UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [x] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to §240.14a-12. |

LMI AEROSPACE, INC.

(Name of Registrant as Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

LMI Aerospace, Inc.

3600 Mueller Road

St. Charles, Missouri 63301

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on July 7, 2005

TO OUR SHAREHOLDERS:

The 2005Annual Meetingof Shareholders (the “Annual Meeting”) of LMI Aerospace, Inc., a Missouri corporation (the“Company”), will be held at the Four Points Sheraton, 3400 Rider Trail South, St. Louis, Missouri 63045, beginning at 10:00 a.m. local time on Thursday, July 7, 2005 for the following purposes:

| 1. | to elect one Class I Director for a term expiring in 2008 or until his successor is elected and qualified; |

| 2. | to ratify the selection of BDO Seidman, LLP to serve as the Company’s independent registered public accounting firm; |

| 3. | to approve the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan; and |

| 4. | to transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on May 27, 2005 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. A list of all shareholders entitled to vote at the Annual Meeting, arranged in alphabetical order and showing the address of and number of shares registered in the name of each shareholder, will be open during usual business hours for the examination by any shareholder for any purpose germane to the Annual Meeting for ten days prior to the Annual Meeting at the office of the Company set forth above.

A copy of the Company’s annual report for its fiscal year ended December 31, 2004, accompanies this notice.

| | By Order of the Board of Directors, |

| | |

| | LAWRENCE E. DICKINSON |

| | Secretary |

St. Charles, Missouri

June 3, 2005

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE ANNUAL MEETING, PLEASE MARK, SIGN, DATE AND RETURN YOUR PROXY IN THE ENCLOSED POSTAGE PREPAID ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AND VOTED AT THE MEETING ACCORDING TO YOUR WISHES. YOUR PROXY WILL NOT BE USED IF YOU ATTEND AND VOTE AT THE MEETING IN PERSON.

LMI Aerospace, Inc.

3600 Mueller Road

St. Charles, Missouri 63301

PROXY STATEMENT

SOLICITATION OF PROXIES

The enclosed proxy is solicited by the Board of Directors of LMI Aerospace, Inc. (the “Company”) to be voted at the 2005 Annual Meeting of Shareholders (the “Annual Meeting”) of the Company to be held at the Four Points Sheraton, 3400 Rider Trail South, St. Louis, Missouri 63045, beginning at 10:00 a.m. local time on Thursday, July 7, 2005, or at any adjournment thereof. The accompanying Notice of Annual Meeting, this Proxy Statement and the enclosed form of proxy are first being mailed or given to shareholders on or about June 3, 2005. Whether or not you expect to attend the meeting in person, please return your executed proxy in the enclosed envelope, and the shares represented thereby will be voted in accordance with your wishes.

Solicitation of proxies is being made by the Company and will be made primarily by mail. In addition to solicitation by mail, officers, directors and employees of the Company may solicit personally, by mail or telephone if proxies are not promptly received. The cost of solicitation will be borne by the Company and will include reimbursement paid to banks, brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses of forwarding solicitation materials to the beneficial owners of the Company’s common stock.

REVOCATION OF PROXY

If, after sending in your proxy, you decide to vote in person or desire to revoke your proxy for any other reason, you may do so by notifying the Secretary of the Company, Lawrence E. Dickinson, in writing at the principal office of the Company of such revocation at any time prior to the voting of the proxy. A properly executed proxy with a later date will also revoke a previously furnished proxy.

RECORD DATE

Only shareholders of record at the close of business on May 27, 2005 will be entitled to vote at the Annual Meeting or any adjournment thereof.

ACTIONS TO BE TAKEN UNDER PROXY

Unless otherwise directed by the giver of the proxy, the persons named in the enclosed form of proxy, that is, Ronald S. Saks, or, if unable or unwilling to serve, Lawrence E. Dickinson, will vote:

| 1. | FOR the election of the person named herein as a nominee for Class I Director of the Company, for a term expiring at the 2008 Annual Meeting of Shareholders or until his successor has been duly elected and qualified; |

| 2. | FOR the ratification of the engagement of BDO Seidman, LLP as the Company’s independent registered public accounting firm; |

| 3. | FOR the approval of the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan; and |

| 4. | According to such person’s judgment on the transaction of such other business as may properly come before the meeting or any adjournment thereof. |

Should the nominees named herein for election as directors become unavailable for any reason, it is intended that the persons named in the proxy will vote for the election of such other person in his stead as may be designated by the Board of Directors. The Board of Directors is not aware of any reason that might cause a nominee to be unavailable to serve.

VOTING SECURITIES AND VOTING RIGHTS

On May 17, 2005, there were outstanding 8,329,265 shares of Common Stock, par value $0.02 per share, each of which is entitled to one vote on all matters submitted, including the election of directors.

A majority of the outstanding shares present or represented by proxy will constitute a quorum at the meeting. The affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote is required to elect a person nominated for director. Shares present at the meeting but which abstain or are represented by proxies which are marked "WITHHOLD AUTHORITY'' with respect to the election of a person to serve on the Board of Directors will be considered in determining whether the requisite number of affirmative votes are cast on such matter. Accordingly, such proxies will have the same effect as a vote against the nominee as to which such abstention or direction applies. Shares not present at the meeting will not affect the election of a director. Broker non-votes will not be treated as shares represented at the meeting with respect to the election of a director and, therefore, will have no effect.

The vote required for the approval of each of Proposal 2—Ratification of Appointment of Independent Registered Public Accounting Firm and Proposal 3 - Approval of the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan will be the affirmative vote of the majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. Shares present at the meeting which abstain (including proxies which deny discretionary authority on any matters properly brought before the meeting) will be counted as shares present and entitled to vote and will have the same effect as a vote against any such matter. Shares not present at the meeting will not effect the outcome as to any such matter. Broker non-votes will not be treated as shares represented at the meeting as to such matter voted on and, therefore, will have no effect.

Votes will be counted by duly appointed inspectors of election, whose responsibilities are to ascertain the number of shares outstanding and the voting power of each, determine the number of shares represented at the meeting and the validity of proxies and ballots, count all votes and report the results to the Company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information as of April 25, 2005 with respect to each person known by the Company to be the beneficial owner of more than five percent of its outstanding shares of Common Stock. This table is based on Schedules 13G and Section 16 filings filed with the Securities and Exchange Commission as well as other information delivered to or obtained by the Company.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class |

| | | |

Ronald S. Saks 3600 Mueller Road St. Charles, Missouri 63301 | 3,065,750 (2) | 36.3% |

| | | |

Joseph and Geraldine Burstein 3600 Mueller Road St. Charles, Missouri 63301 | 614,296 (3) | 7.3% |

| (1) | Reflects the number of shares outstanding on April 25, 2005, and, with respect to each person, assumes the exercise of all stock options held by such person that are exercisable currently or within 60 days of the date of this proxy statement (such options being referred to hereinafter as "currently exercisable options"). |

| (2) | Includes 648,015 shares held of record by Mr. Saks, trustee of the LMI Aerospace, Inc. Profit Sharing and Savings Plan and Trust, for the benefit of certain executive officers and employees of the Company. Of those 648,015 shares, 172,074 shares are held for the benefit of certain executive officers, including 108,358 shares held for the benefit of Mr. Saks. Such executive officers and employees maintaindispositive power only over such shares.Also included are 2,417,735shares of Common Stock deemed beneficially owned by Mr. Saksand held of record by the Ronald S. Saks Revocable Trust U/T/A dated June 21, 1991, of which Mr. Saks, as trustee, maintains voting and investment authority. Mr. Saks reported sole voting power of3,065,750 shares; no shared voting power; sole dispositive power of2,526,093 shares; and no shared dispositive power. |

| (3) | Includes 599,296 shares of Common Stock reported are held of record by the Joseph Burstein Revocable Trust U/T/A dated August 20, 1983, for which Mr. and Mrs. Burstein, as co-trustees, share voting anddispositive power. Includes 15,000 shares issuable upon the exercise of currently exercisable options to purchase such shares held by Mr. Burstein. Mr. and Mrs. Burstein reported no sole voting power; shared voting power of all599,296 shares; no sole dispositive power; and shared dispositive power of all599,296 shares. |

SECURITY OWNERSHIP OF MANAGEMENT

Under regulations of the Securities and Exchange Commission, persons who have power to vote or to dispose of our shares, either alone or jointly with others, are deemed to be beneficial owners of those shares. The following table sets forth, as of April 25, 2005, the beneficial ownership of the outstanding Common Stock of each current director (including the nominees for election as directors), each of the Named Executive Officers named in the Summary Compensation Table set forth herein and the executive officers and directors as a group.

