MOODY'S CORPORATION REPORTS RESULTS FOR SECOND QUARTER 2022

| | | | | | | | | | | | | | |

| SECOND QUARTER 2022 SUMMARY |

| | | | |

Moody’s Corporation

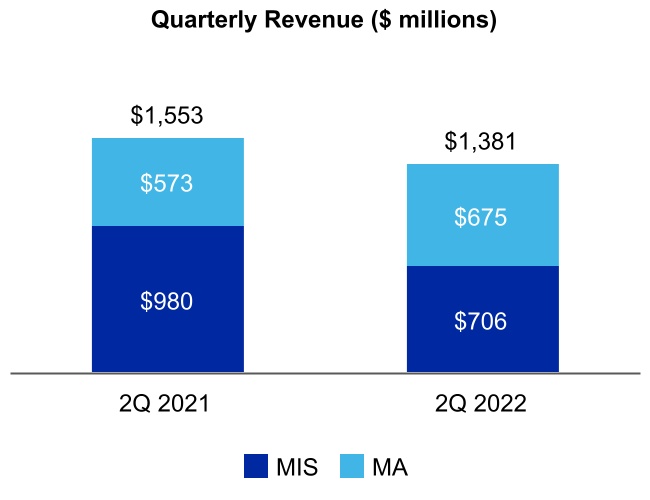

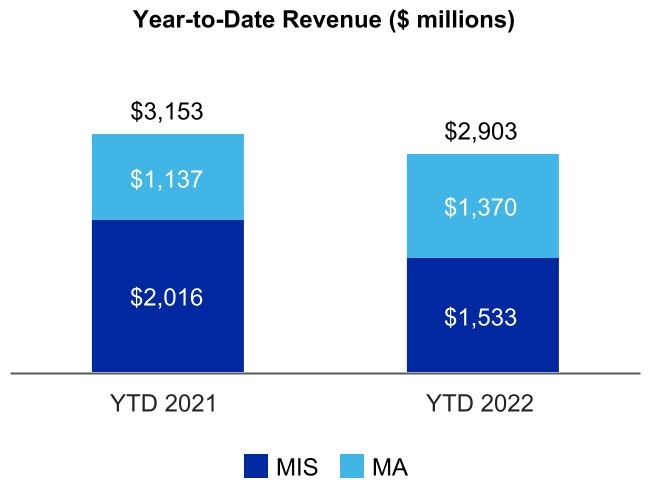

(MCO) Revenue | | Moody’s Investors Service

(MIS) Revenue | | Moody’s Analytics

(MA) Revenue |

| 2Q 2022 | | 2Q 2022 | | 2Q 2022 |

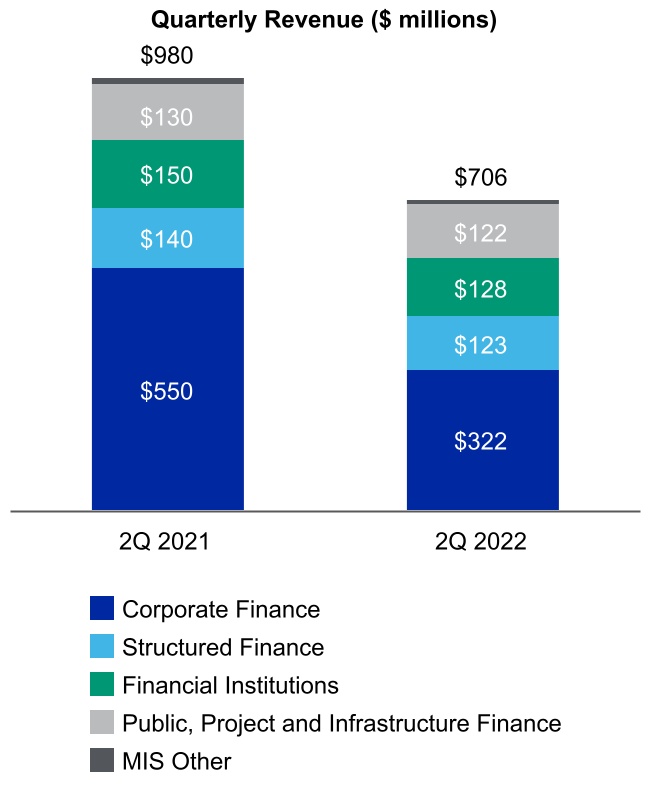

$1.4 billion ⇓ 11% | | $706 million ⇓ 28% | | $675 million ⇑ 18% |

| YTD 2022 | | YTD 2022 | | YTD 2022 |

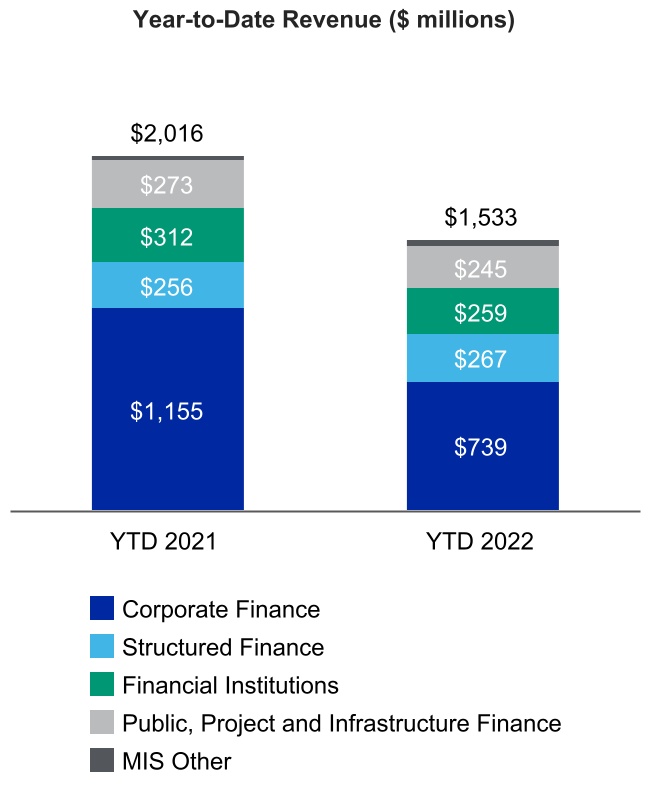

$2.9 billion ⇓ 8% | | $1.5 billion ⇓ 24% | | $1.4 billion ⇑ 20% |

| | | | |

| MCO Diluted EPS | | MCO Adjusted Diluted EPS1 | | MCO FY 2022 Projected |

| 2Q 2022 | | 2Q 2022 | | Diluted EPS |

$1.77 ⇓ 42% | | $2.22 ⇓ 31% | | $8.10 - $8.60 |

| YTD 2022 | | YTD 2022 | | Adjusted Diluted EPS1 |

$4.45 ⇓ 36% | | $5.11 ⇓ 30% | | $9.20 - $9.70 |

NEW YORK, NY - July 26, 2022 - Moody's Corporation (NYSE: MCO) today announced results for the second quarter of 2022 and updated its outlook for full year 2022.

1

| | | | | |

“In times of heightened uncertainty, our customers rely on Moody’s unparalleled global insights and analysis to deliver comprehensive and integrated perspectives on risk.” “Demand for our market-leading products and solutions that enable decision makers to holistically identify, measure and manage risk propelled Moody’s Analytics to another quarter of impressive growth. While the fundamental drivers underpinning debt issuance remain firmly intact, global economic uncertainty significantly curtailed market activity. Given year-to-date performance and our expectation for continued cyclical market disruption, we have lowered our full year 2022 adjusted diluted EPS guidance range to $9.20 to $9.70.” |

Rob Fauber President and Chief Executive Officer |

1 Refer to the tables at the end of this press release for reconciliations of adjusted and organic measures to U.S. GAAP.

