UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ |

|

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

|

☒ | Preliminary Proxy Statement |

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☐ | Definitive Proxy Statement |

| |

☐ | Definitive Additional Materials |

| |

☐ | Soliciting Material under §240.14a-12 |

SP PLUS CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): |

|

☒ | No fee required |

| |

☐ | Fee paid previously with preliminary materials |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| |

| | |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

DATED MARCH 20, 2023

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

2023

SP PLUS CORPORATION

SP+ CORPORATION 2023 PROXY STATEMENT |

SP PLUS CORPORATION

200 E. Randolph Street, Suite 7770

Chicago Illinois 60601-7702

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | |

Date and Time: | Place: | Record Date: |

May 10, 2023 1:00 p.m. Central time | AON Center 200 East Randolph Street 77th Floor | March 17, 2023 |

| Chicago, IL 60601 | |

| | |

Dear Stockholders:

We are pleased to invite you to the SP Plus Corporation 2023 Annual Meeting of Stockholders.

Proposals:

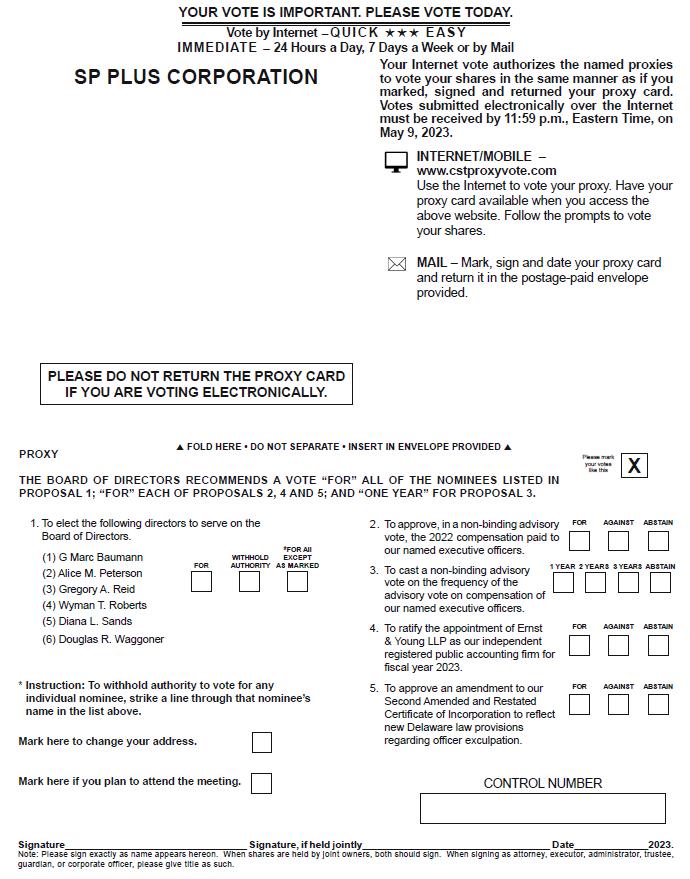

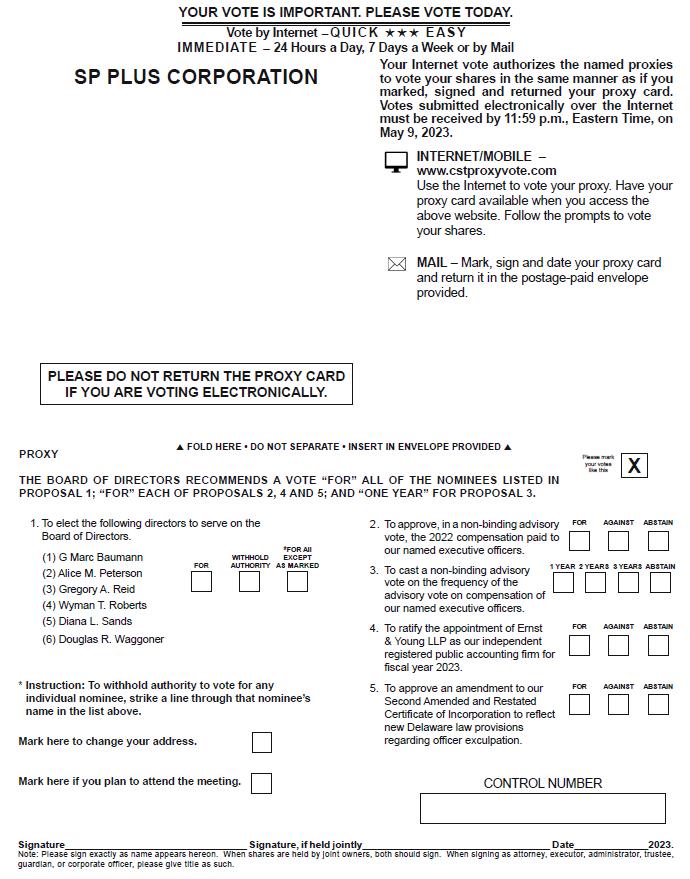

Item 1: | To elect the following directors to serve on the Board of Directors: G Marc Baumann, Alice M. Peterson, Gregory A. Reid, Wyman T. Roberts, Diana L. Sands and Douglas R. Waggoner. |

Item 2: | To consider and cast a non-binding advisory vote on a resolution approving the 2022 compensation paid to our named executive officers. |

Item 3: | To consider an advisory vote on the frequency of the advisory vote on compensation of our named executive officers. |

Item 4: | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2023. |

Item 5: | To approve an amendment to our Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation. |

Stockholders may transact any other business that may be properly brought before the meeting, or any adjournments or postponements thereof.

Stockholders of record at the close of business on March 17, 2023 are entitled to notice of, and to vote at, the meeting or any adjournments or postponements thereof. On the Record Date, there were 23,424,685 shares of common stock of SP Plus Corporation issued and outstanding and entitled to vote at the meeting. A list of stockholders entitled to vote at the meeting will be available for inspection at our headquarters at least 10 days prior to the meeting and will also be available for inspection at the meeting.

Your vote is important! We strongly encourage you to exercise your right to vote as a stockholder, whether in person or by proxy. Whether or not you expect to be present at the meeting, to ensure that your vote will be counted, please complete, sign and date the enclosed proxy card and return it promptly in the envelope provided, or vote via Internet according to the instructions on the proxy card. Stockholders attending the meeting may vote in person even if they have previously returned proxy cards. You may vote by any one of the following methods.

Voting Methods:

• | Written ballot—Complete and return proxy card in the mail |

• | In person—Attend and vote at the meeting |

On behalf of the Board of Directors: | | |

| | |

Wenyu T. Blanchard | | |

Chief Legal Officer, Corporate Secretary | | |

| | |

Chicago, March 30, 2023 | | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be Held on May 10, 2023: The Proxy Statement and the 2022 Annual Report to Stockholders are available at http://www.cstproxy.com/spplus/2023 On this site, you will be able to access our 2023 Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and all amendments or supplements to the foregoing materials that are required to be furnished to stockholders. |

SP+ CORPORATION 2023 PROXY STATEMENT |

SP PLUS CORPORATION

200 E. Randolph Street, Suite 7700

Chicago, Illinois 60601-7702

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

SP+ CORPORATION 2023 PROXY STATEMENT |

i

SP+ CORPORATION 2023 PROXY STATEMENT |

ii

SP+ CORPORATION 2023 PROXY STATEMENT |

iii

GENERAL INFORMATION

SP+ blends industry-leading technology and best-in-class operations to deliver mobility solutions that enable the efficient movement of people, vehicles and personal belongings. We are committed to elevating the consumer experience while meeting the objectives of our diverse client base across North America and Europe. We are a leading provider of technology-driven mobility solutions for aviation, commercial, hospitality, healthcare and institutional clients. As of December 31, 2022, we employed approximately 19,000 employees, including 12,400 full-time and 6,600 part-time employees.