Name of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Class |

| Ronald S. Saks | 3,065,750 (2) | 36.3% |

| Joseph Burstein | 614,296 (3) | 7.3% |

| Sanford S. Neuman | 313,440 (4) | 3.7% |

| Duane E. Hahn | 281,874 (5) | 3.3% |

| Brian D. Geary | 102,000 (6) | 1.2% |

| Thomas G. Unger | 17,000 (7) | * |

| John M. Roeder | 3,000 (8) | * |

| Paul L. Miller, Jr. | 3,000 (9) | * |

| Robert T. Grah | 75,729 (10) | * |

| Lawrence E. Dickinson | 65,204 (11) | * |

| Michael J. Biffignani | 10,119 (12) | * |

| Brian P. Olsen | 11,250 (13) | * |

| | | |

All directors & executive officers as a group (12 in group) | 4,544,320 (14) | 53.2% |

* Less than 1%.

| (1) | Reflects the number of shares outstanding on April 25, 2005, and with respect to each person, assumes the exercise of all stock options held by such person that are exercisable currently or within 60 days of the date of this proxy statement (such options being referred to hereinafter as “currently exercisable options”). |

| (2) | See Note (2) to the table “Security Ownership of Certain Beneficial Owners.” |

| (3) | See Note (3) to the table “Security Ownership of Certain Beneficial Owners.” |

| (4) | Includes 282,940 shares held of record by a revocable trust of which Mr. Neuman, as trustee, has voting and investment power, and 15,500 shares held by certain trusts of which Mr. Neuman, as trustee, has voting and investment power. Also includes 15,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (5) | Includes 274 shares of Common Stock held of record by Mr. Saks, as trustee of the Company’s Profit Sharing Plan for the benefit of Mr. Hahn, over which Mr. Hahn maintains investment power only. Also includes 7,500 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (6) | Includes 12,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (7) | Includes 15,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (8) | Includes 3,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (9) | Includes 3,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (10) | Includes 17,024 shares of Common Stock held of record by Mr. Saks as trustee of the Company’s Profit Sharing Plan for the benefit of Mr. Grah, over which Mr. Grah maintains investment power only. Also includes 27,450 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (11) | Includes 46,299 shares of Common Stock held of record by Mr. Saks as trustee of the Company’s Profit Sharing Plan for the benefit of Mr. Dickinson, over which Mr. Dickinson maintains investment power only, and 2,200 shares of Common Stock directly or indirectly owned by Mr. Dickinson’s children, who might be deemed to maintain a principal residence at Mr. Dickinson’s residence. Mr. Dickinson has disclaimed beneficial ownership of such shares. Also includes 7,500 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (12) | Includes 119 shares of Common Stock held of record by Mr. Saks as trustee of the Company’s Profit Sharing Plan for the benefit of Mr. Biffignani, over which Mr. Biffignani maintains investment power only. Also includes 10,000 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (13) | Includes 11,250 shares of Common Stock issuable upon the exercise of currently exercisable options to purchase such shares. |

| (14) | Includes56,200 shares subject to currently exercisable options held by non-director executives of the Company and 70,500 shares subject to currently exercisable options held by directors of the Company. |

PROPOSAL 1 - ELECTION OF DIRECTORS

INFORMATION ABOUT THE NOMINEES AND CURRENT DIRECTORS

The Company's Restated Articles of Incorporation, as amended, and Amended and Restated By-laws provide for a division of the Board of Directors into three classes. One of the classes is elected each year to serve a three-year term. The terms of the current Class I Director expires at the Annual Meeting.

The Company’s Amended and Restated By-Laws currently specify that the number of directors shall be not less than three (3) nor more than nine (9), subject to amendment by the Board of Directors.

Duane E. Hahn, a current director of the Company, has notified the Company that he will not be standing for reelection, thereby creatingone (1) vacancy for a Class I Director on the Board of Directors following the Annual Meeting. As of the Annual Meeting, there are two (2) vacancies for Class I Directors on the Board of Directors, and the number of directors is seven (7).The Company's By-laws provide that vacancies on the Board of Directors may be filled by the remaining members of the Board of Directors.Although the Board intends to fill both vacancies, no persons have yet been selected, and it is not expected that such vacancies will be filled until after the Annual Meeting. Proxies solicited by the Company for the election of directors cannot be voted for a greater number of persons than the number of nominees named in the proxy.

The following table sets forth for each director, such director's age, principal occupation for at least the last five years, present position with the Company, the year in which such director was first elected or appointed a director (each serving continuously since first elected or appointed), directorships with other companies whose securities are registered with the Securities and Exchange Commission, and the class of such director.

Class I: To be elected to serve as Director until 2008

Name | Age | Principal Occupation | Service as Director Since |

Sanford S. Neuman | 69 | Assistant Secretary of the Company; Chairman of the law firm, Gallop, Johnson & Neuman, L.C. since March 31, 2005; Managing Member of Gallop, Johnson & Neuman, L.C. from May 2000 to March 31, 2005; Member of Gallop, Johnson & Neuman, L.C. for more than the last five years. | 1984 |

Class II: To continue to serve as Director until 2006

Name | Age | Principal Occupation | Service as Director Since |

Thomas G. Unger | 56 | Director of Fife Fabrication, Inc., a manufacturer of sheet metal parts and assemblies, since early 1998; prior thereto, Chief Executive Officer of Tyee Aircraft since 1982. | 1999 |

| | | | |

| | | | |

John M. Roeder | 62 | Financial consultant since 2001; prior thereto, Office Managing Partner, Arthur Andersen, an international accounting firm, until 1999. Mr. Roeder is also the Director in Residence at The Institute for Excellence in Corporate Governance of The University of Texas at Dallas - School of Management. Mr. Roeder is a member of the board of directors and the audit committee of Fiduciary/Claymore MLP Opportunity Fund and Fiduciary/Claymore Dynamic Equity Fund, which are traded on the New York Stock Exchange. | 2003 |

Paul L. Miller, Jr. | 62 | President and Chief Executive Officer of P. L. Miller & Associates, a management consulting firm which specializes in strategic and financial planning for privately held companies and distressed businesses and in international business development. He is also a principal in Stewart, Miller, and Associates, a financial advisory firm for small to middle market companies. Mr. Miller has served as president of an international subsidiary of an investment banking firm and, for over 20 years, was president of consumer product manufacturing and distribution firms. Mr. Miller is also a director of Ameren Corp., which is traded on the New York Stock Exchange. As of May 6, 2005, Mr. Miller became Chairman of the Board and President of Kennedy Capital Management, Inc. | 2003 |

Class III: To continue to serve as Director until 2007

Name | Age | Principal Occupation | Service as Director Since |

Ronald S. Saks | 61 | Chief Executive Officer and President since 1984. | 1984 |

Joseph Burstein | 76 | Chairman of the Board of Directors of the Company since 1984. | 1984 |

Brian D. Geary | 49 | Director of the Company since June 3, 2002; prior thereto, President of Versaform Corporation since July, 1978. | 2002 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE CLASS I DIRECTOR.

