- MCO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Moody's (MCO) DEF 14ADefinitive proxy

Filed: 11 Mar 20, 1:21pm

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

[Amendment No. ]

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

MOODY’S CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with written preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| March 11, 2020 |

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Moody’s Corporation to be held on Tuesday, April 21, 2020, at 9:30 a.m. EDT at the Company’s principal executive offices at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007.

The Notice of Annual Meeting and Proxy Statement accompanying this letter describe the business to be acted upon at the meeting. The Annual Report for the year ended December 31, 2019 is also enclosed.

On March 11, 2020, we mailed to many of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our 2020 Proxy Statement and 2019 Annual Report and vote online. The Notice included instructions on how to request a paper ore-mail copy of the proxy materials, including the Notice of Annual Meeting, Proxy Statement, Annual Report, and proxy card or voting instruction card. Stockholders who requested paper copies of the proxy materials or previously elected to receive the proxy materials electronically did not receive a Notice and will receive the proxy materials in the format requested.

Your vote is important. Whether or not you plan to attend the annual meeting, we encourage you to review the proxy materials and hope you will vote as soon as possible. You may vote by proxy over the Internet or by telephone by using the instructions provided in the Notice. Alternatively, if you requested and received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet, by telephone or by written proxy or voting instruction card will ensure your representation at the annual meeting regardless of whether you attend in person. Instructions regarding the three methods of voting are contained in the Notice or proxy card or voting instruction card.

| Sincerely, | ||

|  | |

Henry A. McKinnell, Jr. Chairman of the Board | Raymond W. McDaniel, Jr. President and Chief Executive Officer |

MOODY’S CORPORATION

7 World Trade Center

250 Greenwich Street

New York, New York 10007*

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

The 2020 Annual Meeting of Stockholders of Moody’s Corporation will be held on Tuesday, April 21, 2020, at 9:30 a.m. EDT at the Company’s offices at 7 World Trade Center at 250 Greenwich Street, New York, New York*, for the following purposes, all as more fully described in the accompanying Proxy Statement:

| 1. | To elect the nine director nominees named in the Proxy Statement to serve aone-year term; |

| 2. | To amend the Moody’s Corporation Restated Certificate of Incorporation to remove supermajority voting standards applicable to the following actions: |

| a. | Future amendments to certain provisions of the Restated Certificate of Incorporation and theBy-Laws; |

| b. | Removing directors from office; and |

| c. | Filling vacancies and newly created directorships at certain special meetings called pursuant to the Delaware General Corporation Law; |

| 3. | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the year 2020; |

| 4. | To vote on an advisory resolution approving executive compensation; and |

| 5. | To transact such other business as may properly come before the meeting. |

The Board of Directors of the Company has fixed the close of business on February 24, 2020 as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting.

| By Order of the Board of Directors, |

|

Elizabeth M. McCarroll Corporate Secretary and Associate General Counsel |

March 11, 2020

| * | We are actively monitoring the public health and travel concerns relating to the coronavirus (COVID-19) and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the annual meeting in person, we will announce alternative arrangements for the meeting, which may include a change in venue or holding the meeting solely by means of remote communication. Please monitor the Company’s website atwww.moodys.com under the headings “About Us—Investor Relations” for updated information. If you are planning to attend the meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the annual meeting. |

IMPORTANT VOTING INFORMATION

Your Participation in Voting the Shares You Own Is Important

If you are the beneficial owner of your shares (meaning that your shares are held in the name of a bank, broker or other nominee), you may receive a Notice of Internet Availability of Proxy Materials from that firm containing instructions that you must follow in order for your shares to be voted. Certain institutions offer telephone and Internet voting. If you received the proxy materials in paper form, the materials include a voting instruction card so you can instruct the holder of record on how to vote your shares. The firm that holds your shares is not permitted to vote on the matters to be considered at the 2020 Annual Meeting of Stockholders, other than to ratify the appointment of KPMG LLP, unless you provide specific instructions by following the instructions from your broker about voting your shares by telephone or Internet or completing and returning the voting instruction card. For your vote to be counted in the election of directors, on the amendments to the Restated Certificate of Incorporation to remove supermajority voting standards, and on the advisory resolution approving executive compensation, you will need to communicate your voting decisions to your bank, broker or other holder of record before the date of the annual meeting.

Voting your shares is important to ensure that you have a say in the governance of the Company and to fulfill the objectives of the majority-voting standard that Moody’s Corporation applies in the election of directors. Please review the proxy materials and follow the relevant instructions to vote your shares. We hope you will exercise your rights and fully participate as a stockholder in the future of Moody’s Corporation.

More Information Is Available

If you have any questions about the voting of your shares or the proxy voting process in general, please contact the bank, broker or other nominee through which you hold your shares. The SEC also has a website (http://www.sec.gov/spotlight/proxymatters.shtml) with more information about voting at annual meetings. Additionally, you may contact the Company’s Investor Relations Department by sending ane-mail toir@moodys.com.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 21, 2020

The Proxy Statement and the Company’s 2019 Annual Report are available at https://materials.proxyvote.com/615369. Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. You may vote your shares via a toll-free telephone number or over the Internet as instructed in the Notice of Internet Availability of Proxy Materials. Alternatively, if you received a paper copy of a proxy or voting instruction card by mail, you may submit your proxy or voting instruction card for the annual meeting by completing, signing, dating and returning your proxy or voting instruction card in thepre-addressed envelope provided. No postage is required if the card is mailed in the United States. If you attend the meeting, you may vote in person, even if you have previously returned your proxy or voting instruction card or voted by telephone or the Internet.

| Page |

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

i

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| 48 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| 65 | ||||

| 66 | ||||

| 68 | ||||

INFORMATION ABOUT THE ANNUAL MEETING, PROXY VOTING AND OTHER INFORMATION | 69 | |||

| 69 | ||||

| 69 | ||||

| 69 | ||||

Special Voting Procedures for Certain Current and Former Employees | 69 | |||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| A-1 | ||||

ii

2020 ANNUAL MEETING INFORMATION

This Proxy Statement is being furnished to the holders of the common stock, par value $0.01 per share (the “Common Stock”), of Moody’s Corporation (“Moody’s” or the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) for use in voting at the 2020 Annual Meeting of Stockholders or any adjournment or postponement thereof (the “Annual Meeting”). This summary highlights certain information from this Proxy Statement. You should read the entire Proxy Statement carefully before voting.

Date and Time | Place | Record Date | ||||||

Tuesday, April 21, 2020 9:30 a.m. EDT | 7 World Trade Center at 250 Greenwich Street, New York, New York* | February 24, 2020 |

| * | We are actively monitoring the public health and travel concerns relating to the coronavirus (COVID-19) and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold the Annual Meeting in person, we will announce alternative arrangements for the meeting, which may include a change in venue or holding the meeting solely by means of remote communication. Please monitor the Company’s website atwww.moodys.com under the headings “About Us—Investor Relations” for updated information. If you are planning to attend the Annual Meeting, please check the website one week prior to the meeting date. As always, we encourage you to vote your shares prior to the Annual Meeting. |

To obtain directions to attend the Annual Meeting and vote in person, please contact the Company’s Investor Relations Department by sending ane-mail toir@moodys.com. This Proxy Statement and the accompanying proxy card are first being made available to stockholders on or about March 11, 2020. The Company’s telephone number is(212) 553-0300.