A copy of our 2022 Annual Report to Stockholders (the “Annual Report”), which includes our Form 10-K for the year ended December 31, 2022, accompanies this Proxy Statement and has been posted on the Internet with this Proxy Statement.

Our main website address is www.spplus.com. We make available free of charge on the Investor Relations section of our website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). We also make available through our website other reports filed with or furnished to the SEC under the Securities Exchange Act of 1934 (the “Exchange Act”), including our proxy statements and reports filed by officers and directors under Section 16(a) of that Act, as well as our Governance Guidelines for the Board of Directors, Code of Business Conduct, Code of Ethics for Certain Executives, and the charters of each of the Board’s committees. We do not intend for information made available through our website to be part of this Proxy Statement.

The SEC maintains an Internet site that contains reports, proxy statements and other information regarding issuers, like us, that file electronically with the SEC. The address of that website is www.sec.gov.

We use the terms “SP Plus,” “SP+,” “our company,” “the Company,” “we,” “our” and “us” in this Proxy Statement to refer to SP Plus Corporation and its consolidated subsidiaries unless the context otherwise requires.

Q: | Why am I receiving these materials? |

A: | Our Board of Directors (the “Board”) is soliciting your proxy for use at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on May 10, 2023. Under rules adopted by the SEC, we are now furnishing proxy materials on the Internet at http://www.cstproxy.com/spplus/2023, in addition to mailing paper copies of the Notice of Internet Availability and Proxy Card. These proxy materials are first being made available via the Internet on or about March 30, 2023, to holders of record of our common stock at the close of business on March 17, 2023 (the “Record Date”). Please note that SP Plus will commence mailing of the Notice of Internet Availability and proxy cards on or about March 30, 2023. |

Q: | When is the Annual Meeting? |

A: | We will hold the Annual Meeting on May 10, 2023 at 1:00 p.m., Central time, subject to any adjournments or postponements. |

Q: | Where will the Annual Meeting be held? |

A: | The Annual Meeting will be held at the AON Center, 200 East Randolph Street, 77th Floor, Chicago, IL 60601. |

Q: | What materials are being provided? |

A: | The Company is making available the following: |

| • | this Proxy Statement for the 2023 Annual Meeting; |

| • | a copy of our Annual Report, which includes our Form 10-K for the year ended December 31, 2022; and |

| • | a proxy card and voting instruction form for the Annual Meeting. |

Stockholders may obtain, free of charge, a copy of the exhibits to our Form 10-K by making a written request to our Investor Relations Team at SP Plus Corporation, Investor Relations, 200 E. Randolph Street, Suite 7700, Chicago Illinois 60601-7702, or by email at investor_relations@spplus.com.

Q: | Where can I find the 2022 audited financial statements for SP Plus? |

A: | The audited financial statements for our year ended December 31, 2022 are included in our Annual Report, which is available at www.cstproxy.com/spplus/2023 together with this Proxy Statement. You may also access these materials through our main website at www.spplus.com. |

SP+ CORPORATION 2023 PROXY STATEMENT |

1

Q: | What items will be voted on at the Annual Meeting? |

A: | Stockholders will vote on five items at the Annual Meeting: |

| • | to elect the following directors to serve on the Board of Directors: G Marc Baumann, Alice M. Peterson, Gregory A. Reid, Wyman T. Roberts, Diana L. Sands and Douglas R. Waggoner. (Proposal No. 1); |

| • | to consider and cast a non-binding advisory vote on a resolution approving the 2022 compensation paid to our named executive officers (Proposal No. 2); |

| • | to consider and cast a non-binding advisory vote on the frequency of the advisory vote on compensation of our named executive officers (Proposal No. 3); |

| • | to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2023 (Proposal No. 4); and |

| • | to approve an amendment to our Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (Proposal No. 5). |

Q: | What are the Board’s voting recommendations? |

A: | The Board recommends that you vote your shares: |

| • | “FOR” each of the nominees named in this Proxy Statement to the Board (Proposal No. 1); |

| • | “FOR” the resolution approving, in a non-binding advisory vote, the 2022 compensation paid to our named executive officers (Proposal No. 2); |

| • | “ONE YEAR” on the non-binding advisory vote recommending the frequency of advisory votes on executive compensation (Proposal No. 3); |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2023 (Proposal No. 4); and |

| • | “FOR” the amendment to our Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (Proposal No. 5). |

Q: | What other matters might arise at the meeting? |

A: | At the date of this Proxy Statement, the Board does not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. The proxies named in the proxy card are authorized to vote in their discretion upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Q: | What happens if a director nominee is unable to stand for election? |

A: | If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders may vote your shares for the substitute nominee. |

Q: | Who may vote at the Annual Meeting? |

A: | Each share of our common stock has one vote on each matter. Only stockholders of record as of the close of business on the Record Date are entitled to receive notice of, to attend, and to vote at the Annual Meeting. As of the Record Date, there were approximately 23,424,685 shares of our common stock outstanding. |

Q: | What is the difference between a stockholder of record and a beneficial owner of shares held in street name? |

A: | Stockholder of Record. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares of our common stock. |

Beneficial Owner of Shares Held in Street Name. If shares of our common stock are held by a broker, bank or other institution, serving as nominee, on your behalf (each referred to as a “broker”), you are considered the beneficial owner of those shares (sometimes referred to as being held in “street name”). If you are a beneficial owner but not a stockholder of record, you should follow the instructions provided by your broker, bank or other record holder to direct your broker on how to vote your shares.

Q: | If I am a stockholder of record of the Company’s shares, how do I vote? |

A: | Our stockholders of record may vote in person at the Annual Meeting or by proxy. There are two ways to vote by proxy: |

| • |  By Internet: by visiting www.cstproxyvote.com and following the on-screen instructions; or By Internet: by visiting www.cstproxyvote.com and following the on-screen instructions; or

|

| • |  By Mail: by marking, signing and dating your proxy card and returning it to us in the envelope provided. By Mail: by marking, signing and dating your proxy card and returning it to us in the envelope provided.

|

In order for your proxy to be validly submitted and for your shares to be voted in accordance with your proxy, we must receive the mailed proxy card prior to the start of the Annual Meeting. Additionally, Internet voting for stockholders will close at 11:59 p.m., Eastern time, on May 9, 2023.

SP+ CORPORATION 2023 PROXY STATEMENT |

2

Q: | If I hold my shares in street name, how do I vote? |

A: | If you hold your shares in street name, you may vote by following the instructions provided by your broker or, in order to vote in person at the Annual Meeting, you must comply with the procedures described below. |

Q: | What is the quorum requirement for the Annual Meeting? |

A: | A majority of the shares entitled to vote at the Annual Meeting must be present at the Annual Meeting in person or by proxy for the transaction of business. This is called a quorum. Your shares will be counted as present for purposes of determining if there is a quorum if you: |

| • | are entitled to vote and you are present at the Annual Meeting; or |

| • | have properly voted on the Internet or by submitting a proxy card form by mail. |

If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained. For purposes of determining a quorum, abstentions and broker non-votes are counted as present.

