UNITED STATES

SEEKING PRIMARILY HIGH CURRENT INCOME AND SECONDARILY CAPITAL APPRECIATION | ||||

| DIVIDEND | ||||

| AND | INCOME FUND | |||

2016 JUNE 30 SEMI-ANNUAL REPORT | ||||

WWW.DIVIDENDANDINCOMEFUND.COM

|

PORTFOLIO ANALYSIS

| ||

June 30, 2016

|

TOP TEN |

June 30, 2016 | |

HOLDINGS

| ||

1 W.R. Berkley Corporation | ||

2 Philip Morris International, Inc. | ||

3 CSX Corp. | ||

4 Johnson & Johnson | ||

5 First American Financial Corporation | ||

6 Chubb Limited | ||

7 Wal-Mart Stores, Inc. | ||

8 Southern Company | ||

9 Cisco Systems, Inc. | ||

10 Quest Diagnostics Incorporated

| ||

Top ten holdings comprise approximately 19% of total assets. Holdings are subject to change. The above portfolio information should not be considered as a recommendation to purchase or sell a particular security and there is no assurance that any securities will remain in or out of the Fund.

TOP TEN |

June 30, 2016 | |

INDUSTRIES

| ||

1 Fire, Marine & Casualty Insurance | ||

2 Commercial Banks | ||

3 National Commercial Banks | ||

4 Railroads, Line-Haul Operating | ||

5 Services - Medical Laboratories | ||

6 Petroleum Refining | ||

7 Investment Advice | ||

8 Motor Vehicles & Passenger Car Bodies | ||

9 Pharmaceutical Preparations | ||

10 Semiconductors & Related Devices

| ||

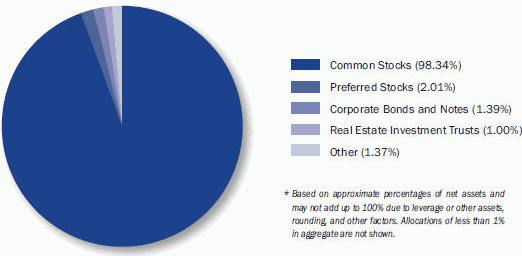

Holdings by Security Type on June 30, 2016*

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016

|

TO OUR SHAREHOLDERS

| ||

June 30, 2016

|

Dear Fellow Shareholders:

It gives us great pleasure to welcome each of our new shareholders to Dividend and Income Fund and to submit this 2016 Semi-Annual Report. The Fund seeks to achieve its primary investment objective of high current income and secondary objective of capital appreciation by investing, under normal circumstances, at least 50% of its total assets in income generating equity securities. These securities may include dividend paying common stocks, convertible securities, preferred stocks, securities of registered investment companies, exchange traded funds organized as investment companies or otherwise, real estate investment trusts, depositary receipts, and other equity related securities. Of course, there can be no assurance that the Fund will achieve its objectives.

Economic and Market Report

The Federal Open Market Committee (FOMC) of the Federal Reserve Bank (the “Fed”) recently released a statement that its information suggested that since April 2016 the “pace of improvement in the labor market has slowed while growth in economic activity appears to have picked up.” Encouragingly, the statement noted that growth in household spending has strengthened and, since the beginning of the year, the housing sector has continued to improve. The statement also noted that inflation has continued to run below 2%, partly reflecting earlier declines in energy prices and in prices of non-energy imports.

The Fed’s board members and bank presidents recently projected a 2016 change in real growth in U.S. GDP in a range of 1.8 – 2.2%, and 1.6 – 2.4% for 2017, and an unemployment rate in a range of 4.5 – 4.9% for 2016 and 4.3 – 4.8% for 2017. The World Bank recently revised its 2016 global growth forecast down to 2.4% from the 2.9% rate projected earlier. The move is “due to sluggish growth in advanced economies, stubbornly low commodity prices, weak global trade, and diminishing capital flows.” Nevertheless, the bank projects growth to strengthen to 2.8% in 2017 and 3.0% in 2018. Yet, due to weak growth, the World Bank also warns that the global economy is “facing increasingly pronounced downside risks,” including increased protectionism and rising private sector debt in emerging markets.

In summary, the U.S. and the global economies appear to be slowing, and risks growing, which suggests to us that investors should exercise increasing caution over the course of 2016 and anticipate continued market volatility.

Investment Strategy and Returns

In view of these economic developments, the Fund’s strategy in the first half of 2016 was to emphasize profitable, conservatively

valued companies across a broad array of industries. Generally, the Fund purchased and held income generating equity securities in seeking to achieve its primary investment objective of high current income and secondary objective of capital appreciation and sold investments that appeared to have appreciated to levels reflecting full or over-valuation. In the first six months of 2016, the Fund’s net investment income, net realized gain on investments, and unrealized appreciation on investments were, respectively, $1,438,741, $1,539,050, and $2,533,736, which contributed significantly to the Fund’s net asset value return of 4.72%, including the reinvestment of dividends, as did dilution occurring under the Fund’s dividend reinvestment plan. Profitable sales in the period were made of, among others, shares of Honeywell International, Inc. in the manufacturing sector and The Clorox Company in the consumer products sector and losses were taken on, among others, Joy Global Inc. in the mining equipment sector and Waddell & Reed Financial, Inc. in the asset management sector which, with other profits and losses realized, resulted in net realized gain on investments. Although no particular investment was responsible for the majority of the unrealized appreciation or depreciation of investments over the period, investments held in the petroleum refining and asset management sectors, including Western Refining, Inc. and Invesco Ltd., respectively, were significant contributors to unrealized depreciation during the period. At the same time, the Fund benefited from unrealized appreciation from its holdings of Exelon Corp. in the utility sector and Johnson & Johnson in the pharmaceutical sector.

The Fund’s market return for the first six months of 2016, also including the reinvestment of dividends, was 3.41%. Generally, the Fund’s total return on a market value basis will be lower than total return on a net asset value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. For comparison, in the same period, the S&P 500 Index total return was 3.84% and the BofA Merrill Lynch US High Yield Master II Total Return Index returned 9.32%. These indexes are unmanaged and do not reflect fees and expenses, nor are they available for direct investment. At June 30, 2016, the Fund’s portfolio included over 100 securities of different issuers, with the top ten amounting to approximately 19% of total assets. At that time, the Fund’s investments totaled approximately $145 million, reflecting the use of about $6 million of leverage on net assets of about $139 million. As the Fund pursues its primary investment objective of seeking high current income, with capital appreciation as a secondary objective, these holdings and allocations are subject to change at any time.

1 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

TO OUR SHAREHOLDERS

| ||

June 30, 2016

|

Quarterly Dividends

On June 1, 2016, the Fund declared its second quarterly dividend for the year, amounting to $0.25 per share. The quarterly dividend distribution reflects the Fund’s current distribution policy to provide shareholders with a relatively stable cash flow and to attempt to reduce or eliminate the Fund’s market price discount to its net asset value per share. As previously reported, the dividend amount was adjusted lower in March 2016 to more closely reflect the net income generated by the Fund’s investments, the current market price and net asset value of the Fund’s shares, the total distribution amount relative to the Fund’s net assets, and related matters. The distribution policy may be changed or discontinued without notice. The distributions are paid from net investment income and any net capital gains, with the balance representing return of capital.

As of June 1, 2016 and based on the Fund’s results and estimates for that quarter, the second quarter distribution would include approximately 25%, 0%, and 75% from net investment income, capital gains, and return of capital, respectively. If, for any distribution, the sum of previously undistributed net investment income and net realized capital gains is less than the amount of the distribution, the difference is treated as a return of capital (tax-free for a shareholder up to the amount of its tax basis in its shares of the Fund). The amount treated as a tax-free return of capital will reduce a shareholder’s adjusted basis in its shares, thereby increasing the shareholder’s potential gain or reducing its potential loss on the subsequent sale of those shares. The foregoing is for informational purposes only and does not, nor does anything else herein, constitute tax advice. Shareholders should consult with their own tax advisor or attorney with regard to their personal tax situation.

The Fund’s distributions are not tied to its investment income and realized capital gains and do not represent yield or investment return. The amounts and sources of distributions reported above are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the entirety of its fiscal year and may be subject to changes based on tax regulations. In early 2017, the Fund intends to send a Form 1099-DIV for the calendar year concerning the tax treatment of the dividend distributions that were paid to shareholders of record during the 12 months ended December 31, 2016.