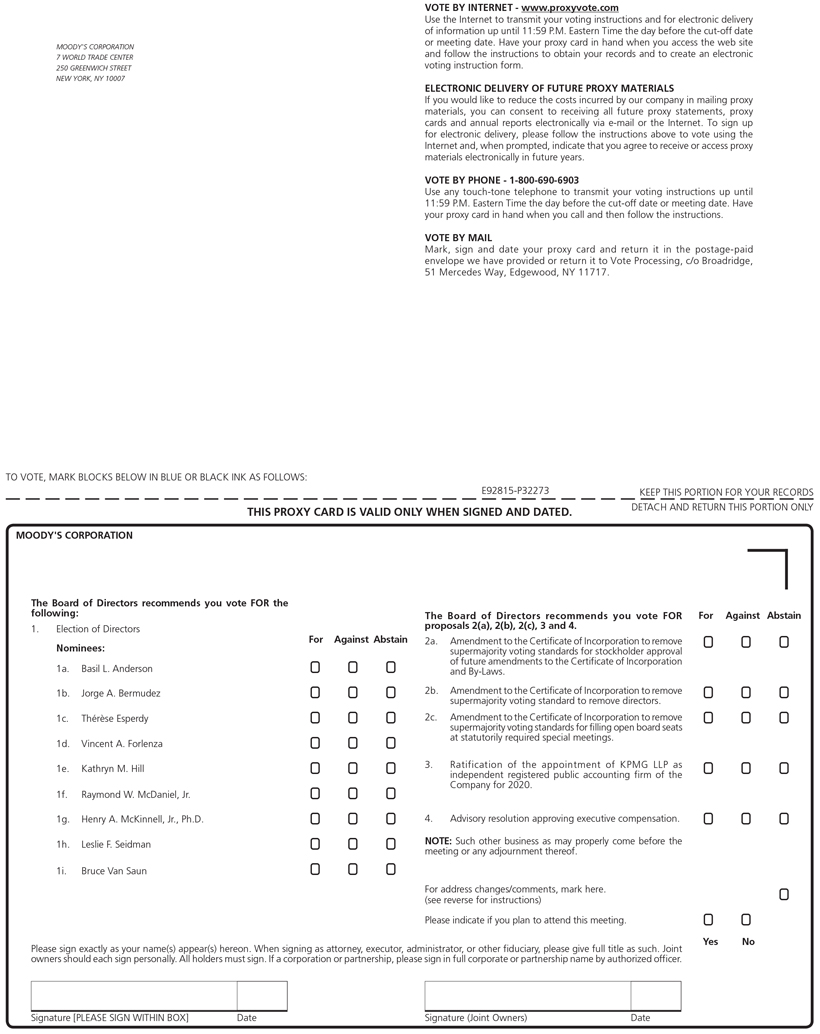

MATTERS TO BE VOTED ON AT THE ANNUAL MEETING

| Items of Business | Board

| Vote Required

| ||||||||

| Item 1 | Election of Directors | FOR each nominee | Majority of votes cast | |||||||

Items 2(a), 2(b) and 2(c) | Amendments to the Certificate of Incorporation to remove the supermajority voting standards applicable to certain actions | FOR each of Items 2(a), 2(b) and 2(c) | 80% of outstanding shares | |||||||

| Item 3 | Ratification of appointment of KPMG LLP as the Company’s Independent Registered Public Accounting Firm for 2020 | FOR | Majority of shares present and entitled to vote | |||||||

| Item 4 | Advisory resolution approving executive compensation | FOR | Majority of shares present and entitled to vote | |||||||

In addition to voting in person at the Annual Meeting, stockholders of record can vote by proxy by following the instructions in the Notice and using the Internet or by calling the toll-free telephone number that is available on the Internet. Alternatively, stockholders of record who requested a paper copy of the proxy materials can vote by proxy by mailing their signed proxy cards. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders to give their voting instructions and to confirm that stockholders’ instructions have been recorded properly.

| MOODY’S2020 PROXY STATEMENT | 1 |

If your shares are held in the name of a bank, broker or other nominee, you may receive a Notice from that firm containing instructions that you must follow in order for your shares to be voted. Certain institutions offer telephone and Internet voting. If you received the proxy materials in paper form, the materials include a voting instruction card so you can instruct the holder of record on how to vote your shares. If you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the bank, broker or other nominee that holds your shares. For additional information, including voting procedures for certain current and former employees, see “Information about the Annual Meeting, Proxy Voting and Other Information” on page 69.

Stockholders will need an admission ticket to enter the Annual Meeting. For stockholders of record, an admission ticket is available over the Internet, or, if you requested paper copies, you will receive a printed proxy card and a printed admission ticket. If you plan to attend the Annual Meeting in person, please retain and bring the admission ticket.

If you are the beneficial owner of your shares (meaning that your shares are held in the name of a bank, broker or other nominee) and you plan to attend the Annual Meeting in person, you may obtain an admission ticket in advance by sending a written request, along with proof of share ownership such as a bank or brokerage account statement, to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. An admission ticket is also available over the Internet. Stockholders who do not have admission tickets will be admitted following verification of ownership at the door.

CORPORATE GOVERNANCE HIGHLIGHTS

Board Independence |

Executive Compensation Governance Practices | |||

✓ Independent Chairman of the Board

✓ Nine of ten current Board members independent

✓ Fully independent Audit, Governance & Nominating, and Compensation & Human Resources Committees

✓ Executive sessions of independent directors at each regular meeting

|

✓ Robust stock ownership guidelines for directors and executive officers

✓ Comprehensive clawback policy

✓ Minimumone-year vesting period for incentive equity awards

✓ Anti-hedging and anti-pledging policy |

Other Board Practices |

✓ All directors elected annually by majority vote (in uncontested elections)

✓ Annual evaluations of the Board, committees and individual directors

✓ Board includes a range of tenures to balance fresh perspectives within-depth knowledge about the Company

|

| 2 | MOODY’S2020 PROXY STATEMENT |

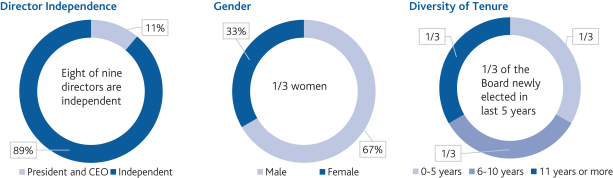

The Company strives to maintain a Board that possesses a combination of skills, professional experience, and diversity of backgrounds and tenure necessary to effectively oversee the Company’s business. In addition, the Board amended the Company’s Corporate Governance Principles in 2019 to include a commitment that, as part of the search process for each new director, the Governance & Nominating Committee will include women and minorities in the pool of candidates (and instruct any search firm the Committee engages to do so) (often called a “Rooney Rule”). Nine of the ten directors currently serving are standing for election at the Annual Meeting. Gerrit Zalm will not stand for reelection to the Board at the Annual Meeting and will retire from the Board at the end of his current term. Information regarding the director nominees is provided below.

| Director Nominee | Audit | Governance & Nominating | Compensation & Resources | Executive | |||||||||||||||||||||||||||||||||||||||||

Basil L. Anderson Former Vice Chairman, Staples, Inc. | ✓ | M | C | M | M | ||||||||||||||||||||||||||||||||||||||||

Jorge A. Bermudez Former Chief Risk Officer, Citigroup, Inc. | ✓ | M | M | M | |||||||||||||||||||||||||||||||||||||||||

Thérèse Esperdy Former Global Chairman of Financial Institutions Group, JPMorgan Chase & Co. | ✓ | M | M | M | |||||||||||||||||||||||||||||||||||||||||

Vincent A. Forlenza Chairman and Former Chief Executive Officer, Becton, Dickinson and Company | ✓ | M | M | M | |||||||||||||||||||||||||||||||||||||||||

Kathryn M. Hill Former Senior Vice President, Cisco Systems, Inc. | ✓ | M | M | C | M | ||||||||||||||||||||||||||||||||||||||||

Raymond W. McDaniel, Jr. President and Chief Executive Officer, Moody’s Corporation | M | ||||||||||||||||||||||||||||||||||||||||||||

Henry A. McKinnell, Jr., Ph.D. Chairman, Moody’s Corporation Former Chairman, Pfizer Inc. | ✓ | M | M | M | C | ||||||||||||||||||||||||||||||||||||||||

Leslie F. Seidman Former Chairman, Financial Accounting Standards Board | ✓ | C | M | M | M | ||||||||||||||||||||||||||||||||||||||||

Bruce Van Saun Chairman and Chief Executive Officer, Citizens Financial Group, Inc. | ✓ | M | M | M | |||||||||||||||||||||||||||||||||||||||||

✓ Independent C: Chairman of Committee M: Member of Committee

| MOODY’S2020 PROXY STATEMENT | 3 |

CORPORATE SOCIAL RESPONSIBILITY

Moody’s manages its business with the goal of delivering value to all of its stakeholders, including its customers, employees, business partners, local communities and stockholders. The Company’s Corporate Social Responsibility (“CSR”) strategy is an integral part of supporting this fundamental commitment to all stakeholders. The senior management of the Company is ultimately responsible for shaping and implementing the CSR strategy. Moody’s CSR Council, chaired by President and Chief Executive Officer Raymond W. McDaniel, Jr. and comprised of members of the management team, evaluates the Company’s CSR progress, generates recommendations to enhance Moody’s approach to CSR and identifies opportunities in Moody’s business that align with the CSR mission. In addition, the Board oversees sustainability matters, with assistance from the Governance & Nominating Committee, as part of its oversight of management and the Company’s overall strategy. Moody’s CSR strategy is focused on the following areas where the Company believes it can make the most impact.

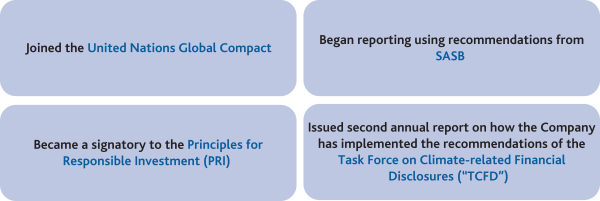

Moody’s advances sustainability by considering environmental, social, and governance factors throughout its operations and two business segments. It uses its expertise and assets to make a positive difference through technology tools, research and analytical services that help other organizations and the investor community better understand the links between sustainability considerations and the global markets. Moody’s efforts to promote sustainability-related thought leadership, assessments and data to market participants include following the policies of recognized sustainability and corporate social responsibility parties that develop standards or frameworks and/or evaluate and assess performance, including Global Reporting Initiative and Sustainability Accounting Standards Board (“SASB”). Moody’s sustainability-related achievements in 2019 included the following:

| 4 | MOODY’S2020 PROXY STATEMENT |

In order to address evolving best practices and new regulatory requirements, the Board of Directors reviews its corporate governance practices and the charters for its standing committees at least annually. After performing its annual governance review for 2019, the Board determined to amend the Company’s Corporate Governance Principles and its charters for the Audit, Governance & Nominating and Compensation & Human Resources Committees. A copy of the Corporate Governance Principles is available on the Company’s website atwww.moodys.com under the headings “About Us—Investor Relations—Corporate Governance—Other Governance Documents.” Copies of the charters of the Audit Committee, the Governance & Nominating Committee, the Compensation & Human Resources Committee and the Executive Committee are available on the Company’s website at www.moodys.com under the headings “About Us—Investor Relations—Corporate Governance—Charter Documents.” Print copies of the Corporate Governance Principles and the committee charters may also be obtained upon request, addressed to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. The Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee assist the Board in fulfilling its responsibilities, as described below. The Executive Committee has the authority to exercise the powers of the Board when it is not in session (subject to applicable law, rules and regulations, and the Company’s Certificate of Incorporation andBy-Laws), advises management and performs other duties delegated to it by the Board from time to time.

During 2019, the Board of Directors met eight times. The Board had four standing committees: an Audit Committee, a Governance & Nominating Committee, a Compensation & Human Resources Committee and an Executive Committee. All incumbent directors attended more than 80% of the total number of meetings of the Board and of all Board committees on which they served in 2019.

Please refer to page 11 for additional information regarding the Audit Committee, page 13 for additional information regarding the Governance & Nominating Committee and page 13 for additional information regarding the Compensation & Human Resources Committee. The Executive Committee did not meet in 2019. Directors are encouraged to attend the Annual Meeting. All individuals elected to the Board at the Company’s 2019 annual meeting of stockholders attended the meeting.

RECOMMENDATION OF DIRECTOR CANDIDATES

The Governance & Nominating Committee considers and makes recommendations to the Board regarding the size, structure, composition and functioning of the Board and engages in succession planning for the Board and key leadership roles on the Board and its committees. The Governance & Nominating Committee is also responsible for overseeing processes for the selection and nomination of director candidates. The Governance & Nominating Committee periodically reviews the skills, experience, characteristics and other criteria for identifying and evaluating directors, and recommends these criteria to the Board. The Governance & Nominating Committee will consider director candidates recommended by stockholders of the Company and may also engage independent search firms from time to time to assist in identifying and evaluating potential director candidates. In considering a candidate for Board membership, whether proposed by stockholders or otherwise, the Governance & Nominating Committee examines the candidate’s business experience, qualifications, attributes and skills relevant to the management and oversight of the Company’s business, independence, the ability to represent diverse stockholder interests, judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of any potential conflicts with the Company’s business and interests. The Committee also seeks diverse occupational and personal backgrounds for the Board. See “Qualifications and Skills of Directors” on page 18 and “Director Nominees” beginning on page 19 for additional information on the Company’s directors. To have a candidate considered by the Governance & Nominating Committee, a stockholder must submit the recommendation in writing and must include the following information:

| • | The name of the stockholder and evidence of the stockholder’s ownership of Company stock, including the number of shares owned and the length of time of ownership; and |

| • | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company, and the candidate’s consent to be named as a director if selected by the Governance & Nominating Committee and nominated by the Board. |

| MOODY’S2020 PROXY STATEMENT | 5 |

The stockholder recommendation and information described above must be sent to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007, and must be received by the Corporate Secretary not less than 120 days prior to the first anniversary of the Company’s most recent annual meeting of stockholders. For the Company’s 2021 annual meeting of stockholders, this deadline is December 22, 2020.

The Governance & Nominating Committee identifies potential nominees by asking current directors and executive officers to notify the Committee if they become aware of persons who meet the criteria described above and might be available to serve on the Board. As described above, the Committee will also consider candidates recommended by stockholders on the same basis as those from other sources. The Governance & Nominating Committee, from time to time, may engage firms that specialize in identifying director candidates for the Committee’s consideration.

Once a person has been identified by or for the Governance & Nominating Committee as a potential candidate, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Governance & Nominating Committee determines that the candidate warrants further consideration, the chairman or another member of the Committee contacts the person. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Governance & Nominating Committee requests information from the candidate, reviews the candidate’s accomplishments and qualifications, including in light of any other candidates whom the Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments.

The Company provides all new directors with an initial orientation session, which includes a comprehensive overview of the Company and the opportunity to meet with key leaders of the organization such as the Chief Executive Officer, Chief Financial Officer, General Counsel, the Presidents of Moody’s Investors Service, Inc. (“Moody’s Investors Service” or “MIS”) and Moody’s Analytics, Inc. (“Moody’s Analytics” or “MA”), the Chief Strategy Officer, the Head of Internal Audit, the Chief Technology Officer and the Controller. This orientation includes, among other topics, an overview of the Company’s business, including MIS and MA, corporate governance, compliance program, strategy, technology and cybersecurity, enterprise risk management, and legal and regulatory matters.