A: | All shares represented by valid proxies received prior to the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. |

Q: | What happens if I do not give specific voting instructions? |

A: | Stockholders of Record. If you are a stockholder of record and you signed and returned a proxy card without giving specific voting instructions, then the persons named as proxy holders, Wenyu T. Blanchard and Ritu Vig, will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. |

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will indicate on the proxy card that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

Q: | Which ballot measures are considered “routine” or “non-routine”? |

A: | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2023 (Proposal No. 4) is a matter considered routine under applicable rules. A broker or other nominee may generally vote on routine matters, and, therefore, no broker non-votes are expected to occur with respect to Proposal No. 4. |

The election of directors (Proposal No. 1), the non-binding advisory vote to approve compensation paid to our 2022 named executive officers (Proposal No. 2), the non-binding advisory vote on the frequency of the advisory vote on compensation of our named executive officers (Proposal No. 3) and the amendment to our Second Amended and Restated Certification of Incorporation to reflect new Delaware law provisions regarding officer exculpation (Proposal No. 5) are considered non-routine matters under applicable rules. A broker or other nominee may not vote without instructions on non-routine matters, and, therefore, broker non-votes may occur with respect to Proposals No. 1, No. 2, No. 3, and No. 5.

Q: | What is the voting requirement to approve each of the proposals? |

A: | With respect to the election of directors (Proposal No. 1), our bylaws currently provide for a plurality voting standard. Accordingly, under the plurality voting standard, the six nominees receiving the highest number of affirmative votes will be elected as directors to serve until the next annual meeting of stockholders and until their successors are duly elected and qualified. In other words, because there are no other nominees for election as directors other than the persons named in the enclosed proxy card and assuming each of those persons receives at least one vote, all of them will be re-elected to our Board. A properly executed proxy marked “Withhold Authority” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. |

The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote will be required to approve, in a non-binding advisory vote, the compensation paid to our 2022 named executive officers (Proposal No. 2).

The frequency of the advisory vote on executive compensation (Proposal No. 3) receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by stockholders.

Although the advisory votes on Proposals No. 2 and No. 3 are non-binding, our Board will review the voting results and will take them into account in making a determination concerning executive compensation and the frequency of such advisory votes.

SP+ CORPORATION 2023 PROXY STATEMENT |

3

The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote will be required to ratify the appointment of our independent registered public accounting firm (Proposal No. 4).

The affirmative vote of holders of a majority of the outstanding shares of stock entitled to vote on the proposal will be required to approve the amendment to our Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (Proposal No. 5).

Q: | How are broker non-votes and abstentions treated? |

A: | Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. With respect to Proposals No. 1 and No. 3, broker non-votes and abstentions would have no effect on the Proposals. With respect to Proposals No. 2 and No. 4, abstentions have the same effect as votes cast AGAINST each such matter and broker non-votes would have no effect on the Proposals. With respect to Proposal No. 5, abstentions and broker non-votes have the same effect as votes AGAINST the matter. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will be considered as present and entitled to vote, but will have no effect on the vote with respect to that matter. |

Q: | Can I change my vote after I have voted? |

A: | You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may change your vote on a later date via the Internet (in which case only your latest Internet proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card with a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you properly vote at the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation prior to the Annual Meeting to our Chief Legal Officer at 200 E. Randolph Street, Suite 7700, Chicago Illinois 60601-7702. |

Q: | As a stockholder, do I have dissenters’ or appraisal rights if I object to any of the proposals? |

A: | No. Our stockholders do not have rights of appraisal or similar rights of dissenters with respect to any of the proposals being presented at the Annual Meeting. |

Q: | Who will serve as the inspector of election? |

A: | Continental Stock Transfer and Trust, our transfer agent, has agreed to provide a representative to act as our Inspector of Election at the Annual Meeting and to assist us in tabulating stockholder votes. |

Q: | Is my vote confidential? |

A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within our company or to third parties, except: |

| • | as necessary to meet applicable legal requirements; |

| • | to allow for the tabulation and certification of votes; or |

| • | to facilitate a successful proxy solicitation. |

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to our management and the Board.

Q: | Who is paying for the cost of this proxy solicitation? |

A: | We are paying the costs of the solicitation of proxies. We have engaged Morrow Sodali LLC to assist in the solicitation of proxies for the Annual Meeting and will pay Morrow Sodali LLC an estimated fee of $6,000, plus any disbursements. The address of Morrow Sodali LLC is 333 Ludlowe Street, 5th Floor, South Tower, Stamford, Connecticut 06902. |

In addition to this notice, the Company encourages banks, brokers and other custodians, nominees and fiduciaries to supply proxy materials to beneficial owners, and reimburses them for their expenses. In addition to soliciting proxies by mail, certain of our directors, officers and regular employees, without any additional compensation, may solicit proxies on our behalf.

All costs of this solicitation will be borne by the Company.

Q: | How can I attend the Annual Meeting? |

A: | Only stockholders as of the Record Date are entitled to attend the Annual Meeting. You must present valid identification containing a photograph, such as a driver’s license or passport. If you are the stockholder of record, your name will be verified against a list of stockholders of record on the Record Date prior to being admitted to the Annual Meeting. If you hold your shares indirectly through a broker, you must bring (i) an acceptable form of identification, such as a driver’s license, (ii) a “legal proxy” form from the broker, and (iii) an account statement or other acceptable evidence showing that you were the beneficial owner of shares of our common stock on the Record Date. |

Q: | What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the next annual meeting of stockholders? |

A: | Requirements for Stockholder Proposals to Be Considered for Inclusion in our 2024 Proxy Materials. Stockholder proposals to be considered for inclusion in the form of proxy relating to the 2024 annual meeting of stockholders must be received no later than December 1, 2023. In addition, all proposals will need to comply with Rule 14a-8 under the Exchange Act, which lists requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals must be delivered to our company’s Chief Legal Officer by mail at 200 E. Randolph Street, Suite 7700, Chicago Illinois 60601-7702. |

SP+ CORPORATION 2023 PROXY STATEMENT |

4

Requirements for Stockholder Proposals to Be Brought Before the Next Annual Meeting of Stockholders and Director Nominations. Notice of any proposal that a stockholder intends to present at the 2024 annual meeting of stockholders, but does not intend to have included in the proxy statement and form of proxy relating to the 2024 annual meeting of stockholders, as well as any director nominations, must be delivered to our company’s Chief Legal Officer by mail at 200 E. Randolph Street, Suite 7700, Chicago, Illinois 60601-7702, not earlier than the close of business on December 12, 2023 and not later than the close of business on January 11, 2024. In addition, the notice must set forth the information required by our bylaws with respect to each director nomination or other proposal that the stockholder intends to present at our 2024 annual meeting.

In addition to satisfying the foregoing requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than our Board of Directors’ nominees must provide notice that sets forth any additional information required by Rule 14a-19 under the Exchange Act in accordance with the advance notice procedure as described above.

Q: | Where are our principal executive offices located and what is our main telephone number? |

A: | Our headquarters are located at 200 E. Randolph Street, Suite 7700, Chicago Illinois 60601-7702. Our telephone number is 312-274-2000. You may contact our Investor Relations Team at this address or by email at investor_relations@spplus.com. |

Q: | What is our company’s fiscal year? |

A: | Our fiscal year is the calendar year beginning on January 1 and ending on December 31. |

SP+ CORPORATION 2023 PROXY STATEMENT |

5

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

The first proposal to be voted on at the Annual Meeting is the election of six directors. The following information about the business background of each person nominated by the Board of Directors (the “Board”) has been furnished to the Company by the director nominees. Our Board currently consists of six members who are elected annually. The following individuals are being nominated to serve as directors:

G Marc Baumann | | Gregory A. Reid | | Diana L. Sands | |

Alice M. Peterson | | Wyman T. Roberts | | Douglas R. Waggoner | |

All of the nominees are current SP Plus directors. If elected, each director will serve until the next annual meeting of stockholders and until a successor is elected and qualified, or until such director’s earlier resignation, removal or death. You may cast your vote in favor of electing the nominees as directors or withhold your vote on one or more nominees.

| OUR BOARD RECOMMENDS A VOTE “FOR” EACH OF THE BOARD’S SIX NOMINEES. |

When the accompanying proxy is properly executed and returned, the shares it represents will be voted in accordance with the directions indicated thereon or, if no direction is indicated, the shares will be voted in favor of the election of the six nominees identified below. We expect each nominee to be able to serve if elected, but, if any nominee notifies us before the Annual Meeting that he or she is unable to do so, then the proxies will be voted for the remainder of those nominated and, as designated by the directors, may be voted (i) for a substitute nominee or nominees, or (ii) to elect such lesser number to constitute the whole Board as equals the number of nominees who are able to serve.

