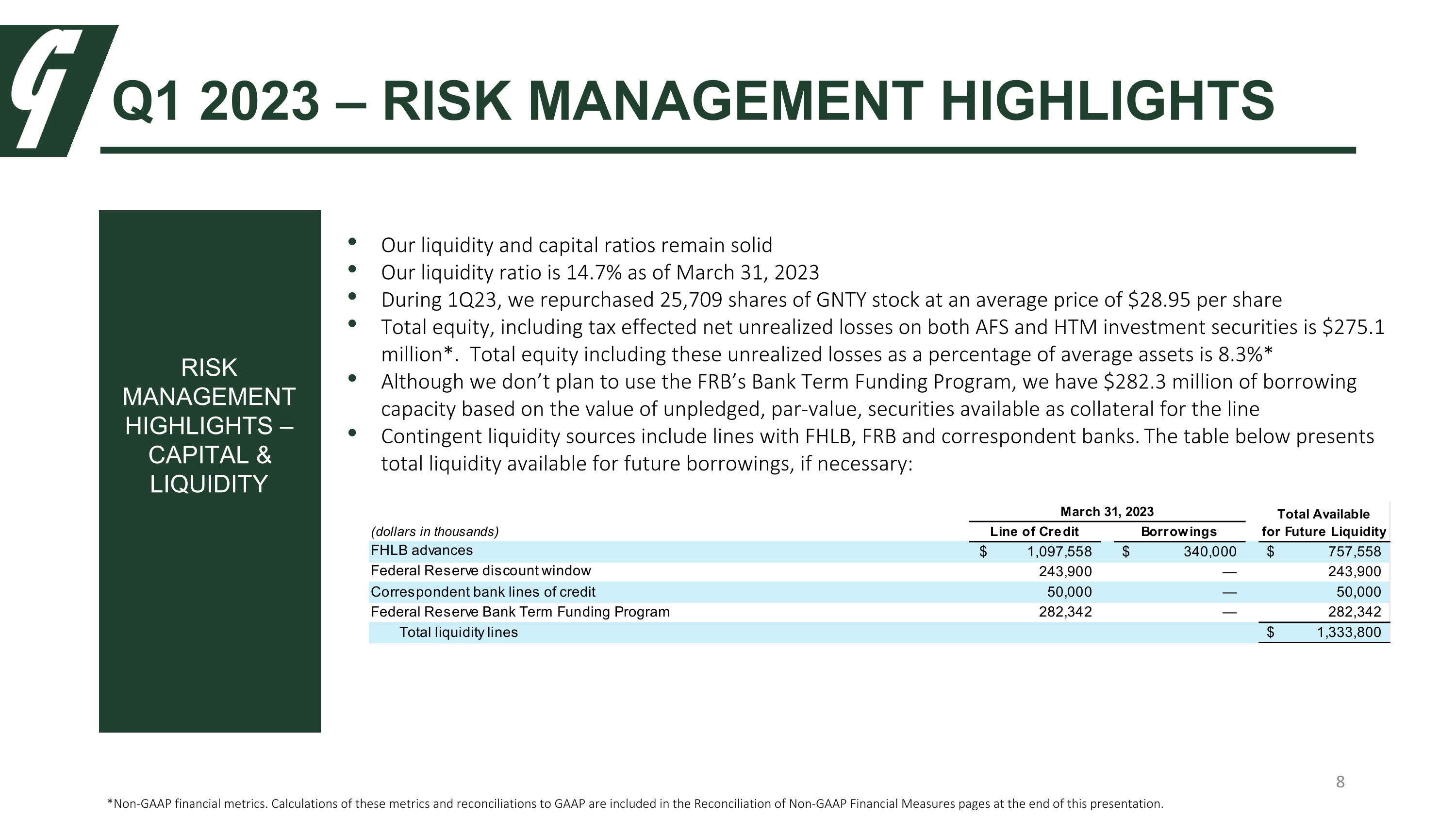

RISK MANAGEMENT HIGHLIGHTS – CAPITAL & LIQUIDITY Our liquidity and capital ratios remain solid Our liquidity ratio is 14.7% as of March 31, 2023 During 1Q23, we repurchased 25,709 shares of GNTY stock at an average price of $28.95 per share Total equity, including tax effected net unrealized losses on both AFS and HTM investment securities is $275.1 million*. Total equity including these unrealized losses as a percentage of average assets is 8.3%* Although we don’t plan to use the FRB’s Bank Term Funding Program, we have $282.3 million of borrowing capacity based on the value of unpledged, par-value, securities available as collateral for the line Contingent liquidity sources include lines with FHLB, FRB and correspondent banks. The table below presents total liquidity available for future borrowings, if necessary: Q1 2023 – RISK MANAGEMENT HIGHLIGHTS *Non-GAAP financial metrics. Calculations of these metrics and reconciliations to GAAP are included in the Reconciliation of Non-GAAP Financial Measures pages at the end of this presentation.