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND COMMITTEES

Determination of Director Independence

Rules of the Nasdaq Stock Market require that a majority of the Board of Directors be “independent,” as defined in Nasdaq Marketplace Rule 4200(a)(15). Under the Nasdaq rule, a director is independent if he or she is not an officer or employee of the Company and does not have any relationship with the Company which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. On March 25, 2004, the Board of Directors reviewed the independence of its directors under the new Nasdaq rules. During this review, the Board of Directors considered transactions and relationships between each director or any member of his or her family and the Company. The Board of Directors determined that Messrs. Unger, Burstein, Miller, Roeder and Neuman are independent under Nasdaq Rule 4200(a)(15).

Board of Directors and Committee Meetings; Annual Meetings; Corporate Governance

During the fiscal year that ended on December 31, 2004, the Board of Directors held four regular meetings and three special meetings. Each director attended in person or by phone 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors held during that portion of the 2004 fiscal year during which he was a director and (ii) the total number of meetings held during the period by all committees of the Board of Directors on which he served during that portion of the 2004 fiscal year during which he served.

The Company has no policy with regard to directors’ attendance at annual meetings, but all of the Company’s directors attended the 2004 annual meeting, either in person or by telephone.

The Board of Directors has two standing committees, the Audit Committee and the Compensation Committee. Each of these committees is comprised solely of independent directors in accordance with the Nasdaq Stock Market Listing Qualifications. The Board of Directors has adopted a written Charter for each committee, each of which is available on the Company’s website,http://www.lmiaerospace.com, and can be obtained free of charge by written request to the attention of the Secretary of the Company at the address appearing on the first page of this Proxy Statement or by telephone at(636) 946-6525.

Audit Committee

The Audit Committee is currently comprised of Messrs. Unger (Chairman), Burstein, Roeder and Miller, each of whom is “independent” in accordance with the standards prescribed by the Nasdaq Stock Market as well as the independence requirements for audit committee members under Rule 10A-3 promulgated under the Securities Exchange Act of 1934. In addition, the Board of Directors has determined that Mr. Unger is qualified as an “audit committee financial expert” as that term is defined in the rules of the Securities and Exchange Commission. The Audit Committee evaluates significant matters relating to the audit and internal controls of the Company and reviews the scope and results of the audits conducted by the Company’s independent public accountants and performs the other functions or duties provided in the Audit Committee Charter. During the 2004 fiscal year, the Audit Committee met five times. In addition, the Chairman of the Audit Committee meets with management and the Company’s independent auditors on a quarterly basis in order to review the Company’s financial statements prior to their release. The Audit Committee has adopted a complaint monitoring procedure to enable confidential and anonymous reporting to the Audit Committee of concerns regarding, among other things, questionable or other accounting matters.

Compensation Committee

The Compensation Committee is currently comprised of Messrs. Neuman (Chairman), Roeder, and Miller. The Board of Directors has determined that each member of the Compensation Committee is independent as defined by the Nasdaq Stock Market. The Compensation Committee reviews the Company’s remuneration policies and practices, including executive compensation, and administers the Company’s stock option plans. During the 2004 fiscal year, the Compensation Committee met three times.

Nomination of Directors

The Board of Directors does not currently have a standing Nominating Committee or a charter regarding the nominating process. Pursuant to the rules of the Nasdaq Stock Market, the Board of Directors has delegated to the independent members of the Board of Directors the authority to identify, evaluate and recommend qualified nominees for election or appointment to the Company’s Board of Directors. The vote of a majority of the independent directors of the Board of Directors is required to approve a nominee for recommendation to the Board of Directors. There currently exists one (1) vacancy for a Class I Director on the Board of Directors.

The independent members of the Board of Directors will give appropriate consideration to written recommendations from shareholders regarding the nomination of qualified persons to serve as directors of the Company, provided that such recommendations contain sufficient information regarding proposed nominees so as to permit the independent members of the Board of Directors to properly evaluate each nominee’s qualifications to serve as a director. Nominations must be addressed to the Secretary of the Company at its address appearing on the first page of this Proxy Statement. The independent members of the Board of Directors may also conduct their own search for potential candidates that may include candidates identified directly by a variety of means as deemed appropriate by the independent directors.

The Board of Directors has adopted a set of corporate governance guidelines establishing general principles with respect to, among other things, director qualifications and responsibility. These guidelines establish certain criteria, experience and skills requirements for potential candidates. There are no established term limits for service as a director of the Company. In general, it is expected that each director of the Company will have the highest personal and professional ethics, integrity and values and will consistently exercise sound and objective business judgment. In addition, it is expected that the Board of Directors as a whole will be made up of individuals with significant senior management and leadership experience, a long-term and strategic perspective and the ability to advance constructive debate. The Company’s Corporate Governance Guidelines are available on its website,http://www.lmiaerospace.com, and can be obtained free of charge by written request to the attention of the Secretary of the Company at the address appearing on the first page of this Proxy Statement or by telephone at (636) 946-6525.

Code of Business Conduct and Ethics

All directors, officers and employees of the Company, including its Chief Executive Officer and its Chief Financial Officer, are required to comply with the Company’s Code of Business Conduct and Ethics to ensure that the Company’s business is conducted in a legal and ethical manner. The Code of Business Conduct and Ethics covers all areas of business conduct, including employment policies and practices, conflict of interest and the protection of confidential information, as well as strict adherence to all laws and regulations applicable to the conduct of our business. Directors, officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of our Code of Business Conduct and Ethics. The Company, through the Audit Committee, has procedures in place to receive, retain and treat complaints received regarding accounting, internal accounting control or auditing matters and to allow for the confidential and anonymous submission of concerns regarding questionable accounting or auditing matters. The Company’s Code of Business Conduct and Ethics can be found on its website,http://www.lmiaerospace.com, and can be obtained free of charge by written request to the attention of the Secretary of the Company at the address appearing on the first page of this Proxy Statement or by telephone at (636) 946-6525.

Director’s Compensation

In 2004, the Company paid to each director who is not an employee of the Company $3,000 for each full day Board of Directors meeting attended and$750 for each committee meeting attended and reimbursed all directors for out-of-pocket expenses incurred in connection with their attendance at Board of Directors and committee meetings. No director who is an employee of the Company received compensation for services rendered as a director.

The Company also maintains the Amended and Restated LMI Aerospace, Inc. 1998 Stock Option Plan, which provides for an automatic annual grant to the Company’s non-employee directors of non-qualified stock options to purchase 3,000 shares of the Company’s Common Stock. Such options are granted on the date of the Company’s Annual Meeting of Shareholders, with each option having an exerciseprice equal to the fair market value of the Company’s common stock on the date of grant.The options granted to non-employee directors pursuant to the plan are immediately exercisable for a period ending on the earlier of the tenth anniversary of the date of grant or the termination of an optionee’s status as a director of the Company; provided, however, that if a director’s termination is the result of the death or disability of the director, the director, or his personal representative, has the right to exercise such options for a twelve month period following such termination.