SP+ CORPORATION 2023 PROXY STATEMENT |

6

BOARD MATTERS

The composition of our nominees to the Board represents a range of qualifications, experiences and skills that will bring diversity of experience and thought to our Board. Described below are certain individual skills that contribute to this.

Board Skills and Diversity

SP+ CORPORATION 2023 PROXY STATEMENT |

7

Nominees for Director

Nominees are set forth below.

| | |

G Marc Baumann Age: 67 | | Mr. Baumann has served as our Chairman of the Board since May 2021, our President since March 2014 and as Chief Executive Officer and a director since January 1, 2015. Mr. Baumann served as our Chief Operating Officer from March 2014 through December 2014, Chief Financial Officer and Treasurer from October 2000 to March 2014, President of Urban Operations from October 2012 to March 2014, and Executive Vice President from October 2000 to October 2012. Mr. Baumann holds a B.S. degree from Northwestern University and an M.B.A. degree from the Kellogg School of Management at Northwestern University. |

| Qualifications: In addition to the qualifications described above, our Board believes that Mr. Baumann’s extensive industry knowledge in transportation and mobility and his deep knowledge of the Company allow him to contribute unique strategic insights to the Board. |

| | |

| | |

Alice M. Peterson Age: 70 Board Committees: • Audit Committee (Chair) • Executive Committee • Nominating and Corporate Governance Committee | | Ms. Peterson has served as a director since March 2018. She has been the President of Kentucky Heritage Hemp Company LLC since 2021. From 2020 to 2021, Ms. Peterson was the principal of The Loretto Group, a consultancy focused on sustainably profitable business growth. From 2019 to 2020, Ms. Peterson served as the Executive Vice President of Operations for Fluresh LLC, a grower and seller of cannabis products. Prior to that, Ms. Peterson was the President of The Loretto Group from 2016 through 2018. From 2012 through 2015, she served as Chief Operating Officer of PPL Group and Big Shoulders Capital, both private equity firms with common ownership. From 2009 to 2010, Ms. Peterson served as the Chief Ethics Officer of SAI Global, a provider of compliance and ethics services, and was a special advisor to SAI Global until 2012. Ms. Peterson served as a director of RIM Finance, LLC, a wholly owned subsidiary of Research in Motion, Ltd., the maker of the Blackberry™ handheld device, from 2000 to 2013. Ms. Peterson served as a director of Patina Solutions, which provides professionals with a flexible basis to help companies achieve their business objectives, from 2012 to 2013. Ms. Peterson served as a director of the general partner of Williams Partners L.P. and its predecessor (a diversified master limited partnership focused on natural gas transportation; gathering, treating and processing; storage; natural gas liquid fractionation; and oil transportation) from 2005 to 2018 and served as the chair of its audit committee and was a member of the conflicts committee. Ms. Peterson previously served as a director of Navistar Financial Corporation, a wholly owned subsidiary of Navistar International (a manufacturer of commercial and military trucks, diesel engines and parts), Hanesbrands Inc. (an apparel company), TBC Corporation (a marketer of private branded replacement tires), and Fleming Companies (a supplier of consumer package goods). Ms. Peterson holds a B.A. degree from the University of Louisville and an M.B.A. in Finance from Vanderbilt University. |

| Qualifications: In addition to the qualifications described above, our Board believes that Ms. Peterson’s financial and accounting, corporate governance, securities and capital markets, executive leadership, strategy development and risk management, and operating experience are particularly important attributes for a director of our company. |

| | |

SP+ CORPORATION 2023 PROXY STATEMENT |

8

| | |

Gregory A. Reid Age: 70 Board Committees: • Audit Committee • Compensation Committee | | Mr. Reid has served as a director since May 2017. He has served as President of BoomDeYada, LLC, a brand development consultancy group, since October 2011. Prior to founding BoomDeYada, Mr. Reid held various marketing and sales positions at YRC Worldwide, Inc., a transportation and global logistics company, including as Senior Vice President of sales and marketing from 1997 to 2001, Senior Vice President and Chief Marketing Officer from 2001 to 2006, and Executive Vice President and Chief Marketing Officer from 2007 to 2011. From 1994 to 1997, Mr. Reid served as a Vice President and General Manager for the Integrated Logistics Division of Ryder System Inc. Mr. Reid holds a Bachelor of Business Administration degree in Marketing from the University of Cincinnati. |

| Qualifications: In addition to the qualifications described above, our Board believes that Mr. Reid’s strategic planning experience, marketing experience and leadership in the transportation and logistics industry are particularly important attributes for a director of our company. |

| | |

| | |

Wyman T. Roberts Age: 63 Board Committees: • Compensation Committee (Chair) • Executive Committee • Nominating and Corporate Governance Committee | | Mr. Roberts has served as a director since April 2015. He retired in 2022 as President and Chief Executive Officer of Brinker International, Inc., a position he held since January 2013, and as President of Chili’s Grill & Bar, a position he held since September 2018. Mr. Roberts served as a director of Brinker International, Inc., from February 2013 to May 2022. From November 2009 to June 2016, Mr. Roberts served as President of Chili’s Grill & Bar. He served in various other executive roles at Brinker International from August 2005 to October 2009, including serving as President of Maggiano’s Little Italy and Chief Marketing Officer. Mr. Roberts served as Executive Vice President and Chief Marketing Officer for NBC’s Universal Parks & Resorts from December 2000 until August 2005. Mr. Roberts has a Bachelor’s degree in Finance and an M.B.A. from Brigham Young University. |

| Qualifications: In addition to the qualifications described above, our Board believes that Mr. Roberts’ understanding of technology-based marketing and experience managing a large workforce are particularly important attributes for a director of our company. |

| | |

SP+ CORPORATION 2023 PROXY STATEMENT |

9

| | |

Diana L. Sands Age: 57 Board Committees: • Audit Committee • Compensation Committee | | Ms. Sands has served as a director since May 2021. Ms. Sands has been a member of the Board of Directors for PDC Energy, Inc. since February 2021 and for Vmo Aircraft Leasing since September 2022. Prior to that, from 2016 to 2020, Ms. Sands was an executive officer and Senior Vice President of the Office of Internal Governance and Administration at The Boeing Company and the Senior Vice President of the Office of Internal Governance from 2014 to 2016, where she oversaw a diverse team including internal audit, ethics & investigations, compliance risk management, security and internal services. Since joining Boeing in 2001, Ms. Sands held senior finance roles, including Corporate Controller from 2012 to 2014 and Vice President of Investor Relations from 2008 to 2012. She also led financial planning and analysis and worked in corporate treasury. Prior to that, Ms. Sands held various roles at General Motors Corporation. Ms. Sands has a Master's in Business Administration from Northwestern's Kellogg School of Management, and a Bachelor's in Business Administration from University of Michigan's Ross Business School. |

| Qualifications: In addition to the qualifications described above, our Board believes that Ms. Sands’ understanding of technology, corporate strategy, ethics, compliance and governance, along with her deep financial expertise are particularly important attributes for a director of our company. |

| | |

| | |

Douglas R. Waggoner Age: 64 Board Committees: • Compensation Committee • Executive Committee (Chair) • Nominating and Corporate Governance Committee (Chair) | | Mr. Waggoner has served as our Lead Independent Director since May 2021 and as a director since April 2015. He has served as Chief Executive Officer of Echo Global Logistics, Inc., a provider of a wide range of transportation and logistics services, since December 2006. He was a board member of Echo from February 2008 to 2021, and was Chairman of the board from June 2015 to 2021. Prior to joining Echo, Mr. Waggoner founded SelecTrans, LLC, a transportation management system software provider based in Chicago, Illinois. From April 2004 to December 2005, Mr. Waggoner served as Chief Executive Officer of USF Bestway, and from January 2002 to April 2004 he served as Senior Vice President of strategic marketing for USF Corporation. Mr. Waggoner holds a Bachelor’s degree in Economics from San Diego State University. |

| Qualifications: In addition to the qualifications described above, our Board believes that Mr. Waggoner’s technology experience and leadership in the transportation and logistics industry are particularly important attributes for a director of our company. |

| | |

SP+ CORPORATION 2023 PROXY STATEMENT |

10

Nomination Process

Identifying Candidates

In evaluating candidates for Board membership, the Nominating and Corporate Governance Committee has assessed the contribution that the candidate’s skills and expertise will make with respect to guiding and overseeing our strategy and operations. The Nominating and Corporate Governance Committee seeks candidates who have the ability to develop a deep understanding of our business and the time and judgment to effectively carry out their responsibilities as members of our Board.

When considering candidates for our Board, the Nominating and Corporate Governance Committee seeks to recommend candidates for our Board that possess a diversity of professional experience, education and other individual qualities and attributes, including diversity in the areas of gender, ethnicity, race, sexual orientation and age, in an effort to contribute to Board diversity.

When our Board has a director opening, the Nominating and Corporate Governance Committee may retain an executive search firm to assist the Board with identifying and evaluating director candidates. The primary functions served by the executive search firm include identifying potential candidates who meet the key attributes, experience and skills described under “Criteria for Board Membership” below, as well as compiling information regarding each candidate’s attributes, experience, skills and independence and conveying the information to the Nominating and Corporate Governance Committee. Numerous candidates are considered as a result of these searches.

Stockholder Recommendations

If you would like to recommend a future nominee for Board membership, you can submit a written recommendation with the name and other pertinent information of the nominee to: Douglas R. Waggoner, Chair of the Nominating and Corporate Governance Committee, c/o SP Plus Corporation, 200 E. Randolph Street, Suite 7700, Chicago, Illinois 60601-7702, Attention: Chief Legal Officer.

Criteria for Board Membership

The Nominating and Corporate Governance Committee has established certain minimum qualification criteria for our director nominees, including:

• | The highest personal and professional ethics, integrity, and honesty, and a commitment to acting in the best interest of the stockholders; |

• | An inquisitive and objective perspective and mature judgment; |

• | Sufficient time available to fulfill all Board and committee responsibilities; |

• | Diversity of viewpoints, background and experience, including at policy-making levels in business, government, education and technology, and in areas that are relevant to our activities; and |

• | Experience in positions with a high degree of responsibility and leadership roles in the companies or institutions with which they are affiliated. |

SP+ CORPORATION 2023 PROXY STATEMENT |

11

OUR CORPORATE GOVERNANCE PRACTICES

General

Our business is managed by our employees under the direction and oversight of our Board. Except for Mr. Baumann, none of our directors is currently an employee of our company. We keep Board members informed of our business through discussions with management, materials we provide to them, visits to our offices, and their participation in Board and Board committee meetings.

Our Board has adopted Governance Guidelines for the Board of Directors (“Governance Guidelines”) that, along with the charters of the principal Board committees and our Code of Business Conduct and Code of Ethics for Certain Executives, provide the framework for the governance of our Company. Complete copies of our Governance Guidelines, the charters of our principal Board committees, our Code of Business Conduct, Code of Ethics and other corporate governance documents may be found on our Investor Relations page at www.spplus.com. Information contained on our website is not part of this Proxy Statement. Our Nominating and Corporate Governance Committee regularly reviews corporate governance developments and modifies these policies as warranted.

We believe that open, effective, and accountable corporate governance practices are key to our relationship with our stockholders. To help our stockholders understand our commitment to this relationship and our governance practices, our Governance Guidelines and certain other of our governance practices are summarized below.

Director Independence

The rules of the Nasdaq Stock Market LLC (“Nasdaq”) require listed companies to have a board of directors with at least a majority of independent directors. These rules have both objective tests and a subjective test for determining who is an “independent director.” On an annual basis, each member of our Board is required to complete a questionnaire designed to provide information to assist the Board in determining whether the director is independent under Nasdaq listing standards and our Governance Guidelines, and whether members of our Audit Committee and Compensation Committee satisfy additional SEC and Nasdaq independence requirements. Our Board has adopted guidelines setting forth certain categories of transactions, relationships and arrangements that it has deemed immaterial for purposes of making its determination regarding a director’s independence, and does not consider any such transactions, relationships, and arrangements in making its subjective determination.

Our Board has determined that each of the following director nominees is independent under the applicable Nasdaq listing rules and under our Governance Guidelines: Alice M. Peterson, Gregory A. Reid, Diana L. Sands, Wyman T. Roberts and Douglas R. Waggoner. Mr. Baumann is not considered independent because he is our President and Chief Executive Officer (“CEO”).

The Board limits membership on the Audit Committee, the Compensation Committee, Executive Committee, and the Nominating and Corporate Governance Committee to independent directors, and all directors serving on such committees have been determined to be independent. Our Governance Guidelines require any director who has previously been determined to be independent to inform the Chair, Lead Independent Director and our Corporate Secretary of any change in his or her principal occupation or status as a member of the Board of any other public company, or any change in circumstance that may cause his or her status as an independent director to change.

Board Leadership Structure

In accordance with our bylaws, our Board elects our Chair and our CEO. Our Governance Guidelines do not require that the roles of Chair and CEO be held by separate individuals, giving the Board flexibility to make a determination when it elects a new Chair or CEO. Mr. Baumann serves as Chairman of the Board and CEO and Mr. Waggoner serves as the Lead Independent Director. The Board believes that having a Chair and a separate Lead Independent Director is appropriate at present.

SP+ CORPORATION 2023 PROXY STATEMENT |

12

| OUR CORPORATE GOVERNANCE PRACTICES | |

| |

| |

| |

The Lead Independent Director’s roles and responsibilities are detailed in the Corporate Governance Guidelines and include:

| • | coordinating with the CEO and Chair to develop meeting agenda and approving final meeting agendas, ensuring there is sufficient time to discuss all agenda items; |

| • | coordinating with the CEO and Chair on the materials sent to the Board, including but not limited to the scope, quality and timeliness of the information, and approving final meeting materials; |

| • | calling closed sessions of the independent directors; |

| • | chairing closed sessions of the independent directors; |

| • | leading Board meetings in the absence of the Chair; |

| • | if requested by major stockholders, ensuring that he is available for consultation and direct communication; and |

| • | leading the annual Board self-assessment, including acting on director feedback as needed. |

In addition, the Lead Independent Director conducts interviews to confirm the continued qualification and willingness to serve of each director whose term is expiring at an annual meeting prior to the time at which directors are nominated for re-election.

Committee Responsibilities

Board committees help our Board run effectively and efficiently and supplement, but do not replace, the oversight of our Board as a whole. There are currently four principal Board committees: the Audit Committee, the Compensation Committee, the Executive Committee and the Nominating and Corporate Governance Committee. The Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance meet regularly; the Executive Committee meets on an as-needed basis. Each committee has a written charter that has been approved by our Board. In addition, at each regularly scheduled Board meeting, a member of each committee reports on any significant matters addressed by the committee since the last Board meeting. Each committee performs an annual self-assessment to evaluate its effectiveness in fulfilling its obligations.

Board’s Role in Risk Oversight

Risk is inherent in every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic, financial, legal and regulatory, operational, and other risks, such as the impact of competition and climate change. Management is responsible for the day-to-day management of the risks that we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board is responsible for satisfying itself that the risk management framework and supporting processes as implemented by management are adequate and functioning as designed.

The Company has an established enterprise risk management process, which identifies key risks to the business and the Board is actively involved in the oversight of key risks inherent in our business. In addition, the Board routinely reviews the Company’s strategic plan and the related key risks, including the output of the Company’s enterprise risk management process. The Board and the Audit Committee have responsibility for oversight of cybersecurity matters. In this regard, both the Board and Audit Committee are briefed regularly on cybersecurity matters, including information security, technology risks, and any significant cyber incidents, and meet regularly with the Company’s Chief Information Security Officer on cybersecurity matters.

Role of Committees in Risk Oversight

While the Board is ultimately responsible for risk oversight, the Board receives regular updates from each of the Committees of the Board to which it has delegated oversight for specific risk areas. The Audit Committee oversees risks related to the Company’s financial statements, financial reporting processes, including our internal controls, cybersecurity risk and compliance with certain legal and regulatory requirements, among other risks. The Nominating and Corporate Governance Committee is responsible for overseeing risks related to our governance structure and environment, social and governance issues, among others. The Compensation Committee is responsible for managing risks related to attracting and retaining key employees to develop and execute the Company’s strategic priorities, which includes oversight of succession planning and design of the Company’s compensation programs applicable to senior management.

The Audit Committee’s charter provides that it will discuss our major risk exposures, including financial, operational, privacy, security, business continuity, legal, cybersecurity and regulatory risks, and the steps we have taken to detect, monitor, and actively manage such exposures. The Audit Committee reviews with our Vice President of Internal Audit significant legal, compliance and regulatory matters that could have a material impact on our financial statements or our business, including material notices to, or inquiries received from, governmental agencies.

SP+ CORPORATION 2023 PROXY STATEMENT |

13

| OUR CORPORATE GOVERNANCE PRACTICES | |

| |

| |

| |

In fulfilling its risk oversight responsibilities, the Board and each Committee receives regular updates from management and has full access to management, as well as the ability to retain outside advisors as it deems necessary. The Chair of each Committee regularly reports back to the full Board on the areas of oversight under the purview of his or her Committee.

Management’s Role in Risk Oversight

Our Vice President of Internal Audit is responsible for our internal audit function and our risk governance framework, which includes risk assessment, monitoring, and reporting. The Vice President of Internal Audit reports directly to the Audit Committee. The Vice President of Internal Audit facilitates the Audit Committee’s review and approval of the internal audit plan and provides regular reporting on audit activities. In addition, through consultation with management, the Vice President of Internal Audit periodically assesses major risks facing our company and coordinates with the executives responsible for such risks through the risk governance process. The Vice President of Internal Audit periodically reviews with the Audit Committee the major risks facing our company and the steps management has taken to detect, monitor, and manage those risks within agreed risk tolerances. The executive responsible for managing a particular risk may also report to the Audit Committee on how the risk is being managed and progress towards agreed mitigation goals.

Risk Assessment of Compensation Policies and Practices

Our management has assessed the compensation policies and practices for our employees and concluded that they do not create risks that are reasonably likely to have a material adverse effect on our company. This analysis was presented to the Audit Committee and the Compensation Committee, both of which agreed with this conclusion.

Attendance at Annual Meetings

All directors are expected to attend our annual meeting of stockholders unless a Board meeting is not scheduled immediately following the annual meeting of stockholders. Our last annual meeting of stockholders was held on May 11, 2022, and all director nominees who were serving on our Board as of that date attended.

Executive Sessions of Independent Directors

As part of each regularly scheduled Board meeting, the outside directors have the opportunity to meet without our management or any director who is not independent. The Lead Independent Director leads these sessions.

Board Compensation

Board compensation is determined by the Compensation Committee and consists of a mixture of equity compensation and cash compensation. The Compensation Committee reviews Board compensation annually. A more detailed description of current Board compensation can be found under the heading “Non-Employee Director Compensation” below.

Outside Advisors

Our Board and each of its committees may retain outside advisors and consultants of their choosing at the Company’s expense. Our Board need not obtain management’s consent to retain outside advisors. In addition, the committees need not obtain either our Board’s or management’s consent to retain outside advisors.

Conflicts of Interest

We expect our directors, executive officers, and other employees to conduct themselves with the highest degree of integrity, ethics, and honesty. Our credibility and reputation depend upon the good judgment, ethical standards, and personal integrity of each director, executive, and employee. Our Governance Guidelines prohibit a director from serving on the board, or in a senior executive role, of another company that would create a significant conflict of interest. In order to better protect our stockholders and us, we regularly review our Governance Guidelines, Code of Business Conduct, Code of Ethics and other corporate governance policies to ensure that they provide clear guidance to our directors, executives, and employees. In addition, on an annual basis, each director and each executive officer is obligated to complete a questionnaire that requires disclosure of any transaction with us in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest.

SP+ CORPORATION 2023 PROXY STATEMENT |

14

| OUR CORPORATE GOVERNANCE PRACTICES | |

| |

| |

| |

Board Effectiveness and Director Performance Reviews

It is important that the Board and its committees are performing effectively and in the best interests of our company and stockholders. The Board performs an annual self-assessment to evaluate its effectiveness in fulfilling its obligations. As part of this annual self-assessment, directors are able to provide feedback on the performance of other directors. The Chair or Lead Independent Director, as applicable, then follows up on this feedback and takes such further action as he or she deems appropriate.

Succession Planning

Our Board recognizes the importance of effective executive leadership to our success, and we review succession plans for our senior leadership positions at least annually. As part of this process, our Board reviews and discusses the capabilities of our senior leadership, as well as succession planning and potential successors for members of our executive staff, including our CEO. In conducting this review, the Board considers, among other factors, organizational and operational needs, competitive challenges, leadership/management potential and development, and emergency situations. The Board has also developed a set of guiding principles relating to Board membership, including the addition of directors with highly relevant professional experience.

Independent Registered Public Accounting Firm Independence

We have taken a number of steps to ensure continued independence of our outside independent registered public accounting firm. Our independent registered public accounting firm reports directly to the Audit Committee, and we limit the use of our independent registered public accounting firm for non-audit services. The fees for services provided by our independent registered public accounting firm in 2022 and 2021 and our policy on pre-approval of non-audit services are described under “Audit Committee Disclosure” below.

Related-Party Transaction Policy

As part of its oversight responsibilities, the charter of our Audit Committee requires that the Audit Committee review all related-party transactions for potential conflicts of interest. In addition, our Board has adopted our Related Party Transaction Policy that requires the Audit Committee to review all transactions between our company and our executive officers, directors, principal stockholders and other related persons for potential conflicts involving amounts in excess of $5,000. This policy is available on the Investor Relations portion of our website.

Codes of Conduct and Ethics

We have adopted a Code of Ethics as part of our compliance program. The Code of Ethics applies to our CEO, Chief Financial Officer, Principal Accounting Officer and all other persons performing similar functions on behalf of our company. In addition, we have adopted a Code of Business Conduct that applies to all of our officers and other employees. Any amendments to, or waivers from, our Code of Ethics for any executive officer will be posted on our website www.spplus.com. These codes are available on the Investor Relations portion of our website and copies will be provided to you without charge upon request to investor_relations@spplus.com.

