Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

Or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-50796

SP Plus Corporation

(Exact Name of Registrant as Specified in Its Charter)

Delaware | | 16-1171179 |

(State or Other Jurisdiction of | | (I.R.S. Employer Identification No.) |

Incorporation or Organization) | | |

200 E. Randolph Street, Suite 7700

Chicago, Illinois 60601-7702

(Address of Principal Executive Offices, Including Zip Code)

(312) 274-2000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.001 par value per share | SP | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | |

Large Accelerated Filer | ☒ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | | |

Class | Outstanding at April 28, 2021 |

Common Stock, $0.001 par value per share | 23,205,424 | | Shares |

Table of Contents

SP PLUS CORPORATION

TABLE OF CONTENTS

1

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

SP Plus Corporation

Condensed Consolidated Balance Sheets

(millions, except for share data) | | March 31, 2021 | | | December 31, 2020 | |

| | (unaudited) | | | | | |

Assets | | | | | | | | |

Cash and cash equivalents | | $ | 18.0 | | | $ | 13.9 | |

Accounts and notes receivable, net | | | 102.1 | | | | 111.2 | |

Prepaid expenses and other current assets | | | 31.5 | | | | 26.8 | |

Total current assets | | | 151.6 | | | | 151.9 | |

Leasehold improvements, equipment and construction in progress, net | | | 51.7 | | | | 53.3 | |

Right-of-use assets | | | 219.9 | | | | 235.1 | |

Goodwill | | | 526.7 | | | | 526.6 | |

Other intangible assets, net | | | 61.0 | | | | 63.1 | |

Deferred taxes | | | 62.2 | | | | 63.8 | |

Other noncurrent assets, net | | | 44.2 | | | | 43.9 | |

Total noncurrent assets | | | 965.7 | | | | 985.8 | |

Total assets | | $ | 1,117.3 | | | $ | 1,137.7 | |

Liabilities and stockholders’ equity | | | | | | | | |

Accounts payable | | $ | 99.1 | | | $ | 97.8 | |

Accrued and other current liabilities | | | 98.0 | | | | 112.7 | |

Short-term lease liabilities | | | 80.4 | | | | 82.1 | |

Current portion of long-term obligations under Senior Credit Facility and other long-term borrowings | | | 26.1 | | | | 25.0 | |

Total current liabilities | | | 303.6 | | | | 317.6 | |

Long-term borrowings, excluding current portion | | | 344.8 | | | | 337.1 | |

Long-term lease liabilities | | | 224.1 | | | | 243.4 | |

Other noncurrent liabilities | | | 58.6 | | | | 58.2 | |

Total noncurrent liabilities | | | 627.5 | | | | 638.7 | |

Total liabilities | | $ | 931.1 | | | $ | 956.3 | |

Stockholders’ equity | | | | | | | | |

Preferred stock, par value $0.01 per share; 5,000,000 shares authorized as of March 31, 2021 and December 31, 2020, respectively; 0 shares issued or outstanding | | $ | 0 | | | $ | 0 | |

Common stock, par value $0.001 per share; 50,000,000 shares authorized as of March 31, 2021 and December 31, 2020; 25,240,166 and 23,205,424 shares issued and outstanding as of March 31, 2021, respectively, and 25,123,128 and 23,088,386 shares issued and outstanding as of December 31, 2020, respectively | | | 0 | | | | 0 | |

Treasury stock, at cost; 2,034,742 shares as of March 31, 2021 and December 31, 2020 | | | (70.6 | ) | | | (70.6 | ) |

Additional paid-in capital | | | 262.3 | | | | 261.4 | |

Accumulated other comprehensive loss | | | (4.0 | ) | | | (4.4 | ) |

Accumulated deficit | | | (1.0 | ) | | | (3.3 | ) |

Total SP Plus Corporation stockholders’ equity | | | 186.7 | | | | 183.1 | |

Noncontrolling interest | | | (0.5 | ) | | | (1.7 | ) |

Total stockholders’ equity | | | 186.2 | | | | 181.4 | |

Total liabilities and stockholders’ equity | | $ | 1,117.3 | | | $ | 1,137.7 | |

See Notes to Condensed Consolidated Financial Statements.

2

Table of Contents

SP Plus Corporation

Condensed Consolidated Statements of Income (Loss)

| | Three Months Ended | |

(millions, except for share and per share data) (unaudited) | | March 31, 2021 | | | March 31, 2020 | |

Services revenue | | | | | | | | |

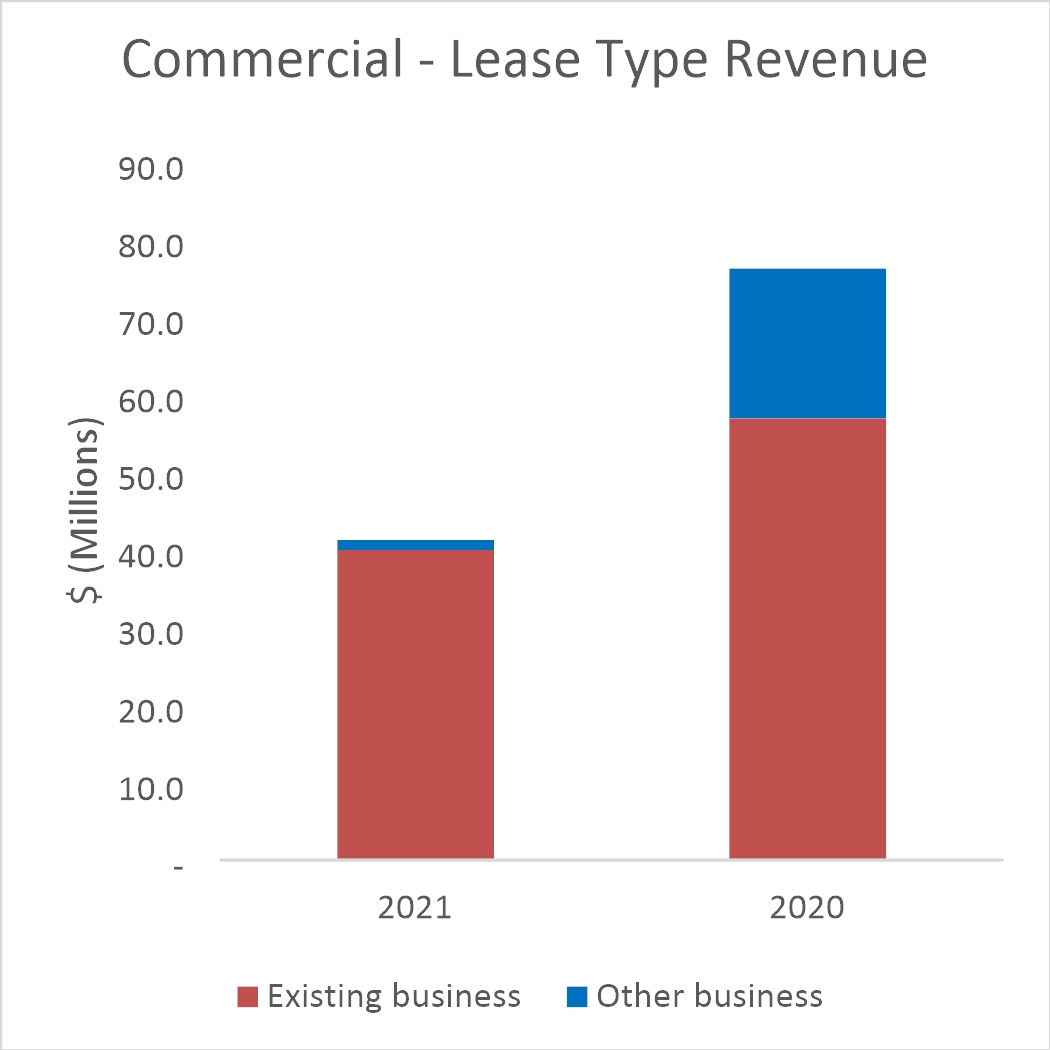

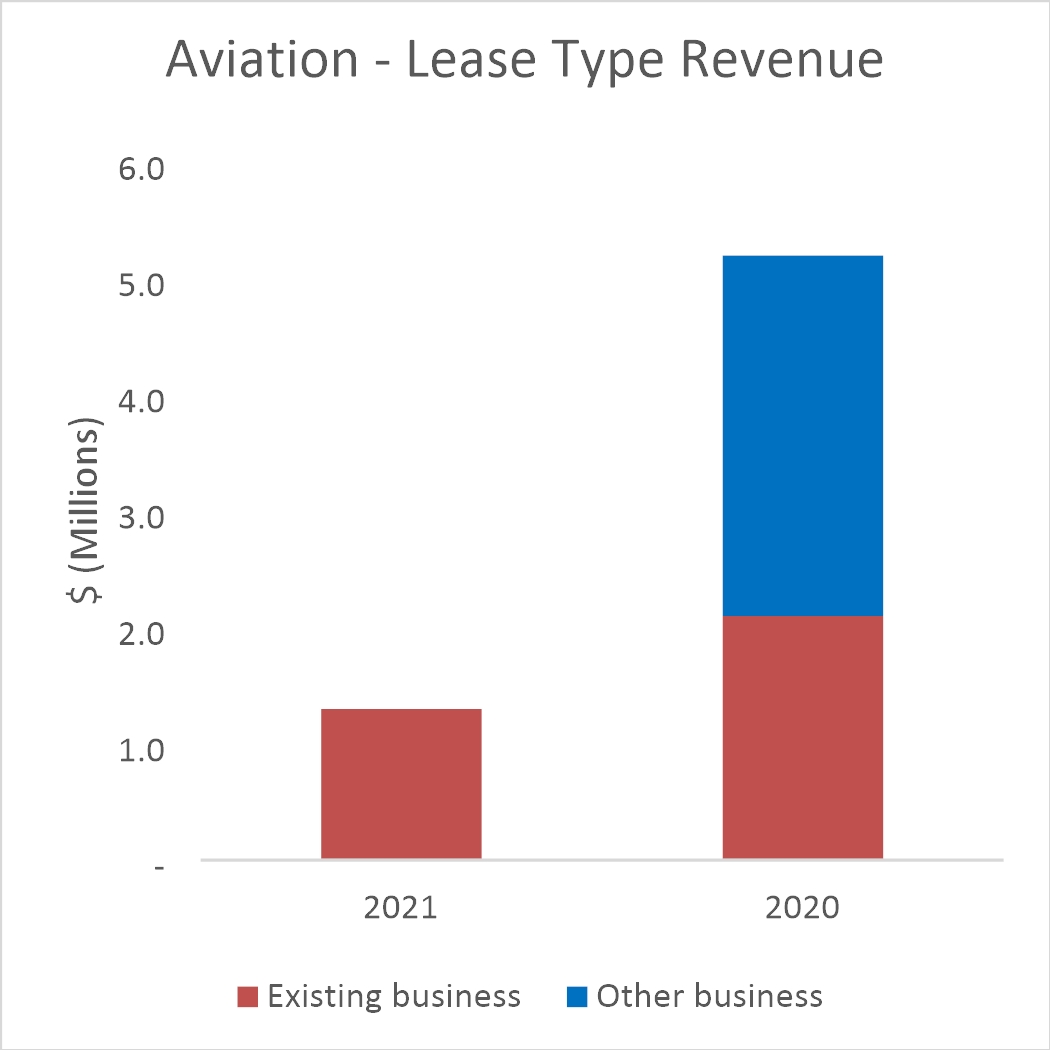

Lease type contracts | | $ | 42.7 | | | $ | 81.7 | |

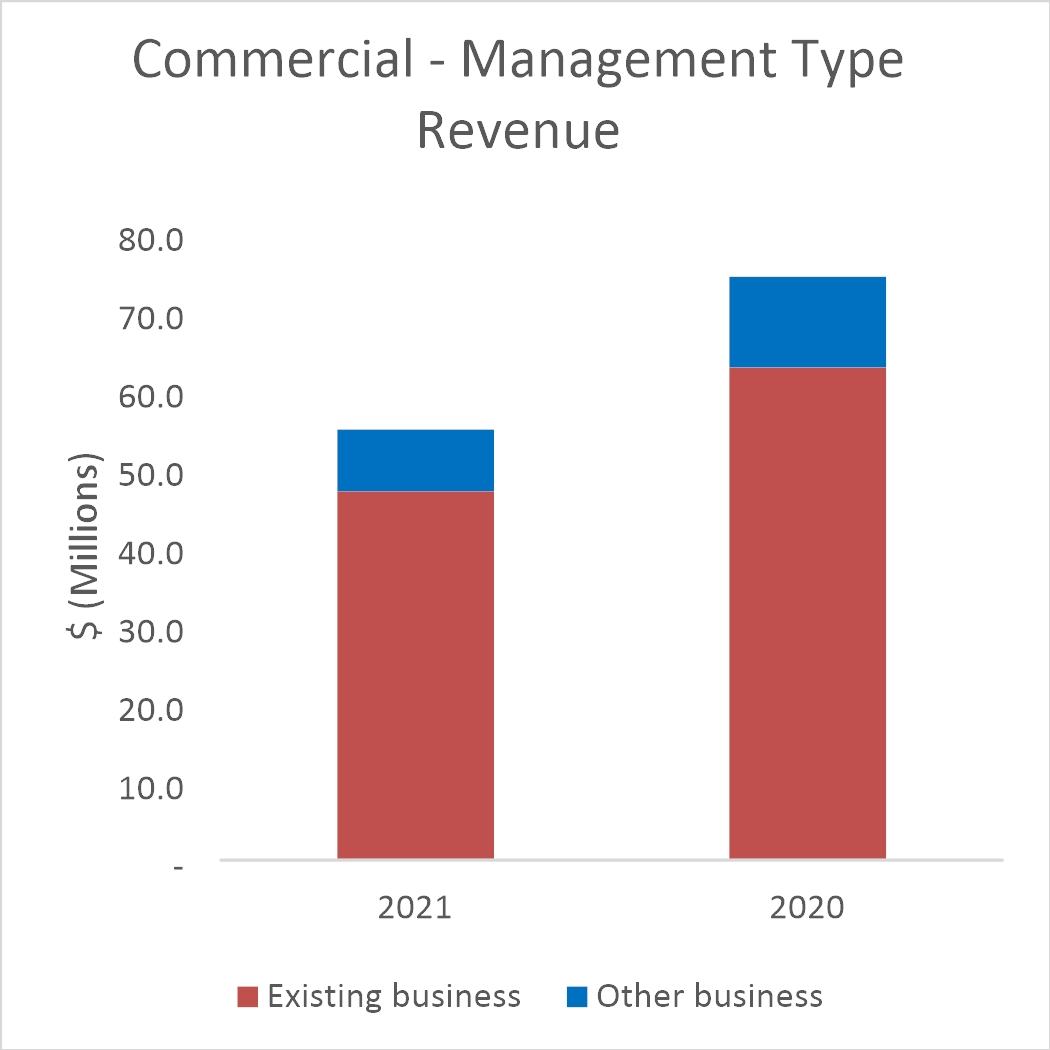

Management type contracts | | | 86.0 | | | | 137.1 | |

| | | 128.7 | | | | 218.8 | |

Reimbursed management type contract revenue | | | 118.0 | | | | 190.9 | |

Total services revenue | | | 246.7 | | | | 409.7 | |

Cost of services | | | | | | | | |

Lease type contracts | | | 35.3 | | | | 80.2 | |

Management type contracts | | | 55.0 | | | | 91.3 | |

| | | 90.3 | | | | 171.5 | |

Reimbursed management type contract expense | | | 118.0 | | | | 190.9 | |

Lease impairment | | | 0.1 | | | | 77.5 | |

Total cost of services | | | 208.4 | | | | 439.9 | |

Gross profit | | | | | | | | |

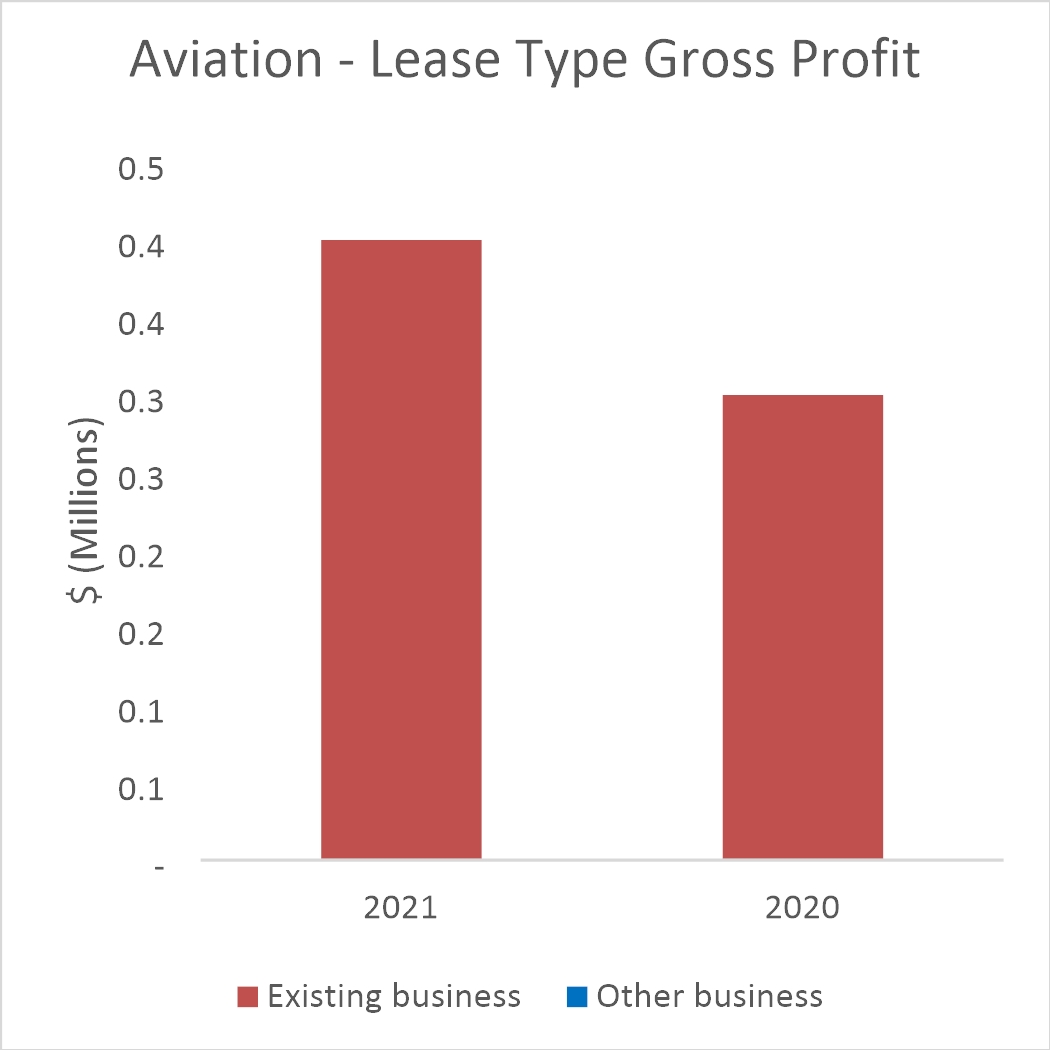

Lease type contracts | | | 7.4 | | | | 1.5 | |

Management type contracts | | | 31.0 | | | | 45.8 | |

Lease impairment | | | (0.1 | ) | | | (77.5 | ) |

Total gross profit | | | 38.3 | | | | (30.2 | ) |

General and administrative expenses | | | 21.0 | | | | 20.7 | |

Depreciation and amortization | | | 6.3 | | | | 7.5 | |

Operating income (loss) | | | 11.0 | | | | (58.4 | ) |

Other expense (income) | | | | | | | | |

Interest expense | | | 5.8 | | | | 4.4 | |

Interest income | | | (0.1 | ) | | | (0.1 | ) |

Gain on sale of other investments | | | 0 | | | | (0.3 | ) |

Total other expenses | | | 5.7 | | | | 4.0 | |

Earnings (loss) before income taxes | | | 5.3 | | | | (62.4 | ) |

Income tax expense (benefit) | | | 1.4 | | | | (16.8 | ) |

Net income (loss) | | | 3.9 | | | | (45.6 | ) |

Less: Net income attributable to noncontrolling interest | | | 1.6 | | | | 0.5 | |

Net income (loss) attributable to SP Plus Corporation | | $ | 2.3 | | | $ | (46.1 | ) |

Common stock data | | | | | | | | |

Net income (loss) per common share | | | | | | | | |

Basic | | $ | 0.11 | | | $ | (2.18 | ) |

Diluted | | $ | 0.11 | | | $ | (2.18 | ) |

Weighted average shares outstanding | | | | | | | | |

Basic | | | 21,113,494 | | | | 21,154,047 | |

Diluted | | | 21,304,068 | | | | 21,154,047 | |

See Notes to Condensed Consolidated Financial Statements.

3

Table of Contents

SP Plus Corporation

Condensed Consolidated Statements of Comprehensive Income (Loss)

| | Three Months Ended | |

(millions) (unaudited) | | March 31, 2021 | | | March 31, 2020 | |

Net income (loss) | | $ | 3.9 | | | $ | (45.6 | ) |

Change in fair value of interest rate collars | | | 0.4 | | | | (2.8 | ) |

Foreign currency translation loss | | | — | | | | (0.2 | ) |

Comprehensive income (loss) | | | 4.3 | | | | (48.6 | ) |

Less: Comprehensive income attributable to noncontrolling interest | | | 1.6 | | | | 0.5 | |

Comprehensive income (loss) attributable to SP Plus Corporation | | $ | 2.7 | | | $ | (49.1 | ) |

See Notes to Condensed Consolidated Financial Statements.

4

Table of Contents

SP Plus Corporation

Condensed Consolidated Statements of Stockholders' Equity

Three months ended March 31, 2020 (unaudited) | |

| | Common Stock | | | | | | | | | | | | | | | | | | | | | | | | | |

(millions, except share data) | | Number of Shares | | | Par Value | | | Additional Paid-In Capital | | | Accumulated Other Comprehensive Loss | | | Retained Earnings (Accumulated Deficit) | | | Treasury Stock | | | Noncontrolling Interest | | | Total | |

Balance at January 1, 2020 | | | 22,950,360 | | | $ | 0 | | | $ | 262.6 | | | $ | (2.7 | ) | | $ | 169.5 | | | $ | (55.3 | ) | | $ | (0.2 | ) | | $ | 373.9 | |

Net (loss) income | | | — | | | | — | | | | — | | | | — | | | | (46.1 | ) | | | — | | | | 0.5 | | | | (45.6 | ) |

Foreign currency translation | | | — | | | | — | | | | — | | | | (0.2 | ) | | | — | | | | — | | | | — | | | | (0.2 | ) |

Change in fair value of interest rate collars | | | — | | | | — | | | | — | | | | (2.8 | ) | | | — | | | | — | | | | — | | | | (2.8 | ) |

Issuance of performance stock units | | | 46,701 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 0 | |

Non-cash stock-based compensation | | | — | | | | — | | | | (2.9 | ) | | | — | | | | — | | | | — | | | | — | | | | (2.9 | ) |

Treasury stock | | | — | | | | — | | | | — | | | | — | | | | — | | | | (15.3 | ) | | | — | | | | (15.3 | ) |

Distributions to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (0.5 | ) | | | (0.5 | ) |

Balance at March 31, 2020 | | | 22,997,061 | | | $ | — | | | $ | 259.7 | | | $ | (5.7 | ) | | $ | 123.4 | | | $ | (70.6 | ) | | $ | (0.2 | ) | | $ | 306.6 | |

Three months ended March 31, 2021 (unaudited) | |

| Common Stock | | | | | | | | | | | | | | | | | | | |

(millions, except share data) | Number of Shares | | Par Value | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Treasury Stock | | Noncontrolling Interest | | Total | |

Balance at January 1, 2021 | | 23,088,386 | | $ | — | | $ | 261.4 | | $ | (4.4 | ) | $ | (3.3 | ) | $ | (70.6 | ) | $ | (1.7 | ) | $ | 181.4 | |

Net (loss) income | | — | | | — | | | — | | | — | | | 2.3 | | | — | | | 1.6 | | | 3.9 | |

Change in fair value of interest rate collars | | — | | | — | | | — | | | 0.4 | | | — | | | — | | | — | | | 0.4 | |

Issuance of restricted stock units | | 35,902 | | | — | | | — | | | — | | | — | | | — | | | — | | | 0 | |

Issuance of performance stock units | | 81,136 | | | — | | | — | | | — | | | — | | | — | | | — | | | 0 | |

Non-cash stock-based compensation | | — | | | — | | | 0.9 | | | — | | | — | | | — | | | — | | | 0.9 | |

Distributions to noncontrolling interest | | — | | | — | | | — | | | — | | | — | | | — | | | (0.4 | ) | | (0.4 | ) |

Balance at March 31, 2021 | | 23,205,424 | | $ | — | | $ | 262.3 | | $ | (4.0 | ) | $ | (1.0 | ) | $ | (70.6 | ) | $ | (0.5 | ) | $ | 186.2 | |

See Notes to Condensed Consolidated Financial Statements.

5

Table of Contents

SP Plus Corporation

Condensed Consolidated Statements of Cash Flows

| | Three Months Ended | |

(millions) (unaudited) | | March 31, 2021 | | | March 31, 2020 | |

Operating activities | | | | | | | | |

Net income (loss) | | $ | 3.9 | | | $ | (45.6 | ) |

Adjustments to reconcile net income (loss) to net cash provided by operations: | | | | | | | | |

Impairment | | | 0.1 | | | | 77.5 | |

Depreciation and amortization | | | 6.3 | | | | 7.5 | |

Non-cash stock-based compensation | | | 0.9 | | | | (2.9 | ) |

Provisions for credit losses on accounts receivable | | | 0.3 | | | | — | |

Deferred income taxes | | | 1.4 | | | | (40.6 | ) |

Other | | | 1.3 | | | | (0.1 | ) |

Changes in operating assets and liabilities | | | | | | | | |

Accounts and notes receivable | | | 8.8 | | | | 3.4 | |

Prepaid and other current assets | | | (4.7 | ) | | | 10.3 | |

Accounts payable | | | 1.3 | | | | 6.1 | |

Accrued liabilities and other | | | (20.6 | ) | | | (7.4 | ) |

Net cash (used in) provided by operating activities | | | (1.0 | ) | | | 8.2 | |

Investing activities | | | | | | | | |

Purchases of leasehold improvements and equipment | | | (2.3 | ) | | | (4.0 | ) |

Cost of contracts purchased | | | (0.4 | ) | | | (0.7 | ) |

Proceeds from sale of other investments and equipment | | | 0.1 | | | | 0.4 | |

Net cash used in investing activities | | | (2.6 | ) | | | (4.3 | ) |

Financing activities | | | | | | | | |

Proceeds from credit facility revolver | | | 97.4 | | | | 220.4 | |

Payments on credit facility revolver | | | (83.1 | ) | | | (206.9 | ) |

Payments on credit facility term loan | | | (2.8 | ) | | | (2.8 | ) |

Payments of debt issuance costs | | | (1.3 | ) | | | — | |

Payments on other long-term borrowings | | | (2.1 | ) | | | (0.8 | ) |

Distributions to noncontrolling interest | | | (0.4 | ) | | | (0.5 | ) |

Repurchases of common stock | | | — | | | | (15.3 | ) |

Net cash provided by (used in) financing activities | | | 7.7 | | | | (5.9 | ) |

Effect of exchange rate changes on cash and cash equivalents | | | — | | | | (0.2 | ) |

Increase (decrease) in cash and cash equivalents | | | 4.1 | | | | (2.2 | ) |

Cash and cash equivalents at beginning of year | | | 13.9 | | | | 24.1 | |

Cash and cash equivalents at end of period | | $ | 18.0 | | | $ | 21.9 | |

Supplemental disclosures | | | | | | | | |

Cash paid (received) during the period for | | | | | | | | |

Interest | | $ | 5.0 | | | $ | 4.1 | |

Income taxes | | $ | 0.2 | | | $ | (0.2 | ) |

See Notes to Condensed Consolidated Financial Statements.

6

Table of Contents

SP Plus Corporation

Notes to Condensed Consolidated Financial Statements

1. Significant Accounting Policies and Practices

The Company

SP Plus Corporation (the "Company") facilitates the efficient movement of people, vehicles and personal belongings with the goal of enhancing the consumer experience while improving bottom line results for the Company’s clients. The Company provides professional parking management, ground transportation, remote baggage check-in and handling, facility maintenance, security, event logistics, and other technology-driven mobility solutions to aviation, commercial, hospitality, healthcare and government clients across North America. The Company typically enters into contractual relationships with property owners or managers as opposed to owning facilities.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States ("U.S. GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, certain information and disclosures normally included in the Condensed Consolidated Balance Sheets, Statements of Income (Loss), Comprehensive Income (Loss), Stockholders' Equity and Cash Flows prepared in conformity with U.S. GAAP have been condensed or omitted as permitted by such rules and regulations.

In the opinion of management, all adjustments (consisting only of adjustments of a normal and recurring nature) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2021 are not necessarily indicative of the results that might be expected for any other interim period or the fiscal year ending December 31, 2021. The financial statements presented in this report should be read in conjunction with the Company’s annual Consolidated Financial Statements and notes thereto included in the Annual Report on Form 10-K filed on February 22, 2021 with the Securities and Exchange Commission.

Cash and Cash Equivalents

Cash equivalents represent funds temporarily invested in money market instruments with maturities of three months or less. Cash equivalents are stated at cost, which approximates fair value. Cash and cash equivalents that are restricted as to withdrawal or use under the terms of certain contractual agreements were $0.3 million as of March 31, 2021 and December 31, 2020, and are included within Cash and cash equivalents within the Condensed Consolidated Balance Sheets.

Equity Investments in Unconsolidated Entities

The Company has ownership interests in 29 active partnerships, joint ventures or similar arrangements that operate parking facilities, of which 24 are consolidated under the VIE or voting interest models and 5 are unconsolidated where the Company’s ownership interests range from 30-50 percent and for which there are no indicators of control. The Company accounts for such investments under the equity method of accounting, and its underlying share of each investee’s equity is included in Other noncurrent assets, net within the Condensed Consolidated Balance Sheets. As the operations of these entities are consistent with the Company’s underlying core business operations, the equity in earnings of these investments are included in Services revenue - lease type contracts within the Condensed Consolidated Statements of Income (Loss). The equity earnings in these related investments were $0.1 million and $0.6 million for the three months ended March 31, 2021 and 2020, respectively.

Other Noncurrent Assets

Other noncurrent assets consisted of advances and deposits and cost of contracts, net, as of March 31, 2021 and December 31, 2020.

Accrued and Other Current Liabilities

Accrued and other current liabilities consisted of accrued rent, compensation, payroll withholdings, property, payroll and other taxes, insurance and other accrued expenses as of March 31, 2021 and December 31, 2020.

Noncontrolling Interests

Noncontrolling interests represent the noncontrolling holders’ percentage share of income or losses from the subsidiaries in which the Company holds a majority, but less than 100 percent, ownership interest and the results of which are consolidated and included within the Condensed Consolidated Financial Statements.

7

Table of Contents

Goodwill

Goodwill represents the excess of the purchase price paid over the fair value of net assets acquired. In accordance with the Financial Accounting Standards Board's ("FASB") authoritative accounting guidance on goodwill, the Company evaluates goodwill for impairment on an annual basis, or more often if events or circumstances change that could cause goodwill to become impaired. The Company has elected to assess the impairment of goodwill annually on October 1 or at an interim date if there is an event or change in circumstances indicating the carrying value may not be recoverable. The goodwill impairment test is performed at the reporting unit level; the Company's reporting units represent its operating segments, consisting of Commercial and Aviation. Factors that could trigger an impairment review include significant under-performance relative to expected historical or projected future operating results, significant changes in the use of acquired assets or the Company’s business strategy, and significant negative industry or economic trends.