During 2005, the Board of Directors approved a change to the compensation plan followed in recent years. Beginning in 2005, all non-employee directors will be paid a retainer of $24,000 to cover all meetings and committee affiliations. Additionally, if the shareholders vote to approve the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan at the Annual Meeting, the Company will cease issuing options to purchase common stock to the non-employee directors and, commencing at theAnnualMeeting of the Company’s shareholders (subject to the registration of the shares of the Company’s Common Stock issuable under theLMI Aerospace, Inc. 2005 Long-Term Incentive Plan), will award 3,000 shares of restricted Common Stock at each annual meeting of the Company’s shareholders. The restricted shares will vest (and the restrictions lapse) over three years but are not eligible for sale until they are vested.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table reflects compensation paid or payable for fiscal years 2004, 2003 and 2002 with respect to the Company's Chief Executive Officer and each of the four most highly compensated executive officers, whose 2004 salaries and bonuses combined exceeded $100,000 in each instance (together the “Named Executive Officers”).

| | | Annual Compensation | Long Term Compensation | |

| | | | | | Awards | Payouts | |

Name and Principal Position | Year | Salary ($)(1) | Bonus ($) | Other Annual Compen- sation | Restricted Stock Award(s) ($) | Securities Underlying Options / SARs (#) | LTIP Payouts ($) | All Other Compen- sation ($) |

Ronald S. Saks................ President and CEO | 2004 | 240,000 | 55,784 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 240,000 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2002 | 240,200 | 0 | 0 | 0 | 0 | 0 | 0 |

Robert T. Grah................ Vice President, Central Operations | 2004 | 179,569 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 175,675 | 3,328 | 0 | 0 | 0 | 0 | 0 |

| 2002 | 140,425 | 3,639 | 0 | 0 | 0 | 0 | 0 |

Brian P. Olsen (2) Vice President, Western Operation | 2004 | 180,000 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 169,000 | 0 | 0 | 0 | 7,500 | 0 | 0 |

| 2002 | 0 | 0 | 0 | 0 | 7,500 | 0 | 0 |

Lawrence E. Dickinson Chief Financial Officer | 2004 | 133,954 | 35,000 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 130,675 | 3,064 | 0 | 0 | 0 | 0 | 0 |

| 2002 | 125,675 | 0 | 0 | 0 | 0 | 0 | 0 |

Michael J. Biffignani Chief Information Officer | 2004 | 157,342 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2003 | 155,675 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2002 | 150,425 | 0 | 0 | 0 | 0 | 0 | 0 |

| (1) | Includes cash and Common Stock contributed to the Company’s profit sharing and 401(k) plan. |

| (2) | Mr. Olsen joined the Company in December 2002 as a Market Sector Director. Mr. Olsen was appointed Vice President, Western Operations in October 2003. |

Option/SAR Grants in Last Fiscal Year

There were no grants of stock options pursuant to the Company’s Amended and Restated 1998 Stock Option Plan to any of the Named Executive Officers during the year ended December 31, 2004. No stock appreciation rights were granted to the Named Executive Officers during such year.

Aggregated Option/SAR Exercises in the Last Fiscal Year

and Fiscal Year-End Option/SAR Values

The following table sets forth certain information concerning option exercises and option holdings for the year ended December 31, 2004 with respect to each of the Named Executive Officers. There were no exercises of options by the Named Executive Officers for the year ended December 31, 2004. Ronald S. Saks, the Company’s Chief Executive Officer, does not hold any stock options. No stock appreciation rights were exercised by the Named Executive Officers during 2004, nor did any Named Officer hold any stock appreciation rights at the end of 2004.

Name (a) | Shares Acquired On Exercise (#) (b) | Value Realized ($) (c) | Number of Securities Underlying Unexercised Options/SARs At Fiscal Year-End (#) Exercisable/ Unexercisable (d) | Value of Unexercised In- The-Money Options/SARs At Fiscal Year- End ($) Exercisable/ Unexercisable (1) (e) |

Brian P. Olsen | 0 | 0 | 9,375/5,625 | 31,538/18,938 |

Robert T. Grah | 0 | 0 | 27,450/0 | 74,100/0 |

Lawrence E. Dickinson | 0 | 0 | 7,500/0 | 22,575/0 |

Michael J. Biffignani | 5,000 | 15,375 | 10,000/0 | 0/0 |

| (1) | The monetary value used in this calculation is $5.41 per share, the fair market value of the stock as of December 31, 2004. |

Employment Arrangements with Named Executive Officers

During 2004, the Company was party to employment agreements with the following executive officers: (i) Ronald S. Saks, Chief Executive Officer; (ii) Brian P. Olsen, Vice President Western Operations, (iii) Robert T. Grah, Vice President Central Region; (iv) Lawrence E. Dickinson, Chief Financial Officer and (v) Michael J. Biffignani, Chief Information Officer.

Mr. Saks’ employment agreement provides for an initial term of employment that commenced as of January 1, 2004 and expires on December 31, 2005. By its terms, the employment agreement automatically renews for additional one-year periods, unless terminated by either Mr. Saks or the Company by October 31 of the then current term beginning in 2005. Mr. Saks’ employment agreement provides for an annual base salary of $240,000 for calendar year 2004 and $258,000 for calendar year 2005. The agreement provides for a performance bonus of 1.5% of the Company’s annual net income that is between $2,000,000 and $8,000,000. Mr. Saks’ total benefit possible under all performance or production incentive programs of the Company under which Mr. Saks may be entitled to a bonus will not exceed $90,000.

The new employment agreements for Messrs. Grah and Olsen provide for initial terms of employment that commenced as of January 1, 2004 and expire on December 31, 2005. By their terms, the employment agreements automatically renew for additional one-year periods, unless terminated by either Messrs. Grah or Olsen, respectively, or the Company by October 31 of the then current term beginning in 2005. The employment agreements provide for annual base salaries for each of Messrs. Grah and Olsen of $175,000 in 2004 and $190,000 thereafter, payable in equal monthly installments. Each of the agreements provides for a performance bonus of 1.0% of the Company’s annual net income that is between $1,000,000 and $1,999,999.99 plus 1.25% of the Company’s net income that is between $2,000,000 and $8,000,000. The total benefit possible under all performance or production incentive programs of the Company under which Messrs. Grah and Olsen may be entitled to a bonus will not exceed $85,000 each.

The employment agreement for Mr. Dickinson provides for a term of employment that commenced as of January 1, 2004 and will expire on December 31, 2005. By its terms, the employment agreement automatically renews for additional one-year periods, unless terminated by either Mr. Dickinson or the Company by October 31, 2005. The employment agreement provides for annual base salary of $133,279 in 2004 and $175,779 in 2005, payable in equal monthly installments. The agreement provides for a performance bonus of 0.7% of the Company’s annual net income that is between $1,000,000 and $1,999,999.99 plus 1.0% of the Company’s net income that is between $2,000,000 and $8,000,000. The total benefit possible under all performance or production incentive programs of the Company under which Mr. Dickinson may be entitled to a bonus will not exceed $67,000.

The employment agreement for Mr. Biffignani provides for an initial one year term expiring on December 31, 2005 and for automatic one-year renewals, unless terminated by either Mr. Biffignani or the Company by October 31 of the year in question. The employment agreement provides for annual base salary of $155,000 in 2004 and $165,000 in 2005, payable in equal monthly installments. The agreement provides for a performance bonus of 0.7% of the Company’s annual net income that is between $1,000,000 and $1,999,999.99 plus 1.0% of the Company’s net income that is between $2,000,000 and $8,000,000. The total benefit possible under all performance or production incentive programs of the Company under which Mr. Biffignani may be entitled to a bonus will not exceed $67,000.

The employment agreements between the Company and each of Messrs. Saks, Grah, Olsen Dickinson and Biffignani may be terminated upon: (i) the dissolution of the Company, (ii) the death or permanent disability of the employee, (iii) ten days written notice by the Company upon breach or default of the terms of the agreement by the employee, (iv) the employee’s unsatisfactory performance of his duties under the agreement, or (v) by the employee upon 30 days written notice to the Company. The employment agreements also permit the Company to terminate the employee’s employment following an act of misconduct.

Messrs. Saks, Grah and Dickinson were each party to an assignment of benefits agreement with the Company in connection with certain life insurance policies, commonly known as “split-dollar” agreements, whereby, historically, the Company shared the cost of such insurance policies. Under the Sarbanes-Oxley Act of 2002, however, such split-dollar agreements may be construed as loans by the Company to executive officers. To satisfy this apparent loan prohibition under Sarbanes-Oxley, the Company and Messrs. Saks, Grah and Dickinson elected to terminate the benefits agreements in December 2003, and Messrs. Saks, Grah and Dickinson have paid to the Company its portion of the benefit assignment accrued to date. As a result of the termination of the benefits agreements, the Company chose tomake bonus payments to Messrs. Grah and Dickinson of $3,328 and $3,064, respectively, in 2003 and to Mr. Saks of $55,748 in 2004. Mr. Saks will also be paid a bonus of $32,000 during 2005 in respect of the termination of these benefits agreements. Additionally, the Company has increased the annual compensation of Messrs. Grah and Dickinson by $3,894 and $3,954, respectively, beginning in 2004 and of Mr. Saks by $24,000 beginning April 1, 2005.

Compensation Committee Interlocks and Insider Participation

During the 2004 fiscal year, Sanford S. Neuman, Paul L. Miller, Jr. and John M. Roeder served on the Compensation Committee. Mr. Neuman is the Chairman and a Member of the law firm Gallop, Johnson & Neuman, L.C., which has provided legal services to the Company in prior years and is expected to provide legal services to the Company in the future. The Nasdaq rules require that the Compensation Committee be comprised solely of independent directors, as defined by Nasdaq Rule 4200. In compliance with these new Nasdaq rules, the Board of Directors has determined that Mr. Neuman is an independent director, and he, therefore, continues to serve on the Compensation Committee.

REPORT OF COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is responsible for recommending to the Board of Directors a compensation package and specific compensation levels for executive officers of the Company. In addition, the Committee establishes and administers the award of stock options under the LMI Aerospace, Inc. 1998 Stock Option Plan. If the shareholders approve the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan, the Committee will also establish and administer awards under such plan.

Compensation Policies

The Company’s executive compensation program is designed to provide a compensation package that attracts and retains quality executive officers, while at the same time aligning the interests of the Company’s executive officers with those of the Company’s shareholders. The Compensation Committee has identified two primary compensation policies that it follows in setting compensation levels for its executive officers: (i) the establishment of compensation levels that are competitive with those of similarly situated manufacturers and (ii) the linking of executive compensation levels to the financial performance of the Company.

Given these policies, the Compensation Committee has developed an overall compensation plan that provides the Company’s executive officers with competitive base salary compensation and with the opportunity to earn additional cash compensation based upon the Company’s achievement of certain specified annual income targets. In addition, the Company has awarded stock options and, if the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan is approved, will award restricted stock and may make other awards to executive officers in an effort to increase executive stock ownership in order to drive long-term growth in value for all of the Company’s shareholders. The Company’s compensation strategy seeks to place a portion of an executive’s compensation package at risk, thereby motivating these individuals to execute the tactics necessary to ensure continued growth, profitability and shareholder value.

Base Salary

Base salaries for the Company’s executive officers are based upon recommendations by the Company’s Chief Executive Officer and a review of additional factors, including the officer’s position and responsibilities, tenure and seniority and experience generally. In addition, the Compensation Committee has in the past compiled data for similarly situated manufacturers in order to determine a competitive baseline for compensating the Company’s executive officers. Because the Compensation Committee believes that the Company may compete with companies outside of the Company’s industry in hiring and retaining qualified executive-level personnel, the Compensation Committee will generally look at the compensation levels paid to executives outside of those companies which are included in the S & P Small Cap Aerospace/Defense Index, included as part of the Performance Graph to this Proxy Statement. The base level of the Company’s executive compensation is generally targeted below the mid-point of this comparative group.

Generally, the compensation levels of each of the Company’s executive officers have been fixed pursuant to the terms of the Company’s employment agreements entered into between the Company and each of its executive officers. As of December 31, 2003, each employment agreement with an executive officer, to which the Company was a party, was terminated in accordance with its terms. In 2004,theCompany executed new employment agreements with Messrs. Saks, Olsen, Grah and Biffignani. Subsequently, the Company entered into a new employment agreement with Mr. Dickinson and recently entered into an amended and restated employment agreement with Mr. Saks.

Bonus

In 2004, certain of the Company’s executive officers had the ability to earn a performance bonus based on the Company’s achievement of certain specified income goals. Because the specified income goals were not achieved, no performance bonuses were earned in 2004.

The Board of Directors reserves the right to grant additional bonus compensation to executive officers under extraordinary circumstances. In 2004, Mr. Saks was awarded a discretionary bonus of $55,784 for payments on certain life insurance policies issued in conjunction with assignment of benefits agreements with the Company. Additionally, in 2004, Mr. Dickinson was awarded a bonus of $35,000 in conjunction with the execution of his employment agreement.

Stock Options

The Company has attempted to provide its employees with incentives in order to maximize the Company’s financial performance and to align employee interests with those of the Company’s shareholders. In determining whether to grant its officers stock options and in what amounts, the Compensation Committee may consider a variety of factors it deems appropriate, including the officer’s position and responsibilities, tenure and seniority, experience generally and, contribution to the Company as well as the Company’s past history with respect to granting options (e.g., the number of outstanding options and the number of options previously issued to an executive officer). The Compensation Committee takes into account the recommendations of the Company’s Chief Executive Officer in determining whether and in what amounts to issue stock options.

During 2004 the Company did not grant any stock options to its executive officers, including the Company’s Chief Executive Officer. The Company determined that due to the number of options already held by its executive officers, additional grants of options were not necessary in order to help promote the Company’s goal of aligning executive and shareholder interests.

Chief Executive Officer Compensation

The Company and its Chief Executive Officer and President, Ronald S. Saks, recently entered into an employment agreement effective as of January 1, 2004. In its consideration of the employment agreement, the Compensation Committee reviewed compensation packages for presidents and chief executive officers of peer companies, the performance of the Common Stock of the Company, given the significant ownership Mr. Saks has in the Company, and the financial performance of the Company. Mr. Saks’ base salary under the new employment agreementwas$240,000 per annum in 2004 and is $258,000 in 2005.

| | Respectfully submitted, |

| | |

| | COMPENSATION COMMITTEE OF THE |

| | BOARD OF DIRECTORS OF |

| | LMI AEROSPACE, INC. |

| | |

| | Sanford S. Neuman,Chairman |

| | Paul L. Miller, Jr.,Member |

| | John M. Roeder,Member |

Notwithstanding anything set forth in any of our previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the preceding report shall not be deemed incorporated by reference in any such filings.

AUDIT COMMITTEE REPORT

The responsibilities of the Audit Committee are provided in its Charter, which has been approved by the Board of Directors of the Company. The Audit Committee Charter was most recently revised and approved by the Board of Directors on April 29, 2004. A copy of the Charter was attached to the 2004 Proxy Statement asAttachment A.

In fulfilling its oversight responsibilities with respect to the December 31, 2004 financial statements, the Audit Committee, among other things, has:

| · | reviewed and discussed with management the Company’s audited financial statements as of and for the fiscal year ended December 31, 2004, including a discussion of the quality and acceptability of our financial reporting and internal controls; |

| · | discussed with the Company’s independent registered public accounting firm, who is responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, its judgment as to the quality, not just the acceptability, of the accounting principles utilized, the reasonableness of significant accounting judgments and estimates and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards, including Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended, by the Auditing Standards Board of American Institute of Certified Public Accountants; |

| · | discussed with the Company’s independent registered public accounting firm its independence from management and the Company, received and reviewed the written disclosures and the letter from the Company’s independent registered public accounting firm required by Independence Standard No. 1,Independence Discussions with Audit Committees, as amended, by the Independence Standards Board, and considered the compatibility of non-audit services with the Company’s independent registered public accounting firm’s independence; and |

| · | discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. |

Based on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004.

| | Respectfully submitted, |

| | |

| | COMPENSATION COMMITTEE OF THE |

| | BOARD OF DIRECTORS OF |

| | LMI AEROSPACE, INC. |

| | |

| | Sanford S. Neuman,Chairman |

| | Paul L. Miller, Jr.,Member |

| | John M. Roeder,Member |

Notwithstanding anything set forth in any of our previous filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, including this proxy statement, in whole or in part, the preceding report shall not be deemed incorporated by reference in any such filings.

FEES BILLED BY INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The following table sets forth the amount of audit fees, audit-related fees, tax fees and all other fees billed or expected to be billed by Ernst & Young LLP, the Company’s former principal accountant, and by BDO Seidman, LLP, the Company’s current independent registered public accounting firm, for the years ended December 31, 2004 and December 31, 2003, respectively:

| | | 2004 | | 2003 (4) | |

| | | | | | | | |

| Audit Fees (1) | | $ | 321,094 | | $ | 344,800 | |

| Audit-Related Fees (2) | | | 4,200 | | | -- | |

| Tax Fees (3) | | | -- | | | 4,220 | |

| All Other Fees | | | -- | | | -- | |

| | | | | | | | |

Total Fees | | $ | 325,294 | | $ | 349,020 | |

| (1) | Includes annual financial statement audit and limited quarterly review services. |

| (2) | Includes fees for services associated with due diligence related to acquisitions and other audit-related services. |

| (3) | Includes fees and expenses for services primarily related to tax compliance, tax advice and tax planning for potential acquisitions. |

| (4) | During 2003, the Company changed its principal accounting firm from Ernst & Young LLP to BDO Seidman, LLP. Included in Audit Fees are billings from Ernst & Young LLP for $104,800 related to three quarterly reviews. Also included in Audit Fees are billings from BDO Seidman, LLP of $240,000 related to its audit of the Company. Tax Fees are for services rendered by Ernst & Young LLP related to advice and tax planning. The Company has elected not to use its current principal accountant for tax services. |

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy that requires advance approval of all audit, audit-related, tax, and other services performed by the Company’s independent registered public accounting firm. All of the fees listed above were pre-approved in accordance with this policy. The policy provides for pre-approval by the Audit Committee of specifically defined audit and permitted non-audit services. Unless the specific service has been previously pre-approved with respect to that year, the Audit Committee must approve the permitted service before the Company’s independent registered public accounting firm is engaged to perform it. The Audit Committee has delegated to the Chair of the Audit Committee authority to approve permitted services provided that the Chair reports any decisions to the Committee at its next scheduled meeting. The Audit Committee, after review and discussion with BDO Seidman, LLP of the Company’s pre-approval policies and procedures, determined that the provision of these services in accordance with such policies and procedures was compatible with maintaining BDO Seidman, LLP’s independence.

COMPARISON OF LMI AEROSPACE, INC. CUMULATIVE TOTAL RETURN

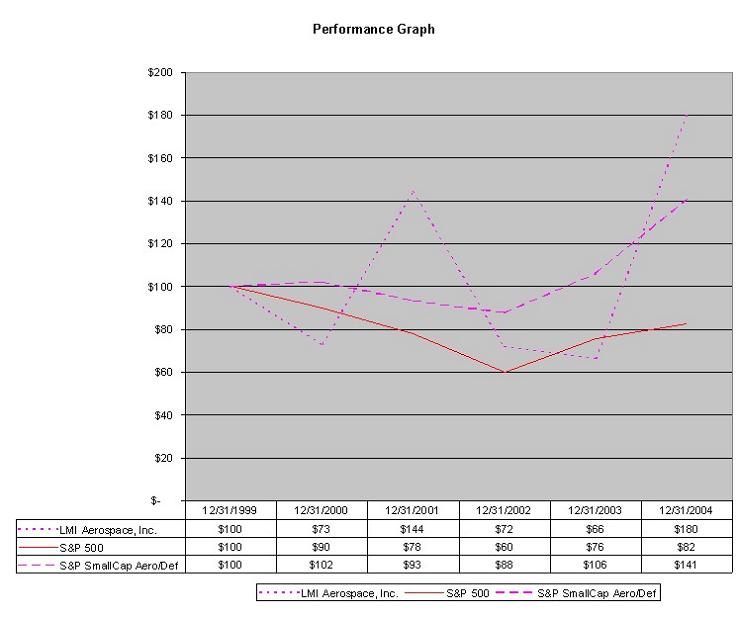

Set forth below is a line graph presentation comparing cumulative shareholder returns since December 31, 1999 on an indexed basis with the S & P 500 Index and the S&P Small Cap Aerospace/Defense Index, which is a nationally recognized industry standard index.

The following graph assumes the investment of $100 in LMI Aerospace, Inc. Common Stock, the S & P 500 Index and the S&P Small Cap Aerospace/Defense Index as well as the reinvestment of all dividends. There can be no assurance that the performance of the Company’s stock will continue into the future with the same or similar trend depicted in the graph below.

CERTAIN TRANSACTIONS

From time to time, the Company has engaged in various transactions with certain of its directors, executive officers and other affiliated parties. The following paragraphs summarize certain information concerning certain transactions and relationships that have occurred during the past fiscal year or are currently proposed.

Sanford S. Neuman, a director of the Company, is the Chairman and a Member of the law firm Gallop, Johnson & Neuman, L.C., which has provided legal services to the Company in prior years and is expected to provide legal services to the Company in the future.

In May of 2002, the Company acquired the outstanding capital stock of Versaform Corporation, a California corporation, and the capital stock of its subsidiary, 541775 B.C., Ltd., a corporation incorporated in the Province of British Columbia, Canada. All of the capital stock of Versaform Corporation and affiliates was owned directly by Brian Geary, an individual residing in the State of California. At the time, 541775 B.C., Ltd. owned all of the outstanding capital stock of Versaform Canada Corporation, a corporation incorporated in the Province of British Columbia, Canada. The Company subsequently, consolidated 541775 B.C., Ltd. and Versaform Canada Corporation with its own wholly-owned Canadian subsidiary, LMIV Holding Ltd., a corporation incorporated in the Province of British Columbia, Canada. In June of 2002, Mr. Geary was appointed as a director of the Company. As part of the transaction pursuant to which it acquired Versaform Canada Corporation, the Company executed a non-negotiable, subordinated promissory note in favor of Mr. Geary, in the principal amount of $1.3 million. This promissory note is payable in 36 monthly installments beginning on July 1, 2002, and bears interest at a rate of 7% per annum. The note was secured by a pledge of 65% of the Company’s interest in its Canadian subsidiary, and pursuant to such pledge, the Company’s Canadian subsidiary was required to meet certain financial and other restrictive covenants. Also, as part of the transaction, the Company is required to pay Mr. Geary additional consideration of up to 5% of the annual net sales received under agreements between Versaform and Hamilton Sundstrand, a customer of Versaform, in excess of $3 million. There have been no payments earned by Mr. Geary for sales to Hamilton Sundstrand. During September 2004, the Company sold the Canadian subsidiary. Mr. Geary released this secured interest in the Canadian subsidiary in conjunction with the Company’s sale of the Canadian subsidiary.