Q & A

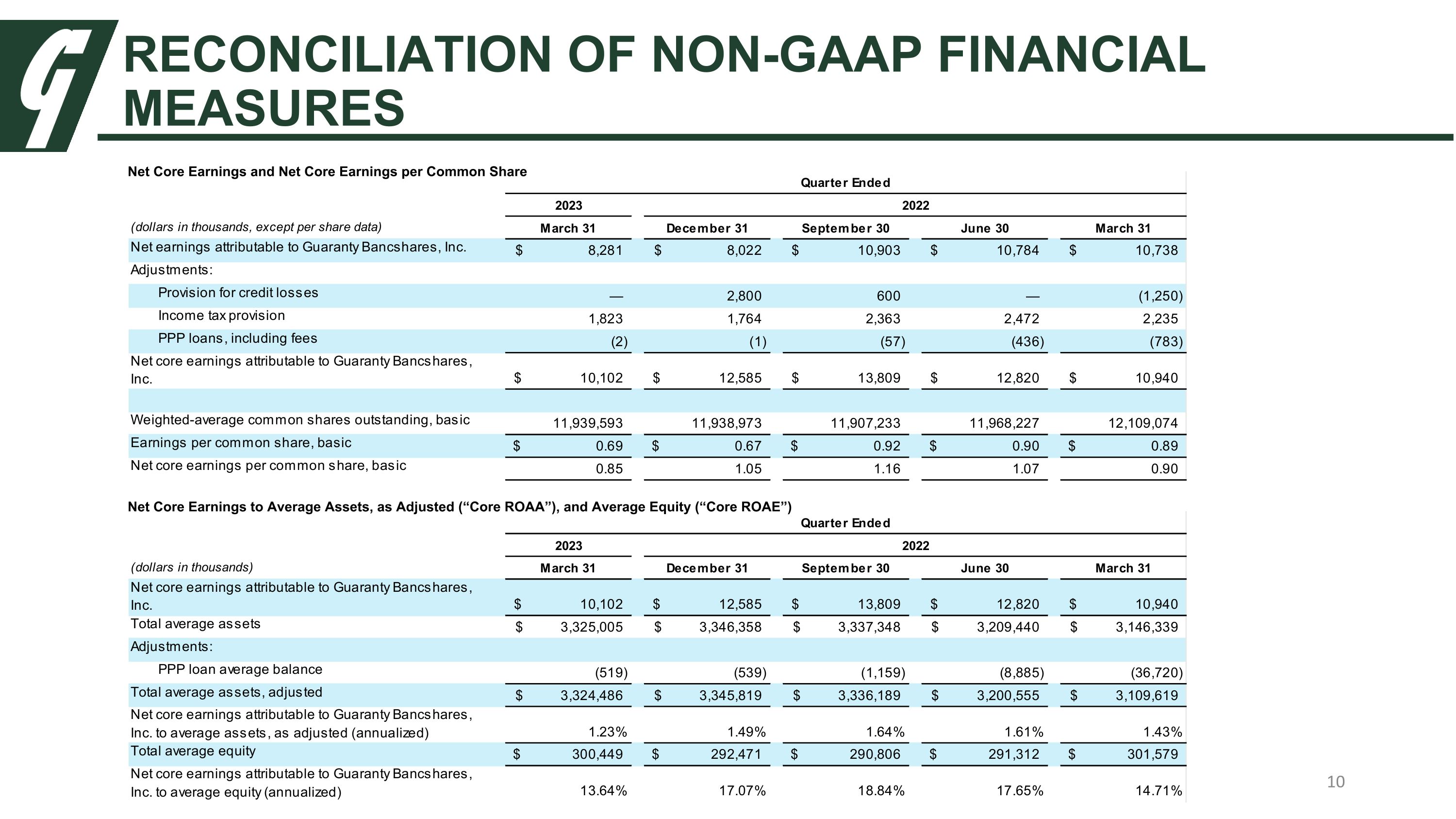

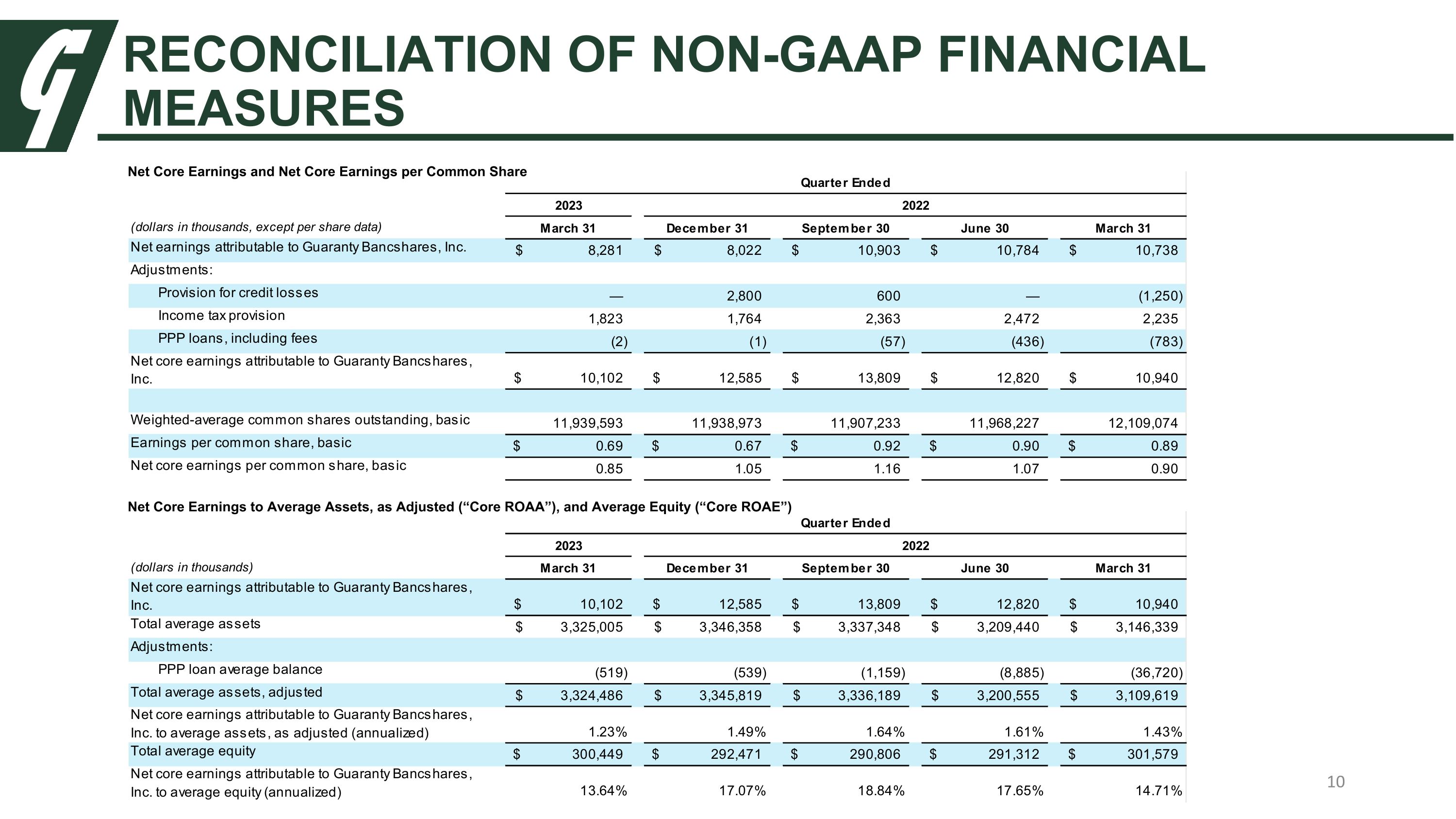

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Net Core Earnings to Average Assets, as Adjusted (“Core ROAA”), and Average Equity (“Core ROAE”) Net Core Earnings and Net Core Earnings per Common Share