Unclaimed Share Accounts

Please be advised that abandoned or unclaimed property laws for

certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to a shareholder is returned to the Fund’s transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund’s transfer agent will follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial advisor or the Fund’s transfer agent.

Fund Website and Dividend Reinvestment Plan

The Fund’s website, www.DividendandIncomeFund.com, provides investors with investment information, news, and other material about the Fund. The website also has links to performance, tax, and daily net asset value reporting. You are invited to use this resource to learn more about the Fund. For those shareholders currently receiving the Fund’s quarterly dividends in cash but are interested in adding to their account through the Fund’s Dividend Reinvestment Plan, we encourage you to review the Plan set forth later in this document and contact the Fund’s Transfer Agent, who will be pleased to assist you with no obligation on your part.

Long Term Strategies

We thank you for investing in the Fund and share your enthusiasm for its potential, as evidenced by the fact that affiliates of the Fund’s investment manager own approximately 8% of the Fund’s outstanding shares, pursuant to the Fund’s governing documents that permit ownership of more than 4.99% of the Fund’s outstanding shares with the prior approval of the Fund’s Board of Trustees. We look forward to serving your investment needs over the years ahead.

Sincerely,

Thomas B. Winmill

President and Portfolio Manager

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 2

|

SCHEDULE OF PORTFOLIO INVESTMENTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

|

Common Stocks (98.15%)

| Shares

| Value

| ||||

Agricultural Chemicals (2.05%) | ||||||

Monsanto Company | 15,000 | $ 1,551,150 | ||||

Potash Corporation of | 80,000 | 1,299,200 | ||||

| ||||||

| 2,850,350 | ||||||

Agriculture Production - Livestock & Animal Specialties (0.73%) | ||||||

Cal-Maine Foods, Inc. (a) | 23,000 | 1,019,360 | ||||

Aircraft Engines & Engine Parts (0.29%) | ||||||

United Technologies Corporation | 3,980 | 408,149 | ||||

Air Transportation, Scheduled (0.46%) | ||||||

Alaska Air Group, Inc. | 5,000 | 291,450 | ||||

Southwest Airlines Co. | 9,000 | 352,890 | ||||

| ||||||

| 644,340 | ||||||

Apparel & Other Finished Products of Fabrics & Similar Material (0.64%) | ||||||

Carter’s, Inc. | 8,300 | 883,701 | ||||

Beverages (1.37%) | ||||||

PepsiCo, Inc. (a) | 18,000 | 1,906,920 | ||||

Biological Products (2.08%) | ||||||

Amgen Inc. (a) | 12,100 | 1,841,015 | ||||

Gilead Sciences, Inc. | 12,570 | 1,048,589 | ||||

| ||||||

| 2,889,604 | ||||||

Blankbooks, Looseleaf Binders & Bookbinding & Related Work (0.86%) | ||||||

Deluxe Corporation | 18,000 | 1,194,660 | ||||

Cable & Other Pay Television Services (0.94%) | ||||||

Rogers Communications Inc. | 32,500 | 1,313,000 | ||||

Cigarettes (2.05%) | ||||||

Philip Morris International, Inc. (a) | 28,000 | 2,848,160 | ||||

Commercial Banks (4.76%) | ||||||

Australia and New Zealand Banking Group Limited | 30,000 | 538,794 | ||||

Banco Bilbao Vizcaya Argentaria, S.A. ADR | 159,500 | 915,530 | ||||

Banco Santander, S.A. ADR | 220,400 | 863,968 | ||||

Barclays PLC ADR | 94,600 | 718,960 | ||||

ING Groep N.V. ADR | 84,300 | 870,819 | ||||

Lloyds Banking Group plc ADR | 243,700 | 723,789 | ||||

The Royal Bank of Scotland Group plc ADR (b) | 141,200 | 663,640 | ||||

Shares

| Value

| |||||

Westpac Banking Corporation | 60,000 | $ 1,325,400 | ||||

| ||||||

| 6,620,900 | ||||||

Computer and Computer Software Stores (0.76%) | ||||||

GameStop Corp. (a) | 40,000 | 1,063,200 | ||||

Computer & Office Equipment (0.98%) | ||||||

International Business Machines Corporation | 9,000 | 1,366,020 | ||||

Computer Communications Equipment (1.75%) | ||||||

Cisco Systems, Inc. (a) | 85,000 | 2,438,650 | ||||

Construction, Mining & Materials Handling Machinery | ||||||

Dover Corp. (a) | 13,500 | 935,820 | ||||

Deep Sea Foreign Transportation of Freight (0.46%) | ||||||

Seaspan Corp. | 45,875 | 640,415 | ||||

Drilling Oil & Gas Wells (0.85%) | ||||||

Transocean Ltd. (b) | 100,000 | 1,189,000 | ||||

Electric Services (1.83%) | ||||||

Southern Company (a) | 47,500 | 2,547,425 | ||||

Electronic & Other Electrical Equipment (0.98%) | ||||||

Emerson Electric Co. | 26,000 | 1,356,160 | ||||

Electronic Computers (0.86%) | ||||||

Apple Inc. (a) | 12,500 | 1,195,000 | ||||

Electronic Connectors (0.61%) | ||||||

Methode Electronics, Inc. | 25,000 | 855,750 | ||||

Electronic & Other Services Combined (1.35%) | ||||||

Exelon Corp. (a) | 51,500 | 1,872,540 | ||||

Engines & Turbines (0.27%) | ||||||

Cummins Inc. | 3,400 | 382,296 | ||||

Finance Services (1.05%) | ||||||

American Express Company (a) | 24,000 | 1,458,240 | ||||

Fire, Marine & Casualty Insurance (4.89%) | ||||||

Chubb Limited (a) | 20,000 | 2,614,200 | ||||

W.R. Berkley Corporation (a) | 70,000 | 4,194,400 | ||||

| ||||||

| 6,808,600 | ||||||

See notes to financial statements.

3 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

SCHEDULE OF PORTFOLIO INVESTMENTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

|

Common Stocks (continued)

