SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

[Amendment No. ]

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

MOODY’S CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Dear Stockholder:

You are cordially invited to attend the 2025 Annual Meeting of Stockholders of Moody’s Corporation to be held on Tuesday, April 15, 2025, at 9:30 a.m. EDT. Due to the greater access that it provides to our stockholders, the Board of Directors has directed that the 2025 Annual Meeting be held as a “virtual meeting” via the internet. We have designed the format of the Annual Meeting to provide stockholders the same ability to participate that they would have at an in-person meeting.

The Notice of Annual Meeting and Proxy Statement accompanying this letter describe the business to be acted upon at the meeting. The Annual Report for the year ended December 31, 2024 is also enclosed.

On March 5, 2025, we mailed to many of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our 2025 Proxy Statement and 2024 Annual Report and vote online. The Notice included instructions on how to request a paper or e-mail copy of the proxy materials, including the Notice of Annual Meeting, Proxy Statement, Annual Report, and proxy card or voting instruction card. Stockholders who requested paper copies of the proxy materials or previously elected to receive the proxy materials electronically did not receive a Notice and will receive the proxy materials in the format requested.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to review the proxy materials and hope you will vote as soon as possible. You may vote by proxy over the internet or by telephone by using the instructions provided in the Notice. Alternatively, if you requested and received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the internet, by telephone, or by written proxy or voting instruction card will ensure your representation at the Annual Meeting regardless of whether you attend. Instructions regarding the three methods of voting are contained in the Notice or proxy card or voting instruction card.

Sincerely,

| | | | | |

| |

Vincent A. Forlenza Chairman of the Board | Robert Fauber President and Chief Executive Officer |

MOODY’S CORPORATION

7 World Trade Center

250 Greenwich Street

New York, New York 10007

NOTICE OF 2025 ANNUAL MEETING

OF STOCKHOLDERS

To Our Stockholders:

The 2025 Annual Meeting of Stockholders of Moody’s Corporation (“Moody’s” or the “Company”) will be held on Tuesday, April 15, 2025, at 9:30 a.m. EDT. The 2025 Annual Meeting will be held virtually via the internet at www.virtualshareholdermeeting.com/MCO2025. The meeting will be held for the following purposes, all as more fully described in the accompanying Proxy Statement:

| | | | | | | | |

| 1 | To elect the nine director nominees named in the Proxy Statement to serve a one-year term; | |

| 2 | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the year 2025; | |

| 3 | To vote on an advisory resolution approving executive compensation; | |

| 4 | To vote on one stockholder proposal if properly presented at the meeting; and | |

| 5 | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. | |

The Board of Directors of the Company has fixed the close of business on February 19, 2025 as the record date for the determination of stockholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

If you experience technical difficulties during the check-in process, or at any time during the Annual Meeting, please call 1-844-986-0822 (U.S.) or +1 303-562-9302 (international) for technical support.

By Order of the Board of Directors,

Elizabeth M. McCarroll

Managing Director, Corporate Governance

and Securities, and Corporate Secretary

March 5, 2025

IMPORTANT VOTING INFORMATION

Your Participation in Voting the Shares You Own Is Important

If you are the beneficial owner of your shares (meaning that your shares are held in the name of a bank, broker or other nominee), you may receive a Notice of Internet Availability of Proxy Materials from the firm that holds the shares containing instructions that you must follow in order for your shares to be voted. Certain institutions offer telephone and internet voting. If you received the proxy materials in paper form, the materials include a voting instruction card so you can instruct the holder of record on how to vote your shares.

Brokers are not permitted to vote on certain items and may elect not to vote on any of the items, unless you provide voting instructions. To ensure that your shares are voted on all items, you will need to communicate your voting decisions to your bank, broker or other holder of record before the date of the Annual Meeting.

Voting your shares is important to ensure that you have a say in the governance of the Company and to fulfill the objectives of the majority-voting standard that Moody’s Corporation applies in the election of directors. Please review the proxy materials and follow the relevant instructions to vote your shares. We hope you will exercise your rights and fully participate as a stockholder in the future of Moody’s Corporation.

More Information Is Available

If you have any questions about the voting of your shares, participating in the Annual Meeting or the proxy voting process in general, please contact the bank, broker or other nominee through which you hold your shares. Additionally, you may contact the Company’s Investor Relations Department by sending an e-mail to ir@moodys.com.

| | | | | | | | |

| | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 15, 2025 The Proxy Statement and the Company’s 2024 Annual Report are available at https://materials.proxyvote.com/615369. Your vote is very important. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the internet as instructed in the Notice of Internet Availability of Proxy Materials. Alternatively, if you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the Annual Meeting by completing, signing, dating and returning your proxy or voting instruction card in the pre-addressed envelope provided. No postage is required if the card is mailed in the United States. If you attend the meeting, you may vote during the meeting via the internet, even if you have previously returned your proxy or voting instruction card or voted by telephone or the internet. We will provide without charge to you a copy of the 2024 Annual Report on Form 10-K, upon written or oral request. You may direct such a request to us via e-mail to ir@moodys.com, or by submitting a written request to the Company’s Investor Relations Department, at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007 or contacting the Company’s Investor Relations Department by telephone, at (212) 553-0300. | |

| | |

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

2025 ANNUAL MEETING INFORMATION

This Proxy Statement is being furnished to the holders of the common stock, par value $0.01 per share (the “Common Stock”), of Moody’s Corporation (“Moody’s” or the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for use in voting at the 2025 Annual Meeting of Stockholders or any adjournment or postponement thereof (the “Annual Meeting”). This summary highlights certain information from this Proxy Statement. You should read the entire Proxy Statement carefully before voting.

| | | | | | | | |

| | |

| | |

| Date and Time | Place | Record Date |

Tuesday, April 15, 2025 9:30 a.m. EDT | Via the internet at www.virtualshareholdermeeting.com/MCO2025 | February 19, 2025 |

| | |

This Proxy Statement and the accompanying proxy card are first being made available to stockholders on March 5, 2025. The Company’s telephone number is (212) 553-0300.

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING

| | | | | | | | | | | | | | |

| Items of Business | Board

Recommendation | Vote

Required |

| | | | |

| 1 | | Election of nine directors | FOR each nominee | Majority of votes cast |

| 2 | | Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2025 | FOR | Majority of shares present and entitled to vote |

| 3 | | Advisory resolution approving executive compensation | FOR | Majority of shares present and entitled to vote |

| 4 | | Stockholder proposal requesting stockholder ratification of certain executive severance arrangements, if properly presented at the meeting. | AGAINST | Majority of shares present and entitled to vote |

| | | | | | | | |

| Moody’s Corporation | 1 | 2025 Proxy Statement |

HOW TO VOTE IN ADVANCE OF THE ANNUAL VIRTUAL MEETING

In addition to voting at the Annual Meeting, stockholders of record can vote by proxy by following the instructions in the Notice of Internet Availability of Proxy Materials (the “Notice”) and using the internet or by calling the toll-free telephone number that is available in the Notice. Alternatively, stockholders of record who requested a paper copy of the proxy materials can vote by proxy by mailing their signed proxy cards. The telephone and internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

| | | | | | | | |

| | |

| | |

| Internet | Phone | Mail |

| go to the website www.proxyvote.com and follow the instructions provided; | call 1-800-690-6903 using a touch-tone phone (toll charges may apply for calls made from outside the United States) and follow the instructions provided; or | if you received a proxy card in the mail, complete, sign, date, and mail the proxy card in the return envelope provided to you. |

| | |

If your shares are held in a “street name” (that is, through a bank, broker or other nominee), you may receive a Notice from the firm that holds the shares containing instructions that you must follow in order for your shares to be voted. Certain institutions offer telephone and internet voting. If you received the proxy materials in paper form, the materials include a voting instruction card so you can instruct the holder of record on how to vote your shares. For additional information, including voting procedures for certain current and former employees, see “Information about the Annual Meeting, Proxy Voting and Other Information” on page 84. HOW TO PARTICIPATE IN THE ANNUAL MEETING

Stockholders of record as of the close of business on February 19, 2025, the record date, are entitled to participate in and vote at the Annual Meeting. To participate in the Annual Meeting, including to vote and ask questions, you must go to the meeting website at www.virtualshareholdermeeting.com/MCO2025, enter the control number found on your proxy card, voting instruction card or the Notice, and follow the instructions on the website. The meeting webcast will begin promptly at 9:30 a.m. EDT. If your shares are held in street name and your voting instruction card or Notice indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in and vote at the Annual Meeting with the 16-digit access code indicated on that voting instruction card or Notice. Otherwise, stockholders who hold their shares in street name should contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the Annual Meeting. Online check-in will begin approximately 15 minutes prior to the beginning of the meeting, and we encourage you to allow ample time for check-in. If you experience technical difficulties during the check-in process, or at any time during the Annual Meeting, please call 1-844-986-0822 (U.S.) or +1 303-562-9302 (international) for technical support.

