MOODY'S CORPORATION REPORTS RESULTS

FOR SECOND QUARTER 2023

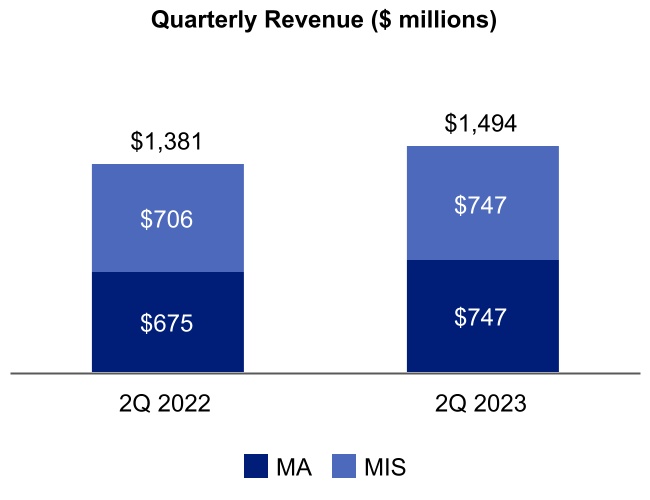

NEW YORK, NY - July 25, 2023 - Moody's Corporation (NYSE: MCO) today announced results for the second quarter 2023, and updated its outlook for full year 2023 to reflect stronger-than-expected investment grade issuance, driven by investor demand for high-quality credits.

| | | | | | | | | | | | | | |

| SECOND QUARTER SUMMARY FINANCIALS |

| | | | |

Moody’s Corporation

(MCO) Revenue | | Moody’s Analytics

(MA) Revenue | | Moody’s Investors Service

(MIS) Revenue |

| 2Q 2023 | | 2Q 2023 | | 2Q 2023 |

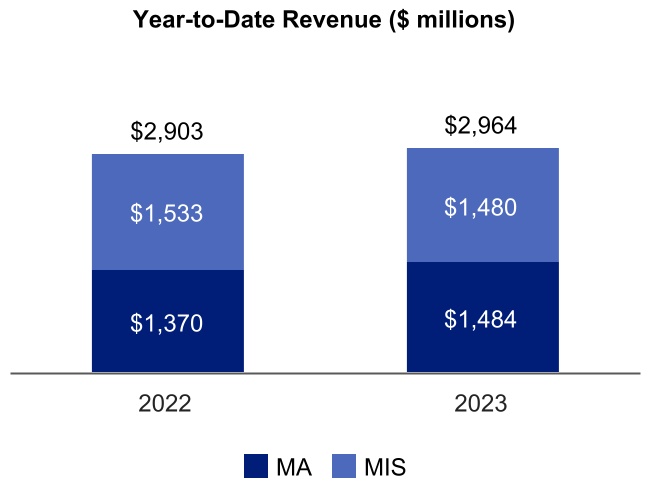

$1.5 billion ⇑ 8% | | $747 million ⇑ 11% | | $747 million ⇑ 6% |

| YTD 2023 | | YTD 2023 | | YTD 2023 |

$3.0 billion ⇑ 2% | | $1.5 billion ⇑ 8% | | $1.5 billion ⇓ 3% |

| | | | |

| MCO Diluted EPS | | MCO Adjusted Diluted EPS1 | | MCO FY 2023 Projected |

| 2Q 2023 | | 2Q 2023 | | Diluted EPS |

$2.05 ⇑ 16% | | $2.30 ⇑ 4% | | $8.70 to $9.20 |

| | | | |

| | | | |

| | | | |

| YTD 2023 | | YTD 2023 | | Adjusted Diluted EPS1 |

$4.77 ⇑ 7% | | $5.29 ⇑ 4% | | $9.75 to $10.25 |

| | | | |

| | | | | |

| “Moody’s is poised to capitalize on the momentous opportunity of generative AI to activate the power of our unique and verified data sets. Drawing on our team of over 14,000 innovators, we are accelerating our customers’ decision-making processes with enhanced analytics and insights that address the evolving world of exponential risk.” |

Rob Fauber President and Chief Executive Officer |

| | | | | |

1 Refer to the tables at the end of this press release for reconciliations of adjusted measures to U.S. GAAP. |

| | |

| Moody’s Corporation (MCO) |

| | | | | | | | |

| Second Quarter 2023 | | Year-to-Date 2023 |

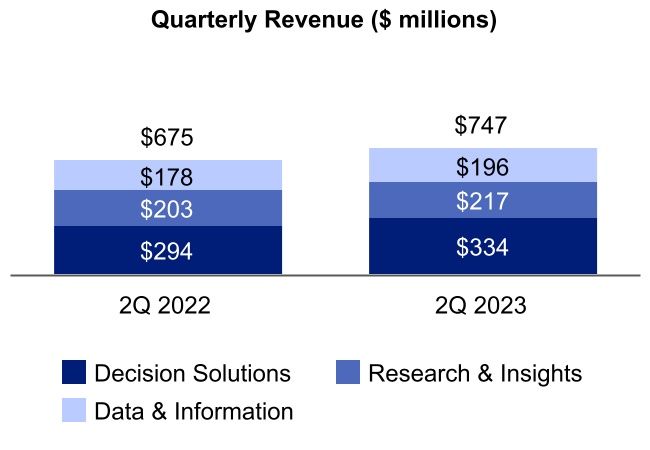

•Revenue increased 8% from the prior-year period. Foreign currency translation had an immaterial impact on MCO’s revenue. •MA reported its 62nd consecutive quarter of growth, up 11% from the prior-year period, on continued strong demand for mission-critical data, analytics and software solutions. •Increased investor demand for high-quality credits, combined with issuers seeking to refinance in advance of the U.S. debt ceiling deadline, led to higher-than-expected investment grade activity in the quarter.

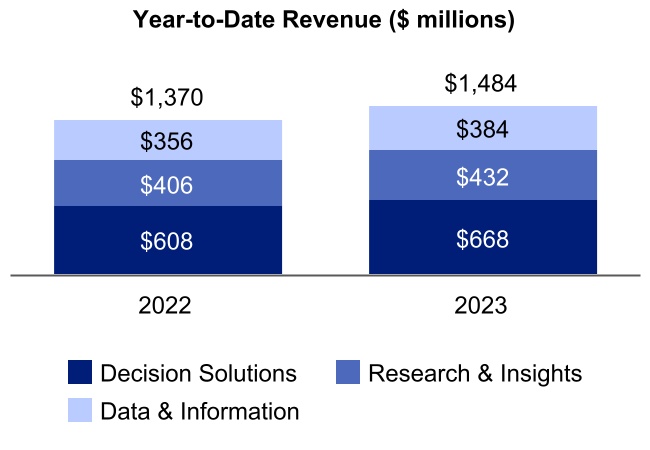

| | •Revenue increased 2% from the prior-year period. Foreign currency translation unfavorably impacted MCO’s revenue by 1%. •MA grew 8% from the prior-year period and represented just over 50% of MCO’s total revenue, up from 47% in the first half of 2022. •MIS’s revenue declined 3% on a strong prior-year first quarter comparable. |

| | | | | | | | |

| Second Quarter 2023 | | Year-to-Date 2023 |

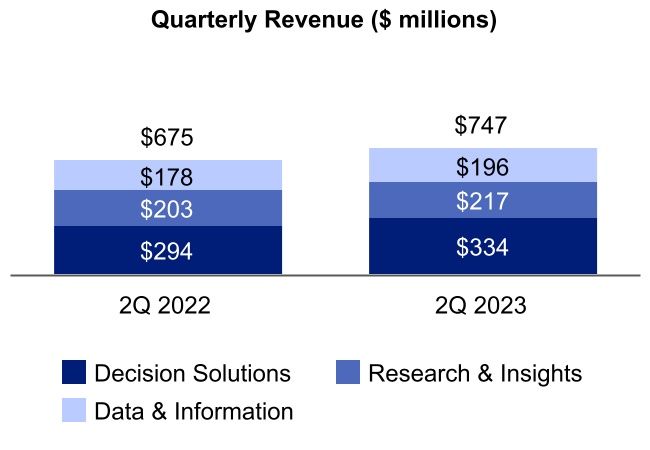

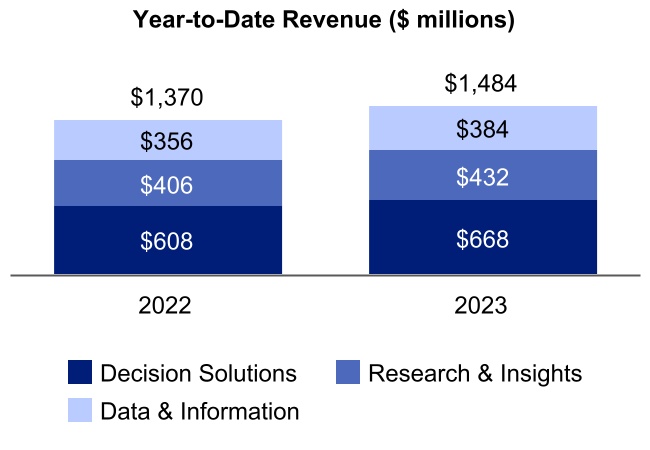

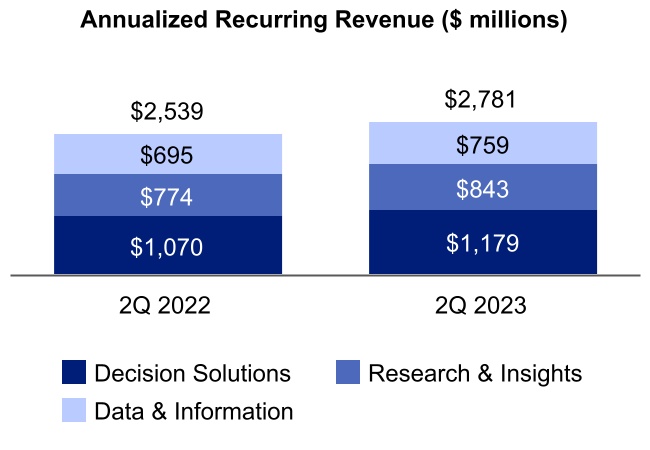

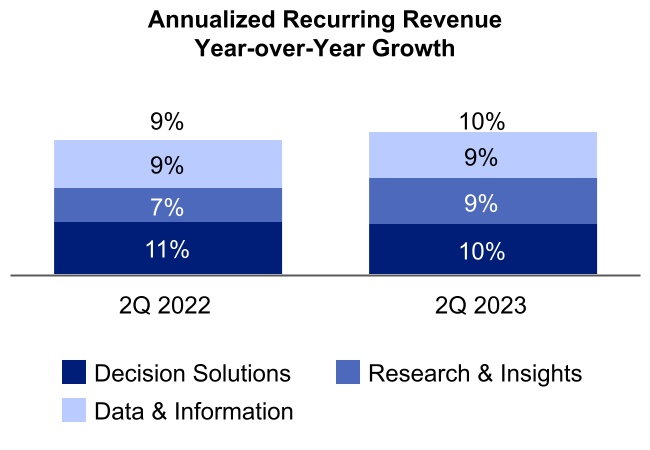

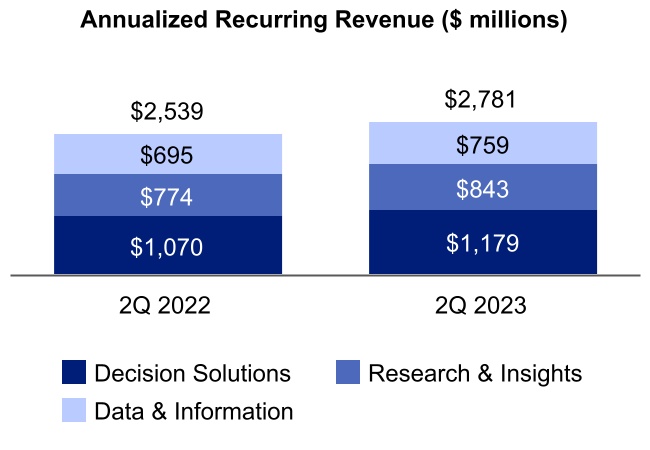

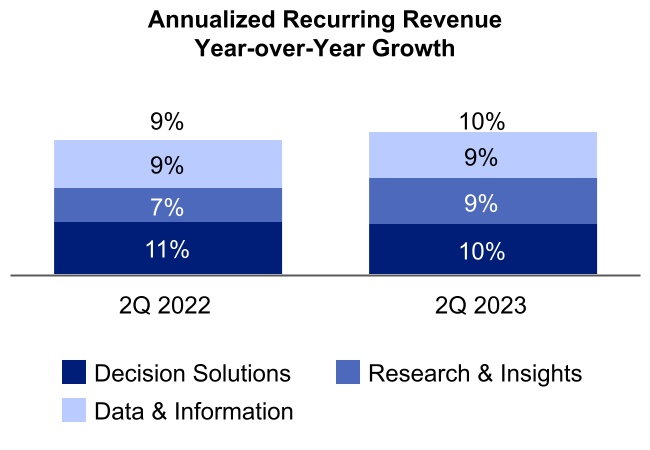

•Reported revenue grew 11%, led by Decision Solutions growth of 14%. Foreign currency translation favorably impacted MA’s revenue by 1%. •Within Decision Solutions: Banking, Insurance and Know Your Customer (KYC) revenue grew 12%, 12%, and 20%, respectively, from the prior-year period. •Banking growth was driven by ongoing demand for SaaS-based customer solutions serving lending, risk management and finance workflows. •Insurance growth was primarily due to continued demand for actuarial modelling and IFRS-17 solutions, as well as increased adoption of capabilities on RMS Intelligent Risk Platform™. •KYC delivered strong growth across a diverse range of customer segments as our best-in-class solutions fulfill several onboarding, screening and monitoring use cases. | | •Reported revenue grew 8% versus the prior-year period and included a 1% unfavorable impact from foreign currency translation. •Customer retention at 93% reflects the mission-critical nature of MA’s innovative data, analytics and workflow solutions in the era of exponential risk. •Expanded disclosure on Decision Solutions2 offers greater visibility into our SaaS businesses serving key customer workflows: Banking, Insurance and KYC. •ARR increased 10% from the prior-year period to $2.8 billion, as strong customer demand and cross-selling execution continue to deliver double-digit growth.

|

| | | | | |

2 Moody’s reclassified certain immaterial revenue relating to structured finance solutions from the Decision Solutions LOB to the Research & Insights LOB. |

| | |

| Moody’s Investors Service (MIS) |

| | | | | | | | |

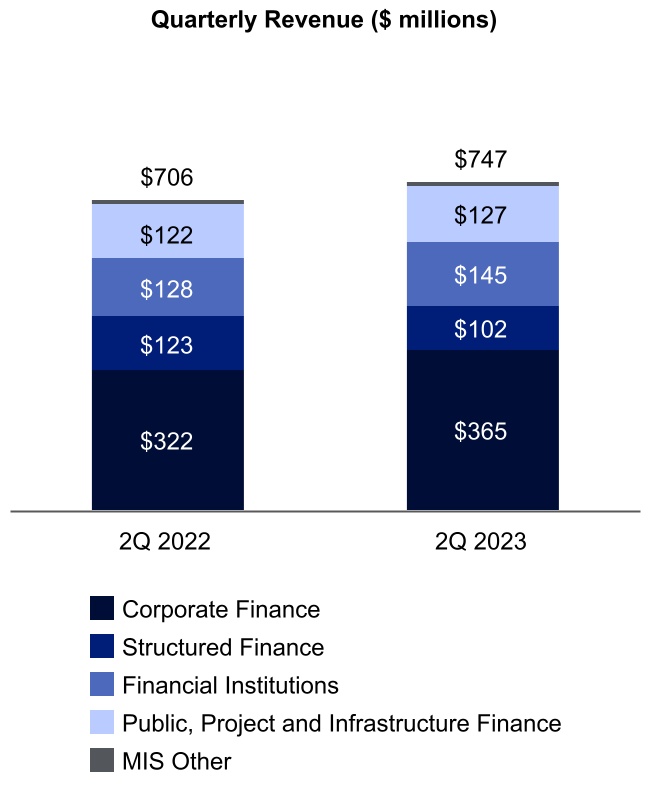

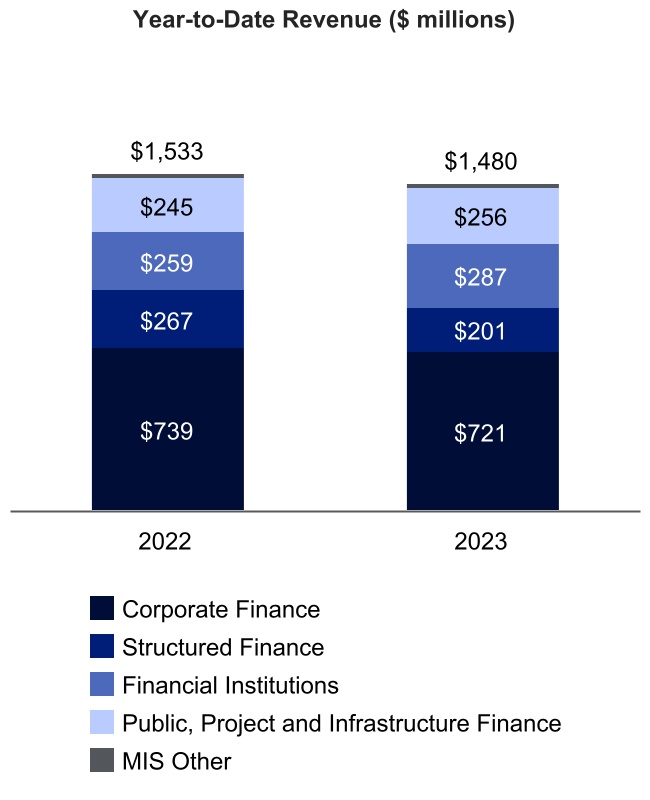

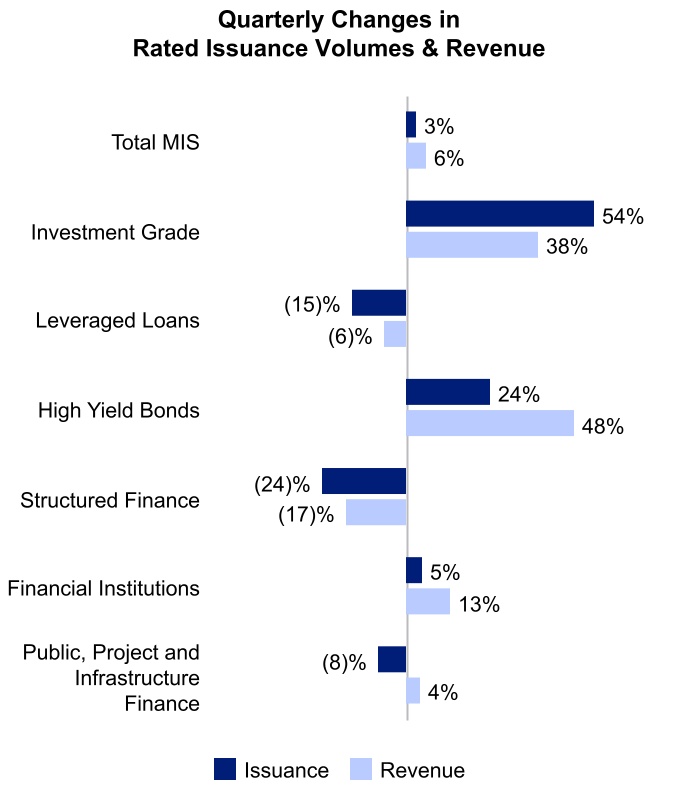

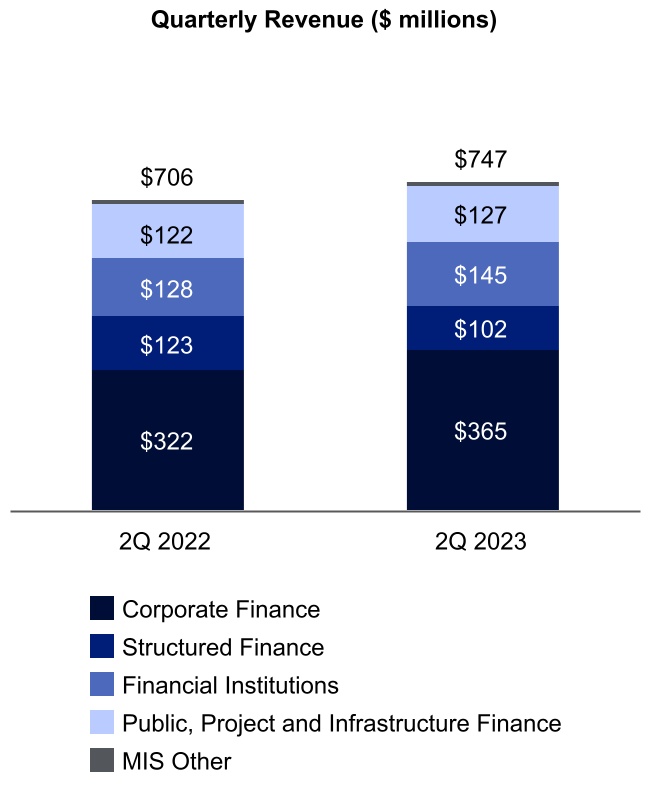

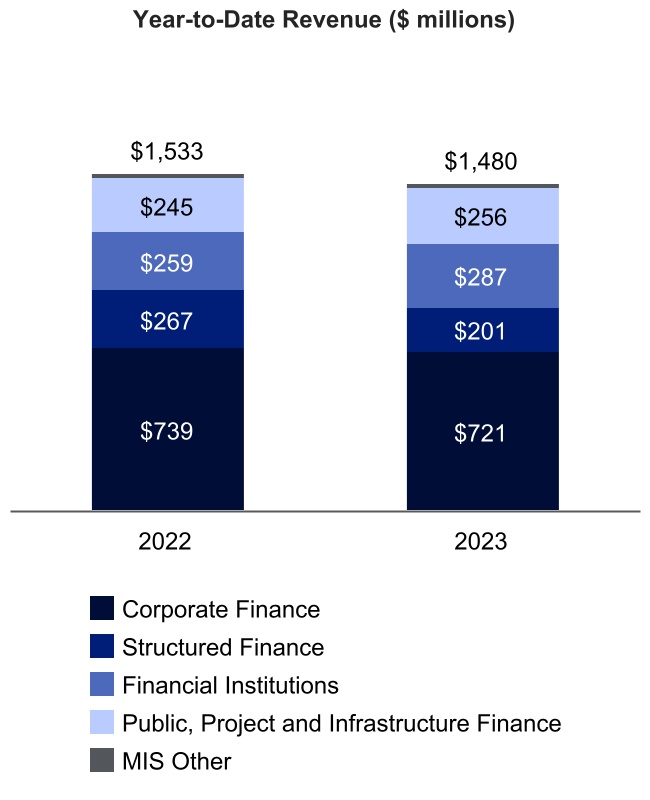

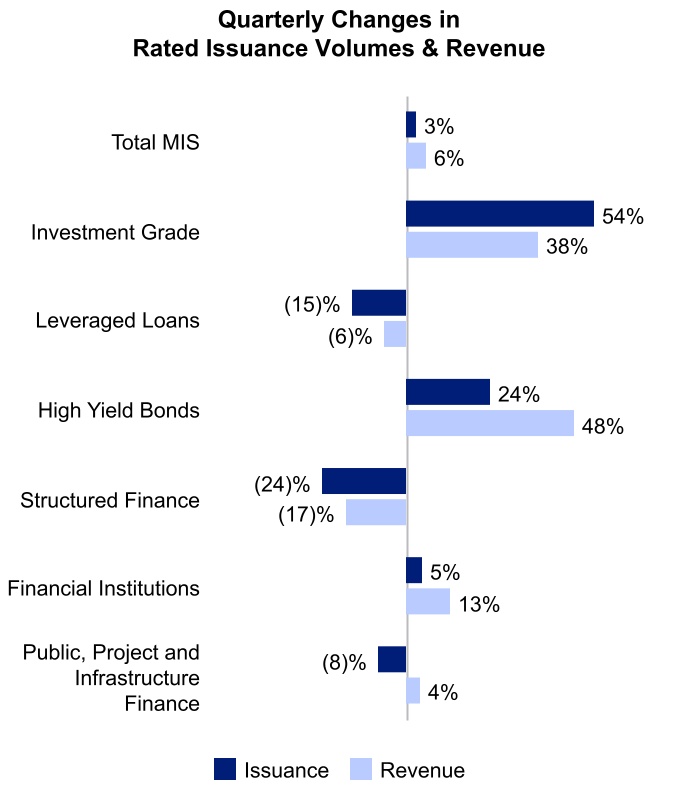

| Second Quarter 2023 | | Year-to-Date 2023 |

•Revenue increased 6% against the prior-year period. Foreign currency translation had an immaterial impact on MIS’s revenue. •Similar to the first quarter, activity was skewed toward higher-rated, investment grade corporate and infrastructure finance issuers who took advantage of constructive market conditions. •Within leveraged finance, the second quarter saw a significant increase in high yield bond issuance, which experienced the strongest quarter since the beginning of 2022, driven mainly by refinancing. Conversely, leveraged loan issuance declined due to subdued M&A activity. •Structured Finance was negatively impacted by a combination of a strong prior-year comparable and a decline in loan supply for CMBS, RMBS and structured credit transactions.

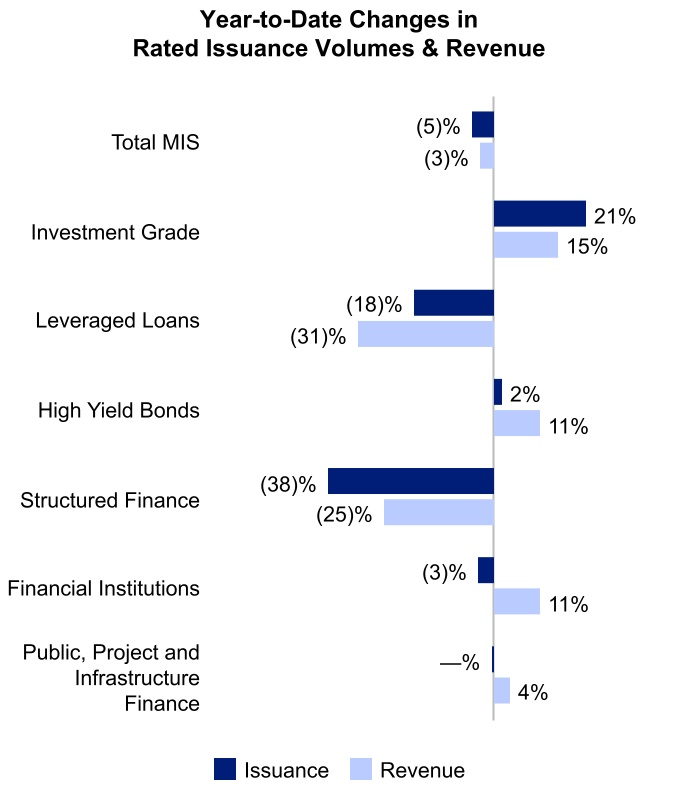

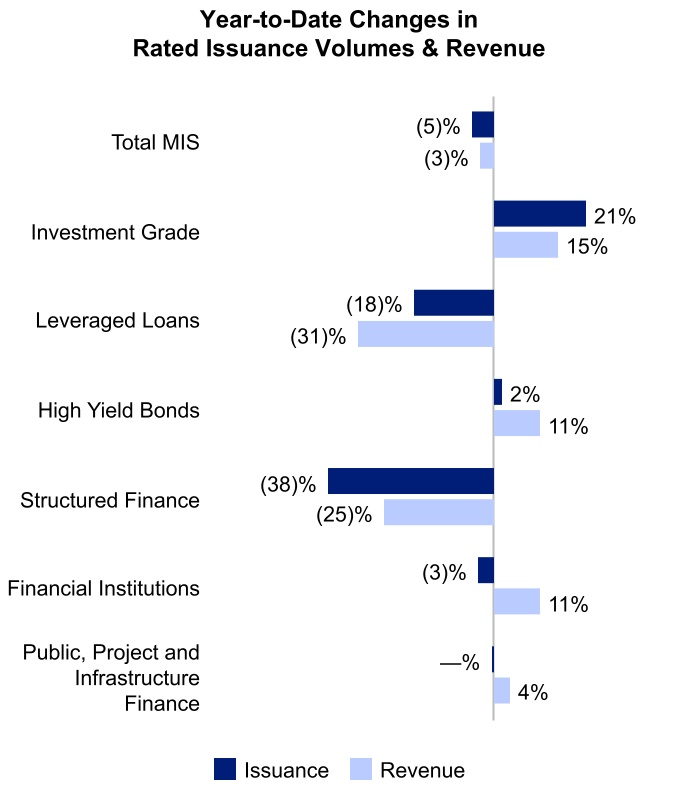

| | •Revenue declined 3% against the prior-year period. Foreign currency translation had an immaterial impact on MIS’s revenue. •Market conditions were increasingly constructive during the first half of 2023, though ongoing uncertainty around inflation, interest rates and recessionary concerns continued to weigh on credit activity. •Improved investment grade issuance, as well as a favorable mix from infrequent bank and insurance issuers positively impacted revenue growth; however, this was offset by lower leveraged loan and Structured Finance volumes.