The Company may perform a qualitative, rather than quantitative, assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If the Company determines impairment is present, the Company would need to perform a quantitative assessment to determine the amount of impairment expense. The determination of fair value of a reporting unit utilizes cash flow projections that assume certain future revenue and cost levels, comparable marketplace data, assumed discount rates based upon current market conditions and other valuation factors, all of which involve the use of significant judgment and estimates. The Company also assesses critical areas that may impact its business including economic conditions, market related exposures, competition, changes in service offerings and changes in key personnel.

Other Intangible Assets, net

Other intangible assets with finite lives are amortized on a straight-line basis over their estimated useful lives. The Company evaluates the remaining useful life of other intangible assets on a periodic basis to determine whether events or circumstances warrant a revision to their remaining useful lives. In addition, other intangible assets are reviewed for impairment when circumstances change that would indicate the carrying value may not be recoverable. Assumptions and estimates about future values and remaining useful lives of intangible assets are complex and subjective. They can be affected by a variety of factors, including external factors such as industry and economic trends, and internal factors, such as changes in the Company's business strategy and forecasts. Although management believes the historical assumptions and estimates are reasonable and appropriate, different assumptions and estimates could materially impact reported financial results.

For both goodwill and intangible assets, future events may indicate differences from management’s judgments and estimates which could, in turn, result in impairment charges. Future events that may result in impairment charges include extended unfavorable economic impacts of the COVID-19 pandemic (“COVID-19”), increases in interest rates, which would impact discount rates, or other factors which could decrease revenues and profitability of existing locations and changes in the cost structure of existing facilities.

Long-Lived Assets

The Company evaluates long-lived assets, including right-of-use ("ROU") assets, leasehold improvements, equipment and construction in progress, for impairment whenever events or circumstances indicate that the carrying value of an asset or asset group may not be recoverable. The Company groups assets at the lowest level for which cash flows are separately identified in order to measure an impairment. Events or circumstances that would result in an impairment review include a significant change in the use of an asset, the planned sale or disposal of an asset, or a projection or forecast that demonstrates continuing losses associated with the use of an asset or long-lived asset group. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of the asset to future undiscounted cash flows expected to be generated by the asset group. If the asset or asset group is determined to be impaired, the impairment recognized is measured by the amount by which the carrying value of the asset or asset group exceeds its fair value.

As a result of the impact of COVID-19 on the Company's operating cash flows, the Company’s management determined certain impairment testing triggers had occurred for ROU assets associated with certain asset groups during the three months ended March 31, 2020. Accordingly, the Company analyzed undiscounted cash flows for ROU assets associated with certain asset groups during the three months ended March 31, 2020. Based on the undiscounted cash flow analysis, the Company determined that estimated net carrying values exceeded undiscounted cash flows for ROU assets associated with certain asset groups and therefore during the three months ended March 31, 2020, ROU assets associated with certain asset groups were impaired. The impairment recognized is measured by the amount by which the carrying value of the ROU asset associated with certain asset groups exceeds its fair value. The Company determined there were no impairment testing triggers during the three months ended March 31, 2021. See Note 2. Leases in the notes to the Condensed Consolidated Financial Statements for further discussion.

Assumptions and estimates used to determine cash flows in the evaluation of impairment and the fair values used to determine the impairment are subject to a degree of judgment and complexity. Any future changes to the assumptions and estimates resulting from changes in actual results or market conditions from those anticipated may affect the carrying value of long-lived assets and could result in additional impairment charges. Future events that may result in impairment charges include extended unfavorable economic impacts of COVID-19, or other factors which could decrease revenues and profitability of existing locations and changes in the cost structure of existing facilities.

8

Table of Contents

Recently Issued Accounting Pronouncements

Recently Adopted Accounting Pronouncements

During the three months ended March 31, 2021, the Company adopted the following Accounting Standards Updates (“ASUs”) with no material impact on the Condensed Consolidated Financial Statements:

ASU | | Topic | | Method of Adoption |

2021-01 | | Reference Rate Reform (Topic 848): Scope | | Prospective |

2020-10 | | Codification Improvements | | Prospective |

2020-03 | | Codification Improvements to Financial Instruments | | Prospective |

2019-11 | | Codification Improvements to Topic 326, Financial Instruments – Credit Losses | | Prospective |

Accounting Pronouncements to be Adopted

Effects of Reference Rate Reform on Financial Reporting

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. This ASU provides optional expedient and exceptions for applying U.S. GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria are met. In response to the concerns about structural risks of interbank offered rates (IBORs) and, particularly, risks associated with the phase out of the London Interbank Offered Rate (LIBOR), regulators in several jurisdictions around the world have undertaken reference rate reform initiatives to identify alternative reference rates that are more observable or transaction based and less susceptible to manipulation. The ASU provides companies with optional guidance to ease the potential accounting burden associated with transitioning away from reference rates that are expected to be discontinued. The ASU can be adopted no later than December 1, 2022 with early adoption permitted. The Company is currently assessing the impact of adopting the standard on the Company's financial position, results of operations, cash flows and financial statement disclosures.

Investments - equity securities; Investments-Equity Method and Joint Ventures; Derivatives and Hedging

In January 2020, the FASB issued ASU 2020-01, Investments-Equity Securities (Topic 321), Investments-Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815). The amendments in this ASU clarify the interaction between the accounting for investments in equity securities, investment in equity method and certain derivatives instruments. The ASU is expected to reduce diversity in practice and increase comparability of the accounting for these interactions. This ASU is effective for fiscal years beginning after December 15, 2021. The Company is currently assessing the impact of adopting the standard on the Company's financial position, results of operations, cash flows and financial statement disclosures.

2. Leases

The Company leases parking facilities, office space, warehouses, vehicles and equipment and determines if an arrangement is a lease at inception. The Company subleases certain real estate to third parties. The Company's sublease portfolio consists of operating leases for space within leased parking facilities.

The Company accounts for leases in accordance with Topic 842. Operating lease ROU assets and lease liabilities are recognized at commencement date based on the present value of lease payments over the lease term. ROU assets represent the Company's "right-of-use" over an underlying asset for the lease term, and lease liabilities represent the Company’s obligation to make lease payments arising from the lease. The ROU asset includes cumulative prepaid or accrued rent, as well as lease incentives, initial direct costs and acquired lease contracts. The short term lease exception has been applied to leases with an initial term of 12 months or less and therefore, these leases are not recorded on the balance sheet.

As most of the Company's leases do not provide an implicit rate, the Company uses its incremental borrowing rate based on the information available at commencement date in determining the present value of lease payments. The Company uses the implicit rate when readily determinable. Lease expense is recognized on a straight-line basis over the lease term.

For leases that include one or more options to renew, the exercise of such renewal options is at the Company's sole discretion or mutual agreement. The Company’s lease term may include renewal options that are at the Company’s sole discretion and are reasonably certain to be exercised. Equipment and vehicle leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise.

9

Table of Contents

Variable lease components comprising of payments that are a percentage of parking services revenue based on contractual levels and rental payments adjusted periodically for inflation are not included in the lease liability. The Company's lease agreements do not contain any material residual value guarantees or material restrictive covenants.

As discussed in Note 1. Significant Accounting Policies and Practices, the Company tests ROU assets when impairment indicators are present. Due to the impact of COVID-19 on the Company's operating cash flows, the Company determined certain impairment testing triggers had occurred within its asset groups during the three months ended March 31, 2020. Accordingly, the Company performed an undiscounted cash flow analysis on certain operating lease ROU assets during the three months ended March 31, 2020. Based on the undiscounted cash flow analysis as of March 31, 2020, the Company determined that certain ROU asset groups had net carrying values that exceeded their estimated undiscounted future cash flows and fair value for these asset groups was determined. The fair value of the ROU assets measured on a non-recurring basis, which is classified as Level 3 in the fair value hierarchy, was determined based on estimates of future discounted cash flows. The estimated fair values were compared to net carrying values, and as a result, ROU assets held and used with a carrying amount of $224.9 million were determined to have a fair value of $147.4 million, resulting in impairment charges of $77.5 million in the Commercial segment during the three months ended March 31, 2020, which was included within Lease impairment in the Condensed Consolidated Statements of Income (Loss). The Company recorded $0.1 million of impairment charges during the three months ended March 31, 2021, which was included within Lease impairment in the Condensed Consolidated Statements of Income (Loss).

In April 2020, the FASB staff provided accounting elections for entities that receive or provide lease-related concessions to mitigate the economic effects of COVID-19 on lessees. The Company elected not to evaluate whether certain concessions provided by lessors in response to COVID-19, that are within the scope of additional interpretation provided by the FASB in April 2020, were lease modifications and has also elected not to apply modification guidance under Topic 842. These concessions will be recognized as a reduction of rent expense in the month they occur and will be recorded within Cost of parking services within the Condensed Consolidated Statements of Income (Loss). As a result of COVID-19, the Company was able to negotiate lease concessions with certain landlords. These rent concessions have been recorded in accordance with the guidance noted above. As a result, the Company recorded $5.0 million related to rent concessions as a reduction to cost of services during the three months ended March 31, 2021. The Company did 0t receive any concessions during the three months ended March 31, 2020.

Costs associated with the right to use the infrastructure on service concession arrangements are recorded as a reduction of revenue in accordance with the scope of ASU No. 2017-10, Service Concession Arrangements (Topic 853): Determining the Customer of the Operation Services. See Note 4. Revenue for further discussion on service concession arrangements.

The components of ROU assets and lease liabilities and classification on the Condensed Consolidated Balance Sheet as of March 31, 2021 (unaudited) and December 31, 2020 were as follows:

(millions) | | Classification | | March 31, 2021 | | | December 31, 2020 | |

Assets | | | | | | | | | | |

Operating | | Right-of-use assets | | $ | 219.9 | | | $ | 235.1 | |

Finance | | Leasehold improvements, equipment and construction in progress, net | | | 27.3 | | | | 28.8 | |

Total leased assets | | | | $ | 247.2 | | | $ | 263.9 | |

Liabilities | | | | | | | | | | |

Current | | | | | | | | | | |

Operating | | Short-term lease liabilities | | $ | 80.4 | | | $ | 82.1 | |

Finance | | Current portion of long-term obligations under Senior Credit Facility and other long-term borrowings | | | 7.4 | | | | 7.8 | |

Noncurrent | | | | | | | | | | |

Operating | | Long-term lease liabilities | | | 224.1 | | | | 243.4 | |

Finance | | Long-term borrowings, excluding current portion | | | 18.7 | | | | 20.5 | |

Total lease liabilities | | | | $ | 330.6 | | | $ | 353.8 | |

10

Table of Contents

The components of lease cost and classification in the Condensed Consolidated Statement of Income (Loss) for the three months ended March 31, 2021 and 2020 (unaudited) were as follows:

| | | | Three Months Ended | |

(millions) | | Classification | | March 31, 2021 | | | March 31, 2020 | |

Operating lease cost (a)(b) | | Cost of services - lease type contracts | | $ | 14.0 | | | $ | 35.6 | |

Short-term lease (a) | | Cost of services - lease type contracts | | | 4.7 | | | | 8.8 | |

Variable lease | | Cost of services - lease type contracts | | | 3.6 | | | | 7.8 | |

Operating lease cost | | | | | 22.3 | | | | 52.2 | |

Finance lease cost | | | | | | | | | | |

Amortization of leased assets | | Depreciation and amortization | | | 1.5 | | | | 0.7 | |

Interest on lease liabilities | | Interest expense | | | 0.3 | | | | 0.2 | |

Lease impairment | | Lease impairment | | | 0.1 | | | | 77.5 | |

Net lease cost | | | | $ | 24.2 | | | $ | 130.6 | |

(a) | Operating lease cost included in General and administrative expenses are related to leases for office space amounting to $1.0 million and $1.5 million for the three months ended March 31, 2021 and 2020, respectively. |

(b) | Includes rent concessions amounting to $5.0 million for the three months ended March 31, 2021. NaN rent concessions were recognized during the three months ended March 31, 2020. |

Sublease income was $0.4 million during the three months ended March 31, 2021 and 2020.

The Company has not entered into operating lease arrangements as of March 31, 2021 that commence in future periods.

Maturities of lease liabilities, lease term, and discount rate information as of March 31, 2021 (unaudited) were as follows:

(millions) | | Operating Leases Liabilities | | | Finance Leases Liabilities | | | Total | |

2021 | | $ | 69.6 | | | $ | 6.4 | | | $ | 76.0 | |

2022 | | | 79.3 | | | | 7.4 | | | | 86.7 | |

2023 | | | 59.2 | | | | 5.3 | | | | 64.5 | |

2024 | | | 41.8 | | | | 3.4 | | | | 45.2 | |

2025 | | | 29.7 | | | | 1.7 | | | | 31.4 | |

After 2025 | | | 69.3 | | | | 5.1 | | | | 74.4 | |

Total lease payments | | | 348.9 | | | | 29.3 | | | | 378.2 | |

Less: Imputed interest | | | 44.4 | | | | 3.2 | | | | 47.6 | |

Present value of lease liabilities | | $ | 304.5 | | | $ | 26.1 | | | $ | 330.6 | |

Weighted-average remaining lease term (years) | | | 5.5 | | | | 5.0 | | | | | |

Weighted-average discount rate | | | 5.0 | % | | | 4.3 | % | | | | |

Future sublease income for the above periods shown was excluded as the amounts are not material.

Supplemental cash flow information related to leases for the three months ended March 31, 2021 and 2020 (unaudited) was as follows:

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Cash paid for amounts included in the measurement of lease liabilities | | | | | | | | |

Operating cash outflows related to operating leases | | $ | 24.0 | | | $ | 50.3 | |

Operating cash outflows related to interest on finance leases | | | 0.3 | | | | 0.2 | |

Financing cash outflows related to finance leases | | | 2.1 | | | | 0.8 | |

Leased assets obtained in exchange for new operating liabilities | | | 1.7 | | | | 8.1 | |

Leased assets obtained in exchange for new finance lease liabilities | | | — | | | | 2.1 | |

3. Restructuring and Other Integration Related Costs

The Company has incurred certain restructuring and other integration related costs related to pre-acquisition matters that were expensed as incurred, which include:

| • | Costs (primarily severance and relocation costs) related to a series of Company initiated workforce reductions to increase organizational effectiveness and provide cost savings that can be reinvested in the Company's growth initiatives, during 2021 and 2020 (included within Cost of services and General and administrative expenses within the Condensed Consolidated Statements of Income (Loss)); and |

11

Table of Contents

| • | Other integration related costs related to pre-acquisition matters (included within Cost of services and General and administrative expenses within the Consolidated Statements of Income (Loss)). |

The restructuring and other integration related costs for the three months ended March 31, 2021 and 2020 (unaudited) were as follows:

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Cost of services - lease type contracts | | $ | 0.2 | | | $ | 0.2 | |

Cost of services - management type contracts | | | 1.6 | | | | 0.2 | |

General and administrative expenses | | | 0.7 | | | | 0.5 | |

The accrual for restructuring and other integration related costs related to pre-acquisition matters of $2.5 million and $1.2 million is included in Accrued and other current liabilities within the Condensed Consolidated Balance Sheets as of March 31, 2021 and December 31, 2020, respectively.

4. Revenue

Contracts with customers and clients

The Company accounts for a contract when it has the approval and commitment from both parties, the rights of the parties are identified, payment terms are identified, the contract has commercial substance and collectability of consideration is probable. Once a contract is identified, the Company evaluates whether the contract should be accounted for as more than one performance obligation. Substantially all of the Company's revenues come from the following two types of arrangements: Lease type and Management type contracts.

Lease type contracts

Under lease type arrangements, the Company pays the property owner a fixed base rent, percentage rent that is tied to the facility’s financial performance, or a combination of both. The Company operates the parking facility and is responsible for most operating expenses, but typically is not responsible for major maintenance, capital expenditures or real estate taxes. Performance obligations related to lease type contracts include parking for transient and monthly parkers. Revenue is recognized over time as the Company provides services. As noted in Note 1. Significant Accounting Policies and Practices and in accordance with Topic 853, certain expenses, primarily rental expense for the contractual arrangements that meet the definition of service concession arrangements, are recorded as a reduction of revenue.

Management type contracts

Management type contract revenue consists of management fees, including both fixed and performance-based fees. In exchange for this consideration, the Company may have a bundle of integrated services that comprise one performance obligations and include services such as managing the facility as well as ancillary services such as accounting, equipment leasing, consulting, insurance and other value-added services. The Company believes that it can generally purchase required insurance for the facility and facility operations at lower rates than clients can obtain on their own because the Company is effectively self-insured for all liability, workers' compensation and health care claims by maintaining a large per-claim deductible. As a result, the Company generates operating income on the insurance provided under its management type contracts by focusing on risk management efforts and controlling losses. Management type contract revenues do not include gross customer collections at the managed facilities as these revenues belong to the property owners rather than the Company. Management type contracts generally provide the Company with management fees regardless of the operating performance of the underlying facilities. Revenue is recognized over time as the Company provides services.

Service concession arrangements

Service concession agreements include both lease type and management type contracts. Revenue generated from service concession arrangements is accounted for under the guidance of Topics 606 and 853. Certain expenses (primarily rental expense) related to service concession arrangements and depreciation and amortization, have been recorded as a reduction of Service revenue - lease type contracts.

As a result of COVID-19, the Company was able to negotiate cost reductions on certain lease type contracts related to service concession arrangements. As a result, the Company recorded $13.4 million related to cost concessions (which increased revenue pursuant to Topic 853) during the three months ended March 31, 2021. The Company did 0t receive any similar cost concessions during the three months ended March 31, 2020.

Contract modifications and taxes

Contracts are often modified to account for changes in contract specifications and requirements. The Company considers contract modifications to exist when the parties to the contract have approved changes to or new enforceable rights and obligations, which may include changes to the contract consideration due to the Company or creates new performance obligations. The Company assesses whether a contract modification results in either a new separate contract, the termination of

12

Table of Contents

the existing contract and creation of a new contract, or modifies the existing contract. Typically, modifications are accounted for prospectively.

Taxes assessed by a governmental authority that are both imposed on and concurrent with a specific revenue-producing transaction, which are collected by the Company from a customer, are excluded from revenue.

Reimbursed management type contract revenue and expense

The Company recognizes both revenues and expenses, in equal amounts, that are directly reimbursed from the property owner for operating expenses incurred under a management type contract. The Company has determined it is the principal in these transactions, as the nature of its performance obligations is for the Company to provide the services on behalf of the customer. As the principal to these related transactions, the Company has control of the promised services before they are transferred to the client.

Disaggregation of revenue

The Company disaggregates its revenue from contracts with customers by type of arrangement for each of the reportable segments. The Company has concluded that such disaggregation of revenue best depicts the overall economic nature, timing and uncertainty of the Company's revenue and cash flows affected by the economic factors of the respective contractual arrangement. See Note 14. Segment Information for further information on disaggregation of the Company's revenue by segment.

Performance obligations

A performance obligation is a promise in a contract to transfer a distinct good or service to the customer or client, and is the unit of account under Topic 606. The contract transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied. The majority of the Company's contracts have a single performance obligation that is not separately identifiable from other promises in the contract and therefore not distinct, comprising the promise to provide a bundle of monthly services or parking services for transient or monthly parkers.

The contract price is generally deemed to be the transaction price. Some management type contracts include performance incentives that are based on variable performance measures. These incentives are constrained at contract inception and recognized once the customer has confirmed that the Company has met the contractually agreed upon performance measures as defined in the contract.

The Company's performance obligations are primarily satisfied over time as the Company provides the related services. Typically, revenue is recognized over time on a straight-line basis as the Company satisfies the related performance obligation. There are certain management type contracts where revenue is recognized based on costs incurred to date plus a reasonable margin. The Company has concluded this is a faithful depiction of how control is transferred to the customer. Performance obligations satisfied at a point in time for the three months ended March 31, 2021 and 2020, respectively, were not significant.

The time between completion of the performance obligation and collection of cash is typically not more than 30 - 60 days. In certain contractual arrangements, such as monthly parker contracts, cash is typically collected in advance of the Company commencing its performance obligations under the contractual arrangement.

On March 31, 2021, the Company had $108.9 million related to performance obligations that were unsatisfied or partially unsatisfied for which the Company expects to recognize revenue. This amount excludes variable consideration primarily related to contracts where the Company and customer share the gross revenues or operating profit for the location and contracts where transaction prices include performance incentives that are constrained at contract inception. These performance incentives are based on measures that are ascertained exclusively by future performance and therefore cannot be estimated at contract inception by the Company. The Company applies the practical expedient that permits exclusion of information about the remaining performance obligations that have original expected durations of one year or less.

The Company expects to recognize the remaining performance obligations as revenue in future periods as follows:

(millions) (unaudited) | | Remaining Performance Obligations | |

2021 | | $ | 39.0 | |

2022 | | | 30.7 | |

2023 | | | 20.8 | |

2024 | | | 10.6 | |

2025 | | | 4.5 | |

2026 and thereafter | | | 3.3 | |

Total | | $ | 108.9 | |

Contract balances

The timing of revenue recognition, billings and cash collections results in accounts receivable, contract assets and contract liabilities. Accounts receivable represent amounts where the Company has an unconditional right to the consideration and

13

Table of Contents

therefore only the passage of time is required for the Company to receive consideration due from the customer. Both lease and management type contracts have customers and clients where amounts are billed as work progresses or in advance in accordance with agreed-upon contractual terms. Billing may occur subsequent to or prior to revenue recognition, resulting in contract assets and contract liabilities. The Company, on occasion, receives advances or deposits from customers and clients, on both lease and management type contracts, before revenue is recognized, resulting in the recognition of contract liabilities.

Contract assets and liabilities are reported on a contract-by-contract basis and are included in Accounts and notes receivable, net, and Accrued and other current liabilities, respectively, on the Condensed Consolidated Balance Sheets. There were 0 impairment charges recorded on contract assets and contract liabilities for the three months ended March 31, 2021 and 2020.

The following table provides information about accounts receivable, contract assets and contract liabilities with customers and clients as of March 31, 2021 (unaudited) and December 31, 2020:

(millions) | | March 31, 2021 | | | December 31, 2020 | |

Accounts receivable | | $ | 96.1 | | | $ | 102.7 | |

Contract asset | | | 6.0 | | | | 8.6 | |

Contract liability | | | (8.2 | ) | | | (12.5 | ) |

Changes in contract assets which include recognition of additional consideration due from the customer are offset by reclassifications of contract asset balances to accounts receivable when the Company obtains an unconditional right to consideration, thereby establishing an accounts receivable. The following table provides information about changes to contract asset balances during the three months ended March 31, 2021 and 2020 (unaudited):

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Balance, beginning of period | | $ | 8.6 | | | $ | 11.0 | |

Additional contract assets | | | 6.0 | | | | 10.2 | |

Reclassification to accounts receivable | | | (8.6 | ) | | | (11.0 | ) |

Balance, end of period | | $ | 6.0 | | | $ | 10.2 | |

Changes in contract liabilities primarily include additional contract liabilities and reductions of contract liabilities when revenue is recognized. The following table provides information about changes to contract liability balances during the three months ended March 31, 2021 and 2020 (unaudited):

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Balance, beginning of period | | $ | (12.5 | ) | | $ | (19.4 | ) |

Additional contract liabilities | | | (8.2 | ) | | | (13.5 | ) |

Recognition of revenue from contract liabilities | | | 12.5 | | | | 19.4 | |

Balance, end of period | | $ | (8.2 | ) | | $ | (13.5 | ) |

Cost of contracts, net

Cost of contracts, net, represents the cost of obtaining contractual rights associated with providing services for management type contracts. Incremental costs incurred to obtain service contracts are amortized on a straight line basis over the estimated life of the contracts, including anticipated renewals and terminations. The amortization period is consistent with the timing of when the Company satisfies the related performance obligations. Estimated lives are based on the contract life.

Amortization expense related to cost of contracts not considered service concession arrangements is included within Depreciation and amortization in the Condensed Consolidated Statements of Income (Loss). Amortization expense of cost of contracts related to service concession arrangements within the scope of Topic 853 and certain management type contracts are recorded as a reduction of revenue and were not significant for the three months ended March 31, 2021 and 2020, respectively. Amortization expense related to cost of contracts for the three months ended March 31, 2021 and 2020 (unaudited) was as follows:

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Amortization expense | | $ | 0.3 | | | $ | 0.4 | |

As of March 31, 2021 and December 31, 2020, cost of contracts net of accumulated amortization included on the Condensed Consolidated Balance Sheets within Other noncurrent assets was $4.4 million and $4.8 million, respectively. NaN impairment charges were recorded for the three months ended March 31, 2021 and 2020, respectively.

14

Table of Contents

5. Legal and Other Commitments and Contingencies

The Company is subject to claims and litigation in the normal course of its business, including those related to labor and employment, contracts, personal injury and other related matters, some of which allege substantial monetary damages and claims. Some of these actions may be brought as class actions on behalf of a class or purported class of employees. While the outcomes of claims and legal proceedings brought against the Company are subject to significant uncertainty, management believes the final outcome will not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

The Company accrues a charge when management determines that it is probable that an asset has been impaired or a liability has been incurred and the amount of loss can be reasonably estimated. When a loss is probable, the Company records an accrual based on the reasonably estimable loss or range of loss. When no point of loss is more likely than another, the Company records the lowest amount in the estimated range of loss and disclose the estimated range. The Company does 0t record liabilities for reasonably possible loss contingencies, but does disclose a range of reasonably possible losses if they are material and the Company is able to estimate such a range. If the Company cannot provide a range of reasonably possible losses, the Company explains the factors that prevent the Company from determining such a range. In addition, the Company accrues for the authoritative judgments or assertions made against the Company by government agencies at the time of their rendering regardless of The Company’s intent to appeal. The Company regularly evaluates current information available to the Company to determine whether an accrual should be established or adjusted. Estimating the probability that a loss will occur and estimating the amount of a loss or a range of loss involves significant estimation and judgment.

6. Other Intangible Assets, net

The components of other intangible assets, net, at March 31, 2021 (unaudited) and December 31, 2020 were as follows:

| | | | | | March 31, 2021 | | | December 31, 2020 | |

(millions) | | Weighted Average Life (Years) | | | Intangible Assets, Gross | | | Accumulated Amortization | | | Intangible Assets, Net | | | Intangible Assets, Gross | | | Accumulated Amortization | | | Intangible Assets, Net | |

Covenant not to compete | | | 2.0 | | | $ | 2.9 | | | $ | (1.5 | ) | | $ | 1.4 | | | $ | 2.9 | | | $ | (1.3 | ) | | $ | 1.6 | |

Trade names and trademarks | | | 2.7 | | | | 0.9 | | | | (0.3 | ) | | | 0.6 | | | | 0.9 | | | | (0.2 | ) | | | 0.7 | |

Proprietary know how | | | 3.4 | | | | 3.8 | | | | (0.6 | ) | | | 3.2 | | | | 3.8 | | | | (0.4 | ) | | | 3.4 | |

Management contract rights | | | 7.9 | | | | 81.0 | | | | (43.9 | ) | | | 37.1 | | | | 81.0 | | | | (42.6 | ) | | | 38.4 | |

Customer relationships | | | 12.7 | | | | 21.5 | | | | (2.8 | ) | | | 18.7 | | | | 21.5 | | | | (2.5 | ) | | | 19.0 | |

Other intangible assets, net | | | 8.9 | | | $ | 110.1 | | | $ | (49.1 | ) | | $ | 61.0 | | | $ | 110.1 | | | $ | (47.0 | ) | | $ | 63.1 | |

Amortization expense related to intangible assets for the three months ended March 31, 2021 and 2020 (unaudited), respectively, which was included in Depreciation and amortization within the Condensed Consolidated Statements of Income (Loss), was as follows:

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Amortization expense | | $ | 2.1 | | | $ | 3.9 | |

7. Goodwill

The changes to the carrying amount of goodwill for the three months ended March 31, 2021 (unaudited) were as follows:

(millions) | | Commercial | | | Aviation | | | Total | |

Net book value as of December 31, 2020 | | | | | | | | | | | | |

Goodwill | | $ | 377.1 | | | $ | 209.0 | | | $ | 586.1 | |

Accumulated impairment losses | | | 0 | | | | (59.5 | ) | | | (59.5 | ) |

Total | | $ | 377.1 | | | $ | 149.5 | | | $ | 526.6 | |

Foreign currency translation | | | 0.1 | | | | 0 | | | | 0.1 | |

Net book value as of March 31, 2021 | | | | | | | | | | | | |

Goodwill | | $ | 377.2 | | | $ | 209.0 | | | $ | 586.2 | |

Accumulated impairment losses | | | 0 | | | | (59.5 | ) | | | (59.5 | ) |

Total | | $ | 377.2 | | | $ | 149.5 | | | $ | 526.7 | |

15

Table of Contents

8. Borrowing Arrangements

Long-term borrowings as of March 31, 2021 (unaudited) and December 31, 2020, in order of preference, were as follows:

| | Amount Outstanding | |

(millions) | | March 31, 2021 | | | December 31, 2020 | |

Senior Credit Facility, net of original discount on borrowings(1) | | $ | 343.9 | | | $ | 332.3 | |

Other borrowings | | | 29.2 | | | | 31.5 | |

Deferred financing costs | | | (2.2 | ) | | | (1.7 | ) |

Total obligations | | | 370.9 | | | | 362.1 | |

Less: Current portion of long-term obligations under Senior Credit Facility and other long-term borrowings | | | 26.1 | | | | 25.0 | |

Total long-term obligations under Senior Credit Facility and other borrowings | | $ | 344.8 | | | $ | 337.1 | |

| (1) | Includes discount on borrowings of $0.8 million and $0.9 million as of March 31, 2021 and December 31, 2020, respectively. |

Senior Credit Facility

On February 16, 2021 (the “Fourth Amendment Effective Date”), the Company entered into the fourth amendment (the “Fourth Amendment”) to the Company’s credit agreement (as amended prior to the Fourth Amendment Effective Date (as defined below), the “Credit Agreement”) with Bank of America, N.A. (“Bank of America”), as Administrative Agent, swing-line lender and a letter of credit issuer; Wells Fargo Bank, N.A., as syndication agent; BMO Harris Bank N.A., JPMorgan Chase Bank, N.A., KeyBank National Association and U.S. Bank National Association, as co-documentation agents; Merrill Lynch, Pierce, Fenner & Smith Incorporated and Wells Fargo Securities, LLC, as joint lead arrangers and bookrunners; and the lenders party thereto (the “Lenders”), pursuant to which the Lenders have made available to the Company a senior secured credit facility (the “Senior Credit Facility”). Prior to the Fourth Amendment Effective Date and pursuant to the third amendment (the “Third Amendment”) to the Credit Agreement, which was entered into on May 6, 2020, the Senior Credit Facility permitted aggregate borrowings of $595.0 million consisting of (i) a revolving credit facility of up to $370.0 million at any time outstanding, which includes a letter of credit facility that is limited to $100.0 million at any time outstanding, and (ii) a term loan facility of $225.0 million (the entire principal amount of which the Company withdrew November 30, 2018). Pursuant to the Credit Agreement as amended by the Fourth Amendment (the “Amended Credit Agreement”), the aggregate commitments under the revolving credit facility decreased by $45.0 million to $325.0 million.

Borrowings under the Senior Credit Facility bear interest, at the Company’s option, at a rate per annum based on the Company’s consolidated total debt to EBITDA ratio for the 12-month period ending as of the last day of the immediately preceding fiscal quarter, determined in accordance with (i) the applicable pricing levels set forth in the Credit Agreement (the “Applicable Margin”) for London Interbank Offered Rate (“LIBOR”) loans, subject to a “floor” on LIBOR of 1.00%, or a comparable or successor rate to LIBOR approved by Bank of America, plus the applicable LIBOR rate, or (ii) the Applicable Margin for base rate loans plus the highest of (x) the federal funds rate plus 0.5%, (y) the Bank of America prime rate and (z) a daily rate equal to the applicable LIBOR rate plus 1.0%, except that the Fourth Amendment provided that, for the period from May 6, 2020 until the date on which the Company delivers a compliance certificate for the fiscal quarter ending June 30, 2022, (i) the interest rate applicable to both the term loan and revolving credit facilities was fixed at LIBOR plus 2.75% per annum and (ii) the per annum rate applicable to unused revolving credit facility commitments was fixed at 0.375% (the “Fixed Margin Rates”).

Also pursuant to the Fourth Amendment, (a) the Company is subject to a Minimum Liquidity (as described in the Amended Credit Agreement) test that requires the Company to have liquidity of at least $40.0 million at each of March 31, 2021 and June 30, 2021, and (b) the Company is subject to a requirement that, at any time cash on hand exceeds $40.0 million for a period of three consecutive business days, the Company must repay revolving loans in an amount equal to such excess. Certain other negative and financial covenants were amended, which included restrictions on certain Investments, Permitted Acquisitions, Restricted Payments and Prepayments of Subordinated Debt (each as defined in the Amended Credit Agreement), through the delivery of the compliance certificate for the fiscal quarters ending March 31, 2022 or June 30, 2022, as applicable.

16

Table of Contents

Prior to the Fourth Amendment Effective Date, the Company was required to maintain a maximum consolidated total debt to EBITDA ratio of between 5.50:1.0 and 3.50:1.0 (with such ratio being waived for the fiscal quarter ended June 30, 2020 and with certain step-ups and step-downs described in, and as calculated in accordance with, the Amended Credit Agreement). In addition, the Company was required to maintain a minimum consolidated fixed charge coverage ratio of not less than 3.50:1.0 (with certain step-ups and step-downs described in the Amended Credit Agreement). Under the terms of the Fourth Amendment, the maximum consolidated debt to EBITDA ratio is waived for each of the quarters ending March 31, 2021 and June 30, 2021. Starting with the quarter ending September 30, 2021, the Company will be required to maintain a maximum consolidated total debt to EBITDA ratio (as calculated in accordance with the Fourth Amendment) of not greater than 5.25:1.0 (with certain step-downs described in the Amended Credit Agreement). As of March 31, 2021, the Company was required to maintain a minimum consolidated fixed coverage ratio of not less than 1.60:1:0 (with certain step-ups and step-downs described in the Amended Credit Agreement).

During the three months ended March 31, 2021, the Company incurred approximately $1.2 million for fees and other customary closing costs in connection with the Amended Credit Agreement.

Under the terms of the Amended Credit Agreement, term loans under the Senior Credit Facility were subject to scheduled quarterly payments of principal in installments equal to 1.25% of initial aggregate principal amount of such term loan through the first quarter of 2021 and will increase to 1.875% thereafter.

Events of default under the Credit Agreement include failure to pay principal or interest when due, failure to comply with the financial and operational covenants, the occurrence of any cross default event, non-compliance with other loan documents, the occurrence of a change of control event, and bankruptcy and other insolvency events. If an event of default occurs and is continuing, the Administrative Agent can, with the consent of the required Lenders, among others, (i) terminate the commitments under the Credit Agreement, (ii) accelerate and require the Company to repay all the outstanding amounts owed under the Credit Agreement, and (iii) require the Company to cash collateralize any outstanding letters of credit.

Each wholly owned domestic subsidiary of the Company (subject to certain exceptions set forth in the Credit Agreement) has guaranteed all existing and future indebtedness and liabilities of the other guarantors and the Company arising under the Credit Agreement. The Company’s obligations under the Credit Agreement and such domestic subsidiaries’ guaranty obligations are secured by substantially all of their respective assets. The Senior Credit Facility matures on November 30, 2023. The proceeds from the Senior Credit Facility may be used to finance working capital, capital expenditures and acquisitions, as well as for other general corporate purposes. The Amended Credit Agreement did not change the guarantors, collateral, maturity date or permitted uses of proceeds, except as otherwise described above.

As of March 31, 2021, the Company was in compliance with its debt covenants under the Credit Agreement.

At March 31, 2021, the Company had $49.5 million of letters of credit outstanding under the Senior Credit Facility and borrowings against the Senior Credit Facility aggregated to $344.7 million.

The weighted average interest rate on the Company's Senior Credit Facility was 3.6% and 2.6% for the periods ended March 31, 2021 and 2020, respectively. That rate included all outstanding LIBOR contracts and letters of credit. The weighted average interest rate on all outstanding borrowings, not including letters of credit, was 3.8% and 2.7%, at March 31, 2021 and 2020, respectively.

Interest Rate Collars

In May 2019, the Company entered into three-year interest rate collar contracts with an aggregate notional amount of $222.3 million and maturity dates of April 2022. The interest rate collars were used to manage interest rate risk associated with variable interest rate borrowings under the Credit Agreement. The interest rate collars established a range where the Company will pay the counterparties if the one-month LIBOR rate falls below the established floor rate, and the counterparties will pay the Company if the one-month LIBOR rate exceeds the established ceiling rate of 2.5%. The interest rate collars settle monthly through the maturity date. No payments or receipts are exchanged on the interest rate collar contracts unless interest rates rise above or fall below the pre-determined ceiling or floor rates. The notional amount amortized consistently with the term loan portion of the Senior Credit Facility under the Credit Agreement prior to the Third Amendment. The fair value of the interest rate collars is a Level 2 fair value measurement, as the fair value is determined based on quoted prices of similar items in active markets. As of March 31, 2021 and December 31, 2020, the liability for interest rate collars of $2.5 million and $3.1 million, respectively, was included in Other noncurrent liabilities in the Condensed Consolidated Balance Sheets. The interest rate collars were classified as cash flow hedges through May 5, 2020.

On May 6, 2020, concurrent with entering into the Third Amendment, the Company de-designated the three-year interest rate collars. Prior to de-designation, the effective portion of the change in the fair value of the interest rate collars was reported in Accumulated other comprehensive loss. Upon de-designation, the balance in Accumulated other comprehensive loss is being reclassified to Other expense (income) in the Condensed Consolidated Statements of Income (Loss) on a straight-line basis through April 2022, which is over the remaining life for which the interest rate collars had previously been designated as cash flow hedges. Changes in the fair value of the interest rate collars after de-designation are included within Other expense (income) in the Condensed Consolidated Statements of Income (Loss). For the three months ended March 31, 2021, $0.6 million of interest was paid for the interest rate collars.

17

Table of Contents

See Note 13. Comprehensive Income (Loss) for the amount of loss recognized in Other Comprehensive income (loss) on the interest rate collars and the loss reclassified from Accumulated other comprehensive loss to the Condensed Consolidated Statements of Income (Loss) during the three months ended March 31, 2021.

Subordinated Convertible Debentures

The Company acquired Subordinated Convertible Debentures ("Convertible Debentures") as a result of the October 2, 2012 acquisition of Central Parking Corporation. The subordinated debenture holders have the right to redeem the Convertible Debentures for $19.18 per share upon their stated maturity (April 1, 2028) or upon acceleration or earlier repayment of the Convertible Debentures. The Convertible Debentures mature at $25 per share. There were 0 redemptions of Convertible Debentures during the periods ended March 31, 2021 and December 31, 2020, respectively. The approximate redemption value of the Convertible Debentures outstanding at each of March 31, 2021 and December 31, 2020 was $1.1 million.

9. Stock Repurchase Program

In July 2019, the Company's Board of Directors (“Board”) authorized the Company to repurchase, on the open market, shares of the Company’s outstanding common stock in an amount not to exceed $50.0 million in aggregate. During the three months ended March 31, 2020, the Company repurchased 393,975 shares of common stock at an average price of $38.78 under this program. During the three months ended March 31, 2021, 0 shares were repurchased under this program.

In March 2020, the Board authorized the Company to repurchase, on the open market, shares of the Company’s outstanding common stock in an amount not to exceed $50.0 million in aggregate. NaN shares have been repurchased under this program.

As of March 31, 2021, $50.0 million and $9.4 million remained available for repurchase under the March 2020 and July 2019 stock repurchase programs, respectively. Under the programs, repurchases of the Company's common stock may be made in open market transactions effected through a broker-dealer at prevailing market prices, in block trades or by other means in accordance with Rules 10b-18, to the extent relied upon, and 10b5-1 under the Exchange Act, at times and prices considered to be appropriate at the Company's discretion. The stock repurchase programs do not obligate the Company to repurchase any particular amount of common stock, have no fixed termination date, and may be suspended at any time at the Company's discretion. On March 10, 2020 and continuing through March 31, 2021, in order to improve the Company's liquidity during COVID-19, the Company suspended repurchases under the stock repurchase programs.

Share repurchase activity under the stock repurchase programs during the three months ended March 31, 2021 and 2020 (unaudited) was as follows:

| | Three Months Ended | |

(millions, except for share and per share data) | | March 31, 2021 | | | March 31, 2020 | |

Total number of shares repurchased | | | — | | | | 393,975 | |

Average price paid per share | | $ | — | | | $ | 38.78 | |

Total value of shares repurchased | | $ | — | | | $ | 15.3 | |

The remaining authorized repurchase amounts in the aggregate under the July 2019 and March 2020 repurchase programs as of March 31, 2021 (unaudited) was as follows:

(millions) | | March 31, 2021 | |

Total authorized repurchase amount | | $ | 100.0 | |

Total value of shares repurchased | | | 40.6 | |

Total remaining authorized repurchase amount | | $ | 59.4 | |

10. Bradley Agreement

In February 2000, the Company, through a partnership agreement with a minority partner (the “Partnership”), entered into a 25-year agreement (the "Bradley Agreement") with the State of Connecticut (the “State”) that was due to expire on April 6, 2025, under which the Company would operate garage and surface parking spaces at Bradley International Airport (“Bradley”) located in the Hartford, Connecticut metropolitan area.

Under the terms of the Bradley Agreement, the parking garage was financed through the issuance of State of Connecticut special facility revenue bonds and provided that the Company deposited, with the trustee for the bondholders, all gross revenues collected from operations of the garage and surface parking. From those gross revenues, the trustee paid debt service on the special facility revenue bonds outstanding, operating and capital maintenance expenses of the garage and surface parking facilities, and specific annual guaranteed minimum payments to the State. All of the cash flows from the parking facilities were pledged as the security of the special facility revenue bonds and were collected and deposited with the bond trustee. Each month the bond trustee made certain required monthly distributions, which were characterized as “Guaranteed Payments.” To the extent the monthly gross receipts generated by the parking facilities were not sufficient for the bond trustee to make the required Guaranteed Payments, the Company was obligated to deliver the deficiency amount to the bond trustee, with such deficiency payments representing interest bearing advances to the bond trustee.

18

Table of Contents

On June 30, 2020, the Company and the State agreed to terminate the Bradley Agreement, with an effective date of May 31, 2020 (the “Termination Agreement”). The Company then entered into a management type contract with the Connecticut Airport Authority, effective June 1, 2020 (the “Bradley Management Agreement”), under which the Company will provide the same parking services for Bradley.

Under the terms of the Bradley Management Agreement, the Company is no longer required to make deficiency payments. In addition, other than the contingent consideration discussed below, the Company has no other ongoing obligations under the Bradley Agreement.

On June 30, 2020, concurrent with the termination of the Bradley Agreement and effective as of May 31, 2020, the Company entered into an agreement to purchase the minority partners’ share in the Partnership previously established to execute the Bradley Agreement for a total cash consideration of $1.7 million. The consideration was paid in cash during the year ended December 31, 2020. Under the terms of the Termination Agreement, the Company may be required to pay additional consideration (“contingent consideration”) to the minority partner, that is contingent on the performance of the operations of Bradley. The contingent consideration is not capped and if any, would be payable to the minority partner in April 2025. Based on a probability weighting of potential payouts, the criteria to accrue for such potential payments had not been met and the contingent consideration was estimated to have no fair value as of March 31, 2021. The Company will continue to evaluate the criteria for making these payments in the future and accrue for such potential payments if deemed necessary.

11. Stock-Based Compensation

Stock Grants

There were 0 stock grants granted during the three months ended March 31, 2021 and 2020, respectively. The Company recognized 0 stock-based compensation expense related to stock grants for the three months ended March 31, 2021 and 2020, respectively.

Restricted Stock Units

During the three months ended March 31, 2021, the Company granted 160,843 and 152,659 restricted stock units to certain executives and employees that vest over two and three years, respectively.

Nonvested restricted stock units as of March 31, 2021, and changes during the three months ended March 31, 2021 (unaudited) were as follows:

| | Shares | | | Weighted Average Grant-Date Fair Value | |

Nonvested as of December 31, 2020 | | | 51,276 | | | $ | 33.24 | |

Granted | | | 313,502 | | | | 34.45 | |

Nonvested as of March 31, 2021 | | | 364,778 | | | $ | 34.28 | |

The Company's stock-based compensation expense related to the restricted stock units for the three months ended March 31, 2021 and 2020 (unaudited), respectively, which is included in General and administrative expenses within the Condensed Consolidated Statements of Income (Loss), was as follows:

| | Three Months Ended | |

(millions) | | March 31, 2021 | | | March 31, 2020 | |

Stock-based compensation expense | | $ | 0.8 | | | $ | 0.3 | |

As of March 31, 2021, there was $10.6 million of unrecognized stock-based compensation costs related to the restricted stock units that are expected to be recognized over a weighted average remaining period of approximately 2.1 years.

Performance Share Units (“PSU’s”)

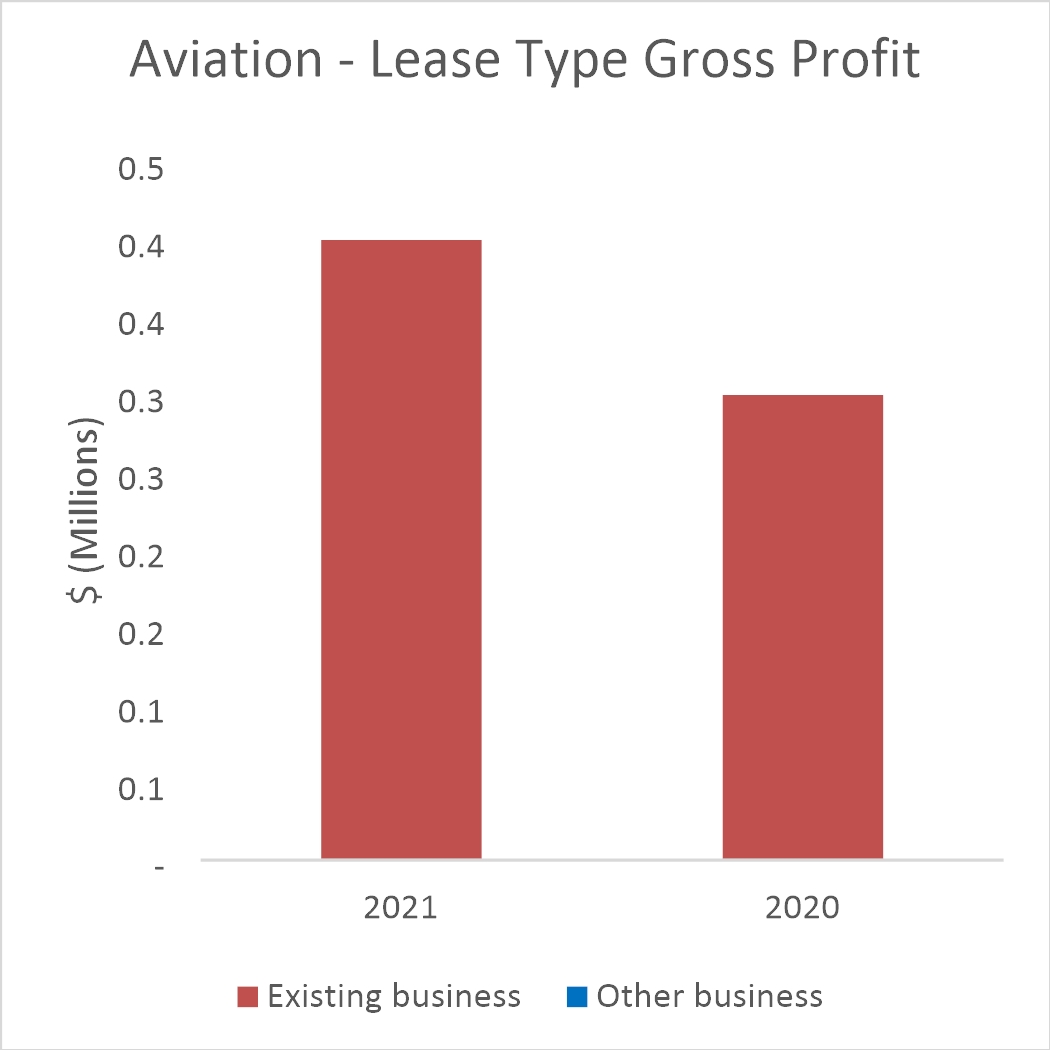

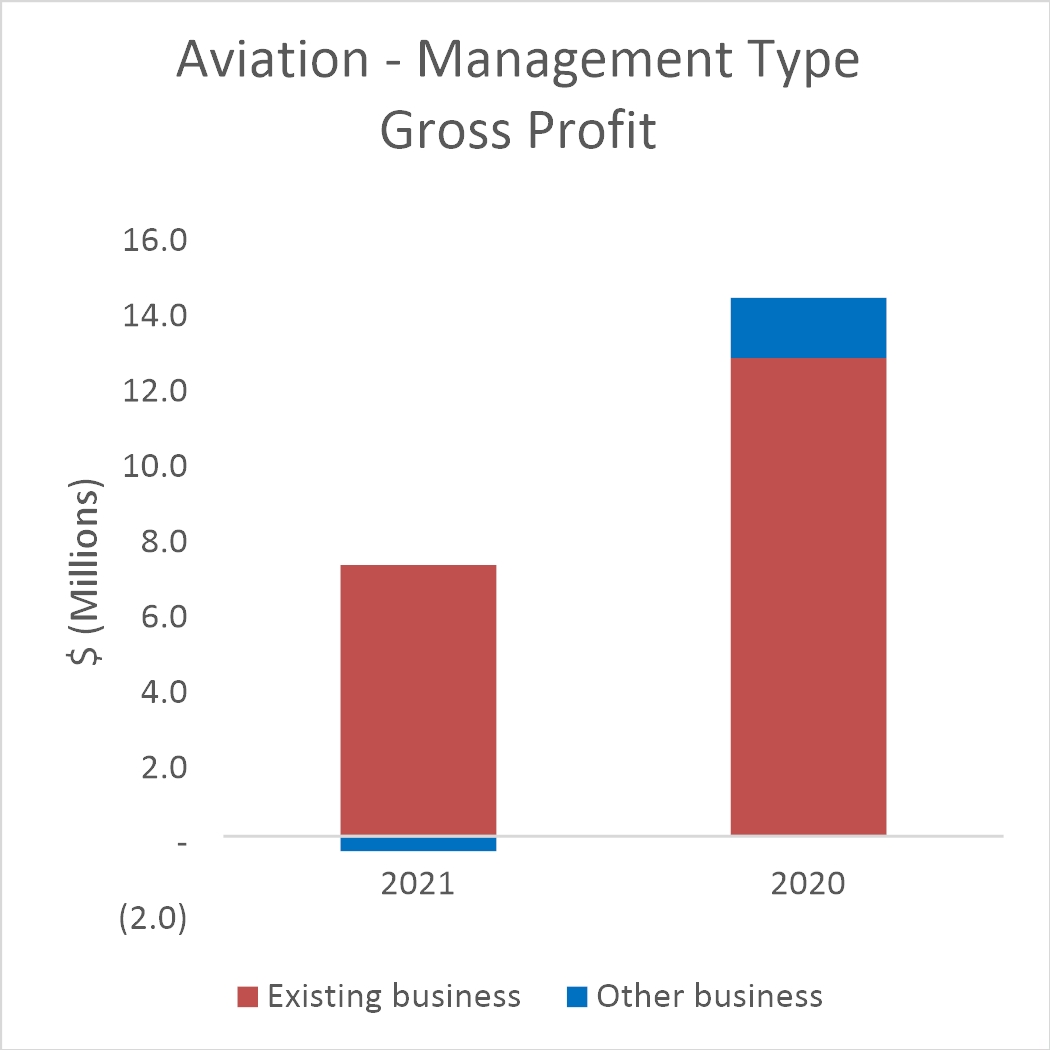

During the three months ended March 31, 2021, the Company granted 50,868 performance share units to certain executives. The performance target is based on the achievement of a certain level income from operations, excluding depreciation and amortization, as well as certain other discretionary adjustments by the Board, over the three-year performance period from 2021 through 2023. The ultimate number of shares issued could change depending on the Company’s results over the performance period. The maximum amount of shares that could be issued for the shares granted in 2021 are 101,736.