UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08727

SunAmerica Senior Floating Rate Fund, Inc.

(Exact name of registrant as specified in charter)

Harborside 5, 185 Hudson Street, Jersey City, NJ 07311

(Address of principal executive offices) (Zip code)

John T. Genoy

Senior Vice President

SunAmerica Asset Management, LLC

Harborside 5, 185 Hudson Street

Jersey City, NJ 07311

(Name and address of agent for service)

Registrant’s telephone number, including area code: (201) 324-6414

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| Item 1. | Reports to Stockholders |

AIG

Senior Floating

Rate Fund

aig.com/funds

Table of Contents

December 31, 2020 ANNUAL REPORT

Shareholders’ Letter

Dear Shareholders:

All of us at Wellington Management Company, AIG and SunAmerica Asset Management hope this annual report finds you and yours safe and well during these challenging times.

As the COVID-19 pandemic continues to evolve, know that we remain focused on serving our Fund shareholders. As such, we are pleased to present this annual report for the AIG Senior Floating Rate Fund, Inc. (the “Fund”) for the 12 months ended December 31, 2020.

Overall, fixed income markets generated solid positive returns during the annual period. In most markets, sovereign yields declined to record lows during the first half of 2020, as the COVID-19 pandemic sparked fears of a global recession and then remained range-bound near these lows, supported by central bank purchase programs. During the second half of the annual period, sovereign yield curves generally steepened, as accommodative central bank policies anchored front-end yields, while the prospect of additional fiscal stimulus lifted inflation expectations.

On the monetary policy front, most global central banks initiated aggressive stimulus measures with large-scale asset purchases and emergency rate cuts during the first quarter of 2020 to help combat the economic impacts of the COVID-19 pandemic. The U.S. Federal Reserve (the Fed) cut rates to zero; committed to buy an unlimited amount of U.S. Treasury and agency mortgage-backed securities; increased the size and scope of its asset purchase program to include corporate bonds, agency commercial mortgage-backed securities and commercial paper; and also supported the municipal funding market. The European Central Bank (ECB) launched a massive asset purchase program – which included non-financial commercial paper for the first time – and eased collateral rules. Many other developed market central banks also added accommodation, while several emerging markets central banks embarked on quantitative easing for the first time. During the second quarter, the Fed amplified its policy response and announced a trillion-dollar lending program, which included high yield bonds. The ECB announced more generous terms for its targeted longer-term refinancing operations. The Bank of England announced an extension of the U.K. government’s overdraft facility and increased its bond purchases. Norway’s central bank cut its policy rate to zero, and Sweden’s Riksbank expanded its quantitative easing program. In the third calendar quarter, the Fed extended its emergency liquidity provisions through the end of 2020 and unveiled a new inflation policy framework that will allow inflation to modestly exceed 2% without a hawkish1 policy response. The ECB announced it would ease bank regulations to free up capital to boost lending. Global central banks maintained highly accommodative policy stances through the fourth quarter of 2020, including the ECB extending its pandemic emergency purchase program through at least March 2022.

Corporate bonds performed strongly for the annual period overall. However, during the first quarter, corporate bonds were challenged amid expectations that declining economic activity and supply-chain disruptions would cause credit fundamentals to deteriorate. For the remainder of the year, the performance of corporate bonds generally improved given the unprecedented speed and magnitude of stimulus measures enacted by global governments and central banks to counter the economic and financial market weakness in the short term. Corporate bond performance was further supported as the year progressed by countries gradually emerging from lockdowns, COVID-19 vaccine developments progressing and strong demand, even as corporate issuance set records for the year. The U.S. dollar strengthened versus most currencies during the first quarter of 2020 but then weakened against most currencies in the remaining three quarters of the annual period.

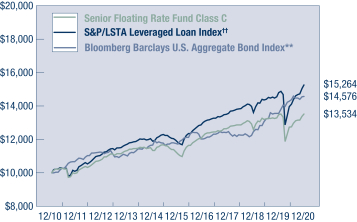

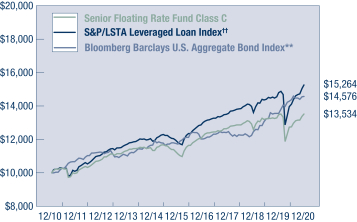

Amid this backdrop, floating rate loans, as represented by the S&P/LSTA Leveraged Loan Index (“LLI”)*, returned 3.12% during the annual period ended December 31, 2020, underperforming the broad U.S. fixed income market. The Bloomberg Barclays U.S. Aggregate Bond Index* returned 7.51% for the same time period.

Within the floating rate loan market, higher quality issuers outperformed in the first quarter of 2020, but lower quality issuers outperformed in each of the subsequent three quarters of the annual period. The sector’s overall credit fundamentals

December 31, 2020 ANNUAL REPORT

Shareholders’ Letter — (continued)

weakened. By the third calendar quarter, however, we started to see some stabilization in fundamentals, although we did not expect leverage to improve to 2019 levels in the near term. Still, we believed bank loan valuations were attractive for long-term investors, more than adequately compensating investors for downside risks. Further, at the end of the annual period, we saw potential for further capital appreciation. Technicals, or supply/demand factors, remained rather supportive. Bank loan mutual funds experienced outflows of $27.8 billion during 2020, less than the $42.7 billion during 2019.** Offsetting these outflows was gross U.S. collateralized loan obligation (“CLO”) volume, one of the main sources of demand for bank loans, which totaled $91.6 billion for the 12-month period†, trailing last year’s pace of $118.3 billion but still strong. At the end of the annual period, retail outflows appeared to have moderated, and we anticipated a favorable technical backdrop going forward given strong CLO demand and limited new issue supply. The trailing 12-month loan default rate, examined by principal amount, was 3.83% at the end of the annual period, as compared to 3.5% at the end of 2019.†† At the end of the annual period, we expected defaults, which had reached a trailing 12-month loan default rate, examined by principal amount, of 6.7% at the end of June 2020, to continue to decline.

On the following pages, you will find a brief discussion regarding the Fund’s annual results. You will also find financial statements and portfolio information for the Fund for the annual period ended December 31, 2020.

As always, we remain diligent in the management of your assets. If you have any questions, or require additional information on this or other AIG Funds, we invite you to visit our website, www.aig.com/funds, or call the Shareholder Services Department at 800-858-8850. We value your ongoing confidence in us and look forward to serving your investment needs in the future.

Sincerely,

THE AIG SENIOR FLOATING RATE FUND PORTFOLIO MANAGER

Jeffrey W. Heuer

Wellington Management Company LLP

Past performance is no guarantee of future results.

| * | | The S&P/LSTA Leveraged Loan Index (LLI) reflects the market-weighted performance of U.S. dollar-denominated institutional leveraged loan portfolios. The LLI is the only domestic leveraged loan index that utilized real-time market weightings, spreads and interest payments. The Bloomberg Barclays U.S. Aggregate Bond Index represents securities that are U.S. domestic, taxable and dollar denominated. The index covers components for government and corporate securities, mortgage pass-through securities and asset-backed securities. Indices are not managed and an investor cannot invest directly into an index. |

| †† | | Source: S&P Leveraged Commentary & Data. |

| 1 | | Hawkish tends to suggest higher interest rates; opposite of dovish. |

The Fund is not a money market fund and its net asset value may fluctuate. Investments in loans involve certain risks including nonpayment of principal and interest; collateral impairment; non-diversification and borrower industry concentration; and lack of an active trading market, in certain cases, which may impair the Fund’s ability to obtain full value for loans sold. The Fund may invest all or substantially all of its assets in loans or other securities (e.g. unsecured loans or high yield securities) that are rated below investment grade, or in comparable unrated securities. Credit risks include the possibility of a default on the loan or bankruptcy of the borrower. The value of these loans is subject to a greater degree of volatility in response to interest rate fluctuations.

SunAmerica Senior Floating Rate Fund, Inc.

EXPENSE EXAMPLE — December 31, 2020 — (unaudited)

Disclosure of Portfolio Expenses in Shareholder Reports

As a shareholder of the AIG Senior Floating Rate Fund (the “Fund”), you may incur two types of costs: (1) transaction costs, including sales charges on purchase payments and contingent deferred sales charges and (2) ongoing costs, including management fees, distribution and account maintenance fees, and other Fund expenses. The example set forth below is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at July 1, 2020 and held until December 31, 2020.

Actual Expenses

The “Actual” section of the table provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the column under the heading entitled “Expenses Paid During the Six Months Ended December 31, 2020” to estimate the expenses you paid on your account during this period. The “Expenses Paid During the Six Months Ended December 31, 2020” column and the “Annualized Expense Ratio” column do not include small account fees that may be charged if your account balance is below $500 ($250 for retirement plan accounts). In addition, the “Expenses Paid During the Six Months Ended December 31, 2020” column and the “Annualized Expense Ratio” column do not include administrative or other fees that may apply to qualified retirement plan accounts and accounts held through financial institutions. See the Fund’s prospectus, your retirement plan documents and/or materials from your financial adviser, for a full description of these fees. Had these fees been included, the “Expenses Paid During the Six Months Ended December 31, 2020” column would have been higher and the “Ending Account Value” column would have been lower.

Hypothetical Example for Comparison Purposes

The “Hypothetical” section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in this Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. The “Expenses Paid During the Six Months Ended December 31, 2020” column and the “Annualized Expense Ratio” column do not include small account fees that may be charged if your account balance is below $500 ($250 for retirement plan accounts). In addition, the “Expenses Paid During the Six Months Ended December 31, 2020” column and the “Annualized Expense Ratio” column do not include administrative or other fees that may apply to qualified retirement plan accounts and accounts held through financial institutions. See the Fund’s prospectus, your retirement plan document and/or materials from your financial adviser for full description of these fees. Had these fees been included, the “Expenses Paid During the Six Months Ended December 31, 2020” column would have been higher and the “Ending Account Value” column would have been lower.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, including sales charges on purchase payments, contingent deferred sales charges and administrative fees, if applicable to your account. Please refer to the Fund’s prospectus, qualified retirement plan document and/or materials from your financial adviser, for more information. Therefore, the “Hypothetical” example is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs and other fees were included, your costs would have been higher.

SunAmerica Senior Floating Rate Fund, Inc.