In September 2002, the Company acquired from Mr. Geary the operations and certain of the assets of the aerospace division of SSFF, an aerospace sheet metal manufacturer based in Denton, Texas. The Company paid Mr. Geary consideration consisting of 90,000 shares of the Company’s common stock for machinery and equipment, issued pursuant to a private placement conforming with the safe harbor provisions of Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended, $115,000 cash for all inventories, and the transfer of certain equipment valued at $60,000. Also, as part of the SSFF transaction, the Company is required to pay Mr. Geary 5% of the gross sales of specific parts to a specific customer during the period beginning on January 1, 2003 and ending on December 31, 2007, not to exceed $500,000. Payments to Mr. Geary under this agreement were $55,000 and $109,000 for the years ended December 31, 2003 and 2004, respectively.

The Company negotiated each of the above transactions on an arm’s-length basis. Although Mr. Geary was not a director at the time of the Company’s acquisition of Versaform, the Company received an opinion from an independent investment banking firm stating that the Company’s acquisition of Versaform was fair from a financial point of view to the holders of the Company’s common stock. Because the Company’s acquisition of SSFF occurred following Mr. Geary’s appointment to the Company’s Board of Directors, and because of the potential conflict of interest created by the Company’s acquisition of assets from Mr. Geary, the Company’s audit committee reviewed the following specific factors relating to the Company’s acquisition of SSFF:

l whether or not the potential conflict of interest arising from the Company’s proposed transaction with SSFF and indirectly with Mr. Geary had been fully disclosed and revealed to the Audit Committee;

l whether or not the proposed transaction had been negotiated at arm’s-length;

l whether or not Mr. Geary had participated in the negotiation of the proposed transaction on behalf of the Company; and

l whether or not the terms of the proposed transaction were fair to the Company and its shareholders.

After full discussion and deliberation of these factors, the members of the Company’s Audit Committee unanimously determined that all relevant facts regarding a potential conflict of interest had been fully disclosed to the Audit Committee, that the terms of the proposed transaction were fair and in the best interests of the Company and its shareholders, and that the transaction had been negotiated at arm’s-length, without participation by or influence of Mr. Geary with respect to the Company’s interest.

The Company leases its facility located at 11011-11021 Olinda Street in Sun Valley, California from multiple landlords, one of whom is a trust for the benefit of Ernest L. Star, the father of Ernest R. Star, the former General Manager of Tempco. Ernest R. Star is a co-trustee of this trust. Pursuant to the terms of the applicable lease agreement, the Company pays the owners of this property aggregate annual rent payments of $155,347 for the lease of a facility with square footage of 22,320. In addition, the Company leases property located at 8866 Laurel CanyonBlvd. in Sun Valley, California from Starwood Company, a company beneficially owned in part by Ernest L. Star. Pursuant to the terms of the applicable lease agreement, the Company pays Starwood Company aggregate annual rent of $172,920 for the lease of a facility having a square footage of 26,200. The leases governing the Company’s occupancy of the above described properties were entered into at the time of the Company’s acquisition of Tempco. Both leases were negotiated on an arm’s-length basis, prior to the time that Ernest R. Star became an officer of the Company. In March 2004, Ernest R. Star resigned his role as General Manager and officer of the Company.

In connection with the refinancing of the Company’s bank debt, certain directors of the Company (Joseph Burstein, Brian Geary, Sanford Neuman and Ronald Saks) invested an aggregate of $1.0 million in subordinated notes with the Company. These notes mature on December 31, 2007, require quarterly interest payments at an annual rate of 12% and allow for prepayment of principal in connection with certain specified events. The issuance of these subordinated notes was reviewed and approved by the members of the Audit Committee, with Mr. Burstein abstaining.

The Company leased property located at 1315 S. Cleveland Street in Oceanside, California from Edward D. Geary, the father of Brian Geary, a member of the Company’s Board of Directors. Pursuant to the applicable lease arrangement, the Company paid Edward D. Geary annual aggregate rent payments of $86,400 for the lease of a 19,000 square foot facility. This lease was assumed by the Company as part of its acquisition of Versaform Corporation and expired on January 31, 2005.

All future transactions between the Company and its officers, directors, principal shareholders and affiliates must be approved by a majority of the independent and disinterested outside directors.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's executive officers, the Company’s directors and persons who own more than 10% of a registered class of the Company's equity securities to file reports of ownership and changes in ownership with the SEC. Such individuals are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms furnished to the Company or written representations that no reports were required to be filed, the Company believes that all such persons complied with all Section 16(a) filing requirements applicable to them with respect to transactions during the 2004 fiscal year.

PROPOSAL 2 - RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed BDO Seidman, LLP, as the Company’s independent registered public accounting firm to audit the consolidated financial statements of the Company for the current fiscal year ending December 31, 2005.

On September 22, 2003, Ernst & Young LLP, the Company’s previous independent accountants, informed the Company that Ernst & Young was resigning as the Company’s independent accountants, effective upon the completion of the quarterly review of the Company’s fiscal quarter ended September 30, 2003. Ernst & Young’s resignation became effective on November 14, 2003.

The reports of Ernst & Young on the financial statements of the Company for the past two fiscal years contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

In connection with the Company's audit for each of the two most recent fiscal years, there were no disagreements with Ernst & Young on any matter of accounting principles or practices, financial statement disclosures or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference thereto in their report in the financial statements for such years.

During the Company's two most recent fiscal years, there were no reportable events as defined in Registration S-K, Item 304(a)(1)(v).

Effective as of December 29, 2003, BDO Seidman, LLP accepted the engagement to serve as the Company’s independent registered public accounting firm.

During the Company’s fiscal years ended December 31, 2001 and 2002, and through December 29, 2003, the Company did not consult with BDO Seidman, LLP with respect to the application of accounting principles to a specified transaction, either contemplated or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, or any matter that was either the subject of a disagreement or a reportable event.

A proposal will be presented at the Annual Meeting to ratify the appointment of BDO Seidman, LLP as the Company’s independent registered public accounting firm. One or more of the representatives of that firm are expected to be present at the Annual Meeting to respond to appropriate questions and to make a statement if they desire to do so. Neither the Company’s Bylaws nor its other governing documents or law require shareholder ratification of the selection of BDO Seidman, LLP as the Company’s independent registered public accounting firm. However, the Audit Committee is submitting the selection of BDO Seidman, LLP to the shareholders for ratification as a matter of good corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF BDO SEIDMAN, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

PROPOSAL 3 - APPROVAL OF THELMI AEROSPACE, INC.