Board and committee meetings, industry and corporate governance update presentations, periodic reports from the Company’s businesses and external training programs also provide the Company’s directors with continuing education throughout their tenure. The Company reimburses directors for expenses associated with attendance at external education programs.

The Company’s Corporate Governance Principles permit the roles of Chairman and Chief Executive Officer to be filled by a single person or different individuals. This flexibility allows the Board to review the structure of the Board periodically and determine whether to separate the two roles based upon the Company’s needs and circumstances from time to time.

Dr. McKinnell serves as Chairman of the Board and Mr. McDaniel serves as President and Chief Executive Officer of Moody’s Corporation. In 2011 and 2012, the Board discussed whether to separate the roles, taking into account numerous considerations that bear upon the issue, including stockholders’ support at the Company’s 2011 annual meeting of a stockholder proposal recommending that, whenever possible, the Company’s chairman be independent. In light of these considerations, the Board determined to appoint an independent Chairman of the Board. The Board continues to believe that strong, independent Board leadership is a critical aspect of effective corporate governance and that the current leadership structure, with an independent Chairman and separate Chief Executive Officer, is in the best interests of the Company and its stockholders at this time. The roles and responsibilities of the Chairman of the Board are detailed in the Company’s Corporate Governance Principles.

| 6 | MOODY’S2020 PROXY STATEMENT |

CODES OF BUSINESS CONDUCT AND ETHICS

The Company has adopted a code of ethics that applies to its Chief Executive Officer, Chief Financial Officer and Controller, or persons performing similar functions. The Company has also adopted a code of business conduct and ethics that applies to the Company’s directors, officers and employees. A current copy of each of these codes is available on the Company’s website atwww.moodys.com under the headings “About Us—Investor Relations—Corporate Governance—Other Governance Documents.” A copy of each is also available in print to stockholders upon request, addressed to the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007. The Company intends to satisfy disclosure requirements regarding any amendments to, or waivers from, the codes of ethics by posting such information on the Company’s website atwww.moodys.com under the headings “About Us—Investor Relations—Corporate Governance—Other Governance Documents.”

To assist it in making determinations of a director’s independence, the Board has adopted independence standards that are set forth below and are included in the Company’s Corporate Governance Principles. The Board has determined that Mr. Anderson, Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Dr. McKinnell, Ms Seidman, Mr. Van Saun and Mr. Zalm, and thus a majority of the directors on the Board, are independent under these standards. The standards adopted by the Board incorporate the director independence criteria included in the New York Stock Exchange (the “NYSE”) listing standards, as well as additional criteria established by the Board. The Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee are composed entirely of independent directors. In accordance with NYSE requirements and the independence standards adopted by the Board, all members of the Audit Committee and the Compensation & Human Resources Committee meet additional heightened independence standards applicable to audit committee and compensation committee members.

An “independent” director is a director whom the Board has determined has no material relationship with the Company or any of its consolidated subsidiaries (for purposes of this section, collectively referred to as the “Company”), either directly, or as a partner, stockholder or officer of an organization that has a relationship with the Company. For purposes of this definition, the Board has determined that a director is not independent if:

| 1. | the director is, or in the past three years has been, an employee of the Company, or an immediate family member of the director is, or in the past three years has been, an executive officer of the Company; |

| 2. | (a) the director, or an immediate family member of the director, is a current partner of the Company’s outside auditor; (b) the director is a current employee of the Company’s outside auditor; (c) a member of the director’s immediate family is a current employee of the Company’s outside auditor and personally works on the Company’s audit; or (d) the director or an immediate family member of the director was in the past three years a partner or employee of the Company’s outside auditor and personally worked on the Company’s audit within that time; |

| 3. | the director, or a member of the director’s immediate family, is or in the past three years has been, an executive officer of another company where any of the Company’s present executive officers serves or served on the compensation committee at the same time; |

| 4. | the director, or a member of the director’s immediate family, has received, during any12-month period in the past three years, any direct compensation from the Company in excess of $120,000, other than compensation for Board service, compensation received by the director’s immediate family member for service as an employee (other than an executive officer) of the Company, and pension or other forms of deferred compensation for prior service with the Company; |

| 5. | the director is a current executive officer or employee, or a member of the director’s immediate family is a current executive officer of another company that makes payments to or receives payments from the Company, or during any of the last three fiscal years, has made payments to or received payments from the Company, for property or services in an amount that, in any single fiscal year, exceeded the greater of $1 million or 2% of the other company’s consolidated gross revenues; or |

| MOODY’S2020 PROXY STATEMENT | 7 |

| 6. | the director, or the director’s spouse, is an executive officer of anon-profit organization to which the Company or the Company foundation makes, or in the past three years has made, contributions that, in any single fiscal year, exceeded the greater of $1 million or 2% of thenon-profit organization’s consolidated gross revenues. (Amounts that the Company foundation contributes under matching gifts programs are not included in the contributions calculated for purposes of this standard.) |

An “immediate family” member includes a director’s spouse, parents, children, siblings, mother- andfather-in-law, sons- anddaughters-in-law, brothers- andsisters-in-law, and anyone (other than a domestic employee) who shares the director’s home.

In addition, a director is not considered independent for purposes of serving on the Audit Committee, and may not serve on the Audit Committee, if the director: (a) accepts, directly or indirectly, from Moody’s Corporation or any of its subsidiaries, any consulting, advisory, or other compensatory fee, other than Board and committee fees and fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with Moody’s Corporation; or (b) is an “affiliated person” of Moody’s Corporation or any of its subsidiaries; each as determined in accordance with SEC regulations.

Furthermore, in determining whether a director is considered independent for purposes of serving on the Compensation & Human Resources Committee, the Board must consider all factors specifically relevant to determining whether the director has a relationship with the Company that is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, including, but not limited to: (a) the source of the director’s compensation, including any consulting, advisory or other compensatory fee paid by the Company to the director; and (b) whether the director is affiliated with Moody’s Corporation, any of its subsidiaries or an affiliate of any subsidiary; each as determined in accordance with SEC regulations.

In assessing independence, the Board took into account that Mr. Anderson, Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Ms Seidman, Mr. Van Saun and Mr. Zalm each served during 2019, or currently serves, as directors, employees or trustees of entities that are rated or have issued securities rated by Moody’s Investors Service, as listed in the Company’s Director and Shareholder Affiliation Policy posted on the Company’s website under the headings “About Moody’s—Investor Relations—Investor Relations Home—Corporate Governance—Other Governance Documents,” and that associated fees from each such entity accounted for less than 1% of the Company’s 2019 revenue. In addition, the Board took into account that the Company from time to time engages in business with entities where one of our directors, director candidates or their immediate family members are employed or have other relationships. The Board found nothing in the relationships to be contrary to the standards for determining independence as contained in the NYSE’s requirements and the Company’s Corporate Governance Principles. A copy of these standards is found in Attachment A to the Company’s Corporate Governance Principles on the Company’s website atwww.moodys.com under the headings “About Moody’s—Investor Relations—Investor Relations Home—Corporate Governance—Other Governance Documents.”