Human Capital Management

Central to our ability to execute on our business strategy is the commitment of our employees to delivering excellence in execution of all aspects of our day-to-day operations. Our aim is to deliver professional, high-quality services through well-trained, service-oriented personnel, which we believe differentiates us from our competitors. Our culture and training programs place a continuing focus on operational excellence. To support our focus on operational excellence, we manage our human capital through a comprehensive, structured program that allows our employees to refine their skills and access continued training and career development opportunities. We evaluate the competencies and performance of all of our key operations and administrative support personnel on an annual basis. We have also dedicated significant resources to human capital management and provide comprehensive training for our employees, delivered through the use of our web-based SP+ University™ learning management system, in addition to facilitated classes. This investment in our people provides our employees with continued training and career development opportunities, in addition to promoting customer service and client retention. Our compensation plans are designed to attract, retain and motivate top talent in our industry.

We strive to create an inclusive environment which promotes diversity across our organization and a safe and engaging work environment where our employees have the opportunity to succeed and grow. Our Women’s Advisory Forum was founded in 2013 to foster growth, leadership and success for women across our organization. In 2020, we launched our Inclusion Council, which reports to the CEO and is charged with setting the Company’s diversity, equity and inclusion strategy and developing related priorities.

SP+ CORPORATION 2023 PROXY STATEMENT |

15

| OUR CORPORATE GOVERNANCE PRACTICES | |

| |

| |

| |

The health and safety of our employees is of paramount importance. Because safety is the responsibility of all our employees, each employee is expected to take all safety and health polices seriously and help enforce these policies within the workplace. We maintain comprehensive health and safety protocols to ensure that appropriate safety precautions are in place.

In addition, we are frequently engaged in collective bargaining negotiations with various union locals. No single collective bargaining agreement covers a material number of our employees. We believe that our employee relations are generally healthy, as evidenced by higher than average rate of tenure and rate of internal promotions.

Insider Trading Restrictions

Our insider trading policy prohibits directors, officers, employees, consultants and certain of their family members (“Covered Persons”) from transactions involving securities, other than certain excluded transactions (such as certain stock option exercises, vesting of restricted stock and gifts), whether such securities were issued by us or another company, while such Covered Person is aware of material non-public information relating to the issuer of the security or from providing such material non-public information to any person who may trade while aware of such information. Trades in our securities by directors and executive officers are prohibited during certain prescribed blackout periods and are required to be pre-cleared by appropriate company personnel.

Hedging and Pledging Policy

Our insider trading policy prohibits Covered Persons from entering into any hedging or monetization transactions relating to our securities or otherwise trading in any instrument relating to the future price of our securities, such as a put or call option, futures contract, short sale, collar, or other derivative security. The policy also prohibits Covered Persons from pledging SP Plus common stock as collateral for any loans.

Communicating with our Board

Our Board welcomes your questions and comments. If you would like to communicate directly with our Board, or our independent directors as a group, then you may submit your communication to our Chief Legal Officer, SP Plus Corporation, 200 E. Randolph Street, Suite 7700, Chicago, Illinois 60601-7702. All appropriate communications and concerns will be forwarded to our Chair, Lead Independent Director, or our independent directors as a group, as applicable.

Corporate Hotline

We have established a corporate hotline and an internal web-based reporting application to allow any employee to confidentially and anonymously lodge a complaint about any accounting, environmental, internal control, auditing, or (where legally permissible) other matters of concern. A copy of our whistleblower policy is set forth on the Investor Relations section of our website.

SP+ CORPORATION 2023 PROXY STATEMENT |

16

BOARD COMMITTEES AND MEETINGS

The Board

Our Board expects that its members will diligently prepare for, attend and participate in all Board and applicable committee meetings. Directors are also expected to become familiar with our management team and operations as a basis for discharging their oversight responsibilities. During 2022, our Board held eight meetings. Each of the directors who served during 2022 attended all of our Board meetings held during his or her tenure.

Committees of the Board

In 2022, our Board had four standing committees to facilitate and assist our Board in the execution of its responsibilities: the Audit Committee, the Compensation Committee, the Executive Committee, and the Nominating and Corporate Governance Committee. Each of these committees operates pursuant to a written charter, which is available in the Corporate Governance section of our website, accessible through our Investor Relations page at www.spplus.com.

Audit Committee

The Audit Committee has three members: Alice M. Peterson, who serves as Chair, Gregory A. Reid, and Diana L Sands. Our Board has determined that all members of the Audit Committee meet Nasdaq’s financial literacy and independence requirements, and that Ms. Peterson and Ms. Sands each qualify as an “audit committee financial expert” for purposes of the rules and regulations of the SEC. We limit the number of public-company audit committees on which any Audit Committee member may serve to three. Our Board will continue to monitor and assess the audit committee memberships of our Audit Committee members on a regular basis.

The Audit Committee’s primary duties and responsibilities are to:

• | meet with our independent registered public accounting firm to review the results of the annual audit and to discuss our financial statements, including the independent registered public accounting firm’s judgment about the quality of accounting principles, the reasonableness of significant judgments, the clarity of the disclosures in our financial statements, our internal control over financial reporting, and management’s report with respect to internal control over financial reporting; |

• | meet with our independent registered public accounting firm to review the interim financial statements prior to the filing of our Quarterly Reports on Form 10-Q and Annual Report on 10-K; |

• | recommend to our Board the independent registered public accounting firm to be retained by us; |

• | oversee the independence of the independent registered public accounting firm; |

• | evaluate the independent registered public accounting firm’s performance; |

• | review and approve the services of the independent registered public accounting firm; |

• | receive and consider the independent registered public accounting firm’s comments as to controls, adequacy of staff and management performance and procedures in connection with audit and financial controls, including our system to monitor and manage business risks and legal and ethical compliance programs; |

• | approve the Audit Committee Report for inclusion in our proxy statement; |

• | approve audit and non-audit services provided to us by our independent registered public accounting firm; |

• | consider conflicts of interest and review all transactions with related persons involving executive officers or Board members that are reasonably expected to exceed specified thresholds; |

• | meet with our Chief Legal Officer to discuss legal matters that may have a material impact on our financial statements or our compliance policies and with other members of management to discuss other areas of risk to our company; |

• | meet with management, the Vice President of Internal Audit and the independent registered public accounting firm to discuss any matters that the Audit Committee or any of these persons or firms believes should be discussed; and |

• | review and approve our policies and decisions about using and entering into swaps. |

A complete description of the Audit Committee’s function may be found in its charter, which may be accessed through the Corporate Governance section of our website, accessible through our Investor Relations page at www.spplus.com.

The Audit Committee held seven meetings in 2022. Each of the directors who served on the Audit Committee during 2022 attended all of the meetings held during his or her tenure.

SP+ CORPORATION 2023 PROXY STATEMENT |

17

| BOARD COMMITTEES AND MEETINGS | |

| |

| |

| |

Compensation Committee

The Compensation Committee consists of four directors: Wyman T. Roberts, who serves as Chair, Gregory A. Reid, Diana L. Sands, and Douglas R. Waggoner. Our Board has determined that all members of the Compensation Committee are independent. The Compensation Committee’s primary duties and responsibilities are to:

• | review and discuss with management the Compensation Discussion and Analysis section of the proxy statement; |

• | assist in defining a total compensation policy for our executives that among others, supports our overall business strategy and objectives, attracts and retains key executives, links total compensation with business objectives and organizational performance, and provides competitive total compensation opportunities at a reasonable cost; |

• | act on behalf of our Board in setting executive compensation policy, administer compensation plans approved by our Board and stockholders, and make decisions or develop recommendations for our Board with respect to the compensation of key executives; |

• | review and determine the annual base salary levels, annual incentive opportunity levels, long-term incentive opportunity levels, executive perquisites, employment agreements, change of control and severance provisions/agreements, benefits, and supplemental benefits of the named executive officers (“NEOs”); |

• | review and approve corporate goals and objectives relevant to the CEO’s compensation, evaluate the CEO’s performance in light of those goals and objectives, and determine the CEO’s compensation level based on this evaluation; evaluate the CEO’s and other key executives’ compensation levels and payouts against pre-established performance goals and objectives, an appropriate peer group, and the awards given to the CEO or other executives in past years; |

• | review and oversee compliance with stock ownership requirements for senior executives and non-employee directors; |

• | review compensation policies and practices applicable to all employees as they relate to risk management and determine whether the risks arising from these compensation policies and practices are reasonably likely to have a material adverse effect; |

• | approve all compensation consultant engagement fees and terms, including engagements with compensation consultants involving services in addition to executive and director compensation; and |

• | prepare a report to be included in our proxy statement and provide other regular reports to our Board. |

A complete description of the Compensation Committee’s function may be found in its charter, which may be accessed through the Corporate Governance section of our main website, accessible through our Investor Relations page at www.spplus.com.