2005 LONG-TERM INCENTIVE PLAN

Under the Amended and Restated LMI Aerospace, Inc. 1998 Stock Option Plan (the “1998 Plan”),the Company has granted stock options to its executive officers and other key employees and has granted on an automatic basis non-qualified stock options to its non-employee directors as a means of developing a sense of proprietorship and personal involvement in the development and financial success of the Company and encouraging them to remain with and devote their best efforts to the business of the Company, thereby advancing the interests of the Company and its shareholders:

Options to acquire a total of 428,743 shares of the Company’s Common Stock have been granted under the 1998 Plan, leaving 471,257 shares available for future grants. The market value of a share of the Company’s Common Stock as of April 25, 2005 was $4.90. If the Plan is not approved, of the amount remaining available for issuance under the 1998 Plan, directors’ stock options covering a total of 18,000 shares will be granted to the Company’s current non-employee directors following the 2005 Annual Meeting. If the Plan is approved, 21,000 shares of restricted stock will be granted to the Company’s current directors following the 2005 Annual Meeting and the registration of the shares of the Company’s Common Stock issuable under the Plan.

The Board of Directors has adopted, subject to the approval by the Company’s shareholders, the LMI Aerospace, Inc. 2005 Long-Term Incentive Plan (the “Plan”) to enable the Company to

· provide long-term incentives to those directors, officers, employees and other individuals with significant responsibility for, or potential impact on, the success and growth of the Company and its subsidiaries, divisions and affiliated businesses,

· associate the interests of such individuals with those of the Company’s shareholders,

· assist the Company in recruiting, retaining and motivating qualified directors, officers, employees and such other individuals on a competitive basis and

· ensure a pay for performance linkage for such individuals.

Summary of the Plan

The following is a summary of the principal features of the Plan. This summary is qualified in its entirety by the more detailed terms and conditions of the Plan, a copy of which is attached asAttachment A to this Proxy Statement. If the Plan is not approved by the required vote of shareholders at the 2005 Annual Meeting, the 1998 Plan will remain in effect. If the Plan is approved, the 1998 Plan will be terminated, no grant of options thereunder will be made following the Annual Meeting, no further awards will be made under the 1998 Plan, the Plan will replace the 1998 Plan following the 2005 Annual Meeting, the Company will file a registration statement under the Securities Act of 1933, as amended, to register the shares of the Company’s Common Stock issuable under the Plan and the Company will grant the shares of restricted stock to its directors as described above as soon as practicable thereafter.

Plan Administration: The Board of Directors has designated the Compensation Committee to administer all aspects of the Plan. The Compensation Committee is composed solely of non-employee directors, as defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended, and “outside directors,” within the meaning of Section 162(m) of the Internal Revenue Code.

The Compensation Committee has the authority to, among other things:

· designate eligible persons to receive awards;

· determine the types of awards to be granted to each participant under the Plan;

· determine the number of shares and/or amount of cash to be covered by (or the method by which payments or other rights are to be determined in connection with) each award;

· determine the terms and conditions of any award or award agreement, including time-based restrictions and performance-based restrictions;

· establish the performance measures for achievement of performance goals with respect to performance awards;

· amend the terms and conditions of any award or award agreement and accelerate the exercisability of any option or waive any restrictions relating to any award;

· determine whether, to what extent and under what circumstances awards may be exercised in cash, shares, promissory notes, other securities, other awards or other property, or canceled, forfeited or and amounts payable with respect to an award shall be deferred;

· construe and interpret the Plan and any instrument or agreement;

· establish, amend, suspend or waive such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration of the Plan; and

· make any other determination and take any other action that the Compensation Committee deems necessary or desirable for the administration of the Plan.

Notwithstanding anything to the contrary contained herein, the Board of Directors or a committee of the Board of Directors other than the Compensation Committee may exercise the powers and duties of the Compensation Committee under the Plan to the extent that the exercise of such authority would not cause any performance-based award to cease to qualify for the Section 162(m) exemption.

Eligibility: The Compensation Committee shall designate thosedirectors (including any non-employee directors), officers, employees and other individualswho will participate in the Plan. In determining which eligible persons shall receive an award and the terms of any award, the Compensation Committee may take into account the nature of the services rendered by the persons, their present and potential contributions to the success of the Company or such other factors as the Compensation Committee deems relevant.

Shares Authorized: Subject to adjustment to prevent dilution or enlargement of benefits in the event of a recapitalization, stock split, reorganization or similar transaction, 1,200,000 shares of the Company’s Common Stock are currently reserved for issuance in connection with awards granted under the Plan.

Awards:The Plan provides for the grant of non-qualified stock options, incentive stock options that qualify under Section 422 of the Code, restricted stock, restricted stock units, stock appreciation rights, performance awards, other stock-based awards and cash bonus awards, each as defined in the Plan.

Options. An option to purchase shares of Common Stock may be granted in the form of a non-qualified stock option or an incentive stock option. The price at which a share may be purchased under an option (the exercise price) will be determined by the Compensation Committee but may not be less than the fair market value of the Company’s Common Stock on the date the option is granted. Except in the case of an adjustment related to a corporate transaction, the exercise price of a stock option may not be decreased after the date of grant,and no outstanding option may be surrendered as consideration for the grant of a new option with a lower exercise price without shareholder approval. The Compensation Committee shall establish the term of each option. All or any portion of an option may be exercised during its term, but no option shall be exercisable in the six month period following the grant date.

With respect to incentive stock options,the amount of incentive stock options that become exercisable for the first time in a particular year cannot exceed a face value of $100,000 per participant, determined using the fair market value of the shares on the date of grant. The per share exercise price for an incentive stock option shall not be less than 110% of the fair market value of a share at the grant date in the case of an incentive stock option granted to an employee who, at the grant date is a 10% shareholder. Further, no incentive stock option shall be exercisable after the expiration of ten (10) years from the grant date (five (5) years in the case of an incentive stock option granted to a 10% shareholder).

If a participant’s employment with the Company and all of its affiliates and service as a director shall terminate for a reason other than retirement (with respect to employees), permanent disability or death, the participant’s options and all unexercised rights thereunder shall expire and automatically terminate.

If termination of employment is due to retirement or if termination of employment or service is due to permanent disability, the participant (or his or her personal representative) shall have the right to exercise any option at any time within the 12-month period (three-month period in the case of retirement for incentive stock options) following such termination of employment or service or the expiration date of such option, whichever shall first occur, provided that such option shall be exercisable only to the extent it was exercisable immediately prior to such termination of employment or service.

If a participant shall die while entitled to exercise an option, the participant’s estate, personal representative or beneficiary, as the case may be, shall have the right to exercise the option at any time within the 12-month period following the date of the participant’s death or the expiration date of such Option, whichever shall first occur, provided that such option shall be exercisable only to the extent that the participant was entitled to exercise the same on the day immediately prior to the participant’s death.

Restricted Stock / Restricted Stock Units. Restricted stock and restricted stock units may be issued to eligible participants, as determined by the Compensation Committee. The restrictions on such awards are determined by the Compensation Committee and may include time-based or performance-based restrictions. Any time-based restriction must be for a minimum of three years. Restricted stock units may be settled in cash, shares or a combination thereof, as determined by the Compensation Committee. Holders of restricted stock will have voting rights during the restriction period. Unless otherwise determined by the Compensation Committee, any dividends payable to a participant during the restriction period will be distributed to the participant only if and when the restrictions imposed on the shares of restricted stock or restricted stock units lapse. All restricted stock and restricted stock units that remain unvested shall terminate upon the termination of the participant’s status as an employee of the Company and its affiliates and as a director of the Company.

SARs. Each stock appreciation right (SAR) granted under the Plan shall confer on the holder upon exercise the right to receive, as determined by the Compensation Committee, cash or a number of shares equal to the excess of (i) the fair market value of one share on the date of exercise (or, if the Compensation Committee shall so determine, at any time during a specified period before or after the date of exercise) over (ii) the grant price of the SAR as determined by the Committee, which grant price shall not be less than 100% of the fair market value of one share on the grant date of the SAR. The terms and conditions of any SAR shall be as determined by the Committee.