BOARD AND COMMITTEE EVALUATION PROCESS

The Company’s Board and committee evaluation process is summarized below. The topics considered during the evaluation include Board effectiveness in overseeing key areas, such as strategy and risk, performance of committees’ duties under their respective charters, Board and committee operations, and individual director performance.

| 1 |

Review of Evaluation Process. The Governance & Nominating Committee annually reviews the evaluation process, including the evaluation method, to ensure that constructive feedback is solicited on the performance of the Board, its Committees, and individual directors. | |

| 2 |

Questionnaire andOne-on-One Interviews.In 2019, as in prior years, the Board, the Audit Committee, the Compensation & Human Resources Committee and the Governance & Nominating Committee each conducted an annual self-evaluation through the use of a written questionnaire. All directors, other than the Chairman, also evaluate Chairman performance through a written |

| 8 | MOODY’S2020 PROXY STATEMENT |

| questionnaire. All questionnaires include open-ended questions to solicit direct feedback and the responses are collected on an unattributed basis. In addition, the Chairman conducts annual interviews with each non-management director to discuss individual Board member performance. | ||

| 3 |

Summary of Written Evaluations.Directors’ responses to the questionnaires are aggregated without attribution and shared with the full Board and the applicable committees. All responses, including written comments, are provided along with an overview of the high and low scores on various topics. | |

| 4 |

Board and Committee Review. Using aggregated results as a reference, the Audit Committee and the Compensation & Human Resources Committee discuss their respective results. Discussions of the Board, Chairman and Governance & Nominating Committee results occur at the Governance & Nominating Committee. Following the committee-level discussions, all evaluation results and feedback, including those from the one-on-one interviews and the Chairman evaluation questionnaire, are discussed by the full Board. | |

5

|

Actions.The Board decides on specific actions to incorporate feedback received, including making any appropriate changes to Board- and committee-related practices. |

THE BOARD’S ROLE IN THE OVERSIGHT OF COMPANY RISK

The Board of Directors oversees the Company’s enterprise-wide approach to the major risks facing the Company and, with the assistance of the Audit Committee and the Compensation & Human Resources Committee, oversees the Company’s policies for assessing and managing its exposure to risk. The Board periodically reviews these risks and the Company’s risk management processes, including in connection with its review of the Company’s strategy. The Board’s responsibilities include reviewing the Company’s practices with respect to risk assessment and risk management and reviewing contingent liabilities and risks that may be material to the Company. The Audit Committee reviews the Company’s policies with respect to enterprise-wide risk assessment and risk management, financial and compliance risks, including risks relating to internal controls and cyber risks, and major legislative and regulatory developments that could materially affect the Company. In addition, at least annually, the Audit Committee, together with the full Board from time to time, reviews the implementation and effectiveness of the Company’s enterprise risk management program with the Chief Risk Officer. The Compensation & Human Resources Committee oversees management’s assessment of whether the Company’s compensation structure, policies and programs create risks that are reasonably likely to have a material adverse effect on the Company and reviews the results of this assessment.

Under the oversight of the Board and its committees, the Chief Executive Officer has established an Enterprise-Wide Risk Committee, comprised of the Chief Executive Officer and his direct reports, which include the Chief Risk Officer. The Enterprise-Wide Risk Committee reviews the work of the Enterprise Risk Function that is managed by the Chief Risk Officer. The Chief Risk Officer oversees risk officers for the Company’s two business segments, MIS and MA, and the support functions in Moody’s Shared Services, Inc. who periodically report on risks and their mitigations within their areas of responsibility. Among other things, the Enterprise Risk Function is responsible for identifying and monitoring existing and emerging risks that are important to the achievement of the Company’s strategic and operative objectives; formulating appropriate polices, monitoring and reporting frameworks to support effective management of important risks; reviewing and evaluating the effectiveness of management processes and action plans to address such risks; advising on and recommending to executive management any significant actions or initiatives that they believe are necessary to effectively manage risk; and seeing that activities of discrete risk management disciplines within the Company are appropriately coordinated. The Chief Risk Officer presented the Enterprise Risk Committee’s analysis to the directors at four meetings in 2019. Additionally, the Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee reviewed risks within their areas of responsibility at separate meetings in 2019. Significant risk issues evaluated by and/or major changes proposed by the Enterprise-Wide Risk Committee and the Chief Risk Officer are discussed at various Board meetings throughout the year.

| MOODY’S2020 PROXY STATEMENT | 9 |

The independent directors routinely meet in executive session at regularly scheduled Board meetings. Dr. McKinnell, the independent Chairman of the Board, establishes the agenda for and presides at these sessions and has the authority to call additional sessions as appropriate.

The Board of Directors has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may communicate with the Board of Directors or with allnon-management directors as a group, or with a specific director or directors (including the Chairman of the Board), by writing to them c/o the Corporate Secretary of the Company at 7 World Trade Center at 250 Greenwich Street, New York, New York 10007.

All communications received as set forth in the preceding paragraph will be opened by the Corporate Secretary for the sole purpose of determining whether the contents represent a message to the Company’s directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee.

The Board and the Compensation & Human Resources Committee review succession planning annually in conjunction with the Board’s review of strategic planning.

ANTI-HEDGING AND ANTI-PLEDGING POLICY; SHORT SALES AND OTHER SPECULATIVE TRADES

All executive officers, directors and their family members are subject to a securities trading policy under which they are prohibited from hedging and pledging Moody’s securities, including any publicly traded securities of a Moody’s subsidiary. The term “family member” is defined in the Company’s policy against insider trading and generally includes family members or entities that hold, purchase or sell Company stock that is attributed to the director or officer. Specifically, the following activities are prohibited under the policy:

| • | Making “short sales” of Moody’s securities. A short sale has occurred if the seller: (i) does not own the securities sold; or (ii) does own the securities sold, but does not deliver or transmit them within the customary settlement period. |

| • | Engaging in short-term or speculative transactions or entering into any transaction (including purchasing or selling forward contracts, equity swaps, puts or calls) that is designed to offset any decrease in the market value of or is otherwise based on the price of Moody’s securities. |

| • | Holding Moody’s securities in margin accounts, buying Moody’s securities on margin or pledging Moody’s securities as collateral for a loan. |

Employees who are not executive officers (and their family members) are prohibited from: (i) making short sales of Moody’s securities; (ii) buying Moody’s securities on margin or in any account in which a financial firm lends cash to purchase the securities; and (iii) engaging in short-term or speculative transactions involving Moody’s securities, including buying or selling put or call options and entering into other derivative transactions involving Moody’s securities. The restrictions in clause (iii) do not prohibit the exercise of Moody’s stock options that employees receive in connection with their compensation.

The Chief Executive Officer, Chief Financial Officer and certain other officers of the Company, enter into Rule10b5-1 stock trading plans from time to time. These plans allow executives to adopt predetermined procedures for trading shares of Company stock in advance of learning any materialnon-public information. The use of these trading plans permits diversification, retirement and tax planning activities. The transactions under the plans will be disclosed publicly through Form 4 filings with the SEC.

| 10 | MOODY’S2020 PROXY STATEMENT |

The Audit Committee represents and assists the Board of Directors in its oversight responsibilities relating to: the integrity of the Company’s financial statements and the financial information provided to the Company’s stockholders and others; the Company’s compliance with legal and regulatory requirements; the Company’s internal controls; the Company’s policies with respect to risk assessment and risk management, and the review of contingent liabilities and risks that might be material to the Company; and the audit process, including the qualifications and independence of the Company’s principal external auditors (the “Independent Auditors”), and the performance of the Independent Auditors and the Company’s internal audit function.

Oversight of Audit Processes

As part of the Audit Committee’s oversight of the audit process, the Audit Committee and its Chairman are directly involved in the selection of the lead engagement partner when there is a rotation required under applicable rules, and the Audit Committee reviews and concurs in the appointment and compensation of the head of the Company’s internal audit function (the “Chief Audit Executive”). The Committee also approves the fees and terms associated with the retention of the Independent Auditors to perform the annual engagement. In determining whether to approve services proposed to be provided by the Independent Auditors, the Committee is provided with summaries of the services, the fee associated with each service as well as information regarding incremental fees to be approved. The Committee also receives benchmarking data for audits of companies of similar sizes and audits of comparable complexity in order to determine the reasonableness of the proposed fees.