Moody’s will endeavor to respond during the Annual Meeting to as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. We will post answers to all proper stockholder questions (whether or not answered during the meeting) received regarding our Company on our Investor Relations website at www.moodys.com under the headings “About Moody’s—Investor Relations” as soon as is practicable following the meeting.

Rules for the conduct of the Annual Meeting will be available on the meeting website. In addition, for information about how to view the rules and the list of stockholders entitled to vote at the Annual Meeting during the ten days ending the day before the Annual Meeting, please visit our Company’s website at moodys.com under the headings “About Moody’s—Investor Relations.”

| | | | | | | | |

| Moody’s Corporation | 2 | 2025 Proxy Statement |

CORPORATE GOVERNANCE HIGHLIGHTS

| | | | | | | | |

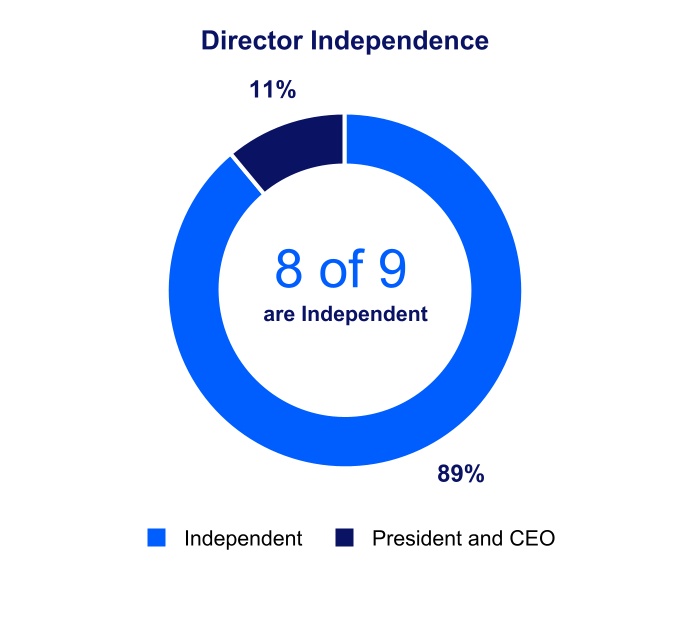

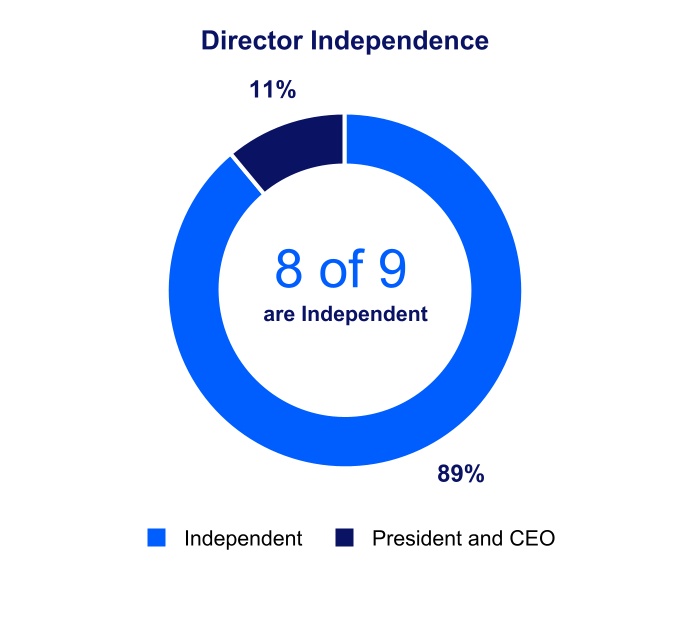

| Board Independence |

| Eight of the 9 Board nominees are independent | |

| Fully independent Audit, Governance & Nominating, and Compensation & Human Resources Committees | |

| Regular executive sessions of independent directors | |

| | |

| Executive Compensation Governance Practices |

| Robust stock ownership guidelines, with retention requirements, for directors and executive officers | |

| Comprehensive clawback policy, applicable to all cash incentive and both time- and performance-based equity-based awards | |

| Minimum one-year vesting period generally applicable to incentive equity awards | |

| Anti-hedging and anti-pledging policy | |

| | |

| Other Board Practices |

| All directors elected annually by majority vote (in uncontested elections) | |

| Annual evaluations of the Board, committees and individual directors | |

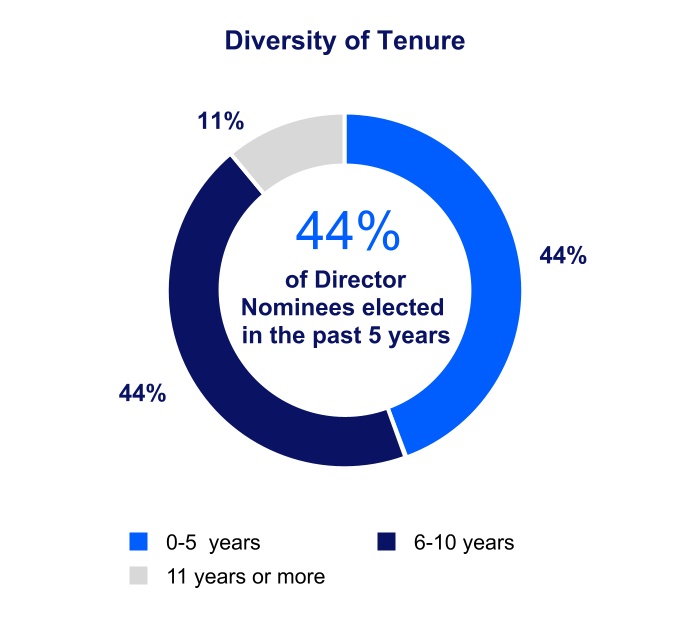

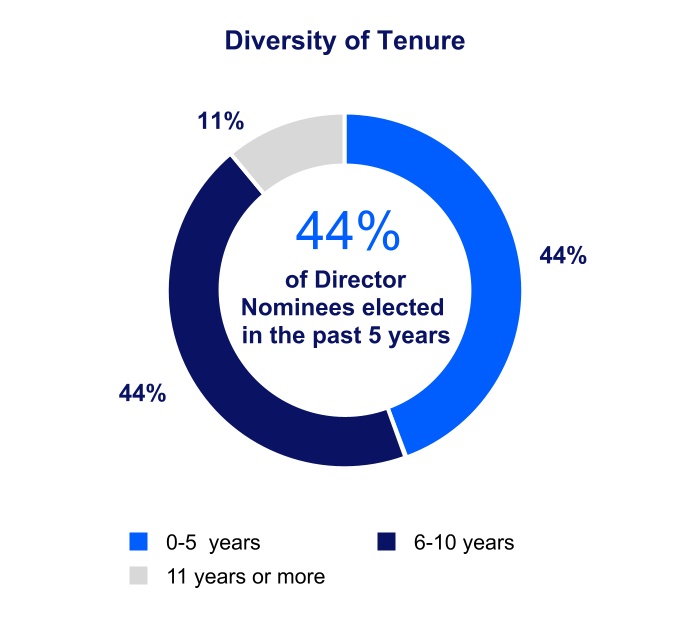

| Board composition reflects an array of backgrounds and experiences and includes a range of tenures to balance fresh perspectives with in-depth knowledge about the Company | |

| | | | | | | | |

| Moody’s Corporation | 3 | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | Committees of the Board |

| Director Nominee |

Independent | Audit | Governance &

Nominating | Compensation

& Human

Resources |

Executive |

| | | | | |

Jorge A. Bermudez Retired Chief Risk Officer, Citigroup, Inc. | | l | ¡ | | ¡ |

Thérèse Esperdy Retired Global Chairman of Financial Institutions Group, JPMorgan Chase & Co. | | ¡ | ¡ | | |

Robert Fauber

President and Chief Executive Officer,

Moody’s Corporation | | | | | ¡ |

Vincent A. Forlenza Chairman of the Board, Moody’s

Corporation Retired Chief Executive Officer, Becton,

Dickinson and Company | | | ¡ | ¡ | l |

Lloyd W. Howell, Jr. Executive Director, NFL Players Association | | | ¡ | l | ¡ |

Jose M. Minaya Global Head, BNY Investments and Wealth | | ¡ | ¡ | | |

Leslie F. Seidman Former Chairman, Financial Accounting Standards Board | | ¡ | l | | ¡ |

Zig Serafin Chief Executive Officer, Qualtrics International Inc. | | | ¡ | ¡ | |

Bruce Van Saun Chairman and Chief Executive Officer, Citizens Financial Group, Inc. | | | ¡ | ¡ | |

| Number of Committee Meetings in 2024 | | 8 | 5 | 6 | – |

l: Chairman ¡: Member

| | | | | | | | |

| Moody’s Corporation | 4 | 2025 Proxy Statement |

DIRECTOR NOMINEE HIGHLIGHTS

The Company strives to maintain a Board that possesses a combination of skills, professional experience, and an array of backgrounds and a range of tenures necessary to effectively oversee the Company’s business. As part of the search process for each new director, the Governance & Nominating Committee strives to have a varied slate of candidates and encourages any search firm the Committee engages to do so as well, from which the Committee selects the most appropriate candidate taking into account consideration of the qualifications and skills addressed below under "Item 1 - Election of Directors; Qualifications and Skills of Directors." Nine out of the ten directors currently serving are standing for election at the Annual Meeting. Kathryn M. Hill will not stand for reelection to the Board at the Annual Meeting and will retire from the Board at the end of her current term. Information regarding the director nominees is provided below, including individualized information presented in the matrix below regarding their experiences, skills and background.