| | |

| Moody’s Corporation (MCO) |

| | | | | |

| Second Quarter 2022 | Year-to-Date 2022 |

•Revenue declined 11% and 13% on a reported and organic constant currency basis1, respectively, from the prior-year period. •Foreign currency translation unfavorably impacted Moody's revenue by 3%. | •Revenue declined 8% and 11% on a reported and organic constant currency basis1, respectively, from the prior-year period. •Foreign currency translation unfavorably impacted Moody’s revenue by 2%. |

| | |

| Moody’s Investors Service (MIS) |

| | | | | |

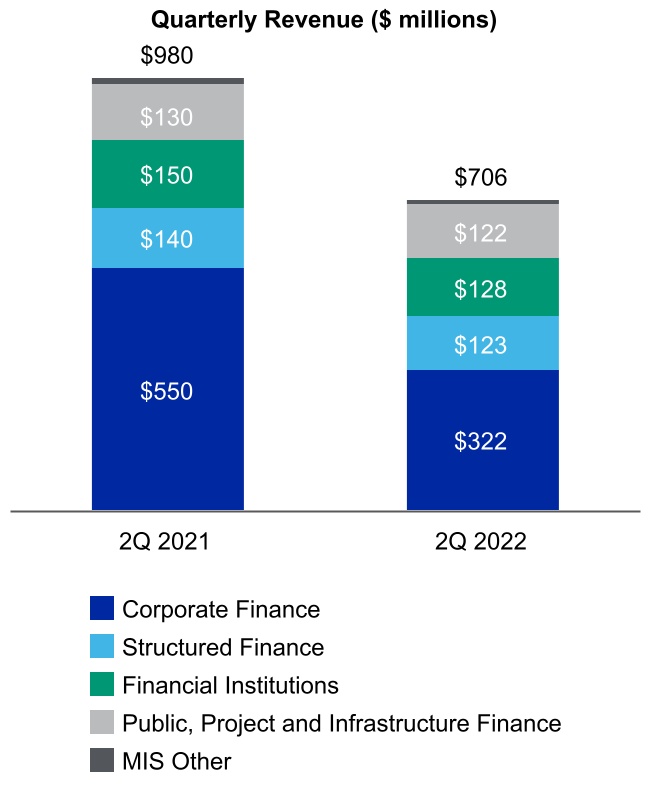

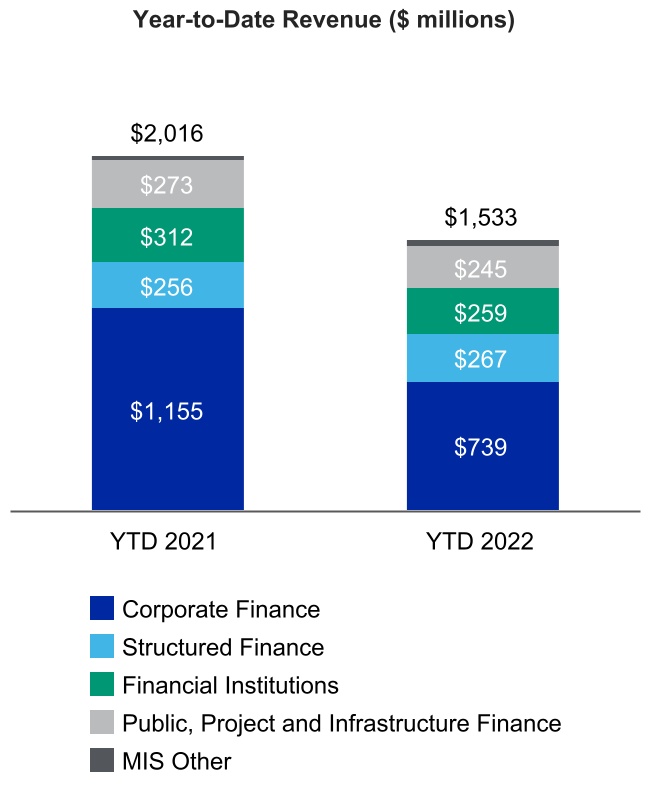

| Second Quarter 2022 | Year-to-Date 2022 |

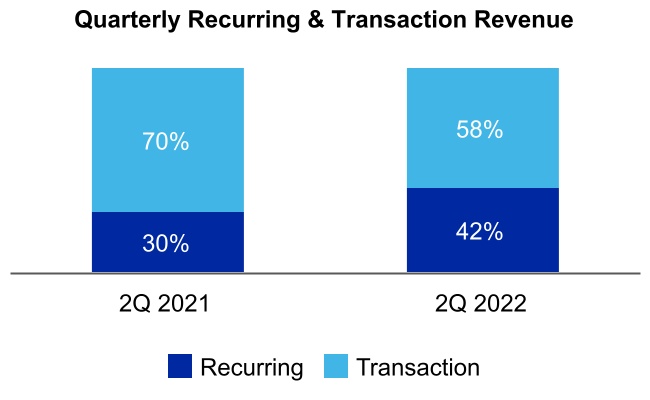

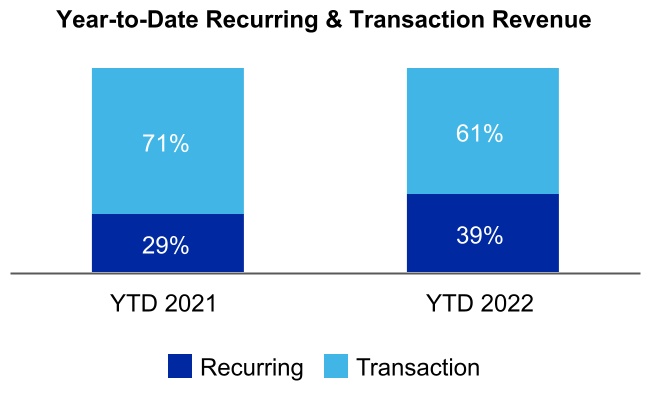

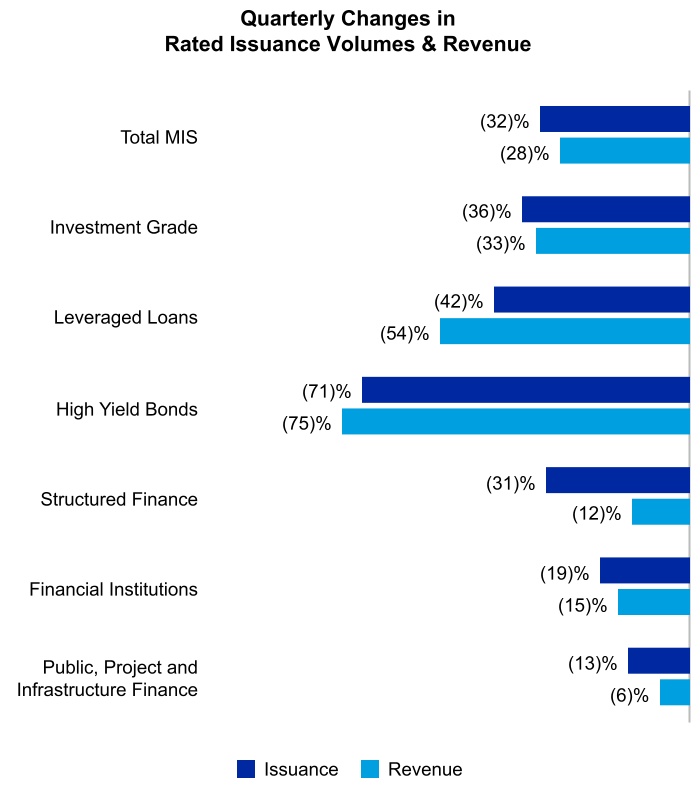

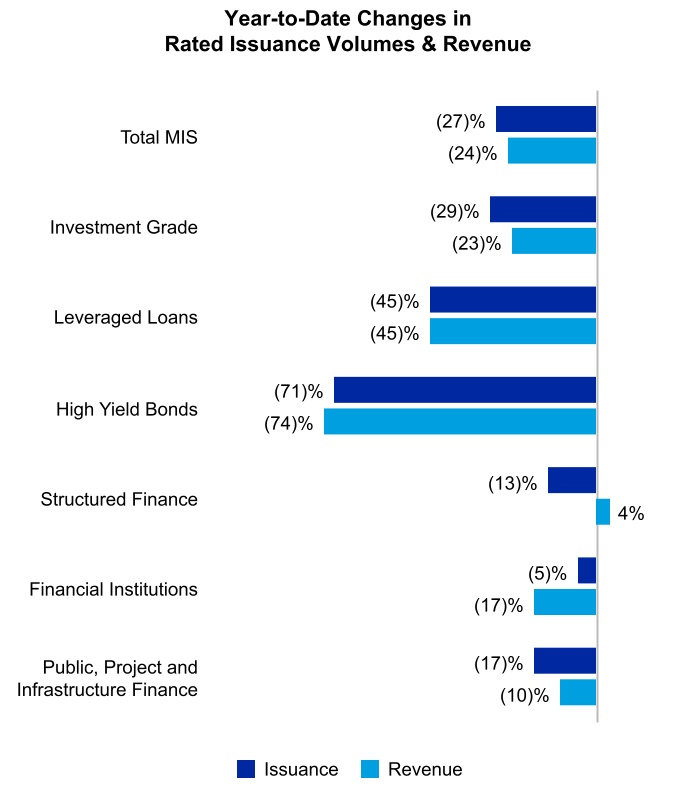

•Revenue declined 28% against a record prior-year period. •Issuance, particularly for leveraged loans and high yield bonds, was dampened due to volatile market conditions. •Investment grade activity decreased due to lower opportunistic refinancing. •Foreign currency translation unfavorably impacted MIS revenue by 2%. | •Revenue declined 24% against a record prior-year period. •Sustained weakness in the macroeconomic environment significantly impacted issuer and investor demand for debt issuance across all asset classes. •Foreign currency translation unfavorably impacted MIS revenue by 2%. |

| | | | | |

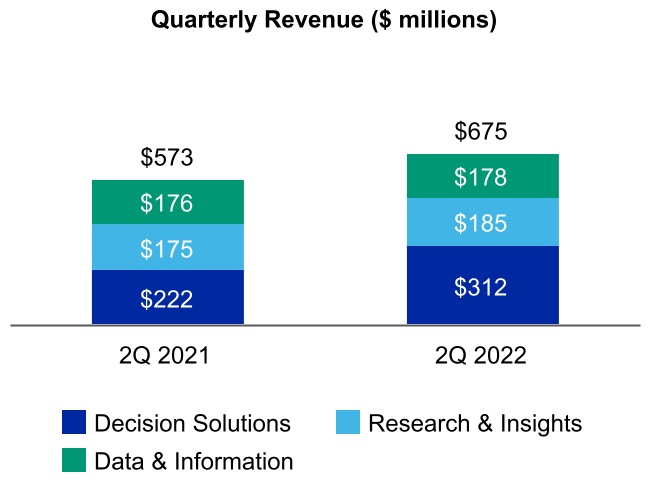

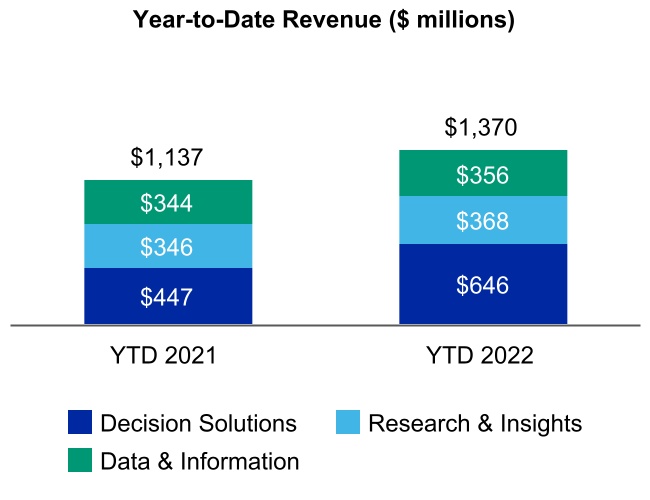

| Second Quarter 2022 | Year-to-Date 2022 |

•Revenue grew 18% from the prior-year period, driven by the RMS acquisition, as well as sustained demand for Know Your Customer solutions and credit research. •Organic constant currency revenue1 growth was 8%. Foreign currency translation unfavorably impacted total MA revenue by 5%. •Organic Annualized Recurring Revenue2 was $2.3 billion, up 9%. | •Multi-year strategic shift toward subscription-based products continued to drive MA’s recurring revenue growth, which comprised 94% of total MA revenue, up from 93% in the prior-year period. •Customer retention of ~96% demonstrates the value of our offerings, particularly in an evolving and increasingly complex risk environment. •Organic constant currency revenue1 growth was 10%. Foreign currency translation unfavorably impacted total MA revenue by 4%. |

| | | | | |

2 Refer to Table 8 at the end of this press release for the definition of and further information on the Annualized Recurring Revenue metric. |

| | | | | |

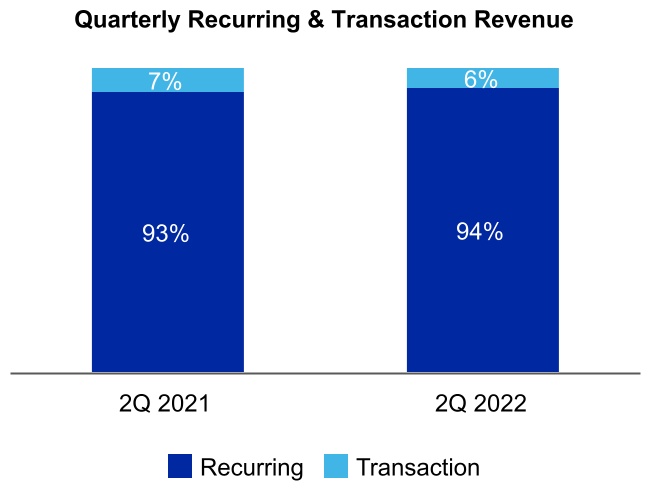

| Second Quarter 2022 | Year-to-Date 2022 |

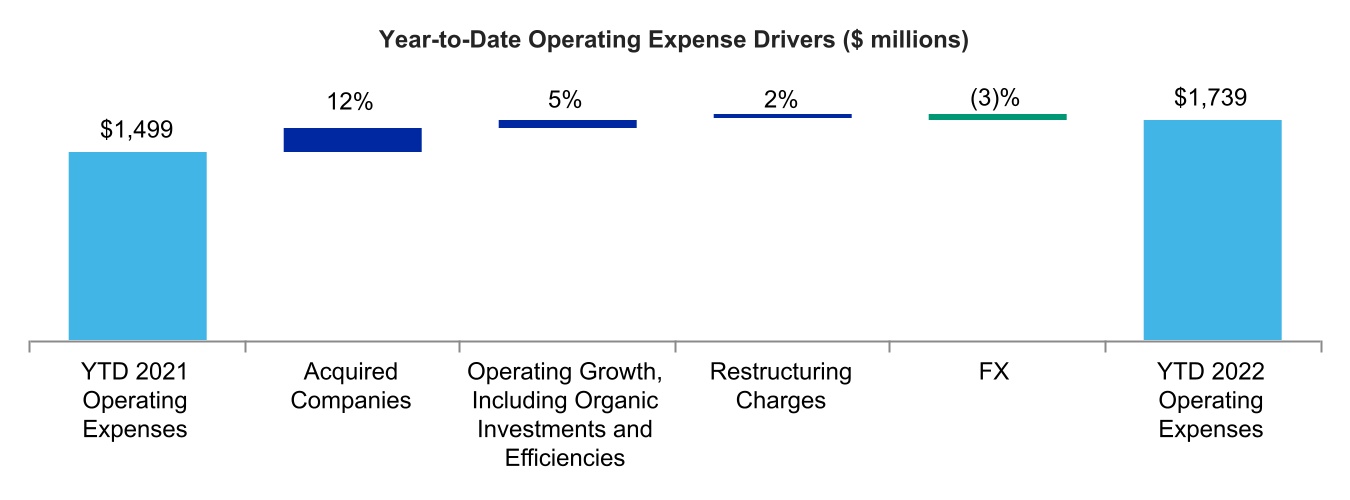

•Operating expense growth of 16% from the prior-year period was primarily due to acquisitions completed in the prior twelve months. •2022 - 2023 Geolocation Restructuring Program to accelerate ongoing cost efficiency initiatives, including the utilization of lower-cost locations and real estate rationalization efforts. •Foreign currency translation favorably impacted operating expenses by 4%. | •Operating expenses grew 16% from the prior-year period, including costs associated with acquisitions completed in the prior twelve months, primarily RMS, of approximately 12 percentage points. •Operating growth, including continued organic investment in high priority growth markets, was balanced by cost control initiatives and lower incentive compensation accruals. •Foreign currency translation favorably impacted operating expenses by 3%. |

| | |

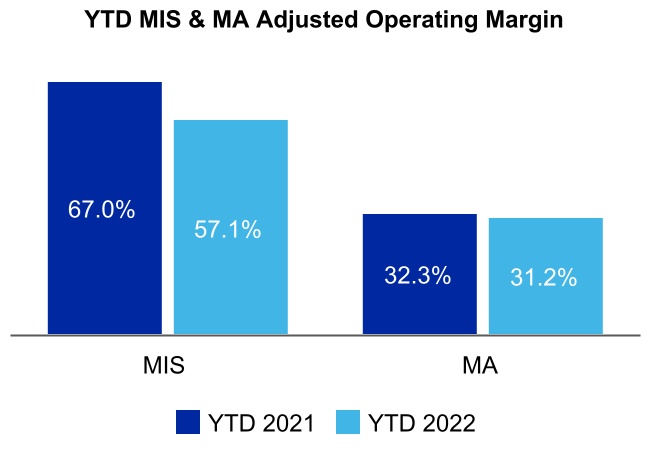

Operating Margin and Adjusted Operating Margin1 |

| | | | | |

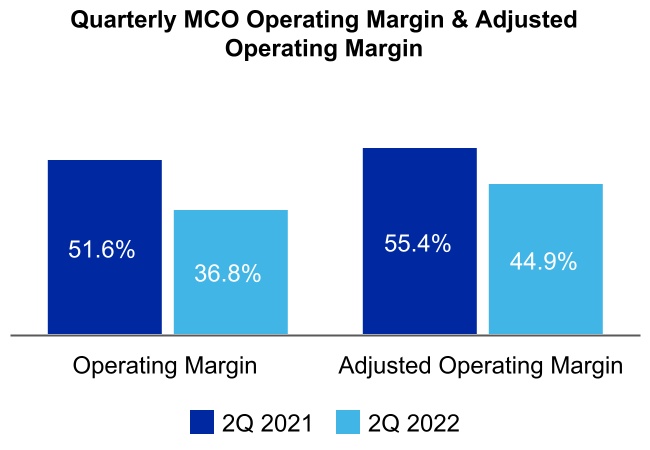

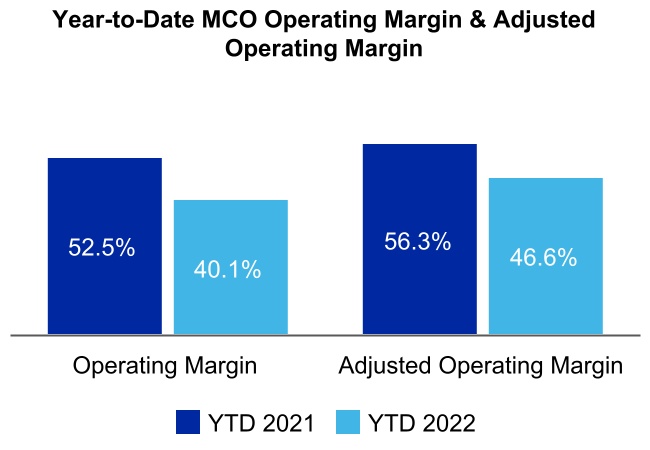

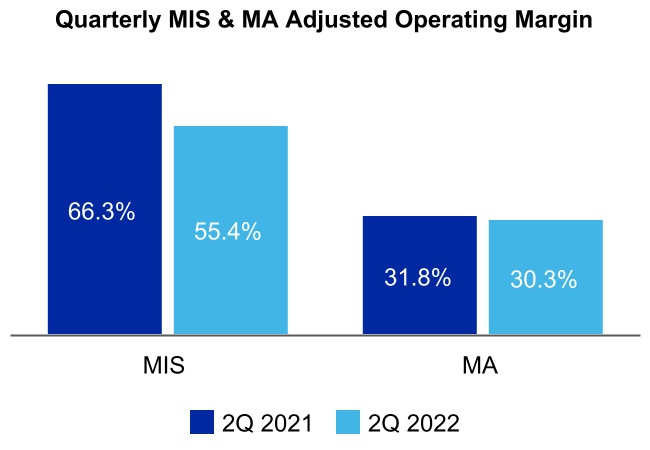

| Second Quarter 2022 | Year-to-Date 2022 |

•MCO’s adjusted operating margin1 decreased from the prior-year period, primarily driven by lower MIS transaction revenue related to subdued market activity. Foreign currency translation unfavorably impacted adjusted operating income1 by 2%. •Recent acquisitions unfavorably impacted MA’s adjusted operating margin by 200 basis points. | •MCO’s adjusted operating margin1 declined from the prior-year period due to sustained weakness in the macroeconomic environment, which significantly impacted demand for debt issuance. Foreign currency translation unfavorably impacted adjusted operating income1 by 2%. •Acquisitions completed in the prior twelve months unfavorably impacted MA’s adjusted operating margin by 290 basis points. |

| | |

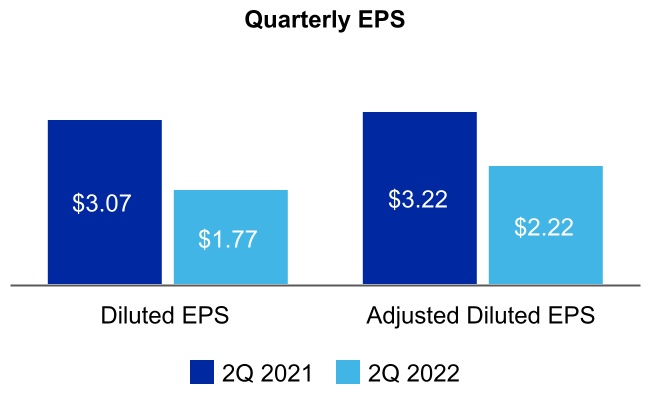

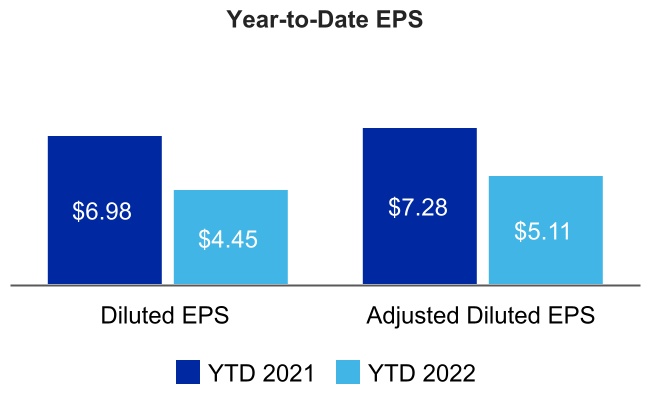

Diluted Earnings Per Share (EPS) and Adjusted Diluted EPS1 |

| | | | | |

| Second Quarter 2022 | Year-to-Date 2022 |

•The decline in EPS from the prior-year period reflected the adverse impact of a cyclical disruption in the issuance markets, partially offset by robust demand for MA’s global integrated risk assessment offerings. •The effective tax rate was 26.2%, up from 23.9%. The increase was primarily due to a non-recurring tax benefit realized in 2021 and a non-deductible loss associated with the Company no longer conducting commercial operations in Russia. | •The decline in EPS from the prior-year period was driven by credit market volatility, partially offset by strong organic growth from MA. •The effective tax rate was 21.6%, up from 19.0%. The increase was largely due to non-recurring tax benefits, including the resolution of uncertain tax positions in the first half of 2021, as well as a non-deductible loss associated with the Company no longer conducting commercial operations in Russia. |

| | |

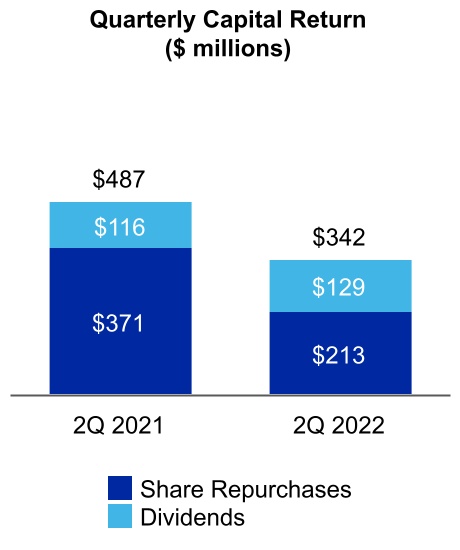

| CAPITAL ALLOCATION AND LIQUIDITY |

| | |

Capital Returned to Shareholders & Free Cash Flow1 |

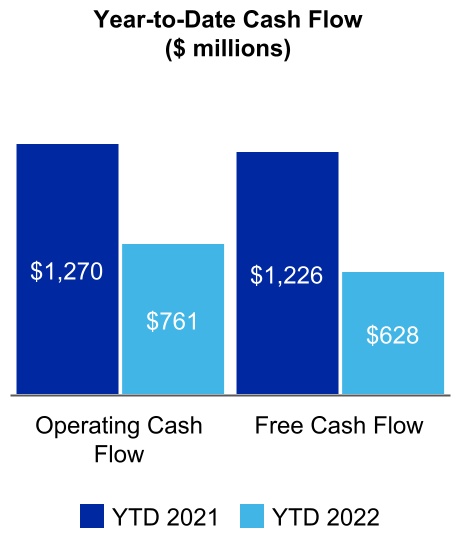

•Cash flow from operations for the first half of 2022 was $761 million and free cash flow1 was $628 million.

•The decline in free cash flow was driven by lower net income, primarily attributable to significantly lower market issuance and increased investment in key organic growth initiatives.

•On July 25, 2022, the Board of Directors declared a regular quarterly dividend of $0.70 per share of MCO Common Stock. The dividend will be payable on September 9, 2022 to stockholders of record at the close of business on August 19, 2022.

•As of June 30, 2022, Moody's had approximately $960 million of share repurchase authority remaining.

•At quarter-end, Moody's had $7.7 billion of outstanding debt and an undrawn $1.25 billion revolving credit facility.

Moody’s updated outlook for full year 2022, as of July 26, 2022, reflects assumptions about numerous factors that could affect its business and is based on currently available information reviewed by management through and as of today’s date. These assumptions include, but are not limited to, the effects of interest rates, inflation, foreign currency exchange rates, capital markets’ liquidity and activity in different sectors of the debt markets. This outlook also reflects assumptions about general economic conditions, including inflation, global GDP growth, the impacts resulting from the crisis in Ukraine and COVID-19, as well as assumptions related to the Company’s own operations and personnel. These assumptions are subject to increased uncertainty due to the current inflationary environment and the crisis in Ukraine. Actual full year 2022 results could differ materially from Moody’s current outlook.

This outlook incorporates various specific macroeconomic assumptions, including:

| | | | | | | | |

| Forecasted Item | Current assumption | Last publicly disclosed assumption |

U.S. GDP(1) growth | 1.5% - 2.5% | 3.5% - 4.5% |

Euro area GDP(1) growth | 1.5% - 2.5% | 2.5% - 3.5% |

| Global benchmark rates | Continue to rise | Increase from historic lows |

| U.S. high yield interest spreads | Fluctuate around 500 bps with periodic volatility for remainder of the year | Widen, moving slightly above historical average of 500 bps |

| U.S. inflation rate | 6.5% - 7.5% | Remain elevated, above central bank targets in many countries |

| Euro area inflation rate | 6.0% - 8.0% | Remain elevated, above central bank targets in many countries |

| U.S. unemployment rate | Rise to approximately 3.7% by end of 2022 | Remain low at approximately 3.5% |

| Global high yield default rate | Rise to 2.5% - 3.5% by end of 2022 | Initially decline before gradually rising to approximately 2.7% by end of 2022 |

| Global MIS rated issuance | Decrease by approximately 30% | Decrease in the mid-teens percent range |

| USD/GBP exchange rate | $1.21 for remainder of the year | $1.32 for remainder of the year |

| USD/EUR exchange rate | $1.05 for remainder of the year | $1.11 for remainder of the year |

Note: All current assumptions are as of July 26, 2022. All last publicly disclosed assumptions are as of May 2, 2022. (1) GDP growth represents real GDP. |

A full summary of Moody's full year 2022 guidance as of July 26, 2022 is included in Table 10 - 2022 Outlook at the end of this press release.

| | | | | | | | |

| Date and Time | July 26, 2022, at 12:00 p.m. Eastern Time (ET) |

| Webcast | The replay and supplemental presentation can be accessed through Moody’s Investor Relations website, ir.moodys.com under “Events & Presentations”. |

| Dial In | U.S. and Canada | ‘+1-877-400-505 |

| Other callers | ‘+1-720-452-9084 |

| Passcode | 8161371 |

| Dial In Replay | A replay will be available from 4:00 p.m. ET, July 26, 2022 until 4:00 p.m. ET, August 24, 2022. |

| U.S. and Canada | ‘+1-888-203-1112 |

| Other callers | ‘+1-719-457-0820 |

| Passcode | 8161371 |

| | |

| ABOUT MOODY’S CORPORATION |

Moody’s (NYSE: MCO) is a global integrated risk assessment firm that empowers organizations to make better decisions. Its data, analytical solutions and insights help decision-makers identify opportunities and manage the risks of doing business with others. We believe that greater transparency, more informed decisions, and fair access to information open the door to shared progress. With approximately 14,000 employees in more than 40 countries, Moody’s combines international presence with local expertise and over a century of experience in financial markets. Learn more at moodys.com/about.

| | |

| “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 |

Certain statements contained in this release are forward-looking statements and are based on future expectations, plans and prospects for Moody’s business and operations that involve a number of risks and uncertainties. Such statements involve estimates, projections, goals, forecasts, assumptions and uncertainties that could cause actual results or outcomes to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements. Stockholders and investors are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements in this release are made as of the date hereof, and Moody’s undertakes no obligation (nor does it intend) to publicly supplement, update or revise such statements on a going-forward basis, whether as a result of subsequent developments, changed expectations or otherwise, except as required by applicable law or regulation. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Moody’s is identifying certain factors that could cause actual results to differ, perhaps materially, from those indicated by these forward-looking statements. Those factors, risks and uncertainties include, but are not limited to the impact of general economic conditions, including inflation, on worldwide credit markets and economic activity and its effect on the volume of debt and other securities issued in domestic and/or global capital markets; the global impacts of each of the crisis in Ukraine and COVID-19 on volatility in the U.S. and world financial markets, on general economic conditions and GDP in the U.S. and worldwide, on global relations, on Moody’s own operations and personnel; other matters that could affect the volume of debt and other securities issued in domestic and/or global capital markets, including regulation, credit quality concerns, changes in interest rates, inflation and other volatility in the financial markets; the level of merger and acquisition activity in the U.S. and abroad; the uncertain effectiveness and possible collateral consequences of U.S. and foreign government actions affecting credit markets, international trade and economic policy, including those related to tariffs, tax agreements and trade barriers; the impact of MIS’s withdrawal of its credit ratings on Russian entities and of Moody’s suspension of commercial operations in Russia; concerns in the marketplace affecting our credibility or otherwise affecting market perceptions of the integrity or utility of independent credit agency ratings; the introduction of competing products or technologies by other companies; pricing pressure from competitors and/or customers; the level of success of new product development and global expansion; the impact of regulation as an NRSRO, the potential for new U.S., state and local legislation and regulations; the potential for increased competition and regulation in the EU and other foreign jurisdictions; exposure to litigation related to our rating opinions, as well as any other litigation, government and regulatory proceedings, investigations and inquiries to which Moody’s may be subject from time to time; provisions in U.S. legislation modifying the pleading standards and EU regulations modifying the liability standards, applicable to credit rating agencies in a manner adverse to credit rating agencies; provisions of EU regulations imposing additional procedural and substantive requirements on the pricing of services and the expansion of supervisory remit to include non-EU ratings used for regulatory purposes; uncertainty regarding the future relationship between the U.S. and China; the possible loss of key employees; failures or malfunctions of our operations and infrastructure; any vulnerabilities to cyber threats or other cybersecurity concerns; the outcome of any review by controlling tax authorities of Moody’s global tax planning initiatives; exposure to potential criminal sanctions or civil remedies if Moody’s fails to comply with foreign and U.S. laws and regulations that are applicable in the jurisdictions in which Moody’s operates, including data protection and privacy laws, sanctions laws, anti-corruption laws, and local laws prohibiting corrupt payments to government officials; the impact of mergers, acquisitions, such as our acquisition of RMS, or other business combinations and the ability of Moody’s to successfully integrate acquired businesses; currency and foreign exchange volatility; the level of future cash flows; the levels of capital investments; and a decline in the demand for credit risk management tools by financial institutions. These factors, risks and uncertainties as well as other risks and uncertainties that could cause Moody’s actual results to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements are described in greater detail under “Risk Factors” in Part I, Item 1A of Moody’s annual report on Form 10-K for the year ended December 31, 2021, and in other filings made by Moody’s from time to time with the SEC or in materials incorporated herein or therein. Stockholders and investors are cautioned that the occurrence of any of these factors, risks and uncertainties may cause Moody’s actual results to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements, which could have a material and adverse effect on Moody’s business, results of operations and financial condition. New factors may emerge from time to time, and it is not possible for Moody’s to predict new factors, nor can Moody’s assess the potential effect of any new factors on it.

Table 1 - Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| Amounts in millions, except per share amounts | 2022 | | 2021 | | 2022 | | 2021 |

| | | | | | | |

| Revenue | $ | 1,381 | | | $ | 1,553 | | | $ | 2,903 | | | $ | 3,153 | |

| | | | | | | |

| Expenses: | | | | | | | |

| Operating | 393 | | | 365 | | | 810 | | | 758 | |

| Selling, general and administrative | 368 | | | 327 | | | 739 | | | 620 | |

| Depreciation and amortization | 81 | | | 60 | | | 159 | | | 119 | |

| Restructuring | 31 | | | — | | | 31 | | | 2 | |

| Total expenses | 873 | | | 752 | | | 1,739 | | | 1,499 | |

| | | | | | | |

| Operating income | 508 | | | 801 | | | 1,164 | | | 1,654 | |

| Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | (55) | | | (49) | | | (108) | | | (56) | |

| Other non-operating (expense) income, net | (10) | | | 6 | | | (4) | | | 22 | |

| Total non-operating (expense) income, net | (65) | | | (43) | | | (112) | | | (34) | |

| Income before provision for income taxes | 443 | | | 758 | | | 1,052 | | | 1,620 | |

| Provision for income taxes | 116 | | | 181 | | | 227 | | | 307 | |

| | | | | | | |

| | | | | | | |

| Net income attributable to Moody's Corporation | $ | 327 | | | $ | 577 | | | $ | 825 | | | $ | 1,313 | |

| | | | | | | |

| Earnings per share attributable to Moody's common shareholders |

| Basic | $ | 1.78 | | | $ | 3.09 | | | $ | 4.47 | | | $ | 7.02 | |

| Diluted | $ | 1.77 | | | $ | 3.07 | | | $ | 4.45 | | | $ | 6.98 | |

| | | | | | | |

| Weighted average number of shares outstanding |

| Basic | 184.1 | | | 186.7 | | | 184.6 | | | 187.0 | |

| Diluted | 184.9 | | | 187.9 | | | 185.4 | | | 188.2 | |

Table 2 - Condensed Consolidated Balance Sheet Data (Unaudited)

| | | | | | | | | | | |

| Amounts in millions | June 30, 2022 | | December 31, 2021 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,617 | | | $ | 1,811 | |

| Short-term investments | 86 | | | 91 | |

| Accounts receivable, net of allowance for credit losses of $46 in 2022 and $32 in 2021 | 1,602 | | | 1,720 | |

| Other current assets | 515 | | | 389 | |

| | | |

| Total current assets | 3,820 | | | 4,011 | |

| Property and equipment, net of accumulated depreciation of $1,058 in 2022 and $1,010 in 2021 | 433 | | | 347 | |

| Operating lease right-of-use assets | 413 | | | 438 | |

| Goodwill | 5,841 | | | 5,999 | |

| Intangible assets, net | 2,300 | | | 2,467 | |

| Deferred tax assets, net | 341 | | | 384 | |

| Other assets | 1,167 | | | 1,034 | |

| Total assets | $ | 14,315 | | | $ | 14,680 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 866 | | | $ | 1,142 | |

| Current portion of operating lease liabilities | 105 | | | 105 | |

| | | |

| Current portion of long-term debt | 499 | | | — | |

| Deferred revenue | 1,285 | | | 1,249 | |

| | | |

| Total current liabilities | 2,755 | | | 2,496 | |

| Non-current portion of deferred revenue | 81 | | | 86 | |

| Long-term debt | 7,158 | | | 7,413 | |

| Deferred tax liabilities, net | 572 | | | 488 | |

| Uncertain tax positions | 336 | | | 388 | |

| Operating lease liabilities | 421 | | | 455 | |

| Other liabilities | 513 | | | 438 | |

| Total liabilities | 11,836 | | | 11,764 | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Moody's shareholders' equity | 2,294 | | | 2,727 | |

| Noncontrolling interests | 185 | | | 189 | |

| Total shareholders' equity | 2,479 | | | 2,916 | |

| Total liabilities, noncontrolling interests and shareholders' equity | $ | 14,315 | | | $ | 14,680 | |

Table 3 - Non-Operating (Expense) Income, Net (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| Amounts in millions | 2022 | | 2021 | | 2022 | | 2021 |

| Interest: | | | | | | | |

| Expense on borrowings | $ | (50) | | | $ | (41) | | | $ | (98) | | | $ | (82) | |

UTPs and other tax related liabilities (1) | (3) | | | (5) | | | (6) | | | 30 | |

| Net periodic pension costs - interest component | (4) | | | (4) | | | (8) | | | (8) | |

| Income | 2 | | | 1 | | | 4 | | | 4 | |

| | | | | | | |

| Total interest expense, net | $ | (55) | | | $ | (49) | | | $ | (108) | | | $ | (56) | |

| Other non-operating (expense) income, net: | | | | | | | |

FX gain/(loss) (2) | $ | (22) | | | $ | 2 | | | $ | (22) | | | $ | — | |

Net periodic pension costs - other components (3) | 6 | | | (3) | | | 12 | | | 1 | |

| Income from investments in non-consolidated affiliates | 2 | | | 1 | | | 4 | | | 9 | |

| Other | 4 | | | 6 | | | 2 | | | 12 | |

| Other non-operating (expense) income, net | (10) | | | 6 | | | (4) | | | 22 | |

| Total non-operating (expense) income, net | $ | (65) | | | $ | (43) | | | $ | (112) | | | $ | (34) | |

| | |

(1) The amount for the six months ended June 30, 2021 includes a $40 million benefit related to the reversal of tax-related interest accruals pursuant to the resolution of tax matters. (2) The 2022 amount reflects $20 million of foreign exchange translation losses reclassified to earnings resulting from the Company no longer conducting commercial operations in Russia. (3) The increase reflects a $7 million loss related to a settlement of pension obligations in 2021 that did not recur in 2022. |

Table 4 - Financial Information by Segment (Unaudited)

The table below presents revenue and Adjusted Operating Income by reportable segment. The Company defines Adjusted Operating Income as operating income excluding: i) depreciation and amortization; and ii) restructuring.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2022 |

| 2021 |

| Amounts in millions | MIS | | MA | | Eliminations | | Consolidated | | MIS | | MA | | Eliminations | | Consolidated |

| Total external revenue | $ | 706 | |

| $ | 675 | |

| $ | — | |

| $ | 1,381 | |

| $ | 980 | |

| $ | 573 | |

| $ | — | |

| $ | 1,553 | |

| Intersegment revenue | 43 | | | 1 | | | (44) | | | — | | | 42 | | | 2 | | | (44) | | | — | |

| Total revenue | 749 | | | 676 | | | (44) | | | 1,381 | | | 1,022 | | | 575 | | | (44) | | | 1,553 | |

| Operating, SG&A | 334 | | | 471 | | | (44) | | | 761 | | | 344 | | | 392 | | | (44) | |

| 692 | |

| Adjusted Operating Income | $ | 415 | | | $ | 205 | | | $ | — | | | $ | 620 | | | $ | 678 | | | $ | 183 | | | $ | — | | | $ | 861 | |

| Adjusted Operating Margin | 55.4 | % | | 30.3 | % | | | | 44.9 | % | | 66.3 | % | | 31.8 | % | | | | 55.4 | % |

| Depreciation and amortization | 21 | |

| 60 | |

| — | |

| 81 | |

| 18 | |

| 42 | |

| — | |

| 60 | |

| Restructuring | 15 | | | 16 | | | — | | | 31 | | | — | | | — | | | — | | | — | |

| Operating income | | | | | | | $ | 508 | | | | | | | | | $ | 801 | |

| Operating margin | | | | | | | 36.8 | % | | | | | | | | 51.6 | % |

| | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2022 | | 2021 |

| Amounts in millions | MIS | | MA | | Eliminations | | Consolidated | | MIS | | MA | | Eliminations | | Consolidated |

| Total external revenue | $ | 1,533 | |

| $ | 1,370 | |

| $ | — | |

| $ | 2,903 | |

| $ | 2,016 | |

| $ | 1,137 | |

| $ | — | |

| $ | 3,153 | |

| Intersegment revenue | 86 | | | 3 | | | (89) | | | — | | | 82 | | | 4 | | | (86) | | | — | |

| Total revenue | 1,619 | | | 1,373 | | | (89) | | | 2,903 | | | 2,098 | | | 1,141 | | | (86) | | | 3,153 | |

| Operating, SG&A | 694 | | | 944 | | | (89) | | | 1,549 | | | 692 | | | 772 | | | (86) | |

| 1,378 | |

| Adjusted Operating Income | $ | 925 | | | $ | 429 | | | $ | — | | | $ | 1,354 | | | $ | 1,406 | | | $ | 369 | | | $ | — | | | $ | 1,775 | |

| Adjusted Operating Margin | 57.1 | % | | 31.2 | % | | | | 46.6 | % | | 67.0 | % | | 32.3 | % | | | | 56.3 | % |

| Depreciation and amortization | 39 | |

| 120 | |

| — | |

| 159 | |

| 36 | |

| 83 | |

| — | | | 119 | |

| Restructuring | 15 | | | 16 | | | — | | | 31 | | | — | | | 2 | | | — | | | 2 | |

| Operating income | | | | | | | $ | 1,164 | | | | | | | | | $ | 1,654 | |

| Operating margin | | | | | | | 40.1 | % | | | | | | | | 52.5 | % |

Table 5 - Adjusted Operating Income and Adjusted Operating Margin (Unaudited)

The Company presents Adjusted Operating Income and Adjusted Operating Margin because management deems these metrics to be useful measures to provide additional perspective on Moody’s operating performance. Adjusted Operating Income excludes the impact of: i) depreciation and amortization; and ii) restructuring. Depreciation and amortization are excluded because companies utilize productive assets of different estimated useful lives and use different methods of acquiring and depreciating productive assets. Restructuring charges are excluded as the frequency and magnitude of these items may vary widely across periods and companies.

Management believes that the exclusion of the aforementioned items, as detailed in the reconciliation below, allows for an additional perspective on the Company’s operating results from period to period and across companies. The Company defines Adjusted Operating Margin as Adjusted Operating Income divided by revenue.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2022 | | 2021 | | 2022 | | 2021 |

| Operating income | $ | 508 | | | $ | 801 | | | $ | 1,164 | | | $ | 1,654 | |

| Depreciation and amortization | 81 | | | 60 | | | 159 | | | 119 | |

| Restructuring | 31 | | | — | | | 31 | | | 2 | |

| Adjusted Operating Income | $ | 620 | | | $ | 861 | | | $ | 1,354 | | | $ | 1,775 | |

| Operating margin | 36.8 | % | | 51.6 | % | | 40.1 | % | | 52.5 | % |

| Adjusted Operating Margin | 44.9 | % | | 55.4 | % | | 46.6 | % | | 56.3 | % |

Table 6 - Free Cash Flow (Unaudited)

The table below reflects a reconciliation of the Company's net cash flow from operating activities to Free Cash Flow. The Company defines Free Cash Flow as net cash provided by operating activities minus payments for capital additions. Management deems capital expenditures essential to the Company's product and service innovations and maintenance of Moody's operational capabilities. Accordingly, capital expenditures are deemed to be a recurring use of Moody's cash flow. Management believes that Free Cash Flow is a useful metric in assessing the Company's cash flows to service debt, pay dividends and to fund acquisitions and share repurchases.

| | | | | | | | | | | |

| Six Months Ended June 30, |

| Amounts in millions | 2022 | | 2021 |

| Net cash provided by operating activities | $ | 761 | | | $ | 1,270 | |

| Capital additions | (133) | | | (44) | |

| Free Cash Flow | $ | 628 | | | $ | 1,226 | |

| Net cash used in investing activities | $ | (172) | | | $ | (251) | |

| Net cash used in financing activities | $ | (712) | | | $ | (792) | |

Table 7 - Organic Constant Currency Revenue Growth (Decline)/

Constant Currency Revenue Growth (Decline) (Unaudited)

Beginning in the second quarter of 2022, the Company began presenting organic constant currency revenue growth (decline) and constant currency revenue growth (decline) as its non-GAAP measure of revenue growth (decline). Previously, the Company presented organic revenue growth (decline), which only excluded the impact of certain acquisition activity. Management deems this revised measure to be useful in providing additional perspective in assessing the Company's revenue growth (decline) excluding both the impacts from inorganic revenue from certain acquisition activity and the impacts of changes in foreign exchange rates. The Company calculates the dollar impact of foreign exchange as the difference between the translation of its current period non-USD functional currency results using comparative prior period weighted average foreign exchange translation rates and current year reported results.

Below is a reconciliation of the Company’s reported revenue and growth (decline) rates to its organic constant currency revenue growth (decline)/constant currency revenue growth (decline) measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | | 2022 | | 2021 | | Change | | Growth | | 2022 | | 2021 | | Change | | Growth |

| MCO revenue | | $ | 1,381 | | | $ | 1,553 | | | $ | (172) | | | (11)% | | $ | 2,903 | | | $ | 3,153 | | | $ | (250) | | | (8)% |

| FX impact | | 47 | | | — | | | 47 | | | | | 75 | | | — | | | 75 | | | |

| Inorganic revenue from acquisitions | | (83) | | | — | | | (83) | | | | | (162) | | | — | | | (162) | | | |

| Organic constant currency MCO revenue | | $ | 1,345 | | | $ | 1,553 | | | $ | (208) | | | (13)% | | $ | 2,816 | | | $ | 3,153 | | | $ | (337) | | | (11)% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| MA revenue | | $ | 675 | | | $ | 573 | | | $ | 102 | | | 18% | | $ | 1,370 | | | $ | 1,137 | | | $ | 233 | | | 20% |

| FX impact | | 27 | | | — | | | 27 | | | | | 40 | | | — | | | 40 | | | |

| Inorganic revenue from acquisitions | | (83) | | | — | | | (83) | | | | | (162) | | | — | | | (162) | | | |

| Organic constant currency MA revenue | | $ | 619 | | | $ | 573 | | | $ | 46 | | | 8% | | $ | 1,248 | | | $ | 1,137 | | | $ | 111 | | | 10% |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| Decision Solutions revenue | | $ | 312 | | | $ | 222 | | | $ | 90 | | | 41% | | $ | 646 | | | $ | 447 | | | $ | 199 | | | 45% |

| FX impact | | 11 | | | — | | | 11 | | | | | 16 | | | — | | | 16 | | | |

| Inorganic revenue from acquisitions | | (83) | | | — | | | (83) | | | | | (160) | | | — | | | (160) | | | |

| Organic constant currency Decision Solutions revenue | | $ | 240 | | | $ | 222 | | | $ | 18 | | | 8% | | $ | 502 | | | $ | 447 | | | $ | 55 | | | 12% |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| Research and Insights revenue | | $ | 185 | | | $ | 175 | | | $ | 10 | | | 6% | | $ | 368 | | | $ | 346 | | | $ | 22 | | | 6% |

| FX impact | | 4 | | | — | | | 4 | | | | | 5 | | | — | | | 5 | | | |

| | | | | | | | | | | | | | | | |

| Constant currency Research and Insights revenue | | $ | 189 | | | $ | 175 | | | $ | 14 | | | 8% | | $ | 373 | | | $ | 346 | | | $ | 27 | | | 8% |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| Data and Information revenue | | $ | 178 | | | $ | 176 | | | $ | 2 | | | 1% | | $ | 356 | | | $ | 344 | | | $ | 12 | | | 3% |

| FX impact | | 12 | | | — | | | 12 | | | | | 19 | | | — | | | 19 | | | |

| Inorganic revenue from acquisitions | | — | | | — | | | — | | | | | (2) | | | — | | | (2) | | | |

| Organic constant currency Data and Information revenue | | $ | 190 | | | $ | 176 | | | $ | 14 | | | 8% | | $ | 373 | | | $ | 344 | | | $ | 29 | | | 8% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| MA recurring revenue | | $ | 633 | | | $ | 533 | | | $ | 100 | | | 19% | | $ | 1,284 | | | $ | 1,054 | | | $ | 230 | | | 22% |

| FX impact | | 25 | | | — | | | 25 | | | | | 37 | | | — | | | 37 | | | |

| Inorganic recurring revenue from acquisitions | | (78) | | | — | | | (78) | | | | | (153) | | | — | | | (153) | | | |

| Organic constant currency MA recurring revenue | | $ | 580 | | | $ | 533 | | | $ | 47 | | | 9% | | $ | 1,168 | | | $ | 1,054 | | | $ | 114 | | | 11% |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Table 8 - Key Performance Metrics - Annualized Recurring Revenue (Unaudited)

The Company presents Annualized Recurring Revenue (“ARR”) and Organic ARR for its MA business as supplemental performance metrics to provide additional insight on the estimated value of MA's recurring revenue contracts at a given point in time. The Company uses these metrics to manage and monitor performance of its MA operating segment and believes that ARR is a key indicator of the trajectory of MA's recurring revenue base.

The Company calculates ARR and Organic ARR by taking the total recurring contract value for each active renewable contract as of the reporting date, divided by the number of days in the contract and multiplied by 365 days to create an annualized value. The Company defines renewable contracts as subscriptions, term licenses, maintenance and renewable services. ARR excludes transaction sales, including training, one-time services and perpetual licenses. In order to compare period-over-period ARR and Organic ARR excluding the effects of foreign currency translation, the Company bases the calculation on currency rates utilized in its operating budget and holds these rates constant for the duration of all current and prior periods being reported. Additionally, Organic ARR excludes contracts related to acquisitions to provide additional perspective in assessing ARR growth excluding the impacts from certain acquisition activity.

The Company’s definition of ARR may differ from definitions utilized by other companies reporting similarly named measures, and this metric should be viewed in addition to, and not as a substitute for, financial measures presented in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Amounts in millions | | June 30, 2022 | | June 30, 2021 | | Change | | Growth | | | | | | | | |

| MA ARR | | $ | 2,608 | | | $ | 2,084 | | | $ | 524 | | | 25% | | | | | | | | |

| Organic MA ARR | | $ | 2,276 | | | $ | 2,084 | | | $ | 192 | | | 9% | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Table 9 - Adjusted Net Income and Adjusted Diluted EPS Attributable to Moody's Common Shareholders (Unaudited)

The Company presents Adjusted Net Income and Adjusted Diluted EPS because management deems these metrics to be useful measures to provide additional perspective on Moody’s operating performance. Adjusted Net Income and Adjusted Diluted EPS exclude the impact of: i) amortization of acquired intangible assets; ii) restructuring charges; and iii) FX translation losses reclassified to earnings resulting from the Company no longer conducting commercial operations in Russia.

The Company excludes the impact of amortization of acquired intangible assets as companies utilize intangible assets with different estimated useful lives and have different methods of acquiring and amortizing intangible assets. These intangible assets were recorded as part of acquisition accounting and contribute to revenue generation. The amortization of intangible assets related to acquisitions will recur in future periods until such intangible assets have been fully amortized. Furthermore, the timing and magnitude of business combination transactions are not predictable, and the purchase price allocated to amortizable intangible assets and the related amortization period are unique to each acquisition and can vary significantly from period to period and across companies. Restructuring charges and FX translation losses resulting from the Company no longer conducting commercial operations in Russia are excluded as the frequency and magnitude of these items may vary widely across periods and companies.

Below is a reconciliation of this measure to its most directly comparable U.S. GAAP amount:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2022 | | 2021 | | 2022 | | 2021 |

| Net income attributable to Moody's common shareholders | | $ | 327 | | | | $ | 577 | | | | $ | 825 | | | | $ | 1,313 | |

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 51 | | | | $ | 36 | | | | $ | 102 | | | | $ | 71 | | |

| Tax on Acquisition-Related Intangible Amortization Expenses | (12) | | | | (8) | | | | (24) | | | | (16) | | |

| Net Acquisition-Related Intangible Amortization Expenses | | 39 | | | | 28 | | | | 78 | | | | 55 | |

| Pre-tax restructuring | $ | 31 | | | | $ | — | | | | $ | 31 | | | | $ | 2 | | |

| Tax on restructuring | (7) | | | | — | | | | (7) | | | | — | | |

| Net restructuring | | 24 | | | | — | | | | 24 | | | | 2 | |

| | | | | | | | | | | |

| FX losses resulting from the Company no longer conducting commercial operations in Russia | | 20 | | | | — | | | | 20 | | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Net Income | | $ | 410 | | | | $ | 605 | | | | $ | 947 | | | | $ | 1,370 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Note: The tax impacts in the table above were calculated using tax rates in effect in the jurisdiction for which the item relates. |

Table 9 - Adjusted Net Income and Adjusted Diluted EPS Attributable to Moody's Common Shareholders (Unaudited) Continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2022 | | 2021 | | 2022 | | 2021 |

| Diluted earnings per share attributable to Moody's common shareholders | | $ | 1.77 | | | | $ | 3.07 | | | | $ | 4.45 | | | | $ | 6.98 | |

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 0.28 | | | | $ | 0.19 | | | | $ | 0.55 | | | | $ | 0.38 | | |

| Tax on Acquisition-Related Intangible Amortization Expenses | (0.07) | | | | (0.04) | | | | (0.13) | | | | (0.09) | | |

| Net Acquisition-Related Intangible Amortization Expenses | | 0.21 | | | | 0.15 | | | | 0.42 | | | | 0.29 | |

| Pre-tax restructuring | $ | 0.17 | | | | $ | — | | | | $ | 0.17 | | | | $ | 0.01 | | |

| Tax on restructuring | (0.04) | | | | — | | | | (0.04) | | | | — | | |

| Net restructuring | | 0.13 | | | | — | | | | 0.13 | | | | 0.01 | |

| FX losses resulting from the Company no longer conducting commercial operations in Russia | | 0.11 | | | | — | | | | 0.11 | | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Diluted EPS | | $ | 2.22 | | | | $ | 3.22 | | | | $ | 5.11 | | | | $ | 7.28 | |

| | | | | | | | | | | |

| | |

| Note: The tax impacts in the table above were calculated using tax rates in effect in the jurisdiction for which the item relates. |

Table 10 - 2022 Outlook

Moody’s updated outlook for full year 2022, as of July 26, 2022, reflects assumptions about numerous factors that could affect its business and is based on currently available information reviewed by management through and as of today’s date. For a complete list of these assumptions, please refer to “Assumptions and Outlook” on page 10 of this earnings release.

| | | | | | | | |

| Full Year 2022 Moody's Corporation Guidance as of July 26, 2022 |

| MOODY'S CORPORATION | Current guidance | Last publicly disclosed guidance |

| Revenue | Decline in the high-single-digit percent range | Approximately flat |

| Operating expenses | Increase in the high-single-digit percent range | NC |

| Operating margin | 37% to 38% | 41% to 42% |

Adjusted Operating Margin (1) | Approximately 44% | Approximately 47% |

| Interest expense, net | $220 to $240 million | $200 to $220 million |

| Effective tax rate | 20.5% to 22.5% | NC |

| Diluted EPS | $8.10 to $8.60 | $9.85 to $10.35 |

Adjusted Diluted EPS (1) | $9.20 to $9.70 | $10.75 to $11.25 |

| Operating cash flow | $1.7 to $1.9 billion | $2.1 to $2.3 billion |

Free Cash Flow (1) | $1.4 to $1.6 billion | $1.8 to $2.0 billion |

| Share repurchases | Approximately $1.0 billion (subject to available cash, market conditions, M&A opportunities and other ongoing capital allocation decisions) | At least $1.5 billion (subject to available cash, market conditions, M&A opportunities and other ongoing capital allocation decisions) |

| Moody's Investors Service (MIS) | Current guidance | Last publicly disclosed guidance |

| MIS global revenue | Decrease in the low-twenties percent range | Decrease in the low-double-digit percent range |

| MIS Adjusted Operating Margin | 54% to 55% | Approximately 59% |

| Moody's Analytics (MA) | Current guidance | Last publicly disclosed guidance |

| MA global revenue | Increase in the mid-teens percent range | Increase in the high-teens percent range |

Organic MA ARR (2) | Increase in the low-double-digit percent range | NC |

| MA Adjusted Operating Margin | Approximately 29% | NC |

NC - There is no difference between the Company’s current guidance and the last publicly disclosed guidance for this item.

Note: All current guidance as of July 26, 2022. All last publicly disclosed guidance is as of May 2, 2022.

(1) These metrics are adjusted measures. See below for reconciliation of these measures to their comparable U.S. GAAP measure.

(2) Refer to Table 8 within this earnings release for the definition of and further information on the Organic MA ARR metric. |

Table 10 - 2022 Outlook Continued

The following are reconciliations of the Company's adjusted forward looking measures to their comparable U.S. GAAP measure:

| | | | | |

| Projected for the Year Ended

December 31, 2022 |

| Operating margin guidance | 37% to 38% |

| Depreciation and amortization | Approximately 6% |

| Restructuring Expense | 0.5% to 1.0% |

| Adjusted Operating Margin guidance | Approximately 44% |

| |

| Projected for the Year Ended

December 31, 2022 |

| Operating cash flow guidance | $1.7 to $1.9 billion |

| Less: Capital expenditures | $250 to $300 million |

| Free Cash Flow guidance | $1.4 to $1.6 billion |

| |

| Projected for the Year Ended

December 31, 2022 |

| Diluted EPS guidance | $8.10 to $8.60 |

| Acquisition-Related Intangible Amortization | Approximately $0.85 |

| Restructuring | Approximately $0.15 |

| FX losses resulting from the Company no longer conducting commercial operations in Russia | Approximately $0.11 |

| Adjusted Diluted EPS guidance | $9.20 to $9.70 |