Responsibilities under the Audit Committee Charter

In fulfilling the responsibilities under its charter, the Audit Committee:

| • | Discusses with, and receives regular status reports from, the Independent Auditors and the head of the internal audit function on the overall scope and plans for their audits, including their scope and plans for evaluating the effectiveness of internal control over financial reporting. Also receives regular updates on the Company’s internal control over financial reporting, and discusses with management and the Independent Auditors their evaluations and conclusions with respect to internal control over financial reporting. |

| • | Meets with the Independent Auditors and the head of the internal audit function, with and without management present, to discuss the results of their respective audits, in addition to holding meetings with members of management, including the General Counsel. |

| • | Reviews significant accounting policies, critical estimates and disclosures with management and the Independent Auditors, including the implementation of any new accounting standards or requirements. |

| • | Reviews and discusses with management and the Independent Auditors the Company’s earnings press releases and periodic filings made with the SEC, including the use of information that is provided to enhance understanding of the results presented in accordance with GAAP. |

| • | Oversees the implementation of new financial reporting systems and their related internal controls. |

| • | Reviews the Company’s financial and compliance risks, including, but not limited to, risks relating to internal controls and cyber risks. The Chairman of the Audit Committee holds a CERT Certificate in Cybersecurity Oversight, issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University. |

| • | Receives periodic reports on the effectiveness of the Company’s compliance program and regular status reports on compliance issues, including reports required by the Audit Committee’s policy for the receipt and treatment of any complaints received by the Company regarding accounting, internal control, auditing and federal securities law matters. |

| • | Provides input regarding the annual evaluation of the Chief Audit Executive. |

| • | Reviews its charter annually and conducts an annual self-evaluation to assess its performance. |

The Audit Committee also has the authority to engage its own outside advisors, including experts in particular areas of accounting, as it determines appropriate.

| MOODY’S2020 PROXY STATEMENT | 11 |

Ongoing Assessment of the Independent Auditors

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the Independent Auditors and, as such, the Independent Auditors report directly to the Audit Committee. KPMG LLP has served as the Company’s Independent Auditors since 2008, and wasre-appointed at the conclusion of a competitive process that the Audit Committee conducted in 2019 to review the selection of the Company’s Independent Auditors. In selecting the Independent Auditors, the Committee considered the relative costs, benefits, challenges, potential impact, and overall advisability of selecting different Independent Auditors. In addition, the Audit Committee conducts an annual performance assessment of the Independent Auditors, seeking performance feedback from all the members of the Committee as well as from officers with audit-related responsibilities. The factors the Audit Committee considered in conducting this assessment included: independence, objectivity and integrity; quality of services and the ability to meet performance delivery dates; responsiveness and ability to adapt; proactivity in identification of opportunities and risks; performance of the lead engagement partners as well as other team members; technical expertise; understanding of the Company’s business and industry; effectiveness of their communication; sufficiency of resources; fee levels in light of the services rendered; and management feedback.

Policy onPre-Approval of Independent Auditors Fees

The Audit Committee has established a policy setting forth the requirements for thepre-approval of audit and permissiblenon-audit services to be provided by the Independent Auditors. Under the policy, the Audit Committeepre-approves the annual audit engagement terms and fees, as well as any other audit services and specified categories ofnon-audit services, subject to certainpre-approved fee levels. In addition, pursuant to the policy, the Audit Committee authorized its Chairman topre-approve other audit and permissiblenon-audit services in 2019 up to $250,000 per engagement and a maximum of $500,000 per year. The policy requires that the Audit Committee Chairman report anypre-approval decisions to the full Audit Committee at its next scheduled meeting. For the year ended December 31, 2019, the Audit Committee or its Chairmanpre-approved all of the services provided by the Independent Auditors, which are described on page 27. The Audit Committee also is responsible for overseeing the audit fee negotiation associated with the retention of the Independent Auditors to perform the annual audit engagement.

Notable Actions in 2019

During 2019, the Audit Committee also reviewed and oversaw the expansion of voluntary sustainability disclosures in the Company’s periodic filings with the SEC and certain other external reports that reflect recommendations from sustainability assessment organizations. The enhanced disclosures recognize growing investor demand for sustainability information. In 2019, the Company began reporting on such matters using recommendations from SASB and also issued its second annual report on how the Company has implemented the TCFD recommendations.

The members of the Audit Committee are Ms Seidman (Chairman), Mr. Anderson, Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Dr. McKinnell, Mr. Van Saun and Mr. Zalm, each of whom is independent under NYSE and SEC rules and under the Company’s Corporate Governance Principles. The Board of Directors has determined that each of Mr. Anderson, Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Dr. McKinnell, Ms Seidman, Mr. Van Saun and Mr. Zalm is an “audit committee financial expert” under the SEC’s rules. The Audit Committee held nine meetings during 2019.

The Audit Committee has reviewed and discussed with management and the Independent Auditors the audited financial statements of the Company for the year ended December 31, 2019 (the “Audited Financial Statements”), management’s assessment of the effectiveness of the Company’s internal control over financial reporting, and the Independent Auditors’ evaluation of the Company’s system of internal control over financial reporting. In addition, the Audit Committee has discussed with KPMG LLP, which reports directly to the Audit Committee, the matters that independent registered public accounting firms must communicate to audit committees under applicable Public Company Accounting Oversight Board (“PCAOB”) standards.

| 12 | MOODY’S2020 PROXY STATEMENT |

The Audit Committee also has discussed with KPMG LLP its independence from the Company, including the matters contained in the written disclosures and letter required by applicable requirements of the PCAOB regarding independent registered public accounting firms’ communications with audit committees about independence. The Audit Committee also has discussed with management of the Company and KPMG LLP such other matters and received such assurances from them as it deemed appropriate. The Audit Committee also considers whether the rendering ofnon-audit services by KPMG LLP to the Company is compatible with maintaining the independence of KPMG LLP from the Company. The Company historically has used KPMG LLP for only a limited number ofnon-audit services each year.

Following the foregoing review and discussions, the Audit Committee recommended to the Board of Directors that the Audited Financial Statements be included in the Company’s Annual Report on Form10-K for the year ended December 31, 2019 for filing with the SEC.

The Audit Committee

Leslie F. Seidman,Chairman

Basil L. Anderson

Jorge A. Bermudez

Thérèse Esperdy

Vincent A. Forlenza

Kathryn M. Hill

Henry A. McKinnell, Jr.

Bruce Van Saun

Gerrit Zalm

THE GOVERNANCE & NOMINATING COMMITTEE

The Governance & Nominating Committee identifies and evaluates possible candidates to serve on the Board and recommends the Company’s director nominees for approval by the Board and the Company’s stockholders. The Governance & Nominating Committee also considers and makes recommendations to the Board of Directors concerning the size, structure, composition and functioning of the Board and its committees, oversees the evaluation of the Board, and develops and reviews the Company’s Corporate Governance Principles.

With respect to the evaluation of the Board, the Governance & Nominating Committee oversees a process for annually assessing the performance, contributions and the independence of incumbent directors in determining whether to recommend them for reelection to the Board. The Board, the Audit Committee, the Compensation & Human Resources Committee and the Governance & Nominating Committee, under that Committee’s oversight, each conduct an annual self-evaluation to assess its performance. The Chairman of the Board conducts annual interviews during which individual Board member evaluations are conducted.

In addition, the Governance & Nominating Committee oversees sustainability matters, including significant issues of corporate social and environmental responsibility, as they pertain to the Company’s business.