| Shares

| Value

| ||||

Food & Kindred Products (0.82%) | ||||||

Nestle S.A. | 14,700 | $ 1,136,457 | ||||

Hospital & Medical Service Plans (1.61%) | ||||||

Anthem, Inc. (a) | 17,100 | 2,245,914 | ||||

Hotels & Motels (0.91%) | ||||||

Las Vegas Sands Corp. | 29,000 | 1,261,210 | ||||

Industrial Trucks, Tractors, Trailers, and Stackers (0.74%) | ||||||

PACCAR Inc. | 20,000 | 1,037,400 | ||||

Industrial Organic Chemicals (0.43%) | ||||||

LyondellBasell Industries N.V. | 8,000 | 595,360 | ||||

Investment Advice (2.79%) | ||||||

Ameriprise Financial Inc. (a) | 9,600 | 862,560 | ||||

The Blackstone Group L.P. (a) | 55,000 | 1,349,700 | ||||

Franklin Resources, Inc. | 21,700 | 724,129 | ||||

Invesco Ltd. | 37,000 | 944,980 | ||||

| ||||||

| 3,881,369 | ||||||

Life Insurance (0.61%) | ||||||

Aviva plc ADR | 79,600 | 850,924 | ||||

Measuring & Controlling Devices (0.85%) | ||||||

Rockwell Automation, Inc. | 10,300 | 1,182,646 | ||||

Metal Mining (0.79%) | ||||||

Rio Tinto plc ADR | 35,000 | 1,095,500 | ||||

Miscellaneous Industrial & Commercial Machinery & | ||||||

Eaton Corporation plc | 18,000 | 1,075,140 | ||||

Motor Vehicle Parts & Accessories (0.69%) | ||||||

BorgWarner Inc. | 8,650 | 255,348 | ||||

Lear Corporation | 7,000 | 712,320 | ||||

| ||||||

| 967,668 | ||||||

Motor Vehicles & Passenger Car Bodies (2.61%) | ||||||

Ford Motor Company (a) | 120,000 | 1,508,400 | ||||

General Motors Company (a) | 41,500 | 1,174,450 | ||||

Volkswagen AG | 35,000 | 946,750 | ||||

| ||||||

| 3,629,600 | ||||||

National Commercial Banks (4.09%) | ||||||

Bank of America Corporation (a) | 54,000 | 716,580 | ||||

Capital One Financial Corporation (a) | 20,200 | 1,282,902 | ||||

Citigroup Inc. | 17,000 | 720,630 | ||||

JPMorgan Chase & Co. | 12,000 | 745,680 | ||||

Shares

| Value

| |||||

The PNC Financial Services Group, Inc. | 8,000 | $ 651,120 | ||||

U.S. Bancorp | 39,000 | 1,572,870 | ||||

| ||||||

| 5,689,782 | ||||||

Natural Gas Transmission (0.83%) | ||||||

Spectra Energy Partners, LP | 24,400 | 1,151,192 | ||||

Other Chemical Products (0.81%) | ||||||

Praxair Inc. | 10,000 | 1,123,900 | ||||

Personal Credit Institutions (0.85%) | ||||||

Discover Financial Services | 22,000 | 1,178,980 | ||||

Petroleum Refining (2.91%) | ||||||

Exxon Mobil Corp. | 17,000 | 1,593,580 | ||||

Phillips 66 (a) | 20,500 | 1,626,470 | ||||

Western Refining, Inc. | 40,000 | 825,200 | ||||

| ||||||

| 4,045,250 | ||||||

Pharmaceutical Preparations (2.54%) | ||||||

Johnson & Johnson (a) | 23,100 | 2,802,030 | ||||

Shire plc | 4,001 | 736,504 | ||||

| ||||||

| 3,538,534 | ||||||

Plastic Materials, Synthetic Resins & Nonvulcan Elastomers (0.70%) | ||||||

Hexcel Corporation | 23,500 | 978,540 | ||||

Printed Circuit Boards (0.34%) | ||||||

Kimball Electronics, Inc. (b) | 37,943 | 472,390 | ||||

Pumps & Pumping Equipment (0.75%) | ||||||

Flowserve Corporation | 23,000 | 1,038,910 | ||||

Radio & TV Broadcasting & Communications Equipment (1.80%) | ||||||

QUALCOMM, Incorporated (a) | 20,000 | 1,071,400 | ||||

Ubiquiti Networks, Inc. (b) | 37,000 | 1,430,420 | ||||

| ||||||

| 2,501,820 | ||||||

Railroads, Line-Haul Operating (3.74%) | ||||||

CSX Corp. (a) | 108,500 | 2,829,680 | ||||

Norfolk Southern Corp. | 15,000 | 1,276,950 | ||||

Union Pacific Corporation | 12,650 | 1,103,713 | ||||

| ||||||

| 5,210,343 | ||||||

Railroad Equipment (1.35%) | ||||||

The Greenbrier Companies, Inc. | 64,500 | 1,878,885 | ||||

Real Estate (0.37%) | ||||||

NorthStar Asset Management Group Inc. | 50,000 | 510,500 | ||||

See notes to financial statements.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 4

|

SCHEDULE OF PORTFOLIO INVESTMENTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

|

Common Stocks (concluded)

| Shares

| Value

| ||||

Retail - Department Stores (1.38%) | ||||||

Dillard’s, Inc. | 13,800 | $ 836,280 | ||||

Kohl’s Corporation | 28,600 | 1,084,512 | ||||

| ||||||

| 1,920,792 | ||||||

Retail - Family Clothing Stores (0.85%) | ||||||

The Buckle, Inc. | 12,650 | 328,774 | ||||

The GAP, Inc. (a) | 40,000 | 848,800 | ||||

| ||||||

| 1,177,574 | ||||||

Retail - Home Furniture, Furnishings & Equipment Stores (0.41%) | ||||||

Williams-Sonoma, Inc. | 10,951 | 570,876 | ||||

Retail - Variety Stores (1.87%) | ||||||

Wal-Mart Stores, Inc. | 35,650 | 2,603,163 | ||||

Savings Institution, Federally Chartered (0.71%) | ||||||

HSBC Holdings plc ADR | 31,400 | 983,134 | ||||

Security & Commodity Brokers, Dealers, Exchanges & Services (0.92%) | ||||||

T. Rowe Price Group, Inc. | 17,500 | 1,276,975 | ||||

Security Brokers, Dealers & Flotation Companies (0.59%) | ||||||

Credit Suisse Group AG ADR | 77,100 | 824,970 | ||||

Semiconductors & Related Devices (2.27%) | ||||||

Intel Corporation | 32,000 | 1,049,600 | ||||

Skyworks Solutions, Inc. | 15,000 | 949,200 | ||||

Texas Instruments Incorporated | 18,500 | 1,159,025 | ||||

| ||||||

| 3,157,825 | ||||||

Services - Advertising Agencies (0.54%) | ||||||

Omnicom Group Inc. | 9,200 | 749,708 | ||||

Services - Business Services (1.14%) | ||||||

The Western Union Company (a) | 83,000 | 1,591,940 | ||||

Services - Computer Processing & Data Preparation (0.79%) | ||||||

DST Systems, Inc. | 9,450 | 1,100,263 | ||||

Services - Computer Programming Services (0.45%) | ||||||

Syntel, Inc. (b) | 13,754 | 622,506 | ||||

Services - Help Supply Services (1.01%) | ||||||

Robert Half International Inc. | 36,700 | 1,400,472 | ||||

Services - Medical Laboratories (2.95%) | ||||||

Laboratory Corporation of America Holdings (a) (b) | 14,000 | 1,823,780 | ||||

Quest Diagnostics Incorporated | 28,000 | 2,279,480 | ||||

| ||||||

| 4,103,260 | ||||||

Shares

| Value

| |||||

Services - Miscellaneous Repair Services (0.0%) | ||||||

Aquilex Holdings LLC Units (c) | 756 | $ - | ||||

Services - Personal Services (0.73%) | ||||||

H&R Block, Inc. | 43,900 | 1,009,700 | ||||

Services - Prepackaged Software (1.32%) | ||||||

Oracle Corporation (a) | 45,000 | 1,841,850 | ||||

Special Industry Machinery (0.85%) | ||||||

Lam Research Corporation | 14,000 | 1,176,840 | ||||

Sporting Goods Stores (1.28%) | ||||||

Dick’s Sporting Goods, Inc. (a) | 39,500 | 1,779,870 | ||||

State Commercial Banks (2.24%) | ||||||

The Bank of Nova Scotia | 24,300 | 1,190,943 | ||||

Deutsche Bank Aktiengesellschaft (b) | 59,300 | 814,189 | ||||

Itau Unibanco Holding S.A. ADR | 117,80 | 1,112,032 | ||||

| ||||||

| 3,117,164 | ||||||

Surety Insurance (0.91%) | ||||||

Assured Guaranty Ltd. | 50,000 | 1,268,500 | ||||

Telephone Communications (0.88%) | ||||||

Verizon Communications Inc. | 22,000 | 1,228,480 | ||||

Title Insurance (1.88%) | ||||||

First American Financial Corporation | 65,000 | 2,614,300 | ||||

Transportation Equipment (1.23%) | ||||||

Polaris Industries Inc. | 20,900 | 1,708,784 | ||||

Wholesale - Drugs, Proprietaries & Druggists’ Sundries (0.77%) | ||||||

AmerisourceBergen Corporation | 13,500 | 1,070,820 | ||||

Wholesale - Electronic Parts & Equipment (0.93%) | ||||||

Avnet, Inc. | 32,000 | 1,296,320 | ||||

Wholesale - Industrial Machinery & Equipment (1.01%) | ||||||

MSC Industrial Direct Co., Inc. | 20,000 | 1,411,200 | ||||

| ||||||

Total common stocks (Cost $132,149,784) | 136,573,760 | |||||

| ||||||

Corporate Bonds and Notes (1.38%)

| Principal Amount

| Value

| ||||

Cogeneration Services & Small Power Producers (0.33%) | ||||||

Covanta Holding Corp., 7.25%, | 450,000 | 463,613 | ||||

Electric Services (0.39%) | ||||||

Elwood Energy LLC, 8.159%, 7/5/26 (a) | 490,360 | 541,848 | ||||

See notes to financial statements.

5 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

SCHEDULE OF PORTFOLIO INVESTMENTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

|

Corporate Bonds and Notes (continued)

| Principal Amount

| Value

| ||||

Hospital & Medical Service Plans (0.18%) | ||||||

Health Net, Inc., 6.375%, 6/1/17 (a) | 250,000 | 258,125 | ||||

Oil & Gas Field Exploration Services (0.11%) | ||||||

CGG-Veritas, 7.75%, 5/15/17 (a) | 169,000 | 149,143 | ||||

Special Industry Machinery (0.37%) | ||||||

Novelis, Inc., 8.375%, 12/15/17 (a) | 500,000 | 511,562 | ||||

| ||||||

Total corporate bonds and notes | 1,924,291 | |||||

| ||||||

Closed End Funds (0.53%)

| Shares

| Value

| ||||

Western Asset Emerging Markets Income Fund Inc. (Cost $682,135) | 67,500 | 731,700 | ||||

| ||||||

Real Estate Investment Trusts (0.99%) | ||||||

New Residential Investment Corp. | 100,000 | 1,384,000 | ||||

| ||||||

Reorganization Interests (0%) | ||||||

Penson Technologies LLC Units (b) (c) | ||||||

(Cost $ 0) | 813,527 | 0 | ||||

| ||||||

| Value

| |||||

Master Limited Partnerships (0.84%)

| ||||||

Natural Gas Transmission (0.84%) | ||||||

Enterprise Products Partners LP Units (a) (Cost $374,214) | 40,000 | $ 1,170,400 | ||||

| ||||||

Preferred Stocks (2.01%)

| ||||||

Financial (2.01%) | ||||||

Annaly Capital Management, Inc., 7.625% Series C | 79,469 | 2,031,228 | ||||

Hatteras Financial Corp., 7.625% | 30,809 | 765,295 | ||||

Solar Cayman Ltd. (a) (b) (c) | 80,000 | 0 | ||||

| ||||||

Total preferred stocks (Cost $3,066,072) | 2,796,523 | |||||

| ||||||

Money Market Fund (0.01%)

| ||||||

SSgA Money Market Fund, 7 day annualized yield 0.20% (Cost: $12,564) | 12,564 | 12,564 | ||||

| ||||||

Total investments (Cost $138,942,416) (103.91%) | 144,593,238 | |||||

Liabilities in excess of other assets | (5,434,758) | |||||

| ||||||

Net assets (100.00%) | $139,158,480 | |||||

| ||||||

| (a) | All or a portion of these securities, have been segregated as collateral and held as collateral in a segregated account pursuant to the Committed Facility Agreement. As of June 30, 2016, the value of securities pledged as collateral was $45,346,416 and there were no securities on loan under the Lending Agreement. |

| (b) | Non-income producing. |

| (c) | Illiquid and/or restricted security that has been fair valued. |

| ADR | American Depositary Receipt |

| LLC | Limited Liability Company |

| LP | Limited Partnership |

| PLC | Public Limited Company |

See notes to financial statements.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 6

|

STATEMENTS OF ASSETS AND LIABILITIES

| (Unaudited)

| |

Financial Statements

|

June 30, 2016

| ||||||

Assets | ||||||

Investments, at value (cost: $138,942,416 ) | $144,593,238 | |||||

Cash | 455 | |||||

Receivables: | ||||||

Capital shares issued on reinvestment of dividends | 257,285 | |||||

Dividends | 182,973 | |||||

Interest | 27,048 | |||||

Foreign withholding tax reclaims | 4,369 | |||||

Other assets | 6,931 | |||||

| ||||||

| Total assets | 145,072,299 | |||||

| ||||||

Liabilities | ||||||

Bank credit facility borrowing | 5,650,000 | |||||

Payables: | ||||||

Accrued expenses | 129,691 | |||||

Investment management | 110,235 | |||||

Administrative services | 23,893 | |||||

| ||||||

Total liabilities | 5,913,819 | |||||

| ||||||

Net Assets | $139,158,480 | |||||

| ||||||

Net Asset Value Per Share | ||||||

(applicable to 10,604,437 shares issued and outstanding) | $ 13.12 | |||||

| ||||||

Net Assets Consist of | ||||||

Paid in capital | $175,689,096 | |||||

Accumulated net realized loss on investments and foreign currencies | (42,181,455) | |||||

Net unrealized appreciation on investments and foreign currencies | 5,650,839 | |||||

| ||||||

| $139,158,480 | ||||||

| ||||||

See notes to financial statements. | ||||||

7 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

STATEMENT OF OPERATIONS

| (Unaudited)

| |

Financial Statements

|

Six Months Ended

| ||||||

Investment Income | ||||||

Dividends (net of $46,236 foreign tax withholding) | $ 2,483,309 | |||||

Interest | 76,086 | |||||

Securities lending income | 22,941 | |||||

| ||||||

Total investment income | 2,582,336 | |||||

| ||||||

Expenses | ||||||

Investment management | 694,615 | |||||

Administrative services | 111,815 | |||||

Interest on bank credit facility | 65,859 | |||||

Exchange listing and registration | 50,400 | |||||

Shareholder communications | 47,803 | |||||

Trustees | 36,951 | |||||

Bookkeeping and pricing | 33,690 | |||||

Custodian | 24,227 | |||||

Insurance | 22,750 | |||||

Legal | 21,727 | |||||

Auditing | 20,930 | |||||

Transfer agent | 9,685 | |||||

Other | 3,450 | |||||

| ||||||

Total expenses | 1,143,902 | |||||

Expense reduction | (307) | |||||

| ||||||

Net expenses | 1,143,595 | |||||

| ||||||

Net investment income | 1,438,741 | |||||

| ||||||

Realized and Unrealized Gain (Loss) | ||||||

Net realized gain (loss) on | ||||||

Investments | 1,546,918 | |||||

Foreign currencies | (7,868) | |||||

Unrealized appreciation on | ||||||

Investments | 2,533,441 | |||||

Translation of assets and liabilities in foreign currencies | 295 | |||||

| ||||||

Net realized and unrealized gain | 4,072,786 | |||||

| ||||||

Net increase in net assets resulting from operations | $ 5,511,527 | |||||

| ||||||

See notes to financial statements. | ||||||

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 8

|

STATEMENTS OF CHANGES IN NET ASSETS

| (Unaudited)

| |

Financial Statements

|

Six Months Ended June 30, 2016

| Year Ended December 31, 2015

| |||||||||||

Operations | ||||||||||||

Net investment income | $ 1,438,741 | $ 2,813,403 | ||||||||||

Net realized gain | 1,539,050 | 4,964,667 | ||||||||||

Unrealized appreciation (depreciation) | 2,533,736 | (20,575,304) | ||||||||||

|

| |||||||||||

Net increase (decrease) in net assets resulting from operations | 5,511,527 | (12,797,234) | ||||||||||

|

| |||||||||||

Distributions to Shareholders | ||||||||||||

Net investment income | (1,438,741) | (2,393,241) | ||||||||||

Return of capital | (3,845,710) | (12,516,950) | ||||||||||

|

| |||||||||||

Total distributions | (5,284,451) | (14,910,191) | ||||||||||

|

| |||||||||||

Capital Share Transactions | ||||||||||||

Reinvestment of distributions to shareholders | 513,973 | 958,981 | ||||||||||

Proceeds from shares issued in rights offering | - | 21,162,983 | ||||||||||

Offering costs of rights offering charged to paid in capital | - | (276,827) | ||||||||||

|

| |||||||||||

Increase in net assets from capital share transactions | 513,973 | 21,845,137 | ||||||||||

|

| |||||||||||

Total change in net assets | 741,049 | (5,862,288) | ||||||||||

Net Assets | ||||||||||||

Beginning of period | 138,417,431 | 144,279,719 | ||||||||||

|

| |||||||||||

End of period | $ 139,158,480 | $ 138,417,431 | ||||||||||

|

| |||||||||||

End of period net assets include undistributed net investment income | $ - | $ - | ||||||||||

|

| |||||||||||

See notes to financial statements. | ||||||||||||

9 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

STATEMENT OF CASH FLOWS

| (Unaudited)

| |

Financial Statements

|

Six Months Ended

| ||||||

Cash Flows From Operating Activities | ||||||

Net increase in net assets resulting from operations | $ 5,511,527 | |||||

Adjustments to reconcile decrease in net assets resulting from operations to net cash provided by (used in) operating activities: | ||||||

Unrealized appreciation of investments and foreign currencies | (2,533,736) | |||||

Net realized gain on sales of investments and foreign currencies | (1,539,050) | |||||

Purchase of long term investments | (40,948,035) | |||||

Proceeds from sales of long term investments | 46,497,626 | |||||

Net purchases of short term investments | (15,632) | |||||

Amortization of premium net of accretion of discount of investments | 669 | |||||

Decrease in dividends receivable | 63,945 | |||||

Decrease in interest receivable | 8,258 | |||||

Decrease in other assets | 22,750 | |||||

Decrease in accrued expenses | (21,205) | |||||

Decrease in investment management fee payable | (13,519) | |||||

Increase in administrative services payable | 6,417 | |||||

| ||||||

Net cash provided by operating activities | 7,040,015 | |||||

| ||||||

Cash Flows from Financing Activities | ||||||

| Cash distributions paid | (4,699,656) | |||||

| Bank credit facility repayment, net | (2,416,137) | |||||

| ||||||

Net cash used in financing activities | (7,115,793) | |||||

| ||||||

Net change in cash | (75,778) | |||||

Cash | ||||||

Beginning of period | 76,233 | |||||

| ||||||

End of period | $ 455 | |||||

| ||||||

Supplemental disclosure of cash flow information: | ||||||

Cash paid for interest on bank credit facility | $ 65,730 | |||||

Non-cash financing activities not included herein consisted of: | ||||||

Reinvestment of dividend distributions | $ 513,973 | |||||

See notes to financial statements. | ||||||

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 10

|

NOTES TO FINANCIAL STATEMENTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

| ||

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES Dividend and Income Fund (the “Fund”), a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), is a non-diversified, closed end management investment company whose shares are listed on the New York Stock Exchange under the ticker symbol DNI. The Fund’s primary investment objective is to seek high current income. Capital appreciation is a secondary objective. The Fund retains Bexil Advisers LLC as its Investment Manager.

The Fund is an investment company and accordingly follows the accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Valuation of Investments – Portfolio securities are valued by various methods depending on the primary market or exchange on which they trade. Most equity securities for which the primary market is in the United States are valued at the official closing price, last sale price or, if no sale has occurred, at the closing bid price. Most equity securities for which the primary market is outside the United States are valued using the official closing price or the last sale price in the principal market in which they are traded. If the last sale price on the local exchange is unavailable, the last evaluated quote or closing bid price normally is used. In the event of an unexpected close of the primary market or exchange, a security may continue to trade on one or more other markets, and the price as reflected on those other trading venues may be more reflective of the security’s value than an earlier price from the primary market or exchange. Accordingly, the Fund may seek to use these additional sources of pricing data or information when prices from the primary market or exchange are unavailable, or are earlier and less representative of current market value. Certain debt securities may be priced through pricing services that may utilize a matrix pricing system which takes into consideration factors such as yields, prices, maturities, call features, and ratings on comparable securities or according to prices quoted by a securities dealer that offers pricing services. Open end investment companies are valued at their net asset value. Securities for which market quotations are not readily available or reliable and other assets may be valued as determined in good faith by

the Investment Manager under the direction of or pursuant to procedures approved by the Fund’s Board of Trustees. Due to the inherent uncertainty of valuation, such fair value pricing values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. A security’s valuation may differ depending on the method used for determining value. The use of fair value pricing by the Fund may cause the net asset value of its shares to differ from the net asset value that would be calculated using market prices. A fair value price is an estimate and there is no assurance that such price will be at or close to the price at which a security is next quoted or next trades.

Investments in Other Investment Companies – The Fund may invest in shares of other investment companies (the “Acquired Fund”) in accordance with the Act and related rules. Shareholders in the Fund bear the pro rata portion of the fees and expenses of an Acquired Fund in addition to the Fund’s expenses. Expenses incurred by the Fund that are disclosed in the Statement of Operations do not include fees and expenses incurred by an Acquired Fund. The fees and expenses of an Acquired Fund are reflected in such fund’s total return.

Option Transactions – The Fund may write (i.e. sell) covered call options on securities or on indexes. The Fund writes covered call options to attempt to enhance returns through price changes of the option, increase income, hedge to reduce overall portfolio risk, and hedge to reduce individual security risk. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as the writer of an option, bears the market risk of an unfavorable change in the price of the option. Writing option contracts results in off-balance sheet risk as the Fund’s ultimate obligation to satisfy terms of the contract may exceed the amount recognized in the statement of assets and liabilities.

Investments in Real Estate Investment Trusts (“REITs”) – Dividend income is recorded based on the income included in distributions

11 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

received from the REIT investments using published REIT reclassifications including some management estimates when actual amounts are not available. Distributions received in excess of this estimated amount are recorded as a reduction of the cost of investments or reclassified to capital gains. The actual amounts of income, return of capital, and capital gains are only determined by each REIT after its fiscal year end, and may differ from the estimated amounts.

Short Sales – The Fund may sell a security short it does not own in anticipation of a decline in the market value of the security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker/dealer through which it made the short sale. The Fund is liable for any dividends or interest paid on securities sold short. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of the short sale. Securities sold short result in off balance sheet risk as the Fund’s ultimate obligation to satisfy the terms of a sale of securities sold short may exceed the amount recognized in the Statement of Assets and Liabilities.

Investment Transactions – Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Realized gains or losses are determined by specifically identifying the cost basis of the investment sold.

Investment Income – Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis. Amortization of premium and accretion of discount on corporate bonds and notes are included in interest income.

Expenses – Expenses deemed by the Investment Manager to have been incurred solely by the Fund are charged to the Fund. Expenses deemed by the Investment Manager to have been incurred jointly by the Fund and one or more of the other investment companies for which the Investment Manager or its affiliates serve as investment manager or other related entities are allocated on the basis of relative net assets, except where a more appropriate allocation can be made fairly in the judgment of the Investment Manager.

Expense Reduction Arrangement – Through arrangements with the Fund’s custodian, credits realized as a result of uninvested cash balances are used to reduce custodian expenses. There were no credits realized from the custodian by the Fund during the periods covered by this report. The Fund is reimbursed by its securities lending provider for certain custody transaction costs associated with securities lending. These reimbursements are included in expense reductions in the Statement of Operations.

Distributions to Shareholders – Distributions to shareholders are determined in accordance with the Fund’s distribution policies and income tax regulations and are recorded on the ex-dividend date.

Income Taxes – No provision has been made for U.S. income taxes because the Fund’s current intention is to continue to qualify as a regulated investment company under the Internal Revenue Code (the “IRC”) and to distribute to its shareholders substantially all of its taxable income and net realized gains. Foreign securities held by the Fund may be subject to foreign taxation. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has reviewed its tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on federal, state, and local income tax returns for open tax years (2013-2015) or expected to be taken in the Fund’s 2016 tax returns.

2. FEES AND TRANSACTIONS WITH RELATED PARTIES The Fund has retained the Investment Manager pursuant to an investment management agreement. Under the terms of the investment management agreement, the Investment Manager receives a fee payable monthly for investment advisory services at an annual rate of 0.95% of the Fund’s Managed Assets. “Managed Assets” means the average weekly value of the Fund’s total assets minus the sum of the Fund’s liabilities, which liabilities exclude debt relating to leverage, short term debt, and the aggregate liquidation preference of any outstanding preferred stock.

Pursuant to the investment management agreement, the Fund reimburses the Investment Manager for providing at cost certain administrative services comprised of compliance and accounting services. For the six months ended June 30, 2016, the Fund’s reimbursements of such costs were $111,815, of which $69,915 and $41,900 was for compliance and accounting services, respectively.

Certain officers and trustees of the Fund are officers and managers of the Investment Manager. As of June 30, 2016, Bexil Securities LLC (“Bexil Securities”), an affiliate of the Investment Manager, owned approximately 8% of the Fund’s outstanding shares, pursuant to the Fund’s governing documents that permit ownership of more than 4.99% of the Fund’s outstanding shares with the prior approval of the Fund’s Board of Trustees. For the six months ended June 30, 2016 and year ended December 31, 2015, Bexil Securities acquired 36,562 and 304,220 shares of the Fund, respectively, through participation in the Fund’s Dividend Reinvestment Plan and 2015 rights offering.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 12

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

3. DISTRIBUTIONS TO SHAREHOLDERS AND DISTRIBUTABLE EARNINGS For the six months ended June 30, 2016, the Fund paid distributions totaling $5,284,451. As of June 30, 2016, the distribution is estimated to be comprised of $1,438,741 and $3,845,710 from net investment income and return of capital, respectively, based on information available at this time and is subject to change. The classification of these distributions for federal income tax purposes will be determined after the Fund’s fiscal year ending December 31, 2016, although the exact amount is not estimable as of June 30, 2016.

For the year ended December 31, 2015, the Fund paid distributions totaling $14,910,191 comprised of $2,393,241 and $12,516,950 of ordinary income and return of capital, respectively.

As of December 31, 2015, the components of distributable earnings on a tax basis were as follows:

Accumulated net realized loss on investments | $ (44,193,371) | |

Unrealized appreciation | 3,589,969

| |

| ||

| $ (40,603,402) | ||

| ||

The difference between book and tax unrealized appreciation is primarily related to wash sales and partnership income.

Federal income tax regulations permit post-October net capital losses, if any, to be deferred and recognized on the tax return of the next succeeding taxable year.

Capital loss carryover is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryover actually available for the Fund to utilize under the IRC and related regulations based on the results of future transactions.

Under the IRC, capital losses incurred in taxable years beginning after November 30, 2011, are allowed to be carried forward indefinitely and retain the character of the original loss. The Fund has a net capital loss carryover as of December 31, 2015 of $44,193,371, of which $42,751,106 and $1,442,265 expires in 2016 and 2018, respectively. As a transition rule, post-enactment net capital losses are required to be utilized before pre-enactment net capital losses.

4. VALUE MEASUREMENTS GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

• Level 1 - unadjusted quoted prices in active markets for identical assets or liabilities including securities actively traded on a securities exchange.

• Level 2 - observable inputs other than quoted prices included in level 1 that are observable for the asset or liability which may include quoted prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

• Level 3 - unobservable inputs for the asset or liability including the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for investments categorized in level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those securities.

13 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

The following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis:

Equity securities (common and preferred stock) – Most publicly traded equity securities are valued normally at the most recent official closing price, last sale price, evaluated quote, or closing bid price. To the extent these securities are actively traded and valuation adjustments are not applied, they may be categorized in level 1 of the fair value hierarchy. Equities on inactive markets or valued by reference to similar instruments may be categorized in level 2.

Corporate bonds and notes – The fair value of corporate bonds and notes are normally estimated using various techniques which may consider, among other things, recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. Although most corporate bonds and notes may be categorized in level 2 of the fair value hierarchy, in instances where lower relative weight is placed on transaction prices, quotations, or similar observable inputs, they may be categorized in level 3.

Restricted and/or illiquid securities – Restricted and/or illiquid securities for which quotations are not readily available or reliable may be valued with fair value pricing as determined in good faith by the Investment Manager under the direction of or pursuant to procedures approved by the Fund’s Board of Trustees. Restricted securities issued by publicly traded

companies are generally valued at a discount to similar publicly traded securities. Restricted or illiquid securities issued by nonpublic entities may be valued by reference to comparable public entities or fundamental data relating to the issuer or both or similar inputs. Depending on the relative significance of valuation inputs, these instruments may be categorized in either level 2 or level 3 of the fair value hierarchy.

Unrealized gains (losses) are included in the related amounts on investments in the Statement of Operations.

The Investment Manager, under the direction of the Fund’s Board of Trustees, considers various valuation approaches for valuing assets categorized within level 3 of the fair value hierarchy. The factors used in determining the value of such assets may include, but are not limited to: the discount applied due to the private nature of the asset; the type of the security; the size of the asset; the initial cost of the security; the existence of any contractual restrictions on the security’s disposition; the price and extent of public trading in similar securities of the issuer or of comparable companies; quotations or evaluated prices from broker-dealers and/or pricing services; information obtained from the issuer or analysts; an analysis of the company’s or issuer’s financial statements; or an evaluation of the forces that influence the issuer and the market in which the asset is purchased and sold. Significant changes in any of those inputs in isolation may result in a significantly lower or higher fair value measurement. The pricing of all fair value assets is normally reported to the Fund’s Board of Trustees.

The following is a summary of the inputs used as of June 30, 2016 in valuing the Fund’s assets. Refer to the Schedule of Portfolio Investments for detailed information on specific investments.

ASSETS

| Level 1

| Level 2

| Level 3

| Total

| ||||||||||||

Investments, at value | ||||||||||||||||

Common stocks | $ 136,573,760 | $ - | $ 0 | $ 136,573,760 | ||||||||||||

Corporate bonds and notes | - | 1,924,291 | - | 1,924,291 | ||||||||||||

Closed end funds | 731,700 | - | - | 731,700 | ||||||||||||

Real estate investment trusts | 1,384,000 | - | - | 1,384,000 | ||||||||||||

Reorganization interests | - | - | 0 | 0 | ||||||||||||

Master limited partnerships | 1,170,400 | - | - | 1,170,400 | ||||||||||||

Preferred stocks | 2,796,523 | - | 0 | 2,796,523 | ||||||||||||

Money market fund | 12,564 | - | - | 12,564 | ||||||||||||

Total investments, at value

|

|

$ 142,668,947

|

|

| $ 1,924,291

|

|

| $ 0

|

|

| $ 144,593,238

|

| ||||

There were no securities transferred from level 1 on December 31, 2015 to level 2 on June 30, 2016.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 14

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

The following is a reconciliation of level 3 assets including securities valued at zero:

Common Stocks

|

Reorganization

|

Preferred Stocks

|

Total

| |||||||||||||

Balance at December 31, 2015 |

|

$ 37,605 |

|

$ |

0 |

|

$ |

0 |

|

$ |

37,605 |

| ||||

Proceeds from sales | - | - | - | - | ||||||||||||

Realized gain (loss) | - | - | - | - | ||||||||||||

Transfers into (out of) level 3 | - | - | - | - | ||||||||||||

Change in unrealized appreciation | (37,605) | - | - | (37,605) | ||||||||||||

Balance at June 30, 2016 |

|

$ 0

|

|

$

|

0

|

|

$

|

0

|

|

$

|

0

|

| ||||

Net change in unrealized appreciation attributable to assets still held as level 3 at June 30, 2016

| $ (37,605) | $ | 0 | $ | 0 | $ | (37,605) | |||||||||

The following table presents additional information about valuation methodologies and inputs used for assets that are measured at fair value and categorized as level 3 as of June 30, 2016:

Fair Value

|

Valuation Technique

|

Unobservable Input

|

Range

| |||||

Common Stocks

| ||||||||

Services - Miscellaneous Repair Services

|

$ 0 |

Share of taxable income and comparable exchange offer

| Discount rate for lack of marketability

|

35% | ||||

Reorganization Interests |

$ 0 |

Cost; last known market value for predecessor securities; estimated recovery on liquidation

| Discount rate for lack of marketability | 100% | ||||

Preferred Stocks

| ||||||||

Financial |

$ 0 |

Most recently reported net asset value

|

Discount rate for lack of marketability

|

100% | ||||

5. INVESTMENT TRANSACTIONS Purchases and proceeds from sales or maturities of investment securities, excluding short term investments, were $40,948,035 and $46,497,626, respectively, for the six months ended June 30, 2016. As of June 30, 2016, for federal income tax purposes, the aggregate cost of securities was $138,942,416 and net unrealized appreciation was $5,650,822, comprised of gross unrealized appreciation of $19,003,101 and gross unrealized depreciation of $13,352,279. The aggregate costs of investments for tax purposes will depend upon the Fund’s investment experience during the entirety of its fiscal year and may be subject to changes based on tax regulations.