|

| | |

| OPERATING EXPENSES AND MARGIN |

| | | | | | | | |

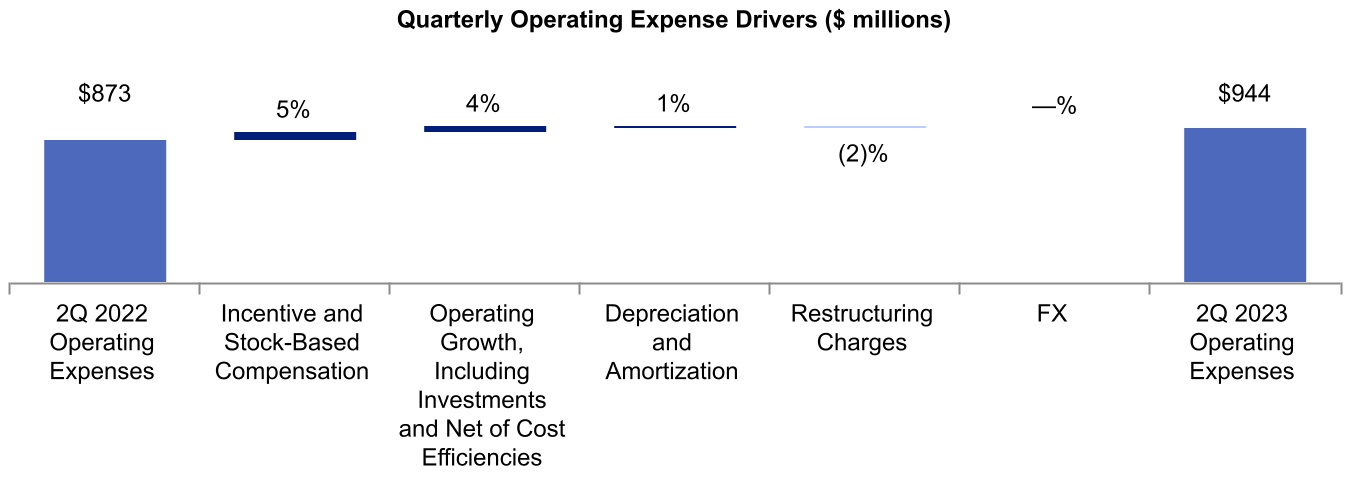

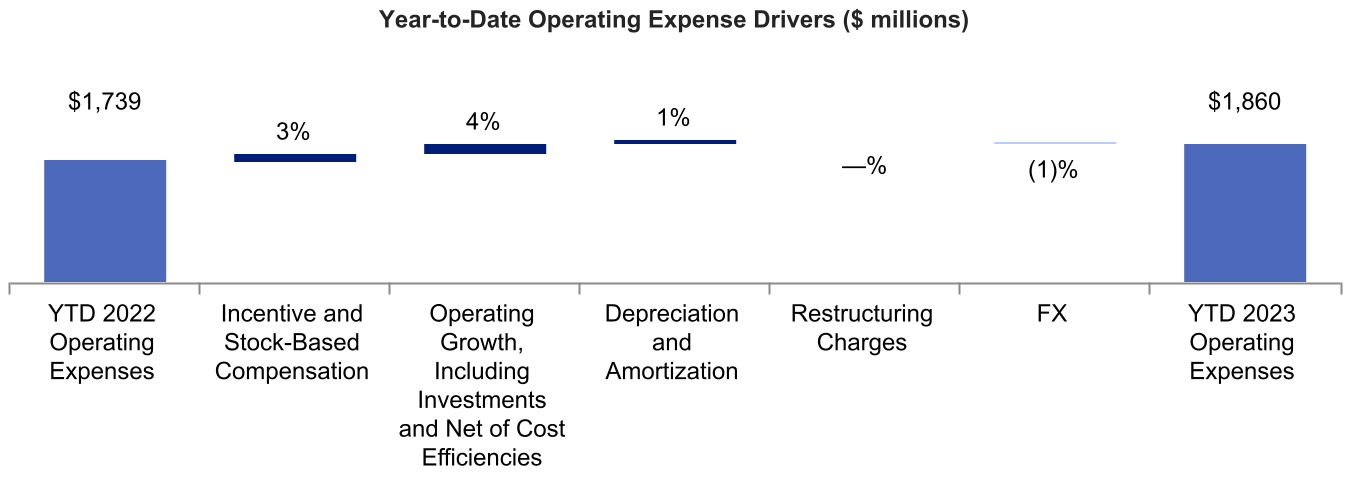

| Second Quarter 2023 | | Year-to-Date 2023 |

•Operating expenses grew 8% versus the prior-year period, including 5% from higher incentive compensation accruals and stock-based compensation. Foreign currency translation had an immaterial impact on operating expenses. •Continued investment in innovation and product development to ensure Moody’s is well-positioned to capture demand from high-growth markets, offsetting expense growth with proactive cost management initiatives. | | •Operating expenses grew 7% versus the prior-year period, including 3% from higher incentive compensation accruals and stock-based compensation. Foreign currency translation favorably impacted operating expenses by 1%. •During the first half of 2023, we accelerated spending on product innovation and employee development related to AI technologies.

|

| | |

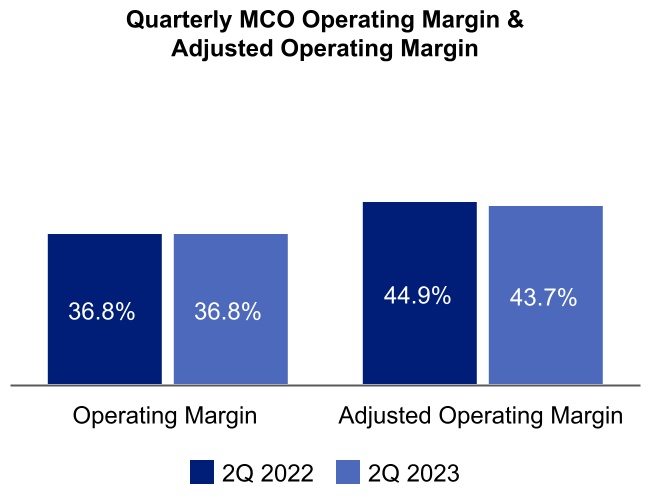

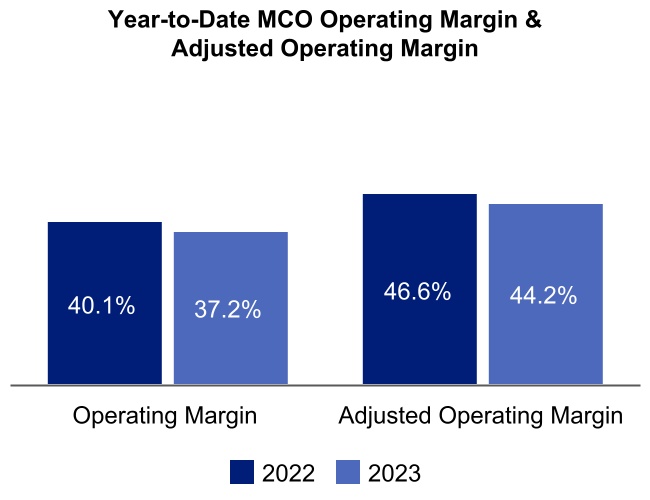

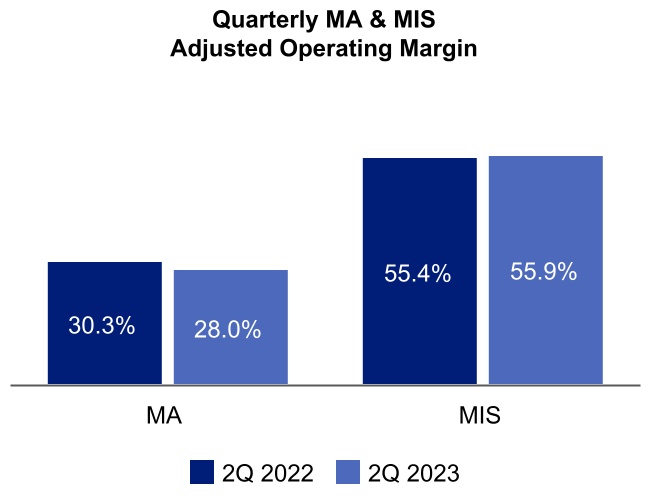

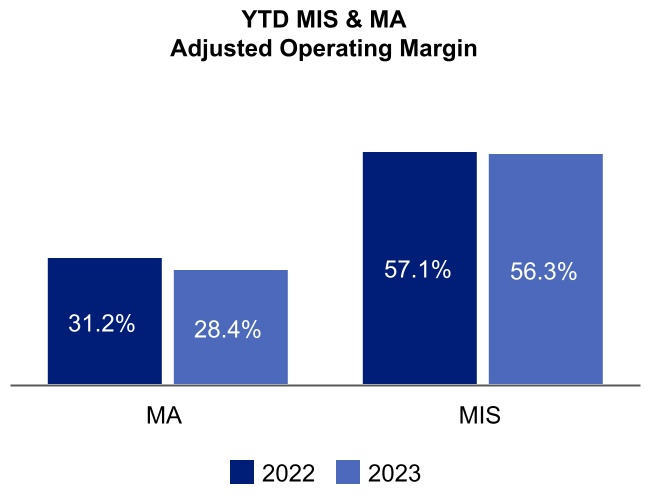

Operating Margin and Adjusted Operating Margin1 |

| | | | | | | | |

| Second Quarter 2023 | | Year-to-Date 2023 |

•MCO’s operating margin was 36.8% and adjusted operating margin1 was 43.7%. Foreign currency translation had an immaterial impact on both operating and adjusted operating margins1. •MA’s adjusted operating margin reflected an increase in strategic sales deployment and product development investments. •MIS’s adjusted operating margin captured operational leverage from both heightened issuance and disciplined expense management. | | •MCO’s operating margin was 37.2% and adjusted operating margin1 was 44.2%. Foreign currency translation had an immaterial impact on both operating and adjusted operating margins1. •The decisive expense management decisions taken as part of the 2022 – 2023 Geolocation Restructuring Program continue to positively impact both MA and MIS’s margins.

|

| | |

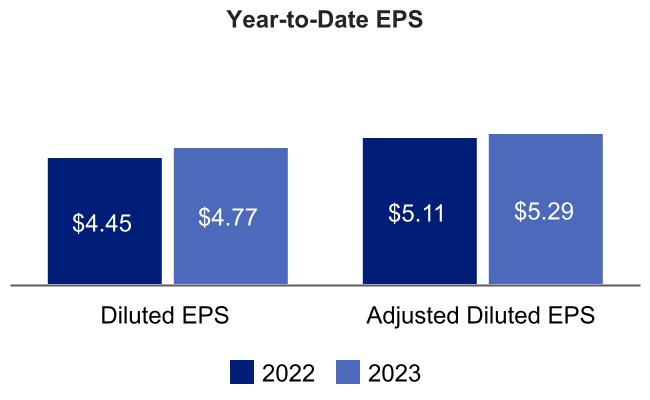

Diluted EPS and Adjusted Diluted EPS1 |

| | | | | | | | |

| Second Quarter 2023 | | Year-to-Date 2023 |

•Diluted and adjusted diluted EPS1 increased from the prior-year period on higher operating income, primarily reflecting MIS’s revenue growth. •The Effective Tax Rate (ETR) was 23.4%, down from 26.2% reported in the prior-year period. The decrease was principally due to excess tax benefits realized from stock-based compensation, along with a non-deductible loss in 2022 associated with the Company no longer conducting commercial operations in Russia. | | •The ETR was 12.0%, significantly lower than the 21.6% reported in the prior-year period, primarily due to the favorable resolutions of uncertain tax positions within U.S. domestic and foreign tax jurisdictions that are not expected to occur to a similar magnitude in future quarters.

|

| | |

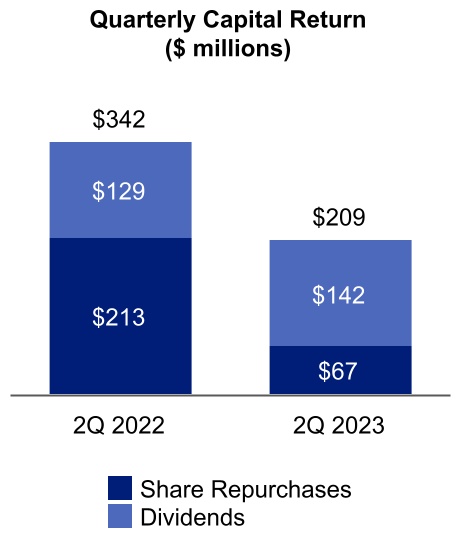

| CAPITAL ALLOCATION AND LIQUIDITY |

| | |

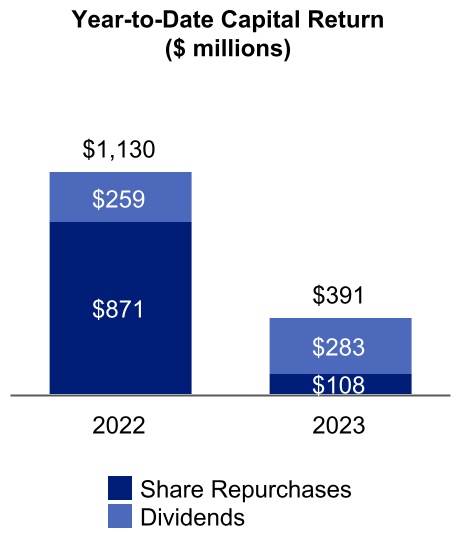

Capital Returned to Shareholders & Free Cash Flow1 |

| | |

•Cash flow from operations for the first half of 2023 was $1,212 million and free cash flow1 was $1,085 million. •The increase in free cash flow1 year-to-date was due to an improvement in working capital. •On July 24, 2023, the Board of Directors declared a regular quarterly dividend of $0.77 per share of MCO Common Stock. The dividend will be payable on September 8, 2023, to stockholders of record at the close of business on August 18, 2023. •During the second quarter of 2023, Moody’s repurchased 0.2 million shares at an average cost of $314.25 per share and issued net 0.2 million shares as part of its employee stock-based compensation programs. The net amount included shares withheld for employee payroll taxes. •As of June 30, 2023, Moody’s had 183.5 million shares outstanding, flat to June 30, 2022, with approximately $740 million of share repurchase authority remaining. •As of June 30, 2023, Moody's had $7.2 billion of outstanding debt and an undrawn $1.25 billion revolving credit facility. |

Moody’s updated outlook for full year 2023, as of July 25, 2023, reflects assumptions about numerous factors that could affect its business and is based on currently available information reviewed by management through, and as of, today’s date. These assumptions include, but are not limited to, the effects of current economic conditions, including the effects of interest rates, inflation, foreign currency exchange rates, capital markets’ liquidity, and activity in different sectors of the debt markets. This outlook also reflects assumptions about global GDP growth, and the impacts resulting from changes in international conditions, including as a result of the Russia-Ukraine military conflict. Actual full year 2023 results could differ materially from Moody’s current outlook.

This outlook incorporates various specific macroeconomic assumptions, including:

| | | | | | | | |

| Forecasted Item | Current assumption | Last publicly disclosed assumption |

U.S. GDP(1) growth | 0.5% - 1.5% | NC |

Euro area GDP(1) growth | 0.0% - 1.0% | NC |

| Global benchmark rates | Remain elevated, with U.S. Fed funds rate above 5%, followed by the potential for rate reductions in early 2024 | NC |

| U.S. high yield spreads | Average approximately 500 bps, with periodic volatility | NC |

| U.S. inflation rate | To decline below 3% by year-end | Averages approximately 5% |

| Euro area inflation rate | Large economies decline to between 3% and 5% by year-end, with considerable variation among countries | Large economies average approximately 6%, with considerable variation

among countries |

| U.S. unemployment rate | Rise toward 4% by year-end | Rise toward 5% by year-end |

| Global high yield default rate | Rise to 4.5% - 5.0% by year-end | Rise to approximately 5% by year-end |

| Global MIS rated issuance | Increase in the mid-single-digit percent range | Increase in the low-single-digit percent range |

| GBP/USD exchange rate | $1.27 for the remainder of the year | $1.24 for the remainder of the year |

| EUR/USD exchange rate | $1.09 for the remainder of the year | NC |

NC - There is no difference between the Company’s current assumption and the last publicly disclosed assumption for this item. Note: All current assumptions are as of July 25, 2023. All last publicly disclosed assumptions are as of April 25, 2023. (1) GDP growth represents real GDP. |

A full summary of Moody's full year 2023 guidance as of July 25, 2023, is included in Table 10 – “2023 Outlook” at the end of this press release.

| | | | | | | | |

| Date and Time | July 25, 2023, at 12:30 p.m. Eastern Time (ET). |

| Webcast | The webcast and its replay can be accessed through Moody’s Investor Relations website, ir.moodys.com, within “Events & Presentations.” |

| Dial In | U.S. and Canada | ‘+1-888-330-2508 |

| Other callers | ‘+1-240-789-2735 |

| Passcode | 9302427 |

| Dial In Replay | A replay will be available immediately after the call on July 25, 2023, and until August 25, 2023. |

| U.S. and Canada | ‘+1-800-770-2030 |

| Other callers | ‘+1-647-362-9199 |

| Passcode | 9302427 |

| | |

| ABOUT MOODY’S CORPORATION |

Moody’s (NYSE: MCO) is a global risk assessment firm that empowers organizations to make better decisions. Its data, analytical solutions and insights help decision-makers identify opportunities and manage the risks of doing business with others. We believe that greater transparency, more informed decisions, and fair access to information open the door to shared progress. With approximately 14,500 employees in more than 40 countries, Moody’s combines international presence with local expertise and over a century of experience in financial markets. Learn more at moodys.com/about.

| | |

| “SAFE HARBOR” STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 |

Certain statements contained in this document are forward-looking statements and are based on future expectations, plans and prospects for Moody’s business and operations that involve a number of risks and uncertainties. Such statements involve estimates, projections, goals, forecasts, assumptions and uncertainties that could cause actual results or outcomes to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements. Stockholders and investors are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements and other information in this document are made as of the date hereof, and Moody’s undertakes no obligation (nor does it intend) to publicly supplement, update or revise such statements on a going-forward basis, whether as a result of subsequent developments, changed expectations or otherwise, except as required by applicable law or regulation. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, Moody’s is identifying certain factors that could cause actual results to differ, perhaps materially, from those indicated by these forward-looking statements. These factors, risks and uncertainties include, but are not limited to: the impact of current economic conditions, including capital market disruptions, inflation and related monetary policy actions by governments in response to inflation, on worldwide credit markets and on economic activity, including on the volume of mergers and acquisitions, and their effects on the volume of debt and other securities issued in domestic and/or global capital markets; the uncertain effectiveness and possible collateral consequences of U.S. and foreign government initiatives and monetary policy to respond to the current economic climate, including instability of financial institutions, credit quality concerns, and other potential impacts of volatility in financial and credit markets; the global impact of the Russia - Ukraine military conflict on volatility in world financial markets, on general economic conditions and GDP in the U.S. and worldwide, on global relations and on the Company's own operations and personnel; other matters that could affect the volume of debt and other securities issued in domestic and/or global capital markets, including regulation, increased utilization of technologies that have the potential to intensify competition and accelerate disruption and disintermediation in the financial services industry, as well as the number of issuances of securities without ratings or securities which are rated or evaluated by non-traditional parties; the level of merger and acquisition activity in the U.S. and abroad; the uncertain effectiveness and possible collateral consequences of U.S. and foreign government actions affecting credit markets, international trade and economic policy, including those related to tariffs, tax agreements and trade barriers; the impact of MIS’s withdrawal of its credit ratings on countries or entities within countries and of Moody’s no longer conducting commercial operations in countries where political instability warrants such action; concerns in the marketplace affecting our credibility or otherwise affecting market perceptions of the integrity or utility of independent credit agency ratings; the introduction or development of competing products or technologies; pricing pressure from competitors and/or customers; the level of success of new product development and global expansion; the impact of regulation as an NRSRO, the potential for new U.S., state and local legislation and regulations; the potential for increased competition and regulation in the EU and other foreign jurisdictions; exposure to litigation related to our rating opinions, as well as any other litigation, government and regulatory proceedings, investigations and inquiries to which Moody’s may be subject from time to time; provisions in U.S. legislation modifying the pleading standards and EU regulations modifying the liability standards applicable to credit rating agencies in a manner adverse to credit rating agencies; provisions of EU regulations imposing additional procedural and substantive requirements on the pricing of services and the expansion of supervisory remit to include non-EU ratings used for regulatory purposes; uncertainty regarding the future relationship between the U.S. and China; the possible loss of key employees and the impact of the global labor environment; failures or malfunctions of our operations and infrastructure; any vulnerabilities to cyber threats or other cybersecurity concerns; the timing and effectiveness of our restructuring programs, such as the 2022 - 2023 Geolocation Restructuring Program; currency and foreign exchange volatility; the outcome of any review by controlling tax authorities of Moody’s global tax planning initiatives; exposure to potential criminal sanctions or civil remedies if Moody’s fails to comply with foreign and U.S. laws and regulations that are applicable in the jurisdictions in which Moody’s operates, including data protection and privacy laws, sanctions laws, anti-corruption laws, and local laws prohibiting corrupt payments to government officials; the impact of mergers, acquisitions, such as our acquisition of RMS, or other business combinations and the ability of Moody’s to successfully integrate acquired businesses; the level of future cash flows; the levels of capital investments; and a decline in the demand for credit risk management tools by financial institutions. These factors, risks and uncertainties as well as other risks and uncertainties that could cause Moody’s actual results to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements are described in greater detail under “Risk Factors” in Part I, Item 1A of Moody’s annual report on Form 10-K for the year ended December 31, 2022, and in other filings made by the Company from time to time with the SEC or in materials incorporated herein or therein. Stockholders and investors are cautioned that the occurrence of any of these factors, risks and uncertainties may cause the Company’s actual results to differ materially from those contemplated, expressed, projected, anticipated or implied in the forward-looking statements, which could have a material and adverse effect on the Company’s business, results of operations and financial condition. New factors may emerge from time to time, and it is not possible for the Company to predict new factors, nor can the Company assess the potential effect of any new factors on it. Forward-looking and other statements in this document may also address our corporate responsibility progress, plans, and goals (including sustainability and environmental matters), and the inclusion of such statements is not an indication that these contents are necessarily material to investors or required to be disclosed in the Company’s filings with the Securities and Exchange Commission. In addition, historical, current, and forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future.

Table 1 - Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| Amounts in millions, except per share amounts | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Revenue | $ | 1,494 | | | $ | 1,381 | | | $ | 2,964 | | | $ | 2,903 | |

| | | | | | | |

| Expenses: | | | | | | | |

| Operating | 426 | | | 393 | | | 854 | | | 810 | |

| Selling, general, and administrative | 415 | | | 368 | | | 801 | | | 739 | |

| Depreciation and amortization | 93 | | | 81 | | | 181 | | | 159 | |

| Restructuring | 10 | | | 31 | | | 24 | | | 31 | |

| Total expenses | 944 | | | 873 | | | 1,860 | | | 1,739 | |

| | | | | | | |

| Operating income | 550 | | | 508 | | | 1,104 | | | 1,164 | |

| Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | (71) | | | (55) | | | (119) | | | (108) | |

| Other non-operating income (expense), net | 13 | | | (10) | | | 13 | | | (4) | |

| | | | | | | |

| Total non-operating (expense) income, net | (58) | | | (65) | | | (106) | | | (112) | |

| Income before provision for income taxes | 492 | | | 443 | | | 998 | | | 1,052 | |

| Provision for income taxes | 115 | | | 116 | | | 120 | | | 227 | |

| | | | | | | |

| | | | | | | |

| Net income attributable to Moody's Corporation | $ | 377 | | | $ | 327 | | | $ | 878 | | | $ | 825 | |

| | | | | | | |

| Earnings per share attributable to Moody's common shareholders |

| Basic | $ | 2.05 | | | $ | 1.78 | | | $ | 4.79 | | | $ | 4.47 | |

| Diluted | $ | 2.05 | | | $ | 1.77 | | | $ | 4.77 | | | $ | 4.45 | |

| | | | | | | |

| Weighted average number of shares outstanding |

| Basic | 183.5 | | | 184.1 | | | 183.4 | | | 184.6 | |

| Diluted | 184.1 | | | 184.9 | | | 184.1 | | | 185.4 | |

Table 2 - Condensed Consolidated Balance Sheet Data (Unaudited)

| | | | | | | | | | | |

| Amounts in millions | June 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,278 | | | $ | 1,769 | |

| Short-term investments | 57 | | | 90 | |

| Accounts receivable, net of allowance for credit losses of $33 in 2023 and $40 in 2022 | 1,542 | | | 1,652 | |

| Other current assets | 513 | | | 583 | |

| | | |

| Total current assets | 4,390 | | | 4,094 | |

| Property and equipment, net of accumulated depreciation of $1,195 in 2023 and $1,123 in 2022 | 541 | | | 502 | |

| Operating lease right-of-use assets | 330 | | | 346 | |

| Goodwill | 5,926 | | | 5,839 | |

| Intangible assets, net | 2,138 | | | 2,210 | |

| Deferred tax assets, net | 265 | | | 266 | |

| Other assets | 1,101 | | | 1,092 | |

| Total assets | $ | 14,691 | | | $ | 14,349 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 877 | | | $ | 1,011 | |

| Current portion of operating lease liabilities | 105 | | | 106 | |

| | | |

| Current portion of long-term debt | 300 | | | — | |

| Deferred revenue | 1,385 | | | 1,258 | |

| | | |

| Total current liabilities | 2,667 | | | 2,375 | |

| Non-current portion of deferred revenue | 67 | | | 75 | |

| Long-term debt | 6,923 | | | 7,389 | |

| Deferred tax liabilities, net | 485 | | | 457 | |

| Uncertain tax positions | 204 | | | 322 | |

| Operating lease liabilities | 344 | | | 368 | |

| Other liabilities | 689 | | | 674 | |

| Total liabilities | 11,379 | | | 11,660 | |

| | | |

|

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Moody's shareholders' equity | 3,144 | | | 2,519 | |

| Noncontrolling interests | 168 | | | 170 | |

| Total shareholders' equity | 3,312 | | | 2,689 | |

| Total liabilities, noncontrolling interests, and shareholders' equity | $ | 14,691 | | | $ | 14,349 | |

Table 3 - Non-Operating (Expense) Income, Net (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended

June 30, |

| Amounts in millions | 2023 | | 2022 | | 2023 | | 2022 |

| Interest: | | | | | | | |

| Expense on borrowings | $ | (75) | | | $ | (50) | | | $ | (145) | | | $ | (98) | |

UTPs and other tax related liabilities(1) | (4) | | | (3) | | | 14 | | | (6) | |

| Net periodic pension costs - interest component | (7) | | | (4) | | | (13) | | | (8) | |

| Income | 15 | | | 2 | | | 25 | | | 4 | |

| Total interest expense, net | $ | (71) | | | $ | (55) | | | $ | (119) | | | $ | (108) | |

| Other non-operating (expense) income, net: | | | | | | | |

FX loss(2) | $ | (5) | | | $ | (22) | | | $ | (31) | | | $ | (22) | |

| | | | | | | |

| Net periodic pension costs - other components | 9 | | | 6 | | | 18 | | | 12 | |

| Income from investments in non-consolidated affiliates | 1 | | | 2 | | | 3 | | | 4 | |

| Gains / losses on investments | 5 | | | (9) | | | 11 | | | (14) | |

Other(3) | 3 | | | 13 | | | 12 | | | 16 | |

| Other non-operating income (expense), net | $ | 13 | | | $ | (10) | | | $ | 13 | | | $ | (4) | |

| | | | | | | |

| Total non-operating (expense) income, net | $ | (58) | | | $ | (65) | | | $ | (106) | | | $ | (112) | |

| | |

(1) The amount for the six months ended June 30, 2023 includes a $22 million reduction of tax-related interest expense primarily related to the resolutions of outstanding tax matters. |

(2) The amounts for the three and six months ended June 30, 2022 include FX translation losses of $20 million reclassified to earnings resulting from the Company no longer conducting commercial operations in Russia. |

(3) The amount for the six months ended June 30, 2023 reflects a benefit of $9 million related to the favorable resolutions of various tax matters. The amounts for the three and six months ended June 30, 2022 reflect an $11 million benefit from a statute of limitations lapse relating to reserves established pursuant to the divestiture of MAKS. |

|

Table 4 - Financial Information by Segment (Unaudited)

The table below shows revenue and Adjusted Operating Income by reportable segment. Adjusted Operating Income is a financial metric utilized by the Company’s chief operating decision maker to assess the profitability of each reportable segment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

| 2023 |

| 2022 |

| Amounts in millions | MA | | MIS | | Eliminations | | Consolidated | | MA | | MIS | | Eliminations | | Consolidated |

| Total external revenue | $ | 747 | |

| $ | 747 | |

| $ | — | |

| $ | 1,494 | |

| $ | 675 | | | $ | 706 | |

| $ | — | |

| $ | 1,381 | |

| Intersegment revenue | 4 | | | 46 | | | (50) | | | — | | | 1 | | | 43 | | | (44) | | | — | |

| Total revenue | 751 | | | 793 | | | (50) | | | 1,494 | | | 676 | | | 749 | | | (44) | | | 1,381 | |

| Operating, SG&A | 541 | | | 350 | | | (50) | | | 841 | | | 471 | | | 334 | | | (44) | |

| 761 | |

| Adjusted Operating Income | $ | 210 | | | $ | 443 | | | $ | — | | | $ | 653 | | | $ | 205 | | | $ | 415 | | | $ | — | | | $ | 620 | |

| Adjusted Operating Margin | 28.0 | % | | 55.9 | % | | | | 43.7 | % | | 30.3 | % | | 55.4 | % | | | | 44.9 | % |

| Depreciation and amortization | 74 | |

| 19 | |

| — | |

| 93 | |

| 60 | | | 21 | |

| — | |

| 81 | |

| Restructuring | 8 | | | 2 | | | — | | | 10 | | | 16 | | | 15 | | | — | | | 31 | |

| Operating income | | | | | | | $ | 550 | | | | | | | | | $ | 508 | |

| Operating margin | | | | | | | 36.8 | % | | | | | | | | 36.8 | % |

| | | | | | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Amounts in millions | MA | | MIS | | Eliminations | | Consolidated | | MA | | MIS | | Eliminations | | Consolidated |

| Total external revenue | $ | 1,484 | | | $ | 1,480 | | | $ | — | |

| $ | 2,964 | |

| $ | 1,370 | | | $ | 1,533 | | | $ | — | |

| $ | 2,903 | |

| Intersegment revenue | 7 | | | 91 | | | (98) | | | — | | | 3 | | | 86 | | | (89) | | | — | |

| Total revenue | 1,491 | | | 1,571 | | | (98) | | | 2,964 | | | 1,373 | | | 1,619 | | | (89) | | | 2,903 | |

| Operating, SG&A | 1,067 | | | 686 | | | (98) | | | 1,655 | | | 944 | | | 694 | | | (89) | |

| 1,549 | |

| Adjusted Operating Income | $ | 424 | | | $ | 885 | | | $ | — | | | $ | 1,309 | | | $ | 429 | | | $ | 925 | | | $ | — | | | $ | 1,354 | |

| Adjusted Operating Margin | 28.4 | % | | 56.3 | % | | | | 44.2 | % | | 31.2 | % | | 57.1 | % | | | | 46.6 | % |

| Depreciation and amortization | 144 | | | 37 | |

| — | |

| 181 | |

| 120 | | | 39 | |

| — | | | 159 | |

| Restructuring | 16 | | | 8 | | | — | | | 24 | | | 16 | | | 15 | | | — | | | 31 | |

| Operating income | | | | | | | $ | 1,104 | | | | | | | | | $ | 1,164 | |

| Operating margin | | | | | | | 37.2 | % | | | | | | | | 40.1 | % |

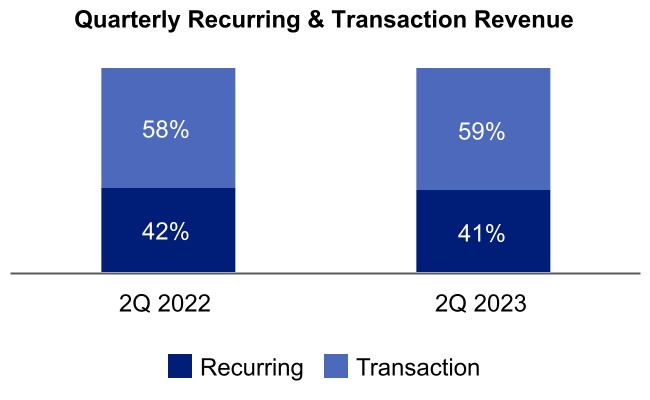

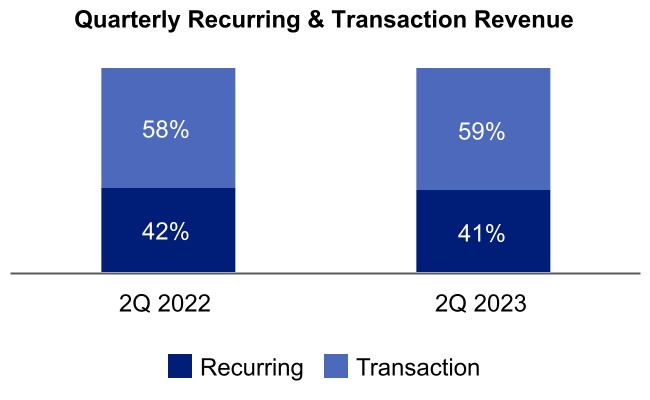

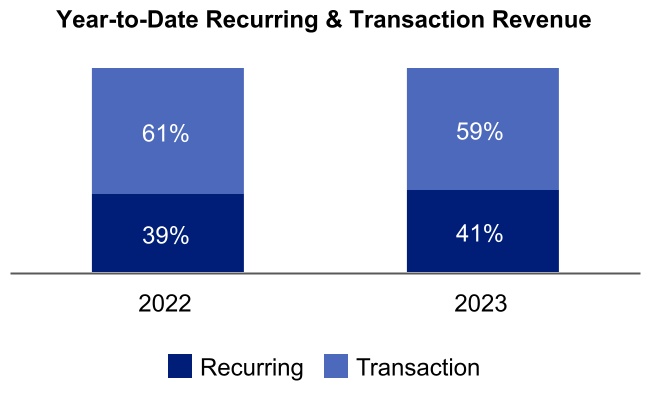

Table 5 - Transaction and Recurring Revenue (Unaudited)

The following tables summarize the split between transaction and recurring revenue. In the MA segment, recurring revenue represents subscription-based revenue and software maintenance revenue. Transaction revenue in MA represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, and training and certification services. In the MIS segment, excluding MIS Other, transaction revenue represents the initial rating of a new debt issuance, as well as other one-time fees, while recurring revenue represents the recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. In MIS Other, transaction revenue represents revenue from professional services, while recurring revenue represents subscription-based revenue.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| | 2023 | | 2022 |

| Amounts in millions | | Transaction | | Recurring | | Total | | Transaction | | Recurring | | Total |

| | | | | | | | | | | | |

| Decision Solutions | | $ | 43 | | | $ | 291 | | | $ | 334 | | | $ | 38 | | | $ | 256 | | | $ | 294 | |

| | 13 | % | | 87 | % | | 100 | % | | 13 | % | | 87 | % | | 100 | % |

| Research & Insights | | $ | 3 | | | $ | 214 | | | $ | 217 | | | $ | 4 | | | $ | 199 | | | $ | 203 | |

| | 1 | % | | 99 | % | | 100 | % | | 2 | % | | 98 | % | | 100 | % |

| Data & Information | | $ | 1 | | | $ | 195 | | | $ | 196 | | | $ | — | | | $ | 178 | | | $ | 178 | |

| | 1 | % | | 99 | % | | 100 | % | | — | % | | 100 | % | | 100 | % |

| Total MA | | $ | 47 | | | $ | 700 | | | $ | 747 | | | $ | 42 | | | $ | 633 | | | $ | 675 | |

| | 6 | % | | 94 | % | | 100 | % | | 6 | % | | 94 | % | | 100 | % |

| | | | | | | | | | | | |

| Corporate Finance | | $ | 236 | |

| $ | 129 | | | $ | 365 | | | $ | 199 | | | $ | 123 | | | $ | 322 | |

| | 65 | % | | 35 | % | | 100 | % | | 62 | % | | 38 | % | | 100 | % |

| Structured Finance | | $ | 48 | | | $ | 54 | | | $ | 102 | | | $ | 73 | | | $ | 50 | | | $ | 123 | |

| | 47 | % | | 53 | % | | 100 | % | | 59 | % | | 41 | % | | 100 | % |

| Financial Institutions | | $ | 73 | | | $ | 72 | | | $ | 145 | | | $ | 57 | | | $ | 71 | | | $ | 128 | |

| | 50 | % | | 50 | % | | 100 | % | | 45 | % | | 55 | % | | 100 | % |

| Public, Project and Infrastructure Finance | | $ | 84 | | | $ | 43 | | | $ | 127 | | | $ | 82 | | | $ | 40 | | | $ | 122 | |

| | 66 | % | | 34 | % | | 100 | % | | 67 | % | | 33 | % | | 100 | % |

| MIS Other | | $ | 2 | | | $ | 6 | | | $ | 8 | | | $ | 1 | | | $ | 10 | | | $ | 11 | |

| | 25 | % | | 75 | % | | 100 | % | | 9 | % | | 91 | % | | 100 | % |

| Total MIS | | $ | 443 | | | $ | 304 | | | $ | 747 | | | $ | 412 | | | $ | 294 | | | $ | 706 | |

| | 59 | % | | 41 | % | | 100 | % | | 58 | % | | 42 | % | | 100 | % |

| | | | | | | | | | | | |

| Total Moody's Corporation | | $ | 490 | | | $ | 1,004 | | | $ | 1,494 | | | $ | 454 | | | $ | 927 | | | $ | 1,381 | |

| | 33 | % | | 67 | % | | 100 | % | | 33 | % | | 67 | % | | 100 | % |

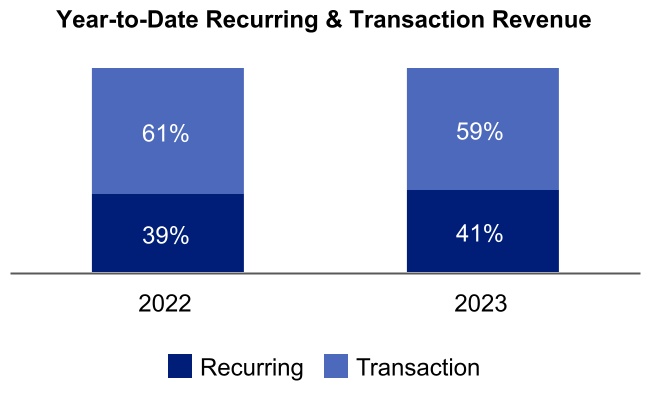

Table 5 - Transaction and Recurring Revenue (Unaudited) Continued

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2023 | | 2022 |

| Amounts in millions | | Transaction | | Relationship | | Total | | Transaction | | Relationship | | Total |

| Decision Solutions | | $ | 83 | | | $ | 585 | | | $ | 668 | | | $ | 78 | | | $ | 530 | | | $ | 608 | |

| | 12 | % | | 88 | % | | 100 | % | | 13 | % | | 87 | % | | 100 | % |

| Research & Insights | | $ | 8 | | | $ | 424 | | | $ | 432 | | | $ | 8 | | | $ | 398 | | | $ | 406 | |

| | 2 | % | | 98 | % | | 100 | % | | 2 | % | | 98 | % | | 100 | % |

| Data & Information | | $ | 1 | | | $ | 383 | | | $ | 384 | | | $ | — | | | $ | 356 | | | $ | 356 | |

| | — | % | | 100 | % | | 100 | % | | — | % | | 100 | % | | 100 | % |

| Total MA | | $ | 92 | |

| $ | 1,392 | | | $ | 1,484 | | | $ | 86 | | | $ | 1,284 | | | $ | 1,370 | |

| | 6 | % | | 94 | % | | 100 | % | | 6 | % | | 94 | % | | 100 | % |

| | | | | | | | | | | | |

| Corporate Finance | | $ | 466 | | | $ | 255 | | | $ | 721 | | | $ | 492 | | | $ | 247 | | | $ | 739 | |

| | 65 | % |

| 35 | % |

| 100 | % |

| 67 | % | | 33 | % | | 100 | % |

| Structured Finance | | $ | 94 | |

| $ | 107 | | | $ | 201 | | | $ | 166 | | | $ | 101 | | | $ | 267 | |

| | 47 | % | | 53 | % | | 100 | % | | 62 | % | | 38 | % | | 100 | % |

| Financial Institutions | | $ | 143 | |

| $ | 144 | | | $ | 287 | | | $ | 118 | | | $ | 141 | | | $ | 259 | |

| | 50 | % | | 50 | % | | 100 | % | | 46 | % | | 54 | % | | 100 | % |

| Public, Project and Infrastructure Finance | | $ | 169 | |

| $ | 87 | | | $ | 256 | | | $ | 161 | | | $ | 84 | | | $ | 245 | |

| | 66 | % | | 34 | % | | 100 | % | | 66 | % | | 34 | % | | 100 | % |

| MIS Other | | $ | 3 | |

| $ | 12 | | | $ | 15 | | | $ | 2 | | | $ | 21 | | | $ | 23 | |

| | 20 | % | | 80 | % | | 100 | % | | 9 | % | | 91 | % | | 100 | % |

| Total MIS | | $ | 875 | |

| $ | 605 | | | $ | 1,480 | | | $ | 939 | | | $ | 594 | | | $ | 1,533 | |

| | 59 | % | | 41 | % | | 100 | % | | 61 | % | | 39 | % | | 100 | % |

| | | | | | | | | | | | |

| Total Moody's Corporation | | $ | 967 | | | $ | 1,997 | | | $ | 2,964 | | | $ | 1,025 | | | $ | 1,878 | | | $ | 2,903 | |

| | 33 | % | | 67 | % | | 100 | % | | 35 | % | | 65 | % | | 100 | % |

Table 6 - Adjusted Operating Income and Adjusted Operating Margin (Unaudited)

The Company presents Adjusted Operating Income and Adjusted Operating Margin because management deems these metrics to be useful measures to provide additional perspective on Moody's operating performance. Adjusted Operating Income excludes the impact of: i) depreciation and amortization; and ii) restructuring charges/adjustments. Depreciation and amortization are excluded because companies utilize productive assets of different estimated useful lives and use different methods of acquiring and depreciating productive assets. Restructuring charges/adjustments are excluded as the frequency and magnitude of these charges may vary widely across periods and companies.

Management believes that the exclusion of the aforementioned items, as detailed in the reconciliation below, allows for an additional perspective on the Company’s operating results from period to period and across companies. The Company defines Adjusted Operating Margin as Adjusted Operating Income divided by revenue.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2023 | | 2022 | | 2023 | | 2022 |

| Operating income | $ | 550 | | | $ | 508 | | | $ | 1,104 | | | $ | 1,164 | |

| Depreciation and amortization | 93 | | | 81 | | | 181 | | | 159 | |

| Restructuring | 10 | | | 31 | | | 24 | | | 31 | |

| Adjusted Operating Income | $ | 653 | | | $ | 620 | | | $ | 1,309 | | | $ | 1,354 | |

| Operating margin | 36.8 | % | | 36.8 | % | | 37.2 | % | | 40.1 | % |

| Adjusted Operating Margin | 43.7 | % | | 44.9 | % | | 44.2 | % | | 46.6 | % |

Table 7 - Free Cash Flow (Unaudited)

The Company defines Free Cash Flow as net cash provided by operating activities minus payments for capital additions. Management believes that Free Cash Flow is a useful metric in assessing the Company’s cash flows to service debt, pay dividends and to fund acquisitions and share repurchases. Management deems capital expenditures essential to the Company’s product and service innovations and maintenance of Moody’s operational capabilities. Accordingly, capital expenditures are deemed to be a recurring use of Moody’s cash flow. Below is a reconciliation of the Company’s net cash flows from operating activities to Free Cash Flow:

| | | | | | | | | | | |

| Six Months Ended June 30, |

| Amounts in millions | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 1,212 | | | $ | 761 | |

| Capital additions | (127) | | | (133) | |

| Free Cash Flow | $ | 1,085 | | | $ | 628 | |

| Net cash used in investing activities | $ | (103) | | | $ | (172) | |

| Net cash used in financing activities | $ | (624) | | | $ | (712) | |

Table 8 - Key Performance Metrics - Annualized Recurring Revenue (Unaudited)

The Company presents Annualized Recurring Revenue (“ARR”) on a constant currency organic basis for its MA business as a supplemental performance metric to provide additional insight on the estimated value of MA's recurring revenue contracts at a given point in time. The Company uses ARR to manage and monitor performance of its MA operating segment and believes that this metric is a key indicator of the trajectory of MA's recurring revenue base.

The Company calculates ARR by taking the total recurring contract value for each active renewable contract as of the reporting date, divided by the number of days in the contract and multiplied by 365 days to create an annualized value. The Company defines renewable contracts as subscriptions, term licenses, maintenance and renewable services. ARR excludes transaction sales including training, one-time services and perpetual licenses. In order to compare period-over-period ARR excluding the effects of foreign currency translation, the Company bases the calculation on currency rates utilized in its current year operating budget and holds these FX rates constant for the duration of all current and prior periods being reported. Additionally, ARR excludes contracts related to acquisitions to provide additional perspective in assessing growth excluding the impacts from certain acquisition activity.

The Company’s definition of ARR may differ from definitions utilized by other companies reporting similarly named measures, and this metric should be viewed in addition to, and not as a substitute for, financial measures presented in accordance with U.S. GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Amounts in millions | June 30, 2023 | | June 30, 2022 | | Change | | Growth |

| MA ARR | | | | | | | |

| Decision Solutions | | | | | | | |

| Banking | $ | 390 | | | $ | 355 | | | $ | 35 | | | 10% |

| Insurance | 497 | | | 467 | | | 30 | | | 6% |

| KYC | 292 | | | 248 | | | 44 | | | 18% |

| Total DS | $ | 1,179 | | | $ | 1,070 | | | $ | 109 | | | 10% |

| Research and Insights | 843 | | | 774 | | | 69 | | | 9% |

| Data and Information | 759 | | | 695 | | | 64 | | | 9% |

| Total MA ARR | $ | 2,781 | | | $ | 2,539 | | | $ | 242 | | | 10% |

| | | | | | | |

Table 9 - Adjusted Net Income and Adjusted Diluted EPS Attributable to Moody's Common Shareholders (Unaudited)

The Company presents Adjusted Net Income and Adjusted Diluted EPS because management deems these metrics to be useful measures to provide additional perspective on Moody's operating performance. Adjusted Net Income and Adjusted Diluted EPS exclude the impact of: i) amortization of acquired intangible assets; ii) restructuring charges/adjustments; and iii) FX translation losses reclassified to earnings resulting from the Company no longer conducting commercial operations in Russia.

The Company excludes the impact of amortization of acquired intangible assets as companies utilize intangible assets with different estimated useful lives and have different methods of acquiring and amortizing intangible assets. These intangible assets were recorded as part of acquisition accounting and contribute to revenue generation. The amortization of intangible assets related to acquisitions will recur in future periods until such intangible assets have been fully amortized. Furthermore, the timing and magnitude of business combination transactions are not predictable and the purchase price allocated to amortizable intangible assets and the related amortization period are unique to each acquisition and can vary significantly from period to period and across companies. Restructuring charges/adjustments and FX translation losses resulting from the Company no longer conducting commercial operations in Russia are excluded as the frequency and magnitude of these items may vary widely across periods and companies.

The Company excludes the aforementioned items to provide additional perspective when comparing net income and diluted EPS from period to period and across companies as the frequency and magnitude of similar transactions may vary widely across periods.

Below is a reconciliation of these measures to their most directly comparable U.S. GAAP measures: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2023 | | 2022 | | 2023 | | 2022 |

| Net income attributable to Moody's common shareholders | | $ | 377 | | | | $ | 327 | | | | $ | 878 | | | | $ | 825 | |

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 50 | | | | $ | 51 | | | | $ | 101 | | | | $ | 102 | | |

| Tax on Acquisition-Related Intangible Amortization Expenses | (12) | | | | (12) | | | | (24) | | | | (24) | | |

| Net Acquisition-Related Intangible Amortization Expenses | | 38 | | | | 39 | | | | 77 | | | | 78 | |

| Pre-tax restructuring | $ | 10 | | | | $ | 31 | | | | $ | 24 | | | | $ | 31 | | |

| Tax on restructuring | (2) | | | | (7) | | | | (6) | | | | (7) | | |

| Net restructuring | | 8 | | | | 24 | | | | 18 | | | | 24 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| FX losses resulting from the Company no longer conducting commercial operations in Russia | | — | | | | 20 | | | | — | | | | 20 | |

| Adjusted Net Income | | $ | 423 | | | | $ | 410 | | | | $ | 973 | | | | $ | 947 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| Amounts in millions | 2023 | | 2022 | | 2023 | | 2022 |

| Diluted earnings per share attributable to Moody's common shareholders | | $ | 2.05 | | | | $ | 1.77 | | | | $ | 4.77 | | | | $ | 4.45 | |

| Pre-tax Acquisition-Related Intangible Amortization Expenses | $ | 0.27 | | | | $ | 0.28 | | | | $ | 0.55 | | | | $ | 0.55 | | |

| Tax on Acquisition-Related Intangible Amortization Expenses | (0.06) | | | | (0.07) | | | | (0.13) | | | | (0.13) | | |

| Net Acquisition-Related Intangible Amortization Expenses | | 0.21 | | | | 0.21 | | | | 0.42 | | | | 0.42 | |

| Pre-tax restructuring | $ | 0.05 | | | | $ | 0.17 | | | | $ | 0.13 | | | | $ | 0.17 | | |

| Tax on restructuring | (0.01) | | | | (0.04) | | | | (0.03) | | | | (0.04) | | |

| Net restructuring | | 0.04 | | | | 0.13 | | | | 0.10 | | | | 0.13 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| FX losses resulting from the Company no longer conducting commercial operations in Russia | | — | | | | 0.11 | | | | — | | | | 0.11 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted Diluted EPS | | $ | 2.30 | | | | $ | 2.22 | | | | $ | 5.29 | | | | $ | 5.11 | |

| | |

| Note: The tax impacts in the tables above were calculated using tax rates in effect in the jurisdiction for which the item relates. |

Table 10 - 2023 Outlook

Moody’s updated outlook for full year 2023, as of July 25, 2023, reflects assumptions about numerous factors that could affect its business and is based on currently available information reviewed by management through, and as of, today’s date. For a complete list of these assumptions, please refer to “Assumptions and Outlook” on page 10 of this earnings release. | | | | | | | | |

| Full Year 2023 Moody's Corporation Guidance as of July 25, 2023 |

| MOODY'S CORPORATION | Current guidance | Last publicly disclosed guidance |

| Revenue | Increase in the high-single-digit

percent range | Increase in the mid-to-high-single-digit

percent range |

| Operating expenses | Increase in the mid-single-digit

percent range | NC |

| Operating margin | Approximately 37% | NC |

Adjusted Operating Margin (1) | 44% to 45% | NC |

| Interest expense, net | $260 to $280 million | $275 to $295 million |

| Effective tax rate | 16% to 18% | 15% to 17% |

| Diluted EPS | $8.70 to $9.20 | $8.45 to $8.95 |

Adjusted Diluted EPS (1) | $9.75 to $10.25 | $9.50 to $10.00 |

| Operating cash flow | $1.9 to $2.1 billion | $1.7 to $1.9 billion |

Free Cash Flow (1) | $1.6 to $1.8 billion | $1.4 to $1.6 billion |

| Share repurchases | Approximately $500 million

(subject to available cash, market conditions, M&A opportunities, and other ongoing

capital allocation decisions) | Approximately $250 million

(subject to available cash, market conditions, M&A opportunities, and other ongoing

capital allocation decisions) |

| Moody's Analytics (MA) | Current guidance | Last publicly disclosed guidance |

| MA global revenue | Increase of approximately 10% | NC |

ARR (2) | Increase in the low-double-digit percent range | NC |

| MA Adjusted Operating Margin | 30% to 31% | Approximately 31% |

| Moody's Investors Service (MIS) | Current guidance | Last publicly disclosed guidance |

| MIS global revenue | Increase in the high-single-digit percent range | Increase in the low-to-mid-single-digit percent range |

| MIS Adjusted Operating Margin | 55% to 56% | Mid-50s percent range |

NC - There is no difference between the Company’s current guidance and the last publicly disclosed guidance for this item. Note: All current guidance as of July 25, 2023. All last publicly disclosed guidance is as of April 25, 2023. (1) These metrics are adjusted measures. See below for reconciliation of these measures to their comparable U.S. GAAP measure. (2) Refer to Table 8 within this earnings release for the definition of and further information on the ARR metric. |

The following are reconciliations of the Company's adjusted forward looking measures to their comparable U.S. GAAP measure: | | | | | |

| Projected for the Year Ended

December 31, 2023 |

| Operating margin guidance | Approximately 37% |

| Depreciation and amortization | Approximately 6.5% |

| Restructuring expense | Approximately 1.0% |

| Adjusted Operating Margin guidance | 44% to 45% |

| |

| Projected for the Year Ended

December 31, 2023 |

| Operating cash flow guidance | $1.9 to $2.1 billion |

| Less: Capital expenditures | Approximately $0.3 billion |

| Free Cash Flow guidance | $1.6 to $1.8 billion |

| |

| Projected for the Year Ended

December 31, 2023 |

| Diluted EPS guidance | $8.70 to $9.20 |

| Acquisition-Related Intangible Amortization | Approximately $0.85 |

| Restructuring | Approximately $0.20 |

| Adjusted Diluted EPS guidance | $9.75 to $10.25 |