The members of the Governance & Nominating Committee are Mr. Anderson (Chairman), Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Ms Hill, Dr. McKinnell, Ms Seidman, Mr. Van Saun and Mr. Zalm, each of whom is independent under NYSE rules and under the Company’s Corporate Governance Principles. The Governance & Nominating Committee met six times during 2019.

THE COMPENSATION & HUMAN RESOURCES COMMITTEE

The Compensation & Human Resources Committee oversees the Company’s overall compensation structure, policies and programs, assesses whether the Company’s compensation structure establishes appropriate incentives for management and employees, and assesses the results of the most recent vote on the Company’s advisory resolution approving executive compensation. The Committee also oversees the evaluation of senior management (including by reviewing and approving performance goals for the Company’s Chief Executive Officer and other executive officers, and by evaluating their performance against approved goals, which, with respect to the Chief Executive Officer, the Committee does in consultation with the Chairman of the Board) and oversees and makes the final decisions regarding compensation arrangements for the Chief Executive Officer and for certain other executive officers, including the named executive officers. The Chief Executive Officer makes

| MOODY’S2020 PROXY STATEMENT | 13 |

recommendations to the Committee regarding the amount and form of executive compensation (except with respect to his compensation). For a description of this process, see the Compensation Discussion and Analysis (the “Compensation Discussion and Analysis” or “CD&A”), beginning on page 33. The Committee administers and makes recommendations to the Board with respect to the Company’s incentive compensation and equity-based compensation plans that are subject to Board approval, including the Company’s key employees’ stock incentive plans. The Committee has authority, acting in a settlor capacity, to establish, amend and terminate the Company’s employee benefit plans, programs and practices, and to review reports from management regarding the funding, investments and other features of such plans, and the Committee delegates to management the responsibilities it has with respect to the Company’s employee benefit plans, programs and practices as the Committee deems appropriate. As discussed below, the Committee annually reviews the form and amount of compensation of directors for service on the Board and its committees and recommends changes to the Board.

The Committee is empowered to retain, at the Company’s expense, such consultants, counsel or other outside advisors as it determines appropriate to assist it in the performance of its functions. In 2019, the Committee retained the services of Meridian Compensation Partners LLC (“Meridian”), an independent compensation consulting company, to provide advice and information about executive and director compensation, including the competitiveness of pay levels, executive compensation design and governance issues, and market trends, as well as technical and compliance considerations. Meridian reports directly and solely to the Compensation & Human Resources Committee. Meridian exclusively provides executive and director compensation consulting services and does not provide any other services to the Company.

The Committee regularly reviews the current engagements and the objectivity and independence of the advice that Meridian provides to the Committee on executive and director compensation. The Committee considered the six specific independence factors adopted by the SEC and the NYSE under Dodd-Frank and other factors it deemed relevant, and the Committee found no conflicts of interest or other factors that would adversely affect Meridian’s independence.

During 2019, management continued to engage Aon Consulting (formerly called Aon Hewitt) as management’s compensation consultant. Aon Consulting worked with the Chief Human Resources Officer and her staff to develop market data regarding Moody’s executive compensation programs. The Committee takes into account that Aon Consulting provides executive compensation-related services to management when it evaluates the information and analyses provided by Aon Consulting.

The members of the Compensation & Human Resources Committee are Ms Hill (Chairman), Mr. Anderson, Mr. Bermudez, Ms Esperdy, Mr. Forlenza, Dr. McKinnell, Ms Seidman, Mr. Van Saun and Mr. Zalm, each of whom is independent under NYSE rules and under the Company’s Corporate Governance Principles. The Compensation & Human Resources Committee met six times during 2019.

REPORT OF THE COMPENSATION & HUMAN RESOURCES COMMITTEE

The Compensation & Human Resources Committee assists the Board in fulfilling its oversight responsibility relating to, among other things, establishing and reviewing compensation of the Company’s executive officers. In this context, the Compensation & Human Resources Committee reviewed and discussed with management the Company’s Compensation Discussion and Analysis, beginning on page 33. Following such reviews and discussions, the Compensation & Human Resources Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation & Human Resources Committee

Kathryn M. Hill,Chairman

Basil L. Anderson

Jorge A. Bermudez

Thérèse Esperdy

Vincent A. Forlenza

Henry A. McKinnell, Jr.

Leslie F. Seidman

Bruce Van Saun

Gerrit Zalm

| 14 | MOODY’S2020 PROXY STATEMENT |

RELATIONSHIP OF COMPENSATION PRACTICES TO RISK MANAGEMENT

When structuring its overall compensation practices for employees of the Company, generally consideration is given as to whether the structure creates incentives for risk-taking behavior and therefore affects the Company’s risk management practices. Attention is given to the elements and the mix of pay as well as seeing that employees’ compensation is aligned with stockholders’ value.

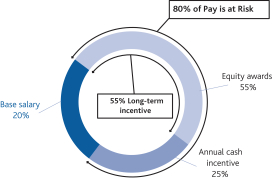

In order to assess whether the Company’s compensation practices and programs create risks that are reasonably likely to have a material adverse effect on the Company, management established a compensation risk committee led by the Chief Human Resources Officer to assess the risk related to the Company’s compensation plans, practices and programs. As part of this annual review, the compensation risk committee assessed the following items: (i) the relative proportion of variable to fixed components of compensation, (ii) the mix of performance periods (short-term, medium-term and long-term), (iii) the mix of payment mechanisms (cash, options, restricted stock units (“RSUs”), performance shares), (iv) the design of the incentive compensation programs, including the performance metrics used, linking the creation of value and earnings quality and sustainability, (v) the process of setting goals, degree of difficulty, spreads between thresholds, targets and maximum payouts, and ratios of payouts as a fraction of earnings, (vi) the maximum payout levels and caps, (vii) the clawback policy and other compensation-related governance policies, (viii) the retirement program design and (ix) the equity ownership and retention guidelines. These items were assessed in the context of the most significant risks currently facing the Company, to determine if the compensation plans, practices and programs incentivize employees to take undue risks. The committee then took into account controls and procedures that operate to monitor and mitigate against risk. The Chief Human Resources Officer presented the compensation risk committee’s conclusions to the Compensation & Human Resources Committee. These conclusions were also reviewed by the Compensation & Human Resources Committee’s independent compensation consultant, Meridian.

The Compensation & Human Resources Committee reviewed these conclusions through a risk assessment lens. As a result of these reviews, the Company does not believe that the Company’s compensation practices and programs create risks that are reasonably likely to have a material adverse effect on the Company, nor does it believe that the practices and programs are designed to promote undue risk taking.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Audit Committee is charged with monitoring and reviewing issues involving potential conflicts of interest, and reviewing and approving all related person transactions, as defined in applicable SEC rules. Under SEC rules, related persons include any director, executive officer, any nominee for director, any person owning 5% or more of the Company’s Common Stock, and any immediate family members of such persons. In addition, under the Company’s Code of Business Conduct and Code of Ethics, special rules apply to executive officers and directors who engage in conduct that creates an actual, apparent or potential conflict of interest. Before engaging in such conduct, such executive officers and directors must make full disclosure of all the facts and circumstances to the Company’s General Counsel and the Audit Committee Chairman, and obtain the prior written approval of the Audit Committee. All conduct is reviewed in a manner so as to (i) maintain the Company’s credibility in the market, (ii) maintain the independence of the Company’s employees and (iii) see that all business decisions are made solely on the basis of the best interests of the Company and not for personal benefit.