The Compensation Committee held three meetings in 2022. Each of the directors who served on the Compensation Committee during 2022 attended all of the meetings held during his or her tenure.

Compensation Committee Interlocks and Insider Participation. During 2022, none of the members of the Compensation Committee served, or have at any time served, as an officer or employee of our company or any of our subsidiaries. In addition, none of our executive officers have served as a member of a board of directors or a compensation committee, or other committee serving an equivalent function, of any other entity of whose executive officers served as a member of our Board or our Compensation Committee. Accordingly, the Compensation Committee members have no interlocking relationships required to be disclosed under SEC rules and regulations.

In addition, none of our directors serve together on both the Board and any other public company boards or any committee thereof.

Executive Committee

The Executive Committee currently consists of three directors: Douglas R. Waggoner, who serves as Chair, Alice M. Peterson, and Wyman T. Roberts. Our Board has determined that all members of the Executive Committee are independent. The Executive Committee’s primary duties and responsibilities include:

• | exercising some or all powers of our Board between regularly scheduled meetings; |

• | conducting the evaluation of the performance of the CEO, reviewing his compensation and making recommendations regarding changes in compensation to the Compensation Committee; |

• | serving as a sounding board for management on emerging issues, problems and initiatives; and |

• | reporting to our Board at the Board’s next meeting on any official actions it has taken. |

SP+ CORPORATION 2023 PROXY STATEMENT |

18

| BOARD COMMITTEES AND MEETINGS | |

| |

| |

| |

Notwithstanding the foregoing, the Executive Committee does not have the powers of our Board for:

• | those matters that are expressly delegated to another committee of our Board; |

• | approving or adopting, or commending to the stockholders, any action or matter expressly required by the General Corporation Law of Delaware (“DGCL”) or our Certificate of Incorporation (the “Certificate”) to be submitted to the stockholders; |

• | adopting, amending or repealing any of our bylaws; |

• | electing officers or filling vacancies on our Board or any committee of our Board; |

• | declaring a dividend, authorizing the issuance of stock (except pursuant to specific authorization by our Board), or such other powers as our Board may from time to time eliminate; and |

• | any other matters that, under the DGCL, the Certificate or our bylaws cannot be delegated by our Board to a committee. |

A complete description of the Executive Committee’s function may be found in its charter, which may be accessed through the Corporate Governance section of our main website, accessible through our Investor Relations page at www.spplus.com.

The Executive Committee held no meetings in 2022.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of three directors: Douglas R. Waggoner, who serves as Chair, Alice M. Peterson, and Wyman T. Roberts. Our Board has determined that all members of the Nominating and Corporate Governance Committee are independent. The Nominating and Corporate Governance Committee’s primary duties and responsibilities are to:

• | have general responsibility for Board selection, including the identification of qualified candidates for Board membership, taking into account gender and age diversity as well as diversity of professional experience, education and other individual qualities and attributes that will contribute to Board heterogeneity; |

• | recommend to our Board the directors to serve on each committee of our Board; |

• | at least annually, review the corporate governance guidelines and recommend to the Board any changes to the corporate governance guidelines; |

• | review the Board’s annual self-assessment process and recommend any changes to the Chair of the Board or Lead Independent Director, as applicable; |

• | approve all director search firm engagement fees and terms; |

• | oversee the Company’s strategy, practices and initiatives related to corporate responsibility and sustainability, including environmental, social and governance (ESG) matters, and review with the Board as appropriate; and |

• | prepare a report to be included in our proxy statement and provide reports to our Board. |

A complete description of the Nominating and Corporate Governance Committee’s function may be found in its charter, which may be accessed through the Corporate Governance section of our main website, accessible through our Investor Relations page at www.spplus.com.

The Nominating and Corporate Governance Committee held three meetings in 2022. Each of the directors who served on the Nominating and Corporate Governance Committee during 2022 attended all of the meetings held during his or her tenure.

SP+ CORPORATION 2023 PROXY STATEMENT |

19

EXECUTIVE OFFICERS

The table below sets forth certain information regarding our executive officers that are not identified in the table under “Board and Corporate Governance Matters-Nominees for Director.”

| | | |

Name | | Age | Position |

Kristopher H. Roy | 48 | Chief Financial Officer & Treasurer |

Christopher R. Sherman | 47 | President, Commercial Division |

Ritu Vig | 45 | President, Aviation Division |

Kristopher H. Roy has served as Chief Financial Officer & Treasurer since September 2019. Mr. Roy served as Senior Vice President and Corporate Controller from 2015 through August 2019. He joined our company in 2013 as Vice President and Assistant Controller. Prior to joining the company, Mr. Roy served as Global Director of Accounting, Consolidation, and Financial Systems at CNH Industrial N.V. and its predecessor from March 2013 to December 2013. He was a Senior Manager with Ernst & Young, LLP from 2009 until 2013. Mr. Roy is a Certified Public Accountant and earned his Bachelor of Arts degree from Michigan State University.

Christopher R. Sherman has served as President, Commercial Division since January 2023. Prior to that, Mr. Sherman was our Chief Strategy Officer, Commercial Division from March 2022 through December 2022 and our Senior Vice President from October 2012 through February 2022. Mr. Sherman served in the following positions at our predecessor company Central Parking Corporation: Vice President from January 2011 through September 2012; General Manager from October 2002 through December 2010 and Operations Manager from September 2001 through September 2002. Mr. Sherman earned his Bachelor of Science degree in Business from the University of Baltimore.

Ritu Vig has served as President, Aviation Division since January 2023. Prior to that, Ms. Vig was our Chief Legal Officer and Corporate Secretary from September 2019 through December 2022. Ms. Vig joined our company in November 2018, when she became Senior Vice President, Deputy General Counsel, a position she held until September 2019. Prior to joining our company, Ms. Vig was Vice President, Associate General Counsel of RR Donnelley & Sons Company from September 2016 through November 2018. Ms. Vig earned her Juris Doctor degree and Bachelor of Science degree in Finance from the University of Illinois and holds a Master of Business Administration from the University of Chicago Booth School of Business.

SP+ CORPORATION 2023 PROXY STATEMENT |

20

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion & Analysis (this “CD&A”) describes the material components of the executive compensation program applicable to our NEOs. While the discussion in the CD&A focuses on our NEOs, many of our executive compensation programs apply broadly across our executive ranks.

Our NEOs for the fiscal year ended December 31, 2022 were:

• | G Marc Baumann, our Chairman and CEO; |

• | Kristopher H. Roy, our Chief Financial Officer; |

• | Robert A. Miles, our President, Bags; |

• | John Ricchiuto, our Executive Advisor, Airport Division1; and |

• | Robert M. Toy, our Executive Advisor, Commercial Division2. |

Executive Summary