15 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

6. ILLIQUID AND RESTRICTED SECURITIES The Fund owns securities which have a limited trading market and/or certain restrictions on trading and, therefore, may be illiquid and/or restricted. Such securities have been valued using fair value pricing. Due to the inherent uncertainty of valuation, fair value pricing values may differ from the values that would have been used had a readily available market for the securities existed. These differences in valuation could be material. Illiquid and/or restricted securities owned as of June 30, 2016 were as follows:

Acquisition Date

|

| Cost

|

| Value

| ||||||||||||||||||

Aquilex Holdings LLC | 3/08/12 | $ | 496,372 | $ 0 | ||||||||||||||||||

Penson Technologies LLC | 4/09/14 | 0 | 0 | |||||||||||||||||||

Solar Cayman Ltd. | 3/07/07 | 568,802 | 0 | |||||||||||||||||||

|

| |||||||||||||||||||||

Total | $ | 1,065,174 | $ 0 | |||||||||||||||||||

|

| |||||||||||||||||||||

Percent of net assets | 0.77 | % | 0.00 | % | ||||||||||||||||||

| ||||||||||||||||||||||

7. BORROWING AND SECURITIES LENDING The Fund has a Committed Facility Agreement (the “CFA”) with BNP Paribas Prime Brokerage, Inc. (“BNP”) which allows the Fund to adjust its credit facility amount up to $45,000,000, subject to BNP’s approval, and a Lending Agreement, as defined below. Borrowings under the CFA are secured by assets of the Fund that were held with the Fund’s custodian in a separate account (the “pledged collateral”). Interest was charged at the 1 month LIBOR (London Inter-bank Offered Rate) plus 0.95% on the amount borrowed and 0.50% on the undrawn balance. Because the Fund adjusts the facility amount each day to equal borrowing drawn that day, the annualized rate charge on undrawn facility amounts provided for by the CFA has not been incurred. The outstanding loan balance and the value of eligible collateral investments as of June 30, 2016 were $5,650,000 and $45,346,416, respectively, and the weighted average interest rate and average daily amount outstanding under the CFA for the six months ended June 30, 2016 were 1.38% and $9,191,784, respectively. The maximum amount outstanding during the six months ended June 30, 2016 was $24,599,574. On July 28, 2016, the Fund entered into a Liquidity Agreement with State Street Bank and Trust Company as described in Note 13 below.

The “Lending Agreement” provides that BNP may borrow a portion of the pledged collateral (the “Lent Securities”) in an amount not to exceed the outstanding borrowings owed by the Fund to BNP under the CFA. BNP may re-register the Lent Securities in its own name or in another name other than the Fund and may pledge, re-pledge, sell, lend, or otherwise transfer or use the Lent Securities with all attendant rights of ownership. The Fund may designate any security within the pledged collateral as ineligible to be a Lent Security, provided there are eligible securities within the pledged collateral in an amount equal to the outstanding borrowing owed by the Fund. BNP must remit payment to the Fund equal to the amount of all dividends, interest, or other

distributions earned or made by the Lent Securities.

Under the Lending Agreement, Lent Securities are marked to market daily and, if the value of the Lent Securities exceeds the value of the then-outstanding borrowings owed by the Fund to BNP under the CFA (the “Current Borrowings”), BNP must, on that day, either (1) return Lent Securities to the Fund’s custodian in an amount sufficient to cause the value of the outstanding Lent Securities to equal the Current Borrowings; or (2) post cash collateral with the Fund’s custodian equal to the difference between the value of the Lent Securities and the value of the Current Borrowings. If BNP fails to perform either of these actions as required, the Fund may recall securities, as discussed below, in an amount sufficient to cause the value of the outstanding Lent Securities to equal the Current Borrowings. The Fund can recall any of the Lent Securities and BNP is obligated, to the extent commercially possible, to return such security or equivalent security to the Fund’s custodian no later than three business days after such request. If the Fund recalls a Lent Security pursuant to the Lending Agreement, and BNP fails to return the Lent Securities or equivalent securities in a timely fashion, BNP normally remains liable to the Fund’s custodian for the ultimate delivery of such Lent Securities, or equivalent securities, and for any buy-in costs that the executing broker for the sales transaction may impose with respect to the failure to deliver. The Fund also had the right to apply and set-off an amount equal to one hundred percent (100%) of the then-current fair value of such Lent Securities against the Current Borrowings. The Fund earns securities lending income consisting of payments received from BNP for lending certain securities, less any rebates paid to borrowers and lending agent fees associated with the loan. As of June 30, 2016, the value of securities on loan was $6,647,463 and for the six months ended June 30, 2016, the Fund earned $22,941 in securities lending income.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 16

|

NOTES TO FINANCIAL STATEMENTS

| (Unaudited)

| |

Financial Statements

| ||

8. SHARE TRANSACTIONS The Fund is authorized to issue an unlimited amount of $0.01 par value shares of beneficial interest. As of June 30, 2016, there were 10,604,437 shares outstanding. Share transactions for the following periods were:

Six Months Ended June 30, 2016 | Year Ended December 31, 2015 | |||||||||||||||

Shares issued in: |

Shares |

Amount |

Shares |

Amount | ||||||||||||

Reinvestment of distributions

| 47,182 | $513,973 | 77,459 | $ 958,981 | ||||||||||||

Rights offering |

|

-

|

|

|

-

|

|

|

1,821,255

|

|

|

21,162,983

|

| ||||

|

47,182

|

|

|

$513,973

|

|

|

1,898,714

|

|

|

$ 22,121,964

|

| |||||

A registration statement allowing the Fund to offer, from time to time, in one or more offerings, including through rights offerings, up to $150,000,000 shares of beneficial interest (the “shelf offering”) was declared effective by the U.S. Securities and Exchange Commission on June 30, 2015. On September 28, 2015, the shareholders of the Fund received one non-transferable right for each share of the Fund held on that date rounded up to the nearest number of rights evenly divisible by three. Three rights were required to purchase one additional share of beneficial interest at the subscription price of $11.62 per share. On November 2, 2015, the Fund issued 1,821,255 shares of beneficial interest and recorded proceeds of $21,162,983, prior to the deduction of shelf and rights offering expenses of $276,827. The NAV per share of the Fund was reduced by approximately $0.53 per share as a result of the issuance of shares below NAV.

9. MARKET AND CREDIT RISKS The Fund may invest in below investment grade fixed income securities (commonly referred to as “junk” bonds), which carry ratings of BB or lower by Standard & Poor’s Ratings Group, a division of The McGraw-Hill Companies, Inc. (“S&P”) and/or Ba1 or lower by Moody’s Investors Service, Inc. (“Moody’s”). Investments in these below investment grade securities may be accompanied by a greater degree of credit risk than higher rated securities. Additionally, lower rated securities may be more susceptible to adverse economic and competitive industry conditions than investment grade securities. The relative illiquidity of some of these securities may adversely affect the ability of the Fund to dispose of such securities in a timely manner and at a fair price at times when it might be necessary or advantageous for the Fund to liquidate portfolio securities.

10. FOREIGN SECURITIES Investments in the securities of foreign issuers involve special risks which include changes in foreign exchange rates and the possibility of future adverse political and economic developments which could adversely affect the value of such securities. Moreover, securities of foreign issuers and traded in foreign markets may be less liquid and their prices more volatile than those of U.S. issuers and markets. In June 2016, the United Kingdom (UK) voted to leave the European Union (EU) following a referendum referred to as “Brexit.” It is expected that the UK will exit the EU within two years, however, the exact timeframe for the UK’s exit is unknown. There is still considerable uncertainty relating to the potential consequences of the withdrawal, including how the financial markets will react. In light of the uncertainties surrounding the impact of the Brexit on the broader global economy, the negative impact could be significant, potentially resulting in increased volatility and illiquidity and lower economic growth for companies that rely significantly on Europe for their business activities and revenues, which could have an adverse effect on the value of the Fund’s investments.

11. CONTINGENCIES The Fund indemnifies its officers and trustees from certain liabilities that might arise from their performance of their duties for the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which may provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as it involves future claims that may be made against the Fund under circumstances that have not occurred.

12. SHARE REPURCHASE PROGRAM In accordance with Section 23(c) of the Act, the Fund may from time to time repurchase its shares in the open market at the discretion of and upon such terms as determined by the Board of Trustees. The Fund did not repurchase any of its shares during 2015 or the six months ended June 30, 2016.

13. SUBSEQUENT EVENTS On July 28, 2016, the Fund entered into a Liquidity Agreement (“LA”) with State Street Bank and Trust Company (“SSB”), the Fund’s custodian, and terminated its CFA and Lending Agreement with BNP. The LA allows the Fund to draw up to $35 million (maximum liquidity commitment) and includes a securities lending authorization by the Fund to SSB to engage in agency securities lending and reverse repurchase activity. Interest is charged on the drawn amount at the rate of one-month LIBOR plus 1.20% per annum. A non-usage fee is charged on the difference between the maximum liquidity commitment and the drawn amount at the rate of one-month LIBOR plus 0.07% per annum.

17 Semi-Annual Report 2016 |

DIVIDEND AND INCOME FUND

|

FINANCIAL HIGHLIGHTS

| June 30, 2016 (Unaudited)

| |

Financial Statements

|

Six Months June 30, 2016

| Year Ended December 31,

| One Month Ended Dec 31, 2011(1)

| Year Ended 2011

| ||||||||||||||||||||||||||||||||||||||||||

| Per Share Operating Performance | 2015

| 2014

| 2013

| 2012

| |||||||||||||||||||||||||||||||||||||||||

Net asset value, beginning of period | $13.11 | $16.66 | $17.20 | $15.53 | $15.48 | $16.88 | $17.36 | ||||||||||||||||||||||||||||||||||||||

Income from investment operations: (2) | |||||||||||||||||||||||||||||||||||||||||||||

Net investment income | 0.14 | 0.31 | 0.34 | 0.40 | 0.56 | 0.08 | 0.96 | ||||||||||||||||||||||||||||||||||||||

Net realized and unrealized gain (loss) on investments | 0.39 | (1.68) | 0.76 | 4.12 | 1.13 | 0.20 | (0.08) | ||||||||||||||||||||||||||||||||||||||

Total income from investment operations | 0.53 | (1.37) | 1.10 | 4.52 | 1.69 | 0.28 | 0.88 | ||||||||||||||||||||||||||||||||||||||

Less distributions: | |||||||||||||||||||||||||||||||||||||||||||||

Net investment income | (0.14) | (0.26) | (1.63) | (1.16) | (0.56) | (0.08) | (0.92) | ||||||||||||||||||||||||||||||||||||||

Return of capital | (0.36) | (1.37) | - | (0.47) | (1.07) | (0.32) | (0.44) | ||||||||||||||||||||||||||||||||||||||

Total distributions | (0.50) | (1.63) | (1.63) | (1.63) | (1.63) | (0.40) | (1.36) | ||||||||||||||||||||||||||||||||||||||

Fund share transactions | |||||||||||||||||||||||||||||||||||||||||||||

Effect of reinvestment of distributions | (0.02) | (0.02) | (0.01) | (0.01) | (0.01) | -* | -* | ||||||||||||||||||||||||||||||||||||||

Decrease in net asset value from rights offering | - | (0.53) | - | (1.21) | - | (1.28) | - | ||||||||||||||||||||||||||||||||||||||

Total Fund share transactions | (0.02) | (0.55) | (0.01) | (1.22) | (0.01) | (1.28) | - | ||||||||||||||||||||||||||||||||||||||

Net asset value, end of period (3) | $13.12 | $13.11 | $16.66 | $17.20 | $15.53 | $15.48 | $16.88 | ||||||||||||||||||||||||||||||||||||||

Market value, end of period (3) | $10.88 | $11.01 | $15.12 | $15.11 | $13.53 | $13.72 | $13.84 | ||||||||||||||||||||||||||||||||||||||

Total Return (4) | |||||||||||||||||||||||||||||||||||||||||||||

Based on net asset value | 4.72 | % | (10.65) | % | 7.28 | % | 23.35 | % | 12.67 | % | (5.52) | % | 5.61 | % | |||||||||||||||||||||||||||||||

Based on market price | 3.41 | % | (17.32) | % | 10.83 | % | 24.38 | % | 10.75 | % | 2.13 | % | (11.15) | % | |||||||||||||||||||||||||||||||

Ratios/Supplemental Data (5) | |||||||||||||||||||||||||||||||||||||||||||||

Net assets, end of period (000s omitted) | $139,158 | $138,417 | $144,280 | $148,081 | $93,951 | $93,123 | $71,329 | ||||||||||||||||||||||||||||||||||||||

Ratios to average net assets of: | |||||||||||||||||||||||||||||||||||||||||||||

Total expenses (6) | 1.66 | %** | 1.65 | % | 1.55 | % | 1.87 | % | 2.57 | % | 2.09 | %** | 2.02 | % | |||||||||||||||||||||||||||||||

Net expenses (7) | 1.66 | %** | 1.65 | % | 1.55 | % | 1.87 | % | 2.57 | % | 2.09 | %** | 2.00 | % | |||||||||||||||||||||||||||||||

Net expenses excluding interest expense on bank credit facility | 1.56 | %** | 1.51 | % | 1.47 | % | 1.72 | % | 2.30 | % | 1.78 | %** | 1.73 | % | |||||||||||||||||||||||||||||||

Net investment income | 2.09 | %** | 2.02 | % | 1.94 | % | 2.38 | % | 3.56 | % | 6.28 | %** | 5.44 | % | |||||||||||||||||||||||||||||||

Portfolio turnover rate | 28 | % | 35 | % | 52 | % | 45 | % | 13 | % | 0 | % | 24 | % | |||||||||||||||||||||||||||||||

Leverage analysis (000s omitted): | |||||||||||||||||||||||||||||||||||||||||||||

Outstanding loan balance under the bank credit facility, end of period | $5,650 | $8,066 | $17,284 | $21,346 | $21,348 | $17,815 | $18,209 | ||||||||||||||||||||||||||||||||||||||

Asset coverage per $1,000, end of period (8) | $25,630 | $18,161 | $9,347 | $7,937 | $5,401 | $6,227 | $4,917 | ||||||||||||||||||||||||||||||||||||||

Average commission rate paid

|

| $0.0126

|

|

| $0.0185

|

|

| $0.0131

|

|

| $0.0139

|

|

| $0.0179

|

|

| $0.0075

|

|

| $0.0347

|

| ||||||||||||||||||||||||

| (1) | The Fund changed its fiscal year from November 30 to December 31, effective December 31, 2011. |

| (2) | The per share amounts were calculated using the average number of shares outstanding during the period. |

| (3) | The Fund implemented a 1-for-4 reverse stock split with an ex-dividend date of December 10, 2012. Prior period net asset values and per share amounts have been restated to reflect the impact of the reverse stock split. The net asset value and market price reported at the original dates prior to the reverse stock split were $3.87 and $4.22, $3.43 and $3.46, respectively, for the one month period ended December 31, 2011 and the year ended November 30, respectively. |

| (4) | Total return on a market value basis is calculated assuming a purchase of shares on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s Dividend Reinvestment Plan. Generally, total return on a net asset value basis will be higher than total return on a market value basis in periods where there is an increase in the discount or a decrease in the premium of the market value to the net asset value from the beginning to the end of such periods. Conversely, total return on a net asset value basis will be lower than total return on a market value basis in periods where there is a decrease in the discount or an increase in the premium of the market value to the net asset value from the beginning to the end of such periods. Total return calculated for a period of less than one year is not annualized. The calculation does not reflect brokerage commissions, if any. |

| (5) | Expenses and income ratios do not include expenses incurred by the Acquired Funds in which the Fund invests. |

| (6) | “Total expenses” are the expenses of the Fund as presented in the Statement of Operations before fee waivers and expense reductions. |

| (7) | “Net expenses” are the expenses of the Fund presented in the Statement of Operations after fee waivers and expense reductions. Fees waived by the Investment Manager reduced the ratio of net expenses by 0.02% for the year ended November 30, 2011. |

| (8) | Represents the value of total assets less liabilities not represented by senior securities representing indebtedness divided by the total number of senior indebtedness units, where one unit equals $1,000 of senior indebtedness. For purposes of this calculation, the bank credit facility is considered a senior security representing indebtedness. |

| * | Less than $0.005 per share. |

| ** | Annualized. |

See notes to financial statements.

DIVIDEND AND INCOME FUND

|

Semi-Annual Report 2016 18

|

| The additional information below and on the following pages is supplemental and not part of the financial statements of the Fund. | ||

BOARD APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

| (Unaudited)

| |

Additional Information

| ||