Our director compensation program is designed to compensate ournon-employee directors fairly for work required for a company of our size and scope and to align their interests with the long-term interests of our stockholders. The Compensation & Human Resources Committee annually reviews the form and amount of the compensation of directors for service on the Board and its committees and recommends changes to the Board. As part of its 2019 review, the Compensation & Human Resources Committee reviewed and considered data provided to the Committee by its independent consultant, Meridian, regarding the form and amount of compensation paid tonon-management directors at the companies in Moody’s peer group used by the Compensation & Human Resources Committee for the assessment of executive compensation (as disclosed beginning on page 36 of this

| MOODY’S2020 PROXY STATEMENT | 15 |

Proxy Statement). The comparative analysis included each element of the director pay program: the annual cash retainer, board and committee fees as well as equity awards. This analysis showed that Moody’s director compensation is competitively positioned relative to the median of its peer group. Its equity to cash ratio was found to be similar to the peer group average and, like many of its peers, Moody’s directors are subject to stock holdings requirements (a multiple of the cash retainer). Moody’s does not provideper-meeting fees for board and committee meetings or anynon-chairman committee member fees.

As a result of this review, the Compensation & Human Resources Committee determined that compensation of directors on the Board and its committees is reasonable and appropriate as compared to the board members of peer companies.

The following table sets forth, for the fiscal year ended December 31, 2019, the total compensation of thenon-management members of the Company’s Board of Directors. Mr. McDaniel does not receive any compensation for serving as a Moody’s director. His compensation for his services as Moody’s President and Chief Executive Officer is reflected in the Summary Compensation Table on page 54 of this Proxy Statement.

Name | Year | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||||||

Basil Anderson |

| 2019 | $ | 130,000 | $ | 180,002 |

| — | $ | 310,002 | |||||||||||||||

Jorge Bermudez |

| 2019 |

| 105,000 |

| 180,002 |

| — |

| 285,002 | |||||||||||||||

Thérèse Esperdy (4) |

| 2019 |

| 105,000 |

| 180,054 |

| — |

| 285,054 | |||||||||||||||

Vincent Forlenza |

| 2019 |

| 105,000 |

| 180,002 |

| — |

| 285,002 | |||||||||||||||

Kathryn Hill |

| 2019 |

| 130,000 |

| 180,002 |

| — |

| 310,002 | |||||||||||||||

Henry McKinnell, Jr. |

| 2019 |

| 165,000 |

| 249,955 |

| — |

| 414,955 | |||||||||||||||

Leslie Seidman |

| 2019 |

| 130,000 |

| 180,002 |

| — |

| 310,002 | |||||||||||||||

Bruce Van Saun |

| 2019 |

| 105,000 |

| 180,002 |

| — |

| 285,002 | |||||||||||||||

Gerrit Zalm |

| 2019 |

| 105,000 |

| 180,002 |

| — |

| 285,002 | |||||||||||||||

| (1) | The Company’snon-management directors received an annual cash retainer of $105,000, payable in quarterly installments in 2019. The Chairmen of the Audit Committee, the Governance & Nominating Committee and the Compensation & Human Resources Committee each received an additional annual cash fee of $25,000, also payable in quarterly installments. The Chairman of the Board received an additional annual cash fee of $60,000. There were no separate meeting fees paid in 2019. |

Anon-management director may elect to defer receipt of all or a portion of his or her annual cash retainer until after termination of service on the Company’s Board of Directors. Deferred amounts are credited to an account and receive the rate of return earned by one or more investment options available under the Profit Participation Plan as selected by the director. Upon a change in control of the Company, alump-sum payment will be made to each director of the amount credited to the director’s deferred account on the date of the change in control, and the total amount credited to each director’s deferred account from the date of the change in control until the date such director ceases to be a director, will be paid in alump-sum. |

| (2) | On February 25, 2019, all thennon-management directors, except Dr. McKinnell, received a grant of approximately $180,000 worth of RSUs issued from the 1998 Moody’s CorporationNon-Employee Directors’ Stock Incentive Plan (the “1998 Directors Plan”) which was equal to 1,037 RSUs. Also on February 25, 2019, Dr. McKinnell received a grant of approximately $250,000 worth of RSUs issued from the 1998 Directors Plan that was equal to 1,440 RSUs. The Compensation & Human Resources Committee authorized the grant of RSU awards for February 25, 2019 on December 17, 2018, and the grant was approved subsequently by the Board on December 17, 2018. The grant of RSU awards was effective on February 25, 2019, the fifth trading day following the date of the public dissemination of the Company’s financial results for 2018. On March 1, 2019, Ms Esperdy received a grant of approximately $180,000 worth of RSUs issued from the 1998 Directors Plan, which was equal to 1,027 RSUs. In each case, the number of RSUs based on the award value has been computed in accordance with FASB ASC Topic 718. For additional information on how Moody’s accounts for equity-based compensation, see Note 17 to the financial statements as contained in the Company’s Annual Report on Form10-K filed with the SEC on February 24, 2020. |

| 16 | MOODY’S2020 PROXY STATEMENT |

The aggregate number of stock awards outstanding, including any accrued dividends, as of December 31, 2019 for each individual who served as anon-management director of the Company during 2019 was as follows: |

Name | Number of Shares Underlying Options | Number of Shares of Unvested RSUs | ||||||

Basil Anderson |

| — |

|

| 1,044 |

| ||

Jorge Bermudez (a) |

| — |

|

| 1,037 |

| ||

Thérèse Esperdy |

| — |

|

| 1,034 |

| ||

Vincent Forlenza |

| — |

|

| 1,044 |

| ||

Kathryn Hill (a) |

| — |

|

| 1,037 |

| ||

Henry McKinnell, Jr. |

| — |

|

| 1,450 |

| ||

Leslie Seidman (a) |

| — |

|

| 1,037 |

| ||

Bruce Van Saun |

| — |

|

| 1,044 |

| ||

Gerrit Zalm (a) |

| — |

|

| 1,037 |

| ||

| (a) | Messrs. Bermudez and Zalm and Ms Hill and Ms Seidman did not defer their RSU awards and receive cash dividends upon vesting of the RSUs. |

| (3) | Perquisites and other personal benefits provided to each individual who served as anon-management director in 2019 were, in the aggregate, less than $10,000 per director. Eachnon-management director is reimbursed for travel, meals and hotel expenses incurred in connection with attending meetings of the Company’s Board of Directors or its committees. For the meetings held at the Company’s executive offices, the Company pays for travel for eachnon-management director and one guest of each director, as well as for their accommodations, meals, Company-arranged activities and other incidental expenses. |

| (4) | Ms Esperdy commenced service as a director on March 1, 2019. |

STOCK OWNERSHIP GUIDELINES FORNON-MANAGEMENT DIRECTORS

Moody’s has adopted stock ownership guidelines for its executives, including the named executive officers and itsnon-management directors, encouraging them to acquire and maintain a meaningful stake in the Company. Moody’s believes that these guidelines encourage its executive officers andnon-management directors to act as owners, thereby better aligning their interests with those of the Company’s stockholders.

| • | The guidelines are intended to ensure an ownership level sufficient to assure stockholders of each director’s commitment to value creation, while satisfying an individual’s need for portfolio diversification. |

| • | Non-management directors are expected, within five years, to acquire and hold shares of the Company’s Common Stock equal in value to five times the annual cash retainer. |

| • | Restricted shares, RSUs and shares owned by immediate family members or through the Company’stax-qualified savings and retirement plans count toward satisfying the guidelines. |

| • | Stock options, whether vested or unvested, do not count toward satisfying the guidelines. |

As of December 31, 2019, each of the directors serving on that date was in compliance with the guidelines.

1998 MOODY’S CORPORATIONNON-EMPLOYEE DIRECTORS’ STOCK INCENTIVE PLAN