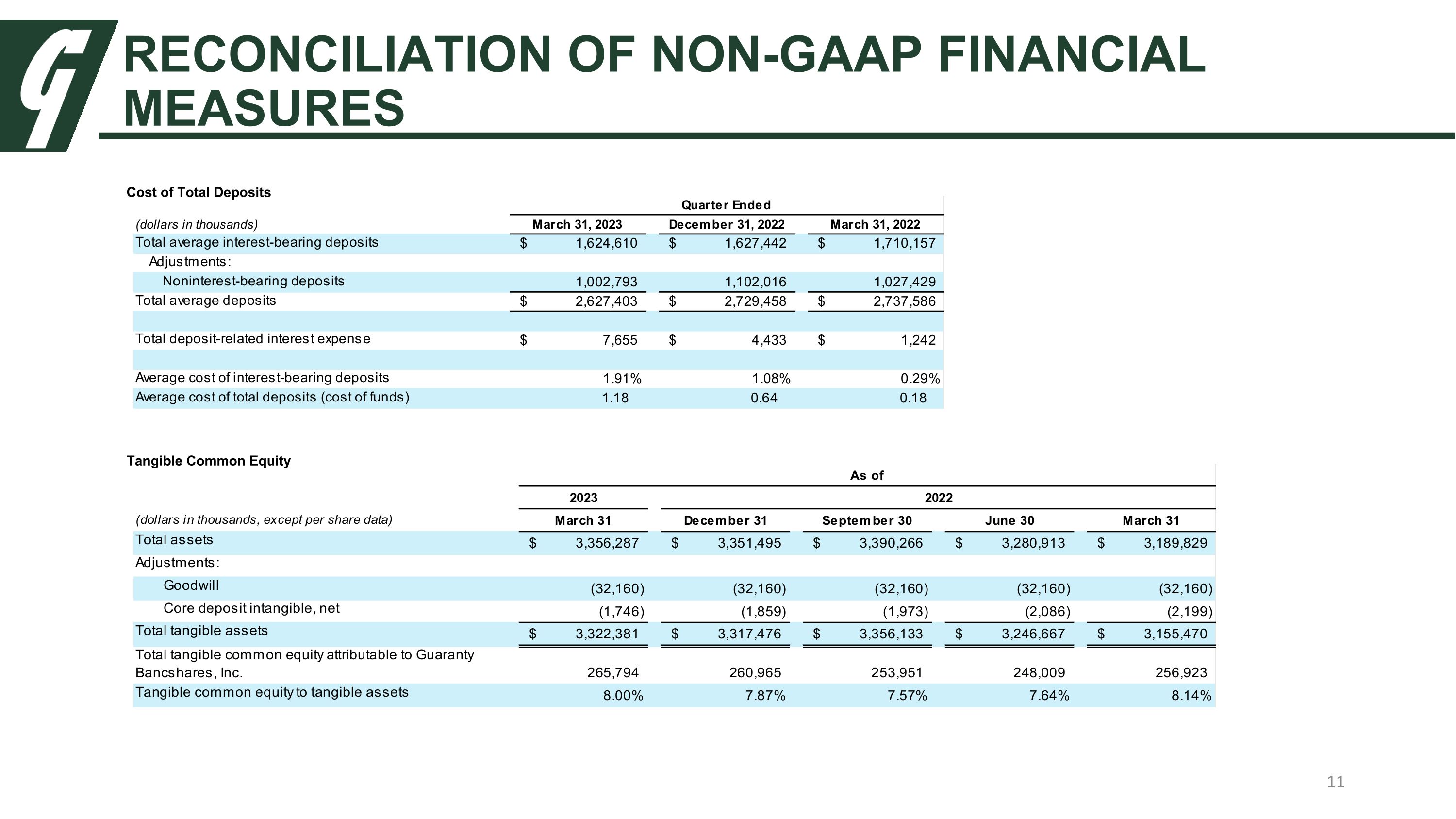

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Cost of Total Deposits Tangible Common Equity

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Net Unrealized Loss on Securities, Tax Effected, as % of Total Equity