| | | | | | | | |

| Moody’s Corporation | 5 | 2025 Proxy Statement |

Board Experience and Skills Matrix

Each “l” in the table below denotes a particular area of experience and expertise and indicates a primary qualification supporting the director’s nomination. A “¡” denotes an area in which a director has other demonstrated proficiency and indicates an additional qualification supporting the director’s nomination. The lack of a mark does not mean a director does not possess meaningful experience or skill in that area.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bermudez | Esperdy | Fauber | Forlenza | Howell | Minaya | Seidman | Serafin | Van Saun |

| Experience and Skills | | | | | | | | | |

Financial Experience Includes experience in accounting, financial planning, financial reporting processes, financial controls structures, capital allocation, financial markets. | l | l | l | ¡ | l | l | l | ¡ | l |

Strategic Planning/ Implementation Strategic experience in business development and M&A, including experience developing and implementing growth strategies | l | l | l | l | l | l | ¡ | l | l |

Innovation & Technology Experience in innovation and technology, including experience managing technological change and innovation of new products, services, content, and technology capabilities | l | | l | l | ¡ | ¡ | ¡ | l | ¡ |

Cybersecurity Experience in information security, digital platforms, data privacy and cybersecurity. | ¡ | ¡ | | ¡ | l | | ¡ | ¡ | ¡ |

Industry Knowledge Experience in the Company’s industries, including credit rating, financial information or enterprise risk software. | l | l | l | | ¡ | l | ¡ | ¡ | ¡ |

Leadership Experience Practical experience managing the operations of a business or large organization in a significant leadership position, including as a chief executive officer, chief financial officer or other senior leadership role. | l | l | l | l | l | l | ¡ | l | l |

Legal, Regulatory & Public Policy Experience or expertise in legal, regulatory or public policy matters, including engaging with regulators as part of a business or through positions with government agencies or regulatory bodies. | l | ¡ | ¡ | l | | ¡ | l | | l |

Public Company Board Experience Experience or expertise in corporate governance matters, including through service on the boards of other public companies. | l | l | | l | l | | l | l | l |

Risk Experience with risk management of a large organization and management of specific types of risk, including risks related to technology, cybersecurity, and financial services. | l | l | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ | ¡ |

Corporate Sustainability Experience with environmental and social oversight at an organization(s), including human capital management, such as through oversight of sustainability and corporate social and environmental responsibility strategies. | ¡ | ¡ | ¡ | l | l | ¡ | l | l | ¡ |

International Experience Leadership experience in global or multinational companies or in international markets, including oversight of international issues and operations and experience in the geographic markets in which Moody’s operates. | l | l | l | l | ¡ | ¡ | ¡ | l | ¡ |

| | | | | | | | |

| Moody’s Corporation | 6 | 2025 Proxy Statement |

SUSTAINABILITY

Moody’s manages its business with the goal of delivering value to all of its stakeholders, including its customers, employees, business partners, local communities and stockholders. Moody’s advances its commitment to sustainability by considering sustainability-related factors throughout its operations, value chain, products and services. It uses its expertise and assets to make a positive difference through technology tools, research and analytical services that help other organizations and the investor community better understand the links between sustainability considerations and the global markets. Moody’s offers many products and services to help market participants evaluate sustainability-related risk and make better risk mitigation and planning decisions.

Moody’s efforts to advance sustainability-related thought leadership, assessments and data for market participants include reporting on a basis consistent with globally-recognized standards and frameworks including the International Sustainability Standards Board (“ISSB”) and the Task Force on Climate-related Financial Disclosures (“TCFD”) recommendations. Moody’s revamped our sustainability website to update information on our sustainability strategy and progress and launched our sustainability-related disclosure site, focusing on information frequently requested by investors and regulators. Our sustainability website also includes our most-recently updated 2020 Decarbonization Plan. We also report on our assessment of Moody's greenhouse gas ("GHG emission") levels, our strategy for reducing our GHG emissions and our progress against our goals.

Board Oversight of Sustainability Matters

The Board oversees sustainability matters, via the Audit, Governance & Nominating, and Compensation & Human Resources Committees, as part of its oversight of management and the Company’s overall strategy. The Board also oversees Moody’s policies for assessing and managing the Company’s exposure to risk, including climate-related risks such as business continuity disruption and reputational or credibility concerns stemming from incorporation of climate-related risks into the credit rating methodologies and credit ratings of Moody’s Ratings.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Audit Committee Oversees financial, risk and other disclosures made in the Company’s annual and quarterly reports related to sustainability and, at least annually, reviews reports by management regarding the adequacy and effectiveness of the Company’s internal controls and procedures related to such sustainability disclosures. Governance & Nominating Committee Oversees sustainability matters, including significant issues of corporate social and environmental responsibility, as they pertain to the Company’s business and to long-term value creation for the Company and its stockholders, and makes recommendations to the Board regarding these issues. Compensation & Human Resources Committee Oversees inclusion of sustainability-related performance goals for determining compensation of certain senior executives (including the Named Executive Officers). | | | | Development of a robust sustainability-related strategy and disclosure framework for the Company | |

| | | | | | |

| | | | | | | | |

| Moody’s Corporation | 7 | 2025 Proxy Statement |

HUMAN CAPITAL

The Board oversees human capital matters, including through the Compensation & Human Resources Committee. Management regularly presents to the directors on relevant human capital topics, including talent management, compensation and benefits, and inclusion and employee engagement. In 2024, the Board oversaw the Company’s public disclosure regarding human capital management in the Company’s Annual Report and this Proxy Statement, as well as its 2023 EEO-1 report.

| | | | | | | | |

| HUMAN CAPITAL MANAGEMENT | |

| Total Rewards | |

| | |

| Moody's Total Rewards programs are designed to attract and maintain a high-performing, engaged and motivated global workforce. The Company's compensation packages include market-competitive salaries, performance-based annual bonuses, and equity grants aligned to the Company's long-term performance for certain employees. The Company's industry leading benefits programs offer comprehensive resources to support physical, mental and financial well-being. The Company invests in AI powered technologies in order to provide employees with a world-class experience accessing and managing their benefits. The Company continuously evaluates its market benchmarks and employee feedback so that benefits are competitive and support the attraction of the best talent. For example, in recent years the Company implemented a global paid parental leave policy to give parents time off to care for and bond with a new child and updated the tuition reimbursement program. The Company also promotes flexible work arrangements, which support the Company's efforts to create a work atmosphere in which people feel valued and inspired to give their best. The Company has implemented a "PurposeFirst" framework, which fosters purpose-driven decisions relating to how and where Moody's teams work. | |

| | |

| Talent Management, Employee Engagement and Retention | |

| | |

| Moody’s believes that the Company's long-term success depends on its ability to attract, develop and retain a high-performing workforce. The Company's goal is to create an environment where colleagues can thrive personally and professionally and can maximize their potential. Moody's culture is one of continuous learning, which the Company believes is crucial for colleagues to thrive as part of the organization and to feel a sense of accomplishment and purpose, and Company leaders are key in reinforcing this. Moody's talent strategy helps create integrated, cohesive talent activities that support the growth and success of the Company's employees and the business. This strategy informs all of Moody's talent programs, guiding efforts to attract, develop and retain top talent. It also helps the Company remain aligned with its overall business objectives and values while designing programs to meet the evolving needs of the organization. Moody’s offers various talent development programs and resources through Moody’s University that are focused on building professional, technical and leadership skills to support employees' goals and objectives. Moody’s also places significant emphasis on its high-potential and high-performance programs, which are designed to identify and nurture emerging leaders within the organization. These programs provide tailored development opportunities, mentorship and the chance to work on strategic projects that drive the business forward. Moody's Employee Experience function conducts listening sessions with employees and creates targeted plans to act on the feedback provided. The Company measures employee engagement via multiple channels, including the Business Engagement Survey (BES) for employees to provide anonymous and candid feedback to management. This periodic survey helps Moody's management understand employees' level of engagement in critical areas, which include, but are not limited to, purpose, leadership, managerial effectiveness, connection, enablement and empowerment and well-being. Managers are accountable for identifying opportunity areas and taking targeted actions based on survey results. The feedback received through the BES is used as a vital input into making decisions to improve employee experience and retention. As the Company strives to make Moody’s a place people want to come and stay, management also carefully monitors global employee turnover rates. | |

