UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark one) | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

Or | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14037

____________________

Moody’s Corporation

(Exact name of registrant as specified in its charter) | | | | | | | | | | | |

| Delaware | | 13-3998945 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

7 World Trade Center at 250 Greenwich Street, New York, New York 10007

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code:

(212) 553-0300

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | MCO | | New York Stock Exchange |

| 1.75% Senior Notes Due 2027 | | MCO 27 | | New York Stock Exchange |

| 0.950% Senior Notes Due 2030 | | MCO 30 | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date:

| | |

| Shares Outstanding at September 30, 2024 |

| 181.2 million |

| | | | | | | | |

| MOODY’S CORPORATION

INDEX TO FORM 10-Q | |

| Page(s) |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| | |

| |

GLOSSARY OF TERMS AND ABBREVIATIONS

The following terms, abbreviations and acronyms are used to identify frequently used terms in this report: | | | | | |

| TERM | DEFINITION |

| |

| |

| ABS | Asset backed securities; a component of SFG |

| Acquisition-Related Intangible Amortization Expense | Amortization of definite-lived intangible assets acquired by the Company from all business combination transactions |

| |

| Adjusted Diluted EPS | Diluted EPS excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Net Income | Net Income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Operating Income | Operating income excluding the impact of certain items as detailed in the section entitled “Non-GAAP Financial Measures” |

| Adjusted Operating Margin | Adjusted Operating Income divided by revenue |

| Americas | Represents countries within North and South America, excluding the U.S. |

| |

| |

| ARR | Annualized Recurring Revenue; a supplemental performance metric to provide additional insight on the estimated value of MA's recurring revenue contracts at a given point in time, excluding the impact of FX and contracts related to acquisitions |

| ASC | The FASB Accounting Standards Codification; the sole source of authoritative GAAP as of July 1, 2009 except for rules and interpretive releases of the SEC, which are also sources of authoritative GAAP for SEC registrants |

| Asia-Pacific | Represents Australia and countries in Asia including but not limited to: China, India, Indonesia, Japan, Republic of South Korea, Malaysia, Singapore, Sri Lanka and Thailand |

| ASU | The FASB Accounting Standards Update to the ASC. Provides background information for accounting guidance and the bases for conclusions on the changes in the ASC. ASUs are not considered authoritative until codified into the ASC |

| AUD | Australian dollar |

| BitSight | A provider that helps global market participants understand cyber risk through ratings, analytics, and performance management tools |

| Board | The board of directors of the Company |

| BPS | Basis points |

| |

| |

| |

| CAD | Canadian dollar |

| CCXI | China Cheng Xin International Credit Rating Co. Ltd.; China’s first and largest domestic credit rating agency approved by the People’s Bank of China; currently Moody’s owns 30% of CCXI |

| CDP | Carbon Disclosure Project; an international nonprofit organization that helps companies, cities, states and regions manage their environmental impact through a global disclosure system |

| CFG | Corporate finance group; an LOB of MIS |

| CLO | Collateralized loan obligation |

| CMBS | Commercial mortgage-backed securities; an asset class within SFG |

| COLI | Corporate-Owned Life Insurance |

| |

| Common Stock | The Company’s common stock |

| Company | Moody’s Corporation and its subsidiaries; MCO; Moody’s |

| CODM | Chief Operating Decision Maker |

| |

| |

| COVID-19 | An outbreak of a novel strain of coronavirus resulting in an international public health crisis and a global pandemic |

| CP | Commercial Paper |

| CP Program | A program entered into on August 3, 2016 allowing the Company to privately place CP up to a maximum of $1 billion for which the maturity may not exceed 397 days from the date of issue, and which is backstopped by the 2024 Facility |

| CRAs | Credit rating agencies |

| |

| |

| Data and Information (D&I) | LOB within MA which provides vast data sets on companies and securities via data feeds and data applications products |

| |

| | | | | |

| TERM | DEFINITION |

| Decision Solutions (DS) | LOB within MA that provides SaaS solutions supporting banking, insurance, and KYC workflows. This LOB utilizes components from the Data & Information and Research & Insights LOBs to provide risk assessment solutions |

| |

| EMEA | Represents countries within Europe, the Middle East and Africa |

| EPS | Earnings per share |

| |

| ESG | Environmental, Social and Governance |

| |

| |

| ESTR | Euro Short-Term Rate |

| ETR | Effective tax rate |

| EU | European Union |

| EUR | euros |

| |

| Excess Tax Benefits | The difference between the tax benefit realized at exercise of an option or delivery of a restricted share and the tax benefit recorded at the time the option or restricted share is expensed under GAAP |

| Exchange Act | The Securities Exchange Act of 1934, as amended |

| External Revenue | Revenue excluding any intersegment amounts |

| FASB | Financial Accounting Standards Board |

| FIG | Financial institutions group; an LOB of MIS |

| |

| Free Cash Flow | Net cash provided by operating activities less cash paid for capital additions |

| |

| FX | Foreign exchange |

| GAAP | U.S. Generally Accepted Accounting Principles |

| GBP | British pounds |

| GCR (Global Credit Rating Company Limited and subsidiaries) | A domestic credit rating agency with operations spanning Africa; the Company acquired a controlling financial interest in GCR in July 2024; the Company previously accounted for GCR as an equity method investment |

| GDP | Gross domestic product |

| GLoBE | Global Anti-Base Erosion, also known as "Pillar II;" tax model issued by the OECD in 2023 |

| |

| ICRA | ICRA Limited; a provider of credit ratings and research in India |

| |

| INR | Indian rupee |

| |

| |

| |

| |

| |

| |

| |

| JPY | Japanese yen |

| KYC | Know-your-customer |

| |

| LOB | Line of business |

| MA | Moody’s Analytics - a reportable segment of MCO; a global provider of: i) data and information; ii) research and insights; and iii) decision solutions, which help companies make better and faster decisions. MA leverages its unique assets and specialized industry knowledge across multiple risks such as credit, market, financial crime, supply chain, catastrophe and climate to deliver integrated risk assessment solutions that enable business leaders to identify, measure and manage the implications of interrelated risks and opportunities |

| |

| MAKS | Moody’s Analytics Knowledge Services; formerly known as Copal Amba; provided offshore research and analytic services to the global financial and corporate sectors; business was divested in the fourth quarter of 2019 and was formerly a reporting unit within the MA reportable segment |

| |

| MCO | Moody’s Corporation and its subsidiaries; the Company; Moody’s |

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| M&A | Mergers and acquisitions |

| MIS | Moody’s Investors Service - a reportable segment of MCO; MIS publishes credit ratings and provides assessment services on a wide range of debt obligations, programs and facilities, and the entities that issue such obligations in markets worldwide, including various corporate, financial institution and governmental obligations, and structured finance securities; consists of five LOBs - SFG; CFG; FIG; PPIF; and MIS Other |

| MIS Other | Consists of financial instruments pricing services in the Asia-Pacific region, ICRA non-ratings revenue, and revenue from professional services. These businesses are components of MIS; MIS Other is an LOB of MIS |

| Moody’s | Moody’s Corporation and its subsidiaries; MCO; the Company |

| | | | | |

| TERM | DEFINITION |

| MSS | Moody's Shared Services; primarily consists of information technology and support staff such as finance, human resources and legal that support both MA and MIS |

| |

| |

| Net Income | Net income attributable to Moody’s Corporation, which excludes net income from consolidated noncontrolling interests belonging to the minority interest holder |

| |

| |

| NM | Percentage change is not meaningful |

| Non-GAAP | A financial measure not in accordance with GAAP; these measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period-to-period comparisons of the Company’s performance, facilitate comparisons to competitors’ operating results and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision making |

| NRSRO | Nationally Recognized Statistical Rating Organization, which is a credit rating agency registered with the SEC |

| |

| |

| |

| OECD | Organization for Economic Co-operation and Development; an international organization that promotes policies that improve economic and social well-being around the world |

| Operating segment | Term defined in the ASC relating to segment reporting; the ASC defines an operating segment as a component of a business entity that has each of the three following characteristics: i) the component engages in business activities from which it may recognize revenue and incur expenses; ii) the operating results of the component are regularly reviewed by the entity’s CODM; and iii) discrete financial information about the component is available |

| |

| |

| Pillar II | Tax model issued by the OECD in 2023; also referred to as the "Global Anti-Base Erosion" or "GLoBE" rules |

| PPIF | Public, project and infrastructure finance; an LOB of MIS |

| |

| |

| |

| |

| |

| |

| |

| Praedicat | A provider of casualty insurance analytics; the Company acquired a controlling financial interest in Praedicat in September 2024; the Company previously accounted for Praedicat as an equity method investment |

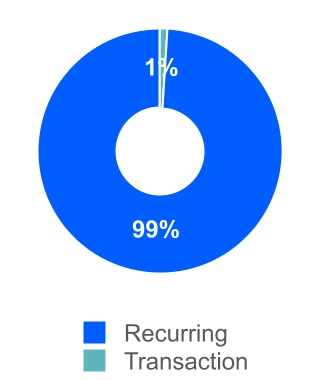

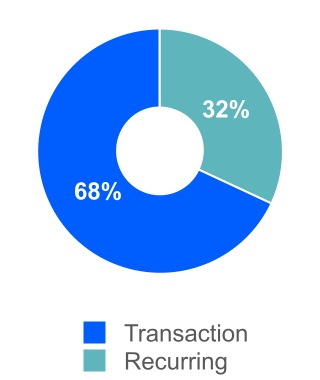

| Recurring Revenue | For MA, represents subscription-based revenue and software maintenance revenue. For MIS, represents recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations, as well as revenue from programs such as commercial paper, medium-term notes and shelf registrations. For MIS Other, represents subscription-based revenue |

| |

| |

| |

| |

| Reporting unit | The level at which Moody’s evaluates its goodwill for impairment under GAAP; defined as an operating segment or one level below an operating segment |

| Research and Insights (R&I) | LOB within MA that provides models, scores, expert insights and commentary. This LOB includes credit research; credit models and analytics; economics data and models; and structured finance solutions |

| |

| |

| RMBS | Residential mortgage-backed securities; an asset class within SFG |

| |

| RMS | Risk Management Solutions, Inc., a global provider of climate and natural disaster risk modeling and analytics; acquired by the Company in September 2021 |

| SaaS | Software-as-a-Service |

| |

| |

| SEC | U.S. Securities and Exchange Commission |

| |

| SFG | Structured finance group; an LOB of MIS |

| SG&A | Selling, general and administrative expenses |

| SGD | Singapore dollar |

| SOFR | Secured Overnight Financing Rate |

| Tax Act | The “Tax Cuts and Jobs Act” enacted into U.S. law on December 22, 2017 which significantly amends the tax code in the U.S. |

| |

| Total Debt | All indebtedness of the Company as reflected on the consolidated balance sheets |

| Transaction Revenue | For MA, represents perpetual software license fees and revenue from software implementation services, risk management advisory projects, and training and certification services. For MIS (excluding MIS Other), represents the initial rating of a new debt issuance as well as other one-time fees. For MIS Other, represents revenue from professional services. |

| U.K. | United Kingdom |

| U.S. | United States |

| USD | U.S. dollar |

| | | | | |

| TERM | DEFINITION |

| UTPs | Uncertain tax positions |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 2022 - 2023 Geolocation Restructuring Program | Restructuring program approved by the chief executive officer of Moody’s on June 30, 2022 relating to the Company's post-COVID-19 geolocation strategy |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 1,813 | | | $ | 1,472 | | | $ | 5,416 | | | $ | 4,436 | |

| Expenses | | | | | | | |

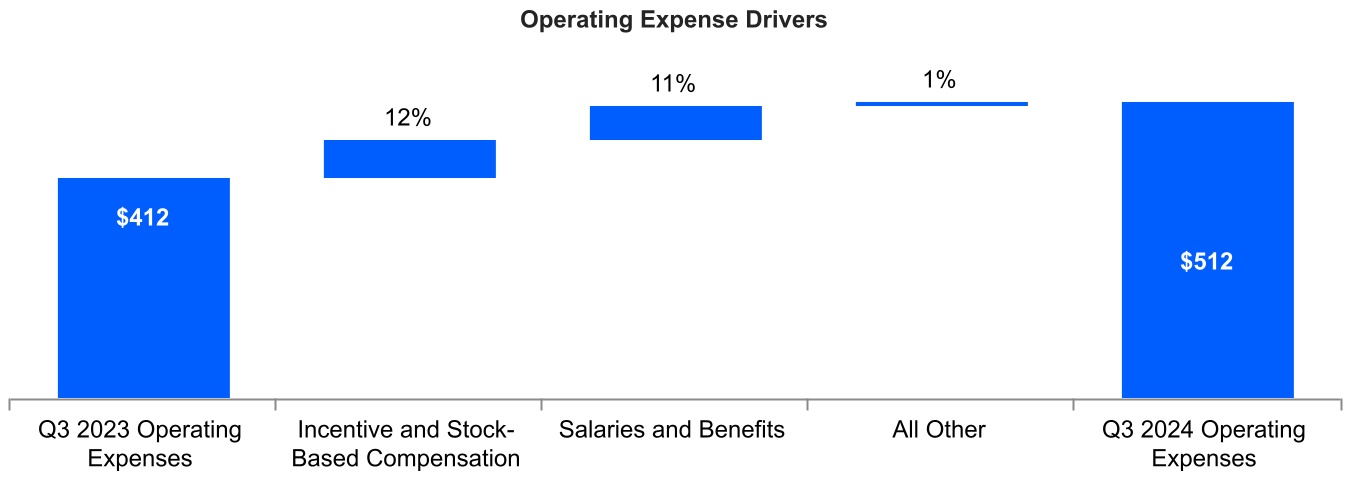

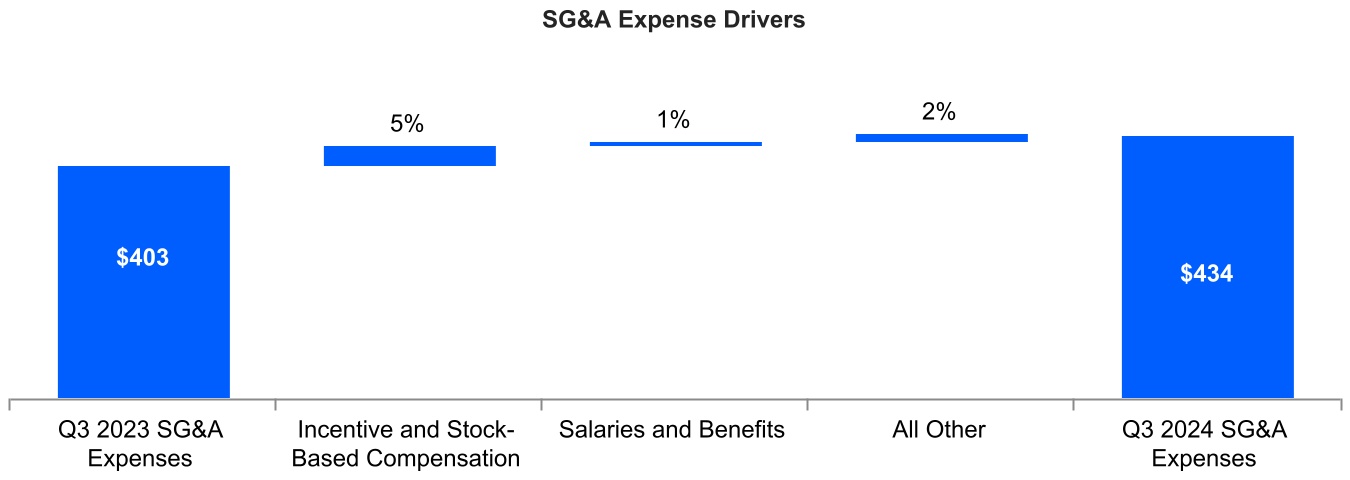

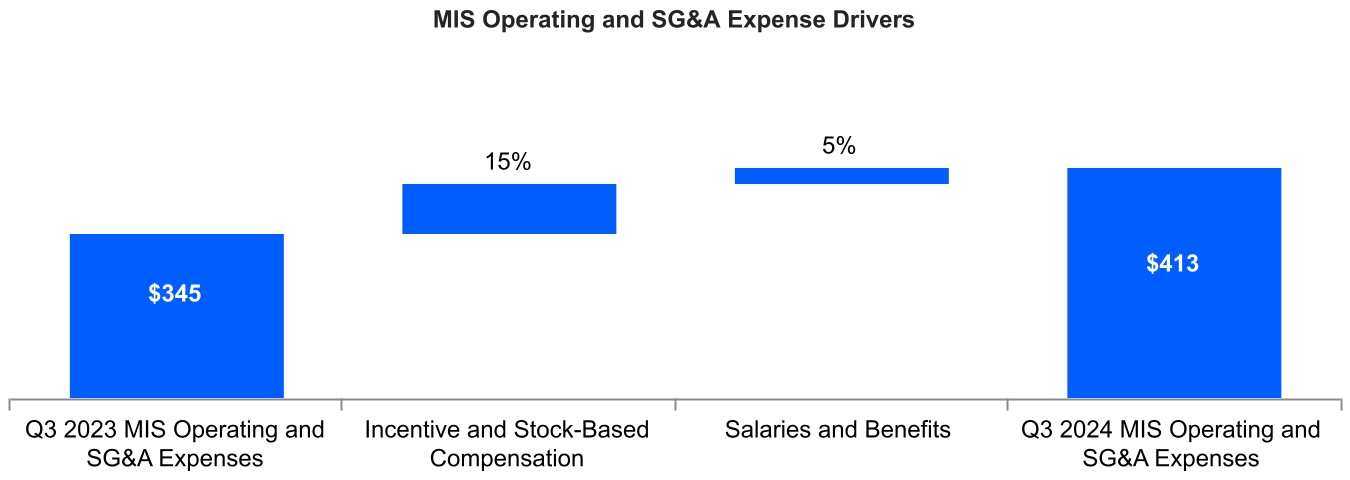

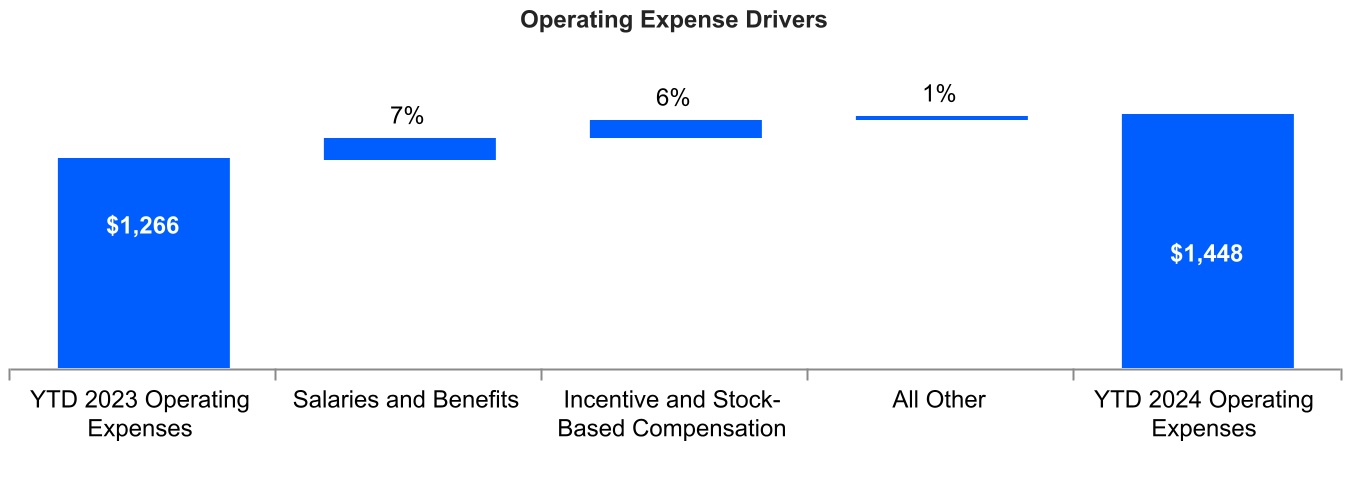

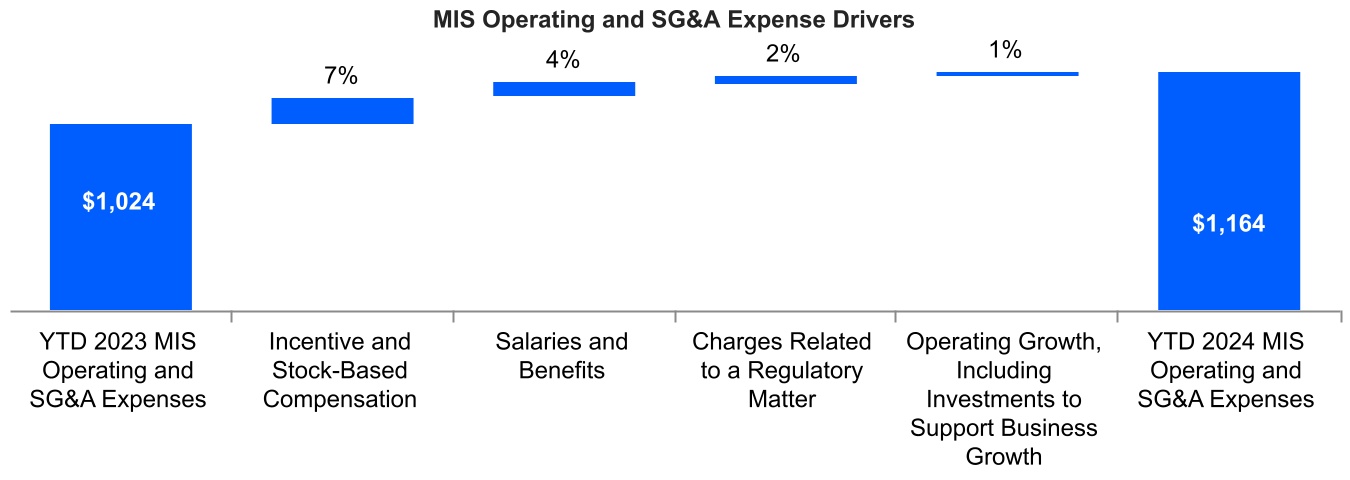

| Operating | 512 | | | 412 | | | 1,448 | | | 1,266 | |

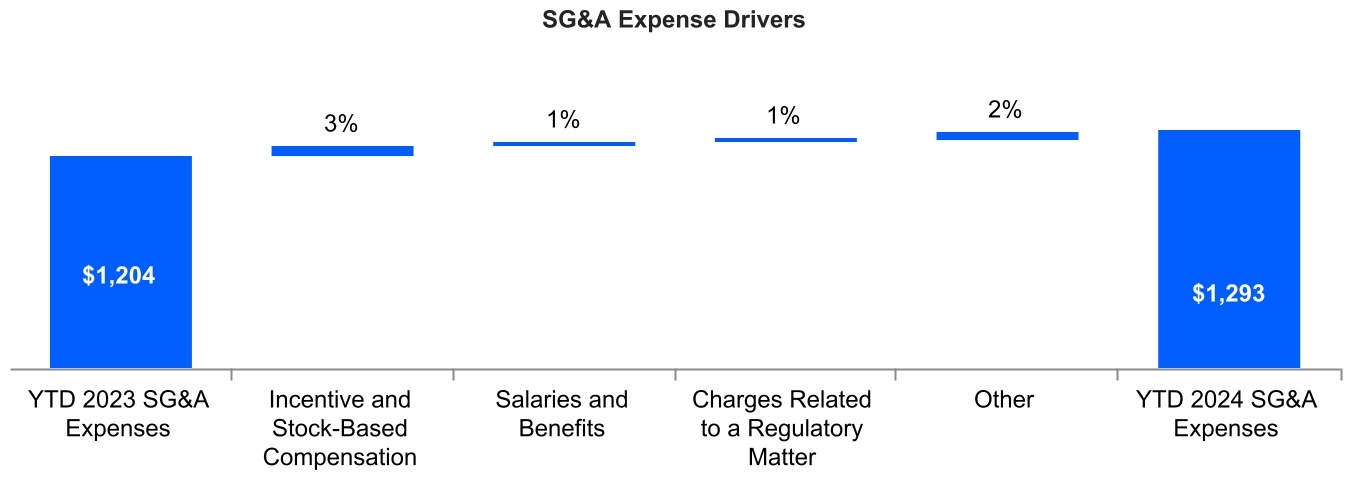

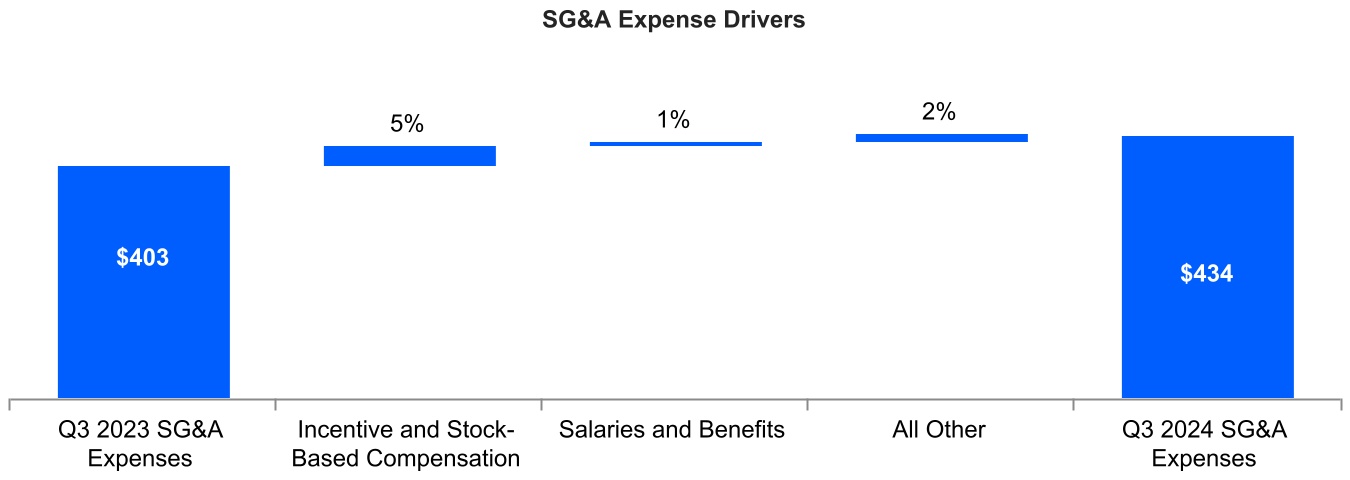

| Selling, general, and administrative | 434 | | | 403 | | | 1,293 | | | 1,204 | |

| Depreciation and amortization | 108 | | | 95 | | | 318 | | | 276 | |

| Restructuring | 6 | | | 27 | | | 13 | | | 51 | |

| Charges related to asset abandonment | 15 | | | — | | | 30 | | | — | |

| | | | | | | |

| Total expenses | 1,075 | | | 937 | | | 3,102 | | | 2,797 | |

| Operating income | 738 | | | 535 | | | 2,314 | | | 1,639 | |

| Non-operating (expense) income, net | | | | | | | |

| Interest expense, net | (60) | | | (66) | | | (185) | | | (185) | |

| Other non-operating income, net | 25 | | | 18 | | | 45 | | | 31 | |

| Total non-operating (expense) income, net | (35) | | | (48) | | | (140) | | | (154) | |

| Income before provision for income taxes | 703 | | | 487 | | | 2,174 | | | 1,485 | |

| Provision for income taxes | 169 | | | 97 | | | 510 | | | 217 | |

| Net income | 534 | | | 390 | | | 1,664 | | | 1,268 | |

| Less: Net income attributable to noncontrolling interests | — | | | 1 | | | 1 | | | 1 | |

| Net income attributable to Moody's | $ | 534 | | | $ | 389 | | | $ | 1,663 | | | $ | 1,267 | |

| Earnings per share attributable to Moody's common shareholders | | | | | | | |

| Basic | $ | 2.94 | | | $ | 2.12 | | | $ | 9.13 | | | $ | 6.91 | |

| Diluted | $ | 2.93 | | | $ | 2.11 | | | $ | 9.09 | | | $ | 6.88 | |

| Weighted average number of shares outstanding | | | | | | | |

| Basic | 181.7 | | | 183.3 | |

| 182.2 | | | 183.4 | |

| Diluted | 182.5 | | | 184.0 | |

| 183.0 | | | 184.1 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(Amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | | | | | $ | 534 | | | | | | | $ | 390 | |

| Other Comprehensive Income (Loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | 252 | | | $ | (3) | | | 249 | | | $ | (174) | | | $ | (2) | | | (176) | |

| | | | | | | | | | | |

| Net (losses) gains on net investment hedges | (184) | | | 48 | | | (136) | | | 124 | | | (31) | | | 93 | |

| | | | | | | | | | | |

| Cash Flow Hedges: | | | | | | | | | | | |

| | | | | | | | | | | |

| Reclassification of losses included in net income | 1 | | | — | | | 1 | | | 1 | | | — | | | 1 | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| Amortization of actuarial gains and prior service credits included in net income | — | | | — | | | — | | | (1) | | | — | | | (1) | |

| Net actuarial gains | — | | | — | | | — | | | 2 | | | (1) | | | 1 | |

| Total other comprehensive income (loss) | $ | 69 | | | $ | 45 | | | $ | 114 | | | $ | (48) | | | $ | (34) | | | $ | (82) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 648 | | | | | | | $ | 308 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, 2024 | | Nine Months Ended

September 30, 2023 |

| |

| Pre-tax

amounts | | Tax

amounts | | After-tax

amounts | | Pre-tax

amounts | | Tax

amounts | | After-tax

amounts |

| Net Income | | | | | $ | 1,664 | | | | | | | $ | 1,268 | |

| Other Comprehensive Income (Loss): | | | | | | | | | | | |

| Foreign Currency Adjustments: | | | | | | | | | | | |

| Foreign currency translation adjustments, net | $ | 98 | | | $ | (3) | | | 95 | | | $ | (14) | | | $ | (4) | | | (18) | |

| | | | | | | | | | | |

| Net (losses) gains on net investment hedges | (40) | | | 10 | | | (30) | | | 11 | | | (3) | | | 8 | |

| | | | | | | | | | | |

| Cash Flow Hedges: | | | | | | | | | | | |

| | | | | | | | | | | |

| Reclassification of losses included in net income | 2 | | | — | | | 2 | | | 2 | | | (1) | | | 1 | |

| Pension and Other Retirement Benefits: | | | | | | | | | | | |

| Amortization of actuarial gains and prior service credits included in net income | (1) | | | — | | | (1) | | | (3) | | | 1 | | | (2) | |

| Net actuarial (losses) gains | (3) | | | 1 | | | (2) | | | 2 | | | (1) | | | 1 | |

| Total other comprehensive loss | $ | 56 | | | $ | 8 | | | $ | 64 | | | $ | (2) | | | $ | (8) | | | $ | (10) | |

| Comprehensive income | | | | | 1,728 | | | | | | | 1,258 | |

| Less: comprehensive loss attributable to noncontrolling interests | | | | | — | | | | | | | (1) | |

| Comprehensive Income Attributable to Moody's | | | | | $ | 1,728 | | | | | | | $ | 1,259 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(Amounts in millions, except share and per share data) | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,642 | | | $ | 2,130 | |

| Short-term investments | 573 | | | 63 | |

| Accounts receivable, net of allowance for credit losses of $35 in 2024 and $35 in 2023 | 1,708 | | | 1,659 | |

| Other current assets | 470 | | | 489 | |

| | | |

| Total current assets | 5,393 | | | 4,341 | |

| Property and equipment, net of accumulated depreciation of $1,442 in 2024 and $1,272 in 2023 | 662 | | | 603 | |

| Operating lease right-of-use assets | 242 | | | 277 | |

| Goodwill | 6,148 | | | 5,956 | |

| Intangible assets, net | 1,970 | | | 2,049 | |

| Deferred tax assets, net | 268 | | | 258 | |

| Other assets | 1,086 | | | 1,138 | |

| Total assets | $ | 15,769 | | | $ | 14,622 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 1,133 | | | $ | 1,076 | |

| Current portion of operating lease liabilities | 109 | | | 108 | |

| | | |

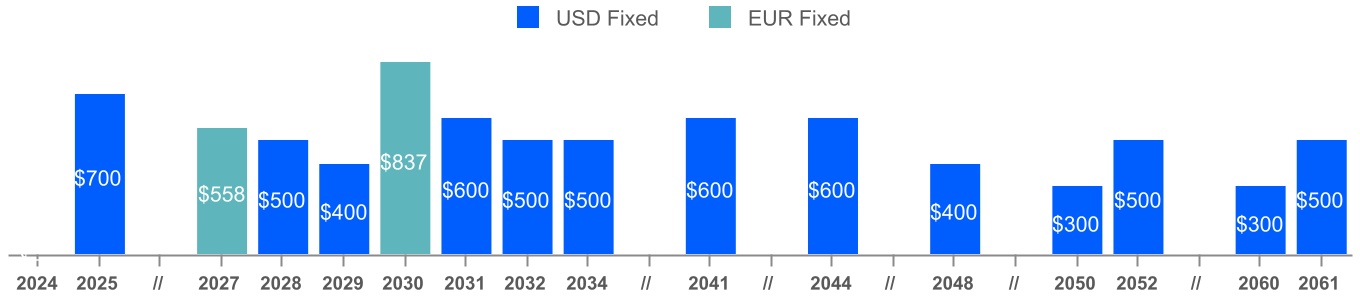

| Current portion of long-term debt | 693 | | | — | |

| Deferred revenue | 1,300 | | | 1,316 | |

| | | |

| Total current liabilities | 3,235 | | | 2,500 | |

| Non-current portion of deferred revenue | 59 | | | 65 | |

| Long-term debt | 6,876 | | | 7,001 | |

| Deferred tax liabilities, net | 416 | | | 402 | |

| Uncertain tax positions | 209 | | | 196 | |

| Operating lease liabilities | 245 | | | 306 | |

| Other liabilities | 661 | | | 676 | |

| Total liabilities | 11,701 | | | 11,146 | |

| Contingencies (Note 15) | | | |

| Shareholders' equity: | | | |

| Preferred stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

| Series common stock, par value $0.01 per share; 10,000,000 shares authorized; no shares issued and outstanding | — | | | — | |

| Common stock, par value $0.01 per share; 1,000,000,000 shares authorized; 342,902,272 shares issued at September 30, 2024 and December 31, 2023, respectively | 3 | | | 3 | |

| Capital surplus | 1,390 | | | 1,228 | |

| Retained earnings | 15,855 | | | 14,659 | |

| Treasury stock, at cost; 161,671,601 and 160,430,754 shares of common stock at September 30, 2024 and December 31, 2023, respectively | (12,840) | | | (12,005) | |

| Accumulated other comprehensive loss | (503) | | | (567) | |

| Total Moody's shareholders' equity | 3,905 | | | 3,318 | |

| Noncontrolling interests | 163 | | | 158 | |

| Total shareholders' equity | 4,068 | | | 3,476 | |

| Total liabilities, noncontrolling interests and shareholders' equity | $ | 15,769 | | | $ | 14,622 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(Amounts in millions) | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | |

| Net income | $ | 1,664 | | | $ | 1,268 | |

| Reconciliation of net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 318 | | | 276 | |

| Stock-based compensation | 166 | | | 143 | |

| Deferred income taxes | 9 | | | (10) | |

| Asset impairment and abandonment-related charges | 15 | | | 12 | |

| | | |

| | | |

| Provision for credit losses on accounts receivable | 14 | | | 15 | |

| Gain on previously held equity method investments | (7) | | | — | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (43) | | | 112 | |

| Other current assets | 25 | | | 151 | |

| | | |

| Other assets | (1) | | | (31) | |

| Lease obligations | (24) | | | (16) | |

| | | |

| Accounts payable and accrued liabilities | 45 | | | (61) | |

| Deferred revenue | (51) | | | (35) | |

| Uncertain tax positions and other non-current tax liabilities | 12 | | | (114) | |

| Other liabilities | 22 | | | (36) | |

| Net cash provided by operating activities | 2,164 | | | 1,674 | |

| Cash flows from investing activities |

| Capital additions | (243) | | | (198) | |

| Purchases of investments | (623) | | | (105) | |

| Sales and maturities of investments | 105 | | | 115 | |

| Purchases of investments in non-consolidated affiliates | (4) | | | (3) | |

| Sales of investments in non-consolidated affiliates | — | | | 1 | |

| | | |

| Cash paid for acquisitions, net of cash acquired | (110) | | | (3) | |

| | | |

| Net cash used in investing activities | (875) | | | (193) | |

| Cash flows from financing activities | | | |

| Repayment of notes | — | | | (500) | |

| Issuance of notes | 496 | | | — | |

| | | |

| | | |

| Proceeds from stock-based compensation plans | 60 | | | 40 | |

| Treasury shares | (812) | | | (278) | |

| | | |

| Repurchase of shares related to stock-based compensation | (85) | | | (67) | |

| Dividends | (465) | | | (424) | |

| Dividends to noncontrolling interests | (1) | | | (2) | |

| Debt issuance costs and related fees | (5) | | | — | |

| | | |

| Net cash used in financing activities | (812) | | | (1,231) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 35 | | | (13) | |

| Increase in cash and cash equivalents | 512 | | | 237 | |

| Cash and cash equivalents, beginning of period | 2,130 | | | 1,769 | |

| Cash and cash equivalents, end of period | $ | 2,642 | | | $ | 2,006 | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital Surplus | | Retained Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at June 30, 2023 | 342.9 | | | $ | 3 | | | $ | 1,124 | | | $ | 14,213 | | | (159.4) | | | $ | (11,626) | | | $ | (570) | | | $ | 3,144 | | | $ | 168 | | | $ | 3,312 | |

| Net income | | | | | | | 389 | | | | | | | | | 389 | | | 1 | | | 390 | |

| Dividends ($0.77 per share) | | | | | | | (142) | | | | | | | | | (142) | | | (8) | | | (150) | |

| Stock-based compensation | | | | | 46 | | | | | | | | | | | 46 | | | | | 46 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 5 | | | | | — | | | 2 | | | | | 7 | | | | | 7 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased, inclusive of excise tax | | | | | — | | | | | (0.5) | | | (171) | | | | | (171) | | | | | (171) | |

| | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $33 million) | | | | | | | | | | | | | (83) | | | (83) | | | — | | | (83) | |

| Net actuarial gains and prior service costs (net of tax of $1 million) | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| Amortization of actuarial gains and prior service credits | | | | | | | | | | | | | (1) | | | (1) | | | | | (1) | |

| Amortization of losses on cash flow hedges | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| | | | | | | | | | | | | | | | | | | |

| Balance at September 30, 2023 | 342.9 | | | $ | 3 | | | $ | 1,175 | | | $ | 14,460 | | | (159.9) | | | $ | (11,795) | | | $ | (652) | | | $ | 3,191 | | | $ | 161 | | | $ | 3,352 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity | | | |

| Shares | | Amount | | | Shares | | Amount | | | | |

| Balance at December 31, 2022 | 342.9 | | | $ | 3 | | | $ | 1,054 | | | $ | 13,618 | | | (159.7) | | | $ | (11,513) | | | $ | (643) | | | $ | 2,519 | | | $ | 170 | | | $ | 2,689 | | | | |

| Net income | | | | | | | 1,267 | | | | | | | | | 1,267 | | | 1 | | | 1,268 | | | | |

| Dividends ($2.31 per share) | | | | | | | (425) | | | | | | | | | (425) | | | (9) | | | (434) | | | | |

| Stock-based compensation | | | | | 143 | | | | | | | | | | | 143 | | | | | 143 | | | | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (22) | | | | | 0.7 | | | (2) | | | | | (24) | | | | | (24) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased, inclusive of excise tax | | | | | — | | | | | (0.9) | | | (280) | | | | | (280) | | | | | (280) | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $7 million) | | | | | | | | | | | | | (9) | | | (9) | | | (1) | | | (10) | | | | |

| Net actuarial gains and prior service costs (net of tax of $1 million) | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | | | | |

| Amortization of actuarial gains and prior service credits (net of tax of $1 million) | | | | | | | | | | | | | (2) | | | (2) | | | | | (2) | | | | |

| Amortization of losses on cash flow hedges (net of tax of $1 million) | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | | | | |

| Balance at September 30, 2023 | 342.9 | | | $ | 3 | | | $ | 1,175 | | | $ | 14,460 | | | (159.9) | | | $ | (11,795) | | | $ | (652) | | | $ | 3,191 | | | $ | 161 | | | $ | 3,352 | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at June 30, 2024 | 342.9 | | | $ | 3 | | | $ | 1,324 | | | $ | 15,478 | | | (160.8) | | | $ | (12,410) | | | $ | (617) | | | $ | 3,778 | | | $ | 160 | | | $ | 3,938 | |

| Net income | | | | | | | 534 | | | | | | | | | 534 | | | — | | | 534 | |

| Dividends ($0.85 per share) | | | | | | | (157) | | | | | | | | | (157) | | | (5) | | | (162) | |

| Stock-based compensation | | | | | 58 | | | | | | | | | | | 58 | | | | | 58 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | 8 | | | | | — | | | 4 | | | | | 12 | | | | | 12 | |

| | | | | | | | | | | | | | | | | | | |

| Noncontrolling interest resulting from majority acquisition | | | | | | | | | | | | | | | — | | | 8 | | | 8 | |

| Treasury shares repurchased, inclusive of excise tax | | | | | | | | | (0.9) | | | (434) | | | | | (434) | | | | | (434) | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $45 million) | | | | | | | | | | | | | 113 | | | 113 | | | — | | | 113 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Amortization of losses on cash flow hedges | | | | | | | | | | | | | 1 | | | 1 | | | | | 1 | |

| Balance at September 30, 2024 | 342.9 | | | $ | 3 | | | $ | 1,390 | | | $ | 15,855 | | | (161.7) | | | $ | (12,840) | | | $ | (503) | | | $ | 3,905 | | | $ | 163 | | | $ | 4,068 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY'S CORPORATION

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (UNAUDITED)

(Amounts in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders of Moody's Corporation | | | |

| Common Stock | | Capital

Surplus | | Retained

Earnings | | Treasury Stock | | Accumulated

Other

Comprehensive

Loss | | Total Moody's

Shareholders'

Equity | | Non- Controlling

Interests | | Total

Shareholders'

Equity |

| Shares | | Amount | | | Shares | | Amount | |

| Balance at December 31, 2023 | 342.9 | | | $ | 3 | | | $ | 1,228 | | | $ | 14,659 | | | (160.4) | | | $ | (12,005) | | | $ | (567) | | | $ | 3,318 | | | $ | 158 | | | $ | 3,476 | |

| Net income | | | | | | | 1,663 | | | | | | | | | 1,663 | | | 1 | | | 1,664 | |

| Dividends ($2.55 per share) | | | | | | | (467) | | | | | | | | | (467) | | | (6) | | | (473) | |

| | | | | | | | | | | | | | | | | | | |

| Stock-based compensation | | | | | 169 | | | | | | | | | | | 169 | | | | | 169 | |

| Shares issued for stock-based compensation plans at average cost, net | | | | | (7) | | | | | 0.6 | | | (18) | | | | | (25) | | | | | (25) | |

| | | | | | | | | | | | | | | | | | | |

| Noncontrolling interest resulting from majority acquisition | | | | | | | | | | | | | | | — | | | 10 | | | 10 | |

| | | | | | | | | | | | | | | | | | | |

| Treasury shares repurchased, inclusive of excise tax | | | | | — | | | | | (1.9) | | | (817) | | | | | (817) | | | | | (817) | |

| | | | | | | | | | | | | | | | | | | |

| Currency translation adjustment, net of net investment hedge activity (net of tax of $7 million) | | | | | | | | | | | | | 65 | | | 65 | | | — | | | 65 | |

| Net actuarial losses (net of tax of $1 million) | | | | | | | | | | | | | (2) | | | (2) | | | | | (2) | |

| Amortization of actuarial gains and prior service credits | | | | | | | | | | | | | (1) | | | (1) | | | | | (1) | |

| Amortization of losses on cash flow hedges | | | | | | | | | | | | | 2 | | | 2 | | | | | 2 | |

| Balance at September 30, 2024 | 342.9 | | | $ | 3 | | | $ | 1,390 | | | $ | 15,855 | | | (161.7) | | | $ | (12,840) | | | $ | (503) | | | $ | 3,905 | | | $ | 163 | | | $ | 4,068 | |

The accompanying notes are an integral part of the consolidated financial statements.

MOODY’S CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(tabular dollar and share amounts in millions, except per share data)

NOTE 1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION

Moody’s is a global integrated risk assessment firm that empowers organizations to anticipate, adapt and thrive in a new era of exponential risk. Our data, analytical solutions and insights help decision-makers identify opportunities and manage the risks of doing business with others. Moody’s reports in two reportable segments: MA and MIS.

MA is a global provider of: i) decision solutions; ii) research and insights; and iii) data and information, which help companies make better and faster decisions. MA leverages its unique assets and specialized industry knowledge across multiple risks such as credit, market, financial crime, supply chain, catastrophe and climate to deliver integrated risk assessment solutions that enable business leaders to identify, measure and manage the implications of interrelated risks and opportunities.

MIS publishes credit ratings and provides assessment services on a wide range of debt obligations, programs and facilities, and the entities that issue such obligations in markets worldwide, including various corporate, financial institution and governmental obligations, and structured finance securities.

These interim financial statements have been prepared in accordance with the instructions to Form 10-Q and should be read in conjunction with the Company’s consolidated financial statements and related notes in the Company’s 2023 annual report on Form 10-K filed with the SEC on February 14, 2024. The results of interim periods are not necessarily indicative of results for the full year or any subsequent period. In the opinion of management, all adjustments (including normal recurring accruals) considered necessary for a fair presentation of financial position, results of operations and cash flows at the dates and for the periods presented have been included. The year-end consolidated balance sheet data was derived from audited financial statements, but does not include all disclosures required by GAAP.

Certain reclassifications have been made to prior period amounts to conform to the current presentation.

Recently Issued Accounting Standards

In November 2023, the FASB issued ASU 2023-07, "Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures" ("ASU No. 2023-07"), which expands segment disclosure requirements for public entities. ASU No. 2023-07 will require entities to disclose significant segment expenses by reportable segment if they are regularly provided to the CODM and included in each reported measure of segment profit or loss. In addition, this ASU permits entities to disclose more than one measure of segment profit or loss used by the CODM. Additionally, disclosure of the CODM’s title and position will be required on an annual basis, as well as an explanation of how the CODM uses the reported measure(s). Furthermore, all existing annual disclosures about segment profit or loss and assets must be provided on an interim basis in addition to disclosure of significant segment expenses and other segment items. This ASU is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and requires retrospective application to all prior periods presented in the financial statements. The Company will adopt this ASU in its Form 10-K for the year ended December 31, 2024 and will provide the aforementioned new required disclosures, including further disaggregation of each segment's operating and SG&A expenses.

In December 2023, the FASB issued ASU 2023-09, "Income Taxes (Topic 740): Improvements to Income Tax Disclosures" ("ASU No. 2023-09"), which is intended to enhance the transparency and decision usefulness of income tax disclosures. The amendments in ASU No. 2023-09 require entities to disclose additional income tax information, primarily related to greater disaggregation of the entity's ETR reconciliation and income taxes paid by jurisdiction disclosures. This ASU is effective for annual periods beginning after December 15, 2024, and should be applied on a prospective basis; however, retrospective application is permitted. The Company is currently evaluating the impact of adopting this ASU on its consolidated financial statements and disclosures.

Reclassification of Previously Reported Revenue by LOB

In the first quarter of 2024, pursuant to the integration of RMS into the Company's order-to-cash systems, the Company reclassified certain prior year revenue by geography disclosures. The impact of the reclassification was not material and prior year revenue disclosures have been reclassified to conform to this new presentation, which is disclosed in Note 2.

NOTE 2. REVENUES

Revenue by Category

The following table presents the Company’s revenues disaggregated by LOB: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| MA: | | | | | | | |

| Decision Solutions (DS) | | | | | | | |

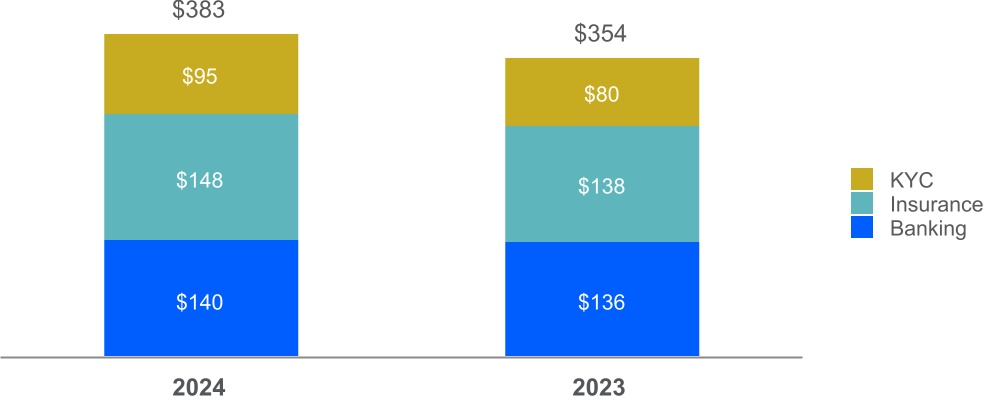

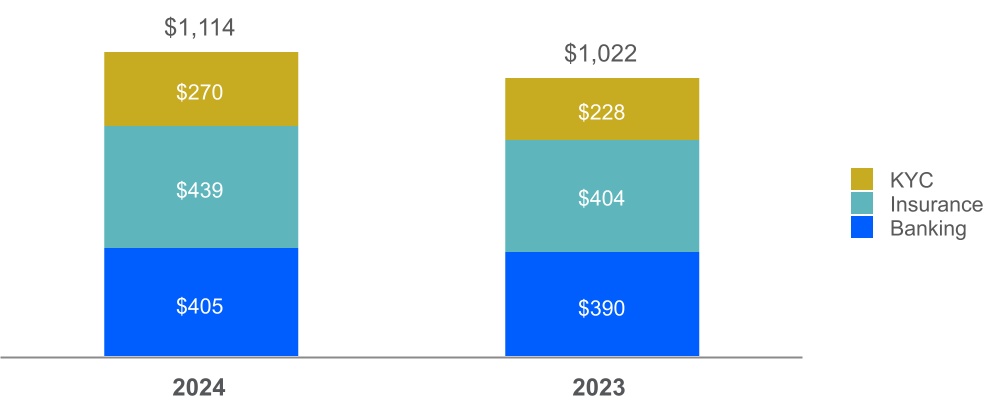

| Banking | $ | 140 | | | $ | 136 | | | $ | 405 | | | $ | 390 | |

| Insurance | 148 | | | 138 | | | 439 | | | 404 | |

| KYC | 95 | | | 80 | | | 270 | | | 228 | |

| Total DS | 383 | | | 354 | | | 1,114 | | | 1,022 | |

| Research and Insights (R&I) | 235 | | | 222 | | | 683 | | | 654 | |

| Data and Information (D&I) | 213 | | | 200 | | | 635 | | | 584 | |

| Total external revenue | 831 | | | 776 | | | 2,432 | | | 2,260 | |

| Intersegment revenue | 3 | | | 3 | | | 10 | | | 10 | |

| Total MA | 834 | | | 779 | | | 2,442 | | | 2,270 | |

| MIS: | | | | | | | |

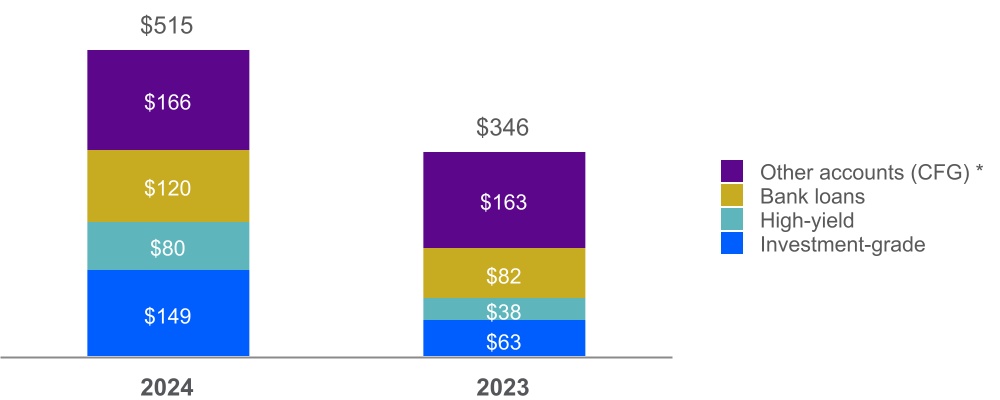

| Corporate Finance (CFG) | | | | | | | |

| Investment-grade | 149 | | | 63 | | | 416 | | | 272 | |

| High-yield | 80 | | | 38 | | | 232 | | | 116 | |

| Bank loans | 120 | | | 82 | | | 422 | | | 209 | |

Other accounts (1) | 166 | | | 163 | | | 499 | | | 470 | |

| Total CFG | 515 | | | 346 | | | 1,569 | | | 1,067 | |

| Structured Finance (SFG) | | | | | | | |

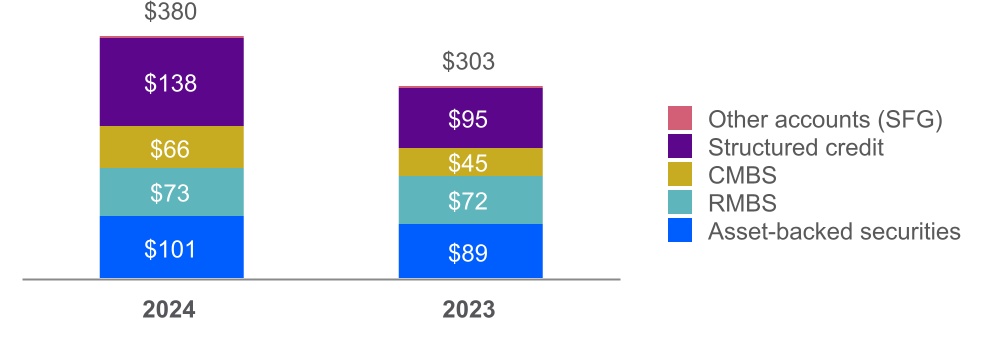

| Asset-backed securities | 34 | | | 30 | | | 101 | | | 89 | |

| RMBS | 24 | | | 22 | | | 73 | | | 72 | |

| CMBS | 27 | | | 17 | | | 66 | | | 45 | |

| Structured credit | 49 | | | 32 | | | 138 | | | 95 | |

| Other accounts | 1 | | | 1 | | | 2 | | | 2 | |

| Total SFG | 135 | | | 102 | | | 380 | | | 303 | |

| Financial Institutions (FIG) | | | | | | | |

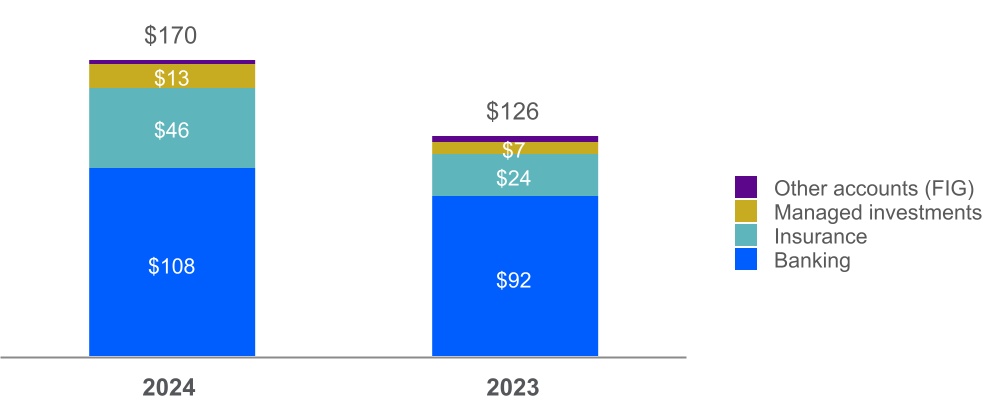

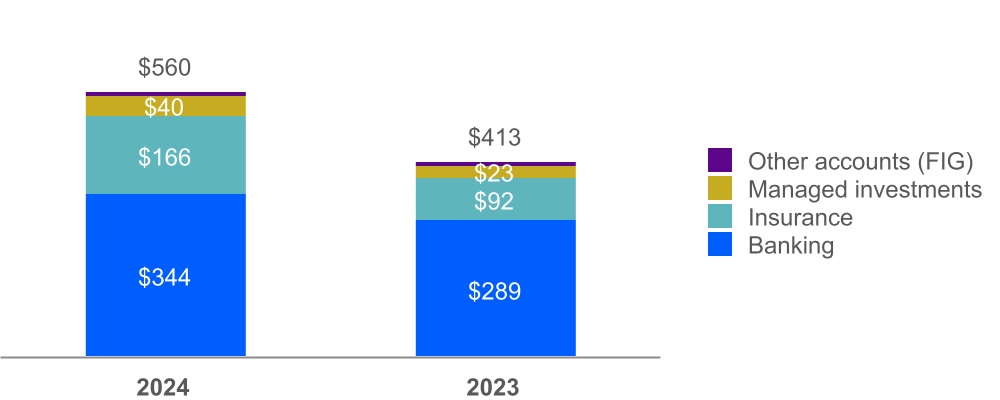

| Banking | 108 | | | 92 | | | 344 | | | 289 | |

| Insurance | 46 | | | 24 | | | 166 | | | 92 | |

| Managed investments | 13 | | | 7 | | | 40 | | | 23 | |

| Other accounts | 3 | | | 3 | | | 10 | | | 9 | |

| Total FIG | 170 | | | 126 | | | 560 | | | 413 | |

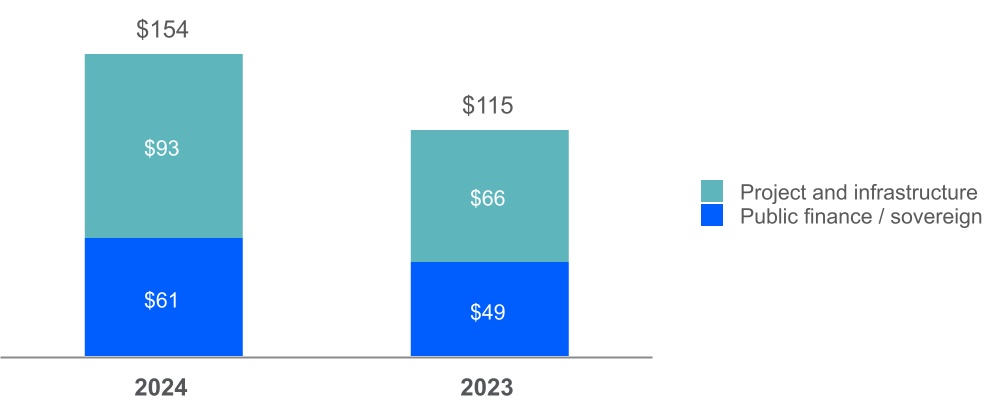

| Public, Project and Infrastructure Finance (PPIF) | | | | | | | |

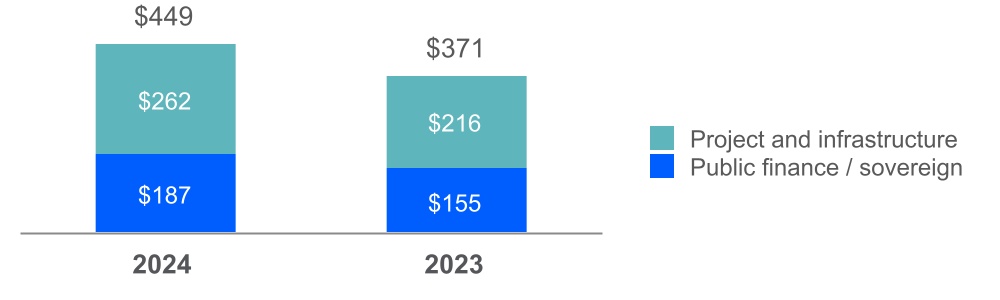

| Public finance / sovereign | 61 | | | 49 | | | 187 | | | 155 | |

| Project and infrastructure | 93 | | | 66 | | | 262 | | | 216 | |

| Total PPIF | 154 | | | 115 | | | 449 | | | 371 | |

| Total ratings revenue | 974 | | | 689 | | | 2,958 | | | 2,154 | |

| MIS Other | 8 | | | 7 | | | 26 | | | 22 | |

| Total external revenue | 982 | | | 696 | | | 2,984 | | | 2,176 | |

| Intersegment revenue | 48 | | | 47 | | | 144 | | | 138 | |

| Total MIS | 1,030 | | | 743 | | | 3,128 | | | 2,314 | |

| Eliminations | (51) | | | (50) | | | (154) | | | (148) | |

| Total MCO | $ | 1,813 | | | $ | 1,472 | | | $ | 5,416 | | | $ | 4,436 | |

(1) Other includes: recurring monitoring fees of a rated debt obligation and/or entities that issue such obligations as well as fees from programs such as commercial paper, medium term notes, and ICRA corporate finance revenue.

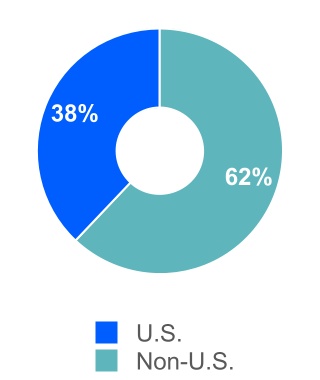

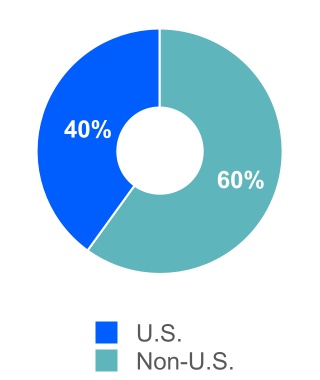

The following table presents the Company’s revenues disaggregated by LOB and geographic area:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| U.S. | | Non-U.S | | Total | | U.S. | | Non-U.S | | Total |

| MA: |

| Decision Solutions | $ | 144 | | | $ | 239 | | | $ | 383 | | | $ | 141 | | | $ | 213 | | | $ | 354 | |

| Research and Insights | 128 | | | 107 | | | 235 | | | 124 | | | 98 | | | 222 | |

| Data and Information | 74 | | | 139 | | | 213 | | | 69 | | | 131 | | | 200 | |

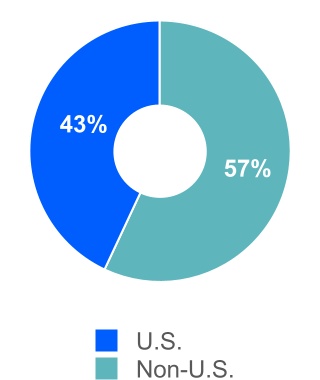

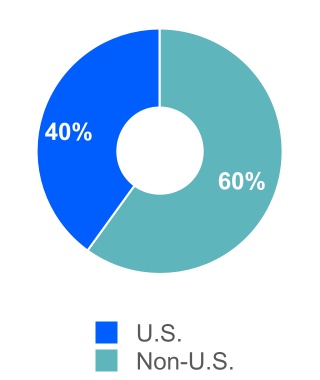

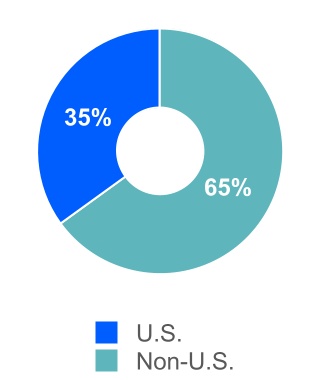

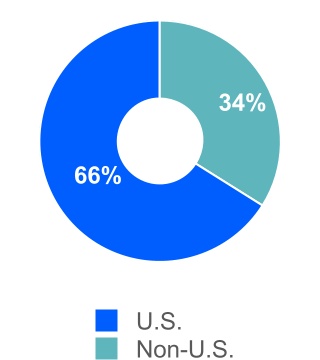

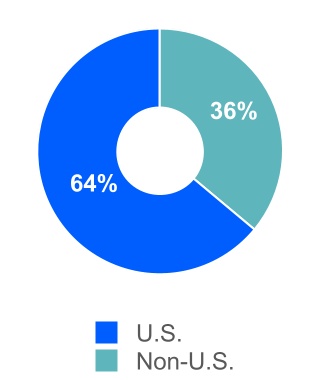

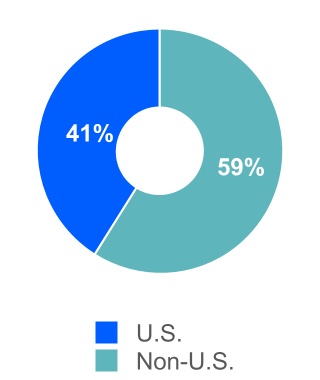

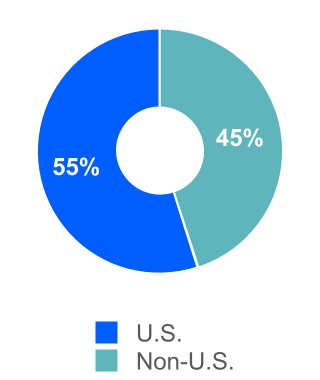

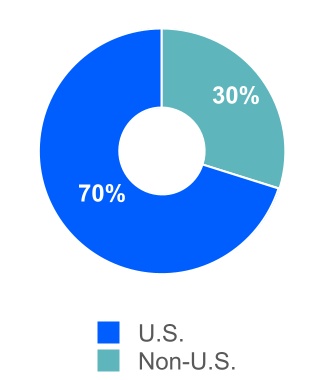

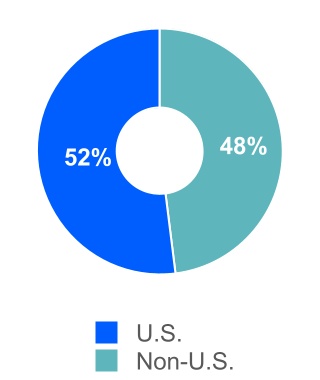

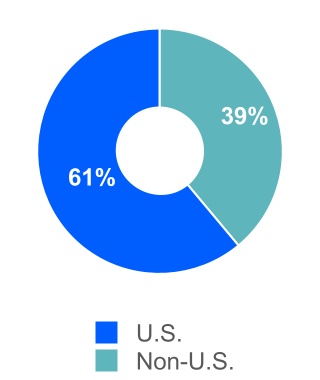

| Total MA | 346 | | | 485 | | | 831 | | | 334 | | | 442 | | | 776 | |

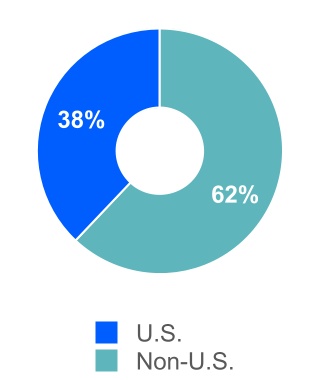

| MIS: |

| Corporate Finance | 364 | | | 151 | | | 515 | | | 242 | | | 104 | | | 346 | |

| Structured Finance | 98 | | | 37 | | | 135 | | | 65 | | | 37 | | | 102 | |

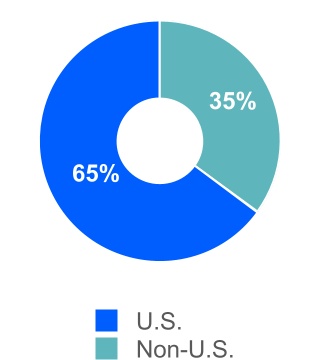

| Financial Institutions | 90 | | | 80 | | | 170 | | | 52 | | | 74 | | | 126 | |

| Public, Project and Infrastructure Finance | 100 | | | 54 | | | 154 | | | 69 | | | 46 | | | 115 | |

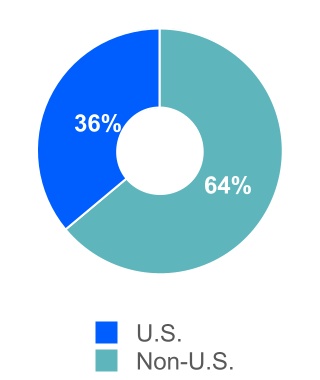

| Total ratings revenue | 652 | | | 322 | | | 974 | | | 428 | | | 261 | | | 689 | |

| MIS Other | 1 | | | 7 | | | 8 | | | — | | | 7 | | | 7 | |

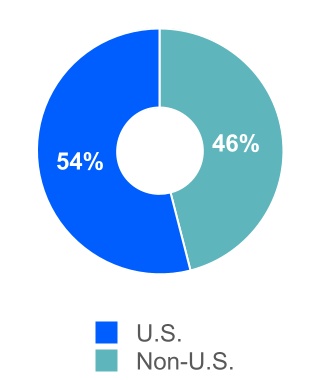

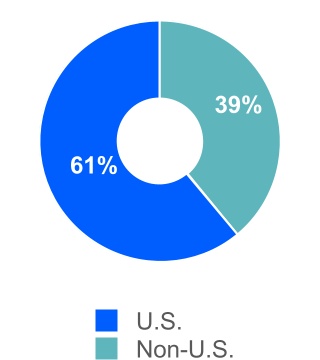

| Total MIS | 653 | | | 329 | | | 982 | | | 428 | | | 268 | | | 696 | |

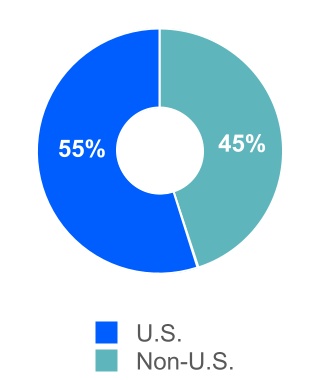

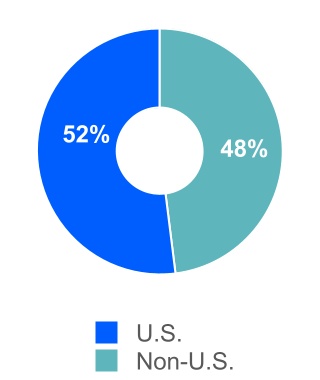

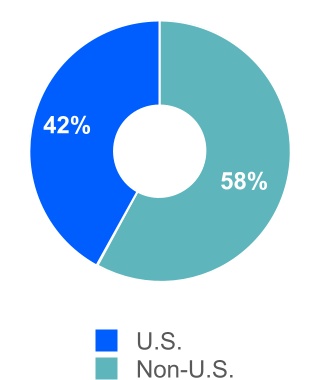

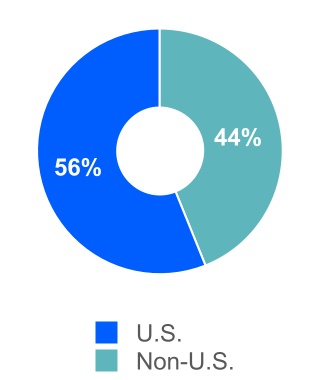

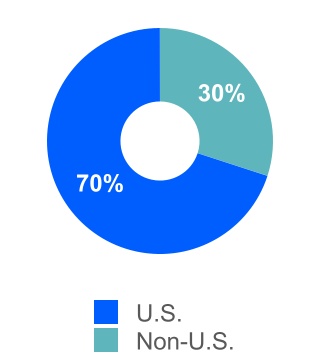

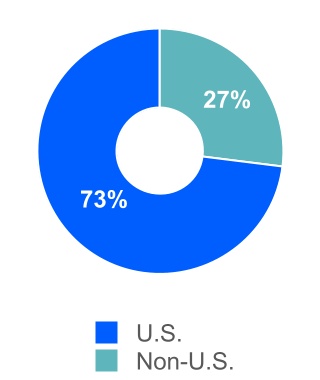

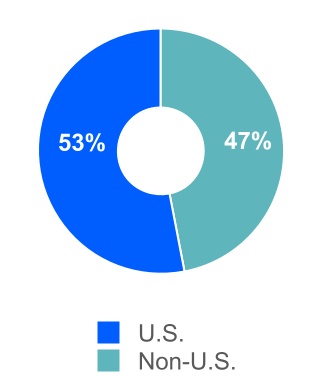

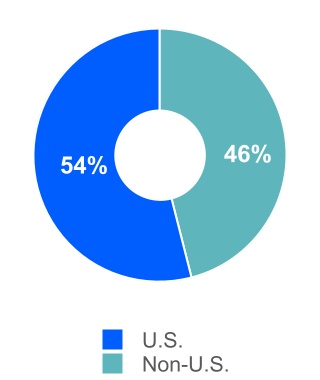

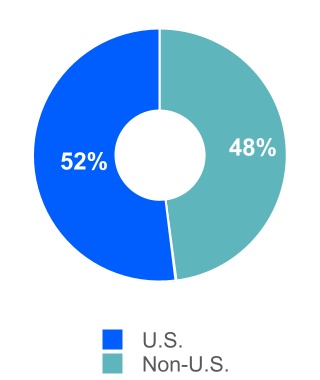

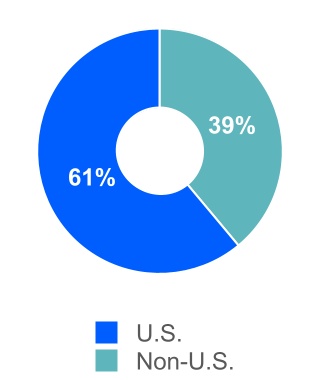

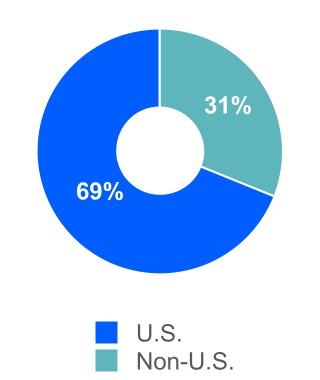

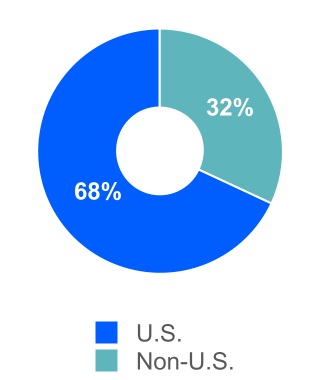

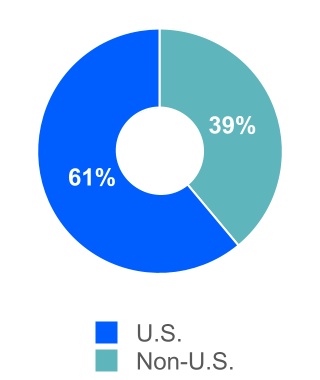

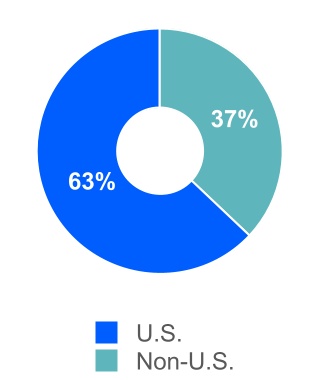

| Total MCO | $ | 999 | | | $ | 814 | | | $ | 1,813 | | | $ | 762 | | | $ | 710 | | | $ | 1,472 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 |

| U.S. | | Non-U.S | | Total | | U.S. | | Non-U.S | | Total |

| MA: |

| Decision Solutions | $ | 420 | | | $ | 694 | | | $ | 1,114 | | | $ | 406 | | | $ | 616 | | | $ | 1,022 | |

| Research and Insights | 374 | | | 309 | | | 683 | | | 361 | | | 293 | | | 654 | |

| Data and Information | 227 | | | 408 | | | 635 | | | 204 | | | 380 | | | 584 | |

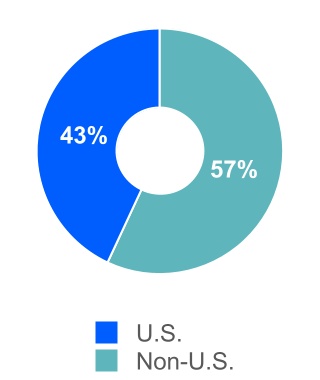

| Total MA | 1,021 | | | 1,411 | | | 2,432 | | | 971 | | | 1,289 | | | 2,260 | |

| MIS: |

| Corporate Finance | 1,078 | | | 491 | | | 1,569 | | | 727 | | | 340 | | | 1,067 | |

| Structured Finance | 266 | | | 114 | | | 380 | | | 186 | | | 117 | | | 303 | |

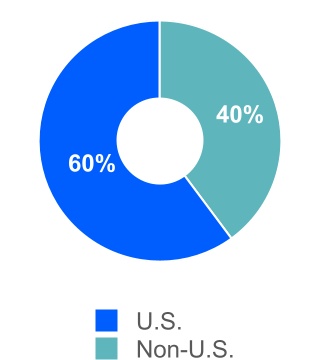

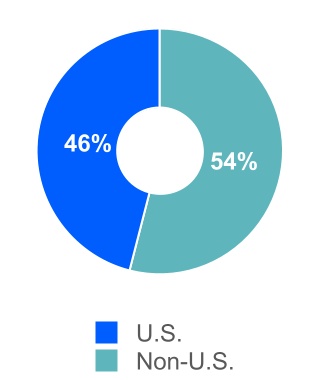

| Financial Institutions | 292 | | | 268 | | | 560 | | | 188 | | | 225 | | | 413 | |

| Public, Project and Infrastructure Finance | 284 | | | 165 | | | 449 | | | 228 | | | 143 | | | 371 | |

| Total ratings revenue | 1,920 | | | 1,038 | | | 2,958 | | | 1,329 | | | 825 | | | 2,154 | |

| MIS Other | 1 | | | 25 | | | 26 | | | — | | | 22 | | | 22 | |

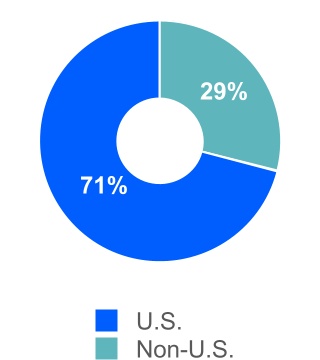

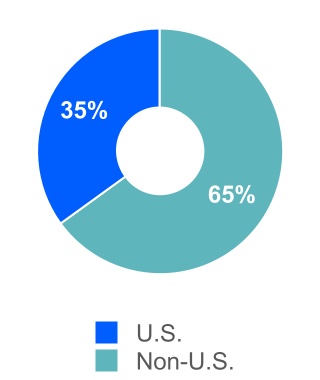

| Total MIS | 1,921 | | | 1,063 | | | 2,984 | | | 1,329 | | | 847 | | | 2,176 | |

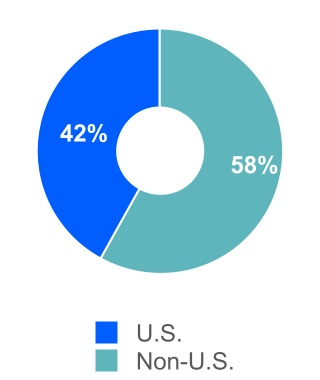

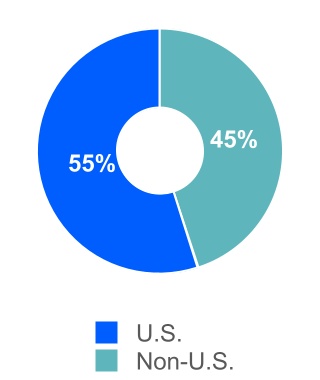

| Total MCO | $ | 2,942 | | | $ | 2,474 | | | $ | 5,416 | | | $ | 2,300 | | | $ | 2,136 | | | $ | 4,436 | |

The following table presents the Company’s reportable segment revenues disaggregated by segment and geographic region:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| MA: | | | | | | | |

| U.S. | $ | 346 | | | $ | 334 | | | $ | 1,021 | | | $ | 971 | |

| Non-U.S.: | | | | | | | |

| EMEA | 334 | | | 310 | | | 969 | | | 895 | |

| Asia-Pacific | 84 | | | 76 | | | 251 | | | 224 | |

| Americas | 67 | | | 56 | | | 191 | | | 170 | |

| Total Non-U.S. | 485 | | | 442 | | | 1,411 | | | 1,289 | |

| Total MA | 831 | | | 776 | | | 2,432 | | | 2,260 | |

| MIS: | |

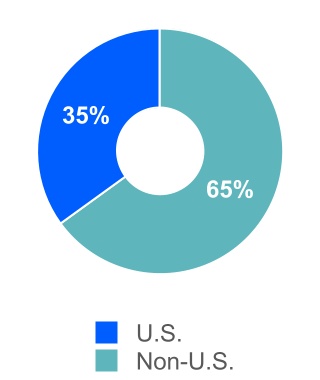

| U.S. | 653 | | | 428 | | | 1,921 | | | 1,329 | |

| Non-U.S.: | | | | | | | |

| EMEA | 212 | | | 155 | | | 685 | | | 509 | |

| Asia-Pacific | 73 | | | 67 | | | 225 | | | 213 | |

| Americas | 44 | | | 46 | | | 153 | | | 125 | |

| Total Non-U.S. | 329 | | | 268 | | | 1,063 | | | 847 | |

| Total MIS | 982 | | | 696 | | | 2,984 | | | 2,176 | |

| Total MCO | $ | 1,813 | | | $ | 1,472 | | | $ | 5,416 | | | $ | 4,436 | |

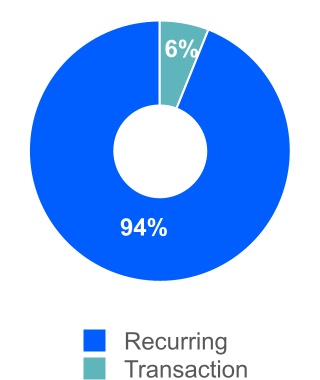

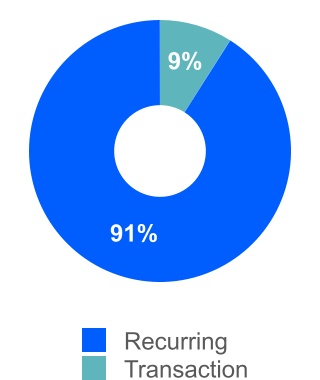

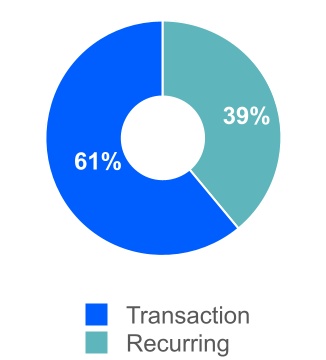

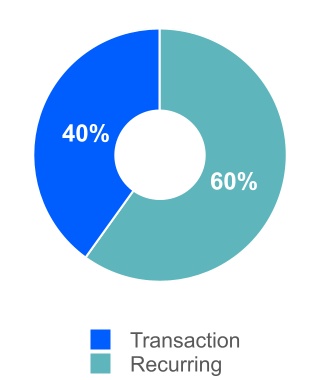

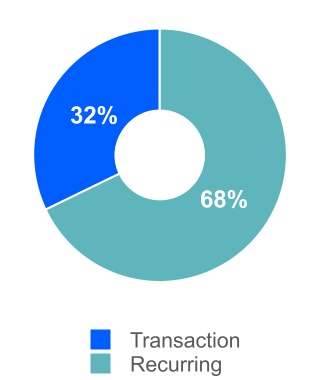

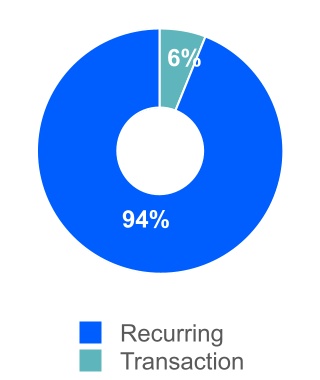

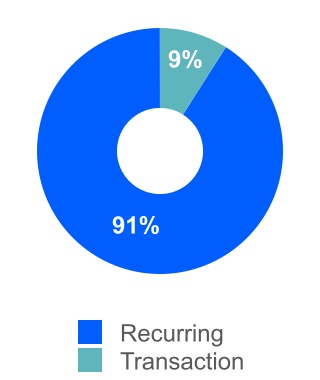

The following table summarizes the split between Transaction Revenue and Recurring Revenue:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, |

| 2024 | | 2023 |

| Transaction | | Recurring | | Total | | Transaction | | Recurring | | Total |

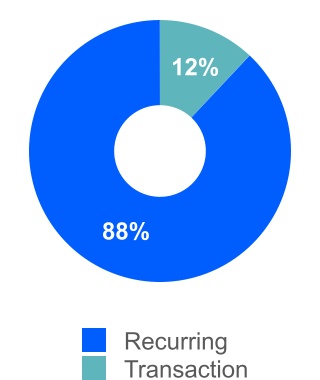

| Decision Solutions | $ | 33 | | | $ | 350 | | | $ | 383 | | | $ | 43 | | | $ | 311 | | | $ | 354 | |

| 9 | % | | 91 | % | | 100 | % | | 12 | % | | 88 | % | | 100 | % |

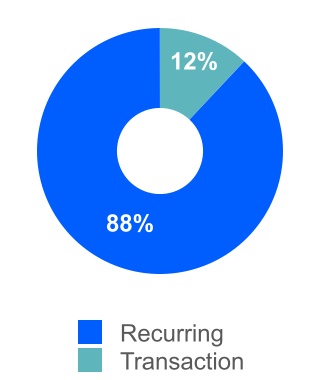

| Research and Insights | $ | 4 | | | $ | 231 | | | $ | 235 | | | $ | 4 | | | $ | 218 | | | $ | 222 | |

| 2 | % | | 98 | % | | 100 | % | | 2 | % | | 98 | % | | 100 | % |

| Data and Information | $ | 1 | | | $ | 212 | | | $ | 213 | | | $ | 1 | | | $ | 199 | | | $ | 200 | |

| — | % | | 100 | % | | 100 | % | | 1 | % | | 99 | % | | 100 | % |

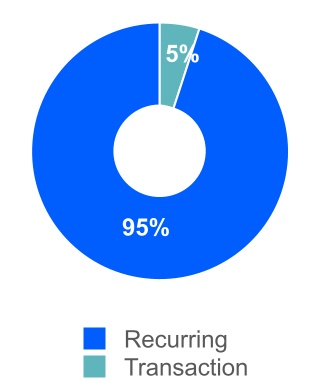

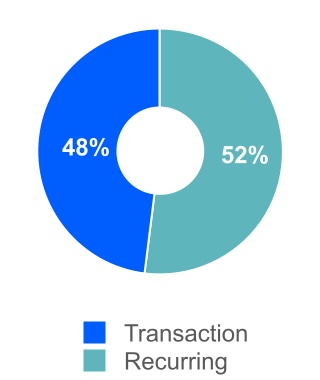

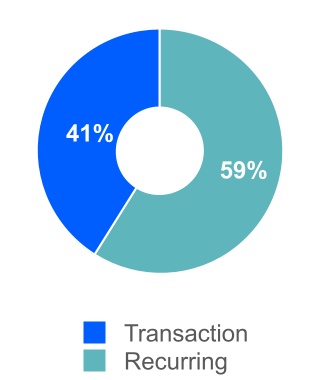

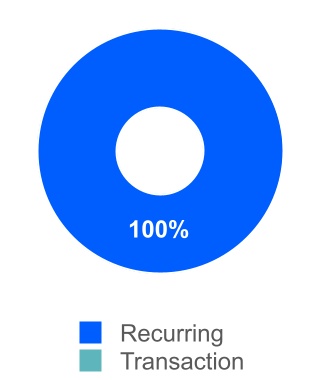

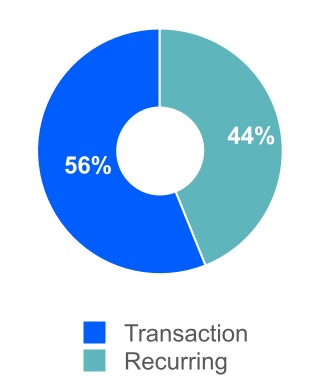

Total MA (1) | $ | 38 | | | $ | 793 | | | $ | 831 | | | $ | 48 | | | $ | 728 | | | $ | 776 | |

| 5 | % | | 95 | % | | 100 | % | | 6 | % | | 94 | % | | 100 | % |

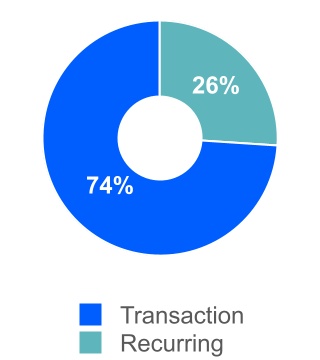

| Corporate Finance | $ | 382 | | | $ | 133 | | | $ | 515 | | | $ | 216 | | | $ | 130 | | | $ | 346 | |

| 74 | % | | 26 | % | | 100 | % | | 62 | % | | 38 | % | | 100 | % |

| Structured Finance | $ | 78 | | | $ | 57 | | | $ | 135 | | | $ | 49 | | | $ | 53 | | | $ | 102 | |

| 58 | % | | 42 | % | | 100 | % | | 48 | % | | 52 | % | | 100 | % |

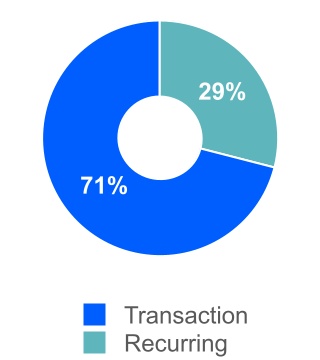

| Financial Institutions | $ | 92 | | | $ | 78 | | | $ | 170 | | | $ | 52 | | | $ | 74 | | | $ | 126 | |

| 54 | % | | 46 | % | | 100 | % | | 41 | % | | 59 | % | | 100 | % |

| Public, Project and Infrastructure Finance | $ | 109 | | | $ | 45 | | | $ | 154 | | | $ | 70 | | | $ | 45 | | | $ | 115 | |

| 71 | % | | 29 | % | | 100 | % | | 61 | % | | 39 | % | | 100 | % |

| MIS Other | $ | 2 | | | $ | 6 | | | $ | 8 | | | $ | 2 | | | $ | 5 | | | $ | 7 | |

| 25 | % | | 75 | % | | 100 | % | | 29 | % | | 71 | % | | 100 | % |

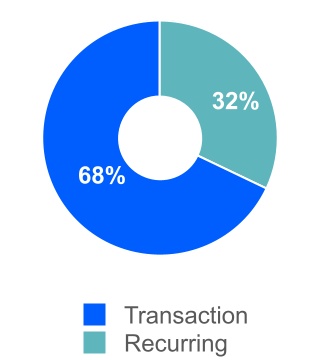

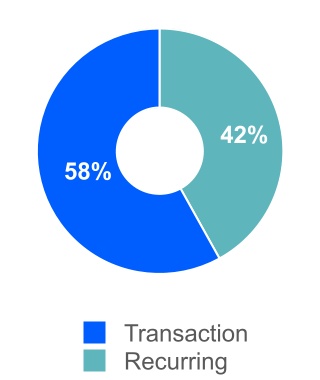

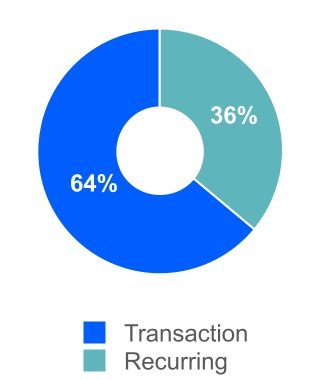

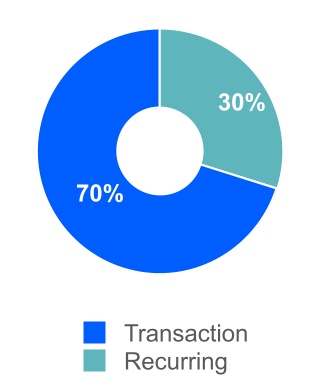

| Total MIS | $ | 663 | | | $ | 319 | | | $ | 982 | | | $ | 389 | | | $ | 307 | | | $ | 696 | |

| 68 | % | | 32 | % | | 100 | % | | 56 | % | | 44 | % | | 100 | % |

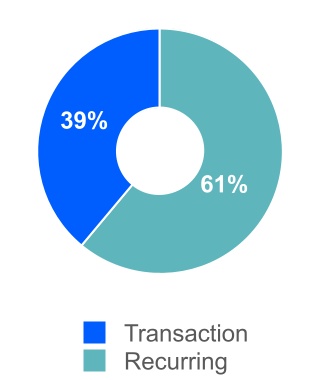

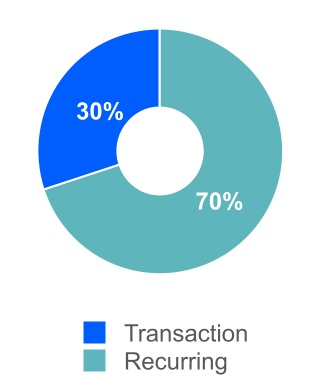

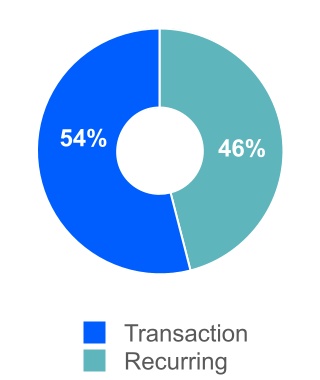

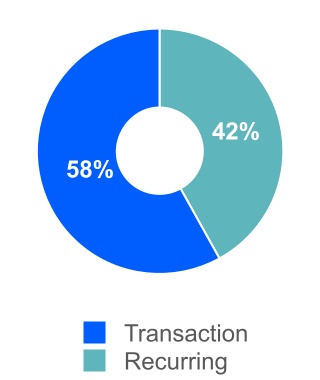

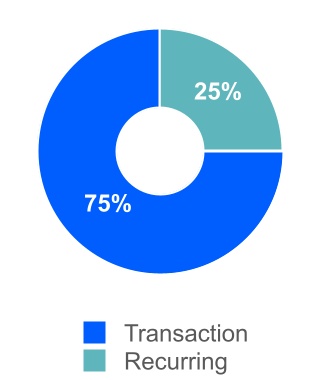

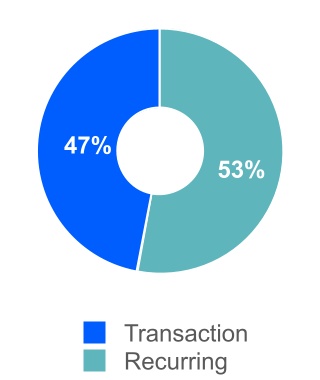

| Total Moody's Corporation | $ | 701 | | | $ | 1,112 | | | $ | 1,813 | | | $ | 437 | | | $ | 1,035 | | | $ | 1,472 | |

| 39 | % | | 61 | % | | 100 | % | | 30 | % | | 70 | % | | 100 | % |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Transaction | | Recurring | | Total | | Transaction | | Recurring | | Total |

| Decision Solutions | $ | 105 | | | $ | 1,009 | | | $ | 1,114 | | | $ | 126 | | | $ | 896 | | | $ | 1,022 | |

| 9 | % | | 91 | % | | 100 | % | | 12 | % | | 88 | % | | 100 | % |

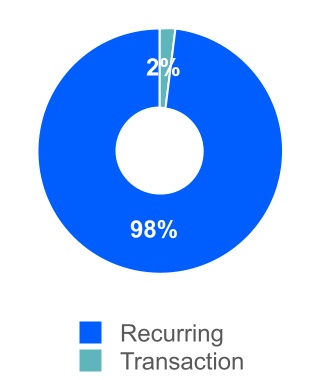

| Research and Insights | $ | 11 | | | $ | 672 | | | $ | 683 | | | $ | 12 | | | $ | 642 | | | $ | 654 | |

| 2 | % | | 98 | % | | 100 | % | | 2 | % | | 98 | % | | 100 | % |

| Data and Information | $ | 3 | | | $ | 632 | | | $ | 635 | | | $ | 2 | | | $ | 582 | | | $ | 584 | |

| — | % | | 100 | % | | 100 | % | | — | % | | 100 | % | | 100 | % |

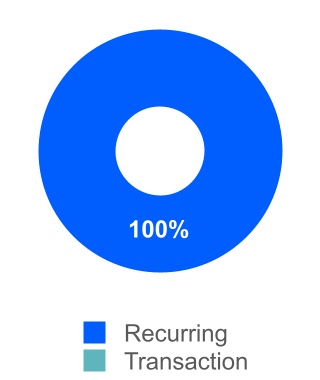

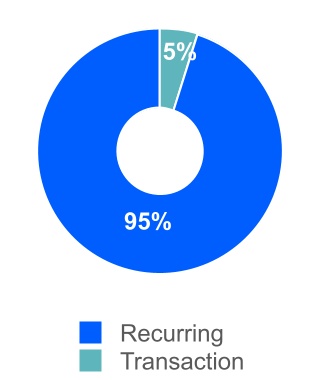

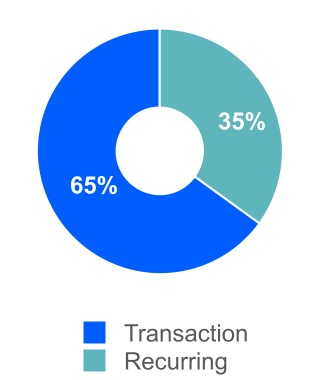

Total MA (1) | $ | 119 | | | $ | 2,313 | | | $ | 2,432 | | | $ | 140 | | | $ | 2,120 | | | $ | 2,260 | |

| 5 | % | | 95 | % | | 100 | % | | 6 | % | | 94 | % | | 100 | % |

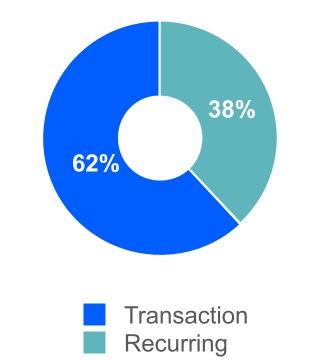

| Corporate Finance | $ | 1,169 | | | $ | 400 | | | $ | 1,569 | | | $ | 682 | | | $ | 385 | | | $ | 1,067 | |

| 75 | % | | 25 | % | | 100 | % | | 64 | % | | 36 | % | | 100 | % |

| Structured Finance | $ | 213 | | | $ | 167 | | | $ | 380 | | | $ | 142 | | | $ | 161 | | | $ | 303 | |

| 56 | % | | 44 | % | | 100 | % | | 47 | % | | 53 | % | | 100 | % |

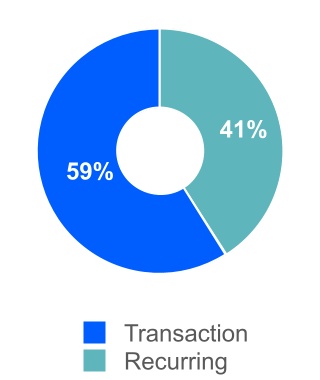

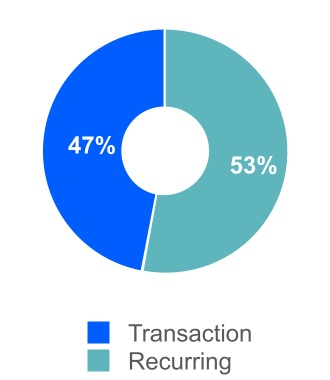

| Financial Institutions | $ | 329 | | | $ | 231 | | | $ | 560 | | | $ | 195 | | | $ | 218 | | | $ | 413 | |

| 59 | % | | 41 | % | | 100 | % | | 47 | % | | 53 | % | | 100 | % |

| Public, Project and Infrastructure Finance | $ | 315 | | | $ | 134 | | | $ | 449 | | | $ | 240 | | | $ | 131 | | | $ | 371 | |

| 70 | % | | 30 | % | | 100 | % | | 65 | % | | 35 | % | | 100 | % |

| MIS Other | $ | 6 | | | $ | 20 | | | $ | 26 | | | $ | 4 | | | $ | 18 | | | $ | 22 | |

| 23 | % | | 77 | % | | 100 | % | | 18 | % | | 82 | % | | 100 | % |

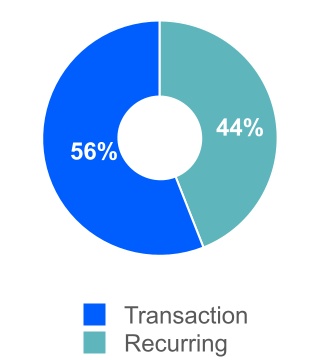

| Total MIS | $ | 2,032 | | | $ | 952 | | | $ | 2,984 | | | $ | 1,263 | | | $ | 913 | | | $ | 2,176 | |

| 68 | % | | 32 | % | | 100 | % | | 58 | % | | 42 | % | | 100 | % |

| Total Moody's Corporation | $ | 2,151 | | | $ | 3,265 | | | $ | 5,416 | | | $ | 1,403 | | | $ | 3,033 | | | $ | 4,436 | |

| 40 | % | | 60 | % | | 100 | % | | 32 | % | | 68 | % | | 100 | % |

(1) Revenue from software implementation services and risk management advisory projects, while classified by management as transactional revenue, is recognized over time under GAAP.The following table presents the timing of revenue recognition:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Nine Months Ended September 30, 2024 | | |

| MA | | MIS | | Total | | MA | | MIS | | Total | | | | | | |

| Revenue recognized at a point in time | $ | 26 | | | $ | 663 | | | $ | 689 | | | $ | 65 | | | $ | 2,032 | | | $ | 2,097 | | | | | | | |

| Revenue recognized over time | 805 | | | 319 | | | 1,124 | | | 2,367 | | | 952 | | | 3,319 | | | | | | | |

| Total | $ | 831 | | | $ | 982 | | | $ | 1,813 | | | $ | 2,432 | | | $ | 2,984 | | | $ | 5,416 | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended September 30, 2023 | | Nine Months Ended September 30, 2023 |

| MA | | MIS | | Total | | MA | | MIS | | Total |

| Revenue recognized at a point in time | $ | 24 | | | $ | 389 | | | $ | 413 | | | $ | 73 | | | $ | 1,263 | | | $ | 1,336 | |

| Revenue recognized over time | 752 | | | 307 | | | 1,059 | | | 2,187 | | | 913 | | | 3,100 | |

| Total | $ | 776 | | | $ | 696 | | | $ | 1,472 | | | $ | 2,260 | | | $ | 2,176 | | | $ | 4,436 | |

Unbilled receivables, deferred revenue and remaining performance obligations

Unbilled receivables

For certain MA arrangements, the timing of when the Company has the unconditional right to consideration and recognizes revenue occurs prior to invoicing the customer. In addition, certain MIS arrangements contain contractual terms whereby the customers are billed in arrears for annual monitoring services, requiring revenue to be accrued as an unbilled receivable as such services are provided.

The following table presents the Company's unbilled receivables, which are included within accounts receivable, net, at September 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2024 | | As of December 31, 2023 |

| MA | | MIS | | MA | | MIS |

| Unbilled Receivables | $ | 119 | | | $ | 470 | | | $ | 119 | | | $ | 415 | |

Deferred revenue

The Company recognizes deferred revenue when a contract requires a customer to pay consideration to the Company in advance of when revenue related to that contract is recognized. This deferred revenue is relieved when the Company satisfies the related performance obligation and revenue is recognized.

Significant changes in the deferred revenue balances during the three and nine months ended September 30, 2024 and 2023 are as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| MA | | MIS | | Total | | MA | | MIS | | Total |

| Balance at June 30, | $ | 1,146 | | | $ | 336 | | | $ | 1,482 | | | $ | 1,116 | | | $ | 336 | | | $ | 1,452 | |

| Changes in deferred revenue | | | | | | | | | | | |

| Revenue recognized that was included in the deferred revenue balance at the beginning of the period | (551) | | | (120) | | | (671) | | | (513) | | | (113) | | | (626) | |

| Increases due to amounts billable excluding amounts recognized as revenue during the period | 410 | | | 92 | | | 502 | | | 410 | | | 82 | | | 492 | |

| Increases due to acquisitions during the period | 5 | | | — | | | 5 | | | — | | | — | | | — | |

| Effect of exchange rate changes | 37 | | | 4 | | | 41 | | | (25) | | | (2) | | | (27) | |

| Total changes in deferred revenue | (99) | | | (24) | | | (123) | | | (128) | | | (33) | | | (161) | |

| Balance at September 30, | $ | 1,047 | | | $ | 312 | | | $ | 1,359 | | | $ | 988 | | | $ | 303 | | | $ | 1,291 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 |

| MA | | MIS | | Total | | MA | | MIS | | Total |

| Balance at December 31, | $ | 1,111 | | | $ | 270 | | | $ | 1,381 | | | $ | 1,055 | | | $ | 278 | | | $ | 1,333 | |

| Changes in deferred revenue | | | | | | | | | | | |

| Revenue recognized that was included in the deferred revenue balance at the beginning of the period | (950) | | | (197) | | | (1,147) | | | (969) | | | (192) | | | (1,161) | |

| Increases due to amounts billable excluding amounts recognized as revenue during the period | 860 | | | 238 | | | 1,098 | | | 908 | | | 218 | | | 1,126 | |

| Increases due to acquisitions during the period | 5 | | | — | | | 5 | | | — | | | — | | | — | |

| Effect of exchange rate changes | 21 | | | 1 | | | 22 | | | (6) | | | (1) | | | (7) | |

| Total changes in deferred revenue | (64) | | | 42 | | | (22) | | | (67) | | | 25 | | | (42) | |

| Balance at September 30, | $ | 1,047 | | | $ | 312 | | | $ | 1,359 | | | $ | 988 | | | $ | 303 | | | $ | 1,291 | |

| Deferred revenue - current | $ | 1,047 | | | $ | 253 | | | $ | 1,300 | | | $ | 986 | | | $ | 240 | | | $ | 1,226 | |

| Deferred revenue - non-current | $ | — | | | $ | 59 | | | $ | 59 | | | $ | 2 | | | $ | 63 | | | $ | 65 | |

For the MA segment, the decrease in deferred revenue for the three months ended September 30, 2024 and 2023 was primarily due to the recognition of annual subscription and maintenance billings from December and January. For the nine months ended September 30, 2024 and 2023, the decrease in the deferred revenue balance is attributable to recognition of revenues related to the aforementioned December billings being mostly offset by the impact of the high concentration of billings in the first quarter.

For the MIS segment, the change in the deferred revenue balance for all periods presented was primarily related to the significant portion of contract renewals that occur during the first quarter and are generally recognized over a one year period.

Remaining performance obligation

Remaining performance obligations in the MA segment include both amounts recorded as deferred revenue on the balance sheet as of September 30, 2024 as well as amounts not yet invoiced to customers as of September 30, 2024, largely reflecting future revenue related to signed multi-year arrangements for hosted and installed subscription-based products. As of September 30, 2024, the aggregate amount of the transaction price allocated to remaining performance obligations was approximately $3.5 billion. The Company expects to recognize into revenue approximately 60% of this balance within one year, approximately 25% of this balance between one to two years and the remaining amount thereafter.

Remaining performance obligations in the MIS segment largely reflect deferred revenue related to monitoring fees for certain structured finance products, primarily CMBS, where the issuers can elect to pay the monitoring fees for the life of the security in advance. As of September 30, 2024, the aggregate amount of the transaction price allocated to remaining performance obligations was approximately $97 million. The Company expects to recognize into revenue approximately 25% of this balance within one year, approximately 50% of this balance between one to five years and the remaining amount thereafter. With respect to the remaining performance obligations for the MIS segment, the Company has applied a practical expedient set forth in ASC Topic 606 permitting the omission of unsatisfied performance obligations relating to contracts with an original expected length of one year or less.

NOTE 3. STOCK-BASED COMPENSATION

Presented below is a summary of the stock-based compensation cost and associated tax benefit included in the accompanying consolidated statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Stock-based compensation cost | $ | 57 | | | $ | 46 | | | $ | 166 | | | $ | 143 | |

| Tax benefit | $ | 12 | | | $ | 10 | | | $ | 36 | | | $ | 32 | |

During the first nine months of 2024, the Company granted 0.2 million employee stock options, which had a weighted average grant date fair value of $120.42 per share. The Company also granted 0.5 million shares of restricted stock in the first nine months of 2024, which had a weighted average grant date fair value of $372.64 per share. Both the employee stock options and restricted stock generally vest ratably over four years. Additionally, the Company granted 0.2 million shares of performance-based awards whereby the number of shares that ultimately vest are based on the achievement of certain non-market-based performance metrics of the Company over a period of two to four years. The weighted average grant date fair value of these awards was $361.83 per share.

The following weighted average assumptions were used in determining the fair value using the Black-Scholes option-pricing model for options granted in 2024:

| | | | | |

| Expected dividend yield | 0.91 | % |

| Expected stock volatility | 28 | % |

| Risk-free interest rate | 4.34 | % |

| Expected holding period | 5.9 years |

Unrecognized stock-based compensation expense at September 30, 2024 was $16 million and $279 million for unvested stock options and restricted stock, respectively, which is expected to be recognized over a weighted average period of 1.8 years and 2.5 years, respectively. Additionally, there was $67 million of unrecognized stock-based compensation expense relating to the aforementioned non-market-based performance-based awards, which is expected to be recognized over a weighted average period of 2.3 years.

The following table summarizes information relating to stock option exercises and restricted stock vesting:

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2024 | | 2023 |

| Exercise of stock options: | | | |

| Proceeds from stock option exercises | $ | 44 | | | $ | 26 | |

| Aggregate intrinsic value | $ | 60 | | | $ | 48 | |

| Tax benefit realized upon exercise | $ | 10 | | | $ | 11 | |

Number of shares exercised | 0.3 | | | 0.2 | |

| Vesting of restricted stock: | | | |

| Fair value of shares vested | $ | 183 | | | $ | 154 | |

| Tax benefit realized upon vesting | $ | 45 | | | $ | 36 | |

| Number of shares vested | 0.5 | | | 0.5 | |

| Vesting of performance-based restricted stock: | | | |

| Fair value of shares vested | $ | 40 | | | $ | 24 | |

| Tax benefit realized upon vesting | $ | 9 | | | $ | 3 | |

| Number of shares vested | 0.1 | | | 0.1 | |

NOTE 4. INCOME TAXES

Moody’s ETR was 24.0% and 19.9% for the three months ended September 30, 2024 and 2023, respectively. Moody’s ETR for the nine months ended September 30, 2024 and 2023 was 23.5% and 14.6%, respectively. The increase in the ETR for the nine months ended September 30, 2024 compared to the same period in the prior year was primarily due to tax benefits recognized in the first quarter of 2023, which reflect the resolution of uncertain tax positions in various U.S. and non-U.S. tax jurisdictions and will not recur in 2024. The Company’s year-to-date provision for income taxes differs from the tax computed by applying its estimated annual ETR to the pre-tax earnings primarily due to the excess tax benefits from stock-based compensation of $23 million and a change in tax rate of a non-U.S. tax jurisdiction of $7 million.

The Company classifies interest related to UTPs in interest expense, net in its consolidated statements of operations. Penalties, if incurred, would be recognized in other non-operating income, net. The Company had a net increase in its UTP reserves of $2 million, net of federal tax, during the third quarter of 2024 and an increase in its UTPs of $13 million, net of federal tax, during the first nine months of 2024.

Moody’s is subject to U.S. federal income tax as well as income tax in various state, local and foreign jurisdictions. The tax years 2021 through 2023 remain open to examination. The Company’s New York City tax returns for 2018 through 2022 are currently under examination. The Company’s U.K. tax returns for 2017 through 2022 remain open to examination.

For ongoing audits, it is possible the balance of UTPs could decrease in the next twelve months as a result of the settlement of such audits, which might involve the payment of additional taxes, the adjustment of certain deferred taxes and/or the recognition of tax benefits. It is also possible that new issues will be raised by tax authorities which could necessitate increases to the balance of UTPs. As the Company is unable to predict the timing or outcome of these audits, it is unable to estimate the amount of future changes to the balance of UTPs at this time. However, the Company believes that it has adequately provided for its financial exposure relating to all open tax years, by tax jurisdiction, in accordance with the applicable provisions of ASC Topic 740 regarding UTPs.

The following table shows the amount the Company paid for income taxes: | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Income taxes paid | $ | 391 | | | $ | 213 | |

Effective in 2024, multiple foreign jurisdictions in which the Company operates have enacted legislation to adopt a minimum tax rate described in the Global Anti-Base Erosion tax model rules (referred to as GloBE or Pillar II) issued by the OECD. A minimum ETR of 15% applies to multinational companies with consolidated revenue above €750 million. Under the GloBE rules, a company is required to determine a combined ETR for all entities located in a jurisdiction. If the jurisdictional effective tax rate is less than 15%, an additional tax generally will be due to bring the jurisdictional ETR up to 15%. We have evaluated the impact of the Pillar II global minimum tax rules on our consolidated financial statements and related disclosures. As of September 30, 2024, the Pillar II minimum tax requirement is not expected to have a material impact on our full-year results of operations or financial position.

NOTE 5. RECONCILIATION OF WEIGHTED AVERAGE SHARES OUTSTANDING

Below is a reconciliation of basic to diluted shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| |

| 2024 | | 2023 | | 2024 | | 2023 |

| Basic | 181.7 | | | 183.3 | | | 182.2 | | | 183.4 | |

| Dilutive effect of shares issuable under stock-based compensation plans | 0.8 | | | 0.7 | | | 0.8 | | | 0.7 | |

| Diluted | 182.5 | | | 184.0 | | | 183.0 | | | 184.1 | |

| Anti-dilutive options to purchase common shares and restricted stock as well as contingently issuable restricted stock which are excluded from the table above | 0.3 | | | 0.4 | | | 0.4 | | | 0.5 | |

The calculation of basic shares outstanding is based on the weighted average number of shares of common stock outstanding during the reporting period. The calculation of diluted EPS requires certain assumptions regarding the use of both cash proceeds and assumed proceeds that would be received upon the exercise of stock options and vesting of restricted stock outstanding as of September 30, 2024 and 2023.

NOTE 6. CASH EQUIVALENTS AND INVESTMENTS

The table below provides additional information on the Company’s cash equivalents and investments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2024 |

| | | | | | | Balance sheet location |

| Cost | | Gains/(Losses) | | Fair Value | | Cash and cash equivalents | | Short-term

investments | | Other

assets |

Certificates of deposit and money market deposit accounts/funds (1) | $ | 1,691 | | | $ | — | | | $ | 1,691 | | | $ | 1,117 | | | $ | 573 | | | $ | 1 | |

| Mutual funds | $ | 101 | | | $ | 11 | | | $ | 112 | | | $ | — | | | $ | — | | | $ | 112 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, 2023 |

| | | | | | | Balance sheet location |

|

Cost | | Gains/(Losses) | |

Fair Value | | Cash and cash

equivalents | | Short-term

investments | | Other

assets |

| | | | | | | | | | | |

Certificates of deposit and money market deposit accounts/funds (1) | $ | 1,178 | | | $ | — | | | $ | 1,178 | | | $ | 1,112 | | | $ | 63 | | | $ | 3 | |

| Mutual funds | $ | 91 | | | $ | 6 | | | $ | 97 | | | $ | — | | | $ | — | | | $ | 97 | |

(1) Consists of time deposits, money market deposit accounts and money market funds. The remaining contractual maturities for the certificates of deposits classified as short-term investments are one month to 12 months at both September 30, 2024 and December 31, 2023. The remaining contractual maturities for the certificates of deposits classified in other assets are 14 months to 15 months at September 30, 2024 and 14 months at December 31, 2023. Time deposits with a maturity of less than 90 days at time of purchase are classified as cash and cash equivalents.

In addition, the Company invested in COLI. As of September 30, 2024 and December 31, 2023, the contract value of the COLI was $49 million and $47 million, respectively.

NOTE 7. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Company is exposed to global market risks, including risks from changes in FX rates and changes in interest rates. Accordingly, the Company uses derivatives in certain instances to manage financial exposures that occur in the normal course of business. The Company does not hold or issue derivatives for speculative purposes.

Derivatives and non-derivative instruments designated as accounting hedges:

Fair Value Hedges

Interest Rate Swaps

The Company has entered into interest rate swaps to convert the fixed interest rate on certain of its long-term debt to a floating interest rate based on the SOFR. The purpose of these hedges is to mitigate the risk associated with changes in the fair value of the long-term debt, thus the Company has designated these swaps as fair value hedges. The fair value of the swaps is adjusted quarterly with a corresponding adjustment to the carrying value of the debt. The changes in the fair value of the swaps and the underlying hedged item generally offset and the net cash settlements on the swaps are recorded each period within interest expense, net in the Company’s consolidated statements of operations.

The following table summarizes the Company’s interest rate swaps designated as fair value hedges: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Notional Amount | | |

| Hedged Item | | Nature of Swap | | As of September 30, 2024 | | As of December 31, 2023 | | Floating Interest Rate |

| 2014 Senior Notes due 2044 | | Pay Floating/Receive Fixed | | $ | 300 | | | $ | 300 | | | SOFR |

| 2017 Senior Notes due 2028 | | Pay Floating/Receive Fixed | | 500 | | | 500 | | | SOFR |

| 2018 Senior Notes due 2029 | | Pay Floating/Receive Fixed | | 400 | | | 400 | | | SOFR |

| 2018 Senior Notes due 2048 | | Pay Floating/Receive Fixed | | 300 | | | 300 | | | SOFR |

| 2020 Senior Notes due 2025 | | Pay Floating/Receive Fixed | | 300 | | | 300 | | | SOFR |

| 2022 Senior Notes due 2052 | | Pay Floating/Receive Fixed | | 500 | | | 500 | | | SOFR |

| 2022 Senior Notes due 2032 | | Pay Floating/Receive Fixed | | 250 | | | 250 | | | SOFR |

| Total | | | | $ | 2,550 | | | $ | 2,550 | | | |

Refer to Note 13 for information on the cumulative amount of fair value hedging adjustments included in the carrying amount of the above hedged items.

The following table summarizes the impact to the statements of operations of the Company’s interest rate swaps designated as fair value hedges:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total amounts of financial statement line item presented in the statements of operations in which the effects of fair value hedges are recorded | | Amount of income/(loss) recognized in the consolidated statements of operations | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | |

| 2024 | | 2023 | | 2024 | | 2023 | |

| Interest expense, net | | $ | (60) | | | $ | (66) | | | $ | (185) | | | $ | (185) | | |

| | | | | | | | | | | |

Description | | Location on Consolidated Statements of Operations | | | | | | | | | |

| Net interest settlements and accruals on interest rate swaps | | Interest expense, net | | $ | (25) | | | $ | (25) | | | $ | (74) | | | $ | (64) | | |

| Fair value changes on interest rate swaps | | Interest expense, net | | $ | 79 | | | $ | (35) | | | $ | 57 | | | $ | (35) | | |

| Fair value changes on hedged debt | | Interest expense, net | | $ | (79) | | | $ | 35 | | | $ | (57) | | | $ | 35 | | |

Net investment hedges

Debt designated as net investment hedges

The Company has designated €500 million of the 2015 Senior Notes Due 2027 and €750 million of the 2019 Senior Notes due 2030 as net investment hedges to mitigate FX exposure related to a portion of the Company’s euro net investment in certain foreign subsidiaries against changes in euro/USD exchange rates. These hedges are designated as accounting hedges under the applicable sections of ASC Topic 815 and will end upon the repayment of the notes in 2027 and 2030, respectively, unless terminated early at the discretion of the Company.

Cross currency swaps designated as net investment hedges

The Company enters into cross-currency swaps to mitigate FX exposure related to a portion of the Company’s euro net investment in certain foreign subsidiaries against changes in euro/USD exchange rates. The following tables provide information on the cross-currency swaps designated as net investment hedges under ASC Topic 815:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 |

| | Pay | | Receive |

| Nature of Swap | | Notional Amount | | Weighted Average Interest Rate | | Notional Amount | | Weighted Average Interest Rate |

| Pay Fixed/Receive Fixed | | € | 965 | | | 2.91% | | $ | 1,014 | | | 4.41% |

| Pay Floating/Receive Floating | | 2,138 | | | Based on ESTR | | 2,250 | | | Based on SOFR |

| Total | | € | 3,103 | | | | | $ | 3,264 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| | Pay | | Receive |

| Nature of Swap | | Notional Amount | | Weighted Average Interest Rate | | Notional Amount | | Weighted Average Interest Rate |

| Pay Fixed/Receive Fixed | | € | 765 | | | 3.67% | | $ | 800 | | | 5.25% |

| Pay Floating/Receive Floating | | 2,138 | | | Based on ESTR | | 2,250 | | | Based on SOFR |

| Total | | € | 2,903 | | | | | $ | 3,050 | | | |

As of September 30, 2024 these hedges will expire and the notional amounts will be settled as follows unless terminated early at the discretion of the Company:

| | | | | | | | | | | | | | |

| Years Ending December 31, | | Notional Amount (Pay) | | Notional Amount (Receive) |

| 2026 | | € | 450 | | | $ | 500 | |

| 2027 | | 531 | | | 550 | |

| 2028 | | 588 | | | 600 | |

| 2029 | | 573 | | | 614 | |

| 2031 | | 481 | | | 500 | |

| 2032 | | 480 | | | 500 | |

| Total | | € | 3,103 | | | $ | 3,264 | |

The following table provides information on the gains/(losses) on the Company’s net investment and cash flow hedges:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Derivative and Non-Derivative Instruments in Net Investment Hedging Relationships | | Amount of Gain/(Loss) Recognized in AOCL on Derivative, net of Tax | | Amount of Loss Reclassified from AOCL into Income, net of Tax | | Gain Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing) |

| Three Months Ended September 30, | | Three Months Ended September 30, | | Three Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |