Exhibit 99.1

Company Profile

Standard Parking is a leading national provider of parking management, ground transportation and other ancillary services to commercial, institutional and municipal clients throughout North America. The Company manages parking facilities containing approximately 1.2 million parking spaces in hundreds of cities across the United States and Canada.

The Company’s SP Plus® brand highlights the Company’s value-added transportation, maintenance and security service lines that complement its core parking operations. The Company also uses the SP Plus® brand to emphasize the extensive subject matter expertise that the Company has developed to meet the varied demands of its assorted end-markets.

The Company’s diversified client base includes some of the nation’s largest private and public owners, managers and developers of major office buildings, residential properties, commercial properties, shopping centers and other retail properties, sports and special event complexes, hotels, and hospitals and medical centers. In the airport market, the Company manages parking, shuttle bus and ground transportation operations serving airports throughout North America.

| | | | | | | | | | | | |

Selected Financials | | In thousands except for per share | |

| | | 2011 | | | 2010 | | | 2009 | |

Revenue | | | | | | | | | | | | |

Lease contracts | | $ | 147,510 | | | $ | 138,664 | | | $ | 140,441 | |

Management contracts | | | 173,725 | | | | 171,331 | | | | 153,382 | |

| | | | | | | | | | | | |

| | | 321,235 | | | | 309,995 | | | | 293,823 | |

Reimbursed management contract expense | | | 408,427 | | | | 411,148 | | | | 401,671 | |

| | | | | | | | | | | | |

Total Revenue | | | 729,662 | | | | 721,143 | | | | 695,494 | |

Gross Profit | | | 88,582 | | | | 86,901 | | | | 78,759 | |

General & administrative expense | | | 48,297 | | | | 47,878 | | | | 44,707 | |

Operating income | | | 33,667 | | | | 32,949 | | | | 28,224 | |

Income before income taxes | | | 29,513 | | | | 27,863 | | | | 22,480 | |

Net income attributable to Standard Parking Corporation | | $ | 17,900 | | | $ | 16,840 | | | $ | 14,092 | |

Earnings per share | | $ | 1.12 | | | $ | 1.06 | | | $ | 0.90 | |

Total assets | | $ | 257,073 | | | $ | 255,632 | | | $ | 242,754 | |

Total debt | | $ | 82,013 | | | $ | 97,902 | | | $ | 113,211 | |

To Our Shareholders:

We are pleased to present this report of our 2011 activity.

On February 29, 2012, we announced the signing of an Agreement and Plan of Merger with Central Parking Corporation. We’re confident that this transformative deal will create significant value for our stockholders, and we look forward to closing the transaction and proceeding with the integration as soon as possible.

In the context of the Company’s 2011 activity, we were able to devote the resources needed to address the Central Parking transaction and at the same time maintain a vigilant, steady focus on the conduct of our day-to-day business. As a result, we are pleased to report 2011 results consistent with our organic growth goals given the constraints of an economic period that perhaps is characterized as patchy at best and during which we faced continuing price pressure from our clients.

Key 2011 highlights include:

| | • | | Adjusted EPS of $1.23, an increase of 16% over 2010 after excluding the impact of merger and acquisition related costs |

| | • | | Free cash flow of $28.9 million, an increase of 89% over 2010 |

| | • | | Operating profit retention rate of 96% |

| | • | | Reduction of the Company’s debt to $82.0 million or 2.1x our 2011 EBITDA |

| | • | | Stock repurchases of $7.5 million |

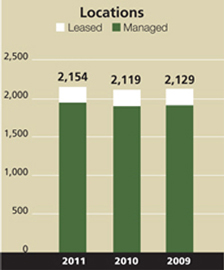

| | • | | Total locations and parking spaces operated grew to 2,154 and approximately 1.2 million, respectively |

In addition, our SP Plus® brand continued to gain traction during 2011. Our auxiliary service lines – SP Plus® Transportation, SP Plus® Maintenance and SP Plus® Security Services – increased their contribution to our growth objective. Similarly, the expertise we’ve developed to meet specialized client needs has resulted in several notable wins for us – such as contract awards received by our SP Plus® Municipal Services operating division from the City of Miami Beach, the City of Milwaukee and the City of Richmond, and the special event assignments received by our SP Plus® GAMEDAY operating division for the National Hockey League’s 2012 Tim Hortons NHL All Star Game and the upcoming 2012 Republican National Convention.

Our on-going investment in our support platforms continues to make us more efficient and lower our cost platform as we leverage our growing size. During 2011, we rolled out our new iProcurement online purchasing system to complement the automated, online iPayables accounts payable system we implemented in 2010. Our iProcurement purchasing system not only expedites the process of procuring the goods and services we need to quickly and cost-efficiently serve our clients, but also imposes tighter controls on the ordering and approval process to ensure, among other things, that our purchases are placed with vendors providing the best pricing.

In terms of back office achievements, it’s also worth noting that during 2011 the vast majority of our clients agreed to receive their monthly financial reports online via our proprietary ClientViewTM online reporting system, in lieu of mailed paper statements. Through ClientViewTM our clients receive a robust, comprehensive package that includes as much detail as they might desire in an eco-friendly fashion that minimizes paper use and thus reduces our carbon footprint.

As a public company, we adhere to rigorous accounting, internal control and reporting standards that are more rigorous than those typically followed by our non-public competitors. We are pleased to report that in 2011, for the seventh consecutive year, we have determined that our internal controls over financial reporting are effective and without material weaknesses. Our independent auditor, Ernst & Young, LLP, completed its evaluation and testing of our internal controls over financial reporting and issued an unqualified opinion.

In summary, 2011 was a very exciting year for us, both in terms of the performance of our operating business as well as the steps taken to position the Company for the transformational merger agreement we recently announced. We believe that the transaction will enable us to accelerate the Company’s growth by putting the strengths we’ve developed over the past several years to work for us in the future. We look forward to reporting to you as we execute on this exciting initiative.

Thank you again for your partnership with us.

Robert S. Roath

Non Executive Chairman of the Board

James A. Wilhelm

President and Chief Executive Officer

Additional Information

The shares of Standard Parking Corporation’s common stock to be issued as consideration under the merger agreement will not be registered under the Securities Act of 1933, as amended, or applicable state securities laws, and, unless so registered, such shares may not be offered or sold in the United States except pursuant to an exemption from the registration requirements of the Securities Act and applicable state securities laws. This letter does not constitute an offer to buy or sell securities, or a solicitation of any vote or approval, nor shall it constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

Standard Parking Corporation (“Standard”) intends to file with the SEC a proxy statement and other relevant materials in connection with the proposed business combination transaction referenced in this letter. Before making any voting decision with respect to the proposed transaction, Standard stockholders are urged to read the proxy statement when it becomes available, and as it may be amended from time to time, because it will contain important information regarding the proposed transaction. Standard’s stockholders may obtain a free copy of the proxy statement and other relevant materials, when available, and other documents filed by Standard with the SEC at the SEC’s website at http://www.sec.gov. In addition, copies of the proxy statement, when available, will be provided free of charge by Standard to all of its stockholders. Additional requests for proxy statements and other relevant materials should be directed to Standard Parking, Investor Relations, 900 N. Michigan Ave., Chicago, IL 60611 or by email at investor_relations@standardparking.com

Standard and Central Parking Corporation (“Central”) and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from Standard’s stockholders with respect to the proposed transaction. Any interests of the executive officers and directors of Standard and Central in the proposed transaction will be described in the proxy statement, when it becomes available. For additional information about Standard’s executive officers and directors, see Standard’s proxy statement filed with the SEC on March 28, 2011.

Use of Non-GAAP Financial Measures

The Company has presented non-GAAP measures for its full year 2011 of its (1) earnings per share, adjusted to exclude expenses incurred with respect to the Central Parking merger as well as a large acquisition that was contemplated earlier in 2011, (2) free cash flow, and (3) debt to EBITDA ratio.

As the Company does not routinely engage in transactions of the magnitude of the Central merger transaction or the earlier contemplated transaction, and consequently does not regularly incur transaction related expenses with correlative size, the Company believes presenting EPS excluding merger and acquisition related expenses provides investors with additional measures of the company’s underlying operating performance. EPS excluding merger and acquisition related expenses (also referred to as adjusted EPS) should not be considered as alternatives to, or more meaningful indicators of, the Company’s operating performance than EPS as determined in accordance with GAAP. In addition, the Company’s adjusted EPS may not be comparable to similarly titled measures of another company.

| | | | |

Standard Parking Corporation Adjusted EPS | | Twelve

Months Ended

12/31/11 | |

EPS, as reported | | $ | 1.12 | |

EPS attributable to merger and acquisition related costs | | $ | 0.11 | |

| | | | |

Adjusted EPS | | $ | 1.23 | |

The Company defines free cash flow as net cash from operating activities, less cash used for investing activities (exclusive of acquisitions), plus the effect of exchange rate changes on cash and cash equivalents. Due to the adoption, effective January 1, 2009, of Financial Accounting Standards Board Accounting Standards Codification Topic 810, Consolidation (formerly FAS 160), the Company’s calculation of free cash flow has been modified to deduct for the distribution to noncontrolling interest, which was previously reported as part of net cash from operating activities. The Company believes that the presentation of free cash flow provides useful information regarding its recurring cash provided by operating activities after certain expenditures. It also demonstrates the Company’s ability to execute its financial strategy. The Company’s presentation of free cash flow has material limitations. The Company’s free cash flow does not represent its cash flow available for discretionary expenditures because it excludes certain expenditures that are required or to which the Company has committed, such as debt service requirements. The Company’s definition of free cash flow may not be comparable to similarly titled measures presented by other companies.

| | | | | | | | |

Standard Parking Corporation Free Cash Flow | | Twelve Months Ended | |

| (in thousands) | | 12/31/11 | | | 12/31/10 | |

Net cash provided by operating activities | | $ | 34,950 | | | $ | 19,534 | |

Net cash (used in) investing activities | | | (5,257 | ) | | | (7,734 | ) |

Acquisitions | | | (14 | ) | | | 3,597 | |

Distribution to noncontrolling interest | | | (388 | ) | | | (271 | ) |

Effect of exchange rate changes on cash and cash equivalents | | | (390 | ) | | | 169 | |

| | | | | | | | |

Free cash flow | | $ | 28,901 | | | $ | 15,295 | |

EBITDA does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined by accounting principles generally accepted in the United States (GAAP), and the Company’s calculations thereof may not be comparable to that reported by other companies. EBITDA is calculated below as it is a basis upon which the Company assesses its liquidity position and because the Company believes that this presents useful information to investors regarding a company’s ability to service and/or incur indebtedness. This belief is based upon the Company’s negotiations with its lenders who have indicated that the amount of indebtedness it will be permitted to incur will be based, in part, on measures similar to its EBITDA. EBITDA does not take into account the Company’s working capital requirements, debt service requirements and other commitments and, accordingly, is not necessarily indicative of amounts that maybe available for discretionary use.

| | | | |

Standard Parking Corporation Debt To EBITDA Ratio (in thousands) | | Twelve

Months Ended

12/31/11 | |

Net income attributable to Standard Parking Corporation | | $ | 17,900 | |

plus: Income tax expense | | | 11,235 | |

plus: Interest expense, net | | | 4,154 | |

plus: Depreciation and amortization | | | 6,618 | |

| | | | |

EBITDA | | $ | 39,907 | |

Long-term borrowings, excluding current portion | | $ | 81,259 | |

Current portion of capital lease and other obligations | | | 754 | |

| | | | |

Total debt | | $ | 82,013 | |

Total debt to EBITDA ratio | | | 2.1x | |

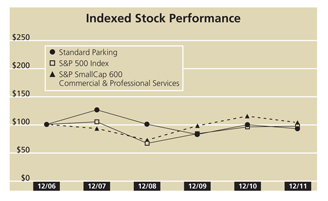

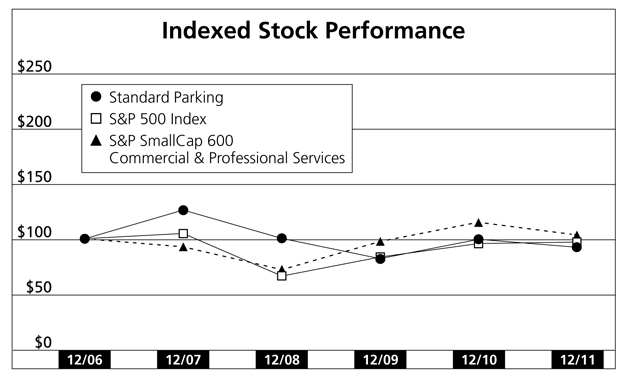

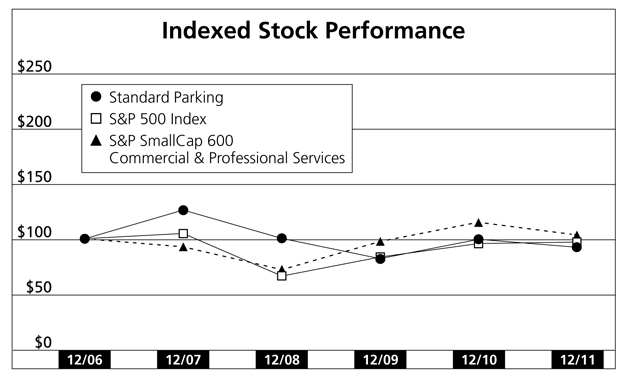

Stock Performance Graph

The performance graph below shows the cumulative total stockholder return of our common stock for the period starting on December 31, 2006 to December 31, 2011. This performance is compared with the cumulative total returns over the same period of the Standard & Poor’s 500 Index and the Standard & Poor’s SmallCap 600 Commercial and Professional Services Index, which includes our direct competitor, ABM Industries Incorporated. The graph assumes that on December 31, 2006, $100 was invested in our common stock and $100 was invested in each of the other two indices, and assumes reinvestment of dividends. The stock performance shown in the graph represents past performance and should not be considered an indication of future performance.

Indexed Returns

Years Ending

| | | | | | | | | | | | | | | | | | | | | | | | |

Company / Index | | 12/31/06 | | | 12/31/07 | | | 12/31/08 | | | 12/31/09 | | | 12/31/10 | | | 12/31/11 | |

Standard Parking Corporation | | $ | 100.00 | | | $ | 126.24 | | | $ | 100.70 | | | $ | 82.69 | | | $ | 98.83 | | | $ | 93.05 | |

S&P 500 Index | | $ | 100.00 | | | $ | 105.49 | | | $ | 66.46 | | | $ | 84.05 | | | $ | 96.71 | | | $ | 98.76 | |

S&P SmallCap 600 | | $ | 100.00 | | | $ | 93.61 | | | $ | 72.77 | | | $ | 98.53 | | | $ | 115.79 | | | $ | 103.49 | |

Commercial & Professional Services