| | |

| | | | | | | | |

| Moody’s Corporation | 8 | 2025 Proxy Statement |

| | | | | | | | |

| HUMAN CAPITAL MANAGEMENT | |

| Inclusion and Belonging | |

| | |

| Moody's believes that a workforce comprised of individuals with varied thoughts, backgrounds and experiences fosters an environment that makes the Company's opinions stronger, products more innovative, workplace more welcoming and improves how the Company relates and responds to customers. The Company is committed to cultivating a culture where every individual feels a sense of belonging and has an equal opportunity to succeed. Moody's Inclusion Operating and Governance Model turns the Company's inclusion strategy into reality by providing a functional framework to guide how the People team, councils, sponsors, BRGs and committees work together. The Global Inclusion Council, chaired by the Company's CEO and composed of senior leaders, is charged with oversight of the Company's global inclusion strategy and its progress. The members of the council meet quarterly. The Company's governance model also includes three Regional Inclusion Councils tasked with overseeing the inclusion strategy within their respective regions. Each council meets on a quarterly basis. The Company's operating model includes 11 active BRGs which represent 48 chapters. These groups are open to all Moody's employees, with more than 4,800 employees participating globally as of December 31, 2024. | |

| | |

CORPORATE GOVERNANCE

In order to address evolving best practices and new regulatory requirements, the Board of Directors reviews its corporate governance practices and the charters for its standing committees at least annually. After performing its annual governance review for 2024, the Board determined to amend the Company’s Corporate Governance Principles as well as the Audit, Compensation & Human Resources and Governance & Nominating Committee charters. A copy of the Corporate Governance Principles is available on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents—Other Governance Documents.” Copies of the charters of the Audit Committee, the Governance & Nominating Committee, the Compensation & Human Resources Committee and the Executive Committee are available on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents.” Print copies of the Corporate Governance Principles and the committee charters may also be obtained upon request, addressed to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. The Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee assist the Board in fulfilling its responsibilities, as described below. The Executive Committee has the authority to exercise the powers of the Board when it is not in session (subject to applicable law, rules and regulations, and the Company’s Certificate of Incorporation and By-Laws), advises management and performs other duties delegated to it by the Board from time to time.

BOARD MEETINGS AND COMMITTEES

During 2024, the Board of Directors met six times. The Board had four standing committees: an Audit Committee, a Governance & Nominating Committee, a Compensation & Human Resources Committee and an Executive Committee. All incumbent directors attended at least 75% of the total number of meetings of the Board and of all Board committees on which they served in 2024.

Please refer to page 16 for additional information regarding the Audit Committee, page 18 for additional information regarding the Governance & Nominating Committee and page 18 for additional information regarding the Compensation & Human Resources Committee. The Executive Committee did not meet in 2024. Directors are expected to attend the Annual Meeting. All individuals elected to the Board at the Company’s 2024 annual meeting of stockholders attended the meeting. RECOMMENDATION OF DIRECTOR CANDIDATES

The Governance & Nominating Committee considers and makes recommendations to the Board regarding the size, structure, composition and functioning of the Board and engages in succession planning for the Board and key leadership roles on the Board and its committees. The Governance & Nominating Committee is also responsible for overseeing processes for the selection and nomination of director candidates. The Governance & Nominating Committee periodically reviews the skills, experience, characteristics and other criteria for identifying and evaluating directors, and recommends these criteria to the Board.

| | | | | | | | |

| Moody’s Corporation | 9 | 2025 Proxy Statement |

The Governance & Nominating Committee will consider director candidates recommended by stockholders of the Company and may also engage independent search firms from time to time to assist in identifying and evaluating potential director candidates. In considering a candidate for Board membership, whether proposed by stockholders or otherwise, the Governance & Nominating Committee examines, among other things, the candidate’s business experience, qualifications, attributes and skills relevant to the management and oversight of the Company’s business. The Committee also examines the candidate’s independence, ability to represent varied stockholder interests, judgment, integrity, ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts or the appearance of conflicts with the Company’s business and interests. The Committee also seeks a range of occupational and personal backgrounds for the Board. As discussed at Item 1 – Election of Directors, on page 25, the Governance & Nominating Committee evaluates these factors in the context of the Board’s current composition and the Company’s current and future business, strategy and operations. See “Qualifications and Skills of Directors” on page 25 and “Director Nominees” beginning on page 26 for additional information on the Company’s directors. To have a candidate considered by the Governance & Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information: •The name of the stockholder and evidence of the stockholder’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and

•The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company, and the candidate’s consent to be named as a director if selected by the Governance & Nominating Committee and nominated by the Board.

The stockholder recommendation and information described above must be sent to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007 or emailed to corporatesecretary@moodys.com, and must be received by the Corporate Secretary not later than 120 days prior to the first anniversary of the date the definitive proxy statement was first released to stockholders in connection with the preceding year’s annual meeting of stockholders. For the Company’s 2026 Annual Meeting of Stockholders, this deadline is November 5, 2025.

The Governance & Nominating Committee identifies potential nominees by asking current directors and executive officers to notify the Committee if they become aware of persons who meet the criteria described above and might be available to serve on the Board. As described above, the Committee will also consider candidates recommended by stockholders on the same basis as those from other sources. The Governance & Nominating Committee, from time to time, also engages third-party search firms that specialize in identifying director candidates for the Committee’s consideration.

Once a person has been identified by or for the Governance & Nominating Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Governance & Nominating Committee determines that the candidate warrants further consideration, the chairman or another member of the Committee contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Governance & Nominating Committee requests information from the candidate, reviews the candidate’s accomplishments and qualifications, including in light of the Board’s current composition, the Company’s current and future business, strategy and operations, and any other candidates whom the Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments.

DIRECTOR EDUCATION

The Company provides all new directors with an initial orientation session, which includes a comprehensive overview of the Company and the opportunity to meet with key leaders of the organization such as the Chief Executive Officer, Chief Financial Officer, General Counsel, the Presidents of Moody's Ratings and Moody’s Analytics (“MA”), the Chief Strategy Development Officer, the Chief Audit Executive, the Chief Administrative Officer, Chief Corporate Affairs Officer, the Chief Compliance Officer and the Chief Accounting Officer and Corporate Controller. This orientation includes, among other topics, an overview of the Company’s business, including Moody's Ratings and Moody's Analytics, corporate governance, compliance programs, strategy, technology and cybersecurity, enterprise risk management, and legal and regulatory matters.

Board and committee meetings, industry and corporate governance update presentations, periodic reports from the Company’s businesses, and external training programs also provide the Company’s directors with continuing education throughout their tenure. The Company reimburses directors for expenses associated with attendance at external education programs. Several field visits beyond the boardroom were conducted in 2024 for the Board, including: (i) sessions focused on the Company’s cybersecurity platforms, providing a comprehensive update into Moody’s cybersecurity framework, scope and coverage across the firm with presentations highlighting defense, perimeter security, network and cloud security and data loss prevention; and (ii) visits

| | | | | | | | |

| Moody’s Corporation | 10 | 2025 Proxy Statement |

to non-US offices, including to the Company’s Global Capability Center in Costa Rica focusing on strategy and how local teams support the work of Moody's Ratings, Moody's Analytics and Moody’s Shared Services, and the Prague office, concentrating on the Company’s European businesses, and certain Moody's Ratings EU Board meetings conducted in various cities throughout the year.

BOARD LEADERSHIP STRUCTURE

The Board periodically reviews its leadership structure to evaluate whether the structure remains appropriate and makes a determination regarding whether or not to separate the roles of Chairman and Chief Executive Officer based upon the circumstances. The Company’s Corporate Governance Principles permit the roles of Chairman and Chief Executive Officer to be filled by a single person or different individuals. This flexibility allows the Board to review the structure of the Board periodically and determine whether to separate the two roles based upon the Company’s needs and circumstances from time to time. In light of the Board’s continued belief that strong, independent Board leadership is a critical aspect of effective corporate governance, the Corporate Governance Principles provide that, whenever and for so long as a Chairman is not an independent director in the future, the independent directors will appoint an independent director to serve as the Lead Independent Director.

Mr. Forlenza has served as the Company’s Chairman of the Board since April 2023, and served as Lead Independent Director prior to that time while our former Chief Executive Officer served as Chairman. Mr. Forlenza has significant public company leadership experience as the former chief executive officer and chairman of a publicly traded, global medical technology company. The Board believes that this structure is the optimal Board leadership structure for the current time because it allows Mr. Fauber to focus on leading the Company’s business and operations. At the same time, Mr. Forlenza can focus on leadership of the Board, including calling and presiding over its meetings and preparing meeting agendas in collaboration with Mr. Fauber.

CODES OF BUSINESS CONDUCT AND ETHICS; INSIDER TRADING POLICIES AND PROCEDURES

The Company has adopted a code of ethics that applies to its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer and Corporate Controller, or persons performing similar functions. The Company has also adopted a code of business conduct that applies to the Company’s directors, officers and employees. A current copy of each of these codes is available on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents—Other Governance Documents.” A copy of each is also available in print to stockholders upon request, addressed to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. The Company intends to satisfy disclosure requirements regarding any amendments to, or waivers from, the code of ethics and the code of business conduct by posting such information on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents—Other Governance Documents.”

Our policies and procedures governing the purchase, sale and other dispositions of the Company’s securities by directors, officers and employees, and by the Company itself, are designed to promote compliance with insider trading laws, rules, regulations and listing standards applicable to the Company. The code of business conduct includes a section relating to insider trading and directs certain categories of stakeholders to our Securities Trading Policy (“STP”).

The STP, which applies to applies to all members of the Moody’s Board of Directors, all Moody’s Executive Officers, as well as generally to all full- and part-time employees of Moody’s and any of its majority or wholly-owned subsidiaries and their immediate family members, contains general prohibitions against: (i) trading in Moody’s securities or securities of another issuer while aware of material non-public information ("MNPI") about Moody’s or such other issuer; (ii) tipping MNPI about Moody’s or MNPI of other issuers acquired as a result of a person’s relationship with Moody’s; and (iii) “shadow trading,” by prohibiting trading while aware of MNPI relating to another issuer (including information about Moody’s that may reasonably be expected to have an effect on the market for another issuer’s security) that is obtained as a result of the employee’s employment or other relationship with Moody’s.

In addition, the STP includes requirements that apply to company insiders against trading in Moody’s securities or entering, amending or terminating 10b5-1 trading plans in respect of Moody’s securities outside of designated window periods, pre-clearance of trades in Moody’s securities, as well as general prohibitions relating to short-selling, hedging and pledging Moody’s securities. As a result of Moody’s Ratings' unique role as a credit rating agency, the STP also includes Monitored Employee Requirements that impose additional restrictions, as well as reporting, trade pre-clearance and post-trade review obligations, relating to trading in non-Moody’s securities by certain rating personnel senior employees and other employees with access to MNPI about other issuers obtained as a result of the credit ratings process ("Moody's Non-Public Ratings Information").

| | | | | | | | |

| Moody’s Corporation | 11 | 2025 Proxy Statement |

The STP assigns an employee's position profile, and therefore whether they are subject to certain of the Monitored Employee Requirements, based on the Employee’s level of access to Moody's Non-Public Ratings Information.

With respect to the Company’s trading in its own securities, Moody’s has established procedures that it has followed for several years, now memorialized in the Company Trading Policy. Among other things, that policy requires that the Treasurer’s office confirm with the General Counsel that the Company is not aware of MNPI prior to and as a condition of share repurchases being commenced or a repurchase agreement being entered into.

The Company’s Securities Trading Policy and Company Trading Policy are attached as Exhibits 19.1 and 19.2, respectively, to the Company's 2024 Annual Report on Form 10-K.

ANTI-HEDGING AND ANTI-PLEDGING POLICY; SHORT SALES AND OTHER SPECULATIVE TRADES

The STP, described above, also includes a prohibition against hedging and pledging Moody’s securities, including any publicly traded securities of a Moody’s subsidiary. Specifically, the following activities are prohibited under the policy: (i) making short sales of Moody’s securities; (ii) buying Moody’s securities on margin; (iii) pledging Moody's securities as collateral for a loan; (iv) engaging in short-term or speculative transactions involving Moody’s securities; and (v) engaging in a derivative transaction primarily including or referencing Moody's securities that hedge or offset, or are designed to hedge or offset, any decrease in value of Moody's securities, including buying or selling put or call options and entering into other derivative transactions involving Moody’s securities. The foregoing restrictions do not prohibit the exercise of Moody’s stock options that employees receive in connection with their compensation, nor do they prohibit any broker-assisted exercise or settlement of equity awards granted by the Company that may involve a short-term extension of credit only until the sale is settled.

Additionally, the STP does not include a prohibition against employees holding Moody's securities in margin accounts, since many brokerage accounts can be set up by default as margin accounts. Instead, it provides that (subject to a technical exception for a broker-assisted exercise or settlement of equity awards) such securities may not be pledged as collateral for a loan, including by being held in a brokerage account where there is an outstanding loan or extension of credit to the account.Additionally, the STP does not include a prohibition against employees holding Moody’s securities in margin accounts, since many brokerage accounts, can be set up by default as margin accounts. Instead, it provides that (subject to a technical exception for broker-assisted exercise or settlement of equity awards) such securities may not be pledged as collateral for a loan, including by being held in a brokerage account where there is an outstanding loan or extension of credit to the account.

DIRECTOR INDEPENDENCE

To assist it in making determinations of a director’s independence, the Board has adopted independence standards that are set forth below and are included in the Company’s Corporate Governance Principles. The Board has determined that Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Mr. Howell, Mr. Minaya, Ms Seidman, Mr. Serafin and Mr. Van Saun and, thus a majority of the directors on the Board, are independent under these standards. The Board has determined that Mr. Fauber, as the Company’s CEO, is the only member of the Board who has not been determined to be independent under these standards. The standards adopted by the Board incorporate the director independence criteria included in the New York Stock Exchange (the “NYSE”) listing standards, as well as additional criteria established by the Board. The Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee are composed entirely of independent directors. In accordance with NYSE requirements and the independence standards adopted by the Board, all members of the Audit Committee and the Compensation & Human Resources Committee meet additional heightened independence standards applicable to audit committee and compensation committee members.

| | | | | | | | |

| Moody’s Corporation | 12 | 2025 Proxy Statement |

An “independent” director is a director whom the Board has determined has no material relationship with the Company or any of its consolidated subsidiaries (for purposes of this section, collectively referred to as the “Company”), either directly, or as a partner, stockholder or officer of an organization that has a relationship with the Company. For purposes of this definition, the Board has determined that a director is not independent if:

| | | | | | | | |

| 1 | the director is, or in the past three years has been, an employee of the Company, or an immediate family member of the director is, or in the past three years has been, an executive officer of the Company; | |

| 2 | (a) the director, or an immediate family member of the director, is a current partner of the Company’s outside auditor; (b) the director is a current employee of the Company’s outside auditor; (c) a member of the director’s immediate family is a current employee of the Company’s outside auditor and personally works on the Company’s audit; or (d) the director or an immediate family member of the director was in the past three years a partner or employee of the Company’s outside auditor and personally worked on the Company’s audit within that time; | |

| 3 | the director, or a member of the director’s immediate family, is or in the past three years has been, an executive officer of another company where any of the Company’s present executive officers serves or served on the compensation committee at the same time; | |

| 4 | the director, or a member of the director’s immediate family, has received, during any 12-month period in the past three years, any direct compensation from the Company in excess of $120,000, other than compensation for Board and committee service, or compensation received by the director’s immediate family member for service as an employee (other than an executive officer) of the Company, and pension or other forms of deferred compensation for prior service with the Company; | |

| 5 | the director is a current executive officer or employee, or a member of the director’s immediate family is a current executive officer, of another company that makes payments to or receives payments from the Company, or during any of the last three fiscal years, has made payments to or received payments from the Company, for property or services in an amount that, in any single fiscal year, exceeded the greater of $1 million or 2% of the other company’s consolidated gross revenues; or | |

| 6 | the director, or the director’s spouse, is an executive officer of a non-profit organization to which the Company or the Company foundation makes, or in the past three years has made, contributions that, in any single fiscal year, exceeded the greater of $1 million or 2% of the non-profit organization’s consolidated gross revenues. (Amounts that the Company foundation contributes under matching gifts programs are not included in the contributions calculated for purposes of this standard.) | |

An “immediate family” member includes a director’s spouse, parents, children, siblings, mother- and father-in-law, sons- and daughters-in-law, brothers- and sisters-in-law, and anyone (other than a domestic employee) who shares the director’s home.

In addition, a director is not considered independent for purposes of serving on the Audit Committee, and may not serve on the Audit Committee, if the director: (a) accepts, directly or indirectly, from Moody’s Corporation or any of its subsidiaries, any consulting, advisory, or other compensatory fee, other than Board and committee fees and fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with Moody’s Corporation (provided that such compensation is not contingent in any way on continued service); or (b) is an “affiliated person” of Moody’s Corporation or any of its subsidiaries, each as determined in accordance with SEC regulations.

Furthermore, in determining whether a director is considered independent for purposes of serving on the Compensation & Human Resources Committee, the Board must consider all factors specifically relevant to determining whether the director has a relationship with the Company that is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (a) the source of the director’s compensation, including any consulting, advisory or other compensatory fee paid by the Company to the director; and (b) whether the director is affiliated with Moody’s Corporation, any of its subsidiaries or an affiliate of any subsidiary; each as determined in accordance with SEC regulations.

In assessing independence, the Board took into account that each of Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Mr. Howell, Mr. Minaya, Ms Seidman, Mr. Serafin and Mr. Van Saun served during 2024, or currently serves, as a director, employee or trustee of entities that are rated or have issued securities rated by Moody’s Ratings, as listed in the Company’s Director and Shareholder Affiliation Policy posted on the Company’s website under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents—Other Governance Documents,” and that in 2024 the associated fees from each such entity accounted for less than 1% of annual revenues of the Company and each of the other entities. In addition, the Board took into account that the Company from time to time engages in business with entities where one of our directors,

| | | | | | | | |

| Moody’s Corporation | 13 | 2025 Proxy Statement |

director candidates or their immediate family members are employed or have other relationships. The Board found nothing in the relationships to be contrary to the standards for determining independence as contained in the NYSE’s requirements and the Company’s Corporate Governance Principles. A copy of these standards is found in Attachment A to the Company’s Corporate Governance Principles on the Company’s website at www.moodys.com under the headings “About Moody’s—Investor Relations—Corporate Governance—Charter Documents—Other Governance Documents.”

BOARD AND COMMITTEE EVALUATION PROCESS

The Board and its committees’ annual evaluation process is summarized below. The topics considered during the evaluation include Board effectiveness in overseeing key areas, such as strategy and risk, performance of committees’ duties under their respective charters, Board and committee operations, and individual director performance.

| | | | | | | | |

| 1 | Review of Evaluation Process The Governance & Nominating Committee annually reviews the evaluation process, including the evaluation method, to ensure that constructive feedback is solicited on the performance of the Board, its committees, and individual directors. | |

| 2 | Questionnaire and One-on-One Interviews The Board, the Audit Committee, the Compensation & Human Resources Committee and the Governance & Nominating Committee each conducts an annual self-evaluation through the use of a written questionnaire. All directors, other than the Chairman, also evaluate the Chairman’s performance through a written questionnaire. All questionnaires include open-ended questions to solicit direct feedback and the responses are collected on an unattributed basis. In addition, the Chairman conducts annual interviews with each non-employee director to discuss individual Board member performance. | |

| 3 | Summary of Written Evaluations Directors’ responses to the questionnaires are aggregated without attribution and shared with the full Board and the applicable committees. All responses, including written comments, are provided along with an overview of the high and low scores on various topics. | |

| 4 | Board and Committee Review Using aggregated results as a reference, the Audit Committee and the Compensation & Human Resources Committee discuss their respective results. Discussions of the Board, Chairman and Governance & Nominating Committee results occur at the Governance & Nominating Committee meeting. Following the committee-level discussions, all evaluation results and feedback, including those from the one-on-one interviews and the Chairman evaluation questionnaire, are discussed by the full Board. | |

| 5 | Actions The Board decides on specific actions to incorporate feedback received, including making any appropriate changes to Board- and committee-related practices. | |

THE BOARD’S ROLE IN THE OVERSIGHT OF COMPANY RISK

The Board of Directors oversees the Company’s enterprise-wide approach to the major risks facing the Company and, with the assistance of the Audit Committee, the Compensation & Human Resources Committee and the Governance & Nominating Committee, oversees the Company’s policies for assessing and managing its exposure to risk. The Audit Committee reviews the Company’s charters, guidelines and approach to enterprise-wide risk assessment and risk management, financial and compliance risks, including risks relating to internal controls and cyber risks, and major legislative and regulatory developments that could materially affect the Company. The Audit Committee reviews the implementation and effectiveness of the Company’s enterprise risk management program. In addition, the Board periodically reviews these risks and, with the assistance of the Audit Committee, the Company’s risk management processes, including in connection with its review of the Company’s strategy. The Audit Committee’s responsibilities include reviewing the Company’s practices with respect to risk assessment and risk management and the Board’s

| | | | | | | | |

| Moody’s Corporation | 14 | 2025 Proxy Statement |

responsibility includes reviewing contingent liabilities and risks that may be material to the Company. The Compensation & Human Resources Committee oversees management’s assessment of whether the Company’s compensation structure, policies and programs create risks that are reasonably likely to have a material adverse effect on the Company and reviews the results of this assessment. The Governance & Nominating Committee oversees risks related to governance, including with respect to succession planning for the Board, and sustainability matters.

Under the oversight of the Board and its committees, the Chief Executive Officer has established an Enterprise-Wide Risk Committee, comprised of the Chief Executive Officer and his direct reports. The Enterprise-Wide Risk Committee reviews the work of the Enterprise Risk Function that is currently managed by the Company's Chief Risk and Resilience Officer. The Chief Risk and Resilience Officer coordinates with risk officers for both Moody's Ratings and Moody's Analytics, and owns the risk oversight of the support functions in Moody’s Shared Services. The Chief Risk and Resilience Officer regularly reports to the Board and the Audit Committee on key and emerging risks and mitigants within their areas of responsibility. Among other things, the Enterprise Risk Function is responsible for identifying and monitoring existing and emerging risks that are important to the achievement of the Company’s strategic and operational objectives; reviewing appropriate polices, monitoring and reporting frameworks to support effective management of important risks as applicable; reviewing and evaluating the effectiveness of management processes and action plans to address such risks; advising on and recommending to executive management any significant actions or initiatives that they believe are necessary to effectively manage risk; and seeing that activities of discrete risk management disciplines within the Company are appropriately coordinated. Additionally, the Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee reviewed risks within their areas of responsibility at separate meetings in 2024. The Chief Risk and Resilience Officer or the Chief Administrative Officer (who previously managed the Company’s Enterprise Risk Function) reviewed the Enterprise-Wide Risk Committee’s analysis with the Board five times in 2024. Significant risk issues evaluated by and/or major changes proposed by the Enterprise-Wide Risk Committee are discussed at various Board meetings throughout the year, and general updates are regularly provided at Board meetings.

Board’s Role in Cybersecurity Oversight

The Board provides oversight of management’s efforts to assess and manage cybersecurity risks and to prepare for and respond to cybersecurity incidents and threats. In addition, the Audit Committee of the Board of Directors regularly receives reports from management regarding the Company’s financial and compliance risks, including, but not limited to, risks relating to internal controls and cybersecurity risks.

The Board of Directors receives regular updates from the Chief Information Security Officer, Chief Technology Services Officer and Chief Administrative Officer regarding matters related to technology and cybersecurity. The Company has protocols, as discussed in the 2024 Annual Report on Form 10-K, by which certain cybersecurity concerns, incidents and threats are escalated within the Company and, where appropriate, reported in a timely manner to the Board.

EXECUTIVE SESSIONS

The independent directors routinely meet in executive session at regularly scheduled Board meetings. Vincent A. Forlenza, the independent Chairman of the Board, establishes the agenda for and presides at these sessions and has the authority to call additional sessions as appropriate.

COMMUNICATIONS WITH DIRECTORS

The Board of Directors has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may communicate with the Board of Directors or with all non-employee directors as a group, or with a specific director or directors (including the Chairman of the Board), by writing to them c/o the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007 or sending an email to corporatesecretary@moodys.com.

The Board has instructed the Corporate Secretary to review correspondence directed to the Board of Directors and, at the Corporate Secretary’s discretion, to forward items that she deems to be appropriate for the Board’s consideration.

| | | | | | | | |

| Moody’s Corporation | 15 | 2025 Proxy Statement |

STOCKHOLDER ENGAGEMENT

Year-round engagement

Our Investor Relations team leads our stockholder engagement program, highlighted by the Company’s Investor Days and more recently, the Innovation Open Houses it hosted in NY and in London spotlighting Moody’s Analytics. On a year-round basis, led by the Chief Financial Officer and the Head of Investor Relations, the Investor Relations team facilitates post-earnings communications, presents at conferences globally (joined by key members of senior management) and conducts non-deal roadshows. In addition, the Company’s IR website includes a wide range of information to help educate key stakeholders through webcasts, podcasts, Moody’s Moments videos and product demo videos. Recognizing the diversity of our stakeholders, we believe providing information in various different formats allows us to reach the greatest number of stakeholders in the communication formats of their preference.

These engagements routinely cover a wide range of topics including: company strategy, governance, sustainability matters such as climate and energy transition, workplace culture, human capital management, regulation and other issues, and involve various members of management and the Chairman of the Board, where applicable.

SUCCESSION PLANNING

The Board, the Compensation & Human Resources Committee and the Governance & Nominating Committee review succession planning annually in conjunction with the Board’s review of strategic planning. In 2024, the Governance & Nominating Committee conducted discussions regarding CEO succession planning and the Compensation & Human Resources Committee discussed succession planning and development of the broader senior leadership group. The Board also reviewed the Company’s business continuity plans, which included emergency succession plans for key executives.

THE AUDIT COMMITTEE

The Audit Committee represents and assists the Board of Directors in its oversight responsibilities relating to: the integrity of the Company’s financial statements and the financial information provided to the Company’s stockholders and others; the Company’s compliance with legal and regulatory requirements; the Company’s internal controls; the Company’s policies with respect to risk assessment and risk management, and the review of contingent liabilities and risks that might be material to the Company; and the audit process, including the qualifications and independence of the Company’s principal external auditors (the “Independent Auditors”), and the performance of the Independent Auditors and the Company’s internal audit function.

OVERSIGHT OF AUDIT PROCESSES

As part of the Audit Committee’s oversight of the audit process, the Audit Committee and its Chairman are directly involved in the selection of the Independent Auditors’ lead engagement partner when there is a rotation required under applicable rules. The Committee also approves the fees and terms associated with the retention of the Independent Auditors to perform the annual engagement. In determining whether to approve services proposed to be provided by the Independent Auditors, the Committee is provided with summaries of the services, the fee associated with each service as well as information regarding incremental fees to be approved. The Committee also receives benchmarking data for audits of companies of similar sizes and audits of comparable complexity in order to determine the reasonableness of the proposed fees. The Audit Committee reviews and concurs in the appointment and compensation of the Company's Chief Audit Executive, head of the Company's internal audit function, and provides input regarding the annual evaluation of the Chief Audit Executive.

RESPONSIBILITIES UNDER THE AUDIT COMMITTEE CHARTER

In fulfilling the responsibilities under its charter, the Audit Committee:

•Discusses with, and receives regular status reports from, the Independent Auditors and the Chief Audit Executive on the overall scope and plans for their audits, including their scope and plans for evaluating the effectiveness of internal control over financial reporting. Also receives regular updates on the Company’s internal control over financial reporting, and discusses with management and the Independent Auditors their evaluations and conclusions with respect to internal control over financial reporting.

•Meets with the Independent Auditors and the Chief Audit Executive, with and without management present, to discuss the results of their respective audits, in addition to holding meetings with members of management, including the General Counsel.

| | | | | | | | |

| Moody’s Corporation | 16 | 2025 Proxy Statement |

•Reviews significant accounting policies, critical estimates and disclosures with management and the Independent Auditors, including the implementation of any new accounting standards or requirements.

•Reviews and discusses with management and the Independent Auditors the Company’s earnings press releases and periodic filings made with the SEC, including the use of information that is provided to enhance understanding of the results presented in accordance with GAAP.

•Oversees financial, risk and other disclosures made in the Company’s annual and quarterly reports related to sustainability, and at least annually reviews any assurance being provided by the Independent Auditors (or other third parties), with respect to such data and disclosures, and any reports by management or others regarding the adequacy and effectiveness of the Company’s internal controls and procedures related to such sustainability disclosures.

•Oversees the implementation of new financial reporting systems and their related internal controls.

•Reviews the Company’s financial and compliance risks, including, but not limited to, risks relating to internal controls and cyber risks.

•Meets with the Chief Compliance Officer and receives periodic reports on the effectiveness of the Company’s compliance program and regular status reports on compliance issues, including reports required by the Audit Committee’s policy for the receipt, retention and treatment of any complaints received by the Company regarding accounting, internal accounting control, auditing and federal securities law matters.

•Reviews its charter annually and conducts an annual self-evaluation to assess its performance.

The Audit Committee also has the authority, at the Company’s expense, to engage its own outside advisors, including experts in particular areas of accounting, as it determines appropriate.

In 2024, areas of focus for the Audit Committee included, among other things, quarterly performance, compliance matters, internal audit matters, auditor reviews, sustainability reporting, and internal controls.

ONGOING ASSESSMENT OF THE INDEPENDENT AUDITORS

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the Independent Auditors and, as such, the Independent Auditors report directly to the Audit Committee. KPMG LLP has served as the Company’s Independent Auditors since 2008 and was re-appointed at the conclusion of a competitive process that the Audit Committee conducted in 2019 to review the selection of the Company’s Independent Auditors. In selecting the Independent Auditors, the Committee considered the relative costs, benefits, challenges, potential impact, and overall advisability of selecting different Independent Auditors. In addition, the Audit Committee conducts an annual performance assessment of the Independent Auditors, seeking performance feedback from all the members of the Committee as well as from officers with audit-related responsibilities. The factors the Audit Committee considered in conducting this assessment included: independence, objectivity and integrity; quality of services and the ability to meet performance delivery dates; responsiveness and ability to adapt; proactivity in identification of opportunities and risks; performance of the lead engagement partners as well as other team members; technical expertise; enhancement of the audit process using more digital tools; understanding of the Company’s business and industry; effectiveness of their communication; sufficiency of resources; fee levels in light of the services rendered; and management feedback.

POLICY ON PRE-APPROVAL OF INDEPENDENT AUDITORS’ FEES

The Audit Committee has established a policy setting forth the requirements for the pre-approval of audit and permissible non-audit services to be provided by the Independent Auditors. Under the policy, the Audit Committee pre-approves the annual audit engagement terms and fees, as well as any other audit services and specified categories of non-audit services, subject to certain pre-approved fee levels. Any fee overruns in excess of the established thresholds are presented to the Audit Committee for approval. In addition, pursuant to the policy, the Audit Committee authorized its Chairman to pre-approve other audit and permissible non-audit services in 2024 up to $250,000 per engagement and a maximum of $500,000 per year. The policy requires that the Audit Committee Chairman report any pre-approval decisions to the full Audit Committee at its next scheduled meeting. For the year ended December 31, 2024, the Audit Committee or its Chairman pre-approved all of the services provided by the Independent Auditors, which are described on page 32. The Audit Committee also is responsible for overseeing the audit fee negotiation associated with the retention of the Independent Auditors to perform the annual audit engagement. The members of the Audit Committee are Mr. Bermudez (Chairman), Ms Esperdy, Mr. Minaya and Ms Seidman, each of whom is independent under NYSE and SEC rules and the Company’s Corporate Governance Principles. The Board of Directors has determined that each of Mr. Bermudez, Ms Esperdy, Mr. Minaya and Ms Seidman is an “audit committee financial expert” under the SEC’s rules. The Audit Committee held eight meetings during 2024.

| | | | | | | | |

| Moody’s Corporation | 17 | 2025 Proxy Statement |

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed with management and KPMG LLP, the Independent Auditors, the audited financial statements of the Company for the year ended December 31, 2024 (the “Audited Financial Statements”), management’s assessment of the effectiveness of the Company’s internal control over financial reporting, and the Independent Auditors’ evaluation of the Company’s system of internal control over financial reporting. In addition, the Audit Committee has discussed with the Independent Auditors, which reports directly to the Audit Committee, the matters that independent registered public accounting firms must communicate to audit committees under applicable Public Company Accounting Oversight Board (“PCAOB”) and SEC standards.

The Audit Committee also has discussed with KPMG LLP its independence from the Company, including the matters contained in the written disclosures and letter required by applicable requirements of the PCAOB regarding independent registered public accounting firms’ communications with audit committees about independence. The Audit Committee also has discussed with management of the Company and KPMG LLP such other matters and received such assurances from them as it deemed appropriate. The Audit Committee also considers whether the rendering of non-audit services by KPMG LLP to the Company is compatible with maintaining the independence of KPMG LLP from the Company. The Company historically has used KPMG LLP for only a limited number of non-audit services each year.

Following the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the Audited Financial Statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, for filing with the SEC.

The Audit Committee

| | | | | | | | | | | | | | | | | | | | | | | |

| Jorge A. Bermudez, Chairman | | Thérèse Esperdy | | Jose M. Minaya | | Leslie F. Seidman | |

THE GOVERNANCE & NOMINATING COMMITTEE

The Governance & Nominating Committee identifies and evaluates possible candidates to serve on the Board and recommends the Company’s director nominees for approval by the Board and the Company’s stockholders. The Governance & Nominating Committee also considers and makes recommendations to the Board of Directors concerning the size, structure, composition and functioning of the Board and its committees, oversees the evaluation of the Board, and develops and reviews the Company’s Corporate Governance Principles.

With respect to the evaluation of the Board, the Governance & Nominating Committee oversees a process for annually assessing the qualifications, performance and contributions, and the independence of incumbent directors in determining whether to recommend them for reelection to the Board. The Board, the Audit Committee, the Compensation & Human Resources Committee and the Governance & Nominating Committee, under the Governance & Nominating Committee’s oversight, each conducts an annual self-evaluation to assess its performance. The Chairman of the Board conducts annual interviews with each non-employee director to discuss individual Board member performance.

In addition, the Governance & Nominating Committee oversees: (i) sustainability matters, including significant issues of corporate social and environmental responsibility, as they pertain to the Company’s operations; (ii) CEO succession planning; (iii) director succession planning; (iv) stockholder proposals received by the Company; (v) corporate governance matters; and (vi) director independence. In 2024, areas of focus for the Governance & Nominating Committee included, among other things, stockholder rights and director skills.

The members of the Governance & Nominating Committee are Ms Seidman (Chairman), Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Mr. Howell, Mr. Minaya, Mr. Serafin and Mr. Van Saun, each of whom is independent under NYSE rules and under the Company’s Corporate Governance Principles. The Governance & Nominating Committee met five times during 2024.

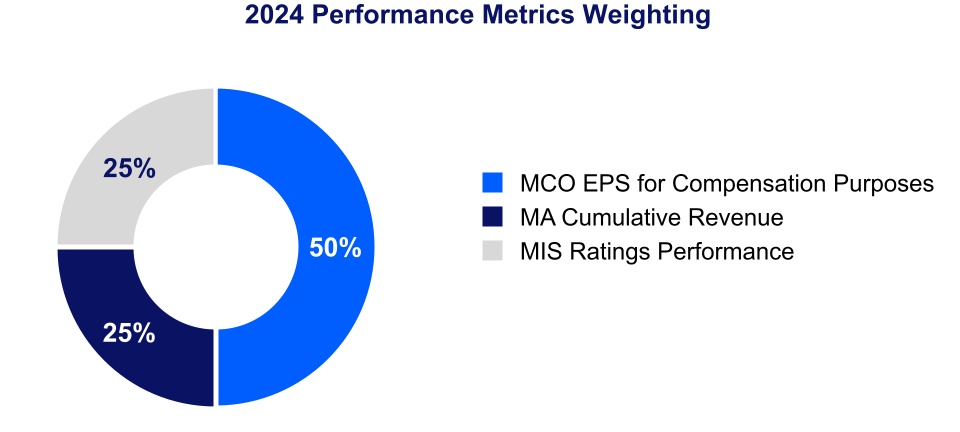

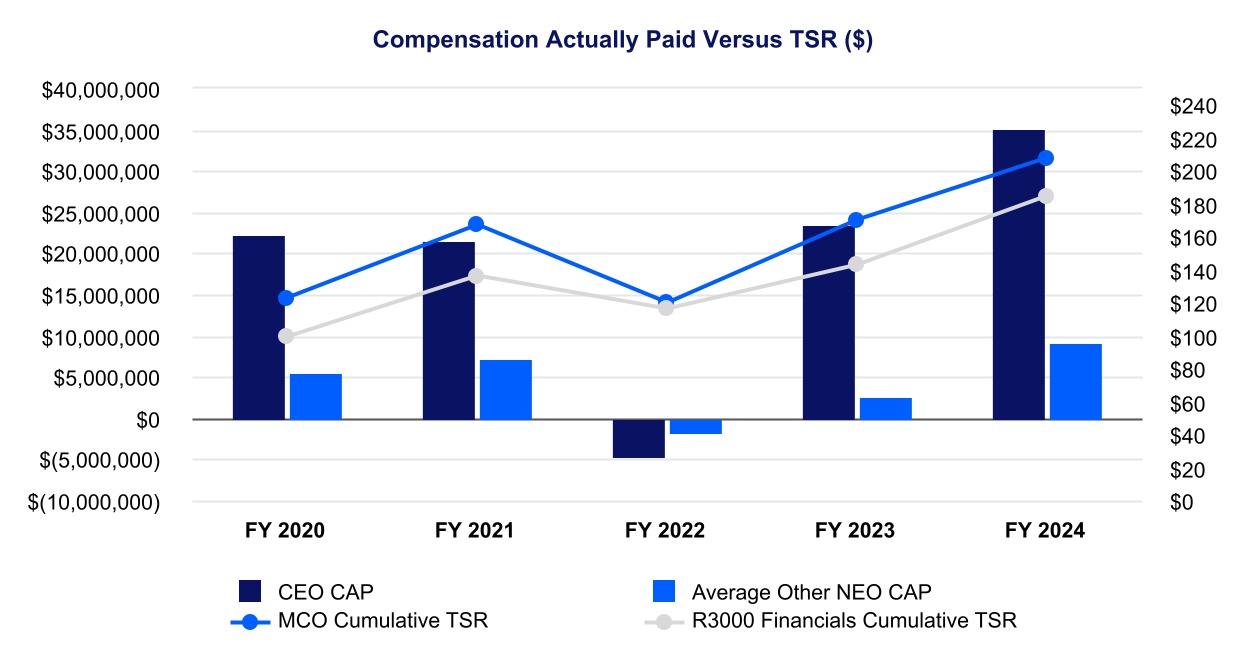

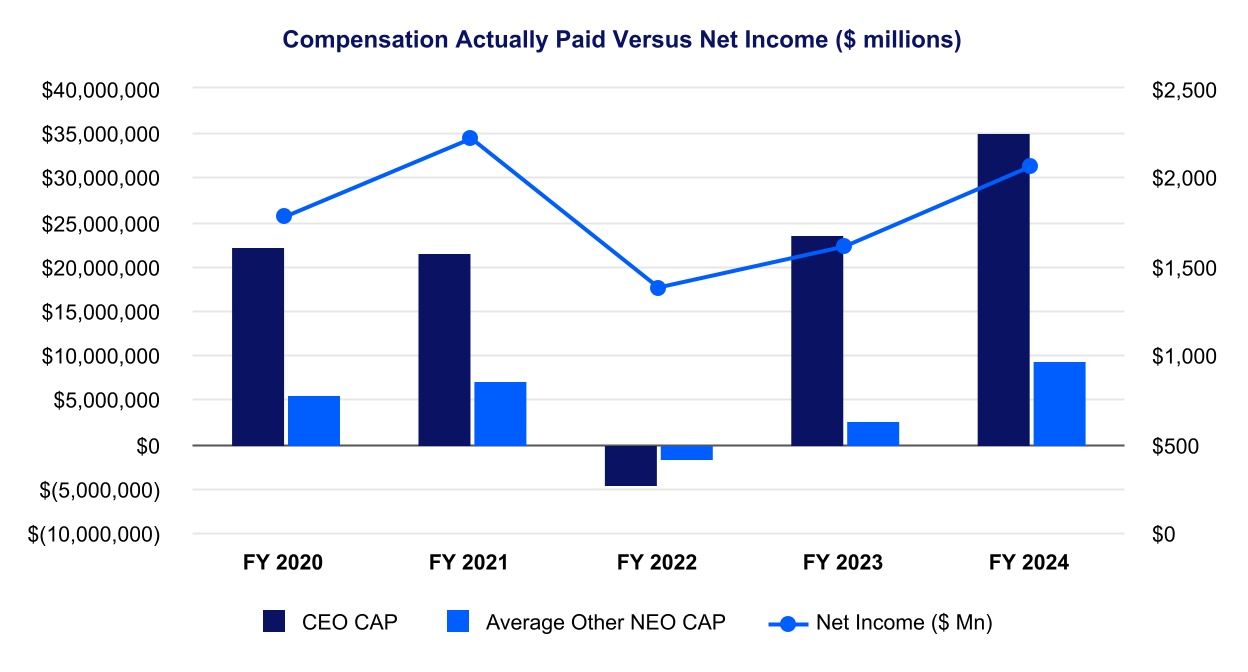

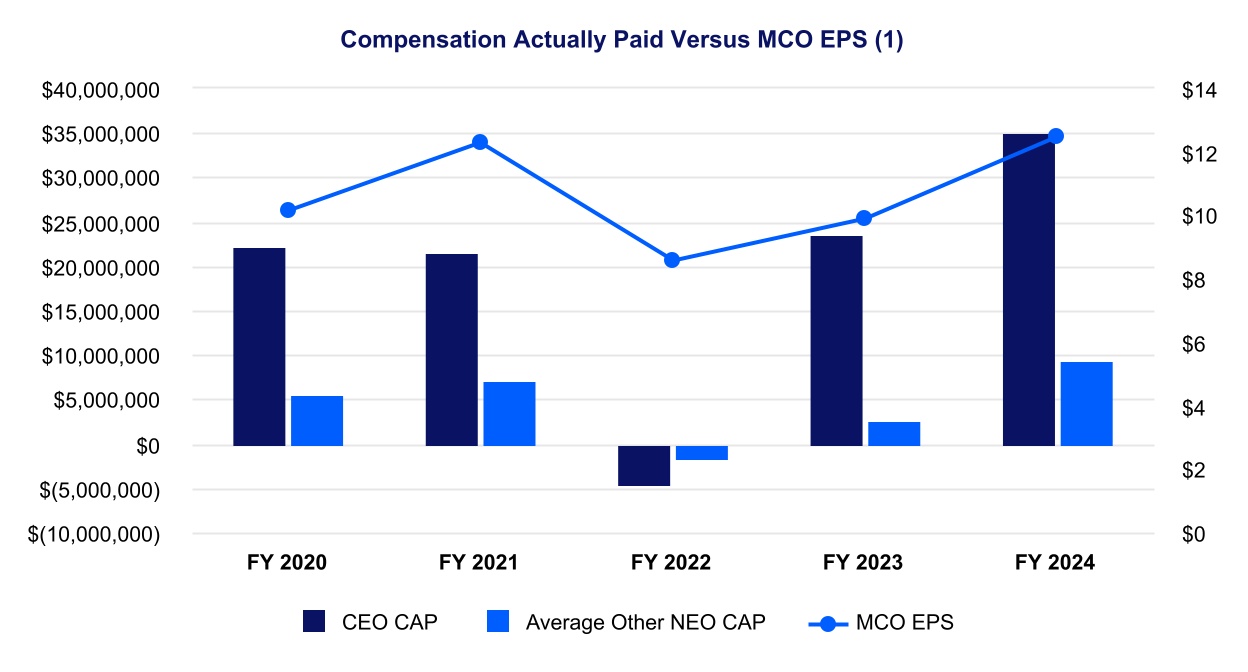

THE COMPENSATION & HUMAN RESOURCES COMMITTEE