EXPENSE EXAMPLE — December 31, 2020 — (unaudited) (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Hypothetical | | | | |

| | | Beginning

Account Value

at July 1, 2020 | | | Ending

Account Value

Using Actual

Return at

December 31, 2020 | | | Expenses Paid

During the

Six Months Ended

December 31, 2020* | | | Beginning

Account Value

at July 1, 2020 | | | Ending Account

Value Using

a Hypothetical 5%

Annual Return at

December 31, 2020* | | | Expenses Paid

During the

Six Months Ended

December 31, 2020* | | | Annualized

Expense

Ratio* | |

AIG Senior Floating Rate Fund# | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | $ | 1,000.00 | | | $ | 1,060.71 | | | $ | 5.28 | | | $ | 1,000.00 | | | $ | 1,020.01 | | | $ | 5.18 | | | | 1.02 | % |

Class C | | $ | 1,000.00 | | | $ | 1,060.19 | | | $ | 7.35 | | | $ | 1,000.00 | | | $ | 1,018.00 | | | $ | 7.20 | | | | 1.42 | % |

Class W | | $ | 1,000.00 | | | $ | 1,063.05 | | | $ | 4.25 | | | $ | 1,000.00 | | | $ | 1,021.01 | | | $ | 4.17 | | | | 0.82 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184 days then divided by 366 days (to reflect the one-half year period). These ratios do not reflect transaction costs, including sales charges on purchase payments, contingent deferred sales charges, small account fees and administrative fees, if applicable to your account. Please refer to your Prospectus, your qualified retirement plan document and/or materials from your financial advisor for more information. |

| # | During the stated period, the investment adviser either waived a portion of or all of the fees and assumed a portion of or all expenses for the Fund. As a result, if these fees and expenses had not been waived or assumed, the “Actual/Hypothetical Ending Account Value” would have been lower and the “Actual/Hypothetical Expenses Paid During the Six Months Ended December 31, 2020” and the “Annualized Expense Ratio” would have been higher. |

SunAmerica Senior Floating Rate Fund, Inc.

STATEMENT OF ASSETS AND LIABILITIES — December 31, 2020

| | | | |

| | | AIG

Senior

Floating Rate

Fund | |

ASSETS: | | | | |

Investments at value (unaffiliated)* | | $ | 147,069,476 | |

Repurchase agreements (cost approximates value) | | | 5,035,000 | |

Cash | | | 85,404 | |

Foreign cash* | | | 602,345 | |

Due from broker | | | 860 | |

Receivable for: | | | | |

Fund shares sold | | | 17,020 | |

Dividends and interest | | | 705,901 | |

Investments sold | | | 542,463 | |

Investments sold on an extended settlement basis | | | 3,369,555 | |

Prepaid expenses and other assets | | | 10,695 | |

Due from investment adviser for expense reimbursements/fee waivers | | | 86,830 | |

Unrealized appreciation on forward foreign currency contracts | | | 1,191 | |

| | | | |

Total assets | | | 157,526,740 | |

| | | | |

LIABILITIES: | | | | |

Payable for: | | | | |

Fund shares redeemed | | | 273,050 | |

Investments purchased | | | 1,362 | |

Investments purchased on an extended settlement basis | | | 6,866,733 | |

Investment advisory and management fees | | | 108,267 | |

Distribution and service maintenance fees | | | 54,107 | |

Administration fees | | | 25,475 | |

Transfer agent fees and expenses | | | 36,271 | |

Directors’ fees and expenses | | | 261 | |

Other accrued expenses | | | 253,753 | |

Dividends payable | | | 44,452 | |

Unrealized depreciation on forward foreign currency contracts | | | 78,622 | |

| | | | |

Total liabilities | | | 7,742,353 | |

| | | | |

Net Assets | | $ | 149,784,387 | |

| | | | |

NET ASSETS REPRESENTED BY: | | | | |

Common stock, $0.01 par value | | $ | 193,972 | |

Additional paid-in capital | | | 190,119,683 | |

| | | | |

| | | 190,313,655 | |

Total accumulated earnings (loss) | | | (40,529,268 | ) |

| | | | |

Net Assets | | $ | 149,784,387 | |

| | | | |

Class A: | | | | |

Net assets | | $ | 97,516,577 | |

Shares outstanding | | | 12,631,238 | |

Net asset value and redemption price per share | | $ | 7.72 | |

Maximum sales charge (3.00% of offering price) | | | 0.24 | |

| | | | |

Maximum offering price to public | | $ | 7.96 | |

| | | | |

Class C: | | | | |

Net assets | | $ | 36,783,139 | |

Shares outstanding | | | 4,767,368 | |

Net asset value, offering and redemption price per share

(excluding any applicable contingent deferred sales charges) | | $ | 7.72 | |

| | | | |

Class W: | | | | |

Net assets | | $ | 15,484,671 | |

Shares outstanding | | | 1,998,564 | |

Net asset value, offering and redemption price per share | | $ | 7.75 | |

| | | | |

*Cost | | | | |

Investments securities (unaffiliated) | | $ | 148,742,477 | |

| | | | |

Foreign cash | | $ | 602,986 | |

| | | | |

See Notes to Financial Statements

SunAmerica Senior Floating Rate Fund, Inc.

STATEMENT OF OPERATIONS — For the year ended December 31, 2020

| | | | |

| | | AIG

Senior

Floating

Rate Fund | |

INVESTMENT INCOME: | | | | |

Interest (unaffiliated) | | $ | 6,884,459 | |

Dividends (unaffiliated) | | | 27,191 | |

Facility and other fee income (Note 2) | | | 128,402 | |

| | | | |

Total investment income | | | 7,040,052 | |

| | | | |

EXPENSES: | | | | |

Investment advisory and management fees | | | 1,404,382 | |

Administrative fees | | | 330,443 | |

Distribution and account maintenance fees: | | | | |

Class A | | | 312,959 | |

Class C | | | 402,053 | |

Service fees: | | | | |

Class W | | | 32,068 | |

Transfer agent fees and expenses: | | | | |

Class A | | | 218,178 | |

Class C | | | 130,217 | |

Class W | | | 48,366 | |

Registration fees: | | | | |

Class A | | | 25,688 | |

Class C | | | 25,721 | |

Class W | | | 17,953 | |

Custodian and accounting fees | | | 80,166 | |

Reports to shareholders | | | 62,475 | |

Audit and tax fees | | | 124,567 | |

Legal fees | | | 68,319 | |

Directors’ fees and expenses | | | 55,386 | |

Other expenses | | | 33,398 | |

| | | | |

Total expenses before fee waivers and expense reimbursements | | | 3,372,339 | |

Fees waived and expenses reimbursed by investment adviser (Note 5) | | | (1,515,401 | ) |

| | | | |

Net expenses | | | 1,856,938 | |

| | | | |

Net investment income (loss) | | | 5,183,114 | |

| | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCIES: | | | | |

Net realized gain (loss) on: | | | | |

Investments (unaffiliated) | | | (11,252,504 | ) |

Forward contracts | | | (1,105,797 | ) |

Net realized foreign exchange gain (loss) on other assets and liabilities | | | 132,332 | |

| | | | |

Net realized gain (loss) on investments and foreign currencies | | | (12,225,969 | ) |

| | | | |

Change in unrealized appreciation (depreciation) on: | | | | |

Investments (unaffiliated) | | | 4,905,315 | |

Forward contracts | | | 2,153 | |

Change in unrealized foreign exchange gain (loss) on other assets and liabilities | | | (81,405 | ) |

| | | | |

Net unrealized gain (loss) on investments and foreign currencies | | | 4,826,063 | |

| | | | |

Net realized and unrealized gain (loss) on investments and foreign currencies | | | (7,399,906 | ) |

| | | | |

INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,216,792 | ) |

| | | | |

See Notes to Financial Statements.

SunAmerica Senior Floating Rate Fund, Inc.

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | AIG

Senior Floating

Rate Fund | |

| | | For the year

ended

December 31,

2020 | | | For the year

ended

December 31,

2019 | |

INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income (loss) | | $ | 5,183,114 | | | $ | 10,409,916 | |

Net realized gain (loss) on investments and foreign currencies | | | (12,225,969 | ) | | | (2,036,314 | ) |

Net unrealized gain (loss) on investments and foreign currencies | | | 4,826,063 | | | | 8,433,667 | |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (2,216,792 | ) | | | 16,807,269 | |

| | | | | | | | |

| | |

Distributions to shareholders from: | | | | | | | | |

Distributable earnings (Class A) | | | (2,317,533 | ) | | | (5,151,087 | ) |

Distributable earnings (Class C) | | | (1,243,493 | ) | | | (3,796,099 | ) |

Distributable earnings (Class W) | | | (627,930 | ) | | | (1,877,654 | ) |

Return of capital (Class A) | | | (329,282 | ) | | | — | |

Return of capital (Class C) | | | (176,679 | ) | | | — | |

Return of capital (Class W) | | | (89,218 | ) | | | — | |

| | | | | | | | |

Total distributions to shareholders | | | (4,784,135 | ) | | | (10,824,840 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from capital share transactions (Note3) | | | (48,837,547 | ) | | | (37,881,251 | ) |

| | | | | | | | |

Total increase (decrease) in net assets | | | (55,838,474 | ) | | | (31,898,822 | ) |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 205,622,861 | | | | 237,521,683 | |

| | | | | | | | |

End of period | | $ | 149,784,387 | | | $ | 205,622,861 | |

| | | | | | | | |

See Notes to Financial Statements

SunAmerica Senior Floating Rate Fund, Inc.

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AIG Senior Floating Rate Fund | |

Period

Ended | | Net

Asset

Value,

beginning

of period | | | Net

investment

income(1) | | | Net gain

(loss) on

investments

(both

realized

and

unrealized) | | | Total from

investment

operations | | | Dividends

from net

investment

income | | | Return

of

Capital | | | Dividends

from net

realized

gains on

investments | | | Total

Distri-

butions | | | Net

Asset

Value,

end of

period | | | Total

Return(2) | | | Net

Assets,

end of

period

(000's) | | | Ratio of

expenses

to average

net

assets(3) | | | Ratio of

net

investment

income to

average

net assets(3) | | | Portfolio

Turnover | |

|

| Class A | |

| 12/31/16 | | $ | 7.61 | | | $ | 0.31 | | | $ | 0.44 | | | $ | 0.75 | | | $ | (0.30 | ) | | | — | | | $ | — | | | $ | (0.30 | ) | | $ | 8.06 | | | | 10.08 | % | | $ | 131,640 | | | | 1.45 | % | | | 3.95 | % | | | 60 | % |

| 12/31/17 | | | 8.06 | | | | 0.30 | | | | 0.03 | | | | 0.33 | | | | (0.30 | ) | | | — | | | | — | | | | (0.30 | ) | | | 8.09 | | | | 4.14 | | | | 93,346 | | | | 1.45 | | | | 3.69 | | | | 68 | |

| 12/31/18 | | | 8.09 | | | | 0.33 | | | | (0.36 | ) | | | (0.03 | ) | | | (0.35 | ) | | | — | | | | — | | | | (0.35 | ) | | | 7.71 | | | | (0.41 | ) | | | 113,869 | | | | 1.22 | | | | 4.21 | | | | 44 | |

| 12/31/19 | | | 7.71 | | | | 0.36 | | | | 0.21 | | | | 0.57 | | | | (0.38 | ) | | | — | | | | — | | | | (0.38 | ) | | | 7.90 | | | | 7.49 | | | | 95,402 | | | | 1.02 | | | | 4.59 | | | | 34 | |

| 12/31/20 | | | 7.90 | | | | 0.24 | | | | (0.20 | ) | | | 0.04 | | | | (0.19 | ) | | | (0.03 | ) | | | — | | | | (0.22 | ) | | | 7.72 | | | | 0.64 | | | | 97,517 | | | | 1.02 | | | | 3.17 | | | | 51 | |

|

| Class C | |

| 12/31/16 | | $ | 7.60 | | | $ | 0.29 | | | $ | 0.44 | | | $ | 0.73 | | | $ | (0.28 | ) | | | — | | | $ | — | | | $ | (0.28 | ) | | $ | 8.05 | | | | 9.76 | % | | $ | 155,688 | | | | 1.75 | % | | | 3.68 | % | | | 60 | % |

| 12/31/17 | | | 8.05 | | | | 0.28 | | | | 0.03 | | | | 0.31 | | | | (0.27 | ) | | | — | | | | — | | | | (0.27 | ) | | | 8.09 | | | | 3.96 | | | | 135,902 | | | | 1.75 | | | | 3.38 | | | | 68 | |

| 12/31/18 | | | 8.09 | | | | 0.31 | | | | (0.38 | ) | | | (0.07 | ) | | | (0.32 | ) | | | — | | | | — | | | | (0.32 | ) | | | 7.70 | | | | (0.90 | ) | | | 95,038 | | | | 1.61 | | | | 3.77 | | | | 44 | |

| 12/31/19 | | | 7.70 | | | | 0.34 | | | | 0.20 | | | | 0.54 | | | | (0.35 | ) | | | — | | | | — | | | | (0.35 | ) | | | 7.89 | | | | 7.08 | | | | 73,506 | | | | 1.42 | | | | 4.19 | | | | 34 | |

| 12/31/20 | | | 7.89 | | | | 0.23 | | | | (0.21 | ) | | | 0.02 | | | | (0.17 | ) | | | (0.02 | ) | | | — | | | | (0.19 | ) | | | 7.72 | | | | 0.38 | | | | 36,783 | | | | 1.42 | | | | 2.92 | | | | 51 | |

|

| Class W | |

| 04/20/17@- | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/17 | | $ | 8.11 | | | $ | 0.25 | | | $ | (0.03 | ) | | $ | 0.22 | | | $ | (0.22 | ) | | | — | | | $ | — | | | $ | (0.22 | ) | | $ | 8.11 | | | | 2.69 | % | | $ | 19,790 | | | | 1.25 | %(4) | | | 3.72 | %(4) | | | 68 | % |

| 12/31/18 | | | 8.11 | | | | 0.35 | | | | (0.37 | ) | | | (0.02 | ) | | | (0.37 | ) | | | — | | | | — | | | | (0.37 | ) | | | 7.72 | | | | (0.34 | ) | | | 28,615 | | | | 1.02 | | | | 4.43 | | | | 44 | |

| 12/31/19 | | | 7.72 | | | | 0.37 | | | | 0.22 | | | | 0.59 | | | | (0.39 | ) | | | — | | | | — | | | | (0.39 | ) | | | 7.92 | | | | 7.70 | | | | 36,715 | | | | 0.82 | | | | 4.78 | | | | 34 | |

| 12/31/20 | | | 7.92 | | | | 0.28 | | | | (0.21 | ) | | | 0.07 | | | | (0.21 | ) | | | (0.03 | ) | | | — | | | | (0.24 | ) | | | 7.75 | | | | 0.99 | | | | 15,485 | | | | 0.82 | | | | 3.57 | | | | 51 | |

| (1) | Calculated based upon average shares outstanding. |

| (2) | Total return is not annualized and does not reflect sales load but does include expense reimbursements. |

| (3) | Net of the following expense waivers and/or reimbursements, if applicable (based on average daily net assets) (see Note 5): |

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/16 | | | 12/31/17 | | | 12/31/18 | | | 12/31/19 | | | 12/31/20 | |

Class A | | | 0.33 | % | | | 0.38 | % | | | 0.64 | % | | | 0.81 | % | | | 0.90 | % |

Class C | | | 0.42 | | | | 0.48 | | | | 0.65 | | | | 0.81 | | | | 0.94 | |

Class W | | | — | | | | 0.50 | (4) | | | 0.69 | | | | 0.85 | | | | 0.94 | |

| @ | Inception date of class. |

See Notes to Financial Statements

AIG Senior Floating Rate Fund

PORTFOLIO PROFILE — December 31, 2020 — (unaudited)

| | | | |

Industry Allocation* | | | | |

Health Care Providers & Services | | | 7.9 | % |

Media | | | 7.9 | |

Software | | | 7.5 | |

Hotels, Restaurants & Leisure | | | 5.8 | |

Insurance | | | 5.3 | |

Chemicals | | | 3.6 | |

Commercial Services & Supplies | | | 3.5 | |

Diversified Telecommunication Services | | | 3.5 | |

Repurchase Agreements | | | 3.4 | |

Specialty Retail | | | 3.4 | |

Pharmaceuticals | | | 3.3 | |

Diversified Financial Services | | | 3.2 | |

Containers & Packaging | | | 2.9 | |

IT Services | | | 2.9 | |

Machinery | | | 2.9 | |

Registered Investment Companies | | | 2.5 | |

Oil, Gas & Consumable Fuels | | | 2.4 | |

Construction & Engineering | | | 2.4 | |

Food Products | | | 2.3 | |

Entertainment | | | 2.3 | |

Trading Companies & Distributors | | | 1.8 | |

Auto Components | | | 1.7 | |

Professional Services | | | 1.7 | |

Capital Markets | | | 1.5 | |

Internet & Direct Marketing Retail | | | 1.3 | |

Construction Materials | | | 1.2 | |

Airlines | | | 1.1 | |

Road & Rail | | | 1.0 | |

Building Products | | | 1.0 | |

Aerospace & Defense | | | 0.9 | |

Food & Staples Retailing | | | 0.9 | |

Personal Products | | | 0.8 | |

Multiline Retail | | | 0.8 | |

Diversified Consumer Services | | | 0.8 | |

Thrifts & Mortgage Finance | | | 0.7 | |

Electronic Equipment, Instruments & Components | | | 0.7 | |

Metals & Mining | | | 0.7 | |

Household Durables | | | 0.6 | |

Leisure Products | | | 0.6 | |

Real Estate Investment Trusts | | | 0.6 | |

Household Products | | | 0.4 | |

Gas Utilities | | | 0.3 | |

Industrial Conglomerates | | | 0.3 | |

Wireless Telecommunication Services | | | 0.3 | |

Life Sciences Tools & Services | | | 0.3 | |

Interactive Media & Services | | | 0.2 | |

Tech Hardware,Storage & Peripheral | | | 0.2 | |

Electric Utilities | | | 0.2 | |

Semiconductors & Semiconductor Equipment | | | 0.1 | |

| | | | |

| | | 101.6 | % |

| | | | |

| | | | |

Credit Quality†# | | | | |

Baa3 | | | 0.9 | % |

Baa1 | | | 0.4 | |

Ba3 | | | 13.9 | |

Ba2 | | | 9.0 | |

Ba1 | | | 5.5 | |

B3 | | | 11.2 | |

B2 | | | 27.1 | |

B1 | | | 25.3 | |

Caa3 | | | 0.5 | |

Caa2 | | | 2.3 | |

Caa1 | | | 3.2 | |

Ca | | | 0.6 | |

Not Rated@ | | | 0.1 | |

| | | | |

| | | 100.0 | % |

| | | | |

| * | Calculated as a percentage of net assets. |

| @ | Represents debt issues that either have no rating, or the rating is unavailable from the data source. |

| # | Calculated as a percentage of total debt issues, excluding short-term securities. |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| LOANS(3)(4) — 88.1% | | | | | | | | | | | | | | | | | | | | |

| Aerospace & Defense — 0.9% | | | | | | | | | | | | | | | | | | | | |

Maxar Technologies, Ltd. | | BTL-B | | B2 | | B | | | 2.90% | | | 1 ML+2.75% | | | 10/04/2024 | | | $ | 366,464 | | | $ | 360,280 | |

Spirit AeroSystems Inc. | | BTL-B | | Ba2 | | BB- | | | 6.00 | | | 1 ML+5.25% | | | 01/15/2025 | | | | 140,000 | | | | 141,050 | |

TransDigm Group, Inc. | | BTL-F | | Ba3 | | B+ | | | 2.40 | | | 1 ML+2.25% | | | 12/09/2025 | | | | 858,982 | | | | 840,924 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,342,254 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Airlines — 0.8% | | | | | | | | | | | | | | | | | | | | |

JetBlue Airways Corp | | BTL | | Ba2 | | B+ | | | 6.25 | | | 3 ML+5.25% | | | 06/17/2024 | | | | 190,125 | | | | 195,252 | |

Mileage Plus Holdings LLC | | BTL-B | | Baa3 | | NR | | | 6.25 | | | 3 ML+5.25% | | | 06/25/2027 | | | | 375,000 | | | | 389,896 | |

SkyMiles IP Ltd | | BTL-B | | Baa1 | | NR | | | 4.75 | | | 3 ML+3.75% | | | 10/20/2027 | | | | 635,000 | | | | 657,225 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,242,373 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Auto Components — 1.5% | | | | | | | | | | | | | | | | | | | | |

Adient US LLC | | BTL-B | | Ba3 | | B+ | | | 4.40 | | | 1 ML+4.25% | | | 05/06/2024 | | | | 422,625 | | | | 422,203 | |

Adient US LLC | | BTL-B | | Ba3 | | B+ | | | 4.46 | | | 3 ML+4.25% | | | 05/06/2024 | | | | 143,750 | | | | 143,606 | |

First Brands Group LLC | | BTL-B | | B3 | | B | | | 8.50 | | | 3 ML+7.50% | | | 02/02/2024 | | | | 677,542 | | | | 674,154 | |

Panther BF Aggregator 2 LP | | BTL-B | | B1 | | B | | | 3.65 | | | 1 ML+3.50% | | | 04/30/2026 | | | | 484,821 | | | | 482,397 | |

Panther BF Aggregator 2 LP(9) | | BTL-B | | B1 | | B | | | 3.75 | | | 1 ME+3.75% | | | 04/30/2026 | | | | 483,376 | | | | 587,933 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 2,310,293 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Building Products — 0.8% | | | | | | | | | | | | | | | | | | | | |

CP Atlas Buyer, Inc. | | BTL-B1 | | B2 | | B | | | 5.25 | | | 3 ML+4.50% | | | 11/23/2027 | | | | 330,000 | | | | 330,103 | |

CP Atlas Buyer, Inc. | | Delayed Draw | | B2 | | B | | | 5.25 | | | 3 ML+4.50% | | | 11/23/2027 | | | | 115,000 | | | | 115,036 | |

NCI Building Systems, Inc. | | BTL-B | | B2 | | B+ | | | 3.90 | | | 1 ML+3.75% | | | 04/12/2025 | | | | 251,968 | | | | 250,834 | |

Wilsonart LLC | | BTL-D | | B2 | | B+ | | | 4.25 | | | 3 ML+3.25% | | | 12/19/2023 | | | | 541,443 | | | | 540,766 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,236,739 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Markets — 1.5% | | | | | | | | | | | | | | | | | | | | |

Deerfield Dakota Holding LLC(9) | | BTL-B | | B2 | | B- | | | 4.00 | | | 1 ME+4.00% | | | 04/09/2027 | | | | 496,877 | | | | 604,227 | |

Deerfield Dakota Holding LLC | | BTL-B | | B2 | | B- | | | 4.75 | | | 3 ML+3.75% | | | 04/09/2027 | | | | 597,249 | | | | 597,343 | |

NFP Corp. | | BTL | | B1 | | B | | | 3.40 | | | 1 ML+3.25% | | | 02/15/2027 | | | | 668,309 | | | | 653,133 | |

PAI Holdco, Inc. | | BTL-B | | B1 | | B | | | 5.00 | | | 3 ML+4.00% | | | 10/28/2027 | | | | 345,000 | | | | 345,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 2,200,134 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Chemicals — 3.6% | | | | | | | | | | | | | | | | | | | | |

ASP Unifrax Holdings, Inc. | | BTL-B1 | | Caa1 | | CCC+ | | | 4.00 | | | 3 ML+3.75% | | | 12/12/2025 | | | | 249,667 | | | | 228,446 | |

ASP Unifrax Holdings, Inc. | | BTL-B2 | | Caa3 | | CCC | | | 8.72 | | | 3 ML+8.50% | | | 12/14/2026 | | | | 375,000 | | | | 315,000 | |

Diamond (BC) BV | | BTL | | B1 | | B- | | | 3.21 | | | 3 ML+3.00% | | | 09/06/2024 | | | | 887,550 | | | | 872,850 | |

Diamond (BC) BV(9) | | BTL | | B1 | | B- | | | 3.25 | | | 3 ME+3.25% | | | 09/06/2024 | | | | 402,674 | | | | 483,113 | |

Diamond (BC) BV | | BTL | | B1 | | B- | | | 6.00 | | | 3 ML+5.00% | | | 09/06/2024 | | | | 394,013 | | | | 390,565 | |

Hexion, Inc. | | BTL | | Ba3 | | B+ | | | 3.73 | | | 6 ML+3.50% | | | 07/01/2026 | | | | 388,705 | | | | 386,275 | |

Messer Industries GmbH | | BTL-B1 | | B1 | | BB- | | | TBD | | | | | | 03/01/2026 | | | | 405,390 | | | | 401,779 | |

SCIH Salt Holdings, Inc. | | BTL-B | | B3 | | B | | | 5.50 | | | 3 ML+4.50% | | | 03/16/2027 | | | | 398,000 | | | | 398,000 | |

Starfruit Finco BV | | BTL-B | | B1 | | B+ | | | 3.15 | | | 1 ML+3.00% | | | 10/01/2025 | | | | 397,219 | | | | 392,055 | |

Tronox Finance LLC | | BTL | | Ba3 | | B+ | | | 3.15 | | | 1 ML+3.00% | | | 09/23/2024 | | | | 384,788 | | | | 382,383 | |

Tronox Finance LLC | | BTL | | Ba3 | | B+ | | | 3.15 | | | 3 ML+3.00% | | | 09/23/2024 | | | | 334,438 | | | | 332,348 | |

U.S. Coating Acquisition, Inc. | | BTL-B2 | | Ba1 | | BBB- | | | 2.00 | | | 3 ML+1.75% | | | 06/01/2024 | | | | 390,560 | | | | 386,898 | |

WR Grace & Co. | | BTL-B1 | | Ba1 | | BBB- | | | 2.00 | | | 3 ML+1.75% | | | 04/03/2025 | | | | 181,867 | | | | 179,139 | |

WR Grace & Co. | | BTL-B2 | | Ba1 | | BBB- | | | 2.00 | | | 3 ML+1.75% | | | 04/03/2025 | | | | 311,771 | | | | 307,094 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 5,455,945 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Commercial Services & Supplies — 3.6% | | | | | | | | | | | | | | | | | | | | |

Amentum Government Services Holdings LLC | | BTL-B | | B1 | | B | | | 3.65 | | | 1 ML+3.50% | | | 02/01/2027 | | | | 532,325 | | | | 528,998 | |

Amentum Government Services Holdings LLC | | BTL-B | | B1 | | B | | | 5.50 | | | 3 ML+4.75% | | | 01/29/2027 | | | | 400,000 | | | | 401,500 | |

APX Group, Inc. | | BTL | | B3 | | B- | | | 5.15 | | | 1 ML+5.00% | | | 12/31/2025 | | | | 634,475 | | | | 630,708 | |

AVSC Holding Corp. | | BTL-B1 | | Caa2 | | CCC | | | 4.50 | | | 3 ML+3.50% | | | 03/03/2025 | | | | 399,576 | | | | 338,974 | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Commercial Services & Supplies (continued) | | | | | | | | | | | | | | | | | | | | |

Brickman Group, Ltd. | | BTL-B | | B1 | | BB- | | | 2.69% | | | 1 ML+2.50% | | | 08/15/2025 | | | $ | 443,424 | | | $ | 438,621 | |

Brickman Group, Ltd. | | BTL-B | | B1 | | BB- | | | 2.69 | | | 3 ML+2.50% | | | 08/15/2025 | | | | 550,502 | | | | 544,538 | |

Clean Harbors, Inc. | | BTL | | Ba1 | | BBB- | | | 1.90 | | | 1 ML+1.75% | | | 06/28/2024 | | | | 533,626 | | | | 531,624 | |

Filtration Group Corporation | | BTL | | B3 | | B | | | 4.50 | | | 1 ML+3.75% | | | 03/29/2025 | | | | 369,075 | | | | 369,075 | |

Techem Verwaltungsgesellschaft 675 mbH(9) | | BTL-B4 | | B1 | | B+ | | | 2.63 | | | 6 ME+2.63% | | | 07/15/2025 | | | | 667,888 | | | | 806,375 | |

Verisure Holdings AB(9) | | BTL-B | | B1 | | B | | | 4.00 | | | 6 ME+4.00% | | | 07/20/2026 | | | | 600,000 | | | | 734,656 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 5,325,069 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Construction & Engineering — 1.9% | | | | | | | | | | | | | | | | | | | | |

Brand Energy & Infrastructure Services, Inc. | | 1st Lien | | B3 | | B- | | | 5.25 | | | 3 ML+4.25% | | | 06/21/2024 | | | | 993,110 | | | | 967,317 | |

Hamilton Holdco, LLC | | BTL-B | | Ba1 | | BB+ | | | 2.26 | | | 3 ML+2.00% | | | 01/02/2027 | | | | 712,984 | | | | 702,289 | |

Power Buyer LLC | | BTL | | B3 | | B- | | | 4.25 | | | 3 ML+3.25% | | | 03/06/2025 | | | | 607,203 | | | | 600,119 | |

Power Buyer LLC | | 2nd Lien | | Caa2 | | CCC | | | 8.25 | | | 3 ML+7.25% | | | 03/06/2026 | | | | 585,000 | | | | 538,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 2,807,925 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Construction Materials —1.2% | | | | | | | | | | | | | | | | | | | | |

Quikrete Holdings, Inc. | | BTL | | Ba3 | | BB- | | | 2.65 | | | 1 ML+2.50% | | | 02/01/2027 | | | | 993,808 | | | | 988,011 | |

Summit Materials LLC | | 1st Lien | | Ba1 | | BBB- | | | 2.15 | | | 1 ML+2.00% | | | 11/21/2024 | | | | 882,700 | | | | 876,448 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,864,459 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Containers & Packaging — 2.7% | | | | | | | | | | | | | | | | | | | | |

Berlin Packaging LLC | | BTL-B1 | | B3 | | B- | | | 3.16 | | | 1 ML+3.00% | | | 11/07/2025 | | | | 513,184 | | | | 504,132 | |

Berlin Packaging LLC | | BTL-B1 | | B3 | | B- | | | 3.26 | | | 3 ML+3.00% | | | 11/07/2025 | | | | 3,004 | | | | 2,951 | |

Berry Plastics Holding Corp. | | BTL-W | | Ba2 | | BBB- | | | 2.15 | | | 1 ML+2.00% | | | 10/01/2022 | | | | 299,624 | | | | 299,119 | |

Berry Plastics Holding Corp. | | BTL-Y | | Ba2 | | BBB- | | | 2.15 | | | 1 ML+2.00% | | | 07/01/2026 | | | | 248,122 | | | | 246,696 | |

Flex Acquisition Co., Inc. | | BTL | | B2 | | B | | | 3.23 | | | 3 ML+3.00% | | | 06/29/2025 | | | | 288,947 | | | | 285,480 | |

Flex Acquisition Co., Inc. | | BTL | | B2 | | B | | | 4.00 | | | 1 ML+3.00% | | | 12/29/2023 | | | | 39,583 | | | | 39,335 | |

Flex Acquisition Co., Inc. | | BTL | | B2 | | B | | | 4.00 | | | 3 ML+3.00% | | | 12/29/2023 | | | | 566,633 | | | | 563,092 | |

Pregis TopCo LLC | | BTL | | B2 | | B- | | | TBD | | | | | | 08/01/2026 | | | | 300,000 | | | | 300,000 | |

Proampac PG Borrower LLC | | BTL | | B2 | | B- | | | 5.00 | | | 1 ML+4.00% | | | 11/03/2025 | | | | 221,042 | | | | 220,490 | |

Proampac PG Borrower LLC | | BTL | | B2 | | B- | | | 5.00 | | | 4 ML+4.00% | | | 11/03/2025 | | | | 395,475 | | | | 394,486 | |

Reynolds Group Holdings, Inc. | | BTL | | B1 | | B+ | | | 2.90 | | | 1 ML+2.75% | | | 02/05/2023 | | | | 191,667 | | | | 190,517 | |

Tosca Services LLC | | BTL-B | | B2 | | B | | | 5.25 | | | 1 ML+4.25% | | | 07/28/2027 | | | | 975,000 | | | | 978,656 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 4,024,954 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Diversified Consumer Services — 0.8% | | | | | | | | | | | | | | | | | | | | |

Belron Finance US LLC | | BTL-B | | Ba3 | | BB | | | 2.46 | | | 3 ML+2.25% | | | 11/13/2025 | | | | 588,000 | | | | 586,530 | |

Belron Finance US LLC | | BTL-B | | Ba3 | | BB | | | 2.46 | | | 3 ML+2.25% | | | 10/30/2026 | | | | 148,500 | | | | 148,129 | |

Weight Watchers International, Inc. | | BTL-B | | Ba2 | | BB | | | 5.50 | | | 1 ML+4.75% | | | 11/29/2024 | | | | 427,860 | | | | 426,880 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,161,539 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Diversified Financial Services —3.2% | | | | | | | | | | | | | | | | | | | | |

EVO Payments International LLC | | BTL | | B2 | | B | | | 3.40 | | | 1 ML+3.25% | | | 12/22/2023 | | | | 913,017 | | | | 912,104 | |

Financial & Risk US Holdings, Inc.(9) | | BTL-B | | B2 | | B | | | 3.25 | | | 1 ME+3.25% | | | 10/01/2025 | | | | 481,140 | | | | 586,071 | |

Financial & Risk US Holdings, Inc. | | BTL-B | | B2 | | B | | | 3.40 | | | 1 ML+3.25% | | | 10/01/2025 | | | | 558,600 | | | | 557,465 | |

GT Polaris, Inc. | | BTL-B | | B2 | | B | | | 5.00 | | | 3 ML+4.00% | | | 09/24/2027 | | | | 194,513 | | | | 194,902 | |

Millennium Trust Company, LLC | | BTL-B | | B2 | | B | | | 5.15 | | | 1 ML+5.00% | | | 03/27/2026 | | | | 417,563 | | | | 409,211 | |

MPH Acquisition Holdings LLC | | BTL-B | | Ba3 | | B+ | | | 3.75 | | | 3 ML+2.75% | | | 06/07/2023 | | | | 700,631 | | | | 697,128 | |

Nets Holding AS(9) | | BTL-B | | B1 | | B- | | | 3.25 | | | 3 ME+3.25% | | | 02/06/2025 | | | | 798,159 | | | | 973,395 | |

Trans Union LLC | | BTL-B5 | | Ba2 | | BBB- | | | 1.90 | | | 1 ML+1.75% | | | 11/16/2026 | | | | 425,820 | | | | 424,312 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 4,754,588 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Diversified Telecommunication Services — 3.5% | | | | | | | | | | | | | | | | | | | | |

Altice France SA | | BTL | | B2 | | B | | | 3.85 | | | 1 ML+3.69% | | | 01/31/2026 | | | | 990,165 | | | | 979,955 | |

Consolidated Communications Inc | | BTL-B | | B2 | | B+ | | | 5.75 | | | 1 ML+4.75% | | | 10/02/2027 | | | | 209,475 | | | | 210,118 | |

Frontier Communications Corp. | | BTL | | B3 | | B+ | | | 5.75 | | | 1 ML+4.75% | | | 10/08/2021 | | | | 560,000 | | | | 562,800 | |

Lorca Finco PLC | | BTL-B2 | | B1 | | B+ | | | TBD | | | | | | 09/17/2027 | | | | 845,000 | | | | 1,033,585 | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Diversified Telecommunication Services (continued) | | | | | | | | | | | | | | | | | |

MTN Infrastructure TopCo, Inc. | | BTL | | B2 | | B | | 4.00% | | 1 ML+3.00% | | | 11/15/2024 | | | $ | 992,507 | | | $ | 989,405 | |

MTN Infrastructure TopCo Inc | | BTL-B | | B2 | | B | | 5.00 | | 1 ML+4.00% | | | 11/17/2024 | | | | 557,200 | | | | 556,852 | |

Telenet Financing USD LLC | | BTL-AR | | Ba3 | | BB- | | 2.16 | | 1 ML+2.00% | | | 04/30/2028 | | | | 920,000 | | | | 906,056 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 5,238,771 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Electric Utilities — 0.2% | | | | | | | | | | | | | | | | | | | |

Exgen Renewables IV LLC | | BTL | | Ba3 | | BB- | | TBD | | | | | 12/15/2027 | | | | 280,000 | | | | 280,117 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Electronic Equipment, Instruments & Components — 0.7% | | | | | | | | | | | | | | | | | |

Avantor, Inc. | | BTL-B3 | | Ba2 | | BB- | | 3.25 | | 1 ML+2.25% | | | 11/21/2024 | | | | 139,963 | | | | 139,876 | |

Avantor, Inc. | | BTL-B4 | | Ba2 | | BB- | | 3.50 | | 1 ML+2.50% | | | 11/08/2027 | | | | 685,000 | | | | 684,714 | |

Lifescan Global Corporation | | BTL-B | | B3 | | B | | 6.23 | | 3 ML+6.00% | | | 10/01/2024 | | | | 207,807 | | | | 197,417 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 1,022,007 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Energy Equipment & Services — 0.0% | | | | | | | | | | | | | | | | | | | |

Philadelphia Energy Solutions LLC†(5)(10)(11)(13) | | BTL-C | | NR | | NR | | 11.24 | | USFRBPLR+6.99% | | | 12/31/2022 | | | | 845,872 | | | | 67,670 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Entertainment — 2.3% | | | | | | | | | | | | | | | | | | | |

Crown Finance US, Inc.(9) | | BTL | | Caa2 | | CCC | | 2.63 | | 3 ME+2.63% | | | 02/28/2025 | | | | 329 | | | | 270 | |

Crown Finance US, Inc.(9) | | BTL | | Caa2 | | CCC | | 2.63 | | 6 ME+2.63% | | | 02/28/2025 | | | | 131,744 | | | | 107,934 | |

Crown Finance US, Inc. | | BTL | | Caa2 | | CCC | | 2.77 | | 3 ML+2.25% | | | 02/28/2025 | | | | 1,457 | | | | 981 | |

Crown Finance US, Inc. | | BTL | | Caa2 | | CCC | | 2.77 | | 6 ML+2.50% | | | 02/28/2025 | | | | 581,077 | | | | 391,258 | |

Crown Finance US, Inc. | | BTL-B1 | | B3 | | B- | | TBD | | | | | 05/23/2024 | | | | 172,482 | | | | 204,679 | |

Delta 2 (Lux) SARL | | BTL-B | | B2 | | B+ | | 3.50 | | 1 ML+2.50% | | | 02/01/2024 | | | | 850,951 | | | | 839,959 | |

NAI Entertainment Holdings LLC | | BTL-B | | B3 | | B+ | | 3.50 | | 1 ML+2.50% | | | 05/08/2025 | | | | 413,200 | | | | 382,985 | |

Nascar Holdings, Inc. | | BTL-B | | Ba3 | | BB | | 2.90 | | 1 ML+2.75% | | | 10/19/2026 | | | | 234,078 | | | | 232,824 | |

UFC Holdings LLC | | BTL | | B2 | | B | | 4.25 | | 6 ML+3.25% | | | 04/29/2026 | | | | 452,324 | | | | 450,854 | |

UFC Holdings LLC | | BTL | | B2 | | B | | 4.25 | | 6 ML+3.25% | | | 04/29/2026 | | | | 497,500 | | | | 495,013 | |

William Morris Endeavor Entertainment LLC | | BTL-B1 | | B3 | | CCC+ | | 2.90 | | 1 ML+2.75% | | | 05/18/2025 | | | | 294,816 | | | | 270,125 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 3,376,882 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Food & Staples Retailing — 0.9% | | | | | | | | | | | | | | | | | | | |

U.S. Foods, Inc. | | BTL-B | | B3 | | BB- | | 1.90 | | 1 ML+1.75% | | | 06/27/2023 | | | | 766,876 | | | | 754,222 | |

U.S. Foods, Inc. | | BTL-B | | B3 | | BB- | | 2.15 | | 1 ML+2.00% | | | 09/13/2026 | | | | 533,250 | | | | 523,252 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 1,277,474 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Food Products — 2.3% | | | | | | | | | | | | | | | | | | | |

Atkins Nutritionals, Inc. | | BTL | | B1 | | BB- | | 4.75 | | 1 ML+3.75% | | | 07/07/2024 | | | | 421,377 | | | | 422,035 | |

Bellring Brands LLC | | BTL-B | | B2 | | B+ | | 6.00 | | 1 ML+5.00% | | | 10/21/2024 | | | | 149,961 | | | | 150,430 | |

CHG PPC Parent LLC | | BTL-B | | B2 | | B | | 2.90 | | 1 ML+2.75% | | | 03/31/2025 | | | | 419,250 | | | | 411,389 | |

Froneri International PLC | | BTL | | B1 | | B+ | | 2.40 | | 1 ML+2.25% | | | 01/31/2027 | | | | 646,750 | | | | 639,636 | |

Froneri International PLC(9) | | BTL | | B1 | | B+ | | 2.63 | | 1 ME+2.63% | | | 01/31/2027 | | | | 700,000 | | | | 842,461 | |

Froneri International PLC(9) | | 2nd Lien | | B3 | | B- | | 5.75 | | 1 ME+5.75% | | | 01/31/2028 | | | | 100,000 | | | | 122,318 | |

Froneri International PLC | | 2nd Lien | | B3 | | B- | | 5.90 | | 1 ML+5.75% | | | 01/31/2028 | | | | 100,000 | | | | 100,500 | |

Hostess Brands LLC | | BTL | | B1 | | BB- | | 3.00 | | 3 ML+2.25% | | | 08/03/2025 | | | | 794,744 | | | | 790,273 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 3,479,042 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Gas Utilities — 0.3% | | | | | | | | | | | | | | | | | | | |

UGI Energy Services LLC | | BTL-B | | Ba3 | | NR | | 3.90 | | 1 ML+3.75% | | | 08/13/2026 | | | | 493,962 | | | | 493,962 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Health Care Providers & Services — 7.5% | | | | | | | | | | | | | | | | | | | |

ADMI Corp | | BTL | | B2 | | B | | TBD | | | | | 12/23/2027 | | | | 635,000 | | | | 634,683 | |

Biogroup LCD(9) | | BTL-B | | B2 | | B- | | 4.75 | | 3 ME+4.75% | | | 04/25/2026 | | | | 510,000 | | | | 623,042 | |

Cano Health LLC | | Delayed Draw | | B3 | | B- | | TBD | | | | | 11/19/2027 | | | | 187,023 | | | | 185,776 | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Health Care Providers & Services (continued) | | | | | | | | | | | | | | | | | | | |

Cano Health LLC | | BTL | | B3 | | B- | | TBD | | | | | 11/19/2027 | | | $ | 512,977 | | | $ | 509,557 | |

Catalent Pharma Solutions, Inc. | | BTL | | Ba1 | | BBB- | | 3.25% | | 1 ML+2.25% | | | 05/18/2026 | | | | 574,763 | | | | 574,403 | |

Change Healthcare Holdings, Inc. | | BTL-B | | B1 | | B+ | | 3.50 | | 1 ML+2.50% | | | 03/01/2024 | | | | 26,822 | | | | 26,677 | |

Change Healthcare Holdings, Inc. | | BTL-B | | B1 | | B+ | | 3.50 | | 3 ML+2.50% | | | 03/01/2024 | | | | 837,168 | | | | 832,633 | |

Dental Corp. Perfect Smile ULC | | 1st Lien | | B2 | | B- | | 4.75 | | 1 ML+3.75% | | | 06/06/2025 | | | | 595,758 | | | | 584,587 | |

DuPage Medical Group, Ltd. | | BTL | | B1 | | B | | 3.75 | | 1 ML+2.75% | | | 08/15/2024 | | | | 405,147 | | | | 401,602 | |

DuPage Medical Group, Ltd. | | 2nd Lien | | Caa1 | | CCC+ | | 7.75 | | 1 ML+7.00% | | | 08/15/2025 | | | | 623,968 | | | | 606,809 | |

Envision Healthcare Corp. | | BTL | | Caa1 | | CCC | | 3.90 | | 1 ML+3.75% | | | 10/10/2025 | | | | 352,784 | | | | 293,987 | |

Eyecare Partners LLC | | BTL | | B3 | | B | | 3.90 | | 1 ML+3.75% | | | 02/18/2027 | | | | 583,429 | | | | 567,385 | |

Eyecare Partners LLC | | Delayed Draw | | B3 | | B | | 3.75-3.90 | | | | | 02/18/2027 | | | | 137,162 | | | | 133,390 | |

Gentiva Health Services, Inc. | | BTL | | B1 | | B | | 3.44 | | 1 ML+3.25% | | | 07/02/2025 | | | | 912,459 | | | | 907,137 | |

IQVIA, Inc.(9) | | BTL-B2 | | Ba1 | | BBB- | | 2.00 | | 3 ME+2.00% | | | 06/11/2025 | | | | 507,674 | | | | 617,541 | |

LGC Group Holdings, Ltd.(9) | | BTL-B | | B3 | | NR | | 3.25 | | 1 ME+3.25% | | | 04/21/2027 | | | | 595,000 | | | | 716,282 | |

MED ParentCo LP | | 1st Lien | | B3 | | B- | | 4.40 | | 1 ML+4.25% | | | 08/31/2026 | | | | 645,136 | | | | 634,383 | |

MED ParentCo LP | | Delayed Draw | | B3 | | B- | | 4.25-4.40 | | | | | 08/31/2026 | | | | 161,780 | | | | 158,868 | |

Pathway Vet Alliance LLC | | Delayed Draw | | B2 | | B | | 4.00-4.15 | | | | | 03/31/2027 | | | | 19,868 | | | | 19,844 | |

Pathway Vet Alliance LLC | | BTL | | B2 | | B | | 4.15 | | 1 ML+4.00% | | | 03/31/2027 | | | | 243,244 | | | | 242,939 | |

Pharmaceutical Product Development, Inc. | | BTL | | Ba2 | | BB- | | 3.50 | | 1 ML+2.50% | | | 08/18/2022 | | | | 504,460 | | | | 503,704 | |

Sound Inpatient Physicians | | 1st Lien | | Ba3 | | B | | 2.90 | | 1 ML+2.75% | | | 06/27/2025 | | | | 561,362 | | | | 555,748 | |

Surgery Center Holdings, Inc. | | 1st Lien | | B2 | | B- | | 4.25 | | 1 ML+3.25% | | | 09/03/2024 | | | | 410,166 | | | | 402,903 | |

Surgery Center Holdings Inc | | BTL | | B2 | | B- | | 9.00 | | 1 ML+8.00% | | | 09/03/2024 | | | | 471,438 | | | | 482,929 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 11,216,809 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure — 4.9% | | | | | | | | | | | | | | | | | | | |

8th Avenue Food & Provisions, Inc. | | BTL | | B2 | | B- | | 3.65 | | 1 ML+3.50% | | | 10/01/2025 | | | | 416,500 | | | | 414,418 | |

8th Avenue Food & Provisions, Inc. | | 2nd Lien | | Caa1 | | CCC | | 7.90 | | 1 ML+7.75% | | | 10/01/2026 | | | | 270,000 | | | | 264,938 | |

Aramark Services, Inc. | | BTL-B1 | | Ba2 | | BB+ | | 1.90 | | 1 ML+1.75% | | | 03/11/2025 | | | | 596,904 | | | | 588,398 | |

Boyd Gaming Corp. | | BTL-B | | Ba3 | | BB- | | 2.35 | | 1 WL+2.25% | | | 09/15/2023 | | | | 621,005 | | | | 615,238 | |

Caesars Resort Collection LLC | | BTL-B | | B1 | | B+ | | 2.90 | | 1 ML+2.75% | | | 12/23/2024 | | | | 992,386 | | | | 971,987 | |

Caesars Resort Collection LLC | | BTL | | B1 | | B+ | | 4.65 | | 1 ML+4.50% | | | 07/21/2025 | | | | 842,888 | | | | 842,993 | |

Carnival Corp | | BTL-B | | Ba2 | | BB- | | 8.50 | | 1 ML+7.50% | | | 06/30/2025 | | | | 462,675 | | | | 476,324 | |

CityCenter Holdings LLC | | BTL-B | | B2 | | B+ | | 2.40 | | 1 ML+2.25% | | | 04/18/2024 | | | | 494,826 | | | | 487,558 | |

Golden Entertainment, Inc. | | BTL-B | | B1 | | B+ | | 3.75 | | 1 ML+3.00% | | | 10/21/2024 | | | | 250,875 | | | | 244,603 | |

IRB Holding Corp | | BTL | | B2 | | B | | TBD | | | | | 12/15/2027 | | | | 485,000 | | | | 484,273 | |

Penn National Gaming, Inc. | | BTL-B1 | | B1 | | BB- | | 3.00 | | 1 ML+2.25% | | | 10/15/2025 | | | | 619,073 | | | | 610,328 | |

Playtika Holding Corp. | | BTL-B | | B1 | | BB- | | 7.00 | | 3 ML+6.00% | | | 12/10/2024 | | | | 897,750 | | | | 902,239 | |

Station Casinos LLC | | BTL-B | | B1 | | BB- | | 2.50 | | 1 ML+2.25% | | | 02/08/2027 | | | | 404,683 | | | | 398,006 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 7,301,303 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Household Durables — 0.6% | | | | | | | | | | | | | | | | | | | |

Installed Building Products, Inc. | | BTL-B | | Ba3 | | BB+ | | 2.40 | | 1 ML+2.25% | | | 04/15/2025 | | | | 500,000 | | | | 490,000 | |

Weber-Stephen Products LLC | | BTL-B | | B1 | | B | | 4.00 | | 1 ML+3.25% | | | 10/30/2027 | | | | 445,000 | | | | 445,159 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 935,159 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Household Products — 0.4% | | | | | | | | | | | | | | | | | | | |

Prestige Brands, Inc. | | BTL-B4 | | Ba3 | | BB | | 2.15 | | 1 ML+2.00% | | | 01/26/2024 | | | | 189,493 | | | | 189,611 | |

Reynolds Consumer Products, Inc. | | BTL | | Ba1 | | BB+ | | 1.90 | | 1 ML+1.75% | | | 02/04/2027 | | | | 337,326 | | | | 334,754 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 524,365 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Industrial Conglomerates — 0.1% | | | | | | | | | | | | | | | | | | | |

Ameriforge Group, Inc.(12) | | BTL | | NR | | NR | | 5.00-14.00 | | 3 ML+8.00% | | | 06/08/2022 | | | | 107,722 | | | | 84,023 | |

UTEX Industries Inc. | | BTL | | NR | | NR | | 11.00 | | 1 ML+9.50% | | | 12/03/2025 | | | | 16,377 | | | | 15,940 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 99,963 | |

| | | | | | | | | | | | | | | | | | | | | | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Insurance — 5.1% | | | | | | | | | | | | | | | | | | | | |

Asurion LLC | | BTL-B6 | | Ba3 | | B+ | | | 3.15% | | | 1 ML+3.00% | | | 11/03/2023 | | | $ | 337,383 | | | $ | 335,644 | |

Asurion LLC | | BTL-B7 | | Ba3 | | B+ | | | 3.15 | | | 1 ML+3.00% | | | 11/03/2024 | | | | 502,076 | | | | 497,839 | |

Acrisure LLC | | BTL-B | | B2 | | B | | | 3.65 | | | 1 ML+3.50% | | | 02/15/2027 | | | | 441,663 | | | | 432,719 | |

Asurion LLC | | 2nd Lien | | B3 | | B | | | 6.65 | | | 1 ML+6.50% | | | 08/04/2025 | | | | 1,390,303 | | | | 1,398,123 | |

Asurion LLC | | BTL-B8 | | Ba3 | | B+ | | | TBD | | | | | | 12/23/2026 | | | | 915,356 | | | | 905,630 | |

Compass Investments, Inc. | | BTL-B | | B2 | | B | | | 3.25 | | | 3 ML+3.00% | | | 05/16/2024 | | | | 1,065,777 | | | | 1,049,569 | |

Hub International, Ltd. | | BTL-B1 | | B2 | | B | | | 2.96-3.00 | | | 3 ML+2.75% | | | 04/25/2025 | | | | 960,375 | | | | 941,931 | |

Hyperion Insurance Group Ltd. | | BTL-B | | B2 | | B | | | TBD | | | | | | 11/12/2027 | | | | 119,931 | | | | 119,631 | |

Hyperion Insurance Group Ltd. | | Delayed Draw | | B2 | | B | | | TBD | | | | | | 11/12/2027 | | | | 144,769 | | | | 144,407 | |

Ryan Specialty Group LLC | | BTL | | B1 | | B | | | 4.00 | | | 1 ML+3.25% | | | 09/01/2027 | | | | 269,325 | | | | 268,315 | |

Sedgwick Claims Management Services, Inc. | | BTL-B | | B2 | | B | | | 3.40 | | | 1 ML+3.25% | | | 12/31/2025 | | | | 1,324,624 | | | | 1,301,996 | |

Sedgwick Claims Management Services, Inc. | | BTL-B3 | | B2 | | B | | | 5.25 | | | 1 ML+4.25% | | | 09/03/2026 | | | | 233,825 | | | | 235,286 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 7,631,090 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Interactive Media & Services — 0.2% | | | | | | | | | | | | | | | | | | | | |

Adevinta ASA | | BTL-B | | Ba3 | | BB- | | | TBD | | | | | | 10/13/2027 | | | | 170,000 | | | | 207,875 | |

Adevinta ASA | | BTL-B | | Ba3 | | BB- | | | TBD | | | | | | 10/13/2027 | | | | 125,000 | | | | 124,792 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 332,667 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Internet & Direct Marketing Retail — 1.3% | | | | | | | | | | | | | | | | | | | | |

Go Daddy Operating Co. LLC | | BTL-B1 | | Ba1 | | BB | | | 1.90 | | | 1 ML+1.75% | | | 02/15/2024 | | | | 393,056 | | | | 391,664 | |

Go Daddy Operating Co. LLC | | BTL-B3 | | Ba1 | | BB | | | 2.65 | | | 1 ML+2.50% | | | 08/10/2027 | | | | 308,450 | | | | 309,735 | |

MH Sub I LLC | | BTL | | B2 | | B | | | 4.75 | | | 1 ML+3.75% | | | 09/13/2024 | | | | 473,074 | | | | 471,497 | |

Rodan & Fields, LLC | | BTL | | Caa2 | | B- | | | 4.16 | | | 1 ML+4.00% | | | 06/16/2025 | | | | 353,905 | | | | 291,087 | |

Shutterfly, Inc. | | BTL-B | | B2 | | B- | | | 7.00 | | | 3 ML+6.00% | | | 09/25/2026 | | | | 460,556 | | | | 457,678 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 1,921,661 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| IT Services — 2.9% | | | | | | | | | | | | | | | | | | | | |

Blackhawk Network Holdings, Inc. | | BTL-B | | B1 | | B- | | | 3.15 | | | 1 ML+3.00% | | | 06/15/2025 | | | | 798,807 | | | | 777,339 | |

CCC Information Services, Inc. | | 1st Lien | | B3 | | B- | | | 4.00 | | | 1 ML+3.00% | | | 04/29/2024 | | | | 899,182 | | | | 896,185 | |

Science Applications International Corp. | | BTL-B | | Ba1 | | BB+ | | | 2.40 | | | 1 ML+2.25% | | | 03/12/2027 | | | | 233,467 | | | | 233,029 | |

Tempo Acquisition LLC | | BTL-B | | B1 | | B | | | 3.75 | | | 1 ML+3.25% | | | 11/02/2026 | | | | 973,035 | | | | 965,129 | |

Web.com Group, Inc. | | BTL-B2 | | Caa2 | | CCC+ | | | 7.90 | | | 1 ML+7.75% | | | 10/09/2026 | | | | 568,466 | | | | 540,517 | |

WEX, Inc. | | BTL-B3 | | Ba2 | | BB- | | | 2.40 | | | 1 ML+2.25% | | | 05/15/2026 | | | | 1,006,984 | | | | 999,431 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 4,411,630 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Leisure Products — 0.6% | | | | | | | | | | | | | | | | | | | | |

Hayward Industries, Inc. | | 1st Lien | | B3 | | B | | | 3.65 | | | 1 ML+3.50% | | | 08/05/2024 | | | | 388,363 | | | | 383,509 | |

SRAM LLC | | BTL-B | | B1 | | BB- | | | 3.75 | | | 1 ML+2.75% | | | 03/15/2024 | | | | 13,708 | | | | 13,656 | |

SRAM LLC | | BTL-B | | B1 | | BB- | | | 3.75 | | | 3 ML+2.75% | | | 03/15/2024 | | | | 227,826 | | | | 226,972 | |

SRAM LLC | | BTL-B | | B1 | | BB- | | | 3.75 | | | 6 ML+2.75% | | | 03/15/2024 | | | | 260,373 | | | | 259,397 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 883,534 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Life Sciences Tools & Services — 0.3% | | | | | | | | | | | | | | | | | | | | |

Syneos Health, Inc. | | BTL-B | | Ba2 | | BB | | | 1.90 | | | 1 ML+1.75% | | | 08/01/2024 | | | | 389,408 | | | | 385,611 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Machinery — 2.9% | | | | | | | | | | | | | | | | | | | | |

Alliance Laundry Systems LLC | | BTL-B | | B2 | | B | | | 4.25 | | | 3 ML+3.50% | | | 10/08/2027 | | | | 415,000 | | | | 414,568 | |

Altra Industrial Motion Corp. | | BTL-B | | Ba2 | | BB- | | | 2.15 | | | 1 ML+2.00% | | | 10/01/2025 | | | | 423,518 | | | | 422,459 | |

Fluidra SA | | BTL-B | | Ba3 | | BB | | | 2.15 | | | 1 ML+2.00% | | | 07/02/2025 | | | | 371,131 | | | | 367,420 | |

Ingersoll-Rand Company Ltd.(9) | | BTL-B | | Ba2 | | BB+ | | | 2.00 | | | 1 ME+2.00% | | | 03/01/2027 | | | | 501,951 | | | | 611,983 | |

Welbilt Inc | | BTL-B | | B3 | | CCC+ | | | 2.65 | | | 1 ML+2.50% | | | 10/23/2025 | | | | 500,000 | | | | 473,125 | |

Navistar International Corp. | | BTL-B | | Ba2 | | BB- | | | 3.66 | | | 1 ML+3.50% | | | 11/06/2024 | | | | 538,104 | | | | 536,927 | |

Vertical Midco GMBH(9) | | BTL-B | | B1 | | B | | | 4.25 | | | 6 ME+4.25% | | | 07/30/2027 | | | | 150,000 | | | | 184,301 | |

Vertical US Newco Inc. | | BTL-B | | B1 | | B | | | 4.57 | | | 6 ML+4.25% | | | 07/30/2027 | | | | 723,188 | | | | 725,560 | |

WireCo WorldGroup, Inc. | | 1st Lien | | Caa1 | | B | | | 6.00 | | | 3 ML+5.00% | | | 09/30/2023 | | | | 594,246 | | | | 563,976 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | 4,300,319 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratings(1) | | | | | | | | | | | | | |

| Industry Description | | Type | | Moody’s | | S&P | | Interest Rate | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Media — 7.3% | | | | | | | | | | | | | | | | | | | |

Banijay Group US Holding Inc | | BTL | | B1 | | B | | 3.90 % | | 1 ML+3.75% | | | 03/01/2025 | | | $ | 423,937 | | �� | $ | 417,578 | |

Banijay Group US Holding Inc | | BTL | | B1 | | B | | TBD | | | | | 03/04/2025 | | | | 170,000 | | | | 206,707 | |

Charter Communications Operating LLC | | BTL-B2 | | Ba1 | | BBB- | | 1.90 | | 1 ML+1.75% | | | 02/01/2027 | | | | 644,156 | | | | 640,220 | |

CSC Holdings, Inc. | | BTL-B | | Ba3 | | BB | | 2.41 | | 1 ML+2.25% | | | 07/17/2025 | | | | 492,752 | | | | 485,362 | |

CSC Holdings, Inc. | | BTL-B5 | | Ba3 | | BB | | 2.66 | | 1 ML+2.50% | | | 04/15/2027 | | | | 501,641 | | | | 496,624 | |

E.W. Scripps Co. | | BTL-B2 | | Ba3 | | BB- | | 2.65 | | 1 ML+2.50% | | | 05/01/2026 | | | | 628,840 | | | | 620,665 | |

E.W. Scripps Co. | | BTL-B3 | | Ba3 | | BB- | | TBD | | | | | 12/15/2027 | | | | 185,000 | | | | 185,046 | |

Gray Television, Inc. | | BTL-C | | Ba2 | | BB | | 2.65 | | 3 ML+2.50% | | | 01/02/2026 | | | | 1,007,627 | | | | 999,230 | |

Houghton Mifflin Harcourt Publishing Company | | BTL-B | | Caa1 | | B | | 7.25 | | 1 ML+6.25% | | | 11/22/2024 | | | | 475,000 | | | | 455,604 | |

ION Media Networks, Inc. | | BTL-B | | B1 | | BB- | | 3.15 | | 1 ML+3.00% | | | 12/18/2024 | | | | 1,036,047 | | | | 1,034,320 | |

Nielsen Fianance LLC | | BTL-B5 | | Ba1 | | BBB- | | 4.75 | | 1 ML+3.75% | | | 06/04/2025 | | | | 99,500 | | | | 100,091 | |

NEP Group, Inc. | | BTL | | Caa1 | | B | | 3.40 | | 1 ML+3.25% | | | 10/20/2025 | | | | 518,532 | | | | 490,877 | |

NEP Group, Inc. | | 2nd Lien | | Caa3 | | CCC | | 7.15 | | 1 ML+7.00% | | | 10/19/2026 | | | | 595,000 | | | | 502,180 | |

Nexstar Broadcasting, Inc. | | BTL-B4 | | Ba3 | | BB | | 2.90 | | 3 ML+2.75% | | | 09/18/2026 | | | | 1,160,393 | | | | 1,151,368 | |

Radiate Holdco LLC | | BTL | | B1 | | B | | 4.25 | | 1 ML+3.50% | | | 09/25/2026 | | | | 260,000 | | | | 260,081 | |

UPC Broadband Holding BV(9) | | BTL-B2 | | B1 | | BB- | | 3.50 | | 3 ME+3.50% | | | 01/31/2029 | | | | 150,000 | | | | 183,575 | |

UPC Broadband Holding BV(9) | | BTL-B1 | | B1 | | BB- | | 3.50 | | 3 ME+3.50% | | | 01/31/2029 | | | | 150,000 | | | | 183,575 | |

UPC Broadband Holding BV | | BTL-B1 | | B1 | | BB- | | 3.67 | | 2 ML+3.50% | | | 01/31/2029 | | | | 560,000 | | | | 560,000 | |

UPC Broadband Holding BV | | BTL-B2 | | B1 | | BB- | | 3.68 | | 2 ML+3.50% | | | 01/31/2029 | | | | 560,000 | | | | 560,000 | |

Virgin Media Bristol LLC | | BTL-Q | | Ba3 | | BB- | | TBD | | | | | 01/31/2029 | | | | 480,000 | | | | 478,350 | |

Ziggo Secured Finance Partnership | | BTL-I | | B1 | | B+ | | 2.66 | | 1 ML+2.50% | | | 04/30/2028 | | | | 1,000,000 | | | | 989,875 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 11,001,328 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Metals & Mining — 0.7% | | | | | | | | | | | | | | | | | | | |

American Rock Salt Co. LLC | | 1st Lien | | B2 | | B | | 4.50 | | 1 ML+3.50% | | | 03/21/2025 | | | | 992,806 | | | | 992,185 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Multiline Retail — 0.8% | | | | | | | | | | | | | | | | | | | |

Peer Holding B.V.(9) | | BTL-B | | B1 | | B+ | | 3.25 | | 6 ME+3.25% | | | 03/08/2025 | | | | 1,000,000 | | | | 1,203,706 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Oil, Gas & Consumable Fuels — 1.6% | | | | | | | | | | | | | | | | | | | |

BCP Renaissance Parent LLC | | BTL | | B2 | | B | | 4.50 | | 3 ML+3.50% | | | 10/31/2024 | | | | 287,879 | | | | 277,659 | |

Grizzly Acquisition, Inc. | | BTL | | Ba3 | | BB | | 3.48 | | 3 ML+3.25% | | | 10/01/2025 | | | | 592,260 | | | | 581,155 | |

Medallion Midland Acquisition LLC | | 1st Lien | | B2 | | B- | | 4.25 | | 1 ML+3.25% | | | 10/30/2024 | | | | 696,497 | | | | 681,696 | |

Oryx Midstream Services LLC | | BTL-B | | B2 | | B- | | 4.15 | | 1 ML+4.00% | | | 05/22/2026 | | | | 570,112 | | | | 554,078 | |

Traverse Midstream Partners LLC | | BTL-B | | B3 | | B | | 6.50 | | 1 ML+5.50% | | | 09/27/2024 | | | | 276,956 | | | | 271,878 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 2,366,466 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Personal Products — 0.8% | | | | | | | | | | | | | | | | | |

Revlon Consumer Products Corp.(5) | | BTL | | Ca | | CC | | 4.25 | | 2 ML+3.50% | | | 09/07/2023 | | | | 3,144 | | | | 1,157 | |

Revlon Consumer Products Corp.(5) | | BTL | | Ca | | CC | | 4.25 | | 3 ML+3.50% | | | 09/07/2023 | | | | 753,972 | | | | 277,462 | |

Sunshine Luxembourg VII SARL | | BTL-B1 | | B2 | | B- | | 4.25 | | 3 ML+4.00% | | | 10/01/2026 | | | | 990,000 | | | | 991,768 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 1,270,387 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Pharmaceuticals — 2.6% | | | | | | | | | | | | | | | | | |

Elanco Animal Health Inc | | BTL-B | | Baa3 | | BB+ | | 1.90 | | 3 ML+1.75% | | | 08/01/2027 | | | | 765,083 | | | | 757,592 | |

Endo Luxembourg Finance Co. I SARL | | BTL-B | | B2 | | B+ | | 5.00 | | 3 ML+4.25% | | | 04/29/2024 | | | | 498,225 | | | | 489,817 | |

Milano Acquisition Corp | | BTL-B | | B2 | | B+ | | 4.75 | | 3 ML+4.00% | | | 10/01/2027 | | | | 455,000 | | | | 454,431 | |

Packaging Coordinators Midco Inc. | | BTL | | B2 | | B- | | 4.50 | | 3 ML+3.75% | | | 11/30/2027 | | | | 380,000 | | | | 380,000 | |

Valeant Pharmaceuticals International, Inc. | | BTL | | Ba2 | | BB | | 2.90 | | 1 ML+2.75% | | | 11/27/2025 | | | | 916,544 | | | | 907,379 | |

Valeant Pharmaceuticals International, Inc. | | BTL | | Ba2 | | BB | | 3.15 | | 1 ML+3.00% | | | 06/02/2025 | | | | 926,551 | | | | 922,063 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 3,911,282 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Professional Services — 1.7% | | | | | | | | | | | | | | | | | |

AlixPartners LLP | | BTL-B | | B2 | | B+ | | 2.65 | | 1 ML+2.50% | | | 04/04/2024 | | | | 1,280,429 | | | | 1,265,224 | |

AlixPartners LLP(9) | | BTL | | B2 | | B+ | | 3.25 | | 3 ME+3.25% | | | 04/04/2024 | | | | 245,625 | | | | 298,782 | |

Dun & Bradstreet Corporation | | BTL | | B1 | | B+ | | 3.90 | | 1 ML+3.75% | | | 02/06/2026 | | | | 1,000,555 | | | | 999,554 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 2,563,560 | |

| | | | | | | | | | | | | | | | | | | | | | |

AIG Senior Floating Rate Fund

PORTFOLIO OF INVESTMENTS — December 31, 2020 — (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Ratings(1) | | | | | | | | | | | | | | |

| Industry Description | | Type | | | Moody’s | | | S&P | | | Interest Rate | | Reference Rate | | Maturity Date(2) | | | Principal Amount** | | | Value (Note 2) | |

| Real Estate Investment Trusts — 0.6% | | | | | | | | | | | | | | | | | | | | |

VICI Properties 1 LLC | | | BTL | | | | Ba2 | | | | BBB- | | | 1.89 % | | 1 ML+1.75% | | | 12/20/2024 | | | $ | 853,864 | | | $ | 838,921 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Road & Rail — 0.8% | | | | | | | | | | | | | | | | | | | | |

Boels Top Holding BV(9) | | | BTL-B | | | | B1 | | | | BB- | | | 4.00 | | 3 ME+4.00% | | | 02/06/2027 | | | | 605,000 | | | | 739,098 | |

Fly Funding II SARL | | | BTL-B | | | | Ba3 | | | | BB+ | | | 2.00 | | 3 ML+1.75% | | | 08/11/2025 | | | | 505,959 | | | | 478,131 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | 1,217,229 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 0.1% | | | | | | | | | | | | | | | | | | | | |

Entegris, Inc. | | | BTL-B | | | | Baa3 | | | | BBB- | | | 2.15 | | 1 ML+2.00% | | | 11/06/2025 | | | | 211,196 | | | | 210,844 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Software — 6.8% | | | | | | | | | | | | | | | | | | | | |

Almonde, Inc. | | | BTL-B | | | | B2 | | | | CCC+ | | | 4.50 | | 6 ML+3.50% | | | 06/13/2024 | | | | 491,556 | | | | 480,719 | |

Almonde, Inc. | | | BTL | | | | Caa2 | | | | CCC- | | | 8.25 | | 6 ML+7.25% | | | 06/13/2025 | | | | 230,000 | | | | 230,095 | |

BY Crown Parent LLC | | | BTL-B1 | | | | B1 | | | | B- | | | 4.00 | | 1 ML+3.00% | | | 02/02/2026 | | | | 399,435 | | | | 397,937 | |

Ceridian HCM Holding, Inc. | | | BTL-B | | | | B2 | | | | B+ | | | 2.60 | | 1 WL+2.50% | | | 04/30/2025 | | | | 571,998 | | | | 563,894 | |

Dcert Buyer, Inc. | | | BTL-B | | | | B2 | | | | B- | | | 4.15 | | 1 ML+4.00% | | | 10/16/2026 | | | | 496,250 | | | | 495,381 | |

E2Open LLC | | | BTL-B | | | | B2 | | | | B | | | TBD | | | | | 10/29/2027 | | | | 490,000 | | | | 488,468 | |

Emerald Topco, Inc. | | | BTL | | | | B2 | | | | B | | | 3.71 | | 3 ML+3.50% | | | 07/24/2026 | | | | 439,438 | | | | 433,944 | |

Epicor Software Corp | | | BTL | | | | B2 | | | | B- | | | 5.25 | | 1 ML+4.25% | | | 07/30/2027 | | | | 1,085,188 | | | | 1,090,614 | |

Epicor Software Corp | | | 2nd Lien | | | | Caa2 | | | | CCC | | | 8.75 | | 1 ML+7.75% | | | 07/31/2028 | | | | 240,000 | | | | 249,300 | |

Hyland Software, Inc. | | | BTL | | | | B1 | | | | B- | | | 4.25 | | 1 ML+3.50% | | | 07/01/2024 | | | | 1,436,335 | | | | 1,437,509 | |

Hyland Software, Inc. | | | 2nd Lien | | | | Caa1 | | | | CCC | | | 7.75 | | 1 ML+7.00% | | | 07/07/2025 | | | | 470,800 | | | | 470,800 | |

SS&C Technologies, Inc. | | | BTL-B3 | | | | Ba2 | | | | BB+ | | | 1.90 | | 1 ML+1.75% | | | 04/16/2025 | | | | 430,814 | | | | 425,361 | |

SS&C Technologies, Inc. | | | BTL | | | | Ba2 | | | | BB+ | | | 1.90 | | 1 ML+1.75% | | | 04/16/2025 | | | | 333,354 | | | | 329,135 | |

SS&C Technologies, Inc. | | | BTL-B5 | | | | Ba2 | | | | BB+ | | | 1.90 | | 1 ML+1.75% | | | 04/16/2025 | | | | 1,150,518 | | | | 1,137,414 | |

Ultimate Software Group, Inc. | | | BTL-B | | | | B1 | | | | B | | | 3.90 | | 1 ML+3.75% | | | 05/04/2026 | | | | 671,500 | | | | 670,493 | |

Ultimate Software Group, Inc. | | | BTL-B | | | | B1 | | | | B | | | 4.75 | | 3 ML+4.00% | | | 05/04/2026 | | | | 339,150 | | | | 340,719 | |

Zelis Payments Buyer, Inc. | | | BTL | | | | B2 | | | | B | | | 4.90 | | 1 ML+4.75% | | | 09/30/2026 | | | | 990,000 | | | | 991,546 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | 10,233,329 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty Retail — 3.1% | | | | | | | | | | | | | | | | | | | | |

Bass Pro Group LLC | | | BTL-B | | | | B1 | | | | B+ | | | 5.75 | | 1 ML+5.00% | | | 09/25/2024 | | | | 701,850 | | | | 702,837 | |

Foundation Building Materials Holding Co. LLC | | | BTL | | | | B2 | | | | BB- | | | 3.15 | | 1 ML+3.00% | | | 08/13/2025 | | | | 269,028 | | | | 268,804 | |

Harbor Freight Tools USA, Inc. | | | BTL-B | | | | Ba3 | | | | BB- | | | 4.00 | | 1 ML+3.25% | | | 10/19/2027 | | | | 509,790 | | | | 509,103 | |

LBM Acquisition LLC | | | Delayed Draw | | | | B2 | | | | B | | | TBD | | | | | 12/09/2027 | | | | 105,299 | | | | 105,246 | |

LBM Acquisition LLC | | | BTL-B | | | | B2 | | | | B | | | TBD | | | | | 12/17/2027 | | | | 473,846 | | | | 473,609 | |

Les Schwab Tire Centers | | | BTL-B | | | | B2 | | | | B | | | 4.25 | | 3 ML+3.50% | | | 11/02/2027 | | | | 300,000 | | | | 299,625 | |

Michaels Stores, Inc. | | | BTL-B | | | | Ba3 | | | | B+ | | | 4.25 | | 1 ML+3.50% | | | 10/01/2027 | | | | 441,048 | | | | 437,741 | |

PetSmart, Inc. | | | BTL | | | | B1 | | | | B | | | 4.50 | | 3 ML+3.50% | | | 03/11/2022 | | | | 419,344 | | | | 418,401 | |

SRS Distribution, Inc. | | | BTL-B | | | | B3 | | | | B | | | 4.40 | | 1 ML+4.25% | | | 05/23/2025 | | | | 351,450 | | | | 350,132 | |

Staples, Inc. | | | BTL | | | | B1 | | | | B | | | 5.21 | | 3 ML+5.00% | | | 04/16/2026 | | | | 498,765 | | | | 482,400 | |

White Cap Buyer LLC | | | BTL-B | | | | B2 | | | | B | | | TBD | | | | | 10/19/2027 | | | | 535,000 | | | | 534,443 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |